SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Ovintiv Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

The presentation attached as Exhibit 1 hereto may be provided to stockholders of Ovintiv Inc.

4Q & YE20 Results Conference Call 14Q & YE20 Results Conference Call 1

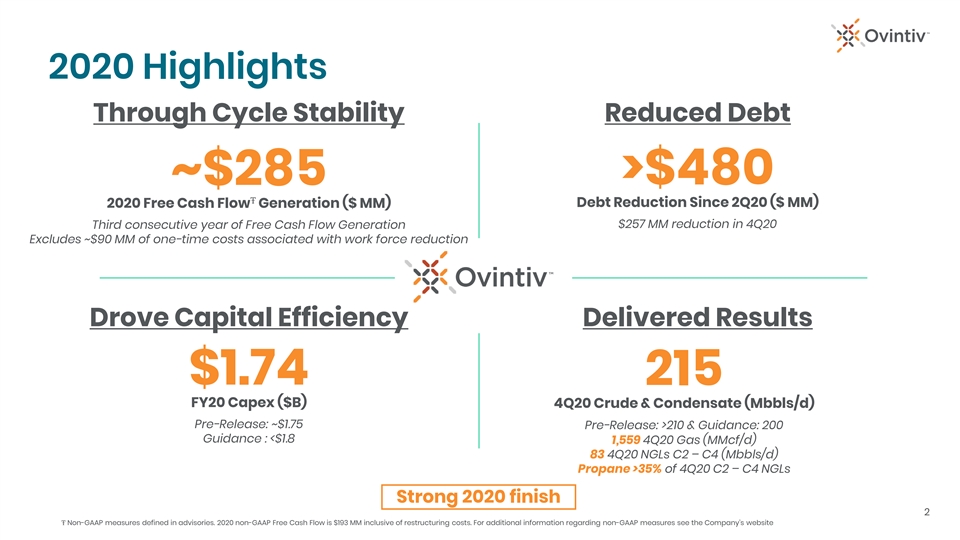

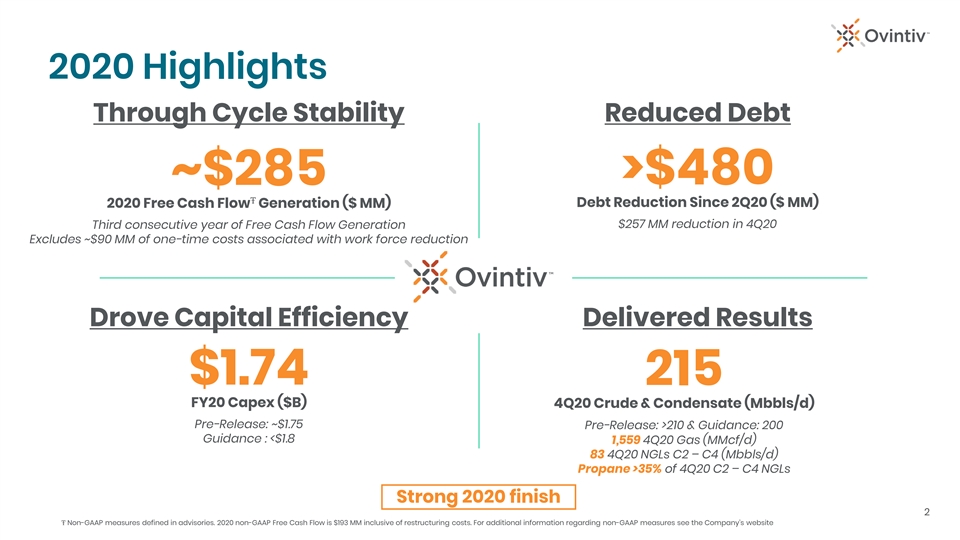

2020 Highlights Through Cycle Stability Reduced Debt ~$285 >$480 Ŧ Debt Reduction Since 2Q20 ($ MM) 2020 Free Cash Flow Generation ($ MM) $257 MM reduction in 4Q20 Third consecutive year of Free Cash Flow Generation Excludes ~$90 MM of one-time costs associated with work force reduction Drove Capital Efficiency Delivered Results $1.74 215 FY20 Capex ($B) 4Q20 Crude & Condensate (Mbbls/d) Pre-Release: ~$1.75 Pre-Release: >210 & Guidance: 200 Guidance : <$1.8 1,559 4Q20 Gas (MMcf/d) 83 4Q20 NGLs C2 – C4 (Mbbls/d) Propane >35% of 4Q20 C2 – C4 NGLs Strong 2020 finish 2 Ŧ Non-GAAP measures defined in advisories. 2020 non-GAAP Free Cash Flow is $193 MM inclusive of restructuring costs. For additional information regarding non-GAAP measures see the Company’s website2020 Highlights Through Cycle Stability Reduced Debt ~$285 >$480 Ŧ Debt Reduction Since 2Q20 ($ MM) 2020 Free Cash Flow Generation ($ MM) $257 MM reduction in 4Q20 Third consecutive year of Free Cash Flow Generation Excludes ~$90 MM of one-time costs associated with work force reduction Drove Capital Efficiency Delivered Results $1.74 215 FY20 Capex ($B) 4Q20 Crude & Condensate (Mbbls/d) Pre-Release: ~$1.75 Pre-Release: >210 & Guidance: 200 Guidance : <$1.8 1,559 4Q20 Gas (MMcf/d) 83 4Q20 NGLs C2 – C4 (Mbbls/d) Propane >35% of 4Q20 C2 – C4 NGLs Strong 2020 finish 2 Ŧ Non-GAAP measures defined in advisories. 2020 non-GAAP Free Cash Flow is $193 MM inclusive of restructuring costs. For additional information regarding non-GAAP measures see the Company’s website

Today’s Key Highlights Continuing to prove position as “New E&P” leader • Focused on free cash generation across our world-class, multi-basin portfolio • Culture of innovation and leadership drives industry leading efficiencies • Today’s announcements continue our track record of leading edge ESG and operating performance 0.15 ~$2.4B reduction 0.10 $4.5B vs. YE20 Total debt target by YE22 Tied to New Debt Methane Intensity compensation for all employees Reduction Targets Target Increased from $1B $1.25B original Target 2019 2025 New 2H20 – YE21 Target Metric Tons (CH / MBOE) 4 (Excludes any asset sale proceeds) th Achieved 7 0.19 S&P 400 & XOP Consecutive Contractor & Employee TRIF New Added to PSU Peer Group Safest Year Ever Compensation Alignment <0.50% ROIC Environmental 4Q20 Flared & Vented Volumes Added to PSU Metrics in 2021 Stewardship as % of sales gas 3 Note: ROIC is Return on Invested Capital. TRIF is Total Recordable Incident FrequencyToday’s Key Highlights Continuing to prove position as “New E&P” leader • Focused on free cash generation across our world-class, multi-basin portfolio • Culture of innovation and leadership drives industry leading efficiencies • Today’s announcements continue our track record of leading edge ESG and operating performance 0.15 ~$2.4B reduction 0.10 $4.5B vs. YE20 Total debt target by YE22 Tied to New Debt Methane Intensity compensation for all employees Reduction Targets Target Increased from $1B $1.25B original Target 2019 2025 New 2H20 – YE21 Target Metric Tons (CH / MBOE) 4 (Excludes any asset sale proceeds) th Achieved 7 0.19 S&P 400 & XOP Consecutive Contractor & Employee TRIF New Added to PSU Peer Group Safest Year Ever Compensation Alignment <0.50% ROIC Environmental 4Q20 Flared & Vented Volumes Added to PSU Metrics in 2021 Stewardship as % of sales gas 3 Note: ROIC is Return on Invested Capital. TRIF is Total Recordable Incident Frequency

Positioned for Success Our Priorities Our Key Ingredients Debt Reduction “NEW” $4.5B Total debt target (YE22) Ŧ ~$1B Free Cash Flow in ’21 @ $50 / $2.75 Strong Capital Discipline Drive Down Emissions 33% methane intensity reduction target Transparent sustainability reporting since ’05 Return of Cash to Shareholders Maintain Scale 200 Mbbls/d crude and condensate Top Tier ESG Performance Significant exposure to oil, natural gas and NGLs Industry Leading Operations Industry Leading Efficiencies ~20% cost reduction achieved ahead of schedule Generate sustainable efficiencies Stability Through Size & Scale Return of Cash to Shareholders Sustainable dividend untouched through downturn >$1.7B in dividends & buybacks since ’18 4 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s websitePositioned for Success Our Priorities Our Key Ingredients Debt Reduction “NEW” $4.5B Total debt target (YE22) Ŧ ~$1B Free Cash Flow in ’21 @ $50 / $2.75 Strong Capital Discipline Drive Down Emissions 33% methane intensity reduction target Transparent sustainability reporting since ’05 Return of Cash to Shareholders Maintain Scale 200 Mbbls/d crude and condensate Top Tier ESG Performance Significant exposure to oil, natural gas and NGLs Industry Leading Operations Industry Leading Efficiencies ~20% cost reduction achieved ahead of schedule Generate sustainable efficiencies Stability Through Size & Scale Return of Cash to Shareholders Sustainable dividend untouched through downturn >$1.7B in dividends & buybacks since ’18 4 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website

Priority #1 - Debt Reduction Total Debt ($B) Debt Reduction Drives Through Cycle Strength • Significant progress on debt reduction, ~$0.5B completed in 2H20 $7.4 • Diminishing legacy costs provide “riskless” margin improvement $6.9 Ŧ • Stay-flat plan generates substantial free cash flow • Scale of base production provides stable cash generation Updated Targets Reconfirmed Targets Reduce $4.5B Total debt 1.5x leverage target Achieved by YE22 @ $50 & $2.75 Debt Capital ~60% ’21 Reinvestment Ratio <75% Reinvestment Ratio $4.5 @ $50 & $2.75 Allocation 2-yrs FCF + $1B $1B disposition target, ~25% complete of Dispositions ~$263 MM proceeds from Duvernay sale 2Q20 YE20 YE22 5 Note: Debt reduction through YE22 assumes $50 and $2.75. Duvernay sale proceeds include $12 MM of potential contingency payments to OVV based on future commodity prices Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s websitePriority #1 - Debt Reduction Total Debt ($B) Debt Reduction Drives Through Cycle Strength • Significant progress on debt reduction, ~$0.5B completed in 2H20 $7.4 • Diminishing legacy costs provide “riskless” margin improvement $6.9 Ŧ • Stay-flat plan generates substantial free cash flow • Scale of base production provides stable cash generation Updated Targets Reconfirmed Targets Reduce $4.5B Total debt 1.5x leverage target Achieved by YE22 @ $50 & $2.75 Debt Capital ~60% ’21 Reinvestment Ratio <75% Reinvestment Ratio $4.5 @ $50 & $2.75 Allocation 2-yrs FCF + $1B $1B disposition target, ~25% complete of Dispositions ~$263 MM proceeds from Duvernay sale 2Q20 YE20 YE22 5 Note: Debt reduction through YE22 assumes $50 and $2.75. Duvernay sale proceeds include $12 MM of potential contingency payments to OVV based on future commodity prices Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website

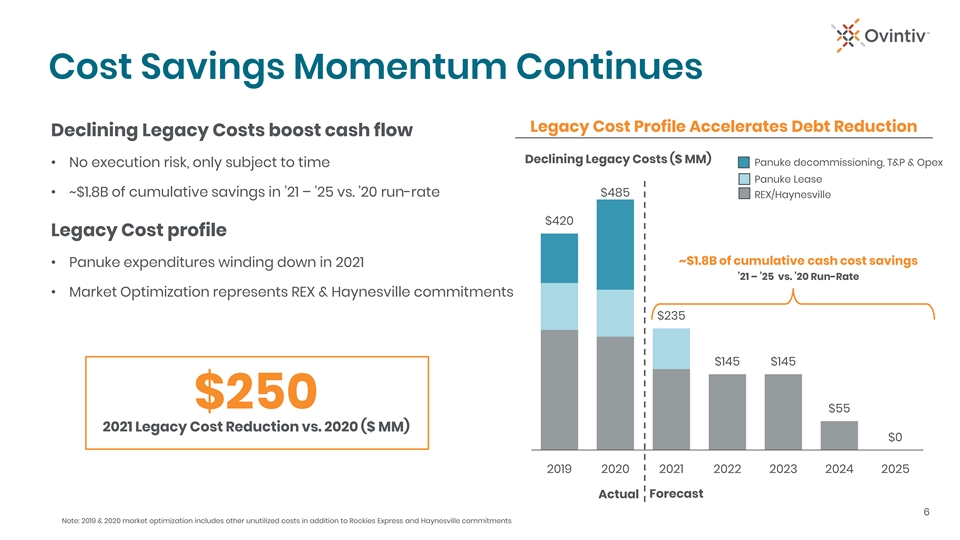

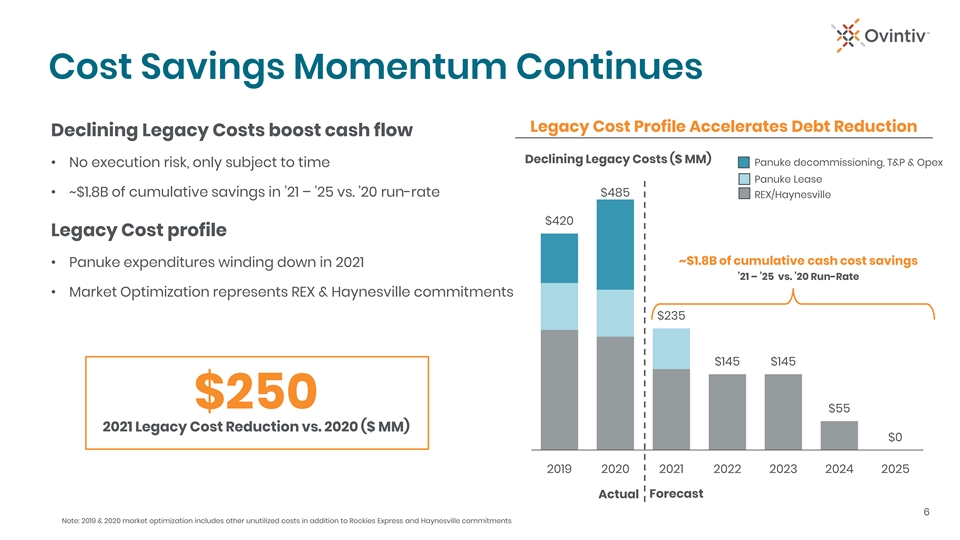

Cost Savings Momentum Continues Legacy Cost Profile Accelerates Debt Reduction Declining Legacy Costs boost cash flow Declining Legacy Costs ($ MM) Panuke decommissioning, T&P & Opex • No execution risk, only subject to time Panuke Lease • ~$1.8B of cumulative savings in ’21 – ’25 vs. ’20 run-rate $485 REX/Haynesville $420 Legacy Cost profile ~$1.8B of cumulative cash cost savings • Panuke expenditures winding down in 2021 ’21 – ’25 vs. ’20 Run-Rate • Market Optimization represents REX & Haynesville commitments $235 $145 $145 $250 $55 2021 Legacy Cost Reduction vs. 2020 ($ MM) $0 2019 2020 2021 2022 2023 2024 2025 Actual Forecast 6 Note: 2019 & 2020 market optimization includes other unutilized costs in addition to Rockies Express and Haynesville commitmentsCost Savings Momentum Continues Legacy Cost Profile Accelerates Debt Reduction Declining Legacy Costs boost cash flow Declining Legacy Costs ($ MM) Panuke decommissioning, T&P & Opex • No execution risk, only subject to time Panuke Lease • ~$1.8B of cumulative savings in ’21 – ’25 vs. ’20 run-rate $485 REX/Haynesville $420 Legacy Cost profile ~$1.8B of cumulative cash cost savings • Panuke expenditures winding down in 2021 ’21 – ’25 vs. ’20 Run-Rate • Market Optimization represents REX & Haynesville commitments $235 $145 $145 $250 $55 2021 Legacy Cost Reduction vs. 2020 ($ MM) $0 2019 2020 2021 2022 2023 2024 2025 Actual Forecast 6 Note: 2019 & 2020 market optimization includes other unutilized costs in addition to Rockies Express and Haynesville commitments

Track Record of Environmental Leadership Proven Track Record Industry leading reporting and performance • Alignment to Task Force on Climate-related Financial Disclosure (TCFD) th • Utilizing Sustainability Accounting Standards Board (SASB) guidance 7 16yrs Consecutive “Safest Sustainability reporting • Publishing annual sustainability reports since 2005 Year Ever” in 2020 Board actively leading and engaged in environmental oversight Recent Highlights • Track record of continuously driving industry leading performance Methane Intensity 33% Methane Intensity reduction target by 2025 33% • Target included in compensation for every employee ’19 – ‘25 Reduction Target rd 3 Party ESG Scores Measured in Tons CH / MBOE 4 Flared & Vented Gas #1 #3 (Ranking out of 12 peers) (Ranking out of 12 peers) <0.50% 4Q20 (% of sales gas) #2 #4 (Ranking out of 12 peers) (Ranking out of 12 peers) 7 Peers: APA, CHK, CLR, COG, DVN, EOG, HES, MRO, MUR, PXD, RRC, XEC. ISS ranking based on average Environmental, Social and Governance quality scoresTrack Record of Environmental Leadership Proven Track Record Industry leading reporting and performance • Alignment to Task Force on Climate-related Financial Disclosure (TCFD) th • Utilizing Sustainability Accounting Standards Board (SASB) guidance 7 16yrs Consecutive “Safest Sustainability reporting • Publishing annual sustainability reports since 2005 Year Ever” in 2020 Board actively leading and engaged in environmental oversight Recent Highlights • Track record of continuously driving industry leading performance Methane Intensity 33% Methane Intensity reduction target by 2025 33% • Target included in compensation for every employee ’19 – ‘25 Reduction Target rd 3 Party ESG Scores Measured in Tons CH / MBOE 4 Flared & Vented Gas #1 #3 (Ranking out of 12 peers) (Ranking out of 12 peers) <0.50% 4Q20 (% of sales gas) #2 #4 (Ranking out of 12 peers) (Ranking out of 12 peers) 7 Peers: APA, CHK, CLR, COG, DVN, EOG, HES, MRO, MUR, PXD, RRC, XEC. ISS ranking based on average Environmental, Social and Governance quality scores

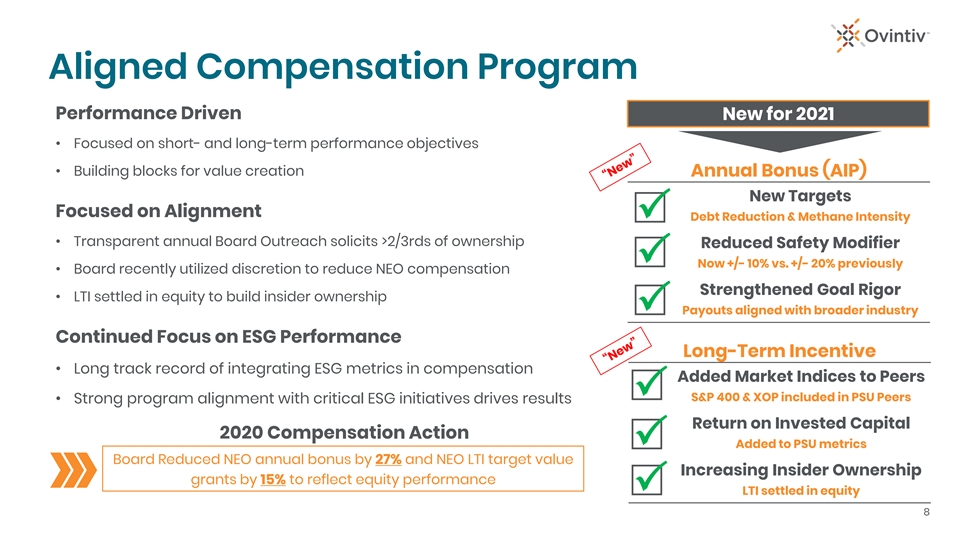

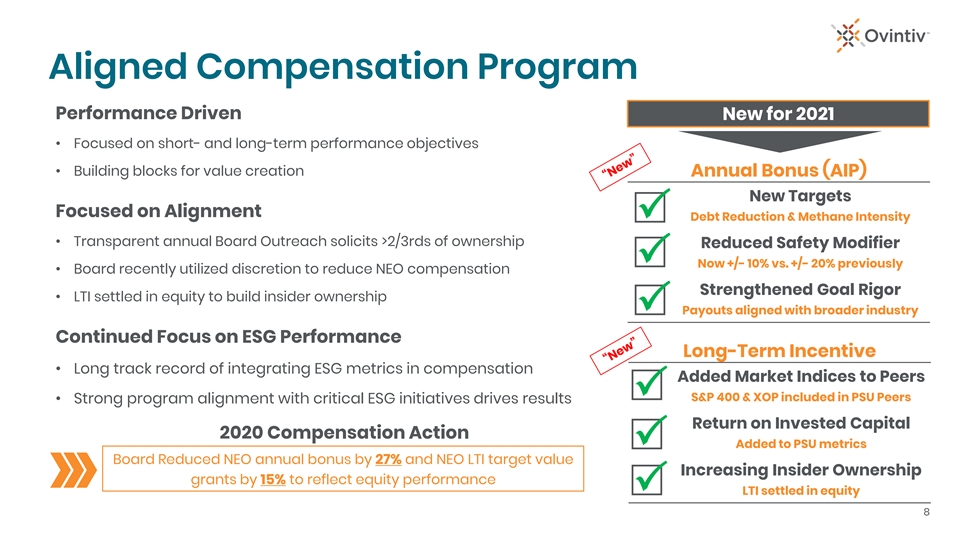

Aligned Compensation Program Performance Driven New for 2021 • Focused on short- and long-term performance objectives • Building blocks for value creation Annual Bonus (AIP) New Targets Focused on Alignment Debt Reduction & Methane Intensity P • Transparent annual Board Outreach solicits >2/3rds of ownership Reduced Safety Modifier P Now +/- 10% vs. +/- 20% previously • Board recently utilized discretion to reduce NEO compensation Strengthened Goal Rigor • LTI settled in equity to build insider ownership Payouts aligned with broader industry P Continued Focus on ESG Performance Long-Term Incentive • Long track record of integrating ESG metrics in compensation Added Market Indices to Peers P S&P 400 & XOP included in PSU Peers • Strong program alignment with critical ESG initiatives drives results Return on Invested Capital 2020 Compensation Action Added to PSU metrics P Board Reduced NEO annual bonus by 27% and NEO LTI target value Increasing Insider Ownership grants by 15% to reflect equity performance LTI settled in equity P 8Aligned Compensation Program Performance Driven New for 2021 • Focused on short- and long-term performance objectives • Building blocks for value creation Annual Bonus (AIP) New Targets Focused on Alignment Debt Reduction & Methane Intensity P • Transparent annual Board Outreach solicits >2/3rds of ownership Reduced Safety Modifier P Now +/- 10% vs. +/- 20% previously • Board recently utilized discretion to reduce NEO compensation Strengthened Goal Rigor • LTI settled in equity to build insider ownership Payouts aligned with broader industry P Continued Focus on ESG Performance Long-Term Incentive • Long track record of integrating ESG metrics in compensation Added Market Indices to Peers P S&P 400 & XOP included in PSU Peers • Strong program alignment with critical ESG initiatives drives results Return on Invested Capital 2020 Compensation Action Added to PSU metrics P Board Reduced NEO annual bonus by 27% and NEO LTI target value Increasing Insider Ownership grants by 15% to reflect equity performance LTI settled in equity P 8

Continuous Board Refreshment Director assessment conducted on an ongoing basis P 3 New Directors added since 2019 Engaged highly regarded executive search firm to assist with renewal process P 3 New independent chair appointed in 2020; independent chair unique P New Committee Chairs in 2020 Committee mandates revised in 2020 to ensure clear oversight on ESG P 2 Retirements 2 longstanding directors retired P ~6 yrs Average Tenure Added a new, highly qualified director in 2020 (Meg Gentle) P 9 Note: Average tenure reflects December 31, 2020Continuous Board Refreshment Director assessment conducted on an ongoing basis P 3 New Directors added since 2019 Engaged highly regarded executive search firm to assist with renewal process P 3 New independent chair appointed in 2020; independent chair unique P New Committee Chairs in 2020 Committee mandates revised in 2020 to ensure clear oversight on ESG P 2 Retirements 2 longstanding directors retired P ~6 yrs Average Tenure Added a new, highly qualified director in 2020 (Meg Gentle) P 9 Note: Average tenure reflects December 31, 2020

Multi-Basin Scale Drives Stability & Optionality Ŧ ’21 Upstream FCF 5% 10% Anadarko Industry Leading Portfolio Permian Stability through cycle 25% 60% Montney Commodity optionality Base Assets @ $50 & $2.75 Multi basin risk diversification Rapid cross-basin learnings Capital discipline Permian Montney Oil Exposure High Value Condensate <1% Federal acreage across Core 3 > 60% oil & C5+ Condensate trades near parity with WTI Durable Cost Reduction Drivers Scale Scale & gas optionality >100 MBOE/d & >decade of inventory >200 MBOE/d & >decade of inventory Simul-frac completions Slim hole wellbore design Anadarko Base Assets Record drilling & completion pace #1 FCF Generating Asset Oil Weighted Wet sand cost savings Driven by strong realizations & low LOE >65% oil Flexible services contract structure Scale Strong CF & Optionality >125 MBOE/d & >decade of inventory Supports debt paydown Note: Upstream Free Cash Flow is before hedges 10 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s websiteMulti-Basin Scale Drives Stability & Optionality Ŧ ’21 Upstream FCF 5% 10% Anadarko Industry Leading Portfolio Permian Stability through cycle 25% 60% Montney Commodity optionality Base Assets @ $50 & $2.75 Multi basin risk diversification Rapid cross-basin learnings Capital discipline Permian Montney Oil Exposure High Value Condensate <1% Federal acreage across Core 3 > 60% oil & C5+ Condensate trades near parity with WTI Durable Cost Reduction Drivers Scale Scale & gas optionality >100 MBOE/d & >decade of inventory >200 MBOE/d & >decade of inventory Simul-frac completions Slim hole wellbore design Anadarko Base Assets Record drilling & completion pace #1 FCF Generating Asset Oil Weighted Wet sand cost savings Driven by strong realizations & low LOE >65% oil Flexible services contract structure Scale Strong CF & Optionality >125 MBOE/d & >decade of inventory Supports debt paydown Note: Upstream Free Cash Flow is before hedges 10 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website

Permian: Delivering Record Performance Record Setting 4Q20 Sets Up Strong ‘21 4Q pacesetter: $390 D&C ($/ft) Record drilling performance $680 • 4Q20 company record lateral length: 15,202’ • 1 million feet drilled without a sidetrack (55 wells) • Record 4Q20 performance of >2k ft/d $560 Innovation demonstrated with simul-frac $470 • ~95% of ’21 program will utilize simul-frac • 24hr record set in 4Q20: • Completed 4.4 kft & pumped 220 Mbbls • ‘20 Simul-frac savings of ~$18.5 mm 2021 Program Overview Rig Completion Capex TILs D&C Count Crews ($ MM) (net) ($/ft) 3 1 - 2 $600 - $650 95 - 105 $480 FY19 1Q20 - 3Q20 4Q20 11Permian: Delivering Record Performance Record Setting 4Q20 Sets Up Strong ‘21 4Q pacesetter: $390 D&C ($/ft) Record drilling performance $680 • 4Q20 company record lateral length: 15,202’ • 1 million feet drilled without a sidetrack (55 wells) • Record 4Q20 performance of >2k ft/d $560 Innovation demonstrated with simul-frac $470 • ~95% of ’21 program will utilize simul-frac • 24hr record set in 4Q20: • Completed 4.4 kft & pumped 220 Mbbls • ‘20 Simul-frac savings of ~$18.5 mm 2021 Program Overview Rig Completion Capex TILs D&C Count Crews ($ MM) (net) ($/ft) 3 1 - 2 $600 - $650 95 - 105 $480 FY19 1Q20 - 3Q20 4Q20 11

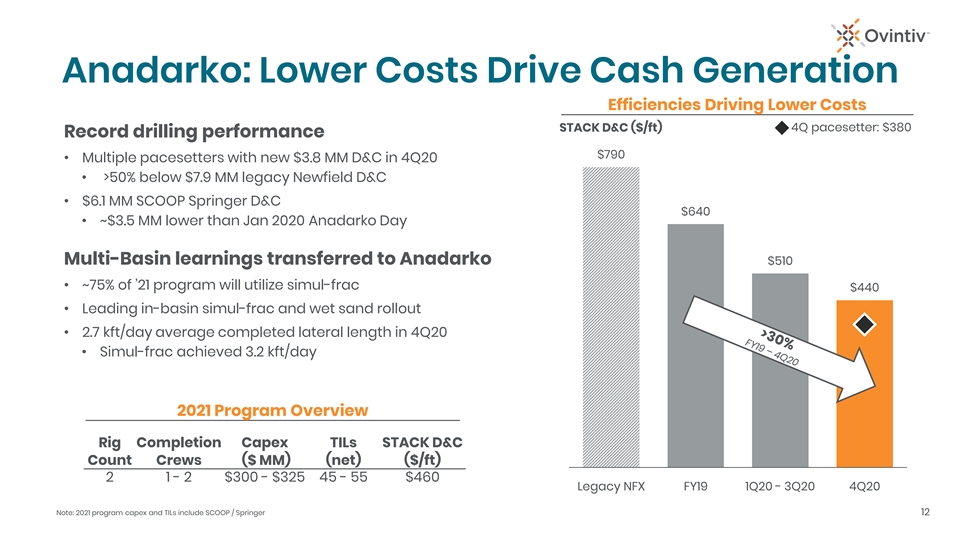

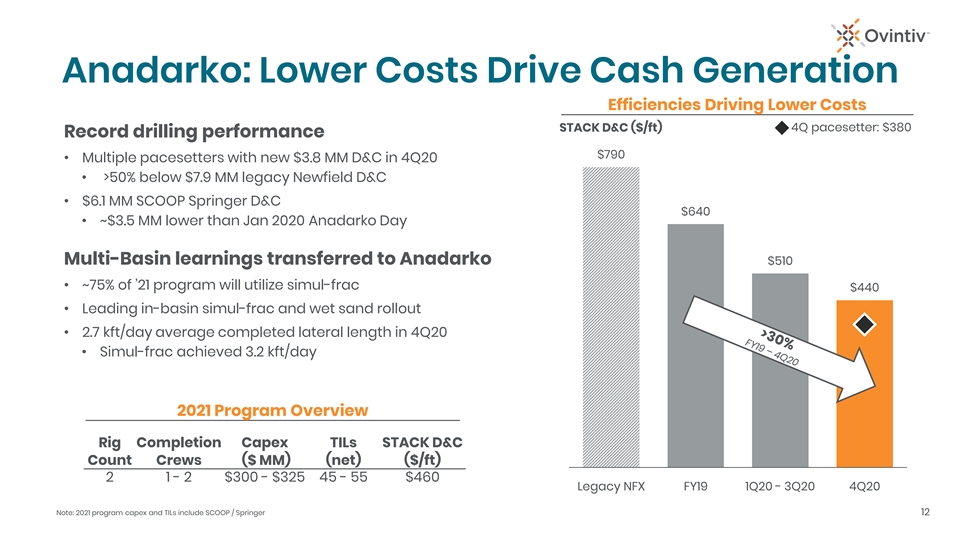

Anadarko: Lower Costs Drive Cash Generation Efficiencies Driving Lower Costs 4Q pacesetter: $380 STACK D&C ($/ft) Record drilling performance $790 • Multiple pacesetters with new $3.8 MM D&C in 4Q20 • >50% below $7.9 MM legacy Newfield D&C • $6.1 MM SCOOP Springer D&C $640 • ~$3.5 MM lower than Jan 2020 Anadarko Day Multi-Basin learnings transferred to Anadarko $510 • ~75% of ’21 program will utilize simul-frac $440 • Leading in-basin simul-frac and wet sand rollout • 2.7 kft/day average completed lateral length in 4Q20 • Simul-frac achieved 3.2 kft/day 2021 Program Overview Rig Completion Capex TILs STACK D&C Count Crews ($ MM) (net) ($/ft) 2 1 - 2 $300 - $325 45 - 55 $460 Legacy NFX FY19 1Q20 - 3Q20 4Q20 Note: 2021 program capex and TILs include SCOOP / Springer 12Anadarko: Lower Costs Drive Cash Generation Efficiencies Driving Lower Costs 4Q pacesetter: $380 STACK D&C ($/ft) Record drilling performance $790 • Multiple pacesetters with new $3.8 MM D&C in 4Q20 • >50% below $7.9 MM legacy Newfield D&C • $6.1 MM SCOOP Springer D&C $640 • ~$3.5 MM lower than Jan 2020 Anadarko Day Multi-Basin learnings transferred to Anadarko $510 • ~75% of ’21 program will utilize simul-frac $440 • Leading in-basin simul-frac and wet sand rollout • 2.7 kft/day average completed lateral length in 4Q20 • Simul-frac achieved 3.2 kft/day 2021 Program Overview Rig Completion Capex TILs STACK D&C Count Crews ($ MM) (net) ($/ft) 2 1 - 2 $300 - $325 45 - 55 $460 Legacy NFX FY19 1Q20 - 3Q20 4Q20 Note: 2021 program capex and TILs include SCOOP / Springer 12

Anadarko: Lower Costs Change the Game Basin Wide Performance Drives Investment • Contiguous & fully HBP’d acreage position (<1% federal exposure) • Low operating costs drive cash flow generation (~$2/BOE in 4Q20) • Access to premium oil markets (realized >98% of WTI in 4Q20) 65% ’21 Program IRR @ $50 / $2.75 • Exposure to robust NGL market recovery (C2-C4 was 27% of ’20 BOE production) Diversified opportunity set and leading-edge • Advantaged royalty rates (<20% royalty) efficiencies drive basin wide economics STACK Demonstrated & Sustainable Cost Saving (’20 vs. ‘19) Unrelenting Cost Reduction Focus $3.8 MM pacesetter D&C (~$4.1 MM less than Legacy NFX) 7% 35% 11% 14% Drilling & completion costs are lower than 1 Lateral Length Cycle Times Opex Facilities Capex Legacy NFX standalone completion costs Multi-pronged cost saving approach drives value from more than just D&C reductions SCOOP Record Development Program (~70% Oil) #1 Springer $6.1 MM ‘20 D&C (vs. $9.5 MM Jan ’20 guide) Free Cash Flow Asset Woodford Oil $5.2 MM ’20 D&C (vs. $5.8 MM Jan ’20 guide) 13 Note: Free cash flow represents upstream free cash flow before hedges and prices represent average benchmark prices 1) Represents 4Q20 facilities capex vs. FY19 facilities capexAnadarko: Lower Costs Change the Game Basin Wide Performance Drives Investment • Contiguous & fully HBP’d acreage position (<1% federal exposure) • Low operating costs drive cash flow generation (~$2/BOE in 4Q20) • Access to premium oil markets (realized >98% of WTI in 4Q20) 65% ’21 Program IRR @ $50 / $2.75 • Exposure to robust NGL market recovery (C2-C4 was 27% of ’20 BOE production) Diversified opportunity set and leading-edge • Advantaged royalty rates (<20% royalty) efficiencies drive basin wide economics STACK Demonstrated & Sustainable Cost Saving (’20 vs. ‘19) Unrelenting Cost Reduction Focus $3.8 MM pacesetter D&C (~$4.1 MM less than Legacy NFX) 7% 35% 11% 14% Drilling & completion costs are lower than 1 Lateral Length Cycle Times Opex Facilities Capex Legacy NFX standalone completion costs Multi-pronged cost saving approach drives value from more than just D&C reductions SCOOP Record Development Program (~70% Oil) #1 Springer $6.1 MM ‘20 D&C (vs. $9.5 MM Jan ’20 guide) Free Cash Flow Asset Woodford Oil $5.2 MM ’20 D&C (vs. $5.8 MM Jan ’20 guide) 13 Note: Free cash flow represents upstream free cash flow before hedges and prices represent average benchmark prices 1) Represents 4Q20 facilities capex vs. FY19 facilities capex

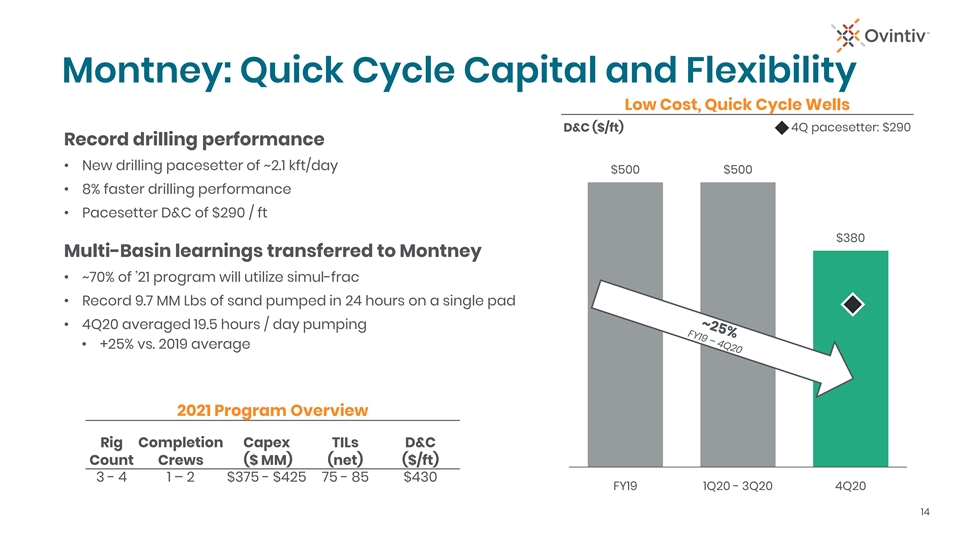

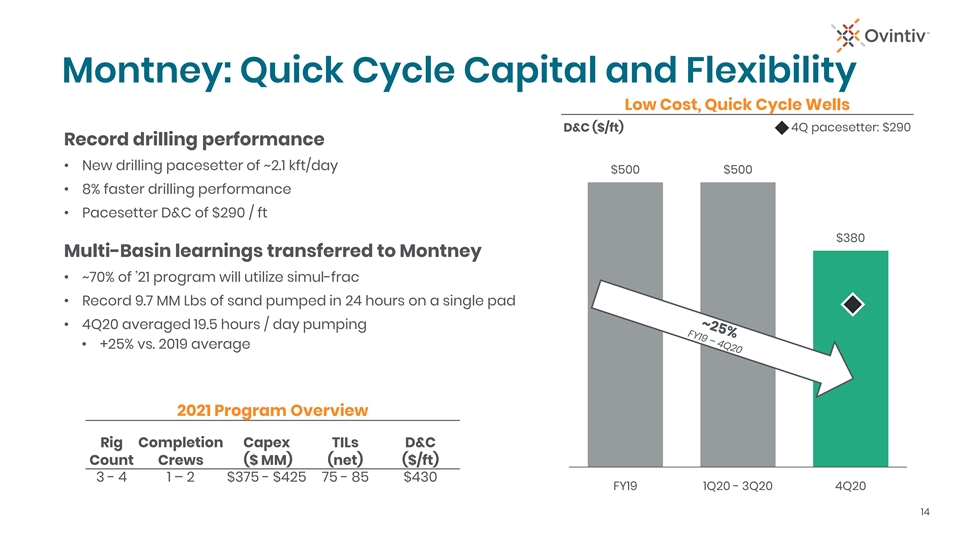

Montney: Quick Cycle Capital and Flexibility Low Cost, Quick Cycle Wells 4Q pacesetter: $290 D&C ($/ft) Record drilling performance • New drilling pacesetter of ~2.1 kft/day $500 $500 • 8% faster drilling performance • Pacesetter D&C of $290 / ft $380 Multi-Basin learnings transferred to Montney • ~70% of ’21 program will utilize simul-frac • Record 9.7 MM Lbs of sand pumped in 24 hours on a single pad • 4Q20 averaged 19.5 hours / day pumping • +25% vs. 2019 average 2021 Program Overview Rig Completion Capex TILs D&C Count Crews ($ MM) (net) ($/ft) 3 - 4 1 – 2 $375 - $425 75 - 85 $430 FY19 1Q20 - 3Q20 4Q20 14Montney: Quick Cycle Capital and Flexibility Low Cost, Quick Cycle Wells 4Q pacesetter: $290 D&C ($/ft) Record drilling performance • New drilling pacesetter of ~2.1 kft/day $500 $500 • 8% faster drilling performance • Pacesetter D&C of $290 / ft $380 Multi-Basin learnings transferred to Montney • ~70% of ’21 program will utilize simul-frac • Record 9.7 MM Lbs of sand pumped in 24 hours on a single pad • 4Q20 averaged 19.5 hours / day pumping • +25% vs. 2019 average 2021 Program Overview Rig Completion Capex TILs D&C Count Crews ($ MM) (net) ($/ft) 3 - 4 1 – 2 $375 - $425 75 - 85 $430 FY19 1Q20 - 3Q20 4Q20 14

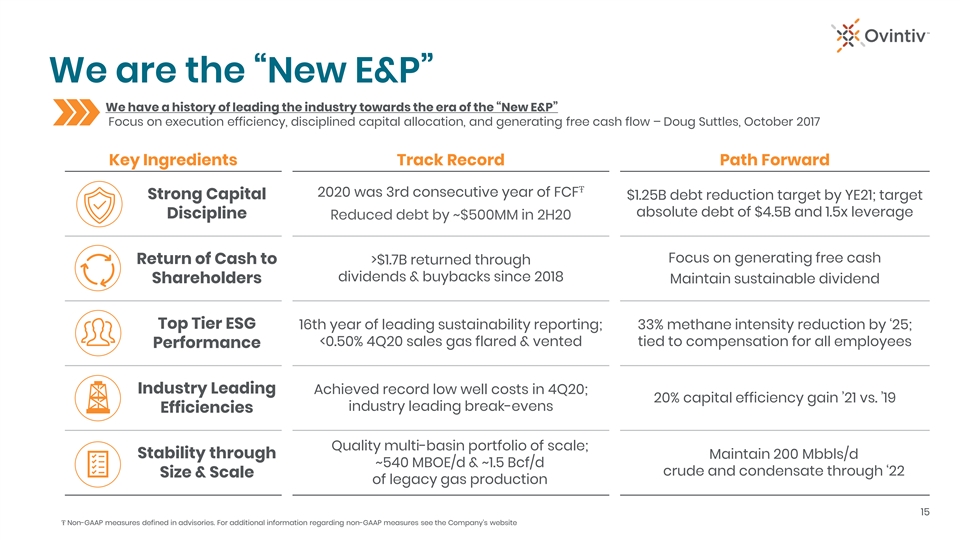

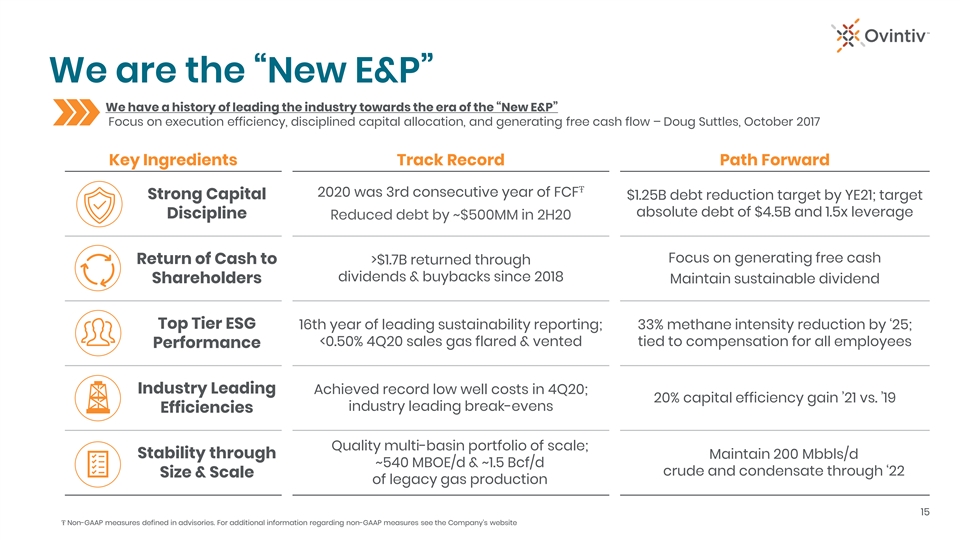

We are the “New E&P” We have a history of leading the industry towards the era of the “New E&P” Focus on execution efficiency, disciplined capital allocation, and generating free cash flow – Doug Suttles, October 2017 Key Ingredients Track Record Path Forward Ŧ 2020 was 3rd consecutive year of FCF Strong Capital $1.25B debt reduction target by YE21; target absolute debt of $4.5B and 1.5x leverage Discipline Reduced debt by ~$500MM in 2H20 Focus on generating free cash Return of Cash to >$1.7B returned through dividends & buybacks since 2018 Shareholders Maintain sustainable dividend Top Tier ESG 16th year of leading sustainability reporting; 33% methane intensity reduction by ‘25; <0.50% 4Q20 sales gas flared & vented tied to compensation for all employees Performance Industry Leading Achieved record low well costs in 4Q20; 20% capital efficiency gain ’21 vs. ’19 industry leading break-evens Efficiencies Quality multi-basin portfolio of scale; Stability through Maintain 200 Mbbls/d ~540 MBOE/d & ~1.5 Bcf/d crude and condensate through ‘22 Size & Scale of legacy gas production 15 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s websiteWe are the “New E&P” We have a history of leading the industry towards the era of the “New E&P” Focus on execution efficiency, disciplined capital allocation, and generating free cash flow – Doug Suttles, October 2017 Key Ingredients Track Record Path Forward Ŧ 2020 was 3rd consecutive year of FCF Strong Capital $1.25B debt reduction target by YE21; target absolute debt of $4.5B and 1.5x leverage Discipline Reduced debt by ~$500MM in 2H20 Focus on generating free cash Return of Cash to >$1.7B returned through dividends & buybacks since 2018 Shareholders Maintain sustainable dividend Top Tier ESG 16th year of leading sustainability reporting; 33% methane intensity reduction by ‘25; <0.50% 4Q20 sales gas flared & vented tied to compensation for all employees Performance Industry Leading Achieved record low well costs in 4Q20; 20% capital efficiency gain ’21 vs. ’19 industry leading break-evens Efficiencies Quality multi-basin portfolio of scale; Stability through Maintain 200 Mbbls/d ~540 MBOE/d & ~1.5 Bcf/d crude and condensate through ‘22 Size & Scale of legacy gas production 15 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website

Future Oriented Information This presentation contains forward-looking statements or information (collectively, “FLS”) within the meaning of applicable securities legislation, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. FLS include: • anticipated operating costs, legacy costs, capital efficiencies, margins, cost savings and sustainability • number of rigs, drilling locations, well performance, spacing, wells per pad, rig release metrics, cycle thereof times, well costs, commodity composition and performance against type curves and versus peers • financial flexibility and ability to maintain balance sheet strength • pacesetting metrics being indicative of future well performance and costs • outcomes of risk management program, including exposure to commodity prices, market access, • commodity price outlook market diversification strategy and physical sales locations • anticipated success of and benefits from technology and innovation • capital investment scenarios and associated production • expected transportation and processing capacity, commitments, curtailments and restrictions, • focus of development and allocation of capital, level of capital productivity and expected return including flexibility of commercial arrangements • anticipated production, cash flow, free cash flow, payout, net present value, rates of return, including • management of balance sheet, including target leverage, available free cash flow, debt reduction expected timeframes and potential upside and expected net debt • expected drilling and completions activity and the timing thereof • planned dividend and the declaration and payment of future dividends, if any • ability to meet targets, including with respect to capital allocation, debt reduction, scale, cash flow • statements regarding the Company’s application of free cash flow to reduce debt reinvestment and emissions-related performance, and the timing thereof • statements regarding the benefits of the Company’s multi-basin portfolio • ESG approach, performance and results, and sustainability thereof FLS involve assumptions, risks and uncertainties that may cause such statements not to occur or results to differ materially. These assumptions include: future commodity prices and differentials; assumptions as specified herein; data contained in key modeling statistics; availability of attractive hedges and enforceability of risk management program; assumed tax, royalty and regulatory regimes; and expectations and projections made in light of the Company’s historical experience. Risks and uncertainties include: commodity price volatility and impact to the Company’s stock price and cash flows; ability to secure adequate transportation and potential curtailments of refinery operations, including resulting storage constraints or widening price differentials; discretion to declare and pay dividends, if any; business interruption, property and casualty losses or unexpected technical difficulties; impact of COVID-19 to the Company’s operations, including maintaining ordinary staffing levels, securing operational inputs, executing on portions of its business and cyber-security risks associated with remote work; counterparty and credit risk; impact of changes in credit rating and access to liquidity, including costs thereof; risks in marketing operations; risks associated with technology; risks associated with lawsuits and regulatory actions, including disputes with partners; risks associated with decommissioning activities, including timing and costs thereof; ability to acquire or find additional reserves; imprecision of reserves estimates and estimates of recoverable quantities; and other risks and uncertainties, as described in the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q and as described from time to time in its other periodic filings as filed on EDGAR and SEDAR. Although the Company believes such FLS are reasonable, there can be no assurance they will prove to be correct. The above assumptions, risks and uncertainties are not exhaustive. FLS are made as of the date hereof and, except as required by law, the Company undertakes no obligation to update or revise any FLS. Certain future oriented financial information or financial outlook information is included in this presentation to communicate current expectations as to Ovintiv’s performance. Readers are cautioned that it may not be appropriate for other purposes. Rates of return for a particular asset or well are on a before-tax basis and are based on specified commodity prices with local pricing offsets, capital costs associated with drilling, completing and equipping a well, field operating expenses and certain type curve assumptions. Pacesetter well costs for a particular asset are a composite of the best drilling performance and best completions performance wells in the current quarter in such asset and are presented for comparison purposes. Drilling and completions costs have been normalized as specified in this presentation based on certain lateral lengths for a particular asset. For convenience, references in this presentation to “Ovintiv”, the “Company”, “we”, “us” and “our” may, where applicable, refer only to or include any relevant direct and indirect subsidiary corporations and partnerships (“Subsidiaries”) of Ovintiv Inc., and the assets, activities and initiatives of such Subsidiaries. 16Future Oriented Information This presentation contains forward-looking statements or information (collectively, “FLS”) within the meaning of applicable securities legislation, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. FLS include: • anticipated operating costs, legacy costs, capital efficiencies, margins, cost savings and sustainability • number of rigs, drilling locations, well performance, spacing, wells per pad, rig release metrics, cycle thereof times, well costs, commodity composition and performance against type curves and versus peers • financial flexibility and ability to maintain balance sheet strength • pacesetting metrics being indicative of future well performance and costs • outcomes of risk management program, including exposure to commodity prices, market access, • commodity price outlook market diversification strategy and physical sales locations • anticipated success of and benefits from technology and innovation • capital investment scenarios and associated production • expected transportation and processing capacity, commitments, curtailments and restrictions, • focus of development and allocation of capital, level of capital productivity and expected return including flexibility of commercial arrangements • anticipated production, cash flow, free cash flow, payout, net present value, rates of return, including • management of balance sheet, including target leverage, available free cash flow, debt reduction expected timeframes and potential upside and expected net debt • expected drilling and completions activity and the timing thereof • planned dividend and the declaration and payment of future dividends, if any • ability to meet targets, including with respect to capital allocation, debt reduction, scale, cash flow • statements regarding the Company’s application of free cash flow to reduce debt reinvestment and emissions-related performance, and the timing thereof • statements regarding the benefits of the Company’s multi-basin portfolio • ESG approach, performance and results, and sustainability thereof FLS involve assumptions, risks and uncertainties that may cause such statements not to occur or results to differ materially. These assumptions include: future commodity prices and differentials; assumptions as specified herein; data contained in key modeling statistics; availability of attractive hedges and enforceability of risk management program; assumed tax, royalty and regulatory regimes; and expectations and projections made in light of the Company’s historical experience. Risks and uncertainties include: commodity price volatility and impact to the Company’s stock price and cash flows; ability to secure adequate transportation and potential curtailments of refinery operations, including resulting storage constraints or widening price differentials; discretion to declare and pay dividends, if any; business interruption, property and casualty losses or unexpected technical difficulties; impact of COVID-19 to the Company’s operations, including maintaining ordinary staffing levels, securing operational inputs, executing on portions of its business and cyber-security risks associated with remote work; counterparty and credit risk; impact of changes in credit rating and access to liquidity, including costs thereof; risks in marketing operations; risks associated with technology; risks associated with lawsuits and regulatory actions, including disputes with partners; risks associated with decommissioning activities, including timing and costs thereof; ability to acquire or find additional reserves; imprecision of reserves estimates and estimates of recoverable quantities; and other risks and uncertainties, as described in the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q and as described from time to time in its other periodic filings as filed on EDGAR and SEDAR. Although the Company believes such FLS are reasonable, there can be no assurance they will prove to be correct. The above assumptions, risks and uncertainties are not exhaustive. FLS are made as of the date hereof and, except as required by law, the Company undertakes no obligation to update or revise any FLS. Certain future oriented financial information or financial outlook information is included in this presentation to communicate current expectations as to Ovintiv’s performance. Readers are cautioned that it may not be appropriate for other purposes. Rates of return for a particular asset or well are on a before-tax basis and are based on specified commodity prices with local pricing offsets, capital costs associated with drilling, completing and equipping a well, field operating expenses and certain type curve assumptions. Pacesetter well costs for a particular asset are a composite of the best drilling performance and best completions performance wells in the current quarter in such asset and are presented for comparison purposes. Drilling and completions costs have been normalized as specified in this presentation based on certain lateral lengths for a particular asset. For convenience, references in this presentation to “Ovintiv”, the “Company”, “we”, “us” and “our” may, where applicable, refer only to or include any relevant direct and indirect subsidiary corporations and partnerships (“Subsidiaries”) of Ovintiv Inc., and the assets, activities and initiatives of such Subsidiaries. 16

Advisory Regarding Oil & Gas Information All reserves estimates referenced in this presentation are effective as of December 31, 2020, prepared by qualified reserves evaluators in accordance with procedures and standards contained in the Canadian Oil and Gas Evaluation ( COGE ) Handbook, National Instrument 51-101 (NI 51-101) and SEC regulations, as applicable. Detailed Canadian and U.S. protocol disclosure will be contained in the Form 51-101F1 and Annual Report on Form 10-K, respectively. Information on the forecast prices and costs used in preparing the Canadian protocol estimates are contained in the Form 51-101F1. For additional information relating to risks associated with the estimates of reserves, see Item 1A. Risk Factors of the Annual Report on Form 10-K. Reserves are the estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, from a given date forward, based on: analysis of drilling, geological, geophysical and engineering data, the use of established technology, and specified economic conditions, which are generally accepted as being reasonable. Proved reserves are those reserves which can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves. Ovintiv uses the terms play and resource play. Play encompasses resource plays, geological formations and conventional plays. Resource play describes an accumulation of hydrocarbons known to exist over a large areal expanse and/or thick vertical section, which when compared to a conventional play, typically has a lower geological and/or commercial development risk and lower average decline rate. Certain information contained within this presentation may constitute “analogous information” as defined in NI 51-101. Analogous information is presented on a basin, sub-basin or area basis utilizing data derived from Ovintiv's internal sources, as well as from a variety of publicly available information sources which are predominantly independent in nature. Production type curves are based on a methodology of analog, empirical and theoretical assessments and workflow with consideration of the specific asset, but are not necessarily indicative of ultimate recovery. Some of this data may not have been prepared by qualified reserves evaluators, may have been prepared based on internal estimates, and the preparation of any estimates may not be in strict accordance with COGEH. Estimates by engineering and geo-technical practitioners may vary and the differences may be significant. Estimates of Ovintiv’s potential gross inventory locations, including premium return well inventory, include proved undeveloped reserves, probable undeveloped reserves and unbooked inventory locations. As of December 31, 2020, on a proforma basis, 1,340 proved undeveloped locations and 1,644 probable undeveloped locations have been categorized as reserves. Unbooked locations have not been classified as reserves and are internal estimates that have been identified by management as an estimation of Ovintiv's multi-year potential drilling activities based on evaluation of applicable geologic, seismic, engineering, production, resource and acreage information. There is no certainty that Ovintiv will drill all unbooked locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, or production. The locations on which Ovintiv will actually drill wells, including the number and timing thereof is ultimately dependent upon the availability of capital, regulatory and partner approvals, seasonal restrictions, equipment and personnel, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained, production rate recovery, transportation constraints and other factors. While certain of the unbooked locations may have been de-risked by drilling existing wells in relative close proximity to such locations, many other unbooked locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional proved or probable reserves, resources or production. 30-day IP and other short-term rates are not necessarily indicative of long-term performance or of ultimate recovery. The conversion of natural gas volumes to barrels of oil equivalent (“BOE”) is on the basis of six thousand cubic feet to one barrel. BOE is based on a generic energy equivalency conversion method primarily applicable at the burner tip and does not represent economic value equivalency at the wellhead. Readers are cautioned that BOE may be misleading, particularly if used in isolation. 17Advisory Regarding Oil & Gas Information All reserves estimates referenced in this presentation are effective as of December 31, 2020, prepared by qualified reserves evaluators in accordance with procedures and standards contained in the Canadian Oil and Gas Evaluation ( COGE ) Handbook, National Instrument 51-101 (NI 51-101) and SEC regulations, as applicable. Detailed Canadian and U.S. protocol disclosure will be contained in the Form 51-101F1 and Annual Report on Form 10-K, respectively. Information on the forecast prices and costs used in preparing the Canadian protocol estimates are contained in the Form 51-101F1. For additional information relating to risks associated with the estimates of reserves, see Item 1A. Risk Factors of the Annual Report on Form 10-K. Reserves are the estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, from a given date forward, based on: analysis of drilling, geological, geophysical and engineering data, the use of established technology, and specified economic conditions, which are generally accepted as being reasonable. Proved reserves are those reserves which can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves. Ovintiv uses the terms play and resource play. Play encompasses resource plays, geological formations and conventional plays. Resource play describes an accumulation of hydrocarbons known to exist over a large areal expanse and/or thick vertical section, which when compared to a conventional play, typically has a lower geological and/or commercial development risk and lower average decline rate. Certain information contained within this presentation may constitute “analogous information” as defined in NI 51-101. Analogous information is presented on a basin, sub-basin or area basis utilizing data derived from Ovintiv's internal sources, as well as from a variety of publicly available information sources which are predominantly independent in nature. Production type curves are based on a methodology of analog, empirical and theoretical assessments and workflow with consideration of the specific asset, but are not necessarily indicative of ultimate recovery. Some of this data may not have been prepared by qualified reserves evaluators, may have been prepared based on internal estimates, and the preparation of any estimates may not be in strict accordance with COGEH. Estimates by engineering and geo-technical practitioners may vary and the differences may be significant. Estimates of Ovintiv’s potential gross inventory locations, including premium return well inventory, include proved undeveloped reserves, probable undeveloped reserves and unbooked inventory locations. As of December 31, 2020, on a proforma basis, 1,340 proved undeveloped locations and 1,644 probable undeveloped locations have been categorized as reserves. Unbooked locations have not been classified as reserves and are internal estimates that have been identified by management as an estimation of Ovintiv's multi-year potential drilling activities based on evaluation of applicable geologic, seismic, engineering, production, resource and acreage information. There is no certainty that Ovintiv will drill all unbooked locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, or production. The locations on which Ovintiv will actually drill wells, including the number and timing thereof is ultimately dependent upon the availability of capital, regulatory and partner approvals, seasonal restrictions, equipment and personnel, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained, production rate recovery, transportation constraints and other factors. While certain of the unbooked locations may have been de-risked by drilling existing wells in relative close proximity to such locations, many other unbooked locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional proved or probable reserves, resources or production. 30-day IP and other short-term rates are not necessarily indicative of long-term performance or of ultimate recovery. The conversion of natural gas volumes to barrels of oil equivalent (“BOE”) is on the basis of six thousand cubic feet to one barrel. BOE is based on a generic energy equivalency conversion method primarily applicable at the burner tip and does not represent economic value equivalency at the wellhead. Readers are cautioned that BOE may be misleading, particularly if used in isolation. 17

Non-GAAP Measures Certain measures in this presentation do not have any standardized meaning as prescribed by U.S. GAAP and, therefore, are considered non-GAAP measures. These measures may not be comparable to similar measures presented by other companies. These measures have been provided for meaningful comparisons between current results and other periods and should not be viewed as a substitute for measures reported under U.S. GAAP. For additional information regarding non-GAAP measures, including reconciliations, see the Company’s website and Ovintiv’s most recent Annual Report as filed on SEDAR and EDGAR. This presentation contains references to non-GAAP measures as follows: • Non-GAAP Cash Flow and Non-GAAP Free Cash Flow – Non-GAAP Cash Flow (or Cash Flow) is defined • Net Debt, Adjusted EBITDA and Net Debt to Adjusted EBITDA and Annualized Leverage – Net Debt is as cash from (used in) operating activities excluding net change in other assets and liabilities, net defined as long-term debt, including the current portion, less cash and cash equivalents. Management change in non-cash working capital and current tax on sale of assets. Non-GAAP Free Cash Flow (or uses this measure as a substitute for total long-term debt in certain internal debt metrics as a measure Free Cash Flow) is Non-GAAP Cash Flow in excess of capital expenditures, excluding net acquisitions and of the company’s ability to service debt obligations and as an indicator of the company’s overall divestitures. Management believes these measures are useful to the company and its investors as a financial strength. Adjusted EBITDA is defined as trailing 12-month net earnings (loss) before income measure of operating and financial performance across periods and against other companies in the taxes, DD&A, impairments, accretion of asset retirement obligation, interest, unrealized gains/losses on industry, and are an indication of the company’s ability to generate cash to finance capital programs, risk management, foreign exchange gains/losses, gains/losses on divestitures and other gains/losses. to service debt and to meet other financial obligations. These measures may be used, along with other Net Debt to Adjusted EBITDA is monitored by management as an indicator of the company’s overall measures, in the calculation of certain performance targets for the company’s management and financial strength. Annualized leverage is defined as net debt to adjusted EBITDA based on Adjusted employees. EBITDA generated in the period(s) on an annualized basis. • Total Costs is non-GAAP measure which includes the summation of production, mineral and other • Upstream Operating Cash Flow – Upstream Operating Cash Flow is a measure that adjusts the taxes, upstream transportation and processing expense, upstream operating expense and Canadian, USA and China Operations revenues for production, mineral and other taxes, transportation administrative expense, excluding the impact of long-term incentive costs, restructuring costs and and processing expense, and operating expense. Management monitors Upstream Operating Cash current expected credit losses. It is calculated as total operating expenses excluding non-upstream Flow as it reflects operating performance and measures the amount of cash generated from the operating costs and non-cash items which include operating expenses from the Market Optimization company’s upstream operations. and Corporate and Other segments, depreciation, depletion and amortization, impairments, accretion of asset retirement obligation, long-term incentive costs, restructuring costs and current expected • Upstream Operating Free Cash Flow – is defined as Upstream Operating Cash Flow in excess of capital credit losses. When presented on a per BOE basis, Total Costs is divided by production volumes. investment, excluding net acquisitions and divestitures Management believes this measure is useful to the company and its investors as a measure of operational efficiency across periods. 18Non-GAAP Measures Certain measures in this presentation do not have any standardized meaning as prescribed by U.S. GAAP and, therefore, are considered non-GAAP measures. These measures may not be comparable to similar measures presented by other companies. These measures have been provided for meaningful comparisons between current results and other periods and should not be viewed as a substitute for measures reported under U.S. GAAP. For additional information regarding non-GAAP measures, including reconciliations, see the Company’s website and Ovintiv’s most recent Annual Report as filed on SEDAR and EDGAR. This presentation contains references to non-GAAP measures as follows: • Non-GAAP Cash Flow and Non-GAAP Free Cash Flow – Non-GAAP Cash Flow (or Cash Flow) is defined • Net Debt, Adjusted EBITDA and Net Debt to Adjusted EBITDA and Annualized Leverage – Net Debt is as cash from (used in) operating activities excluding net change in other assets and liabilities, net defined as long-term debt, including the current portion, less cash and cash equivalents. Management change in non-cash working capital and current tax on sale of assets. Non-GAAP Free Cash Flow (or uses this measure as a substitute for total long-term debt in certain internal debt metrics as a measure Free Cash Flow) is Non-GAAP Cash Flow in excess of capital expenditures, excluding net acquisitions and of the company’s ability to service debt obligations and as an indicator of the company’s overall divestitures. Management believes these measures are useful to the company and its investors as a financial strength. Adjusted EBITDA is defined as trailing 12-month net earnings (loss) before income measure of operating and financial performance across periods and against other companies in the taxes, DD&A, impairments, accretion of asset retirement obligation, interest, unrealized gains/losses on industry, and are an indication of the company’s ability to generate cash to finance capital programs, risk management, foreign exchange gains/losses, gains/losses on divestitures and other gains/losses. to service debt and to meet other financial obligations. These measures may be used, along with other Net Debt to Adjusted EBITDA is monitored by management as an indicator of the company’s overall measures, in the calculation of certain performance targets for the company’s management and financial strength. Annualized leverage is defined as net debt to adjusted EBITDA based on Adjusted employees. EBITDA generated in the period(s) on an annualized basis. • Total Costs is non-GAAP measure which includes the summation of production, mineral and other • Upstream Operating Cash Flow – Upstream Operating Cash Flow is a measure that adjusts the taxes, upstream transportation and processing expense, upstream operating expense and Canadian, USA and China Operations revenues for production, mineral and other taxes, transportation administrative expense, excluding the impact of long-term incentive costs, restructuring costs and and processing expense, and operating expense. Management monitors Upstream Operating Cash current expected credit losses. It is calculated as total operating expenses excluding non-upstream Flow as it reflects operating performance and measures the amount of cash generated from the operating costs and non-cash items which include operating expenses from the Market Optimization company’s upstream operations. and Corporate and Other segments, depreciation, depletion and amortization, impairments, accretion of asset retirement obligation, long-term incentive costs, restructuring costs and current expected • Upstream Operating Free Cash Flow – is defined as Upstream Operating Cash Flow in excess of capital credit losses. When presented on a per BOE basis, Total Costs is divided by production volumes. investment, excluding net acquisitions and divestitures Management believes this measure is useful to the company and its investors as a measure of operational efficiency across periods. 18

Solicitation of Proxies & Information Regarding Participants SOLICITATION OF PROXIES – Ovintiv intends to file a proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities in connection with its solicitation of proxies for its 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”). OVINTIV STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by Ovintiv with the SEC without charge from the SEC’s website at www.sec.gov and Canadian securities regulatory authorities at www.sedar.com. Certain Information Regarding Participants Ovintiv, its directors and certain of its executive officers may be deemed to be participants in connection with the solicitation of proxies from Ovintiv’s stockholders in connection with the matters to be considered at the 2021 Annual Meeting. Information regarding the ownership of Ovintiv’s directors and executive officers in Ovintiv common stock is included in their SEC filings on Forms 3, 4, and 5, which can be found through the SEC’s website at www.sec.gov. Information can also be found in Ovintiv’s other SEC filings. More detailed and updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC. These documents can be obtained free of charge from the sources indicated above. 19Solicitation of Proxies & Information Regarding Participants SOLICITATION OF PROXIES – Ovintiv intends to file a proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities in connection with its solicitation of proxies for its 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”). OVINTIV STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by Ovintiv with the SEC without charge from the SEC’s website at www.sec.gov and Canadian securities regulatory authorities at www.sedar.com. Certain Information Regarding Participants Ovintiv, its directors and certain of its executive officers may be deemed to be participants in connection with the solicitation of proxies from Ovintiv’s stockholders in connection with the matters to be considered at the 2021 Annual Meeting. Information regarding the ownership of Ovintiv’s directors and executive officers in Ovintiv common stock is included in their SEC filings on Forms 3, 4, and 5, which can be found through the SEC’s website at www.sec.gov. Information can also be found in Ovintiv’s other SEC filings. More detailed and updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC. These documents can be obtained free of charge from the sources indicated above. 19

2020

AppendixAppendix

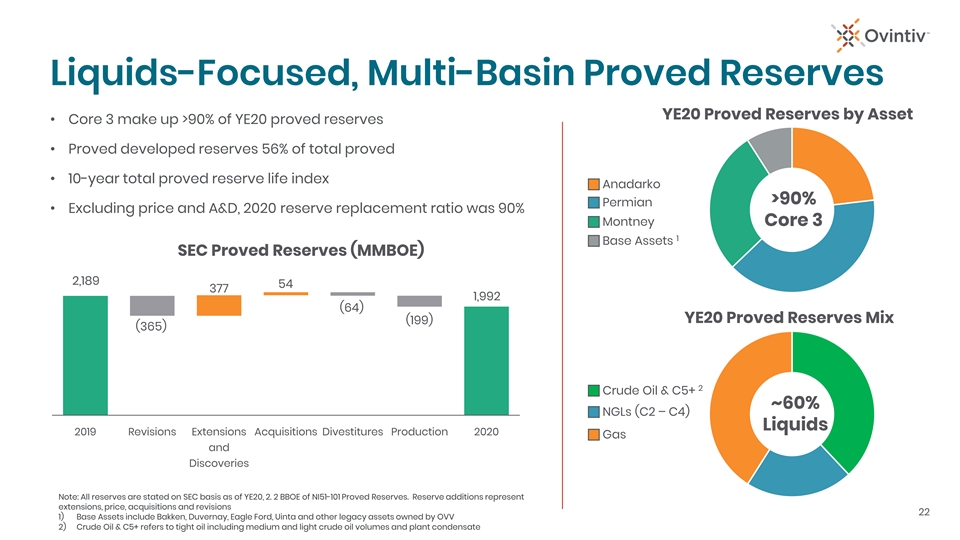

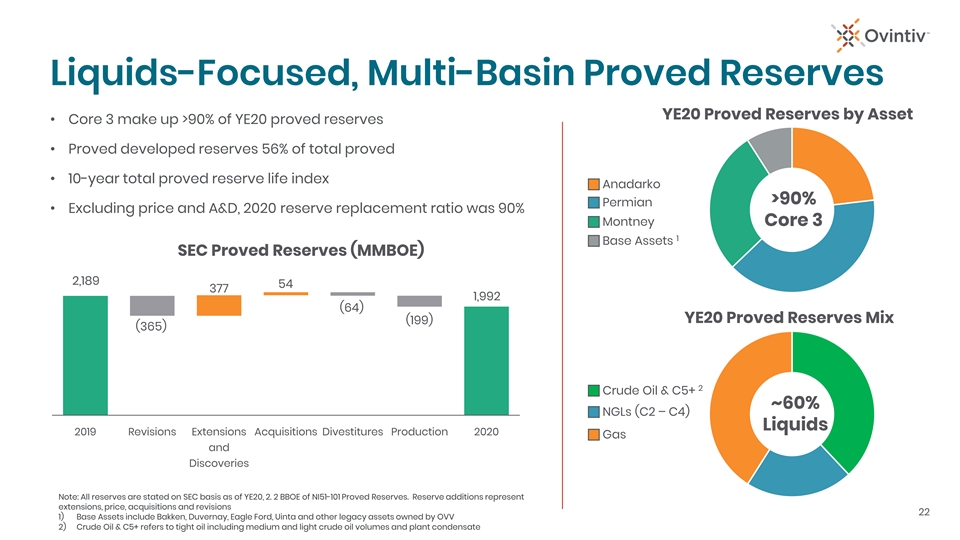

Liquids-Focused, Multi-Basin Proved Reserves YE20 Proved Reserves by Asset • Core 3 make up >90% of YE20 proved reserves • Proved developed reserves 56% of total proved • 10-year total proved reserve life index Anadarko >90% Permian • Excluding price and A&D, 2020 reserve replacement ratio was 90% Montney Core 3 1 Base Assets SEC Proved Reserves (MMBOE) 2,189 54 377 1,992 (64) YE20 Proved Reserves Mix (199) (365) 2 Crude Oil & C5+ ~60% NGLs (C2 – C4) Liquids 2019 Revisions Extensions Acquisitions Divestitures Production 2020 Gas and Discoveries Note: All reserves are stated on SEC basis as of YE20, 2. 2 BBOE of NI51-101 Proved Reserves. Reserve additions represent extensions, price, acquisitions and revisions 22 1) Base Assets include Bakken, Duvernay, Eagle Ford, Uinta and other legacy assets owned by OVV 2) Crude Oil & C5+ refers to tight oil including medium and light crude oil volumes and plant condensateLiquids-Focused, Multi-Basin Proved Reserves YE20 Proved Reserves by Asset • Core 3 make up >90% of YE20 proved reserves • Proved developed reserves 56% of total proved • 10-year total proved reserve life index Anadarko >90% Permian • Excluding price and A&D, 2020 reserve replacement ratio was 90% Montney Core 3 1 Base Assets SEC Proved Reserves (MMBOE) 2,189 54 377 1,992 (64) YE20 Proved Reserves Mix (199) (365) 2 Crude Oil & C5+ ~60% NGLs (C2 – C4) Liquids 2019 Revisions Extensions Acquisitions Divestitures Production 2020 Gas and Discoveries Note: All reserves are stated on SEC basis as of YE20, 2. 2 BBOE of NI51-101 Proved Reserves. Reserve additions represent extensions, price, acquisitions and revisions 22 1) Base Assets include Bakken, Duvernay, Eagle Ford, Uinta and other legacy assets owned by OVV 2) Crude Oil & C5+ refers to tight oil including medium and light crude oil volumes and plant condensate

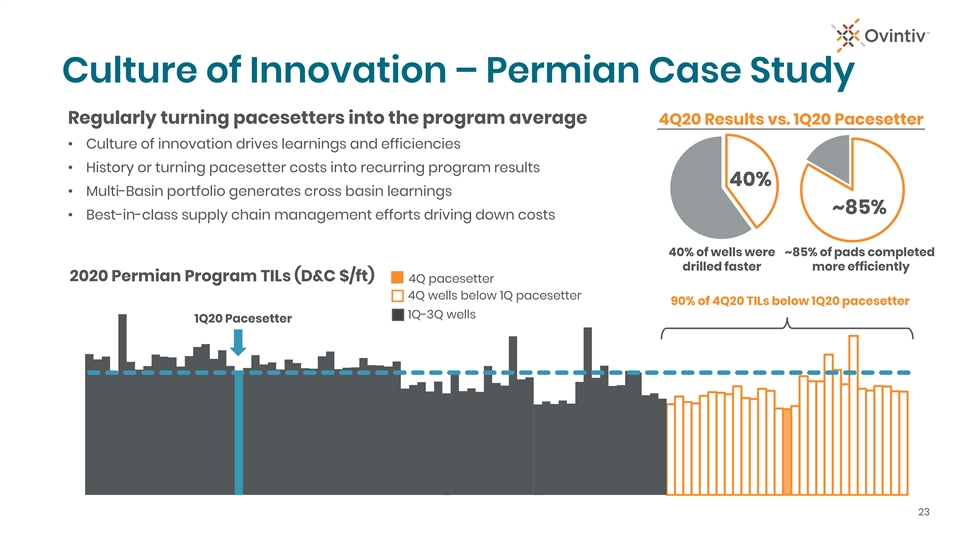

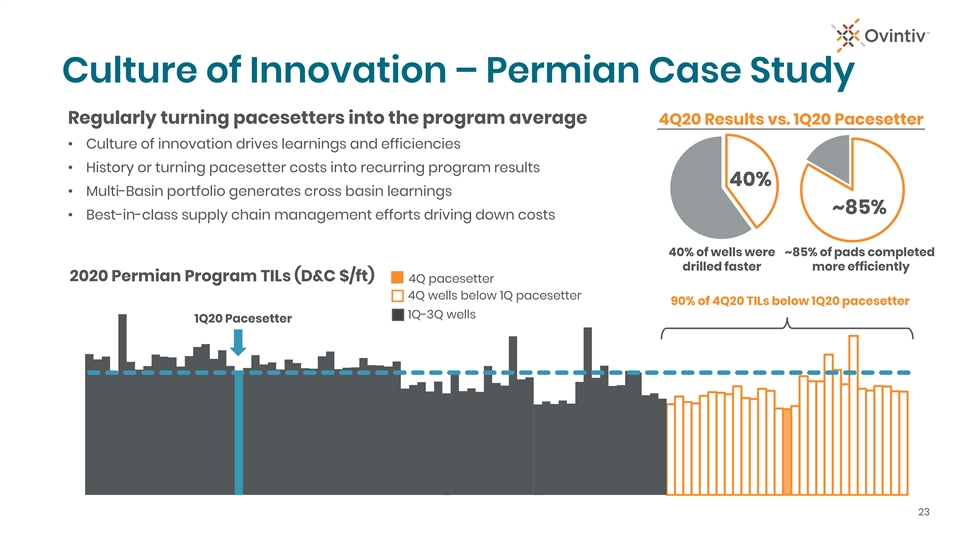

Culture of Innovation – Permian Case Study Regularly turning pacesetters into the program average 4Q20 Results vs. 1Q20 Pacesetter • Culture of innovation drives learnings and efficiencies • History or turning pacesetter costs into recurring program results 40% • Multi-Basin portfolio generates cross basin learnings ~85% • Best-in-class supply chain management efforts driving down costs 40% of wells were ~85% of pads completed drilled faster more efficiently 2020 Permian Program TILs (D&C $/ft) 4Q pacesetter 4Q wells below 1Q pacesetter 90% of 4Q20 TILs below 1Q20 pacesetter 1Q-3Q wells 1Q20 Pacesetter 23Culture of Innovation – Permian Case Study Regularly turning pacesetters into the program average 4Q20 Results vs. 1Q20 Pacesetter • Culture of innovation drives learnings and efficiencies • History or turning pacesetter costs into recurring program results 40% • Multi-Basin portfolio generates cross basin learnings ~85% • Best-in-class supply chain management efforts driving down costs 40% of wells were ~85% of pads completed drilled faster more efficiently 2020 Permian Program TILs (D&C $/ft) 4Q pacesetter 4Q wells below 1Q pacesetter 90% of 4Q20 TILs below 1Q20 pacesetter 1Q-3Q wells 1Q20 Pacesetter 23

Financial & Operational Detail Ŧ Total Costs 2021 Guidance Details FY21 Upstream T&P $12.59 Crude & Condensate (Mbbls/d) ~200 $12.25 – $12.50 $11.60 PMOT NGLs C2 – C4 (Mbbls/d) ~80 Natural Gas (MMcf/d) ~1,550 Upstream Opex Capital Expenditures ($ MM) ~$1,500 G&A Ŧ Total Costs ($ / BOE) ~$12.25 – $12.50 Note: Crude and condensate is approximately 75% / 25% respectively ‘21 Total Cost Guidance Drivers 2021 Corporate Items • Operating and G&A flat versus ‘20 Quarterly Run Rate ` • PMOT up ~$0.25-$0.30/BOE from Ŧ stronger commodity prices Market Optimization (Cash Flow Impact) $28 - $30 MM • T&P up ~$0.40 - $0.45/BOE from Corporate G&A (Excluding LTI) ~$70 - $74 MM additional T&P capacity in place Less Sublease Revenue ~$19 MM to optimize margins Corporate G&A Less Sublease Rev. $51 - $55 MM Interest Expense on debt $85 - $90 MM FY19 FY20 2021F F/X Rates Consolidated DD&A $7.15 / BOE 0.754 0.746 ~0.75 24 Note: Total Costs include BOW lease in G&A, before sublease revenues. Total Costs upstream Opex excludes LTI and G&A excludes LTI and restructuring costs Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s websiteFinancial & Operational Detail Ŧ Total Costs 2021 Guidance Details FY21 Upstream T&P $12.59 Crude & Condensate (Mbbls/d) ~200 $12.25 – $12.50 $11.60 PMOT NGLs C2 – C4 (Mbbls/d) ~80 Natural Gas (MMcf/d) ~1,550 Upstream Opex Capital Expenditures ($ MM) ~$1,500 G&A Ŧ Total Costs ($ / BOE) ~$12.25 – $12.50 Note: Crude and condensate is approximately 75% / 25% respectively ‘21 Total Cost Guidance Drivers 2021 Corporate Items • Operating and G&A flat versus ‘20 Quarterly Run Rate ` • PMOT up ~$0.25-$0.30/BOE from Ŧ stronger commodity prices Market Optimization (Cash Flow Impact) $28 - $30 MM • T&P up ~$0.40 - $0.45/BOE from Corporate G&A (Excluding LTI) ~$70 - $74 MM additional T&P capacity in place Less Sublease Revenue ~$19 MM to optimize margins Corporate G&A Less Sublease Rev. $51 - $55 MM Interest Expense on debt $85 - $90 MM FY19 FY20 2021F F/X Rates Consolidated DD&A $7.15 / BOE 0.754 0.746 ~0.75 24 Note: Total Costs include BOW lease in G&A, before sublease revenues. Total Costs upstream Opex excludes LTI and G&A excludes LTI and restructuring costs Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website

Key Modeling Assumptions Hedge Positions (January 31, 2021) FY Consolidated Sensitivities Oil and Condensate $ rounded Unhedged $ rounded F/X +0.05 1Q21 2Q21 3Q21 4Q21 2021 90 74 69 69 75 Volume Mbbls/d Oil: +/- $5 $375 MM Cash Flow $(50) MM WTI 3-Way Call Strike $/bbl $50.03 $51.05 $52.65 $52.65 $51.48 Options Put Strike $/bbl $40.66 $41.32 $42.53 $42.53 $41.68 Ŧ Gas: +/- $0.25 $140 MM Total Costs $0.40 / BOE Put (Sold) Strike $/bbl $32.58 $32.29 $32.82 $32.82 $32.62 Volume Mbbls/d 50 40 30 30 37 WTI Swaps Price $/bbl $44.49 $47.54 $46.37 $46.37 $46.06 WTI Volume Mbbls/d 15 15 15 15 15 Costless Call Strike $/bbl $45.84 $45.84 $45.84 $45.84 $45.84 Collars Put Strike $/bbl $35.00 $35.00 $35.00 $35.00 $35.00 Natural Gas 1Q21 2Q21 3Q21 4Q21 2021 880 1,030 1,030 880 955 Volume MMcf/d NYMEX $3.55 $3.37 $3.37 $3.35 $3.41 Call Strike $/mcf 3-Way Put Strike $/mcf $2.90 $2.87 $2.87 $2.88 $2.88 Options Put (Sold) Strike $/mcf $2.50 $2.50 $2.50 $2.50 $2.50 - - 165 165 83 NYMEX Volume MMcf/d Swaps Price $/mcf $2.51 $2.51 $2.51 Ovintiv also manages key market basis differential risks for gas and liquids 25 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s websiteKey Modeling Assumptions Hedge Positions (January 31, 2021) FY Consolidated Sensitivities Oil and Condensate $ rounded Unhedged $ rounded F/X +0.05 1Q21 2Q21 3Q21 4Q21 2021 90 74 69 69 75 Volume Mbbls/d Oil: +/- $5 $375 MM Cash Flow $(50) MM WTI 3-Way Call Strike $/bbl $50.03 $51.05 $52.65 $52.65 $51.48 Options Put Strike $/bbl $40.66 $41.32 $42.53 $42.53 $41.68 Ŧ Gas: +/- $0.25 $140 MM Total Costs $0.40 / BOE Put (Sold) Strike $/bbl $32.58 $32.29 $32.82 $32.82 $32.62 Volume Mbbls/d 50 40 30 30 37 WTI Swaps Price $/bbl $44.49 $47.54 $46.37 $46.37 $46.06 WTI Volume Mbbls/d 15 15 15 15 15 Costless Call Strike $/bbl $45.84 $45.84 $45.84 $45.84 $45.84 Collars Put Strike $/bbl $35.00 $35.00 $35.00 $35.00 $35.00 Natural Gas 1Q21 2Q21 3Q21 4Q21 2021 880 1,030 1,030 880 955 Volume MMcf/d NYMEX $3.55 $3.37 $3.37 $3.35 $3.41 Call Strike $/mcf 3-Way Put Strike $/mcf $2.90 $2.87 $2.87 $2.88 $2.88 Options Put (Sold) Strike $/mcf $2.50 $2.50 $2.50 $2.50 $2.50 - - 165 165 83 NYMEX Volume MMcf/d Swaps Price $/mcf $2.51 $2.51 $2.51 Ovintiv also manages key market basis differential risks for gas and liquids 25 Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website