January 20, 2022, the Vice Chancellor issued her decision on our motion to dismiss, ruling that the Action is stayed until the Compensation Committee itself resolves whether it has sole authority to resolve the parties’ contract interpretation dispute. On August 2, 2022 the Vice Chancellor issued an order dismissing the action, but Terrell filed a notice of appeal to the Delaware Supreme Court later that month. The appeal remains pending.

Subsequently, the parties agreed upon a process for coordinating submissions and/or presentations to the Compensation Committee. The parties made their respective written submissions to the Compensation Committee on March 31, 2022, and on July 21, 2022, the Compensation Committee determined that (i) the Compensation Committee has sole authority

under the SOA to resolve the parties’ contract interpretation dispute, and (ii) Terrell’s most recent options agreement superseded and nullified any option rights Terrell may have had under his prior agreements. On August 2, 2022, the Vice Chancellor issued an order dismissing the Action for lack of subject matter jurisdiction.

On August 23, 2022, Terrell filed a notice of appeal of the Vice Chancellor’s order of dismissal to the Delaware Supreme Court. The appeal was fully briefed between October and November 2022, and oral argument was held before the Delaware Supreme Court on February 8, 2023. The Delaware Supreme Court reserved decision, and the appeal remains pending and undecided as of the date of this filing.

In a separate matter, on or about August 17 and 23, 2021, Tony Tontat, who at the time was the Chief Financial Officer and a member of the Board, submitted substantially identical reports (the “Complaints”) through the Company’s complaint hotline. These Complaints, alleged, among other topics, risks associated with the Company’s public disclosures in securities filings and in statements made to the public, investors, and potential investors regarding (i) the anticipated timing of the FDA authorization of the IND applications and (ii) the anticipated timing of human clinical trials. These Complaints were subsequently submitted to the Audit Committee of the Board.

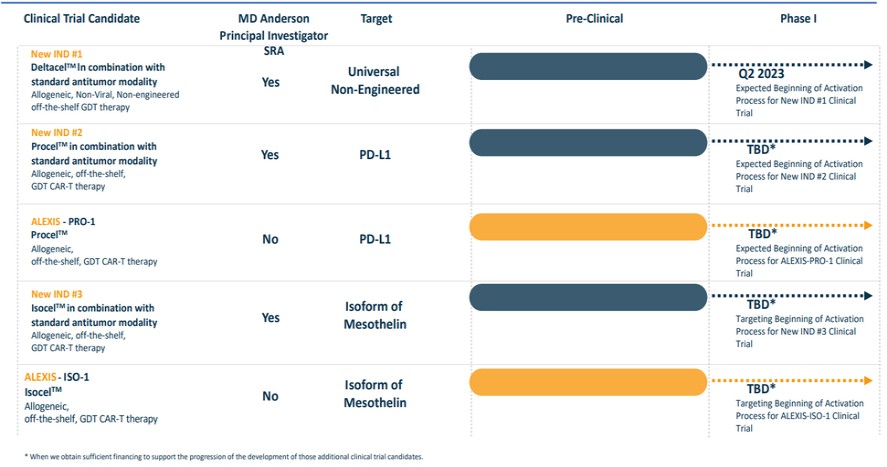

After receiving the Complaints, the Audit Committee recommended that the Board form, and the Board did in turn form, a Special Committee comprised of three independent directors (the “Special Committee”) to review the Complaints and other related issues (the “Internal Review”). The Special Committee retained an independent counsel to assist it in conducting the Internal Review.On February 2, 2022, following the conclusion of the Internal Review, the Special Committee reported the results of its Internal Review to the Board. The Board approved certain actions to address the fact that we had received communications from the FDA on June 16 and June 17, 2021, that the FDA was placing the IND applications that we submitted to the FDA on May 14 and May 17, 2021, for the ALEXIS-PRO-1 and ALEXIS-ISO-1 product candidates, respectively, on clinical hold (the “June 16 and 17 FDA Communications”). On July 13, 2021, we received the FDA’s formal clinical hold letters, which asked us to address key components regarding the chemical, manufacturing, and control components of the IND applications. On July 16, 2021, we issued a press release disclosing that we had received comments from the FDA on the two INDs, but did not use the term “clinical hold.” We then consummated a public offering of $40 million of our common stock pursuant to the Registration Statement on July 2, 2021. On August 13, 2021, we issued a press release announcing that these INDs were placed on clinical hold. We did not disclose the June 16 and 17, 2021 FDA Communications in (i) the Registration Statement on Form S-1 (Registration No. 333-257427) that was filed on June 25, 2021 and declared effective on June 29, 2021, nor the final prospectus contained therein dated June 29, 2021 (collectively, the “Registration Statement”); or (ii) the Form 10-Q for the fiscal quarter ended June 30, 2021 that was filed with the Securities and Exchange Commission on August 13, 2021.

As a result of the disclosure omission of the June 16 and 17 FDA Communications, on March 7, 2022, entities related to Sabby Management LLC (the “Sabby Entities”) and Empery Asset Management, LP (the “Empery Entities”) filed a complaint in the United States District Court for the Southern District of New York asserting claims against us and certain current and former officers and directors of the Company for alleged violations of Sections 11, 12, and 15 of the Securities Act of 1933 in connection with the purchase of common stock through our public offering that closed on July 2, 2021. On July 1, 2022, the defendants filed motions to dismiss the complaint. In response, on July 22, 2022, the plaintiffs amended their complaint to, among other things, include our underwriters on the July 2, 2021, public offering, ThinkEquity LLC, as a defendant. The plaintiffs seek unspecified damages; rescission to the extent they still hold our securities, or if sold, rescissory damages; reasonable costs and expenses, including attorneys’ and experts’ fees; and other unspecified equitable and injunctive relief. The two parties reached a settlement agreement in principle on September 26, 2022, which our board of directors approved on September 27, 2022. The settlement contained a cash component of $75,000 payable to Sabby Entities and $75,000 to Empery Entities.

As part of the settlement, we also agreed to issue subordinated convertible notes (the “Settlement Notes”) in the aggregate principal amount of $1,656,720 to each of the Empery Entities and the Sabby Entities. The Settlement Notes are convertible into shares (the “Conversion Shares”) of our common stock at an initial conversion price per share of