Exhibit 2

DISCLAIMER This presentation contains forward - looking statements that can be identified by the use of forward - looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others . Forward - looking statements appear in a number of places in this presentation and include, but are not limited to, statements regarding our intent, belief or current expectations . Forward - looking statements are based on our management’s beliefs and assumptions and on information currently available to our management . Forward - looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events . Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward - looking statements . Further information on these and other factors that could affect our financial results is included in filings we have made and will make with the U . S . Securities and Exchange Commission from time to time, including in the section titled “Risk Factors” in our most recent Form F - 1 and 424 (b) prospectus . These documents are avaialble on the SEC Filings section of the investor relations section of our website at : https : //ir . vastaplatform . com . We prepared this presentation solely for informational purposes . The information in this presentation does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any of our securities or securities of our subsidiaries or affiliates, nor should it or any part of it form the basis of, or be relied on in connection with any contract to purchase or subscribe for any of our securities or any of our subsidiaries or affiliates nor shall it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever . We have included in this presentation our EBITDA, Adjusted EBITDA, Free Cash Flow and Adjusted Cash Conversion Ratio, which are non - GAAP financial measures, together with their reconciliations, for the periods indicated . We understand that, although EBITDA, Adjusted EBITDA, Free Cash Flow and Adjusted Cash Conversion Ratio are used by investors and securities analysts in their evaluation of companies, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under IFRS . Additionally, our calculations of Adjusted EBITDA, Free Cash Flow and Adjusted Cash Conversion Ratio may be different from the calculation used by other companies, including our competitors in the education services industry, and therefore, our measures may not be comparable to those of other companies .

INDEX August, 2020 2Q20 Earnings Presentation

The largest IPO of a Brazilian education company 1 .

Vasta raised $405 million with its IPO WE APPRECIATE THE TRUST AND CONFIDENCE The IPO puts Vasta in a comfortable cash position to finance its growth history Strong demand with more than 15x the offered volume

RECAP OF OUR MISSION AND BUSINESS CASE 2 .

7 Our Mission “ “ 7 Our mission is to help private K - 12 schools to be better and more profitable, supporting their digital transformation.

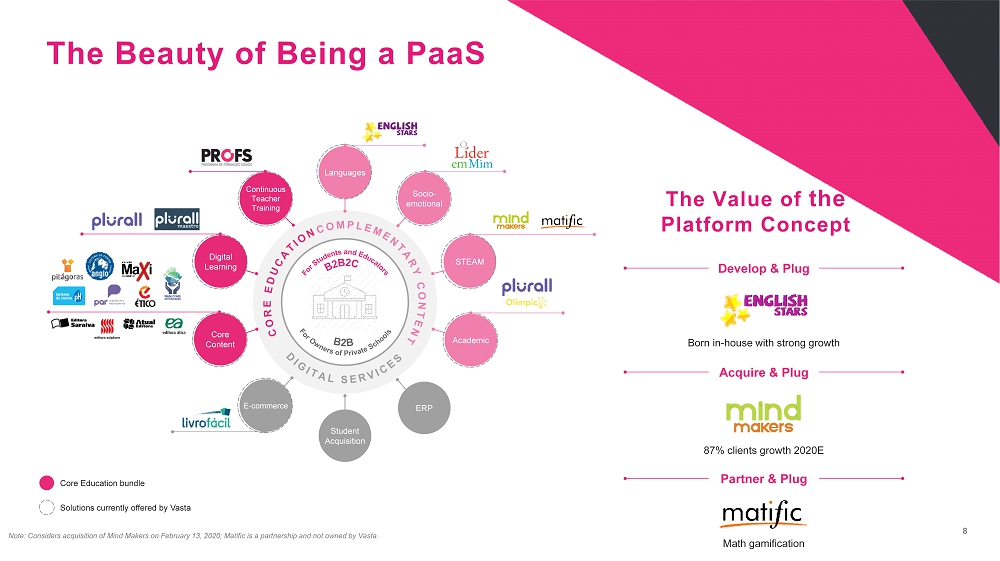

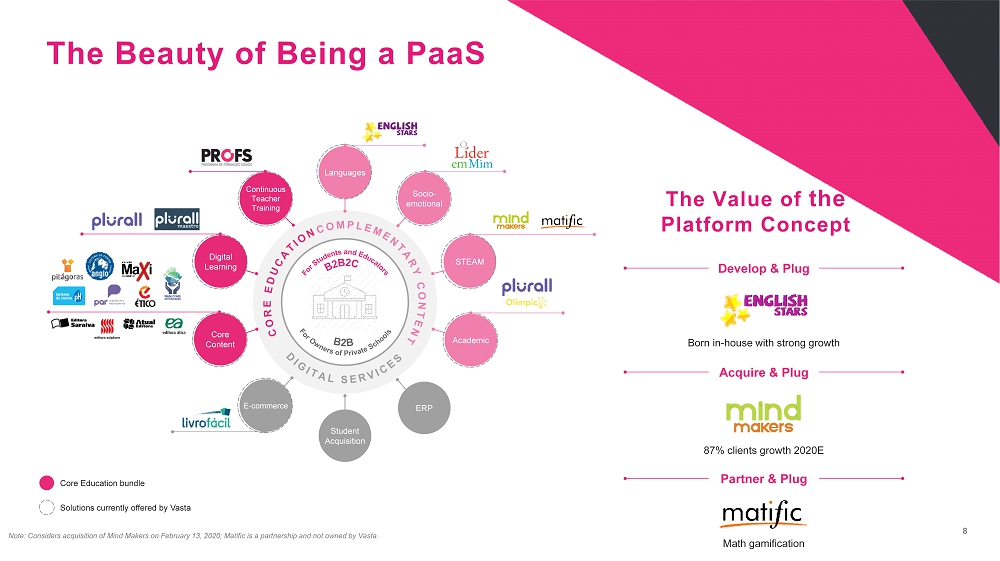

8 Note: Considers acquisition of Mind Makers on February 13, 2020; Matific is a partnership and not owned by Vasta. Solutions currently offered by Vasta Core Education bundle Languages Socio - emotional Continuous Teacher Training Digital Learning Core Content Student Acquisition ERP E - commerce STEAM Academic The Beauty of Being a PaaS The Value of the Platform Concept Develop & Plug Acquire & Plug Partner & Plug Born in - house with strong growth 87% clients growth 2020E Math gamification

9 2Q20 & 1H20 Financial Highlights 3 .

1H20 Results in line with the Flash Numbers Net revenue from sales and services Revenue, EBITDA and Net Loss in accordance with the range established in the prospectus EBITDA Net profit (loss) for the period Prospectus Low High R$507.2 million R$515.6 million R$103.2 million R$111.5 million R$(32.9) million R$(24.1) million 1H20 R$512.7 million R$110.0 million R$(27.3) million

COMPANY READY TO DELIVER 2020 ACV • This chart shows that Vasta is ready to deliver the 2020 ACV; • The graph also shows the seasonality of the business, highlighting the lower representation of the 2Q and 3Q; • Seasonality that was even stronger this year, with revenue concentration in the first half of the business cycle. R$ 676 million 32% 39% 15% 4Q19 1Q20 2Q20 3Q20 2020 ACV 86% of the ACV has already been achieved

Results show a similar behavior 36% 14% 14% 37% 38% 12% 1T 2T 3T 4T % of Net Revenue per quarter¹ 41.6% 0.4% 3% 55% 42.7% - 0.6% 1T 2T 3T 4T % of Adjusted EBITDA per quarter¹ 2019 2020 • This means that, as was the case in 2019, we normally have very strong fourth quarters • As of today , the 2021 ACV campaign reinforces this trend ¹ For 2020, the estimated percentage respects the seasonality of the last year and is based on the current business cycle for 20 21, that is, without considering additional impacts related to Covid - 19 2Q 1Q 4Q 3Q 2Q 1Q 4Q 3Q

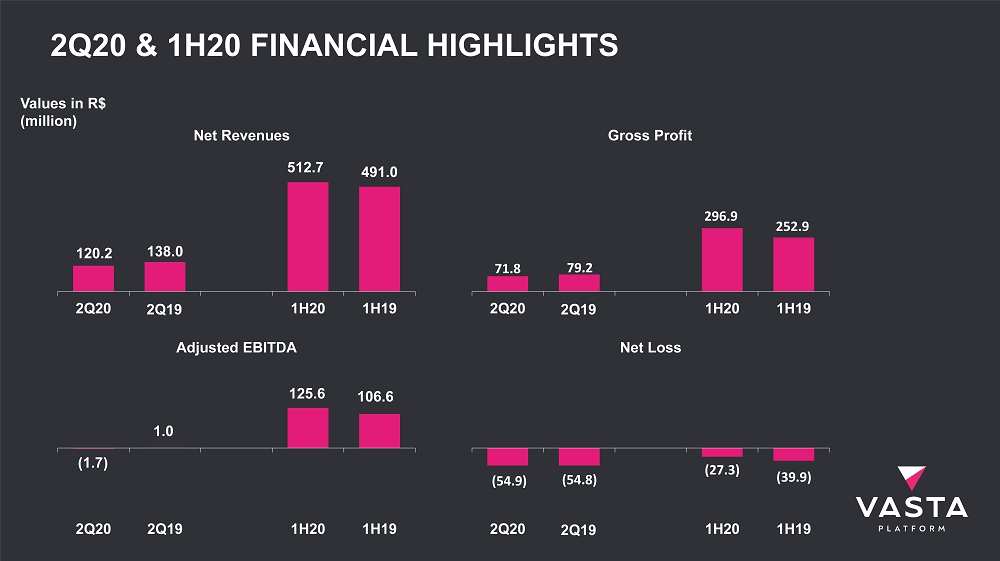

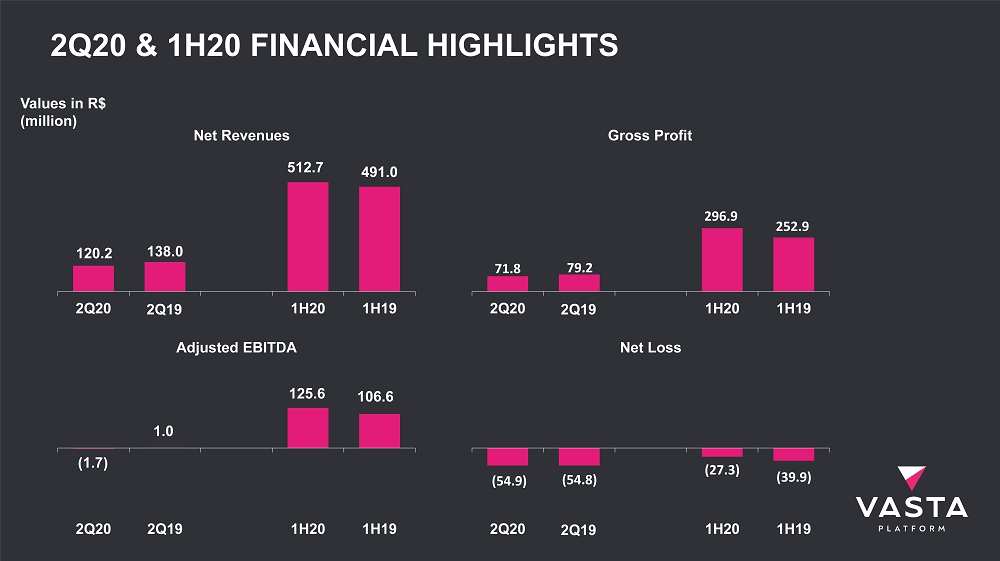

2Q20 & 1H20 FINANCIAL HIGHLIGHTS Net Revenues 71.8 79.2 296.9 252.9 2Q20 2T19 1H20 1H19 Gross Profit Adjusted EBITDA (54.9) (54.8) (27.3) (39.9) 2Q20 2T19 1H20 1H19 Net Loss 120.2 138.0 512.7 491.0 2Q20 2T19 1H20 1H19 Values in R$ (million) (1.7) 1.0 125.6 106.6 2Q20 2Q19 1H20 1H19 2Q19 2Q19 2Q19

Digital education will change the educational world and help Vasta to deliver continuous ACV growth 4 .

Plurall : To Infinity and Beyond! 1 in 4 students (4) uses Plurall as its digital learning platform Trial version is converting 4 times more schools into subscription contracts than regular go - to - market strategy Domain Total Visits (1) (Millions) Traffic Share (%) Vasta (2) 35.7 53.4% Competitor A 15.1 22.6% Competitor E 3.5 5.2% Competitor O 3.2 4.8% Competitor P 2.9 4.4% Competitor B 2.3 3.5% Competitor U 1.4 2.1% Competitor C 1.4 2.1% Competitor S 0.7 1.0% Competitor P 0.6 0.9% Competitor D 0.0 0.1% Competitor F 0.0 0.0% Total Visits (1) Source: Similar Web (www.similarweb.com) 1 Considers the period between May 2020 and July 2020. 2 Includes plurall.net, pdaredepitagoras.com.br and pdaredecrista.com.br. 3 Considers students above 11 years - old in Brazilian K - 12 private schools. – Live classes – Pedagogical Content – Games – Assessments – Tutoring – Homework – Adaptive learning – (...) + 3 million live classes since the beginning of lockdown 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 Jan Feb Mar Apr May Jun Jul plurall.net Competitor A Competitor O Competitor E Competitor P Competitor B Competitor C Competitor U Competitor S Competitor P Competitor Y Competitor D Competitor F Over the last 3 months , Vasta has more than 50% of the educational traffic

16 WINNING PROPOSITION SUPPORTING ALL STAKEHOLDERS TO UNDERGO THE DIGITAL TRANSFORMATION IN PRIVATE K - 12 c STUDENTS PARENTS EDUCATORS OWNERS Empower students with abilities that go beyond core and complementary knowledge Improve real - time engagement and children accountability levels Insights and analytics to target growth and teaching plans delivering personalized learning Differentiated and in - depth understanding of schools’ needs aiming to maximize profitability and time allocation

Investor Relations ir.vastaplatform.com