Filed by Peugeot S.A.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Peugeot S.A.

Form F-4 File No.: 333-240094

Peugeot S.A. posted a copy of the following document on its website on November 23, 2020.

Document made available to the public on November 23, 2020

Peugeot S.A.

Société Anonyme with a share capital of €894,828,213

Route de Gisy, 78140 Vélizy-Villacoublay

552 100 554 R.C.S. Versailles

(the “Company” or “PSA”)

Report of the Managing Board to the Special Meeting of Shareholders Entitled to Double

Voting Rights

Ladies and Gentlemen, Dear Shareholders,

We have convened you to the special meeting of the holders of shares of the Company continuously held in registered form by the same shareholders for a minimum of two years and to which double voting rights are attached pursuant to article 11 of the bylaws of the Company (the “Double Voting Rights”) to be held on January 4, 2021 (the “Special Meeting”) in accordance with the provisions of articles L. 236-9 and L. 225-99 of the French Commercial Code in order for you to approve (i) the contemplated cross-border merger by way of absorption of the Company with and into Fiat Chrysler Automobiles N.V. (“FCA”, together with PSA, the “Merging Companies”), (ii) the removal of the Double Voting Rights, subject to the definitive completion of the aforementioned cross-border merger, and (iii) the powers for formalities.

The following resolutions are submitted to the Special Meeting:

| 1. | Review and approval of the contemplated cross-border merger by way of absorption of the Company with and into FCA; |

| 2. | Removal of the double voting rights; and |

| 3. | Powers for formalities. |

The text of the resolutions submitted to the Special Meeting is attached hereto as Schedule 1.

Information relating to the financial situation, the operations and the results of the Company since the beginning of the ongoing financial year can be found on the Company’s website (https://www.groupe-psa.com) in (i) Section 4.6 of the universal registration document of the Company filed with the French financial markets authority (Autorité des marches financiers) (the “AMF”) on April 21, 2020 , (ii) the half-year financial report of the Company as of June 30, 2020 filed with the AMF on July 27, 2018 and (iii) the press releases published by the Company since the beginning of the ongoing financial year.

A prospectus has been prepared in connection with the application for the listing and admission to trading (i) on the Mercato Telematico Azionario (“MTA”) of the FCA common shares to be issued in the Merger (as such term is defined below), and (ii) on Euronext Paris of the FCA common shares, including the FCA common shares to be issued in the Merger, approved by the Netherlands authority for the financial markets (Autoriteit Financiële Markten) on November 20, 2020 (the “Admission Prospectus”).

This report prepared in accordance with article R. 236-16 of the French commercial code is made available to the shareholders of the Company at the registered office of the Company, Centre Technique de Vélizy, Route de Gisy, 78140 Vélizy-Villacoublay and on the Company’s website (https://www.groupe-psa.com). The Admission Prospectus, which includes a French translation of the summary, is made available to the shareholders of the Company under the same conditions as this report.

| 1. | INFORMATION RELATING TO THE COMPANIES INVOLVED IN THE CROSS-BORDER MERGER |

| 1.1 | PSA |

PSA is a société anonyme incorporated under the laws of France, having its registered office located at Centre Technique de Vélizy, Route de Gisy, 78140 Vélizy-Villacoublay and registered with the Versailles Trade and Companies Register under number 552 100 554.

PSA is the holding company of Groupe PSA (the “Groupe PSA”).

At December 31, 2019, the Company had 656 employees, all located in France. At the same date, Groupe PSA, comprising the Company and its subsidiaries, had 208,780 employees, of whom 62,101 were located in France.

In 2019 Groupe PSA was the second largest car manufacturer in Europe based on the volume of vehicles sold. It has a presence in 160 countries and operates 17 production sites across the world. Groupe PSA sold 1,033,253 and 3,479,096 vehicles and recorded revenue of €25,120 million and €74,731 million and operating income of €482 million and €4,668 million in the six months ended June 30, 2020 and the fiscal year ended December 31, 2019, respectively.

The capital stock of PSA consists of 894,828,213 issued and outstanding ordinary shares, with a nominal value of €1.00 per share (each, a “PSA Ordinary Share”). PSA has also issued to General Motors 39,727,324 outstanding equity warrants giving entitlement to subscribe for PSA Ordinary Shares, on the basis of one PSA Ordinary Share for one equity warrant, at an exercise price of €1.00 per PSA Share, between July 31, 2022 and July 31, 2026 (the “PSA Equity Warrants”).

The Ordinary Shares of PSA are currently listed on Euronext Paris.

| 1.2 | FCA |

FCA is a public limited liability company (naamloze vennootschap), incorporated under the laws of the Netherlands, with corporate seat in Amsterdam, the Netherlands, and address at 25 St. James’s Street, SW1A 1HA, London, United Kingdom, registered with the Dutch trade register under number: 60372958.

The authorized share capital of FCA is forty million Euro (€40,000,000), divided into two billion (2,000,000,000) common shares, with nominal value of one Euro cent (€0.01) per share (each, a “FCA Common Share”) and two billion (2,000,000,000) special voting shares, with a nominal value of one Euro cent (€0.01) per share.

FCA is a global automotive group engaged in designing, engineering, manufacturing, distributing and selling vehicles, components and production systems worldwide through over a hundred manufacturing facilities and over forty research and development centers. FCA has operations in more than forty countries and sells its vehicles directly or through distributors and dealers in more than a hundred and thirty countries.

On December 11, 2019, FCA established a French permanent establishment (the “FCA French PE”), which is registered with the Versailles Trade and Companies Register under number 879 786 085. FCA Common Shares (as defined below) are currently traded on the NYSE and on the MTA.

| 2. | BACKGROUND TO THE MERGER AND REASONS TO MERGE |

| 2.1. | Background |

On December 17, 2019, PSA and FCA entered into a combination agreement, which was subsequently amended on September 14, 2020 (as amended, the “Combination Agreement”), to effect a strategic combination of their businesses.

It is intended that the combination will be achieved by means of a cross-border legal merger pursuant to the provisions of the Directive 2017/1132/EU of the European Parliament and of the Council of June 14, 2017 relating to certain aspects of company law transposed into Dutch law in Part 7, Sections 2, 3 and 3A of Book 2 of the Dutch Civil Code and into French law under articles L. 236-25 et seq. and R. 236-13 et seq. of the French Commercial (the “Merger”).

PSA and FCA entered into the common draft terms of the cross-border merger (the “Cross-Border Merger Terms”) pursuant to which as at the effective time of the Merger, (i) PSA will be merged with and into FCA and will cease to exist as a stand-alone entity, while (ii) by operation of law, FCA, as the surviving entity, will acquire all assets and assume all liabilities, rights, obligations and other legal relationships of PSA.

On the day immediately following completion of the Merger, FCA will be renamed Stellantis N.V. (“Stellantis”).

The Combination Agreement and the Cross-Border Merger Terms are available on the Company’s website (https://www.groupe-psa.com).

| 2.2. | Reasons to merge |

PSA and FCA announced on December 18, 2019 their intention to build a new world leader in the automotive sector that would have the leadership, resources and scale to be at the forefront of a new era of sustainable mobility.

The Merging Companies have the following reasons to merge:

| a) | the Merger will create an industry leader with the management, capabilities, resources and scale to successfully capitalize on the opportunities presented by the new era in sustainable mobility. Following the Merger, Stellantis is expected to be the fourth largest global automotive OEM by volume based on 2019 results. Stellantis will have a balanced and profitable global presence with a highly complementary and iconic brand portfolio; |

| b) | Stellantis will be able to offer an expanded range of models and brands as well as services to better meet customers’ changing needs, with a portfolio of vehicles that will cover all key vehicle segments, from luxury, premium, and mainstream passenger cars to SUVs, trucks and light commercial vehicles; |

| c) | the Merger will add scale and substantial geographic balance in addition to product diversity, as well as accelerating PSA’s entry into significant markets such as North America. FCA’s strength in North America and Latin America and PSA’s solid position in Europe will result in a much greater geographic balance for Stellantis compared to each of FCA and PSA, with approximately 46 percent of revenues derived from Europe, Middle East and Africa and Eurasia and approximately 44 percent from North America, based on combined 2019 revenues, excluding Faurecia. The Merger will also create opportunities for Stellantis to reshape the strategy in other geographic regions, including China; |

| d) | with an already strong global R&D footprint, comprised of 51 centers and approximately 33,000 dedicated employees in the aggregate as of December 31, 2019, excluding Faurecia Stellantis will have a robust base to foster innovation and further drive development of transformational capabilities in new energy vehicles, sustainable mobility, autonomous driving and connectivity, allowing it to effectively compete with other automakers in these emerging trends in the automotive industry. Stellantis will be able to leverage on the best among a broad set of platforms, powertrains and vehicles and to converge new vehicle launches on the most efficient technology. Compared to the Merging Companies separately, Stellantis will have the capacity to accelerate the deployment of electrification technologies and to improve the ability to identify CO2 abating technologies preferred by customers. Stellantis will be able to deploy these technologies across its broad range of brands in a shorter timeframe and react more quickly to changes in regulation and customer preferences; |

| e) | the Merging Companies expect synergies to be achieved in the following four areas: (i) technology, platforms and products: the sharing and convergence of PSA’s and FCA’s respective platforms, products and powertrains along with the optimization of R&D investments and manufacturing processes is expected to create significant efficiencies, in particular, as investments will be amortized over the combined production of the Merging Companies; (ii) purchasing: procurement savings are expected to result from leveraging the Stellantis’s enlarged scale, leading to lower product costs and broader access to new suppliers (in particular in respect to electric or high tech components), as well as from the harmonization of platforms; (iii) selling, general and administrative expenses (“G&A”‘): savings are expected from the integration of functions such as sales and marketing, and the optimization of costs in regions where both parties have a well-established presence (i.e., EMEA and LATAM); and (iv) all other functions: synergies are expected from the optimization of other functions, including logistics, where savings are expected from the optimization of logistics for new cars and the effect of the procurement volume increase on FCA’s and PSA’s combined expenditures, as well as supply chain, quality and after-market operations. The annual industrial synergies are expected to exceed €5 billion, with approximately 80 percent of synergies to be achieved after four years from the completion of the Merger. Approximately 75 percent of synergies are expected to arise from technology, platform and product convergences and procurement savings, approximately 7 percent from SG&A, and the remaining synergies are expected from all other functions. The annual run-rate synergies are expected to exceed the costs necessary to achieve such synergies within the first year following the Merger, and the total one-time cost to achieve the synergies is estimated at €4 billion; and |

| f) | the transaction will create a more stable and resilient group, significantly improving its ability to withstand economic downturns, which, in the automotive industry, are typically exacerbated by high cyclicality and low margins. The Merging Companies expect that the more robust combined balance sheet and financial flexibility resulting from the Merger, together with the benefit of the synergies and the improved business balance across geographies, will enhance the resilience of Stellantis across market cycles. |

| 3. | MAIN TERMS AND CONDITIONS OF THE MERGER |

| 3.1. | Implementation of the Merger |

Upon completion of the Merger, FCA shall acquire all assets, liabilities and legal relationships of PSA by universal succession of title and PSA shall cease to exist as a stand-alone entity.

Subject to the terms and conditions of the Cross-Border Merger, the Merger will be effective at 00:00 a.m. Central European Time on the first day after the date on which a Dutch civil law notary executes a notarial deed of cross-border merger with respect to the Merger in accordance with applicable Dutch and French law (the “Effective Time”).

At the Effective Time, all assets, liabilities and legal relationships that are held by PSA (including, without limitation, all shareholdings held by PSA in its subsidiaries), will be allocated to the FCA French PE.

Between the Merging Companies it is furthermore agreed that, at the Effective Time, the Merger will enter into effect retroactively as from the first day of the calendar year during which the Effective Time occurs.

| 3.2. | Exchange Ratio |

Each PSA Ordinary Share will be exchanged for 1.742 common shares of FCA (the “Exchange Ratio”) each with a nominal value of €0.01 per share (the “FCA Common Shares”).

Pursuant to Article L. 236-3, II, of the French Commercial Code and pursuant to the terms of the Cross-Border Merger Terms, no FCA share will be allotted and issued in respect of PSA Ordinary Shares which, at the Effective Time of the Merger, are held in treasury by the PSA or are held by FCA (the “PSA Excluded Shares”).

The Exchange Ratio is fixed and will not be adjusted for changes in the market value of FCA Common Shares or the PSA Ordinary Shares.

| 3.3. | Methods and criteria used to determine the Exchange Ratio |

The Exchange Ratio was determined through arm’s-length negotiations between FCA and PSA.

PSA believes that the Exchange Ratio is appropriate in light of PSA’s and FCA’s relative market capitalization before the combination was announced, their respective prospects and earnings potential, and the expected synergies from the combination, and taking into account the distributions expected to be made prior to the completion of the Merger.

A fixed Exchange Ratio that will not be adjusted for fluctuations in the market price of PSA Ordinary Shares or FCA Common Shares is also consistent with the principles underlying the “merger of equal” structure of the combination.

| (i) | Sources of information |

The below valuation analysis was based on the following sources:

| - | PSA and FCA’s consolidated financial statements at December 31, 2018; |

| - | PSA and FCA’s annual reports at December 31, 2018; |

| - | PSA and FCA’s half-year financial report at June 30, 2019; |

| - | FCA Q3 2019 report at September 30, 2019; |

| - | PSA and FCA company presentations and company press releases available on PSA and FCA websites; and |

| - | Market data sources: Bloomberg, Factset, Thomson Eikon, market analysts’ research reports covering PSA and FCA. |

| (ii) | Methods used for the determination of the Exchange Ratio |

Methods used for the determination of the Exchange Ratio have been the following:

| - | An analysis of the average market capitalizations for PSA and FCA over a 5-year period (1); |

| - | An analysis of market analysts’ target prices for both companies (2); |

| - | An analysis of market analysts’ sum of the parts (SOTP) valuations and implied share prices (3) |

Note on methodology: Market capitalizations determined using the 3 methodologies below are based on fully diluted NOSH, excluding with respect to PSA the PSA Equity Warrants, i.e. 901.9 millions of ordinary shares for PSA and 1,570.3 million of common shares for FCA (as reported by both companies as of June 30, 2019)

| (1) | Average Market Capitalization: The average market capitalization ratio for the 1-5 preceding years of PSA and FCA is around 50/50 as set forth below (as of October 25, 2019 prior to the announcement of the contemplated combination): |

| Period | PSA | FCA |

| Average market capitalization ratio for 5 preceding years (Oct-2014 - Oct-2019) | 51% | 49% |

| Average market capitalization ratio for 4 preceding years (Oct-2015 - Oct-2019) | 51% | 49% |

| Average market capitalization ratio for 3 preceding years (Oct-2016 - Oct-2019) | 49% | 51% |

| Average market capitalization ratio for 2 preceding years (Oct-2017 - Oct-2019) | 47% | 53% |

| Average market capitalization ratio for 1 preceding year (Oct-2018 - Oct-2019) | 50% | 50% |

| Average market capitalization ratio as at October 25, 2019 (French time) | 55% | 45% |

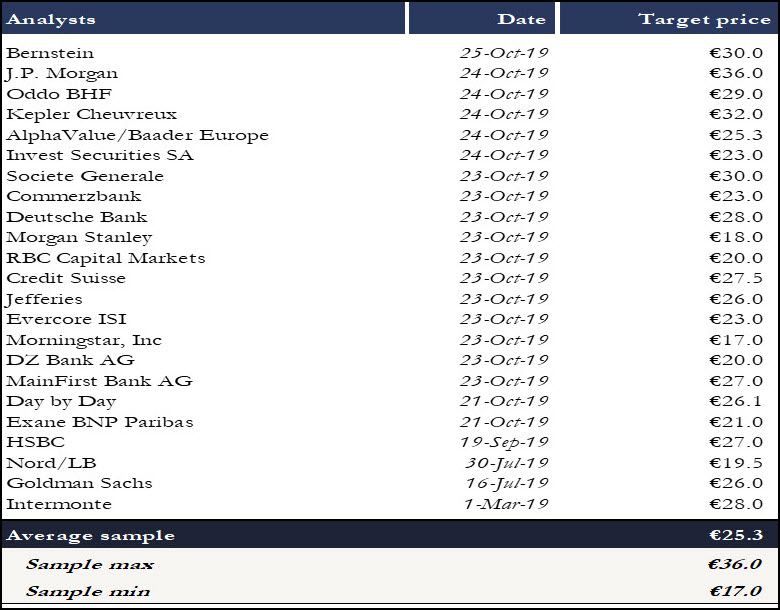

| (2) | Market analysts’ target prices: Based on the average target prices of analysts covering PSA and FCA extracted from Bloomberg and FactSet databases as of October 25, 2019 prior to the announcement of the contemplated combination: |

| ● | for PSA the average of 23 analysts target prices is €25.3 per share, implying a market capitalization of PSA based on a fully diluted number of shares of €22.8 billion; |

Analysts Date Target price Bernstein 25-Oct-19 €30.0 J.P. Morgan 24-Oct-19 €36.0 Oddo BHF 24-Oct-19 €29.0 Kepler Cheuvreux 24-Oct-19 €32.0 AlphaValue/Baader Europe 24-Oct-19 €25.3 Invest Securities SA 24-Oct-19 €23.0 Societe Generale 23-Oct-19 €30.0 Commerzbank 23-Oct-19 €23.0 Deutsche Bank 23-Oct-19 €28.0 Morgan Stanley 23-Oct-19 €18.0 RBC Capital Markets 23-Oct-19 €20.0 Credit Suisse 23-Oct-19 €27.5 Jefferies 23-Oct-19 €26.0 Evercore ISI 23-Oct-19 €23.0 Morningstar, Inc 23-Oct-19 €17.0 DZ Bank AG 23-Oct-19 €20.0 MainFirst Bank AG 23-Oct-19 €27.0 Day by Day 21-Oct-19 €26.1 Exane BNP Paribas 21-Oct-19 €21.0 HSBC 19-Sep-19 €27.0 Nord/LB 30-Jul-19 €19.5 Goldman Sachs 16-Jul-19 €26.0 Intermonte 1-Mar-19 €28.0 Average sample €25.3 Sample max €36.0 Sample min €17.0

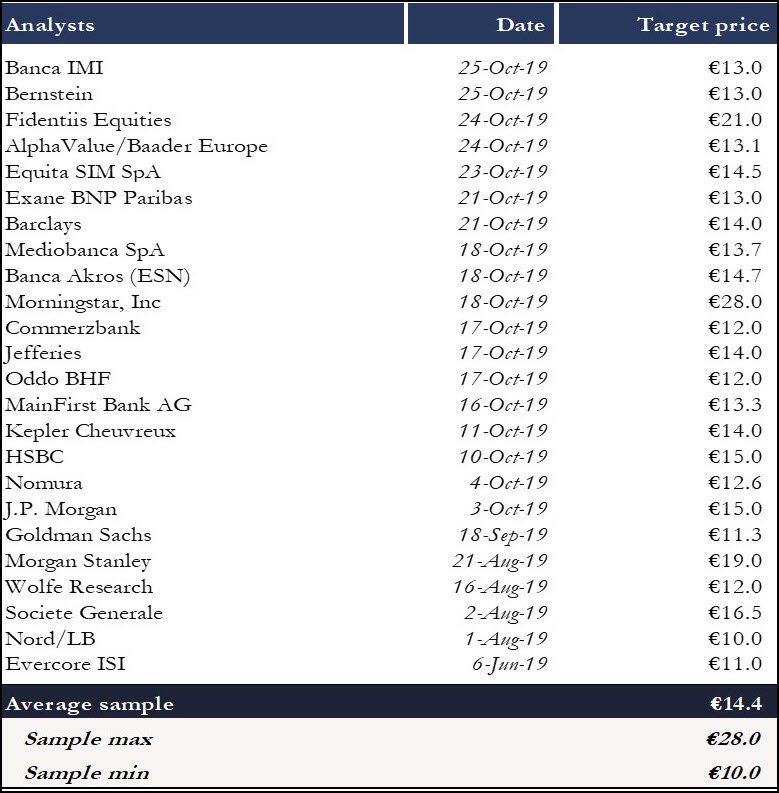

| ● | for FCA the average of 24 analysts target prices is €14.4 per share, implying a market capitalization of PSA based on a fully diluted number of shares of €22.6 billion. |

Analysts Date Target price Banca IMI 25-Oct-19 €13.0 Bernstein 25-Oct-19 €13.0 Fidentiis Equities 24-Oct-19 €21.0 AlphaValue/Baader Europe 24-Oct-19 €13.1 Equita SIM SpA 23-Oct-19 €14.5 Exane BNP Paribas 21-Oct-19 €13.0 Barclays 21-Oct-19 €14.0 Mediobanca SpA 18-Oct-19 €13.7 Banca Akros (ESN) 18-Oct-19 €14.7 Morningstar, Inc 18-Oct-19 €28.0 Commerzbank 17-Oct-19 €12.0 Jefferies 17-Oct-19 €14.0 Oddo BHF 17-Oct-19 €12.0 MainFirst Bank AG 16-Oct-19 €13.3 Kepler Cheuvreux 11-Oct-19 €14.0 HSBC 10-Oct-19 €15.0 Nomura 4-Oct-19 €12.6 J.P. Morgan 3-Oct-19 €15.0 Goldman Sachs 18-Sep-19 €11.3 Morgan Stanley 21-Aug-19 €19.0 Wolfe Research 16-Aug-19 €12.0 Societe Generale 2-Aug-19 €16.5 Nord/LB 1-Aug-19 €10.0 Evercore ISI 6-Jun-19 €11.0 Average sample €14.4 Sample max €28.0 Sample min €10.0

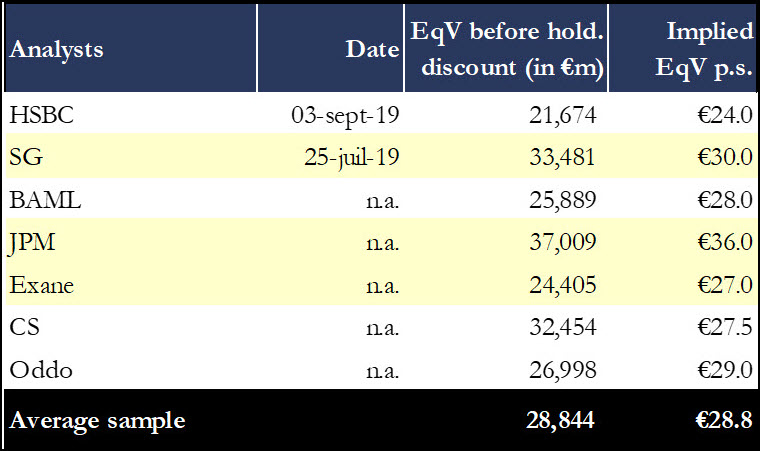

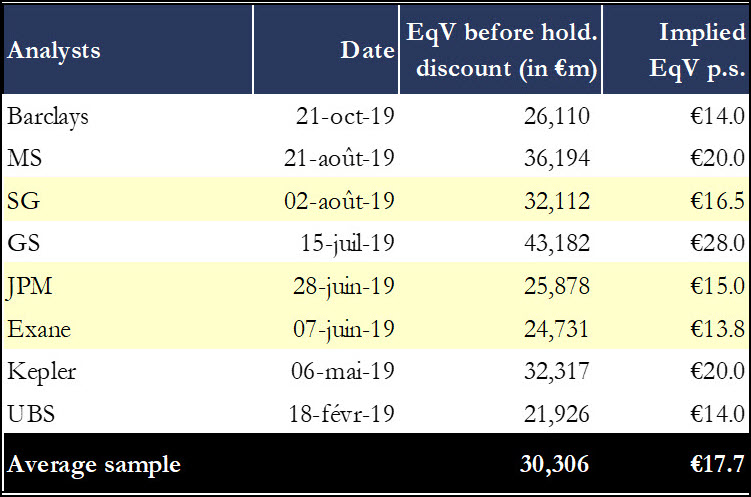

| (3) | Sum of the parts (SOTP): Based on reports publicly available on databases such as Thomson as of October 25, 2019 prior to the announcement of the contemplated combination: |

| ● | for PSA the average value per share of reports published by HSBC, Société Générale, Bank of America Merrill Lynch, J.P. Morgan, Exane, Credit Suisse and Oddo is €28.8 implying a market capitalization of PSA based on a fully diluted number of shares of €26.0 billion (note: analysts also publishing a SOTP for FCA are in yellow); |

Analysts Date EqV before hold. discount (in €m) Implied EqV p.s. HSBC 03-sept-19 21,674 €24.0 SG 25-juil-19 33,481 €30.0 BAML n.a. 25,889 €28.0 JPM n.a. 37,009 €36.0 Exane n.a. 24,405 €27.0 CS n.a. 32,454 €27.5 Oddo n.a. 26,998 €29.0 Average sample 28,844 €28.8

| ● | for FCA the average value per share of reports published by Barclays, Morgan Stanley, Société Générale, Goldman Sachs, J.P. Morgan, Exane, Kepler Cheuvreux and UBS is €17.7, implying a market capitalization of FCA based on fully diluted number of shares €27.8 billion, respectively (note: analysts also publishing a SOTP for PSA are in yellow). |

Analysts Date EqV before hold. discount (in €m) Implied EqV p.s. Barclays 21-oct-19 26,110 €14.0 MS 21-août-19 36,194 €20.0 SG 02-août-19 32,112 €16.5 GS 15-juil-19 43,182 €28.0 JPM 28-juin-19 25,878 €15.0 Exane 07-juin-19 24,731 €13.8 Kepler 06-mai-19 32,317 €20.0 UBS 18-févr-19 21,926 €14.0 Average sample 30,306 €17.7

| (iii) | Methods excluded for the determination of the Exchange Ratio |

The following methods were not relevant in the context of the transaction and were thus excluded for the determination of the Exchange Ratio for the following reasons:

| - | Analysis of comparable companies’ trading multiples: absence of immediate correlation between market forecasts and the evolution of market capitalizations, notably due to the high volatility in the automotive industry; |

| - | Analysis of comparable precedent transactions in the European automotive industry: no recent sizable comparable transaction between two profitable auto companies. |

| 3.4. | Financial statements used for the determination of the terms and conditions of the Merger |

The terms and conditions of the Merger have been based on such factors as those described in section 3.3 of this report. To the extent accounts, amongst other factors, were used to establish the terms and conditions of the Merger, such accounts were the following:

| a) | for PSA, the individual statutory accounts prepared under French generally accepted accounting principles as at December 31, 2019 as set out in Schedule 3 of the Cross-Border Merger Terms and the consolidated accounts of the Groupe PSA prepared in accordance with IFRS as at June 30, 2020 as set out in Schedule 4 of the Cross-Border Merger Terms; |

| b) | for FCA, the consolidated accounts as at December 31, 2019 as set out in Schedule 5 and the interim consolidated accounts as at June 30, 2020 as set out in Schedule 6 of the Cross-Border Merger Terms. |

| 3.5. | Designation and value of the transferred assets and liabilities |

At the Effective Time, all of the assets and liabilities of PSA (without limitation) will be legally transferred to FCA and allocated to the FCA French PE.

The description of the assets and liabilities to be legally transferred to FCA as a result of the Merger is included in the Cross-Border Merger Terms for information purposes only and based solely on the PSA accounts. The description is not exhaustive as the Cross-Border Merger will result in a transfer by universal succession of title to all the assets and liabilities of PSA to FCA as of the Effective Time.

For the purposes of the Dutch statutory accounts:

| a) | FCA shall record as of the first day of the calendar year during which the Effective Time occurs the acquired PSA’s assets and liabilities at their historical carrying values in the PSA statutory accounts as at December 31, 2020 prepared in accordance with Part 9 of Book 2 of the Dutch Civil Code with application of IFRS accounting principles (“Combination 3”) and approved by the FCA board of directors after the Effective Time; and |

| b) | FCA’s assets and liabilities shall be recorded, at the Effective Time, at their respective fair values as applied under Combination 3. |

The total definitive value of the transferred assets, liabilities and net assets will be determined on the basis of PSA statutory accounts as at December 31, 2020 prepared in accordance with Combination 3.

On the basis of a simplified balance sheet of PSA as at June 30, 2020 prepared in accordance with Combination 3 (the “Provisional Accounts”), the provisional book value of the transferred assets amounts to €24,826 million:

Assets | ASSETS (in million euros) | |||

| Intangible assets | 0.10 | |||

| Tangible fixed assets | 23.84 | |||

| Equity method investments* | 17,286.05 | |||

| *Automotive | 14,168.30 | |||

| Cancellation of deferred tax assets as a result of the tax group integration | -1,902.93 | |||

| Automotive equipement | 1,778.21 | |||

| Financing activities | 3,200.96 | |||

| Others* | 41.53 | |||

| Other non-current financial assets | 2.37 | |||

| Other non-current assets | 26.23 | |||

| Total non-current assets | 17,338.59 | |||

| Loans and receivables - finance companies | 0.01 | |||

| Trade receivables | 71.70 | |||

| Current taxes | 85.11 | |||

| Deferred tax assets | 928.06 | |||

Operating assets | 1,084.88 | |||

| Current financial assets | 304.40 | |||

| Cash and cash equivalents | 6,097.99 | |||

| Total current assets | 7,487.26 | |||

TOTAL ASSETS | 24,825.85 | |||

Based on the Provisional Accounts, the provisional book value of the transferred liabilities amounts to €5,242 million:

LIABILITIES (in million euros) | ||||

| Non-current financial liabilities | 4,030.75 | |||

| Other non-current liabilities | 7.61 | |||

| Non-current provisions | 25.35 | |||

| Total non-current liabilities | 4,063.71 | |||

| Current provisions | 13.47 | |||

| Trade payable | 77.46 | |||

| Current taxes | 80.75 | |||

| Other payables | 526.79 | |||

Operating liabilities | 698.46 | |||

| Current financial liabilities | 479.50 | |||

| Total current liabilities | 1,177.96 | |||

| TOTAL LIABILITIES | 5,241.67 | |||

Given that the exact amount of the definitive value of PSA net asset will only be known after the Effective Time and in the absence of any guarantee as to the definitive value of PSA net asset legally transferred to FCA, it has been decided, by common agreement of the Merging Companies, that the provisional net asset value retained for the purpose of the merger will be equal to the net asset value based on the Provisional Accounts (i.e. €19,584 million) to which a 10% discount will be applied. Therefore the provisional net asset value retained for the purpose of the Merger will be equal to €17,625.76 million.

| 3.6. | Conditions precedent – Effective Date |

The completion of the Merger is subject to the prior satisfaction or, to the extent permitted by applicable law, the waiver in whole or in part, of the conditions precedent set forth in the Cross-Border Merger Terms (the “Conditions Precedent”). Such Conditions Precedent notably include:

| a) | the approval of the Merger and of the removal of the double voting rights attached to certain PSA Ordinary Shares by the extraordinary general meeting of PSA’s shareholders with a two-thirds majority of the votes cast by the shareholders present or represented at such meeting, provided that at least 25 percent of the PSA Ordinary Shares carrying voting rights are present or represented at such meeting. |

| b) | the approval of the Merger and of the removal of the Double Voting Rights by the Special Meeting with a two-third majority of the votes cast by the shareholders entitled to double voting rights present ore represented at such meeting, provided that at least one-third of the PSA Ordinary Shares carrying double voting rights are present or represented at such meeting; |

| c) | the approval of the Merger and of the other transactions contemplated in the Cross-Border Merger Terms (including the appointment of the new members of the FCA board of directors and the amendment to the FCA’s articles of association) by an extraordinary general meeting of FCA’s shareholders; |

| d) | the Common Shares of FCA (including the Common Shares of FCA to be allotted to the holders of PSA Ordinary Shares in connection with the Merger) shall have been authorized for listing on Euronext Paris, the New York Stock Exchange and the MTA organized and managed by Borsa Italiana S.p.A; |

| e) | the registration statement on Form F-4 prepared in connection with the FCA common shares to be issued in the Merger shall have been declared effective by the U.S. Securities Exchange Commission and shall not be the subject of any stop order suspending the effectiveness of such registration statement; |

| f) | all necessary consents of the Netherlands authority for the financial markets with respect to the Admission Prospectus shall have been obtained; |

| g) | antitrust approvals and the clearance from the European Central Bank shall have been obtained; |

| h) | the pre-merger certificate (attestation de conformité) shall have been issued by the clerk of the Commercial Court of Versailles pursuant to Articles L. 236-29 and R. 236-17 of the French commercial code; |

| i) | no opposition shall have been validly filed by creditors of FCA or any opposition shall have been withdrawn, resolved or lifted by an enforceable court order by the relevant court of the Netherlands; |

| j) | no material adverse effect shall have occurred with respect to a Merging Company prior to the Effective Time which continues to exist as of such date, provided that this condition may be waived in writing only by FCA in the event of a material adverse effect with respect to PSA and only by PSA in the event of a material adverse effect with respect to FCA. |

| 3.7. | Merger appraisers |

In accordance with Article L. 236-10 of the French Commercial Code, Mr. Olivier Péronnet, whose office is located at 14 rue de Bassano, 75116 Paris, has been appointed, upon the request of PSA, pursuant to a ruling issued by the President of the Commercial Court of Nanterre on 11 February 2020, for the purposes of preparing a report on the fairness of the Exchange Ratio and a report assessing the value of the net asset transferred by PSA to FCA as a result of the Merger.

| 3.8. | Support of the Reference shareholders |

Each of the reference shareholders of PSA – Établissements Peugeot Frères and FFP (“EPF/FFP”), Bpifrance Participations and Lions Participations (“BPI”), Dongfeng Motor Group Company Ltd. (“DFG”) and Dongfeng Motor (Hong-Kong) International Co Ltd. (“DMHK”, and, together with DFG, “Dongfeng”, and together with EPF/FFP and BPI, the “Reference Shareholders”) – have entered into a letter agreement with PSA (the “Letter Agreement”).

Each Reference Shareholder has undertaken pursuant to its Letter Agreement to, among other things, vote (or cause to be voted) all PSA Ordinary Shares owned or controlled by it or as to which it has the power to vote in favor of any decision in furtherance of the approval of the transactions contemplated by the Combination Agreement that is submitted to the shareholders of PSA.

| 4. | ECONOMIC CONSEQUENCES AND CONSEQUENCES OF THE MERGER FOR THE SHAREHOLDERS, THE EMPLOYEES AND THE CREDITORS |

| 4.1. | Economic consequences of the Merger |

The main economic aspects of the Merger have been described in section 2 of this report. From an economic perspective, it is expected that the Merger:

| (i) | will deliver annual industrial synergies which are expected to exceed €5 billion, with approximately 80 percent of the synergies to be achieved after four years from the completion of the Merger; the annual run-rate synergies are expected to exceed the costs necessary to achieve such synergies within the first year following completion of the Merger; |

| (ii) | will lead to a more robust combined balance sheet and financial flexibility, so that Stellantis is more resilient across market cycles compared to each Merging Company separately; and |

| (iii) | will lead to a broader and complementary brand portfolio, covering all key vehicle segments. |

The total one-time cost to achieve the synergies is estimated at €4 billion.

| 4.2. | Consequences of the Merger for the shareholders |

At the Effective Time, by virtue of the merger and without any action on the part of any holder of PSA Ordinary Shares, FCA will issue for each outstanding PSA ordinary share (other than the PSA Excluded Shares) 1.742 FCA Common Shares (the “New FCA Common Shares”).

The PSA ordinary shares will no longer be outstanding and automatically cease to exist.

The common shares of FCA, to be renamed Stellantis after the Merger, will be admitted to trading on the NYSE, Euronext Paris and the MTA.

The shareholders of PSA will be entitled to share in the profits of FCA, commencing on the day of the Effective Time. The New FCA Common Shares allotted pursuant to the Merger will rank pari passu in all respects with all other FCA Common Shares issued and outstanding at the Effective Time.

Fractional entitlement

No fractional FCA Common Shares shall be issued and allotted. Any fractional entitlements in connection with the Cross-Merger will be settled as follows:

| (i) | With respect to fractional entitlements of the former holders of PSA Ordinary Shares held in administered registered form (nominatif administré), or bearer form (au porteur), each relevant authorized intermediary in the centralized depositary and clearing systems of Euroclear France shall (i) aggregate such fractional entitlements of such holders, (ii) sell the corresponding FCA Common Shares on behalf of such holders in the market for cash and subsequently (iii) distribute the net cash proceeds to such holders proportionate to each such holder’s fractional entitlements. |

| (ii) | With respect to fractional entitlements of former holders of PSA Ordinary Shares held in pure registered form (nominatif pur), Société Générale Securities Services shall (i) aggregate such fractional entitlements of such holders, (ii) sell the corresponding FCA Common Shares on behalf of such holders in the market for cash and subsequently (iii) distribute the net cash proceeds to such holders proportionate to each such holder’s fractional entitlements. |

Without prejudice to the foregoing, each holder of PSA Ordinary Shares that benefits from a fractional entitlement to a FCA Common Share may waive any cash consideration in respect thereto.

Double Voting Rights

The completion of the Merger will entail a cancellation of the Double Voting Rights. Pursuant to Article L. 225-99 of the French Commercial Code, the cancellation of the Double Voting Rights, to be definitive, requires the approval of the Special Meeting of shareholders benefiting from double voting rights.

Following completion of the Merger, there will be no carryover of the existing double voting rights pursuant to the existing FCA loyalty voting structure.

However, Stellantis will adopt a loyalty voting structure pursuant to which shareholders of Stellantis may at any time elect to participate in the loyalty voting structure by requesting that Stellantis registers all or some of their common shares of Stellantis in the loyalty register of Stellantis shareholders’ register.

If the common shares have been registered in the loyalty register for an uninterrupted period of three years in the name of the same shareholder, such shareholder will be entitled to receive an additional vote for each of the common shares registered in the loyalty register.

| 4.3. | Consequences of the Merger for the employees |

In accordance with Article L. 1224-1 of the French Labor Code, all employment contracts in force immediately prior to the completion of the Merger between PSA and its employees will be transferred without change to FCA by operation of law at the time of the completion of the Merger.

In accordance with Article L. 2261-14 of the French Labor Code, the collective bargaining agreements applicable within PSA at date of the completion of the Merger will be reconsidered. It is intended to enter into negotiations with union delegates with a view to continuing these agreements within the FCA French PE.

The works council (Comité social et économique) currently in place within PSA will be maintained and the current mandates of the employee representatives will continue until their term, i.e., April 2022.

Regarding the participation of the employees on the board, the Merging Companies have agreed in the Combination Agreement that both the general meeting of FCA and the general meeting of PSA will decide, in accordance with applicable law, to waive the setting up of and negotiation with the special negotiating body and to be subject to the standard rules for employee participation on the board of directors of Stellantis as applied under Dutch law and as reflected in the articles of association of Stellantis that will be effective after completion of the Merger. The general meeting of PSA held on June 25, 2020 adopted a resolution to that effect.

Employee representative bodies of each of the Merging Companies have nominated an employee representative to serve on the Board of Directors of Stellantis following completion of the Merger. Their nomination will be submitted to the shareholders’ meeting of FCA convened to approve the Merger.

The competent works councils and employee representative bodies within Groupe PSA , including the works council (Comité social et économique) of PSA whose opinion was obtained on November 8, 2019, have been informed about and consulted with in respect of the Merger and the last opinion required from said works councils was obtained on November 26, 2019. The opinion of the Comité social et économique is attached hereto as Schedule 2.

| 4.4. | Consequences of the Merger for the creditors |

As a result of the Merger, at the Effective Time, all assets and liabilities of PSA (without limitation) will be transferred to FCA by universal succession of title and FCA will be automatically subrogated in all of the rights and obligations of PSA resulting from any contract or commitment, of whatever nature, and in particular:

| a) | all obligations resulting from the undertakings of PSA towards the beneficiaries of performance shares of PSA outstanding at the Effective Time. In accordance with the terms of the Cross-Border Merger Terms, each outstanding equity incentive award with respect to the PSA Ordinary Shares that is subject to performance conditions, vesting or other restrictions under the performance shares plans of PSA will be automatically converted at the Effective Time into a restricted share unit award with respect to a number of common shares of FCA equal to the product of the number of the PSA Ordinary Shares underlying such equity incentive award and the Exchange Ratio (with the number of common shares of FCA to be received by each holder to be rounded down to the nearest whole number without any cash compensation paid or due to such holder); and |

| b) | all obligations resulting from the undertakings of PSA toward the holders of the outstanding PSA Equity Warrants in accordance with the terms of the Cross-Border Merger Terms (except to the extent the PSA Equity Warrants have been cancelled prior to the Effective Time). Each PSA Equity Warrant will cease to represent an equity warrant giving entitlement to subscribe for PSA Ordinary Shares and will be converted into one (1) equity warrant giving entitlement to subscribe for a number of common shares of FCA equal to the exercise ratio of the PSA Equity Warrant, multiplied by the Exchange Ratio (a “FCA Equity Warrant”), at an exercise price per FCA Equity Warrant equal to EUR 1.00. |

Pursuant to French law, the creditors of PSA, other than PSA’s bondholders, may file an opposition against the Merger with the Clerk of the Commercial Court of Versailles for a period of 30 days following the later of the publication of the Cross-Border Merger Terms in the French official bulletin of civil and commercial announcement (BODACC), in the French official bulletin of legal notices (BALO) and in a newspaper that publishes legal notices in the Yvelines. The relevant notices have been published. Such opposition does not prevent the notarial deed of merger from being executed or the Merger from being completed. However, the Commercial Court of Versailles may, in its discretion, order either the repayment of the debt or the granting of further collateral (which will be offered by FCA and has to be deemed sufficient by the court), or it may reject such opposition.

In addition, in accordance with French law, holders of each tranche of bonds issued by PSA are grouped together in a bondholders assembly (masse) (the “Bonds”), which must vote on certain transactions affecting the issuer of such bonds, including statutory mergers such as the Merger. PSA has convened the bondholders’ assemblies under the Bonds and such meetings have been held on November 13, 2020, and the bondholders’ assemblies have approved the Merger.

***

We invite you to approve the resolutions submitted to you.

We will be happy to answer any question you may have and provide you with any further information.

_________________

The Managing Board

SCHEDULE 1

Text of the resolutions presented to the Special Meeting

Peugeot S.A.

Société anonyme with a share capital of €894,828,213

Route de Gizy, 78140 Vélizy-Villacoublay

552 100 554 R.C.S. Versailles

(the “Company”)

Special Meeting

Resolutions

| 1. | Review and approval of the contemplated cross-border merger by way of absorption of the Company with and into Fiat Chrysler Automobiles N.V. ; |

| 2. | Removal of the double voting rights; and |

| 3. | Powers for formalities. |

[...]

1st resolution

Review and approval of the contemplated cross-border merger by way of absorption of the

Company with and into Fiat Chrysler Automobiles N.V.

The Special Meeting, deliberating in accordance with the quorum and majority requirements applicable to special meetings of shareholders, after considering:

| - | the report of the Managing Board of the Company prepared pursuant to Articles L. 236-27 and R. 236-16 of the French Commercial Code, to which the opinion of the works council (Comité social et économique) of the Company dated November 8, 2019 is appended; |

| - | the reports relating to the terms and conditions of the contemplated cross-border merger by absorption of the Company with and into Fiat Chrysler Automobiles N.V., a public limited liability company (naamloze vennootschap), incorporated under the laws of the Netherlands, with corporate seat in Amsterdam, the Netherlands, and address at 25 St. James’s Street, SW1A 1HA, London, United Kingdom, registered with the Dutch trade register under number: 60372958 (“FCA”) (the “Cross Border Merger”) and to the valuation of the contributions prepared by Olivier Péronnet, from Finexsi, appointed by an order of the President of the Nanterre commercial Court issued on February 11, 2020 pursuant to Articles L. 236-10 and L. 225-147 of the French Commercial Code; |

| - | the combination agreement entered into on December 17, 2019 between the Company and FCA as amended on September 14, 2020 (the “Combination Agreement”); |

| - | the common draft terms of the Cross-Border Merger (including their schedules, the “Cross-Border Merger Terms”) entered into on October 27, 2020 between the Company and FCA; |

| - | the prospectus relating to the application for listing and admission to trading (i) on the Mercato Telematico Azionario of the FCA common shares to be issued in the Cross-Border Merger, and (ii) on Euronext Paris of the FCA common shares, including the FCA common shares to be issued in the Cross-Border Merger, approved by the Netherlands authority for the financial markets (Autoriteit Financiële Markten) on November 20, 2020 and a French translation of the summary of such prospectus; |

| - | the annual financial statements of the Company relating to the financial years ended on December 31, 2019, December 31, 2018 and December 31, 2017 approved by the general meetings of the Company and certified by the statutory auditors of the Company; |

| - | the management reports relating to the financial years ended on December 31, 2019, December 31, 2018 and December 31, 2017 of the Company; |

| - | the 2020 half-yearly financial report of the Company including the consolidated half-year financial statements of the Company as at June 30, 2020, having been subject to a limited review by the statutory auditors of the Company; |

| - | the 2020 half-yearly financial report of FCA including the unaudited condensed consolidated financial statements of FCA as of and for the three and six months ended June 30, 2020; and |

| - | the draft resolutions submitted to the Extraordinary General Meeting of Shareholders to be held today; |

| 1. | Acknowledges that the Extraordinary General Meeting of Shareholders will be called upon to approve the following, and itself approves: |

| - | the Cross-Border Merger pursuant to the terms and conditions of the Cross-Border Merger Terms; |

| - | the Cross-Border Merger Terms as a whole, under which it is agreed that subject to the prior satisfaction of the conditions precedent set forth in Article 13 of the Cross-Border Merger Terms, or, to the extent permitted by the Cross-Border Merger Terms or by applicable law, the waiver in whole or in part of said conditions precedent, the Company will transfer to FCA all its assets and liabilities by way of a merger by absorption of the Company with and into FCA; |

| - | the universal transfer of the Company’s assets and liabilities (transmission universelle de patrimoine) to FCA as a result of the Cross-Border Merger; |

| - | the setting of the effective time of the Cross-Border Merger at 00:00 a.m. Central European Time after the day on which a Dutch civil law notary executes the Dutch notarial deed to effect the Cross-Border Merger (the “Effective Time”) in accordance with the terms of the Cross-Border Merger Terms and subject to the prior satisfaction of the conditions precedent set forth in Article 13 of the Cross-Border Merger Terms or, to the extent permitted by the Cross-Border Merger Terms or by applicable law, the waiver in whole or in part, of said conditions precedent; |

2

| - | the setting of the date of the Cross-Border Merger’s retroactive effect, agreed between the Company and FCA, as from the first day of the calendar year during which the Effective Time occurs; |

| - | the provisional book value of the assets contributed by the Company amounting to €24,826 million and of the liabilities transferred by the Company amounting to €5,242 million, i.e. a provisional book value of the Company’s net asset amounting to €17,625.76 million, after having applied a 10% discount, in each case determined on the basis of a simplified balance sheet of the Company as at June 30, 2020 prepared in accordance with Part 9 of Book 2 of the Dutch Civil Code with application of IFRS accounting principles; and |

| - | the merger consideration in exchange for the contribution pursuant to the Cross-Border Merger according to which each ordinary share of the Company, with a nominal value of €1.00, (the “PSA Ordinary Shares”) (other than the Excluded PSA Shares, as defined below) outstanding immediately prior to the date and time determined in the relevant Euronext notice (the “Merger Record Time”) shall be exchanged for 1.742 common shares of FCA (the “Exchange Ratio”), each with a nominal value of €0.01 per share (the “FCA Common Shares”). |

| 2. | Acknowledges that, subject to the conditions precedent set forth in Article 13 of the Cross-Border Merger Terms or, to the extent permitted by the Cross-Border Merger Terms or by applicable law, the waiver in whole or in part, of said conditions precedent: |

| - | pursuant to Article L. 236-3(II), of the French Commercial Code and pursuant to the terms of the Cross-Border Merger Terms, no FCA share will be allotted and issued in respect of PSA Ordinary Shares which, at the Effective Time of the Cross-Border Merger, are held in treasury by the Company or by FCA or are otherwise referred to in Article L. 236-3(II) of the French Commercial Code (the “Excluded PSA Shares”); |

| - | the definitive value of the transferred assets and liabilities of the Company and the Company’s net asset will be determined by the surviving entity based on the individual financial statements of the Company on the first day of the calendar year during which the Effective Time occurs and after adjustments to be made in accordance with Part 9 of Book 2 of the Dutch Civil Code with application of IFRS accounting principles; |

| - | FCA will increase its share capital in exchange for the contribution pursuant to the Cross-Border Merger by issuing and allotting, at the Merger Record Time, for each issued and outstanding PSA Ordinary Share (excluding the Excluded PSA Shares) 1.742 FCA Common Shares, provided that no fractional FCA Common Shares shall be issued and allotted and any fractional entitlements in connection with the Cross-Border Merger will be settled as determined pursuant to Article 6.1 of the Cross-Border Merger Terms; |

| - | the new FCA Common Shares issued as part of the Cross-Border Merger, and represented by the Book-Entry Positions, shall be issued and allotted to Cede & Co, as nominee for The Depository Trust Company (“DTC”), for inclusion in the centralized depositary and clearing systems of DTC and Euroclear France, and ultimately, directly or indirectly, on behalf and for the benefit of the former holders of PSA Ordinary Shares; it being specified that the book-entry positions previously representing PSA Ordinary Shares (other than Excluded PSA Shares, if any), which include all PSA Ordinary Shares (other than Excluded |

3

| | PSA Shares, if any) held in (i) pure registered form (nominatif pur), (ii) administered registered form (nominatif administré), and (iii) bearer form (au porteur) shall following the implementation of the Cross-Border Merger be exchanged for book-entry positions representing FCA Common Shares issued and allotted in accordance with the Exchange Ratio (the “Book-Entry Positions”); |

| | - | the new FCA Common Shares allotted pursuant to the Cross-Border Merger will be ranked pari passu in all respects with all other FCA Common Shares issued and outstanding at the Merger Record Time, and no special rights or restrictions will apply to any of the new FCA Common Shares; |

| | - | the new FCA Common Shares will be fully paid-up and free of any encumbrances; they will be admitted to trading on (i) the regulated markets of Euronext Paris and the MTA, and (ii) the NYSE; |

| | - | FCA will assume, at the Effective Time, all rights and obligations of the Company, and in particular: |

| o | all obligations resulting from the undertakings of the Company towards the beneficiaries of performance shares of the Company outstanding at the Effective Time, it being specified that, in accordance with the terms of the Cross-Border Merger Terms, each outstanding equity incentive award with respect to PSA Ordinary Shares that is subject to performance conditions, vesting or other restrictions under the performance shares plans of the Company will be automatically converted at the Effective Time into a restricted share unit award with respect to a number of FCA Common Shares equal to the product of the number of PSA Ordinary Shares underlying such equity incentive award and the Exchange Ratio (for purposes of determining the number of PSA Ordinary Shares underlying an equity incentive award, performance conditions will be deemed satisfied at a level that is to be determined by the Company prior to the Effective Time, and the number of FCA Common Shares to be received by each holder will be rounded down to the nearest whole number without any cash compensation paid or due to such holder); |

| o | all obligations resulting from the undertakings of the Company toward the holders of the outstanding equity warrants issued by the Company (the “PSA Equity Warrants”), in accordance with the terms of the Cross-Border Merger Terms, except to the extent the PSA Equity Warrants have been cancelled prior to the Effective Time, it being specified that each PSA Equity Warrant will cease to represent an equity warrant giving entitlement to subscribe PSA Ordinary Shares and will be automatically converted into one (1) equity warrant giving entitlement to subscribe a number of FCA Common Shares equal to the exercise ratio of the PSA Equity Warrant in effect immediately prior to the Effective Time, multiplied by the Exchange Ratio (a “FCA Equity Warrant”), at an exercise price per FCA Equity Warrant equal to €1.00; and |

| o | all other obligations resulting from the undertakings of the Company towards any other creditors, including its bondholders; |

4

| | - | subject to the definitive effectiveness of the Cross-Border Merger following the execution by a Dutch civil law notary of the Dutch notarial deed of Cross-Border Merger, the Company will be dissolved without liquidation as of the Effective Time. |

2nd resolution

Removal of the double voting rights

The Special Meeting, deliberating in accordance with the quorum and majority requirements applicable to special general meetings of shareholders, as a result of the preceding resolution, after considering the report of the Managing Board and pursuant to Article L. 225-99 of the French Commercial Code:

| 1. | Acknowledges that the Extraordinary General Meeting of Shareholders of the Company of today is called upon to decide, in accordance with the quorum and majority requirements for extraordinary general meetings of Shareholders in its second resolution the removal, subject to the definitive completion of the Cross-Border Merger and at the Effective Time, of the double voting rights which will be attached, at this date, to the PSA Ordinary Shares pursuant to Article 11 of the bylaws of the Company; |

| 2. | Acknowledges that, pursuant to Article L. 225-99 of the French Commercial Code, the decision of the Extraordinary General Meeting, to be definitive, requires the approval of the removal of the double voting rights attached to the PSA Ordinary Shares by the Special Meeting of Shareholders benefiting from double voting rights; |

| 3. | Approves the removal, subject to the definitive completion of the Cross-Border Merger at the Effective Time, of the double voting rights which will be attached to the PSA Ordinary Shares at this date pursuant to Article 11 of the bylaws of the Company; |

| 4. | Acknowledges that as a result of this resolution and of the second resolution submitted to the Extraordinary General Meeting of Shareholders of the Company today, each PSA Ordinary Share will entitle its holder to one voting right as of the Effective Time; and |

| 5. | Acknowledges that the bylaws of the Company will not be amended as a result of this resolution and of the second resolution submitted to the Extraordinary General Meeting of Shareholders of the Company today, the Company being dissolved as of right at the Effective Time as a result of the Cross-Border Merger. |

3rd resolution

Powers for formalities

The Special Meeting, deliberating in accordance with the quorum and majority requirements applicable to special meetings of shareholders gives all powers to the holder of an original, a copy or a certified extract of the minutes of this Special Meeting in order to carry out any legal submission, publicity or any other formalities or have them carried out.

5

SCHEDULE 2

Opinion of the Comité social et économique of PSA

PSA/HRTD

| PEUGEOT S.A. WORKS COUNCIL (COMITE SOCIAL ET ECONOMIQUE - “CSE”) |

Minutes of extraordinary meeting no. 534

held on Friday November 8, 2019 at 4.00pm

The following persons were present:

Mr. Xavier CHEREAU, President of the CSE,

Mr. Aymar de L’HERMITE, Site Director,

Ms. Brigitte BARDET, Ms. Carole COUSIN, Ms. Christine HABASQUE, Ms. Isabelle

LEBAILLY, Ms. Emmanuelle MALHERBE, Ms. Françoise PIMET MOISANT,

Mr. Pascal CROZES, Mr. Jacques de SAINT-EXUPERY, Mr. Guy TANKOUA, Mr. Eric

HENAULT, Mr. Didier MONTANT, Mr. Vitor SANTOS RIBEIRO, Mr. Thierry TARANTO,

Members of the CSE

Ms. Marie-Christine FORGET LABROUSSE, representative of the trade union the CFE-CGC

Ms. Florence MARTINEZ, representative of the trade union the CFTC

2

| I. | PROCEDURE FOR INFORMING AND CONSULTING THE CSE ON THE CONTEMPLATED COMBINATION OF THE PSA GROUP AND THE FCA GROUP THROUGH THE MERGER OF PEUGEOT S.A. AND FIAT CHRYSLER AUTOMOBILES N.V. |

Xavier CHEREAU commented on the information document which had been sent with the meeting’s convening notice. He explained that it was for the Group a strategic and exciting project which prepares and protects the future of the company and of its employees.

Xavier CHEREAU proposed to focus the meeting on the strategic aspects of the project and to respond to the questions with the assistance of Christophe PINEAU, Director of Strategy, and Franck BERNARD, who is in charge of International Employee Relations.

Xavier CHEREAU then presented FCA, the strategic benefit for the Group, the legal aspects of the project and then the employment aspects.

The current discussions open a way forward for the creation of a new group of a global dimension and with worldwide resources, whose capital would be owned 50% by the shareholders of the PSA Group and 50% by the shareholders of FCA. In a rapidly evolving environment, facing new challenges in the areas of connected, electric, shared and autonomous mobility, the new combined entity would take advantage of its worldwide R&D capacities and of its ecosystem, to accelerate innovation and meet these challenges with agility and economic efficiency.

| − | The new entity would create the fourth largest automobile manufacturer in the world in terms of vehicle sales per year (8.7 million vehicles) | |

| − | At its creation, the margins generated by the new entity would be among the highest in the markets on which it operates, carried by the strength of FCA in North America and in Latin America and the PSA Group in Europe | |

| − | The new entity would strengthen the two groups’ respective brands in the segments of luxury, premium and general sedan cars, SUVs, and heavy trucks and light commercial vehicles, which would make them stronger together | |

| − | The entity resulting from the merger would combine the extended expertise of the two groups in the technologies which construct new sustainable mobility, particularly, electric motors, autonomous cars and digital and connected technologies. | |

| − | The progressive annual synergies are estimated to be approximately €3.7 billion, without plant closures | |

| − | A highly respected joint management team, recognized for exceptional value creation and its proven track record of previous successful merger transactions |

| − | The Board of Directors of the Dutch parent company would have a balanced representation with a majority of independent members. John ELKANN would be Chairman of the Board of Directors and Carlos TAVARES would be CEO and Member of the Board. | |

| Xavier CHEREAU then mentioned the prospective timetable for information-consultation of employee representatives: | ||

| − | November 8, 2019: CSE of Peugeot S.A. is consulted | |

| − | November 18, 2019: PSA Automobiles S.A. is consulted | |

| − | November 26, 2019: European Group Works Council (Comité de Groupe Européen) of PSA is informed | |

After these meetings and after submission of the opinions of all of the employee representative bodies concerned by the Project, the latter would have to be subject to a final agreement.

This timetable for completion of the Project will also depend on obtaining the regulatory authorizations as regards merger control and foreign investment.

Following these discussions, the members of the CSE, having been consulted, unanimously issued a favorable opinion.

| Secretary to the CSE | President of the CSE |

[Signature] | [Signature] |

| Jacques de SAINT-EXUPERY | Xavier CHEREAU |

IMPORTANT NOTICE

This communication is for informational purposes only and is not intended to and does not constitute an offer or invitation to exchange or sell or solicitation of an offer to subscribe for or buy, or an invitation to exchange, purchase or subscribe for, any securities, any part of the business or assets described herein, or any other interests or the solicitation of any vote or approval in any jurisdiction in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. This communication should not be construed in any manner as a recommendation to any reader of this document.

This communication is not a prospectus, product disclosure statement or other offering document for the purposes of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14th 2017.

An offer of securities in the United States pursuant to a business combination transaction will only be made, as may be required, through a prospectus which is part of an effective registration statement filed with the U.S. Securities and Exchange Commission (“SEC”). A registration statement on Form F-4 was filed with the SEC in connection with the combination of Fiat Chrysler Automobiles N.V. (“FCA”) and Peugeot S.A. (“PSA”) through a cross-border merger and was declared effective by the SEC on November 20, 2020, and the prospectus was mailed to the holders of PSA ordinary shares (other than holders of PSA ordinary shares who are non-U.S. persons (as defined in the applicable rules of the SEC)) on or about November 23, 2020. Shareholders of PSA and FCA who are U.S. persons or are located in the United States are advised to read the registration statement because it contains important information relating to the proposed transaction. You may obtain free copies of all documents filed with the SEC regarding the proposed transaction, documents incorporated by reference, and FCA’s SEC filings at the SEC’s website at http://www.sec.gov.