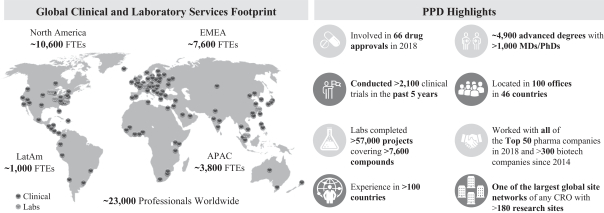

challenges and developments to create an ongoing dialogue with our customers and prospective customers and to promote our scientific expertise, differentiated service offerings, quality, technology and innovation. In support of these efforts, we exhibit, provide speakers, present papers and host customer meetings at key industry events, and publish scientific articles in industry, trade, medical and pharmaceutical journals.

Backlog and Authorizations

Our backlog represents anticipated direct revenue for work not yet completed or performed (i) under signed contracts, letters of intent and, in some cases, awards that are supported by other forms of written communication and (ii) where there is sufficient or reasonable certainty about the customer’s ability and intent to fund and commence the services within six months. Our backlog excludes anticipated third-party pass-through andout-of-pocket revenue.

Backlog and backlog conversion to direct revenue vary from period to period depending upon new authorizations, contract modifications, cancellations and the amount of direct revenue recognized under existing contracts. The weighted average duration of contracts in our backlog fluctuates from period to period based on the contracts constituting our backlog at any given time. We adjust backlog for foreign currency fluctuations and exclude direct revenue that has been recognized as revenue in our statements of operations.

Although an increase in backlog will generally result in an increase in future direct revenue to be recognized over time (depending on future contract modifications, contract cancellations and other adjustments), an increase in backlog at a particular point in time does not necessarily correspond to an increase in direct revenue during a particular period. The timing and extent to which backlog will result in direct revenue depends on many factors, including the timing of commencement of work, the rate at which we perform services, scope changes, cancellations, delays, receipt of regulatory approvals and the nature, duration, size, complexity and phase of the studies. Our contracts generally have terms ranging from several months to several years. In addition, delayed projects remain in backlog until they are canceled. As a result of these factors, our backlog might not be a reliable indicator of future direct revenue and we might not realize all or any part of the direct revenue from the authorizations in backlog as of any point in time. Our backlog was $6,805.7 million at September 30, 2019, $6,313.7 million at December 31, 2018 and $5,730.6 million at December 31, 2017.

We add new authorizations to backlog based on the aforementioned criteria for backlog. New authorizations vary from period to period depending on numerous factors, including customer authorization volume, sales performance and overall health of the biopharmaceutical industry, among others. New authorizations have and will continue to vary significantly from quarter to quarter and from year to year. Once work begins, we recognize direct revenue over the life of the contract based on our performance of services under the contract. Our net authorizations were $2,814.4 million and $2,448.9 million, respectively, for the nine months ended September 30, 2019 and 2018 and $3,421.0 million, $2,485.4 million and $3,051.6 million, respectively, for the years ended December 31, 2018, 2017 and 2016.

Competition

The drug development services industry is highly competitive, consisting of hundreds of small, limited-scope service providers and a limited number of large full-service global development companies. While the industry has seen an increasing level of consolidation over the past several years, largely driven by the larger full-service providers, it remains highly fragmented.

Our Clinical Development Services segment competes primarily with a small number of other global, full-service CROs, although we also compete against small andmedium-sized niche CROs,in-house R&D departments of biopharmaceutical companies, universities and teaching hospitals. We generally compete on the basis of scientific and therapeutic experience, project team expertise, qualifications and experience, ability to recruit patients, price, quality and the ability to innovate to achieve time and cost savings for our customers, amongst other factors. Our major competitors include IQVIA, ICON, PAREXEL International Corporation, PRA

115