U N A U D I T E D C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S venBio Global Strategic Fund, L.P. December 31, 2019

venBio Global Strategic Fund, L.P. Unaudited Consolidated Financial Statements Year Ended December 31, 2019 Contents Unaudited Consolidated Statement of Assets, Liabilities, and Partners’ Capital ............................1 Unaudited Consolidated Schedule of Investments ..........................................................................2 Unaudited Consolidated Statement of Operations ...........................................................................4 Unaudited Consolidated Statement of Changes in Partners’ Capital ...............................................5 Unaudited Consolidated Statement of Cash Flows ..........................................................................6 Notes to Unaudited Consolidated Financial Statements ..................................................................7

Assets Investments, at fair value (cost of $67,432,764) 106,334,788$ Cash 4,576,369 Escrow receivable 4,053,407 Total assets 114,964,564$ Liabilities and partners' capital Liabilities: Due to affiliate 29,078$ Total liabilities 29,078 Partners' capital: General Partner 22,847,923 Limited Partners 92,087,563 Total partners' capital 114,935,486 Total liabilities and partners' capital 114,964,564$ See accompanying notes. venBio Global Strategic Fund, L.P. December 31, 2019 Unaudited Consolidated Statement of Assets, Liabilities, and Partners’ Capital (Stated in United States Dollars) 1

Number of Shares Cost Fair Value Investments (92.5% of partners' capital) Biotechnology (92.5%) Ireland (17.8%) ALX Oncology Limited (17.8%) (1)(6) Series A Preferred Stock 20,400,000 20,400,000$ 20,400,000$ Common Shares 3,040,000 15,196 15,196 20,415,196 20,415,196 Solstice Biologics Limited (0.0%) (2)(6) Series A-1 Preferred Stock 5,454,545 3,000,000 - Series A-2 Preferred Stock 4,666,667 3,500,000 - Series A-3 Preferred Stock 4,666,667 3,500,000 - Series A-4 Preferred Stock 3,098,413 2,323,810 - Series A-5 Preferred Stock 3,098,413 2,323,810 - Common Units 900,000 900 - Promissory Note 2,633,333 - Warrants 3,511,111 6 - 17,281,859 - Total Ireland 37,697,055 20,415,196 United States (74.7%) Aragon Pharmaceuticals (1.5%) (6) Milestone Earnouts 38,265 1,721,604 Metacrine, Inc. (19.5%) (3)(6) Series A Preferred Stock 10,000,000 10,000,000 14,000,000 Series B Preferred Stock 2,408,478 2,890,174 3,709,056 Series C Preferred Stock 2,020,054 4,282,514 4,646,124 17,172,688 22,355,180 venBio Global Strategic Fund, L.P. Unaudited Consolidated Schedule of Investments December 31, 2019 (Stated in United States Dollars) 2

Number of Shares Cost Fair Value Investments (continued) (92.5% of partners' capital) Biotechnology (continued) (92.5%) United States (continued) (74.7%) Precision Biosciences, Inc. (51.4%) (4)(6) Common Stock 4,265,141 9,924,756$ 59,242,808$ Tollnine, Inc. (2.3%) (5)(6) Series Seed Preferred Stock 2,600,000 2,600,000 2,600,000 Total United States 29,735,709 85,919,592 Total investments, at fair value 67,432,764$ 106,334,788$ Percentage of partners' capital Cost Fair value Total common stock 51.5% 9,940,852$ 59,258,004$ Total preferred stock 39.5% 54,820,308 45,355,180 Total milestone earnouts 1.5% 38,265 1,721,604 Total promissory notes 0.0% 2,633,333 - Total warrants 0.0% 6 - 92.5% 67,432,764$ 106,334,788$ (1) Acquisition date for ALX Oncology Limited was March 2015. (2) Acquisition date for Solstice Biologics Limited was November 2012. (3) Acquisition date for Metacrine, Inc. was January 2015. (4) Marketable public security. Acquisition date for Precision Biosciences, Inc. was April 2015. (5) Acquisition date for Tollnine, Inc. was May 2018. (6) Security is non income producing insomuch as it has not paid interest or dividends in the last year. See accompanying notes. Investment by type, at fair value Total investments, at fair value (Stated in United States Dollars) December 31, 2019 venBio Global Strategic Fund, L.P. Unaudited Consolidated Schedule of Investments (continued) 3

Expenses Management fees, net 703,010$ Professional fees 245,522 Other expenses 85,175 Deal expenses 33,953 Total expenses 1,067,660 Net investment loss (1,067,660) Net realized gain on investments 7,714,053 Change in net unrealized gain on investments 2,129,303 Net gain on investments 9,843,356 Net income 8,775,696$ See accompanying notes. Unaudited Consolidated Statement of Operations Year Ended December 31, 2019 venBio Global Strategic Fund, L.P. (Stated in United States Dollars) 4

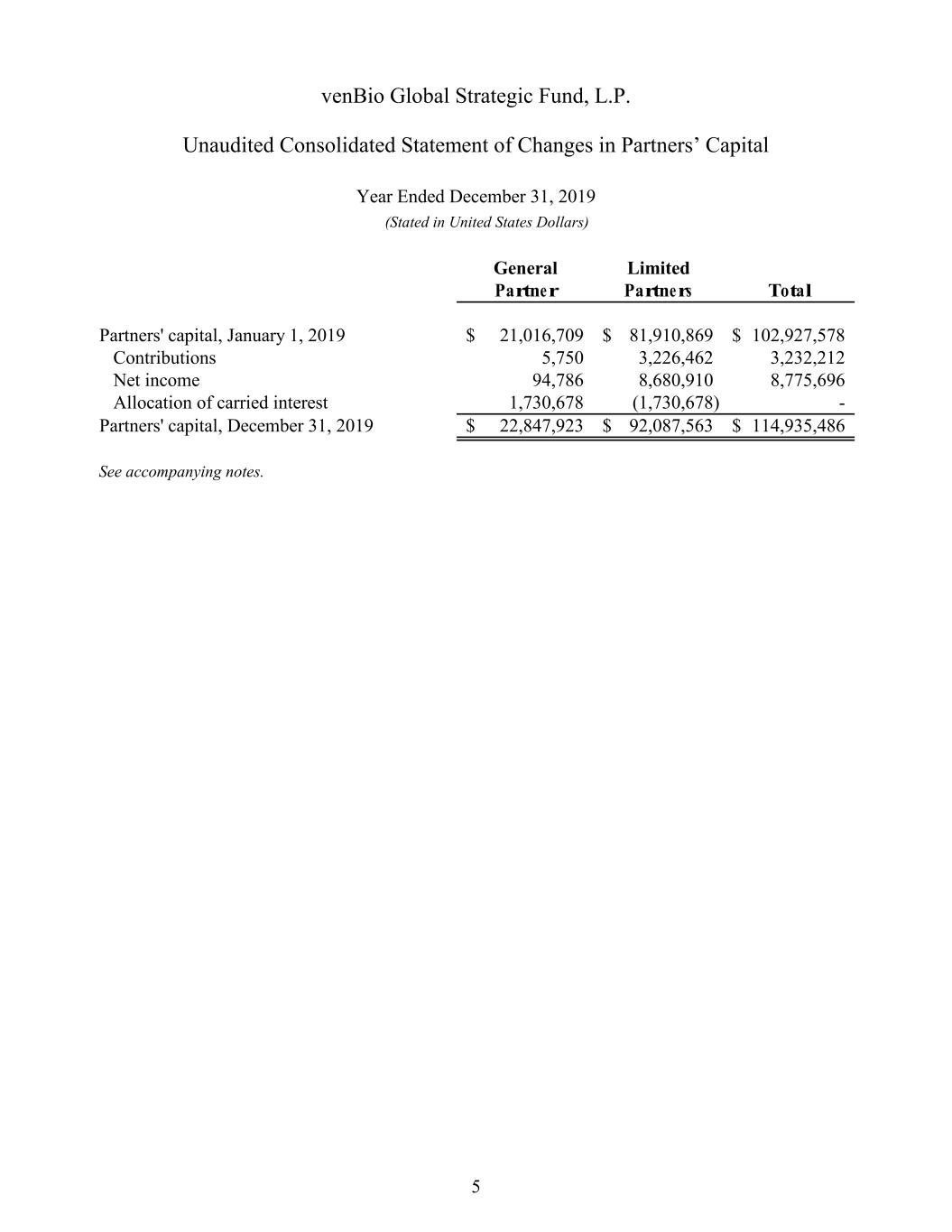

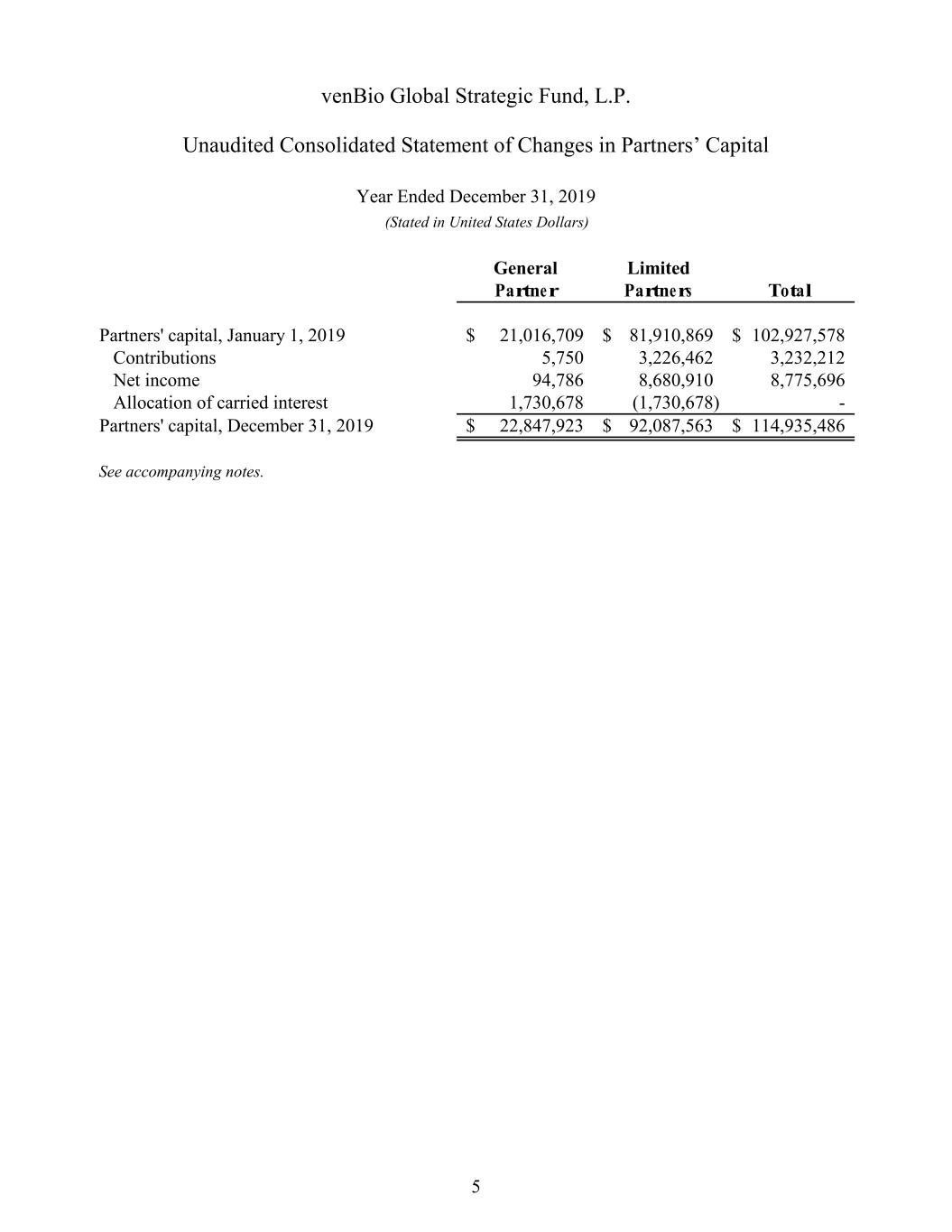

General Limited Partner Partners Total Partners' capital, January 1, 2019 21,016,709$ 81,910,869$ 102,927,578$ Contributions 5,750 3,226,462 3,232,212 Net income 94,786 8,680,910 8,775,696 Allocation of carried interest 1,730,678 (1,730,678) - Partners' capital, December 31, 2019 22,847,923$ 92,087,563$ 114,935,486$ See accompanying notes. venBio Global Strategic Fund, L.P. Year Ended December 31, 2019 Unaudited Consolidated Statement of Changes in Partners’ Capital (Stated in United States Dollars) 5

Operating activities Net income 8,775,696$ Adjustments to reconcile net income resulting from operations to net cash provided by operating activities: Purchases of investment securities (2,400,000) Proceeds from sale of investments 8,794,036 Net realized gain on investments (7,714,053) Change in net unrealized gain on investments (2,129,303) Changes in operating assets and liabilities: Increase in escrow receivable (4,053,407) Decrease in other assets 2,784 Increase in due to affiliate 26,784 Net cash provided by operating activities 1,302,537 Financing activities Proceeds from capital contributions 3,232,212 Net cash provided by financing activities 3,232,212 Net increase in cash 4,534,749 Cash at beginning of year 41,620 Cash at end of year 4,576,369$ See accompanying notes. Year Ended December 31, 2019 Unaudited Consolidated Statement of Cash Flows venBio Global Strategic Fund, L.P. (Stated in United States Dollars) 6

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements December 31, 2019 (Stated in United States Dollars) 1. The Partnership venBio Global Strategic Fund, L.P. (the Partnership) was formed as a Cayman Islands exempted limited partnership dated March 25, 2010. The general partner of the Partnership is venBio Global Strategic GP, L.P. (the General Partner). The primary investment objective of the Partnership is to make strategic equity and equity-related investments principally in entities operating in the life sciences industry and/or assets relating thereto and to achieve significant returns from its investments. The initial term of the Partnership shall continue until September 19, 2021, at which time the Partnership will commence winding up, unless its term is extended in accordance with the Partnership’s limited partnership agreement (the Agreement). Refer to the Agreement for more information. 2. Summary of Significant Accounting Policies Basis of Consolidated Presentation The accompanying consolidated financial statements are presented in accordance with accounting principles generally accepted in the United States (U.S. GAAP) and are stated in U.S. dollars. The consolidated financial statements include the accounts of venBio SPV (Cayman), Ltd. and venBio SPV, LLC. The Partnership owns 100% of venBio SPV (Cayman), Ltd. at December 31, 2019, and venBio SPV (Cayman), Ltd. owns 100% of venBio SPV, LLC at December 31, 2019. All significant intercompany balances and transactions have been eliminated in consolidation. venBio SPV (Cayman), Ltd., a Cayman Islands exempted limited partnership, was established on November 9, 2012, to invest specifically in venBio SPV, LLC, a Delaware limited liability company. As of December 31, 2019, venBio SPV, LLC holds common shares in ALX Oncology Limited and Solstice Biologics Limited. The Partnership and the consolidated entities each are an investment company and applies specialized accounting guidance as outlined in Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 946 – Investment Companies. The General Partner has evaluated this guidance and has determined that each entity continues to meet the criteria to be classified as an investment company. 7

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Use of Estimates The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, including the fair value of investments, and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. Investments – Fair Value and Investment Transactions The Partnership’s investments are reflected on the consolidated statements of assets, liabilities, and partners’ capital at fair value, with unrealized gains and losses resulting from changes in fair value reflected in the change in net unrealized gain on investments on the consolidated statement of operations. Foreign investments are valued and reported in U.S. dollar amounts at the valuation date. Fair value is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). The fair values of the Partnership’s investments are based on observable market prices when available. The Partnership values its investments, in the absence of observable market prices, using the valuation methodologies described below applied on a consistent basis. For some investments, little market activity may exist; management’s determination of fair value is then based on the best information available in the circumstances and may incorporate management’s own assumptions and involves a significant degree of management’s judgment. Investments in private operating companies consist of direct private common and preferred stock (together or individually "equity") investments. The transaction price, excluding transaction costs, is typically the Partnership’s best estimate of fair value at inception. When evidence supports a change to the carrying value from the transaction price, adjustments are made to reflect expected exit values in the investment's principal market under current market conditions. Ongoing reviews by the Partnership’s management are based on an assessment of trends in the performance of each underlying investment from the inception date through the most recent valuation date. The valuation methodologies used to value private investments may include reference to valuations of comparable companies in the relevant asset class and/or reference to public market or private transactions where such transactions exist. Generally, these valuations are derived by multiplying a key performance metric of the investee company (e.g., revenue, sales) by the relevant valuation multiple observed for comparable companies or transactions. The valuation multiple is often adjusted for differences between the investment and the referenced comparables. 8

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Investments – Fair Value and Investment Transactions (continued) Private investments may also be valued at cost, or the most recent financing price, for a period of time after an acquisition as the best indicator of fair value. The most recent financing may also be utilized in a back-solve option pricing model. The option pricing model treats a portfolio company’s common stock and preferred stock as call options on the enterprise or equity value of the portfolio company, with exercise or strike prices based on the characteristics of each series or class of equity in the portfolio company’s capital structure (e.g. liquidation preference of a given series of preferred stock). This method is sensitive to certain key assumptions, such as volatility and time to exit, that are not observable. Milestone earnouts are valued based on the risk-adjusted probability of receipt/completion of the milestone (also can be referred to as PTRS – Probability of Technical and Regulatory Success) and then Net Present Value (NPV) adjusted based on the future projected cash flows. These valuation methodologies involve a significant degree of management judgment and because of the inherent uncertainty of valuation, these estimated values may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material. U.S. GAAP establishes a hierarchal disclosure framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is affected by a number of factors, including the type of investment, the characteristics specific to the investment and the state of the market place, including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices in an orderly market will generally have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value. Investments measured and reported at fair value are classified and disclosed in one of the following categories: Level I – Quoted prices are available in active markets for identical investments as of the reporting date. The type of investments in Level I include listed equities and listed derivatives. The Partnership does not adjust the quoted price for these investments, even in situations where the Partnership holds a large position and a sale could reasonably affect the quoted price. Level II – Pricing inputs are other than quoted prices in active markets, which are either directly or indirectly observable as of the reporting date, and fair value is determined through the use of models or other valuation methodologies. Investments that are generally included in this category include corporate bonds and loans, less liquid and restricted equity securities and certain over-the-counter derivatives. 9

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Investments – Fair Value and Investment Transactions (continued) Level III – Pricing inputs are unobservable for the investment and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require significant management judgment or estimation. Investments that are included in this category generally include private investments of equity and/or debt, milestone earnouts, general and limited partnership interests in corporate private equity. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The Partnership’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and it considers factors specific to the investment. Fair Value Hierarchy The following table summarizes the valuation of the Partnership’s investments by the fair value hierarchy levels as of December 31, 2019: Investments, at fair value Level I Level II Level III Total Common stock 59,242,808$ -$ $ 15,196 $ 59,258,004 Preferred stock - - 45,355,180 45,355,180 Milestone earnouts - - 1,721,604 1,721,604 Total investments, at fair value 59,242,808$ -$ $ 47,091,980 $ 106,334,788 Fair Value 10

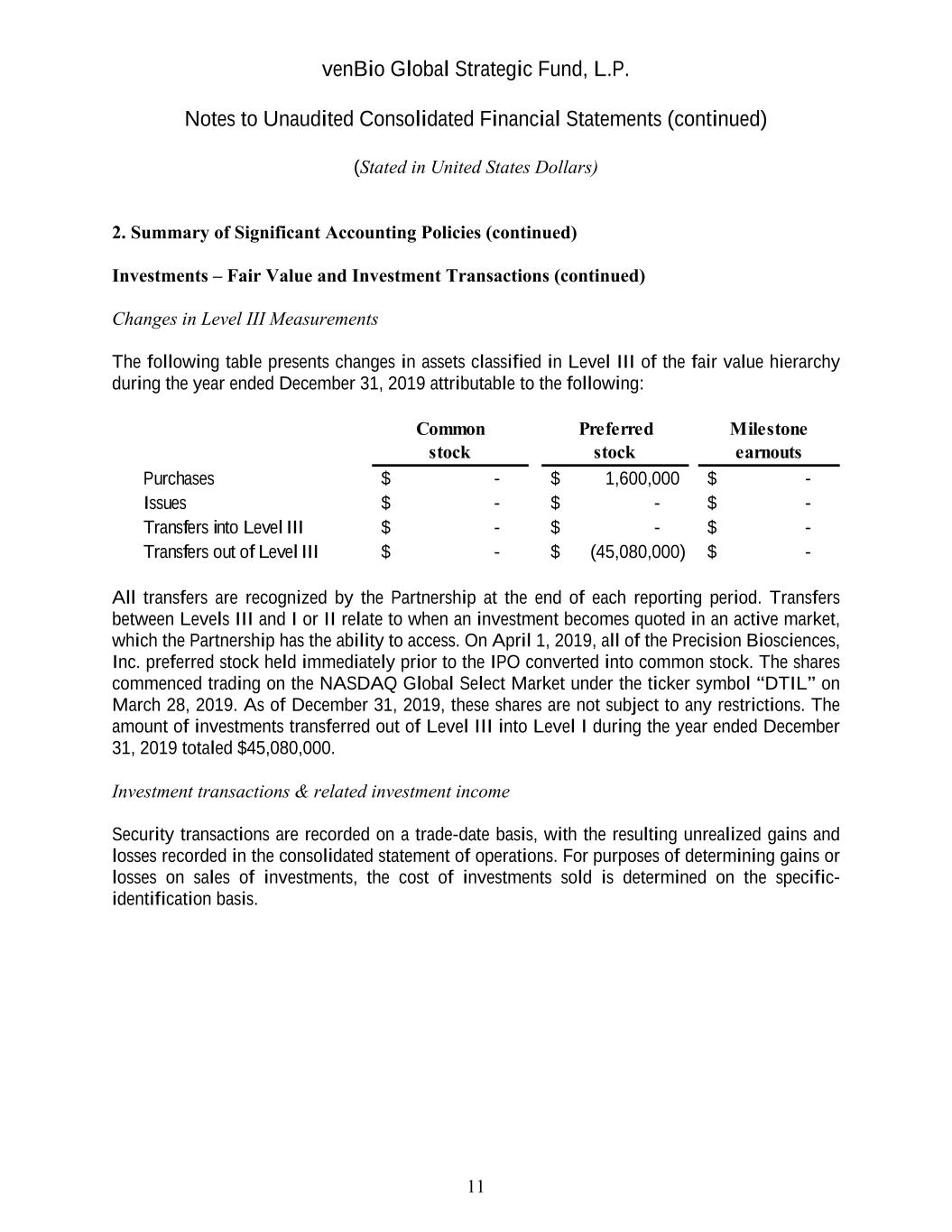

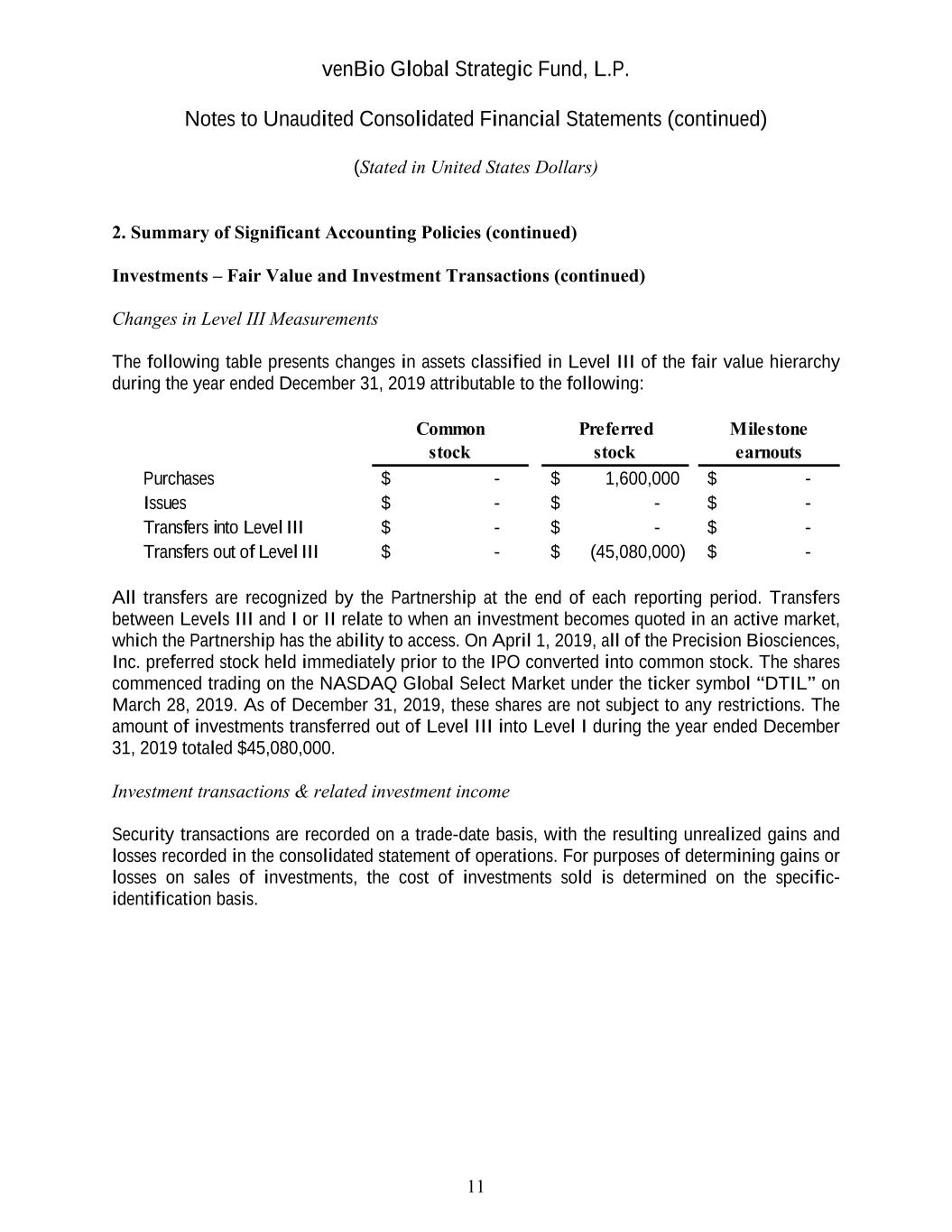

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Investments – Fair Value and Investment Transactions (continued) Changes in Level III Measurements The following table presents changes in assets classified in Level III of the fair value hierarchy during the year ended December 31, 2019 attributable to the following: All transfers are recognized by the Partnership at the end of each reporting period. Transfers between Levels III and I or II relate to when an investment becomes quoted in an active market, which the Partnership has the ability to access. On April 1, 2019, all of the Precision Biosciences, Inc. preferred stock held immediately prior to the IPO converted into common stock. The shares commenced trading on the NASDAQ Global Select Market under the ticker symbol “DTIL” on March 28, 2019. As of December 31, 2019, these shares are not subject to any restrictions. The amount of investments transferred out of Level III into Level I during the year ended December 31, 2019 totaled $45,080,000. Investment transactions & related investment income Security transactions are recorded on a trade-date basis, with the resulting unrealized gains and losses recorded in the consolidated statement of operations. For purposes of determining gains or losses on sales of investments, the cost of investments sold is determined on the specific- identification basis. Common Preferred Milestone stock stock earnouts Purchases -$ 1,600,000$ -$ Issues -$ -$ -$ Transfers into Level III -$ -$ -$ Transfers out of Level III -$ (45,080,000)$ -$ 11

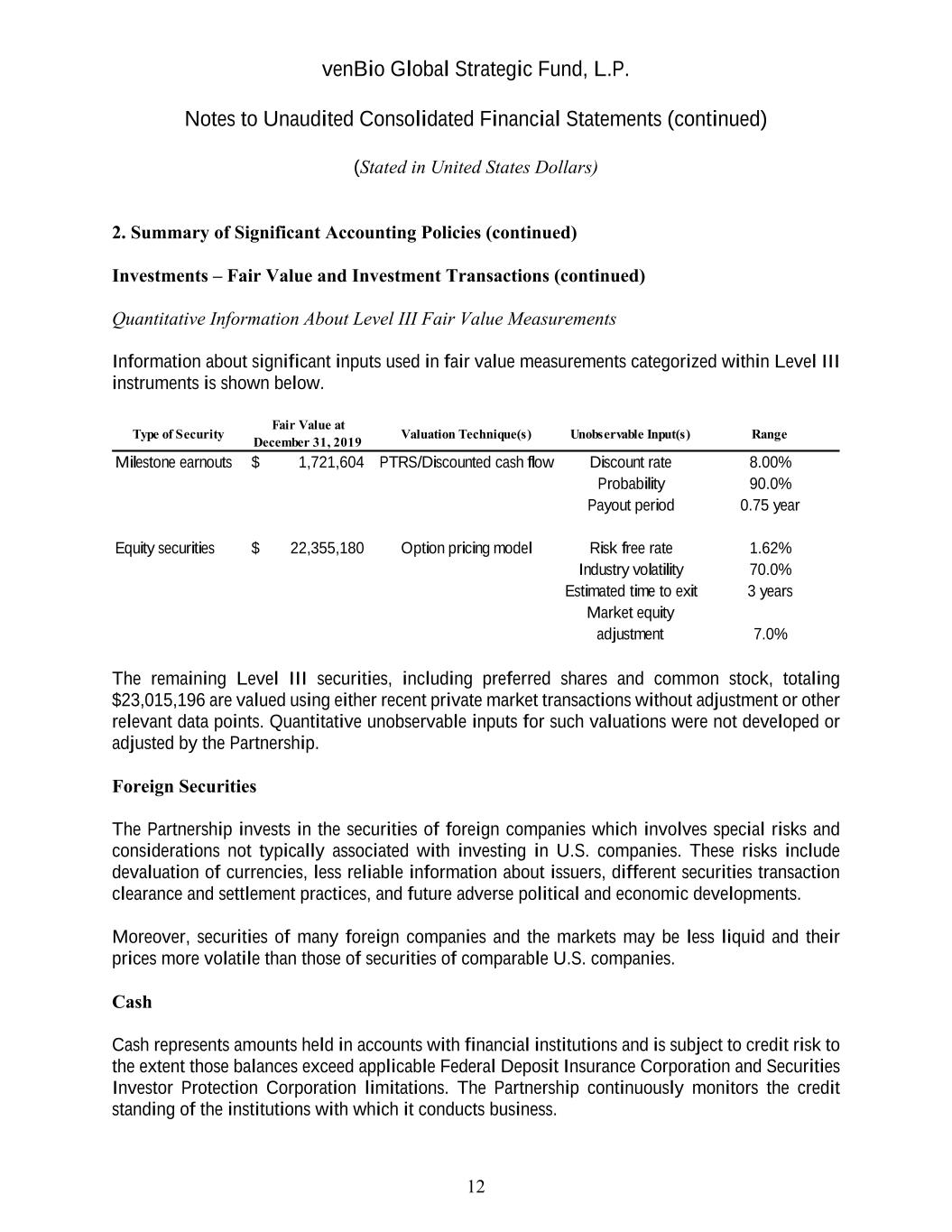

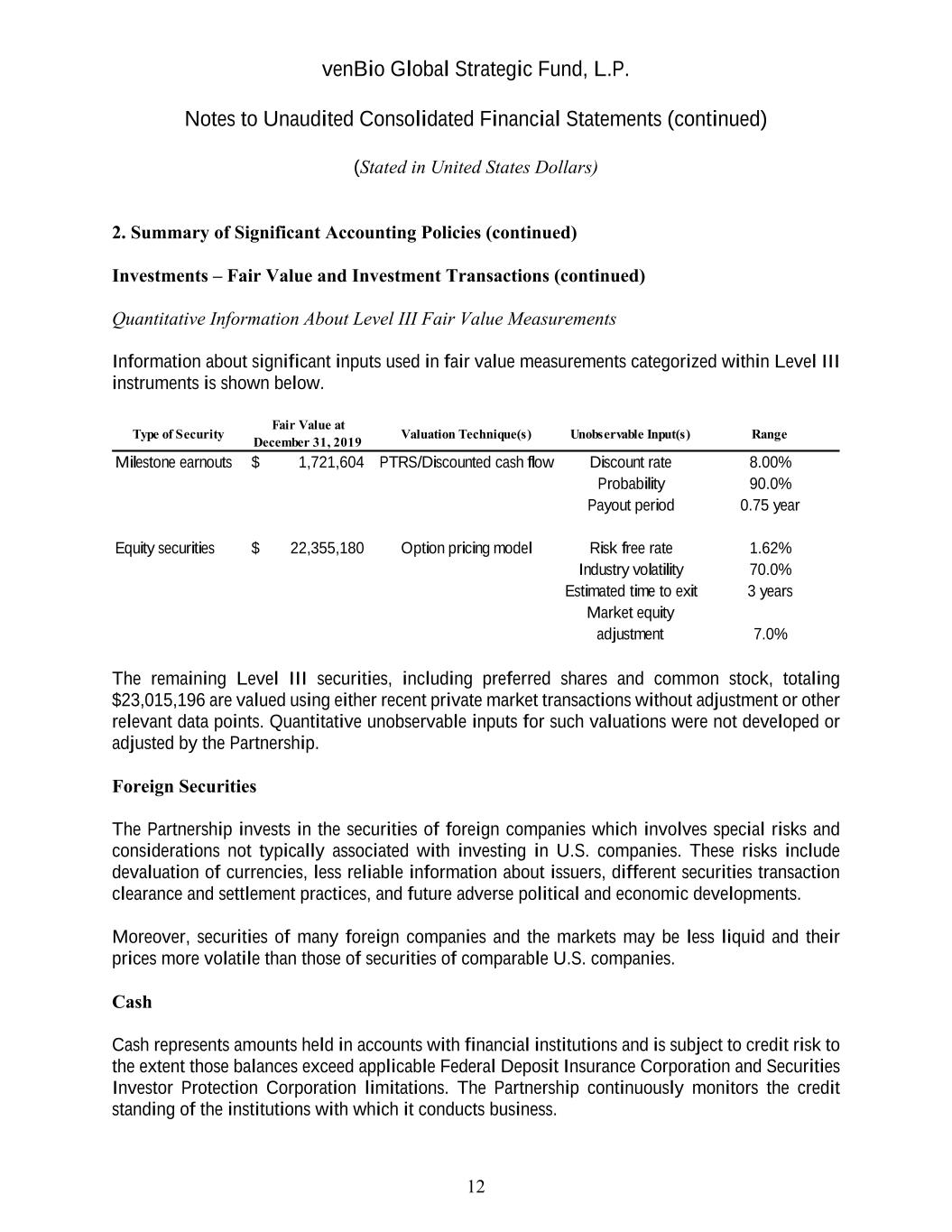

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Investments – Fair Value and Investment Transactions (continued) Quantitative Information About Level III Fair Value Measurements Information about significant inputs used in fair value measurements categorized within Level III instruments is shown below. The remaining Level III securities, including preferred shares and common stock, totaling $23,015,196 are valued using either recent private market transactions without adjustment or other relevant data points. Quantitative unobservable inputs for such valuations were not developed or adjusted by the Partnership. Foreign Securities The Partnership invests in the securities of foreign companies which involves special risks and considerations not typically associated with investing in U.S. companies. These risks include devaluation of currencies, less reliable information about issuers, different securities transaction clearance and settlement practices, and future adverse political and economic developments. Moreover, securities of many foreign companies and the markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies. Cash Cash represents amounts held in accounts with financial institutions and is subject to credit risk to the extent those balances exceed applicable Federal Deposit Insurance Corporation and Securities Investor Protection Corporation limitations. The Partnership continuously monitors the credit standing of the institutions with which it conducts business. Type of Security Fair Value at December 31, 2019 Valuation Technique(s) Unobservable Input(s) Range Milestone earnouts 1,721,604$ PTRS/Discounted cash flow Discount rate 8.00% Probability 90.0% Payout period 0.75 year Equity securities 22,355,180$ Option pricing model Risk free rate 1.62% Industry volatility 70.0% Estimated time to exit 3 years Market equity adjustment 7.0% 12

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Market and Other Risk Factors At December 31, 2019, the Partnership’s portfolio of investments includes non-publicly traded securities. The non-publicly traded securities trade, if at all, in an illiquid marketplace. The portfolio is concentrated in the life sciences industry. Risks affecting this industry include, but are not limited to, increased competition, rapid changes in technology, government actions, and changes in economic conditions. These risk factors could have a material effect on the ultimate realized value of the Partnership’s investments. Professional Fees and Other Expenses Professional fees and other expenses represent annual audit and tax fees, as well as legal and other miscellaneous expenses. Milestone Earnouts Milestone earnouts refers to additional amounts from liquidated investments that management believes may be realized at future dates and/or as future events occur. The value of estimated milestone earnouts may vary based on the input assumptions, estimates and other items that require significant judgment or estimation by the General Partner. On a periodic basis, the General Partner will review and adjust, if necessary, the assumptions and estimates for the milestone earnout proceeds. While the milestone earnouts amounts reflect a concentration of risk, the General Partner considers counterparty performance risk in its determination of projected earnout amounts. All counterparties to current earnout arrangements are deemed to represent reputable financially secure companies. The projected earnout amounts are included in investments on the accompanying consolidated statement of assets, liabilities, and partners’ capital. Aragon Pharmaceuticals, Inc. (“Aragon”) entered into a merger agreement and was effectively acquired by Johnson & Johnson. Consideration for this agreement provided to the Aragon shareholders consisted of upfront cash proceeds, newly formed company Seragon Pharmaceuticals, Inc.’s common stock, escrow holdback and projected earnouts based on milestone achievements. Projected earnout payments are contingent upon completion of milestone achievements with one remaining payment expected in 2020. The Partnership’s share of the maximum gross remaining earnout milestone payment is approximately $2,000,000 and is valued at $1,721,604 at December 31, 2019. 13

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 2. Summary of Significant Accounting Policies (continued) Escrow Receivable During 2019, Aragon completed a milestone achievement related to EU First Approval. As of December 31, 2019, the entire proceeds of $4,053,407, related to the milestone achievement is in escrow. Income Taxes No provision for U.S. federal, U.S. state, or local income taxes has been made in the accompanying consolidated financial statements, as partners are individually liable for their own tax payments. The Partnership performs an evaluation of tax positions taken or expected to be taken in the course of preparing the Partnership tax returns to determine whether the tax positions are “more-likely- than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax expense. The Partnership has recorded no expense or liability related to any uncertain tax positions as of December 31, 2019. The Partnership does not expect that its assessment related to unrecognized tax benefits will materially change over the next 12 months. However, the Partnership’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, the nexus of income among various tax jurisdictions; compliance with U.S. federal, U.S. state, and foreign tax laws; and changes in the administrative practices and precedents of the relevant taxing authorities. Generally, the Partnership is subject to income tax examinations by major taxing authorities for the last three years preceding the date of these consolidated financial statements. The Partnership recognizes interest and penalties, if any, as income tax expense in the consolidated statement of operations. During the year ended December 31, 2019, the Partnership did not accrue any interest and penalties. 3. Related-Party Transactions The Partnership pays venBio Partners LLC (the Management Company) (or its designee) an annual management fee equal to the sum of all limited partner fee amounts for such annual period. The limited partner fee amount shall mean with respect to each annual period and each limited partner with a subscription: (i) less than $75 million, an amount equal to 2.2% of such limited partner’s subscription; (ii) equal to or greater than $75 million, but less than $100 million, 2.0% of such limited partner’s subscription; (iii) equal to or greater than $100 million but less than $125 million, 1.8% of such limited partner’s subscription; and (iv) equal to or greater than $125 million, 1.5% of such limited partner’s subscription. 14

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 3. Related-Party Transactions (continued) Beginning September 19, 2016, the first day following the expiration of the investment period, the percentage used in calculating each limited partner’s management fees was reduced by 0.2% per annual period, with a minimum percentage threshold of 1.25%. Furthermore, if the limited partner’s aggregate invested capital (as defined in the Agreement) is less than 50% of the limited partner’s aggregate subscriptions, the management fee will be based on the aggregate invested capital as of the first day of each period for which the management fee is being paid rather than subscriptions. The percentage was reduced by an additional 0.2% in 2019, subject to the minimum percentage threshold above. For the year ended December 31, 2019, the management fee base is the aggregate limited partner’s invested capital. The gross management fee has been reduced each quarter by the deemed contributions made by the General Partner and receipt of any board compensation from portfolio companies, as follows: Year Ended December 31, 2019 Gross management fee $ 726,010 Deemed contributions by General Partner (23,000) Net management fee $ 703,010 The Partnership shall bear and be responsible for all expenses of the Partnership other than Ordinary Operating Expenses, defined below, which shall be borne by the Management Company. Ordinary Operating Expenses are defined as ordinary overhead and operating administrative expenses of the General Partner and the Management Company incurred in connection with maintaining and operating the General Partner’s and the Management Company’s office, including wages, salaries, rent, utilities and routine office equipment expense. Certain members of the General Partner serve on the Board of Directors of various portfolio companies in which the Partnership invests. Additionally, the Partnership may coinvest with other entities with the same General Partner as the Partnership. At December 31, 2019, the Partnership held an investment with a fair value of $20,415,196 that was coinvested with an affiliated Partnership. 15

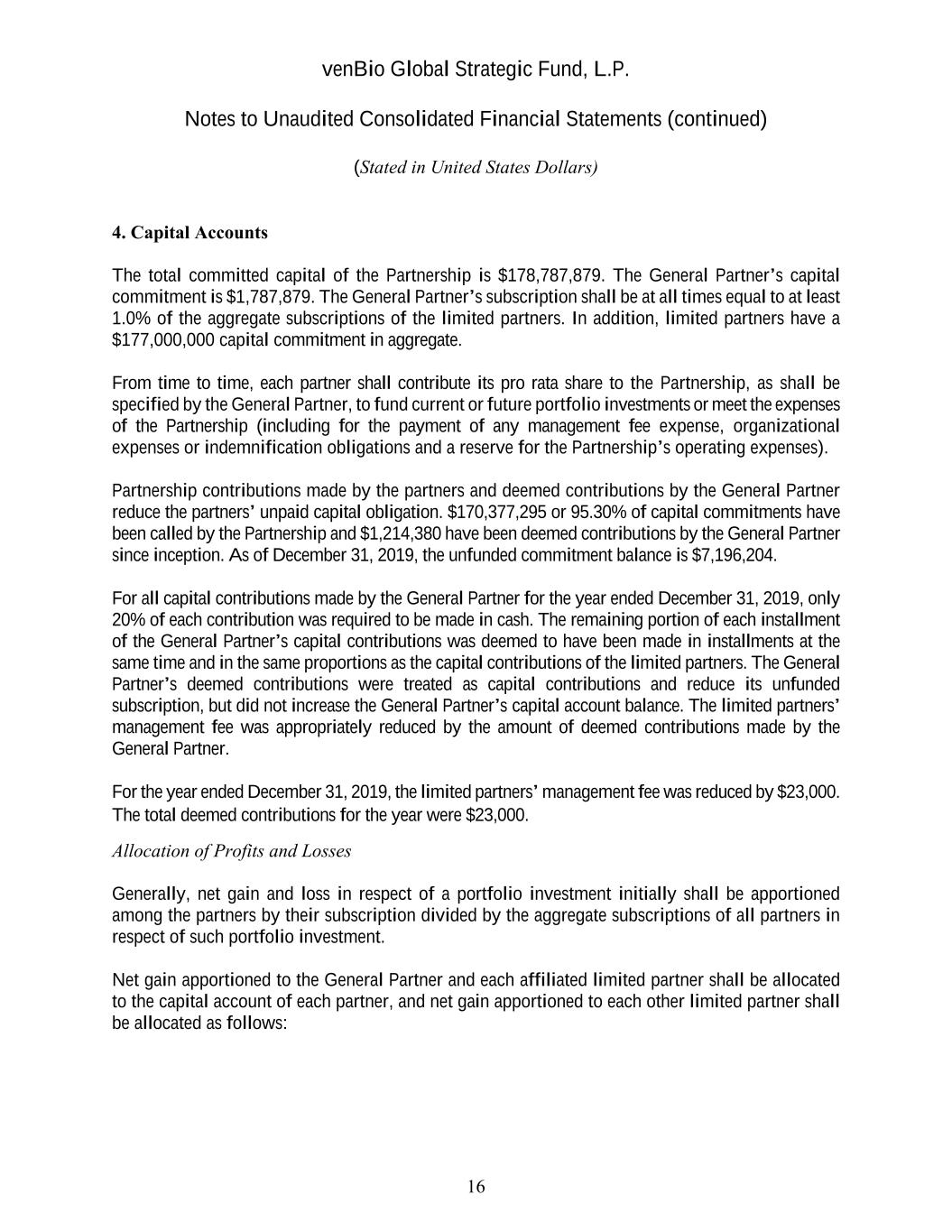

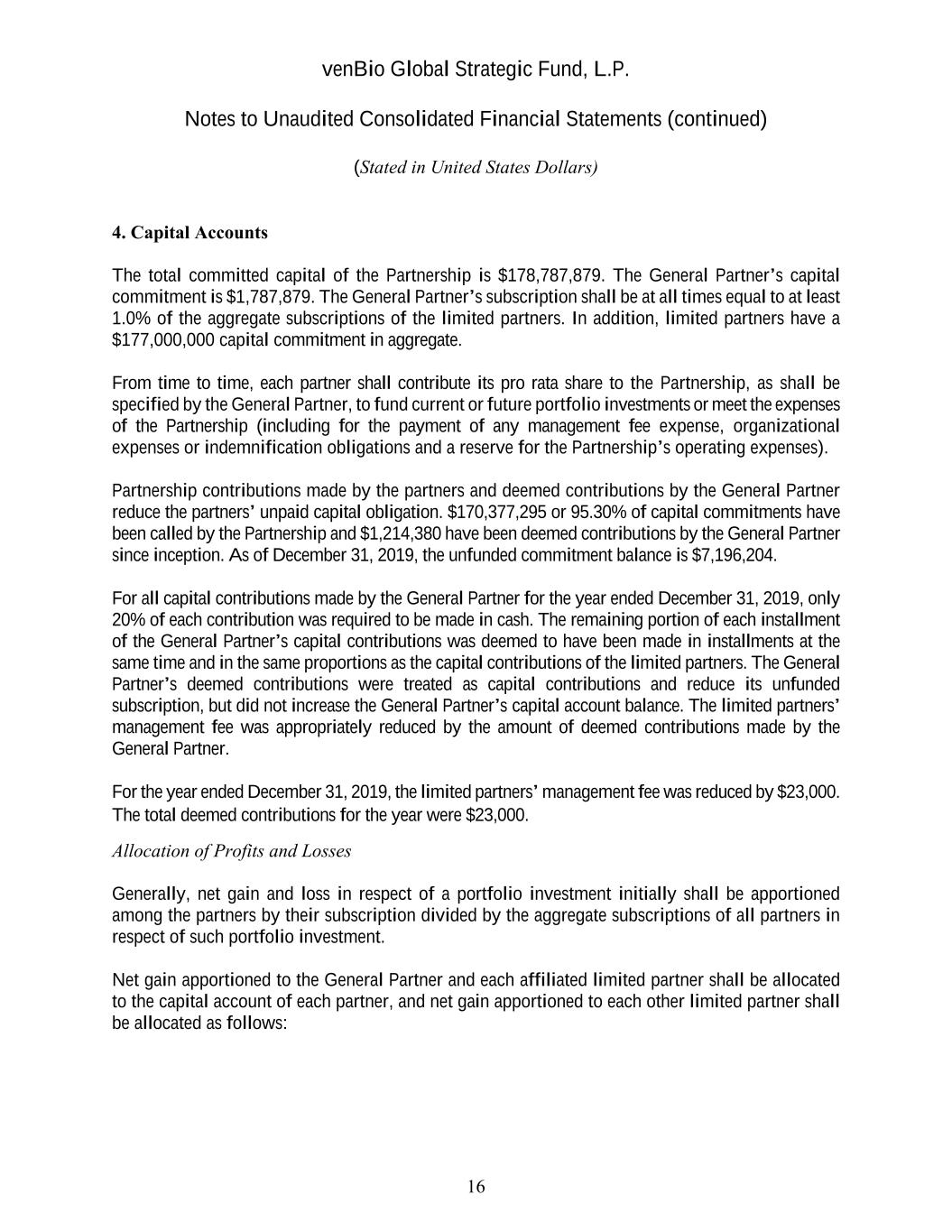

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 4. Capital Accounts The total committed capital of the Partnership is $178,787,879. The General Partner’s capital commitment is $1,787,879. The General Partner’s subscription shall be at all times equal to at least 1.0% of the aggregate subscriptions of the limited partners. In addition, limited partners have a $177,000,000 capital commitment in aggregate. From time to time, each partner shall contribute its pro rata share to the Partnership, as shall be specified by the General Partner, to fund current or future portfolio investments or meet the expenses of the Partnership (including for the payment of any management fee expense, organizational expenses or indemnification obligations and a reserve for the Partnership’s operating expenses). Partnership contributions made by the partners and deemed contributions by the General Partner reduce the partners’ unpaid capital obligation. $170,377,295 or 95.30% of capital commitments have been called by the Partnership and $1,214,380 have been deemed contributions by the General Partner since inception. As of December 31, 2019, the unfunded commitment balance is $7,196,204. For all capital contributions made by the General Partner for the year ended December 31, 2019, only 20% of each contribution was required to be made in cash. The remaining portion of each installment of the General Partner’s capital contributions was deemed to have been made in installments at the same time and in the same proportions as the capital contributions of the limited partners. The General Partner’s deemed contributions were treated as capital contributions and reduce its unfunded subscription, but did not increase the General Partner’s capital account balance. The limited partners’ management fee was appropriately reduced by the amount of deemed contributions made by the General Partner. For the year ended December 31, 2019, the limited partners’ management fee was reduced by $23,000. The total deemed contributions for the year were $23,000. Allocation of Profits and Losses Generally, net gain and loss in respect of a portfolio investment initially shall be apportioned among the partners by their subscription divided by the aggregate subscriptions of all partners in respect of such portfolio investment. Net gain apportioned to the General Partner and each affiliated limited partner shall be allocated to the capital account of each partner, and net gain apportioned to each other limited partner shall be allocated as follows: 16

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 4. Capital Accounts (continued) Allocation of Profits and Losses (continued) (a) First, 100% to the limited partner in an amount equal to the sum of (1) the net loss (if any) previously allocated to the limited partner and (2) the management fee expense previously allocated to the limited partner, in each case to the extent not offset by prior allocations of net gain made; and (b) Thereafter, the limited partner’s Carried Interest (as defined below) percentage to the General Partner and the remainder to the limited partner. Net loss apportioned to the General Partner and each affiliated limited partner shall be allocated to the capital account of each partner, and net loss apportioned to each other limited partner shall be allocated as follows: (a) First, to the limited partner and the General Partner, in proportion to their respective amounts of net gain (if any) previously allocated to the limited partner and the General Partner in respect of the limited partner and not offset by prior allocations of net loss, an amount of net loss equal to the aggregate amount of such net gain (if any); and (b) Thereafter, to the limited partner. The management fee shall be allocated to the limited partners in proportion to their respective limited partner fee amounts. After the application of the above, the General Partner shall be entitled to receive a priority allocation of net gain that otherwise would have been allocated to the limited partners in the same proportions as allocations were made to the limited partners, in an amount equal to the amount of net gain that otherwise would have been allocated to the General Partner, provided that allocations of net gain will be made only if, and to the extent that, the available net gain as of such time is at least equal to such allocations. 17

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 4. Capital Accounts (continued) Allocation of Profits and Losses (continued) Limited partners with a subscription below $75 million are subject to a carried interest percentage of 20% and limited partners with a subscription of $75 million or greater are subject to a carried interest percentage of 17.5% (individually or in the aggregate “Carried Interest”). The General Partner’s Carried Interest is determined after taking into account all net gains and net losses allocated to the General Partner on a cumulative basis since the inception of the Partnership. The amount of accrued Carried Interest, calculated from both realized and unrealized gains, allocated from the limited partners to the General Partner, is $1,730,678 for the year ended December 31, 2019 and $60,149,586 since inception. The Carried Interest to the General Partner will remain provisional until final liquidation of the Partnership. Distributions Distributable proceeds attributable to any portfolio investment initially shall be apportioned among the partners in proportion to their respective sharing percentages in respect of such portfolio investment. Distributable proceeds apportioned to the General Partner shall be distributed to the General Partner, and distributable proceeds apportioned to each other limited partner shall be distributed as follows: (a) First, 100% to the limited partner until the cumulative amount distributed to the limited partner is equal to such limited partner’s capital contributions; and (b) Thereafter, the limited partner’s Carried Interest percentage to the General Partner and the remainder to the limited partner. As a result of the General Partner’s Carried Interest, the Partnership shall distribute to the General Partner in cash, with respect to each fiscal year, either during the year or within 90 days thereafter, an amount (a “Tax Distribution”) equal to the aggregate federal, state and local tax liability the partner would have incurred. During the year ended December 31, 2019, the Partnership neither made Tax Distributions nor discretionary distributions. Total cumulative distributions of the Partnership are $373,742,154 as of December 31, 2019. 18

venBio Global Strategic Fund, L.P. Notes to Unaudited Consolidated Financial Statements (continued) (Stated in United States Dollars) 5. Indemnification Generally, no partner is individually liable for any debts or obligations of the Partnership in excess of its unpaid capital commitments. As described in the Agreement, the limited partners have indemnified the General Partner in connection with its activities on behalf of the Partnership. The Partnership has not had any claims or losses pursuant to these indemnifications and expects the risk of loss to be remote. 6. Financial Highlights Financial highlights are calculated for limited partners taken as a whole. An individual investor’s results may vary from these results based on different fee arrangements and the timing of capital transactions. The internal rate of return of the limited partners since inception is net of Carried Interest allocations, if any, to the General Partner and was computed based on the actual dates of the capital contributions and distributions, and the aggregate limited partners’ capital at the end of each measurement period. The net investment loss ratio does not reflect any effect of Carried Interest to the General Partner. Financial highlights for the year ended December 31, 2019, are as follows: Internal rate of return, since inception: Beginning of year 75.75 % End of year 74.39 % Ratios to average limited partners’ capital: Expenses before Carried Interest allocation 1.21 % Allocation of Carried Interest 1.97 % Expenses after Carried Interest allocation 3.18 % Net investment loss (1.21)% 19