UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_______to_______

Commission file number: 001-39232

Rush Street Interactive, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 84-3626708 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | |

900 N. Michigan Avenue, Suite 950 Chicago, Illinois 60611 | (773) 893-5855 |

| (Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

| Class A common stock, $0.0001 par value per share | RSI | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| Emerging growth company | x | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of July 31, 2024, there were 83,108,062 shares outstanding of the registrant’s Class A common stock, $0.0001 par value per share, and 142,404,310 shares outstanding of the registrant’s Class V common stock, $0.0001 per value per share.

TABLE OF CONTENTS

Rush Street Interactive, Inc.

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended, that reflect future plans, estimates, beliefs and expected performance. The forward-looking statements depend upon events, risks and uncertainties that may be outside of our control. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Any statements contained herein that are not statements of historical fact may be forward-looking statements.

Our projections, including for revenues, market share, expenses and profitability, are subject to significant risks, assumptions, estimates and uncertainties. You are cautioned that our business and operations are subject to a variety of risks and uncertainties, many of which are beyond our control, and, consequently, our actual results may differ materially from those projected.

Factors that could cause or contribute to such differences include, but are not limited to, the following:

•competition in the online casino, online sports betting and retail sports betting (i.e., such as within a bricks-and-mortar casino) industries is intense and, as a result, we may fail to attract and/or retain customers, which may negatively impact our operations, growth prospects and financial condition;

•economic downturns, such as recessions, inflation, and political and market conditions beyond our control, including a reduction in consumer discretionary spending and sports leagues shortening, delaying or cancelling parts of their seasons or certain events due to external factors such as pandemics or international conflicts, could adversely affect our business, financial condition, results of operations and prospects;

•our growth prospects may suffer if we are unable to develop or maintain competitive offerings, if we fail to pursue additional offerings, if we lose any of our executives or other key employees or if we are unable to scale and support our information technology and other systems and platforms to meet the Company’s needs;

•our business is subject to a variety of U.S. and foreign laws (including the laws of Canada, Colombia, Mexico and Peru, where we have business operations), many of which are unsettled and still developing, and our growth prospects depend on the legal status of real-money gaming in various jurisdictions;

•failure to comply with regulatory requirements or, as necessary or appropriate, successfully obtain a license or permit applied for could adversely impact our ability to comply with licensing and regulatory requirements or to obtain or maintain licenses in other jurisdictions, or could cause financial institutions, online platforms, vendors and distributors to stop providing services to us;

•we rely on information technology and other systems and platforms (including reliance on third-party providers to validate the identity and location of our customers and to process customer deposits and withdrawals), and any breach or disruption of such systems or platforms could compromise our networks and the information stored there could be accessed, disclosed, lost, corrupted or stolen;

•we have a history of losses (calculated in accordance with accounting principles generally accepted in the United States) and may continue to incur losses in the future;

•certain of our officers and directors may allocate their time to other businesses and potentially have conflicts of interest with our business;

•we license certain trademarks and domain names from Rush Street Gaming, LLC (“RSG”) and its affiliates, and RSG’s and its affiliates’ use of such trademarks and domain names, or failure to protect or enforce our intellectual property rights, could harm our business, financial condition, results of operations and prospects;

•we currently, and will likely continue to, rely on licenses and service agreements to use the intellectual property rights and technology of related or third parties that are incorporated into or used in our products and services; and

•other factors described in our Annual Report on Form 10-K for our most recently completed fiscal year, including the “Business”, “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” sections, as

well as described in our other filings with the SEC, such as this Report, our other Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

Due to the uncertain nature of these factors, management cannot assess the impact of each factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any of these statements to reflect events or circumstances occurring after the date of this Report, unless required by law. New factors may emerge, and it is not possible to predict all factors that may affect our business and prospects.

Limitations of Key Metrics and Other Data

The numbers for our key metrics, which include our monthly active users (“MAUs”) and average revenue per MAU (“ARPMAU”), are calculated using internal company data based on the activity of user accounts. While these numbers are based on what we believe to be reasonable estimates of our user base and activity levels for the applicable period of measurement, there are inherent challenges in measuring usage of our offerings across large online and mobile populations based in numerous jurisdictions. In addition, we continuously seek to improve our estimates of our user base and user activity, and such estimates may change due to improvements or changes in our methodology.

We regularly evaluate these metrics to estimate the number of “duplicate” accounts among our MAUs and remove the effects of such duplicate accounts on our key metrics. A duplicate account is one that a user maintains in addition to his or her principal account. Generally, duplicate accounts arise as a result of users signing up to use more than one of our brands (i.e., BetRivers, PlaySugarHouse and RushBet) or to use our offerings in more than one jurisdiction, for instance when a user lives in New Jersey but works in New York. The estimates of duplicate accounts are based on an internal review of a limited sample of accounts, and we apply significant judgment in making this determination. For example, to identify duplicate accounts we use data signals such as similar IP addresses or usernames. Our estimates may change as our methodologies evolve, including through the application of new data signals or technologies, which may allow us to identify previously undetected duplicate accounts and may improve our ability to evaluate a broader population of our users. Duplicate accounts are very difficult to measure, and it is possible that the actual number of duplicate accounts may vary significantly from our estimates.

Our data limitations may affect our understanding of certain details of our business. We regularly review our processes for calculating these metrics, and from time to time we may discover inaccuracies in our metrics or make adjustments to improve their accuracy, including adjustments that may result in the recalculation of our historical metrics. We believe that any such inaccuracies or adjustments are immaterial unless otherwise stated. In addition, our key metrics and related information and estimates, including the definitions and calculations of the same, may differ from those published by third parties or from similarly titled metrics of our competitors due to differences in operations, offerings, methodology and access to information.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

RUSH STREET INTERACTIVE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands except for share and per share data)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 193,815 | | | $ | 168,330 | |

| Restricted cash | 5,039 | | | 2,647 | |

| Players’ receivables | 10,085 | | | 10,516 | |

| Due from affiliates | 16,803 | | | 33,471 | |

| Prepaid expenses and other current assets | 18,465 | | | 13,651 | |

| Total current assets | 244,207 | | | 228,615 | |

| | | |

| Intangible assets, net | 78,442 | | | 74,874 | |

| Property and equipment, net | 8,019 | | | 8,611 | |

| Operating lease assets | 2,924 | | | 1,276 | |

| Other assets | 7,144 | | | 5,204 | |

| Total assets | $ | 340,736 | | | $ | 318,580 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 31,800 | | | $ | 32,347 | |

| Accrued expenses | 64,773 | | | 51,131 | |

| Players’ liabilities | 39,731 | | | 42,135 | |

| Current deferred royalty liabilities | 1,754 | | | 1,712 | |

| Current operating lease liabilities | 772 | | | 621 | |

| Other current liabilities | 8,466 | | | 9,747 | |

| Total current liabilities | 147,296 | | | 137,693 | |

| | | |

| Non-current deferred royalty liabilities | 11,505 | | | 12,395 | |

| Non-current operating lease liabilities | 1,724 | | | 673 | |

| Other non-current liabilities | 2,090 | | | 1,690 | |

| Total liabilities | 162,615 | | | 152,451 | |

| | | |

| Commitments and contingencies (Note 12) | | | |

| | | |

| Stockholders’ equity | | | |

| Class A common stock, $0.0001 par value, 750,000,000 shares authorized as of June 30, 2024 and December 31, 2023; 80,481,719 and 72,387,409 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 8 | | | 7 | |

| Class V common stock, $0.0001 par value, 200,000,000 shares authorized as of June 30, 2024 and December 31, 2023; 144,904,310 and 150,434,310 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 14 | | | 15 | |

| | | |

| Additional paid-in capital | 203,967 | | | 192,163 | |

| Accumulated other comprehensive loss | (1,406) | | | (100) | |

| Accumulated deficit | (139,144) | | | (138,317) | |

| Total stockholders’ equity attributable to Rush Street Interactive, Inc. | 63,439 | | | 53,768 | |

| | | |

| Non-controlling interests | 114,682 | | | 112,361 | |

| Total stockholders’ equity | 178,121 | | | 166,129 | |

| Total liabilities and stockholders’ equity | $ | 340,736 | | | $ | 318,580 | |

See accompanying notes to unaudited condensed consolidated financial statements.

RUSH STREET INTERACTIVE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands except for share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Revenue | | $ | 220,379 | | | $ | 165,062 | | | $ | 437,807 | | | $ | 327,423 | |

| | | | | | | | |

| Operating costs and expenses | | | | | | | | |

| Costs of revenue | | 144,477 | | | 109,853 | | | 289,000 | | | 217,007 | |

| Advertising and promotions | | 36,944 | | | 40,965 | | | 75,348 | | | 90,905 | |

| General and administrative | | 27,206 | | | 20,558 | | | 53,074 | | | 42,150 | |

| Depreciation and amortization | | 7,555 | | | 7,988 | | | 14,656 | | | 13,743 | |

| Total operating costs and expenses | | 216,182 | | | 179,364 | | | 432,078 | | | 363,805 | |

| Income (loss) from operations | | 4,197 | | | (14,302) | | | 5,729 | | | (36,382) | |

| | | | | | | | |

| Other income | | | | | | | | |

| Interest income, net | | 1,917 | | | 288 | | | 3,476 | | | 668 | |

| Income (loss) before income taxes | | 6,114 | | | (14,014) | | | 9,205 | | | (35,714) | |

| | | | | | | | |

| Income tax expense | | 6,396 | | | 2,720 | | | 11,696 | | | 5,520 | |

| Net loss | | (282) | | | (16,734) | | | (2,491) | | | (41,234) | |

| Net loss attributable to non-controlling interests | | (182) | | | (11,595) | | | (1,664) | | | (28,835) | |

| Net loss attributable to Rush Street Interactive, Inc. | | $ | (100) | | | $ | (5,139) | | | $ | (827) | | | $ | (12,399) | |

| | | | | | | | |

| Net loss per common share attributable to Rush Street Interactive, Inc. – basic and diluted | | $ | (0.00) | | | $ | (0.08) | | | $ | (0.01) | | | $ | (0.19) | |

| Weighted-average common shares outstanding – basic and diluted | | 80,049,123 | | | 67,389,454 | | | 78,038,275 | | | 66,330,641 | |

See accompanying notes to unaudited condensed consolidated financial statements.

RUSH STREET INTERACTIVE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Net loss | $ | (282) | | | $ | (16,734) | | | $ | (2,491) | | | $ | (41,234) | |

| | | | | | | |

| Other comprehensive income (loss) | | | | | | | |

| Foreign currency translation adjustment | (3,734) | | | 1,626 | | | (3,633) | | | 1,970 | |

| Comprehensive loss | (4,016) | | | (15,108) | | | (6,124) | | | (39,264) | |

| Comprehensive loss attributable to non-controlling interests | (2,589) | | | (10,463) | | | (4,005) | | | (27,460) | |

| Comprehensive loss attributable to Rush Street Interactive, Inc. | $ | (1,427) | | | $ | (4,645) | | | $ | (2,119) | | | $ | (11,804) | |

See accompanying notes to unaudited condensed consolidated financial statements.

RUSH STREET INTERACTIVE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Amounts in thousands except for share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common Stock | | Class V

Common Stock | | Additional

Paid-in

Capital | | Accumulated Other Comprehensive Loss | | Accumulated

Deficit | | Total Stockholders’ Equity Attributable to RSI | | Non-

Controlling

Interests | | Total

Stockholders’

Equity |

| Shares | | Amount | | Shares | | Amount | | | | | | |

| Balance at December 31, 2023 | 72,387,409 | | | $ | 7 | | | 150,434,310 | | | $ | 15 | | | $ | 192,163 | | | $ | (100) | | | $ | (138,317) | | | $ | 53,768 | | | $ | 112,361 | | | $ | 166,129 | |

| Share-based compensation | 2,106,202 | | | — | | | — | | | — | | | 2,979 | | | — | | | — | | | 2,979 | | | 5,446 | | | 8,425 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 35 | | | — | | | 35 | | | 66 | | | 101 | |

| Issuance of Class A Common Stock upon RSILP Unit Exchanges | 5,050,000 | | | 1 | | | (5,050,000) | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (727) | | | (727) | | | (1,482) | | | (2,209) | |

| Allocation of equity and non-controlling interests upon changes in RSILP ownership | — | | | — | | | — | | | — | | | 4,769 | | | (7) | | | — | | | 4,762 | | | (4,762) | | | — | |

| Balance at March 31, 2024 (Unaudited) | 79,543,611 | | | 8 | | | 145,384,310 | | | 14 | | | 199,911 | | | (72) | | | (139,044) | | | 60,817 | | | 111,629 | | | 172,446 | |

| Share-based compensation | 458,108 | | | — | | | — | | | — | | | 3,460 | | | — | | | — | | | 3,460 | | | 6,231 | | | 9,691 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | (1,327) | | | — | | | (1,327) | | | (2,407) | | | (3,734) | |

| Issuance of Class A Common Stock upon RSILP Unit Exchanges | 480,000 | | | — | | | (480,000) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (100) | | | (100) | | | (182) | | | (282) | |

| Allocation of equity and non-controlling interests upon changes in RSILP ownership | — | | | — | | | — | | | — | | | 596 | | | (7) | | | — | | | 589 | | | (589) | | | — | |

| Balance at June 30, 2024 (Unaudited) | 80,481,719 | | | $ | 8 | | | 144,904,310 | | | $ | 14 | | | $ | 203,967 | | | $ | (1,406) | | | $ | (139,144) | | | $ | 63,439 | | | $ | 114,682 | | | $ | 178,121 | |

RUSH STREET INTERACTIVE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Amounts in thousands except for share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common Stock | | Class V

Common Stock | | Additional

Paid-in

Capital | | Accumulated Other Comprehensive Loss | | Accumulated

Deficit | | Total Stockholders’ Equity Attributable to RSI | | Non-

Controlling

Interests | | Total

Stockholders’

Equity |

| Shares | | Amount | | Shares | | Amount | | | | | | |

| Balance at December 31, 2022 | 65,111,616 | | | $ | 6 | | | 155,955,584 | | | $ | 16 | | | $ | 177,683 | | | $ | (1,648) | | | $ | (120,012) | | | $ | 56,045 | | | $ | 134,829 | | | $ | 190,874 | |

| Share-based compensation | 702,759 | | | — | | | — | | | — | | | 2,330 | | | — | | | — | | | 2,330 | | | 5,345 | | | 7,675 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 101 | | | — | | | 101 | | | 243 | | | 344 | |

| Issuance of Class A Common Stock upon RSILP Unit Exchanges | 1,500,000 | | | 1 | | | (1,500,000) | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (7,260) | | | (7,260) | | | (17,240) | | | (24,500) | |

| Allocation of equity and non-controlling interests upon changes in RSILP ownership | — | | | — | | | — | | | — | | | 1,565 | | | (47) | | | — | | | 1,518 | | | (1,518) | | | — | |

| Balance at March 31, 2023 (Unaudited) | 67,314,375 | | | 7 | | | 154,455,584 | | | 15 | | | 181,578 | | | (1,594) | | | (127,272) | | | 52,734 | | | 121,659 | | | 174,393 | |

| Share-based compensation | 238,765 | | | — | | | — | | | — | | | 2,288 | | | — | | | — | | | 2,288 | | | 5,230 | | | 7,518 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 494 | | | — | | | 494 | | | 1,132 | | | 1,626 | |

| Issuance of Class A Common Stock upon RSILP Unit Exchanges | 13,892 | | | — | | | (13,892) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (5,139) | | | (5,139) | | | (11,595) | | | (16,734) | |

| Allocation of equity and non-controlling interests upon changes in RSILP ownership | — | | | — | | | — | | | — | | | 137 | | | (3) | | | — | | | 134 | | | (134) | | | — | |

| Balance at June 30, 2023 (Unaudited) | 67,567,032 | | | $ | 7 | | | 154,441,692 | | | $ | 15 | | | $ | 184,003 | | | $ | (1,103) | | | $ | (132,411) | | | $ | 50,511 | | | $ | 116,292 | | | $ | 166,803 | |

See accompanying notes to unaudited condensed consolidated financial statements.

RUSH STREET INTERACTIVE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| (Unaudited) | | (Unaudited) |

| Cash flows from operating activities | | | |

| Net loss | $ | (2,491) | | | $ | (41,234) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities | | | |

| Share-based compensation expense | 18,116 | | | 15,193 | |

| Depreciation and amortization expense | 14,656 | | | 13,743 | |

| Deferred income taxes | (838) | | | — | |

| Noncash lease expense | 468 | | | 320 | |

| Long-lived assets write-off | — | | | 683 | |

| Changes in operating assets and liabilities: | | | |

| Players’ receivables | 196 | | | 2,370 | |

| Due from affiliates | 16,668 | | | 6,112 | |

| Prepaid expenses and other assets | (5,496) | | | (2,112) | |

| Accounts payable | 50 | | | (11,902) | |

| Accrued expenses and other liabilities | 11,690 | | | (15,613) | |

| Players’ liabilities | (1,901) | | | (4,715) | |

| Net cash provided by (used in) operating activities | 51,118 | | | (37,155) | |

| | | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (630) | | | (752) | |

| Acquisition of gaming licenses | (3,364) | | | (6,446) | |

| Internally developed software costs | (12,487) | | | (11,447) | |

| Media content production costs | (576) | | | (470) | |

| Short-term investments | (1,862) | | | — | |

| Net cash used in investing activities | (18,919) | | | (19,115) | |

| | | |

| Cash flows from financing activities | | | |

| Principal payments of finance lease liabilities | (455) | | | (247) | |

| Net cash used in financing activities | (455) | | | (247) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (3,867) | | | 1,865 | |

| | | |

| Net change in cash, cash equivalents and restricted cash | 27,877 | | | (54,652) | |

Cash, cash equivalents and restricted cash, at the beginning of the period (1) | 170,977 | | | 206,081 | |

Cash, cash equivalents and restricted cash, at the end of the period (1) | $ | 198,854 | | | $ | 151,429 | |

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| (Unaudited) | | (Unaudited) |

| Supplemental disclosure of noncash investing and financing activities: | | | |

| Right-of-use assets obtained in exchange for new or modified operating lease liabilities | $ | 1,582 | | | $ | — | |

| Right-of-use assets obtained in exchange for new or modified finance lease liabilities | $ | 983 | | | $ | 1,445 | |

| Allocation of equity and non-controlling interests upon changes in RSILP ownership | $ | 5,351 | | | $ | 1,652 | |

| Property and equipment purchases in Accounts Payable and Accrued Expenses | $ | 26 | | | $ | 132 | |

| Capitalized intangible assets in Accounts Payable and Accrued Expenses | $ | 497 | | | $ | 70 | |

| | | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for income taxes | $ | 14,994 | | | $ | 7,248 | |

| Cash paid for interest | $ | 502 | | | $ | 453 | |

____________________________________(1)Cash and cash equivalents and Restricted cash are each presented separately on the condensed consolidated balance sheets.

See accompanying notes to unaudited condensed consolidated financial statements.

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1.Description of Business

Rush Street Interactive, Inc. is a holding company organized under the laws of the State of Delaware and through its main operating subsidiary, Rush Street Interactive, LP and its subsidiaries (collectively, “RSILP”), is a leading online gaming company that provides online casino and sports betting in the U.S., Canadian and Latin American markets. Rush Street Interactive, Inc. and its subsidiaries (including RSILP) are collectively referred to as “RSI” or the “Company.” The Company is headquartered in Chicago, Illinois.

2.Summary of Significant Accounting Policies and Recent Accounting Pronouncements

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and the applicable regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in annual consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. Therefore, these unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the related notes thereto as of and for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K, as filed with the SEC on March 7, 2024.

These unaudited condensed consolidated financial statements include the accounts of the Company, its directly and indirectly wholly owned subsidiaries, and all entities in which the Company has a controlling interest. RSI is deemed to have a controlling interest of RSILP through its wholly owned subsidiary, RSI GP, LLC (“RSI GP”), which is the sole general partner of RSILP. For consolidated entities that are less than wholly owned, third-party holdings of equity interests are presented as non-controlling interests in the Company’s condensed consolidated balance sheets and condensed consolidated statements of changes in equity. The portion of net loss attributable to the non-controlling interests is presented as net loss attributable to non-controlling interests in the Company’s condensed consolidated statements of operations, while the portion of comprehensive loss attributable to non-controlling interests is reported as comprehensive loss attributable to non-controlling interests in the Company’s condensed consolidated statements of comprehensive loss. All intercompany accounts and transactions have been eliminated upon consolidation.

The Company is organized as an umbrella partnership-C corporation (“UP-C”), resulting from the transactions contemplated in the Business Combination Agreement, dated as of July 27, 2020, among RSILP, the sellers set forth on the signature pages thereto (collectively, the “Sellers” and each, a “Seller”), dMY Sponsor, LLC (the “Sponsor”) and Rush Street Interactive GP, LLC (as amended and/or restated from time to time, the “Business Combination Agreement” and the transactions contemplated thereby, the “Business Combination”). As an UP-C, substantially all of the combined company’s assets are held by RSILP and the Company’s primary assets are its equity interests in RSILP (which are held indirectly through wholly owned subsidiaries of the Company – RSI ASLP, Inc. (the “Special Limited Partner”) and RSI GP). The non-controlling interest represents the Class A Common Units of RSILP (“RSILP Units”) held by holders other than the Company. As of June 30, 2024, the Company owned 35.71% of the RSILP Units and the holders of the non-controlling interest owned 64.29% of the RSILP Units.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation. Such reclassifications had no impact on the Company’s reported total revenues, expenses, net loss, current assets, total assets, current liabilities, total liabilities, stockholders’ equity, non-controlling interests or cash flows. No reclassifications of prior period balances were material to the unaudited condensed consolidated financial statements.

Interim Unaudited Condensed Consolidated Financial Statements

The accompanying condensed consolidated balance sheet as of June 30, 2024 and the condensed consolidated statements of operations, comprehensive loss, changes in equity and cash flows for the three and six months ended June 30, 2024 and 2023 are unaudited. The condensed consolidated balance sheet as of December 31, 2023 was derived from audited consolidated financial statements, but may omit certain disclosures required by U.S. GAAP previously disclosed in the most recent annual consolidated financial statements. The interim unaudited condensed consolidated financial statements have been prepared on a basis consistent with the annual consolidated financial statements and, in the opinion of

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

management, reflect all adjustments, which include only normal recurring adjustments, necessary to state fairly the Company’s financial condition, its operations and cash flows for the periods presented. The historical results are not necessarily indicative of future results, and the results of operations for the three and six months ended June 30, 2024 are not necessarily indicative of the results to be expected for the full year or any future period.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. Significant estimates and assumptions reflected in the condensed consolidated financial statements relate to and include, but are not limited to: the valuation of share-based awards; internally developed software; long-lived assets and investments in equity; estimated useful lives of property and equipment and intangible assets; redemption rate assumptions associated with the loyalty program and other discretionary player bonuses; deferred revenue; accrued expenses; determination of the incremental borrowing rate to calculate operating lease liabilities and finance lease liabilities; and deferred taxes and amounts associated with the tax receivable agreement (“TRA”) entered into in connection with the closing of the transactions contemplated in the Business Combination Agreement on December 29, 2020.

Cash and Cash Equivalents and Restricted Cash

Cash and cash equivalents consist of highly liquid, unrestricted savings, checking, instant access internet banking accounts, money market funds and certificates of deposits with original maturities of 90 days or less at acquisition.

Restricted cash includes any cash and cash equivalents held by the Company that are legally restricted as to withdrawals or usage. This consists of certain deposits that are restricted under regulatory requirements. Regardless of whether customer deposits are legally restricted, the Company maintains separate bank accounts to segregate cash that resides in customers’ accounts from operational funds.

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consist primarily of prepaid expenses and short-term investments. Prepaid expenses consist of various advance payments for goods or services to be received in the future. These costs include insurance, subscriptions, marketing, other contracted services and deposits paid in advance. As of June 30, 2024 and December 31, 2023, the Company had prepaid expenses of $7.6 million and $7.5 million, respectively.

Short-term investments consist of certificates of deposit with an original maturity greater than three months but less than one year. As of June 30, 2024 and December 31, 2023, the Company had short-term investments of $4.6 million and $3.1 million, respectively.

Surety Bonds

The Company had been issued $30.0 million and $28.0 million in surety bonds as of June 30, 2024 and December 31, 2023, respectively, that are used to satisfy regulatory requirements related to securing cash held for the benefit of customers.

The Company had been issued $4.6 million in surety bonds as of June 30, 2024 and December 31, 2023 to satisfy regulatory requirements necessary to operate in certain jurisdictions.

There have been no claims against any of the Company’s surety bonds and the likelihood of future claims is expected to be remote.

Foreign Currency Gains and Losses

The financial statements of foreign subsidiaries are translated into U.S. dollars in accordance with Accounting Standards Codification (“ASC”) 830, Foreign Currency Matters, using period-end exchange rates for assets and liabilities, and average exchange rates for the period for revenues, costs and expenses. The U.S. dollar effects that arise from

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

translating the net assets of these subsidiaries at changing rates are recorded in the foreign currency translation adjustment account, which is included in equity as a component of accumulated other comprehensive loss.

If transactions are recorded in a currency other than the subsidiary’s functional currency, remeasurement into the functional currency is required and may result in transaction gains or losses. Transaction losses were $1.3 million and $1.7 million for the three and six months ended June 30, 2024, respectively, compared to gains of $1.1 million and $1.5 million for the same respective periods in 2023. Amounts are recorded in general and administrative on the Company’s unaudited condensed consolidated statements of operations.

Recently Adopted Accounting Pronouncements

In August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-6, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, which simplifies accounting for convertible instruments by removing major separation models required under current U.S. GAAP. This ASU removes certain settlement conditions that are required for equity contracts to qualify for the derivative scope exception, and it also simplifies the diluted earnings per share calculation in certain areas. This ASU is effective for the Company in calendar year 2024. The Company adopted ASU 2020-6 and the adoption did not have a material impact on its condensed consolidated financial statements and related disclosures.

Recent Accounting Pronouncements Not Yet Adopted

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280). The amendments in this ASU require disclosures, on an annual and interim basis, of significant segment expenses that are regularly provided to the Chief Operating Decision Maker (“CODM”), as well as the aggregate amount of other segment items included in the reported measure of segment profit or loss. This ASU requires that a public entity disclose the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss. Public entities will be required to provide all annual disclosures currently required by Topic 280 in interim periods, and entities with a single reportable segment are required to provide all the disclosures required by the amendments in the update and existing segment disclosures in Topic 280. This ASU is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and requires retrospective adoption. Early adoption is permitted. The Company will adopt this standard beginning with its fiscal year ending December 31, 2024. The Company is currently evaluating these new disclosure requirements and does not expect the adoption to have a material impact.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which is intended to enhance the transparency, decision usefulness and effectiveness of income tax disclosures. The amendments in this ASU require a public entity to disclose a tabular tax rate reconciliation, using both percentages and currency, with specific categories. A public entity is also required to provide a qualitative description of the states and local jurisdictions that make up the majority of the effect of the state and local income tax category and the net amount of income taxes paid, disaggregated by federal, state and foreign taxes and also disaggregated by individual jurisdictions. The amendments also remove certain disclosures that are no longer considered cost beneficial. The amendments are effective prospectively for annual periods beginning after December 15, 2024, and early adoption and retrospective application are permitted. The Company is currently evaluating the impact of these new disclosure requirements on its condensed consolidated financial statements and does not expect the adoption to have a material impact.

3.Revenue Recognition

The Company’s revenue from contracts with customers is derived from online casino, online sports betting, retail sports betting and social gaming.

Online casino and online sports betting

Online casino offerings typically include the full suite of games available in land-based casinos, such as table games (i.e., blackjack and roulette) and slot machines. The Company generates revenue from these offerings through hold, or gross winnings, as customers play against the house. Online casino revenue is generated based on total customer bets less

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

amounts paid to customers for winning bets, less other incentives awarded to customers, plus or minus the changes in unsettled bets and the progressive jackpot liability.

Online sports betting involves a user placing a bet on the outcome of a sporting event, sports-related activity or a series of the same, with the chance to win a pre-determined amount, often referred to as fixed odds. Online sports betting revenue is generated by setting odds such that there is a built-in theoretical margin in each bet offered to customers. Online sports betting revenue is generated based on total customer bets less amounts paid to customers for winning bets, less other incentives awarded to customers, plus or minus the change in unsettled bets.

Retail sports betting

The Company provides retail sports services to land-based partners in exchange for a monthly commission based on that partner’s retail sportsbook revenue. Services generally include ongoing management and oversight of the retail sportsbook, technical support for the partner’s customers, risk management, advertising and promotion, and support for third-party vendors’ sports betting equipment. The Company has a single performance obligation to provide retail sports services and records the revenue as services are performed and when the commission amounts are no longer constrained (i.e., the amount is known).

Certain relationships with business partners provide the Company the ability to operate the retail sportsbook. In this scenario, revenue is generated based on total customer bets less amounts paid to customers for winning bets, less other incentives awarded to customers, plus or minus the change in unsettled retail sports bets and unclaimed retail tickets for settled retail bets.

Social gaming

The Company provides a social gaming platform for users to enjoy free-to-play games that use virtual credits. While virtual credits are issued to users for free, some users may choose to purchase additional virtual credits through the Company’s virtual cashier. The Company has a single performance obligation associated with social gaming services to provide social gaming services to users upon the redemption of virtual credits. Deferred revenue is recorded when users purchase virtual credits and revenue is recognized when the virtual credits are redeemed and the Company’s performance obligation has been fulfilled.

Disaggregation of revenue for the three and six months ended June 30, 2024 and 2023, was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Online casino and online sports betting | $ | 218,849 | | | $ | 160,746 | | | $ | 434,471 | | | $ | 318,418 | |

| Retail sports betting | 461 | | | 3,272 | | | 1,169 | | | 6,935 | |

| Social gaming | 1,069 | | | 1,044 | | | 2,167 | | | 2,070 | |

| Total revenue | $ | 220,379 | | | $ | 165,062 | | | $ | 437,807 | | | $ | 327,423 | |

Revenue by geographic region for the three and six months ended June 30, 2024 and 2023, was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| United States and Canada | $ | 188,513 | | | $ | 146,610 | | | $ | 377,050 | | | $ | 293,307 | |

| Latin America, including Mexico | 31,866 | | | 18,452 | | | 60,757 | | | 34,116 | |

| Total revenue | $ | 220,379 | | | $ | 165,062 | | | $ | 437,807 | | | $ | 327,423 | |

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Deferred revenue associated with online casino and online sports betting revenue and retail sports betting revenue includes unsettled customer bets and is included within players’ liabilities in the condensed consolidated balance sheets.

The deferred revenue balances as of June 30, 2024 and 2023 were as follows:

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| ($ in thousands) | 2024 | | 2023 |

| Deferred revenue, beginning of period | $ | 7,013 | | | $ | 7,840 | |

| Deferred revenue, end of period | $ | 6,582 | | | $ | 4,963 | |

| Revenue recognized during the period from amounts included in deferred revenue at the beginning of the period | $ | 7,013 | | | $ | 7,840 | |

4.Intangible Assets, Net

The Company had the following intangible assets, net as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ in thousands) | Weighted- Average Remaining Amortization Period (years) | | Gross

Carrying

Amount | | Accumulated

Amortization | | Net |

| License Fees | | | | | | | |

| June 30, 2024 | 7.08 | | $ | 52,366 | | | $ | (18,366) | | $ | 34,000 |

| December 31, 2023 | 7.75 | | $ | 61,015 | | | $ | (25,946) | | $ | 35,069 |

| | | | | | | |

| Internally Developed Software | | | | | | | |

| June 30, 2024 | 2.29 | | $ | 56,308 | | | $ | (19,865) | | $ | 36,443 |

| December 31, 2023 | 2.37 | | $ | 43,868 | | | $ | (12,601) | | $ | 31,267 |

| | | | | | | |

| Developed Technology | | | | | | | |

| June 30, 2024 | 5.50 | | $ | 5,931 | | | $ | (1,853) | | $ | 4,078 |

| December 31, 2023 | 6.00 | | $ | 5,931 | | | $ | (1,483) | | $ | 4,448 |

| | | | | | | |

Other intangible assets(1) | | | | | | | |

| June 30, 2024 | 2.60 | | $ | 6,470 | | | $ | (2,549) | | $ | 3,921 |

| December 31, 2023 | 3.15 | | $ | 5,873 | | | $ | (1,783) | | $ | 4,090 |

_____________________________(1)Other intangible assets include trademark, media content and customer lists.

Amortization expense was $6.7 million and $12.8 million for the three and six months ended June 30, 2024, respectively, compared to amortization expense of $6.8 million and $11.5 million for the same respective periods in 2023.

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

5. Property and Equipment, net

The Company had the following property and equipment, net as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| ($ in thousands) | June 30,

2024 | | December 31, 2023 |

| Computers, software and related equipment | $ | 4,342 | | | $ | 4,259 | |

| Operating equipment and servers | 3,090 | | | 4,779 | |

| Furniture | 1,169 | | | 782 | |

| Leasehold improvements | 1,832 | | | 1,805 | |

| Property and equipment not yet placed into service | 323 | | | 610 | |

| Total property and equipment | 10,756 | | | 12,235 | |

| Less: accumulated depreciation | (6,907) | | | (7,641) | |

| 3,849 | | | 4,594 | |

| | | |

| Finance lease right-of-use assets | 6,045 | | | 5,519 | |

| Less: accumulated amortization | (1,875) | | | (1,502) | |

| 4,170 | | | 4,017 | |

| | | |

| Property and equipment, net | $ | 8,019 | | | $ | 8,611 | |

The Company recorded depreciation expense on property and equipment of $0.5 million and $1.1 million for the three and six months ended June 30, 2024, respectively, compared to depreciation expense of $0.9 million and $1.7 million for the same respective periods in 2023. The Company recorded amortization expense on finance lease right-of-use assets of $0.4 million and $0.8 million for the three and six months ended June 30, 2024, respectively, and $0.3 million and $0.5 million for the same respective periods in 2023.

6. Accrued Expenses and Other Current Liabilities

The Company has the following accrued expenses as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| ($ in thousands) | June 30,

2024 | | December 31,

2023 |

| Accrued operating expenses | $ | 32,793 | | | $ | 21,748 | |

| Accrued marketing expenses | 14,294 | | | 10,119 | |

| Accrued compensation and related expenses | 10,904 | | | 13,781 | |

| Accrued administrative expenses | 6,152 | | | 4,706 | |

| Accrued other expenses | 630 | | | 777 | |

| Total accrued expenses | $ | 64,773 | | | $ | 51,131 | |

Other current liabilities includes income tax payable totaling $6.2 million and $8.1 million as of June 30, 2024 and December 31, 2023, respectively.

7. Stockholders’ Equity

Non-Controlling Interests

Non-controlling interests represents the RSILP Units held by holders other than the Company.

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Non-controlling interests owned 64.29% and 67.51% of the RSILP Units outstanding as of June 30, 2024 and December 31, 2023, respectively. The table below illustrates a rollforward of the non-controlling interests’ ownership during the six months ended June 30, 2024:

| | | | | | | | |

| | Non-Controlling Interest % |

Non-controlling interests ownership % as of December 31, 2023: | | 67.51 | % |

| Issuance of Class A Common Stock upon RSILP Unit Exchanges | | (2.48) | % |

| Issuance of Class A Common Stock in connection with the vesting of certain share-based equity grants | | (0.74) | % |

Non-controlling interests ownership % as of June 30, 2024: | | 64.29 | % |

Non-controlling interests owned 69.57% and 70.55% of the RSILP Units outstanding, as of June 30, 2023 and December 31, 2022, respectively. The table below illustrates a rollforward of the non-controlling interests’ ownership during the six months ended June 30, 2023:

| | | | | | | | |

| | Non-Controlling Interest % |

Non-controlling interests ownership % as of December 31, 2022: | | 70.55 | % |

| Issuance of Class A Common Stock upon RSILP Unit Exchanges | | (0.68) | % |

| Issuance of Class A Common Stock in connection with the vesting of certain share-based equity grants | | (0.30) | % |

Non-controlling interests ownership % as of June 30, 2023: | | 69.57 | % |

8. Share-Based Compensation

The Company adopted the Rush Street Interactive, Inc. 2020 Omnibus Equity Incentive Plan, as amended from time to time (the “2020 Plan”), to attract, retain and incentivize employees, certain consultants and directors who will contribute to the success of the Company. Awards that may be granted under the 2020 Plan include incentive stock options, non-qualified stock options, stock appreciation rights, restricted awards, performance share awards, cash awards and other equity-based awards.

In 2023, the Compensation Committee of the Board and the full Board each approved an amendment to the 2020 Plan to increase the number of shares of Class A Common Stock reserved under the 2020 Plan by 22.4 million shares, with the Company’s stockholders approving such amendment at the Company’s 2023 annual meeting of stockholders on June 1, 2023. There are approximately 35.8 million shares of Class A Common Stock reserved under the 2020 Plan. The 2020 Plan will terminate on December 29, 2030.

Restricted Stock Units (“RSUs”) and Options

The Company granted 1,989,288 and 2,498,739 RSUs with service conditions during the six months ended June 30, 2024 and 2023, respectively. RSUs with service conditions generally vest over a three to four year period, with each tranche vesting annually. The grant date fair value of RSUs with service conditions is determined based on the quoted market price.

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company granted 1,152,122 and 1,495,303 RSUs with market-based conditions (e.g., share price targets, total shareholder return) during the six months ended June 30, 2024 and 2023, respectively. RSUs with market-based conditions generally vest over a three-year period and fair value was determined using a Monte Carlo simulation using the following assumptions during the six months ended June 30:

| | | | | | | | | | | |

| 2024 | | 2023 |

| Volatility rate | 68.48 | % | | 69.78 | % |

| Risk-free interest rate | 4.55 | % | | 3.85 | % |

| Average expected life (in years) | 2.8 | | 2.8 |

| Dividend yield | None | | None |

| Stock price at grant date | $ | 5.79 | | | $ | 3.28 | |

The Company granted 630,897 and 1,084,445 stock options during the six months ended June 30, 2024 and 2023, respectively. The estimated grant date fair value of stock options was determined using a Black-Scholes valuation model using the following weighted-average assumptions during the six months ended June 30:

| | | | | | | | | | | |

| 2024 | | 2023 |

| Volatility rate | 68.00 | % | | 70.00 | % |

| Risk-free interest rate | 4.30 | % | | 3.80 | % |

| Average expected life (in years) | 6.0 | | 6.0 |

| Dividend yield | None | | None |

| Stock price at grant date | $ | 5.79 | | $ | 3.28 |

| Exercise price | $ | 5.79 | | $ | 3.28 |

RSU activity for the six months ended June 30, 2024 and 2023 was as follows:

| | | | | | | | | | | |

| Number of units | | Weighted-average

grant price |

| Unvested balance at December 31, 2023 | 9,218,142 | | | $ | 5.70 | |

| Granted | 3,141,410 | | | 7.06 | |

Vested(1) | (2,008,720) | | | 5.03 | |

| Forfeited | (69,295) | | | 7.75 | |

| Unvested balance at June 30, 2024 | 10,281,537 | | | $ | 6.23 | |

| | | |

| Unvested balance at December 31, 2022 | 7,492,613 | | | $ | 7.48 | |

| Granted | 3,994,042 | | | 4.12 | |

Vested(1) | (1,144,771) | | | 4.37 | |

| Forfeited | (53,845) | | | 11.26 | |

| Unvested balance at June 30, 2023 | 10,288,039 | | | $ | 6.51 | |

______________________________(1)Includes 297,320 and 203,247 of RSUs that vested during the six months ended June 30, 2024 and 2023, respectively, but the resulting shares of Class A Common Stock have not yet been issued. There were 549,039 and 840,164 RSUs that vested for which the resulting shares of Class A Common Stock were not issued as of June 30, 2024 and 2023, respectively.

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The aggregate fair value of the RSUs granted during the three and six months ended June 30, 2024 was approximately $1.2 million and $22.2 million, respectively, compared to the aggregate fair value of the RSUs granted of nil and $16.5 million for the same respective periods in 2023. The aggregate grant date fair value of RSUs vested during the three and six months ended June 30, 2024 was approximately $4.1 million and $10.1 million, respectively, compared to $1.4 million and $5.0 million for the same respective periods in 2023.

As of June 30, 2024, the Company had unrecognized share-based compensation expense related to RSUs of $42.3 million. The outstanding RSUs had a remaining weighted-average vesting period of 1.07 years as of June 30, 2024.

Stock option activity for the six months ended June 30, 2024 was as follows:

| | | | | | | | | | | |

| Number of options | | Weighted-average

exercise price |

| Outstanding balance at December 31, 2023 | 1,971,611 | | | $ | 4.16 | |

| Granted | 630,897 | | | 5.79 | |

| Exercised | — | | | — | |

| Forfeited | — | | | — | |

| Outstanding balance at June 30, 2024 | 2,602,508 | | | $ | 4.56 | |

| | | |

| Exercisable balance at June 30, 2024 | 721,761 | | | $ | 5.17 | |

Stock option activity for the six months ended June 30, 2023 was as follows:

| | | | | | | | | | | |

| Number of options | | Weighted-average

exercise price |

| Outstanding balance at December 31, 2022 | 887,166 | | | $ | 5.24 | |

| Granted | 1,084,445 | | | 3.28 | |

| Exercised | — | | | — | |

| Forfeited | — | | | — | |

| Outstanding balance at June 30, 2023 | 1,971,611 | | | $ | 4.16 | |

The weighted-average grant-date fair values of options granted during the three and six months ended June 30, 2024 was nil and $3.74, respectively, compared to nil and $2.14 for the same periods in 2023. The aggregate fair value of stock options granted during the three and six months ended June 30, 2024 was nil and $2.4 million, respectively, compared to nil and $2.3 million for the same respective periods in 2023. The outstanding stock options and exercisable stock options as of June 30, 2024 had an intrinsic value of $13.7 million and $3.8 million, respectively.

As of June 30, 2024, the Company had unrecognized share-based compensation expense related to stock options of $4.2 million. The outstanding options had a remaining weighted-average vesting period of 1.11 years as of June 30, 2024.

Share-based compensation expense for the three and six months ended June 30, 2024 and 2023 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Six Months Ended June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Costs of revenue | $ | 295 | | | $ | 269 | | | $ | 565 | | | $ | 526 | |

| Advertising and promotions | 690 | | | 559 | | | 1,260 | | | 1,095 | |

| General and administrative | 8,706 | | | 6,690 | | | 16,291 | | | 13,572 | |

| Total share-based compensation expense | $ | 9,691 | | | $ | 7,518 | | | $ | 18,116 | | | $ | 15,193 | |

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

9. Income Taxes

Income tax expense for the three and six months ended June 30, 2024 and 2023 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Six Months Ended June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Income tax expense | $ | 6,396 | | | $ | 2,720 | | | $ | 11,696 | | | $ | 5,520 | |

The Company recognized federal, state and foreign income tax expense of $6.4 million and $11.7 million during the three and six months ended June 30, 2024, respectively, compared to $2.7 million and $5.5 million during the same periods in 2023. The effective tax rates for the three and six months ended June 30, 2024 were 104.6% and 127.1%, respectively, and were (19.4)% and (15.5)% during the same periods in 2023. The difference between the Company’s effective tax rate and the U.S. statutory tax rate of 21% was primarily due to a full valuation allowance recorded on the Company’s net U.S. deferred tax assets, non-taxable income / (loss) attributable to non-controlling interest and income tax rate differences related to the Company’s Colombia operations for which both current and deferred taxes were recorded. The Company evaluates the realizability of the deferred tax assets on a quarterly basis and establishes a valuation allowance when it is more likely than not that all or a portion of a deferred tax asset may not be realized.

In connection with the Business Combination, the Special Limited Partner entered into the TRA, which generally provides that it pay 85% of certain net tax benefits, if any, that the Company (including the Special Limited Partner) realizes (or in certain cases is deemed to realize) as a result of an increase in tax basis and tax benefits related to the transactions contemplated under the Business Combination Agreement and the exchange of Retained RSILP Units (as defined in the Business Combination Agreement) for Class A Common Stock (or cash at the Company’s option) pursuant to RSILP’s amended and restated limited partnership agreement and tax benefits related to entering into the TRA, including tax benefits attributable to payments under the TRA. These payments are the obligation of the Special Limited Partner and not of RSILP. The actual increase in the Special Limited Partner’s allocable share of RSILP’s tax basis in its assets, as well as the amount and timing of any payments under the TRA, will vary depending upon a number of factors, including the timing of exchanges, the market price of the Class A Common Stock at the time of the exchange and the amount and timing of the recognition of RSI and its consolidated subsidiaries’ (including the Special Limited Partner’s) income.

Based primarily on historical losses of RSILP, management has determined it is more-likely-than-not that the Company will be unable to utilize its deferred tax assets subject to the TRA; therefore, management applies a full valuation allowance to deferred tax asset or a corresponding liability under the TRA related to the tax savings the Company may realize from the utilization of tax deductions related to basis adjustments created by the transactions in the Business Combination Agreement. The unrecognized TRA liability as of June 30, 2024 and December 31, 2023 was $74.2 million and $63.7 million, respectively. The increase in the liability is primarily due to the issuance of Class A Common Stock upon RSILP Unit exchanges. Due to the fact that the Company's deferred tax assets and corresponding TRA liability are unrecognized, this increase had no impact on the condensed consolidated statements of operations and condensed consolidated statements of comprehensive loss.

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

10. Loss Per Share

The basic and diluted loss per share for the three and six months ended June 30, 2024 and 2023 were as follows (amounts in thousands, except for share and per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Numerator: | | | | | | | |

| Net loss | $ | (282) | | | $ | (16,734) | | | $ | (2,491) | | | $ | (41,234) | |

| Less: Net loss attributable to non-controlling interests | (182) | | | (11,595) | | | (1,664) | | | (28,835) | |

| Net loss attributable to Rush Street Interactive, Inc. – basic and diluted | $ | (100) | | | $ | (5,139) | | | $ | (827) | | | $ | (12,399) | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted-average common shares outstanding – basic and diluted | 80,049,123 | | | 67,389,454 | | | 78,038,275 | | | 66,330,641 | |

| | | | | | | |

| Loss per Class A Common Share - basic and diluted | $ | (0.00) | | | $ | (0.08) | | | $ | (0.01) | | | $ | (0.19) | |

The Class V Common Stock does not participate in the Company’s earnings or losses and is therefore not a participating security. As such, separate presentation of basic and diluted earnings per share of Class V Common Stock under the two-class method has not been presented.

The Company excluded the following securities from its computation of diluted shares outstanding for the three and six months ended June 30, 2024 and 2023 as their effect would have been anti-dilutive:

| | | | | | | | | | | |

| 2024 | | 2023 |

RSILP Units(1) | 144,904,310 | | | 154,441,692 | |

| Unvested RSUs | 10,281,537 | | | 10,288,039 | |

| Vested RSUs (Class A Common Stock not yet issued) | 549,039 | | | 840,164 | |

| Outstanding Stock Options | 2,602,508 | | | 1,971,611 | |

_____________________________________

(1) RSILP Units that are held by non-controlling interest holders and may be exchanged, subject to certain restrictions, for Class A Common Stock. Upon exchange of an RSILP Unit, a share of Class V Common Stock is cancelled.

11. Related Parties

Affiliated Land-Based Casinos

Neil Bluhm and his adult children (including Ms. Leslie Bluhm), through their individual capacities, entities or trusts that they have created for the benefit of themselves or their family members, and Greg Carlin, through his individual capacity, entities or trusts that he has created for the benefit of himself or his family members, are direct or indirect owners, directors and/or officers of certain land-based casinos. The Company has entered into certain agreements with these affiliated land-based casinos that create strategic partnerships aimed to capture the online gaming, online sports betting and retail sports services markets in the various states and municipalities where the land-based casinos operate.

Generally, the Company pays a royalty fee to the land-based casino (calculated as a percentage of the Company’s revenue less reimbursable costs or other consideration received as defined in the applicable agreement) in exchange for the right to operate real-money online casino and/or online sports betting under the gaming license of the land-based casinos or for marketing gaming offerings under the land-based casinos’ brand. Royalties related to arrangements with affiliated casinos were $17.8 million and $33.4 million for the three and six months ended June 30, 2024 compared to $13.6 million and $21.3 million for the same periods in 2023, which were net of any consideration received from the affiliated casino for

RUSH STREET INTERACTIVE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

reimbursable costs, as well as costs that are paid directly by the affiliate casino on the Company’s behalf. Net royalties paid are recorded as costs of revenue in the accompanying condensed consolidated statements of operations.

In certain cases, the affiliate casino maintains the bank account that processes cash deposits and withdrawals for the Company’s customers. Accordingly, at any point in time, the Company will record a receivable from the affiliate, representing the Company’s total gaming revenue (with customers) that was collected by the affiliate, less consideration payable to the affiliate for use of its license, which is offset by any consideration owed to the Company from the affiliate based on the terms of the applicable agreement. Receivables due from affiliated land-based casinos were $16.8 million and $33.5 million at June 30, 2024 and December 31, 2023, respectively.

In addition, the Company provides retail sports services to certain affiliated land-based casinos in exchange for a monthly commission based on the casino’s retail sportsbook revenue. Services generally include ongoing management and oversight of the retail sportsbook, technical support for the casino’s customers, risk management, advertising and promotion, and support for third-party vendors’ sports betting equipment. Revenue recognized relating to retail sports services provided to affiliated land-based casinos for the three and six months ended June 30, 2024 and 2023 were not material to the condensed consolidated financial statements. Any payables due to the affiliated land-based casinos are netted against affiliate receivables to the extent a right of offset exists.

12. Commitments and Contingencies

Legal Matters

The Company is not a party to any material legal proceedings and is not aware of any material pending or threatened claims. From time to time however, the Company may be subject to various legal proceedings and claims that arise in the ordinary course of its business activities.

Other Contractual Obligations

The Company is a party to several non-cancelable contracts with vendors and licensors for marketing and other strategic partnership-related agreements where the Company is obligated to make future minimum payments under the non-cancelable terms of these contracts as follows ($ in thousands):

| | | | | |

| Remainder of 2024 | $ | 11,430 | |

| Year ending December 31, 2025 | 10,208 | |

| Year ending December 31, 2026 | 7,290 | |

| Year ending December 31, 2027 | 6,306 | |

| Year ending December 31, 2028 | 4,775 | |

| Thereafter | 21,760 | |

Total(1) | $ | 61,769 | |

_____________________________________

| | | | | |

| (1) | Includes obligations under license and market access commitments totaling $40.7 million, obligations under non-cancelable contracts with marketing vendors totaling $14.9 million and non-cancelable lease contracts totaling $6.2 million. Certain market access arrangements require the Company to make additional payments at a contractual milestone date if the market access fees paid through that milestone date do not meet a minimum contractual threshold. In these instances, the Company calculates the future minimum payment as the total milestone payment less any amounts already paid to the partner and includes such payments in the period in which the milestone date occurs. |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with, and is qualified in its entirety by, our Annual Report on Form 10-K for the year ended December 31, 2023 (our “Annual Report”), and our unaudited condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q (this “Report”). In addition to historical financial information, the following discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results and timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those discussed under the sections of this Report captioned “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors.” For a discussion of limitations in measuring certain of our key metrics, see the section of this Report captioned “Limitations of Key Metrics and Other Data.”

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains certain financial measures, in particular the presentation of Adjusted EBITDA, which are not presented in accordance with generally accepted accounting principles of the United States (“GAAP”). We present these non-GAAP financial measures because they provide us and readers of this Report with additional insight into our operational performance relative to earlier periods and relative to our competitors. These non-GAAP financial measures are not a substitute for any GAAP financial information. Readers of this Report should use these non-GAAP financial measures only in conjunction with the comparable GAAP financial measures. Reconciliations of Adjusted EBITDA to Net Loss, the most comparable GAAP measure, are provided in this Report.

Unless the context requires otherwise, all references in this Report to the “Company,” “we,” “us,” or “our” refer to Rush Street Interactive, Inc. and its subsidiaries.

Our Business

We are a leading online gaming and entertainment company that focuses primarily on online casino and online sports betting in the U.S., Canadian and Latin American markets. Our mission is to engage and delight players by delivering friendly, fun and fair betting experiences. In furtherance of this mission, we strive to create an online community for our customers where we are transparent and honest, treat our customers fairly, show them that we value their time and loyalty, and listen to feedback. We also endeavor to implement industry leading responsible gaming practices and provide our customers with a cutting-edge online gaming platform and exciting, personalized offerings that will enhance their user experience.

We provide our customers with an array of leading gaming offerings such as real-money online casino, online sports betting and retail sports betting (i.e., sports betting services provided at bricks-and-mortar locations), as well as social gaming, which involves free-to-play games using virtual credits that users can earn or purchase. We launched our first social gaming website in 2015 and began accepting real-money bets in the United States in 2016. Currently, we offer real-money online casino, online sports betting and/or retail sports betting in 15 U.S. states and the four international markets as outlined in the table below.

| | | | | | | | | | | | | | | | | | | | |

| Jurisdictions | | Online Casino | | Online Sports

Betting | | Retail Sports

Betting |

| Domestic: | | | | | | |

| Arizona | | | | ü | | |

| Colorado | | | | ü | | |

| Delaware | | ü | | ü | | |

| Illinois | | | | ü | | ü |

| Indiana | | | | ü | | ü |

| Iowa | | | | ü | | |

| Louisiana | | | | ü | | |

| Maryland | | | | ü | | ü |

| Michigan | | ü | | ü | | ü |

| New Jersey | | ü | | ü | | |

| New York | | | | ü | | ü |

| Ohio | | | | ü | | |

| Pennsylvania | | ü | | ü | | ü |

| Virginia | | | | ü | | ü |

| West Virginia | | ü | | ü | | |

| | | | | | |

| International: | | | | | | |

| Colombia | | ü | | ü | | |

| Mexico | | ü | | ü | | |

| Ontario (Canada) | | ü | | ü | | |

| Peru* | | ü | | ü | | |

* Launched online casino and online sports betting in July 2024.

Our real-money online casino and online sports betting offerings are currently provided under our BetRivers and PlaySugarHouse brands in the United States and Canada and under our RushBet brand in Latin America (which includes Mexico). We operate and/or support retail sports betting for our bricks-and-mortar partners under our brands or our partners’ respective brands depending on the terms of our arrangement. Many of our social gaming offerings are marketed under our own brands, although we also offer social gaming under our partners’ brands as well. Our decision about what brand or brands to use is market and/or partner specific, and is based on brand awareness, market research, marketing efficiency, contractual obligations and applicable gaming rules and regulations.

Trends in Key Metrics

Monthly Active Users

MAUs is the number of unique users per month who have placed at least one real-money bet across one or more of our online casino or online sports betting offerings. We average the MAUs for the months in the relevant period. We exclude users who have made a deposit but have not yet placed a real-money bet on at least one of our online offerings. We also exclude users who have placed a real-money bet but only with promotional incentives.

MAUs is a key indicator of the scale of our user base and awareness of our brands. We believe that year-over-year MAUs is also generally indicative of the long-term revenue growth potential of our business, although MAUs in individual periods may be less indicative of our longer-term expectations. We expect the number of MAUs to grow as we attract, retain and re-engage users in new and existing jurisdictions and expand our offerings to appeal to a wider audience.

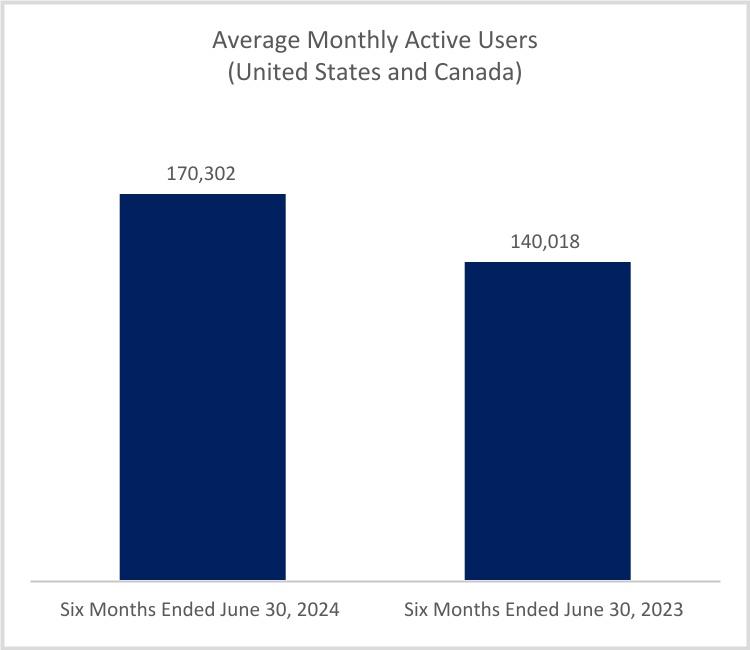

The chart below presents our average MAUs in the United States and Canada for the six months ended June 30, 2024 and 2023:

The increase in MAUs in the United States and Canada was mainly due to our continued growth and strong customer retention rates in existing markets and expansion into new markets such as Delaware, which was partially offset by our exit from the Connecticut market. Additionally, we continue to achieve a positive response from our strategic advertising and marketing efforts.

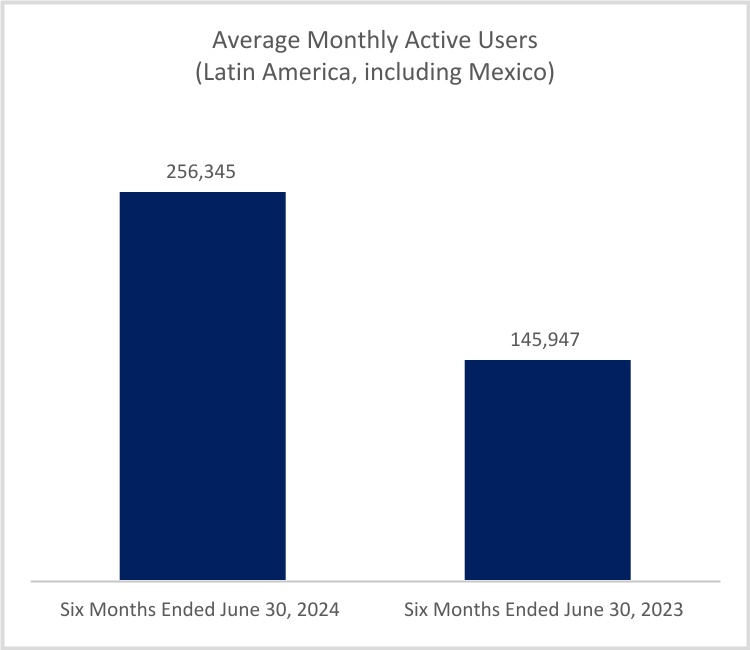

The chart below presents our average MAUs in Latin America (including Mexico) for the six months ended June 30, 2024 and 2023:

The increase in MAUs in Latin America was mainly due to our continued growth and strong customer retention rates in Colombia and Mexico. Additionally, we continue to achieve a positive response from our strategic advertising and marketing efforts.

Average Revenue Per Monthly Active User

ARPMAU for an applicable period is monthly revenue divided by average MAUs. This key metric represents our ability to drive usage and monetization of our online offerings.

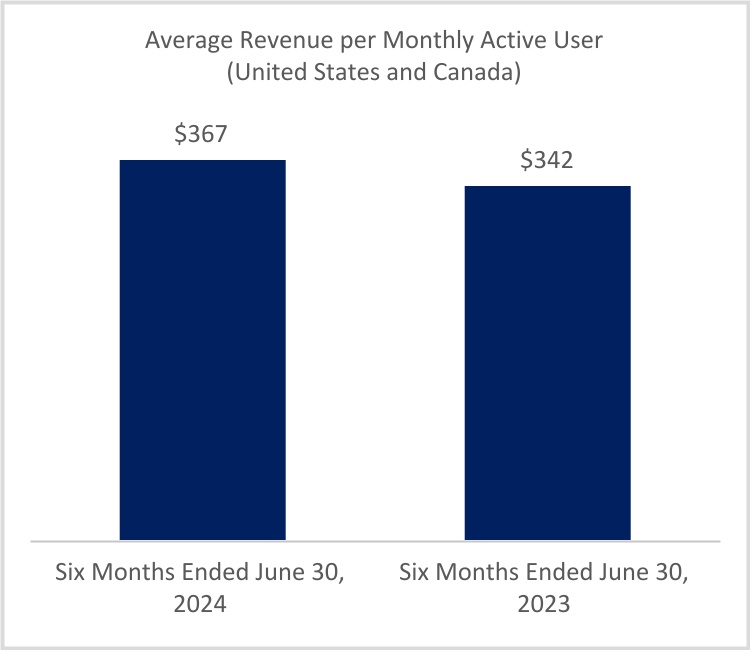

The chart below presents our ARPMAU in the United States and Canada for the six months ended June 30, 2024 and 2023:

The year-over-year increase in ARPMAU in the United States and Canada was mainly due to our continued growth in markets that launched during 2023 where we offer online casino in addition to online sports betting, such as Delaware, the impact of our strategic advertising and marketing efforts in other markets where offer online casino and our focus on retaining quality players.

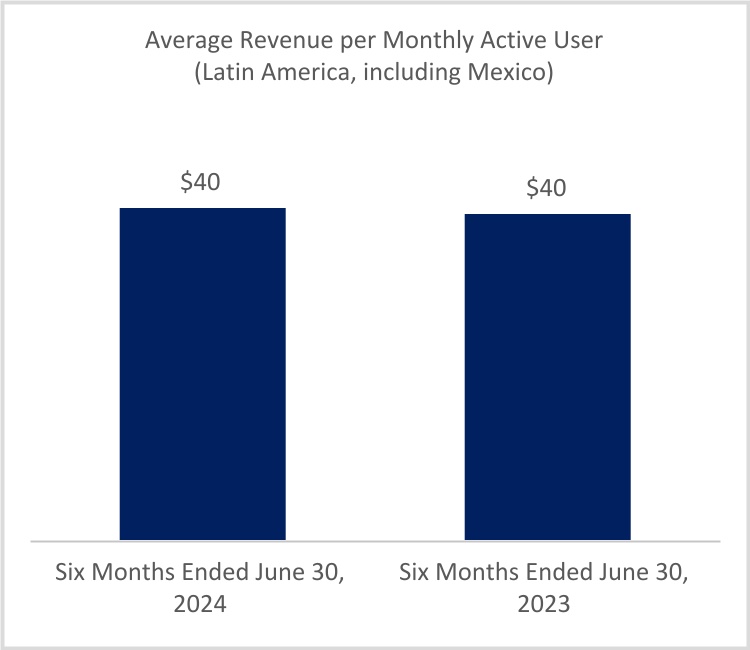

The chart below presents our ARPMAU in Latin America (including Mexico) for the six months ended June 30, 2024 and 2023:

ARPMAU in Latin America remained consistent overall at $40 for the six months ended June 30, 2024 and 2023. Latin America ARPMAU was impacted by continued growth in Mexico, favorable foreign exchange rates, and outsized MAU growth which was accompanied by MAUs of varying average revenue.

Non-GAAP Information

This Report includes Adjusted EBITDA, which is a non-GAAP performance measure that we use to supplement our results presented in accordance with GAAP. We believe Adjusted EBITDA provides useful information to investors regarding our results of operations and operating performance, as it is similar to measures reported by our public competitors and is regularly used by securities analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Non-GAAP financial measures are not intended to be considered in isolation or as a substitute for any GAAP financial measures and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.