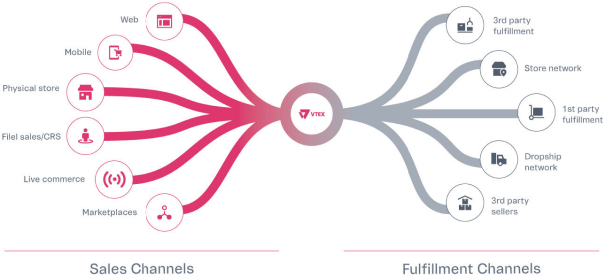

dependent, in part, on our ability to successfully develop, market, and sell our platform to new and existing customers and to help our customers capture omnichannel commerce opportunities both regionally and globally.

Successful rollout of new geographies

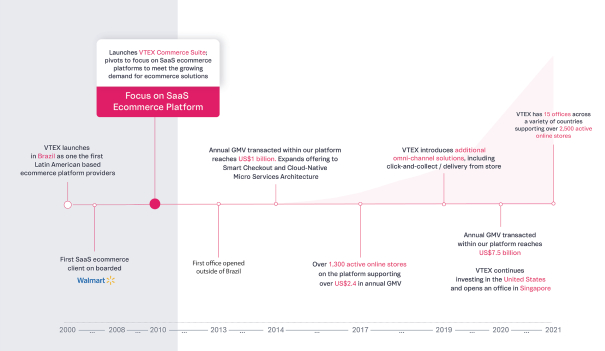

We are investing in the expansion of our regional sales and marketing capabilities in order to grow our business within new regions in Latin America and the rest of the world. In some cases, we are expanding with existing customers to new geographies. For instance, a global electronics brand manufacturer uses the VTEX platform to power its ecommerce direct to consumer initiatives in 19 countries. We started our operations in Brazil in 2000, opened our first office outside of Brazil in 2013 and expanded outside of Latin America to the United States in 2017. We have operations in five cities in Brazil, six cities in Latin America and eight cities in the rest of the world with 882, 231, and 125 employees, respectively, as of March 31, 2021.

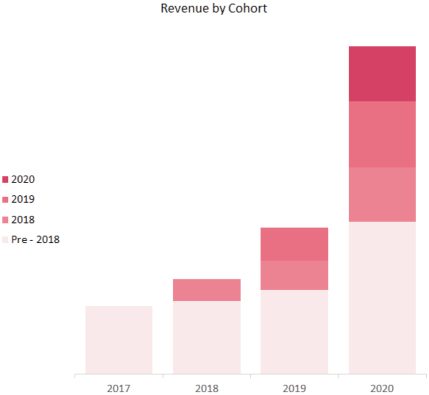

For the three months ended March 31, 2021 and the year ended December 31, 2020, purchases originated from customers in Brazil represented 56.1% and 57.2% of our total revenue, compared to 72.8% and 70.8% for the same periods for the three months ended March 31, 2020 and the year ended December 31, 2019, respectively, highlighting our growing diversification outside of Brazil, in Latin America and the rest of the world. For the three months ended March 31, 2021 and the year ended December 31, 2020, our revenues in Brazil increased 20.0% and 30.0% and 48.7% and 70.7%, on an FX neutral basis, respectively. For the three months ended March 31, 2021 and the year ended December 31, 2020, revenues in Latin America, excluding Brazil increased 143.4% and 143.6% and 146.6% and 166.7%, on an FX neutral basis, respectively. Revenues from the rest of the world increased 185.6% and 95.8% and 178.6% and 94.8%, on an FX neutral basis in the same periods, respectively. Revenues from Latin America, excluding Brazil, and the rest of the world represented 34.3% and 9.6%, of our total revenues for the three months ended March 31, 2021, up from 22.0% and 5.2% for the three months ended March 31, 2020. Revenues from Latin America, excluding Brazil, and the rest of the world represented 37.0% and 5.8%, of our total revenues for the year ended December 31, 2020, up from 24.4% and 4.7% for the year ended December 31, 2019.

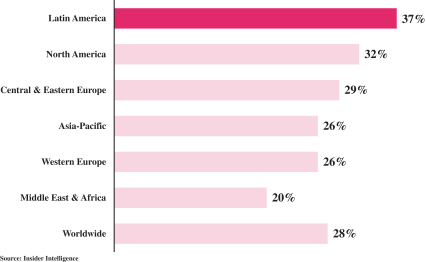

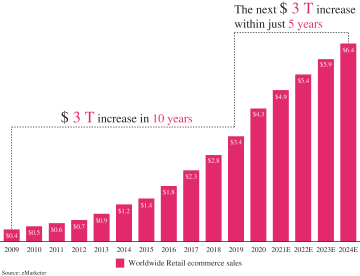

This rapid growth highlights the success of our platform’s expansion beyond Brazil. Although we believe our platform can compete successfully globally, we have historically focused on Latin America. Given our brand awareness and market position, we believe that most of our growth in the short to medium term will continue to come from Latin America where we have a leadership position and ecommerce is expected to accelerate given its current under penetration. Over the past several years we have invested, and plan to continue investing, in our operations in the United States and Europe, although only limited growth may result from these regions in the short to medium term.

Latin American Macroeconomic Environment

We operate across various countries, and in particular a number of emerging economies in Latin America. As a result, our revenues and profitability may be affected by political and economic developments in these countries and the effect that these factors have on the availability of credit, disposable income, employment rates, and average wages in these countries. Although we believe the ongoing secular shift to ecommerce strongly benefit our business, our operations may be impacted by changes in economic conditions in each of the countries in which we operate.

As of December 31, 2020, Latin America had a total GDP of US$3.5 trillion, over 600 million inhabitants, with an average GDP per capita of US$7,749.5. Important industries have consolidated their presence in the region and acquired scale, the most notable being retail, manufacturing, financial services, transportation and communication, construction, agribusiness and mining.

Brazil is the largest economy in Latin America, as measured by GDP, and we have historically carried out the majority of our operations in Brazil. While we have been growing our revenues outside of Brazil, our revenues and profitability may be affected by political and economic developments in Brazil and the effect that these factors have on the availability of credit, disposable income, employment rates and average wages in the country. Our operations in Brazil, and the financial services industry in general, are particularly sensitive to changes in Brazilian economic conditions. The real/U.S. dollar exchange rate reported by the Central Bank was R$5.197 per US$1.00 on December 31, 2020, which reflected a 29.0% depreciation of the real against the U.S. dollar during

96