UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23493

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund

(Exact name of registrant as specified in charter)

280 Park Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 832-3232

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Item 1. Reports to Stockholders.

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

To Our Shareholders:

We would like to share with you our report for the period October 28, 2020 (commencement of investment operations) through October 31, 2020. The total returns for Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (the Fund) and its comparative benchmarks were:

| | | | |

| | | For the Period

October 28, 2020 (commencement

of investment operations) through

October 31, 2020 | |

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund at Net Asset Valuea | | | 0.00 | %b |

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund at Market Valuea | | | 0.00 | % |

ICE BofA 7% Constrained DRD Eligible Preferred Securities Indexc | | | 0.11 | % |

Blended Benchmark—50% ICE BofA 7% Constrained DRD Eligible Preferred Securities Index/35% ICE BofA US IG Institutional Capital Securities Index/15% Bloomberg Barclays Developed Market Contingent Capital Indexc | | | –0.04 | % |

Bloomberg Barclays US Aggregate Bond Indexc | | | –0.31 | % |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

The Fund expects to make regular monthly distributions at a level rate (the Policy). Distributions paid by the Fund are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund’s investment company taxable income and net realized gains. As a result of the Policy, the Fund may pay distributions in excess of the Fund’s investment company taxable income and net realized gains. This excess would be a return of capital distributed from the Fund’s assets. Distributions of capital decrease the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

| a | As a closed-end investment company, the price of the Fund’s exchange-traded shares will be set by market forces and can deviate from the net asset value (NAV) per share of the Fund. |

| b | The returns shown are based on net asset values reported on October 31, 2020 and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| c | For benchmark descriptions, see page 3. |

1

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

Fund Performance

The Fund had a flat return for the period beginning October 28, 2020 (commencement of investment operations) and ending October 31, 2020. During this brief period of operation within the fiscal year the Fund’s IPO proceeds were, among other things, temporarily invested in ETFs, with plans to fully invest the assets in securities consistent with the Fund’s investment objectives of (primarily) high current income and (secondarily) capital appreciation. As such, the Fund’s holdings at period end is not representative of the portfolio’s anticipated investment exposure when fully invested under the Fund’s investment strategy. See Note 8 in Notes to Financial Statements.

Sincerely,

| | |

| |  |

WILLIAM F. SCAPELL Portfolio Manager | | ELAINE ZAHARIS-NIKAS Portfolio Manager |

| | |

|

|

JERRY DOROST Portfolio Manager |

2

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

Benchmark Descriptions

ICE BofA 7% Constrained DRD Eligible Preferred Securities Index contains all securities in the ICE BofA Fixed Rate Preferred Securities Index that are DRD (dividends received deduction) eligible, but caps issuer exposure at 7%. The ICE BofA US IG Institutional Capital Securities Index tracks the performance of US dollar denominated investment grade hybrid capital corporate and preferred securities publicly issued in the US domestic market. The Bloomberg Barclays Developed Market USD Contingent Capital Index includes hybrid capital securities in developed markets with explicit equity conversion or write down loss absorption mechanisms that are based on an issuer’s regulatory capital ratio or other explicit solvency-based triggers. The Bloomberg Barclays US Aggregate Bond Index is a broad-market measure of the US dollar-denominated investment-grade fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and commercial mortgage-backed securities.

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed infrastructure and natural resource equities, as well as preferred securities and other income solutions.

3

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

October 31, 2020

Top Ten Holdingsa,b

(Unaudited)

| | | | | | | | |

Security | | Value | | | % of

Net

Assets | |

| | |

iShares Preferred & Income Securities ETF | | $ | 43,753,760 | | | | 3.5 | |

iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 25,408,700 | | | | 2.0 | |

Apollo Global Management, Inc., 6.375%, Series A | | | 15,766,932 | | | | 1.3 | |

iShares 1-3 Year Treasury Bond ETF | | | 12,100,200 | | | | 1.0 | |

iShares 7-10 Year Treasury Bond ETF | | | 12,006,000 | | | | 1.0 | |

Enstar Finance LLC, 5.75%, due 9/1/40 | | | 7,426,746 | | | | 0.6 | |

Wachovia Capital Trust III, 5.57% (FRN) | | | 6,191,796 | | | | 0.5 | |

Cooperatieve Rabobank UA, 6.625% (Netherlands) | | | 5,996,492 | | | | 0.5 | |

Digital Realty Trust, Inc., 6.625%, Series C | | | 5,983,394 | | | | 0.5 | |

Markel Corp., 6.00% | | | 5,611,281 | | | | 0.5 | |

| a | Top ten holdings (excluding short-term investments and derivative instruments) are determined on the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Schedule of Investments for additional details on such other positions. |

| b | The Fund recently commenced investment operations and as of October 31, 2020 has not yet fully invested the proceeds from its initial public offering; therefore, the top ten holdings is not representative of the portfolio’s anticipated investment exposure when fully invested under the Fund’s investment strategy. |

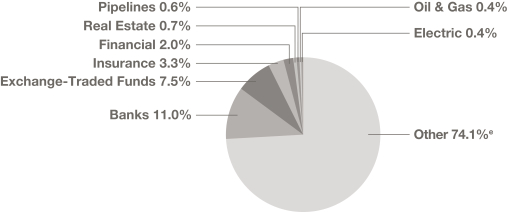

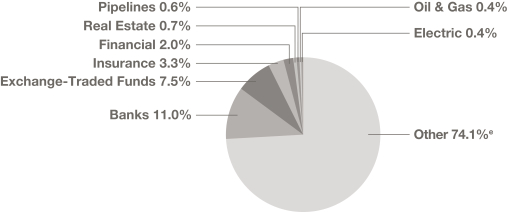

Sector Breakdownc,d

(Based on Net Assets)

(Unaudited)

| c | Excludes derivative instruments. |

| d | The Fund recently commenced investment operations and as of October 31, 2020 has not yet fully invested the proceeds from its initial public offering; therefore, the sector breakdown is not representative of the portfolio’s anticipated investment exposure when fully invested under the Fund’s investment strategy. |

| e | Includes short-term investments. |

4

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

EXCHANGE-TRADED FUNDS | | | 7.5% | | | | | | | | | |

BOND | | | 4.0% | | | | | | | | | |

iShares 1-3 Year Treasury Bond ETF | | | | 140,000 | | | $ | 12,100,200 | |

iShares 7-10 Year Treasury Bond ETF | | | | 100,000 | | | | 12,006,000 | |

iShares iBoxx Investment Grade Corporate Bond ETF | | | | 190,000 | | | | 25,408,700 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 49,514,900 | |

| | | | | | | | | | | | |

U.S. EQUITY | | | 3.5% | | | | | | | | | |

iShares Preferred & Income Securities ETF | | | | 1,208,000 | | | | 43,753,760 | |

| | | | | | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS

(Identified cost—$93,309,772) | | | | | | | | 93,268,660 | |

| | | | | | | | | | | | |

PREFERRED SECURITIES—$25 PAR VALUE | | | 3.2% | | | | | | | | | |

BANKS | | | 0.5% | | | | | | | | | |

Bank of America Corp., 5.875%, Series HHa | | | | 2,768 | | | | 74,432 | |

Bank of America Corp., 6.00%, Series GGa | | | | 4,467 | | | | 119,850 | |

Capital One Financial Corp., 6.00%, Series Ha | | | | 6,182 | | | | 161,103 | |

Citigroup, Inc., 6.30%, Series Sa | | | | 5,386 | | | | 137,074 | |

GMAC Capital Trust I, 6.065% (3 Month US LIBOR + 5.785%), due 2/15/40, Series 2 (TruPS) (FRN)b | | | | 11,451 | | | | 294,749 | |

Huntington Bancshares, Inc., 6.25%, Series Da | | | | 12,800 | | | | 327,936 | |

Regions Financial Corp., 5.70% to 5/15/29, Series Ca,c | | | | 7,700 | | | | 211,365 | |

Truist Financial Corp., 5.20%, Series Fa | | | | 3,462 | | | | 88,004 | |

Truist Financial Corp., 5.20%, Series Ga | | | | 2,236 | | | | 56,884 | |

Wells Fargo & Co., 4.70%, Series AAa | | | | 67,265 | | | | 1,661,445 | |

Wells Fargo & Co., 4.75%, Series Za | | | | 100,000 | | | | 2,498,000 | |

Wells Fargo & Co., 5.125%, Series Oa | | | | 8,236 | | | | 207,382 | |

Wells Fargo & Co., 5.25%, Series Pa | | | | 9,462 | | | | 237,969 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,076,193 | |

| | | | | | | | | | | | |

ELECTRIC | | | 0.1% | | | | | | | | | |

Duke Energy Corp., 5.75%, Series Aa | | | | 28,153 | | | | 793,915 | |

| | | | | | | | | | | | |

FINANCIAL | | | 1.6% | | | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES | | | 1.6% | | | | | | | | | |

Apollo Global Management, Inc., 6.375%, Series Aa | | | | 607,121 | | | | 15,766,932 | |

Ares Management Corp., 7.00%, Series Aa | | | | 5,901 | | | | 153,544 | |

KKR & Co., Inc., 6.50%, Series Ba | | | | 2,000 | | | | 52,860 | |

See accompanying notes to financial statements.

5

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

Oaktree Capital Group LLC, 6.625%, Series Aa | | | | 100 | | | $ | 2,672 | |

Synchrony Financial, 5.625%, Series Aa | | | | 130,517 | | | | 3,274,672 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,250,680 | |

| | | | | | | | | | | | |

INVESTMENT BANKER/BROKER | | | 0.0% | | | | | | | | | |

Charles Schwab Corp./The, 5.95%, Series Da | | | | | | | 18,047 | | | | 467,417 | |

| | | | | | | | | | | | |

TOTAL FINANCIAL | | | | | | | | 19,718,097 | |

| | | | | | | | | | | | |

INDUSTRIALS—CHEMICAL | | | 0.0% | | | | | | | | | |

CHS, Inc., 7.50%, Series 4a | | | | 3,071 | | | | 86,049 | |

CHS, Inc., 7.875%, Series 1a | | | | 1,600 | | | | 44,752 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 130,801 | |

| | | | | | | | | | | | |

INSURANCE | | | 0.3% | | | | | | | | | |

LIFE/HEALTH INSURANCE | | | 0.1% | | | | | | | | | |

Athene Holding Ltd., 6.35% to 6/30/29, Series Aa,c | | | | 13,007 | | | | 348,328 | |

Athene Holding Ltd., 6.375% to 6/30/25, Series Ca,c | | | | 29,599 | | | | 796,213 | |

Brighthouse Financial, Inc., 6.75%, Series Ba | | | | 9,982 | | | | 272,708 | |

MetLife, Inc., 5.625%, Series Ea | | | | 8,552 | | | | 230,733 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,647,982 | |

| | | | | | | | | | | | |

MULTI-LINE—FOREIGN | | | 0.0% | | | | | | | | | |

PartnerRe Ltd., 7.25%, Series H (Bermuda)a | | | | 9,698 | | | | 253,409 | |

| | | | | | | | | | | | |

PROPERTY CASUALTY | | | 0.1% | | | | | | | | | |

Axis Capital Holdings Ltd., 5.50%, Series Ea | | | | 24,032 | | | | 612,335 | |

National General Holdings Corp., 7.50%, Series Ca | | | | 11,427 | | | | 297,445 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 909,780 | |

| | | | | | | | | | | | |

PROPERTY CASUALTY—FOREIGN | | | 0.0% | | | | | | | | | |

Enstar Group Ltd., 7.00% to 9/1/28, Series D (Bermuda)a,c | | | | 5,921 | | | | 157,617 | |

| | | | | | | | | | | | |

REINSURANCE | | | 0.1% | | | | | | | | | |

Arch Capital Group Ltd., 5.25%, Series Ea | | | | 4,078 | | | | 103,948 | |

Arch Capital Group Ltd., 5.45%, Series Fa | | | | 15,687 | | | | 409,431 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 513,379 | |

| | | | | | | | | | | | |

TOTAL INSURANCE | | | | | | | | 3,482,167 | |

| | | | | | | | | | | | |

INTEGRATED TELECOMMUNICATIONS SERVICES | | | 0.0% | | | | | | | | | |

Telephone & Data Systems, Inc., 6.875%, due 11/15/59 | | | | 1,251 | | | | 31,700 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

6

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

PIPELINES | | | 0.0% | | | | | | | | | |

Energy Transfer Operating LP, 7.625% to 8/15/23, Series Da,c | | | | 7,800 | | | $ | 146,172 | |

| | | | | | | | | | | | |

REAL ESTATE | | | 0.7% | | | | | | | | | |

DATA CENTERS | | | 0.5% | | | | | | | | | |

Digital Realty Trust, Inc., 6.625%, Series Ca | | | | 228,461 | | | | 5,983,394 | |

| | | | | | | | | | | | |

NET LEASE | | | 0.0% | | | | | | | | | |

VEREIT, Inc., 6.70%, Series Fa | | | | 17,939 | | | | 451,166 | |

| | | | | | | | | | | | |

RESIDENTIAL | | | 0.2% | | | | | | | | | |

American Homes 4 Rent, 6.35%, Series Ea | | | | 49,701 | | | | 1,280,298 | |

American Homes 4 Rent, 6.50%, Series Da | | | | 76,429 | | | | 1,977,982 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,258,280 | |

| | | | | | | | | | | | |

TOTAL REAL ESTATE | | | | | | | | 9,692,840 | |

| | | | | | | | | | | | |

UTILITIES—MULTI-UTILITIES | | | 0.0% | | | | | | | | | |

NiSource, Inc., 6.50% to 3/15/24, Series Ba,c | | | | 1,908 | | | | 52,966 | |

| | | | | | | | | | | | |

TOTAL PREFERRED SECURITIES—$25 PAR VALUE

(Identified cost—$39,891,477) | | | | | | | | 40,124,851 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Principal

Amount | | | | |

PREFERRED SECURITIES—CAPITAL SECURITIES | | | 15.3% | | | | | | | | | |

BANKS | | | 4.9% | | | | | | | | | |

Bank of America Corp., 5.875% to 3/15/28, Series FFa,c | | | $ | 5,000,000 | | | | 5,385,884 | |

Bank of America Corp., 6.10% to 3/17/25, Series AAa,c | | | | 5,000,000 | | | | 5,523,025 | |

Bank of America Corp., 6.25% to 9/5/24, Series Xa,c | | | | 5,000,000 | | | | 5,439,364 | |

Citigroup, Inc., 5.95% to 5/15/25, Series Pa,c | | | | 4,000,000 | | | | 4,200,170 | |

Citigroup, Inc., 6.25% to 8/15/26, Series Ta,c | | | | 5,000,000 | | | | 5,589,575 | |

Comerica, Inc., 5.625% to 7/1/25a,c | | | | 3,000,000 | | | | 3,210,000 | |

Huntington Bancshares, Inc., 5.625% to 7/15/30, Series Fa,c | | | | 3,000,000 | | | | 3,363,750 | |

JPMorgan Chase & Co., 6.10% to 10/1/24, Series Xa,c | | | | 5,000,000 | | | | 5,262,889 | |

JPMorgan Chase & Co., 6.125% to 4/30/24, Series Ua,c | | | | 5,000,000 | | | | 5,220,402 | |

PNC Financial Services Group, Inc./The, 6.75% to 8/1/21, Series Oa,c | | | | 4,000,000 | | | | 4,084,445 | |

See accompanying notes to financial statements.

7

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

| | | | | | | | | | | | |

Regions Financial Corp., 5.75% to 6/15/25, Series Da,c | | | $ | 2,500,000 | | | $ | 2,684,375 | |

Wachovia Capital Trust III, 5.57% (3 Month US LIBOR + 0.930%, Floor 5.57%) (FRN)a,b | | | | 6,175,000 | | | | 6,191,796 | |

Wells Fargo & Co., 5.875% to 6/15/25, Series Ua,c | | | | 5,000,000 | | | | 5,366,577 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 61,522,252 | |

| | | | | | | | | | | | |

BANKS—FOREIGN | | | 5.6% | | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA, 8.875% to 4/14/21 (Spain)a,c,d,e | | | | 2,000,000 | | | | 2,388,162 | |

Bank of Ireland Group PLC, 7.50% to 5/19/25 (Ireland)a,c,d,e | | | | 2,000,000 | | | | 2,460,323 | |

Bankinter SA, 8.625% to 5/10/21 (Spain)a,c,d,e | | | | 2,000,000 | | | | 2,385,522 | |

Barclays PLC, 7.875% to 3/15/22

(United Kingdom)a,c,d,e | | | | 2,400,000 | | | | 2,482,320 | |

BNP Paribas SA, 6.75% to 3/14/22, 144A

(France)a,c,e,f | | | | 3,000,000 | | | | 3,072,180 | |

BNP Paribas SA, 7.195% to 6/25/37, 144A

(France)a,c,f | | | | 5,000,000 | | | | 5,329,101 | |

BNP Paribas SA, 7.625% to 3/30/21, 144A

(France)a,c,e,f | | | | 2,400,000 | | | | 2,431,500 | |

Cooperatieve Rabobank UA, 6.625% to 6/29/21

(Netherlands)a,c,d,e | | | | 5,000,000 | | | | 5,996,492 | |

Credit Agricole SA, 7.875% to 1/23/24, 144A (France)a,c,e,f | | | | 2,000,000 | | | | 2,210,320 | |

Credit Agricole SA, 8.125% to 12/23/25, 144A (France)a,c,e,f | | | | 2,000,000 | | | | 2,353,400 | |

Credit Suisse Group AG, 7.25% to 9/12/25, 144A (Switzerland)a,c,e,f | | | | 2,000,000 | | | | 2,168,810 | |

Credit Suisse Group AG, 7.50% to 7/17/23, 144A (Switzerland)a,c,e,f | | | | 2,000,000 | | | | 2,125,020 | |

Erste Group Bank AG, 8.875% to 10/15/21, Series EMTN (Austria)a,c,d,e | | | | 2,000,000 | | | | 2,472,445 | |

HSBC Holdings PLC, 6.875% to 6/1/21 (United Kingdom)a,c,e | | | | 2,400,000 | | | | 2,435,724 | |

ING Groep N.V., 6.875% to 4/16/22 (Netherlands)a,c,d,e | | | | 2,000,000 | | | | 2,073,270 | |

See accompanying notes to financial statements.

8

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

| | | | | | | | | | | | |

Lloyds Banking Group PLC, 7.625% to 6/27/23 (United Kingdom)a,c,d,e | | | $ | 2,000,000 | | | $ | 2,712,452 | |

Lloyds Bank PLC, 12.00% to 12/16/24, 144A (United Kingdom)a,c,f | | | | 5,000,000 | | | | 5,606,450 | |

Natwest Group PLC, 8.00% to 8/10/25 (United Kingdom)a,c,e | | | | 2,200,000 | | | | 2,467,520 | |

Natwest Group PLC, 8.625% to 8/15/21 (United Kingdom)a,c,e | | | | 3,000,000 | | | | 3,102,990 | |

Societe Generale SA, 7.375% to 9/13/21, 144A (France)a,c,e,f | | | | 2,400,000 | | | | 2,470,608 | |

Societe Generale SA, 7.875% to 12/18/23, 144A (France)a,c,e,f | | | | 3,000,000 | | | | 3,202,725 | |

UBS Group AG, 7.00% to 1/31/24, 144A (Switzerland)a,c,e,f | | | | 2,000,000 | | | | 2,153,890 | |

UBS Group AG, 7.125% to 8/10/21 (Switzerland)a,c,d,e | | | | 3,000,000 | | | | 3,076,875 | |

UniCredit SpA, 8.00% to 6/3/24 (Italy)a,c,d,e | | | | 2,200,000 | | | | 2,320,635 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 69,498,734 | |

| | | | | | | | | | | | |

ELECTRIC | | | 0.3% | | | | | | | | | |

CenterPoint Energy, Inc., 6.125% to 9/1/23, Series Aa,c | | | | 2,000,000 | | | | 2,024,559 | |

Southern California Edison Co., 6.25% to 2/1/22, Series Ea,c | | | | 1,666,000 | | | | 1,640,433 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,664,992 | |

| | | | | | | | | | | | |

FINANCIAL | | | 0.4% | | | | | | | | | |

Charles Schwab Corp./The, 5.375% to 6/1/25, Series Ga,c | | | | 5,000,000 | | | | 5,487,500 | |

| | | | | | | | | | | | |

INSURANCE | | | 3.0% | | | | | | | | | |

LIFE/HEALTH INSURANCE | | | 0.3% | | | | | | | | | |

MetLife, Inc., 5.875% to 3/15/28, Series Da,c | | | | 500,000 | | | | 556,604 | |

SBL Holdings, Inc., 7.00% to 5/13/25, 144Aa,c,f | | | | 3,450,000 | | | | 2,867,813 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,424,417 | |

| | | | | | | | | | | | |

LIFE/HEALTH INSURANCE—FOREIGN | | | 1.1% | | | | | | | | | |

Aegon NV, 5.625% to 4/15/29 (Netherlands)a,c,d,e | | | | 2,000,000 | | | | 2,519,778 | |

Dai-ichi Life Insurance Co., Ltd./The, 7.25% to 7/25/21, 144A (Japan)a,c,f | | | | 4,000,000 | | | | 4,178,560 | |

See accompanying notes to financial statements.

9

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

| | | | | | | | | | | | |

La Mondiale SAM, 5.05% to 12/17/25 (France)a,c,d | | | $ | 2,000,000 | | | $ | 2,589,368 | |

Legal & General Group PLC, 5.625% to 3/24/31

(United Kingdom)a,c,d,e | | | | 3,000,000 | | | | 3,981,310 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,269,016 | |

| | | | | | | | | | | | |

MULTI-LINE | | | 0.4% | | | | | | | | | |

UnipolSai Assicurazioni SpA, 5.75% to 6/18/24, Series EMTN (Italy)a,c,d | | | | 4,500,000 | | | | 5,483,161 | |

| | | | | | | | | | | | |

PROPERTY CASUALTY | | | 1.2% | | | | | | | | | |

Assurant, Inc., 7.00% to 3/27/28, due 3/27/48c | | | | 2,000,000 | | | | 2,180,428 | |

Enstar Finance LLC, 5.75% to 9/1/25, due 9/1/40c | | | | 7,300,000 | | | | 7,426,746 | |

Markel Corp., 6.00% to 6/1/25a,c | | | | 5,275,000 | | | | 5,611,281 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,218,455 | |

| | | | | | | | | | | | |

TOTAL INSURANCE | | | | | | | | 37,395,049 | |

| | | | | | | | | | | | |

OIL & GAS—FOREIGN | | | 0.4% | | | | | | | | | |

BP Capital Markets PLC, 4.875% to 3/22/30 (United Kingdom)a,c | | | | 5,000,000 | | | | 5,262,500 | |

| | | | | | | | | | | | |

PIPELINES | | | 0.1% | | | | | | | | | |

Energy Transfer Operating LP, 7.125% to 5/15/30, Series Ga,c | | | | 2,000,000 | | | | 1,637,220 | |

| | | | | | | | | | | | |

PIPELINES—FOREIGN | | | 0.6% | | | | | | | | | |

Enbridge, Inc., 5.75% to 4/15/30, due 7/15/80, Series 20-A (Canada)c | | | | 4,000,000 | | | | 4,084,397 | |

Transcanada Trust, 5.50% to 9/15/29, due 9/15/79 (Canada)c | | | | 3,000,000 | | | | 3,077,935 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,162,332 | |

| | | | | | | | | | | | |

TOTAL PREFERRED SECURITIES—CAPITAL SECURITIES

(Identified cost—$192,046,438) | | | | | | | | 191,630,579 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

10

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

SHORT-TERM INVESTMENTS | | | 100.0% | | | | | |

MONEY MARKET FUNDS | |

State Street Institutional Treasury Plus Money Market Fund, Premier Class, 0.02%g | | | | 1,250,100,000 | | | $ | 1,250,100,000 | |

| | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$1,250,100,000) | | | | | | | | 1,250,100,000 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTSIN SECURITIESh

(Identified cost—$1,575,347,687) | | | 126.0% | | | | | | | | 1,575,124,090 | |

LIABILITIESIN EXCESSOF OTHER ASSETS | | | (26.0) | | | | | | | | (325,475,350 | ) |

| | | | | | | | | | | | |

NET ASSETS (Equivalent to $24.99 per share based on

50,004,000 shares of common stock outstanding) | | | 100.0% | | | | | | | $ | 1,249,648,740 | |

| | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Counterparty | | Contracts to

Deliver | | | | | In Exchange

For | | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

Brown Brothers Harriman | | EUR | | | 23,090,000 | | | USD | | | 26,903,614 | | | | 12/2/20 | | | $ | (5,343 | ) |

Brown Brothers Harriman | | GBP | | | 5,235,000 | | | USD | | | 6,784,277 | | | | 12/2/20 | | | | 1,122 | |

| | | | | | | | | | | | | | | | | | $ | (4,221 | ) |

| |

Glossary of Portfolio Abbreviations

| | |

EMTN | | Euro Medium Term Note |

ETF | | Exchange-Traded Fund |

EUR | | Euro Currency |

FRN | | Floating Rate Note |

GBP | | Great British Pound |

LIBOR | | London Interbank Offered Rate |

TruPS | | Trust Preferred Securities |

USD | | United States Dollar |

See accompanying notes to financial statements.

11

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

SCHEDULE OF INVESTMENTS—(Continued)

October 31, 2020

Note: Percentages indicated are based on the net assets of the Fund.

| a | Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. |

| b | Variable rate. Rate shown is in effect at October 31, 2020. |

| c | Security converts to floating rate after the indicated fixed-rate coupon period. |

| d | Securities exempt from registration under Regulation S of the Securities Act of 1933. These securities are subject to resale restrictions. Aggregate holdings amounted to $42,942,113 which represents 3.4% of the net assets of the Fund, of which 0.0% are illiquid. |

| e | Contingent Capital security (CoCo). CoCos are debt or preferred securities with loss absorption characteristics built into the terms of the security for the benefit of the issuer. Aggregate holdings amounted to $65,064,271 which represents 5.2% of the net assets of the Fund. |

| f | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. Aggregate holdings amounted to $40,170,377 which represents 3.2% of the net assets of the Fund, of which 0.0% are illiquid. |

| g | Rate quoted represents the annualized seven-day yield. |

| h | The Fund recently commenced investment operations and as of October 31, 2020 has not yet fully invested the proceeds from its initial public offering; therefore, the total investments in securities is not representative of the portfolio’s anticipated investment exposure when fully invested under the Fund’s investment strategy. |

| | | | |

Country Summary | | % of Net

Assetsh | |

| |

United States | | | 17.9 | |

| |

United Kingdom | | | 2.2 | |

| |

France | | | 1.9 | |

| |

Netherlands | | | 0.9 | |

| |

Switzerland | | | 0.8 | |

| |

Italy | | | 0.6 | |

| |

Canada | | | 0.6 | |

| |

Other (includes short-term investments) | | | 75.1 | |

| | | | |

| | | 100.0 | |

| | | | |

See accompanying notes to financial statements.

12

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2020

| | | | |

ASSETS: | |

Investments in securities, at value (Identified cost—$1,575,347,687) | | $ | 1,575,124,090 | |

Receivable for dividends and interest | | | 2,844,714 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | 1,122 | |

| | | | |

Total Assets | | | 1,577,969,926 | |

| | | | |

LIABILITIES: | | | | |

Unrealized depreciation on forward foreign currency exchange contracts | | | 5,343 | |

Payable for: | | | | |

Investment securities purchased | | | 328,085,993 | |

Investment management fees | | | 68,311 | |

Administration fees | | | 4,099 | |

Trustees’ fees | | | 350 | |

Other liabilities | | | 157,090 | |

| | | | |

Total Liabilities | | | 328,321,186 | |

| | | | |

NET ASSETS | | $ | 1,249,648,740 | |

| | | | |

NET ASSETS consist of: | | | | |

Paid-in capital | | $ | 1,249,871,515 | |

Total distributable earnings/(accumulated loss) | | | (222,775 | ) |

| | | | |

| | $ | 1,249,648,740 | |

| | | | |

NET ASSET VALUE PER SHARE: | | | | |

($1,249,648,740 ÷ 50,004,000 shares outstanding) | | $ | 24.99 | |

| | | | |

MARKET PRICE PER SHARE | | $ | 25.00 | |

| | | | |

MARKET PRICE PREMIUM (DISCOUNT) TO NET ASSET VALUE PER SHARE | | | 0.04 | % |

| | | | |

See accompanying notes to financial statements.

13

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

STATEMENT OF OPERATIONS

For the Period October 28, 2020a through October 31, 2020

| | | | |

Investment Income: | |

Dividend income | | $ | 1,365 | |

| | | | |

Expenses: | | | | |

Shareholder reporting expenses | | | 110,000 | |

Investment management fees | | | 68,311 | |

Professional fees | | | 37,840 | |

Administration fees | | | 7,099 | |

Custodian fees and expenses | | | 1,250 | |

Trustees’ fees and expenses | | | 350 | |

Miscellaneous | | | 5,000 | |

| | | | |

Total Expenses | | | 229,850 | |

| | | | |

Net Investment Income (Loss) | | | (228,485 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) | | | — | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments in securities | | | (223,597 | ) |

Forward foreign currency exchange contracts | | | (4,221 | ) |

Foreign currency translations | | | 5,043 | |

| | | | |

Net change in unrealized appreciation (depreciation) | | | (222,775 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | (222,775 | ) |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | (451,260 | ) |

| | | | |

| a | Commencement of investment operations. |

See accompanying notes to financial statements.

14

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | | For the Period

October 28, 2020a

through

October 31, 2020 | |

Change in Net Assets: | |

From Operations: | | | | |

Net investment income (loss) | | $ | (228,485 | ) |

Net change in unrealized appreciation (depreciation) | | | (222,775 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (451,260 | ) |

| | | | |

Capital Stock Transactions: | | | | |

Increase (decrease) in net assets from Fund share transactions | | | 1,250,000,000 | |

| | | | |

Total increase (decrease) in net assets | | | 1,249,548,740 | |

Net Assets: | | | | |

Beginning of period | | | 100,000 | |

| | | | |

End of period | | $ | 1,249,648,740 | |

| | | | |

| a | Commencement of investment operations. |

See accompanying notes to financial statements.

15

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

FINANCIAL HIGHLIGHTS

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | | |

Per Share Operating Data: | | For the Period

October 28, 2020a

through

October 31, 2020 | |

Net asset value, beginning of period | | | $25.00 | |

| | | | |

Income (loss) from investment operations: | | | | |

| |

Net investment income (loss)b | | | (0.01 | ) |

Net realized and unrealized gain (loss) | | | (0.00 | )c |

| | | | |

Total from investment operations | | | (0.01 | ) |

| | | | |

Net increase (decrease) in net asset value | | | (0.01 | ) |

| | | | |

Net asset value, end of period | | | $24.99 | |

| | | | |

Market value, end of period | | | $25.00 | |

| | | | |

| |

| | | | | |

Total net asset value returnd | | | (0.04 | )%e |

| | | | |

Total market value returnd | | | 0.00 | %e |

| | | | |

| |

| | | | | |

Ratios/Supplemental Data: | | | | |

| |

Net assets, end of year (in millions) | | | $1,249.6 | |

| | | | |

Ratios to average daily net assets: | | | | |

| |

Expenses | | | 1.24 | %f |

| | | | |

Expenses (excluding interest expense) | | | 1.24 | %f |

| | | | |

Net investment income (loss) | | | (1.22 | )%f |

| | | | |

Ratio of expenses to average daily managed assetsg | | | 1.24 | %f |

| | | | |

Portfolio turnover rate | | | 0 | %e |

| | | | |

Revolving Credit Agreement | | | | |

| |

Asset coverage ratio for revolving credit agreement | | | N/A | h |

| | | | |

Asset coverage per $1,000 for revolving credit agreement | | | N/A | h |

| | | | |

Amount of loan outstanding (in millions) | | | N/A | h |

| | | | |

| a | Commencement of investment operations. |

| b | Calculation based on average shares outstanding. |

| c | Amount is less than $0.005. |

| d | Total net asset value return measures the change in net asset value per share over the period indicated. Total market value return is computed based upon the Fund’s market price per share and excludes the effects of brokerage commissions. |

| f | Ratios for periods less than one year are annualized. Certain professional and shareholder reporting expenses incurred by the Fund are not annualized for periods less than one year. |

| g | Average daily managed assets represent net assets plus the outstanding balance of the revolving credit agreement. |

| h | See Note 8 in Notes to Financial Statements. |

See accompanying notes to financial statements.

16

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund, a Maryland statutory trust, (the Fund), was organized on November 14, 2019, and is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a non-diversified, closed-end management statutory trust. The Fund’s primary investment objective is high current income. The Fund’s secondary investment objective is capital appreciation. The Fund had no assets until September 15, 2020 when it sold 4,000 shares for $100,000 to Cohen & Steers Capital Management, Inc. (the investment manager). Investment operations commenced on October 28, 2020.

The Fund has a limited term and intends to terminate as of the first business day following the twelfth anniversary of the effective date of the Fund’s initial registration statement, which the Fund expects to occur on or about October 27, 2032 (the Dissolution Date); provided that the Fund’s Board of Trustees may, by a vote of the majority of the Board of Trustees and seventy-five percent (75%) of the members of the Board of Trustees of who either (i) have been a member of the Board of Trustees for a period of at least thirty-six months (or since the commencement of the Fund’s operations, if less than thirty-six months) or (ii) were nominated to serve as a member of the Board of Trustees by a majority of the Continuing Trustees then members of the Board of Trustees (a Board Action Vote), without shareholder approval, extend the Dissolution Date (i) once for up to one year, and (ii) once for up to an additional one year, to a date up to and including two years after the initial Dissolution Date, which later date shall then become the Dissolution Date.

As of a date within twelve months preceding the Dissolution Date, the Board of Trustees may, by a Board Action Vote, cause the Fund to conduct a tender offer to common shareholders to purchase 100% of the then outstanding common shares of the Fund at a price equal to the net asset value (NAV) per common share on the expiration date of the tender offer (an Eligible Tender Offer). In an Eligible Tender Offer, the Fund will offer to purchase all common shares held by each common shareholder; provided that if the number of properly tendered common shares would result in the Fund having aggregate net assets below $200 million (the Dissolution Threshold), the Eligible Tender Offer will be canceled, no common shares will be repurchased pursuant to the Eligible Tender Offer, and the Fund will terminate as otherwise scheduled. Following the completion of an Eligible Tender Offer, the Board of Trustees may, by a Board Action Vote, eliminate the Dissolution Date without shareholder approval and cause the Fund to have a perpetual existence.

The investment manager has agreed to pay all organizational and offering expenses of the Fund of approximately $53,500 and $1,320,000, respectively. The investment manager has also agreed to pay, from its own assets, compensation to the underwriters in connection with the offering.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic (ASC) 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

17

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price. Forward foreign currency exchange contracts are valued daily at the prevailing forward exchange rate. Centrally cleared interest rate swaps are valued at the price determined by the relevant exchange or clearinghouse.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Trustees.

Readily marketable securities traded in the over-the-counter (OTC) market, including listed securities whose primary market is believed by the investment manager to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment manager, pursuant to delegation by the Board of Trustees, to reflect the fair value of such securities.

Fixed-income securities are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment manager, pursuant to delegation by the Board of Trustees, to reflect the fair value of such securities. The pricing services or broker-dealers use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services or broker-dealers may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services or broker-dealers also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features which are then used to calculate the fair values.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at NAV.

The policies and procedures approved by the Fund’s Board of Trustees delegate authority to make fair value determinations to the investment manager, subject to the oversight of the Board of Trustees. The investment manager has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Trustees. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

18

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

Securities for which market prices are unavailable, or securities for which the investment manager determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund’s Board of Trustees. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The Fund’s use of fair value pricing may cause the NAV of Fund shares to differ from the NAV that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund’s investments is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing investments may or may not be an indication of the risk associated with those investments. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the inputs used as of October 31, 2020 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | | | | | |

| | | Total | | | Quoted Prices

in Active

Markets for

Identical

Investments

(Level 1) | | | Other

Significant

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | |

Exchange Traded Funds | | $ | 93,268,660 | | | $ | 93,268,660 | | | $ | — | | | $ | — | |

| Preferred Securities—$25 Par Value: | | | | | | | | | | | | | | | | |

Banks | | | 6,076,193 | | | | 4,414,748 | | | | 1,661,445 | | | | — | |

Other Industries | | | 34,048,658 | | | | 34,048,658 | | | | — | | | | — | |

19

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

| | | | | | | | | | | | | | | | |

| | | Total | | | Quoted Prices

in Active

Markets for

Identical

Investments

(Level 1) | | | Other

Significant

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | |

Preferred Securities— | | | | | | | | | | | | | | | | |

Capital Securities | | $ | 191,630,579 | | | $ | — | | | $ | 191,630,579 | | | $ | — | |

Short-Term Investments | | | 1,250,100,000 | | | | — | | | | 1,250,100,000 | | | | — | |

| | | | | | | | | | | | | | | | |

Total Investments in Securitiesa | | $ | 1,575,124,090 | | | $ | 131,732,066 | | | $ | 1,443,392,024 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Forward Foreign Currency | | | | | | | | | | | | | | | | |

Exchange Contracts | | $ | 1,122 | | | $ | — | | | $ | 1,122 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Derivative Assetsa | | $ | 1,122 | | | $ | — | | | $ | 1,122 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Forward Foreign Currency | | | | | | | | | | | | | | | | |

Exchange Contracts | | $ | (5,343 | ) | | $ | — | | | $ | (5,343 | ) | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Derivative Liabilitiesa | | $ | (5,343 | ) | | $ | — | | | $ | (5,343 | ) | | $ | — | |

| | | | | | | | | | | | | | | | |

| a | Portfolio holdings are disclosed individually on the Schedule of Investments. |

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income, which includes the amortization of premiums and accretion of discounts, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions from real estate investment trusts (REITs) and exchange-traded funds (ETFs) are recorded as ordinary income, net realized capital gains or return of capital based on information reported by the REITs, ETFs and management’s estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the REITs and ETFs and actual amounts may differ from the estimated amounts.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign currency transaction gains or losses arise from sales of foreign currencies, (excluding gains and losses on forward foreign currency exchange contracts, which are presented separately, if any) currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign

20

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency translation gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gains/losses are included in or are a reduction of ordinary income for federal income tax purposes.

Forward Foreign Currency Exchange Contracts: The Fund enters into forward foreign currency exchange contracts to hedge the currency exposure associated with certain of its non-U.S. dollar denominated securities. A forward foreign currency exchange contract is a commitment between two parties to purchase or sell foreign currency at a set price on a future date. The market value of a forward foreign currency exchange contract fluctuates with changes in foreign currency exchange rates. These contracts are marked to market daily and the change in value is recorded by the Fund as unrealized appreciation and/or depreciation on forward foreign currency exchange contracts. Realized gains or losses equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed are included in net realized gain or loss on forward foreign currency exchange contracts. For federal income tax purposes, the Fund has made an election to treat gains and losses from forward foreign currency exchange contracts as capital gains and losses.

Forward foreign currency exchange contracts involve elements of market risk in excess of the amounts reflected on the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the contract. Risks may also arise upon entering these contracts from the potential inability of the counterparties to meet the terms of their contracts. In connection with these contracts, securities may be identified as collateral in accordance with the terms of the respective contracts.

Centrally Cleared Interest Rate Swap Contracts: The Fund may use interest rate swaps in connection with borrowing under its revolving credit agreement. The interest rate swaps are intended to reduce interest rate risk by countering the effect that an increase in short-term interest rates could have on the performance of the Fund’s shares as a result of the floating rate structure of interest owed pursuant to the revolving credit agreement. When entering into interest rate swaps, the Fund will agree to pay the other party to the interest rate swap (which is known as the counterparty) a fixed rate payment in exchange for the counterparty’s agreement to pay the Fund a variable rate payment that was intended to approximate the Fund’s variable rate payment obligation on the revolving credit agreement. The payment obligation is based on the notional amount of the swap. Depending on the state of interest rates in general, the use of interest rate swaps could enhance or harm the overall performance of the Fund. Swaps are marked-to-market daily and changes in the value are recorded as unrealized appreciation (depreciation).

Immediately following execution of a swap agreement, the swap agreement will be novated to a central counterparty (the CCP) and the Fund’s counterparty on the swap agreement will become the CCP. The Fund is required to interface with the CCP through a broker. Upon entering into a centrally cleared swap, the Fund is required to deposit initial margin with the broker in the form of cash or securities in an amount that varies depending on the size and risk profile of the particular swap. Securities deposited as initial margin will be designated on the Schedule of Investments and cash deposited will be recorded on the Statement of Assets and Liabilities as cash collateral pledged for interest rate swap contracts. The

21

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

daily change in valuation of centrally cleared swaps will be recorded as a receivable or payable for variation margin in the Statement of Assets and Liabilities. Payments received from or paid to the counterparty, including at termination, are recorded as realized gain (loss) in the Statement of Operations.

Swap agreements involve, to varying degrees, elements of market and counterparty risk, and exposure to loss in excess of the related amounts reflected on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreements may default on its obligation to perform or disagree as to the meaning of contractual terms in the agreements and that there may be unfavorable changes in interest rates.

As of October 31, 2020, the Fund did not have any centrally cleared interest rateSwap contracts outstanding.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are typically declared quarterly and paid monthly. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund in accordance with the Fund’s Reinvestment Plan, unless the shareholder has elected to have them paid in cash. Dividends from net investment income are subject to recharacterization for tax purposes.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company (RIC), if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to RICs, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Accordingly, no provision for federal income or excise tax is necessary. Dividends and interest income from holdings in non-U.S. securities is recorded net of non-U.S. taxes paid. Management has analyzed the Fund’s tax positions taken on federal and applicable state income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for the current tax year and has concluded that as of October 31, 2020, no additional provisions for income tax are required in the Fund’s financial statements. The Fund’s tax positions for the current tax year for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

Note 2. Investment Management Fees, Administration Fees and Other Transactions with Affiliates

Investment Management Fees: Cohen & Steers Capital Management, Inc. serves as the Fund’s investment manager pursuant to an investment management agreement (the investment management agreement). Under the terms of the investment management agreement, the investment manager provides the Fund with day-to-day investment decisions and generally manages the Fund’s investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Trustees.

For the services provided to the Fund, the investment manager receives a fee, accrued daily and paid monthly, at the annual rate of 1.00% of the average daily managed assets of the Fund. Managed assets are equal to the Fund’s net assets, plus the principal amount of loans from financial institutions or

22

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

debt securities issued by the Fund, the liquidation preference of preferred shares issued by the Fund, if any, and the proceeds of any reverse repurchase agreements entered into by the Fund, if any.

Administration Fees: The Fund has entered into an administration agreement with the investment manager under which the investment manager performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.06% of the average daily managed assets of the Fund. For the period from October 28, 2020 (commencement of investment operations) through October 31, 2020, the Fund incurred $4,099 in fees under this administration agreement. Additionally, the Fund pays State Street Bank and Trust Company as co-administrator under a fund accounting and administration agreement.

Trustees’ and Officers’ Fees: Certain trustees and officers of the Fund are also directors, officers and/or employees of the investment manager. The Fund does not pay compensation to trustees and officers affiliated with the investment manager except for the Chief Compliance Officer, who received compensation from the investment manager, which was reimbursed by the Fund, in the amount of $577 for the period from October 28, 2020 (commencement of investment operations) through October 31, 2020.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the period from October 28, 2020 (commencement of investment operations) through October 31, 2020, totaled $325,247,687 and $0, respectively.

Note 4. Derivative Investments

The following tables present the value of derivatives held at October 31, 2020 and the effect of derivatives held during the period October 28, 2020 (commencement of investment operations) through October 31, 2020, along with the respective location in the financial statements.

Statement of Assets and Liabilities

| | | | | | | | | | | | |

| | | Assets | | | Liabilities | |

Derivatives | | Location | | Fair Value | | | Location | | Fair Value | |

Foreign Exchange Risk: | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contractsa | | Unrealized appreciation | | $ | 1,122 | | | Unrealized depreciation | | $ | 5,343 | |

| a | Not subject to a master netting agreement or another similar arrangement. |

Statement of Operations

| | | | | | | | | | |

Derivatives | | Location | | Realized

Gain (Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | |

Foreign Exchange Risk: | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | Net Realized and Unrealized Gain (Loss) | | $ | — | | | $ | (4,221 | ) |

23

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

The following summarizes the volume of the Fund’s forward foreign currency exchange contracts activity for the period October 28, 2020 (commencement of investment operations) through October 31, 2020:

| | | | |

| | | Forward Foreign

Currency Exchange

Contracts | |

Average Notional Amount | | $ | 33,687,891 | |

Note 5. Income Tax Information

As of October 31, 2020, the tax-basis components of accumulated earnings, the federal tax cost and net unrealized appreciation (depreciation) in value of investments held were as follows:

| | | | |

Cost of investments in securities for federal income tax purposes | | $ | 1,575,347,687 | |

| | | | |

Gross unrealized appreciation on investments | | $ | 302,719 | |

Gross unrealized depreciation on investments | | | (521,273 | ) |

| | | | |

Net unrealized appreciation (depreciation) on investments | | $ | (218,554 | ) |

| | | | |

As of October 31, 2020, the Fund has a net capital loss carryforward of $4,221 which may be used to offset future capital gains. These losses are a short-term capital loss carryforward and long-term capital loss carryforward of $1,688 and $2,533, respectively, which under current federal income tax rules, may offset capital gains recognized in any future period.

As of October 31, 2020, the Fund had temporary book/tax differences primarily attributable to unrealized loss on forward currency contracts and permanent differences primarily attributable to the Fund’s net investment loss. To reflect reclassifications arising from the permanent differences, paid-in capital was charged $228,485 and total distributable earnings/(accumulated loss) was credited $228,485. Net assets were not affected by this reclassification.

Note 6. Capital Stock

Under the Amended and Restated Declaration of Trust, the Fund is authorized to issue an unlimited number of shares of beneficial interest.

On October 28, 2020, the Fund completed the initial public offering of 50,000,000 shares of common stock. Proceeds paid to the Fund amounted to approximately $1,250,000,000.

On December 10, 2019, the Board of Trustees approved the delegation of its authority to management to effect repurchases, pursuant to management’s discretion and subject to market conditions and investment considerations, of up to 10% of the Fund’s common shares outstanding (Share Repurchase Program) as of October 28, 2020 (commencement of investment operations), through the fiscal year ended October 31, 2020. On December 8, 2020, the Board of Trustees of the Fund approved continuation of the Share Repurchase Program of up to 10% of the Fund’s common shares outstanding as of January 1, 2021 through December 31, 2021.

24

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

NOTES TO FINANCIAL STATEMENTS—(Continued)

During the period October 28, 2020 (commencement of investment operations) through October 31, 2020, the Fund issued no shares of common stock for the reinvestment of dividends.

Note 7. Other

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 8. Subsequent Events

On December 14, 2020, the Fund’s Board of Trustees announced the Fund’s first monthly distribution of $0.13 per common share and the schedule of distributions for December 2020 and January, February and March 2021.

In connection with the Fund’s initial public offering, the Fund granted the underwriters an option to purchase an additional 7,500,000 shares of common stock at the public offering price of $25.00 per share within 45 days of the date of the Fund’s prospectus, October 27, 2020 (the overallotment option). On December 1, 2020, the overallotment option was partially exercised, whereby underwriters exercised this option to purchase 3,000,000 shares of common stock. Additionally, on December 11, 2020, underwriters exercised this option to purchase 2,215,271 shares of common stock. Proceeds paid to the Fund amounted to $75,000,000 and $55,381,775, respectively.

On December 8, 2020, the Fund entered into a $720,000,000 revolving credit agreement (the credit agreement) with State Street Bank and Trust Company (State Street) whereby funds may be drawn in U.S. dollars, Euros and Great British Pounds (GBP), subject to certain limitations. Borrowings under the credit agreement, which are secured by certain assets of the Fund, bear interest based on currency-specific variable rates plus a margin. In addition, the Fund is subject to a commitment fee for the unused portion of the credit agreement. Through December 22, 2020, the Fund borrowed USD 645,000,000 and GBP 33,000,000 (which equates to USD 43,934,256) on the line of credit at a current effective interest rate of 0.92%. In connection with the credit agreement, the Fund paid origination fees amounting to $360,000.

Management has evaluated events and transactions occurring after October 31, 2020 through the date that the financial statements were issued, and has determined that no additional disclosure in the financial statements is required.

25

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (the “Fund”) as of October 31, 2020, and the related statements of operations and changes in net assets, including the related notes, and the financial highlights for the period October 28, 2020 (commencement of operations) through October 31, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2020, and the results of its operations, changes in its net assets, and the financial highlights for the period October 28, 2020 (commencement of operations) through October 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2020 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

New York, New York

December 22, 2020

We have served as the auditor of one or more investment companies in the Cohen & Steers family of mutual funds since 1991.

26

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

AVERAGE ANNUAL TOTAL RETURNS

(Periods ended October 31, 2020) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on Net Asset Value | | | | | | Based on Market Value | |

| One Year | | | Five Years | | | Since Inception

(10/28/20) | | | | | | One Year | | | Five Years | | | Since Inception

(10/28/20) | |

| | — | % | | | — | % | | | 0.00 | %a | | | | | | | — | % | | | — | % | | | 0.00 | % |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return will vary and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan.

| a | The returns shown are based on net asset values reported on October 31, 2020 and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

REINVESTMENT PLAN

The Fund has a dividend reinvestment plan commonly referred to as an “opt-out” plan (the Plan). Each common shareholder who participates in the Plan will have all distributions of dividends and capital gains (Dividends) automatically reinvested in additional common shares by Computershare as agent (the Plan Agent). Shareholders who elect not to participate in the Plan will receive all Dividends in cash paid by check mailed directly to the shareholder of record (or if the shares are held in street or other nominee name, then to the nominee) by the Plan Agent, as dividend disbursing agent. Shareholders whose common shares are held in the name of a broker or nominee should contact the broker or nominee to determine whether and how they may participate in the Plan.

The Plan Agent serves as agent for the shareholders in administering the Plan. After the Fund declares a Dividend, the Plan Agent will, as agent for the shareholders, either: (i) receive the cash payment and use it to buy common shares in the open market, on the NYSE or elsewhere, for the participants’ accounts or (ii) distribute newly issued common shares of the Fund on behalf of the participants.

The Plan Agent will receive cash from the Fund with which to buy common shares in the open market if, on the Dividend payment date, NAV per share exceeds the market price per share plus estimated brokerage commissions on that date. The Plan Agent will receive the Dividend in newly issued common shares of the Fund if, on the Dividend payment date, the market price per share plus estimated brokerage commissions equals or exceeds the NAV per share of the Fund on that date. The number of shares to be issued will be computed at a per share rate equal to the greater of (i) the NAV or (ii) 95% of the closing market price per share on the payment date.

If the market price per share is less than the NAV on a Dividend payment date, the Plan Agent will have until the last business day before the next ex-dividend date for the common stock, but in no event more than 30 days after the Dividend payment date (as the case may be, the Purchase Period), to invest the Dividend amount in shares acquired in open market purchases. If at the close of business on any day during the Purchase Period on which NAV is calculated the NAV equals or is less than the market price

27

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

per share plus estimated brokerage commissions, the Plan Agent will cease making open market purchases and the uninvested portion of such Dividends shall be filled through the issuance of new shares of common stock from the Fund at the price set forth in the immediately preceding paragraph.

Participants in the Plan may withdraw from the Plan upon notice to the Plan Agent. Such withdrawal will be effective immediately if received not less than ten days prior to a Dividend record date; otherwise, it will be effective for all subsequent Dividends. If any participant elects to have the Plan Agent sell all or part of his or her shares and remit the proceeds, the Plan Agent is authorized to deduct a $15.00 fee plus $0.10 per share brokerage commissions.

The Plan Agent’s fees for the handling of reinvestment of Dividends will be paid by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of Dividends. The automatic reinvestment of Dividends will not relieve participants of any income tax that may be payable or required to be withheld on such Dividends. The Fund reserves the right to amend or terminate the Plan. All correspondence concerning the Plan should be directed to the Plan Agent at 800-432-8224.

OTHER INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 866-227-0757, (ii) on our website at cohenandsteers.com or (iii) on the SEC’s website at http://www.sec.gov. In addition, the Fund’s proxy voting record for the most recent 12-month period ended June 30 is available by August 31 of each year (i) without charge, upon request, by calling 866-227-0757 or (ii) on the SEC’s website at http://www.sec.gov.

Disclosures of the Fund’s complete holdings are required to be made monthly on Form N-PORT, with every third month made available to the public by the SEC 60 days after the end of the Fund’s fiscal quarter. The Fund’s Form N-PORT is available (i) without charge, upon request, by calling 866-227-0757 or (ii) on the SEC’s website at http://www.sec.gov.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund’s investment company taxable income and net realized gains. Distributions in excess of the Fund’s investment company taxable income and net realized gains are a return of capital distributed from the Fund’s assets. To the extent this occurs, the Fund’s shareholders of record will be notified of the estimated amount of capital returned to shareholders for each such distribution and this information will also be available at cohenandsteers.com. The final tax treatment of all distributions is reported to shareholders on their 1099-DIV forms, which are mailed after the close of each calendar year. Distributions of capital decrease the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

Notice is hereby given in accordance with Rule 23c-1 under the 1940 Act that the Fund may purchase, from time to time, shares of its common stock in the open market.

28

COHEN & STEERS TAX-ADVANTAGED PREFERRED SECURITIES AND INCOME FUND

CURRENT INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT POLICIES AND PRINCIPAL RISKS OF THE FUND

The information contained herein is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares.

Investment Objectives