- QNGWQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Quanergy Systems (QNGWQ) 8-KOther Events

Filed: 23 Aug 23, 4:09pm

Exhibit 99.1

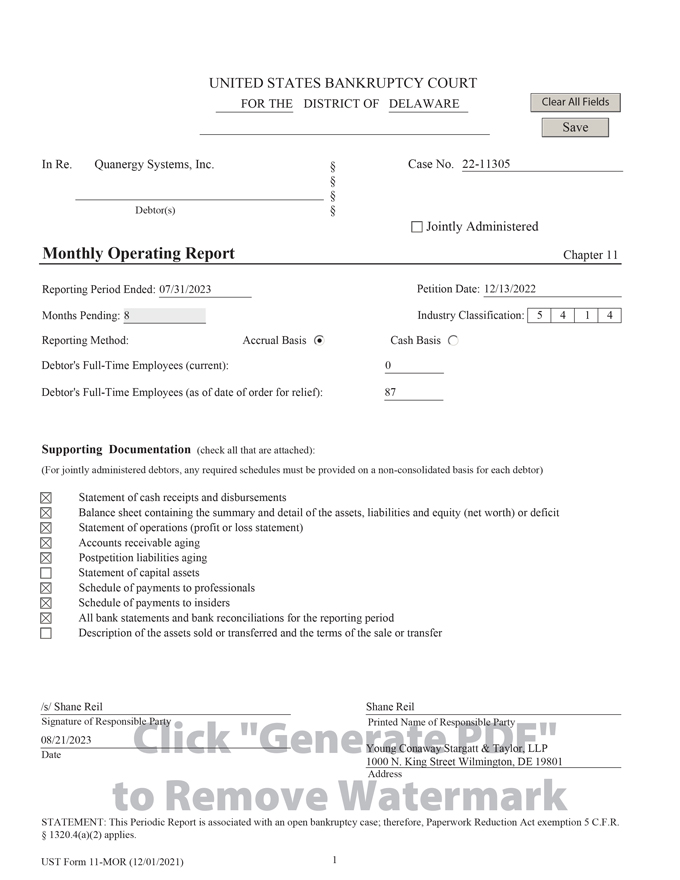

THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re: | Chapter 11 | |

QUANERGY SYSTEMS, INC., 1 | Case No. 22-11305 (CTG) | |

Debtor. | ||

NOTES TO MONTHLY OPERATING REPORT

On December 13, 2022 (the “Petition Date”), the above-captioned debtor and debtor in possession (the “Debtor”) filed a voluntary petition for relief under chapter 11 of the Bankruptcy Code with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”).

Please be advised that the accompanying monthly operating report and the exhibits thereto (the “MOR”) are unaudited, preliminary, and may not comply with generally accepted accounting principles in the United States of America (“U.S. GAAP”) in all material respects.

The MOR is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the reporting requirements of the Bankruptcy Code and the United States Trustee. The unaudited financial statements have been derived from the Debtor’s books and records. The MOR generally reflects the operations and financial position of the Debtor on a consolidated basis with non-Debtor Quanergy Perception Technologies, Inc. The information presented herein has not been subjected to all procedures that would typically be applied to financial information presented in accordance with U.S. GAAP. Upon the application of such procedures, the financial information could be subject to changes, and these changes could be material. The information furnished in the MOR includes normal recurring adjustments, but does not include all of the adjustments that would typically be made for interim financial statements in accordance with U.S. GAAP.

Given the complexity of the Debtor’s business, inadvertent errors, omissions or over-inclusions may have occurred. Accordingly, the Debtor hereby reserves the right to amend or supplement the MOR, if necessary, but shall be under no obligation to do so.

| 1 | The Debtor and the last four digits of its taxpayer identification number are: Quanergy Systems, Inc. (5845). The Debtor’s mailing address for purposes of the Chapter 11 Case is c/o SierraConstellation Partners, LLC 355 S. Grand Avenue Suite 1450 Los Angeles, CA 90071. |

Quanergy Systems, Inc.

Exhibits to the May MOR

For the period July 1, 2023 through July 31, 2023

| Page # | Table of Contents | |

3 | Statement of Cash Receipts and Disbursements | |

4 | Balance Sheet for period ending July 31, 2023 | |

5 | Statement of Operations | |

6 | Accounts Receivable as of July 31, 2023 | |

7 | Post-petition Accounts Payable as of July 31, 2023 | |

8 | Bank Reconciliation | |

9 | Payments Made on Pre-Petition Debt as of July 31, 2023 | |

10 | Payments to Insiders | |

11 | Payments to Professionals as of July 31, 2023 |

2

Quanergy Systems, Inc.

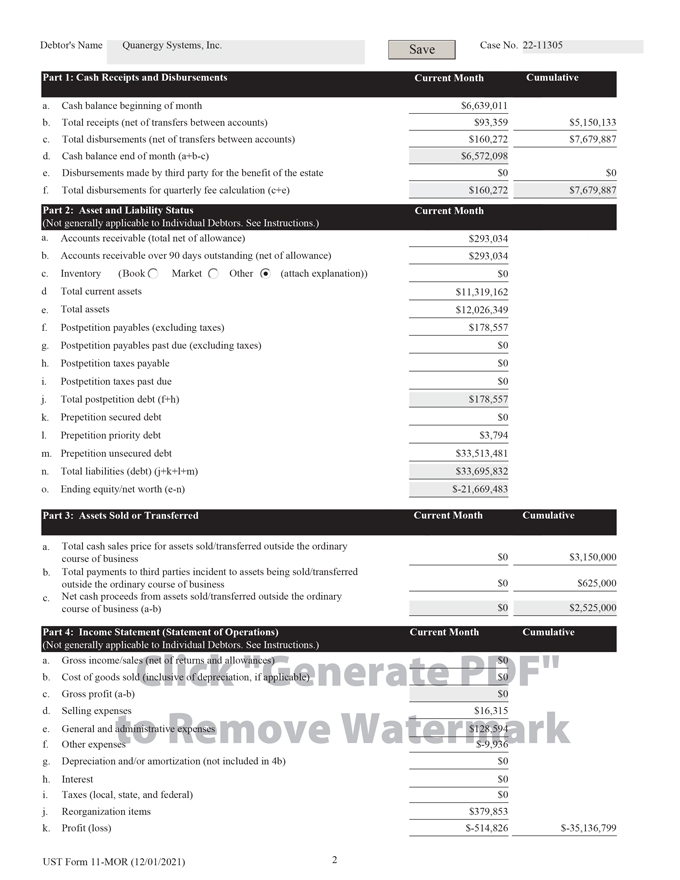

Statement of Cash Receipts and Disbursements

($ in USD)

| 7/1-7/31 | ||||

Beginning Cash Balance | $ | 6,639,011 | ||

Receipts | ||||

Advisory and Tax Refunds | $ | 15,714 | ||

NewCo Prefunding | 77,645 | |||

|

| |||

Total Receipts | $ | 93,359 | ||

Operating Disbursements | ||||

Prefunded NewCo Payments | $ | 68,475 | ||

AP | 74,042 | |||

Other | 2,618 | |||

|

| |||

Total Operating Disbursements | $ | 145,135 | ||

|

| |||

Operating Cash Flow | $ | (51,776 | ) | |

|

| |||

Restructuring Related | ||||

Professional fees | $ | 11,790 | ||

UST fees | 3,347 | |||

|

| |||

Total Restructuring Related | $ | 15,137 | ||

|

| |||

Net Cash Flow | $ | (66,913 | ) | |

|

| |||

Ending Cash Balance | $ | 6,572,098 | ||

3

Quanergy Systems, Inc.

Balance Sheet for period ending July 31, 2023

($ in USD)

| 7/31/2023 | ||||

Assets | ||||

Current Assets: | ||||

Cash and cash equivalents | $ | 6,572,098 | ||

Restricted cash | 70,000 | |||

Accounts receivable, net of allowance for doubtful accounts | 293,034 | |||

Prepaid business insurance and D&O | 3,647,140 | |||

Prepaid expenses and other current assets | 736,890 | |||

|

| |||

Total Current Assets | $ | 11,319,162 | ||

Operating lease assets | $ | 478,156 | ||

Other long-term assets | 229,031 | |||

|

| |||

Total Assets | $ | 12,026,349 | ||

|

| |||

Liabilities and Stockholders’ Equity | ||||

Current Liabilities: | ||||

Accounts payable | $ | 6,249,032 | ||

Accrued expenses | 1,626,724 | |||

Accrued liabilities | 9,897,864 | |||

Accrued liabilities (Post petition) | 178,557 | |||

Professional fees (Post petition) | 4,566,523 | |||

Other current liabilities | 954,592 | |||

|

| |||

Total Current Liabilities | $ | 23,473,292 | ||

Operating lease liabilities | $ | 478,156 | ||

Other long-term liabilities | 9,744,384 | |||

|

| |||

Total Liabilities | $ | 33,695,832 | ||

Total Stockholders’ equity | $ | (21,669,483 | ) | |

|

| |||

Total Liabilities and Stockholders’ Equity | $ | 12,026,349 | ||

|

| |||

4

Quanergy Systems, Inc.

Statement of Operations

($ in USD)

| 7/1 - 7/31 | ||||

Revenue | $ | — | ||

Cost of sales | — | |||

|

| |||

Gross Margin | $ | — | ||

Selling expenses | $ | 16,315 | ||

General and administrative | 128,594 | |||

Restructuring expenses | 379,853 | |||

Other operating expenses | (9,936 | ) | ||

|

| |||

Income (loss) from operations | $ | (514,826 | ) | |

Other income: | ||||

Interest income | $ | — | ||

Loss on asset sale | — | |||

|

| |||

Income (loss) before income taxes | $ | (514,826 | ) | |

Income tax | $ | — | ||

|

| |||

Net Income (loss) | $ | (514,826 | ) | |

5

Quanergy Systems, Inc.

Accounts Receivable as of July 31, 2023

($ in USD)

| 7/31/2023 | ||||

Accounts Receivable Reconciliation | ||||

Total Accounts Receivable at the beginning of the reporting period | $ | 839,824 | ||

+ Amounts billed during the period | — | |||

- Amounts collected during the period | — | |||

- Amounts written off as uncollectible during the period | (46,575 | ) | ||

|

| |||

Total Accounts Receivable at the end of the reporting period | $ | 793,249 | ||

| 7/31/2023 | ||||

Accounts Receivable Aging | ||||

Current | $ | — | ||

1-30 Days Past Due | — | |||

31-60 Days Past Due | — | |||

61-90 Days Past Due | — | |||

91+ Days Past Due | 793,249 | |||

|

| |||

Total | $ | 793,249 | ||

6

Quanergy Systems, Inc.

Post-petition Accounts Payable Aging as of July 31, 2023

($ in USD)

| 7/31/2023 | ||||

Current | $ | — | ||

1-30 Days Past Due | — | |||

31-60 Days Past Due | — | |||

61-90 Days Past Due | — | |||

|

| |||

Total | $ | — | ||

7

Quanergy Systems, Inc.

Bank Reconciliation

($ in USD)

Silicon Valley Bank x2011

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x2011 | Silicon Valley Bank | $ | 1,959,464 | $ | (265 | ) | $ | 1,959,199 | ||||||

| Negative adjustment of $265 due to check (#12639) made to CoWay USA Inc. | ||||||||||||||

Silicon Valley Bank x4224 | ||||||||||||||

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x4224 | Silicon Valley Bank | $ | 70,000 | $ | — | $ | 70,000 | |||||||

Silicon Valley Bank x1506 | ||||||||||||||

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x1506 | Silicon Valley Bank | $ | 4,604,899 | $ | — | $ | 4,604,899 | |||||||

Silicon Valley Bank x1498 | ||||||||||||||

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x1498 | Silicon Valley Bank | $ | 8,000 | $ | — | $ | 8,000 | |||||||

Silicon Valley Bank x2927 | ||||||||||||||

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x2927 | Silicon Valley Bank | $ | — | $ | — | $ | — | |||||||

Silicon Valley Bank x1679 | ||||||||||||||

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x1679 | Silicon Valley Bank | $ | — | $ | — | $ | — | |||||||

8

Quanergy Systems, Inc.

Payments Made on Pre-Petition Debt as of July 31, 2023

($ in USD)

| Payee Name | Date | Amount | Description | |||||||||

| $ | — | |||||||||||

|

| |||||||||||

Total | $ | — | ||||||||||

9

Quanergy Systems, Inc.

Payments to Insiders (7/1/2023 - 7/31/2023)

($ in USD)

| as of | Description | Amount | ||||

7/31/2023 | Salary, benefits & consulting | $ | 24,167 | |||

10

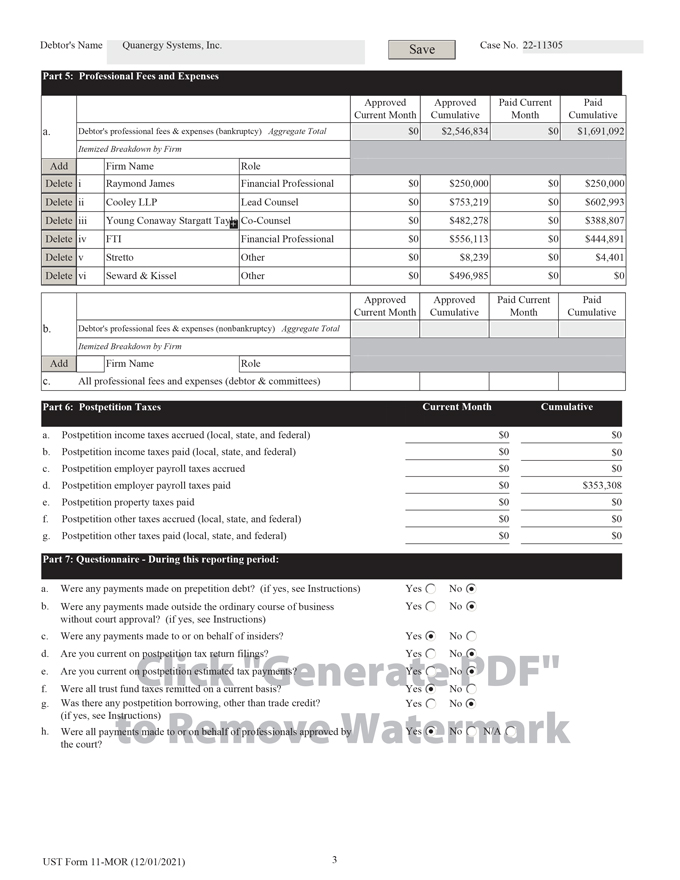

Quanergy Systems, Inc.

Payments to Professionals as of July 31, 2023

($ in USD)

| Professional Firm | Date | Amount | Description | |||||||

Stretto | 7/26/2023 | $ | 11,790 | Professional fees for services rendered from June 1, 2023 - June 30, 2023 | ||||||

|

| |||||||||

Total | $ | 11,790 | Total professional fees paid in current month | |||||||

11