- QNGWQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Quanergy Systems (QNGWQ) 424B3Prospectus supplement

Filed: 25 Oct 23, 4:06pm

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-264238

PROSPECTUS SUPPLEMENT NO. 24

(To the Prospectus dated May 13, 2022)

Up to 21,320,000 Shares of Common Stock Issuable Upon Exercise of Warrants

Up to 57,538,996 Shares of Common Stock

Up to 7,520,000 Warrants to Purchase Common Stock

This prospectus supplement supplements the prospectus, dated May 13, 2022 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-264238). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on October 24, 2023 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of an aggregate of up to 21,320,000 shares of our common stock, $0.0001 par value per share (the “Common Stock”), consisting of (i) 7,520,000 shares of Common Stock issuable upon the exercise of 7,520,000 warrants (the “Private Warrants”) originally issued in a private placement to CITIC Capital Acquisition Corp. (“CCAC”) in connection with the initial public offering of CCAC and (ii) 13,800,000 shares of Common Stock issuable upon the exercise of 13,800,000 warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued in the initial public offering of CCAC.

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus or their permitted transferees (the “selling securityholders”) of (i) up to 57,538,996 shares of Common Stock consisting of (a) 3,695,000 shares of Common Stock purchased by subscripts for $10.00 per share in a private placement pursuant to subscription agreements entered into in connection with the Business Combination (as defined in the Prospectus), (b) 7,520,000 shares of Common Stock issuable upon exercise of the Private Warrants which have an exercise price equal to $11.50 per share, (c) 6,900,000 shares of Common Stock originally issued to CCAC for approximately $0.004 per share, (d) 34,422,480 shares of Common Stock issued in connection with the Business Combination (as defined in the Prospectus) as merger consideration at an acquiror share value of $10.00 per share, (e) 197,875 shares held by Tomoyuki Izuhara pursuant to the exercise of options to purchase Common Stock at exercise prices ranging from $0.36 to $4.29 per share, and (f) 4,803,641 shares of Common Stock issued pursuant to the Share Issuance Agreements (as defined in the Prospectus), at a deemed per share price of $1.9841, and (ii) up to 7,520,000 Private Warrants.

The common stock and Warrants were listed on the New York Stock Exchange (“NYSE”) under the symbols “QNGY” and “QNGY WS,” respectively. Trading in these securities was suspended on the NYSE after market close on November 8, 2022 and the NYSE filed a Form 25 with the SEC to delist the securities on April 5, 2023. The common stock and Warrants currently trade exclusively on the OTC Pink Marketplace under the symbols “QNGYQ” and “QNGWQ”, respectively. On October 24, 2023, the last reported sales price of our common stock on the over-the-counter market was $0.00 per share and the last reported sales price of our Warrants was $0.00 per warrant.

This prospectus supplement should be read in conjunction with the Prospectus, including any amendments or supplements thereto, which is to be delivered with this prospectus supplement. This prospectus supplement is qualified by reference to the Prospectus, including any amendments or supplements thereto, except to the extent that the information in this prospectus supplement updates and supersedes the information contained therein.

This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements thereto.

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. The Prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning on page 8 of the Prospectus and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus supplement or the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated October 25, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 19, 2023

Quanergy Systems, Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 001-39222 | 88-0535845 | ||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

c/o SierraConstellation Partners, LLC 355 S. Grand Avenue, Suite 1450 Los Angeles, California | 90071 | |||

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 408 245-9500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 par value per share | QNGYQ | N/A | ||

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $230.00 per share | QNGWQ | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01. | Other Events. |

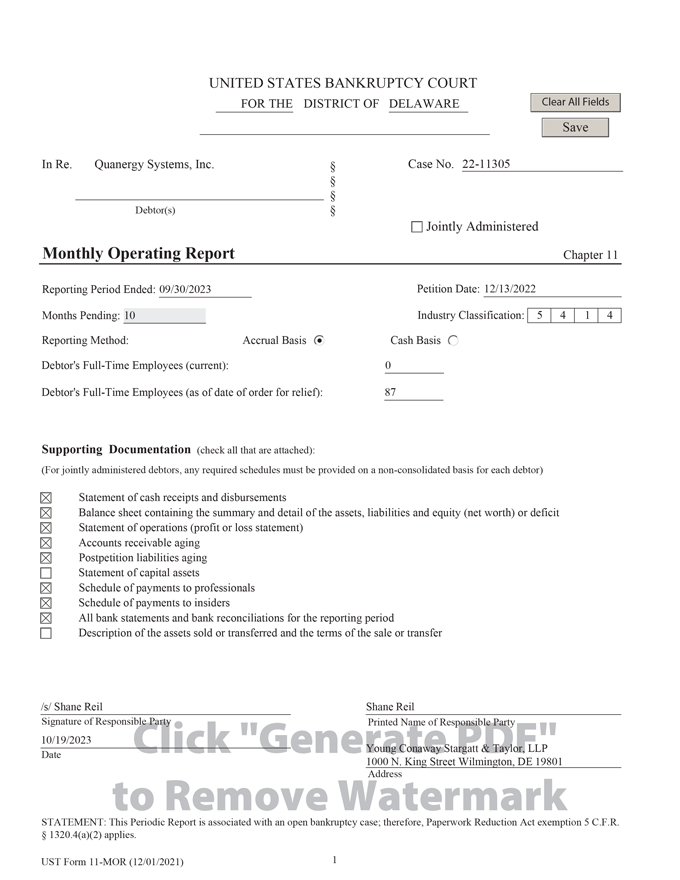

As previously disclosed in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 13, 2022, on December 13, 2022, Quanergy Systems, Inc. (the “Company”) filed a voluntary petition (Case No. 22-11305) for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (such court, the “Bankruptcy Court” and such case, the “Case”).

On October 19, 2023, the Company filed its monthly operating report with the United States Bankruptcy Court for the period beginning September 01, 2023 and ending September 30, 2023 (the “Monthly Operating Report”). The Monthly Operating Report is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Note Regarding the Monthly Operating Report

The Company cautions investors and potential investors not to place undue reliance upon the information contained in the Monthly Operating Report, which was not prepared for the purpose of providing the basis for an investment decision relating to any Company securities. The Monthly Operating Report is limited in scope and has been prepared solely for the purpose of complying with requirements of the Bankruptcy Court. The Monthly Operating Report was not reviewed by independent accountants, is in a format prescribed by applicable bankruptcy laws, and is subject to future adjustment. The financial information in the Monthly Operating Report is not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), and, therefore, may exclude items required by GAAP, such as certain reclassifications, eliminations, accruals, valuations and disclosures. The Monthly Operating Report also relates to a period that is different from the historical periods required in the Company’s reports pursuant to the Securities Exchange Act of 1934, as amended.

Cautionary Note Regarding Trading in the Company’s Securities

The Company cautions that trading in the Company’s securities during the pendency of the Case is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Case. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit | Description | |

| 99.1 | Monthly Operating Report, for the period covering September 01, 2023 through September 30, 2023, filed with the United States Bankruptcy Court for the District of Delaware. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| QUANERGY SYSTEMS, INC. | ||||

| Dated: October 24, 2023 | By: | /s/ Patrick Archambault | ||

Patrick Archambault Chief Financial Officer | ||||

Exhibit 99.1

THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re:

QUANERGY SYSTEMS, INC.,1

Debtor.

|

Chapter 11

Case No. 22-11305 (CTG) |

NOTES TO MONTHLY OPERATING REPORT

On December 13, 2022 (the “Petition Date”), the above-captioned debtor and debtor in possession (the “Debtor”) filed a voluntary petition for relief under chapter 11 of the Bankruptcy Code with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”).

Please be advised that the accompanying monthly operating report and the exhibits thereto (the “MOR”) are unaudited, preliminary, and may not comply with generally accepted accounting principles in the United States of America (“U.S. GAAP”) in all material respects.

The MOR is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the reporting requirements of the Bankruptcy Code and the United States Trustee. The unaudited financial statements have been derived from the Debtor’s books and records. The MOR generally reflects the operations and financial position of the Debtor on a consolidated basis with non-Debtor Quanergy Perception Technologies, Inc. The information presented herein has not been subjected to all procedures that would typically be applied to financial information presented in accordance with U.S. GAAP. Upon the application of such procedures, the financial information could be subject to changes, and these changes could be material. The information furnished in the MOR includes normal recurring adjustments, but does not include all of the adjustments that would typically be made for interim financial statements in accordance with U.S. GAAP.

Given the complexity of the Debtor’s business, inadvertent errors, omissions or over-inclusions may have occurred. Accordingly, the Debtor hereby reserves the right to amend or supplement the MOR, if necessary, but shall be under no obligation to do so.

| 1 | The Debtor and the last four digits of its taxpayer identification number are: Quanergy Systems, Inc. (5845). The Debtor’s mailing address for purposes of the Chapter 11 Case is c/o SierraConstellation Partners, LLC 355 S. Grand Avenue Suite 1450 Los Angeles, CA 90071. |

Quanergy Systems, Inc.

Exhibits to the September MOR

For the period September 1, 2023 through September 30, 2023

| Page # | Table of Contents | |

3 | Statement of Cash Receipts and Disbursements | |

4 | Balance Sheet for period ending September 30, 2023 | |

5 | Statement of Operations | |

6 | Accounts Receivable as of September 30, 2023 | |

7 | Post-petition Accounts Payable as of September 30, 2023 | |

8 | Bank Reconciliation | |

9 | Payments Made on Pre-Petition Debt as of September 30, 2023 | |

10 | Payments to Insiders | |

11 | Payments to Professionals | |

12 | Payments to Professionals To Date |

2

Quanergy Systems, Inc.

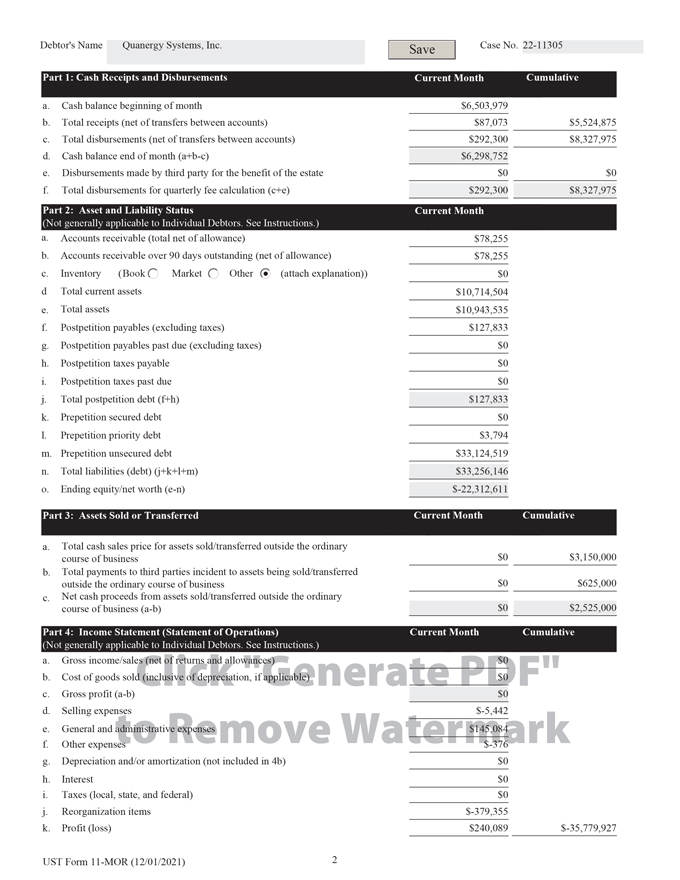

Statement of Cash Receipts and Disbursements

($ in USD)

| 9/1-9/30 | ||||

Beginning Cash Balance | $ | 6,503,979 | ||

Receipts | ||||

Collections | $ | 36,360 | ||

Subsidiary dividend1 | 376 | |||

NewCo prefunding | 50,337 | |||

|

| |||

Total Receipts | $ | 87,073 | ||

Operating Disbursements | ||||

Pre-petition liability payments | $ | — | ||

Prefunded NewCo payments | 50,347 | |||

AP | 81,410 | |||

Other | 461 | |||

|

| |||

Total Operating Disbursements | $ | 132,218 | ||

|

| |||

Operating Cash Flow | $ | (45,145 | ) | |

|

| |||

Restructuring Related | ||||

Professional fees | $ | 160,082 | ||

|

| |||

Total Restructuring Related | $ | 160,082 | ||

|

| |||

Net Cash Flow | $ | (205,227 | ) | |

|

| |||

Ending Cash Balance | $ | 6,298,752 | ||

| [1] | Subsidiary income represents the return of cash from the Company’s wholly owned subsidiaries which are being closed down. It is part of the accumulated profits of the subsidiaries in the foreign territories in which they operate, and the return of the remaining cash to the Company is considered dividend income. |

3

Quanergy Systems, Inc.

Balance Sheet for period ending September 30, 2023

($ in USD)

| 9/30/2023 | ||||

Assets | ||||

Current Assets: | ||||

Cash and cash equivalents | $ | 6,298,752 | ||

Restricted cash | 70,000 | |||

Accounts receivable, net of allowance for doubtful accounts | 78,255 | |||

Prepaid business insurance and D&O | 3,530,556 | |||

Prepaid expenses and other current assets | 736,941 | |||

|

| |||

Total Current Assets | $ | 10,714,504 | ||

Other long-term assets | $ | 229,031 | ||

|

| |||

Total Assets | $ | 10,943,535 | ||

|

| |||

Liabilities and Stockholders’ Equity | ||||

Current Liabilities: | ||||

Accounts payable | $ | 6,250,311 | ||

Accrued expenses | 1,626,724 | |||

Accrued liabilities | 9,827,864 | |||

Accrued liabilities (Post petition) | 127,833 | |||

Professional fees (Post petition) | 4,349,959 | |||

Other current liabilities | 975,915 | |||

|

| |||

Total Current Liabilities | $ | 23,158,606 | ||

Operating lease liabilities | $ | 478,156 | ||

Other long-term liabilities | 9,619,384 | |||

|

| |||

Total Liabilities | $ | 33,256,146 | ||

Total Stockholders’ equity | $ | (22,312,611 | ) | |

|

| |||

Total Liabilities and Stockholders’ Equity | $ | 10,943,535 | ||

|

| |||

4

Quanergy Systems, Inc.

Statement of Operations

($ in USD)

| 9/1-9/30 | ||||

Revenue | $ | — | ||

Cost of sales | — | |||

|

| |||

Gross Margin | $ | — | ||

Selling expenses | $ | (5,442 | ) | |

General and administrative | 145,084 | |||

Lease expenses | — | |||

Restructuring expenses | (379,355 | ) | ||

Other operating expenses | (376 | ) | ||

|

| |||

Income (loss) from operations | $ | 240,089 | ||

Other income: | ||||

Interest income | $ | — | ||

Loss on asset sale | — | |||

|

| |||

Income (loss) before income taxes | $ | 240,089 | ||

Income tax | $ | — | ||

|

| |||

Net Income (loss) | $ | 240,089 | ||

5

Quanergy Systems, Inc.

Accounts Receivable as of September 30, 2023

($ in USD)

| 9/30/2023 | ||||

Accounts Receivable Reconciliation | ||||

Total Accounts Receivable at the beginning of the reporting period | $ | 609,412 | ||

+ Amounts billed during the period | — | |||

- Amounts collected during the period | (36,360 | ) | ||

|

| |||

Total Accounts Receivable at the end of the reporting period | $ | 573,052 | ||

| 9/30/2023 | ||||

Accounts Receivable Aging | ||||

Current | $ | — | ||

1-30 Days Past Due | — | |||

31-60 Days Past Due | — | |||

61-90 Days Past Due | — | |||

91+ Days Past Due | 573,052 | |||

|

| |||

Total | $ | 573,052 | ||

6

Quanergy Systems, Inc.

Post-petition Accounts Payable Aging as of September 30, 2023

($ in USD)

| 9/30/2023 | ||||

Current | $ | — | ||

1-30 Days Past Due | — | |||

31-60 Days Past Due | — | |||

61-90 Days Past Due | — | |||

|

| |||

Total | $ | — | ||

7

Quanergy Systems, Inc.

Bank Reconciliation

($ in USD)

Silicon Valley Bank x2011

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x2011 | Silicon Valley Bank | $ | 1,335,208 | $ | — | $ | 1,335,208 | |||||||

Silicon Valley Bank x4224

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x4224 | Silicon Valley Bank | $ | 70,000 | $ | — | $ | 70,000 | |||||||

Silicon Valley Bank x1506

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x1506 | Silicon Valley Bank | $ | 4,955,544 | $ | — | $ | 4,955,544 | |||||||

Silicon Valley Bank x1498

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x1498 | Silicon Valley Bank | $ | 8,000 | $ | — | $ | 8,000 | |||||||

Silicon Valley Bank x2927

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x2927 | Silicon Valley Bank | $ | — | $ | — | $ | — | |||||||

Silicon Valley Bank x1679

| Bank Reconciliation | Bank Name | Bank Balance | Adjustments | Book Balance | ||||||||||

x1679 | Silicon Valley Bank | $ | — | $ | — | $ | — | |||||||

8

Quanergy Systems, Inc.

Payments Made on Pre-Petition Debt as of September 30, 2023

($ in USD)

| Payee Name | Date | Amount | Description | |||||||||

N/A | N/A | N/A | ||||||||||

|

|

|

| |||||||||

Total | $ | — | ||||||||||

9

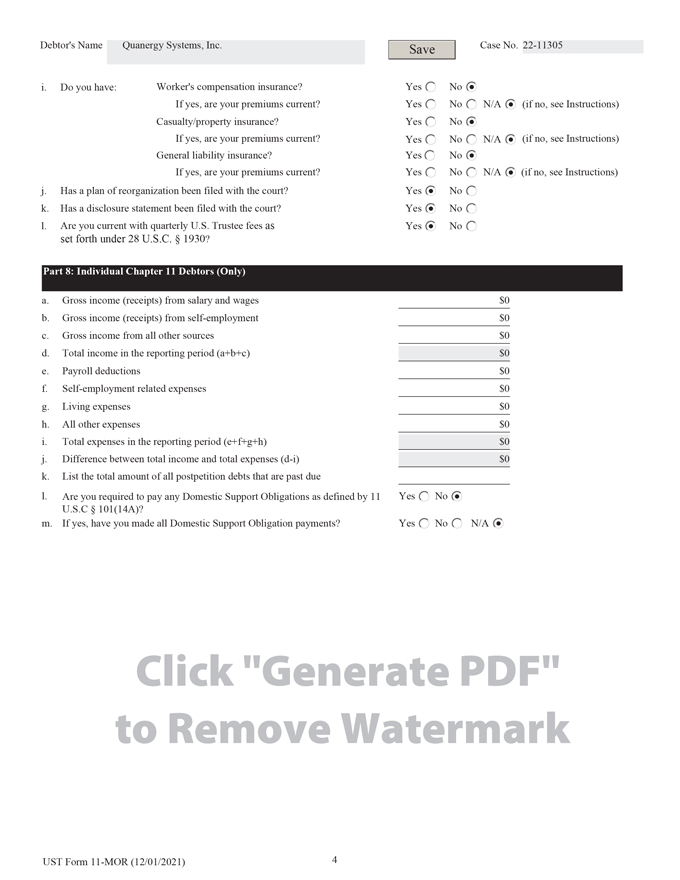

Quanergy Systems, Inc.

Payments to Insiders (9/1/2023 - 9/30/2023)

($ in USD)

| as of | Description | Amount | ||

| 9/30/2023 | Salary, benefits & consulting | $24,167 |

10

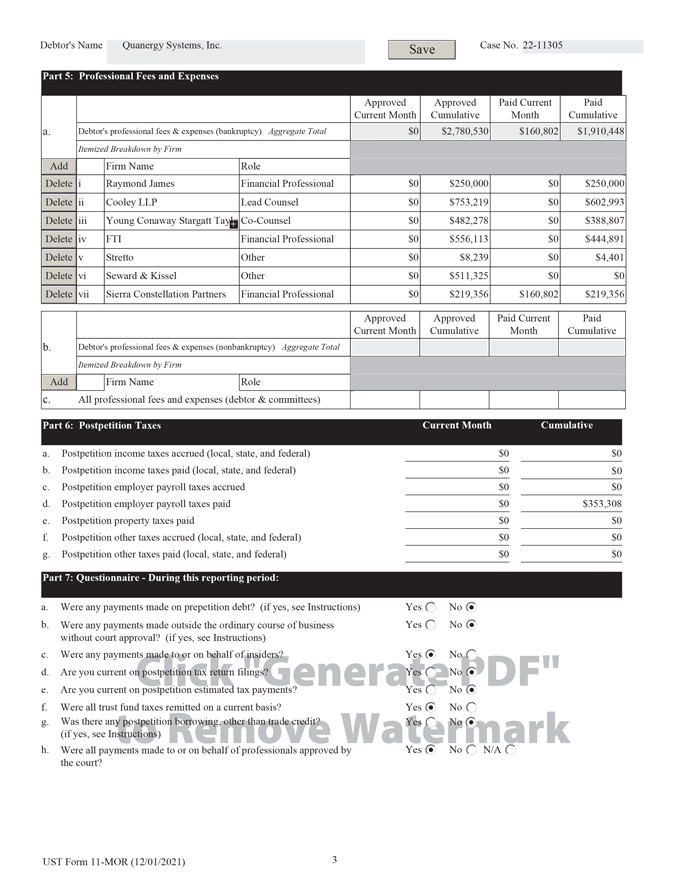

Quanergy Systems, Inc.

Payments to Debtor’s Professionals (9/1/2023 - 9/30/2023)*

($ in USD)

| Professional Firm | Date | Amount | Description | |||||||||

N/A | N/A | $ | — | |||||||||

|

|

|

| |||||||||

Total | $ | — | Total professional fees paid in current month | |||||||||

| * | Payments not listed on Part 5 of MOR |

11

Quanergy Systems, Inc.

Payments to Debtor’s Professionals to date

($ in USD)

2023 | ||||||||||||||||||||||||||||||||||||||||

| Professional Firm | January | February | March | April | May | June | July | August | September | Total | ||||||||||||||||||||||||||||||

Cooley | $ | — | $ | 229,253 | $ | 373,740 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 602,993 | ||||||||||||||||||||

FTI Consulting | — | — | 444,891 | — | — | — | — | — | — | 444,891 | ||||||||||||||||||||||||||||||

Raymond James | 125,000 | 125,000 | — | — | — | — | — | — | — | 250,000 | ||||||||||||||||||||||||||||||

Seward & Kissel LLP | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

Sierra Constellation Partners | — | — | 59,274 | — | — | — | — | — | 160,082 | 219,357 | ||||||||||||||||||||||||||||||

Stretto, Inc | — | — | 174,974 | 51,921 | — | 57,731 | 11,790 | 16,798 | — | 313,215 | ||||||||||||||||||||||||||||||

Young Conaway Stargatt & Taylor, LLP | — | 191,643 | 197,164 | — | — | — | — | — | — | 388,807 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total | $ | 125,000 | $ | 545,895 | $ | 1,250,044 | $ | 51,921 | $ | — | $ | 57,731 | $ | 11,790 | $ | 16,798 | $ | 160,082 | $ | 2,219,263 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

12