SHIFT4 PAYMENTS, LLC NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in millions, except share, unit, per unit and merchant count amounts)

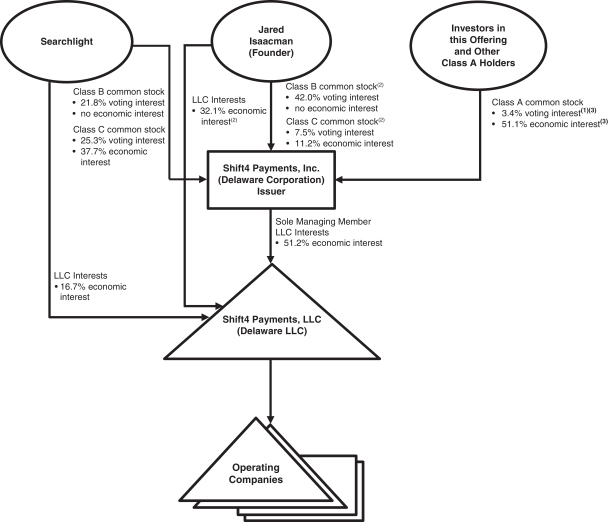

As of March 31, 2020, the Company is authorized to issue 100,000 Class A Common units, and as of March 31, 2020, 60,000 units are issued and outstanding to Searchlight II GWN, L.P., or SCP or SCP Common Units, and 40,000 units are issued and outstanding to Rook Holdings Inc., or Rook or Rook Common Units, a wholly owned corporation of which the Company’s current Chief Executive Officer is the sole stockholder.

Prior to May 31, 2021, Class A Common units arenon-transferrable, except in the event the Company’s current Chief Executive Officer is terminated for a reason other than for cause or resignation; all Class A Common units (but not less than all) held by Rook can be transferred. Members holding Class A Common units are entitled to one vote per unit.

As of March 31, 2020, the Company has 1,010 Class B Common units authorized, issued and outstanding. Members holding Class B Common units are not entitled to vote on any matters of the Company and are not entitled to any distributions until aggregate distributions to holders of Class A Common units exceed $565.2, after which holders of Class B Common units are entitled to 1.11% of distributions to holders of Class A Common units and Class B Common units up to $655.0, after which holders of Class B Common units share in distributions with holders of Class A Common units on a pro rata basis. In addition, if aggregate distributions to holders of Class A Common units exceed $565.2, holders of Class B Common units are entitled to a special distribution of $9.0, divided on a pro rata basis.

Liquidation

In the event of a liquidation, dissolution orwinding-up of the Company’s affairs, after payment of the Company’s debts and liabilities, and after paying any accumulated preferred dividends, any assets available for distribution will be paid as follows:

i. To holders of the Class A Common units on apro-rata basis, until their respective invested capital balance is equal to zero;

ii. To holders of the Redeemable Preferred units with respect to the excess, if any, of the stated value of $100,000 per unit over cumulative preferred dividends;

iii. To holders of the SCP Common Units until such holders receive the greater of an internal rate of return of 22.50% or 2.75 times the invested capital associated with the SCP Common Units;

iv. 85% to holders of the Rook Common Units, on a pro rata basis, and 15% to holders of the SCP Common Units, on a pro rata basis until holders of the Rook Common Units have received the greater of an internal rate of return of 22.50% or 2.75 times the Class A invested capital associated with the Rook Common Units;

v. To holders of the Class A Common units pro rata basis, provided that the Class A Common unit ownership interest of each holder of Rook Common Units shall be increased by 6.3% of the holder’s pro rata share of Rook Common Units and the Class A Common unit ownership interest of each holder of SCP Common Units shall be decreased by 6.3% of the holder’s pro rata share of SCP Common Units.

Any distributions to holders of Class B Common units in a liquidation after payment of the Company’s debts and liabilities, and after paying any accumulated preferred dividends, are subject to the terms related to distributions to holders of Class B Common units stated above.

Operating segments are defined as components of an enterprise for which discrete financial information is available that is evaluated regularly by the Chief Operating Decision Maker, or CODM, for the purposes of

F-66