financial reports, we may face restricted access to the capital markets and our stock price may be adversely affected.

The Concurrent Convertible Notes Offering and future sales, or the perception of future sales, by us or our existing stockholders in the public market following this offering could cause the market price for our Class A common stock to decline.

The sale of shares of our Class A common stock in the public market, or the perception that such sales could occur, could harm the prevailing market price of shares of our Class A common stock. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

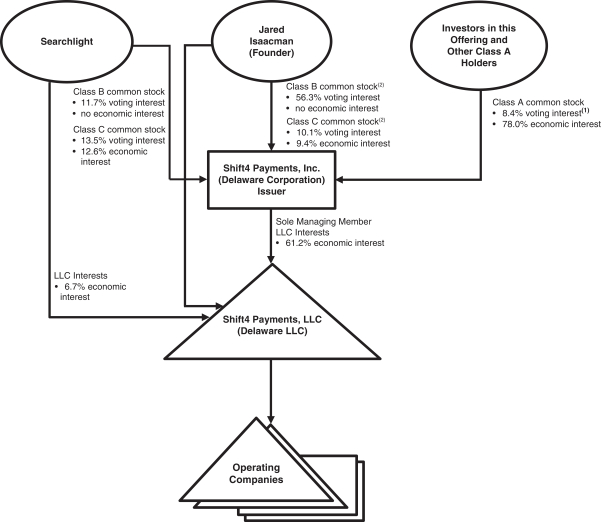

Upon consummation of this offering, we will have outstanding a total of 38,403,975 shares of Class A common stock. Of these shares, all shares sold in this offering, the IPO and the September Follow-on Offering (totaling 36,750,000 shares of Class A common stock) will be freely tradable without restriction or further registration under the Securities Act, other than any shares held by our “affiliates,” as that term is defined in Rule 144 under the Securities Act, whose sales would be subject to the Rule 144 resale restrictions, other than the holding period requirement. The remaining shares of Class A common stock (including shares issuable upon exchange or redemption of LLC Interests and shares of our Class C common stock) will be “restricted securities,” as that term is defined in Rule 144 under the Securities Act. These restricted securities are eligible for public sale only if they are registered under the Securities Act or if they qualify for an exemption from registration under Rules 144 or 701 under the Securities Act. See “Shares Eligible For Future Sale.”

In connection with the IPO, our directors and executive officers, and substantially all of our stockholders (including the selling stockholders in this offering) entered into lock-up agreements with the underwriters for the IPO, or the IPO lock-up agreements, pursuant to which each of these persons or entities, subject to certain exceptions, for a period of 180 days after June 4, 2020, agreed that, without the prior written consent of any two of Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and Goldman Sachs & Co. LLC, or collectively, the Lock-up Release Parties, they would not (1) offer, pledge, loan, announce the intention to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any shares of our common stock or any securities convertible into or exercisable or exchangeable for our common stock (including, without limitation, common stock or such other securities which may be deemed to be beneficially owned by such directors, executive officers, managers and members in accordance with the rules and regulations of the SEC and securities which may be issued upon exercise of a stock option or warrant), or (2) enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the common stock or such other securities, whether any such transaction described in clause (1) or (2) above is to be settled by delivery of common stock or such other securities, in cash or otherwise, or (3) make any demand for or exercise any right with respect to the registration of any shares of our common stock or any security convertible into or exercisable or exchangeable for our common stock. See “Shares Eligible for Future Sale—IPO Lock-Up Agreements.” In connection with the Follow-on Offering, Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and Goldman Sachs & Co. LLC have given written consent to permit filing of the registration statement. Additionally, Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and Goldman Sachs & Co. LLC have agreed to release the restrictions under the IPO lock-up agreements of the Continuing Equity Owners, including our Founder and Rook, subject to the delivery and effectiveness of the lock-up agreements described under “Shares Eligible for Future Sale—Follow-on Lock-Up Agreements.”

In connection with the Follow-on Offering, our officers and directors, the selling stockholders in the Follow-on Offering and the other Continuing Equity Owners agreed that, without the prior written consent of any two of the Lock-up Release Parties, we and they will not, subject to certain exceptions, during the period ending 90 days after September 10, 2020 (1) offer, sell, contract to sell, loan, pledge, grant any option to purchase, make any short sale or otherwise transfer or dispose of, directly or indirectly or publicly disclose the intention to make any offer, loan, sale, pledge or disposition of any shares of our Class A common stock or Class C common stock, or any options or warrants to purchase any shares of our Class A common stock or Class C common stock, or any

56