| We shop. You save. 4th Quarter Fiscal 2022 Earnings Conference Call Presentation August 29, 2022 Exhibit 99.2

| We shop. You save. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: the ultimate duration and impact of the ongoing COVID-19 pandemic and any other significant public health events; our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets; risks from third-party products; failure to enroll individuals during the Medicare annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions, including inflation; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; potential litigation and other legal proceedings or inquiries; our existing and future indebtedness; our ability to maintain compliance with our debt covenants; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; and failure to market and sell Medicare plans effectively or in compliance with laws. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in the most recent Annual Report on Form 10-K (the “Annual Report”) filed by us with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on publications and other data obtained from third-party sources. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third-party sources. No Offer or Solicitation; Further Information This presentation is for informational purposes only and is not an offer to sell with respect to any securities. This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in the Annual Report and subsequent quarterly reports. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our GAAP financial results, we have presented in this presentation Adjusted EBITDA and Adjusted EBITDA Margin, which are non-GAAP financial measures. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We define Adjusted EBITDA as income (loss) before interest expense, income tax expense (benefit), depreciation and amortization, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. The most directly comparable GAAP measure is net income (loss). We monitor and have presented in this presentation Adjusted EBITDA because it is a key measure used by our management and Board of Directors to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. In particular, we believe that excluding the impact of these expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance. For further discussion regarding this non-GAAP measure, please see today’s press release. Disclaimer 2

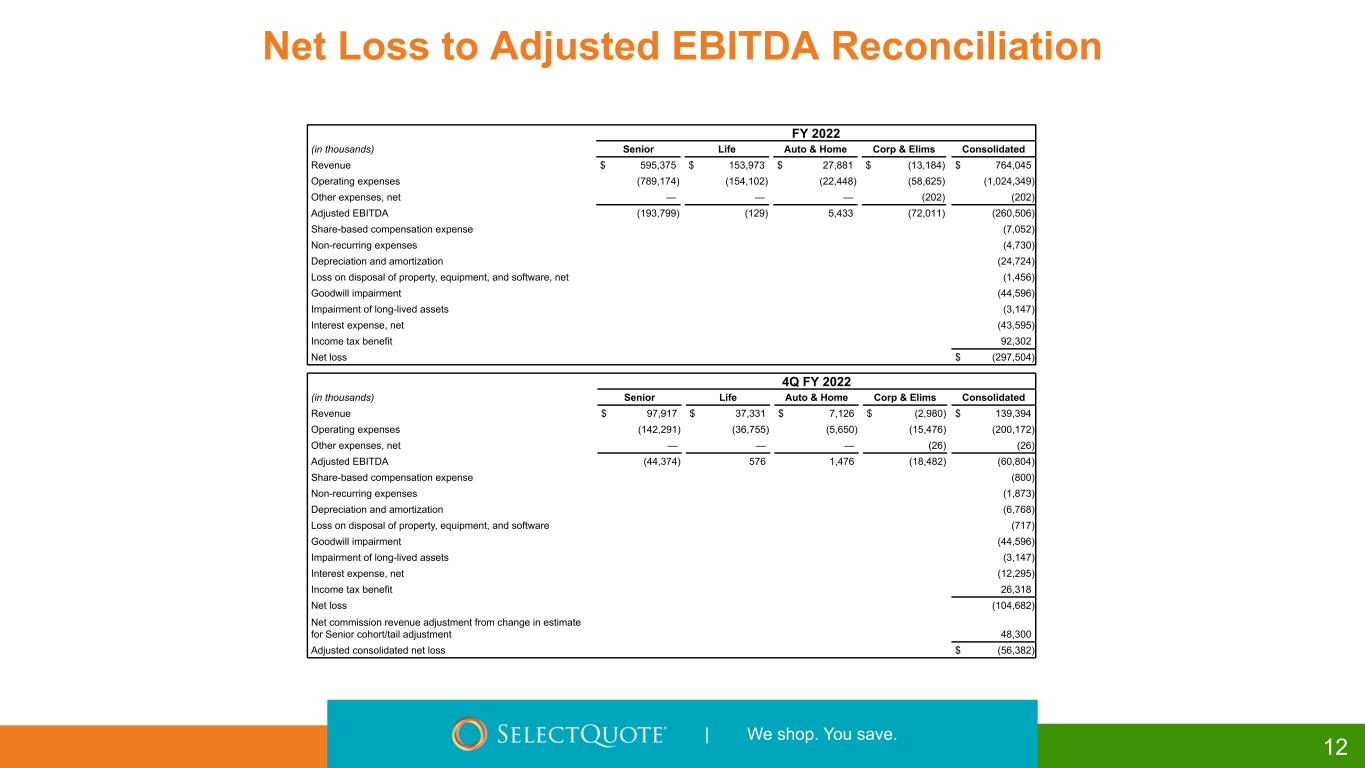

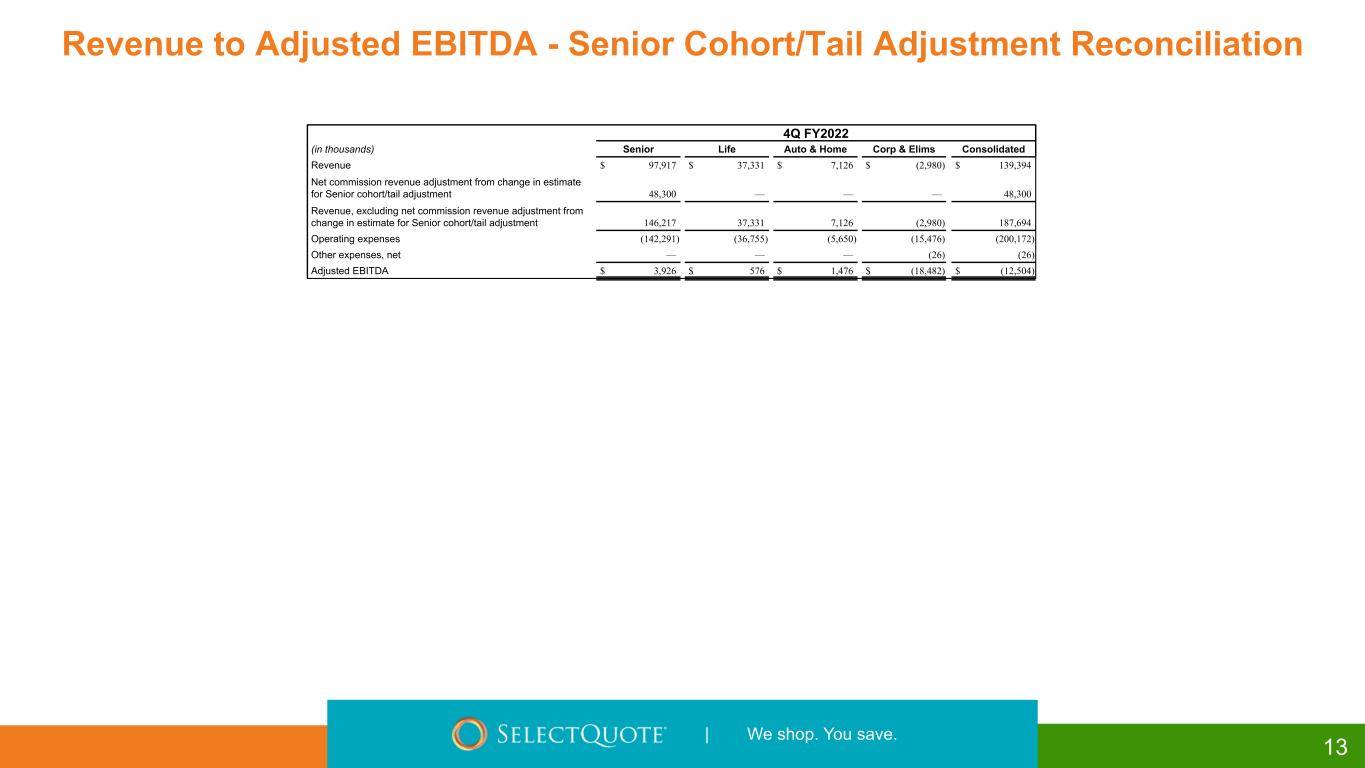

| We shop. You save. 4Q Earnings Highlights 3 *See reconciliations from GAAP measure, net income (loss), to non-GAAP measure, Adjusted EBITDA, on slides 12-15. SelectQuote delivered 4Q results ahead of internal forecasts, excluding the impact of $48 million of cohort\tail adjustment for 2021 and prior cohorts A second consecutive quarter of stronger operational results for the Senior division: • Agent close rates up 31% YoY • Marketing cost per approved policy down 35% YoY • SelectRx membership exceeded original forecast of 25K members Positive early indicators that retention may be stabilizing and even slightly improving year-over-year in the wake of significant marketing, sales, and operational actions taken in late 3Q, in contrast to negative year-over-year retention trends over the first three quarters of FY22 4Q results include a cohort \ tail adjustment of $48 million, related to cohorts we consider probable to exceed constraints in 2023 or 2024 • With this adjustment, we have significantly de-risked the potential for further adjustments in the future • New business that reflects lower persistency assumptions and 15% constraint seems to be performing in line with expectations to date 4Q Consolidated Revenue totaled $139 million. Excluding $48 million of cohort \ tail adjustment, Consolidated Revenue totaled $188 million. 4Q Consolidated Net Loss totaled $105 million or $(0.64) per diluted share. Excluding $48 million of cohort \ tail adjustment, Consolidated Net Loss totaled $56 million. 4Q Consolidated Adjusted EBITDA totaled $(61) million. Excluding $48 million of cohort \ tail adjustment, Consolidated Adjusted EBITDA totaled $(13) million. FY23 Revenue and Adjusted EBITDA guidance reflect decision to reduce operating leverage and to place more emphasis upon cashflow

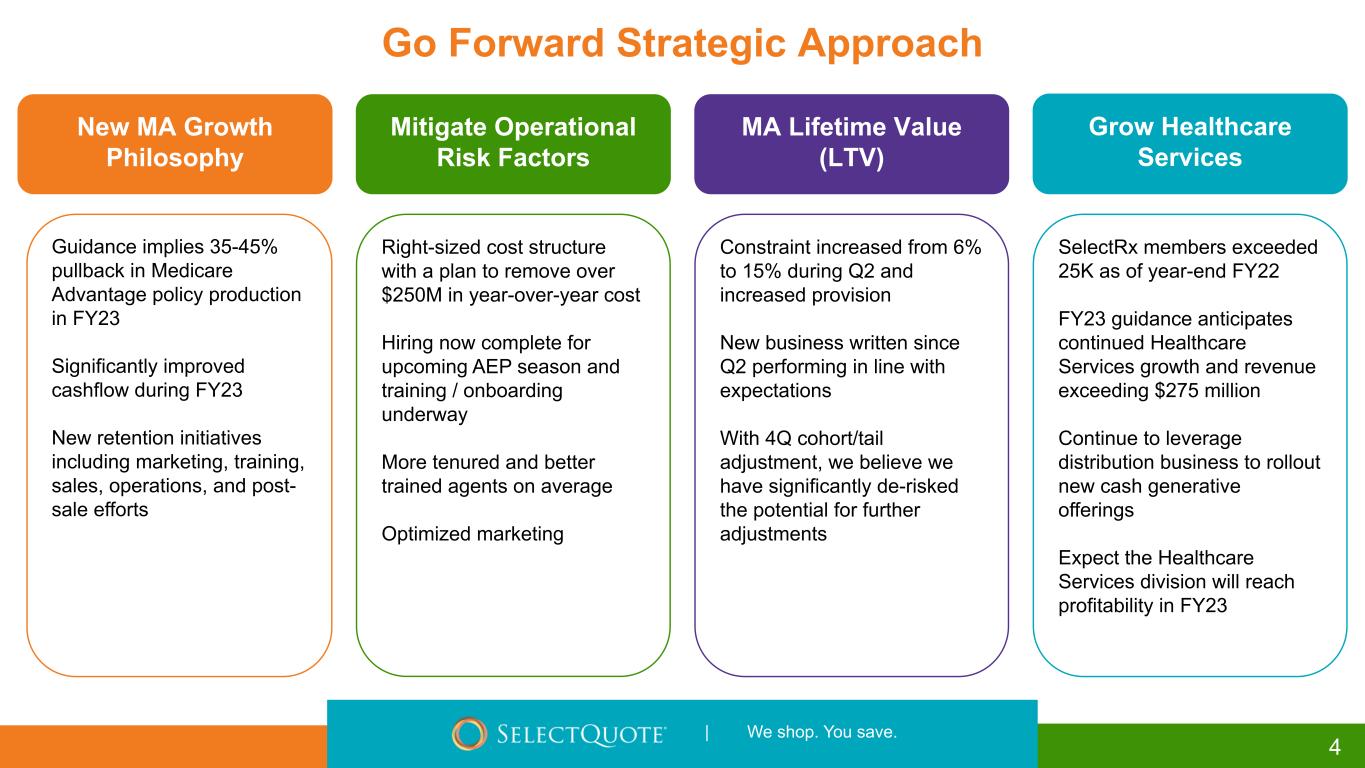

| We shop. You save.| . . Guidance implies 35-45% pullback in Medicare Advantage policy production in FY23 Significantly improved cashflow during FY23 New retention initiatives including marketing, training, sales, operations, and post- sale efforts Constraint increased from 6% to 15% during Q2 and increased provision New business written since Q2 performing in line with expectations With 4Q cohort/tail adjustment, we believe we have significantly de-risked the potential for further adjustments SelectRx members exceeded 25K as of year-end FY22 FY23 guidance anticipates continued Healthcare Services growth and revenue exceeding $275 million Continue to leverage distribution business to rollout new cash generative offerings Expect the Healthcare Services division will reach profitability in FY23 Grow Healthcare Services MA Lifetime Value (LTV) Mitigate Operational Risk Factors New MA Growth Philosophy Go Forward Strategic Approach 4 Right-sized cost structure with a plan to remove over $250M in year-over-year cost Hiring now complete for upcoming AEP season and training / onboarding underway More tenured and better trained agents on average Optimized marketing

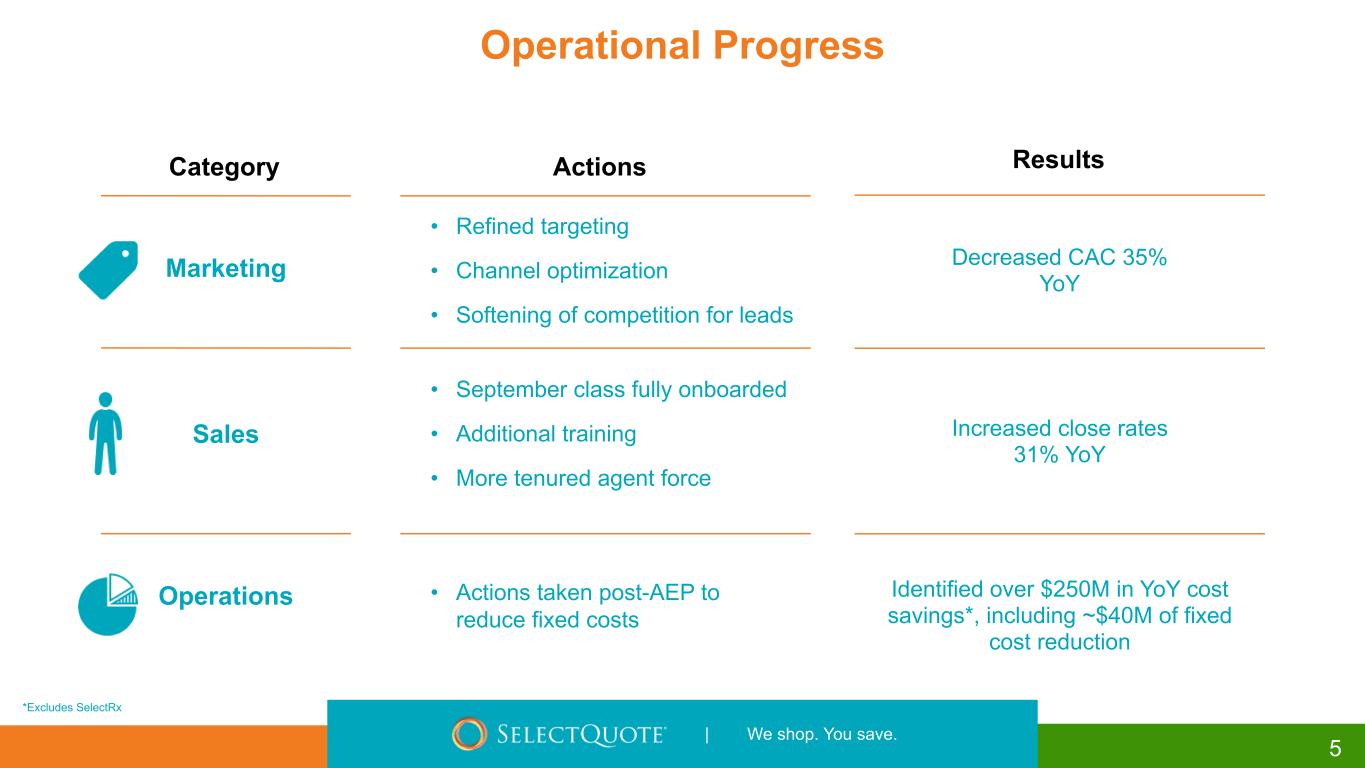

| We shop. You save. Operational Progress Category Actions Marketing Sales Operations • Refined targeting • Channel optimization • Softening of competition for leads • September class fully onboarded • Additional training • More tenured agent force • Actions taken post-AEP to reduce fixed costs 5 *Excludes SelectRx Results Decreased CAC 35% YoY Increased close rates 31% YoY Identified over $250M in YoY cost savings*, including ~$40M of fixed cost reduction

| We shop. You save. SelectRx Progress 6 Members 4Q21 1Q22 2Q22 3Q22 4Q22 — 5,000 10,000 15,000 20,000 25,000 30,000

| We shop. You save. 7 PRIOR APPROACH GOING FORWARD FY23 Guiding Principles Market share prioritized over margins and cashflow Significant operating leverage MA LTVs reflective of less competitive market Very focused on insurance distribution Disciplined policy production with focus on margins and cashflow Reduced operating leverage MA LTV forecasting principles focused on reducing volatility in results Leveraging distribution strength and scaling Healthcare Services ecosystem 7

| We shop. You save. SelectQuote Senior KPI’s TOTAL POLICIES APPROVED 000s MA LTV 8 PER UNIT OPERATING COSTS * *Represents Senior and InsideResponse operating costs divided by approved MA/MS policies 117 144 83 116 34 28 MA Other 4Q21 4Q22 $1,121 $877 4Q21 4Q22 $1,103 $836 4Q21 4Q22

| We shop. You save. Medicare Advantage LTV by Annual Cohort Cohort Tail Adjusted LTVs (excludes Production Bonus & Ancillary Revenue) $875 $925 $1,260 $1,287 $1,279 $1,259 $258 $258 $253 $143 Collected Amounts per Policy Outstanding Amount LTV Cohort/Tail Adjustments 2023E 2022 2021 2020 2019 2018 9

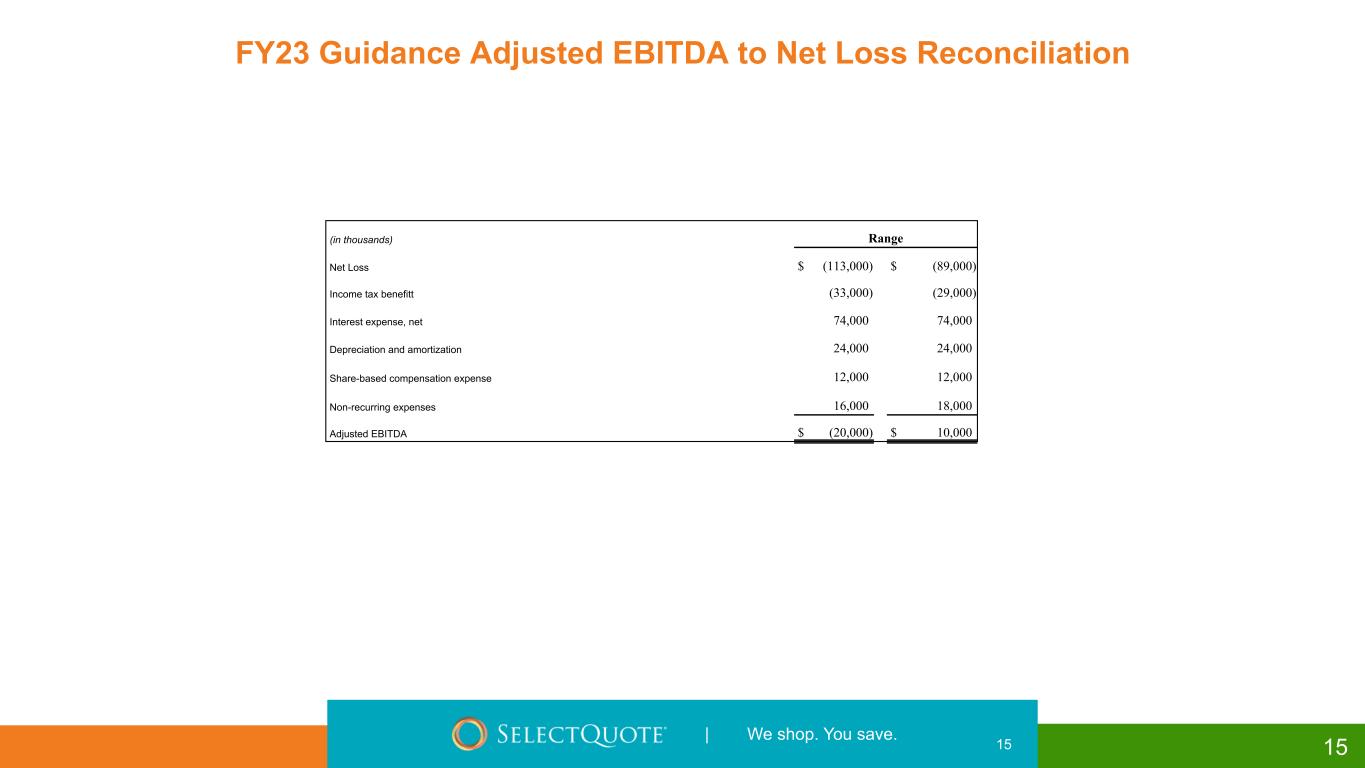

| We shop. You save. 10 SelectQuote - FY2023 Consolidated Guidance ($ in millions) Range Implied YoY Growth Revenue $850 - $950 11% - 25% Net Loss ($113) - ($89) NM Adjusted EBITDA* ($20) - $10 NM *See reconciliations from GAAP measure, net income, to non-GAAP measure, Adjusted EBITDA, on slides 12-15.

| We shop. You save. Supplemental Information 11

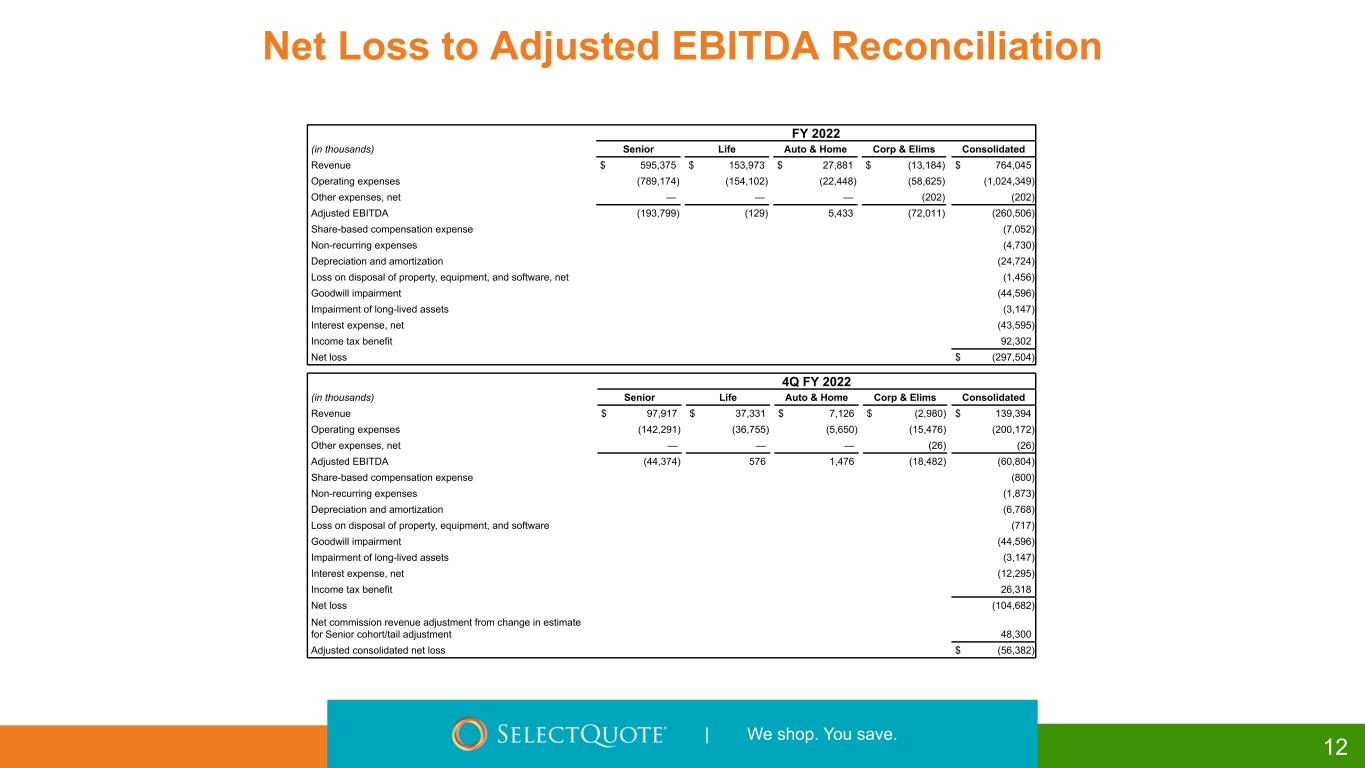

| We shop. You save. Net Loss to Adjusted EBITDA Reconciliation FY 2022 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 595,375 $ 153,973 $ 27,881 $ (13,184) $ 764,045 Operating expenses (789,174) (154,102) (22,448) (58,625) (1,024,349) Other expenses, net — — — (202) (202) Adjusted EBITDA (193,799) (129) 5,433 (72,011) (260,506) Share-based compensation expense (7,052) Non-recurring expenses (4,730) Depreciation and amortization (24,724) Loss on disposal of property, equipment, and software, net (1,456) Goodwill impairment (44,596) Impairment of long-lived assets (3,147) Interest expense, net (43,595) Income tax benefit 92,302 Net loss $ (297,504) 12 4Q FY 2022 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 97,917 $ 37,331 $ 7,126 $ (2,980) $ 139,394 Operating expenses (142,291) (36,755) (5,650) (15,476) (200,172) Other expenses, net — — — (26) (26) Adjusted EBITDA (44,374) 576 1,476 (18,482) (60,804) Share-based compensation expense (800) Non-recurring expenses (1,873) Depreciation and amortization (6,768) Loss on disposal of property, equipment, and software (717) Goodwill impairment (44,596) Impairment of long-lived assets (3,147) Interest expense, net (12,295) Income tax benefit 26,318 Net loss (104,682) Net commission revenue adjustment from change in estimate for Senior cohort/tail adjustment 48,300 Adjusted consolidated net loss $ (56,382)

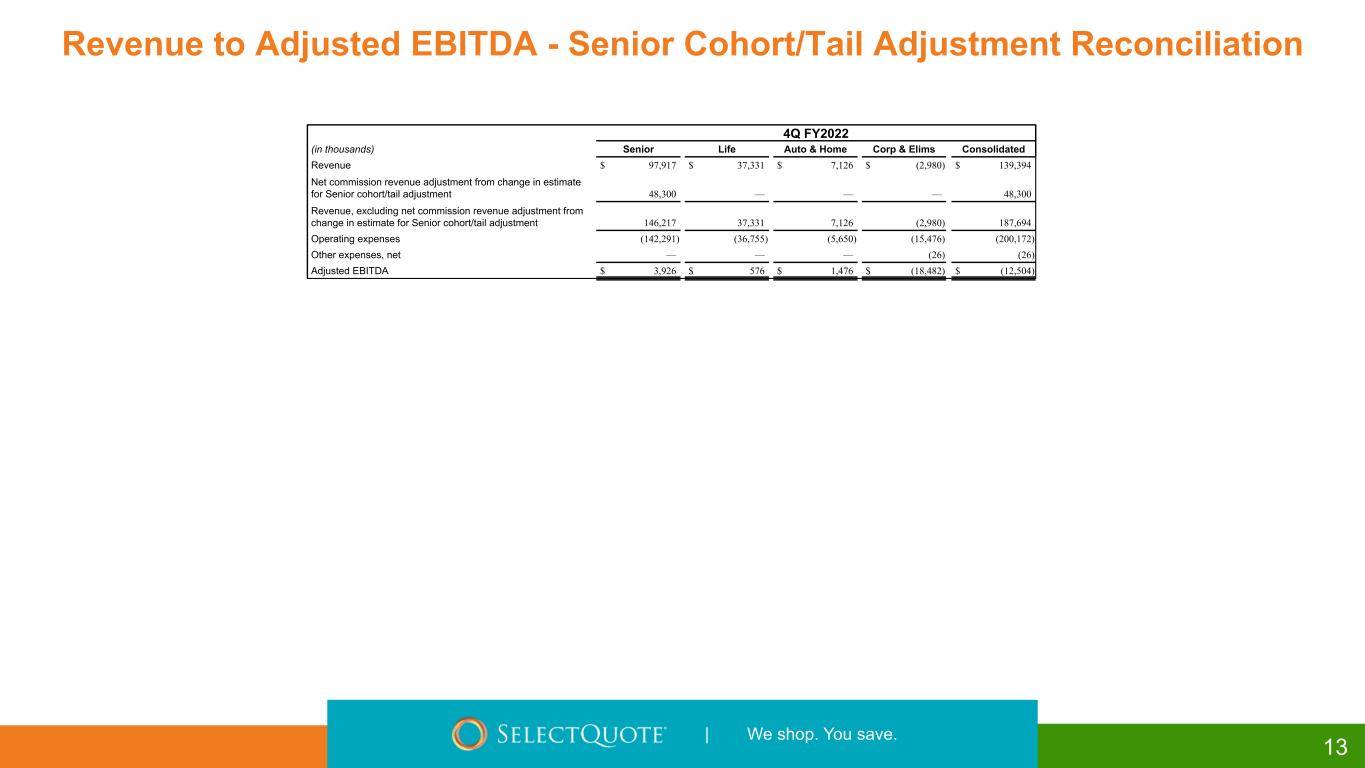

| We shop. You save. Revenue to Adjusted EBITDA - Senior Cohort/Tail Adjustment Reconciliation 4Q FY2022 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 97,917 $ 37,331 $ 7,126 $ (2,980) $ 139,394 Net commission revenue adjustment from change in estimate for Senior cohort/tail adjustment 48,300 — — — 48,300 Revenue, excluding net commission revenue adjustment from change in estimate for Senior cohort/tail adjustment 146,217 37,331 7,126 (2,980) 187,694 Operating expenses (142,291) (36,755) (5,650) (15,476) (200,172) Other expenses, net — — — (26) (26) Adjusted EBITDA $ 3,926 $ 576 $ 1,476 $ (18,482) $ (12,504) 13

| We shop. You save. Net Income to Adjusted EBITDA Reconciliation FY 2021 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 728,701 $ 177,669 $ 30,913 $ (7,302) $ 929,981 Operating expenses (484,924) (155,127) (22,735) (46,899) (709,685) Other expenses, net — — — (100) (100) Adjusted EBITDA 243,777 22,542 8,178 (54,301) 220,196 Share-based compensation expense (5,165) Non-recurring expenses (6,065) Fair value adjustments to contingent earnout obligations (1,488) Depreciation and amortization (16,142) Loss on disposal of property, equipment, and software (686) Interest expense, net (29,320) Loss on extinguishment of debt (3,315) Income tax expense (33,156) Net income $ 124,859 14 4Q FY 2021 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 124,391 $ 56,718 $ 7,161 $ (3,008) $ 185,262 Operating expenses (99,561) (49,595) (5,845) (12,128) (167,129) Other expenses, net — — — (43) (43) Adjusted EBITDA 24,830 7,123 1,316 (15,179) 18,090 Share-based compensation expense (1,476) Non-recurring expenses (575) Depreciation and amortization (4,883) Loss on disposal of property, equipment, and software (425) Interest expense, net (8,422) Income tax expense (1,513) Net income $ 796

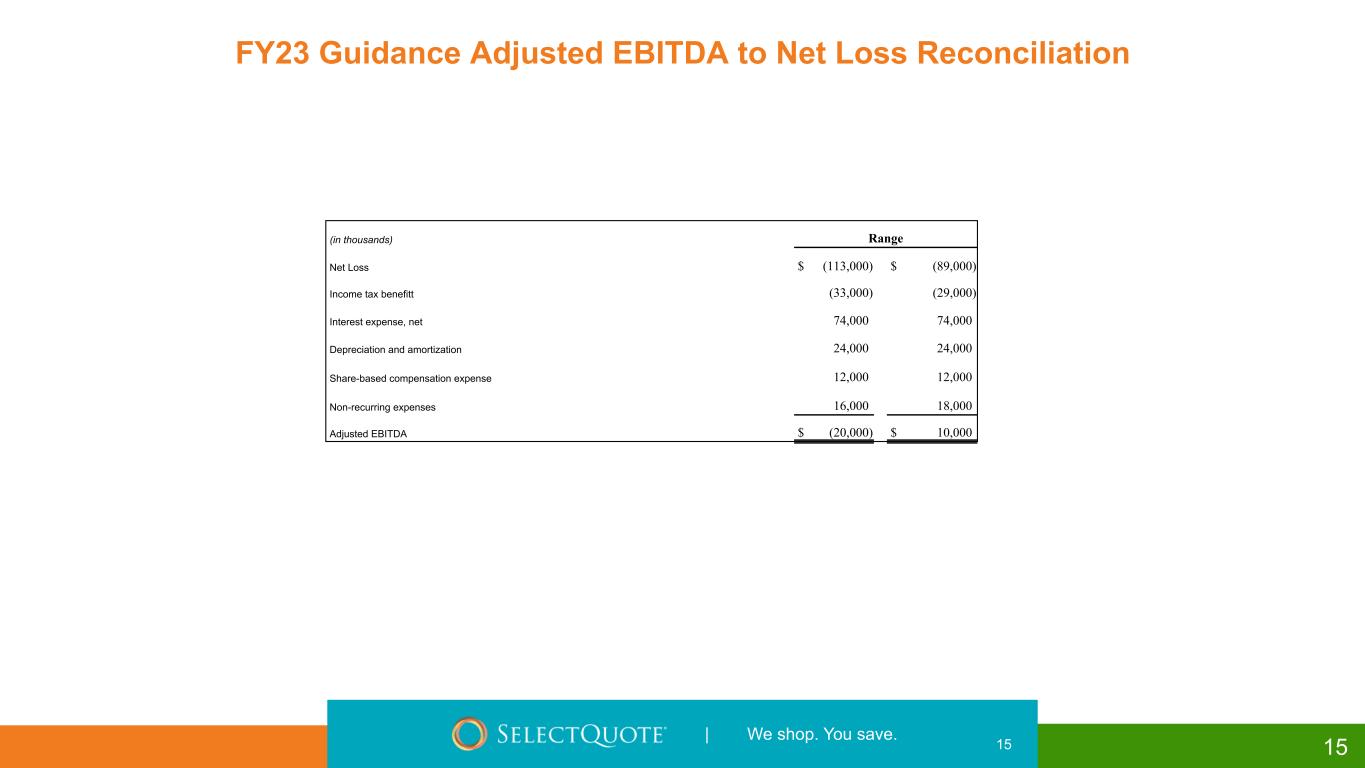

| We shop. You save. (in thousands) Range Net Loss $ (113,000) $ (89,000) Income tax benefitt (33,000) (29,000) Interest expense, net 74,000 74,000 Depreciation and amortization 24,000 24,000 Share-based compensation expense 12,000 12,000 Non-recurring expenses 16,000 18,000 Adjusted EBITDA $ (20,000) $ 10,000 FY23 Guidance Adjusted EBITDA to Net Loss Reconciliation 15 15

| We shop. You save. 16 SelectQuote Inc. 6800 West 115th Street Suite 2511 Overland Park, Kansas 66211 Phone: (913) 599-9225 Investor Relations investorrelations@selectquote.com