UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23494

T. Rowe Price Exchange-Traded Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: November 30, 2023

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

SEMIANNUAL REPORT

November 30, 2023

| | T. ROWE PRICE |

| TBUX | Ultra Short-Term Bond ETF |

| | For more insights from T. Rowe Price investment professionals, go to troweprice.com. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Go Paperless

Going paperless offers a host of benefits, which include:

| ■ | Timely delivery of important documents |

| ■ | Convenient access to your documents anytime, anywhere |

| ■ | Strong security protocols to safeguard sensitive data |

If you invest through a financial intermediary such as an investment advisor, a bank, or a brokerage firm, please contact that organization and ask if it can provide electronic documentation.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Market Commentary

Dear Shareholder

Major global stock and bond indexes produced mixed returns during the first half of your fund’s fiscal year, the six-month period ended November 30, 2023. Nearly all equity benchmarks finished the period with positive results after a strong rally in November; however, rising U.S. Treasury yields left some fixed income sectors in negative territory.

Within the S& P 500 Index, the financials sector recovered from the failure of three large regional banks earlier in the year and recorded the best results for the period. The information technology sector also delivered strong gains as technology companies benefited from investor enthusiasm for artificial intelligence developments. Outside the U.S., stocks in developed markets generally outpaced their counterparts in emerging markets, although emerging Europe and Latin America produced very strong returns at the regional level.

The U.S. economy was the strongest among the major markets during the period, with gross domestic product growth coming in at 5.2% in the third quarter’s revised estimate, the highest since the end of 2021. Corporate fundamentals were also broadly supportive. Although year-over-year earnings growth contracted in the first and second quarters of 2023, results were better than expected, and earnings growth turned positive again in the third quarter.

Inflation remained a concern for both investors and policymakers, but lower-than-expected inflation data in November helped spur a rally late in the period as many investors concluded that the Federal Reserve had reached the end of its hiking cycle. The Fed raised its short-term lending benchmark rate to a target range of 5.25% to 5.50% in July, the highest level since March 2001, and then held rates steady for the remainder of the period.

Despite a drop in yields as investor sentiment shifted in November, intermediate- and longer-term U.S. Treasury yields finished the period notably higher. After starting the period at 3.64%, the yield on the benchmark 10-year Treasury note briefly reached 5.00% in October for the first time since late 2007 before falling to 4.37% by the end of November. The rise in yields led to negative returns in some fixed income sectors, but both investment-grade and high yield corporate bonds produced solid returns, supported by the higher coupons that have become available over the past year as well as by increasing hopes that the economy might be able to avoid a recession.

Global economies and markets showed surprising resilience in 2023, but considerable uncertainty remains as we look ahead. Geopolitical events, the path of monetary policy, and the impact of the Fed’s rate hikes on the economy all

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

raise the potential for additional volatility. We believe this environment makes skilled active management a critical tool for identifying risks and opportunities, and our investment teams will continue to use fundamental research to help identify securities that can add value to your portfolio over the long term.

You may notice that this report no longer contains the commentary on your fund’s performance and positioning that we previously included in the semiannual shareholder letters. The Securities and Exchange Commission adopted new rules recently that will require fund reports to transition to a new format known as a Tailored Shareholder Report. This change will require a much more concise summary of performance rather than the level of detail we have provided historically while also aiming to be more visually engaging. As we prepare to make changes to the annual reports to meet the new regulatory requirements by mid-2024, we felt the time was right to discontinue the optional six-month semiannual fund letter to focus on the changes to come.

Although semiannual fund letters will no longer be produced, you may continue to access current fund information as well as insights and perspectives from our investment team on our personal investing website.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

CEO and President

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Portfolio Summary

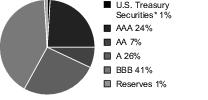

CREDIT QUALITY DIVERSIFICATION

Based on net assets as of 11/30/23.

*U.S. Treasury securities are issued by the U.S. Treasury and are backed by the full faith and credit of the U.S. government. The ratings of U.S. Treasury securities are derived from the ratings on the U.S. government.

Sources: Credit ratings for the securities held in the fund are provided by Moody’s, Standard & Poor’s and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest-rated securities. If the rating agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated (NR). T. Rowe Price uses the rating of the underlying investment vehicle to determine the creditworthiness of credit default swaps. The fund is not rated by any agency. Securities that have not been rated by any rating agency totaled 0.01% of the portfolio at the end of the reporting period.

Note: Copyright © 2023 Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries.

Note: © 2023, Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Client by Moody’s. MOODY’S INFORMATION MAY NOT BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT. Moody's® is a registered trademark.

Note: Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

(negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the appropriateness of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

FUND EXPENSE EXAMPLE

As a shareholder, you may incur two types of costs: (1) transaction costs, such as brokerage commissions on purchases and sales, and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as brokerage commissions paid on purchases and sales of shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

FUND EXPENSE EXAMPLE (continued)

Ultra Short-Term Bond ETF

| | Beginning

Account Value

6/1/23 | Ending

Account Value

11/30/23 | Expenses Paid

During Period*

6/1/23 to 11/30/23 |

| Actual | $1,000.00 | $1,032.30 | $0.86 |

| Hypothetical (assumes 5% return before expenses) | 1,000.00 | 1,024.15 | 0.86 |

| * | Expenses are equal to the fund’s annualized expense ratio for the 6-month period (0.17%), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), and divided by the days in the year (366) to reflect the half-year period. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Unaudited

For a share outstanding throughout each period

| | 6 Months

Ended | Year

Ended | 9/28/21 (1)

Through |

| | 11/30/23 | 5/31/23 | 5/31/22 |

| NET ASSET VALUE | | | |

| Beginning of period | $ 48.67 | $ 49.07 | $ 50.00 |

| Investment activities | | | |

| Net investment income(2) (3) | 1.26 | 1.63 | 0.31 |

| Net realized and unrealized gain/loss | 0.32 | (0.13) | (0.94) |

| Total from investment activities | 1.58 | 1.50 | (0.63) |

| Distributions | | | |

| Net investment income | (1.19) | (1.69) | (0.27) |

| Net realized gain | - | (0.21) | (0.03) |

| Total distributions | (1.19) | (1.90) | (0.30) |

| NET ASSET VALUE | | | |

| End of period | $ 49.06 (4) | $ 48.67 | $ 49.07 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Unaudited

For a share outstanding throughout each period

| | 6 Months

Ended | Year

Ended | 9/28/21 (1)

Through |

| | 11/30/23 | 5/31/23 | 5/31/22 |

| Ratios/Supplemental Data |

| Total return, based on NAV(3) (5) | 3.23% (4) | 3.15% | (1.31)% |

Ratios to average net

assets:(3) | | | |

Gross expenses before

waivers/payments by

Price Associates | 0.17% (6) | 0.17% | 0.17% (6) |

Net expenses after

waivers/payments by

Price Associates | 0.17% (6) | 0.17% | 0.17% (6) |

| Net investment income | 5.14% (6) | 3.34% | 0.94% (6) |

| Portfolio turnover rate(7) | 45.6% | 61.2% | 12.5% |

Net assets, end of period

(in thousands) | $ 112,834 | $ 54,755 | $ 36,801 |

| (1) | Inception date |

| (2) | Per share amounts calculated using average shares outstanding method. |

| (3) | See Note 6 for details to expense-related arrangements with Price Associates. |

| (4) | Net asset value and Total return include adjustments made in accordance with U.S. generally accepted accounting principles for financial reporting purposes and may differ from the net asset value and total returns for share holder transactions. |

| (5) | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions. Total return is not annualized for periods less than one year. |

| (6) | Annualized |

| (7) | Portfolio turnover excludes securities received or delivered through in-kind share transactions. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

November 30, 2023 Unaudited

| PORTFOLIO OF INVESTMENTS‡ | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| ASSET-BACKED SECURITIES 18.8% |

| Auto Backed 10.4% | | |

| Ally Auto Receivables Trust, Series 2023-A, Class A2, 6.15%, 1/17/34 (1) | 296 | 297 |

| Ally Auto Receivables Trust, Series 2023-A, Class B, 6.01%, 1/17/34 (1) | 178 | 177 |

| AmeriCredit Automobile Receivables Trust, Series 2020-3, Class C, 1.06%, 8/18/26 | 100 | 96 |

| ARI Fleet Lease Trust, Series 2023-B, Class A2, 6.05%, 7/15/32 (1) | 200 | 201 |

| CarMax Auto Owner Trust, Series 2020-4, Class B, 0.85%, 6/15/26 | 327 | 310 |

| CarMax Auto Owner Trust, Series 2023-3, Class A2B, FRN, SOFR30A + 0.60%, 5.924%, 11/16/26 | 510 | 510 |

| CarMax Auto Owner Trust, Series 2023-3, Class A3, 5.28%, 5/15/28 | 340 | 340 |

| Carvana Auto Receivables Trust, Series 2021-N4, Class B, 1.24%, 9/11/28 | 10 | 9 |

| Carvana Auto Receivables Trust, Series 2022-N1, Class A1, 2.31%, 12/11/28 (1) | 35 | 35 |

| Carvana Auto Receivables Trust, Series 2023-N1, Class A, 6.36%, 4/12/27 (1) | 71 | 71 |

| Carvana Auto Receivables Trust, Series 2023-N3, Class A, 6.41%, 9/10/27 (1) | 212 | 212 |

| Carvana Auto Receivables Trust, Series 2023-P3, Class A2, 6.09%, 11/10/26 (1) | 425 | 425 |

| Chase Auto Credit Linked Notes, Series 2021-3, Class B, 0.76%, 2/26/29 (1) | 425 | 409 |

| Drive Auto Receivables Trust, Series 2020-2, Class D, 3.05%, 5/15/28 | 42 | 42 |

| Enterprise Fleet Financing, Series 2020-2, Class A2, 0.61%, 7/20/26 (1) | 7 | 7 |

| Enterprise Fleet Financing, Series 2021-2, Class A3, 0.74%, 5/20/27 (1) | 305 | 288 |

| Enterprise Fleet Financing, Series 2022-3, Class A2, 4.38%, 7/20/29 (1) | 532 | 524 |

| Enterprise Fleet Financing, Series 2023-2, Class A2, 5.56%, 4/22/30 (1) | 400 | 398 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Enterprise Fleet Financing LLC, Series 2023-3, Class A2, 6.40%, 3/20/30 (1) | 275 | 278 |

| Exeter Automobile Receivables Trust, Series 2022-3A, Class B, 4.86%, 12/15/26 | 100 | 100 |

| Exeter Automobile Receivables Trust, Series 2022-4A, Class B, 4.57%, 1/15/27 | 250 | 248 |

| Exeter Automobile Receivables Trust, Series 2022-5A, Class B, 5.97%, 3/15/27 | 200 | 199 |

| Exeter Automobile Receivables Trust, Series 2022-6A, Class A3, 5.70%, 8/17/26 | 25 | 25 |

| Exeter Automobile Receivables Trust, Series 2023-1A, Class B, 5.72%, 4/15/27 | 310 | 309 |

| Exeter Automobile Receivables Trust, Series 2023-3A, Class B, 6.11%, 9/15/27 | 165 | 165 |

| Exeter Automobile Receivables Trust, Series 2023-4A, Class A2, 6.07%, 12/15/25 | 425 | 425 |

| Exeter Automobile Receivables Trust, Series 2023-4A, Class B, 6.31%, 10/15/27 | 275 | 275 |

| Ford Credit Auto Lease Trust, Series 2023-A, Class B, 5.29%, 6/15/26 | 120 | 119 |

| Ford Credit Auto Lease Trust, Series 2023-B, Class B, 6.20%, 2/15/27 | 180 | 181 |

| Ford Credit Auto Owner Trust, Series 2020-1, Class B, 2.29%, 8/15/31 (1) | 635 | 606 |

| Ford Credit Floorplan Master Owner Trust, Series 2023-1, Class B, 5.31%, 5/15/28 (1) | 100 | 99 |

| GM Financial Automobile Leasing Trust, Series 2023-2, Class B, 5.54%, 5/20/27 | 80 | 79 |

| HPEFS Equipment Trust, Series 2023-1A, Class A2, 5.43%, 8/20/25 (1) | 144 | 144 |

| JPMorgan Chase, Series 2021-1, Class B, 0.875%, 9/25/28 (1) | 173 | 169 |

| JPMorgan Chase, Series 2021-2, Class B, 0.889%, 12/26/28 (1) | 43 | 42 |

| JPMorgan Chase, Series 2021-2, Class C, 0.969%, 12/26/28 (1) | 44 | 43 |

| JPMorgan Chase Bank, Series 2021-3, Class D, 1.009%, 2/26/29 (1) | 183 | 176 |

| Navistar Financial Dealer Note Master Owner Trust II, Series 2023-1, Class A, 6.18%, 8/25/28 (1) | 185 | 185 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Octane Receivables Trust, Series 2023-1A, Class A, 5.87%, 5/21/29 (1) | 67 | 67 |

| Octane Receivables Trust, Series 2023-1A, Class B, 5.96%, 7/20/29 (1) | 200 | 198 |

| Octane Receivables Trust, Series 2023-3A, Class A2, 6.44%, 3/20/29 (1) | 925 | 927 |

| Octane Receivables Trust, Series 2023-3A, Class B, 6.48%, 7/20/29 (1) | 265 | 267 |

| Santander Consumer Auto Receivables Trust, Series 2021-BA, Class B, 1.45%, 10/16/28 (1) | 2 | 2 |

| Santander Drive Auto Receivables Trust, Series 2022-5, Class B, 4.43%, 3/15/27 | 250 | 246 |

| Santander Drive Auto Receivables Trust, Series 2022-6, Class B, 4.72%, 6/15/27 | 150 | 147 |

| Santander Drive Auto Receivables Trust, Series 2022-7, Class A2, 5.81%, 1/15/26 | 26 | 25 |

| Santander Drive Auto Receivables Trust, Series 2023-1, Class B, 4.98%, 2/15/28 | 85 | 84 |

| Santander Drive Auto Receivables Trust, Series 2023-3, Class A3, 5.61%, 10/15/27 | 635 | 634 |

| Santander Drive Auto Receivables Trust, Series 2023-4, Class A2, 6.18%, 2/16/27 | 555 | 556 |

| Santander Drive Auto Receivables Trust, Series 2023-4, Class A3, 5.73%, 4/17/28 | 190 | 190 |

| SFS Auto Receivables Securitization Trust, Series 2023-1A, Class A2B, FRN, SOFR30A + 0.80%, 6.125%, 3/22/27 (1) | 63 | 63 |

| World Omni Auto Receivables Trust, Series 2021-A, Class B, 0.64%, 12/15/26 | 25 | 23 |

| World Omni Select Auto Trust, Series 2020-A, Class B, 0.84%, 6/15/26 | 84 | 83 |

| | | 11,730 |

| Collateralized Debt Obligations 0.4% | | |

| BlueMountain, Series 2015-3A, Class A1R, CLO, FRN, 3M TSFR + 1.26%, 6.677%, 4/20/31 (1) | 224 | 223 |

| Symphony Static, Series 2021-1A, Class A, CLO, FRN, 3M TSFR + 1.09%, 6.47%, 10/25/29 (1) | 181 | 180 |

| | | 403 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Equipment Lease Heavy Duty 0.7% | | |

| MMAF Equipment Finance, Series 2020-A, Class A3, 0.97%, 4/9/27 (1) | 400 | 379 |

| MMAF Equipment Finance, Series 2020-BA, Class A5, 0.85%, 4/14/42 (1) | 100 | 93 |

| MMAF Equipment Finance, Series 2023-A, Class A2, 5.79%, 11/13/26 (1) | 105 | 105 |

| SCF Equipment Leasing, Series 2023-1A, Class A2, 6.56%, 1/22/30 (1) | 220 | 220 |

| | | 797 |

| Other Asset-Backed Securities 6.8% | | |

| ARI Fleet Lease Trust, Series 2021-A, Class A2, 0.37%, 3/15/30 (1) | 14 | 14 |

| Axis Equipment Finance Receivables, Series 2021-1A, Class A2, 0.75%, 11/20/26 | 16 | 16 |

| Dell Equipment Finance Trust, Series 2023-2, Class A3, 5.65%, 1/22/29 (1) | 100 | 100 |

| Dell Equipment Finance Trust, Series 2023-3, Class A3, 6.57%, 4/23/29 (1) | 245 | 247 |

| DLLAA, Series 2021-1A, Class A3, 0.67%, 4/17/26 (1) | 125 | 121 |

| DLLAA, Series 2023-1A, Class A2, 5.93%, 7/20/26 (1) | 525 | 526 |

| DLLAA, Series 2023-1A, Class A3, 5.64%, 2/22/28 (1) | 325 | 325 |

| DLLAD, Series 2023-1A, Class A2, 5.19%, 4/20/26 (1) | 247 | 245 |

| Elara HGV Timeshare Issuer, Series 2017-A, Class A, 2.69%, 3/25/30 (1) | 11 | 11 |

| Hardee's Funding, Series 2018-1A, Class A2II, 4.959%, 6/20/48 (1) | 57 | 54 |

| Hilton Grand Vacations Trust, Series 2018-AA, Class A, 3.54%, 2/25/32 (1) | 229 | 222 |

| HPEFS Equipment Trust, Series 2021-2A, Class D, 1.29%, 3/20/29 (1) | 300 | 290 |

| HPEFS Equipment Trust, Series 2022-1A, Class B, 1.79%, 5/21/29 (1) | 1,000 | 972 |

| HPEFS Equipment Trust, Series 2023-2A, Class A3, 5.99%, 1/21/31 (1) | 250 | 251 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| HPEFS Equipment Trust, Series 2023-2A, Class B, 6.25%, 1/21/31 (1) | 110 | 111 |

| Kubota Credit Owner Trust, Series 2023-2A, Class A2, 5.61%, 7/15/26 (1) | 685 | 684 |

| Kubota Credit Owner Trust, Series 2023-2A, Class A3, 5.28%, 1/18/28 (1) | 525 | 524 |

| M&T Equipment Notes, Series 2023-1A, Class A2, 6.09%, 7/15/30 (1) | 430 | 430 |

| M&T Equipment Notes, Series 2023-1A, Class A3, 5.74%, 7/15/30 (1) | 580 | 578 |

| MVW, Series 2020-1A, Class A, 1.74%, 10/20/37 (1) | 83 | 77 |

| MVW, Series 2021-1WA, Class A, 1.14%, 1/22/41 (1) | 43 | 39 |

| Navient Private Education Refi Loan Trust, Series 2021-CA, Class A, 1.06%, 10/15/69 (1) | 60 | 52 |

| Nelnet Student Loan Trust, Series 2021-DA, Class AFL, FRN, 1M TSFR + 0.80%, 6.136%, 4/20/62 (1) | 60 | 59 |

| Octane Receivables Trust, Series 2021-1A, Class A, 0.93%, 3/22/27 (1) | 18 | 17 |

| Octane Receivables Trust, Series 2021-2A, Class A, 1.21%, 9/20/28 (1) | 61 | 59 |

| Octane Receivables Trust, Series 2022-1A, Class A2, 4.18%, 3/20/28 (1) | 43 | 43 |

| Octane Receivables Trust, Series 2022-2A, Class A, 5.11%, 2/22/28 (1) | 55 | 55 |

| Octane Receivables Trust, Series 2023-2A, Class A2, 5.88%, 6/20/31 (1) | 166 | 165 |

| Santander Bank Auto Credit-Linked Notes, Series 2021-1A, Class B, 1.833%, 12/15/31 (1) | 59 | 58 |

| Santander Bank Auto Credit-Linked Notes, Series 2022-A, Class B, 5.281%, 5/15/32 (1) | 168 | 166 |

| Santander Bank Auto Credit-Linked Notes, Series 2022-B, Class B, 5.721%, 8/16/32 (1) | 99 | 99 |

| Santander Retail Auto Lease Trust, Series 2020-A, Class B, 1.61%, 1/20/26 (1) | 180 | 173 |

| Sierra Timeshare Receivables Funding, Series 2019-3A, Class A, 2.34%, 8/20/36 (1) | 41 | 39 |

| Sierra Timeshare Receivables Funding, Series 2020-2A, Class A, 1.33%, 7/20/37 (1) | 36 | 34 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Verdant Receivables, Series 2023-1A, Class A2, 6.24%, 1/13/31 (1) | 590 | 589 |

| Verizon Master Trust, Series 2021-1, Class B, 0.69%, 5/20/27 | 269 | 262 |

| | | 7,707 |

| Student Loans 0.3% | | |

| Navient Private Education Refi Loan Trust, Series 2019-A, Class A2A, 3.42%, 1/15/43 (1) | 69 | 66 |

| Navient Private Education Refi Loan Trust, Series 2020-FA, Class A, 1.22%, 7/15/69 (1) | 61 | 54 |

| Navient Private Education Refi Loan Trust, Series 2020-GA, Class A, 1.17%, 9/16/69 (1) | 70 | 62 |

| Navient Private Education Refi Loan Trust, Series 2020-HA, Class A, 1.31%, 1/15/69 (1) | 89 | 81 |

| Navient Private Education Refi Loan Trust, Series 2021-GA, Class A, 1.58%, 4/15/70 (1) | 75 | 64 |

| SMB Private Education Loan Trust, Series 2016-B, Class A2B, FRN, 1M TSFR + 1.56%, 6.887%, 2/17/32 (1) | 32 | 32 |

| | | 359 |

| Whole Loans Backed 0.2% | | |

| Progress Residential Trust, Series 2020-SFR3, Class B, CMO, ARM, 1.495%, 10/17/27 (1) | 235 | 216 |

Total Asset-Backed Securities

(Cost $21,238) | | 21,212 |

| CORPORATE BONDS 63.7% |

| Advertising 0.5% | | |

| WPP Finance, 3.75%, 9/19/24 | 600 | 588 |

| | | 588 |

| Airlines 0.3% | | |

| SMBC Aviation Capital Finance, 3.55%, 4/15/24 (1) | 400 | 396 |

| | | 396 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Automotive 3.9% | | |

| Daimler Trucks Finance North America, FRN, SOFR + 0.75%, 6.097%, 12/13/24 (1) | 300 | 300 |

| Ford Motor Credit, 2.30%, 2/10/25 | 300 | 285 |

| Ford Motor Credit, 3.664%, 9/8/24 | 300 | 294 |

| Ford Motor Credit, 4.134%, 8/4/25 | 250 | 240 |

| Hyundai Capital America, 1.30%, 1/8/26 (1) | 250 | 228 |

| Hyundai Capital America, 1.80%, 10/15/25 (1) | 410 | 381 |

| Hyundai Capital America, 5.50%, 3/30/26 (1) | 85 | 84 |

| Hyundai Capital America, 5.65%, 6/26/26 (1) | 200 | 199 |

| Hyundai Capital America, 6.25%, 11/3/25 (1) | 70 | 71 |

| LeasePlan, 2.875%, 10/24/24 (1) | 600 | 582 |

| Nissan Motor, 3.522%, 9/17/25 (1) | 295 | 281 |

| Nissan Motor Acceptance, 1.125%, 9/16/24 (1) | 416 | 399 |

| Volkswagen Group of America Finance, 5.80%, 9/12/25 (1) | 300 | 300 |

| Volkswagen Group of America Finance, 6.00%, 11/16/26 (1) | 545 | 550 |

| Volkswagen Group of America Finance, FRN, SOFR + 0.95%, 6.296%, 6/7/24 (1) | 200 | 200 |

| | | 4,394 |

| Banking 22.4% | | |

| ABN AMRO Bank, VR, 6.339%, 9/18/27 (1)(2) | 200 | 201 |

| Australia & New Zealand Banking Group, 4.50%, 3/19/24 (1) | 800 | 796 |

| Banco Santander, 5.147%, 8/18/25 | 400 | 395 |

| Bangkok Bank, 4.05%, 3/19/24 | 250 | 249 |

| Bank of America, 4.45%, 3/3/26 | 400 | 390 |

| Bank of America, VR, 4.83%, 7/22/26 (2) | 200 | 197 |

| Bank of America, VR, 5.08%, 1/20/27 (2) | 200 | 198 |

| Bank of America, FRN, SOFR + 0.66%, 6.007%, 2/4/25 | 200 | 199 |

| Bank of Ireland Group, VR, 6.25%, 9/16/26 (1)(2) | 400 | 399 |

| Bank of Montreal, 5.30%, 6/5/26 | 550 | 549 |

| Banque Federative du Credit Mutuel, 4.935%, 1/26/26 (1) | 400 | 394 |

| Banque Federative du Credit Mutuel, 5.896%, 7/13/26 (1) | 400 | 402 |

| Barclays, 4.375%, 9/11/24 | 400 | 393 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Barclays, VR, 5.304%, 8/9/26 (2) | 400 | 392 |

| BPCE SA, 2.375%, 1/14/25 (1) | 500 | 481 |

| CaixaBank, VR, 6.684%, 9/13/27 (1)(2) | 550 | 554 |

| Canadian Imperial Bank of Commerce, FRN, SOFRINDX + 0.40%, 5.747%, 12/14/23 | 300 | 300 |

| Capital One Financial, VR, 1.34%, 12/6/24 (2) | 400 | 400 |

| Capital One Financial, 4.25%, 4/30/25 (3) | 180 | 175 |

| Capital One Financial, FRN, SOFR + 1.35%, 6.697%, 5/9/25 | 200 | 199 |

| Citigroup, 4.40%, 6/10/25 | 400 | 392 |

| Citigroup, FRN, SOFR + 0.69%, 6.042%, 1/25/26 | 500 | 496 |

| Cooperatieve Rabobank, 4.625%, 12/1/23 | 750 | 750 |

| Danske Bank, VR, 3.77%, 3/28/25 (1)(2) | 400 | 396 |

| Danske Bank, VR, 6.259%, 9/22/26 (1)(2) | 235 | 236 |

| Deutsche Bank, VR, 1.45%, 4/1/25 (2) | 300 | 295 |

| Deutsche Bank, 3.70%, 5/30/24 | 200 | 197 |

| Discover Bank, 2.45%, 9/12/24 | 900 | 873 |

| Emirates NBD Bank PJSC, 2.625%, 2/18/25 | 400 | 384 |

| Fifth Third Bancorp, 2.375%, 1/28/25 | 160 | 154 |

| Fifth Third Bank, 3.85%, 3/15/26 | 650 | 615 |

| Goldman Sachs Group, FRN, SOFR + 0.50%, 5.847%, 9/10/24 | 100 | 99 |

| Goldman Sachs Group, FRN, SOFR + 0.70%, 6.049%, 1/24/25 | 400 | 399 |

| Goldman Sachs Group, FRN, SOFR + 1.39%, 6.737%, 3/15/24 | 50 | 50 |

| Huntington Bancshares, 2.625%, 8/6/24 (3) | 225 | 219 |

| Huntington National Bank, VR, 5.70%, 11/18/25 (2) | 335 | 327 |

| ING Groep, VR, 3.87%, 3/28/26 (2) | 800 | 778 |

| Intesa Sanpaolo, 3.25%, 9/23/24 (1) | 500 | 488 |

| Intesa Sanpaolo, 5.25%, 1/12/24 | 300 | 300 |

| Intesa Sanpaolo, 7.00%, 11/21/25 (1) | 200 | 202 |

| Lloyds Banking Group, VR, 2.44%, 2/5/26 (2) | 635 | 608 |

| Lloyds Banking Group, 4.50%, 11/4/24 | 400 | 393 |

| Mitsubishi UFJ Financial Group, VR, 5.06%, 9/12/25 (2) | 400 | 397 |

| Mitsubishi UFJ Financial Group, VR, 5.72%, 2/20/26 (2) | 400 | 400 |

| Morgan Stanley, VR, 5.05%, 1/28/27 (2)(3) | 240 | 237 |

| Morgan Stanley Bank, FRN, SOFR + 0.78%, 6.13%, 7/16/25 | 800 | 799 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| NatWest Group, VR, 5.85%, 3/2/27 (2) | 400 | 399 |

| PNC Bank NA, 3.875%, 4/10/25 | 500 | 486 |

| PNC Financial Services Group, VR, 5.812%, 6/12/26 (2)(3) | 240 | 240 |

| Santander U.K. Group Holdings, VR, 1.09%, 3/15/25 (2) | 400 | 393 |

| Siam Commercial Bank, 3.90%, 2/11/24 | 400 | 399 |

| Societe Generale, 4.25%, 4/14/25 (1) | 500 | 485 |

| Societe Generale, 5.00%, 1/17/24 (1) | 400 | 399 |

| Standard Chartered, VR, 3.97%, 3/30/26 (1)(2) | 200 | 194 |

| Standard Chartered, 5.20%, 1/26/24 (1) | 400 | 399 |

| Standard Chartered, VR, 6.187%, 7/6/27 (1)(2) | 400 | 401 |

| Toronto-Dominion Bank, FRN, SOFR + 1.08%, 6.42%, 7/17/26 | 550 | 549 |

| Truist Financial, FRN, SOFR + 0.40%, 5.747%, 6/9/25 | 445 | 436 |

| UBS Group, VR, 2.59%, 9/11/25 (1)(2) | 500 | 485 |

| UBS Group, VR, 6.327%, 12/22/27 (1)(2) | 300 | 303 |

| US Bancorp, 3.60%, 9/11/24 | 100 | 98 |

| US Bancorp, VR, 5.73%, 10/21/26 (2) | 465 | 462 |

| Wells Fargo, 3.00%, 4/22/26 | 800 | 757 |

| Wells Fargo, 4.10%, 6/3/26 | 290 | 282 |

| Woori Bank, 4.75%, 4/30/24 | 400 | 398 |

| | | 25,312 |

| Broadcasting 0.4% | | |

| Interpublic Group, 4.20%, 4/15/24 | 400 | 396 |

| | | 396 |

| Building & Real Estate 0.2% | | |

| EMG SUKUK, 4.564%, 6/18/24 | 200 | 198 |

| | | 198 |

| Cable Operators 0.2% | | |

| Cox Communications, 3.15%, 8/15/24 (1) | 200 | 196 |

| | | 196 |

| Chemicals 0.5% | | |

| Celanese US Holdings, 1.40%, 8/5/26 | 348 | 310 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| LG Chem, 4.375%, 7/14/25 | 280 | 274 |

| | | 584 |

| Consumer Products 0.2% | | |

| Mattel, 3.375%, 4/1/26 (1) | 285 | 266 |

| | | 266 |

| Diversified Chemicals 0.2% | | |

| Bayer US Finance II, 4.25%, 12/15/25 (1) | 290 | 279 |

| | | 279 |

| Drugs 1.3% | | |

| AbbVie, 3.80%, 3/15/25 | 525 | 514 |

| BNP Paribas SA, 4.25%, 10/15/24 | 500 | 492 |

| Viatris, 1.65%, 6/22/25 | 515 | 483 |

| | | 1,489 |

| Electric Utilities 0.2% | | |

| Israel Electric, 5.00%, 11/12/24 | 200 | 196 |

| | | 196 |

| Energy 4.7% | | |

| APA Infrastructure, 4.20%, 3/23/25 (1) | 800 | 783 |

| DCP Midstream Operating, 5.375%, 7/15/25 | 740 | 739 |

| Energy Transfer, 6.05%, 12/1/26 | 315 | 319 |

| Energy Transfer , 5.75%, 4/1/25 | 200 | 199 |

| EQT, 6.125%, 2/1/25 | 200 | 200 |

| Gray Oak Pipeline, 2.60%, 10/15/25 (1) | 125 | 117 |

| MPLX, 4.875%, 12/1/24 | 500 | 494 |

| MPLX, 4.875%, 6/1/25 | 200 | 197 |

| Occidental Petroleum, 5.50%, 12/1/25 | 300 | 300 |

| Occidental Petroleum, 5.55%, 3/15/26 | 150 | 150 |

| Occidental Petroleum, 5.875%, 9/1/25 | 478 | 480 |

| Occidental Petroleum, 8.50%, 7/15/27 | 125 | 135 |

| Reliance Industries, 4.125%, 1/28/25 | 250 | 245 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Sabine Pass Liquefaction, 5.75%, 5/15/24 | 156 | 156 |

| Western Midstream Operating, 3.10%, 2/1/25 | 322 | 312 |

| Western Midstream Operating, 3.95%, 6/1/25 | 500 | 485 |

| | | 5,311 |

| Exploration & Production 0.2% | | |

| Aker BP, 2.00%, 7/15/26 (1) | 300 | 273 |

| | | 273 |

| Financial 4.2% | | |

| AerCap Ireland Capital, 3.15%, 2/15/24 | 300 | 298 |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 6.10%, 1/15/27 | 225 | 226 |

| Air Lease, 4.25%, 2/1/24 | 200 | 199 |

| Ally Financial, 3.875%, 5/21/24 (3) | 400 | 395 |

| Ally Financial, 4.625%, 3/30/25 | 200 | 196 |

| Ally Financial, 5.125%, 9/30/24 | 200 | 198 |

| CNO Financial Group, 5.25%, 5/30/25 | 577 | 571 |

| Fab Sukuk Co, 3.875%, 1/22/24 | 200 | 199 |

| General Motors Financial, 4.00%, 1/15/25 | 100 | 98 |

| General Motors Financial, 6.05%, 10/10/25 | 300 | 301 |

| General Motors Financial, FRN, SOFR + 0.76%, 6.107%, 3/8/24 | 390 | 390 |

| Indian Railway Finance, 3.73%, 3/29/24 | 400 | 398 |

| LSEGA Financing, 1.375%, 4/6/26 (1) | 400 | 363 |

| QNB Finance, 3.50%, 3/28/24 | 200 | 198 |

| Synchrony Financial, 4.25%, 8/15/24 | 190 | 187 |

| Western Union, 2.85%, 1/10/25 | 510 | 492 |

| | | 4,709 |

| Food/Tobacco 0.5% | | |

| Imperial Brands Finance, 3.125%, 7/26/24 (1) | 200 | 196 |

| Imperial Brands Finance, 4.25%, 7/21/25 (1) | 400 | 390 |

| | | 586 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Forest Products 0.2% | | |

| Celulosa Arauco Constitucion, 4.50%, 8/1/24 | 200 | 197 |

| | | 197 |

| Gas & Gas Transmission 0.2% | | |

| Kinder Morgan Energy, 4.25%, 9/1/24 | 200 | 198 |

| | | 198 |

| Health Care 1.4% | | |

| Baxter International, FRN, SOFRINDX + 0.44%, 5.785%, 11/29/24 | 250 | 249 |

| HCA, 5.375%, 2/1/25 | 950 | 943 |

| Utah Acquisition Sub, 3.95%, 6/15/26 | 420 | 400 |

| | | 1,592 |

| Information Technology 0.8% | | |

| Microchip Technology, 0.972%, 2/15/24 | 500 | 495 |

| NXP, 4.875%, 3/1/24 | 400 | 398 |

| | | 893 |

| Insurance 4.6% | | |

| Athene Global Funding, 2.514%, 3/8/24 (1) | 250 | 248 |

| Athene Global Funding, FRN, SOFRINDX + 0.72%, 6.063%, 1/7/25 (1) | 200 | 198 |

| Brighthouse Financial Global Funding, 1.00%, 4/12/24 (1) | 125 | 123 |

| Brighthouse Financial Global Funding, 1.20%, 12/15/23 (1) | 150 | 149 |

| Brighthouse Financial Global Funding, FRN, SOFR + 0.76%, 6.108%, 4/12/24 (1) | 245 | 244 |

| Brown & Brown, 4.20%, 9/15/24 | 150 | 148 |

| CNO Global Funding, 1.65%, 1/6/25 (1) | 400 | 379 |

| Corebridge Financial, 3.50%, 4/4/25 | 1,200 | 1,161 |

| Equitable Financial Life Global Funding, 1.40%, 7/7/25 (1) | 185 | 172 |

| Equitable Financial Life Global Funding, 5.50%, 12/2/25 (1) | 621 | 616 |

| First American Financial, 4.60%, 11/15/24 | 650 | 640 |

| Principal Financial Group, 3.40%, 5/15/25 | 250 | 241 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Voya Financial, 3.65%, 6/15/26 | 900 | 858 |

| | | 5,177 |

| Manufacturing 1.3% | | |

| Carrier Global, 5.80%, 11/30/25 (1) | 305 | 307 |

| POSCO, 4.375%, 8/4/25 | 400 | 392 |

| VF, 2.40%, 4/23/25 | 785 | 740 |

| | | 1,439 |

| Media & Communications 0.5% | | |

| Warnermedia Holdings, 3.638%, 3/15/25 | 589 | 573 |

| | | 573 |

| Media & Entertainment 0.4% | | |

| Take-Two Interactive Software, 5.00%, 3/28/26 | 450 | 447 |

| | | 447 |

| Metals & Mining 0.4% | | |

| ABJA Investment, 5.95%, 7/31/24 | 400 | 398 |

| Freeport-McMoRan, 5.00%, 9/1/27 | 5 | 5 |

| | | 403 |

| Oil Field Services 0.3% | | |

| Energy Transfer, 5.875%, 1/15/24 (3) | 350 | 350 |

| | | 350 |

| Other Telecommunications 0.4% | | |

| British Telecommunications, 4.50%, 12/4/23 | 400 | 400 |

| | | 400 |

| Real Estate Investment Trust Securities 3.5% | | |

| Brixmor Operating Partnership, 3.65%, 6/15/24 | 391 | 385 |

| Brixmor Operating Partnership, 3.85%, 2/1/25 | 200 | 194 |

| Brixmor Operating Partnership, 4.125%, 6/15/26 | 100 | 96 |

| CubeSmart, 4.00%, 11/15/25 | 675 | 652 |

| Essex Portfolio, 3.875%, 5/1/24 | 750 | 743 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Kilroy Realty, 3.45%, 12/15/24 | 575 | 556 |

| Scentre Group Trust, 3.50%, 2/12/25 (1) | 900 | 875 |

| WP Carey, 4.60%, 4/1/24 | 400 | 398 |

| | | 3,899 |

| Retail 0.9% | | |

| 7-Eleven, 0.80%, 2/10/24 (1) | 95 | 94 |

| Advance Auto Parts, 5.90%, 3/9/26 | 100 | 99 |

| Nordstrom, 2.30%, 4/8/24 | 85 | 84 |

| Walgreens Boots Alliance, 3.80%, 11/18/24 | 750 | 733 |

| | | 1,010 |

| Transportation 0.7% | | |

| Penske Truck Leasing, 2.70%, 11/1/24 (1) | 200 | 194 |

| Penske Truck Leasing, 3.45%, 7/1/24 (1) | 400 | 394 |

| Penske Truck Leasing, 3.95%, 3/10/25 (1) | 200 | 195 |

| | | 783 |

| Transportation Services 0.3% | | |

| HPHT Finance, 2.875%, 11/5/24 | 400 | 390 |

| | | 390 |

| Utilities 4.1% | | |

| American Electric Power, 2.031%, 3/15/24 | 500 | 494 |

| American Electric Power, 5.699%, 8/15/25 | 278 | 278 |

| Constellation Energy Generation, 3.25%, 6/1/25 | 1,096 | 1,058 |

| Enel Finance International NV, 6.80%, 10/14/25 (1) | 400 | 406 |

| NextEra Energy Capital Holdings, 6.051%, 3/1/25 | 200 | 200 |

| NRG Energy, 3.75%, 6/15/24 (1) | 200 | 196 |

| Pacific Gas and Electric, 3.15%, 1/1/26 | 595 | 561 |

| Pacific Gas and Electric, 4.95%, 6/8/25 | 200 | 197 |

| Sempra Energy, 3.30%, 4/1/25 | 100 | 97 |

| Southern, 4.48%, 8/1/24 | 495 | 489 |

| Southern California Edison, FRN, SOFRINDX + 0.83%, 6.177%, 4/1/24 | 25 | 25 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Vistra Operations, 3.55%, 7/15/24 (1) | 545 | 534 |

| Vistra Operations, 5.125%, 5/13/25 (1) | 135 | 133 |

| | | 4,668 |

| Wireless Communications 3.8% | | |

| American Tower, 1.60%, 4/15/26 | 975 | 888 |

| American Tower, 2.40%, 3/15/25 | 186 | 178 |

| Crown Castle, 1.05%, 7/15/26 | 395 | 352 |

| Crown Castle, 1.35%, 7/15/25 (3) | 300 | 280 |

| Crown Castle International, 4.45%, 2/15/26 | 500 | 488 |

| Rogers Communications, 2.95%, 3/15/25 | 475 | 458 |

| Rogers Communications, 3.625%, 12/15/25 | 400 | 383 |

| Sprint, 7.125%, 6/15/24 | 750 | 753 |

| Sprint, 7.625%, 3/1/26 | 500 | 519 |

| | | 4,299 |

Total Corporate Bonds

(Cost $71,935) | | 71,891 |

| FOREIGN GOVERNMENT OBLIGATIONS & MUNICIPALITIES 1.0% |

| Foreign Govt & Muni (Excl Canadian) 1.0% | | |

| Japan Treasury Discount Bill, (0.246)%, 2/13/24 (JPY) | 169,400 | 1,143 |

| | | 1,143 |

Total Foreign Government Obligations & Municipalities

(Cost $1,118) | | 1,143 |

| NON-U.S. GOVERNMENT MORTGAGE-BACKED SECURITIES 7.6% |

| Commercial Mortgage-Backed Securities 2.8% | | |

| Austin Fairmont Hotel Trust, Series 2019-FAIR, Class A, ARM, 1M TSFR + 1.10%, 6.42%, 9/15/32 (1) | 475 | 472 |

| BX Trust, Series 2020-VKNG, Class A, ARM, 1M TSFR + 1.04%, 6.367%, 10/15/37 (1) | 596 | 591 |

| BX Trust, Series 2021-ARIA, Class A, ARM, 1M TSFR + 1.01%, 6.337%, 10/15/36 (1) | 665 | 646 |

| COMM Mortgage Trust, Series 2014-CR21, Class A3, 3.528%, 12/10/47 | 20 | 20 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| COMM Mortgage Trust, Series 2014-LC15, Class A4, 4.006%, 4/10/47 | 308 | 306 |

| Fontainebleau Miami Beach Trust, Series 2019-FBLU, Class A, 3.144%, 12/10/36 (1) | 450 | 433 |

| Great Wolf Trust, Series 2019-WOLF, Class A, ARM, 1M TSFR + 1.15%, 6.472%, 12/15/36 (1) | 625 | 621 |

| ONE Mortgage Trust, Series 2021-PARK, Class A, ARM, 1M TSFR + 0.81%, 6.137%, 3/15/36 (1) | 115 | 108 |

| | | 3,197 |

| Whole Loans Backed 4.8% | | |

| Angel Oak Mortgage Trust, Series 2019-5, Class A1, CMO, ARM, 2.59%, 10/25/49 (1) | 54 | 52 |

| Angel Oak Mortgage Trust, Series 2021-2, Class A1, CMO, ARM, 0.99%, 4/25/66 (1) | 94 | 77 |

| Angel Oak Mortgage Trust, Series 2021-5, Class A1, CMO, ARM, 0.95%, 7/25/66 (1) | 120 | 99 |

| Angel Oak Mortgage Trust, Series 2022-1, Class A1, CMO, ARM, 2.88%, 12/25/66 (1) | 98 | 85 |

| Bellemeade Re, Series 2022-1, Class M1A, CMO, ARM, SOFR30A + 1.75%, 7.078%, 1/26/32 (1) | 104 | 104 |

| BINOM Securitization Trust, Series 2021-INV1, Class A1, CMO, ARM, 2.03%, 6/25/56 (1) | 67 | 56 |

| COLT Funding, Series 2021-4, Class A1, CMO, ARM, 1.40%, 10/25/66 (1) | 78 | 60 |

| Connecticut Avenue Securities Trust, Series 2021-R01, Class 1M1, CMO, ARM, SOFR30A + 0.75%, 6.078%, 10/25/41 (1) | 1 | 1 |

| Connecticut Avenue Securities Trust, Series 2021-R03, Class 1M1, CMO, ARM, SOFR30A + 0.85%, 6.178%, 12/25/41 (1) | 53 | 53 |

| Connecticut Avenue Securities Trust, Series 2023-R05, Class 1M1, CMO, ARM, SOFR30A + 1.90%, 7.229%, 6/25/43 (1) | 54 | 54 |

| Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M1, CMO, ARM, SOFR30A + 1.70%, 7.028%, 7/25/43 (1) | 219 | 220 |

| Eagle RE, Series 2021-2, Class M1A, CMO, ARM, SOFR30A + 1.55%, 6.878%, 4/25/34 (1) | 8 | 8 |

| Ellington Financial Mortgage Trust, Series 2023-1, Class A1, CMO, ARM, 5.73%, 2/25/68 (1) | 167 | 164 |

| Freddie Mac Stacr Remic Trust, Series 2023-HQA3, Class A1, CMO, ARM, SOFR30A + 1.85%, 7.173%, 11/25/43 (1) | 115 | 116 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA1, Class M1A, CMO, ARM, SOFR30A + 1.00%, 6.328%, 1/25/42 (1) | 145 | 144 |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA2, Class M1A, CMO, ARM, SOFR30A + 1.30%, 6.628%, 2/25/42 (1) | 192 | 191 |

| Freddie Mac STACR REMIC Trust, Series 2022-DNA5, Class M1A, CMO, ARM, SOFR30A + 2.95%, 8.278%, 6/25/42 (1) | 200 | 205 |

| New Residential Mortgage Loan Trust, Series 2023-NQM1, Class A1A, CMO, ARM, 6.864%, 10/25/63 (1) | 683 | 685 |

| OBX Trust, Series 2022-NQM1, Class A1, CMO, ARM, 2.31%, 11/25/61 (1) | 156 | 130 |

| OBX Trust, Series 2023-NQM10, Class A1, CMO, ARM, 6.465%, 10/25/63 (1) | 460 | 460 |

| Progress Residential Trust, Series 2019-SFR4, Class B, CMO, ARM, 2.937%, 10/17/36 (1) | 800 | 775 |

| Verus Securitization Trust, Series 2019-INV3, Class A1, CMO, ARM, 3.692%, 11/25/59 (1) | 96 | 93 |

| Verus Securitization Trust, Series 2021-2, Class A1, CMO, ARM, 1.03%, 2/25/66 (1) | 100 | 83 |

| Verus Securitization Trust, Series 2021-4, Class A1, CMO, ARM, 0.94%, 7/25/66 (1) | 101 | 78 |

| Verus Securitization Trust, Series 2021-5, Class A1, CMO, ARM, 1.01%, 9/25/66 (1) | 135 | 105 |

| Verus Securitization Trust, Series 2021-R3, Class A1, CMO, ARM, 1.02%, 4/25/64 (1) | 74 | 66 |

| Verus Securitization Trust, Series 2023-3, Class A1, CMO, ARM, 5.93%, 3/25/68 (1) | 299 | 296 |

| Verus Securitization Trust, Series 2023-INV1, Class A1, CMO, ARM, 5.999%, 2/25/68 (1) | 132 | 131 |

| Verus Securitization Trust, Series 2023-INV3, Class A1, CMO, ARM, 6.876%, 11/25/68 (1) | 770 | 773 |

| Vista Point Securitization Trust, Series 2020-2, Class A1, CMO, ARM, 1.48%, 4/25/65 (1) | 70 | 63 |

| | | 5,427 |

Total Non-U.S. Government Mortgage-Backed Securities

(Cost $8,821) | | 8,624 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (EXCLUDING MORTGAGE-BACKED) 2.2% |

| U.S. Treasury Obligations 2.2% | | |

| U.S. Treasury Bills, 5.195%, 11/29/24 | 650 | 618 |

| U.S. Treasury Bills, 5.383%, 5/30/24 | 650 | 633 |

| U.S. Treasury Bills, 5.466%, 4/18/24 (4) | 565 | 554 |

| U.S. Treasury Notes, 4.625%, 11/15/26 | 480 | 482 |

| U.S. Treasury Notes, 4.875%, 11/30/25 | 170 | 170 |

| | | 2,457 |

Total U.S. Government Agency Obligations (Excluding Mortgage-Backed)

(Cost $2,455) | | 2,457 |

| SHORT-TERM INVESTMENTS 5.6% |

| Commercial Paper 5.6% | | |

| Bacardi-Martini, 5.977%, 12/19/23 (5) | 500 | 499 |

| Bayer, 6.297%, 7/9/24 (5) | 550 | 530 |

| Canadian Natural Resources, 6.022%, 12/22/23 (5) | 300 | 299 |

| Crown Castle, 6.035%, 12/5/23 (5) | 300 | 300 |

| Harley-Davidson Financial Services, 6.039%, 12/5/23 (5) | 700 | 699 |

| Harley-Davidson Financial Services, 6.037%, 12/6/23 (5) | 300 | 300 |

| Ovintiv, 6.156%, 12/19/23 | 750 | 748 |

| Ovintiv, 6.123%, 12/20/23 | 250 | 249 |

| Stanley Black & Decker, 6.051%, 1/18/24 (5) | 750 | 744 |

| Syngenta Wilmington, 6.281%, 12/5/23 (5) | 1,100 | 1,099 |

| Targa Resources, 6.001%, 12/1/23 (5) | 300 | 300 |

| Walgreens Boots Alliance, 6.281%, 12/29/23 (5) | 250 | 249 |

| Western Midstream Operating, 6.207%, 1/3/24 (5) | 300 | 298 |

| | | 6,314 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Par/Shares | $ Value |

| (Amounts in 000s) | | |

| Money Market Funds 0.0% | | |

| T. Rowe Price Government Reserve Fund, 5.42% (6)(7) | 1 | 1 |

Total Short-Term Investments

(Cost $6,315) | | 6,315 |

| SECURITIES LENDING COLLATERAL 1.6% |

| Investments in a Pooled Account through Securities Lending Program with State Street Bank 1.6% | | |

| Money Market Funds 1.6% | | |

| T. Rowe Price Government Reserve Fund, 5.42% (6)(7) | 1,792 | 1,792 |

| Total Investments in a Pooled Account through Securities Lending Program with State Street Bank | | 1,792 |

Total Securities Lending Collateral

(Cost $1,792) | | 1,792 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

(Amount in 000s, except for contracts)

| Options Purchased 0.0% |

| OTC Options Purchased 0.0% |

| Description | Contracts | Notional

Amount | $ Value |

| Counterparty: Bank of America, Credit Default Swap, Protection Bought (Relevant Credit: Markit CDX.NA.IG-S41, 1 Year Index, 12/20/28), Pay 1.00% Quarterly, Receive upon credit default, 01/17/24 @ 0.73% (8) | 1 | 5,000 | 3 |

| Total Options Purchased (Cost $4) | | 3 |

Total Investments in Securities

100.5% of Net Assets (Cost $113,678) | | $113,437 |

| ‡ | Par/Shares and Notional Amount are denominated in U.S. dollars unless otherwise noted. |

| (1) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. Total value of such securities at period-end amounts to $43,318 and represents 38.4% of net assets. |

| (2) | Security is a fix-to-float security, which carries a fixed coupon until a certain date, upon which it switches to a floating rate. Reference rate and spread are provided if the rate is currently floating. |

| (3) | All or a portion of this security is on loan at November 30, 2023. See Note 4. |

| (4) | At November 30, 2023, all or a portion of this security is pledged as collateral and/or margin deposit to cover future funding obligations. |

| (5) | Commercial paper exempt from registration under Section 4(2) of the Securities Act of 1933 and may be resold in transactions exempt from registration only to dealers in that program or other "accredited investors" -- total value of such securities at period-end amounts to $5,317 and represents 4.7 % of net assets. |

| (6) | Seven-day yield |

| (7) | Affiliated Companies |

| (8) | Non-income producing. |

| 1M TSFR | One month term SOFR (Secured overnight financing rate) |

| 3M TSFR | Three month term SOFR (Secured overnight financing rate) |

| ARM | Adjustable Rate Mortgage (ARM); rate shown is effective rate at period-end. The rates for certain ARMs are not based on a published reference rate and spread but may be determined using a formula based on the rates of the underlying loans. |

| CLO | Collateralized Loan Obligation |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| CMO | Collateralized Mortgage Obligation |

| FRN | Floating Rate Note |

| JPY | Japanese Yen |

| OTC | Over-the-counter |

| SOFR | Secured overnight financing rate |

| SOFR30A | 30-day Average term SOFR (Secured Overnight Financing Rate) |

| SOFRINDX | SOFR (Secured overnight financing rate) Index |

| USD | U.S. Dollar |

| VR | Variable Rate; rate shown is effective rate at period-end. The rates for certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and based on current market conditions. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| Description | Notional

Amount | $ Value | Initial

$ Value | Unrealized

$ Gain/(Loss) |

| CENTRALLY CLEARED SWAPS 0.0% |

| Credit Default Swaps, Protection Sold 0.0% |

| Protection Sold (Relevant Credit: AT&T, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 125 | — | — | — |

| Protection Sold (Relevant Credit: Citigroup, A3*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 60 | — | — | — |

| Protection Sold (Relevant Credit: Bank of America, A1*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 60 | — | — | — |

| Protection Sold (Relevant Credit: Verizon Communications, Baa1*), Receive 1.00% Quarterly, Pay upon credit default 12/20/23 | 125 | — | — | — |

| Protection Sold (Relevant Credit: Freeport-McMoran, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 200 | 1 | — | 1 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| Description | Notional

Amount | $ Value | Initial

$ Value | Unrealized

$ Gain/(Loss) |

| Protection Sold (Relevant Credit: Hess, Baa3*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 100 | 1 | — | 1 |

| Protection Sold (Relevant Credit: Devon Energy, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 100 | 1 | — | 1 |

| Protection Sold (Relevant Credit: AT&T, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 275 | 2 | 1 | 1 |

| Protection Sold (Relevant Credit: Verizon Communications, Baa1*), Receive 1.00% Quarterly, Pay upon credit default 6/20/24 | 275 | 2 | 1 | 1 |

| Protection Sold (Relevant Credit: AT&T, Baa2*), Receive 1.00% Quarterly, Pay upon credit default 12/20/24 | 275 | 2 | 1 | 1 |

| Total Centrally Cleared Credit Default Swaps, Protection Sold | 6 |

| Net payments (receipts) of variation margin to date | $ (6) |

| Variation margin receivable (payable) on centrally cleared swaps | $(—) |

| * | Credit ratings as of November 30, 2023. Ratings shown are from Moody’s Investors Service and if Moody’s does not rate a security, then Standard & Poor’s (S&P) is used. Fitch is used for securities that are not rated by either Moody’s or S&P. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| FORWARD CURRENCY EXCHANGE CONTRACTS |

| Counterparty | Settlement | Receive | | Deliver | | Unrealized

Gain/(Loss) |

| JP Morgan Chase Bank | 2/13/24 | USD | 1,136 | JPY | 169,400 | $(19) |

Net unrealized gain (loss) on open forward

currency exchange contracts | $(19) |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| | Expiration

Date | Notional

Amount | Value and

Unrealized

Gain (Loss) |

| Short, 66 Three Month SOFR Futures contracts | 09/24 | (15,674) | $ (23) |

| Short, 31 U.S. Treasury Notes five year contracts | 03/24 | (3,288) | (24) |

| Short, 1 U.S. Treasury Notes ten year contracts | 03/24 | (109) | — |

| Short, 58 U.S. Treasury Notes two year contracts | 03/24 | (11,833) | (26) |

| Short, 2 Ultra U.S. Treasury Notes ten year contracts | 03/24 | (226) | (1) |

| Long, 25 Three Month SOFR Futures contracts | 06/24 | 5,921 | 5 |

| Net payments (receipts) of variation margin to date | 105 |

| Variation margin receivable (payable) on open futures contracts | $ 36 |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

AFFILIATED COMPANIES

($000s)

The fund may invest in certain securities that are considered affiliated companies. As defined by the 1940 Act, an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or a company that is under common ownership or control. The following securities were considered affiliated companies for all or some portion of the six months ended November 30, 2023. Net realized gain (loss), investment income, change in net unrealized gain/loss, and purchase and sales cost reflect all activity for the period then ended.

| Affiliate | Net Realized Gain

(Loss) | Changes in Net

Unrealized

Gain/Loss | Investment

Income |

| T. Rowe Price Government Reserve Fund | $ — | $— | $—++ |

| Totals | $—# | $— | $ —+ |

| Supplementary Investment Schedule |

| Affiliate | Value

5/31/23 | Purchase

Cost | Sales

Cost | Value

11/30/23 |

| T. Rowe Price Government Reserve Fund | $ 86 | ¤ | ¤ | $ 1,793 |

| | Total | | | $1,793^ |

| ++ | Excludes earnings on securities lending collateral, which are subject to rebates and fees as described in Note 4. |

| # | Capital gain distributions from mutual funds represented $0 of the net realized gain (loss). |

| + | Investment income comprised $0 of dividend income and $0 of interest income. |

| ¤ | Purchase and sale information not shown for cash management funds. |

| ^ | The cost basis of investments in affiliated companies was $1,793. |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

November 30, 2023 Unaudited

STATEMENT OF ASSETS AND LIABILITIES

($000s, except shares and per share amounts)

| Assets | |

| Investments in securities, at value (cost $113,678) | $ 113,437 |

| Receivable for investment securities sold | 2,596 |

| Interest and dividends receivable | 849 |

| Cash deposits on centrally cleared swaps | 195 |

| Variation margin receivable on futures contracts | 36 |

| Total assets | 117,113 |

| Liabilities | |

| Payable for investment securities purchased | 2,396 |

| Obligation to return securities lending collateral | 1,792 |

| Due to custodian | 56 |

| Unrealized loss on forward currency exchange contracts | 19 |

| Investment management and administrative fees payable | 16 |

| Total liabilities | 4,279 |

| NET ASSETS | $ 112,834 |

| Net assets consists of: | |

| Total distributable earnings (loss) | $ (277) |

Paid-in capital applicable to 2,300,000 shares of $0.0001 par value

capital stock outstanding; 4,000,000,000 shares authorized | 113,111 |

| NET ASSETS | $112,834 |

| NET ASSET VALUE PER SHARE | $ 49.06 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Unaudited

STATEMENT OF OPERATIONS

($000s)

| | 6 Months

Ended |

| | 11/30/23 |

| Investment Income (Loss) | |

| Income | |

| Interest | $ 2,568 |

| Securities lending | 2 |

| Total income | 2,570 |

| Expenses | |

| Investment management and administrative expense | 82 |

| Miscellaneous expense | 1 |

| Total expenses | 83 |

| Net investment income | 2,487 |

| Realized and Unrealized Gain / Loss | |

| Net realized gain (loss) | |

| Securities | (129) |

| Futures | 312 |

| Swaps | 2 |

| Options written | (14) |

| Forward currency exchange contracts | 52 |

| Net realized gain | 223 |

| Change in net unrealized gain / loss | |

| Securities | 481 |

| Futures | (79) |

| Swaps | 5 |

| Options written | 3 |

| Forward currency exchange contracts | (29) |

| Change in unrealized gain / loss | 381 |

| Net realized and unrealized gain / loss | 604 |

| INCREASE IN NET ASSETS FROM OPERATIONS | $3,091 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Unaudited

STATEMENT OF CHANGES IN NET ASSETS

($000s)

| | 6 Months

Ended | | Year

Ended |

| | 11/30/23 | | 5/31/23 |

| Increase (Decrease) in Net Assets | | | |

| Operations | | | |

| Net investment income | $ 2,487 | | $ 1,680 |

| Net realized gain (loss) | 223 | | (25) |

| Change in net unrealized gain / loss | 381 | | (7) |

| Increase in net assets from operations | 3,091 | | 1,648 |

| Distributions to shareholders | | | |

| Net earnings | (2,491) | | (1,976) |

| Capital share transactions* | | | |

| Shares sold | 57,479 | | 26,775 |

| Shares redeemed | — | | (8,493) |

| Increase in net assets from capital share transactions | 57,479 | | 18,282 |

| Net Assets | | | |

| Increase during period | 58,079 | | 17,954 |

| Beginning of period | 54,755 | | 36,801 |

| End of period | $112,834 | | $54,755 |

| *Share information | | | |

| Shares sold | 1,175 | | 550 |

| Shares redeemed | — | | (175) |

| Increase in shares outstanding | 1,175 | | 375 |

The accompanying notes are an integral part of these financial statements.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Unaudited

NOTES TO FINANCIAL STATEMENTS

T. Rowe Price Exchange-Traded Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Ultra Short-Term Bond ETF (the fund) is a diversified, open-end management investment company established by the corporation. The fund seeks a high level of income consistent with low volatility of principal value.

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation

The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions

Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from other investment companies are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions, if any, are declared and paid monthly. A capital gain distribution, if any, may also be declared and paid by the fund annually. Dividends and distributions cannot be automatically reinvested in additional shares of the fund.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Currency Translation

Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as provided by an outside pricing service. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the respective date of such transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is not bifurcated from the portion attributable to changes in market prices.

Capital Transactions

The fund issues and redeems shares at its net asset value (NAV) only with Authorized Participants and only in large blocks of 25,000 shares (each, a “Creation Unit”). The fund’s NAV per share is computed at the close of the New York Stock Exchange (NYSE). However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Individual fund shares may not be purchased or redeemed directly with the fund. An Authorized Participant may purchase or redeem a Creation Unit of the fund each business day that the fund is open in exchange for the delivery of a designated portfolio of in-kind securities and/or cash. When purchasing or redeeming Creation Units, Authorized Participants are also required to pay a fixed and/or variable purchase or redemption transaction fee as well as any applicable additional variable charge to defray the transaction cost to a fund.

Individual fund shares may be purchased and sold only on a national securities exchange through brokers. Shares are listed for trading on NYSE Arca, Inc. (NYSE Arca) and because the shares will trade at market prices rather than NAV, shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount). The fund’s shares are ordinarily valued as of the close of regular trading (normally 4:00 p.m. Eastern time) on each day that the NYSE Arca is open.

New Accounting Guidance

The FASB issued Accounting Standards Update (ASU), ASU 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting in March 2020 and ASU 2021-01 in January 2021 which provided further amendments and clarifications to Topic 848. These ASUs provide optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (LIBOR), and other interbank-offered based reference rates, through December 31, 2022. In December 2022, FASB issued ASU 2022-06 which defers the sunset date of Topic 848 from December 31, 2022 to December 31, 2024, after which entities will no longer be

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

permitted to apply the relief in Topic 848. Management intends to rely upon the relief provided under Topic 848, which is not expected to have a material impact on the fund’s financial statements.

Indemnification

In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 – VALUATION

Fair Value

The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fund’s Board of Directors (the Board) has designated T. Rowe Price Associates, Inc. as the fund’s valuation designee (Valuation Designee). Subject to oversight by the Board, the Valuation Designee performs the following functions in performing fair value determinations: assesses and manages valuation risks; establishes and applies fair value methodologies; tests fair value methodologies; and evaluates pricing vendors and pricing agents. The duties and responsibilities of the Valuation Designee are performed by its Valuation Committee. The Valuation Designee provides periodic reporting to the Board on valuation matters.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the Valuation Designee’s assumptions in determining fair value)

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques

Debt securities are generally traded in the over-the-counter (OTC) market and are valued at prices furnished by independent pricing services or by broker dealers who make markets in such securities. When valuing securities, the independent pricing services consider factors such as, but not limited to, the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation. Listed options, and OTC options with a listed equivalent, are valued at the mean of the closing bid and asked prices and exchange-traded options on futures contracts are valued at closing settlement prices. Swaps are valued at prices furnished by an independent pricing service or independent swap dealers. Forward currency exchange contracts are valued using the prevailing forward exchange rate. Futures contracts are valued at closing settlement prices. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Designee. The Valuation Designee has adopted methodologies for determining the fair value of investments for which market quotations are not readily available or deemed unreliable, including the use of other pricing sources. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Designee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Designee may also consider other valuation methods such as

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions. Fair value prices determined by the Valuation Designee could differ from those of other market participants, and it is possible that the fair value determined for a security may be materially different from the value that could be realized upon the sale of that security.

Valuation Inputs

The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on November 30, 2023 (for further detail by category, please refer to the accompanying Portfolio of Investments):

| ($000s) | Level 1 | Level 2 | Level 3 | Total Value |

| Assets | | | | |

| Fixed Income1 | $ — | $105,327 | $— | $105,327 |

| Short-Term Investments | 1 | 6,314 | — | 6,315 |

| Securities Lending Collateral | 1,792 | — | — | 1,792 |

| Options Purchased | — | 3 | — | 3 |

| Total Securities | 1,793 | 111,644 | — | 113,437 |

| Swaps* | — | 6 | — | 6 |

| Futures Contracts* | 5 | — | — | 5 |

| Total | $1,798 | $111,650 | $— | $113,448 |

| Liabilities | | | | |

| Forward Currency Exchange Contracts | $ — | $ 19 | $— | $ 19 |

| Futures Contracts* | 74 | — | — | 74 |

| Total | $ 74 | $ 19 | $— | $ 93 |

| 1 | Includes Asset-Backed Securities, Corporate Bonds, Foreign Government Obligations & Municipalities, Non-U.S. Government Mortgage-Backed Securities, U.S. Government & Agency Mortgage-Backed Securities and U.S. Government Agency Obligations (Excluding Mortgage-Backed). |

| * | The fair value presented includes cumulative gain (loss) on open futures contracts and centrally cleared swaps; however, the net value reflected on the accompanying Portfolio of Investments is only the unsettled variation margin receivable (payable) at that date. |

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

NOTE 3 – DERIVATIVE INSTRUMENTS

During the six months ended November 30, 2023, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes and may use them to establish both long and short positions within the fund’s portfolio. Potential uses include to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, to enhance return, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based.

The fund values its derivatives at fair value and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. Generally, the fund accounts for its derivatives on a gross basis. It does not offset the fair value of derivative liabilities against the fair value of derivative assets on its financial statements, nor does it offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. The following table summarizes the fair value of the fund’s derivative instruments held as of November 30, 2023, and the related location on the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| ($000s) | Location on Statement of

Assets and Liabilities | Fair Value |

| Assets | | |

| Interest rate derivatives | Futures* | $ 5 |

| Credit derivatives | Centrally cleared swaps* and Securities^ | 9 |

| Total | | $14 |

| Liabilities | | |

| Interest rate derivatives | Futures* | $74 |

| Foreign exchange derivatives | Forwards | 19 |

| Total | | $93 |

| | |

| * | The fair value presented includes cumulative gain (loss) on open futures contracts and centrally cleared swaps; however, the value reflected on the accompanying Statement of Assets and Liabilities is only the unsettled variation margin receivable (payable) at that date. |

| ^ | Options purchased are reported as securities. |

Additionally, the amount of gains and losses on derivative instruments recognized in fund earnings during the six months ended November 30, 2023, and the related location on the accompanying Statement of Operations is summarized in the following table by primary underlying risk exposure:

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

| ($000s) | Location of Gain (Loss) on Statement of Operations |

| | Securities^ | Options

Written | Futures | Forward

Currency

Exchange

Contracts | Swaps | Total |

| Realized Gain (Loss) | | | | | | |

| Interest rate derivatives | $(1) | $(14) | $312 | $ — | $— | $ 297 |

| Foreign exchange derivatives | — | — | — | 52 | — | 52 |

| Credit derivatives | — | — | — | — | 2 | 2 |

| Total | $(1) | $(14) | $312 | $ 52 | $ 2 | $ 351 |

| Change in Unrealized Gain (Loss) | | | | | | |

| Interest rate derivatives | $ 1 | $ 3 | $ (79) | $ — | $— | $ (75) |

| Foreign exchange derivatives | — | — | — | (29) | — | (29) |

| Credit derivatives | (1) | — | — | — | 5 | 4 |

| Total | $ — | $ 3 | $ (79) | $(29) | $ 5 | $(100) |

| | |

| ^ | Options purchased are reported as securities and are reflected in the accompanying Portfolio of Investments. |

Counterparty Risk and Collateral

The fund invests in derivatives in various markets, which expose it to differing levels of counterparty risk. Counterparty risk on exchange-traded and centrally cleared derivative contracts, such as futures, exchange-traded options, and centrally cleared swaps, is minimal because the clearinghouse provides protection against counterparty defaults. For futures and centrally cleared swaps, the fund is required to deposit collateral in an amount specified by the clearinghouse and the clearing firm (margin requirement), and the margin requirement must be maintained over the life of the contract. Each clearinghouse and clearing firm, in its sole discretion, may adjust the margin requirements applicable to the fund.

T. ROWE PRICE ULTRA SHORT-TERM BOND ETF

Derivatives, such as non-cleared bilateral swaps, forward currency exchange contracts, and OTC options, that are transacted and settle directly with a counterparty (bilateral derivatives) may expose the fund to greater counterparty risk. To mitigate this risk, the fund has entered into master netting arrangements (MNAs) with certain counterparties that permit net settlement under specified conditions and, for certain counterparties, also require the exchange of collateral to cover mark-to-market exposure. MNAs may be in the form of International Swaps and Derivatives Association master agreements (ISDAs) or foreign exchange letter agreements (FX letters).

MNAs provide the ability to offset amounts the fund owes a counterparty against amounts the counterparty owes the fund (net settlement). Both ISDAs and FX letters generally allow termination of transactions and net settlement upon the occurrence of contractually specified events, such as failure to pay or bankruptcy. In addition, ISDAs specify other events, the occurrence of which would allow one of the parties to terminate. For example, a downgrade in credit rating of a counterparty below a specified rating would allow the fund to terminate, while a decline in the fund’s net assets of more than a specified percentage would allow the counterparty to terminate. Upon termination, all transactions with that counterparty would be liquidated and a net termination amount settled. ISDAs typically include collateral agreements whereas FX letters do not. Collateral requirements are determined daily based on the net aggregate unrealized gain or loss on all bilateral derivatives with a counterparty, subject to minimum transfer amounts that typically range from $100,000 to $250,000. Any additional collateral required due to changes in security values is typically transferred the next business day.