INVESTOR EVENT APRIL 22, 2021 Exhibit 99.1

Forward-Looking Statements and Disclaimers This presentation does not constitute or form part of any offer or invitation to purchase, otherwise acquire, issue, subscribe for, sell or otherwise dispose of any securities, nor any solicitation of any offer to purchase, otherwise acquire, issue, subscribe for, sell, or otherwise dispose of any securities. The release, publication or distribution of this presentation in certain jurisdictions may be restricted by law and therefore persons in such jurisdictions into which this presentation is released, published or distributed should inform themselves about and observe such restrictions. Certain statements in this presentation are forward-looking statements which are based on the Company’s expectations, intentions and projections regarding the Company’s future performance, anticipated events or trends and other matters that are not historical facts, including expectations regarding: (i) the Company’s 2021 outlook and guidance; (ii) the Company’s annual and long-term goals and targets and the path to achieving those goals and targets; (iii) the Company’s strategic priorities; (iv) the Company’s estimated revenue mix, both on a consolidated and a segment basis; (v) future revenue growth through organic growth and/or acquisitions and the drivers of that growth; (vi) future margin expansion opportunities, the Company’s initiatives to support that expansion and the path to achieving the Company’s margin target; (vii) the Company’s ability to grow inspection and services revenue and the impact of such growth on recurring revenue, margins and customer relationships; (viii) the Company’s recurring revenue opportunities and the impact of the Company’s diverse end markets and the regulatory-driven demand for its services; (ix) the Company’s ability to partner with well capitalized customers who have projects that continue to progress despite macro volatility; (x) segment growth opportunities as a result of potential increases in infrastructure spending; (xi) future margin expansion through reduced costs, performance improvements, disciplined project and customer selection, mix of work or other means; (xii) future earnings growth; (xiii) future debt levels and leverage; (xiv) the pipeline of incremental M&A targets, the Company’s M&A target criteria and the acquisition multiples; (xv) future cash flows, the creation and continuation of significant capacity for opportunistic M&A and the Company’s other intended uses of cash, including for share buybacks, and other working capital requirements; and (xvi) the Company’s ability to achieve its long-term value creation targets. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including: (i) economic conditions, competition and other risks that may affect the Company’s future performance, including the impacts of the COVID-19 pandemic on the Company’s business, markets, supply chain, customers and workforce, on the credit and financial markets, on the alignment of expenses and revenues and on the global economy generally; (ii) the ability to recognize the anticipated benefits of the Company’s acquisitions, including its ability to successfully integrate and make necessary capital investments to support additional acquisitions, and the Company’s ability to take advantage of strategic opportunities; (iii) changes in applicable laws or regulations; (iv) the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; (v) the trading price of the Company’s common stock, which may be positively or negatively impacted by market and economic conditions, including as a result of the COVID-19 pandemic, the availability of Company common stock, the Company’s financial performance or determinations following the date of this announcement to use the Company’s funds for other purposes; and (vi) other risks and uncertainties. Given these risks and uncertainties, prospective investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. BUILDING GREAT LEADERS®

Non-GAAP Financial Measures This presentation contains non-U.S. GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The Company uses certain non-U.S. GAAP financial measures that are included in this press release and the additional financial information both in explaining its results to shareholders and the investment community and in its internal evaluation and management of its businesses. The Company’s management believes that these non-U.S. GAAP financial measures and the information they provide are useful to investors since these measures (a) permit investors to view the Company’s performance using the same tools that management uses to evaluate the Company’s past performance, reportable business segments and prospects for future performance, (b) permit investors to compare the Company with its peers and (c) determine certain elements of management’s incentive compensation. Specifically: Earnings before interest, taxes, depreciation and amortization (“EBITDA”) is the measure of profitability used by management to manage its segments and, accordingly, in its segment reporting. The Company supplements the reporting of its consolidated financial information with certain non-U.S. GAAP financial measures, including EBITDA and adjusted EBITDA, which is defined as EBITDA excluding the impact of certain non-cash and other specifically identified items (“adjusted EBITDA”), and adjusted EBITDA margin. The Company believes these non-U.S. GAAP measures provide meaningful information and help investors understand the Company’s financial results and assess its prospects for future performance. The Company uses EBITDA and adjusted EBITDA to evaluate its performance, both internally and as compared with its peers, because it excludes certain items that may not be indicative of the Company’s core operating results. Consolidated EBITDA is calculated in a manner consistent with segment EBITDA, which is a measure of segment profitability. The Company’s management believes that adjusted EBITDA, which excludes business transformation and other expenses for the integration of acquired businesses, the impact and results of businesses classified as assets held-for-sale and businesses divested, and other events such as impairment charges, share-based compensation associated with prior ownership and the sale of APi Group, Inc. (the “APi Acquisition”), transaction and other costs related to acquisitions, amortization of intangible assets and depreciation remeasurements associated with acquisitions, net COVID-19 relief, and certain tax benefits from the APi Acquisition, is useful because it provides investors with a meaningful perspective on the current underlying performance of the Company’s core ongoing operations. The Company’s management believes that organic net revenues growth provides a consistent basis for year-over-year comparisons in net revenues as it excludes the impacts of material acquisitions, completed divestitures, and changes in foreign currency impacts. Foreign currency impacts represents the effect of foreign currency on current period reported net revenues and is calculated as the difference between current period net revenues by applying the prior year average monthly exchange rates to the current year local currency net revenues amounts (excluding acquisitions and divestitures). Adjusted net revenues is defined as net revenues excluding the impact and results of businesses classified as assets held-for-sale and businesses divested. The Company’s management believes that this measure is useful as a supplement to enable investors to compare period-over-period results on a more consistent basis without the effects of businesses classified as assets held-for-sale and businesses divested, which more meaningfully reflects the Company’s core ongoing operations and performance. The Company uses adjusted net revenues to evaluate its performance, both internally and as compared with its peers, because it excludes certain items that may not be indicative of the Company’s core operating results. BUILDING GREAT LEADERS®

Non-GAAP Financial Measures (Cont’d) The Company presents free cash flow, adjusted free cash flow and adjusted free cash flow conversion, which are liquidity measures used by management as factors in determining the amount of cash that is available for working capital needs or other uses of cash, however, it does not represent residual cash flows available for discretionary expenditures. Free cash flow is defined as cash provided by (used in) operating activities less capital expenditures. Adjusted free cash flow is defined as cash provided by (used in) operating activities plus or minus events including, but not limited to, transaction and other costs related to acquisitions, business transformation and other expenses for the integration of acquired businesses, impacts of businesses classified as assets held-for-sale and businesses divested, and one-time and other events such COVID related payroll tax deferral and relief items. Adjusted free cash flow conversion is defined as adjusted free cash flow as a percentage of adjusted EBITDA. The Company’s management believes that adjusted gross profit, adjusted selling, general and administrative (“SG&A”) expenses, adjusted net income and adjusted EPS, which all exclude business transformation and other expenses for the integration of acquired businesses, the impact and results of businesses classified as assets held-for-sale and businesses divested, and other events such as impairment charges, share-based compensation associated with prior ownership and the APi Acquisition, transaction and other costs related to acquisitions, amortization of intangible assets and depreciation remeasurements associated with acquisitions, net COVID-19 relief, and certain tax benefits from the APi Acquisition, is useful because it provides investors with a meaningful perspective on the current underlying performance of the Company’s core ongoing operations in each of those respective measures. The Company does not provide reconciliations of forward-looking non-U.S. GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for acquisitions and divestitures, business transformation and other expenses for the integration of acquired businesses, one-time and other events such as impairment charges, transaction and other costs related to acquisitions, amortization of intangible assets, net COVID-19 relief, and certain tax benefits from the APi Acquisition, and other charges reflected in the Company’s reconciliation of historic numbers, the amount of which, based on historical experience, could be significant. While the Company believes these non-U.S. GAAP measures are useful in evaluating the Company’s performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with U.S. GAAP. Additionally, these non-U.S. GAAP financial measures may differ from similar measures presented by other companies. A reconciliation of these historical non-U.S. GAAP financial measures is included later in this presentation. BUILDING GREAT LEADERS®

BUILDING GREAT LEADERS® PRESENTERS Welcome Remarks Sir Martin E. Franklin James E. Lillie Russ Becker

Agenda BUILDING GREAT LEADERS® SECTION PRESENTERS Welcome Remarks Russ Becker CEO and President Sir Martin E. Franklin Co-Chair, Board of Directors James E. Lillie Co-Chair, Board of Directors Who We Are and the Path Forward Russ Becker CEO and President Driving Margin Expansion Building Great Leaders Paul Grunau Chief Learning Officer Velma Korbel Chief Diversity, Equity, and Inclusion Officer Safety Services Jeff Daane Safety Services Segment Leader Specialty Services Joe Walsh Specialty Services Segment Leader Industrial Services Russ Becker CEO and President Disciplined Project and Customer Selection Russ Becker CEO and President Growing Inspection and Service Revenue Courtney Brogard Vice President of Inspection Sales Leverage SG&A / COGS Tom Lydon Chief Financial Officer Integration Kristin Schultes Vice President of Integration Growth through M&A Russ Becker CEO and President Sir Martin E. Franklin Co-Chair, Board of Directors James E. Lillie Co-Chair, Board of Directors Financial Perspective & Investment Opportunity Tom Lydon Chief Financial Officer James E. Lillie Co-Chair, Board of Directors Q&A All

Today’s Presenters Kristin Schultes Vice President of Integration Tom Lydon Chief Financial Officer Russ Becker CEO and President Jeff Daane Safety Services Segment Leader Paul Grunau Chief Learning Officer Sir Martin E. Franklin Co-Chair, Board of Directors Velma Korbel Chief Diversity, Equity, and Inclusion Officer James E. Lillie Co-Chair, Board of Directors Courtney Brogard Vice President of Inspection Sales Joe Walsh Specialty Services Segment Leader

Key Investment Criteria OUR GOAL TODAY To demonstrate and reinforce the drivers that will deliver consistent, profitable growth for our shareholders A leader in each of the niche industries we serve Strong free cash flow generation Strong leadership team with proven track record Services-focused business model that is well diversified across end markets, customers and projects A culture of leadership centered on our people is key to our success A protective moat around the business

BUILDING GREAT LEADERS® Who We Are Russ Becker PRESENTER

Who We Are We are a market-leading business services provider of safety, specialty and industrial services We provide statutorily mandated services and other contracting services to a strong base of long-standing customers across industries, primarily in north America and with an expanding platform in Europe We have a winning leadership culture driven by entrepreneurial business leaders to deliver innovative solutions for our customers

Our Culture OUR VALUES OUR PURPOSE THE RESULTS + Safety, heath and well-being of all our leaders Caring and enduring relationships with others Honesty and integrity Excellence, nothing less Joy in our work and in each other Combining individual company agilities with large company advantages Shareholder Value Creation Who We Are

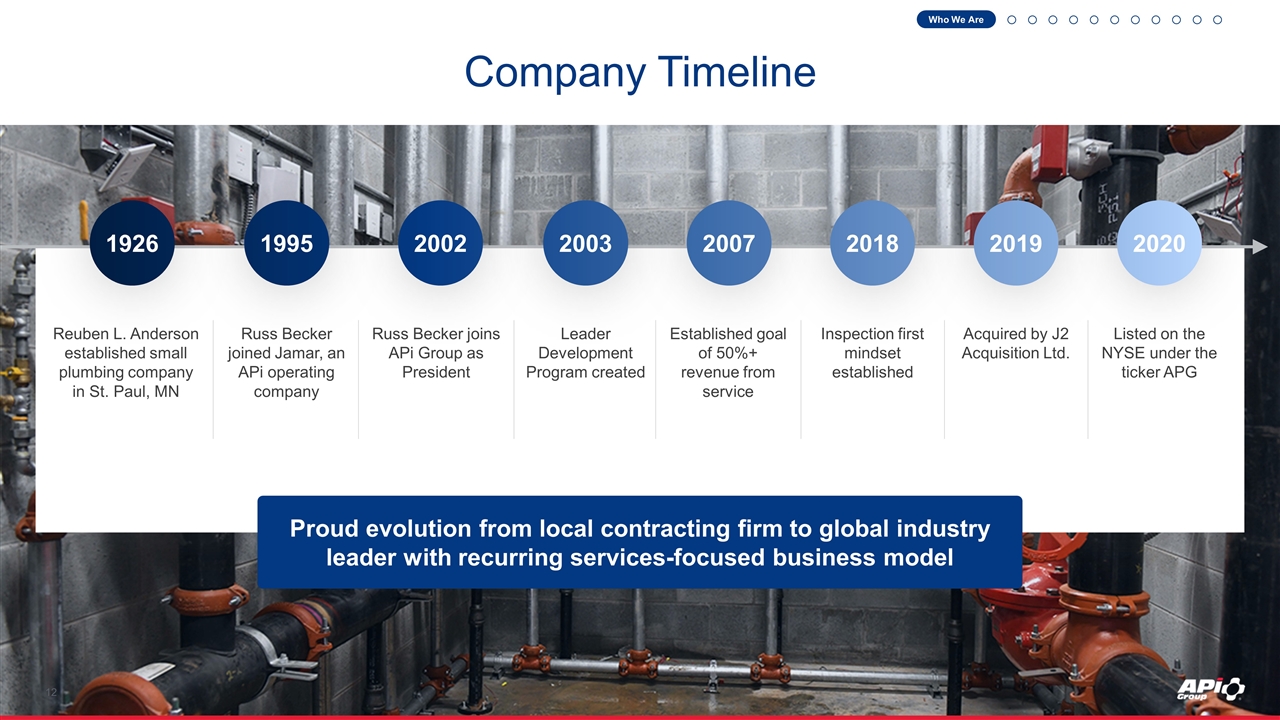

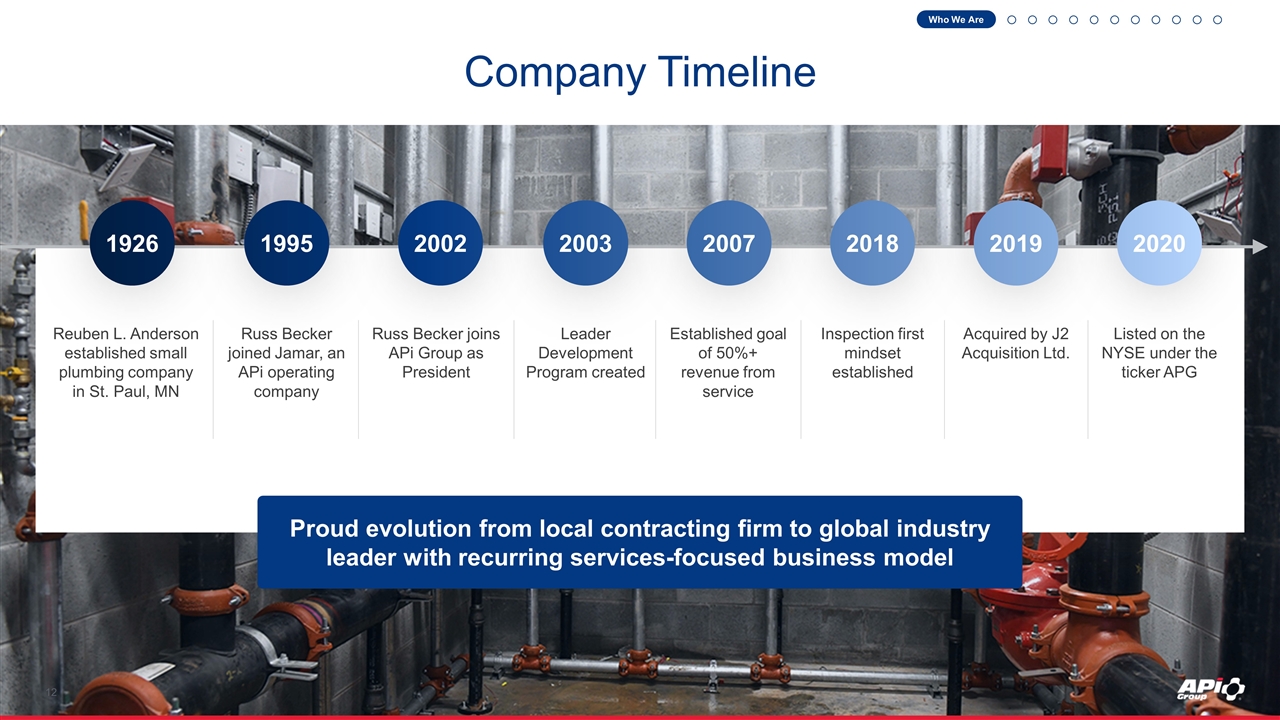

Proud evolution from local contracting firm to global industry leader with recurring services-focused business model Reuben L. Anderson established small plumbing company in St. Paul, MN Established goal of 50%+ revenue from service Acquired by J2 Acquisition Ltd. Listed on the NYSE under the ticker APG Russ Becker joined Jamar, an APi operating company Leader Development Program created Inspection first mindset established 1926 2007 2019 2020 1995 2003 2018 2002 Russ Becker joins APi Group as President Who We Are Company Timeline

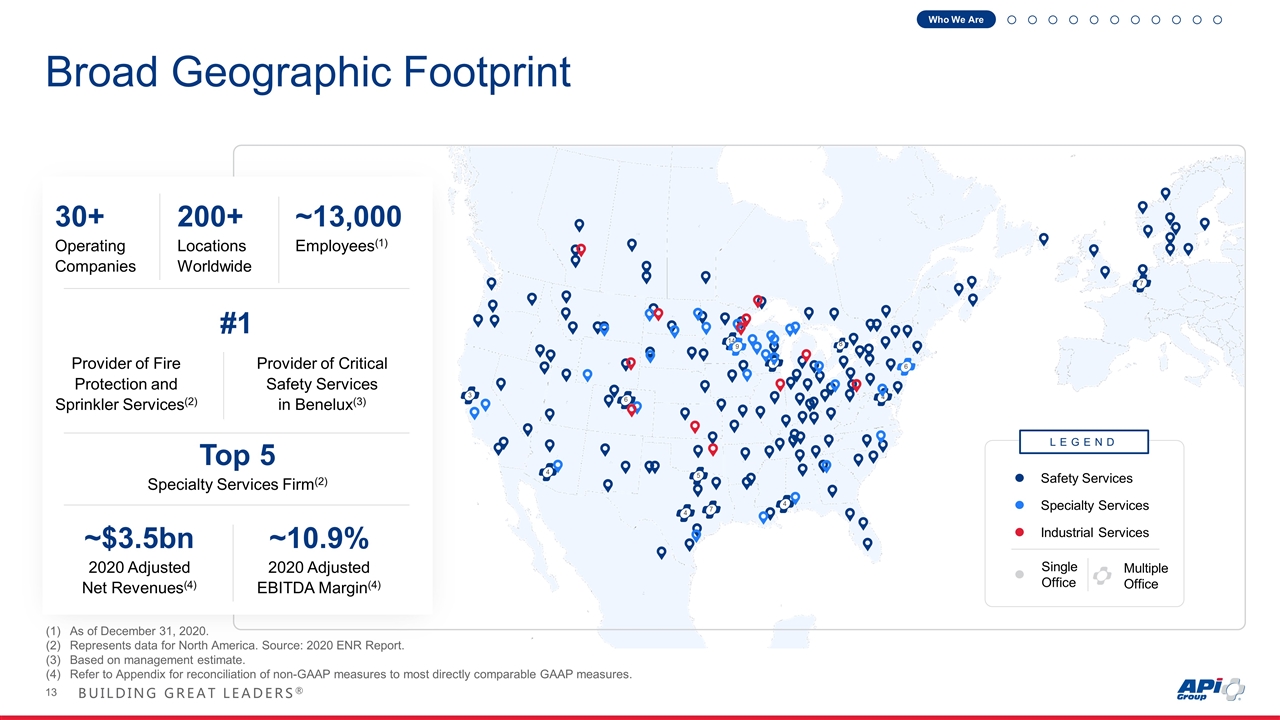

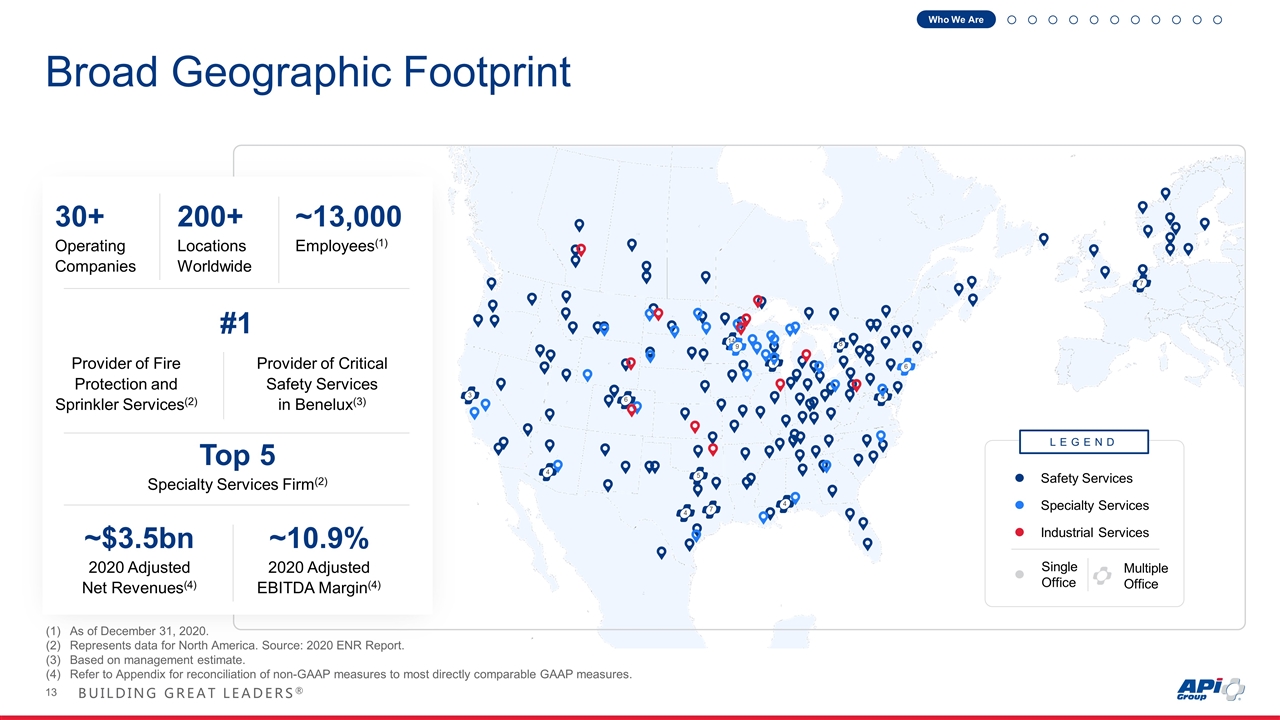

Broad Geographic Footprint 3 6 14 4 4 4 5 4 7 4 7 8 6 9 As of December 31, 2020. Represents data for North America. Source: 2020 ENR Report. Based on management estimate. Refer to Appendix for reconciliation of non-GAAP measures to most directly comparable GAAP measures. Who We Are Top 5 Specialty Services Firm(2) 200+ Locations Worldwide 30+ Operating Companies ~13,000 Employees(1) #1 Provider of Fire Protection and Sprinkler Services(2) ~$3.5bn 2020 Adjusted Net Revenues(4) ~10.9% 2020 Adjusted EBITDA Margin(4) Provider of Critical Safety Services in Benelux(3) LEGEND Safety Services Specialty Services Industrial Services Single Office Multiple Office

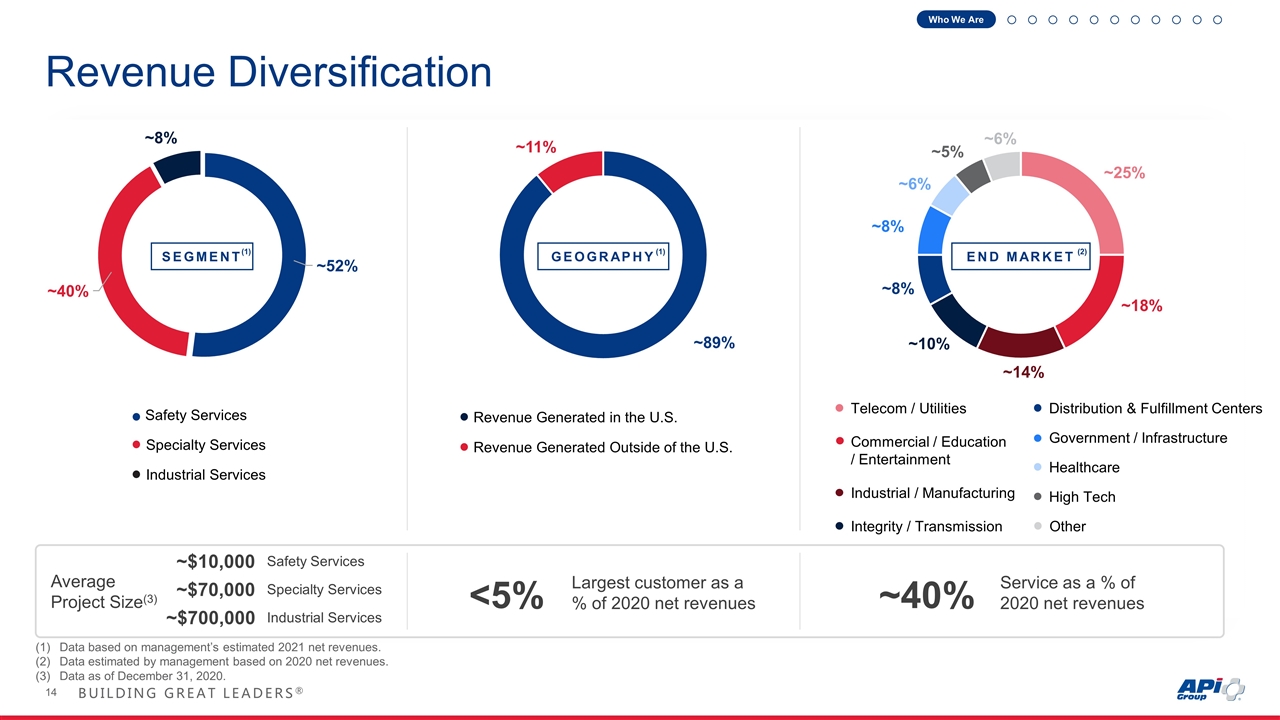

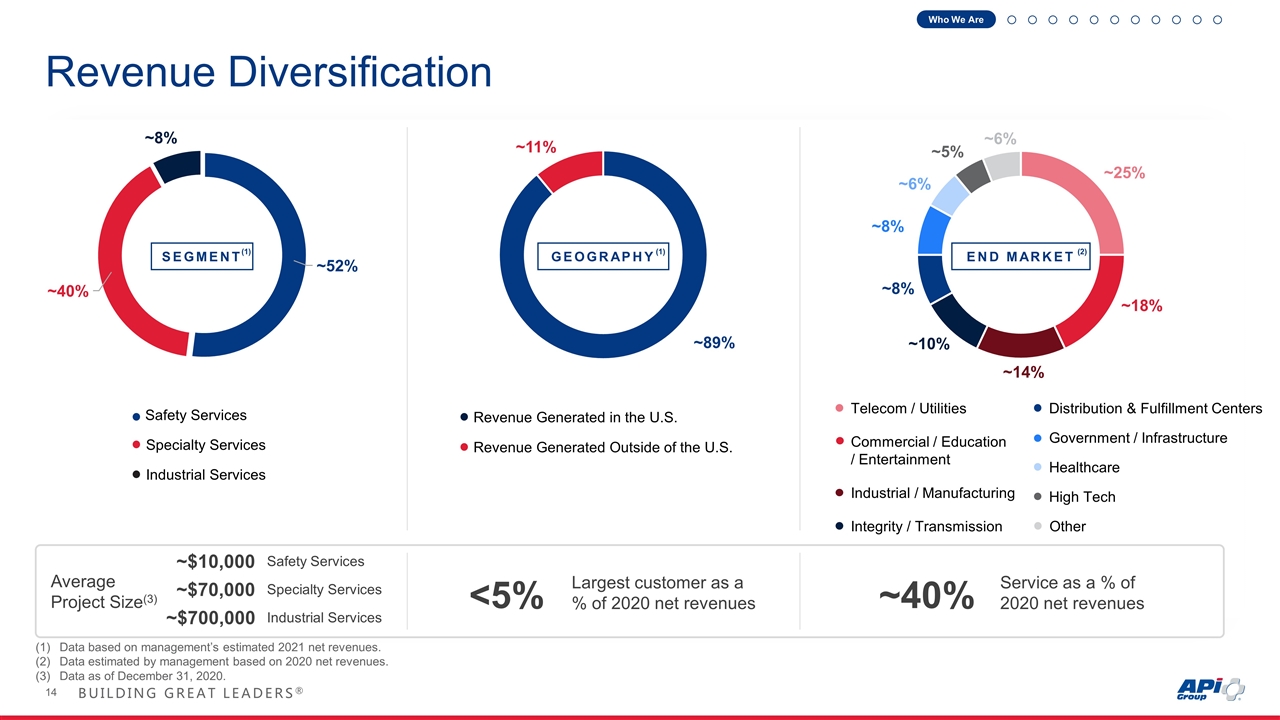

Who We Are Segment Breakdown Revenue Diversification Industrial Services Specialty Services Safety Services SEGMENT Revenue Generated Outside of the U.S. Revenue Generated in the U.S. GEOGRAPHY Average Project Size(3) ~89% ~40% Service as a % of 2020 net revenues <5% Largest customer as a % of 2020 net revenues END MARKET Other Commercial / Education / Entertainment Telecom / Utilities High Tech Integrity / Transmission Government / Infrastructure Distribution & Fulfillment Centers Industrial / Manufacturing Healthcare ~5% ~18% ~14% ~10% ~8% ~$10,000 Safety Services ~$700,000 Industrial Services ~$70,000 Specialty Services Data based on management’s estimated 2021 net revenues. Data estimated by management based on 2020 net revenues. Data as of December 31, 2020. (1) (1) (2) (1)

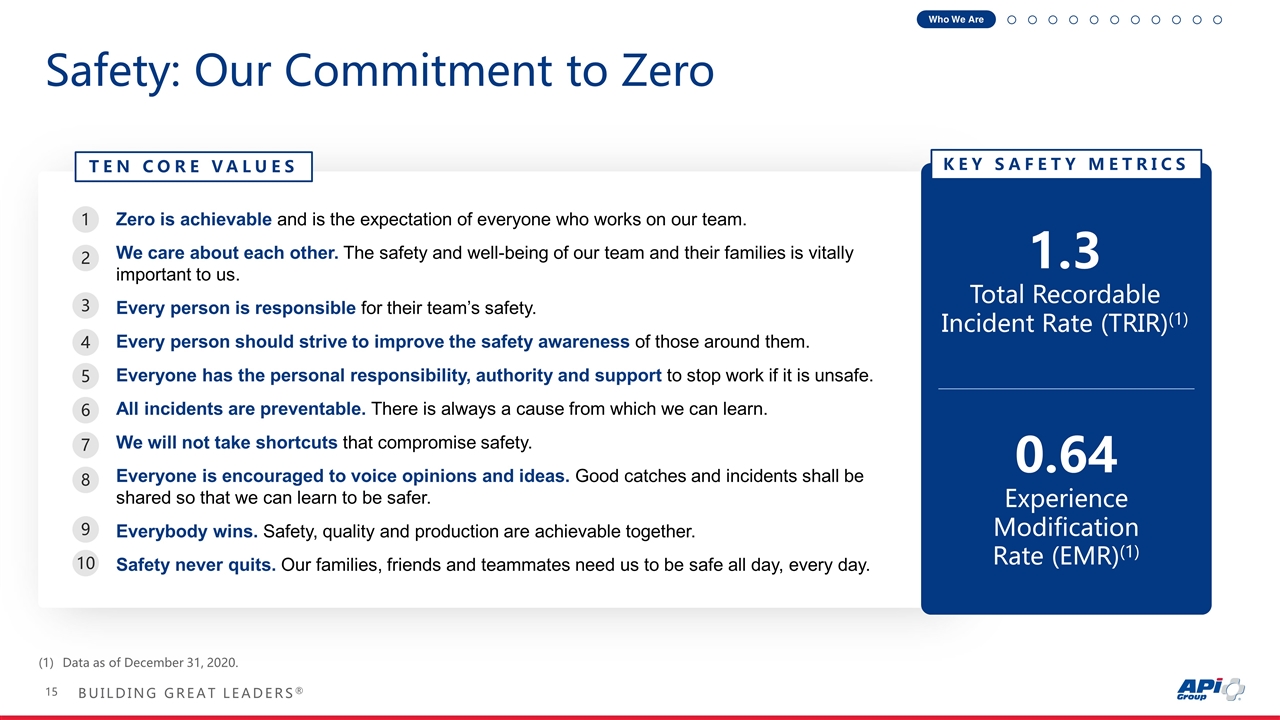

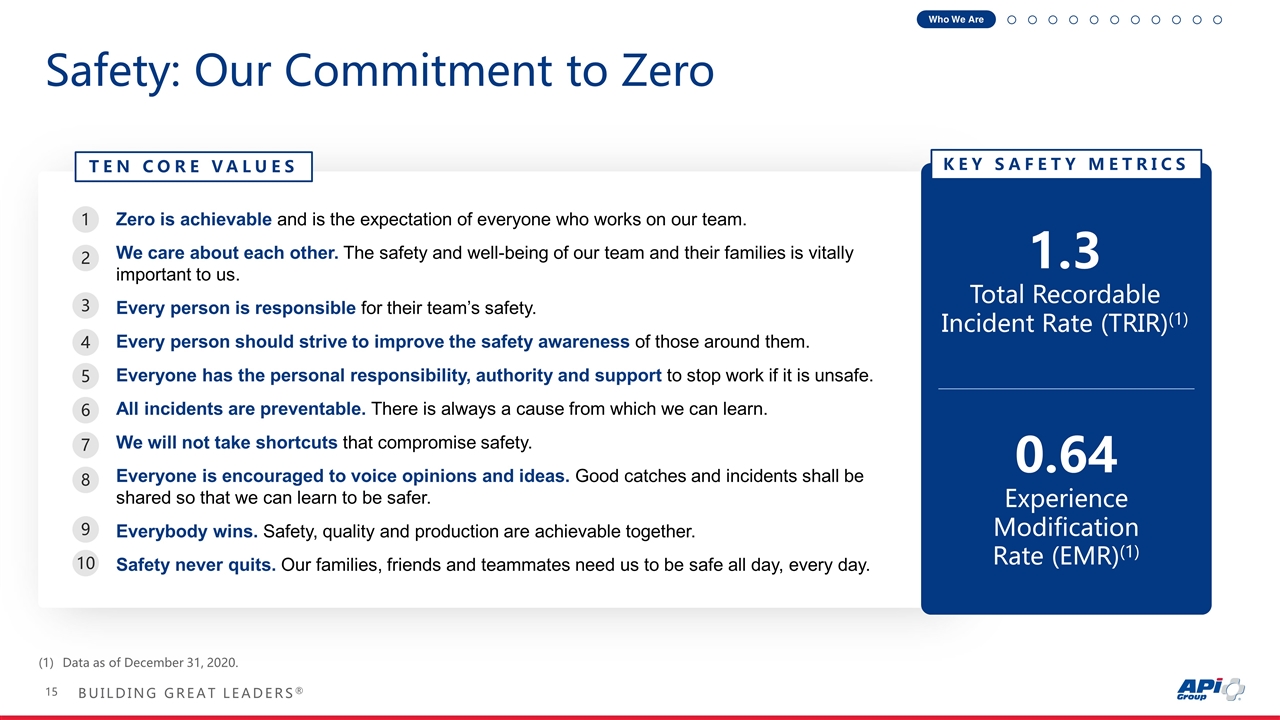

Safety: Our Commitment to Zero 1.3 Total Recordable Incident Rate (TRIR)(1) 0.64 Experience Modification Rate (EMR)(1) Key SAFETY Metrics Who We Are Ten Core Values Zero is achievable and is the expectation of everyone who works on our team. We care about each other. The safety and well-being of our team and their families is vitally important to us. Every person is responsible for their team’s safety. Every person should strive to improve the safety awareness of those around them. Everyone has the personal responsibility, authority and support to stop work if it is unsafe. All incidents are preventable. There is always a cause from which we can learn. We will not take shortcuts that compromise safety. Everyone is encouraged to voice opinions and ideas. Good catches and incidents shall be shared so that we can learn to be safer. Everybody wins. Safety, quality and production are achievable together. Safety never quits. Our families, friends and teammates need us to be safe all day, every day. 1 2 3 4 5 6 7 8 9 10 Data as of December 31, 2020.

The Path Forward BUILDING GREAT LEADERS® PRESENTER Russ Becker

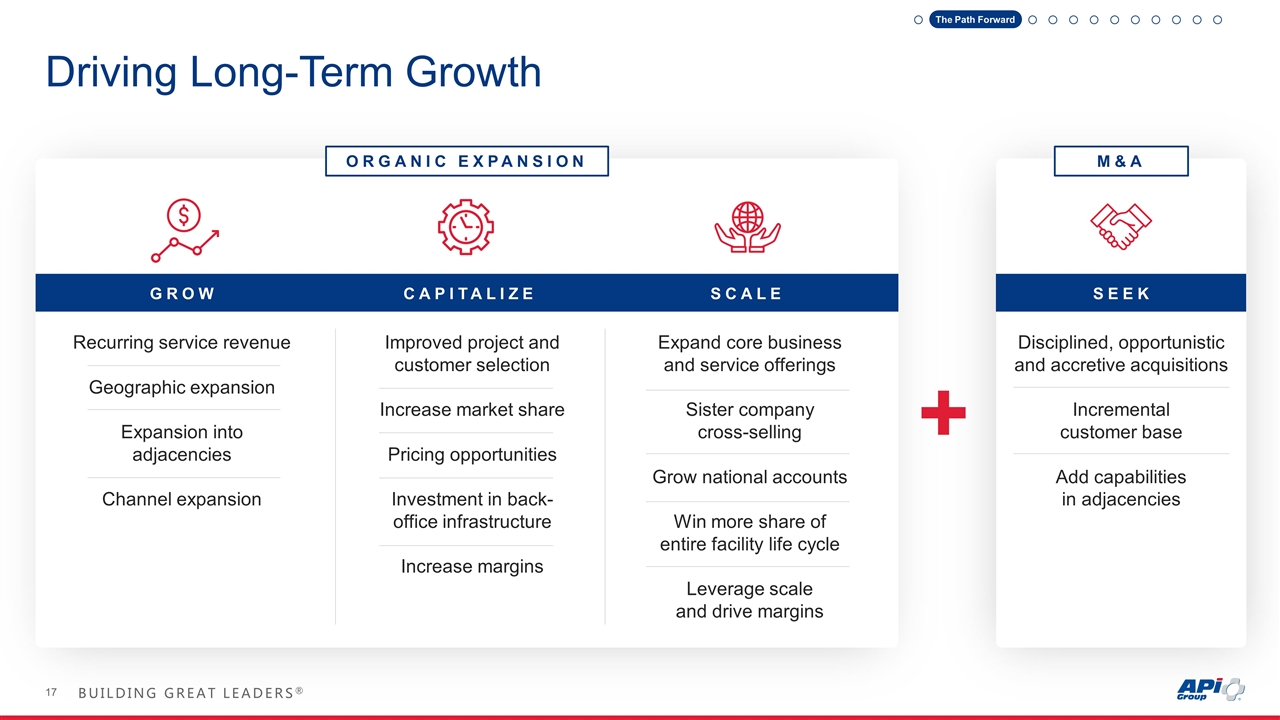

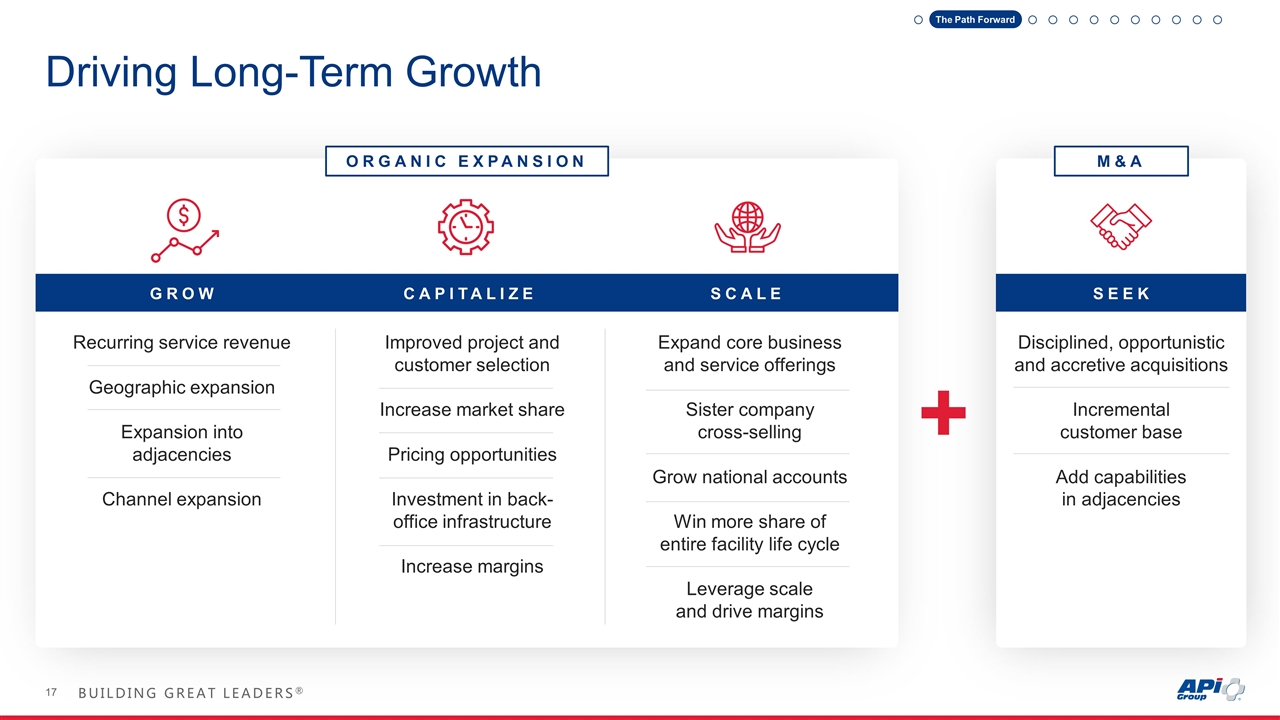

Driving Long-Term Growth + GROW Recurring service revenue Geographic expansion Expansion into adjacencies Channel expansion CAPITALIZE Improved project and customer selection Increase market share Pricing opportunities Investment in back-office infrastructure Increase margins SCALE Expand core business and service offerings Sister company cross-selling Grow national accounts Win more share of entire facility life cycle Leverage scale and drive margins SEEK Disciplined, opportunistic and accretive acquisitions Incremental customer base Add capabilities in adjacencies ORGANIC EXPANSION M&A The Path Forward

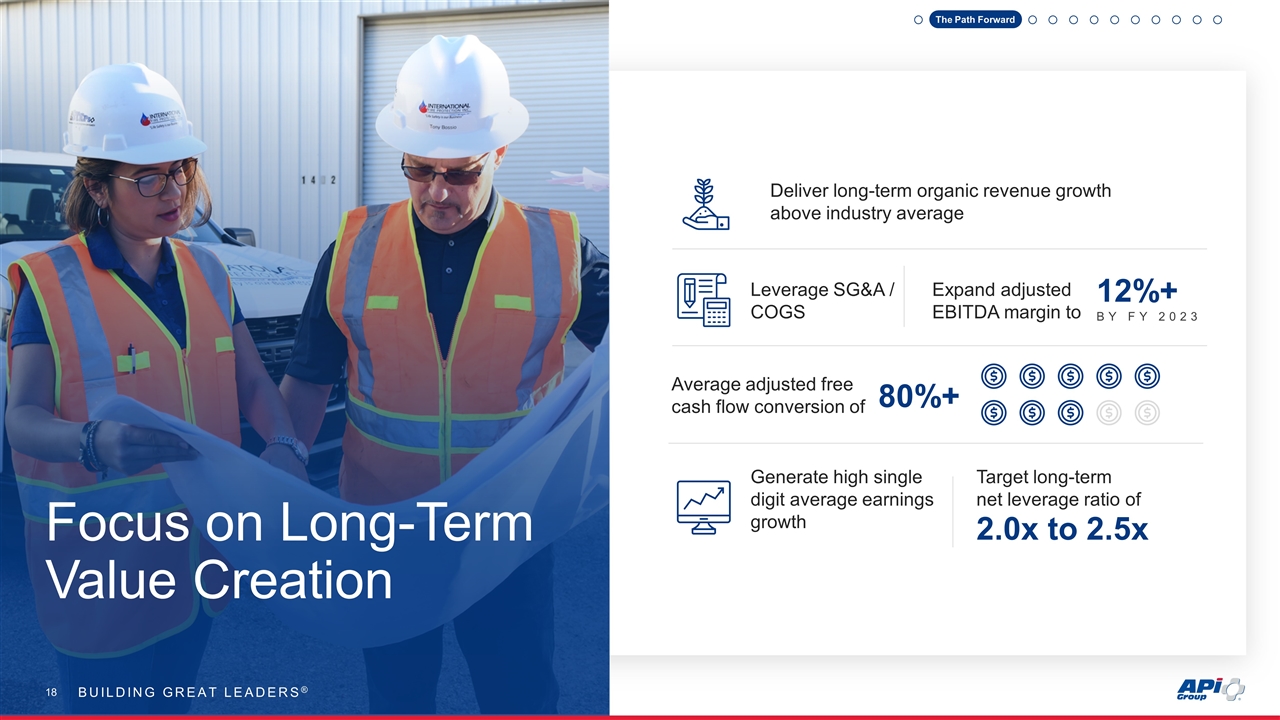

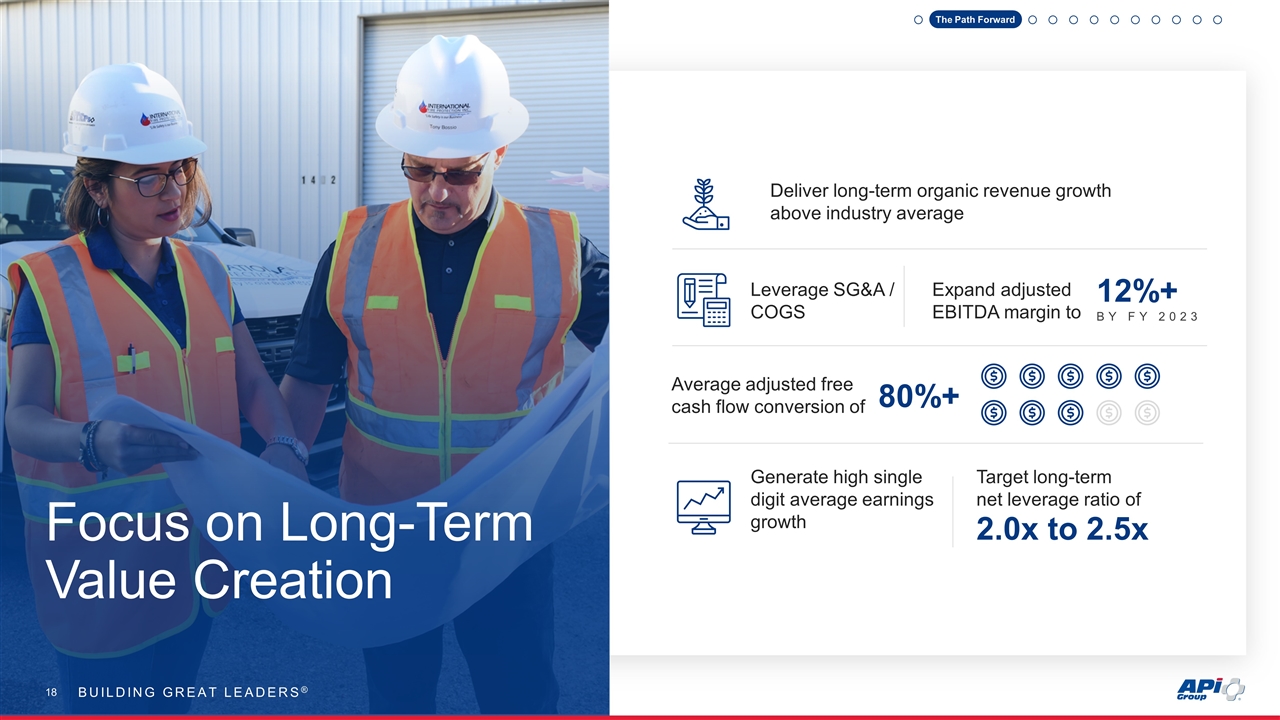

Deliver long-term organic revenue growth above industry average Leverage SG&A / COGS Expand adjusted EBITDA margin to 12%+ BY FY 2023 Average adjusted free cash flow conversion of 80%+ Generate high single digit average earnings growth 2.0x to 2.5x Target long-term net leverage ratio of Focus on Long-Term Value Creation BUILDING GREAT LEADERS® The Path Forward

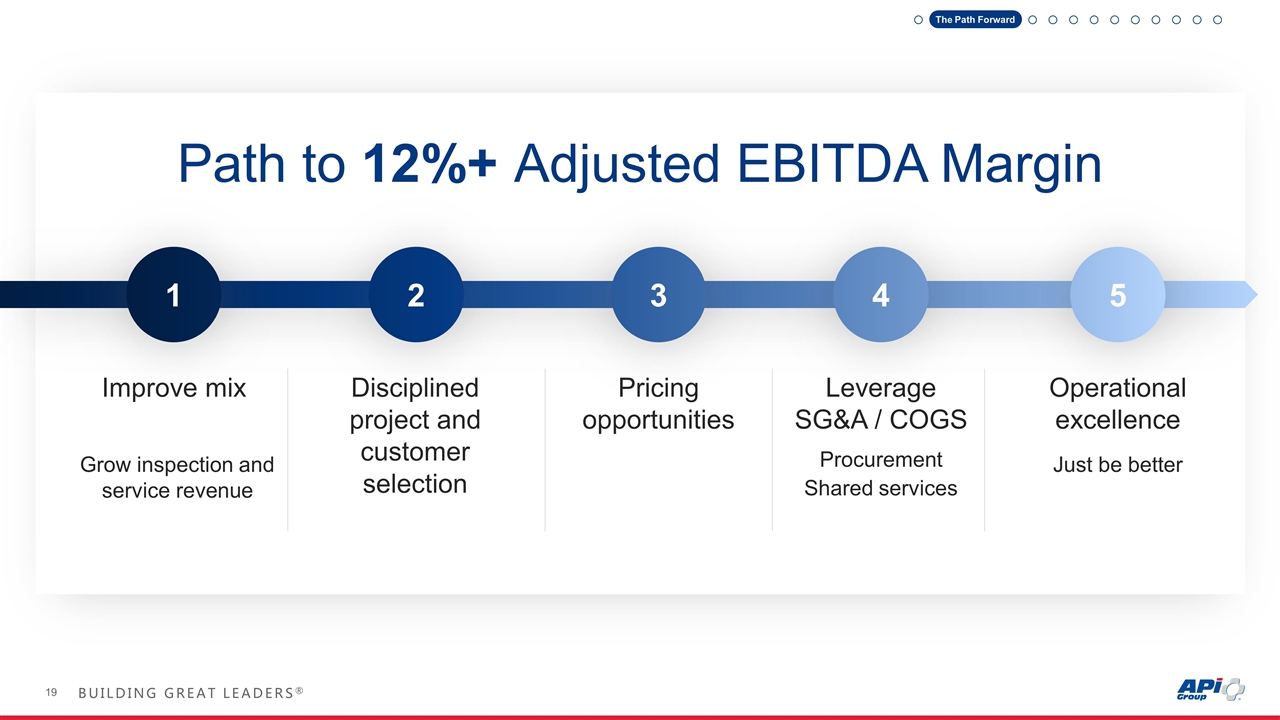

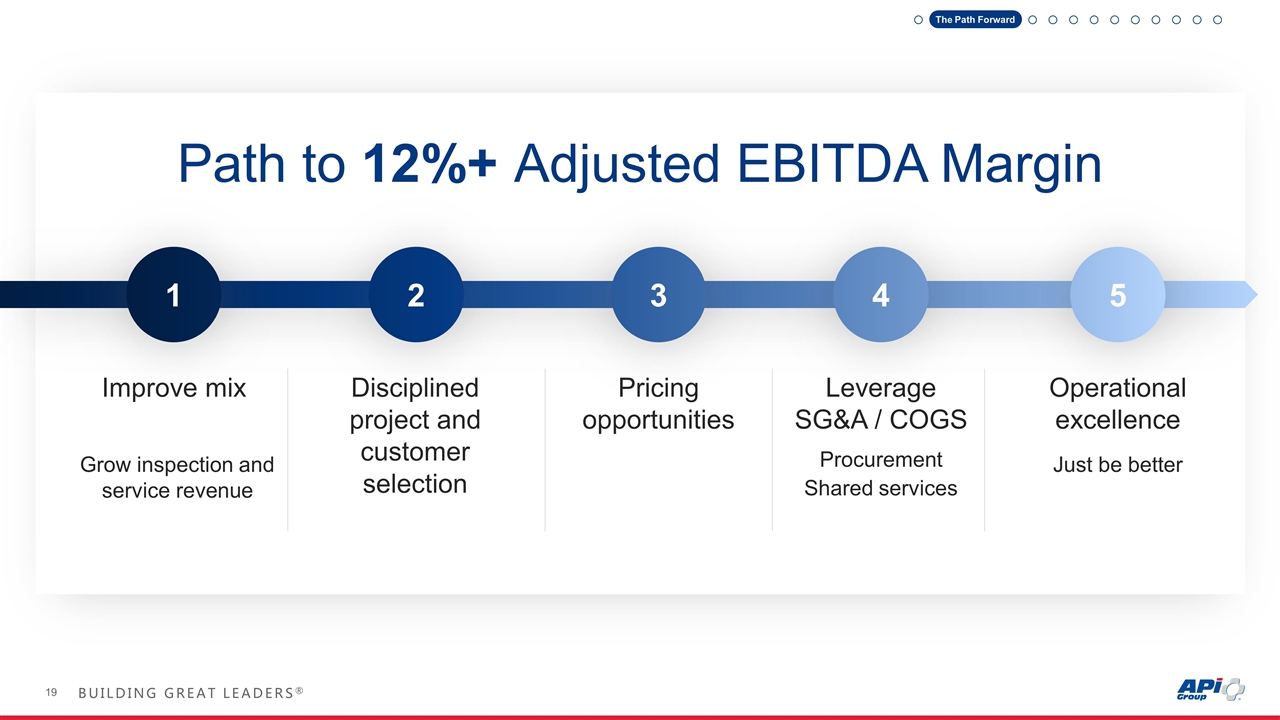

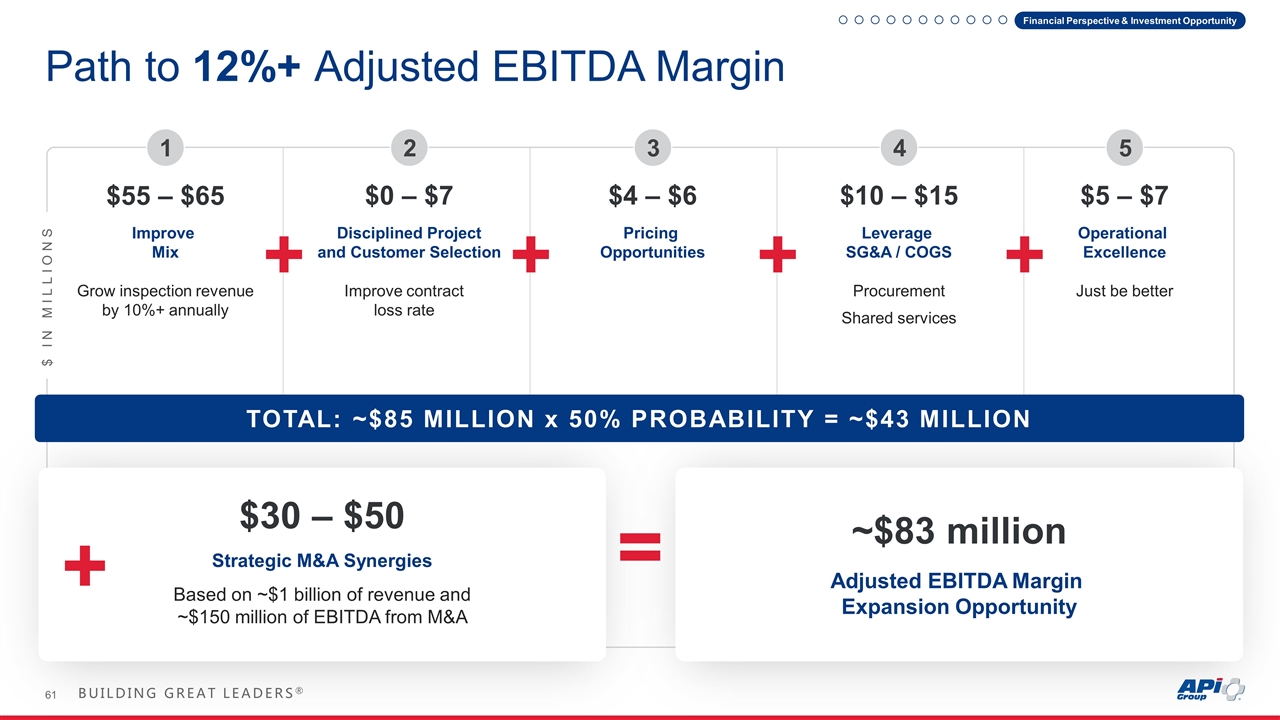

Improve mix Grow inspection and service revenue Disciplined project and customer selection Leverage SG&A / COGS Procurement Shared services Pricing opportunities Operational excellence Just be better 1 2 4 3 5 Path to 12%+ Adjusted EBITDA Margin The Path Forward

Driving Margin Expansion BUILDING GREAT LEADERS® PRESENTERS PRESENTERS Russ Becker Jeff Daane Kristin Schultes Tom Lydon Joe Walsh Paul Grunau Velma Korbel

Driving Margin Expansion: Building Great Leaders BUILDING GREAT LEADERS® PRESENTERS Paul Grunau Velma Korbel

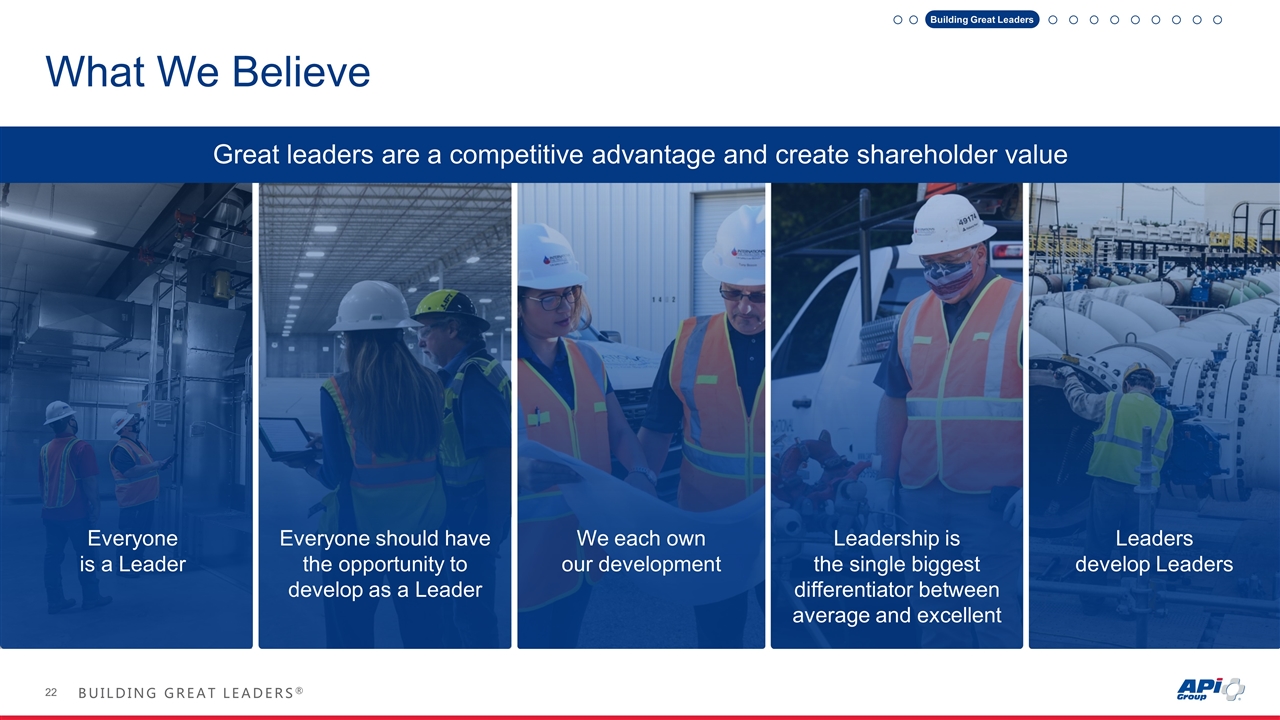

What We Believe Great leaders are a competitive advantage and create shareholder value We each own our development Leadership is the single biggest differentiator between average and excellent Leaders develop Leaders Building Great Leaders Everyone is a Leader Everyone should have the opportunity to develop as a Leader

Best-in-Class Leadership Development Accelerated Readiness Program (“ARP”) Field Leader Development Additional Leadership Opportunities Executive coaching Leadership compass Learning management system Succession development EQI, DISC, and 360 assessments, debriefs and workshops Field Leader Day Field Leaders Sent to FMI Field Leadership Institute Since 2014 FMI Field Leader Institute 650+ Attendees of One-Day Leading Self Program ~2,500 Inclusive access to online learning technology 20-month cohort program to accelerate the readiness of individuals to successfully lead business units, branch offices, or large departments within operating companies and APi Group ~$25 – $30 million Spend on Leadership Development Over the Last Five Years Building Great Leaders

LEADERSHIP BLUEPRINT LEADING SELF LEADING TEAMS AND BUSINESSES LEADING OTHERS Building Great Leaders

Building Great Leaders Talent Acquisition & Retention Cross-functional leadership development platform designed to enable independent company leadership, cultivate broad management skills, enhance organizational flexibility, and empower the next cohort of leaders across our businesses Seven rotations at individual operating companies over a 12-month period Values and culture at APi have long been influenced by our leadership’s respect and reverence for the values of the military Veteran’s Rotational Program (VRP) Designed to assist veterans in their transition to a civilian job with one of our operating companies Four rotations at operating companies over the course of a year ~450 Average Number of Veterans Hired Annually Over the Past Three Years Leader Development Program Veteran Hiring Initiatives DIVERSITY, EQUITY AND INCLUSION Fostering an environment where everyone feels welcomed, included and valued Driving workforce diversity Expanding leadership competencies to include cultural fluency

BUILDING GREAT LEADERS® PRESENTER Jeff Daane Driving Margin Expansion: Safety Services

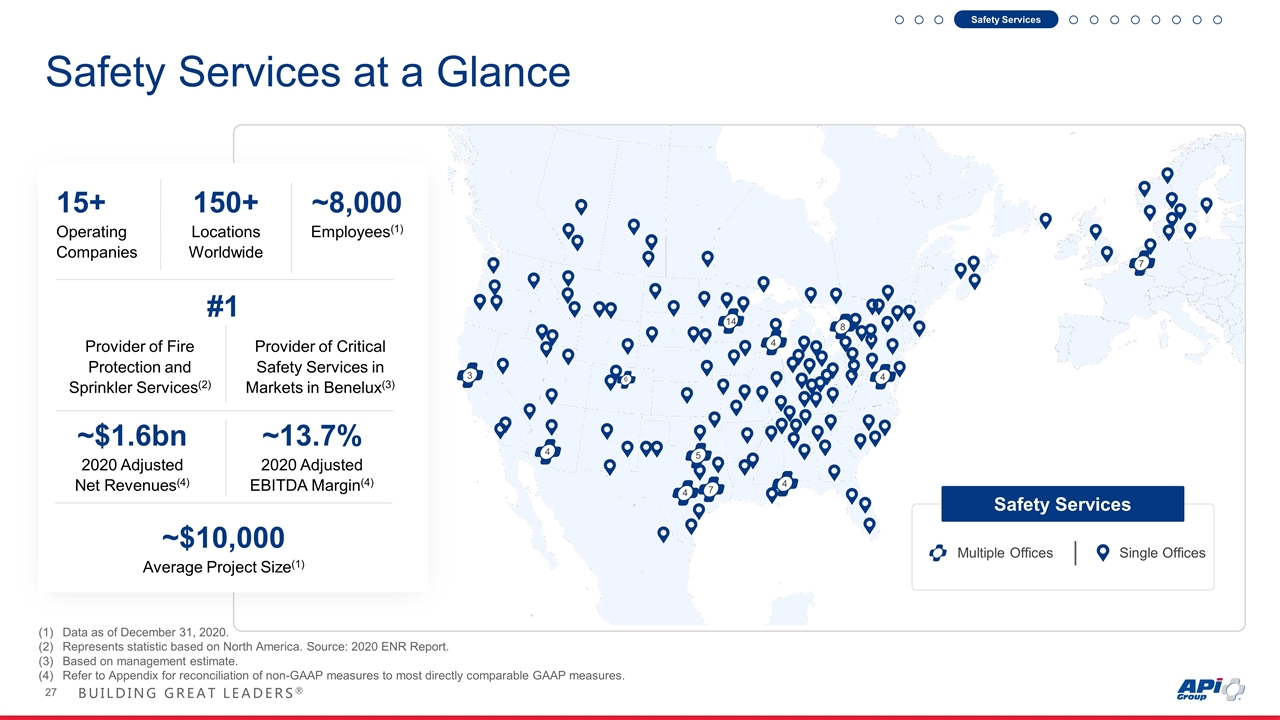

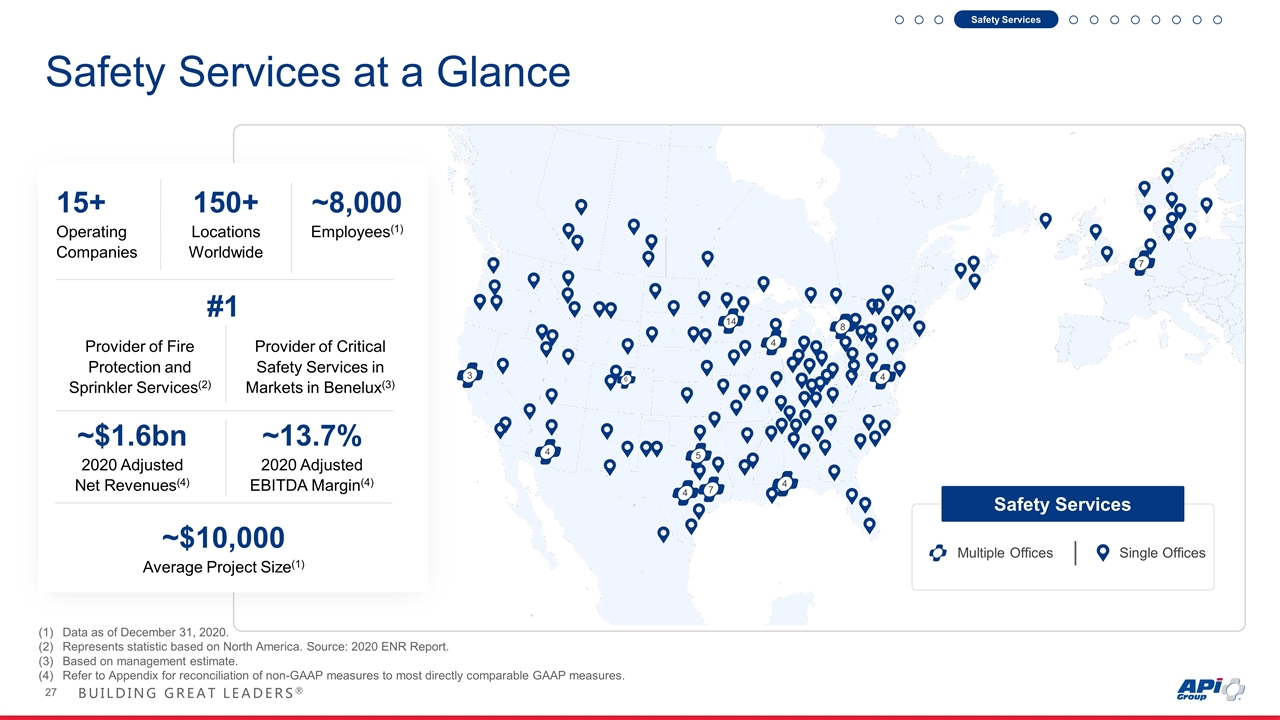

Safety Services at a Glance 3 6 Safety Services Multiple Offices Single Offices 14 4 4 8 4 5 4 7 4 7 3 #1 150+ Locations Worldwide 15+ Operating Companies ~8,000 Employees(1) ~$10,000 Average Project Size(1) Safety Services Data as of December 31, 2020. Represents statistic based on North America. Source: 2020 ENR Report. Based on management estimate. Refer to Appendix for reconciliation of non-GAAP measures to most directly comparable GAAP measures. Provider of Fire Protection and Sprinkler Services(2) Provider of Critical Safety Services in Markets in Benelux(3) ~$1.6bn 2020 Adjusted Net Revenues(4) ~13.7% 2020 Adjusted EBITDA Margin(4)

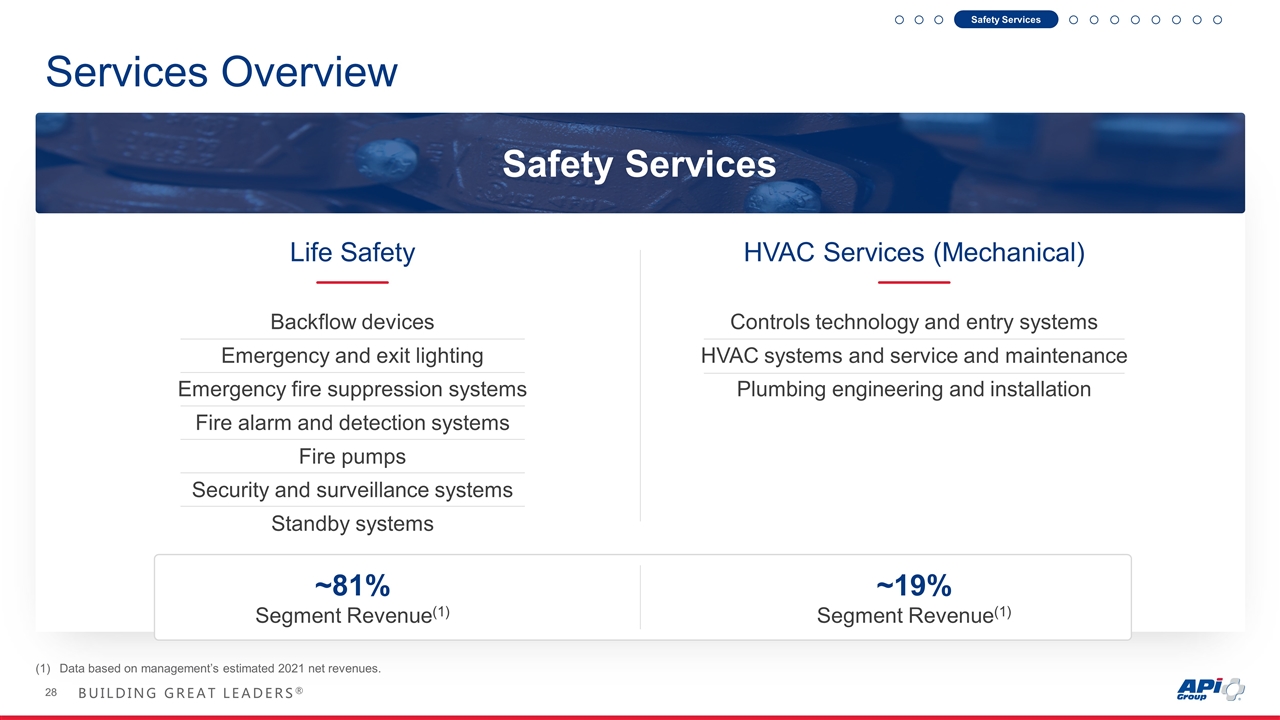

Services Overview Life Safety Backflow devices Emergency and exit lighting Emergency fire suppression systems Fire alarm and detection systems Fire pumps Security and surveillance systems Standby systems HVAC Services (Mechanical) Controls technology and entry systems HVAC systems and service and maintenance Plumbing engineering and installation ~81% Segment Revenue(1) ~19% Segment Revenue(1) Safety Services Safety Services Data based on management’s estimated 2021 net revenues.

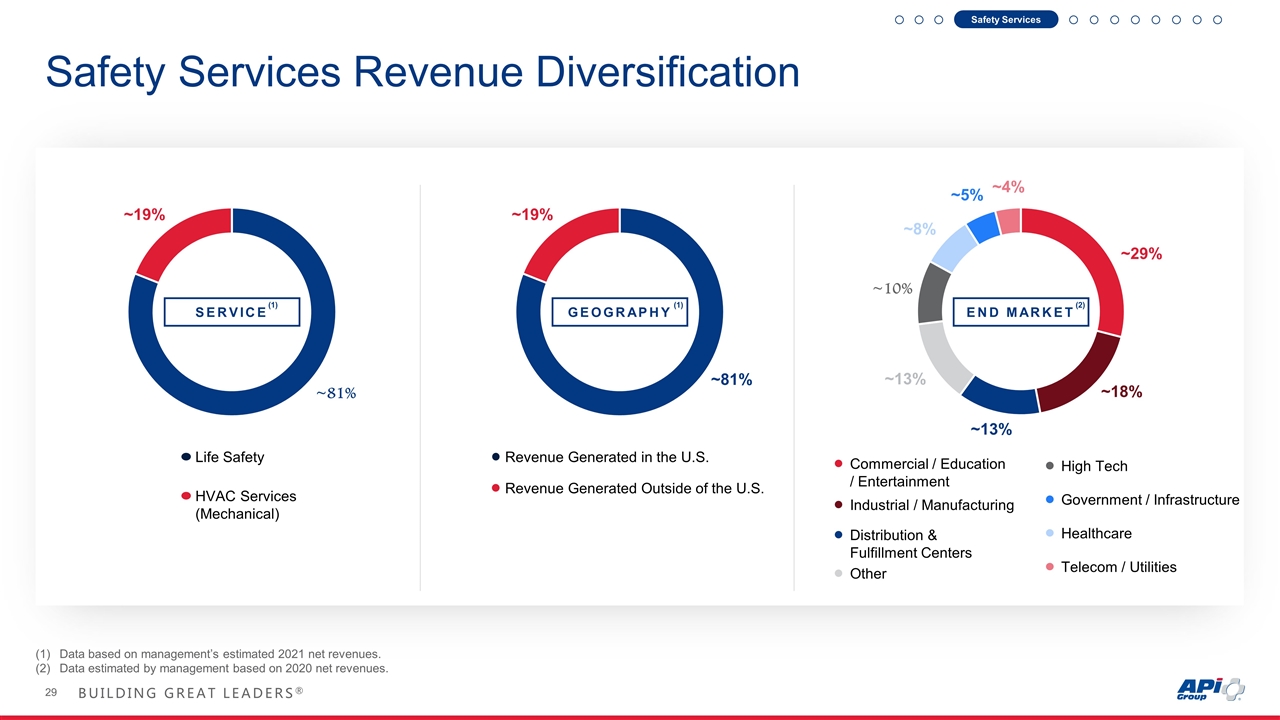

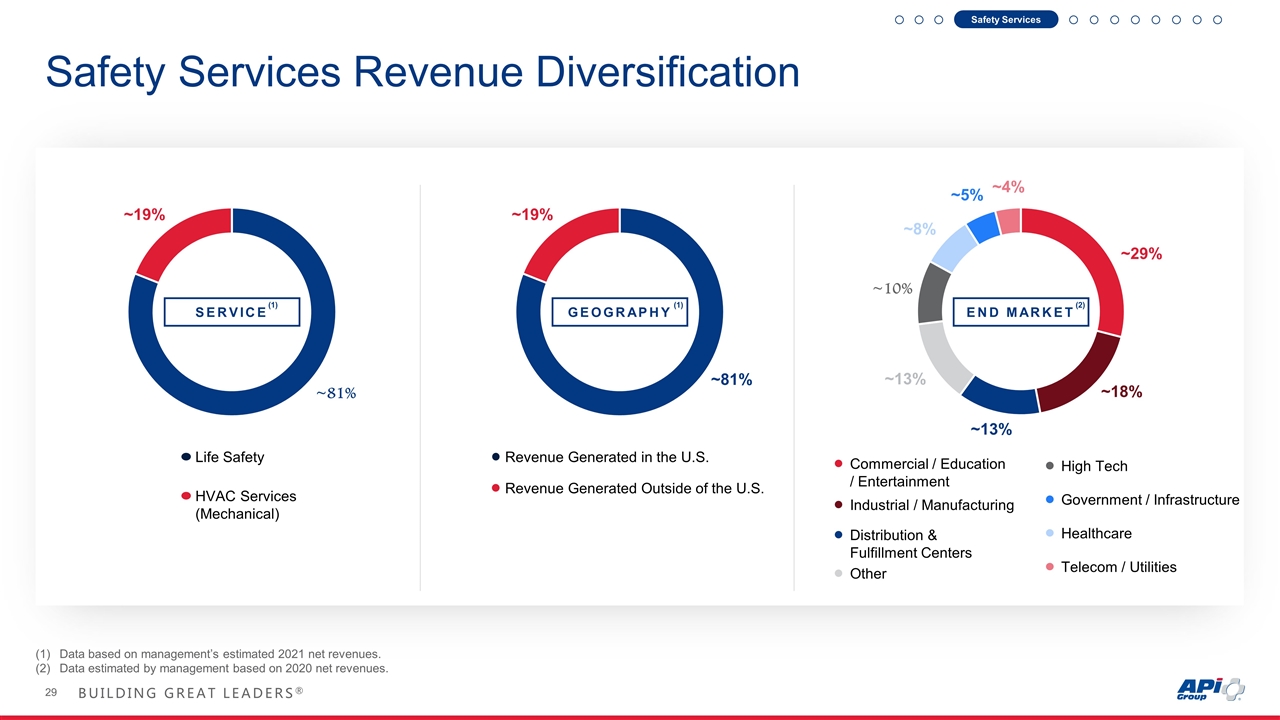

Safety Services Safety Services Revenue Diversification SERVICE HVAC Services (Mechanical) Life Safety Revenue Generated Outside of the U.S. Revenue Generated in the U.S. ~29% ~18% ~13% ~13% ~8% ~5% ~4% GEOGRAPHY END MARKET Data based on management’s estimated 2021 net revenues. Data estimated by management based on 2020 net revenues. Other Commercial / Education / Entertainment Telecom / Utilities High Tech Government / Infrastructure Distribution & Fulfillment Centers Industrial / Manufacturing Healthcare (1) (1) (2)

12%+: Strategic Priorities / Growth Drivers Increasing Share with Existing Customers $4.4 – $7.5 MARGIN EXPANSION OPPORTUNITIES GROWTH DRIVERS EXAMPLE Defibrillator Services AEDs found in public settings throughout the U.S. ~3.2mm Total number of AEDs required if rapid defibrillation is going to be available to large number of people experiencing sudden cardiac arrest ~10% Safety Services Grow inspection and service revenue Disciplined project and customer selection Increase cross-selling opportunities Pricing opportunities Leverage SG&A / COGS Capitalize on back-office and branch location synergies Procurement Mandated building codes and inspections and maintenance requirements Increasing system complexity driven by variations in building design Expand cross selling service offerings (e.g. AEDs, monitoring, security) HVAC COVID-driven opportunities Expand national accounts Source: Readiness Systems. (1) (1)

PRESENTER BUILDING GREAT LEADERS® Joe Walsh Driving Margin Expansion: Specialty Services

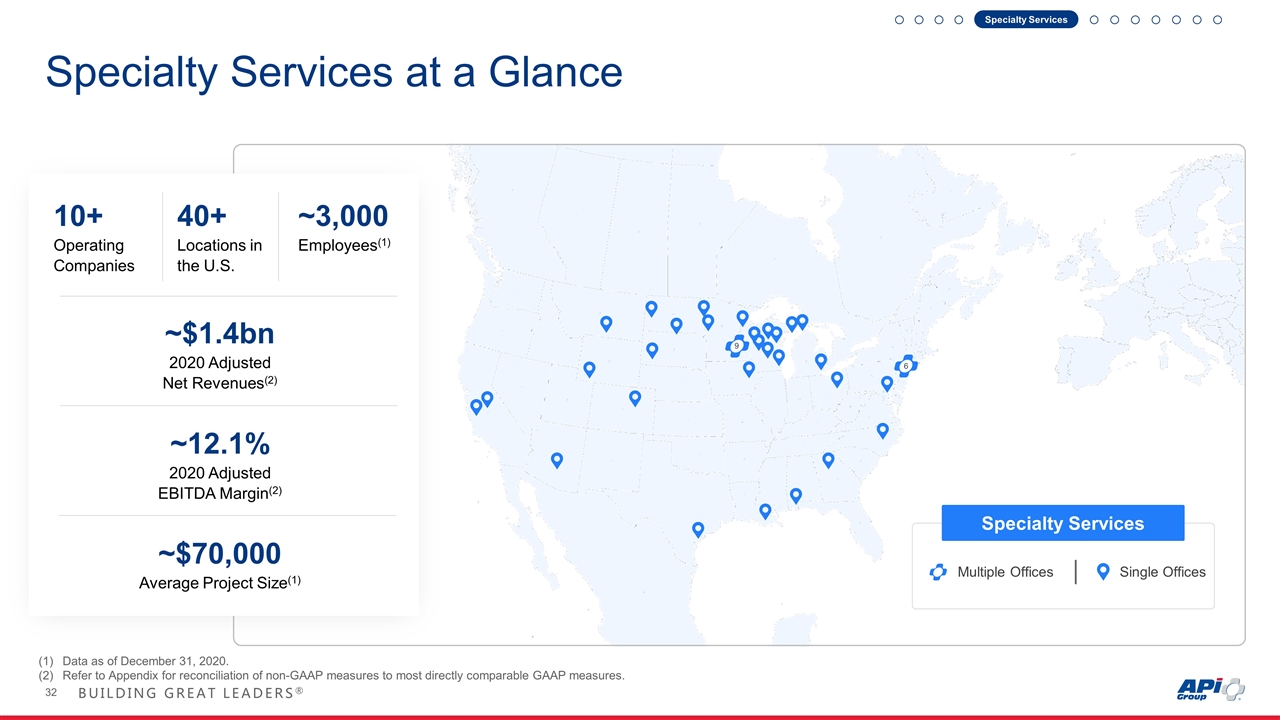

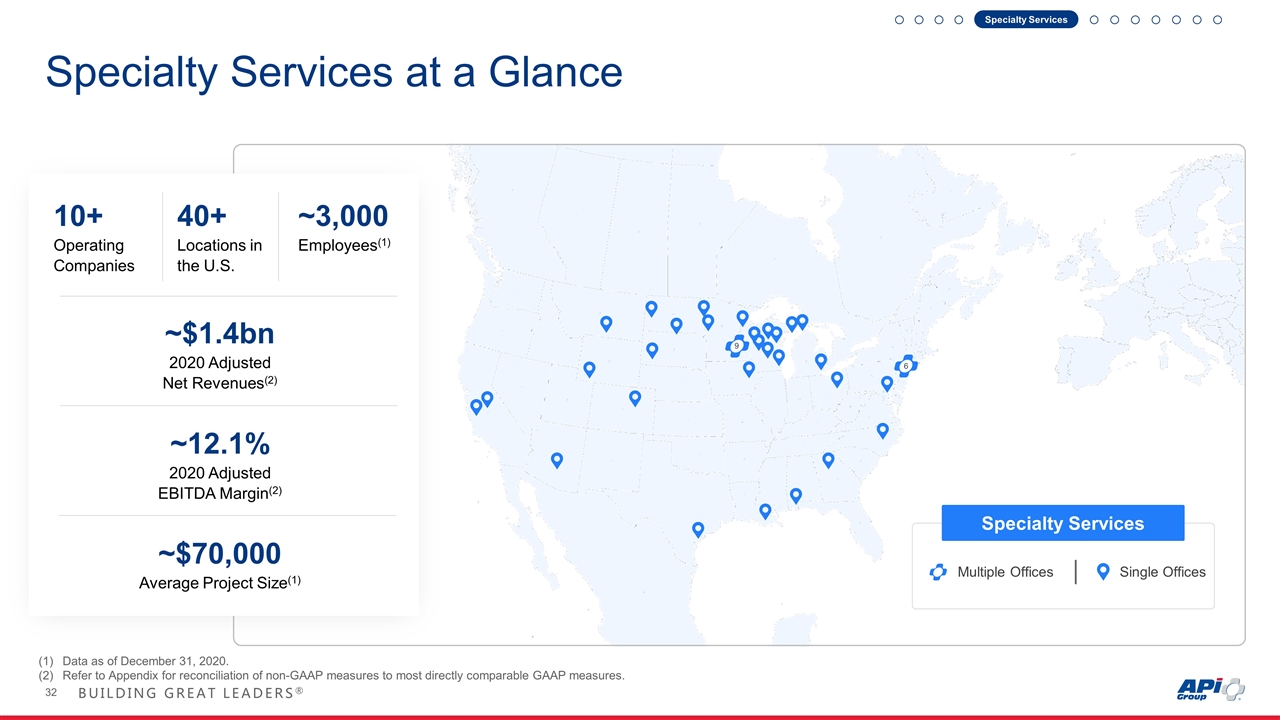

Specialty Services at a Glance 6 9 Specialty Services Multiple Offices Single Offices 40+ Locations in the U.S. 10+ Operating Companies ~3,000 Employees(1) ~$70,000 Average Project Size(1) Specialty Services ~$1.4bn 2020 Adjusted Net Revenues(2) ~12.1% 2020 Adjusted EBITDA Margin(2) Data as of December 31, 2020. Refer to Appendix for reconciliation of non-GAAP measures to most directly comparable GAAP measures.

Specialty Services Services Overview Specialty Services Infrastructure / Utility Electric and gas utility maintenance Fiber optic and cellular system installation and maintenance including 5G Natural gas line distribution services Underground electrical, transmission line and fiber optic cable installation Water line and sewer installation Fabrication Structural fabrication and erection Specialty Contracting Insulation, ventilation, and temperature control Plant maintenance and outage services Specialty industrial and commercial ductwork ~57% Segment Revenue(1) ~31% Segment Revenue(1) ~12% Segment Revenue(1) Data based on management’s estimated 2021 net revenues.

Specialty Services Revenue Diversification Specialty Contracting Fabrication Infrastructure / Utility Revenue Generated in the U.S. ~13% ~10% ~8% ~5% ~4% ~2% Data based on management’s estimated 2021 net revenues. Data estimated by management based on 2020 net revenues. Other Commercial / Education / Entertainment Telecom / Utilities High Tech Government / Infrastructure Distribution & Fulfillment Centers Industrial / Manufacturing Healthcare Specialty Services SERVICE GEOGRAPHY END MARKET (1) (1) (2)

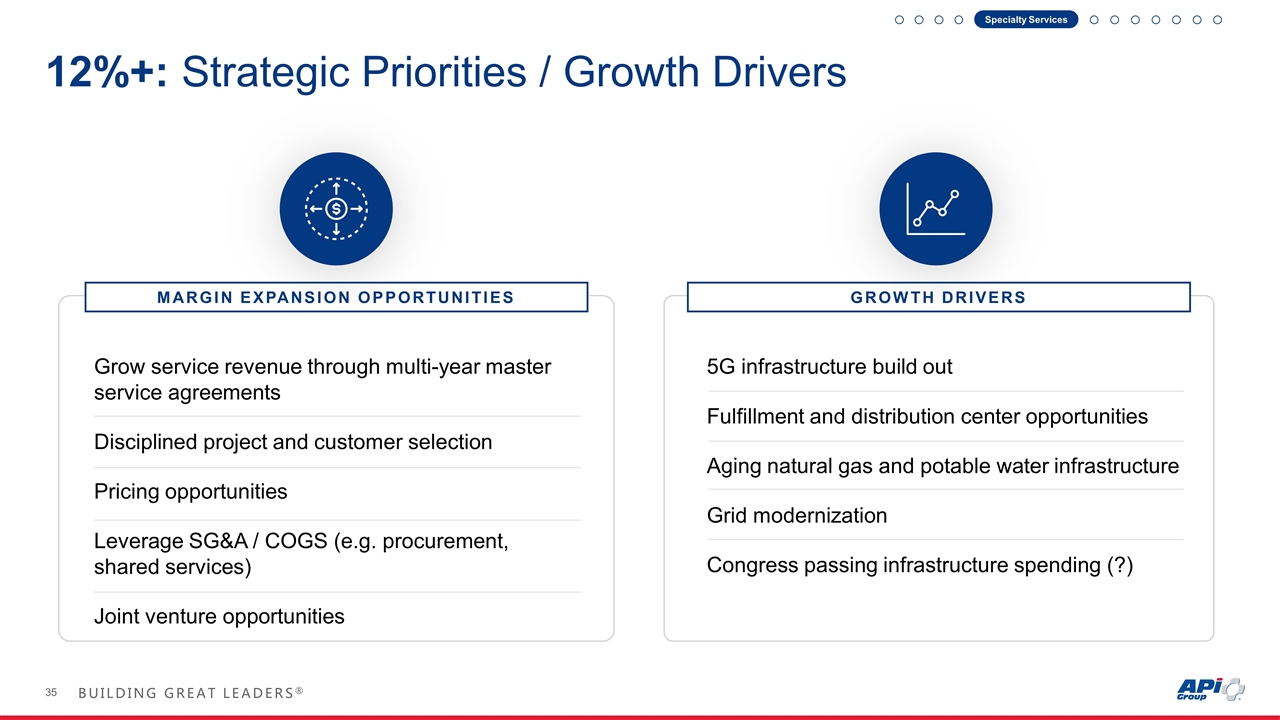

Specialty Services 12%+: Strategic Priorities / Growth Drivers MARGIN EXPANSION OPPORTUNITIES GROWTH DRIVERS Grow service revenue through multi-year master service agreements Disciplined project and customer selection Pricing opportunities Leverage SG&A / COGS (e.g. procurement, shared services) Joint venture opportunities 5G infrastructure build out Fulfillment and distribution center opportunities Aging natural gas and potable water infrastructure Grid modernization Congress passing infrastructure spending (?)

BUILDING GREAT LEADERS® PRESENTER Russ Becker Driving Margin Expansion: Industrial Services

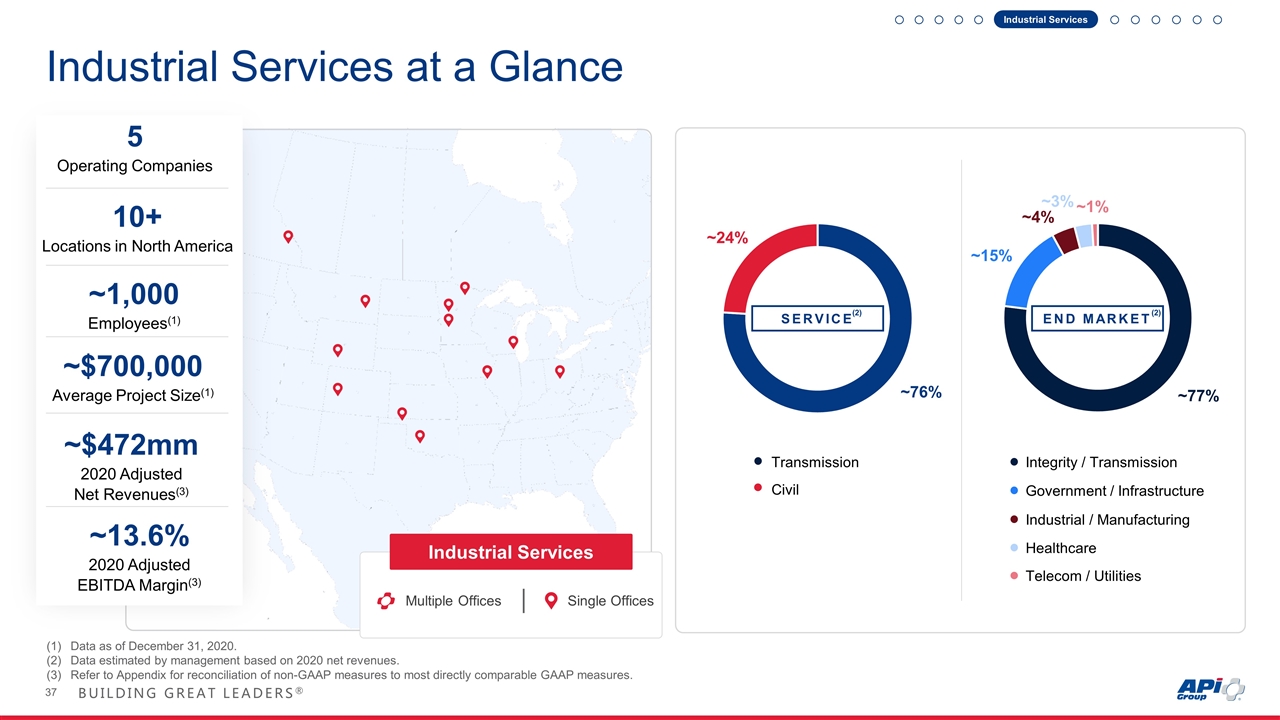

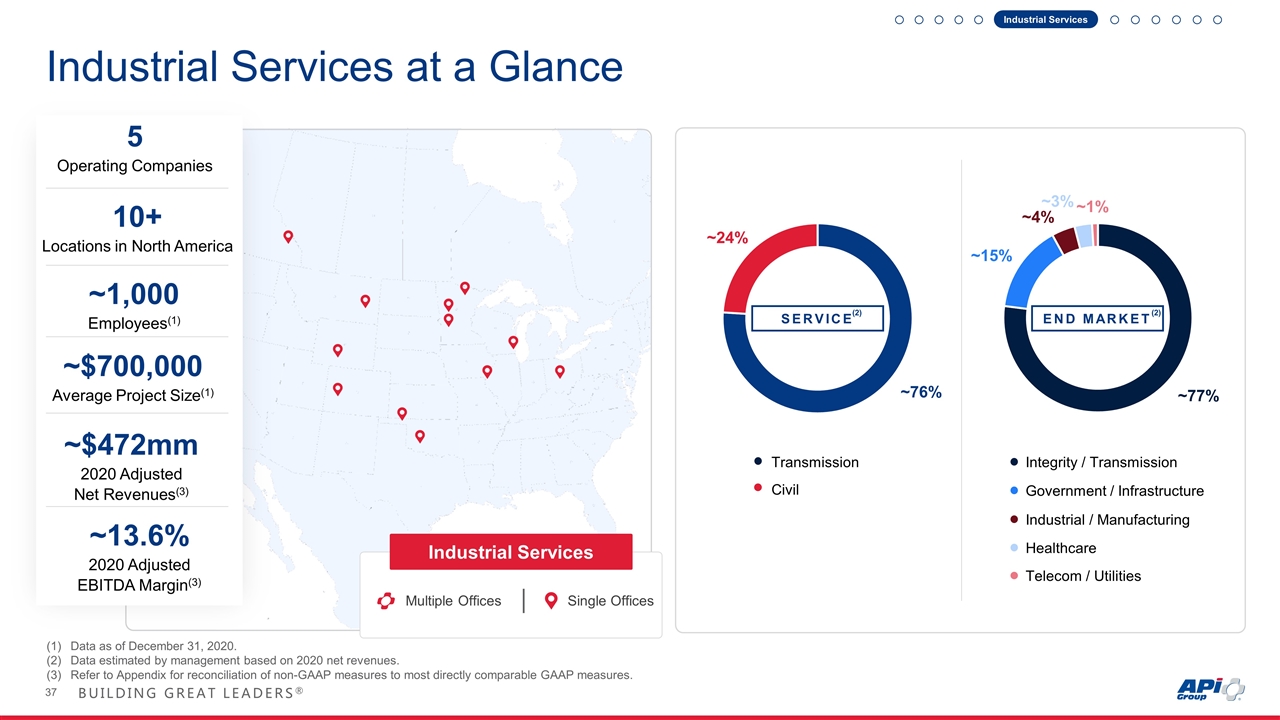

Industrial Services at a Glance Industrial Services Multiple Offices Single Offices 10+ Locations in North America 5 Operating Companies ~1,000 Employees(1) ~$700,000 Average Project Size(1) SERVICE Civil Transmission ~77% ~15% ~4% ~3% ~1% Telecom / Utilities Integrity / Transmission Government / Infrastructure Industrial / Manufacturing Healthcare Industrial Services Data as of December 31, 2020. Data estimated by management based on 2020 net revenues. Refer to Appendix for reconciliation of non-GAAP measures to most directly comparable GAAP measures. END MARKET (2) (2) ~$472mm 2020 Adjusted Net Revenues(3) ~13.6% 2020 Adjusted EBITDA Margin(3)

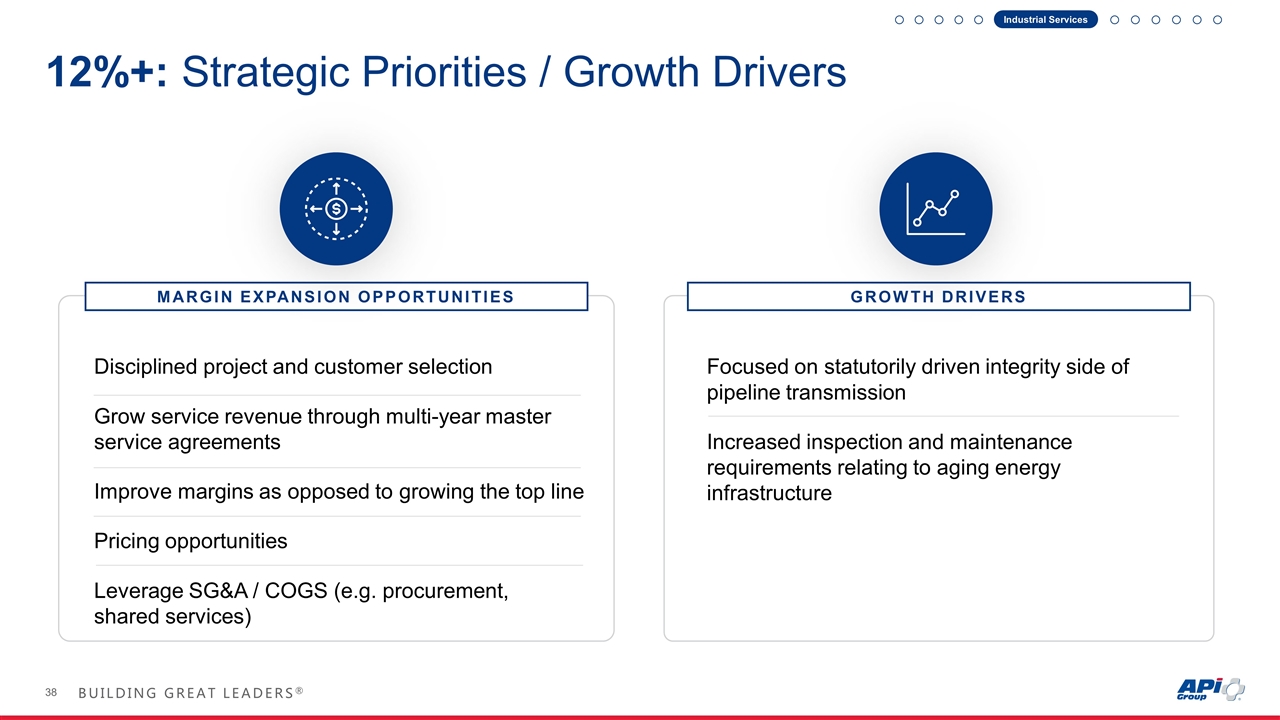

12%+: Strategic Priorities / Growth Drivers Disciplined project and customer selection Grow service revenue through multi-year master service agreements Improve margins as opposed to growing the top line Pricing opportunities Leverage SG&A / COGS (e.g. procurement, shared services) Focused on statutorily driven integrity side of pipeline transmission Increased inspection and maintenance requirements relating to aging energy infrastructure Industrial Services MARGIN EXPANSION OPPORTUNITIES GROWTH DRIVERS

BUILDING GREAT LEADERS® PRESENTER Driving Margin Expansion: Disciplined Project and Customer Selection Russ Becker

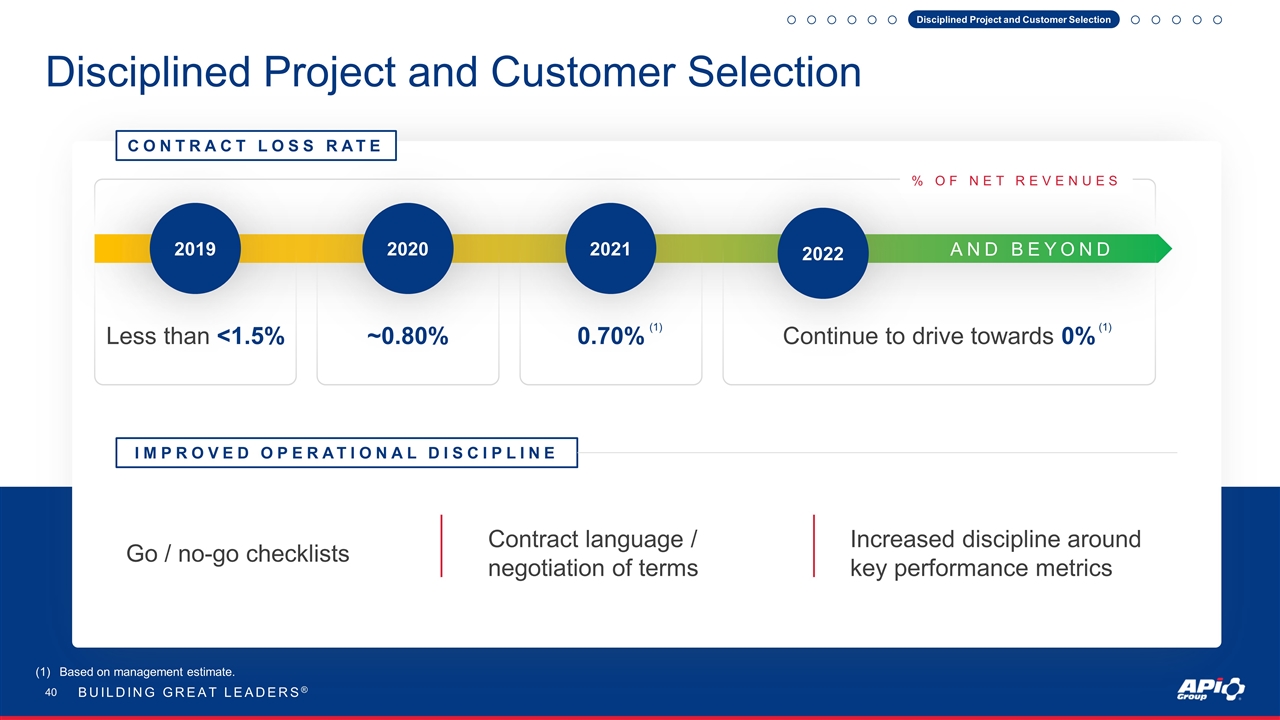

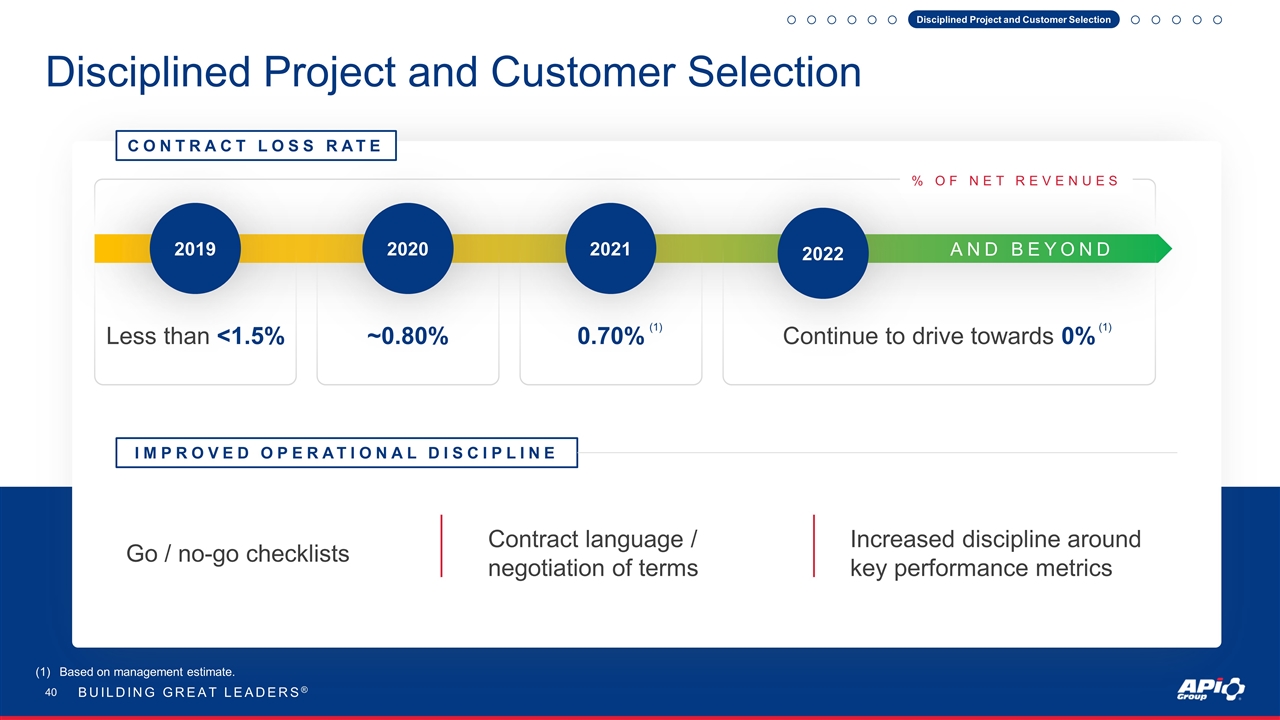

Disciplined Project and Customer Selection BUILDING GREAT LEADERS® Disciplined Project and Customer Selection Contract Loss Rate Contract language / negotiation of terms Go / no-go checklists Improved Operational Discipline AND BEYOND 2022 Increased discipline around key performance metrics Less than <1.5% 2019 ~0.80% 2020 2021 0.70% Continue to drive towards 0% % OF NET REVENUES (1) (1) Based on management estimate.

BUILDING GREAT LEADERS® Driving Margin Expansion: Growing Inspection and Service Revenue Courtney Brogard PRESENTER

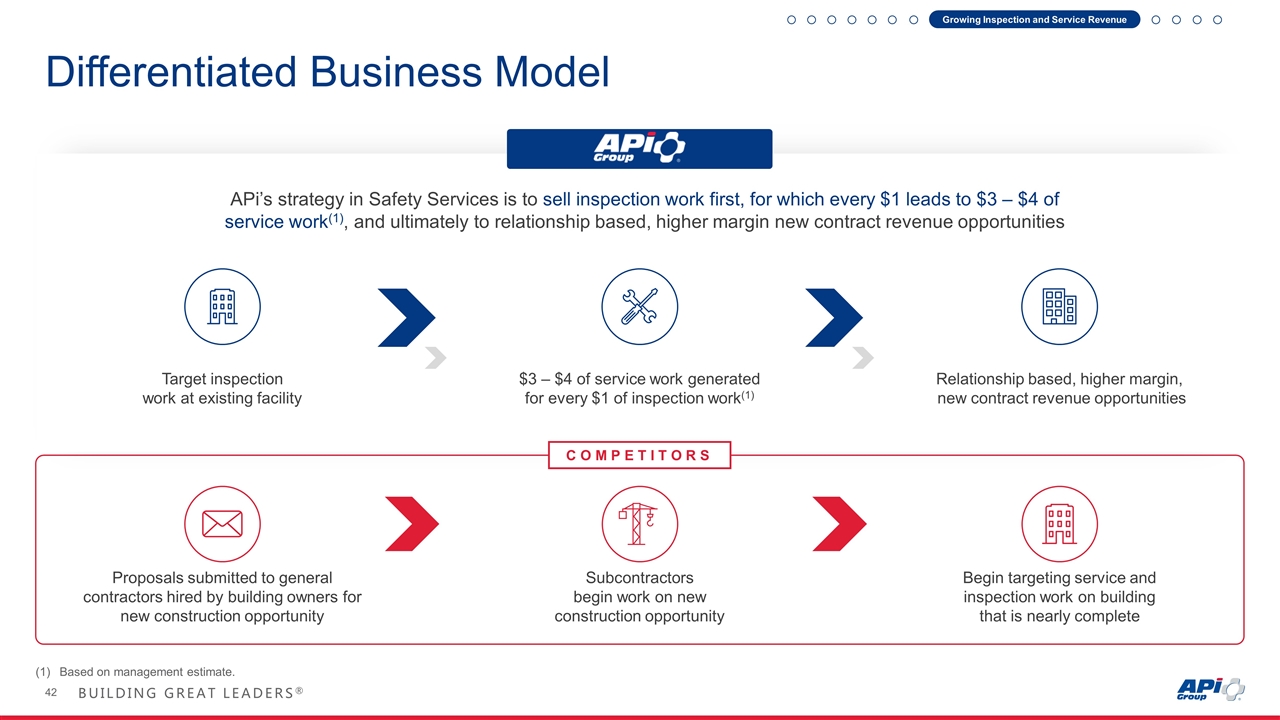

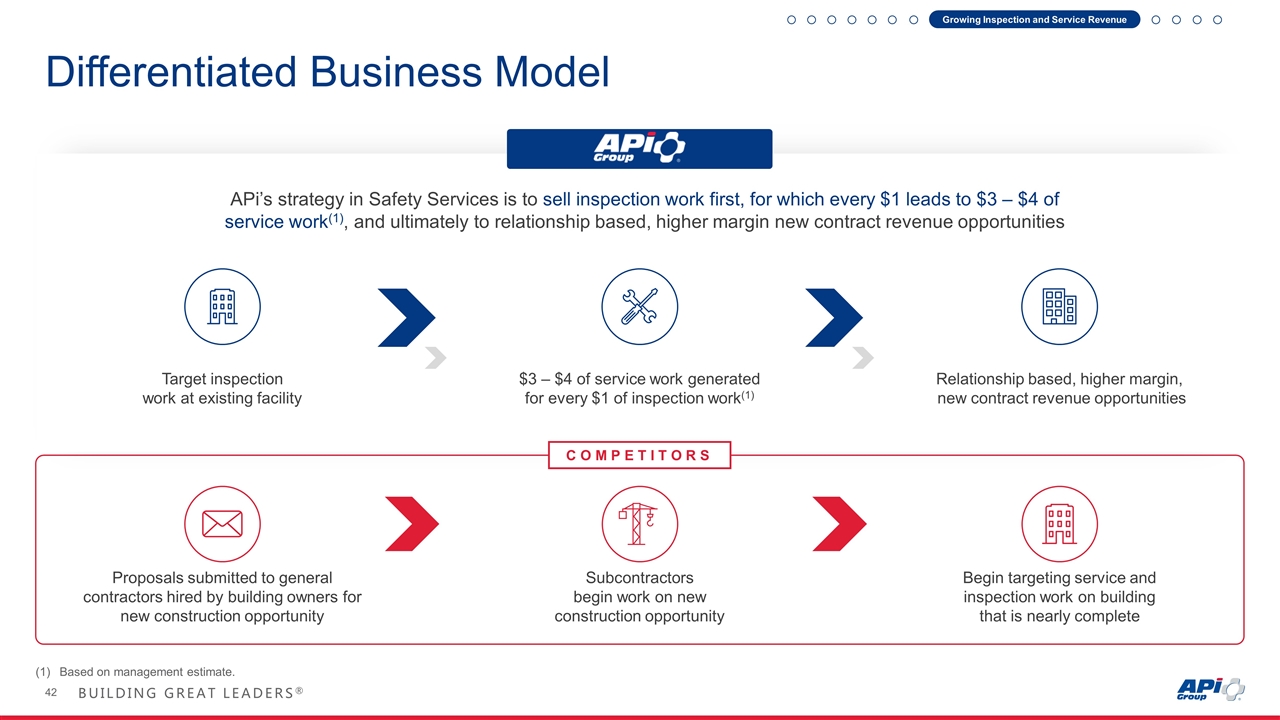

Growing Inspection and Service Revenue Differentiated Business Model COMPETITORS APi’s strategy in Safety Services is to sell inspection work first, for which every $1 leads to $3 – $4 of service work(1), and ultimately to relationship based, higher margin new contract revenue opportunities Target inspection work at existing facility Proposals submitted to general contractors hired by building owners for new construction opportunity $3 – $4 of service work generated for every $1 of inspection work(1) Subcontractors begin work on new construction opportunity Relationship based, higher margin, new contract revenue opportunities Begin targeting service and inspection work on building that is nearly complete Based on management estimate.

Driving Recurring Revenue Multiplier effect (3-4x) service return(1) Stable, higher margin recurring revenue Economic resiliency Clearly defined objectives and goals Statutorily mandated Pricing opportunities BUILDING GREAT LEADERS® Growing Inspection and Service Revenue Based on management estimate.

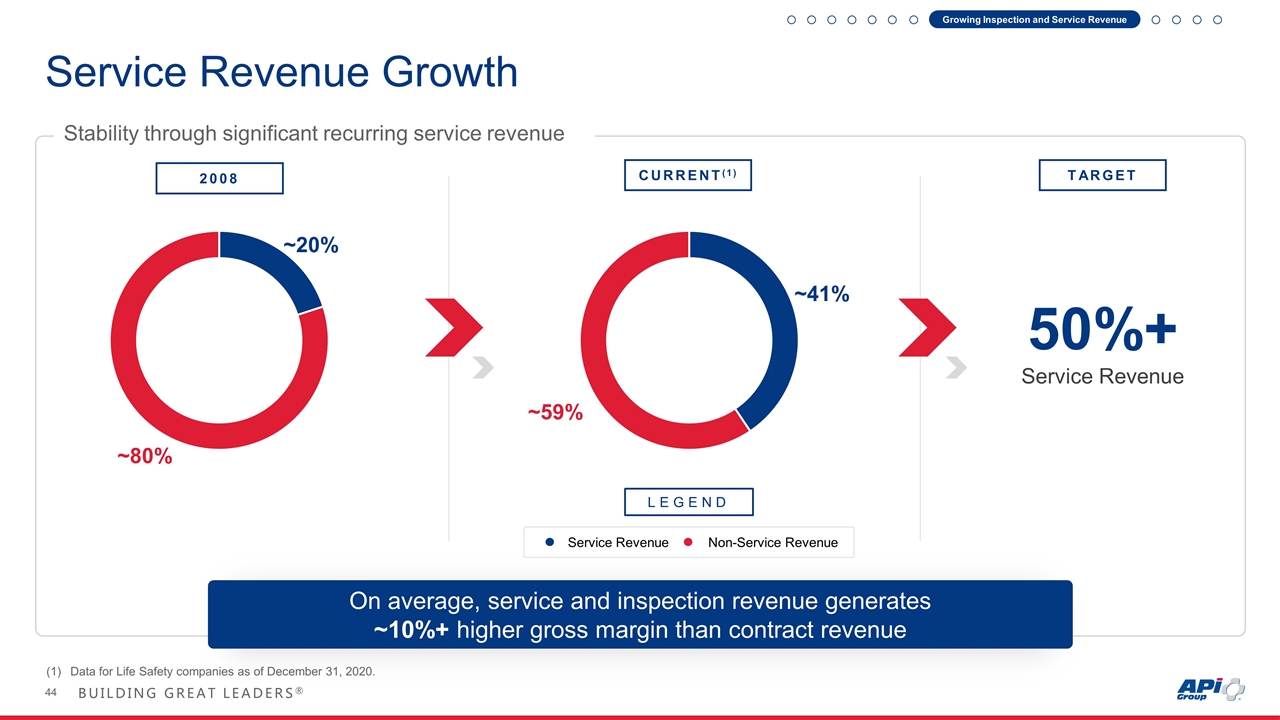

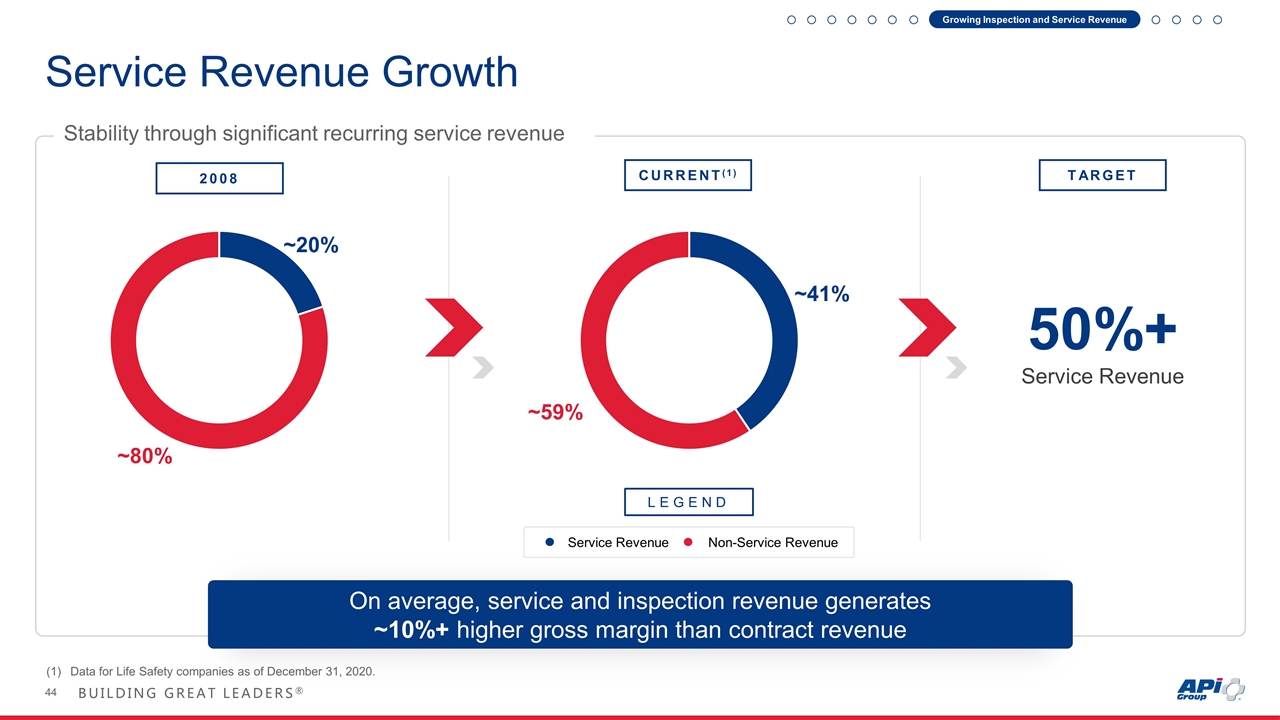

Service Revenue Growth 50%+ Service Revenue 2008 CURRENT(1) TARGET Stability through significant recurring service revenue On average, service and inspection revenue generates ~10%+ higher gross margin than contract revenue Data for Life Safety companies as of December 31, 2020. Growing Inspection and Service Revenue LEGEND Service Revenue Non-Service Revenue

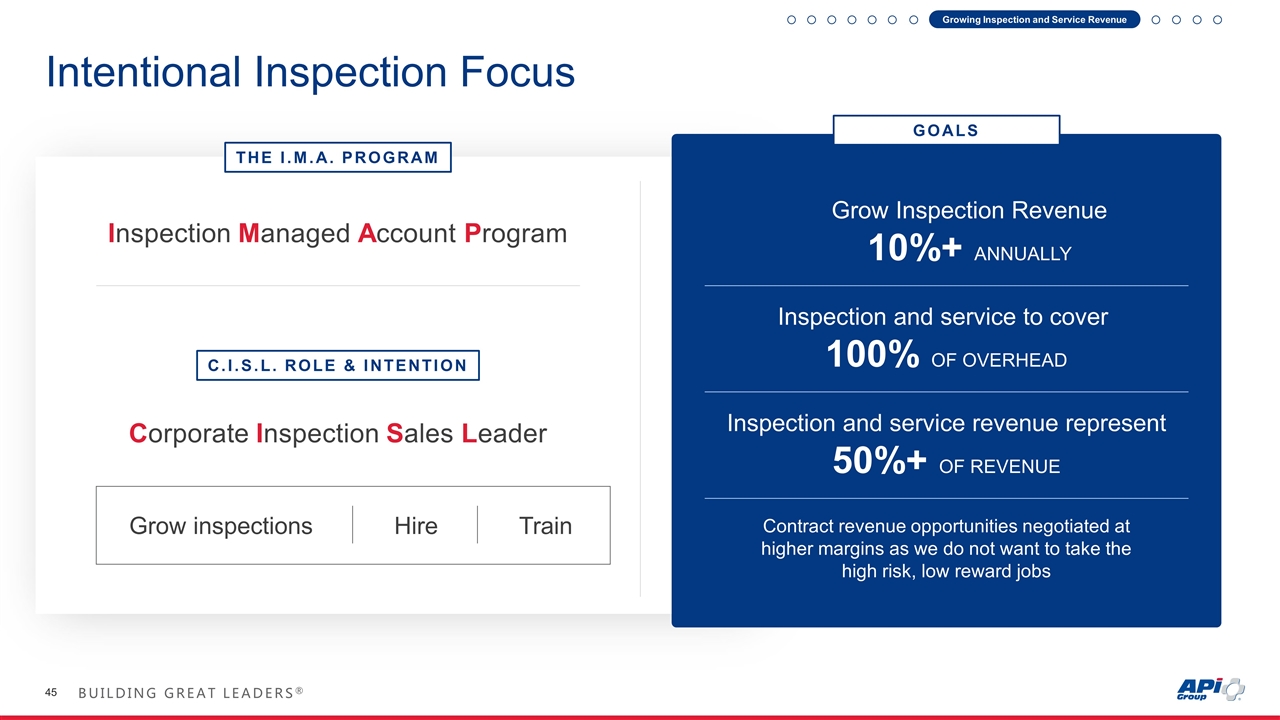

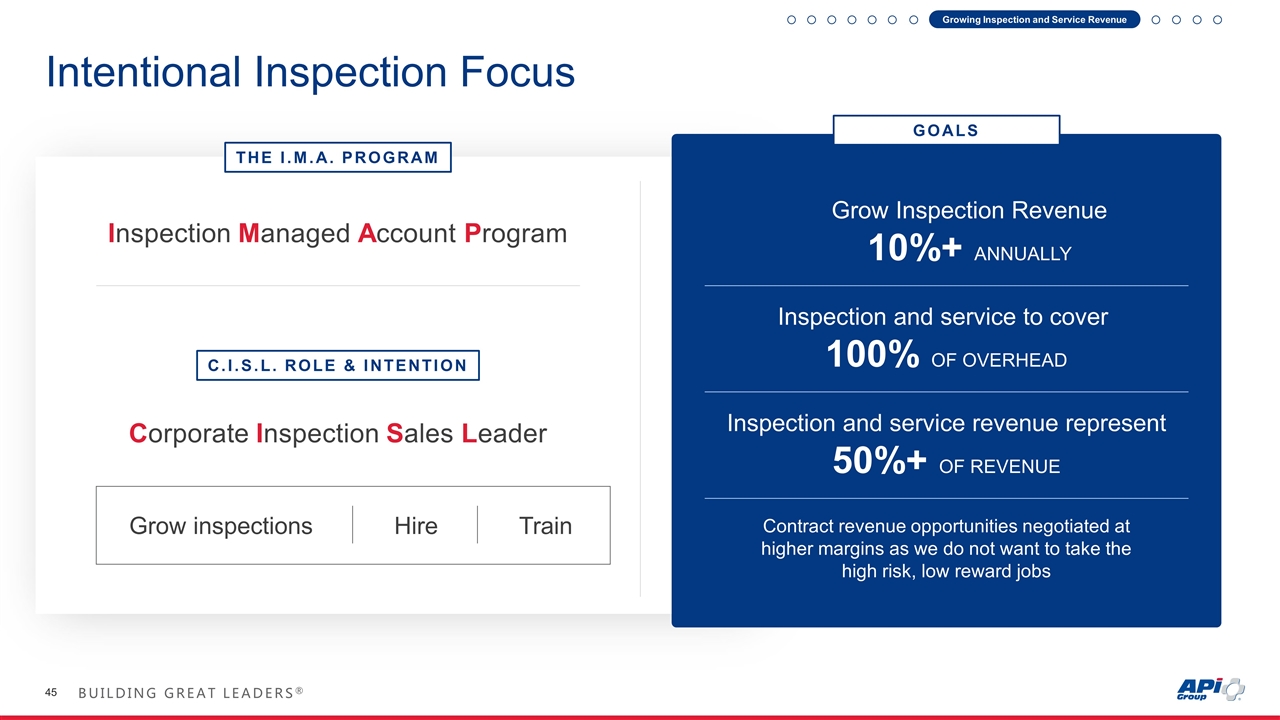

Intentional Inspection Focus THE I.M.A. PROGRAM C.I.S.L. ROLE & INTENTION Corporate Inspection Sales Leader Grow inspections Hire Train Inspection Managed Account Program Grow Inspection Revenue 10%+ ANNUALLY Inspection and service revenue represent 50%+ OF REVENUE Inspection and service to cover 100% OF OVERHEAD Contract revenue opportunities negotiated at higher margins as we do not want to take the high risk, low reward jobs GOALS Growing Inspection and Service Revenue

PRESENTER BUILDING GREAT LEADERS® PRESENTER Driving Margin Expansion: Leverage SG&A / COGS Tom Lydon

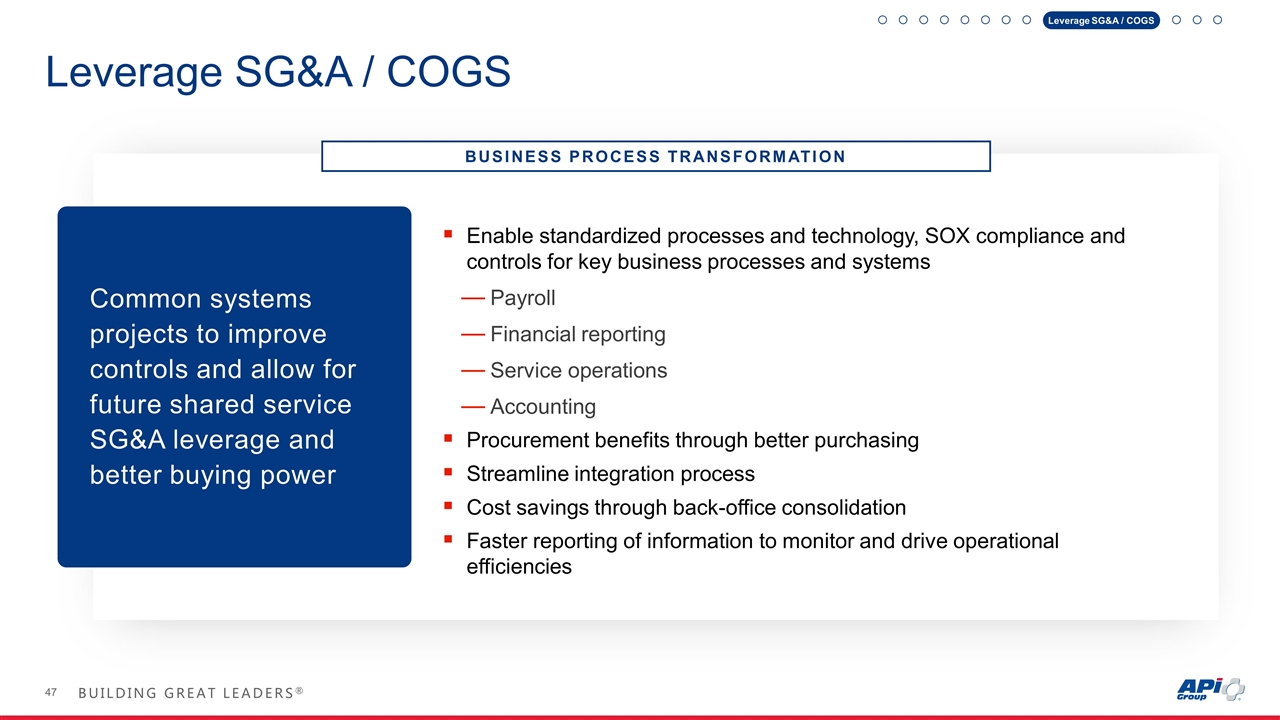

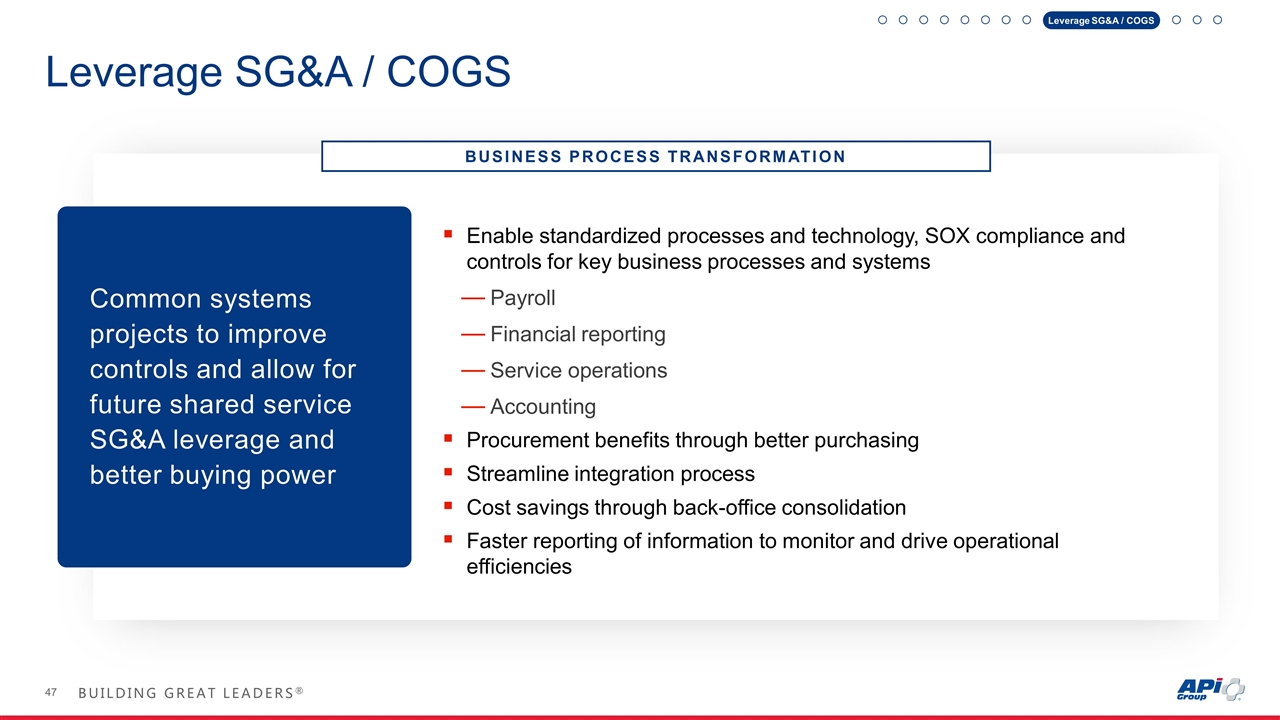

Leverage SG&A / COGS BUSINESS PROCESS TRANSFORMATION Common systems projects to improve controls and allow for future shared service SG&A leverage and better buying power Leverage SG&A / COGS Enable standardized processes and technology, SOX compliance and controls for key business processes and systems Payroll Financial reporting Service operations Accounting Procurement benefits through better purchasing Streamline integration process Cost savings through back-office consolidation Faster reporting of information to monitor and drive operational efficiencies

PRESENTER BUILDING GREAT LEADERS® Driving Margin Expansion: Integration Kristin Schultes

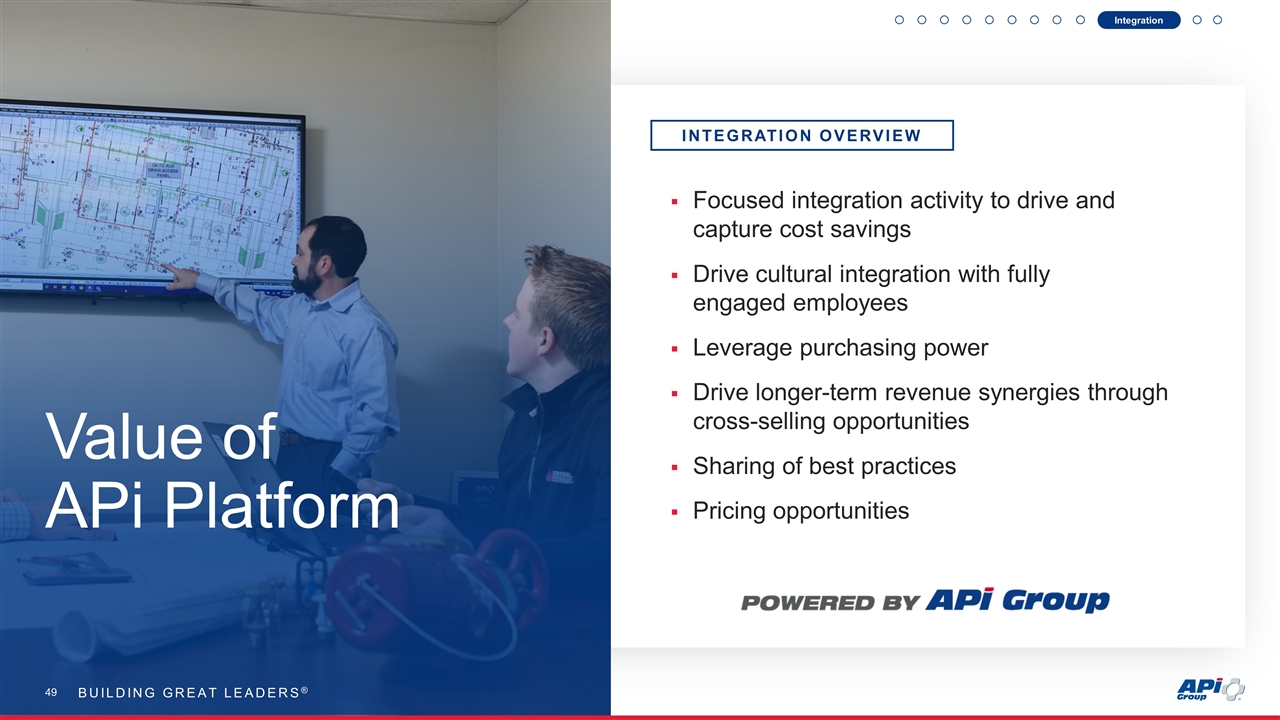

Integration Value of APi Platform Focused integration activity to drive and capture cost savings Drive cultural integration with fully engaged employees Leverage purchasing power Drive longer-term revenue synergies through cross-selling opportunities Sharing of best practices Pricing opportunities INTEGRATION OVERVIEW BUILDING GREAT LEADERS®

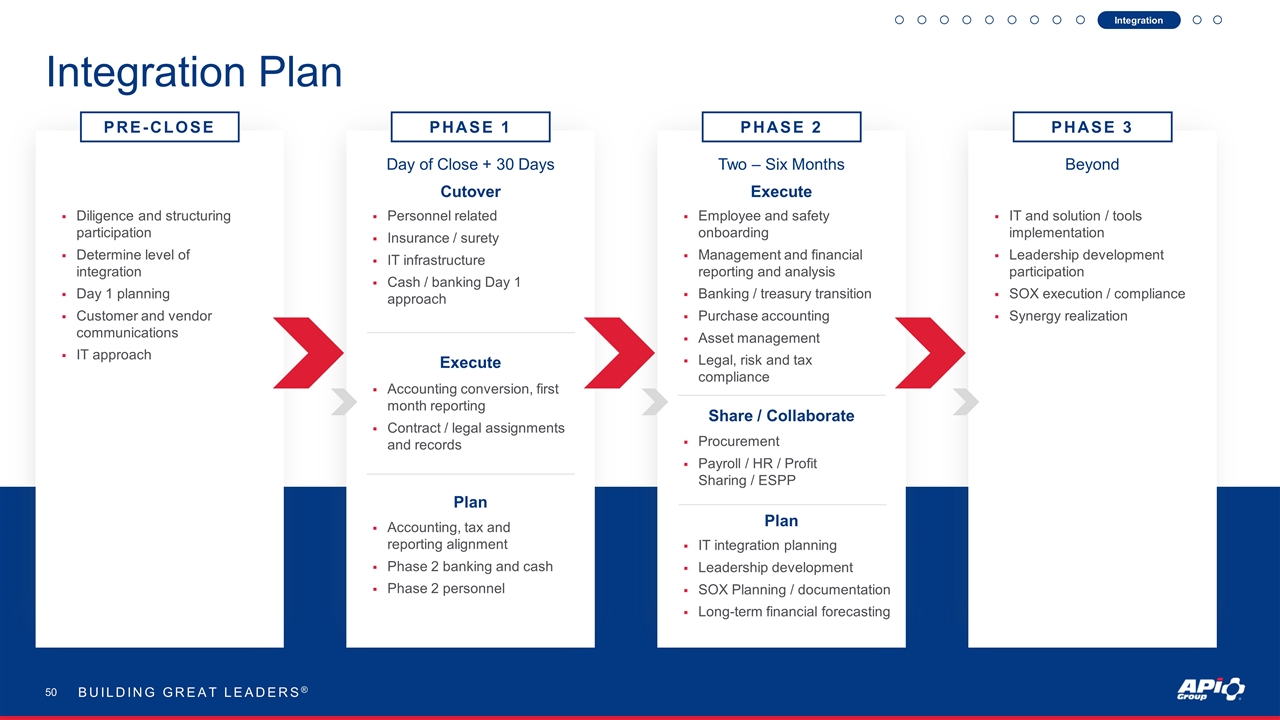

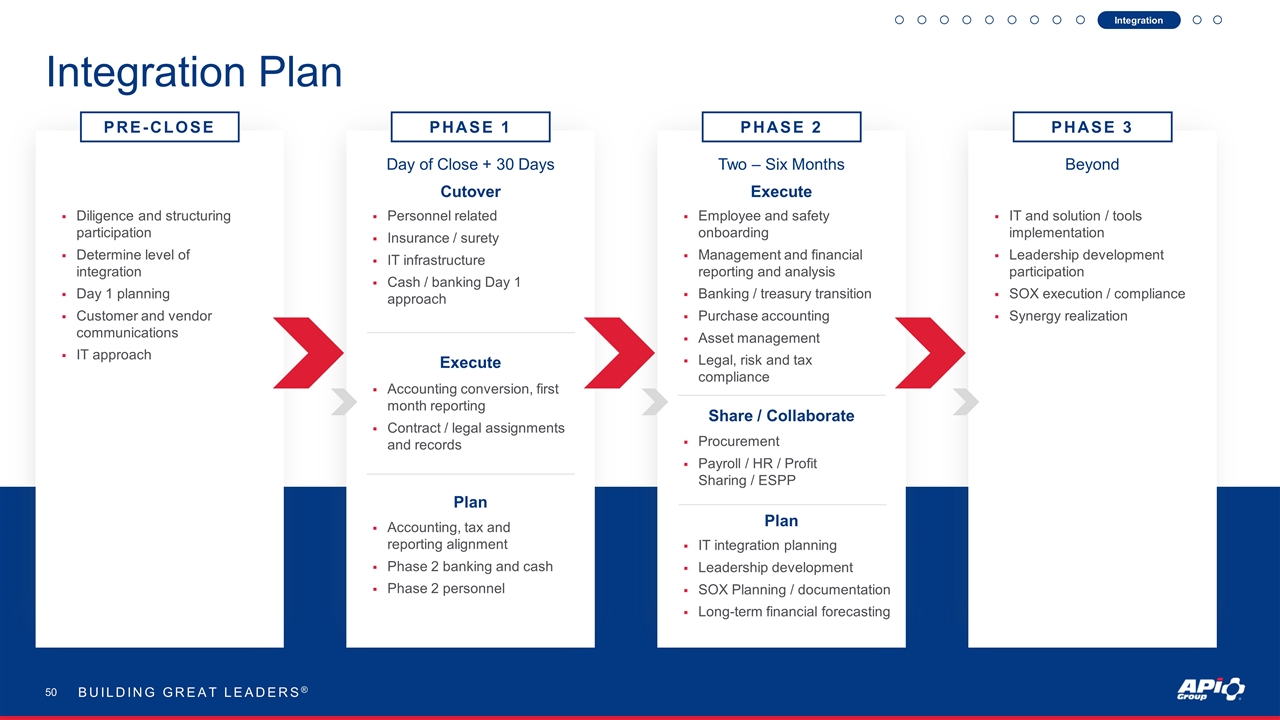

Integration Plan BUILDING GREAT LEADERS® PRE-CLOSE PHASE 1 PHASE 2 PHASE 3 Day of Close + 30 Days Two – Six Months Beyond Diligence and structuring participation Determine level of integration Day 1 planning Customer and vendor communications IT approach Personnel related Insurance / surety IT infrastructure Cash / banking Day 1 approach Employee and safety onboarding Management and financial reporting and analysis Banking / treasury transition Purchase accounting Asset management Legal, risk and tax compliance IT and solution / tools implementation Leadership development participation SOX execution / compliance Synergy realization Cutover Execute Plan Accounting conversion, first month reporting Contract / legal assignments and records Accounting, tax and reporting alignment Phase 2 banking and cash Phase 2 personnel Execute Share / Collaborate Procurement Payroll / HR / Profit Sharing / ESPP Plan IT integration planning Leadership development SOX Planning / documentation Long-term financial forecasting Integration

Growth Through M&A BUILDING GREAT LEADERS® PRESENTERS Sir Martin E. Franklin James E. Lillie Russ Becker

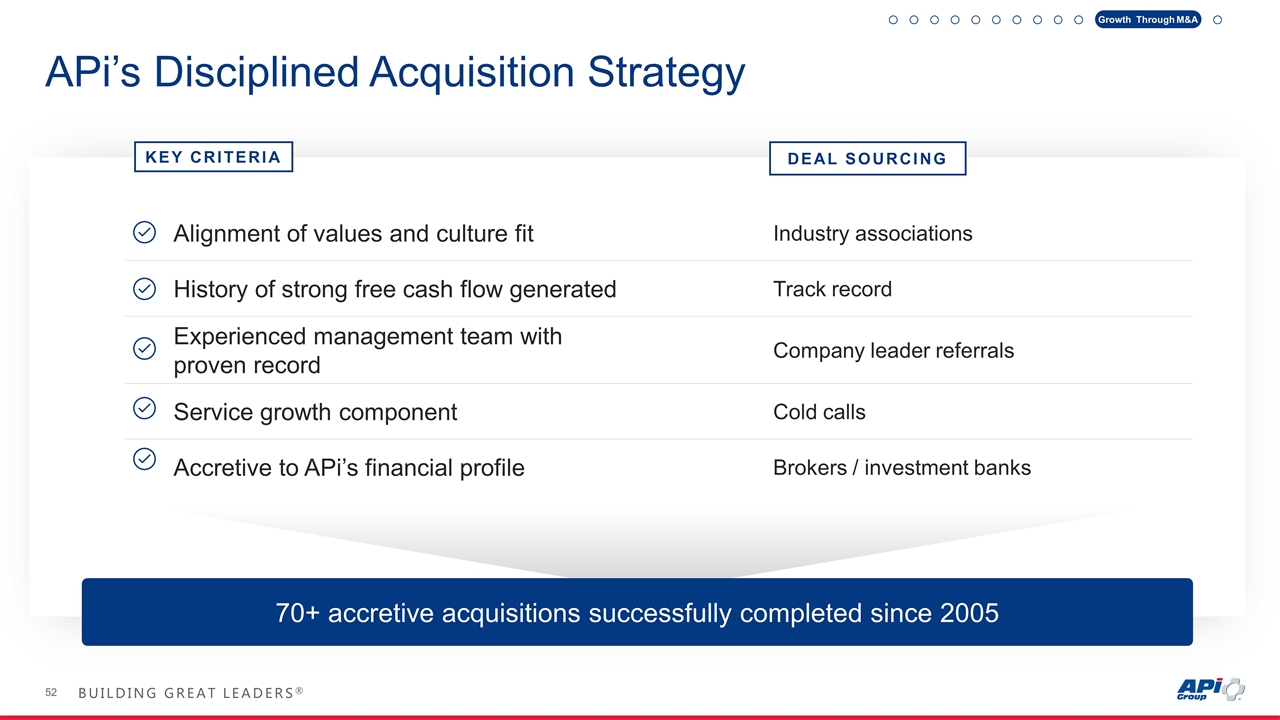

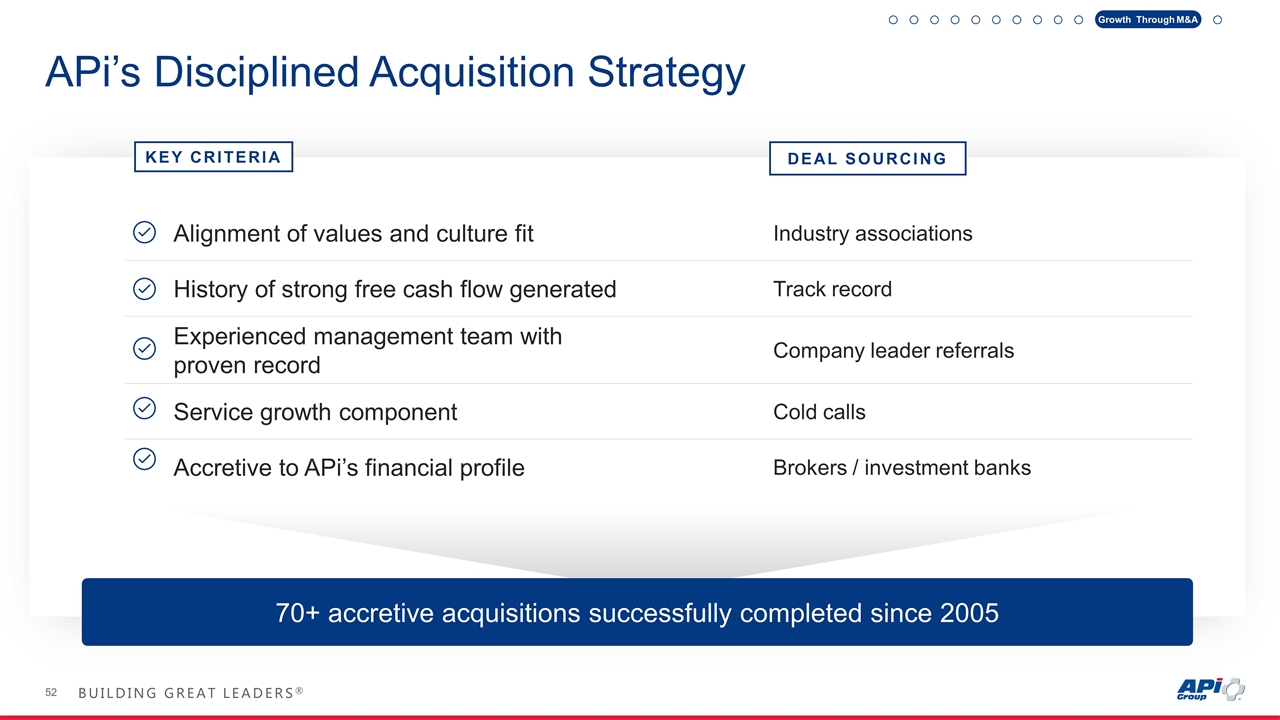

APi’s Disciplined Acquisition Strategy KEY CRITERIA DEAL SOURCING Alignment of values and culture fit Industry associations History of strong free cash flow generated Track record Experienced management team with proven record Company leader referrals Service growth component Cold calls Accretive to APi’s financial profile Brokers / investment banks 70+ accretive acquisitions successfully completed since 2005 Growth Through M&A

Potential Areas of Interest Fire & Life Safety Elevator & Escalator Repair & Maintenance HVAC Services Utility & Telecom Services Leverage existing competencies and infrastructure Strengthen recurring, inspection, maintenance and service revenue Complementary to existing life safety offerings with adjacent in-building system integration scope of work High degree of visibility and resiliency Growth Through M&A

Financial Perspective & Investment Opportunity BUILDING GREAT LEADERS® PRESENTERS Tom Lydon James E. Lillie

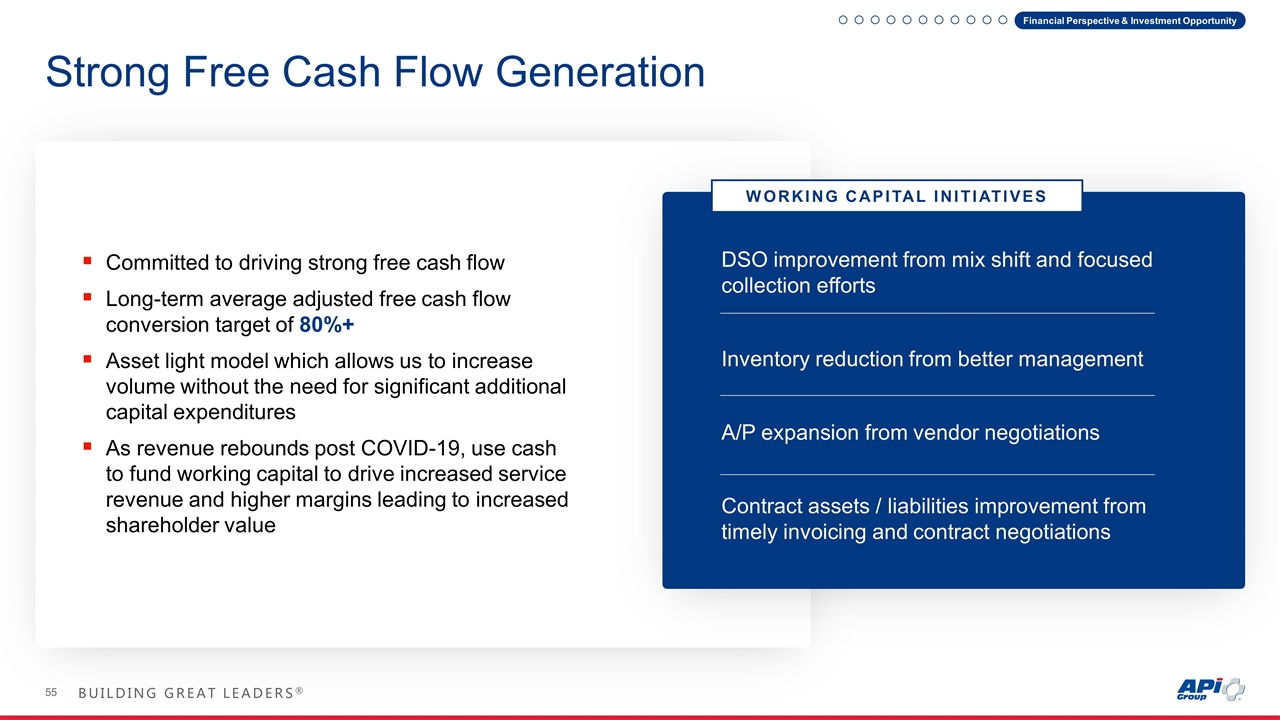

Strong Free Cash Flow Generation Committed to driving strong free cash flow Long-term average adjusted free cash flow conversion target of 80%+ Asset light model which allows us to increase volume without the need for significant additional capital expenditures As revenue rebounds post COVID-19, use cash to fund working capital to drive increased service revenue and higher margins leading to increased shareholder value WORKING CAPITAL INITIATIVES DSO improvement from mix shift and focused collection efforts Inventory reduction from better management A/P expansion from vendor negotiations Contract assets / liabilities improvement from timely invoicing and contract negotiations Financial Perspective & Investment Opportunity

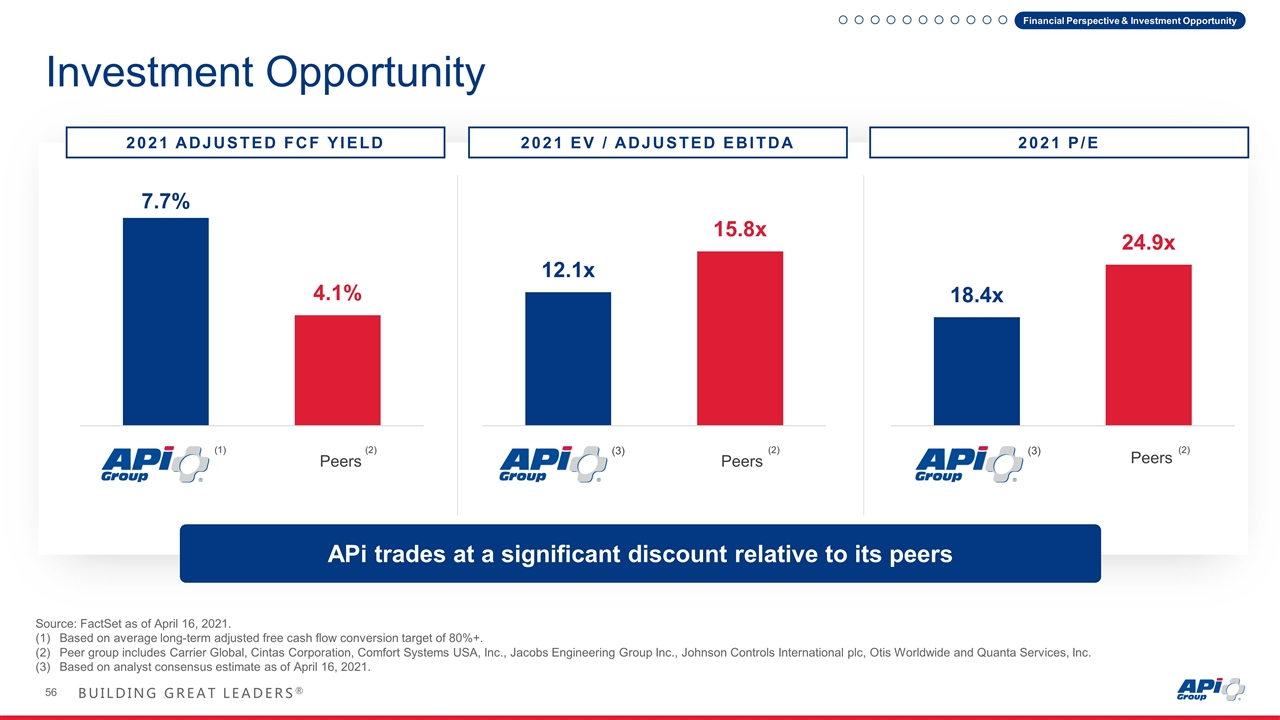

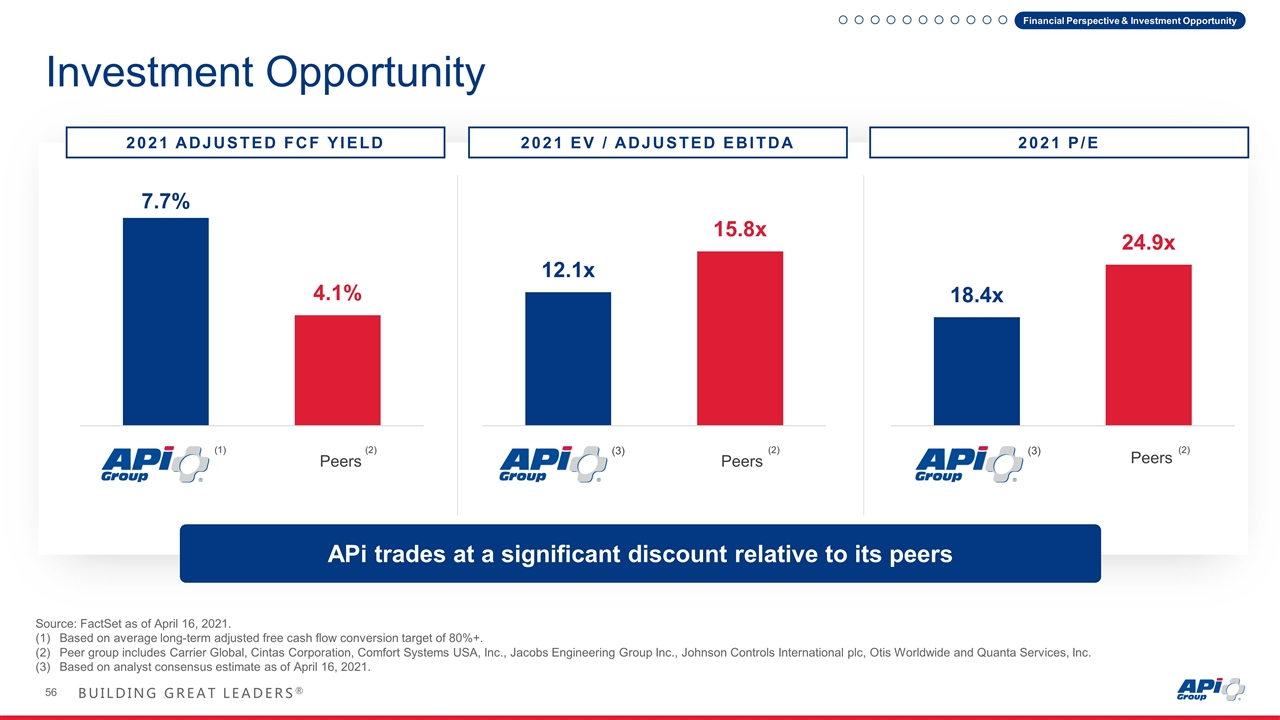

Investment Opportunity 2021 ADJUSTED FCF YIELD Source: FactSet as of April 16, 2021. Based on average long-term adjusted free cash flow conversion target of 80%+. Peer group includes Carrier Global, Cintas Corporation, Comfort Systems USA, Inc., Jacobs Engineering Group Inc., Johnson Controls International plc, Otis Worldwide and Quanta Services, Inc. Based on analyst consensus estimate as of April 16, 2021. APi trades at a significant discount relative to its peers Peers (1) 2021 EV / ADJUSTED EBITDA Peers (3) Peers (3) 2021 P/E (2) (2) (2) Financial Perspective & Investment Opportunity

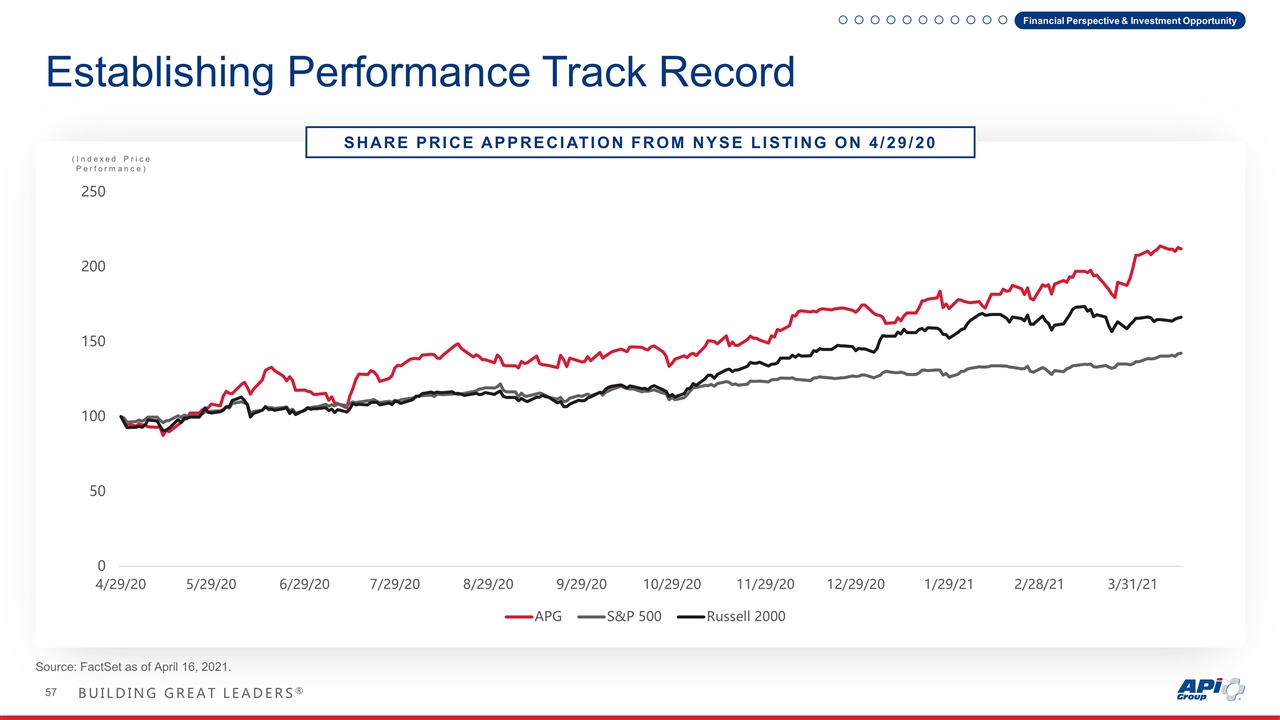

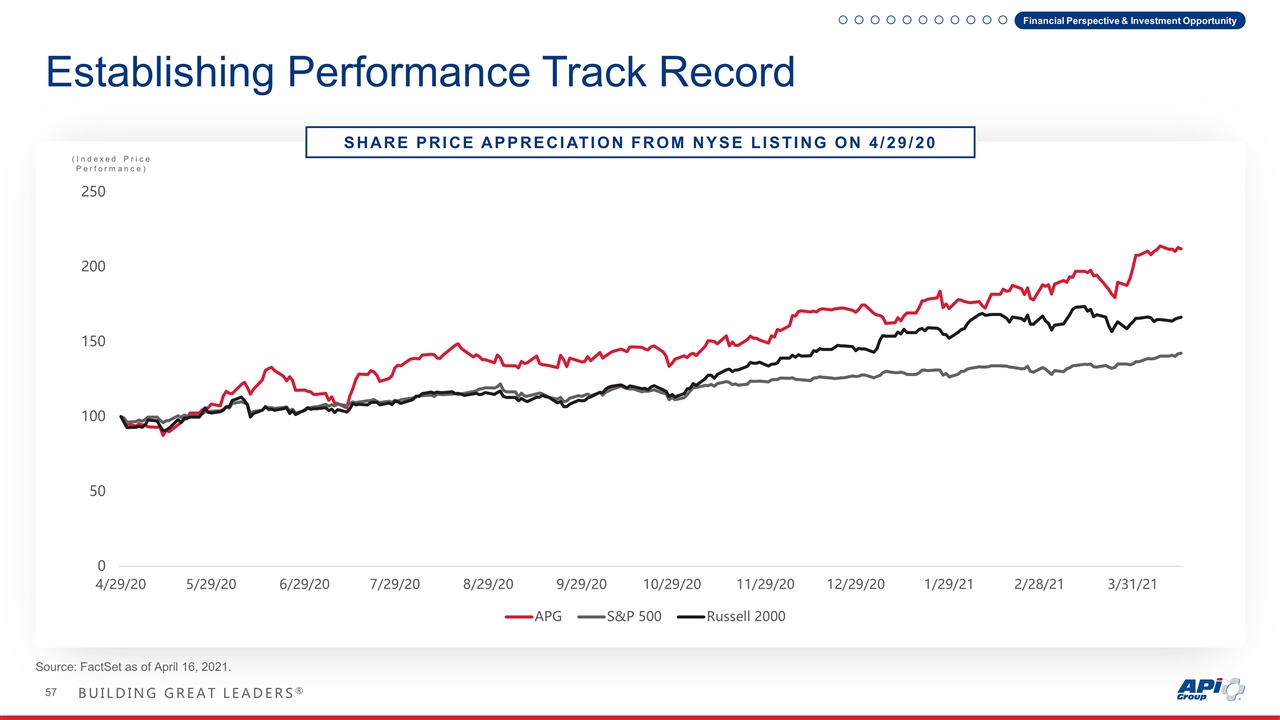

Establishing Performance Track Record SHARE PRICE APPRECIATION FROM NYSE LISTING ON 4/29/20 Source: FactSet as of April 16, 2021. (Indexed Price Performance) Financial Perspective & Investment Opportunity

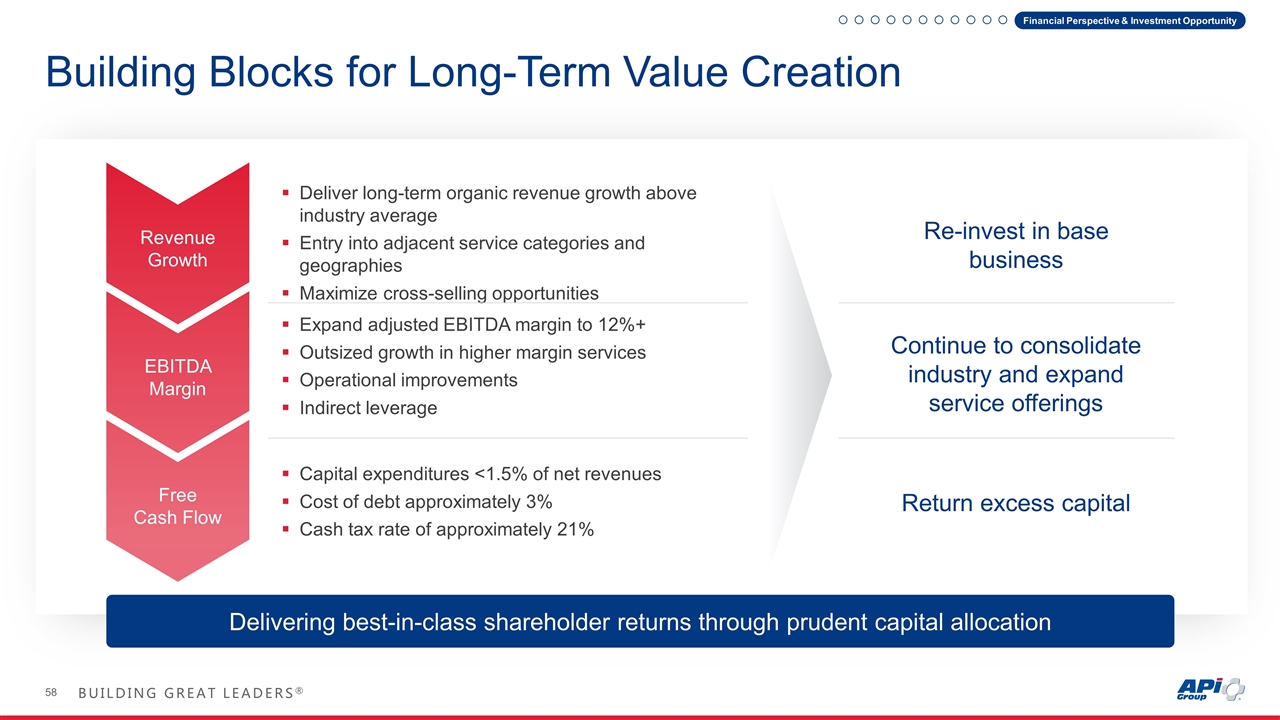

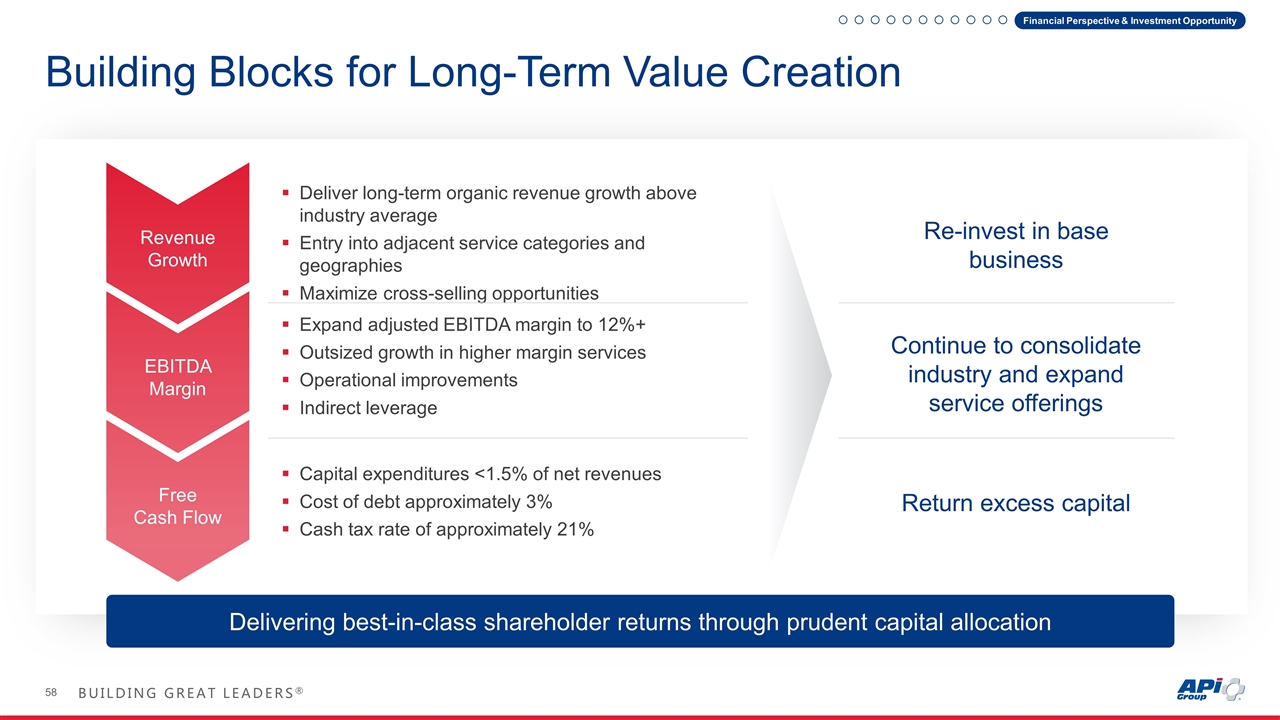

Building Blocks for Long-Term Value Creation Delivering best-in-class shareholder returns through prudent capital allocation Deliver long-term organic revenue growth above industry average Entry into adjacent service categories and geographies Maximize cross-selling opportunities Revenue Growth EBITDA Margin Free Cash Flow Expand adjusted EBITDA margin to 12%+ Outsized growth in higher margin services Operational improvements Indirect leverage Capital expenditures <1.5% of net revenues Cost of debt approximately 3% Cash tax rate of approximately 21% Re-invest in base business Continue to consolidate industry and expand service offerings Return excess capital Financial Perspective & Investment Opportunity

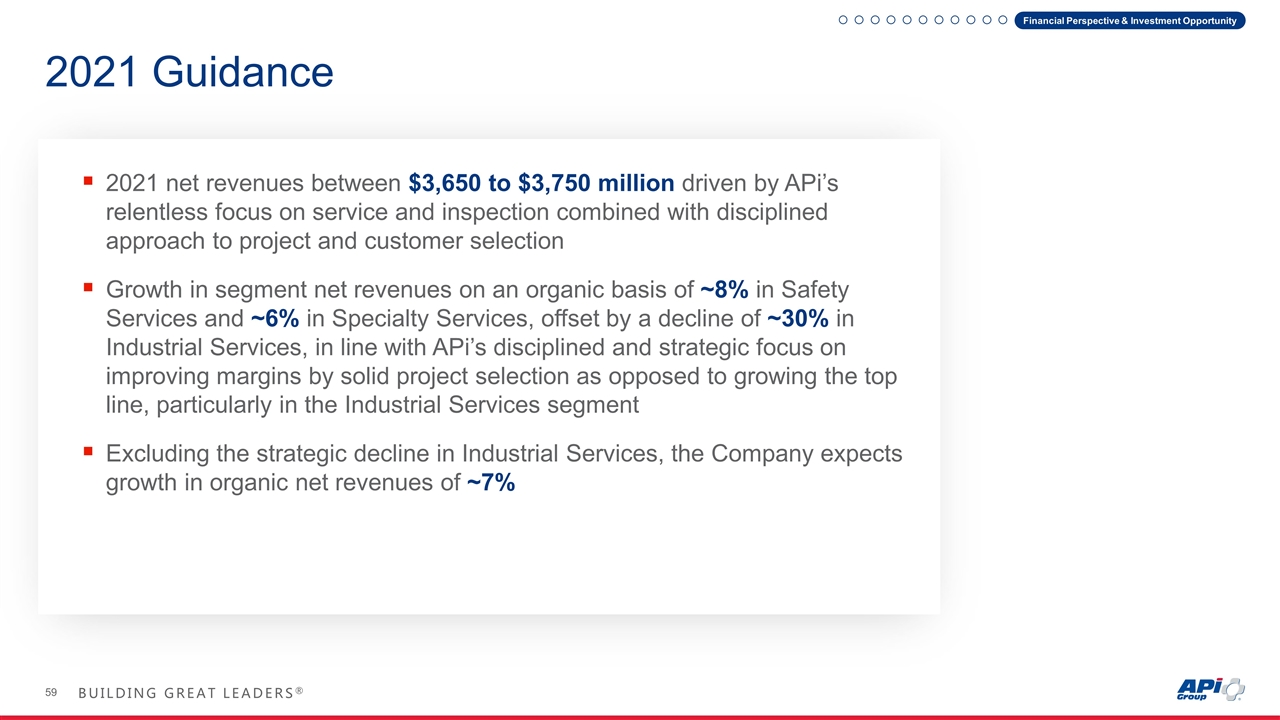

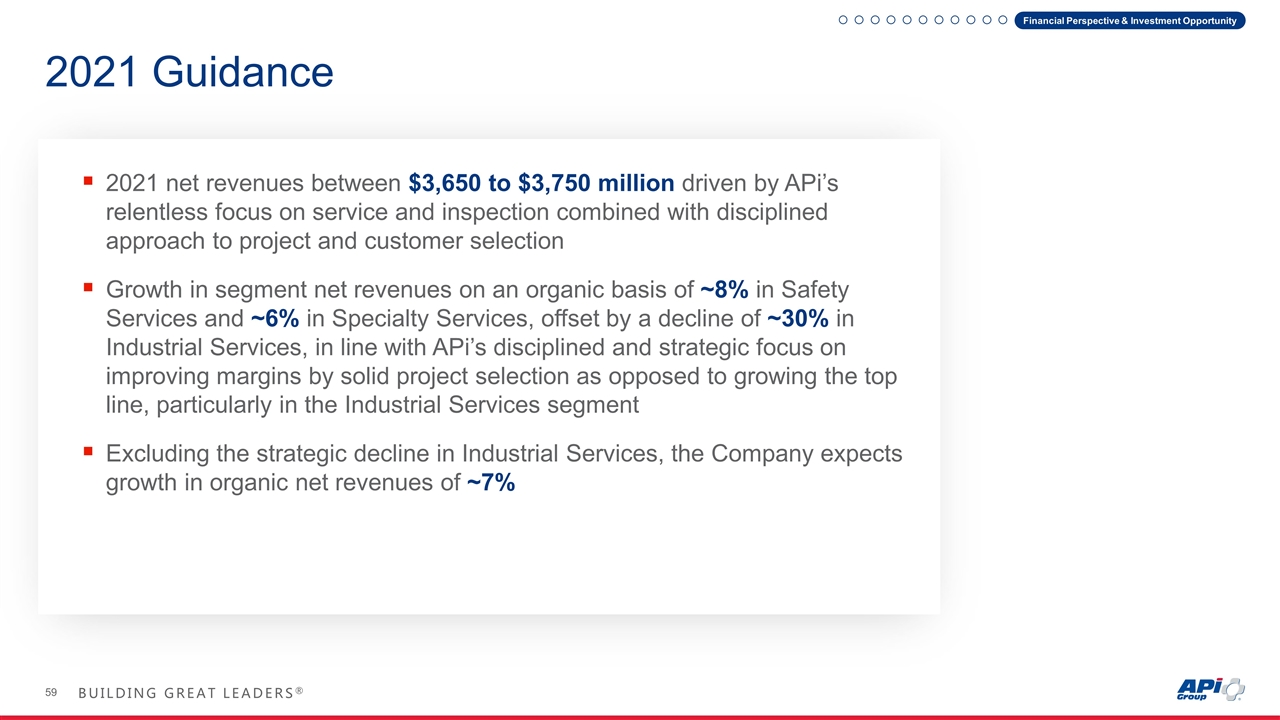

2021 Guidance 2021 net revenues between $3,650 to $3,750 million driven by APi’s relentless focus on service and inspection combined with disciplined approach to project and customer selection Growth in segment net revenues on an organic basis of ~8% in Safety Services and ~6% in Specialty Services, offset by a decline of ~30% in Industrial Services, in line with APi’s disciplined and strategic focus on improving margins by solid project selection as opposed to growing the top line, particularly in the Industrial Services segment Excluding the strategic decline in Industrial Services, the Company expects growth in organic net revenues of ~7% Financial Perspective & Investment Opportunity

BUILDING GREAT LEADERS® PRESENTER Driving Margin Expansion: Path to 12%+ Adjusted EBITDA Margin Russ Becker

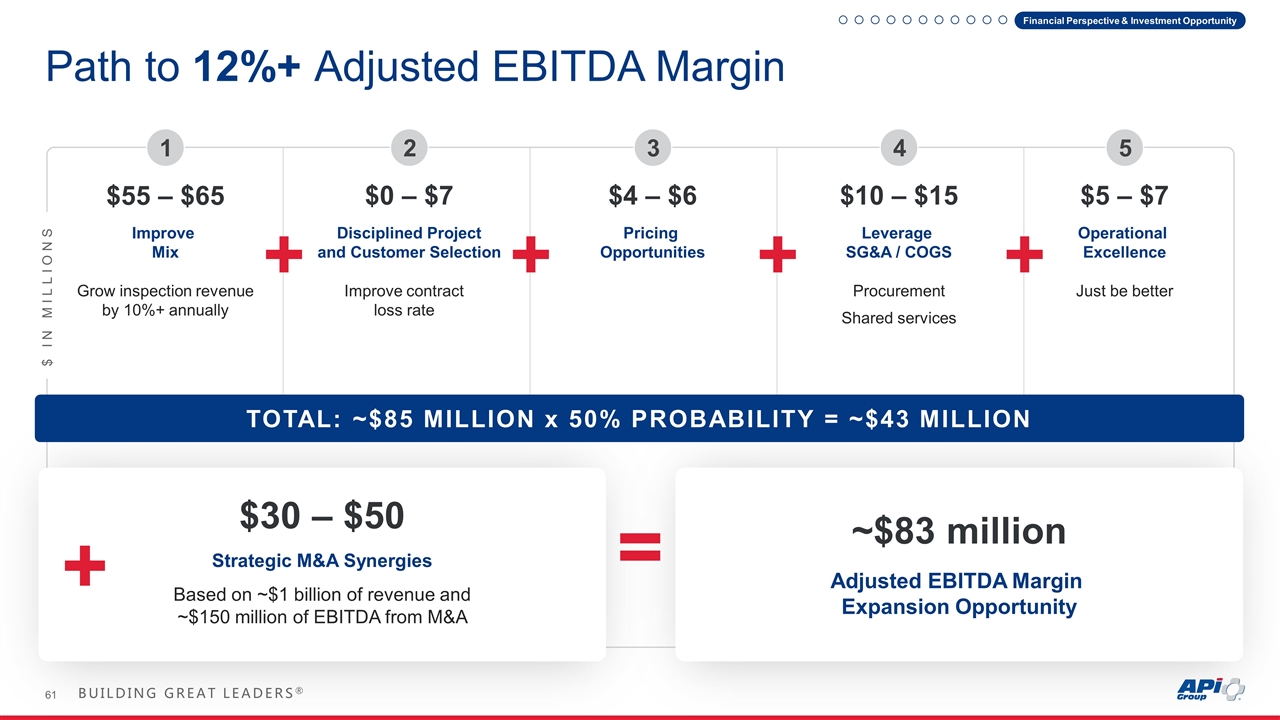

Path to 12%+ Adjusted EBITDA Margin = Based on ~$1 billion of revenue and ~$150 million of EBITDA from M&A Strategic M&A Synergies $30 – $50 $ IN MILLIONS Grow inspection revenue by 10%+ annually Improve Mix $55 – $65 1 + Just be better Operational Excellence $5 – $7 5 Improve contract loss rate Disciplined Project and Customer Selection $0 – $7 2 Pricing Opportunities $4 – $6 3 Procurement Shared services Leverage SG&A / COGS $10 – $15 4 + + + + TOTAL: ~$85 MILLION x 50% PROBABILITY = ~$43 MILLION Adjusted EBITDA Margin Expansion Opportunity ~$83 million Financial Perspective & Investment Opportunity

13%+ Adjusted EBITDA by YE 2025 New Goal Financial Perspective & Investment Opportunity

Q&A Session

Appendix

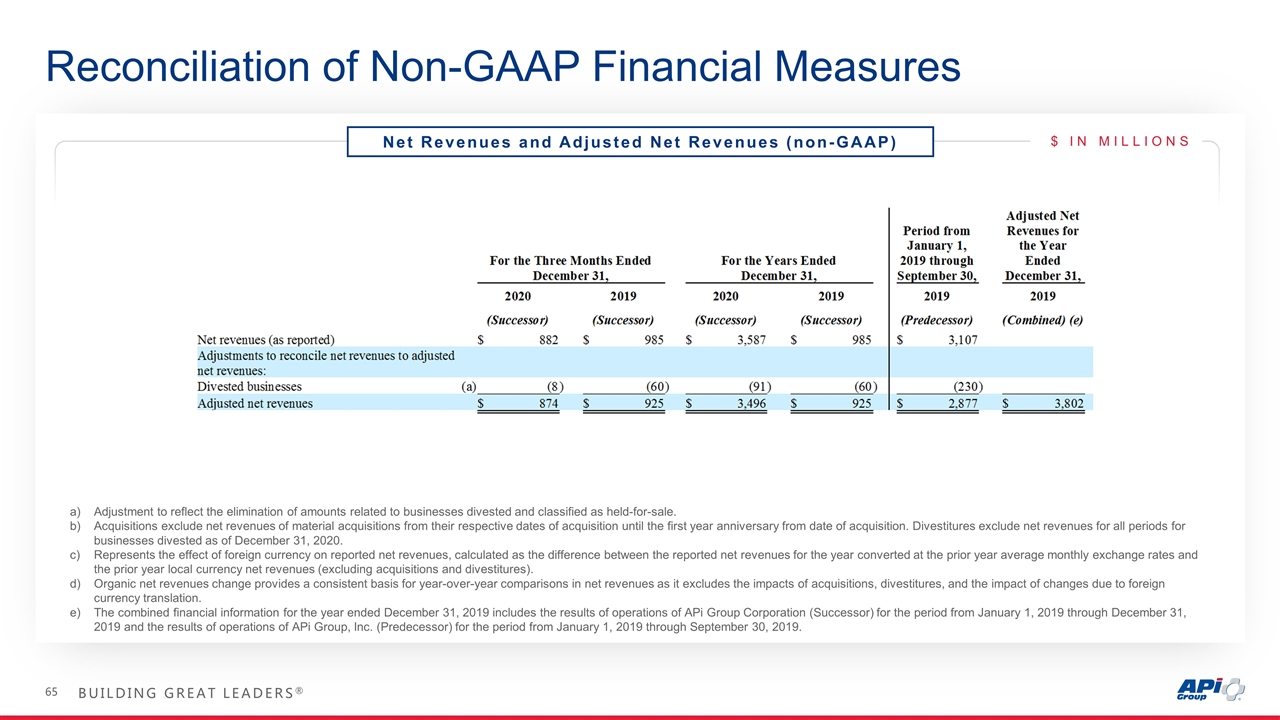

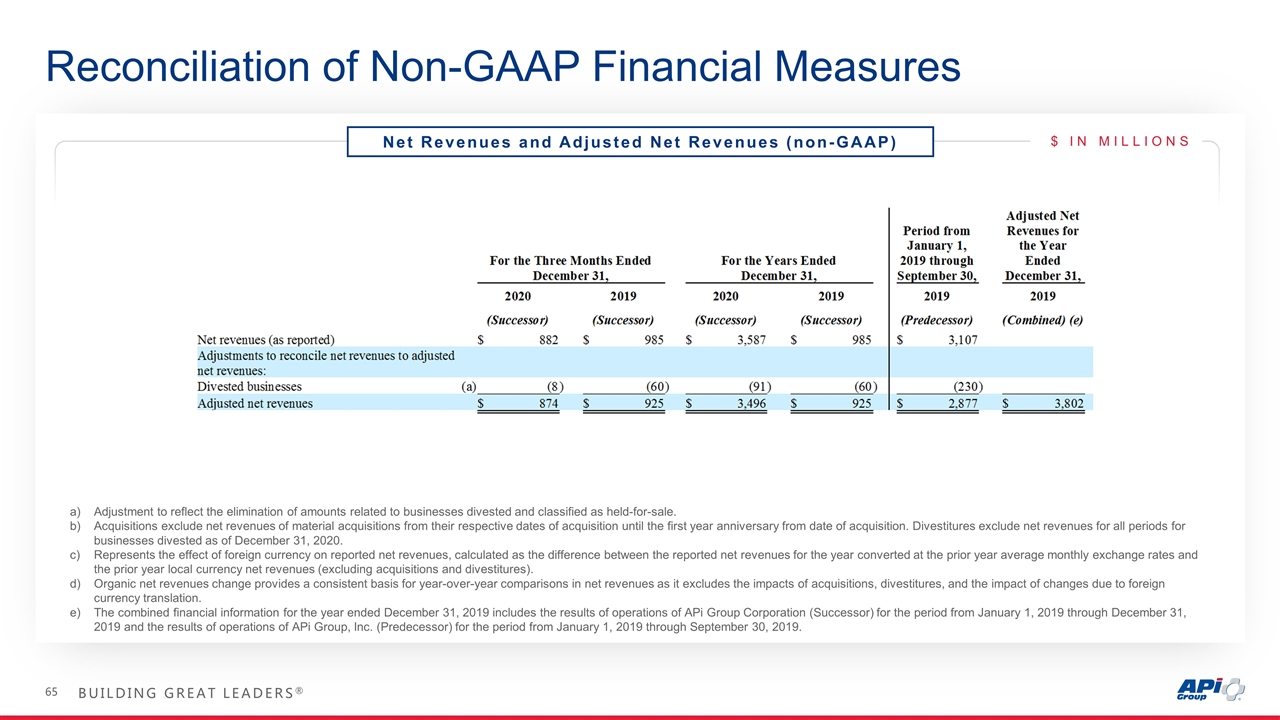

Reconciliation of Non-GAAP Financial Measures $ IN MILLIONS Net Revenues and Adjusted Net Revenues (non-GAAP) Adjustment to reflect the elimination of amounts related to businesses divested and classified as held-for-sale. Acquisitions exclude net revenues of material acquisitions from their respective dates of acquisition until the first year anniversary from date of acquisition. Divestitures exclude net revenues for all periods for businesses divested as of December 31, 2020. Represents the effect of foreign currency on reported net revenues, calculated as the difference between the reported net revenues for the year converted at the prior year average monthly exchange rates and the prior year local currency net revenues (excluding acquisitions and divestitures). Organic net revenues change provides a consistent basis for year-over-year comparisons in net revenues as it excludes the impacts of acquisitions, divestitures, and the impact of changes due to foreign currency translation. The combined financial information for the year ended December 31, 2019 includes the results of operations of APi Group Corporation (Successor) for the period from January 1, 2019 through December 31, 2019 and the results of operations of APi Group, Inc. (Predecessor) for the period from January 1, 2019 through September 30, 2019.

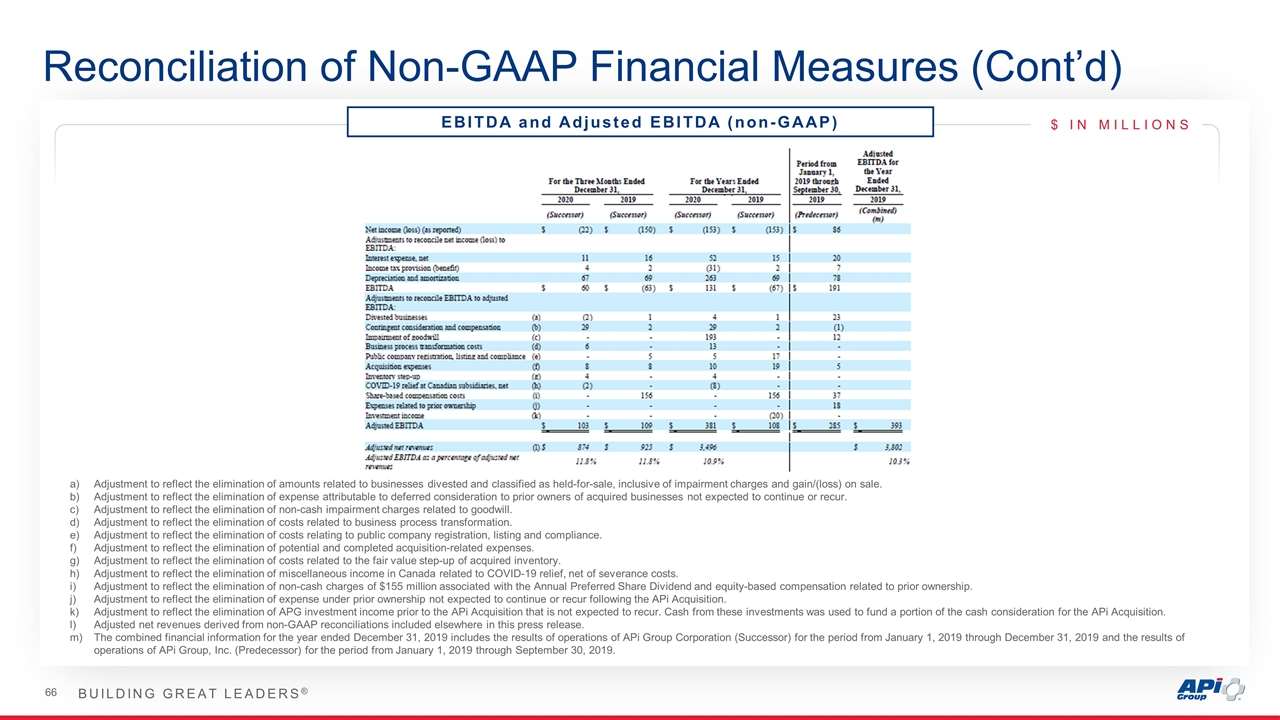

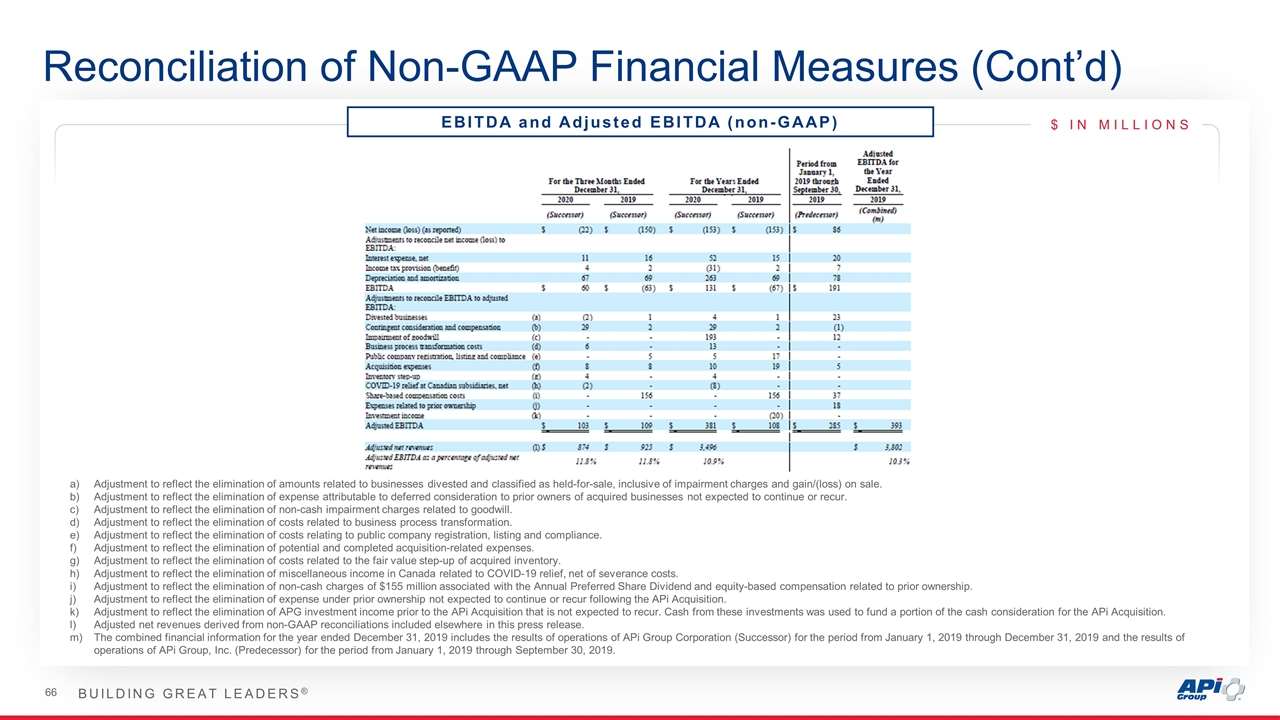

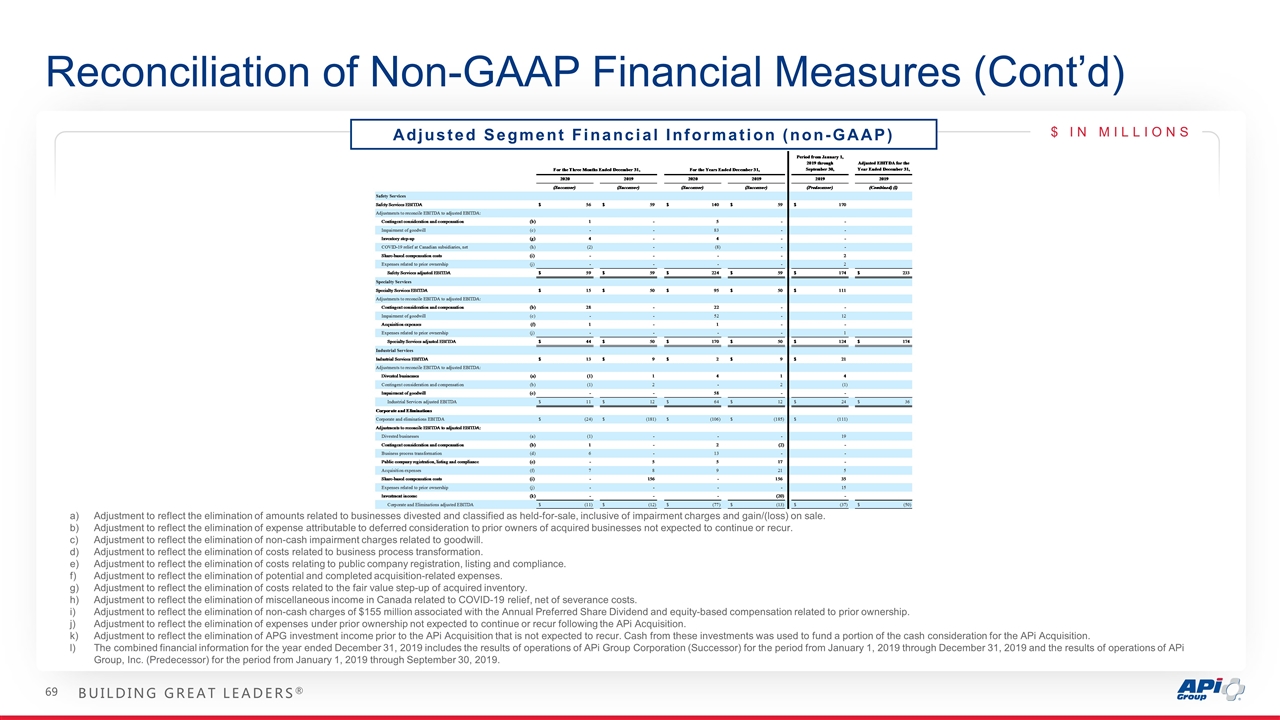

Reconciliation of Non-GAAP Financial Measures (Cont’d) $ IN MILLIONS EBITDA and Adjusted EBITDA (non-GAAP) Adjustment to reflect the elimination of amounts related to businesses divested and classified as held-for-sale, inclusive of impairment charges and gain/(loss) on sale. Adjustment to reflect the elimination of expense attributable to deferred consideration to prior owners of acquired businesses not expected to continue or recur. Adjustment to reflect the elimination of non-cash impairment charges related to goodwill. Adjustment to reflect the elimination of costs related to business process transformation. Adjustment to reflect the elimination of costs relating to public company registration, listing and compliance. Adjustment to reflect the elimination of potential and completed acquisition-related expenses. Adjustment to reflect the elimination of costs related to the fair value step-up of acquired inventory. Adjustment to reflect the elimination of miscellaneous income in Canada related to COVID-19 relief, net of severance costs. Adjustment to reflect the elimination of non-cash charges of $155 million associated with the Annual Preferred Share Dividend and equity-based compensation related to prior ownership. Adjustment to reflect the elimination of expense under prior ownership not expected to continue or recur following the APi Acquisition. Adjustment to reflect the elimination of APG investment income prior to the APi Acquisition that is not expected to recur. Cash from these investments was used to fund a portion of the cash consideration for the APi Acquisition. Adjusted net revenues derived from non-GAAP reconciliations included elsewhere in this press release. The combined financial information for the year ended December 31, 2019 includes the results of operations of APi Group Corporation (Successor) for the period from January 1, 2019 through December 31, 2019 and the results of operations of APi Group, Inc. (Predecessor) for the period from January 1, 2019 through September 30, 2019.

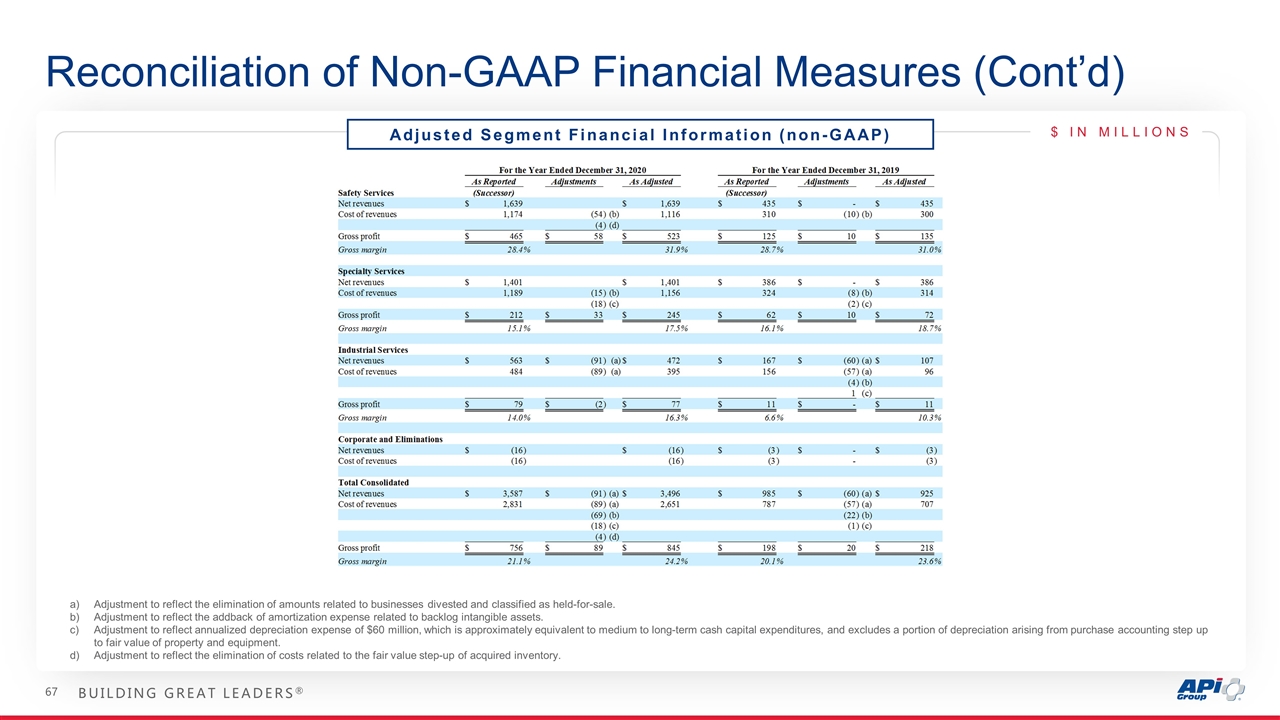

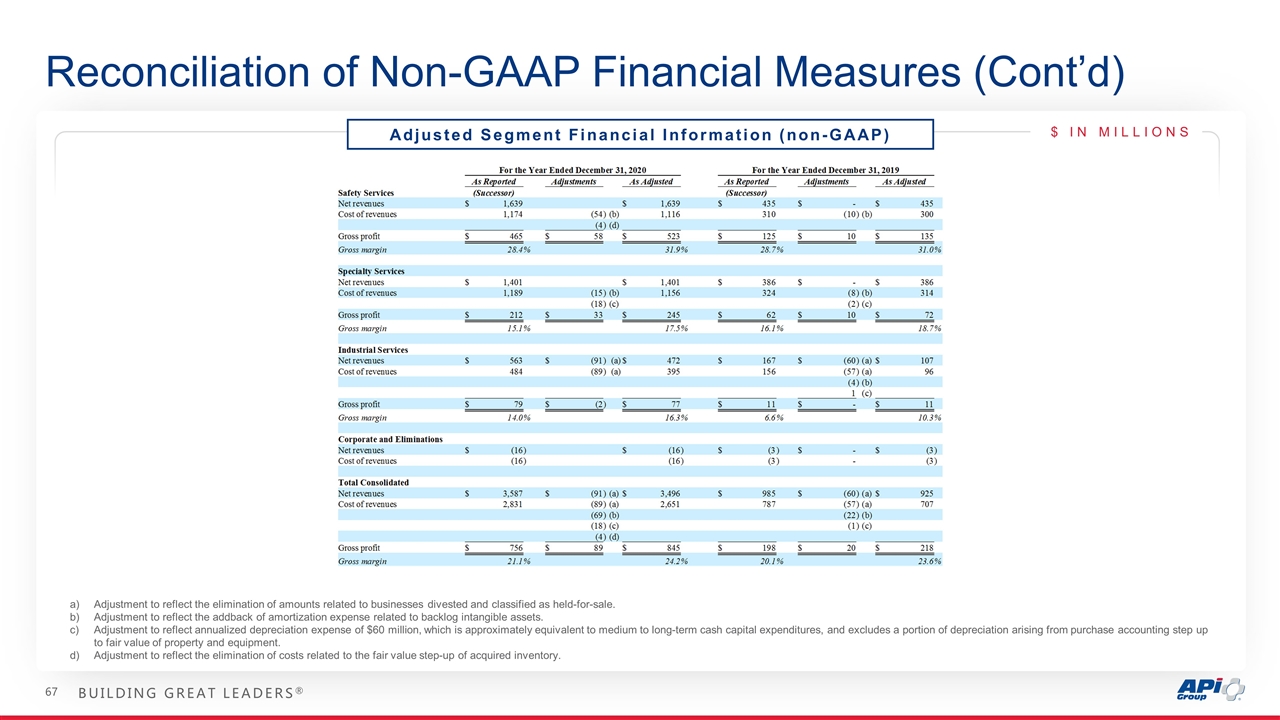

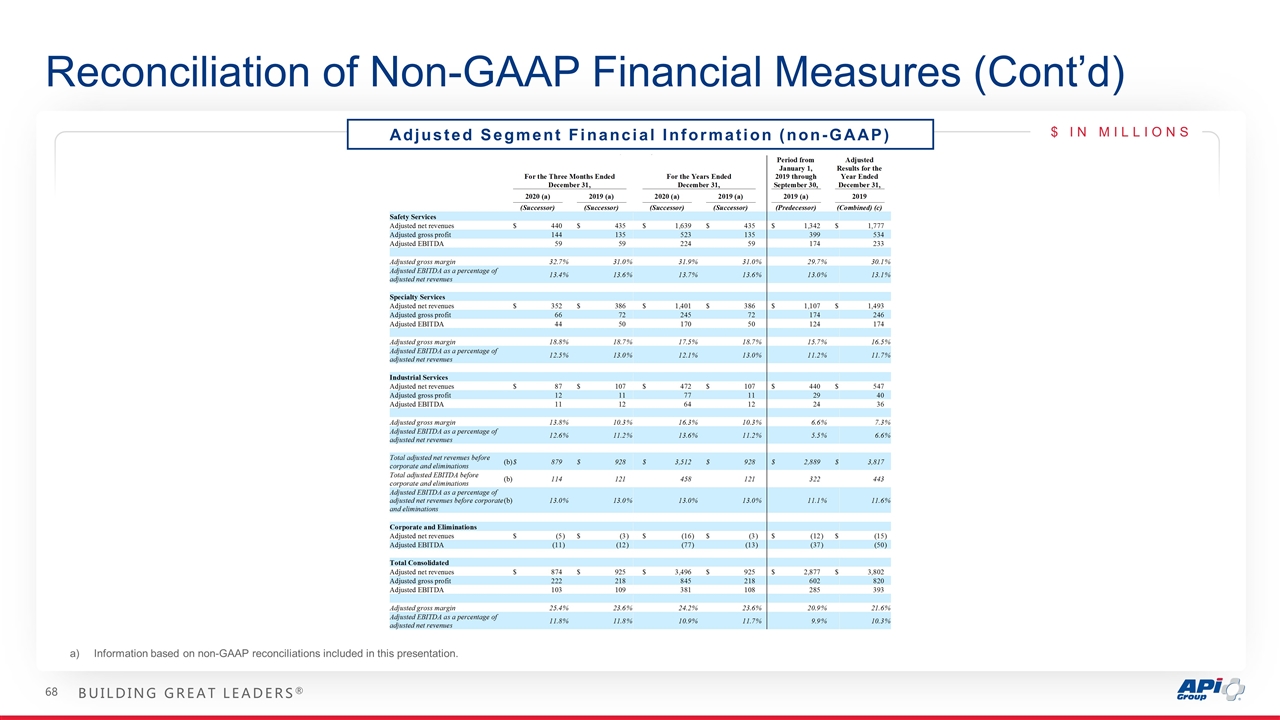

Reconciliation of Non-GAAP Financial Measures (Cont’d) Adjustment to reflect the elimination of amounts related to businesses divested and classified as held-for-sale. Adjustment to reflect the addback of amortization expense related to backlog intangible assets. Adjustment to reflect annualized depreciation expense of $60 million, which is approximately equivalent to medium to long-term cash capital expenditures, and excludes a portion of depreciation arising from purchase accounting step up to fair value of property and equipment. Adjustment to reflect the elimination of costs related to the fair value step-up of acquired inventory. $ IN MILLIONS Adjusted Segment Financial Information (non-GAAP)

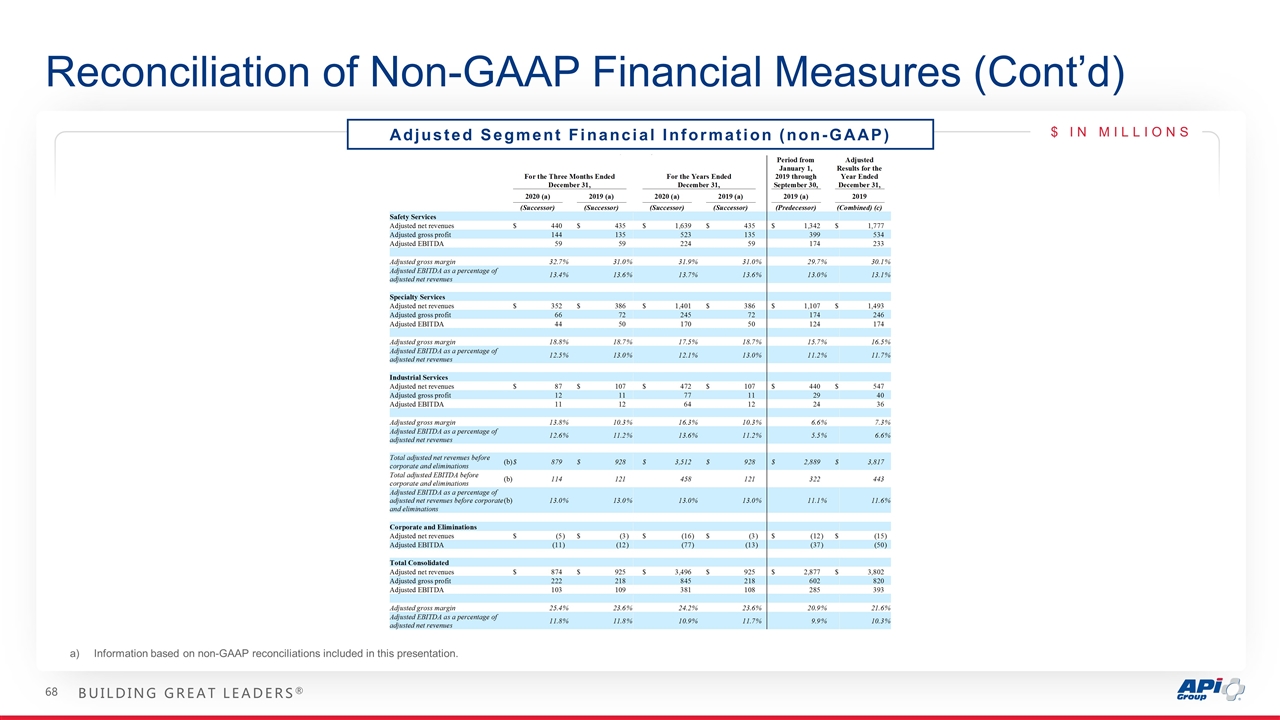

Reconciliation of Non-GAAP Financial Measures (Cont’d) Information based on non-GAAP reconciliations included in this presentation. $ IN MILLIONS Adjusted Segment Financial Information (non-GAAP)

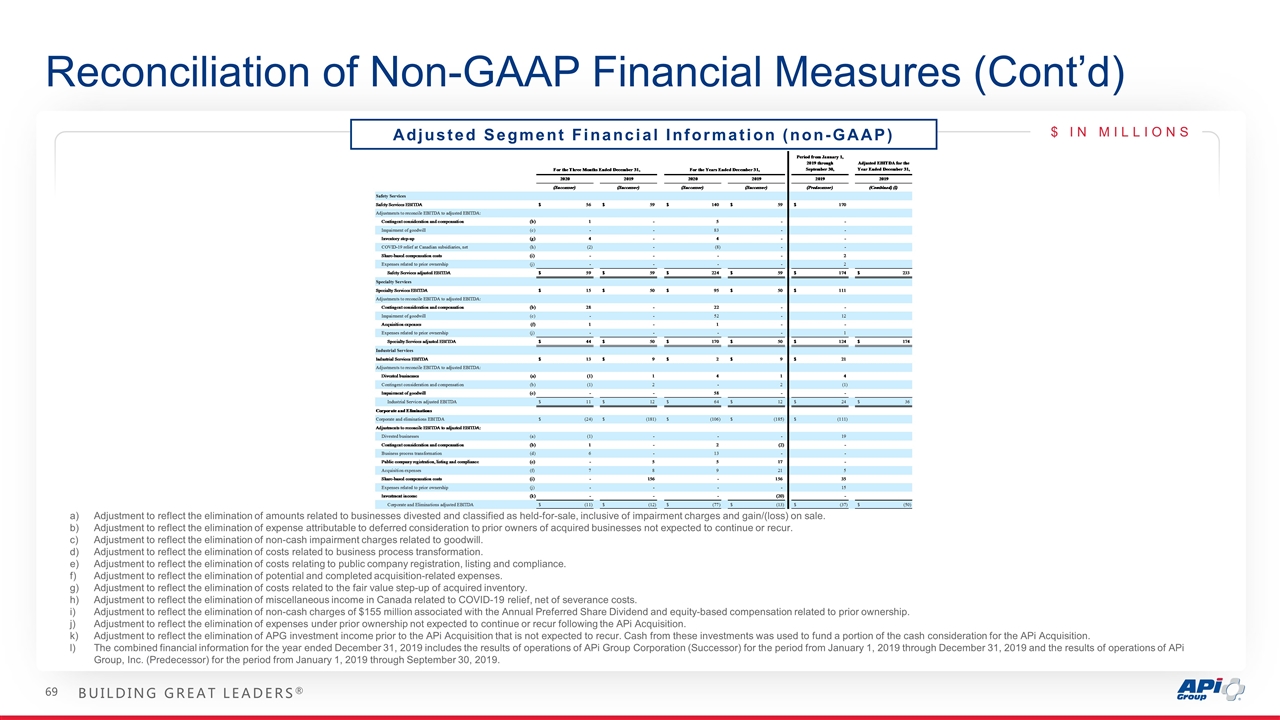

Reconciliation of Non-GAAP Financial Measures (Cont’d) Adjustment to reflect the elimination of amounts related to businesses divested and classified as held-for-sale, inclusive of impairment charges and gain/(loss) on sale. Adjustment to reflect the elimination of expense attributable to deferred consideration to prior owners of acquired businesses not expected to continue or recur. Adjustment to reflect the elimination of non-cash impairment charges related to goodwill. Adjustment to reflect the elimination of costs related to business process transformation. Adjustment to reflect the elimination of costs relating to public company registration, listing and compliance. Adjustment to reflect the elimination of potential and completed acquisition-related expenses. Adjustment to reflect the elimination of costs related to the fair value step-up of acquired inventory. Adjustment to reflect the elimination of miscellaneous income in Canada related to COVID-19 relief, net of severance costs. Adjustment to reflect the elimination of non-cash charges of $155 million associated with the Annual Preferred Share Dividend and equity-based compensation related to prior ownership. Adjustment to reflect the elimination of expenses under prior ownership not expected to continue or recur following the APi Acquisition. Adjustment to reflect the elimination of APG investment income prior to the APi Acquisition that is not expected to recur. Cash from these investments was used to fund a portion of the cash consideration for the APi Acquisition. The combined financial information for the year ended December 31, 2019 includes the results of operations of APi Group Corporation (Successor) for the period from January 1, 2019 through December 31, 2019 and the results of operations of APi Group, Inc. (Predecessor) for the period from January 1, 2019 through September 30, 2019. $ IN MILLIONS Adjusted Segment Financial Information (non-GAAP)