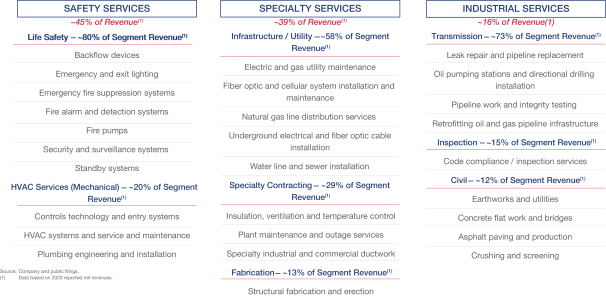

Safety Services (approximately 45% of 2020 net revenues)—A leading provider of safety services in North America and Europe, focusing on end-to-end integrated occupancy systems (fire protection services, Heating, Ventilation, and Air Conditioning (“HVAC”) and entry systems), including design, installation, inspection and service of these integrated systems. The work performed within this segment includes customers in various industries and facilities such as commercial, data center, distribution, education, healthcare, high tech, industrial and special-hazard settings. According to the 2020 Engineering News-Record (“ENR”) report, we were the largest provider of fire protection and sprinkler services in North America and management estimates we were a leading provider of critical safety services in markets in the Benelux region. The average project size in the safety services segment was approximately $10,000 as of December 31, 2020.

Specialty Services (approximately 39% of 2020 net revenues)—A leading provider of a variety of infrastructure services and specialized industrial plant services, which include maintenance and repair of critical infrastructure such as electric, gas, water, sewer and telecommunications infrastructure. According to the ENR report, we were a top five specialty services firm in 2020. Our services include engineering and design, fabrication, installation, maintenance service and repair, and retrofitting and upgrading. Customers within this segment include private and public utilities, communications, healthcare, education, manufacturing, industrial plants and governmental agencies throughout the United States. The average project size in the specialty services segment was approximately $70,000 as of December 31, 2020.

Industrial Services (approximately 16% of 2020 net revenues)—A leading provider of a variety of services to the energy industry focused on transmission and distribution. This segment’s services include oil and gas pipeline infrastructure, access and road construction, supporting facilities, and performing ongoing integrity management and maintenance. The average project size in the industrial services segment was approximately $700,000 as of December 31, 2020.

Our Industry

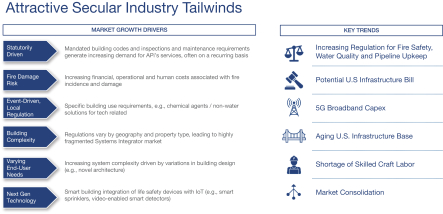

The industries in which we operate are highly fragmented and comprised of national, regional and local companies that provide services to customers across various end markets and geographies. We believe the following industry trends are affecting, and will continue to affect, demand for our services.

Increased Regulation. The life safety industry is highly regulated at the federal, state and local levels and continuous regulatory changes, including mandated building codes and inspections and maintenance requirements, continue to generate increasing demand for our services, often on a recurring basis. Specifically, the Uniform Building Codes written by the National Fire Protection Association, and the International Code Council regulate fire suppression and sprinkler systems. Among other things, these codes require testing, inspections, repair, maintenance and specific retrofits of building fire suppression and sprinkler systems which generates recurring revenue related to those services. As these associations and government agencies continue to adopt new, more stringent regulations, the demand for our services increases.

Additionally, in the United States, the Tax Cuts and Jobs Act of 2017 provides federal tax incentives to businesses that install fire suppression and sprinkler systems in new buildings, upgrade existing systems or retrofit existing structures with systems.

COVID-19 and Non-Residential Construction. The negative economic impacts of COVID-19 have had an overall negative impact on non-residential construction. However, certain end markets we serve have been less impacted, such as data centers and distribution. As a leading provider of specialty contracting services, we are impacted by these macroeconomic events and are unable to know if the recovery from COVID-19 economic impacts in all markets we serve will rebound timely and completely. We believe that certain services driven by regulatory requirements assist our ability to have demand for our services even in tough markets; however, these markets may experience additional congestion.

S-6