- APG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

APi (APG) DEF 14ADefinitive proxy

Filed: 29 Apr 24, 5:14pm

Filed by the Registrant | x | Filed by a party other than the Registrant | o |

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

x | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Under Rule 240.14a-12 |

x | No fee required. | |

o | Fee paid previously with preliminary materials. | |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| Notice of 2024 Annual Meeting of Shareholders |

Date and Time June 14, 2024 8:30 a.m. (Central Time) |  Location Virtual-only at www.virtualshareholdermeeting.com/APG2024 |  Record Date April 19, 2024 |

Matter | Board Recommendation | Page | ||

Proposal 1—Election of Directors | FOR each Director Nominee | 16 | ||

Proposal 2—Ratification of KPMG as Independent Auditor | FOR | 45 | ||

Proposal 3—Advisory Vote on Executive Compensation | FOR | 47 |

Before the Meeting | During the Meeting | ||

via the Internet at www.proxyvote.com |  by Mail |  by Telephone at 1-800-690-6903 |  www.virtualshareholdermeeting.com/APG2024 |

Name | Director Since | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

Sir Martin E. Franklin, Board Co-Chair | 2017 | No | |||

James E. Lillie, Board Co-Chair | 2017 | Yes | |||

Ian G.H. Ashken | 2019 | Yes | ✓* | ✓ | |

Russell A. Becker | 2019 | No | |||

Paula D. Loop | 2022 | Yes | ✓ | ✓ | |

Anthony E. Malkin | 2019 | Yes | ✓ | ||

Thomas V. Milroy | 2017 | Yes | ✓* | ||

Cyrus D. Walker | 2019 | Yes | ✓ | ✓* | |

Carrie A. Wheeler | 2019 | Yes | ✓ |

| 1 |

Shareholder Value Creation Model |  |

Building Great Leaders | Growing Revenue | Expanding Margins | Generating Free Cash Flow |

•Teammate safety and engagement •Everyone, everywhere is a leader •Best-in-class field leaders and leadership development •Paying for performance •ESG & diversity, equity and inclusion | •Delivering long-term organic revenue growth above industry average •Go-to-market strategy of selling inspections first •Expanding share with new and existing customers •Expanding capabilities and geographies | •13%+ Adjusted EBITDA Margin by 2025 •Improving mix with long-term target of 60% + of revenue •Pricing initiatives •Disciplined project and customer selection •Systems, scale, leverage and operational excellence •Procurement savings and $125M value capture •Strategic M&A | •Long-Term target of 80% adjusted free cash flow conversion and net leverage ratio of <2.5x •Asset light, low capex operating model •Continuously pursuing accretive M&A and portfolio optimization |

2 |  |

| 3 |

Leadership | Leadership at every level enables us to win. Our leaders drive performance and productivity. They set expectations for, and model, the culture we aspire for safety, inclusion and professional development. Our leaders execute on our vision and direction for the future. Strong leadership is crucial in our quest to become the number one people-first public company that is number one in business performance in our industry. | |

Safety | Safety is our number-one value. We have adopted modern safety approaches to change workplace behavior to create better safety outcomes. We want our employees to be safe and feel safe. Our approach to safety, and our investment in the right safety resources, goes beyond physical risks and embraces techniques that affect the mental health and psychological safety of our team. | |

Environment | We have undertaken several projects to understand our impact on the environment. Our businesses pride themselves on being able to provide innovative solutions to our customers. We want to be able to add value for our customer in their approach to addressing their own environmental impact. Internally, we want to understand our impact on the environment by assessing the extent of the carbon footprint of our operations. We expect this will take time, but things that are done right usually do. We are in it for the long-haul. | |

Inclusion | Inclusion at APi centers on attracting, retaining and growing diverse talent. Diversity, Equity and Inclusion is a strategic imperative to win the battle for talent. We have equipped our top leaders and operating company presidents with the tools to understand their worldview and intercultural competence/cultural fluency. We offer learning opportunities (courses, events, speakers, mentoring opportunities, etc.) to support their cultural fluency development. Our leaders’ cultural competence will lead to a more inclusive culture which will, in turn, positively affect our outcomes related to talent. | |

Governance | APi has developed policies and programs that assure strong corporate Governance of our sustainability strategy. Through our materiality assessment, our stakeholders demand board oversight, transparency and robust ethics and compliance. We have adopted policies in several areas to mitigate key risks and that facilitate the appropriate levels of compliance, including with respect to cybersecurity risk, labor and human rights, and conflicts of interest. |

4 |  |

ü | Non-classified Board – annual election of all directors | ü | Board oversight of risk management |

ü | Independent Lead Director and Committees | ü | Executive Sessions during each Board meeting with non-employee directors in attendance |

ü | Separate CEO and Board Co-Chairs | ü | Annual Board and Committee self-evaluations |

ü | Majority voting standard for uncontested director elections | ü | Age limit for directors (75) |

ü | Code of Conduct applicable to all directors and executive officers | ü | Director and executive officer stock ownership requirements |

ü | Clawback policy for performance-based compensation | ü | Open communication encouraged among directors and management |

| 5 |

6 |  |

Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||

Ian G.H. Ashken* | Paula D. Loop | Ian G.H. Ashken | ||

Paula D. Loop | Thomas V. Milroy* | Anthony E. Malkin | ||

Carrie A. Wheeler | Cyrus D. Walker | Cyrus D. Walker* |

| 7 |

8 |  |

| 9 |

10 |  |

| 11 |

12 |  |

| 13 |

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Total ($) | |||

Sir Martin E. Franklin | — | — | — | |||

James E. Lillie | $75,000 | $100,000 | $175,000 | |||

Ian G.H. Ashken | $90,000 | $100,000 | $190,000 | |||

David S. Blitzer | — | — | — | |||

Paula D. Loop | $82,500 | $100,000 | $182,500 | |||

Anthony E. Malkin | $80,000 | $100,000 | $180,000 | |||

Thomas V. Milroy | $88,750 | $100,000 | $188,750 | |||

Cyrus D. Walker | $90,000 | $100,000 | $190,000 | |||

Carrie A. Wheeler | $83,750 | $100,000 | $183,750 |

14 |  |

Name | Aggregate Number of Restricted Stock Units Outstanding at December 31, 2023 | Aggregate Number of Unexercised Stock Options Outstanding at December 31, 2023 | ||

Sir Martin E. Franklin | — | — | ||

James E. Lillie | 3,948 | — | ||

Ian G.H. Ashken | 3,948 | — | ||

David S. Blitzer | — | — | ||

Paula D. Loop | 3,948 | — | ||

Anthony E. Malkin | 3,948 | — | ||

Thomas V. Milroy | 3,948 | 37,500 | ||

Cyrus D. Walker | 3,948 | — | ||

Carrie A. Wheeler | 3,948 | — |

| 15 |

Director Since 2017 Co-Chair Since 2019 Age: 59 Other Public Co. Boards: •Nomad Foods Limited •Element Solutions Inc •Admiral Acquisition Limited | Sir Martin E. Franklin |

Sir Martin has served as a director of APi Group Corporation since September 2017 and has served as Co-Chair since October 2019. Sir Martin is the founder and Chief Executive Officer of Mariposa Capital, LLC, and Chairman and controlling shareholder of Royal Oak Enterprises, LLC, a manufacturer of charcoal and grilling products, since July 2016. Sir Martin is also founder and Executive Chairman of Element Solutions Inc, a specialty chemicals company, and has served as a director since its inception in April 2013, co-founder and co-chairman of Nomad Foods Limited, a leading European frozen food company, and has served as a director since its inception in April 2014, and a founder and director of Admiral Acquisition Limited since May 2023. Sir Martin was the co-founder and Chairman of Jarden Corporation (“Jarden”) from 2001 until April 2016 when Jarden merged with Newell Brands Inc (“Newell”) serving also as its CEO from 2001 to 2011 and its Executive Chairman from 2011-2016. Prior to founding Jarden in 2001, between 1992 and 2000, Sir Martin served as the Chairman and/or Chief Executive Officer of three public companies: Benson Eyecare Corporation, an optical products and services company; Lumen Technologies, Inc., a holding company that designed, manufactured and marketed lighting products; and Bollé Inc., a holding company that designed, manufactured and marketed sunglasses, goggles and helmets worldwide. Qualifications: We believe Sir Martin’s qualifications to serve on our Board include his executive leadership experience, experience as a member of other corporate boards and his knowledge of public companies. | |

16 |  |

Director Since 2017 Co-Chair Since 2019 Age: 62 Other Public Co. Boards: • Nomad Foods Limited | James E. Lillie |

Mr. Lillie has served as a director of APi Group Corporation since September 2017 and has served as Co-Chair since October 2019. Previously, he served as Jarden’s Chief Executive Officer from June 2011 until Jarden’s business combination with Newell in 2016. From 2003 to 2011 he served as Jarden’s Chief Operating Officer and President (from 2004). From 2000 to 2003, Mr. Lillie served as Executive Vice President of Operations at Moore Corporation, Limited. From 1999 to 2000, he served as Executive Vice President of Operations at Walter Industries, Inc., a Kohlberg, Kravis, Roberts & Company (“KKR”) portfolio company. From 1990 to 1999, Mr. Lillie held a succession of senior level management positions across a variety of disciplines including human resources, manufacturing, finance and operations at World Color, Inc., another KKR portfolio company. Since June 2015, Mr. Lillie has served on the board of directors of Nomad Foods Limited and served on the board of directors of Tiffany & Co. from February 2017 until January 2021. Qualifications: We believe Mr. Lillie’s qualifications to serve on our Board include his executive experience, service on other corporate boards and his knowledge of public companies. | |

Director Since 2019 Age: 63 Committees: •Audit (Chair) •Nominating and Corporate Governance Other Public Co. Boards: •Nomad Foods Limited •Element Solutions Inc. | Ian G.H. Ashken |

Mr. Ashken has served as a director of APi Group Corporation since October 2019. Previously, he was the co-founder of Jarden and served at various times as its Vice Chairman, President, Chief Financial Officer, Secretary, and a director from June 2001 until the consummation of Jarden’s business combination with Newell in April 2016. Prior to Jarden, Mr. Ashken served as the Vice Chairman and/or Chief Financial Officer of three public companies: Benson Eyecare Corporation, Lumen Technologies, Inc. and Bollé Inc. between 1992 and 2000. Mr. Ashken also serves as a director of Element Solutions Inc and Nomad Foods Limited and is a director or trustee of a number of private companies. Qualifications: We believe Mr. Ashken’s qualifications to serve on our Board include his executive experience, service on other corporate boards and his knowledge of public companies. | |

(Chief Executive Officer) Director Since 2019 Age: 58 Other Public Co. Boards: •None | Russell A. Becker |

Mr. Becker has served as a director of APi Group Corporation since October 2019. Mr. Becker joined APi Group, Inc. in 2002 as President and Chief Operating Officer and became CEO in 2004. Mr. Becker has continued to serve as CEO of APi Group Corporation following its acquisition of APi Group, Inc. in October 2019. Prior to leading APi Group, Inc., Mr. Becker served in a variety of roles at The Jamar Company, a subsidiary of APi Group, Inc., including as a Manager of Construction from 1995 to 1997 and as President from 1998 until he joined APi Group, Inc. in 2002. Mr. Becker served as a project manager for Ryan Companies from 1993 to 1995 and as a field engineer with Cherne Contracting from 1991 to 1993. Since July 2017, Mr. Becker has served on the board of directors of Liberty Diversified Industries and since January 2019 has served on the board of directors for Marvin Companies, each a private company. Mr. Becker also serves on the advisory board for the Science of Engineering at Michigan Technological University. Qualifications: We believe Mr. Becker’s qualifications to serve on our Board include his extensive knowledge of APi Group and his years of executive leadership at APi Group. |

| 17 |

Director Since 2022 Age: 62 Committees: •Audit •Compensation Other Public Co. Boards: •Fastly, Inc. •Robinhood Markets, Inc. | Paula D. Loop |

Ms. Loop has served as a director of APi Group Corporation since March 2022. Ms. Loop retired as an Assurance Partner at PricewaterhouseCoopers (“PwC”) in June 2021 after over 30 years with PwC. At PwC she was the leader of PwC’s Governance Insights Center and served on the Board of Partners from 2017 to 2021. She was also previously the New York Metro Regional Assurance Leader leading one of PwC’s largest Assurance practices. Ms. Loop has significant experience working with boards and audit committees across multiple markets and industry sectors on governance, accounting and SEC reporting matters. She serves as a director of Robinhood Markets, a financial services company, since June 2021 and as a director of Fastly Inc., an edge cloud computing company, since July 2021. Ms. Loop holds a bachelor’s degree in business administration from the University of California at Berkeley. Qualifications: We believe Ms. Loop’s qualifications to serve on our Board include her public company experience specifically working with boards, audit committees and SEC reporting, and her service on other public company boards. | |

Director Since 2019 Age: 61 Committees: •Nominating and Corporate Governance Other Public Co. Boards: •Empire State Realty Trust, Inc. | Anthony E. Malkin |

Mr. Malkin has served as a director of APi Group Corporation since October 2019. Since October 2013, Mr. Malkin has served as Chairman and Chief Executive Officer of Empire State Realty Trust, Inc. (“ESRT”), a real estate investment trust. Mr. Malkin joined ESRT’s predecessor entities in 1989. Mr. Malkin is the Chairman of Malkin Holdings L.L.C. Mr. Malkin has been a leader in existing building energy efficiency retrofits through coordinating the team of Clinton Climate Initiative, Johnson Controls, JLL and Rocky Mountain Institute in a groundbreaking project at the Empire State Building. Mr. Malkin led the development of standards for energy efficient office tenant installations, now known as the Tenant Energy Optimization Program, at the Urban Land Institute. Mr. Malkin also serves as a member of the Real Estate Roundtable and Chair of its Sustainability Policy Advisory Committee, the Climate Mobilization Advisory Board of the New York City Department of Buildings, Urban Land Institute, the Board of Governors of the Real Estate Board of New York, and the Partnership for New York City’s Innovation Council. Qualifications: We believe Mr. Malkin’s qualifications to serve on our Board include his real estate investment experience, service on other corporate boards and his knowledge of public companies. | |

18 |  |

(Lead Independent Director) Director Since 2017 Age: 68 Committees: •Compensation (Chair) Other Public Co. Boards: •Interfor Corporation •Admiral Acquisition Limited | Thomas V. Milroy |

Mr. Milroy has served as a director of APi Group Corporation since September 2017. Mr. Milroy has been retired since 2015, and worked for BMO Capital Markets (“BMOCM”), an investment banking firm, from 1993 to January 2015. From March 2008 to October 2014, Mr. Milroy served as Chief Executive Officer of BMOCM and acted as senior advisor to the Chief Executive Officer of BMO Financial Group from November 2014 until his retirement in January 2015. During his tenure as Chief Executive Officer at BMOCM, he was responsible for all of BMO’s business involving corporate, institutional and government clients globally. Mr. Milroy also serves as a director of Interfor Corporation, a large lumber producer, Admiral Acquisition Limited, and Generation Capital Limited, a private investment company. Mr. Milroy is a member of the Law Society of Ontario. Previously, Mr. Milroy served as a director of Tim Hortons Inc. from August 2013 to December 2014 and Restaurant Brands International Inc. from December 2014 to June 2018. Qualifications: We believe Mr. Milroy’s qualifications to serve on our Board include his experience as past Chief Executive Officer of a large financial services company, service on other corporate boards and his knowledge of finance, investment and corporate banking, mergers and acquisitions, risk assessment and business development. | |

Director Since 2019 Age: 56 Committees: •Nominating and Corporate Governance (Chair) • Compensation Other Public Co. Boards: •Houlihan Lokey, Inc. | Cyrus D. Walker |

Mr. Walker has served as a director of APi Group Corporation since October 2019. As of August 2023, Mr. Walker has served as a Strategic Advisor for Fifth Down Capital, an investment firm that focuses on private companies in the global internet, software, consumer, and fintech industries. Mr. Walker has served as a director for Starwood Credit Income Real Estate Trust (S-CREDIT) since November 2023. Since February 2022, Mr. Walker has been a principal at Discovery Land Company, a U.S.- based real estate developer and operator of private communities and resorts. Since January 2022, Mr. Walker has been an operating partner at Vistria Group, a private equity investment firm, and has served as a director for The Mather Group, an investment advisory firm and affiliate of Vistria Group. Mr. Walker has served as a director for Flores & Associates LLC, also a Vistria Group affiliated company, since August 2022. Mr. Walker has served as a director of privately held jewelry company, Kendra Scott, since May 2021, and as a director of Houlihan Lokey, Inc since November 2020. From April 2018 to March 2022, Mr. Walker served as the founder and Chief Executive Officer of The Dibble Group, an insurance brokerage and consulting firm and from January 2000, has served in several roles at Nemco Group, LLC, an insurance brokerage and consulting firm, including serving as its Co-Chief Executive Officer until April 2012, when it was acquired by a subsidiary of NFP Corp., a multi-national insurance brokerage and consulting business. Mr. Walker also founded and served as Chief Executive Officer of OSI Benefits, an insurance brokerage consulting firm and division of Opportunity Systems, Inc., from 1995 to January 2000. Qualifications: We believe Mr. Walker’s qualifications to serve on our Board include his executive experience and service on other corporate boards. | |

| 19 |

Director Since 2019 Age: 52 Committees: •Audit Other Public Co. Boards: •Opendoor •TKO Group Holdings, Inc. | Carrie A. Wheeler |

Ms. Wheeler has served as a director of APi Group Corporation since October 2019. Ms. Wheeler has served as Chief Executive Officer of Opendoor, a technology firm for residential real estate, since December 2022. She previously served as Opendoor’s Chief Financial Officer since September 2020. From 1996 to 2017, Ms. Wheeler was with TPG Global, a global private equity firm, including as a Partner and Head of Consumer and Retail Investing. In addition, Ms. Wheeler has served as a director for TKO Group Holdings, Inc. since September 2023, and has previously served on a number of other corporate boards, including Dollar Tree, Neiman Marcus Group, and Petco Animal Supplies. Qualifications: We believe Ms. Wheeler’s qualifications to serve on our Board include her executive leadership, extensive experience in business assessment, mergers and acquisitions, financing and guiding public market transactions, her current experience as a Chief Executive Officer and former Chief Financial Officer of a public company, and her substantial experience serving on other corporate boards, including her previous service on other companies’ audit committees. | |

✔ | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. |

20 |  |

Name(1) | Title | |

Russell A. Becker | CEO and President | |

Kevin S. Krumm | Executive Vice President and CFO | |

Louis B. Lambert | Senior Vice President, General Counsel and Secretary | |

Kristina M. Morton | Senior Vice President and Chief People Officer |

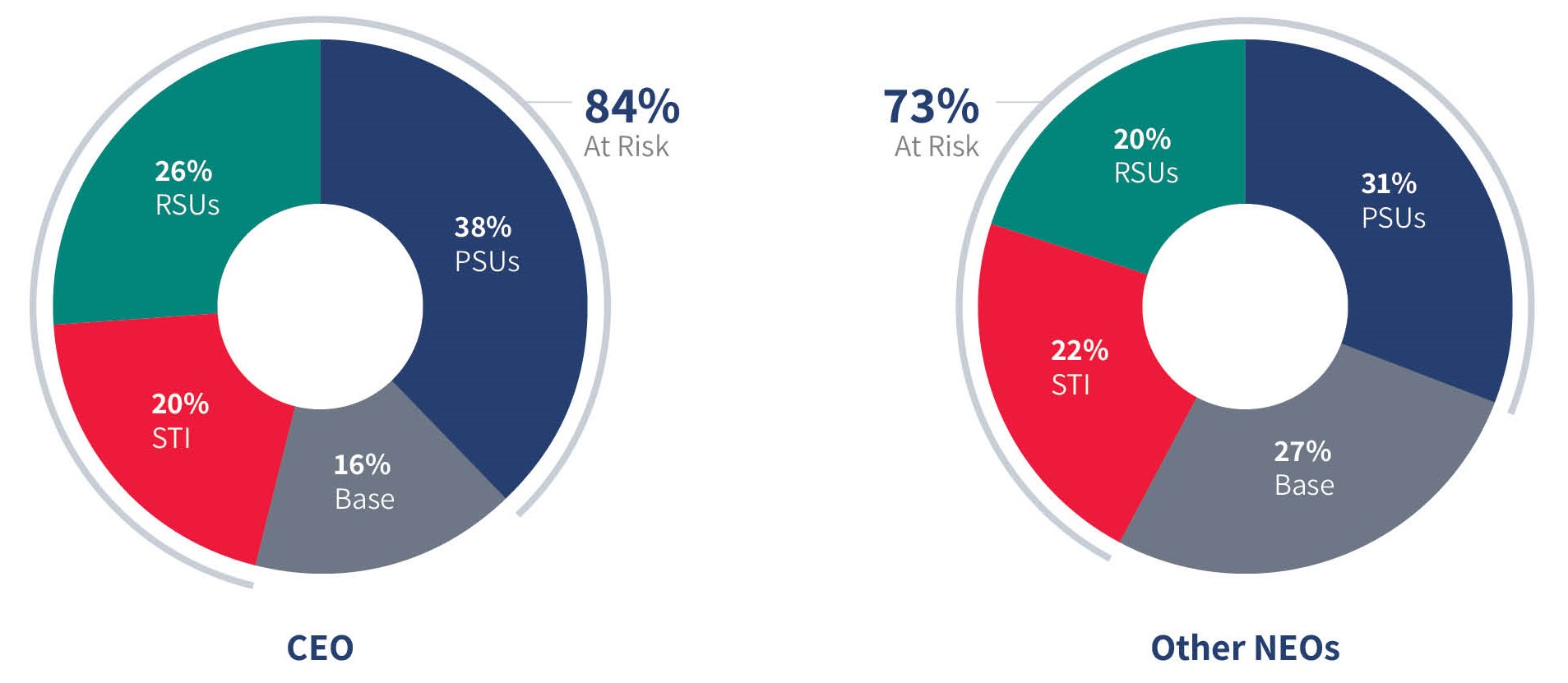

Strategically Aligned | Align with business strategies to deliver winning performance |

Performance Based | Tie significant portions of compensation to performance metrics that align to our short- and long-term goals |

Drives Shareholder Value Creation | Align each executive's interests with shareholder's interests |

Market Informed | Design programs and compensation levels competitive with the external market |

Motivates & Retains Executives | Attract and retain key executives capable of leading the business forward |

| 21 |

22 |  |

What We DO | ||

ü | Pay for performance with a substantial majority of pay dependent on performance, not guaranteed | |

ü | Use multi-year vesting terms for annual executive officer equity awards | |

ü | Balance short- and long-term incentives | |

ü | Require executive officers to place compensation at risk of “clawback” actions by the Company in appropriate circumstances | |

ü | Engage an independent compensation consultant | |

ü | Benchmark compensation to peer and market data during compensation decision-making process | |

ü | Maintain stock ownership guidelines for officers | |

What We DON’T DO | ||

X | Maintain single trigger severance provisions upon a change in control in employment agreements | |

X | Permit liberal share recycling | |

X | Stock option repricing or exchange without shareholder approval | |

X | Permit hedging or short sales of the Company’s stock | |

X | Provide excise tax gross-ups for change in control payments | |

X | Provide excessive severance to executive officers | |

X | Provide excessive perquisites | |

| 23 |

Role | Responsibilities | Description | |||

Compensation Committee | Oversees Programs and Decisions | Our Board has adopted a written Compensation Committee Charter that governs the responsibilities of the Compensation Committee. The Compensation Committee is responsible for, among other things: •reviewing and approving corporate goals and objectives with respect to compensation for the CEO, evaluating the CEO’s performance and approving the CEO’s compensation based on such evaluation; and •determining compensation for the Company’s other executive officers. In reviewing and determining executive compensation, the Compensation Committee generally considers: compensation levels at peer companies and information derived from compensation surveys provided by outside consultants, as further described below; the Company’s past-year performance and growth; the results of any Say-on-Pay votes by shareholders; achievement of specific pre-established financial goals; a subjective determination of the executives’ past performance and expected future contributions to the Company; past equity awards granted to such executives; and the recommendation of the CEO. | |||

Shareholders | Provide Feedback | The Compensation Committee evaluates the most recent advisory vote of the Company's shareholders on executive compensation, known as the "Say-on-Pay" vote, as well as other feedback that it may receive from the Company's largest shareholders in connection with this vote. Our Say-on- Pay results consistently reflect strong support for the linkage between pay and performance in our compensation programs. Over the past three years our Say-on-Pay results have been above 95%. | |||

2021 | 2022 | 2023 | |||

Say on Pay Results | 97.5% | 96.5% | 95.5% | ||

The Compensation Committee believes these voting results demonstrate significant continuing support for our executive compensation program. We seek input from our shareholders and conduct shareholder engagement efforts throughout the year. The Compensation Committee will continue to consider the views of our shareholders in connection with executive pay practices and programs and will make adjustments based on evolving best practices and changing regulatory or other requirements. | |||||

Independent Compensation Consultant | Advises Compensation Committee | In 2023, the Compensation Committee used WTW to serve as the independent compensation consultant. The information from WTW regarding pay practices at peer companies is used by the Compensation Committee as a resource in its deliberations regarding executive compensation and will be useful in determining the marketplace competitiveness as well as reasonableness and appropriateness of our executive compensation programs. | |||

Executive Officers | Provide Input and Insights | The Compensation Committee considers input from our CEO, CFO, and Chief People Officer when determining performance metrics and objectives for our STI and LTI plans and evaluating performance against such metrics and objectives. Our CEO and Chief People Officer then evaluate the individual performance and the competitive pay positioning of senior management members who report directly to the CEO, including the NEOs, and then make recommendations to the Compensation Committee regarding the target compensation for such NEOs and other executive officers of the Company. | |||

24 |  |

2023 Peer Group | ||||

ADT Inc. | Comfort Systems USA, Inc. | Resideo Technologies, Inc. | ||

ABM Industries Incorporated | Ecolab Inc. | SNC-Lavalin Group Inc. | ||

Aramark | EMCOR Group, Inc. | The Brink's Company | ||

ASGN Incorporated | Jacobs Engineering Group Inc. | Waste Connections, Inc. | ||

Cintas Corporation | Otis Worldwide Corporation | Xylem Inc. | ||

Clean Harbors, Inc. | Republic Services, Inc. | |||

Reference Peer | ||||

Johnson Controls International plc | ||||

Peer Group Changes Made for 2023 | ||||

Removed from peer group: | ||||

Dycom Industries, Inc. | Primoris Services Corporation | Tutor Perini Corporation | ||

MasTec, Inc. | Quanta Services, Inc. | |||

Added to peer group: | ||||

ABM Industries Incorporated | Republic Services, Inc. | Waste Connections, Inc. | ||

Clean Harbors, Inc. | The Brink's Company | |||

| 25 |

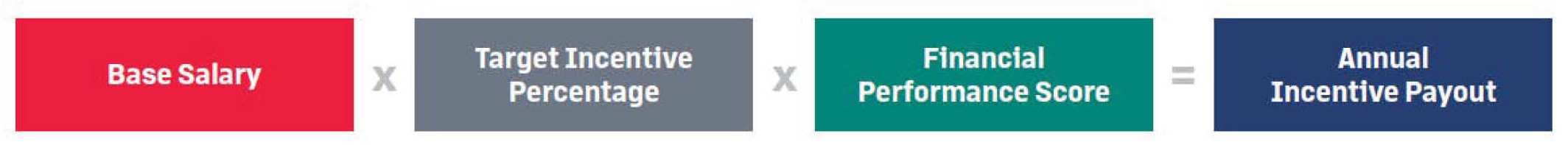

Role | Compensation Element & Purpose | Key Characteristics | How the Amount is Determined |

Fixed | Base Salary Attract and retain top talent | Fixed compensation component paid in cash | Base salary decisions are informed by peer group market data by role, individual contributions to business outcomes, pay equity and future potential, among other factors |

Variable (At- Risk) | Short-Term Incentives (STI) Align compensation with annual financial performance on key financial metrics and motivate the achievement of those results For further details see the "Short-Term Incentive Compensation" section | Variable compensation payable in cash, based on the achievement of pre- established annual financial goals 100% based on Adjusted EBITDA Payouts can range from 0-200% of target | Each NEO has an individual target set as a % of base salary Individual target STI % are informed by peer group market data by role, job scope and responsibilities, pay equity and future potential Payouts are determined based on actual financial results vs. the pre- established annual financial goals |

Long-Term Incentives (LTI) Align the interests of our executives with shareholders, encourage long-term value creation and serve as a retention vehicle For further details on the Performance Share Units ("PSUs") and Restricted Stock Units ("RSUs") see the "Long- Term Incentive (LTI)" section. | Variable compensation tied to stock price performance and, in some cases, pre- established 3-year financial goals 60% Cumulative Adjusted EBITDA PSUs, payout range of 0-200%; 40% RSUs | Each NEO has an individual target set as a % of base salary Individual target LTI %s are informed by peer group market data by role, individual contributions to business outcomes, pay equity and future potential, among other factors |

26 |  |

Name | Base Salary | Increase (%) | ||

Russell A. Becker | $1,425,000 | 5.6% | ||

Kevin S. Krumm | $792,000 | 5.6% | ||

Louis B. Lambert(1) | $500,000 | 0% | ||

Kristina M. Morton | $475,000 | 5.6% |

| 27 |

Payout % | 0% | 40% | 100% | 200% |

Metric | < Threshold | Threshold | Target | Maximum |

2023 Adjusted EBITDA Targets ($ in millions) | <$719.2 | $719.2 | $757.0 | $794.9 |

2023 Adjusted EBITDA Actual Performance ($ in millions) | $783.2 | |||

2023 Financial Performance Score | 169.1% | |||

Named Executive Officer | Target STI as a % of Base Salary | Financial Performance Payout Factor | Payout |

Russell A. Becker | 125% | 169.1% | $3,012,094 |

Kevin S. Krumm | 100% | 169.1% | $1,339,272 |

Louis B. Lambert | 75% | 169.1% | $634,125 |

Kristina M. Morton | 75% | 169.1% | $602,419 |

28 |  |

Named Executive Officer | Target LTI as a % of Base Salary | Total Grant Date Fair Value ($) | PSUs | RSUs |

Russell A. Becker | 400% | $5,700,030 | $3,420,023 | $2,280,007 |

Kevin S. Krumm | 250% | $1,980,021 | $1,188,003 | $792,018 |

Louis B. Lambert | 175% | $875,018 | $525,006 | $350,012 |

Kristina M. Morton | 150% | $712,530 | $427,509 | $285,021 |

Payout % | 0% | 25% | 100% | 200% |

Metric | < Threshold | Threshold | Target | Maximum |

2023 Adjusted EBITDA Margin Targets | <10.7% | 10.7% | 11.3% | 13.3% |

2023 Adjusted EBITDA Margin Actual Performance | 11.3% | |||

2021-2023 PSU Performance | 100.0% | |||

| 29 |

30 |  |

Title | Stock Ownership Guidelines | |

CEO | 5x Base Salary | |

Executive Vice Presidents & Senior Vice Presidents | 2x Base Salary |

| 31 |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1)(2) | Non-Equity Incentive Plan Compensation ($)(3) | All Other Compensation ($)(4) | Total ($) | ||||||

Russell A. Becker | 2023 | $1,425,000 | — | $5,700,030 | $3,012,094 | $60,506 | $10,197,630 | ||||||

President and Chief Executive Officer | 2022 | $1,350,000 | — | $5,400,052 | $1,898,100 | $53,705 | $8,701,857 | ||||||

2021 | $1,250,012 | — | $5,700,280 | $1,025,000 | $52,216 | $8,027,508 | |||||||

Kevin S. Krumm | 2023 | $792,315 | — | $1,980,020 | $1,339,272 | $39,732 | $4,151,339 | ||||||

Executive Vice President and Chief Financial Officer | 2022 | $750,000 | — | $1,875,022 | $1,054,500 | $27,398 | $3,706,920 | ||||||

2021 | $213,068 | — | $1,250,003 | $220,000 | $5,199 | $1,688,270 | |||||||

Louis B. Lambert | 2023 | $500,000 | — | $875,018 | $634,125 | $22,127 | $2,031,270 | ||||||

Senior Vice President,General Counsel and Secretary | 2022 | $218,750 | $120,000 | $600,013 | $230,672 | $5,431 | $1,174,866 | ||||||

Kristina M. Morton | 2023 | $475,000 | — | $712,530 | $602,419 | $32,061 | $1,822,010 | ||||||

Senior Vice President, Chief People Officer | 2022 | $397,211 | $107,000 | $1,600,017 | $418,859 | $16,896 | $2,539,983 |

32 |  |

R. Becker | K. Krumm | L. Lambert | K. Morton | |

401(k) Contributions by Company | ||||

Profit Sharing(1) | $9,081 | $9,081 | $0 | $0 |

Cash Match | $9,494 | $11,250 | $11,250 | $11,250 |

Executive Life and Disability | $27,067 | $6,535 | $1,877 | $11,811 |

Annual Executive Physicals | $0 | $3,866 | $0 | $0 |

Club Fees | $5,864 | $0 | $0 | $0 |

Car Allowance | $9,000 | $9,000 | $9,000 | $9,000 |

Total | $60,506 | $39,732 | $22,127 | $32,061 |

Name | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Grant Date and Approval Date | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | Grant Date Fair Value of Stock Awards ($)(4) | ||||

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | ||||

Russell A. Becker | $712,500 | $1,781,250 | $3,562,500 | 2/27/2023 | 36,508 | 146,030 | 292,060 | $3,420,023 | |

2/27/2023 | 97,353 | $2,280,007 | |||||||

Kevin S. Krumm | $316,800 | $792,000 | $1,584,000 | 2/27/2023 | 12,682 | 50,726 | 101,452 | $1,188,003 | |

2/27/2023 | 33,818 | $792,018 | |||||||

Louis B. Lambert | $150,000 | $375,000 | $750,000 | 2/27/2023 | 5,604 | 22,417 | 44,834 | $525,006 | |

2/27/2023 | 14,945 | $350,012 | |||||||

Kristina M. Morton | $142,500 | $356,250 | $712,500 | 2/27/2023 | 4,564 | 18,254 | 36,508 | $427,509 | |

2/27/2023 | 12,170 | $285,021 | |||||||

| 33 |

Name | Stock Awards | |||||

Grant Date | Number of Shares or Units of Stock That Have Not Vested (#)(1) | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | Equity Incentive Plan Awards: # of Unearned Shares Not Vested (#) | Equity Incentive Plan Awards: Value Unearned Shares Not Vested ($)(2) | ||

Russell A. Becker | 2/27/2023 | 97,353 | $3,368,414 | |||

2/27/2023 | (3) | 36,508 | $1,263,177 | |||

3/9/2022 | 34,666 | $1,199,444 | ||||

3/9/2022 | (4) | 143,618 | $4,969,183 | |||

3/9/2022 | (5) | 26,000 | $899,600 | |||

2/17/2021 | 17,452 | $603,839 | ||||

2/17/2021 | (6) | 209,425 | $7,246,105 | |||

Kevin S. Krumm | 2/27/2023 | 33,818 | $1,170,103 | |||

2/27/2023 | (3) | 12,682 | $438,797 | |||

3/9/2022 | 12,036 | $416,446 | ||||

3/9/2022 | (4) | 49,868 | $1,725,433 | |||

3/9/2022 | (5) | 9,028 | $312,369 | |||

9/20/2021 | 20,148 | $697,121 | ||||

Louis B. Lambert | 2/27/2023 | 14,945 | $517,097 | |||

2/27/2023 | (3) | 5,605 | $193,933 | |||

8/2/2022 | 22,359 | $773,621 | ||||

Kristina M. Morton | 2/27/2023 | 12,170 | $421,082 | |||

2/27/2023 | (3) | 4,564 | $157,914 | |||

3/9/2022 | 51,356 | $1,776,918 | ||||

34 |  |

Name | Stock Awards(1) | |||

# of Shares Acquired on Vesting (#) | Value Realized on Vesting ($)(2) | |||

Russell A. Becker | 34,785 | $778,797 | ||

Kevin S. Krumm | 26,167 | $709,156 | ||

Louis B. Lambert | 11,180 | $322,990 | ||

Kristina M. Morton | 25,679 | $583,427 | ||

| 35 |

Name | Termination without Cause or for Good Reason not in connection with a Change in Control ($) | Death or Disability ($) | Termination without Cause or for Good Reason in connection with a Change in Control ($) | Change in Control ($) | ||||

Russell A. Becker | ||||||||

Cash Severance | $8,193,750 | $1,781,250 | $8,193,750 | — | ||||

Intrinsic Value of Equity(1) | — | — | $26,037,919 | $5,171,697 | ||||

Insurance Benefits(2) | — | — | $38,051 | — | ||||

Total | $8,193,750 | $1,781,250 | $34,269,719 | $5,171,697 | ||||

Kevin S. Krumm | ||||||||

Cash Severance | $3,960,000 | $792,000 | $3,960,000 | — | ||||

Intrinsic Value of Equity(1) | — | — | $7,013,628 | $2,283,669 | ||||

Insurance Benefits(2) | $38,051 | — | $38,051 | — | ||||

Total | $3,998,051 | $792,000 | $11,011,678 | $2,283,669 | ||||

Louis B. Lambert | ||||||||

Cash Severance | $875,000 | — | $1,125,000 | — | ||||

Intrinsic Value of Equity(1) | — | — | $2,066,347 | $1,290,718 | ||||

Insurance Benefits(2) | $16,315 | — | $16,315 | — | ||||

Total | $891,315 | — | $3,207,661 | $1,290,718 | ||||

Kristina M. Morton | ||||||||

Cash Severance | $831,250 | — | $1,068,750 | — | ||||

Intrinsic Value of Equity(1) | — | — | $2,829,588 | $2,198,000 | ||||

Insurance Benefits(2) | $24,547 | — | $24,547 | — | ||||

Total | $855,797 | — | $3,922,885 | $2,198,000 |

36 |  |

| 37 |

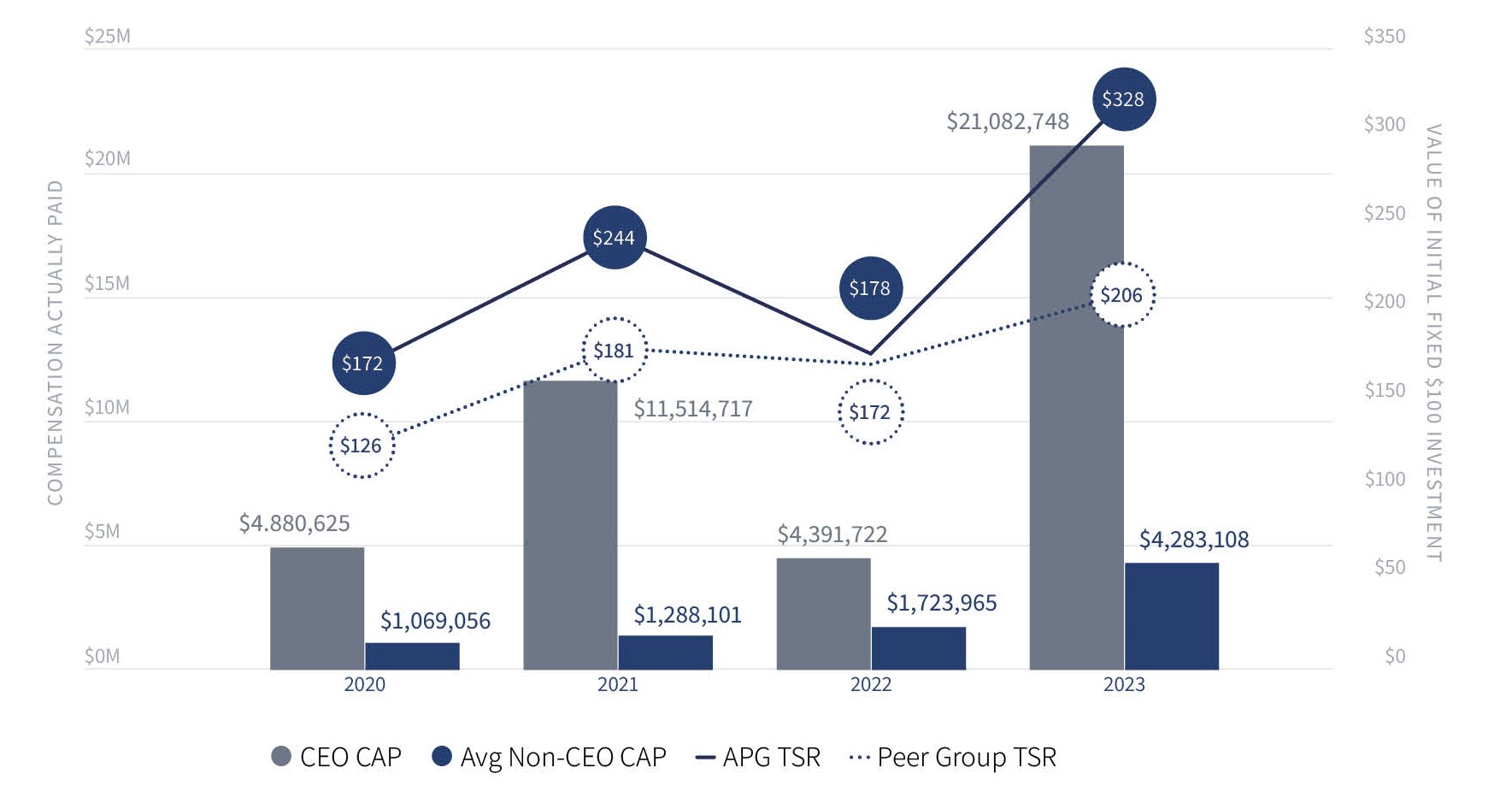

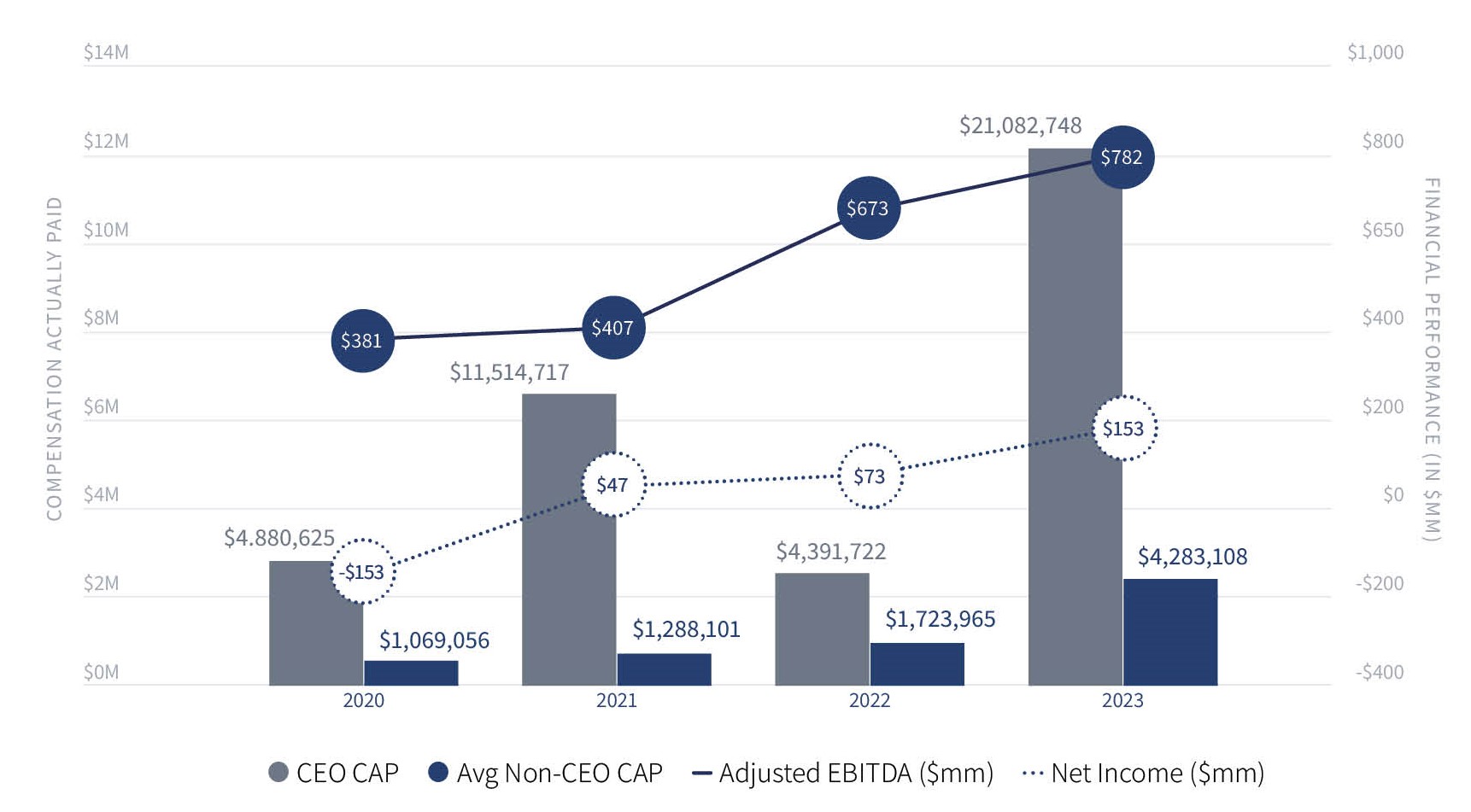

Year | Summary Compensation Table Total for PEO (1) | Compensation Actually Paid to PEO (1)(2) | Average Summary Compensation Table Total for Non-PEO NEOs (1) | Average Compensation Actually Paid to Non-PEO NEOs (1)(3) | Value of Initial Fixed $100 Investment Based On: | Net Income (Loss) (millions) | Adjusted EBITDA (millions) | |

Total Shareholder Return | Peer Group Total Shareholder Return (4) | |||||||

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) |

2023 | $10,197,630 | $21,082,748 | $2,668,206 | $4,283,108 | $328 | $206 | $153 | $782 |

2022 | $8,701,857 | $4,391,722 | $1,928,794 | $1,723,965 | $178 | $172 | $73 | $673 |

2021 | $8,027,508 | $11,514,717 | $1,611,370 | $1,288,101 | $244 | $181 | $47 | $407 |

2020 | $1,742,994 | $4,880,625 | $858,874 | $1,069,057 | $172 | $126 | ($153) | $381 |

Year | Stock Awards Value Reported for the Covered Year | Year End Fair Value of Equity Awards Granted in the Covered Year | Year over Year Change in Fair Value of Equity Awards Outstanding and Unvested at Year End | Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Covered Year | Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Covered Year | Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Covered Year | Value of Dividends or Other Earnings Paid on Stock Awards not Otherwise Reflected in Fair Value or Total Compensation | Total Equity Award Adjustments |

2023 | ($5,700,030) | $8,421,052 | $8,039,605 | $124,491 | $0 | $0 | $0 | $10,885,118 |

2022 | ($5,400,052) | $4,910,468 | ($1,700,530) | ($2,120,022) | $0 | $0 | $0 | ($4,310,135) |

2021 | ($5,700,280) | $6,746,096 | $1,244,597 | $496,532 | $700,263 | $0 | $0 | $3,487,209 |

2020 | $— | $— | $2,482,662 | $654,969 | $0 | $0 | $0 | $3,137,631 |

38 |  |

Year | Stock Awards Value Reported for the Covered Year (a) | Average Year End Fair Value of Equity Awards Granted in the Covered Year | Year over Year Average Change in Fair Value of Equity Awards Outstanding and Unvested at Year End | Year over Year Average Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Covered Year | Average Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Covered Year | Average Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Covered Year | Average Value of Dividends or Other Earnings Paid on Stock Awards not Otherwise Reflected in Fair Value or Total Compensation | Total Average Equity Award Adjustments |

2023 | ($1,189,189) | $1,756,873 | $903,867 | $143,351 | $0 | $0 | $0 | $1,614,902 |

2022 | ($949,022) | $878,847 | ($91,897) | ($42,757) | $0 | $0 | $0 | ($204,829) |

2021 | ($819,570) | $515,967 | $49,560 | $40,286 | $71,988 | ($181,500) | $0 | ($323,269) |

2020 | ($148,190) | $— | $305,231 | $53,141 | $0 | $0 | $0 | $210,182 |

| 39 |

40 |  |

| 41 |

Beneficial Owner | Shares Beneficially Owned | ||

Number | % of Common Stock | ||

More than 5% Shareholders: | |||

Entities managed by Viking Global Investors LP | 28,984,298 | (1) | 10.6% |

Sir Martin E. Franklin | 33,252,458 | (2) | 12.2% |

The Vanguard Group | 20,790,443 | (3) | 7.6% |

BlackRock, Inc. | 15,598,412 | (4) | 5.7% |

Named Executive Officers and Directors: | |||

Sir Martin E. Franklin | 33,252,458 | (2) | 12.2% |

James E. Lillie | 6,601,614 | (5) | 2.4% |

Ian G.H. Ashken | 6,310,789 | (6) | 2.3% |

Russell A. Becker | 3,147,384 | (7) | 1.2% |

Kevin S. Krumm | 37,641 | (8) | * |

Louis B. Lambert | 8,754 | * | |

Paula D. Loop | 10,214 | (9) | * |

Thomas V. Milroy | 79,510 | (10) | * |

Anthony E. Malkin | 198,210 | (11) | * |

Kristina M. Morton | 33,900 | * | |

Cyrus D. Walker | 32,010 | (9) | * |

Carrie A. Wheeler | 32,010 | (9) | * |

All Current Executive Officers and Directors as a group (12 persons): | 49,744,494 | (12) | 18.2% |

42 |  |

| 43 |

44 |  |

Services Provided | 2023 (KPMG) ($) | 2022 (KPMG) ($) | ||

Audit Fees(1) | $10,285,000 | $8,864,000 | ||

Audit Related Fees(2) | $279,000 | $1,627,000 | ||

Tax Fees(3) | $30,000 | $1,161,000 | ||

All Other Fees | $— | $— | ||

Total | $10,594,000 | $11,652,000 |

| 45 |

✔ | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE 2024 FISCAL YEAR. |

46 |  |

✔ | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS IN 2023. |

| 47 |

48 |  |

| 49 |

50 |  |

Q: | Who can attend the 2024 Annual Meeting? | ||

A: | Shareholders of record as of the Record Date (April 19, 2024), beneficial owners with control numbers or legal proxies obtained from the shareholders of record as of the Record Date, and guests may attend the 2024 Annual Meeting virtually. See the Notice of 2024 Annual Meeting for additional information on how to gain access to the 2024 Annual Meeting. If your shares are registered directly in your name with our transfer agent, Computershare, you are a “registered holder,” which means you are the shareholder of record with respect to those shares. If your shares are held by a bank or broker, the bank or broker is the shareholder of record. You are the “beneficial owner” (and hold your shares in “street name”) and the bank or broker is your “nominee.” If you hold shares as a participant in the (1) APi Group, Inc. Employee Stock Ownership Plan (“ESOP”), (2) APi Group 401(k) & Profit Sharing Plan, (3) APi Group Safe Harbor 401(k) & Profit Sharing Plan, and/or (4) the Vipond Inc. Employees’ Profit Sharing Plan (collectively, “employee benefit plans”), the plan trustee of the applicable plan is the shareholder of record and your nominee. | ||

Q: | Who may vote at the 2024 Annual Meeting? | ||

A: | You are receiving this proxy statement, the accompanying proxy card or voting instruction form and our annual report to shareholders because you own shares of common stock or shares of Series A Preferred Stock, (the “Series A Preferred Stock”) of APi Group Corporation that entitle you to vote at the 2024 Annual Meeting. If you are a participant in an employee benefit plan, you may vote in advance of the 2024 Annual Meeting (as described below under “How do I Vote?”) and, if you do, your vote will be counted at that meeting; however, except as otherwise described below, you will not be able to vote at the 2024 Annual Meeting. With that exception, anyone owning shares of common stock or Series A Preferred Stock at the close of business on the Record Date may vote electronically at the 2024 Annual Meeting. You may cast at or prior to the 2024 Annual Meeting (1) one vote for each share of common stock held by you on the Record Date and (2) one vote for each share of Series A Preferred Stock held by you on the Record Date, on all items of business presented in this proxy statement and at the 2024 Annual Meeting. Each share of Series A Preferred Stock will entitle the holder thereof to vote together with the holders of common stock as a single class. As of the close of business on the Record Date, we had (a) 272,636,981 shares of common stock issued and outstanding, and (b) 4,000,000 shares of Series A Preferred Stock issued and outstanding. Each share of common stock and Series A Preferred Stock is entitled to one vote per share. | ||

| 51 |

Q: | How do I vote? | ||

A: | Registered Holder: If you are a registered holder, there are four ways to vote: •Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the proxy card or voting instruction form mailed to you. •By Telephone. You may vote by proxy by calling the toll-free number found on the proxy card or voting instruction form. •By Mail. You may vote by proxy by filling out the proxy card or voting instruction form and returning it in the envelope provided. •During the Meeting. You must attend the 2024 Annual Meeting virtually as a shareholder to vote during the meeting. Please see the information below for how to attend the 2024 Annual Meeting. If you attend the 2024 Annual Meeting as a shareholder, you can follow the online instructions to vote your shares during the meeting. Beneficial Owners: If you are a beneficial owner of shares held in “street name,” a proxy card or voting instruction form has been forwarded to you by your broker or other nominee. You have the right to direct your broker or other nominee on how to vote your shares by following the instructions on the proxy card or voting instruction form, which generally provides four ways to vote: •Via the Internet. You may vote by proxy via the Internet by visiting www.proxyvote.com and entering the control number found on the proxy card or voting instruction form provided by your broker or other nominee. The availability of Internet voting may depend on the voting process of your broker or other nominee. •By Mail. You may vote by proxy by filling out the proxy card or voting instruction form provided by your broker or other nominee and returning it in the envelope provided. •By Telephone. You may vote by proxy by calling the toll-free number found on the proxy card or voting instruction form. •During the Annual Meeting. To vote your shares during the 2024 Annual Meeting, you must follow the instructions provided by your broker or other nominee and attend the meeting as a shareholder. Please see “How can I attend the 2024 Annual Meeting” below for information on how to attend the meeting as a shareholder to vote your shares during the meeting. If you attend the 2024 Annual Meeting as a guest, you will not be able to vote your shares during the meeting. If you vote over the Internet or by telephone, you do not need to return your proxy card or voting instruction form. Internet and telephone voting for shareholders will be available 24 hours a day, and will close at 10:59 p.m., Central Time, on June 13, 2024. Even if you plan to attend the 2024 Annual Meeting virtually, the Company recommends that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the 2024 Annual Meeting. | ||

52 |  |

Q: | How do I vote? (Continued) | ||

A: | Participants in the employee benefit plans: •Shares Held in Your Account under the ESOP. If you are a participant or beneficiary with an account in the ESOP, you are entitled to direct the ESOP’s trustee as to how any shares that have been allocated to your ESOP account and that remained in your ESOP account as of the Record Date should be voted at the 2024 Annual Meeting. •Shares Held in Your Account under the APi Group 401(k) & Profit Sharing Plan, the APi Group Safe Harbor 401(k) & Profit Sharing Plan or the Vipond Inc. Employees’ Profit Sharing Plan. If you are a participant or beneficiary with an account in one or more of (1) the APi Group 401(k) & Profit Sharing Plan, (2) the APi Group Safe Harbor 401(k) & Profit Sharing Plan and/or (3) the Vipond Inc. Employees’ Profit Sharing Plan, you will be permitted to direct the applicable plan trustee(s) or other intermediary as to how any shares held in your plan account as of the Record Date should be voted at the 2024 Annual Meeting. You have the right to direct your nominee(s) or other intermediary on how to vote your shares by following the instructions on the proxy card or voting instruction form forwarded to you by your nominee(s), which generally provides three ways to vote: •Via the Internet. You may vote by proxy via the Internet by visiting www.proxyvote.com and entering the control number found on the proxy card or voting instruction form provided by your nominee. The availability of Internet voting may depend on the voting process of your nominee. •By Telephone. You may vote by proxy by calling the toll-free number found on the proxy card or voting instruction form. •By Mail. You may vote by proxy by filling out the proxy card or voting instruction form provided by your nominee and returning it in the envelope provided. Earlier Voting Deadlines for Participants in Certain Employee Benefit Plans. Because the ESOP’s trustee and the other employee benefits plans’ trustee(s) or other intermediary will vote on your behalf, and in accordance with your directions, except as noted below, you will not be able to vote during the 2024 Annual Meeting and must vote by following deadlines: •Votes of shares held in an ESOP account must be made by 10:59 p.m. (Central Time) on June 5, 2024. •Votes of shares held in a APi Group 401(k) & Profit Sharing Plan or APi Group Safe Harbor 401(k) & Profit Sharing Plan account must be made by 10:59 p.m. (Central Time) on June 11, 2024. •Votes of shares held in a Vipond Inc. Employees’ Profit Sharing Plan account must be made by 10:59 p.m. (Central Time) on June 13, 2024 in order to vote prior to the 2024 Annual Meeting, or you may vote during the meeting. See “How can I attend the 2024 Annual Meeting” below for information on how to attend the meeting as a shareholder to vote your shares during the meeting. | ||

| 53 |

Q. | How can I attend the 2024 Annual Meeting? | ||

A. | The 2024 Annual Meeting will be held in a virtual-only format via live webcast. No physical meeting will be held. To access the 2024 Annual Meeting, please visit www.virtualshareholdermeeting.com/APG2024. You may begin logging into the 2024 Annual Meeting on the day of the meeting at 8:15 a.m., Central Time, 15 minutes in advance of the start of the meeting. We encourage you to access the meeting prior to the start time and allow ample time for the check-in procedures. You may log in using one of two options: (1) join as a guest or (2) join as a shareholder. To join as a guest, you will need to enter the information requested on the screen to register as a guest. If you enter the meeting as a guest, you will not be able to vote your shares or submit questions during the meeting. If you were a registered holder or a beneficial owner as of the Record Date, you may join the 2024 Annual Meeting as a shareholder by entering the 16-digit control number found on the proxy card or voting instruction form previously received in connection with the 2024 Annual Meeting. If you are a beneficial owner as of the Record Date and you do not have a 16-digit control number, you should contact your bank, broker or other nominee (preferably at least 5 days before the meeting) and obtain a “legal proxy” in order to be able to attend and participate in the meeting. You must join the meeting as a shareholder to vote your shares or submit questions during the meeting. If you were a participant in an employee benefit plan and you have a control number, you may join the 2024 Annual Meeting as a shareholder using that control number. Otherwise, you may join the meeting as a guest. | ||

Q. | What if I need technical assistance accessing the virtual-only meeting? | ||

A. | The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plugins. Beginning 15 minutes prior to the meeting start, technicians will be available to assist you with any technical difficulties you may have accessing the virtual meeting webcast. If you encounter any difficulties accessing the webcast, please call the technical support number that will be posted on the annual meeting website log-in page located at www.virtualshareholdermeeting.com/APG2024. | ||

Q. | How do I ask questions at the 2024 Annual Meeting? | ||

A. | Shareholders will have the ability to submit questions during the 2024 Annual Meeting via the meeting website at www.virtualshareholdermeeting.com/APG2024 by following the instructions available on the meeting page. Questions relevant to 2024 Annual Meeting matters will be answered during the meeting, subject to time constraints. To ensure that as many shareholders as possible are able to ask questions during the 2024 Annual Meeting, each shareholder will be permitted no more than two questions. Questions from multiple shareholders on the same topic or that are otherwise related may be grouped, summarized and answered together. If you join the meeting as a guest, you will not be able to ask questions. Responses to questions relevant to 2024 Annual Meeting matters that are not answered during the meeting will be posted on the Company’s Investor Relations webpage. | ||

54 |  |

Q. | How do I obtain electronic access to the proxy materials? | ||

A. | This proxy statement and our Annual Report are available to shareholders free of charge at http://materials.proxyvote.com/00187Y. If you are a beneficial owner or a participant in an employee benefit plan, you may be able to elect to receive future annual reports or proxy statements by email. For information regarding electronic delivery of proxy materials for shares held in “street name” or in an employee benefit plan, you should contact your broker or other nominee. | ||

Q. | What constitutes a quorum, and why is a quorum required? | ||

A. | State law requires that we have a quorum of shareholders present in person or by proxy for all items of business to be voted at the 2024 Annual Meeting. The presence at the 2024 Annual Meeting, in person or by proxy, of the holders of a majority in voting power of the shares of common stock and Series A Preferred Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum, permitting us to conduct the business of the 2024 Annual Meeting. Proxies received but marked as abstentions, if any, and broker non-votes (described below) will be included in the calculation of the number of shares considered to be present at the 2024 Annual Meeting for quorum purposes. If we do not have a quorum, then the person presiding over the 2024 Annual Meeting or the shareholders present at the 2024 Annual Meeting may, by a majority in voting power thereof, adjourn the meeting from time to time, as authorized by our bylaws, until a quorum is present. | ||

Q. | What am I voting on? | ||

A. | Those entitled to vote are asked to vote on the following three proposals. Our Board’s recommendation for each of these proposals is set forth below: | ||

Proposal | Board Recommendation | ||

1.To elect nine directors for a one-year term expiring at the 2025 Annual Meeting of Shareholders | FOR each Director Nominee | ||

2. To ratify the appointment of KPMG LLP ("KPMG") as our independent registered public accounting firm for the 2024 fiscal year. | FOR | ||

3. To approve, on an advisory basis, the compensation of our NEOs | FOR | ||

We will also consider other proposals that properly come before the 2024 Annual Meeting in accordance with our bylaws. | |||

| 55 |

Q. | Is my vote confidential? | ||

A. | Yes. We encourage shareholder participation in corporate governance by ensuring the confidentiality of shareholder votes. We have designated Broadridge Financial Solutions, Inc. as inspector to receive and tabulate shareholder votes. Your vote on any particular proposal will be kept confidential and will not be disclosed to us or any of our officers or employees except (1) where disclosure is required by applicable law, (2) where disclosure of your vote is expressly requested by you or (3) where we conclude in good faith that a bona fide dispute exists as to the authenticity of one or more proxies, ballots or votes, or as to the accuracy of any tabulation of such proxies, ballots or votes. Aggregate vote totals will be disclosed to us from time to time and publicly announced following the 2024 Annual Meeting. | ||

Q. | What happens if additional matters are presented at the 2024 Annual Meeting? | ||

A. | Our bylaws provide that items of business may be brought before the 2024 Annual Meeting only (1) pursuant to the Notice of 2024 Annual Meeting (or any supplement thereto) included in this proxy statement, (2) by or at the direction of the Board, or (3) by a shareholder of the Company who was a shareholder at the time proper notice of such business is delivered to our Corporate Secretary, who is entitled to vote at the meeting and who complies with the notice procedures set forth in our bylaws. Other than the three items of business described in this proxy statement, we are not aware of any other business to be acted upon at the 2024 Annual Meeting as of the date of this proxy statement. If you grant a proxy, the persons named as proxy holders, Russell A. Becker, Kevin S. Krumm and Louis B. Lambert, will have the discretion to vote your shares on any additional matters properly presented for a vote at the 2024 Annual Meeting in accordance with Delaware law and our bylaws. | ||

Q. | How many votes are needed to approve each proposal? | ||

A. | The table below sets forth, for each proposal described in this proxy statement, the vote required for approval of the proposal, assuming a quorum is present: | ||

Proposal | Vote Required | ||

1.To elect nine directors for a one-year term expiring at the 2025 Annual Meeting of Shareholders | The majority of votes cast | ||

2.To ratify the appointment of KPMG as our independent registered public accounting firm for the 2024 fiscal year | The majority of votes cast | ||

3.To approve, on an advisory basis, the compensation of our NEOs | The majority of votes cast | ||

Q. | What if I am a registered holder and I return my proxy without making any selections? | ||

A. | If you are a registered holder and sign and return your proxy card or voting instruction form without making any selections, your shares will be voted “FOR” all director nominees and “FOR” proposals 2 and 3. If other matters properly come before the 2024 Annual Meeting, Russell A. Becker, Kevin S. Krumm and Louis B. Lambert will have the authority to vote on those matters for you at their discretion. As of the date of this proxy statement, we are not aware of any matters that will come before the 2024 Annual Meeting other than those disclosed in this proxy statement. | ||

56 |  |

Q. | What if I am a beneficial owner and I do not give the broker or other nominee voting instructions? | ||

A. | If you are a beneficial owner and your shares are held in the name of a broker or other nominee, such nominee is bound by the rules of the NYSE regarding whether or not it can exercise discretionary voting power for any particular proposal if the broker has not received voting instructions from you. Brokers have the authority to vote shares for which their customers do not provide voting instructions on certain “routine” matters. A broker non-vote occurs when a broker or other nominee who holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received voting instructions from the beneficial owner of the shares. Broker non-votes are included in the calculation of the number of votes considered to be present at the 2024 Annual Meeting for purposes of determining the presence of a quorum but are not considered a vote cast. The table below sets forth, for each proposal described in this proxy statement, whether a broker can exercise discretion and vote your shares absent your instructions and if not, the impact of such broker non-vote on the approval of the applicable proposal | ||

Proposal | Can Brokers Vote Absent Instructions ? | Impact of Broker Non-Vote | |

1.To elect ten directors for a one-year term expiring at the 2025 Annual Meeting of Shareholders | No | None | |

2.To ratify the appointment of KPMG as our independent registered public accounting firm for the 2024 fiscal year | Yes | Not Applicable | |

3.To approve, on an advisory basis, the compensation of our NEOs | No | None | |

Q. | What if I am a participant in an employee benefit plan and I do not give the nominee voting instructions? | ||

A. | If you are a participant in an employee benefit plan and you do not provide voting instructions (or your instructions are incomplete or unclear) as to one or more of the matters to be voted on, the unvoted shares in your account will be treated as follows: •The ESOP. The ESOP’s trustee will vote shares in your account with respect to each applicable proposal in the same proportion for which the trustee received timely, complete and clear voting instructions. •The APi Group 401(k) & Profit Sharing Plan and APi Group Safe Harbor 401(k) & Profit Sharing Plan. The trustee will vote shares in your account with respect to each applicable proposal in the same proportion for which the trustee received timely, complete and clear voting instructions. •The Vipond Inc. Employees’ Profit Sharing Plan. The intermediary will vote only those shares for which it received timely, complete and clear voting instructions. The intermediary will not vote unvoted shares in your account. | ||

| 57 |

Q. | What if I abstain on a proposal? | ||

A. | If you sign and return your proxy card or voting instruction form marked “Abstain” on any proposal, your shares will not be voted on that proposal. Marking “Abstain” with respect to any of the proposals described in this proxy statement will not have any impact on the approval of the applicable proposal. | ||

Q. | Can I change my vote or revoke my proxy after I have delivered my proxy card or voting instruction form? | ||

A. | Yes. If you are a registered holder, you may change your vote or revoke your proxy by (1) voting in person at the 2024 Annual Meeting, (2) delivering to the Corporate Secretary (at the address indicated below) a revocation of proxy or (3) executing a new proxy bearing a later date. Corporate Secretary APi Group Corporation 1100 Old Highway 8 NW New Brighton, MN 55112 United States If you are a beneficial owner, you must follow the instructions provided by your broker or other nominee to change your vote or revoke your proxy. If you are a participant in an employee benefit plan, you may change your vote or revoke your proxy by executing a new proxy bearing a later date, prior to the voting cutoff date for the applicable plan. | ||

Q. | If I am a registered holder or a beneficial owner and I plan to attend the 2024 Annual Meeting, should I still vote by proxy? | ||

A. | Yes. Casting your vote in advance does not affect your right to attend the 2024 Annual Meeting. If you vote in advance and also attend the 2024 Annual Meeting, you do not need to vote again at the 2024 Annual Meeting unless you want to change your vote. Please see the information above under “How do I vote?” for information on how to vote. | ||

Q. | Am I entitled to dissenter’s rights? | ||

A. | No. Delaware General Corporation Law does not provide for dissenter’s rights in connection with the matters being voted on at the 2024 Annual Meeting. | ||

Q. | Where can I find voting results of the 2024 Annual Meeting? | ||

A. | We will announce the voting results for the proposals at the 2024 Annual Meeting and publish final detailed voting results in a Form 8-K filed with the SEC within four business days after the 2024 Annual Meeting. | ||

Q. | Who should I call with other questions? | ||

A. | If you have any questions about this proxy statement or the 2024 Annual Meeting, or need assistance voting your shares, please contact our proxy solicitor, Morrow Sodali at 1-800-662-5200. | ||

58 |  |

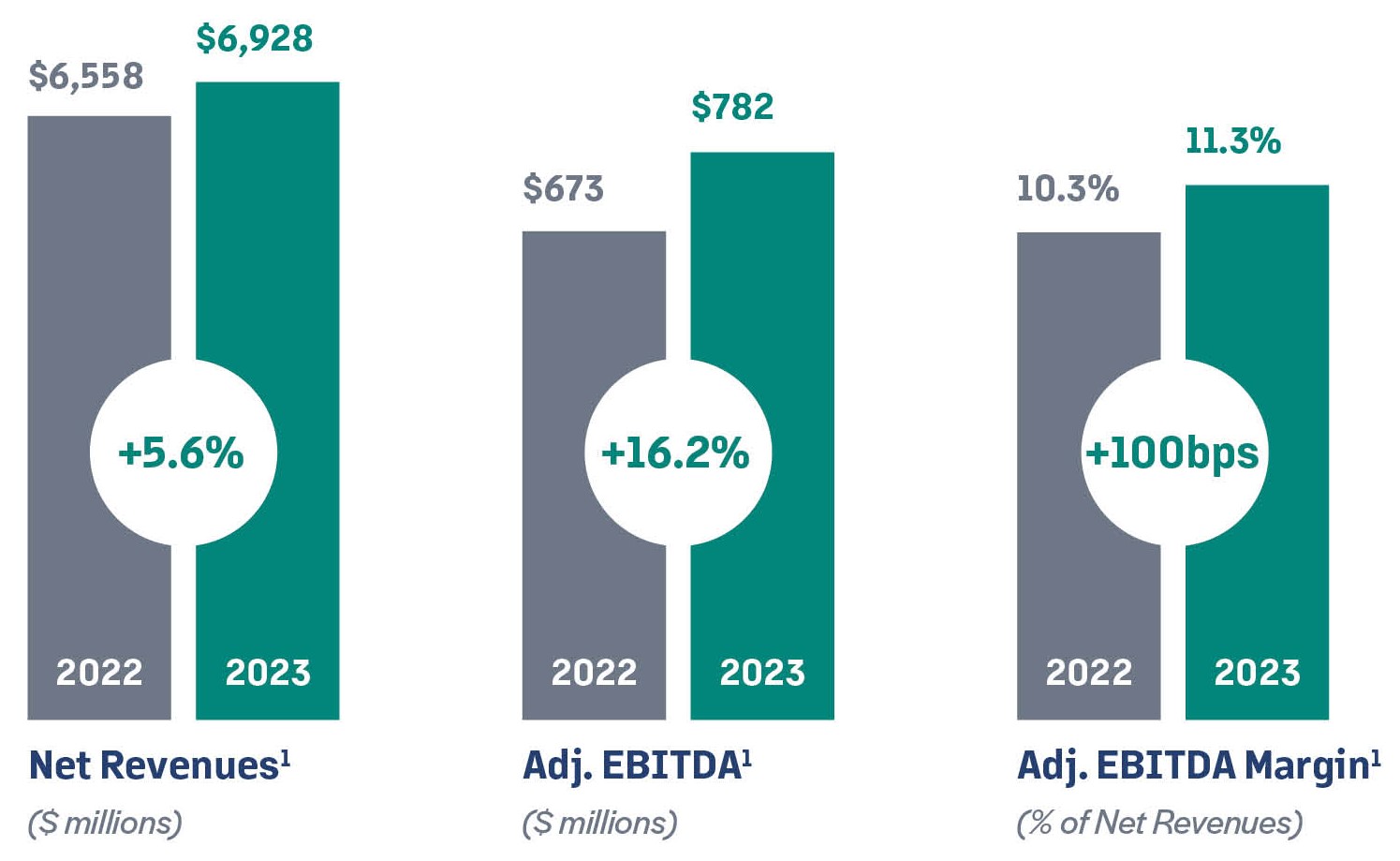

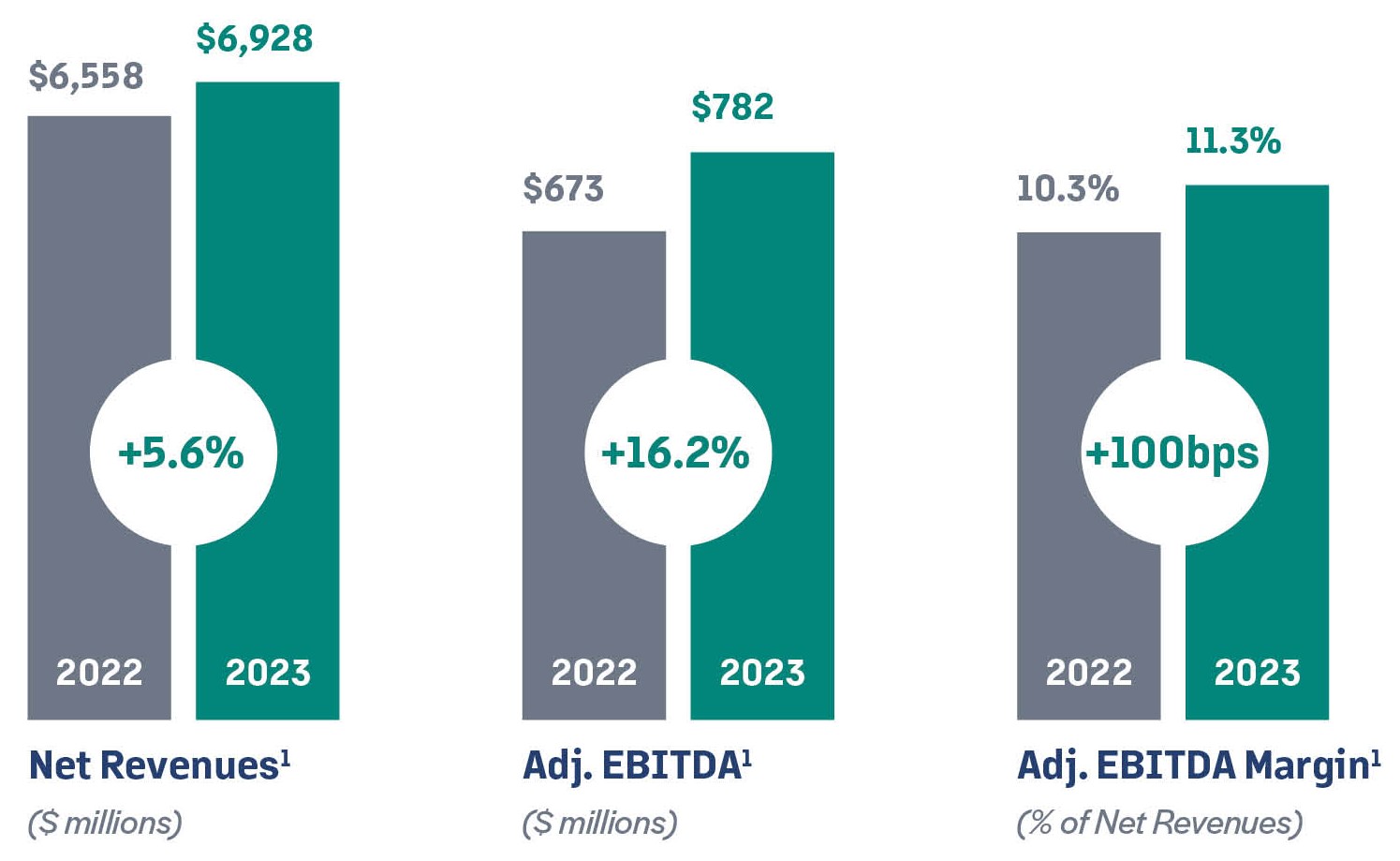

For the Year Ended December 31, | ||||||

2023 | 2022 | |||||

Net income (as reported) | $153 | $73 | ||||

Adjustments to reconcile net income to EBITDA: | ||||||

Interest expense, net | 145 | 125 | ||||

Income tax provision | 79 | 20 | ||||

Depreciation and amortization | 303 | 304 | ||||

EBITDA | $680 | $522 | ||||

Adjustments to reconcile EBITDA to adjusted EBITDA: | ||||||

Contingent consideration and compensation | (a) | 14 | 9 | |||

Non-service pension benefit | (b) | (12) | (42) | |||

Inventory step-up | (c) | — | 9 | |||

Business process transformation expenses | (d) | 30 | 31 | |||

Acquisition related expenses | (e) | 7 | 121 | |||

Loss (gain) on extinguishment of debt, net | (f) | 7 | (5) | |||

Restructuring program related costs | (g) | 46 | 30 | |||

Other | (h) | 10 | (2) | |||

Adjusted EBITDA | $782 | $673 | ||||

Net revenues | $6,928 | $6,558 | ||||

Adjusted EBITDA as a % of net revenues | 11.3% | 10.3% | ||||

| A-1 | ||||

For the Year Ended December 31, | ||||||

2023 | 2022 | |||||

Net cash provided by operating activities | (a) | $514 | $270 | |||

Less: Purchases of property and equipment | (a) | $(86) | $(79) | |||

Free cash flow | $428 | $191 | ||||

Add: Cash payments related to following items: | ||||||

Contingent compensation | (b) | $18 | $3 | |||

Pension contributions | (c) | $— | $27 | |||

Business process transformation expenses | (d) | $32 | $36 | |||

Acquisition related expenses | (e) | $5 | $130 | |||

Restructuring payments | (f) | $30 | $8 | |||

Payroll tax deferral | (g) | $9 | $11 | |||

Other | (h) | $15 | $6 | |||

Adjusted Free cash flow | $537 | $412 | ||||

| A-2 | ||||