Quarterly Supplemental Information Fourth Quarter 2020

Table of Contents 2 03 Corporate Overview 04 Earnings Release 08 Quarterly Highlights 09 Consolidated Statement of Operations and Comprehensive Income (Loss) 10 Funds from Operations and Adjusted Funds from Operations 11 EBITDAre, Adjusted EBITDAre, NOI and Cash NOI 12 Consolidated Balance Sheets 13 Debt, Capitalization and Financial Ratios 14 Investment Activity 15 Portfolio Information 18 Lease Expiration Schedule 19 Non-GAAP Measures and Definitions 22 Forward Looking and Cautionary Statements

Corporate Overview 3 5910 North Central Expressway Suite 1600 Dallas, Texas, 75075 Phone: (972) 579 – 4825 Website: www.netstreit.com Corporate Headquarters Transfer Agent Computershare PO Box 505000 Louisville, Kentucky 40233 Phone: (866) 637 – 9460 Website: www.computershare.com Corporate Profile NETSTREIT Corp. (NYSE: NTST) is an internally managed Real Estate Investment Trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e-commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country in order to generate consistent cash flows and dividends for its investors. Mark Manheimer, Chief Executive Officer Andy Blocher, Chief Financial Officer Jeff Fuge, Senior Vice President of Acquisitions Randy Haugh, Senior Vice President of Finance Kirk Klatt, Senior Vice President of Real Estate Trish McBratney, SVP, Chief Accounting Officer Chad Shafer, Senior Vice President of Underwriting Management Team Todd Minnis – Chair Matthew Troxell – Lead Independent Michael Christodolou Heidi Everett Mark Manheimer Lori Wittman Robin Zeigler Board of Directors

Earnings Release 4 NETSTREIT REPORTS FOURTH QUARTER AND FULL YEAR 2020 FINANCIAL AND OPERATING RESULTS – Reports Net Income of $0.15 and $0.01 and Adjusted Funds from Operations (“AFFO”) of $0.20 and $0.69 per diluted share, for the Fourth Quarter and Full Year 2020, respectively – – Collected 100.0% of Fourth Quarter 2020 Contractual Rents as Contemplated in Original Leases – – Completed $409 Million of Acquisitions in 2020 – Dallas TX – March 4, 2021 – NETSTREIT (NYSE: NTST) (the “Company”), today announced financial and operating results for the fourth quarter and full year ended December 31, 2020. “2020 was a very important year for NETSTREIT, and we are extremely proud of all of our accomplishments. Our portfolio performed well throughout a period of elevated economic stress and we credit our sector-leading collections to our portfolio quality and the defensive characteristics that define our strategy. We also completed our Initial Public Offering, which enhances our access to capital as we look to continue to grow. Further, we continued to improve our already strong portfolio composition through thoughtful acquisitions and dispositions which resulted in a larger, more diversified and higher quality asset base, which is another example of our ability to execute our strategy to drive cash flow growth and generate a strong, safe yield over time,” said Mark Manheimer, Chief Executive Officer of NETSTREIT. “As we look ahead to 2021, we are focused on continuing to capitalize on our significant growth opportunity within the net lease sector, utilizing our dedicated platform and high-quality balance sheet.” FOURTH QUARTER AND FULL YEAR 2020 HIGHLIGHTS • Reported net income per diluted share of $0.15, Core Funds from Operations (“Core FFO”) per diluted share of $0.181 and AFFO per diluted share of $0.201 (see non-GAAP financial measures reconciliation) for the fourth quarter of 2020 • Reported net income per diluted share of $0.01, Core FFO per diluted share of $0.652 and AFFO per diluted share of $0.692 (see non-GAAP financial measures reconciliation) for the full year 2020 • Prior to giving any consideration to deferral or abatement arrangements granted as a result of COVID, the Company collected 100.0% of fourth quarter contractual rent. For the full year 2020, the Company collected 96.9% of contractual rent PORTFOLIO UPDATE As of December 31, 2020, the NETSTREIT portfolio was comprised of 203 properties, contributing $41.8 million of annualized base rent3, with a weighted-average remaining lease term of 10.5 years, of which 70.0% were leased to investment grade rated tenants and 8.0% were leased to tenants with investment grade profiles (unrated tenants with more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x). The portfolio was 100.0% occupied as of December 31, 2020.

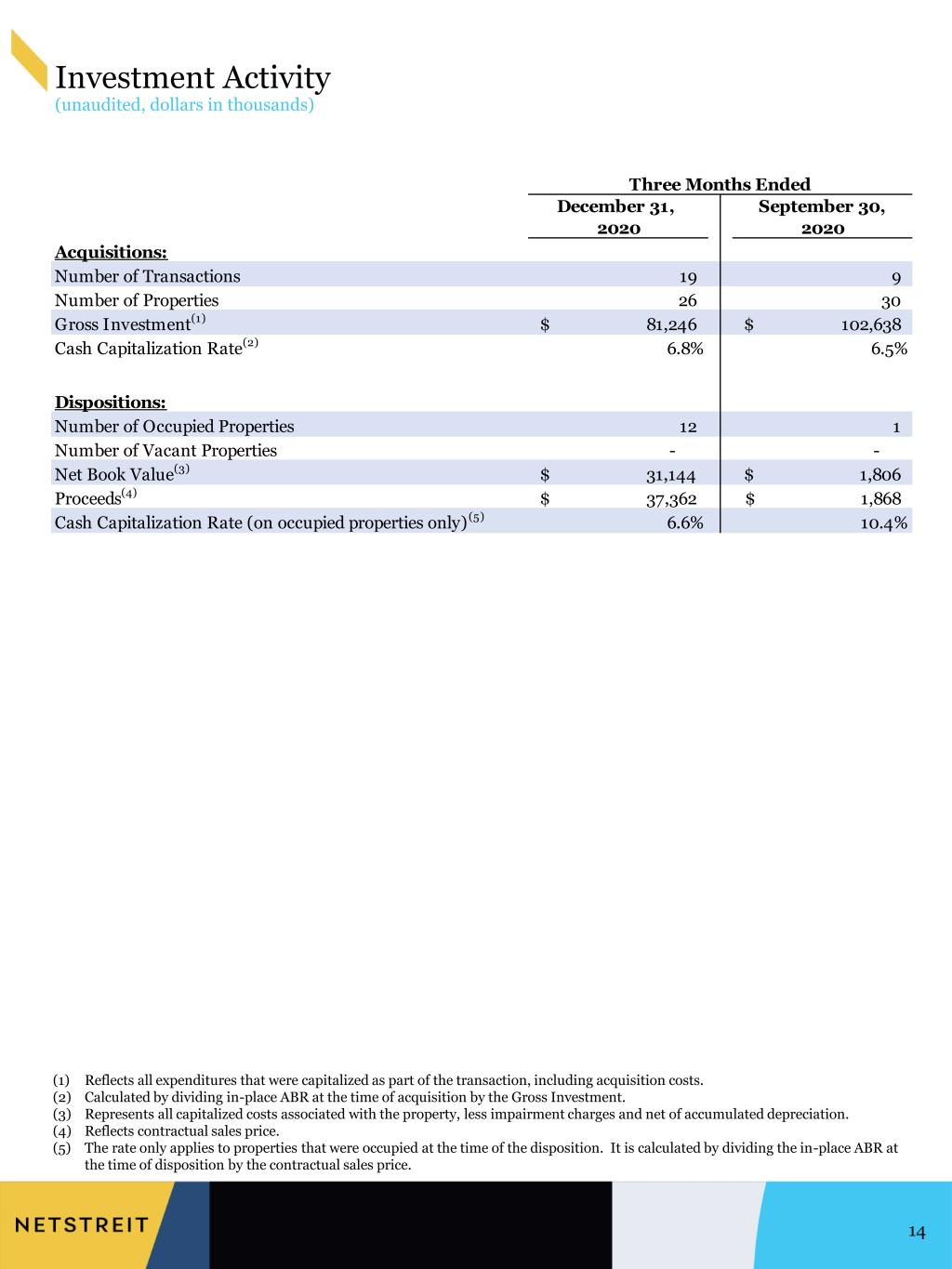

Earnings Release 5 INVESTMENT ACTIVITY During the quarter ended December 31, 2020, the Company invested approximately $81.2 million in 26 properties at an initial cash capitalization rate of 6.8%. Acquisitions completed during the quarter had a weighted-average remaining lease term of 8.8 years, and 68.7% are occupied by investment grade rated tenants. Over the same period, the Company sold 12 properties for total proceeds of $37.4 million. The cash capitalization rate on the 12 properties was 6.6%. During the year ended December 31, 2020, the Company invested approximately $409 million in 124 properties at an initial cash capitalization rate of 6.7%. Acquisitions completed during the year had a weighted-average remaining lease term of 11.2 years, and 71.9% were occupied by investment grade rated tenants. Over the same period, the Company sold 15 properties, including one vacant property, for total proceeds of $50 million. The cash capitalization rate on the 14 occupied properties was 6.6%. Over the course of 2020, the Company’s portfolio increased from 94 properties to 203 properties. The portfolio’s weighted average lease term remaining improved from 10.1 years to 10.5 years, and the portfolio’s investment grade percentage increased from 63.7% to 70.0%. During the year, the Company added 23 new tenants, 4 new industries, and 10 new states to its portfolio. BALANCE SHEET AND LIQUIDITY At quarter end, total debt outstanding was $175 million, with a weighted average term of four years and a contractual interest rate, including the impact of the fixed rate swap, of 1.36% (excluding the impact of deferred fee amortization). Including the effect of the interest rate swap, 100% of the Company’s outstanding debt balances were at a fixed rate and the Company’s net debt to annualized adjusted EBITDA ratio was 2.8x. Additionally, the ending cash balance, which included $14.8 million of restricted cash held in 1031 exchange accounts, was $92.6 million, and the Company had an unused revolving line of credit with $250 million of capacity. DIVIDEND On March 3, 2021, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share for the first quarter of 2021, which will be paid on March 30, 2021 to shareholders of record on March 15, 2021. 2021 OUTLOOK On January 5, 2021, the Company announced the following external growth targets for full year 2021: • The Company expects acquisition activity, net of dispositions, to total $320 million • The Company expects to continue to review its portfolio and complete opportunistic dispositions to further improve portfolio diversification and mitigate risk

Earnings Release 6 In addition, the Company is introducing the following targets for full year 2021: • The Company expects cash G&A to be in the range of $11.0 to $12.0 million, with additional non-cash compensation expense of $3.0 to $4.0 million • The Company expects cash interest expense, including unused line of credit facility fees, of $3.0 to $3.5 million, and an additional $0.6 million of non-cash deferred financing fee amortization • The Company expects to incur state and franchise taxes in the range of $0.2 to $0.3 million which will be reported as “income taxes” in the Company’s financial statements for 2021. EARNINGS WEBCAST AND CONFERENCE CALL A conference call will be held on Friday, March 5, 2021 at 10:00 AM ET. During the conference call the Company’s officers will review fourth quarter performance, discuss recent events, and conduct a question and answer period. The webcast will be accessible on the “Investor Relations” section of the Company’s website at www.NETSTREIT.com. To listen to the live webcast, please go to the site at least fifteen minutes prior to the scheduled start time to register, as well as download and install any necessary audio software. A replay of the webcast will be available for 90 days on the Company’s website shortly after the call. The conference call can also be accessed by dialing 1-877-451-6152 for domestic callers or 1-201-389- 0879 for international callers. A dial-in replay will be available starting shortly after the call until March 12, 2021, which can be accessed by dialing 1-844-512-2921 for domestic callers or 1-412-317- 6671 for international callers. The passcode for this dial-in replay is 13714402. SUPPLEMENTAL PACKAGE The Company’s supplemental package will be available prior to the conference call in the Investor Relations section of the Company’s website at www.investors.netstreit.com. About NETSTREIT NETSTREIT is an internally managed Real Estate Investment Trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e-commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country with the goal of generating consistent cash flows and dividends for its investors. Investor Relations ir@netstreit.com 972-597-4825 (1) Per share amounts include weighted average common shares of 27,897,168 and weighted average operating partnership units of 2,033,718 for the three-months ended December 31, 2020.

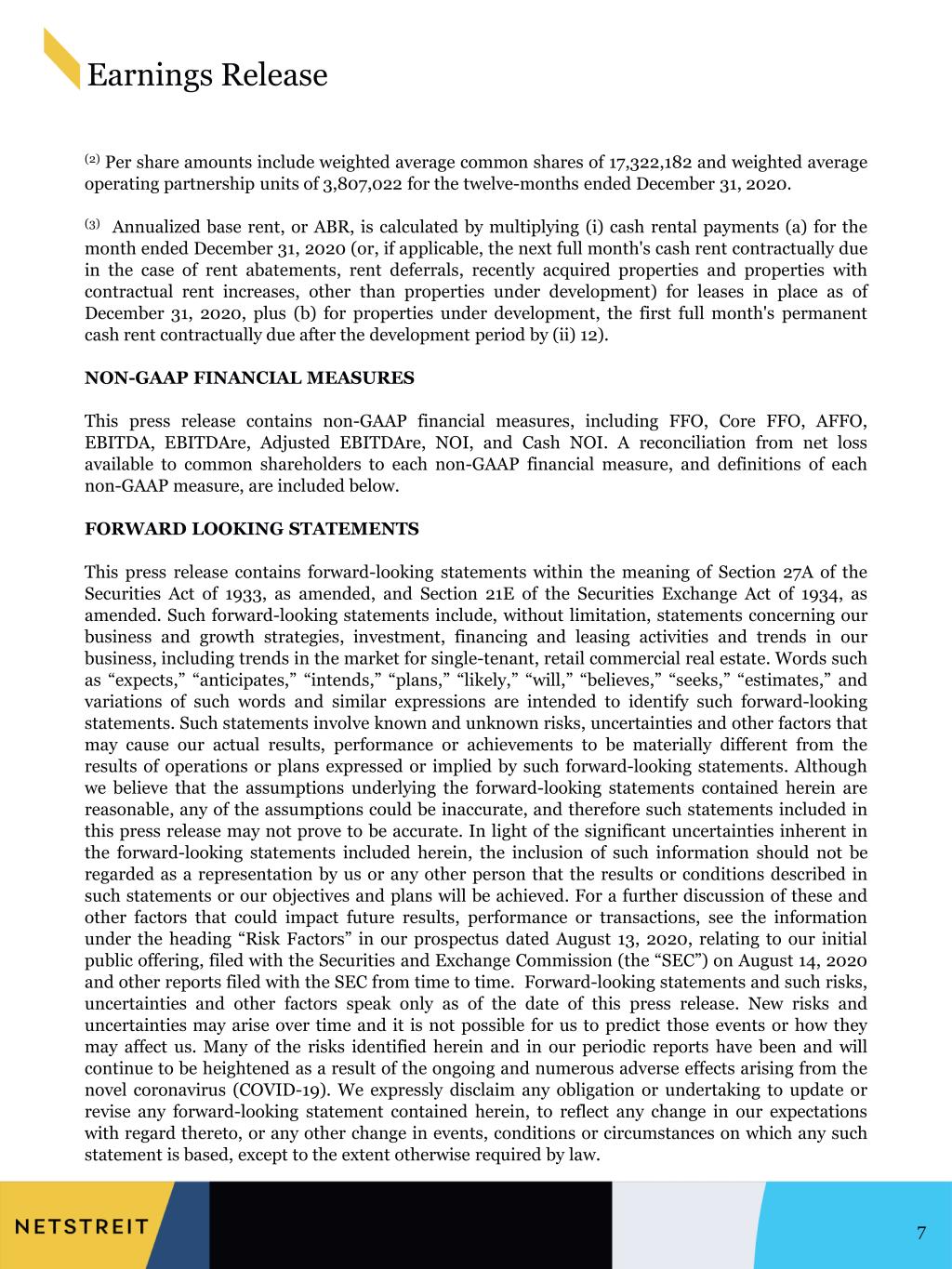

Earnings Release 7 (2) Per share amounts include weighted average common shares of 17,322,182 and weighted average operating partnership units of 3,807,022 for the twelve-months ended December 31, 2020. (3) Annualized base rent, or ABR, is calculated by multiplying (i) cash rental payments (a) for the month ended December 31, 2020 (or, if applicable, the next full month's cash rent contractually due in the case of rent abatements, rent deferrals, recently acquired properties and properties with contractual rent increases, other than properties under development) for leases in place as of December 31, 2020, plus (b) for properties under development, the first full month's permanent cash rent contractually due after the development period by (ii) 12). NON-GAAP FINANCIAL MEASURES This press release contains non-GAAP financial measures, including FFO, Core FFO, AFFO, EBITDA, EBITDAre, Adjusted EBITDAre, NOI, and Cash NOI. A reconciliation from net loss available to common shareholders to each non-GAAP financial measure, and definitions of each non-GAAP measure, are included below. FORWARD LOOKING STATEMENTS This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities and trends in our business, including trends in the market for single-tenant, retail commercial real estate. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this press release may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our prospectus dated August 13, 2020, relating to our initial public offering, filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2020 and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this press release. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from the novel coronavirus (COVID-19). We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.

Quarterly Highlights (unaudited, in thousands, except share, per share data and square feet) 8 (1) Weighted by ABR; excludes lease extension options. (2) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BBB- (S&P), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher. (3) Tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody's, or NAIC. (4) Percentage calculations do not include any deferral or abatement arrangements granted as a result of the COVID-19 pandemic. (5) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BB+ (S&P), Ba1 (Moody's) or NAIC3 (National Association of Insurance Commissioners) or lower. Financial Results December 31, 2020 September 30, 2020 Net income (loss) 4,510$ (2,341)$ Net income (loss) per common share outstanding - diluted $ 0.15 (0.11)$ Funds from Operations (FFO) $ 5,513 2,582$ FFO per common share outstanding - diluted $ 0.18 0.11$ Core Funds from Operations (Core FFO) $ 5,513 3,473$ Core FFO per common share outstanding - diluted $ 0.18 0.15$ Adjusted Funds from Operations (AFFO) $ 5,934 4,777$ AFFO per common share outstanding - diluted $ 0.20 0.21$ Dividends per share 0.20$ 0.10$ Weighted average common shares outstanding - diluted 30,021,750 23,135,675 Portfolio Metrics Number of leases 203 189 Square feet 3,733,062 3,376,371 Occupancy 100.0% 100.0% Weighted average lease term remaining (years) (1 ) 10.5 11.1 Investment grade (rated) - % of ABR (2) 70.0% 68.0% Investment grade profile (unrated) - % of ABR (3) 8.0% 6.4% Rent Collection Update - Percentage of Contractual Rent (4) Collection % % of Total Due Collection % % of Total Due Investment grade (rated) (2) 100.0% 68.9% 99.4% 63.9% Investment grade profile (unrated) (3) 100.0% 8.0% 100.0% 7.3% Sub-investment grade (rated) (5) 100.0% 8.7% 91.4% 8.0% Sub-investment grade profile (unrated) 100.0% 14.4% 96.4% 20.8% Total 100.0% 100.0% 98.1% 100.0% Sepetember 30, 2020 Three Months Ended Three Months Ended December 31, 2020

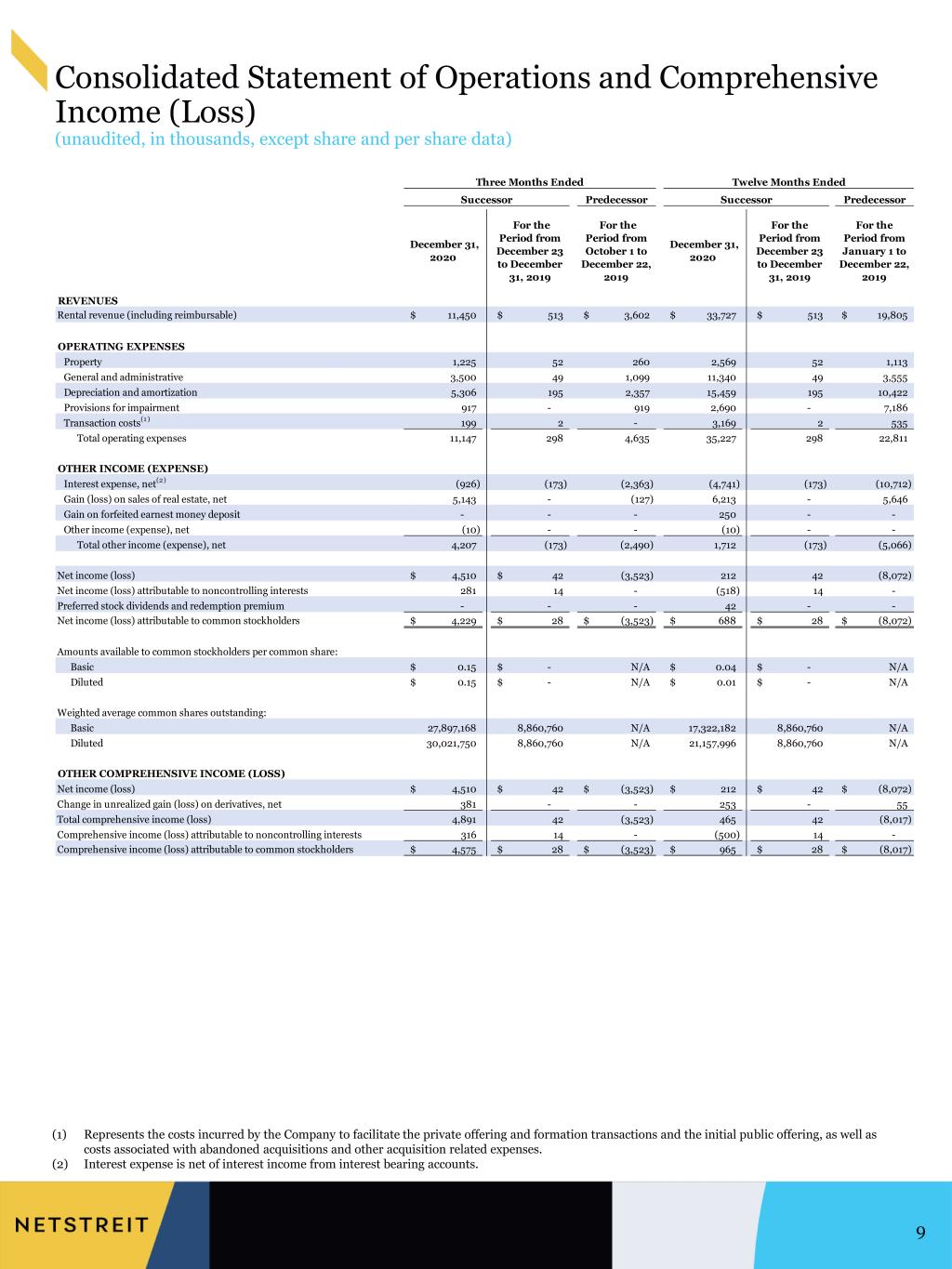

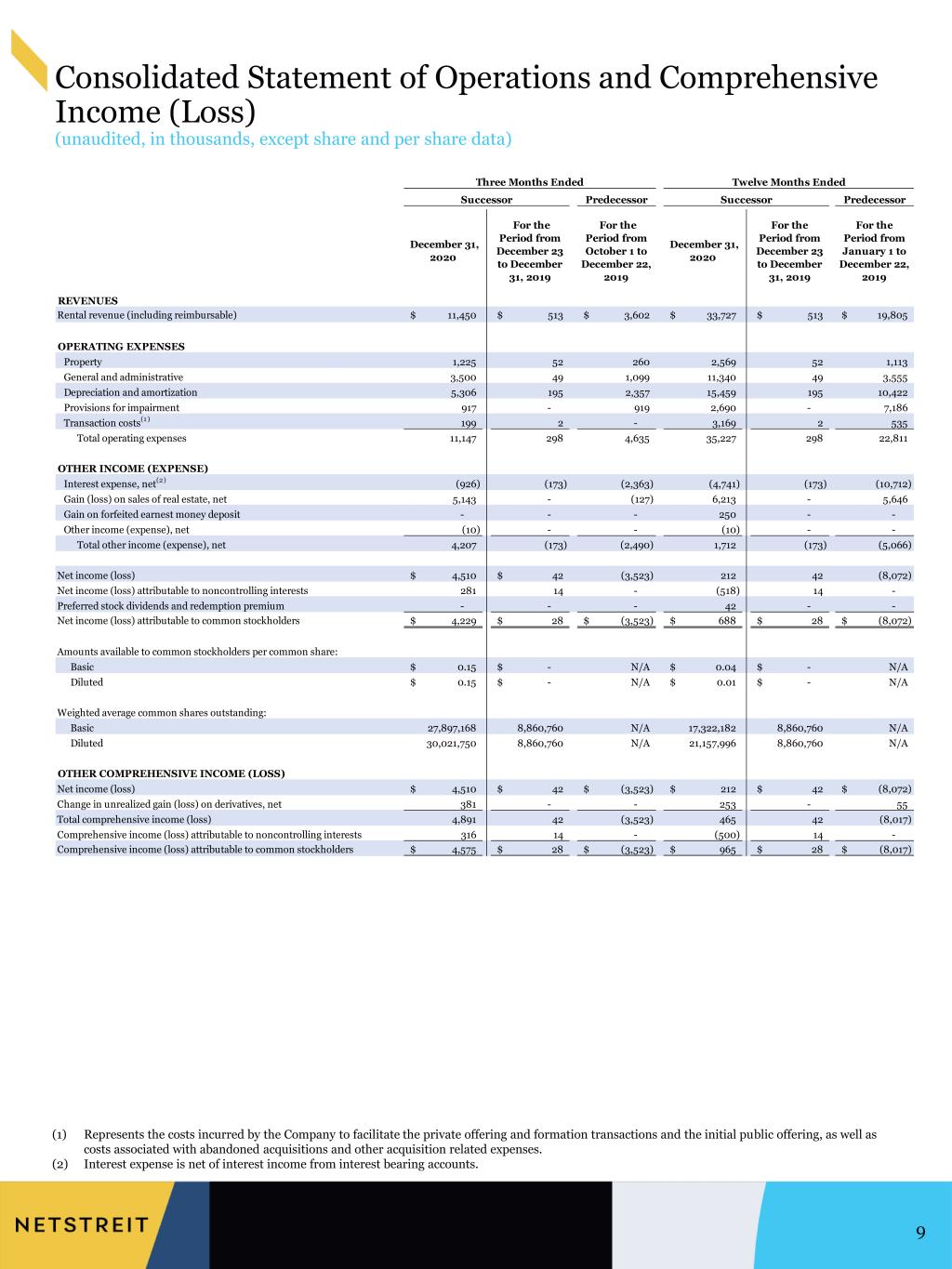

Consolidated Statement of Operations and Comprehensive Income (Loss) (unaudited, in thousands, except share and per share data) 9 (1) Represents the costs incurred by the Company to facilitate the private offering and formation transactions and the initial public offering, as well as costs associated with abandoned acquisitions and other acquisition related expenses. (2) Interest expense is net of interest income from interest bearing accounts. Three Months Ended Predecessor Predecessor December 31, 2020 For the Period from December 23 to December 31, 2019 For the Period from October 1 to December 22, 2019 December 31, 2020 For the Period from December 23 to December 31, 2019 For the Period from January 1 to December 22, 2019 REVENUES Rental revenue (including reimbursable) 11,450$ 513$ 3,602$ 33,727$ 513$ 19,805$ OPERATING EXPENSES Property 1,225 52 260 2,569 52 1,113 General and administrative 3,500 49 1,099 11,340 49 3,555 Depreciation and amortization 5,306 195 2,357 15,459 195 10,422 Provisions for impairment 917 - 919 2,690 - 7,186 Transaction costs (1 ) 199 2 - 3,169 2 535 Total operating expenses 11,147 298 4,635 35,227 298 22,811 OTHER INCOME (EXPENSE) Interest expense, net (2) (926) (173) (2,363) (4,741) (173) (10,712) Gain (loss) on sales of real estate, net 5,143 - (127) 6,213 - 5,646 Gain on forfeited earnest money deposit - - - 250 - - Other income (expense), net (10) - - (10) - - Total other income (expense), net 4,207 (173) (2,490) 1,712 (173) (5,066) Net income (loss) 4,510$ 42$ (3,523) 212 42 (8,072) Net income (loss) attributable to noncontrolling interests 281 14 - (518) 14 - Preferred stock dividends and redemption premium - - - 42 - - Net income (loss) attributable to common stockholders 4,229$ 28$ (3,523)$ 688$ 28$ (8,072)$ Amounts available to common stockholders per common share: Basic 0.15$ -$ N/A 0.04$ -$ N/A Diluted 0.15$ -$ N/A 0.01$ -$ N/A Weighted average common shares outstanding: Basic 27,897,168 8,860,760 N/A 17,322,182 8,860,760 N/A Diluted 30,021,750 8,860,760 N/A 21,157,996 8,860,760 N/A OTHER COMPREHENSIVE INCOME (LOSS) Net income (loss) 4,510$ 42$ (3,523)$ 212$ 42$ (8,072)$ Change in unrealized gain (loss) on derivatives, net 381 - - 253 - 55 Total comprehensive income (loss) 4,891 42 (3,523) 465 42 (8,017) Comprehensive income (loss) attributable to noncontrolling interests 316 14 - (500) 14 - Comprehensive income (loss) attributable to common stockholders 4,575$ 28$ (3,523)$ 965$ 28$ (8,017)$ Twelve Months Ended Successor Successor

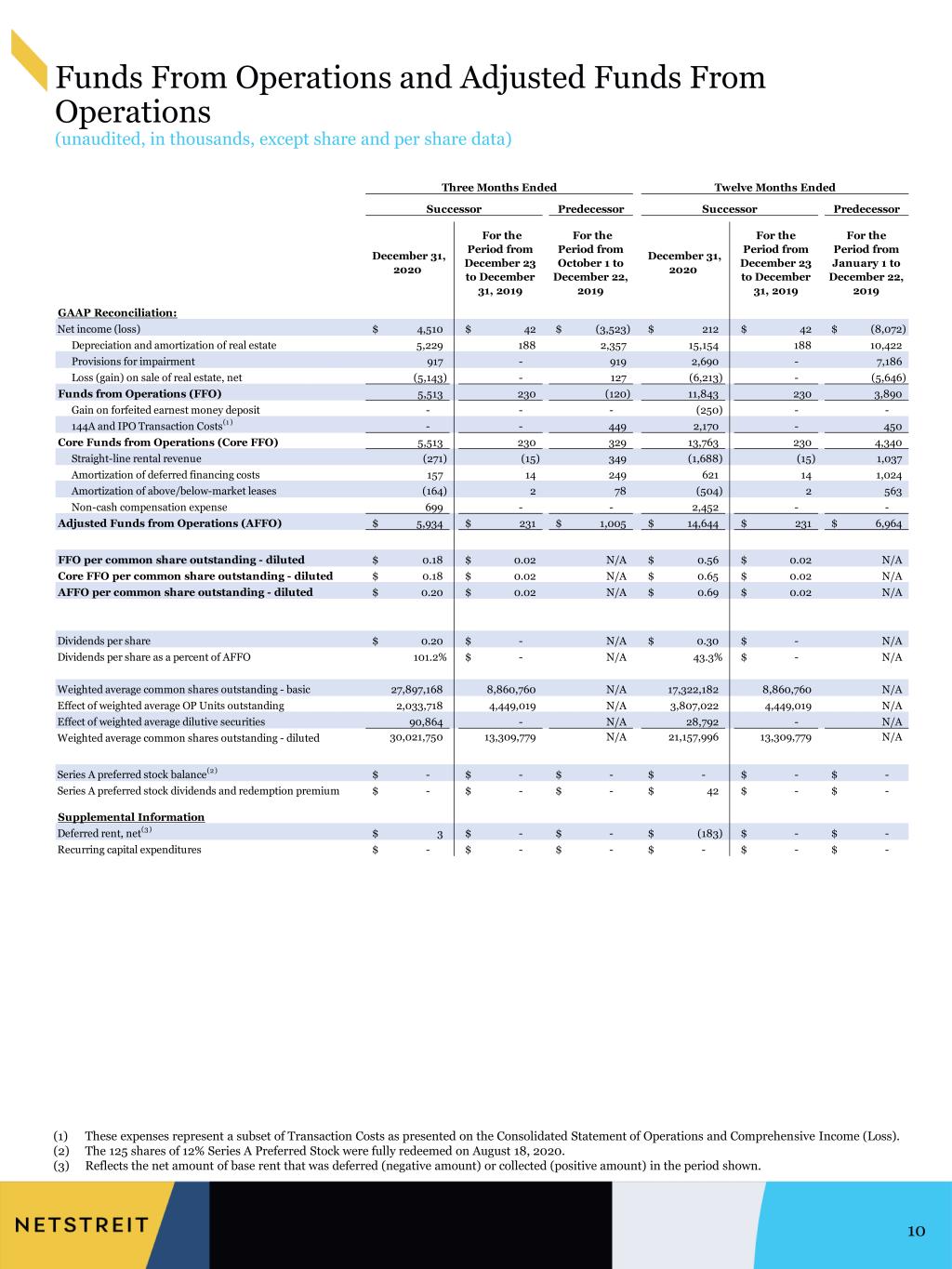

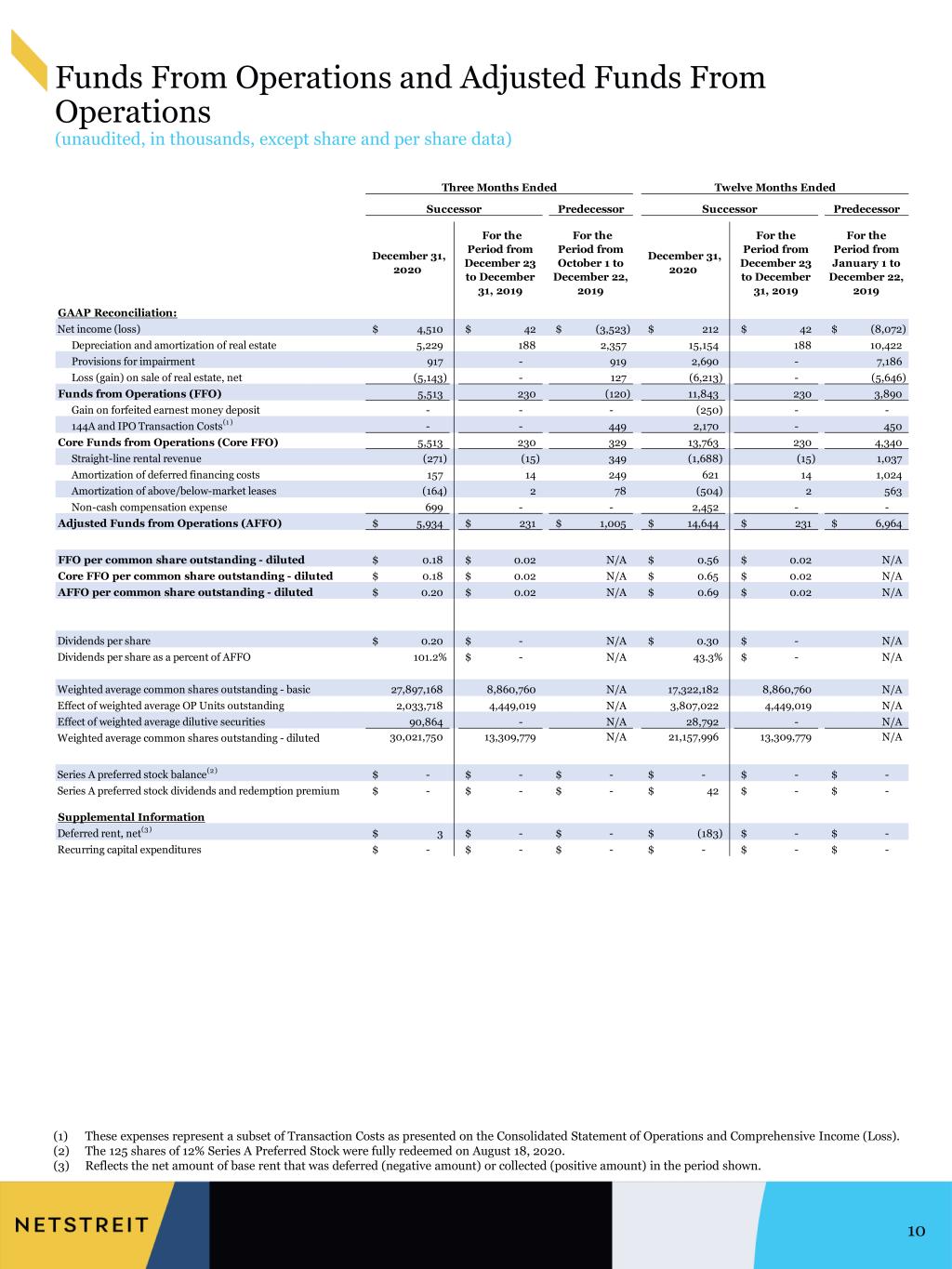

Funds From Operations and Adjusted Funds From Operations (unaudited, in thousands, except share and per share data) 10 (1) These expenses represent a subset of Transaction Costs as presented on the Consolidated Statement of Operations and Comprehensive Income (Loss). (2) The 125 shares of 12% Series A Preferred Stock were fully redeemed on August 18, 2020. (3) Reflects the net amount of base rent that was deferred (negative amount) or collected (positive amount) in the period shown. Predecessor Predecessor December 31, 2020 For the Period from December 23 to December 31, 2019 For the Period from October 1 to December 22, 2019 December 31, 2020 For the Period from December 23 to December 31, 2019 For the Period from January 1 to December 22, 2019 GAAP Reconciliation: Net income (loss) 4,510$ 42$ (3,523)$ 212$ 42$ (8,072)$ Depreciation and amortization of real estate 5,229 188 2,357 15,154 188 10,422 Provisions for impairment 917 - 919 2,690 - 7,186 Loss (gain) on sale of real estate, net (5,143) - 127 (6,213) - (5,646) Funds from Operations (FFO) 5,513 230 (120) 11,843 230 3,890 Gain on forfeited earnest money deposit - - - (250) - - 144A and IPO Transaction Costs (1 ) - - 449 2,170 - 450 Core Funds from Operations (Core FFO) 5,513 230 329 13,763 230 4,340 Straight-line rental revenue (271) (15) 349 (1,688) (15) 1,037 Amortization of deferred financing costs 157 14 249 621 14 1,024 Amortization of above/below-market leases (164) 2 78 (504) 2 563 Non-cash compensation expense 699 - - 2,452 - - Adjusted Funds from Operations (AFFO) 5,934$ 231$ 1,005$ 14,644$ 231$ 6,964$ FFO per common share outstanding - diluted 0.18$ 0.02$ N/A 0.56$ 0.02$ N/A Core FFO per common share outstanding - diluted 0.18$ 0.02$ N/A 0.65$ 0.02$ N/A AFFO per common share outstanding - diluted 0.20$ 0.02$ N/A 0.69$ 0.02$ N/A Dividends per share 0.20$ -$ N/A 0.30$ -$ N/A Dividends per share as a percent of AFFO 101.2% -$ N/A 43.3% -$ N/A Weighted average common shares outstanding - basic 27,897,168 8,860,760 N/A 17,322,182 8,860,760 N/A Effect of weighted average OP Units outstanding 2,033,718 4,449,019 N/A 3,807,022 4,449,019 N/A Effect of weighted average dilutive securities 90,864 - N/A 28,792 - N/A Weighted average common shares outstanding - diluted 30,021,750 13,309,779 N/A 21,157,996 13,309,779 N/A Series A preferred stock balance (2) -$ -$ -$ -$ -$ -$ Series A preferred stock dividends and redemption premium -$ -$ -$ 42$ -$ -$ Supplemental Information Deferred rent, net (3) 3$ -$ -$ (183)$ -$ -$ Recurring capital expenditures -$ -$ -$ -$ -$ -$ Twelve Months EndedThree Months Ended Successor Successor

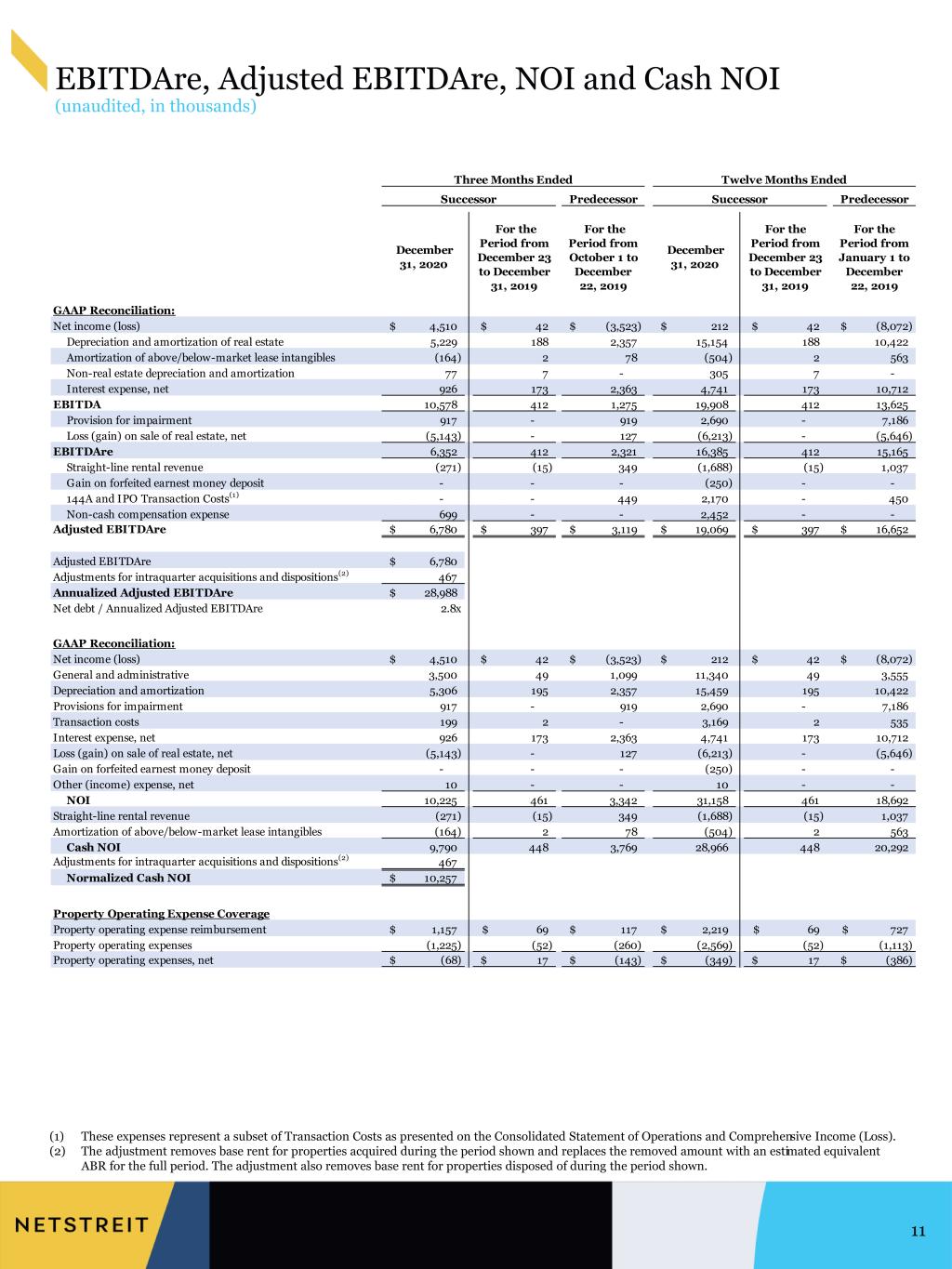

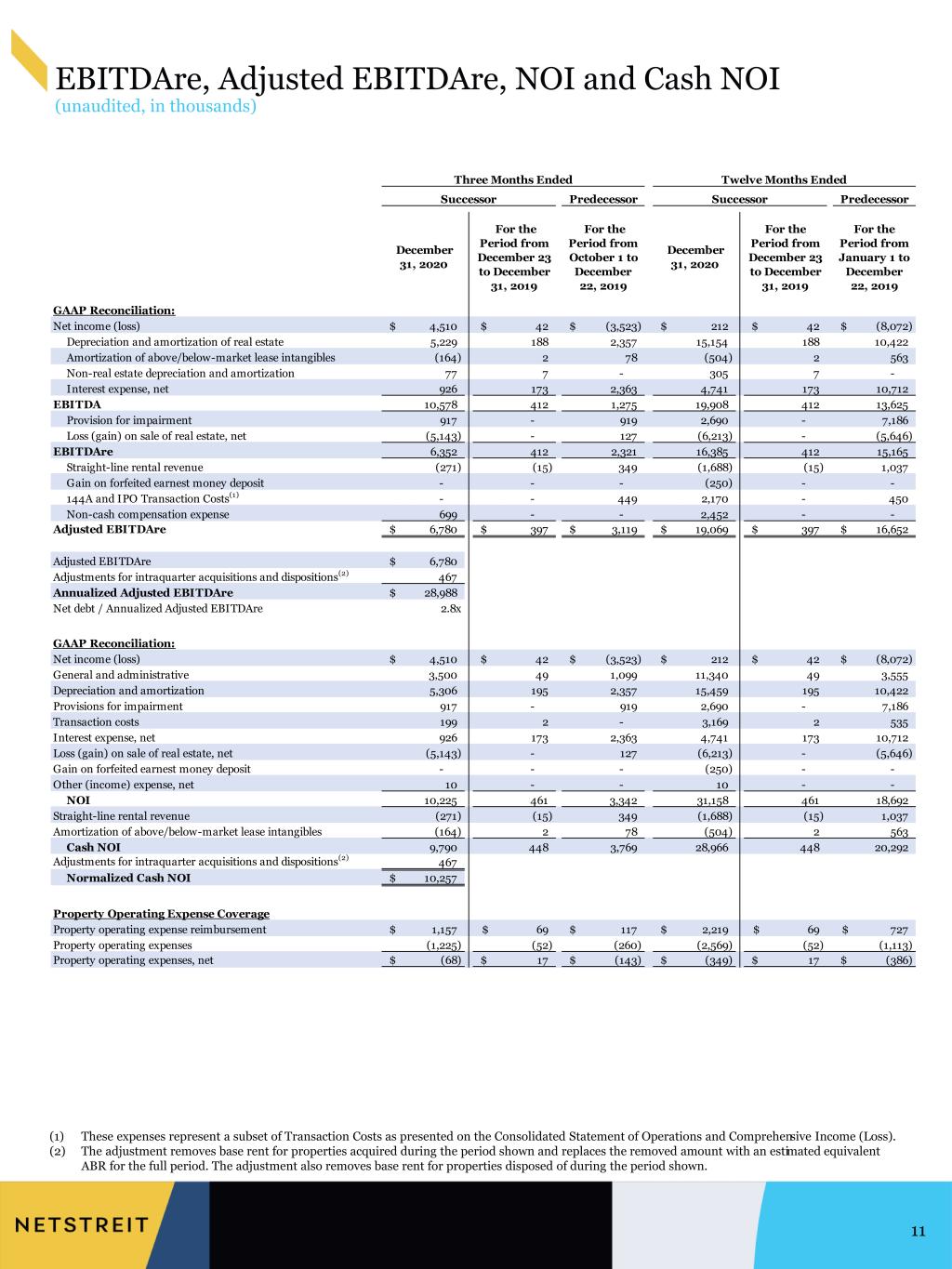

EBITDAre, Adjusted EBITDAre, NOI and Cash NOI (unaudited, in thousands) 11 (1) These expenses represent a subset of Transaction Costs as presented on the Consolidated Statement of Operations and Comprehensive Income (Loss). (2) The adjustment removes base rent for properties acquired during the period shown and replaces the removed amount with an estimated equivalent ABR for the full period. The adjustment also removes base rent for properties disposed of during the period shown. Predecessor Predecessor December 31, 2020 For the Period from December 23 to December 31, 2019 For the Period from October 1 to December 22, 2019 December 31, 2020 For the Period from December 23 to December 31, 2019 For the Period from January 1 to December 22, 2019 GAAP Reconciliation: Net income (loss) 4,510$ 42$ (3,523)$ 212$ 42$ (8,072)$ Depreciation and amortization of real estate 5,229 188 2,357 15,154 188 10,422 Amortization of above/below-market lease intangibles (164) 2 78 (504) 2 563 Non-real estate depreciation and amortization 77 7 - 305 7 - Interest expense, net 926 173 2,363 4,741 173 10,712 EBITDA 10,578 412 1,275 19,908 412 13,625 Provision for impairment 917 - 919 2,690 - 7,186 Loss (gain) on sale of real estate, net (5,143) - 127 (6,213) - (5,646) EBITDAre 6,352 412 2,321 16,385 412 15,165 Straight-line rental revenue (271) (15) 349 (1,688) (15) 1,037 Gain on forfeited earnest money deposit - - - (250) - - 144A and IPO Transaction Costs (1) - - 449 2,170 - 450 Non-cash compensation expense 699 - - 2,452 - - Adjusted EBITDAre 6,780$ 397$ 3,119$ 19,069$ 397$ 16,652$ Adjusted EBITDAre 6,780$ Adjustments for intraquarter acquisitions and dispositions (2) 467 Annualized Adjusted EBITDAre 28,988$ Net debt / Annualized Adjusted EBITDAre 2.8x GAAP Reconciliation: Net income (loss) 4,510$ 42$ (3,523)$ 212$ 42$ (8,072)$ General and administrative 3,500 49 1,099 11,340 49 3,555 Depreciation and amortization 5,306 195 2,357 15,459 195 10,422 Provisions for impairment 917 - 919 2,690 - 7,186 Transaction costs 199 2 - 3,169 2 535 Interest expense, net 926 173 2,363 4,741 173 10,712 Loss (gain) on sale of real estate, net (5,143) - 127 (6,213) - (5,646) Gain on forfeited earnest money deposit - - - (250) - - Other (income) expense, net 10 - - 10 - - NOI 10,225 461 3,342 31,158 461 18,692 Straight-line rental revenue (271) (15) 349 (1,688) (15) 1,037 Amortization of above/below-market lease intangibles (164) 2 78 (504) 2 563 Cash NOI 9,790 448 3,769 28,966 448 20,292 Adjustments for intraquarter acquisitions and dispositions (2) 467 Normalized Cash NOI 10,257$ Property Operating Expense Coverage Property operating expense reimbursement 1,157$ 69$ 117$ 2,219$ 69$ 727$ Property operating expenses (1,225) (52) (260) (2,569) (52) (1,113) Property operating expenses, net (68)$ 17$ (143)$ (349)$ 17$ (386)$ Twelve Months Ended SuccessorSuccessor Three Months Ended

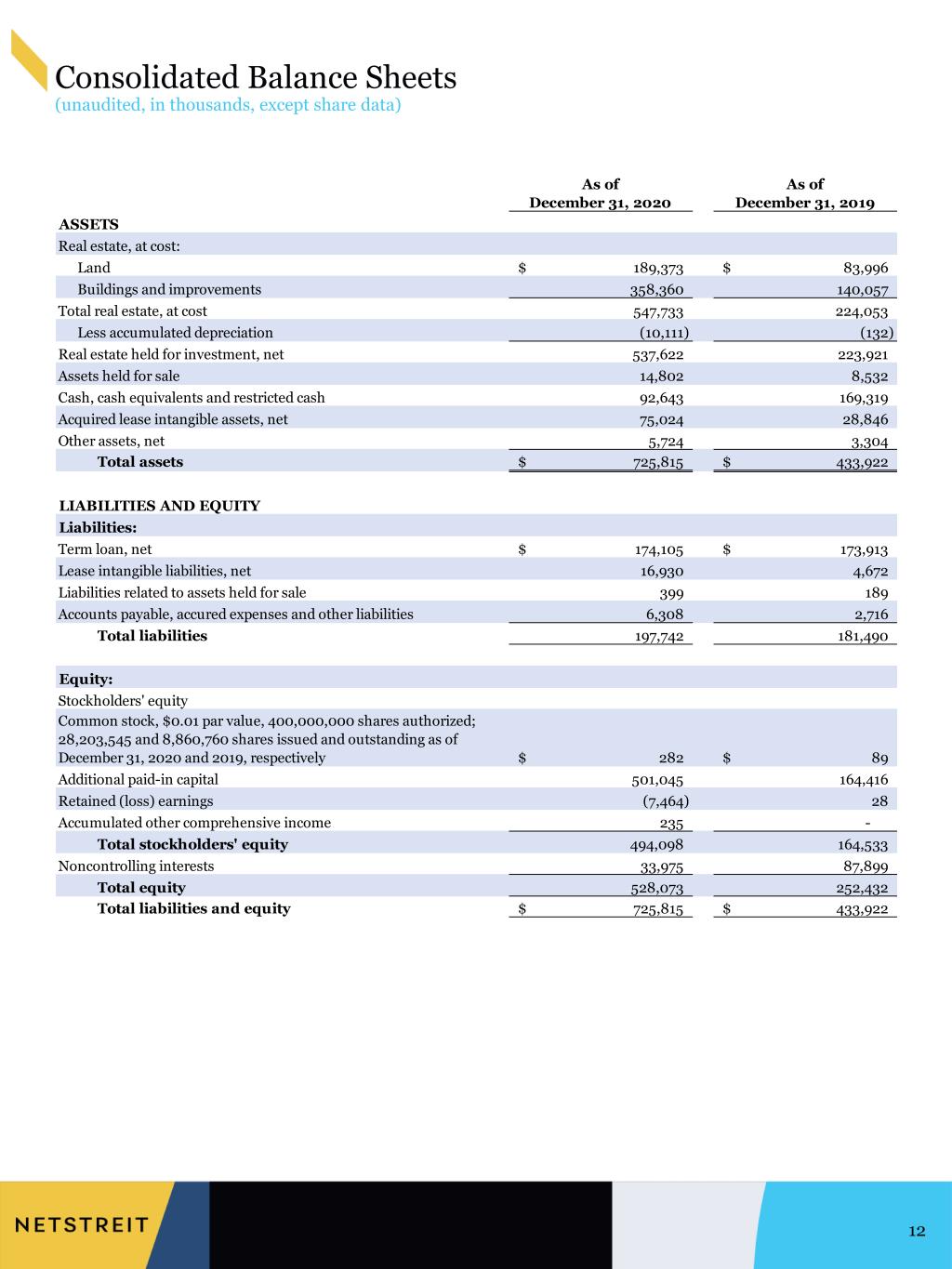

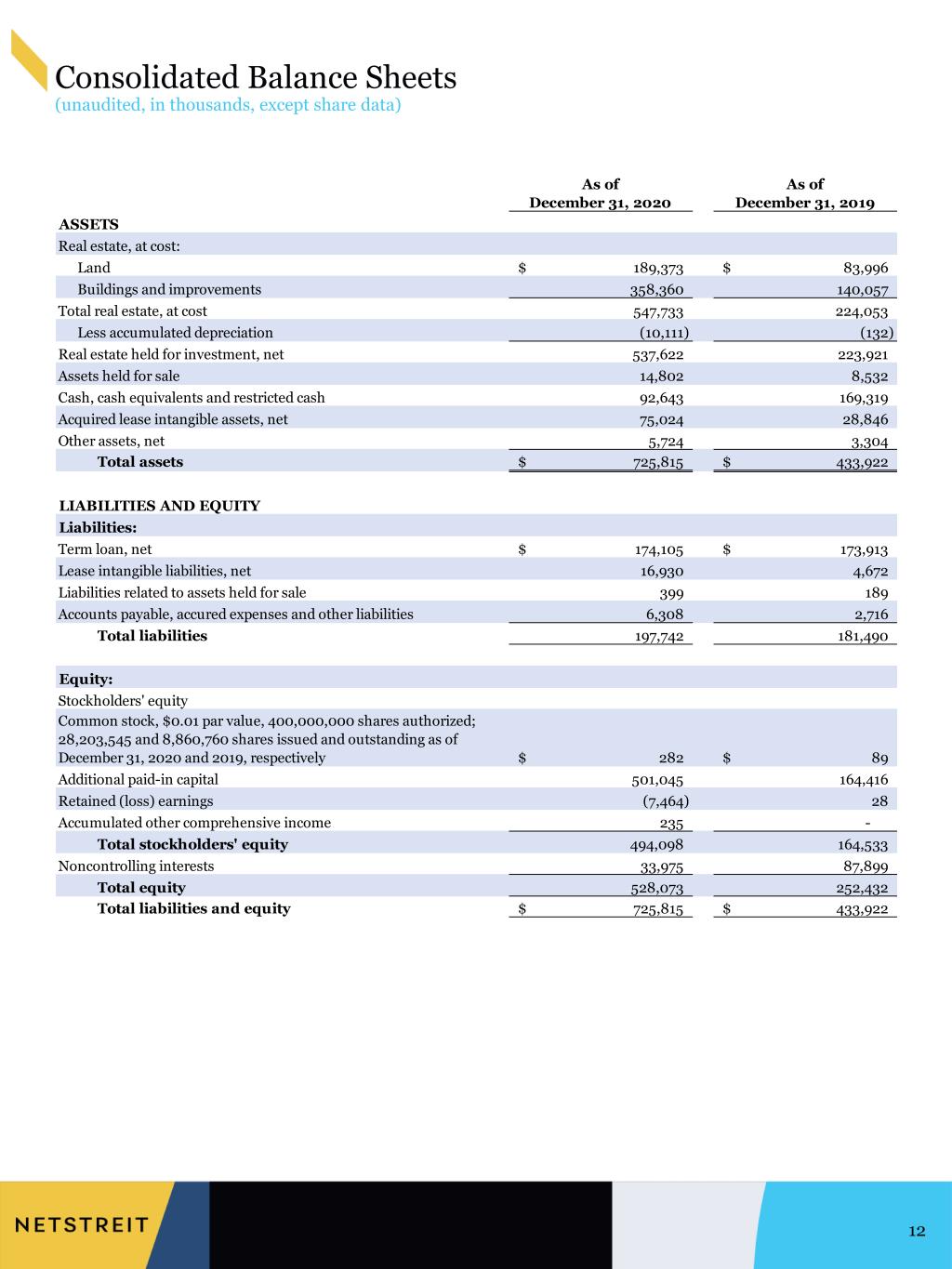

Consolidated Balance Sheets (unaudited, in thousands, except share data) 12 As of As of December 31, 2020 December 31, 2019 ASSETS Real estate, at cost: Land 189,373$ 83,996$ Buildings and improvements 358,360 140,057 Total real estate, at cost 547,733 224,053 Less accumulated depreciation (10,111) (132) Real estate held for investment, net 537,622 223,921 Assets held for sale 14,802 8,532 Cash, cash equivalents and restricted cash 92,643 169,319 Acquired lease intangible assets, net 75,024 28,846 Other assets, net 5,724 3,304 Total assets 725,815$ 433,922$ LIABILITIES AND EQUITY Liabilities: Term loan, net 174,105$ 173,913$ Lease intangible liabilities, net 16,930 4,672 Liabilities related to assets held for sale 399 189 Accounts payable, accured expenses and other liabilities 6,308 2,716 Total liabilities 197,742 181,490 Equity: Stockholders' equity Common stock, $0.01 par value, 400,000,000 shares authorized; 28,203,545 and 8,860,760 shares issued and outstanding as of December 31, 2020 and 2019, respectively 282$ 89$ Additional paid-in capital 501,045 164,416 Retained (loss) earnings (7,464) 28 Accumulated other comprehensive income 235 - Total stockholders' equity 494,098 164,533 Noncontrolling interests 33,975 87,899 Total equity 528,073 252,432 Total liabilities and equity 725,815$ 433,922$

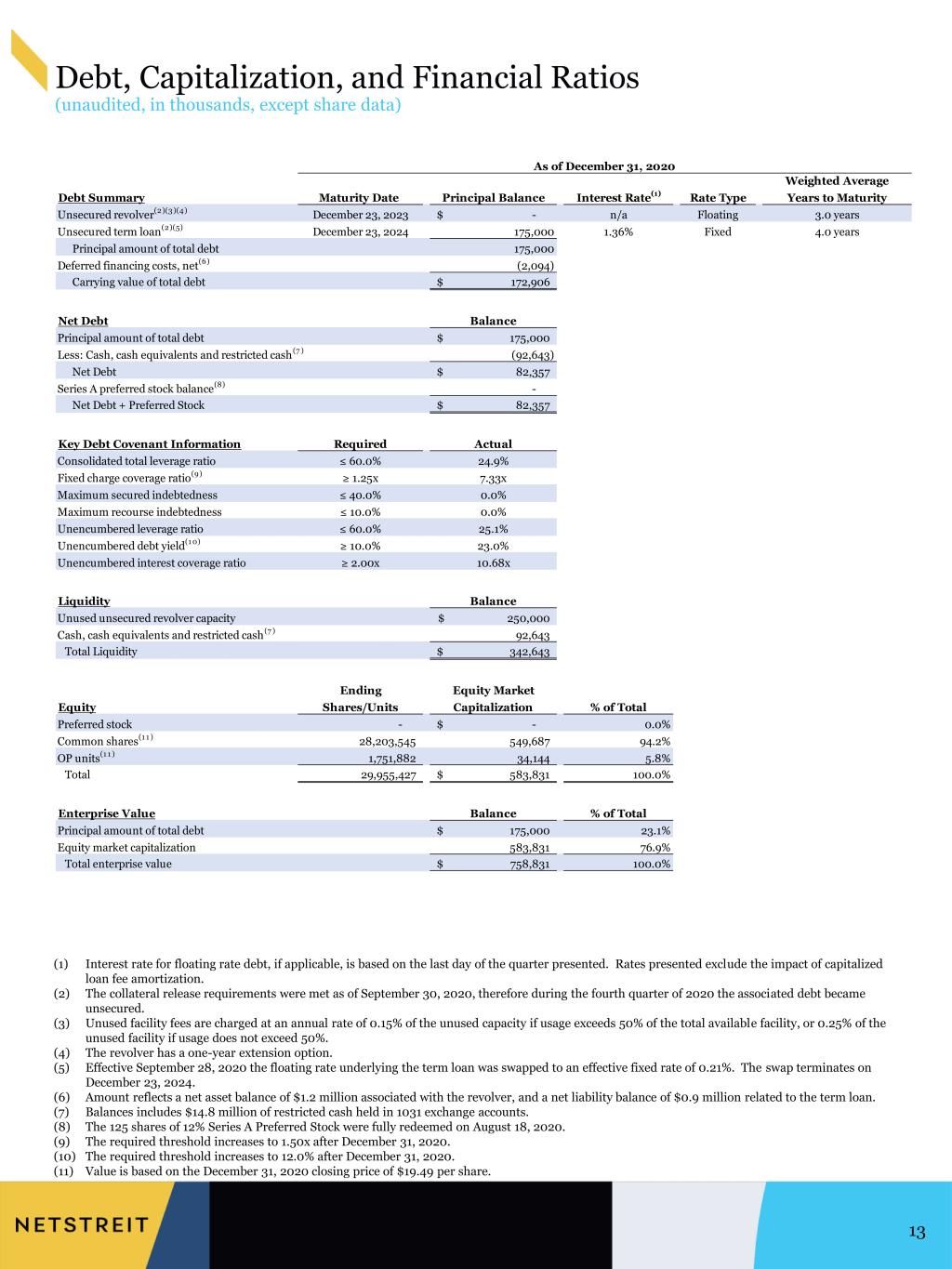

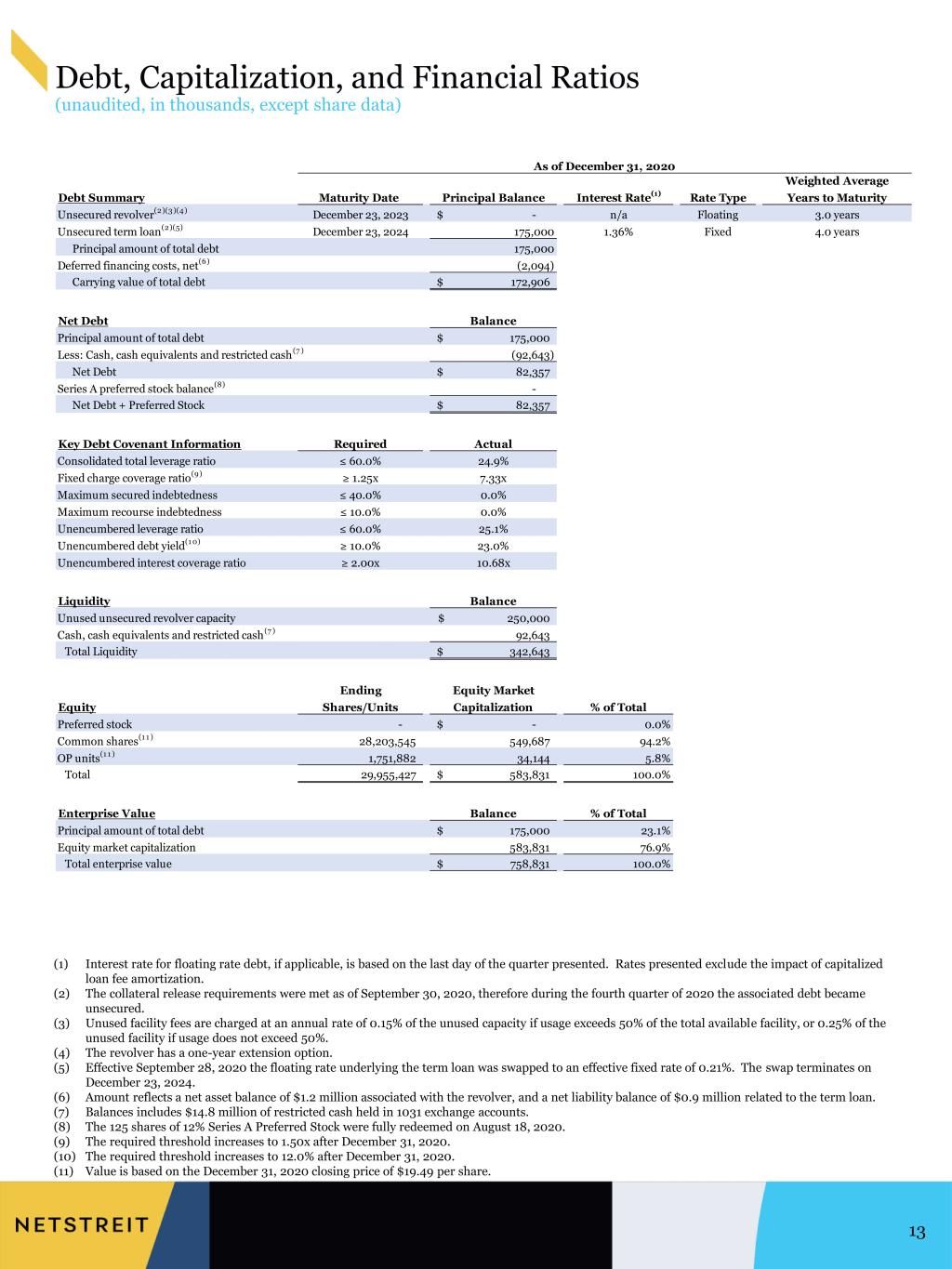

Debt, Capitalization, and Financial Ratios (unaudited, in thousands, except share data) 13 (1) Interest rate for floating rate debt, if applicable, is based on the last day of the quarter presented. Rates presented exclude the impact of capitalized loan fee amortization. (2) The collateral release requirements were met as of September 30, 2020, therefore during the fourth quarter of 2020 the associated debt became unsecured. (3) Unused facility fees are charged at an annual rate of 0.15% of the unused capacity if usage exceeds 50% of the total available facility, or 0.25% of the unused facility if usage does not exceed 50%. (4) The revolver has a one-year extension option. (5) Effective September 28, 2020 the floating rate underlying the term loan was swapped to an effective fixed rate of 0.21%. The swap terminates on December 23, 2024. (6) Amount reflects a net asset balance of $1.2 million associated with the revolver, and a net liability balance of $0.9 million related to the term loan. (7) Balances includes $14.8 million of restricted cash held in 1031 exchange accounts. (8) The 125 shares of 12% Series A Preferred Stock were fully redeemed on August 18, 2020. (9) The required threshold increases to 1.50x after December 31, 2020. (10) The required threshold increases to 12.0% after December 31, 2020. (11) Value is based on the December 31, 2020 closing price of $19.49 per share. As of December 31, 2020 Weighted Average Debt Summary Maturity Date Principal Balance Interest Rate (1) Rate Type Years to Maturity Unsecured revolver (2)(3)(4) December 23, 2023 -$ n/a Floating 3.0 years Unsecured term loan (2)(5) December 23, 2024 175,000 1.36% Fixed 4.0 years Principal amount of total debt 175,000 Deferred financing costs, net (6) (2,094) Carrying value of total debt 172,906$ Net Debt Balance Principal amount of total debt 175,000$ Less: Cash, cash equivalents and restricted cash (7 ) (92,643) Net Debt 82,357$ Series A preferred stock balance (8) - Net Debt + Preferred Stock 82,357$ Key Debt Covenant Information Required Actual Consolidated total leverage ratio ≤ 60.0% 24.9% Fixed charge coverage ratio (9) ≥ 1.25x 7.33x Maximum secured indebtedness ≤ 40.0% 0.0% Maximum recourse indebtedness ≤ 10.0% 0.0% Unencumbered leverage ratio ≤ 60.0% 25.1% Unencumbered debt yield (1 0) ≥ 10.0% 23.0% Unencumbered interest coverage ratio ≥ 2.00x 10.68x Liquidity Balance Unused unsecured revolver capacity 250,000$ Cash, cash equivalents and restricted cash (7 ) 92,643 Total Liquidity 342,643$ Ending Equity Market Equity Shares/Units Capitalization % of Total Preferred stock - -$ 0.0% Common shares (1 1 ) 28,203,545 549,687 94.2% OP units (1 1 ) 1,751,882 34,144 5.8% Total 29,955,427 583,831$ 100.0% Enterprise Value Balance % of Total Principal amount of total debt 175,000$ 23.1% Equity market capitalization 583,831 76.9% Total enterprise value 758,831$ 100.0%

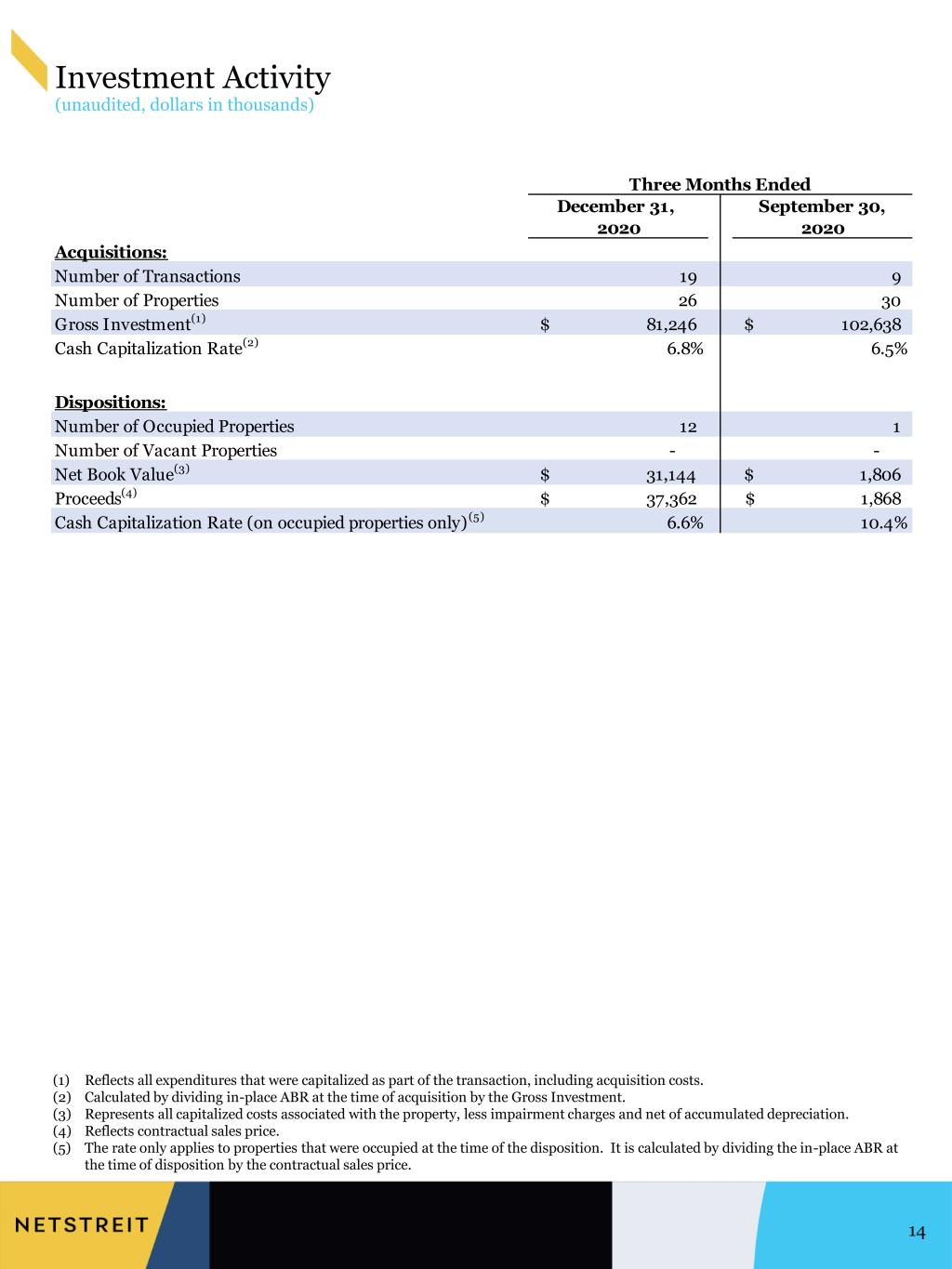

Investment Activity (unaudited, dollars in thousands) 14 (1) Reflects all expenditures that were capitalized as part of the transaction, including acquisition costs. (2) Calculated by dividing in-place ABR at the time of acquisition by the Gross Investment. (3) Represents all capitalized costs associated with the property, less impairment charges and net of accumulated depreciation. (4) Reflects contractual sales price. (5) The rate only applies to properties that were occupied at the time of the disposition. It is calculated by dividing the in-place ABR at the time of disposition by the contractual sales price. December 31, September 30, 2020 2020 Acquisitions: Number of Transactions 19 9 Number of Properties 26 30 Gross Investment (1) 81,246$ 102,638$ Cash Capitalization Rate (2) 6.8% 6.5% Dispositions: Number of Occupied Properties 12 1 Number of Vacant Properties - - Net Book Value (3) 31,144$ 1,806$ Proceeds (4) 37,362$ 1,868$ Cash Capitalization Rate (on occupied properties only) (5) 6.6% 10.4% Three Months Ended

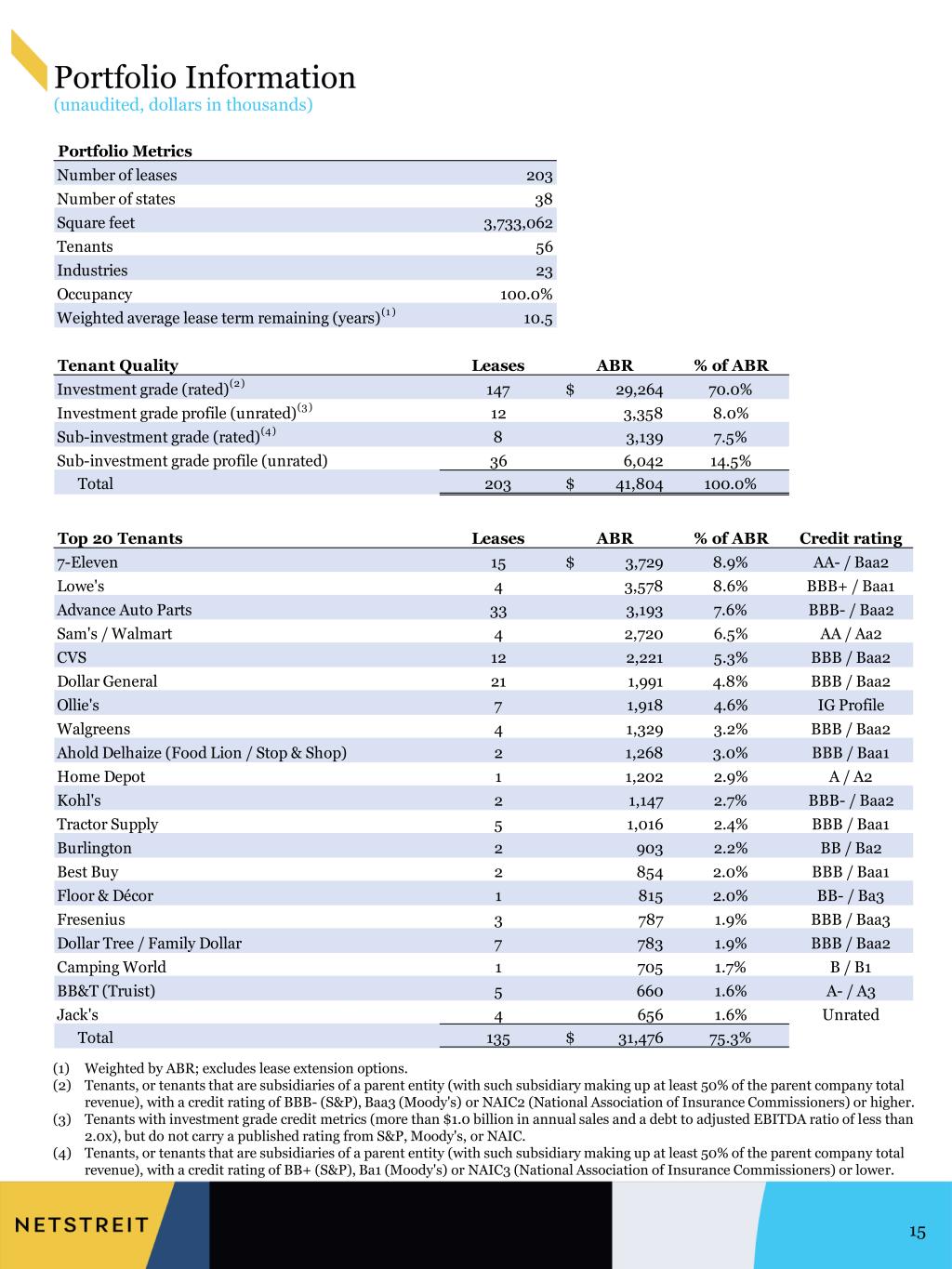

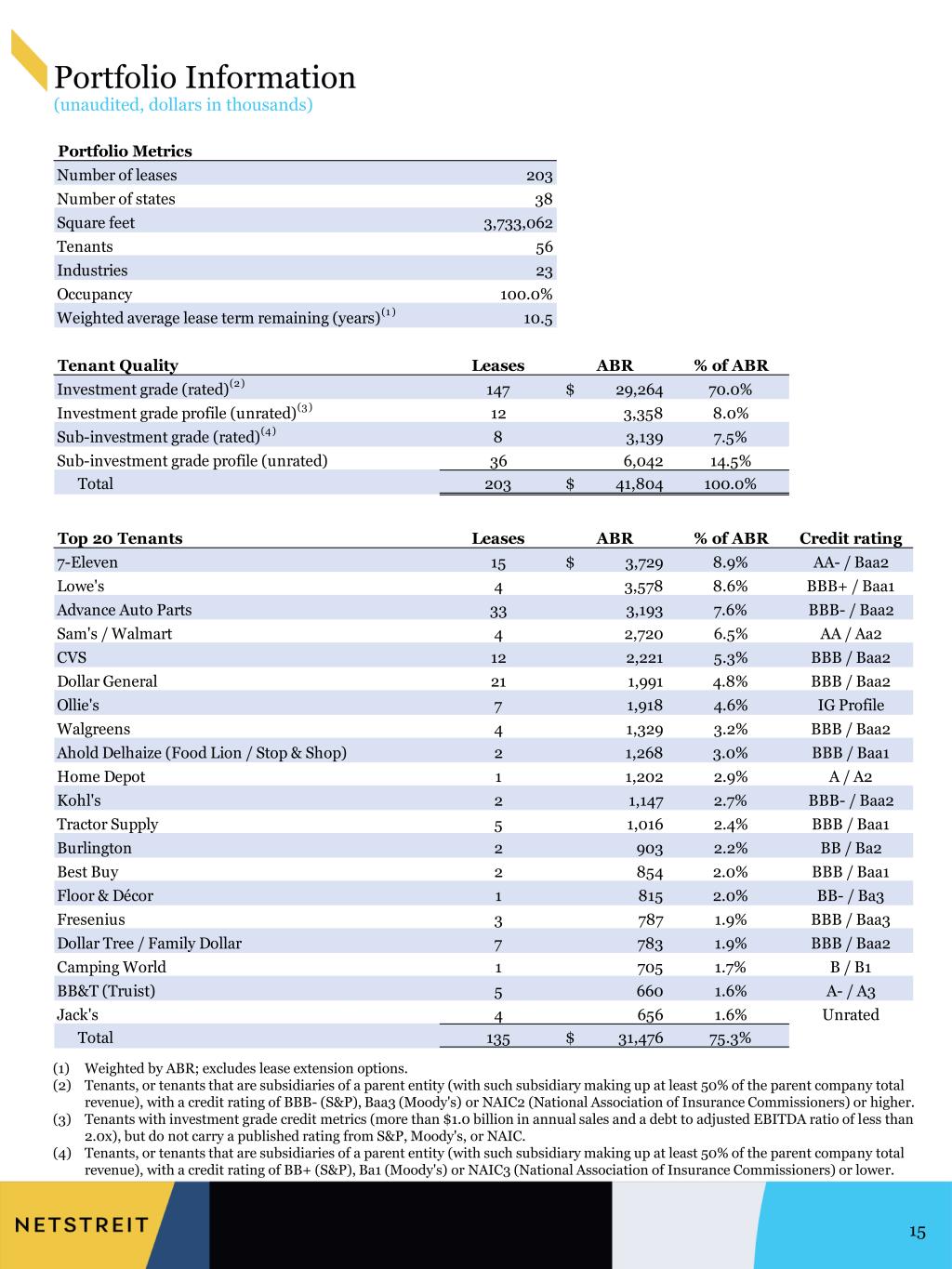

Portfolio Information (unaudited, dollars in thousands) 15 (1) Weighted by ABR; excludes lease extension options. (2) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BBB- (S&P), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher. (3) Tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody's, or NAIC. (4) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BB+ (S&P), Ba1 (Moody's) or NAIC3 (National Association of Insurance Commissioners) or lower. Portfolio Metrics Number of leases 203 Number of states 38 Square feet 3,733,062 Tenants 56 Industries 23 Occupancy 100.0% Weighted average lease term remaining (years) (1 ) 10.5 Tenant Quality Number of Leases ABR % of ABR Investment grade (rated) (2) 147 29,264$ 70.0% Investment grade profile (unrated) (3) 12 3,358 8.0% Sub-investment grade (rated) (4) 8 3,139 7.5% Sub-investment grade profile (unrated) 36 6,042 14.5% Total 203 41,804$ 100.0% Top 20 Tenants Number of Leases ABR % of ABR Credit rating 7-Eleven 15 3,729$ 8.9% AA- / Baa2 Lowe's 4 3,578 8.6% BBB+ / Baa1 Advance Auto Parts 33 3,193 7.6% BBB- / Baa2 Sam's / Walmart 4 2,720 6.5% AA / Aa2 CVS 12 2,221 5.3% BBB / Baa2 Dollar General 21 1,991 4.8% BBB / Baa2 Ollie's 7 1,918 4.6% IG Profile Walgreens 4 1,329 3.2% BBB / Baa2 Ahold Delhaize (Food Lion / Stop & Shop) 2 1,268 3.0% BBB / Baa1 Home Depot 1 1,202 2.9% A / A2 Kohl's 2 1,147 2.7% BBB- / Baa2 Tractor Supply 5 1,016 2.4% BBB / Baa1 Burlington 2 903 2.2% BB / Ba2 Best Buy 2 854 2.0% BBB / Baa1 Floor & Décor 1 815 2.0% BB- / Ba3 Fresenius 3 787 1.9% BBB / Baa3 Dollar Tree / Family Dollar 7 783 1.9% BBB / Baa2 Camping World 1 705 1.7% B / B1 BB&T (Truist) 5 660 1.6% A- / A3 Jack's 4 656 1.6% Unrated Total 135 31,476$ 75.3%

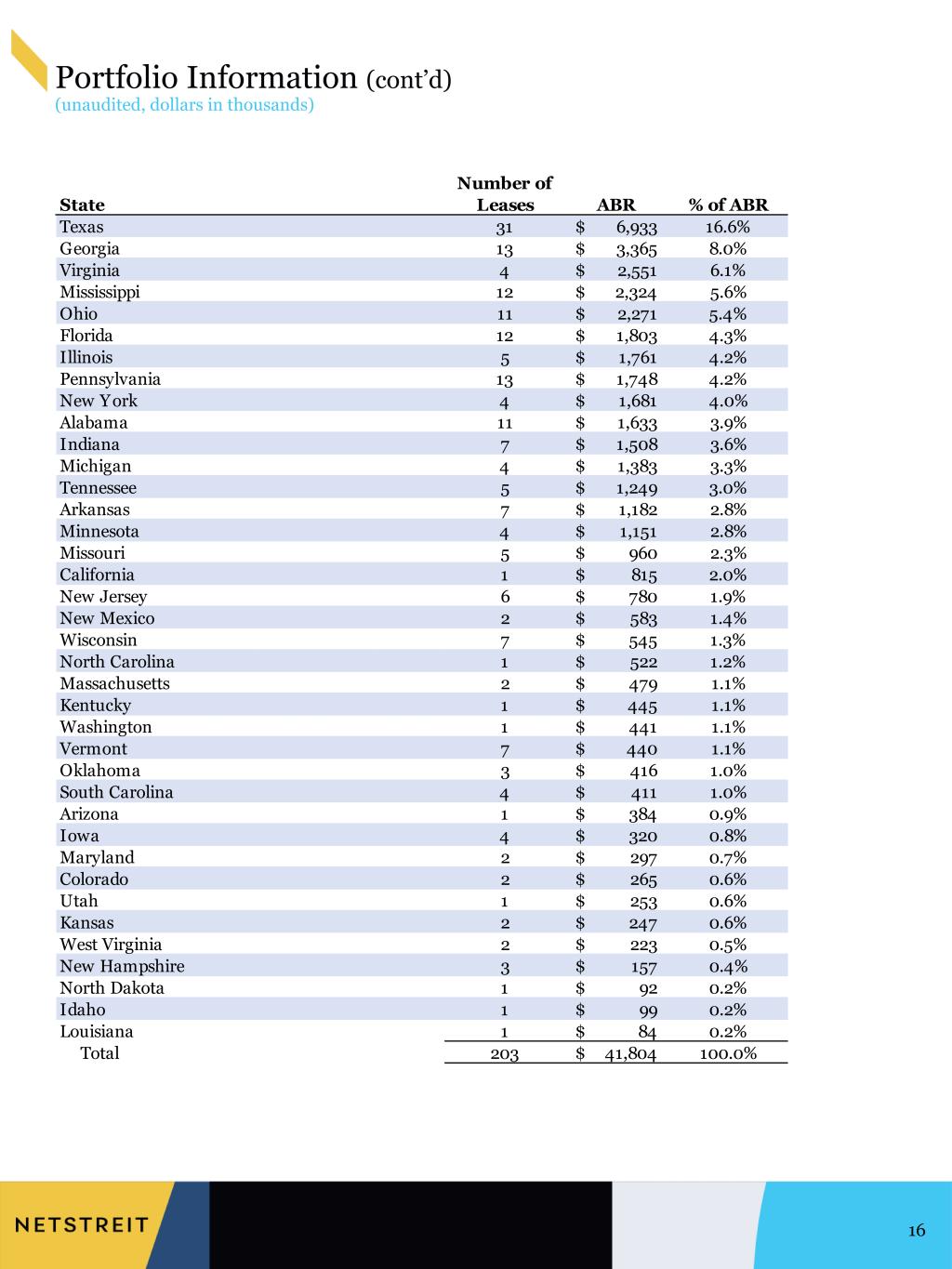

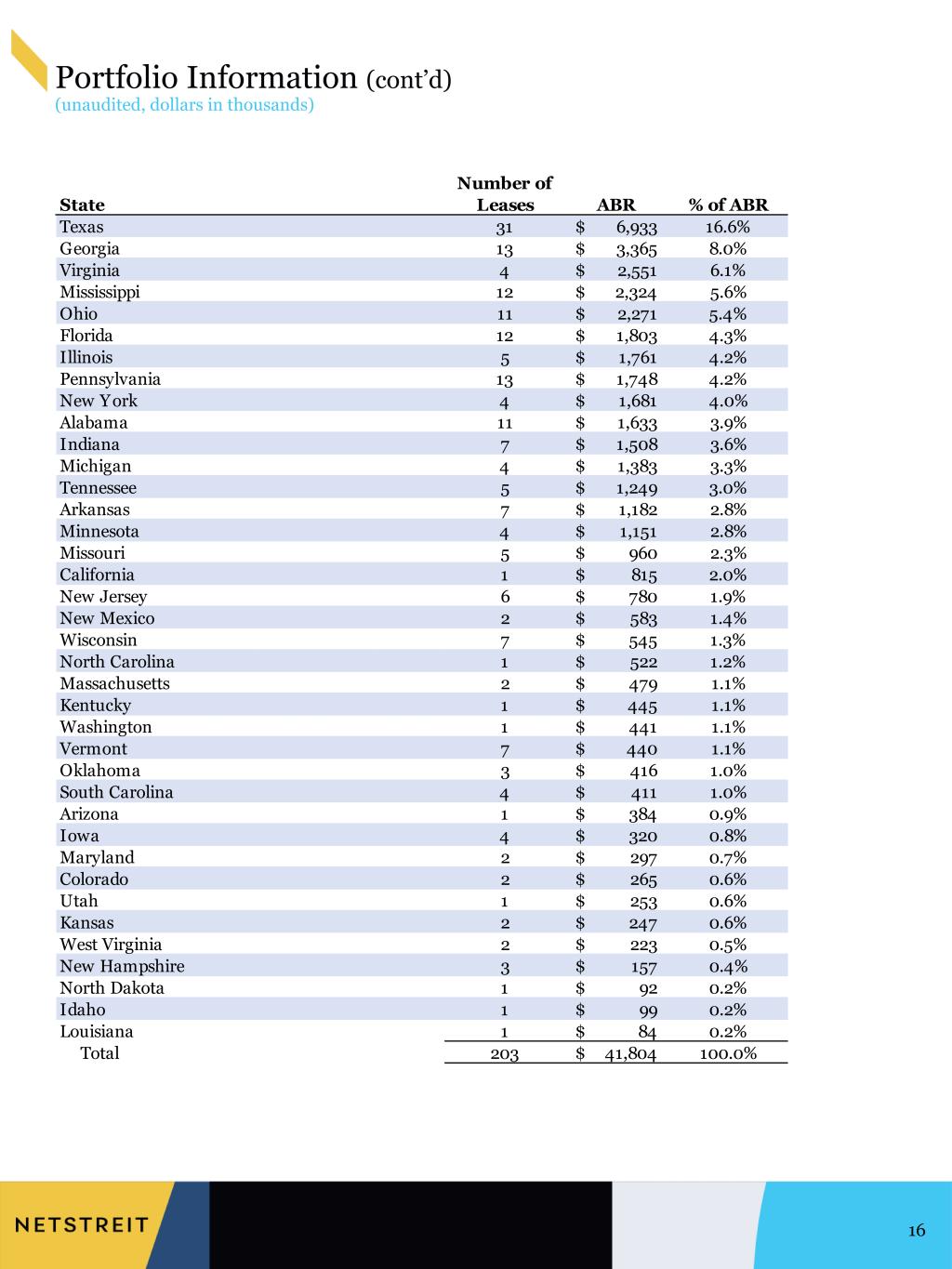

Portfolio Information (cont’d) (unaudited, dollars in thousands) 16 State Number of Leases ABR % of ABR Texas 31 6,933$ 16.6% Georgia 13 3,365$ 8.0% Virginia 4 2,551$ 6.1% Mississippi 12 2,324$ 5.6% Ohio 11 2,271$ 5.4% Florida 12 1,803$ 4.3% Illinois 5 1,761$ 4.2% Pennsylvania 13 1,748$ 4.2% New York 4 1,681$ 4.0% Alabama 11 1,633$ 3.9% Indiana 7 1,508$ 3.6% Michigan 4 1,383$ 3.3% Tennessee 5 1,249$ 3.0% Arkansas 7 1,182$ 2.8% Minnesota 4 1,151$ 2.8% Missouri 5 960$ 2.3% California 1 815$ 2.0% New Jersey 6 780$ 1.9% New Mexico 2 583$ 1.4% Wisconsin 7 545$ 1.3% North Carolina 1 522$ 1.2% Massachusetts 2 479$ 1.1% Kentucky 1 445$ 1.1% Washington 1 441$ 1.1% Vermont 7 440$ 1.1% Oklahoma 3 416$ 1.0% South Carolina 4 411$ 1.0% Arizona 1 384$ 0.9% Iowa 4 320$ 0.8% Maryland 2 297$ 0.7% Colorado 2 265$ 0.6% Utah 1 253$ 0.6% Kansas 2 247$ 0.6% West Virginia 2 223$ 0.5% New Hampshire 3 157$ 0.4% North Dakota 1 92$ 0.2% Idaho 1 99$ 0.2% Louisiana 1 84$ 0.2% Total 203 41,804$ 100.0%

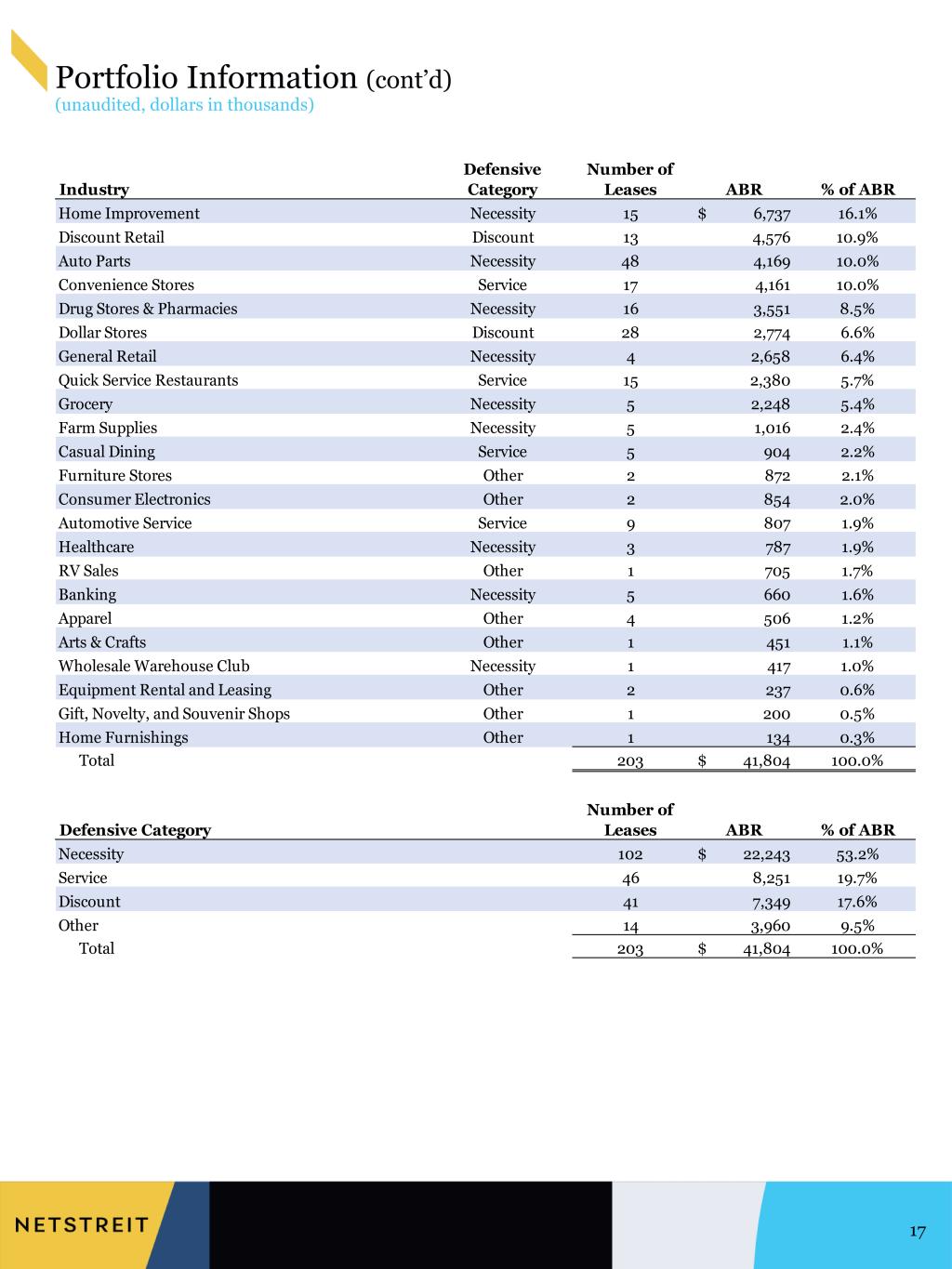

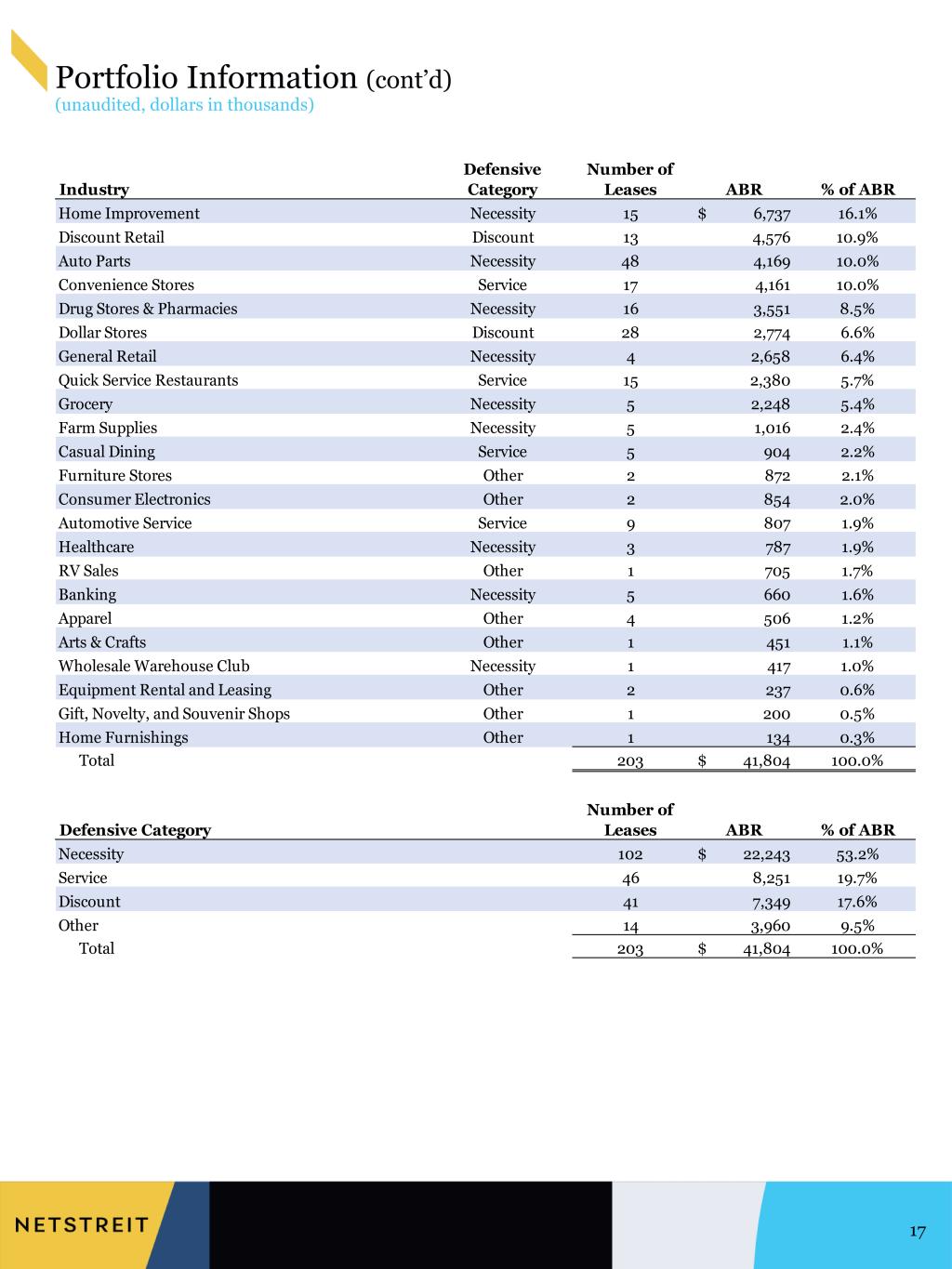

Portfolio Information (cont’d) (unaudited, dollars in thousands) 17 Industry Defensive Category Number of Leases ABR % of ABR Home Improvement Necessity 15 6,737$ 16.1% Discount Retail Discount 13 4,576 10.9% Auto Parts Necessity 48 4,169 10.0% Convenience Stores Service 17 4,161 10.0% Drug Stores & Pharmacies Necessity 16 3,551 8.5% Dollar Stores Discount 28 2,774 6.6% General Retail Necessity 4 2,658 6.4% Quick Service Restaurants Service 15 2,380 5.7% Grocery Necessity 5 2,248 5.4% Farm Supplies Necessity 5 1,016 2.4% Casual Dining Service 5 904 2.2% Furniture Stores Other 2 872 2.1% Consumer Electronics Other 2 854 2.0% Automotive Service Service 9 807 1.9% Healthcare Necessity 3 787 1.9% RV Sales Other 1 705 1.7% Banking Necessity 5 660 1.6% Apparel Other 4 506 1.2% Arts & Crafts Other 1 451 1.1% Wholesale Warehouse Club Necessity 1 417 1.0% Equipment Rental and Leasing Other 2 237 0.6% Gift, Novelty, and Souvenir Shops Other 1 200 0.5% Home Furnishings Other 1 134 0.3% Total 203 41,804$ 100.0% Defensive Category Number of Leases ABR % of ABR Necessity 102 22,243$ 53.2% Service 46 8,251 19.7% Discount 41 7,349 17.6% Other 14 3,960 9.5% Total 203 41,804$ 100.0%

Lease Expiration Schedule (unaudited, dollars in thousands) 18 ABR Expiring Year of Number of ABR as a % of Expiration Leases Expiring Expiring Total Portfolio 2021 - -$ 0.0% 2022 - - 0.0% 2023 3 267 0.6% 2024 1 92 0.2% 2025 6 2,280 5.5% 2026 7 1,816 4.3% 2027 8 2,740 6.6% 2028 20 3,114 7.4% 2029 22 3,335 8.0% 2030 26 6,074 14.5% 2031 30 4,868 11.6% 2032 13 3,329 8.0% 2033 20 2,687 6.4% 2034 9 1,165 2.8% 2035 23 7,570 18.1% 2036 4 667 1.6% 2037 2 273 0.7% 2038 - - 0.0% 2039 6 845 2.0% 2040 1 240 0.6% 2041 1 192 0.5% 2042 - - 0.0% 2043 1 250 0.6% TOTAL 203 41,804$ 100%

Non-GAAP Measures and Definitions 19 FFO, Core FFO, and AFFO FFO means funds from operations. It is a non-GAAP measure defined by NAREIT as net income (computed in accordance with GAAP), excluding real estate-related expenses including, but not limited to, gains (losses) from sales, impairment adjustments, and depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Our calculation of FFO is consistent with FFO as defined by NAREIT. Core FFO means core funds from operations. It is a non-GAAP financial measure defined as FFO adjusted for gains from forfeited earnest money deposits and non-recurring 144A and IPO transaction costs. We believe the presentation of Core FFO provides investors with a metric to assist in their evaluation of our operating performance across multiple periods because it removes the effect of unusual and non-recurring items that are not expected to impact our operating performance on an ongoing basis. AFFO means adjusted funds from operations. It is a non-GAAP financial measure defined as Core FFO adjusted for GAAP net income related to non-cash revenues and expenses, such as straight-line rental revenue, amortization of above and below-market lease-related intangibles, stock-based compensation expense, and amortization of deferred financing costs. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values historically have risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO to be useful in evaluating potential property acquisitions and measuring operating performance. We further consider FFO, Core FFO and AFFO to be useful in determining funds available for payment of distributions. FFO, Core FFO and AFFO do not represent net income or cash flows from operations as defined by GAAP. You should not consider FFO, Core FFO and AFFO to be alternatives to net income as a reliable measure of our operating performance; nor should you consider FFO, Core FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity. FFO, Core FFO and AFFO do not measure whether cash flow is sufficient to fund our cash needs, including principal amortization, capital improvements and distributions to stockholders. FFO, Core FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined by GAAP. Further, FFO, Core FFO and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO, Core FFO and AFFO.

Non-GAAP Measures and Definitions (cont’d) 20 EBITDA, EBITDAre and Adjusted EBITDAre EBITDA is computed by us as earnings before interest, income taxes and depreciation and amortization. EBITDAre is the NAREIT definition of EBITDA (as defined above), but it is further adjusted to follow the definition included in a white paper issued in 2017 by NAREIT, which recommended that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from the sales of depreciable property and real estate impairment losses. Adjusted EBITDAre, as computed by us, is EBITDAre adjusted to exclude straight-line rental revenue, gains from forfeited earnest money deposits, non-recurring 144A and IPO transaction costs, and stock-based compensation expense. Annualized Adjusted EBITDAre is Adjusted EBITDAre multiplied by four. We present EBITDA, EBITDAre and Adjusted EBITDAre as they are measures commonly used in our industry. We believe that these measures are useful to investors and analysts because they provide supplemental information concerning our operating performance, exclusive of certain non-cash items and other costs. We use EBITDA and EBITDAre as measures of our operating performance and not as measures of liquidity. EBITDA, EBITDAre and Adjusted EBITDAre do not include all items of revenue and expense included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Additionally, our computation of EBITDA and EBITDAre may differ from the methodology for calculating these metrics used by other equity REITs and, therefore, may not be comparable to similarly titled measures reported by other equity REITs. NOI, Cash NOI, and Normalized Cash NOI NOI means net operating income, and it is computed in accordance with GAAP. It is calculated by subtracting property operating expenses from rental revenue including reimbursements (as presented on the Statement of Operations). Cash NOI is computed by us as GAAP NOI excluding straight-line rental revenue and amortization of above/below-market leases adjustments. Normalized Cash NOI is computed by us as Cash NOI adjusted to remove Cash NOI for properties acquired during the period shown, and then replace the removed amount with an estimated equivalent ABR for the full period. It is further adjusted to remove Cash NOI for properties disposed of during the period shown.

Non-GAAP Measures and Definitions (cont’d) 21 Other Definitions ABR means annualized base rent. ABR is calculated by multiplying (i) cash rental payments (a) for the month ended December 31, 2020 (or, if applicable, the next full month’s cash rent contractually due in the case of rent abatements, rent deferrals, recently acquired properties and properties with contractual rent increases, other than properties under development) for leases in place as of December 31, 2020, plus (b) for properties under development, the first full month’s permanent cash rent contractually due after the development period by (ii) 12. Defensive Category is considered by us to represent tenants that focus on necessity goods and essential services in the retail sector, including discount stores, grocers, drug stores and pharmacies, home improvement, automotive service and quick-service restaurants, which we refer to as defensive retail industries. The defensive sub-categories as we define them are as follows: (1) Necessity, which are retailers that are considered essential by consumers and include sectors such as drug stores, grocers and home improvement, (2) Discount, which are retailers that offer a low price point and consist of off-price and dollar stores, (3) Service, which consist of retailers that provide services rather than goods, including, tire and auto services and quick service restaurants, and (4) Other, which are retailers that are not considered defensive in terms of being considered necessity, discount or service, as defined by us. Leases are individual properties with a distinct lease agreement in place, and in the case of master lease arrangements each property under the master lease is counted as a separate lease. Net Debt is computed by us as the principal amount of total debt outstanding less cash and cash equivalents. Occupancy is expressed as a percentage, and it is the number of economically occupied properties divided by the total number of properties owned. Properties under development are excluded from the calculation. OP units means operating partnership units not held by NETSTREIT.

Forward Looking and Cautionary Statements 22 This supplemental report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities and trends in our business, including trends in the market for single-tenant, retail commercial real estate. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this supplemental report may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our prospectus dated August 13, 2020, relating to our initial public offering, filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2020 and other reports filed with the SEC from time to time. Forward- looking statements and such risks, uncertainties and other factors speak only as of the date of this supplemental report. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from the novel coronavirus (COVID-19). We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.