Quarterly Supplemental Information First Quarter 2021

Table of Contents 2 03 Corporate Overview 04 Earnings Release 08 Quarterly Highlights 09 Consolidated Statement of Operations and Comprehensive Income (Loss) 10 Funds from Operations and Adjusted Funds from Operations 11 EBITDAre, Adjusted EBITDAre, NOI and Cash NOI 12 Consolidated Balance Sheets 13 Debt, Capitalization and Financial Ratios 14 Investment Activity 15 Portfolio Information 19 Lease Expiration Schedule 20 Non-GAAP Measures and Definitions 23 Forward Looking and Cautionary Statements

Corporate Overview 3 5910 North Central Expressway Suite 1600 Dallas, Texas, 75075 Phone: (972) 579 – 4825 Website: www.netstreit.com Corporate Headquarters Transfer Agent Computershare PO Box 505000 Louisville, Kentucky 40233 Phone: (866) 637 – 9460 Website: www.computershare.com Corporate Profile NETSTREIT Corp. (NYSE: NTST) is an internally managed Real Estate Investment Trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e-commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country in order to generate consistent cash flows and dividends for its investors. Mark Manheimer, Chief Executive Officer Andy Blocher, Chief Financial Officer Jeff Fuge, Senior Vice President of Acquisitions Randy Haugh, Senior Vice President of Finance Kirk Klatt, Senior Vice President of Real Estate Trish McBratney, SVP, Chief Accounting Officer Chad Shafer, Senior Vice President of Underwriting Management Team Todd Minnis – Chair Matthew Troxell – Lead Independent Michael Christodolou Heidi Everett Mark Manheimer Lori Wittman Robin Zeigler Board of Directors

Earnings Release 4 NETSTREIT REPORTS FIRST QUARTER 2021 FINANCIAL AND OPERATING RESULTS – Reports Net Income of $0.02 and Adjusted Funds from Operations (“AFFO”) of $0.23 per diluted share – – Completed $89.5 Million of Net Investment Activity – – Initiates Full Year 2021 AFFO Guidance in Range of $0.95 - $0.99 Per Share – – Subsequent to Quarter End, Raised Gross Proceeds of $203.6 million through Follow On Offering – Dallas TX – April 29, 2021 – NETSTREIT (NYSE: NTST) (the “Company”), today announced financial and operating results for the first quarter ended March 31, 2021. “We are very pleased to have a strong start to 2021. Our portfolio’s steady operational performance, with 100% rent collections for the past eight months, has allowed us to accelerate our focus on growth. With $89.5 million of acquisition and development activity completed in the first quarter, we continue to uncover highly accretive opportunities and have built an attractive pipeline. Given this level of confidence, we increased our external growth target and reloaded our balance sheet through a transformational equity offering in early April. We are now tasked with effectively deploying that capital and in doing so, believe we can drive attractive per share earnings growth and value accretion for shareholders,” said Mark Manheimer, Chief Executive Officer of NETSTREIT. FIRST QUARTER 2021 HIGHLIGHTS ● Reported net income per share of $0.02, Core Funds from Operations (“Core FFO”) per share of $0.221 and AFFO per share of $0.231 per share (see non-GAAP reconciliation attached) ● The Company collected 100% of rent payments for the first quarter and for the month of April 2021, resulting in eight consecutive months of 100% rent collections PORTFOLIO UPDATE As of March 31, 2021, the NETSTREIT portfolio was comprised of 2352 leases, contributing $48.0 million of annualized base rent3, with a weighted-average remaining lease term of 10.1 years, of which 69.6% were occupied by investment grade rated tenants and 11.2% were occupied by tenants with investment grade profiles (unrated tenants with more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x). The portfolio was 100.0% occupied as of March 31, 2021. INVESTMENT ACTIVITY During the quarter ended March 31, 2021, the Company had total net investment activity of $89.5 million, which includes acquisitions and development. The Company invested approximately $88.2 million in 31 properties at an initial cash capitalization rate of 6.7%. Acquisitions completed during the quarter had a weighted-average remaining lease term of 8.8 years, and 65.7% of the properties

Earnings Release 5 are occupied by investment grade rated tenants. The Company also provided $1.3 million of funding in the first quarter to support an estimated $4.4 million development project for an investment grade tenant that is expected to be completed in the next 12 months. The Company did not complete any dispositions during the first quarter. This transaction activity enhanced tenant diversification, increasing the total tenant count from 56 at the end of 2020 to 60 tenants. The Company added Marshalls (TJX Companies), Natural Grocers (Vitamin Cottage Natural Food Markets, Inc), Ross Stores, Inc. and Wawa, Inc. to its portfolio. Additionally, this transaction activity enhanced the Company’s geographic diversity by adding a property in one new state to the portfolio. BALANCE SHEET AND LIQUIDITY At quarter end, total debt outstanding was $188 million, with a weighted average term of 3.7 years and a quarter end contractual interest rate, including the impact of the fixed rate swap, of 1.36% (excluding the impact of deferred fee amortization). 93% of the Company’s debt was at a fixed rate and the Company’s net debt to annualized adjusted EBITDA ratio was 4.7x. Additionally, the ending cash balance was $13.7 million, and the Company had $13.0 million outstanding on its revolving line of credit. ACTIVITY SUBSEQUENT TO QUARTER END In April, the Company completed a follow on offering of 10,915,688 shares of common stock, which includes the full exercise of the underwriters’ option to purchase additional shares, at a price to the public of $18.65 per share. Gross proceeds to the Company from the offering, before deducting underwriting discounts and commissions and other offering expenses, were approximately $203.6 million. Proceeds from the offering are being used to fund acquisition activity and repay amounts outstanding on the Company’s line of credit. DIVIDEND On April 27, 2021, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share for the second quarter of 2021, which will be paid on June 15, 2021 to shareholders of record on June 1, 2021. 2021 OUTLOOK The Company is initiating its full year 2021 AFFO per share guidance in the range of $0.95 to $0.99 per share. This AFFO guidance is based on the follow assumptions: ● On April 5, 2021, the Company increased its external growth target for full year 2021 and now expects net acquisition activity, inclusive of dispositions, to total $360 million, from its previously provided target of $320 million ● The Company continues to expect cash G&A to be in the range of $11.0 to $12.0 million, with additional non-cash compensation expense of $3.0 to $4.0 million

Earnings Release 6 ● The Company continues to expect cash interest expense, including unused line of credit facility fees, of $3.0 to $3.5 million, and an additional $0.6 million of non-cash deferred financing fee amortization ● The Company continues to expect to incur state and franchise taxes in the range of $0.2 to $0.3 million which will be reported as “income taxes” in the Company’s financial statements for 2021 ● Full year 2021 diluted weighted average shares outstanding, which includes the impact of OP units, as well as the potential usage of the ATM beginning in August 2021, are expected to be in the range of 38 to 39 million EARNINGS WEBCAST AND CONFERENCE CALL A conference call will be held on Friday, April 30, 2021 at 10:00 AM ET. During the conference call the Company’s officers will review third quarter performance, discuss recent events, and conduct a question and answer period. The webcast will be accessible on the “Investor Relations” section of the Company’s website at www.NETSTREIT.com. To listen to the live webcast, please go to the site at least fifteen minutes prior to the scheduled start time to register, as well as download and install any necessary audio software. A replay of the webcast will be available for 90 days on the Company’s website shortly after the call. The conference call can also be accessed by dialing 1-877-451-6152 for domestic callers or 1-201-389- 0879 for international callers. A dial-in replay will be available starting shortly after the call until May 7, 2021, which can be accessed by dialing 1-844-512-2921 for domestic callers or 1-412-317-6671 for international callers. The passcode for this dial-in replay is 13718331. SUPPLEMENTAL PACKAGE The Company’s supplemental package will be available prior to the conference call in the Investor Relations section of the Company’s website at www.investors.netstreit.com. About NETSTREIT NETSTREIT is an internally managed Real Estate Investment Trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e-commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country with the goal of generating consistent cash flows and dividends for its investors. Investor Relations ir@netstreit.com 972-597-4825 (1) Per share amounts include weighted average common shares of 28,348,975, weighted average operating partnership units of 1,616,005 and weighted average effect of dilutive unvested restricted stock units of 87,960 for the three-months ended March 31, 2021.

Earnings Release 7 (2) Leases are individual properties with a distinct lease agreement in place, development activities where a lease is expected at a future date, or in the case of master lease arrangements each property under the master lease is counted as a separate lease. (3) Annualized base rent, or ABR, is calculated by multiplying (i) cash rental payments (a) for the month ended March 31, 2021 (or, if applicable, the next full month's cash rent contractually due in the case of rent abatements, rent deferrals, recently acquired properties and properties with contractual rent increases, other than properties under development) for leases in place as of March 31, 2021, plus (b) for properties under development, the first full month's permanent cash rent contractually due after the development period by (ii) 12. NON-GAAP FINANCIAL MEASURES This press release contains non-GAAP financial measures, including FFO, Core FFO, AFFO, EBITDA, EBITDAre, Adjusted EBITDAre, NOI, and Cash NOI. A reconciliation from net loss available to common shareholders to each non-GAAP financial measure, and definitions of each non-GAAP measure, are included below. FORWARD LOOKING STATEMENTS This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities and trends in our business, including trends in the market for single-tenant, retail commercial real estate. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this press release may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our Form 10-K for the year ended December 31, 2020 filed with the Securities and Exchange Commission (the “SEC”) and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this press release. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from the novel coronavirus (COVID-19). We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.

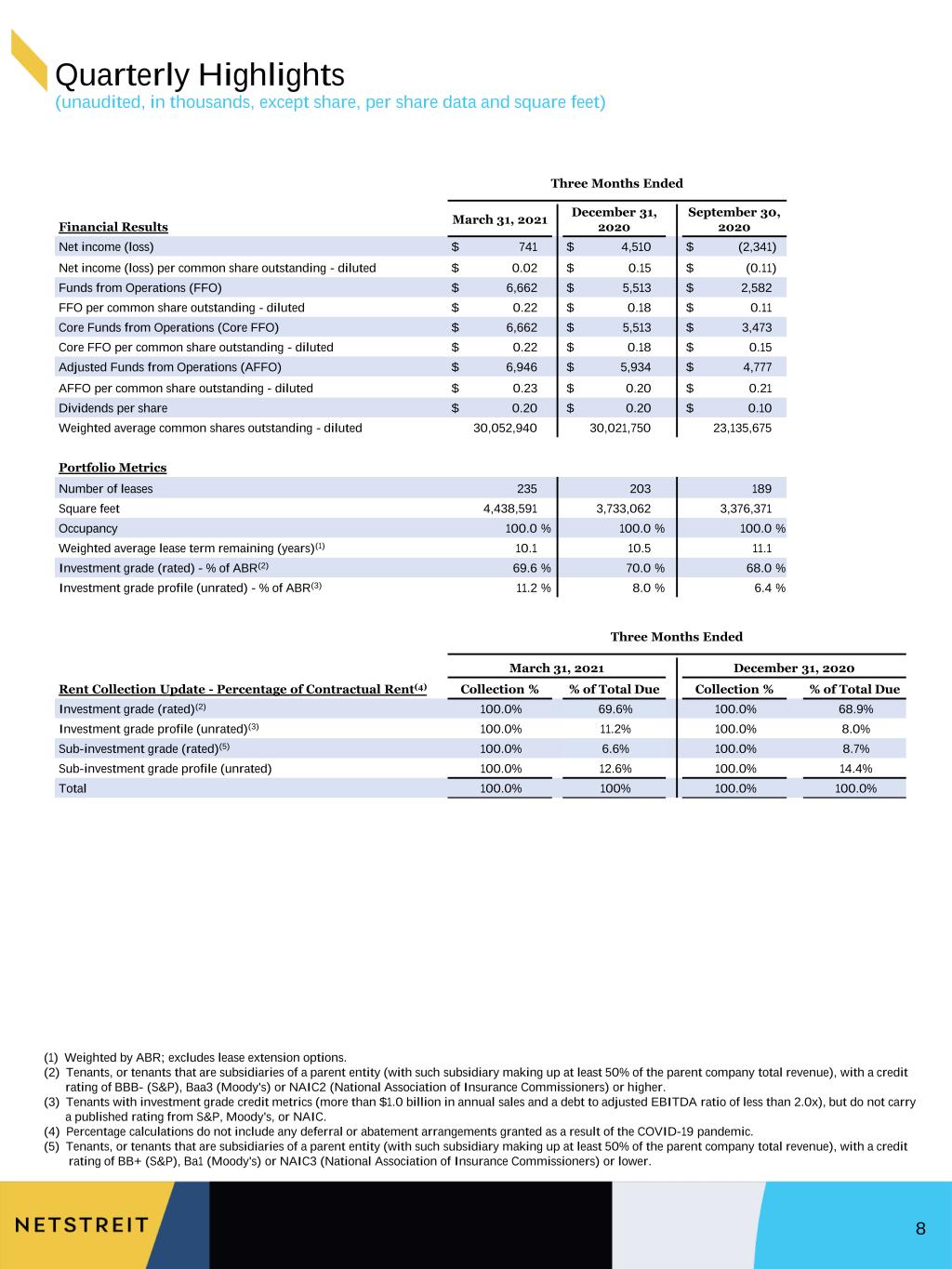

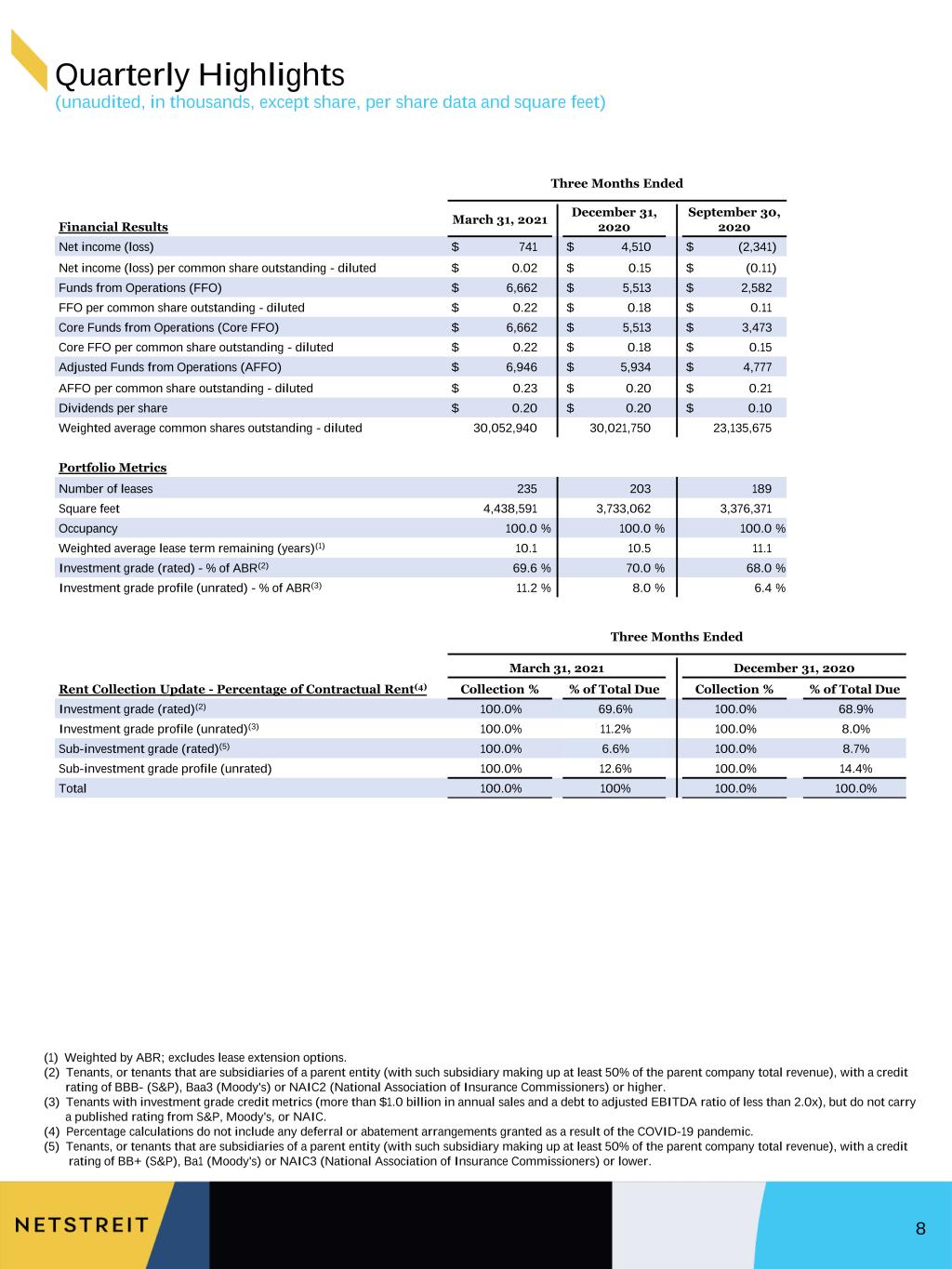

Quarterly Highlights (unaudited, in thousands, except share, per share data and square feet) 8 (1) Weighted by ABR; excludes lease extension options. (2) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BBB- (S&P), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher. (3) Tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody's, or NAIC. (4) Percentage calculations do not include any deferral or abatement arrangements granted as a result of the COVID-19 pandemic. (5) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BB+ (S&P), Ba1 (Moody's) or NAIC3 (National Association of Insurance Commissioners) or lower. Three Months Ended Financial Results March 31, 2021 December 31, 2020 September 30, 2020 Net income (loss) $ 741 $ 4,510 $ (2,341) Net income (loss) per common share outstanding - diluted $ 0.02 $ 0.15 $ (0.11) Funds from Operations (FFO) $ 6,662 $ 5,513 $ 2,582 FFO per common share outstanding - diluted $ 0.22 $ 0.18 $ 0.11 Core Funds from Operations (Core FFO) $ 6,662 $ 5,513 $ 3,473 Core FFO per common share outstanding - diluted $ 0.22 $ 0.18 $ 0.15 Adjusted Funds from Operations (AFFO) $ 6,946 $ 5,934 $ 4,777 AFFO per common share outstanding - diluted $ 0.23 $ 0.20 $ 0.21 Dividends per share $ 0.20 $ 0.20 $ 0.10 Weighted average common shares outstanding - diluted 30,052,940 30,021,750 23,135,675 Portfolio Metrics Number of leases 235 203 189 Square feet 4,438,591 3,733,062 3,376,371 Occupancy 100.0 % 100.0 % 100.0 % Weighted average lease term remaining (years)(1) 10.1 10.5 11.1 Investment grade (rated) - % of ABR(2) 69.6 % 70.0 % 68.0 % Investment grade profile (unrated) - % of ABR(3) 11.2 % 8.0 % 6.4 % Three Months Ended March 31, 2021 December 31, 2020 Rent Collection Update - Percentage of Contractual Rent(4) Collection % % of Total Due Collection % % of Total Due Investment grade (rated)(2) 100.0% 69.6% 100.0% 68.9% Investment grade profile (unrated)(3) 100.0% 11.2% 100.0% 8.0% Sub-investment grade (rated)(5) 100.0% 6.6% 100.0% 8.7% Sub-investment grade profile (unrated) 100.0% 12.6% 100.0% 14.4% Total 100.0% 100% 100.0% 100.0%

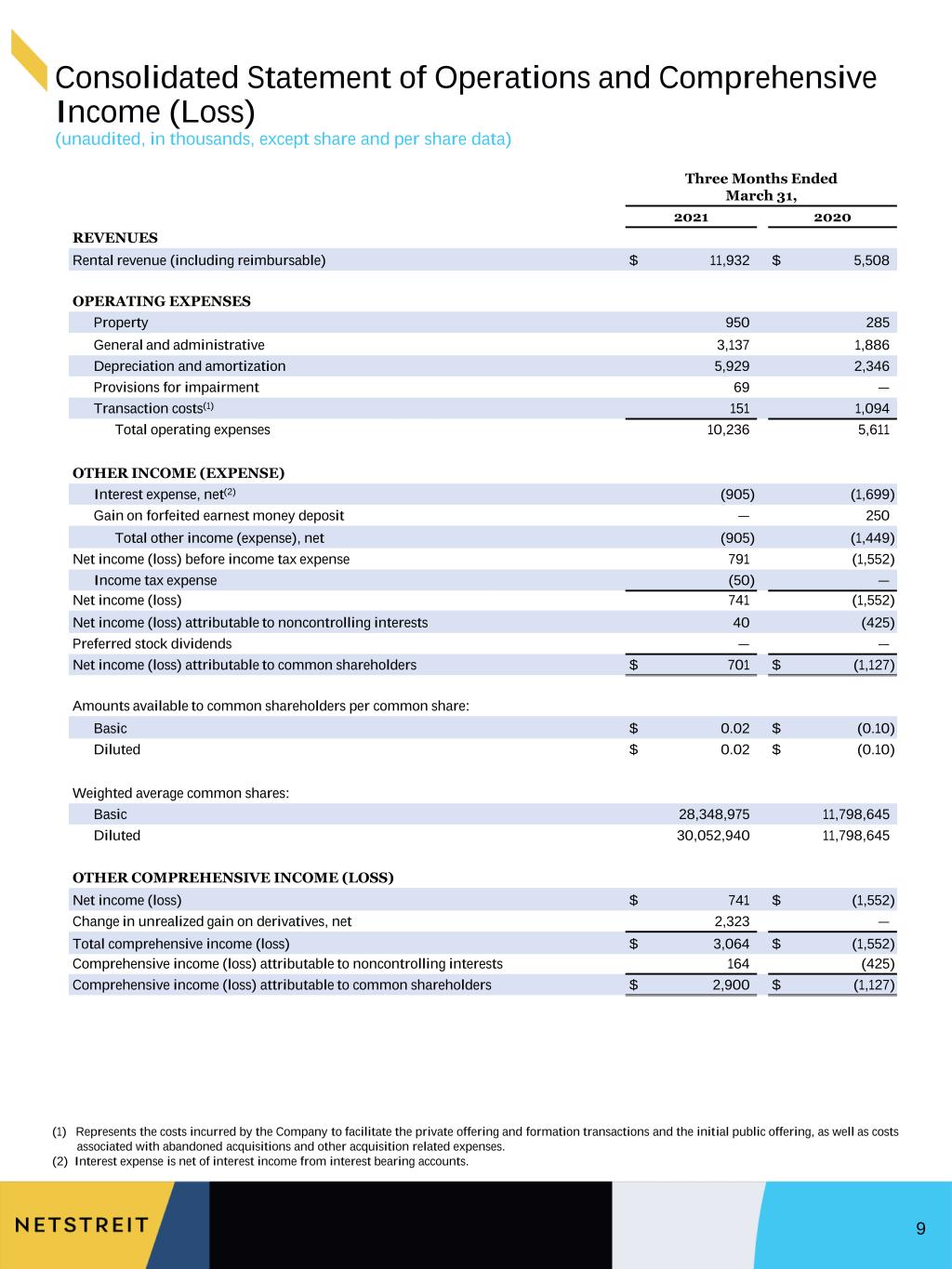

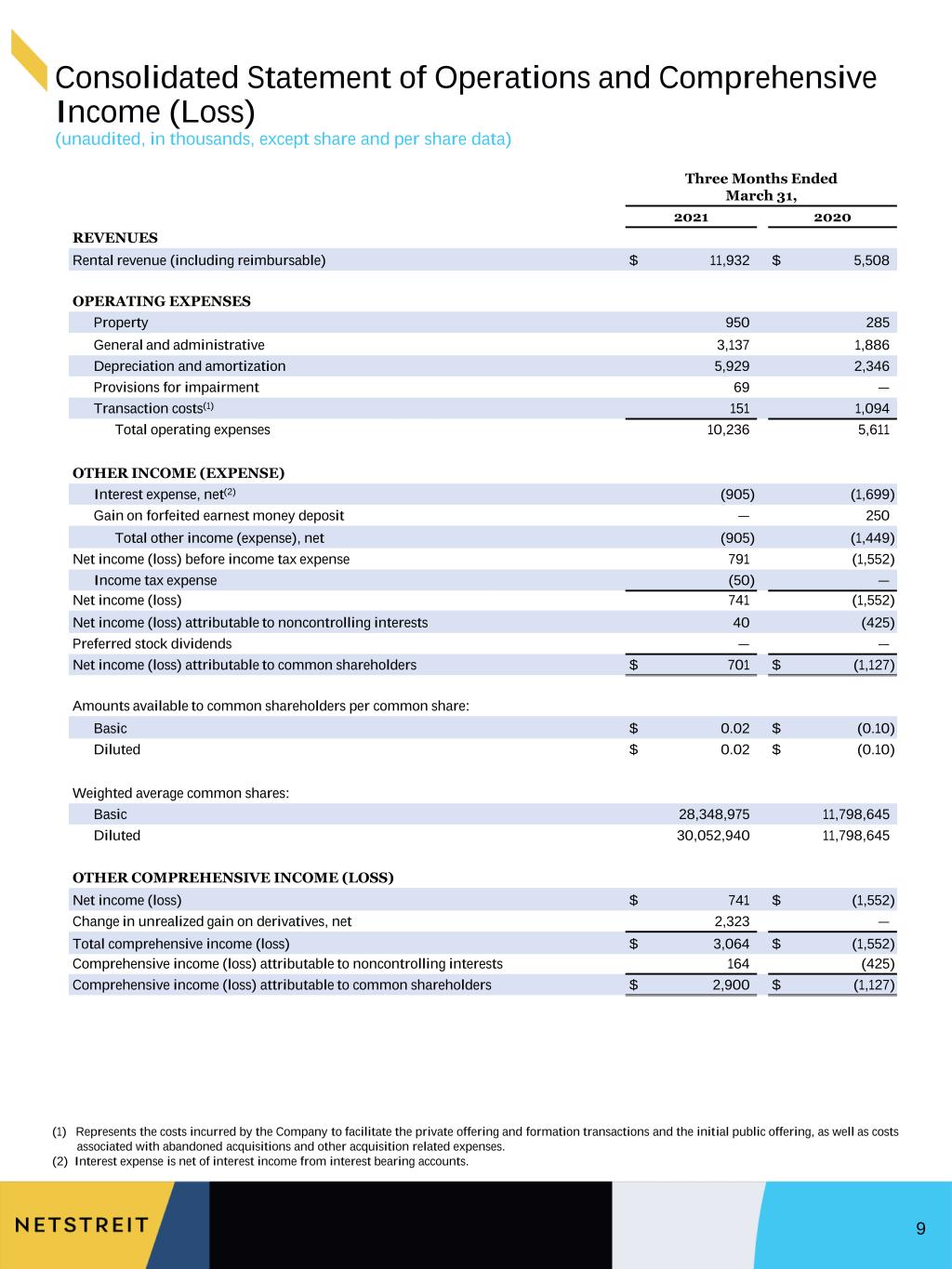

Consolidated Statement of Operations and Comprehensive Income (Loss) (unaudited, in thousands, except share and per share data) 9 Three Months Ended March 31, 2021 2020 REVENUES Rental revenue (including reimbursable) $ 11,932 $ 5,508 OPERATING EXPENSES Property 950 285 General and administrative 3,137 1,886 Depreciation and amortization 5,929 2,346 Provisions for impairment 69 — Transaction costs(1) 151 1,094 Total operating expenses 10,236 5,611 OTHER INCOME (EXPENSE) Interest expense, net(2) (905) (1,699) Gain on forfeited earnest money deposit — 250 Total other income (expense), net (905) (1,449) Net income (loss) before income tax expense 791 (1,552) Income tax expense (50) — Net income (loss) 741 (1,552) Net income (loss) attributable to noncontrolling interests 40 (425) Preferred stock dividends — — Net income (loss) attributable to common shareholders $ 701 $ (1,127) Amounts available to common shareholders per common share: Basic $ 0.02 $ (0.10) Diluted $ 0.02 $ (0.10) Weighted average common shares: Basic 28,348,975 11,798,645 Diluted 30,052,940 11,798,645 OTHER COMPREHENSIVE INCOME (LOSS) Net income (loss) $ 741 $ (1,552) Change in unrealized gain on derivatives, net 2,323 — Total comprehensive income (loss) $ 3,064 $ (1,552) Comprehensive income (loss) attributable to noncontrolling interests 164 (425) Comprehensive income (loss) attributable to common shareholders $ 2,900 $ (1,127) (1) Represents the costs incurred by the Company to facilitate the private offering and formation transactions and the initial public offering, as well as costs associated with abandoned acquisitions and other acquisition related expenses. (2) Interest expense is net of interest income from interest bearing accounts.

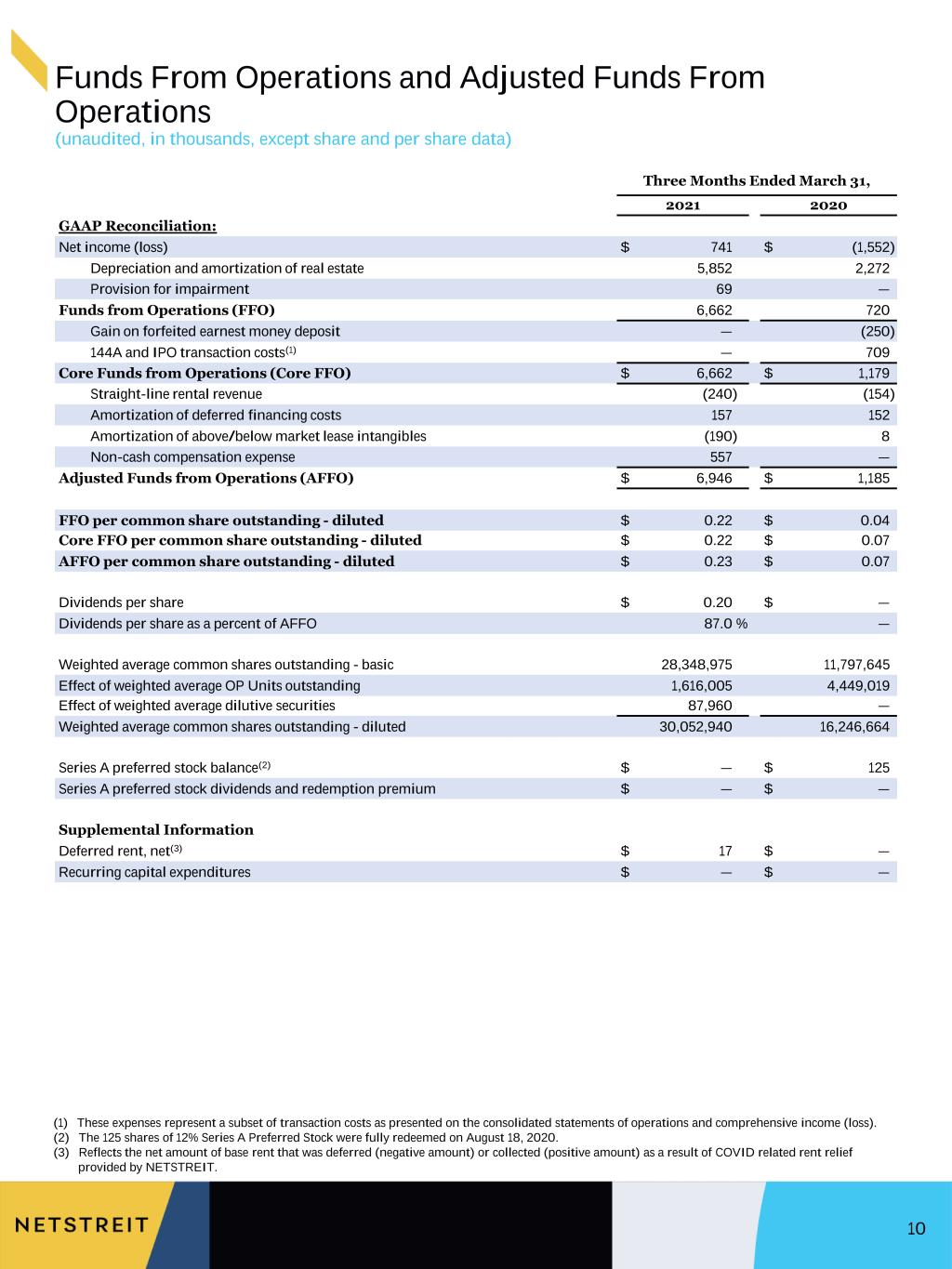

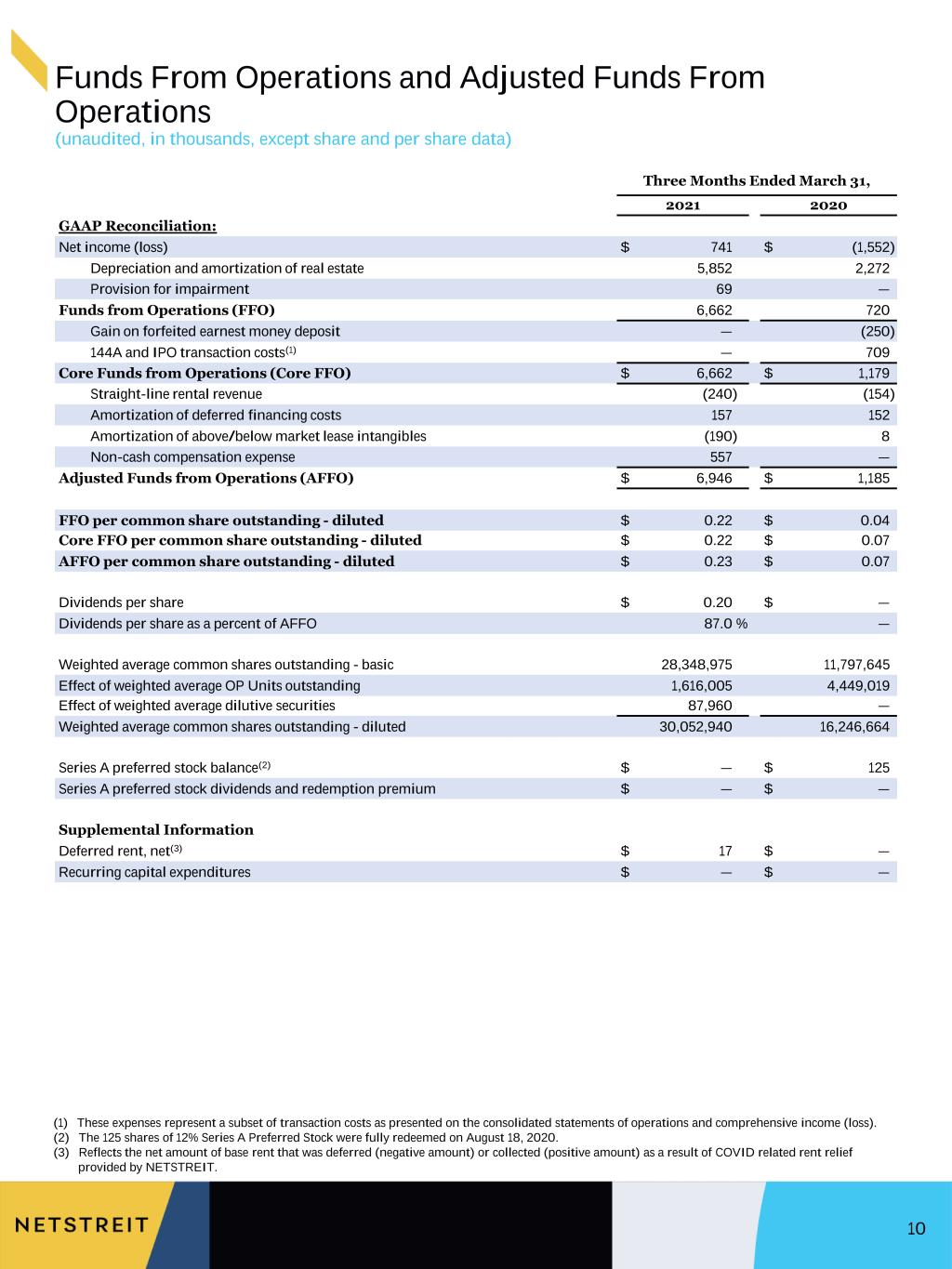

Funds From Operations and Adjusted Funds From Operations (unaudited, in thousands, except share and per share data) 10 Three Months Ended March 31, 2021 2020 GAAP Reconciliation: Net income (loss) $ 741 $ (1,552) Depreciation and amortization of real estate 5,852 2,272 Provision for impairment 69 — Funds from Operations (FFO) 6,662 720 Gain on forfeited earnest money deposit — (250) 144A and IPO transaction costs(1) — 709 Core Funds from Operations (Core FFO) $ 6,662 $ 1,179 Straight-line rental revenue (240) (154) Amortization of deferred financing costs 157 152 Amortization of above/below market lease intangibles (190) 8 Non-cash compensation expense 557 — Adjusted Funds from Operations (AFFO) $ 6,946 $ 1,185 FFO per common share outstanding - diluted $ 0.22 $ 0.04 Core FFO per common share outstanding - diluted $ 0.22 $ 0.07 AFFO per common share outstanding - diluted $ 0.23 $ 0.07 Dividends per share $ 0.20 $ — Dividends per share as a percent of AFFO 87.0 % — Weighted average common shares outstanding - basic 28,348,975 11,797,645 Effect of weighted average OP Units outstanding 1,616,005 4,449,019 Effect of weighted average dilutive securities 87,960 — Weighted average common shares outstanding - diluted 30,052,940 16,246,664 Series A preferred stock balance(2) $ — $ 125 Series A preferred stock dividends and redemption premium $ — $ — Supplemental Information Deferred rent, net(3) $ 17 $ — Recurring capital expenditures $ — $ — (1) These expenses represent a subset of transaction costs as presented on the consolidated statements of operations and comprehensive income (loss). (2) The 125 shares of 12% Series A Preferred Stock were fully redeemed on August 18, 2020. (3) Reflects the net amount of base rent that was deferred (negative amount) or collected (positive amount) as a result of COVID related rent relief provided by NETSTREIT.

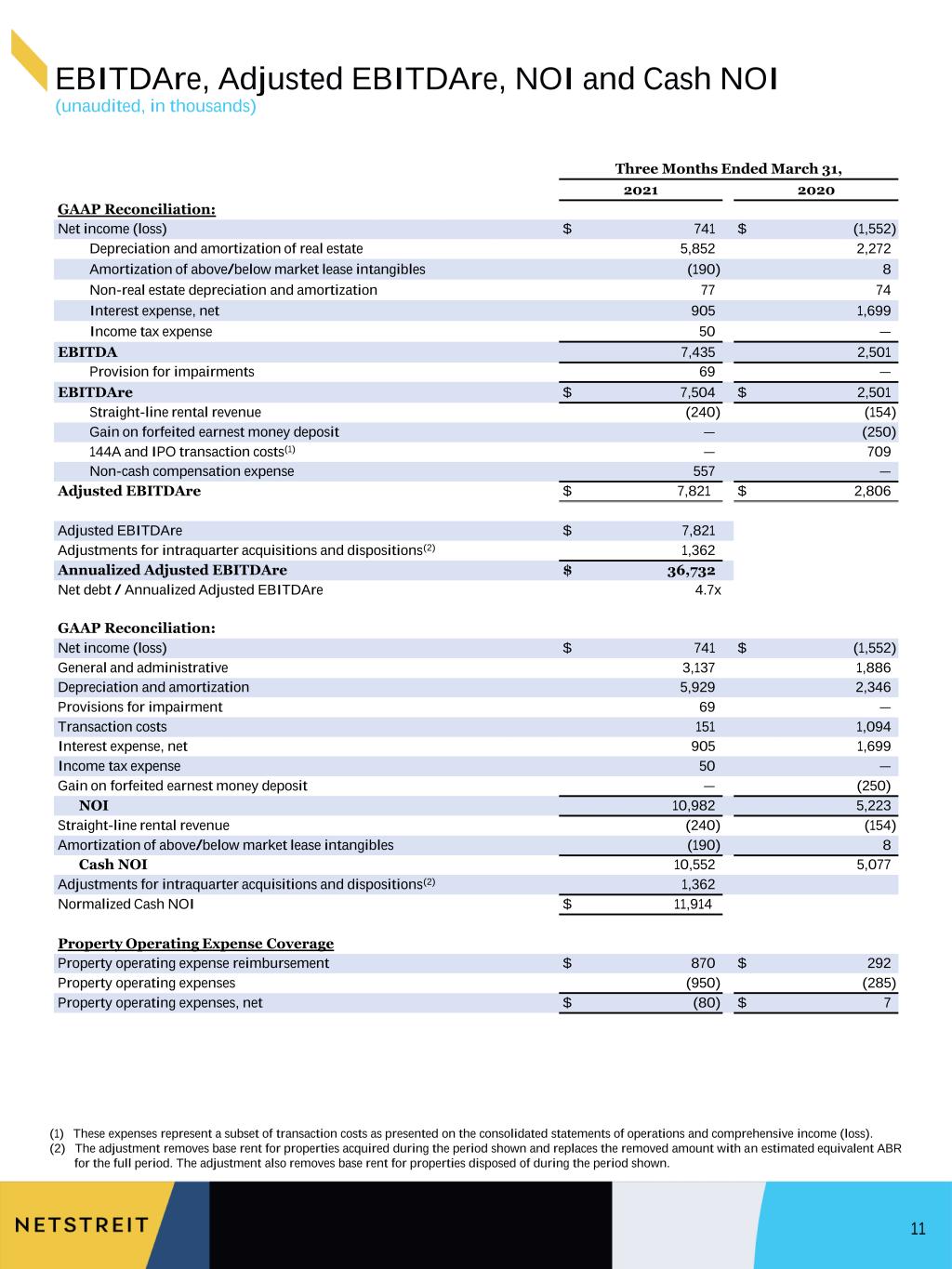

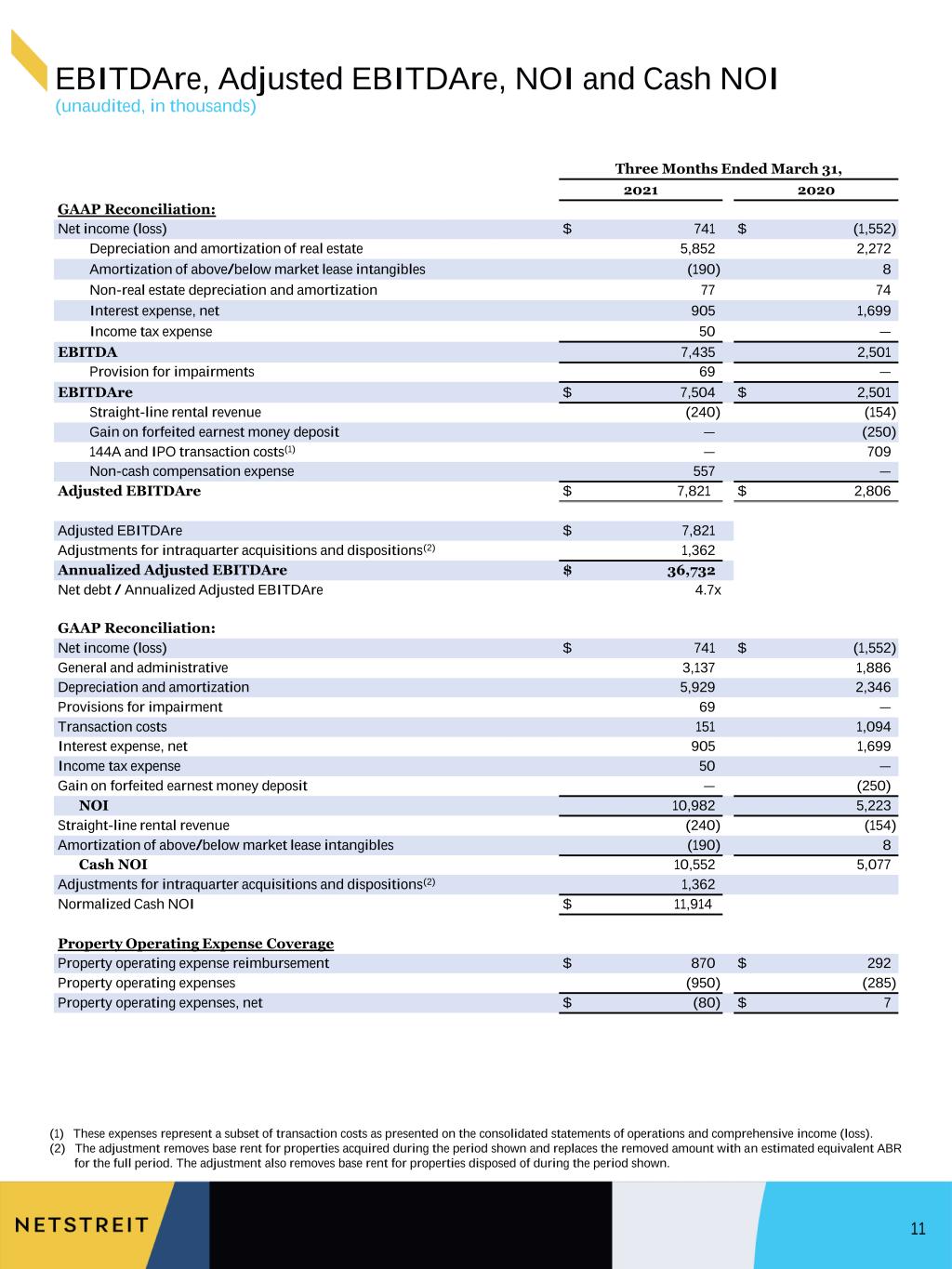

EBITDAre, Adjusted EBITDAre, NOI and Cash NOI (unaudited, in thousands) 11 (1) These expenses represent a subset of transaction costs as presented on the consolidated statements of operations and comprehensive income (loss). (2) The adjustment removes base rent for properties acquired during the period shown and replaces the removed amount with an estimated equivalent ABR for the full period. The adjustment also removes base rent for properties disposed of during the period shown. Three Months Ended March 31, 2021 2020 GAAP Reconciliation: Net income (loss) $ 741 $ (1,552) Depreciation and amortization of real estate 5,852 2,272 Amortization of above/below market lease intangibles (190) 8 Non-real estate depreciation and amortization 77 74 Interest expense, net 905 1,699 Income tax expense 50 — EBITDA 7,435 2,501 Provision for impairments 69 — EBITDAre $ 7,504 $ 2,501 Straight-line rental revenue (240) (154) Gain on forfeited earnest money deposit — (250) 144A and IPO transaction costs(1) — 709 Non-cash compensation expense 557 — Adjusted EBITDAre $ 7,821 $ 2,806 Adjusted EBITDAre $ 7,821 Adjustments for intraquarter acquisitions and dispositions(2) 1,362 Annualized Adjusted EBITDAre $ 36,732 174,284 Net debt / Annualized Adjusted EBITDAre 4.7x 0.00474 GAAP Reconciliation: Net income (loss) $ 741 $ (1,552) General and administrative 3,137 1,886 Depreciation and amortization 5,929 2,346 Provisions for impairment 69 — Transaction costs 151 1,094 Interest expense, net 905 1,699 Income tax expense 50 — Gain on forfeited earnest money deposit — (250) NOI 10,982 5,223 Straight-line rental revenue (240) (154) Amortization of above/below market lease intangibles (190) 8 Cash NOI 10,552 5,077 Adjustments for intraquarter acquisitions and dispositions(2) 1,362 Normalized Cash NOI $ 11,914 Property Operating Expense Coverage Property operating expense reimbursement $ 870 $ 292 Property operating expenses (950) (285) Property operating expenses, net $ (80) $ 7

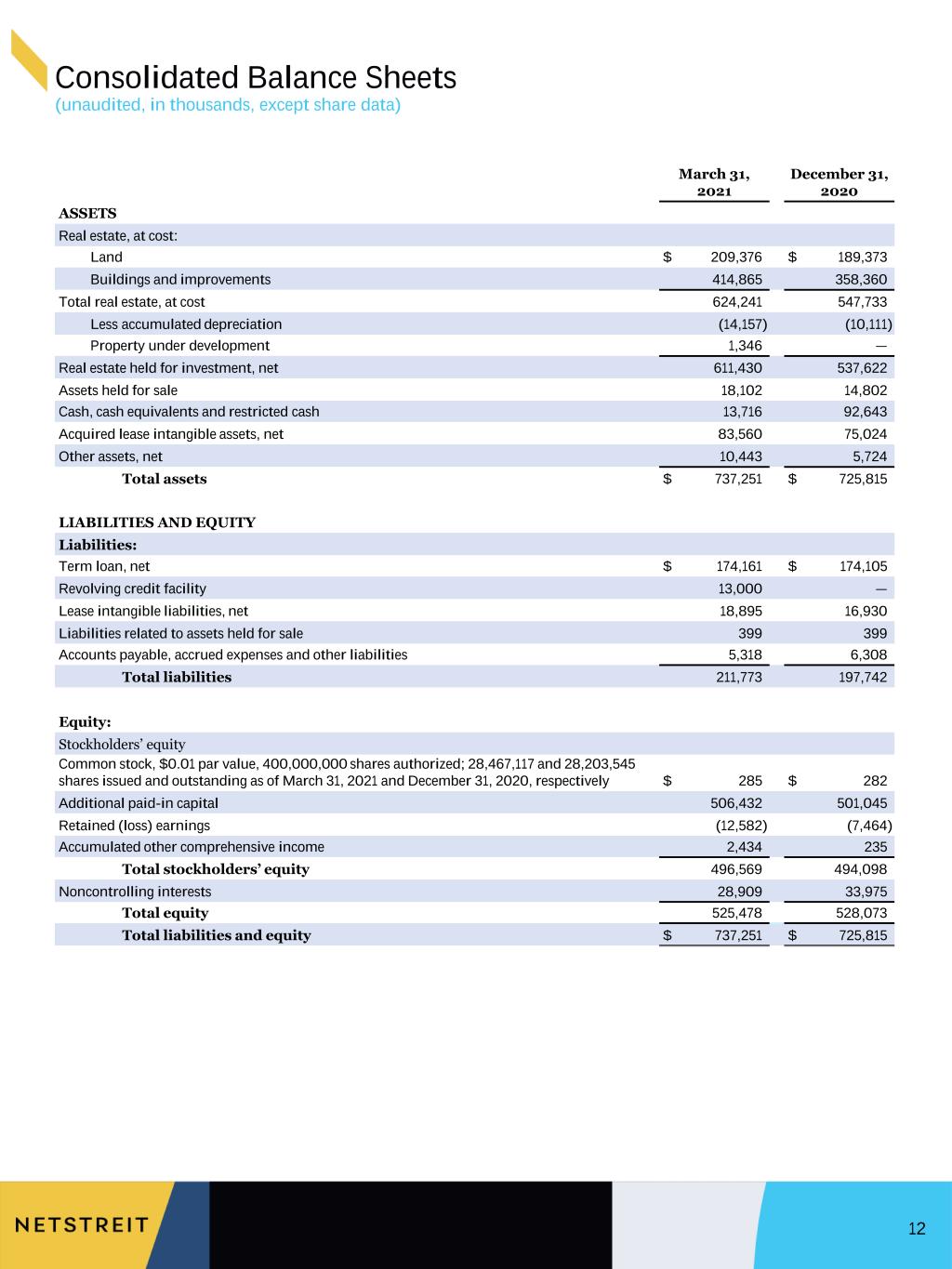

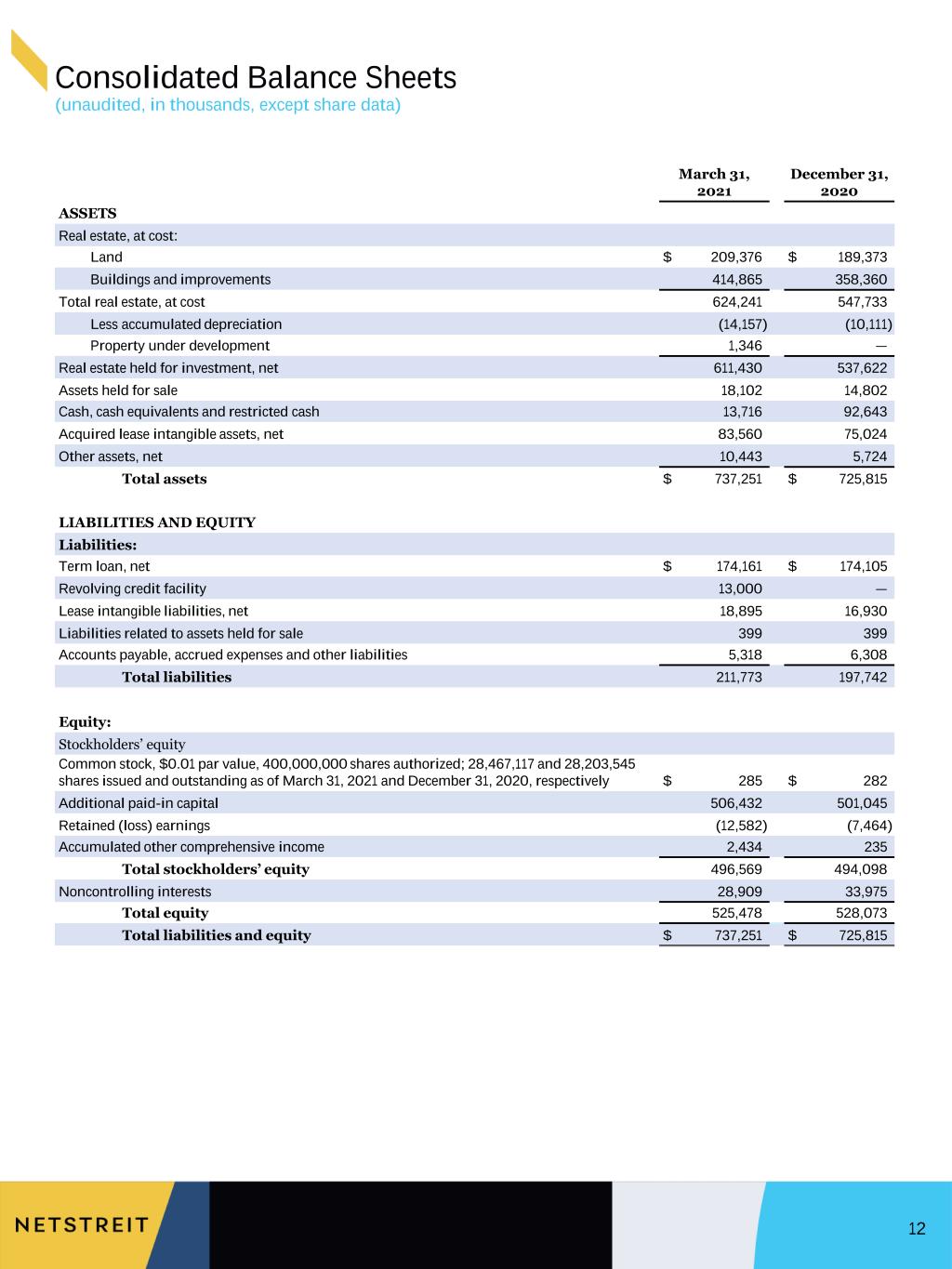

Consolidated Balance Sheets (unaudited, in thousands, except share data) 12 March 31, 2021 December 31, 2020 ASSETS Real estate, at cost: Land $ 209,376 $ 189,373 Buildings and improvements 414,865 358,360 Total real estate, at cost 624,241 547,733 Less accumulated depreciation (14,157) (10,111) Property under development 1,346 — Real estate held for investment, net 611,430 537,622 Assets held for sale 18,102 14,802 Cash, cash equivalents and restricted cash 13,716 92,643 Acquired lease intangible assets, net 83,560 75,024 Other assets, net 10,443 5,724 Total assets $ 737,251 $ 725,815 LIABILITIES AND EQUITY Liabilities: Term loan, net $ 174,161 $ 174,105 Revolving credit facility 13,000 — Lease intangible liabilities, net 18,895 16,930 Liabilities related to assets held for sale 399 399 Accounts payable, accrued expenses and other liabilities 5,318 6,308 Total liabilities 211,773 197,742 Equity: Stockholders’ equity Common stock, $0.01 par value, 400,000,000 shares authorized; 28,467,117 and 28,203,545 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively $ 285 $ 282 Additional paid-in capital 506,432 501,045 Retained (loss) earnings (12,582) (7,464) Accumulated other comprehensive income 2,434 235 Total stockholders’ equity 496,569 494,098 Noncontrolling interests 28,909 33,975 Total equity 525,478 528,073 Total liabilities and equity $ 737,251 $ 725,815

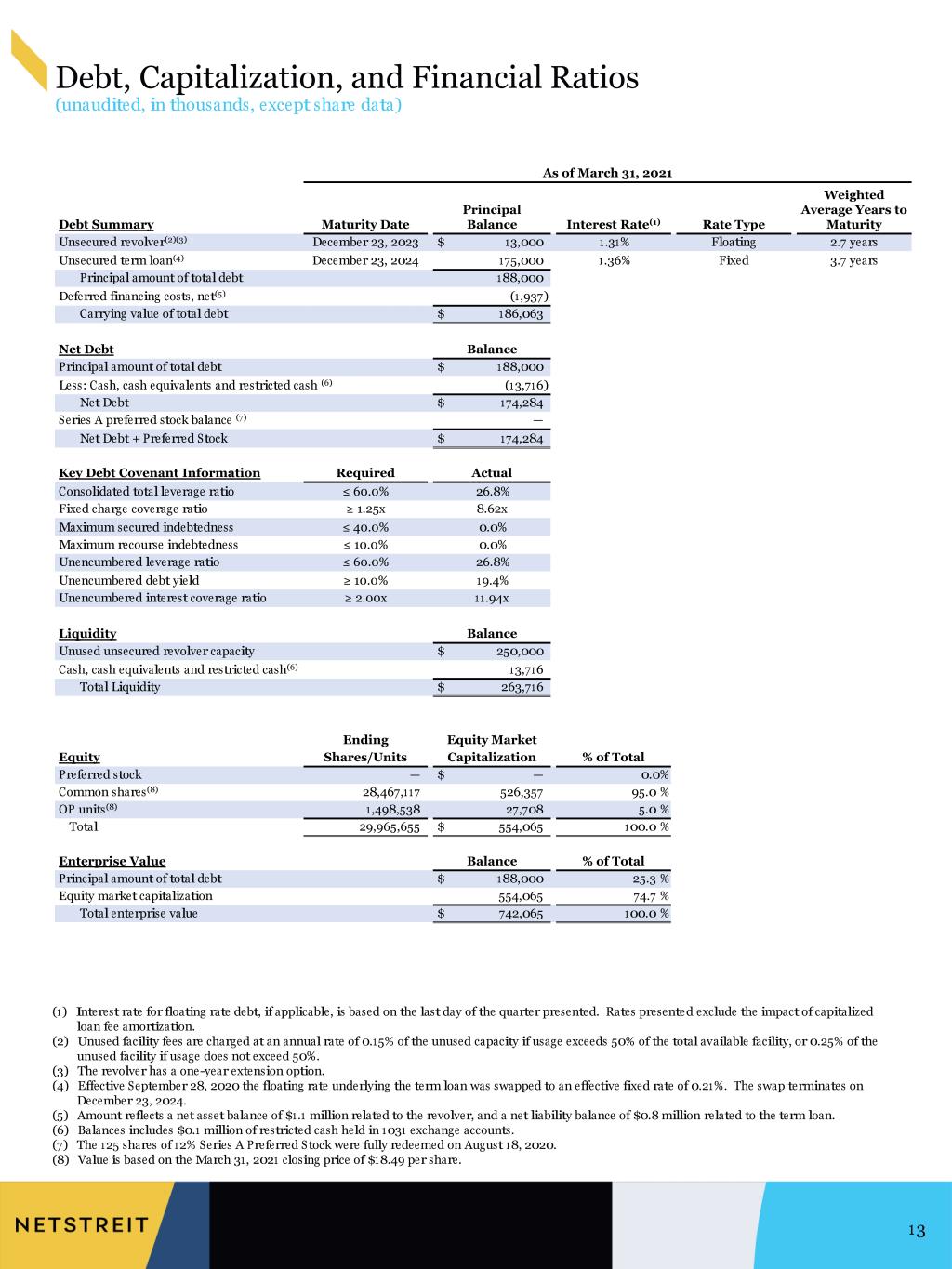

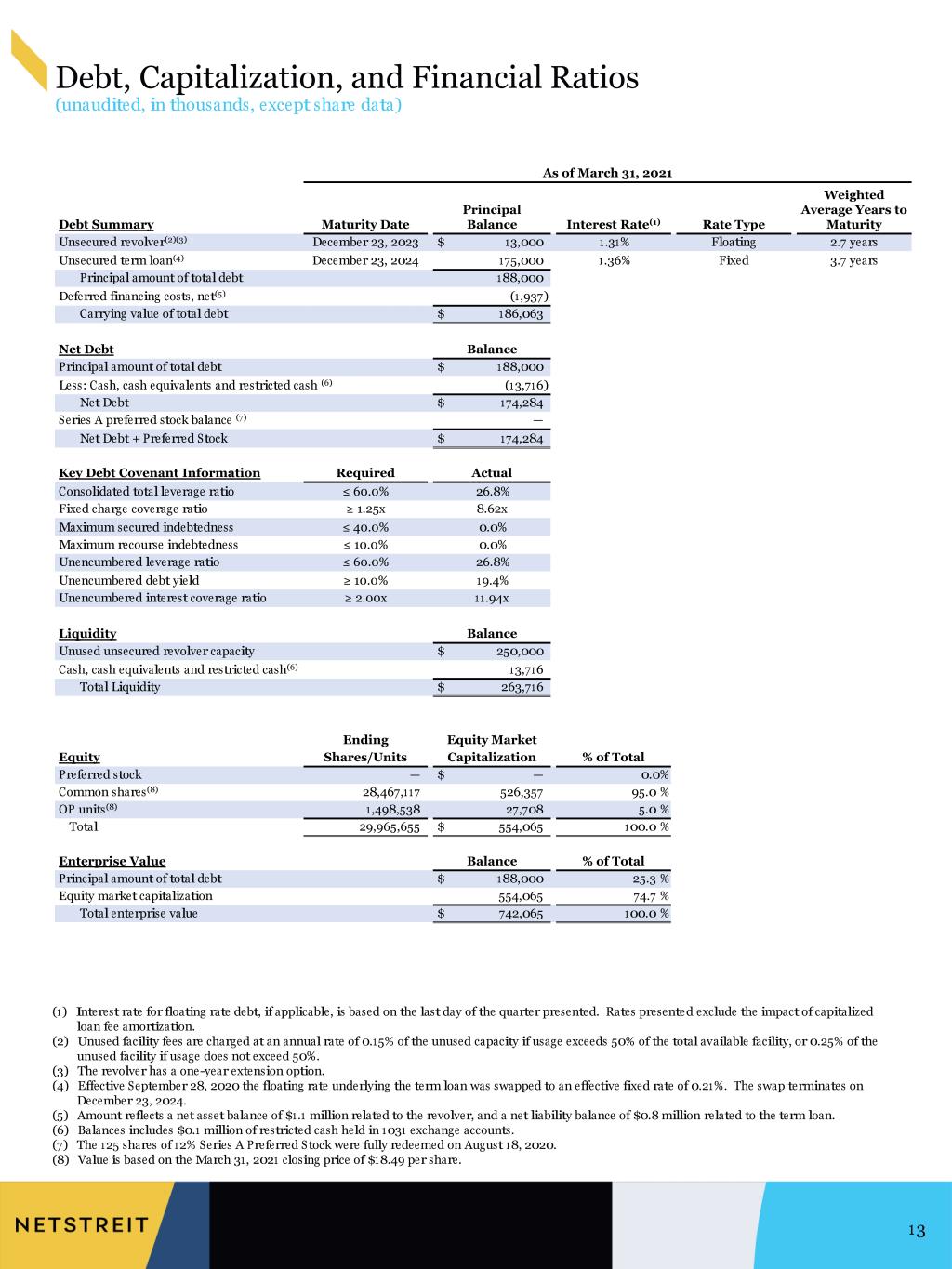

Debt, Capitalization, and Financial Ratios (unaudited, in thousands, except share data) 13 As of March 31, 2021 Debt Summary Maturity Date Principal Balance Interest Rate(1) Rate Type Weighted Average Years to Maturity Unsecured revolver(2)(3) December 23, 2023 $ 13,000 1.31% Floating 2.7 years Unsecured term loan(4) December 23, 2024 175,000 1.36% Fixed 3.7 years Principal amount of total debt 188,000 Deferred financing costs, net(5) (1,937) Carrying value of total debt $ 186,063 Net Debt Balance Principal amount of total debt $ 188,000 Less: Cash, cash equivalents and restricted cash (6) (13,716) Net Debt $ 174,284 Series A preferred stock balance (7) — Net Debt + Preferred Stock $ 174,284 Key Debt Covenant Information Required Actual Consolidated total leverage ratio ≤ 60.0% 26.8% Fixed charge coverage ratio ≥ 1.25x 8.62x Maximum secured indebtedness ≤ 40.0% 0.0% Maximum recourse indebtedness ≤ 10.0% 0.0% Unencumbered leverage ratio ≤ 60.0% 26.8% Unencumbered debt yield ≥ 10.0% 19.4% Unencumbered interest coverage ratio ≥ 2.00x 11.94x Liquidity Balance Unused unsecured revolver capacity $ 250,000 Cash, cash equivalents and restricted cash(6) 13,716 Total Liquidity $ 263,716 Ending Equity Market Equity Shares/Units Capitalization % of Total Preferred stock — $ — 0.0% Common shares(8) 28,467,117 526,357 95.0 % OP units(8) 1,498,538 27,708 5.0 % Total 29,965,655 $ 554,065 100.0 % Enterprise Value Balance % of Total Principal amount of total debt $ 188,000 25.3 % Equity market capitalization 554,065 74.7 % Total enterprise value $ 742,065 100.0 % (1) Interest rate for floating rate debt, if applicable, is based on the last day of the quarter presented. Rates presented exclude the impact of capitalized loan fee amortization. (2) Unused facility fees are charged at an annual rate of 0.15% of the unused capacity if usage exceeds 50% of the total available facility, or 0.25% of the unused facility if usage does not exceed 50%. (3) The revolver has a one-year extension option. (4) Effective September 28, 2020 the floating rate underlying the term loan was swapped to an effective fixed rate of 0.21%. The swap terminates on December 23, 2024. (5) Amount reflects a net asset balance of $1.1 million related to the revolver, and a net liability balance of $0.8 million related to the term loan. (6) Balances includes $0.1 million of restricted cash held in 1031 exchange accounts. (7) The 125 shares of 12% Series A Preferred Stock were fully redeemed on August 18, 2020. (8) Value is based on the March 31, 2021 closing price of $18.49 per share.

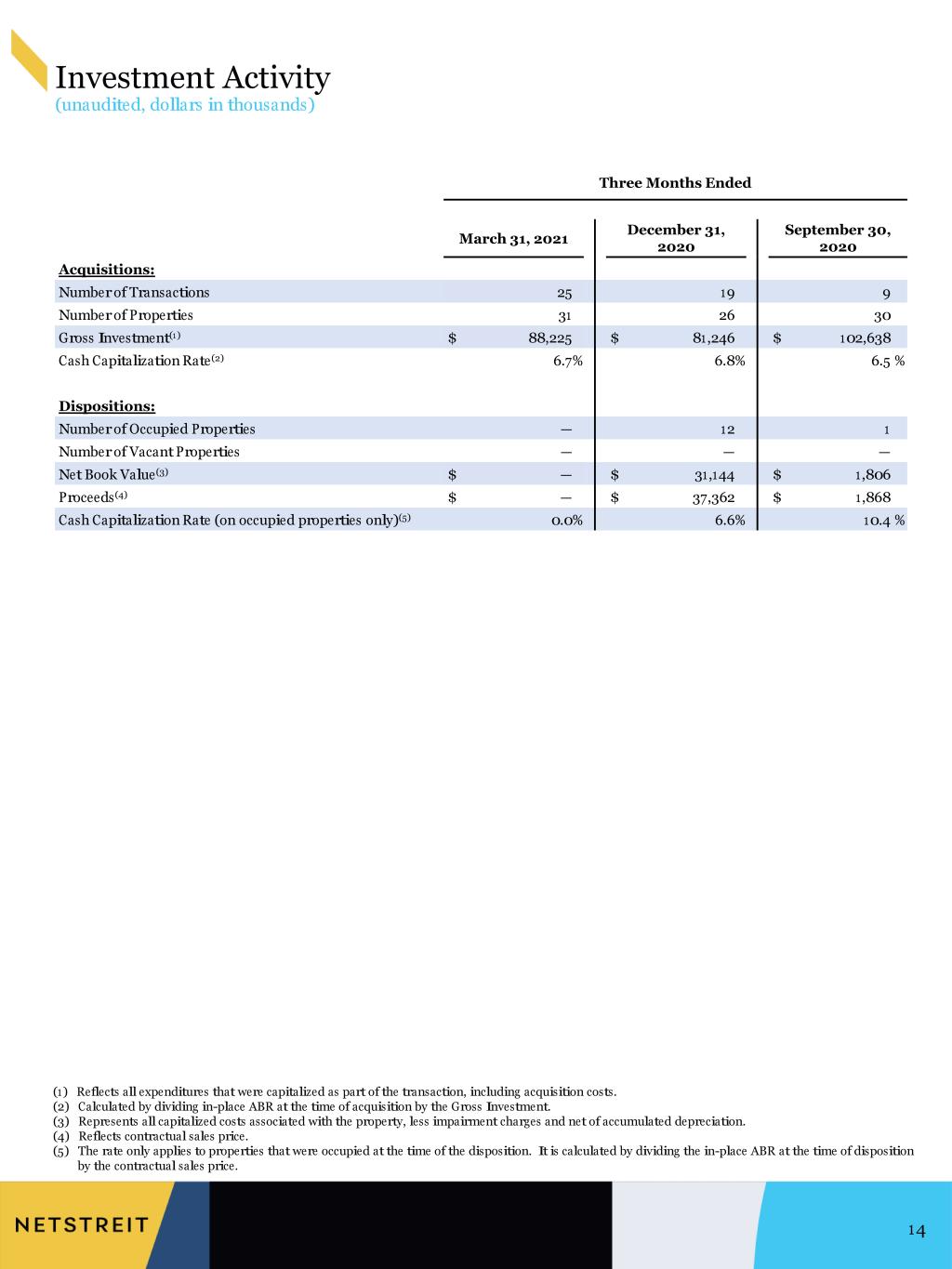

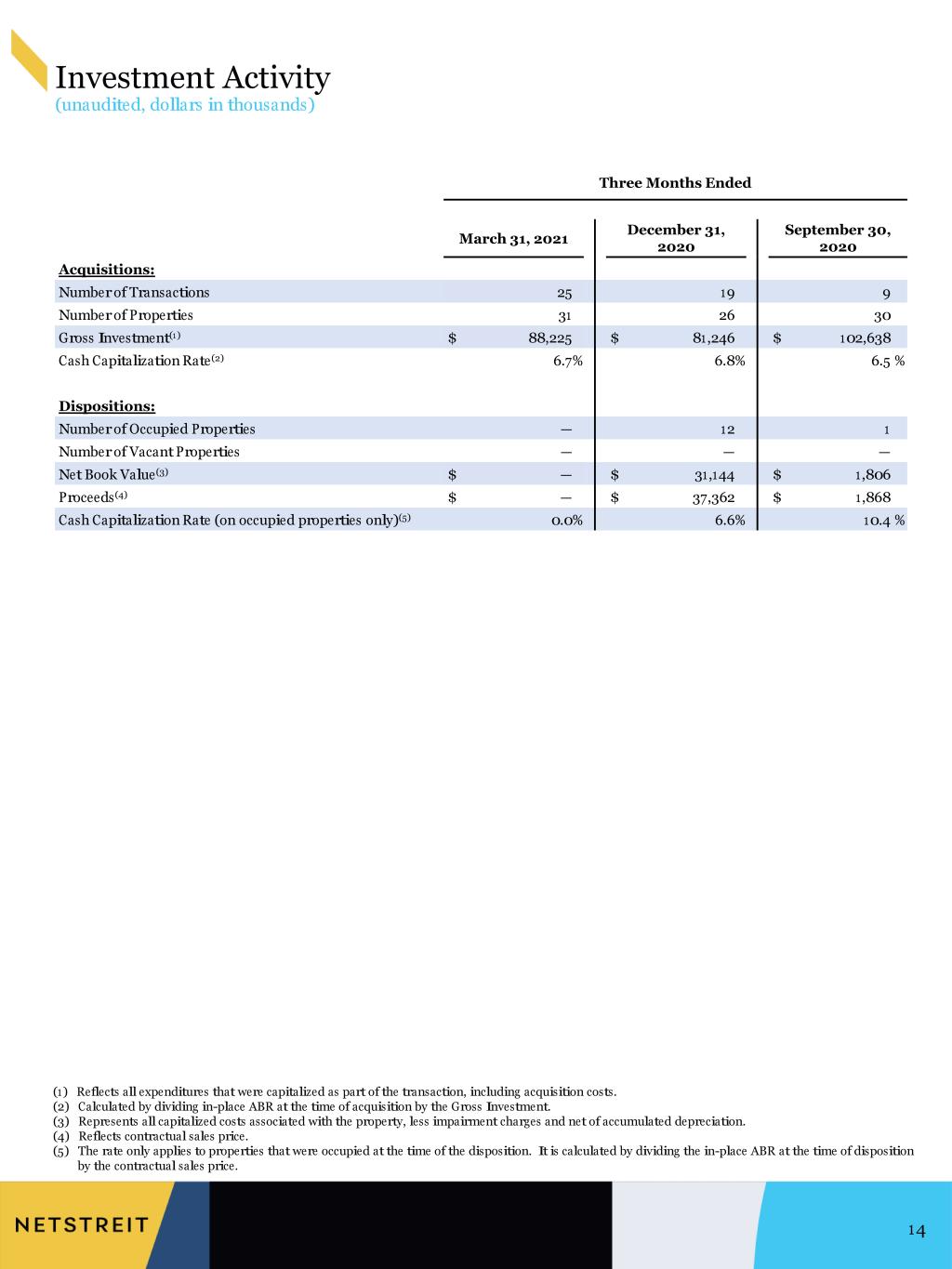

Investment Activity (unaudited, dollars in thousands) 14 (1) Reflects all expenditures that were capitalized as part of the transaction, including acquisition costs. (2) Calculated by dividing in-place ABR at the time of acquisition by the Gross Investment. (3) Represents all capitalized costs associated with the property, less impairment charges and net of accumulated depreciation. (4) Reflects contractual sales price. (5) The rate only applies to properties that were occupied at the time of the disposition. It is calculated by dividing the in-place ABR at the time of disposition by the contractual sales price. Three Months Ended March 31, 2021 December 31, 2020 September 30, 2020 Acquisitions: Number of Transactions 25 19 9 Number of Properties 31 26 30 Gross Investment(1) $ 88,225 $ 81,246 $ 102,638 Cash Capitalization Rate(2) 6.7% 6.8% 6.5 % Dispositions: Number of Occupied Properties — 12 1 Number of Vacant Properties — — — Net Book Value(3) $ — $ 31,144 $ 1,806 Proceeds(4) $ — $ 37,362 $ 1,868 Cash Capitalization Rate (on occupied properties only)(5) 0.0% 6.6% 10.4 %

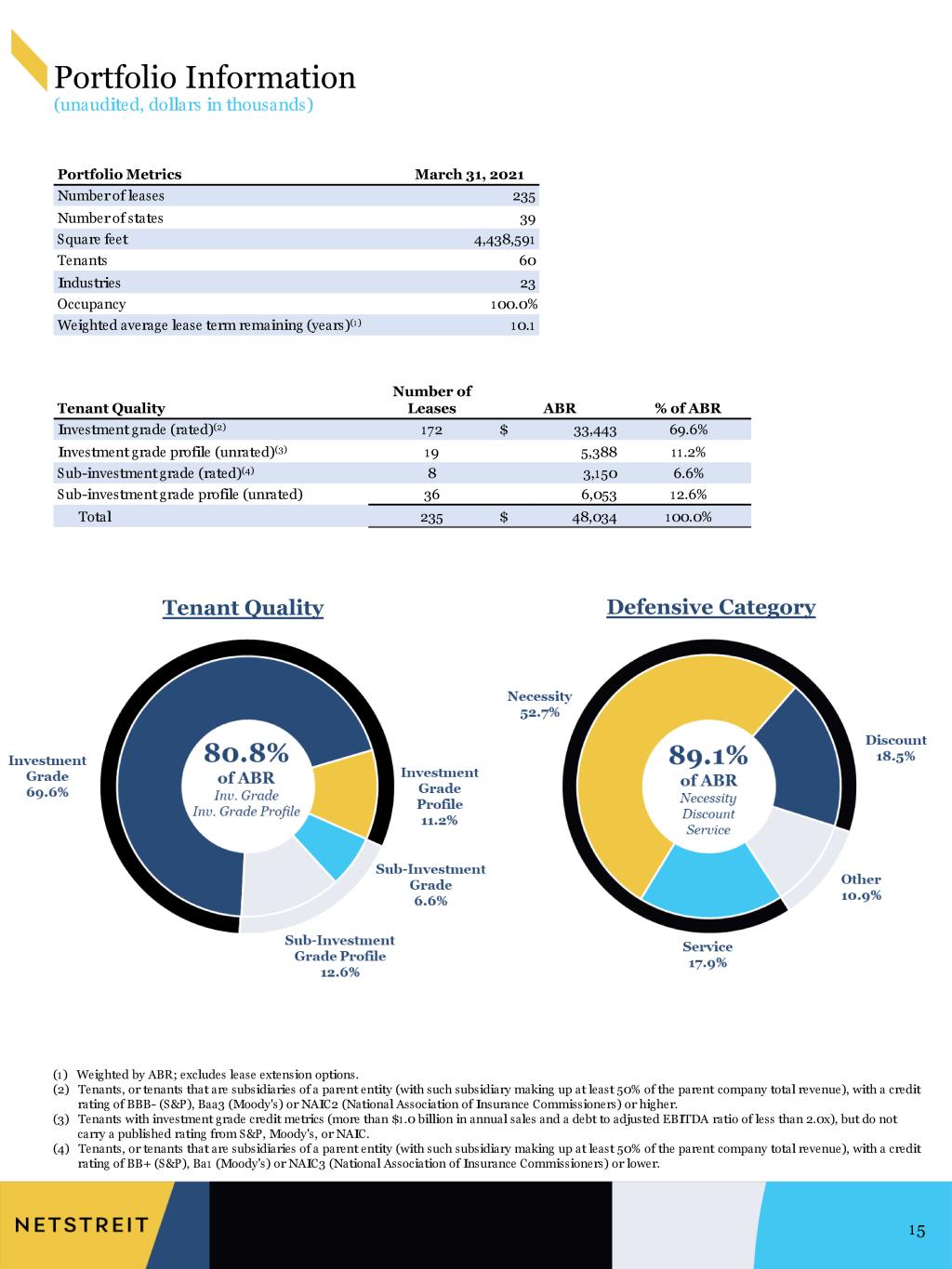

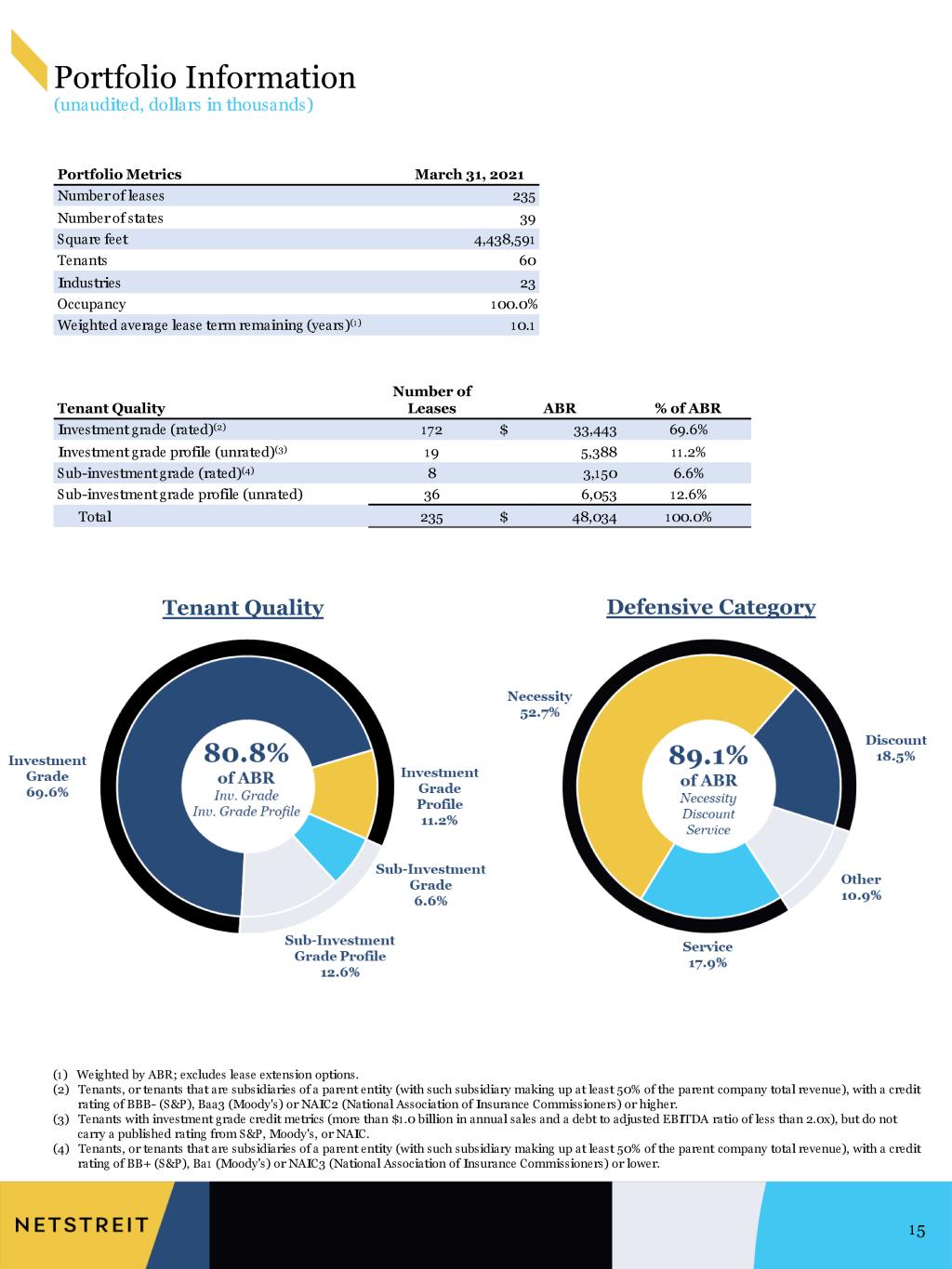

Portfolio Information (unaudited, dollars in thousands) 15 (1) Weighted by ABR; excludes lease extension options. (2) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BBB- (S&P), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher. (3) Tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody's, or NAIC. (4) Tenants, or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BB+ (S&P), Ba1 (Moody's) or NAIC3 (National Association of Insurance Commissioners) or lower. Tenant Quality Number of Leases ABR % of ABR Investment grade (rated)(2) 172 $ 33,443 69.6% Investment grade profile (unrated)(3) 19 5,388 11.2% Sub-investment grade (rated)(4) 8 3,150 6.6% Sub-investment grade profile (unrated) 36 6,053 12.6% Total 235 $ 48,034 100.0% Portfolio Metrics March 31, 2021 Number of leases 235 Number of states 39 Square feet 4,438,591 Tenants 60 Industries 23 Occupancy 100.0% Weighted average lease term remaining (years)(1) 10.1 Tenant Quality Defensive Category

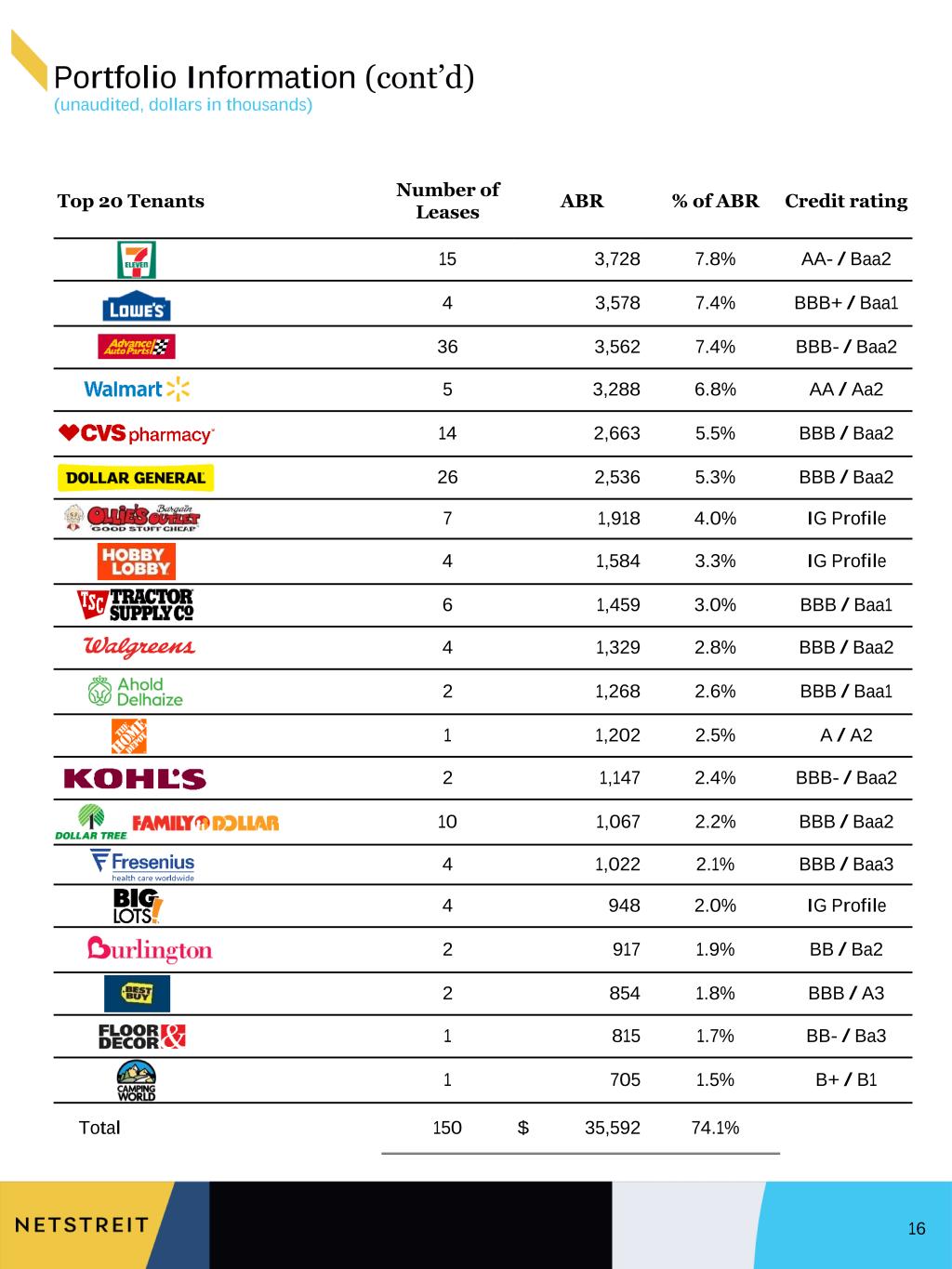

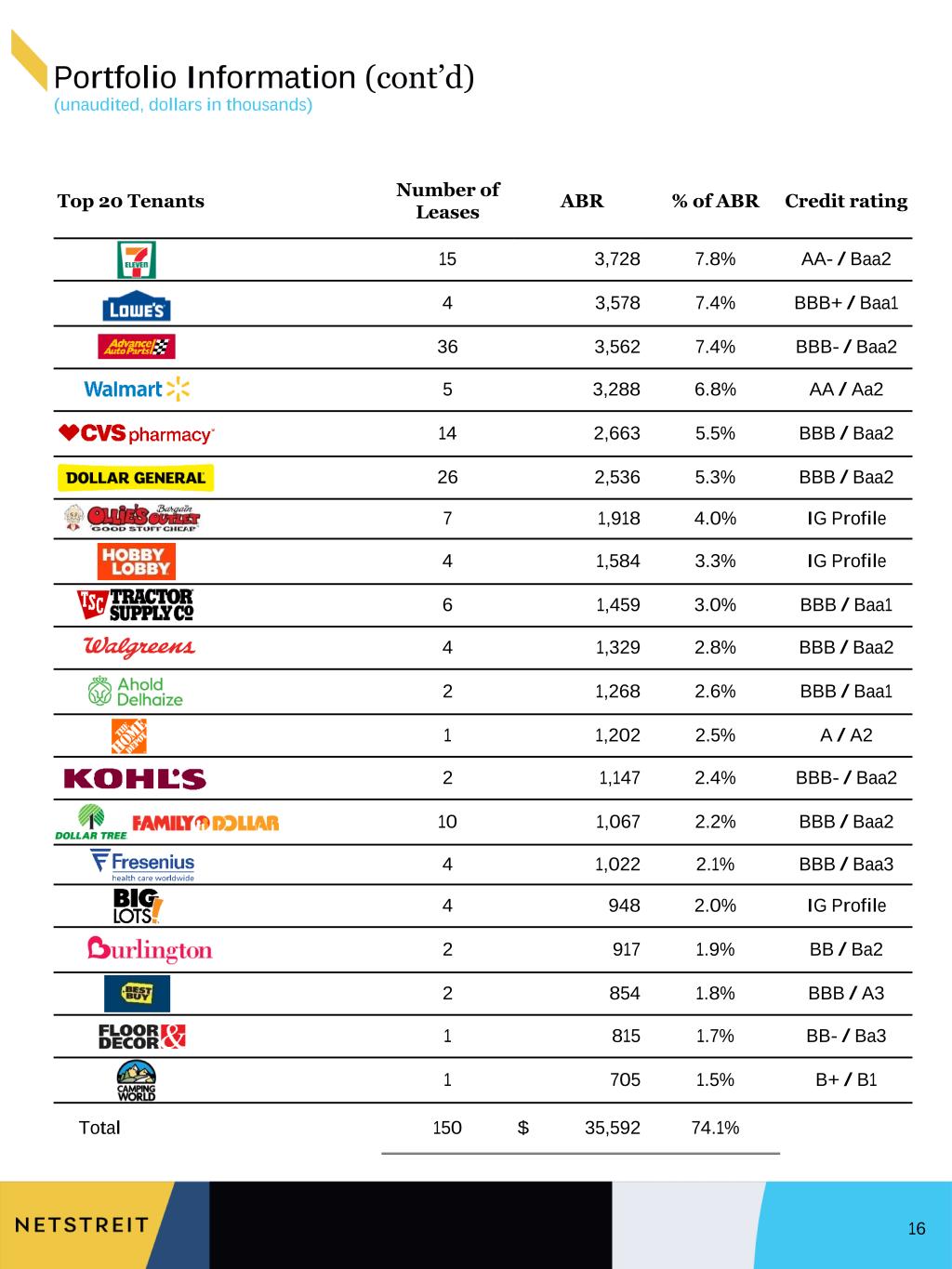

Portfolio Information (cont’d) (unaudited, dollars in thousands) 16 Top 20 Tenants Number of Leases ABR % of ABR Credit rating 15 3,728 7.8% AA- / Baa2 4 3,578 7.4% BBB+ / Baa1 36 3,562 7.4% BBB- / Baa2 5 3,288 6.8% AA / Aa2 14 2,663 5.5% BBB / Baa2 26 2,536 5.3% BBB / Baa2 7 1,918 4.0% IG Profile 4 1,584 3.3% IG Profile 6 1,459 3.0% BBB / Baa1 4 1,329 2.8% BBB / Baa2 2 1,268 2.6% BBB / Baa1 1 1,202 2.5% A / A2 2 1,147 2.4% BBB- / Baa2 10 1,067 2.2% BBB / Baa2 4 1,022 2.1% BBB / Baa3 4 948 2.0% IG Profile 2 917 1.9% BB / Ba2 2 854 1.8% BBB / A3 1 815 1.7% BB- / Ba3 1 705 1.5% B+ / B1 Total 150 $ 35,592 74.1%

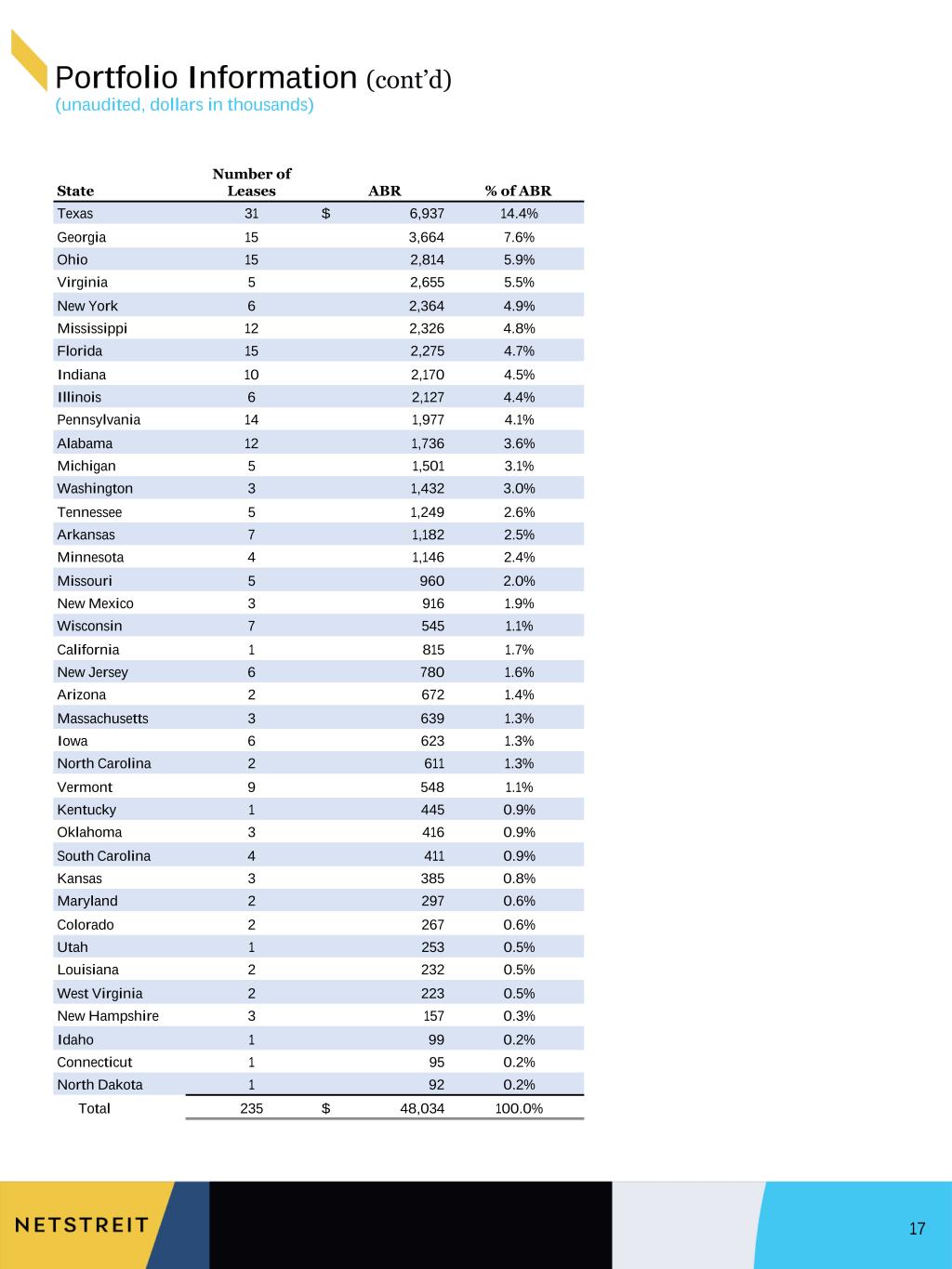

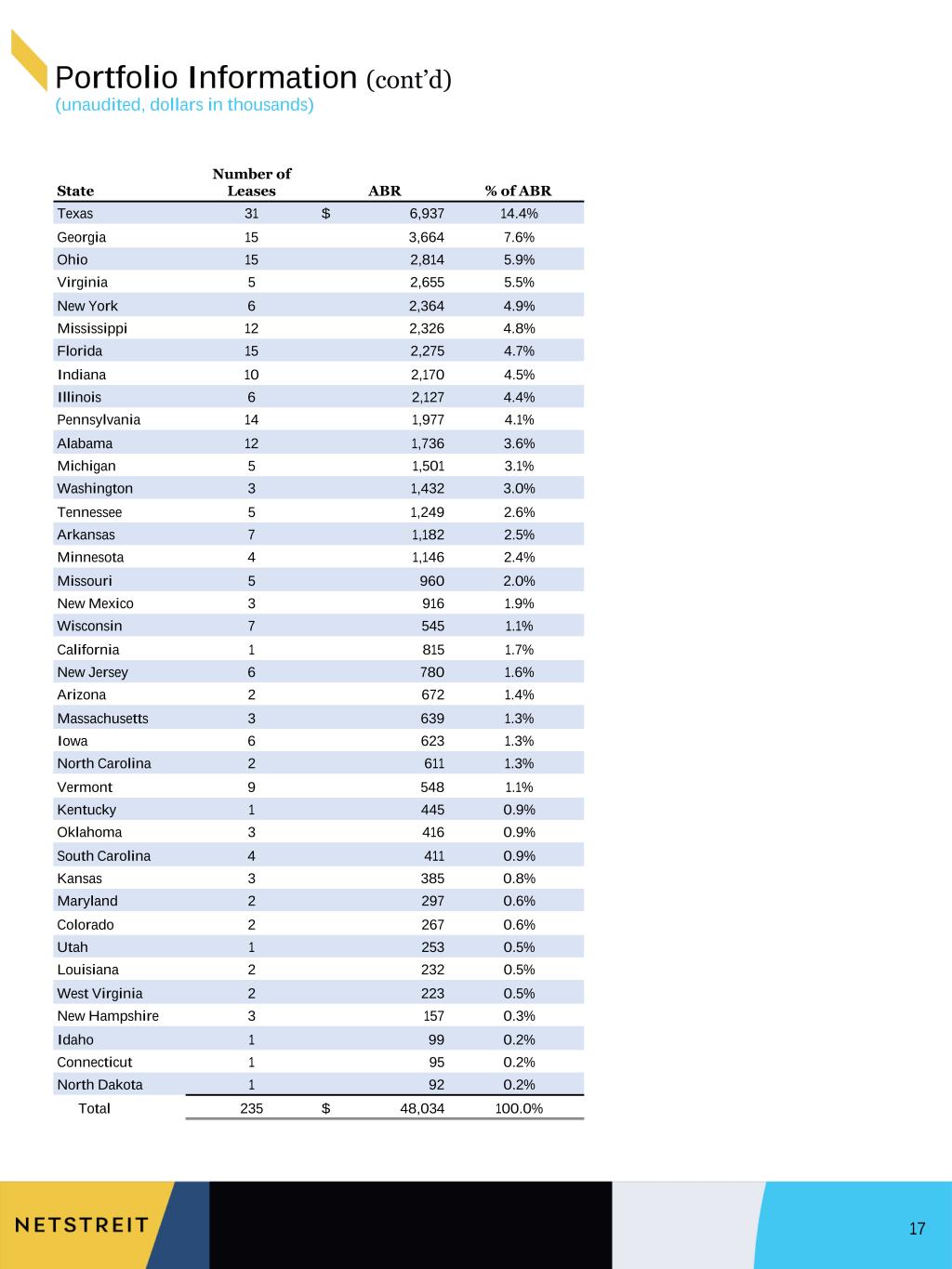

Portfolio Information (cont’d) (unaudited, dollars in thousands) 17 State Number of Leases ABR % of ABR Texas 31 $ 6,937 14.4% Georgia 15 3,664 7.6% Ohio 15 2,814 5.9% Virginia 5 2,655 5.5% New York 6 2,364 4.9% Mississippi 12 2,326 4.8% Florida 15 2,275 4.7% Indiana 10 2,170 4.5% Illinois 6 2,127 4.4% Pennsylvania 14 1,977 4.1% Alabama 12 1,736 3.6% Michigan 5 1,501 3.1% Washington 3 1,432 3.0% Tennessee 5 1,249 2.6% Arkansas 7 1,182 2.5% Minnesota 4 1,146 2.4% Missouri 5 960 2.0% New Mexico 3 916 1.9% Wisconsin 7 545 1.1% California 1 815 1.7% New Jersey 6 780 1.6% Arizona 2 672 1.4% Massachusetts 3 639 1.3% Iowa 6 623 1.3% North Carolina 2 611 1.3% Vermont 9 548 1.1% Kentucky 1 445 0.9% Oklahoma 3 416 0.9% South Carolina 4 411 0.9% Kansas 3 385 0.8% Maryland 2 297 0.6% Colorado 2 267 0.6% Utah 1 253 0.5% Louisiana 2 232 0.5% West Virginia 2 223 0.5% New Hampshire 3 157 0.3% Idaho 1 99 0.2% Connecticut 1 95 0.2% North Dakota 1 92 0.2% Total 235 $ 48,034 100.0%

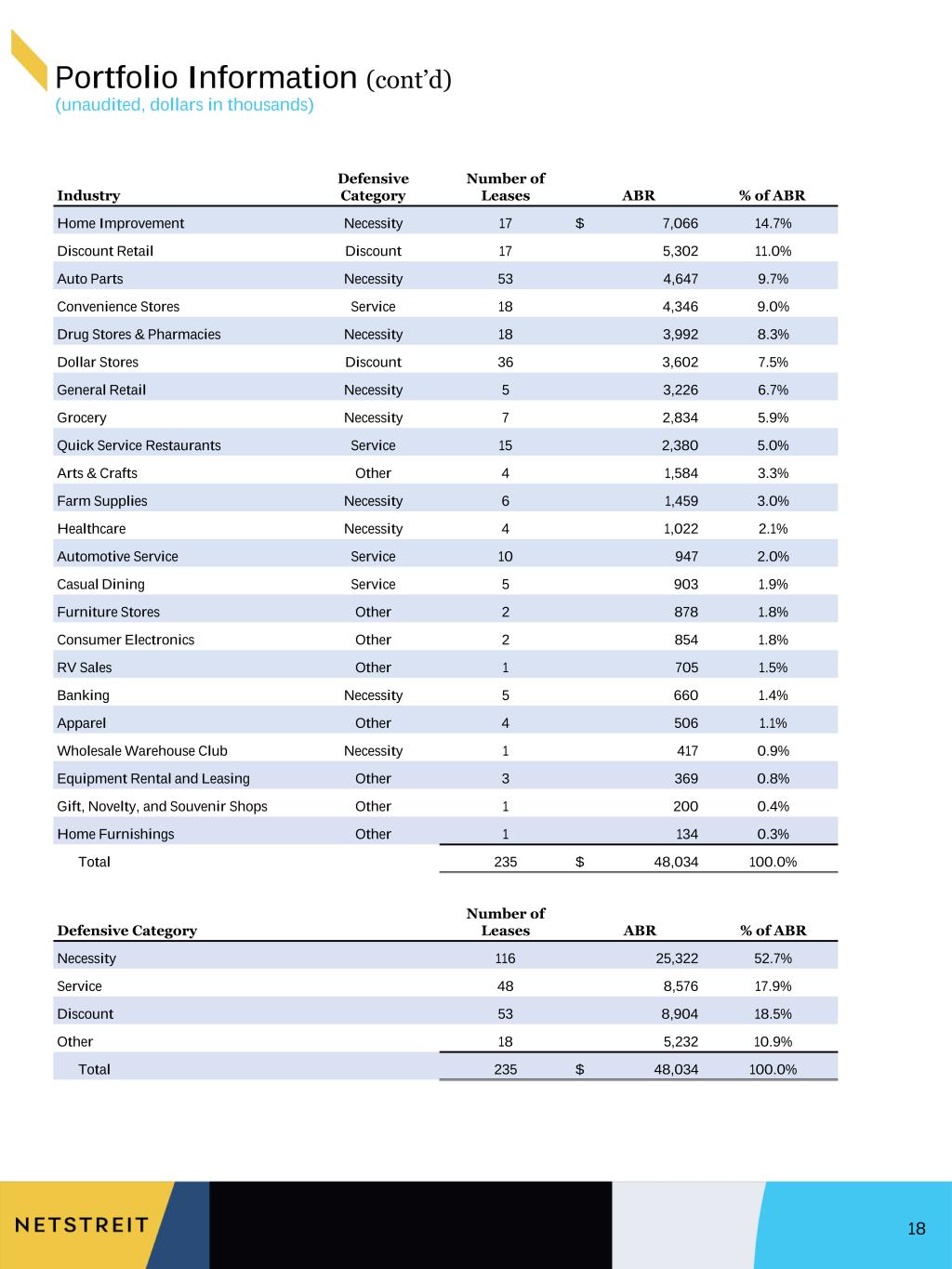

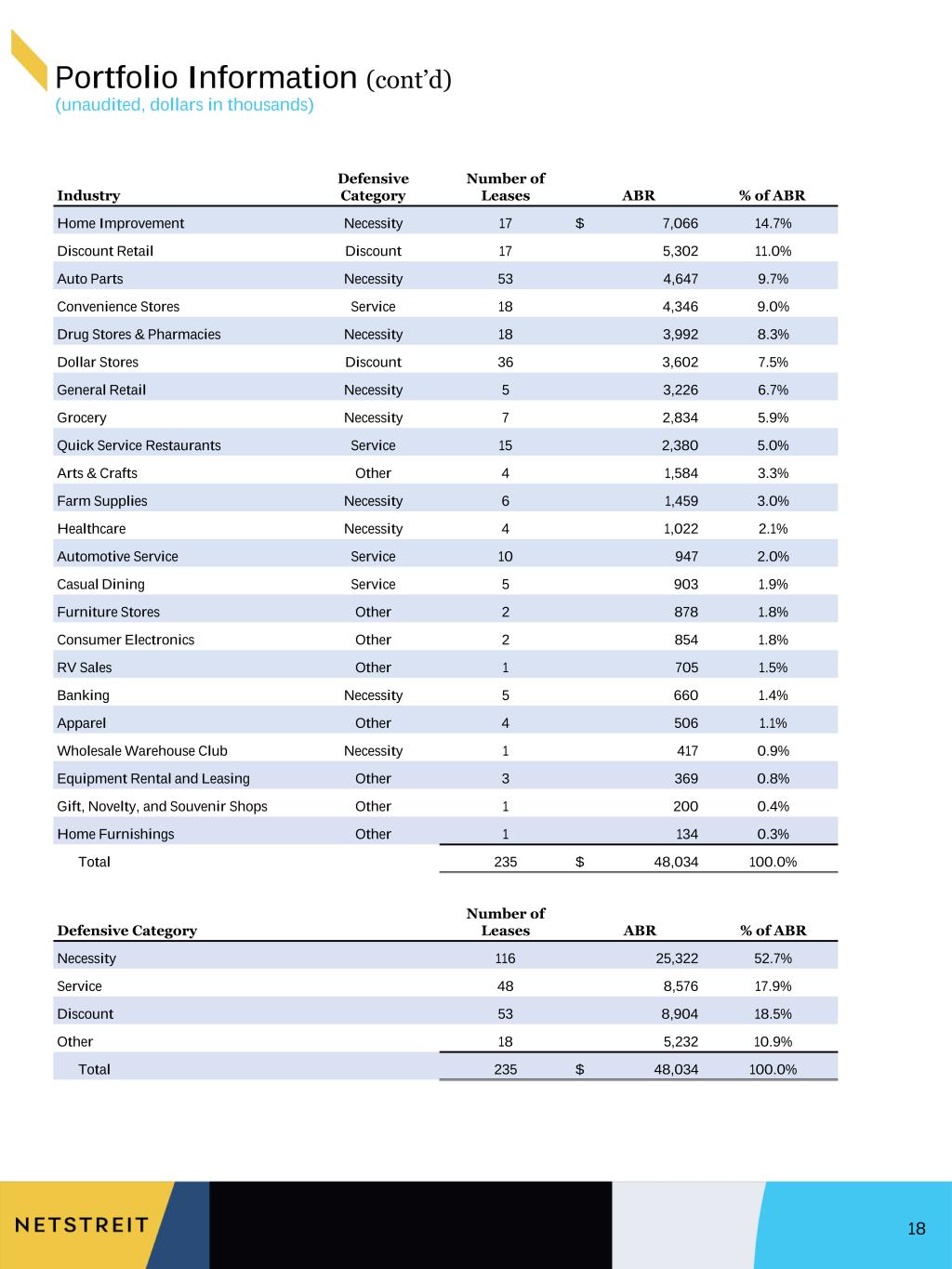

Portfolio Information (cont’d) (unaudited, dollars in thousands) 18 Industry Defensive Category Number of Leases ABR % of ABR Home Improvement Necessity 17 $ 7,066 14.7% Discount Retail Discount 17 5,302 11.0% Auto Parts Necessity 53 4,647 9.7% Convenience Stores Service 18 4,346 9.0% Drug Stores & Pharmacies Necessity 18 3,992 8.3% Dollar Stores Discount 36 3,602 7.5% General Retail Necessity 5 3,226 6.7% Grocery Necessity 7 2,834 5.9% Quick Service Restaurants Service 15 2,380 5.0% Arts & Crafts Other 4 1,584 3.3% Farm Supplies Necessity 6 1,459 3.0% Healthcare Necessity 4 1,022 2.1% Automotive Service Service 10 947 2.0% Casual Dining Service 5 903 1.9% Furniture Stores Other 2 878 1.8% Consumer Electronics Other 2 854 1.8% RV Sales Other 1 705 1.5% Banking Necessity 5 660 1.4% Apparel Other 4 506 1.1% Wholesale Warehouse Club Necessity 1 417 0.9% Equipment Rental and Leasing Other 3 369 0.8% Gift, Novelty, and Souvenir Shops Other 1 200 0.4% Home Furnishings Other 1 134 0.3% Total 235 $ 48,034 100.0% Defensive Category Number of Leases ABR % of ABR Necessity 116 25,322 52.7% Service 48 8,576 17.9% Discount 53 8,904 18.5% Other 18 5,232 10.9% Total 235 $ 48,034 100.0%

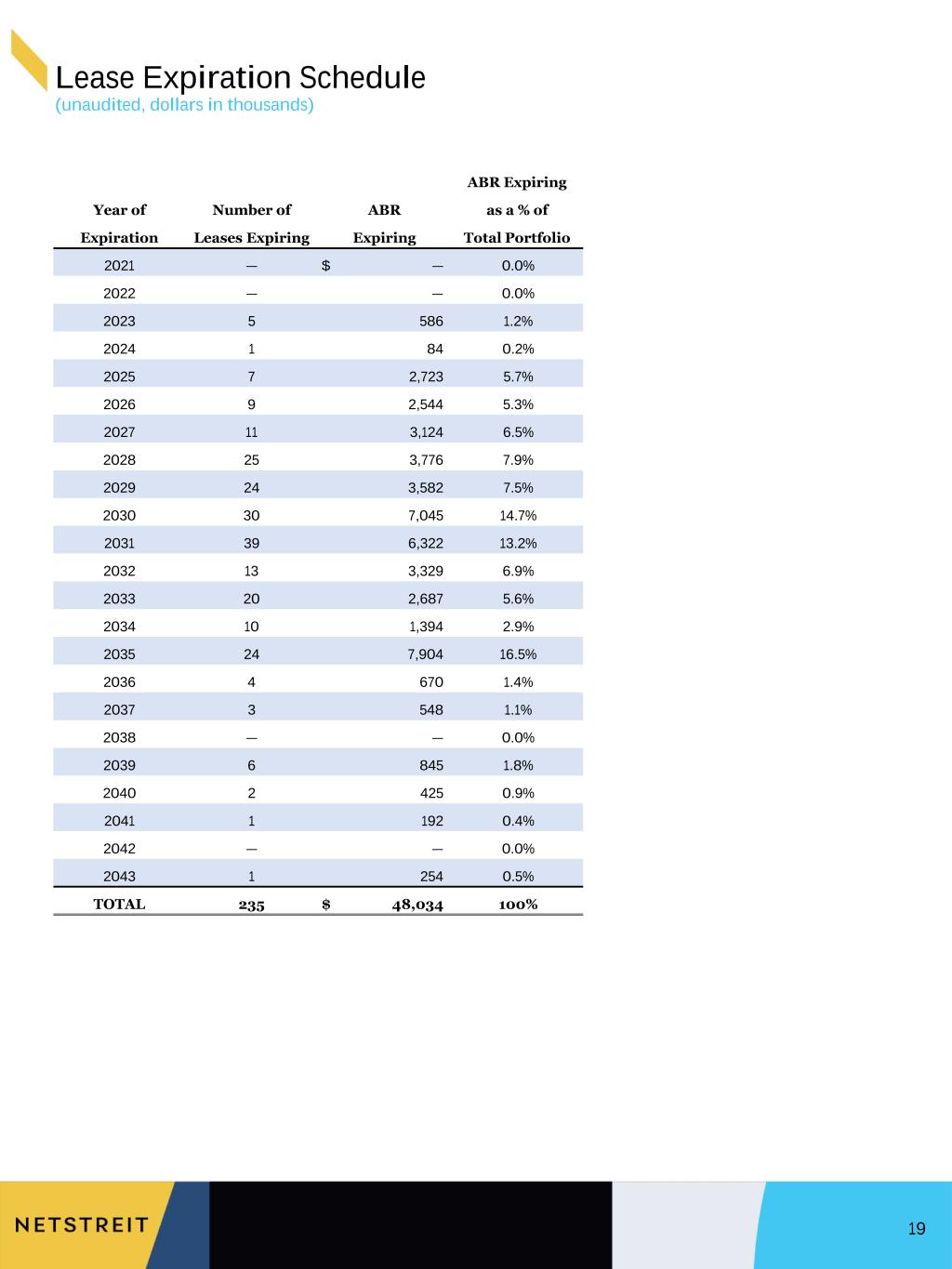

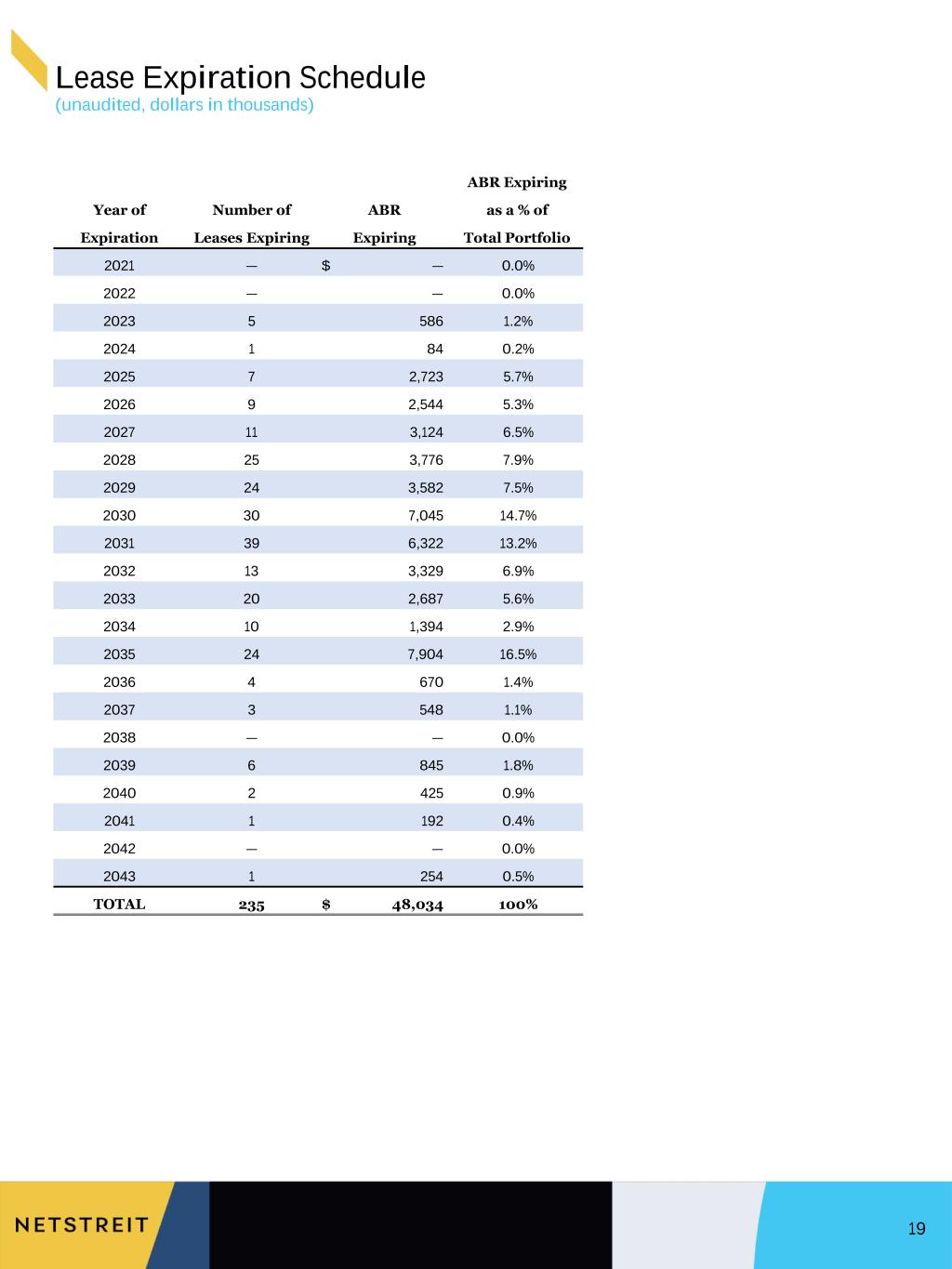

Lease Expiration Schedule (unaudited, dollars in thousands) 19 ABR Expiring Year of Number of ABR as a % of Expiration Leases Expiring Expiring Total Portfolio 2021 — $ — 0.0% 2022 — — 0.0% 2023 5 586 1.2% 2024 1 84 0.2% 2025 7 2,723 5.7% 2026 9 2,544 5.3% 2027 11 3,124 6.5% 2028 25 3,776 7.9% 2029 24 3,582 7.5% 2030 30 7,045 14.7% 2031 39 6,322 13.2% 2032 13 3,329 6.9% 2033 20 2,687 5.6% 2034 10 1,394 2.9% 2035 24 7,904 16.5% 2036 4 670 1.4% 2037 3 548 1.1% 2038 — — 0.0% 2039 6 845 1.8% 2040 2 425 0.9% 2041 1 192 0.4% 2042 — — 0.0% 2043 1 254 0.5% TOTAL 235 $ 48,034 100%

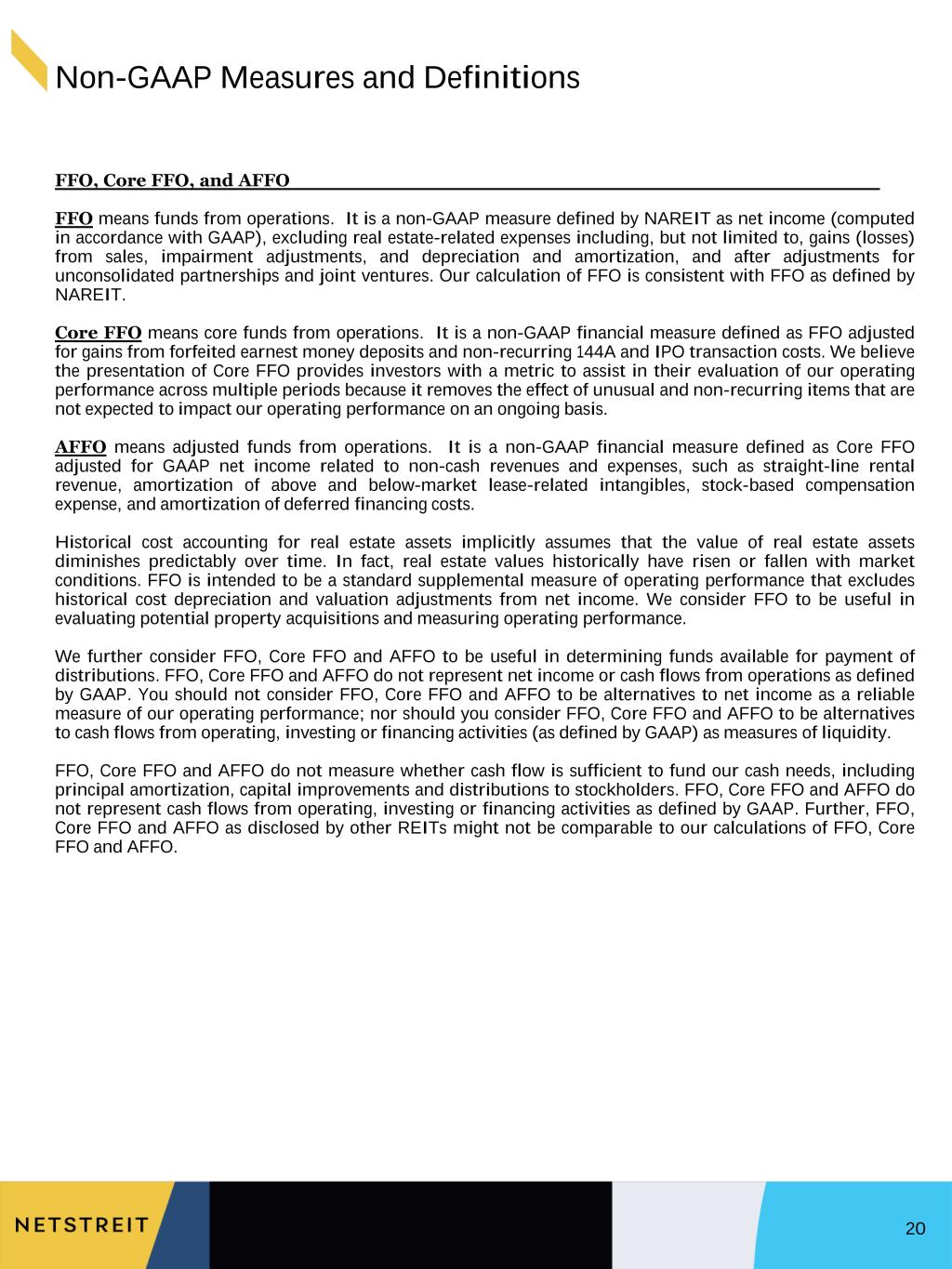

Non-GAAP Measures and Definitions 20 FFO, Core FFO, and AFFO FFO means funds from operations. It is a non-GAAP measure defined by NAREIT as net income (computed in accordance with GAAP), excluding real estate-related expenses including, but not limited to, gains (losses) from sales, impairment adjustments, and depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Our calculation of FFO is consistent with FFO as defined by NAREIT. Core FFO means core funds from operations. It is a non-GAAP financial measure defined as FFO adjusted for gains from forfeited earnest money deposits and non-recurring 144A and IPO transaction costs. We believe the presentation of Core FFO provides investors with a metric to assist in their evaluation of our operating performance across multiple periods because it removes the effect of unusual and non-recurring items that are not expected to impact our operating performance on an ongoing basis. AFFO means adjusted funds from operations. It is a non-GAAP financial measure defined as Core FFO adjusted for GAAP net income related to non-cash revenues and expenses, such as straight-line rental revenue, amortization of above and below-market lease-related intangibles, stock-based compensation expense, and amortization of deferred financing costs. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values historically have risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO to be useful in evaluating potential property acquisitions and measuring operating performance. We further consider FFO, Core FFO and AFFO to be useful in determining funds available for payment of distributions. FFO, Core FFO and AFFO do not represent net income or cash flows from operations as defined by GAAP. You should not consider FFO, Core FFO and AFFO to be alternatives to net income as a reliable measure of our operating performance; nor should you consider FFO, Core FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity. FFO, Core FFO and AFFO do not measure whether cash flow is sufficient to fund our cash needs, including principal amortization, capital improvements and distributions to stockholders. FFO, Core FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined by GAAP. Further, FFO, Core FFO and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO, Core FFO and AFFO.

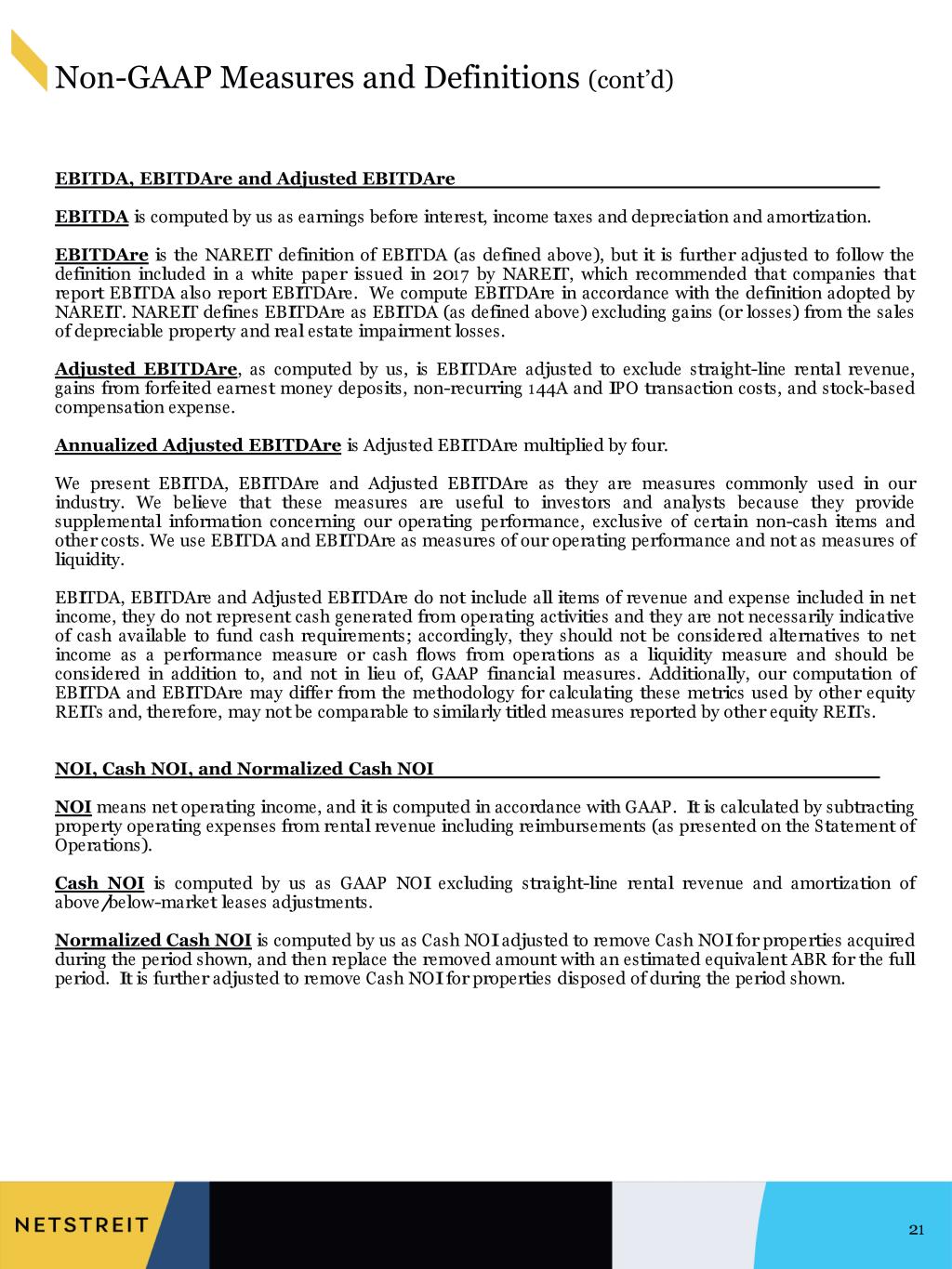

Non-GAAP Measures and Definitions (cont’d) 21 EBITDA, EBITDAre and Adjusted EBITDAre EBITDA is computed by us as earnings before interest, income taxes and depreciation and amortization. EBITDAre is the NAREIT definition of EBITDA (as defined above), but it is further adjusted to follow the definition included in a white paper issued in 2017 by NAREIT, which recommended that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from the sales of depreciable property and real estate impairment losses. Adjusted EBITDAre, as computed by us, is EBITDAre adjusted to exclude straight-line rental revenue, gains from forfeited earnest money deposits, non-recurring 144A and IPO transaction costs, and stock-based compensation expense. Annualized Adjusted EBITDAre is Adjusted EBITDAre multiplied by four. We present EBITDA, EBITDAre and Adjusted EBITDAre as they are measures commonly used in our industry. We believe that these measures are useful to investors and analysts because they provide supplemental information concerning our operating performance, exclusive of certain non-cash items and other costs. We use EBITDA and EBITDAre as measures of our operating performance and not as measures of liquidity. EBITDA, EBITDAre and Adjusted EBITDAre do not include all items of revenue and expense included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Additionally, our computation of EBITDA and EBITDAre may differ from the methodology for calculating these metrics used by other equity REITs and, therefore, may not be comparable to similarly titled measures reported by other equity REITs. NOI, Cash NOI, and Normalized Cash NOI NOI means net operating income, and it is computed in accordance with GAAP. It is calculated by subtracting property operating expenses from rental revenue including reimbursements (as presented on the Statement of Operations). Cash NOI is computed by us as GAAP NOI excluding straight-line rental revenue and amortization of above/below-market leases adjustments. Normalized Cash NOI is computed by us as Cash NOI adjusted to remove Cash NOI for properties acquired during the period shown, and then replace the removed amount with an estimated equivalent ABR for the full period. It is further adjusted to remove Cash NOI for properties disposed of during the period shown.

Non-GAAP Measures and Definitions (cont’d) 22 Other Definitions ABR means annualized base rent. ABR is calculated by multiplying (i) cash rental payments (a) for the month ended March 31, 2021 (or, if applicable, the next full month’s cash rent contractually due in the case of rent abatements, rent deferrals, recently acquired properties and properties with contractual rent increases, other than properties under development) for leases in place as of March 31, 2021, plus (b) for properties under development, the first full month’s permanent cash rent contractually due after the development period by (ii) 12. Defensive Category is considered by us to represent tenants that focus on necessity goods and essential services in the retail sector, including discount stores, grocers, drug stores and pharmacies, home improvement, automotive service and quick-service restaurants, which we refer to as defensive retail industries. The defensive sub-categories as we define them are as follows: (1) Necessity, which are retailers that are considered essential by consumers and include sectors such as drug stores, grocers and home improvement, (2) Discount, which are retailers that offer a low price point and consist of off-price and dollar stores, (3) Service, which consist of retailers that provide services rather than goods, including, tire and auto services and quick service restaurants, and (4) Other, which are retailers that are not considered defensive in terms of being considered necessity, discount or service, as defined by us. Leases are individual properties with a distinct lease agreement in place, development activities where a lease is expected at a future date, or in the case of master lease arrangements each property under the master lease is counted as a separate lease. Net Debt is computed by us as the principal amount of total debt outstanding less cash and cash equivalents. Occupancy is expressed as a percentage, and it is the number of economically occupied properties divided by the total number of properties owned. Properties under development are excluded from the calculation. OP units means operating partnership units not held by NETSTREIT.

Forward Looking and Cautionary Statements 23 This supplemental report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities and trends in our business, including trends in the market for single-tenant, retail commercial real estate. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this supplemental report may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our Form 10-K for the year ended December 31, 2020 filed with the Securities and Exchange Commission (the “SEC”) and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this supplemental report. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from the novel coronavirus (COVID-19). We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.