1 Investor Presentation June 2023

Disclaimer 2 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities, including our ability to enter into definitive documentation with respect to our new term loan and existing term loan extension on the terms described herein or at all, trends in our business, including trends in the market for single-tenant, retail commercial real estate, and macroeconomic conditions, including inflation, rising interest rates and instability in the banking system. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this presentation may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements, or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our Form 10-K for the year ended December 31, 2022, filed with the SEC on February 23, 2023, and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this presentation. New risks and uncertainties may arise over time, and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from rising interest rates and instability in macroeconomic conditions. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law. This presentation also includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, FFO, Core FFO, AFFO, EBITDA, EBITDAre, Adjusted EBITDAre, Annualized Adjusted EBITDAre, NOI, Cash NOI, Normalized Cash NOI, Net Debt and Pro forma Net Debt. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. The Company believes these non-GAAP measures provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing its financial results with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Certain monetary amounts, percentages and other figures included in this presentation have been subject to rounding adjustments. Certain other amounts that appear in this presentation may not sum due to rounding.

Investment Highlights & Business Update 3 Note: Portfolio data and balance sheet as of March 31, 2023, unless otherwise noted. Figures represent percentage of ABR unless otherwise noted. 1. Represents tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody's, or NAIC. 2. Pro forma (PF) adjustment assumes the 4.8 million of unsettled shares from the August 2022 forward equity offering were settled for cash on March 31, 2023. 3. Company has received commitments for a proposed new three-year $250 million senior unsecured delayed draw term loan, which includes two one-year extension options and one six-month extension option, totaling 5.5 year of available term. 4. Pro forma (PF) adjustment assumes the 4.8 million of unsettled shares from the August 2022 forward equity offering were settled for cash on March 31, 2023, and includes the new 5.5-year $250 million term loan commitment from lenders. 5. Company has received commitments to extend the existing $175 million term loan maturity to January 2026 from December 2024, with a one-year extension option to further extend maturity to January 2027. 6. Quarter-to-date (QTD) as of June 2, 2023. 87% Necessity, Discount, and Service-Oriented Tenants 100% Occupancy 100% Rent Collections 25 Retail Industries 83 Tenants $652 million Total PF Liquidity4 4.1x PF Net Debt2 / Annualized Adjusted EBITDAre ✓Focused on growing portfolio with high quality tenants that offer strong credit profiles and provide consistent performance through various economic cycles ✓Proactive asset management with successful track record of maintaining full occupancy and strong rent collections through the pandemic ✓Well diversified by tenant and retail industry across 45 states ✓Low leverage with no immediate-term debt maturities; abundant liquidity supported by active ATM program ✓Received firm commitments for a new 5.5-year $250 million unsecured term loan3 and firm commitments to extend expiration of $175 million term loan5 to 2027 High Grade & Diverse Net Lease Portfolio Well Capitalized Balance Sheet 82% Investment Grade and Investment Grade Profile1 6.7% Cash Yield on New Investments Since 3Q’20 ✓Strong investment pace since 2020 with a strong pipeline of investment opportunities at attractive cash yields ✓$97.2 million of completed acquisitions and loans quarter to date (QTD) at weighted average cash yield of 6.9% Proven Ability to Source Attractive Investment Opportunities 2027 First Debt Maturity5 $115 million Avg. Quarterly Investments Since 1Q’20 27% Gross Debt / PF Undepreciated Gross Assets2 6.9% QTD Cash Yield6 $97 million QTD Investments6

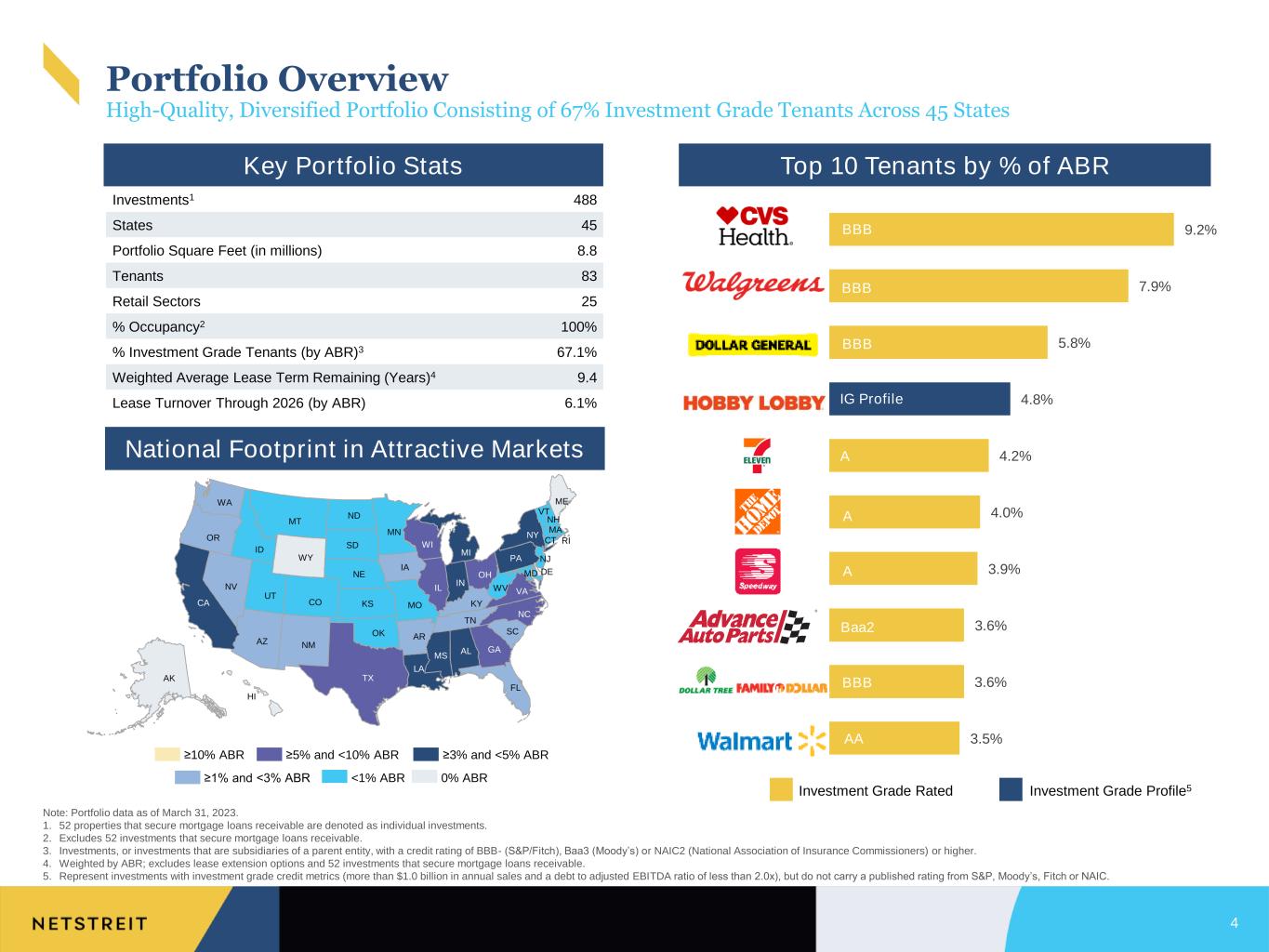

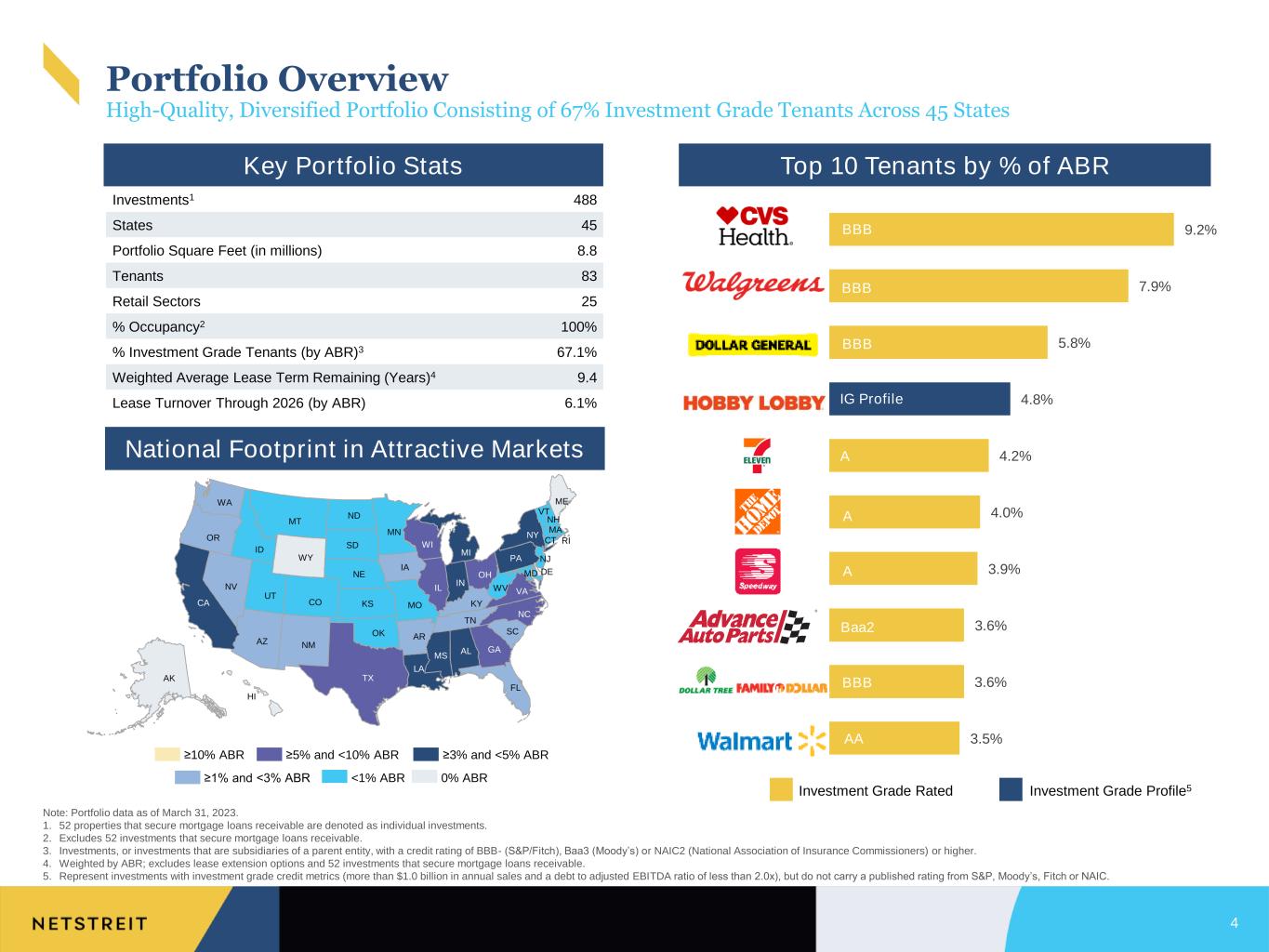

9.2% 7.9% 5.8% 4.8% 4.2% 4.0% 3.9% 3.6% 3.6% 3.5% Portfolio Overview High-Quality, Diversified Portfolio Consisting of 67% Investment Grade Tenants Across 45 States 4 Note: Portfolio data as of March 31, 2023. 1. 52 properties that secure mortgage loans receivable are denoted as individual investments. 2. Excludes 52 investments that secure mortgage loans receivable. 3. Investments, or investments that are subsidiaries of a parent entity, with a credit rating of BBB- (S&P/Fitch), Baa3 (Moody’s) or NAIC2 (National Association of Insurance Commissioners) or higher. 4. Weighted by ABR; excludes lease extension options and 52 investments that secure mortgage loans receivable. 5. Represent investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody’s, Fitch or NAIC. Key Portfolio Stats Investments1 488 States 45 Portfolio Square Feet (in millions) 8.8 Tenants 83 Retail Sectors 25 % Occupancy2 100% % Investment Grade Tenants (by ABR)3 67.1% Weighted Average Lease Term Remaining (Years)4 9.4 Lease Turnover Through 2026 (by ABR) 6.1% National Footprint in Attractive Markets Top 10 Tenants by % of ABR Investment Grade Rated BBB Investment Grade Profile5 ≥1% and <3% ABR <1% ABR ≥5% and <10% ABR ≥3% and <5% ABR 0% ABR AK HI WA OR MT CA AZ WY NV ID UT CO NM TX OK ND SD NE KS LA AR MO IA MN WI IL IN MI OH KY TN FL MS AL GA SC NC VAWV PA DE NJ NY ME VT NH MA MD CT RI ≥10% ABR Baa2 A BBB A IG Profile A BBB AA BBB

Convenience Stores: Home Improvement: Dollar Stores: Grocery: Drug Stores & Pharmacies: Portfolio Diversification In Defensive Retail Sectors Nationally Diversified Portfolio Primarily Comprised of Recession Resilient Retail Tenants Note: Portfolio data as of March 31, 2023. All figures represent percentage of ABR. Due to rounding, respective defensive retail sector exposure may not precisely reflect the absolute figures. Top Industries54.1% Necessity 17.1% Discount 13.0% Other 1 17.1% 2 12.2% 3 11.9% 4 9.4% 5 8.9% 15.9% Service 87.0% of ABR Necessity Discount Service 5

Resilient, Cycle-Tested Investment Grade Credit Tenants with Durable Cash Flows1 >60% 82.0% (67.1% Investment Grade Credit and 14.9% Investment Grade Profile) Granular Assets in Highly Fragmented, Undercapitalized Market Segment $3.3 million Avg. Asset Size $1 to $10 million Avg. Asset Size Net Lease Retail Assets with Long Lease Term Benefiting From Contractual Rent Growth ~10 Year WALT 9.4 Year2 WALT Diversification by Industry, Tenant, State1 <15% Industry <50% Top 10 Tenants <15% State 17% Industry 51% Top 10 Tenants 8% State Significant Focus on Fundamental Real Estate Underwriting Attractive cost basis with durable valuation supported by market rents and demos, physical structure and location, and alternative use analyses 6 Note: Portfolio data as of March 31, 2023. 1. Portfolio statistics as a percentage of ABR. 2. Weighted by ABR; excludes lease extension options and 52 investments that secure mortgage loans receivable. Current MetricsInvestment Philosophy Portfolio Strategy Defensive Tenancy in Necessity-Based and E-commerce-Resistant Retail Industries1 87.0%Primarily Consistent Investment Approach Disciplined and Deliberate Portfolio Construction

“Market-Taker Assets” 7 Inefficiently Priced Assets TYPICAL TRANSACTION - Well marketed transaction - Straight-forward transaction - Ability to finance transaction - Highly competitive, well capitalized investors TYPICAL TRANSACTION - Not highly marketed - May involve transaction structuring that limits buyer pool - Limited financing options - Less competitive Efficiently Priced Assets Acquisition Strategy – Bell Curve Investing Acquisition Strategy is Focused on Inefficiently Priced Assets Where Risk Adjusted Returns are Higher

8 Real Estate Valuation Unit-Level Profitability • Review underlying key real estate metrics to maximize re- leasing potential • Location analysis • Alternative use analysis • Determine rent coverage (min. 2.0x) and cost variability • Assess volatility and likelihood of cash flow weakness C B Tenant Credit Underwriting • Evaluate corporate level financials • Assess business risks • Determine ownership/sponsorship • Rigorous credit underwriting A L e v e l o f U n d e rw ri ti n g E m p h a s is Stringent Three-Part Underwriting Process Our Three-Pronged Approach Results in Superior Downside Protection

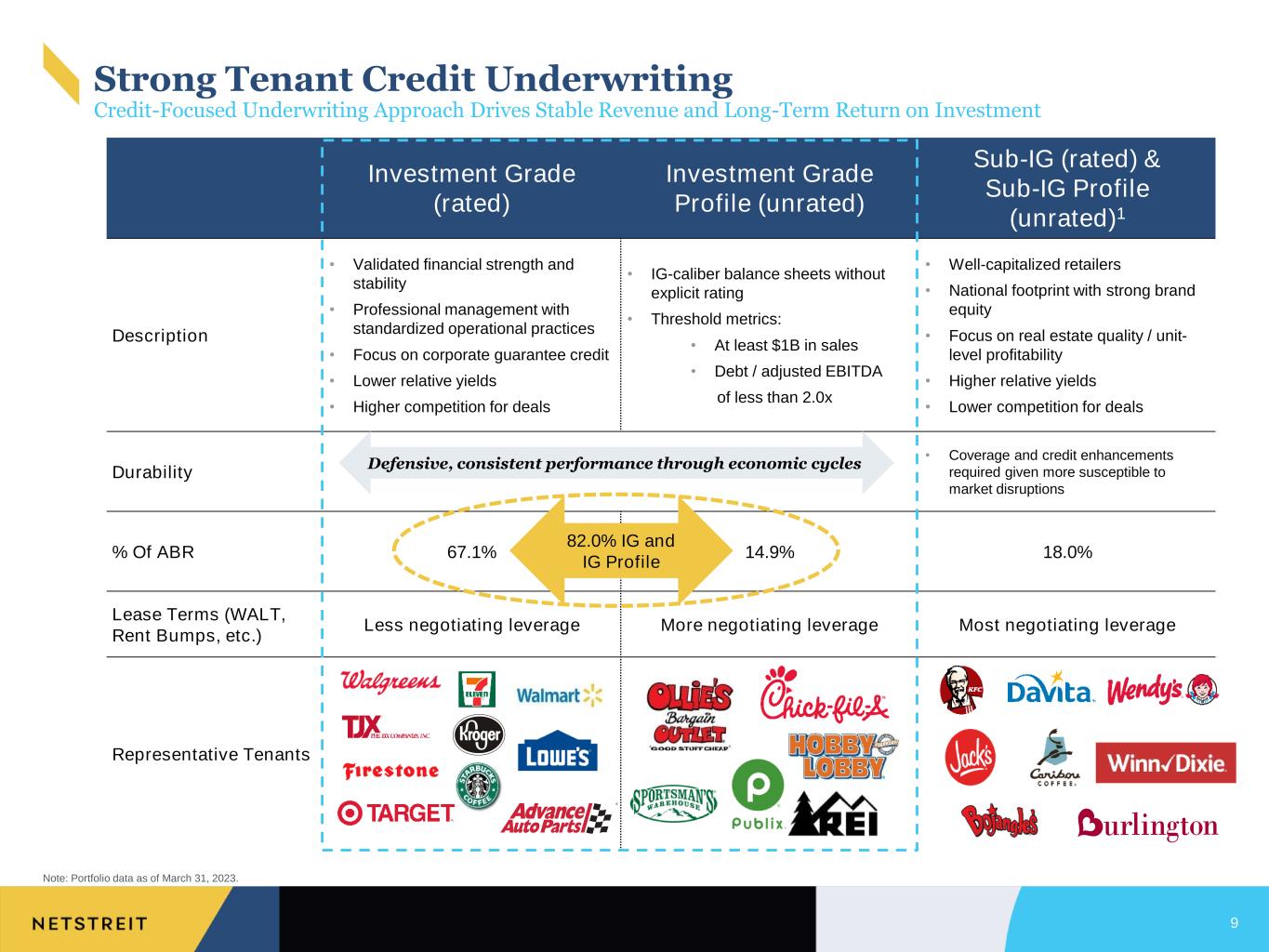

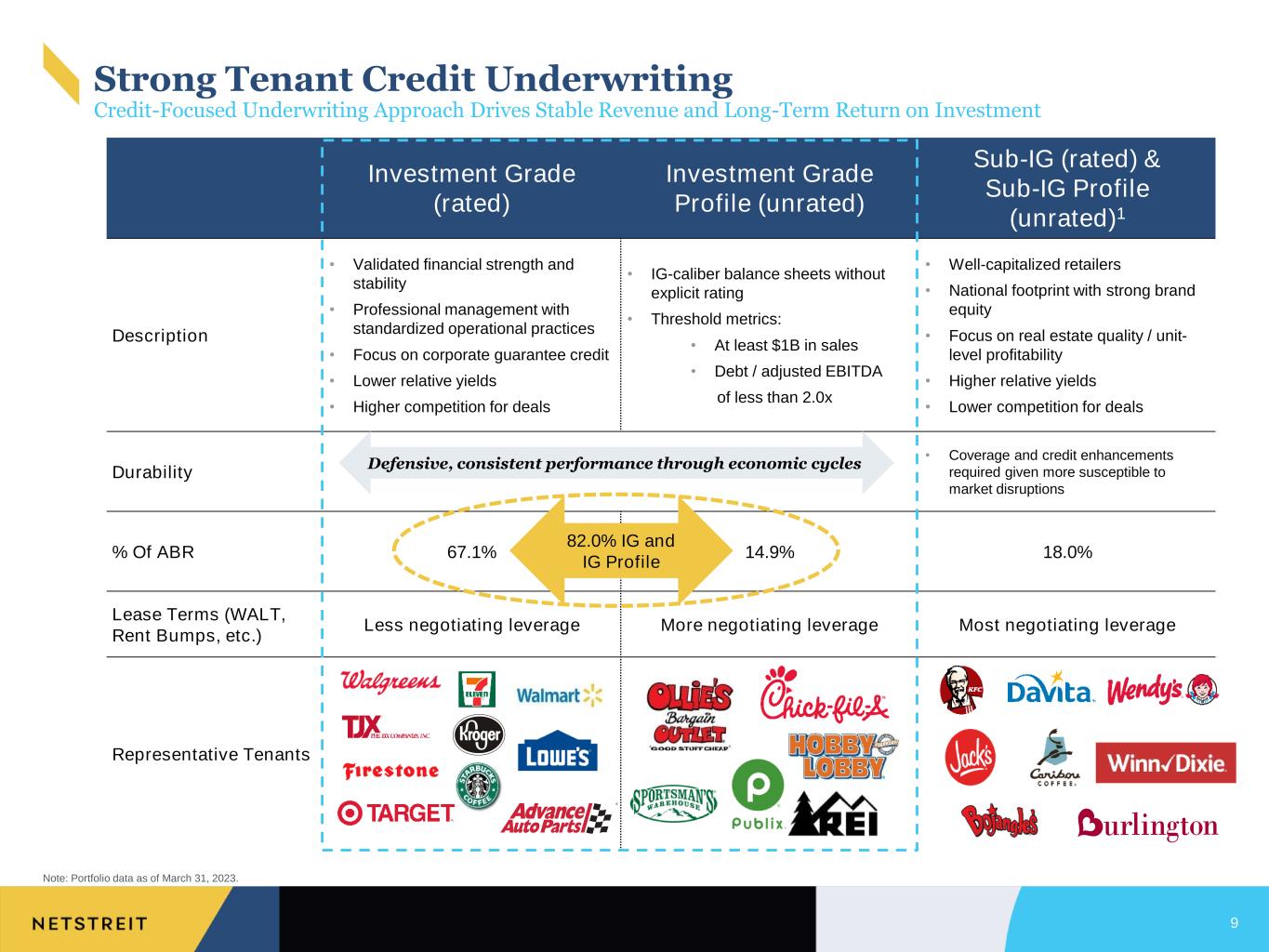

Investment Grade (rated) Investment Grade Profile (unrated) Sub-IG (rated) & Sub-IG Profile (unrated)1 Description • Validated financial strength and stability • Professional management with standardized operational practices • Focus on corporate guarantee credit • Lower relative yields • Higher competition for deals • IG-caliber balance sheets without explicit rating • Threshold metrics: • At least $1B in sales • Debt / adjusted EBITDA of less than 2.0x • Well-capitalized retailers • National footprint with strong brand equity • Focus on real estate quality / unit- level profitability • Higher relative yields • Lower competition for deals Durability • Coverage and credit enhancements required given more susceptible to market disruptions % Of ABR 67.1% 14.9% 18.0% Lease Terms (WALT, Rent Bumps, etc.) Less negotiating leverage More negotiating leverage Most negotiating leverage Representative Tenants 9 Note: Portfolio data as of March 31, 2023. 82.0% IG and IG Profile Defensive, consistent performance through economic cycles Strong Tenant Credit Underwriting Credit-Focused Underwriting Approach Drives Stable Revenue and Long-Term Return on Investment

10 Market-Level Considerations Property-Level Considerations • Fungibility of building for alternative uses • Replacement cost • Location analysis • Traffic counts • Nearby uses and traffic drivers, complementary nature thereof • Accessibility and parking capacity • Ingress and egress • Visibility / signage • Vacancy analysis • Marketability of the real estate without current tenant • List of likely replacement tenants • Rent analysis • Market rent versus in-place rent • Demographic analysis • Current demographics plus trends and forecasts • Competitive analysis • Market position versus competing retail corridors Real Estate Valuation Real Estate Closely Follows Credit as a Top Priority: We Utilize a Ground-Up Framework Rooted in Real Estate Fundamentals to Underpin Valuation and Further Quantify the Upside Potential of an Investment

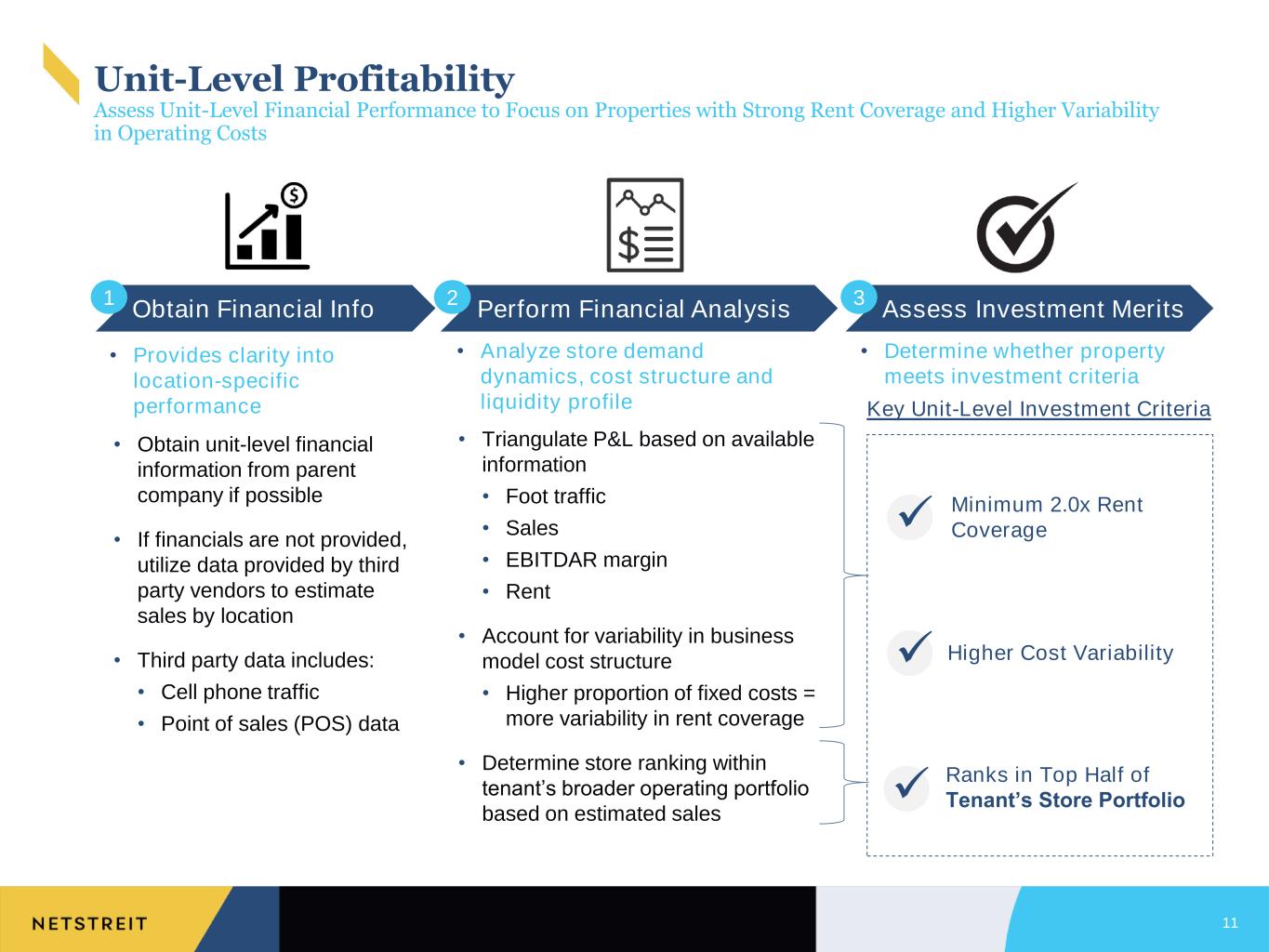

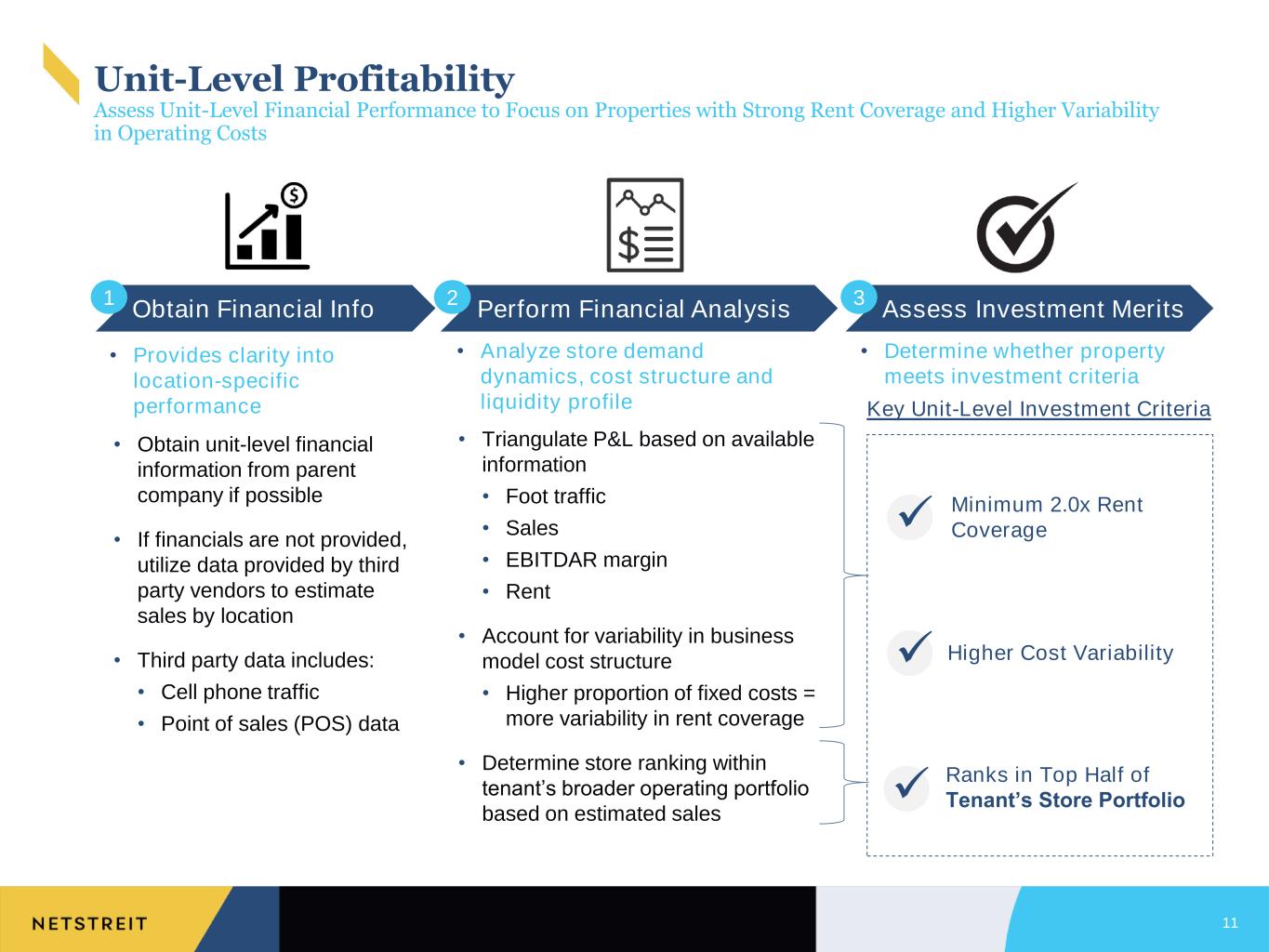

11 Obtain Financial Info Perform Financial Analysis 2 Assess Investment Merits 1 3 • Provides clarity into location-specific performance • Analyze store demand dynamics, cost structure and liquidity profile • Determine whether property meets investment criteria • Obtain unit-level financial information from parent company if possible • If financials are not provided, utilize data provided by third party vendors to estimate sales by location • Third party data includes: • Cell phone traffic • Point of sales (POS) data • Triangulate P&L based on available information • Foot traffic • Sales • EBITDAR margin • Rent • Account for variability in business model cost structure • Higher proportion of fixed costs = more variability in rent coverage • Determine store ranking within tenant’s broader operating portfolio based on estimated sales Key Unit-Level Investment Criteria Minimum 2.0x Rent Coverage✓ Higher Cost Variability✓ Ranks in Top Half of Tenant’s Store Portfolio✓ Unit-Level Profitability Assess Unit-Level Financial Performance to Focus on Properties with Strong Rent Coverage and Higher Variability in Operating Costs

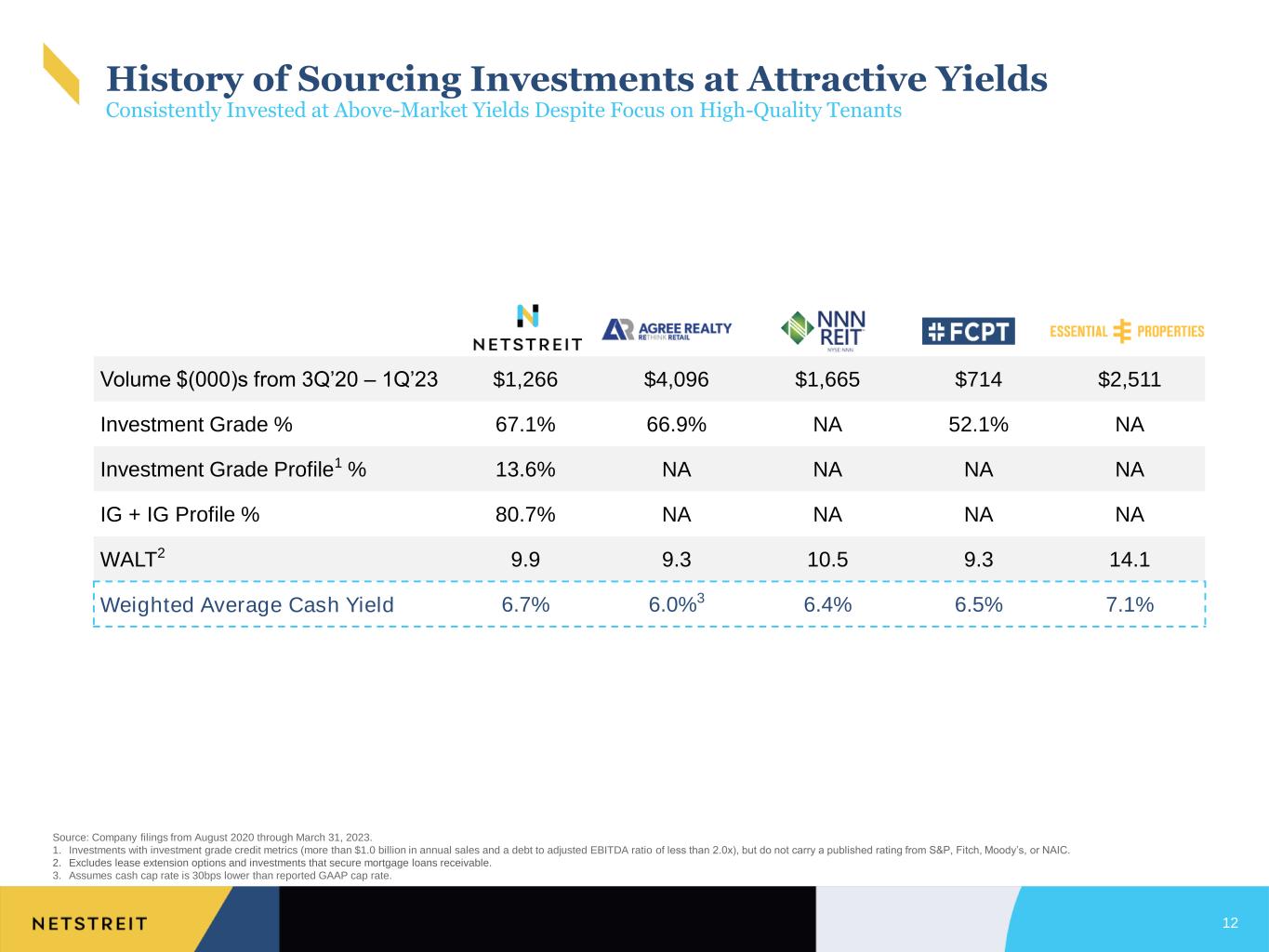

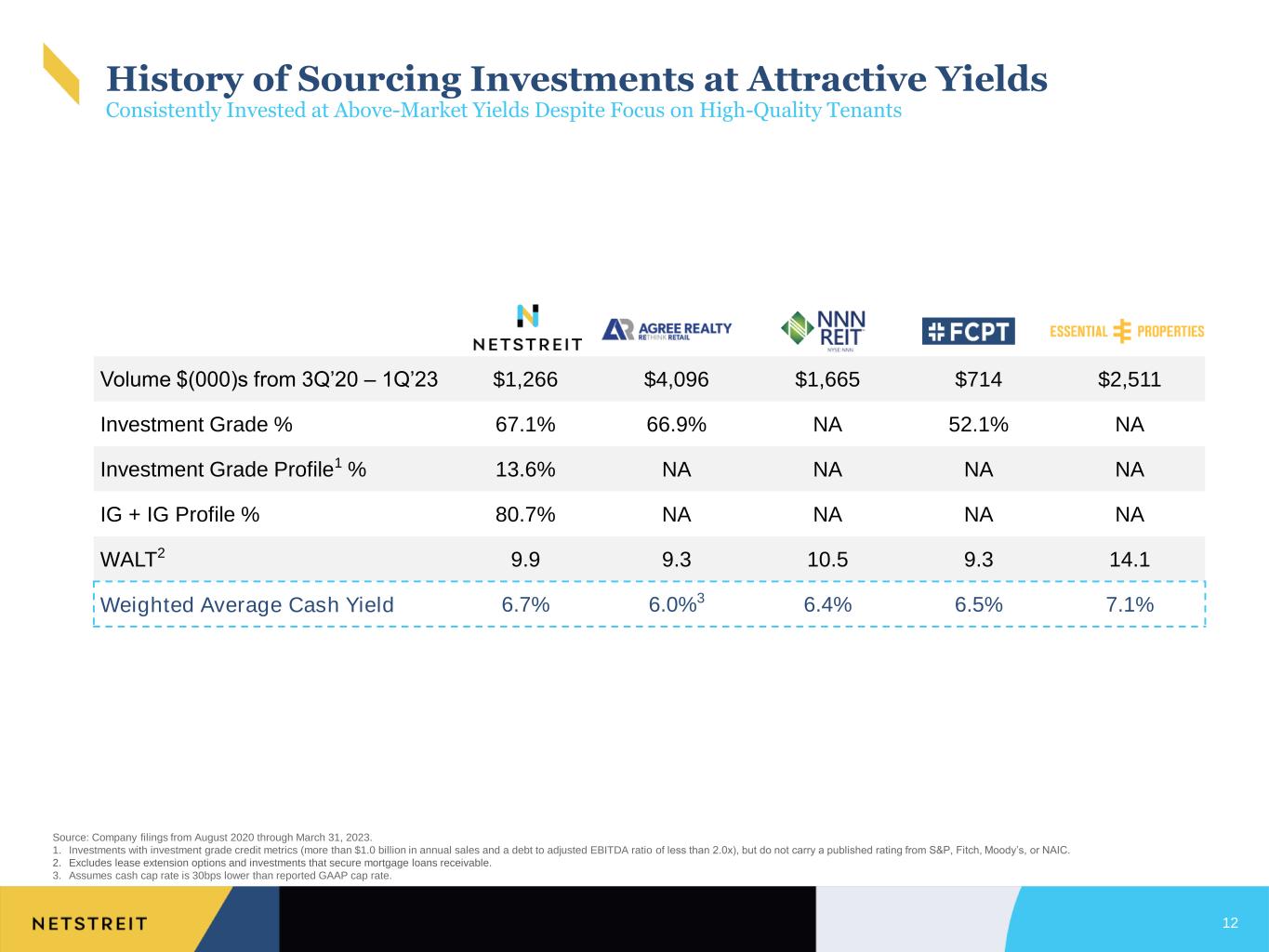

12 Source: Company filings from August 2020 through March 31, 2023. 1. Investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody’s, or NAIC. 2. Excludes lease extension options and investments that secure mortgage loans receivable. 3. Assumes cash cap rate is 30bps lower than reported GAAP cap rate. Volume $(000)s from 3Q’20 – 1Q’23 $1,266 $4,096 $1,665 $714 $2,511 Investment Grade % 67.1% 66.9% NA 52.1% NA Investment Grade Profile1 % 13.6% NA NA NA NA IG + IG Profile % 80.7% NA NA NA NA WALT2 9.9 9.3 10.5 9.3 14.1 Weighted Average Cash Yield 6.7% 6.0%3 6.4% 6.5% 7.1% History of Sourcing Investments at Attractive Yields Consistently Invested at Above-Market Yields Despite Focus on High-Quality Tenants

$74 $150 $103 $81 $88 $117 $90 $151 $138 $133 $131 $104 $129 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 2Q'22 3Q'22 4Q'22 1Q'23 Completed Investments New Quarterly Investments Strong External Growth Profile Dependable Track Record of Procuring New Investments 433 Completed Investments 13 1. Includes completed developments and mortgage loans receivable. ($ in millions) Avg. Acquisition Activity per Completed Quarter = $115 million Cumulative Investments Since 20191 Investment Activity: 24 44 30 26 $225 $327 $614 $409 31 35 $497 26 $704 $854 32 $992 37 26 $1,125 $1,257 27 $1,361 24 71 $1,489

14 Note: Portfolio data as of March 31, 2023. Since inception, the Company has disposed of 72 properties totaling approximately $214 million, which has materially improved portfolio performance metrics such as tenant quality, WALT, and geographic diversity Identify properties not meeting strategy and/or risk management criteria (i.e. rent coverage) Periodically review all properties for changes in performance, credit, and local conditions Leverage 1031 exchange transfers where possible to access deep, non- institutional market for portfolio optimization Strategic Recycling Perpetual Stratification Active Monitoring Identify Active Asset Management Continuously Track Property Performance to Stratify Portfolio and Ensure a Secure Rental Stream

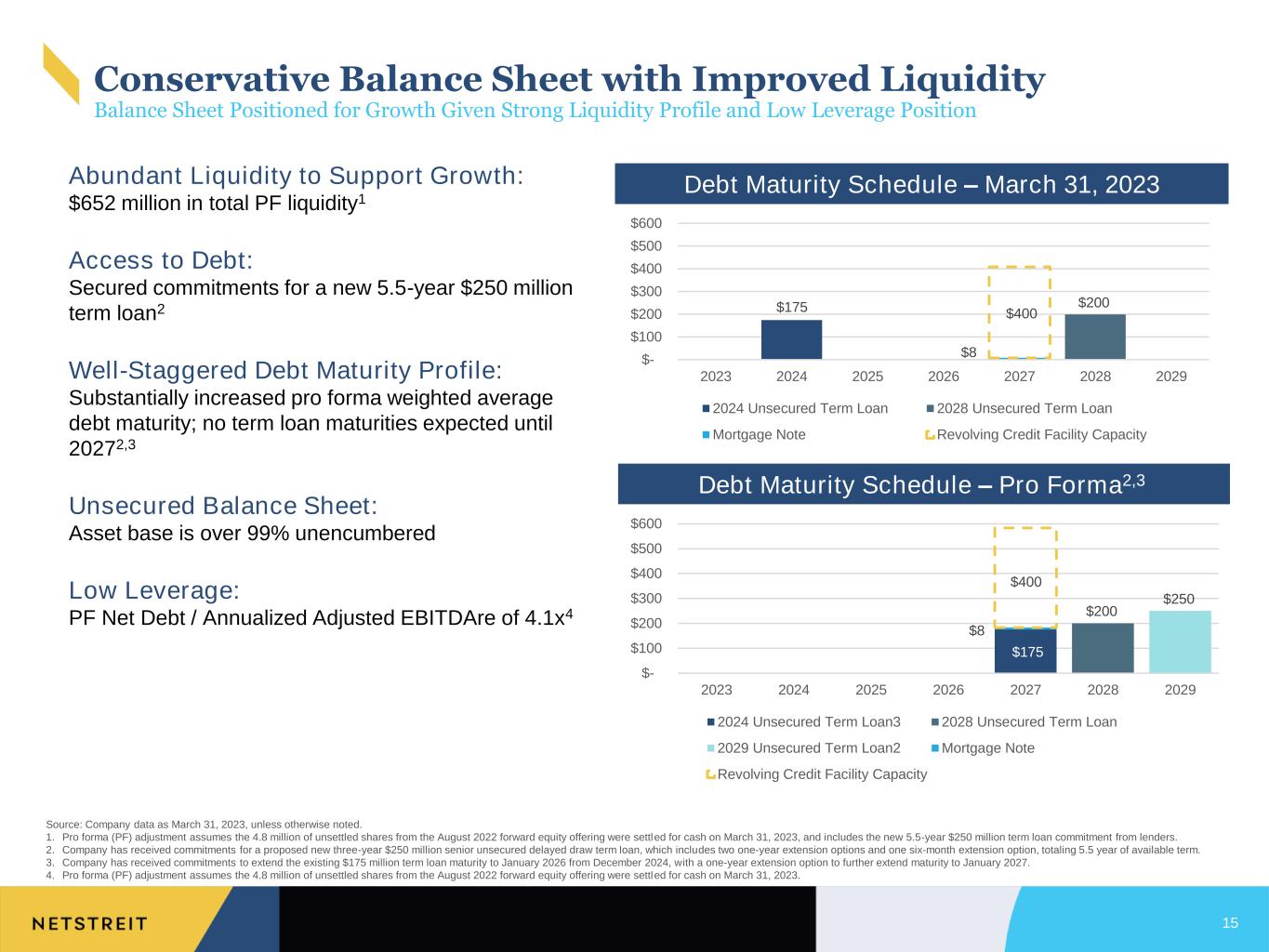

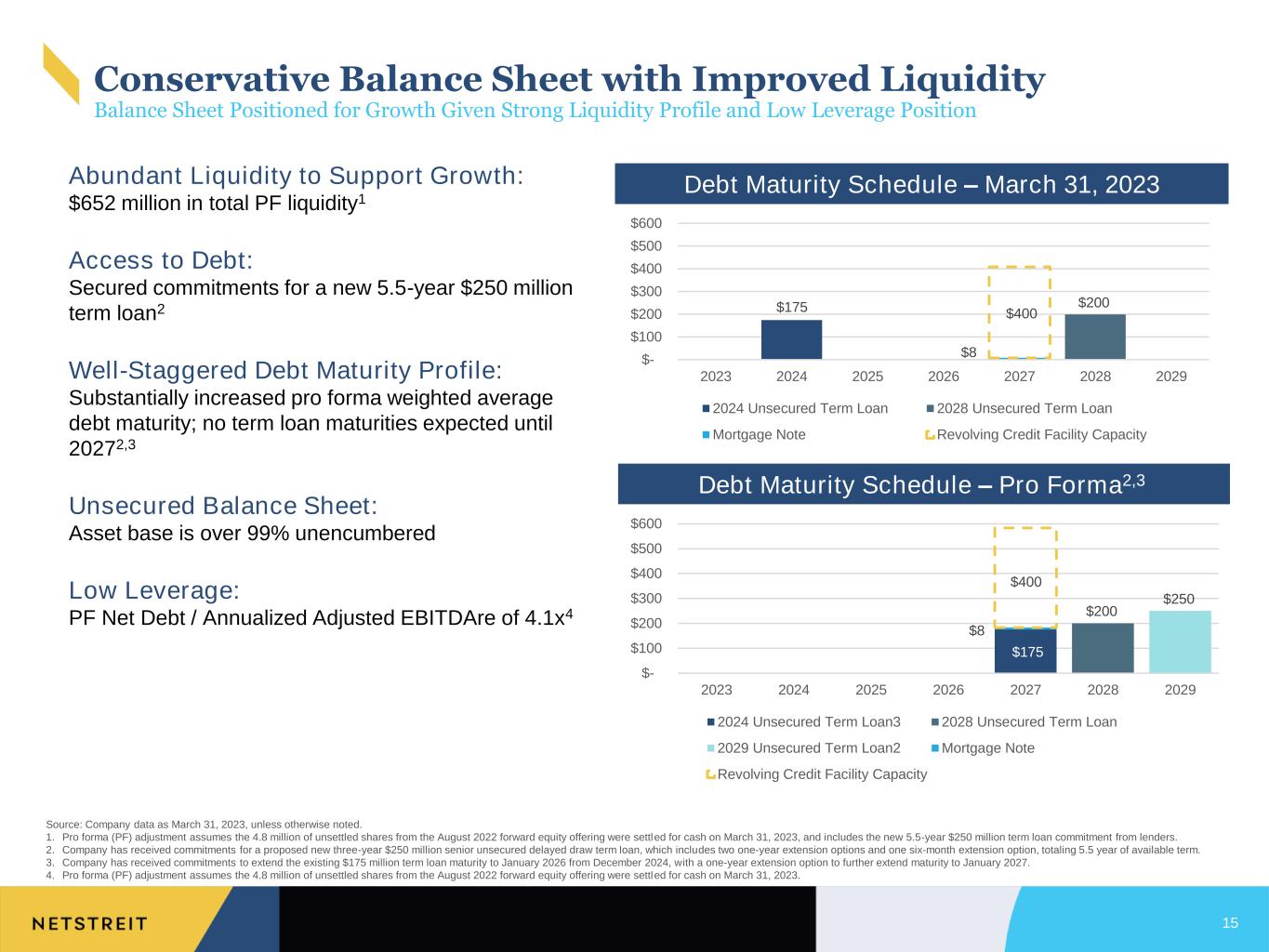

15 Conservative Balance Sheet with Improved Liquidity Balance Sheet Positioned for Growth Given Strong Liquidity Profile and Low Leverage Position Debt Maturity Schedule – March 31, 2023 Debt Maturity Schedule – Pro Forma2,3 Abundant Liquidity to Support Growth: $652 million in total PF liquidity1 Access to Debt: Secured commitments for a new 5.5-year $250 million term loan2 Well-Staggered Debt Maturity Profile: Substantially increased pro forma weighted average debt maturity; no term loan maturities expected until 20272,3 Unsecured Balance Sheet: Asset base is over 99% unencumbered Low Leverage: PF Net Debt / Annualized Adjusted EBITDAre of 4.1x4 Source: Company data as March 31, 2023, unless otherwise noted. 1. Pro forma (PF) adjustment assumes the 4.8 million of unsettled shares from the August 2022 forward equity offering were settled for cash on March 31, 2023, and includes the new 5.5-year $250 million term loan commitment from lenders. 2. Company has received commitments for a proposed new three-year $250 million senior unsecured delayed draw term loan, which includes two one-year extension options and one six-month extension option, totaling 5.5 year of available term. 3. Company has received commitments to extend the existing $175 million term loan maturity to January 2026 from December 2024, with a one-year extension option to further extend maturity to January 2027. 4. Pro forma (PF) adjustment assumes the 4.8 million of unsettled shares from the August 2022 forward equity offering were settled for cash on March 31, 2023. $175 $200 $8 $400 $- $100 $200 $300 $400 $500 $600 2023 2024 2025 2026 2027 2028 2029 2024 Unsecured Term Loan 2028 Unsecured Term Loan Mortgage Note Revolving Credit Facility Capacity $175 $200 $250 $8 $400 $- $100 $200 $300 $400 $500 $600 2023 2024 2025 2026 2027 2028 2029 2024 Unsecured Term Loan3 2028 Unsecured Term Loan 2029 Unsecured Term Loan2 Mortgage Note Revolving Credit Facility Capacity

100% 54% 79% 21% 36% 55% 26% 17% 16% 7% 3% 16% 3% 25% 17% 5% 2% FCPT NTST EPRT ADC O NNN SRC Service Discount Necessity Portfolio Highlights Relative to Peers NTST’s Stable & Predictable Cash Flow Profile Drives Superior Risk-Adjusted Returns 68% 67% 61% 41% 20% 18% NA Source: Public filings as of March 31, 2023. 1. EPRT investment grade concentration assumed to be 0%; although, it is not disclosed by the company. 2. NNN investment grade concentration as of 4Q22. Lease Rollover Through 2026 Average Investment Size per Property Investment Grade %(1) Portfolio Composition Weighted-Average Lease Term 2 3.5% 6.1% 7.7% 12.1% 14.2% 14.4% 17.4% $2.4 $2.7 $2.9 $3.3 $4.0 $4.1 $4.6 100% 87% 82% 62% 60% 60% 31% 13.9 9.4 8.0 8.8 10.3 10.4 9.4

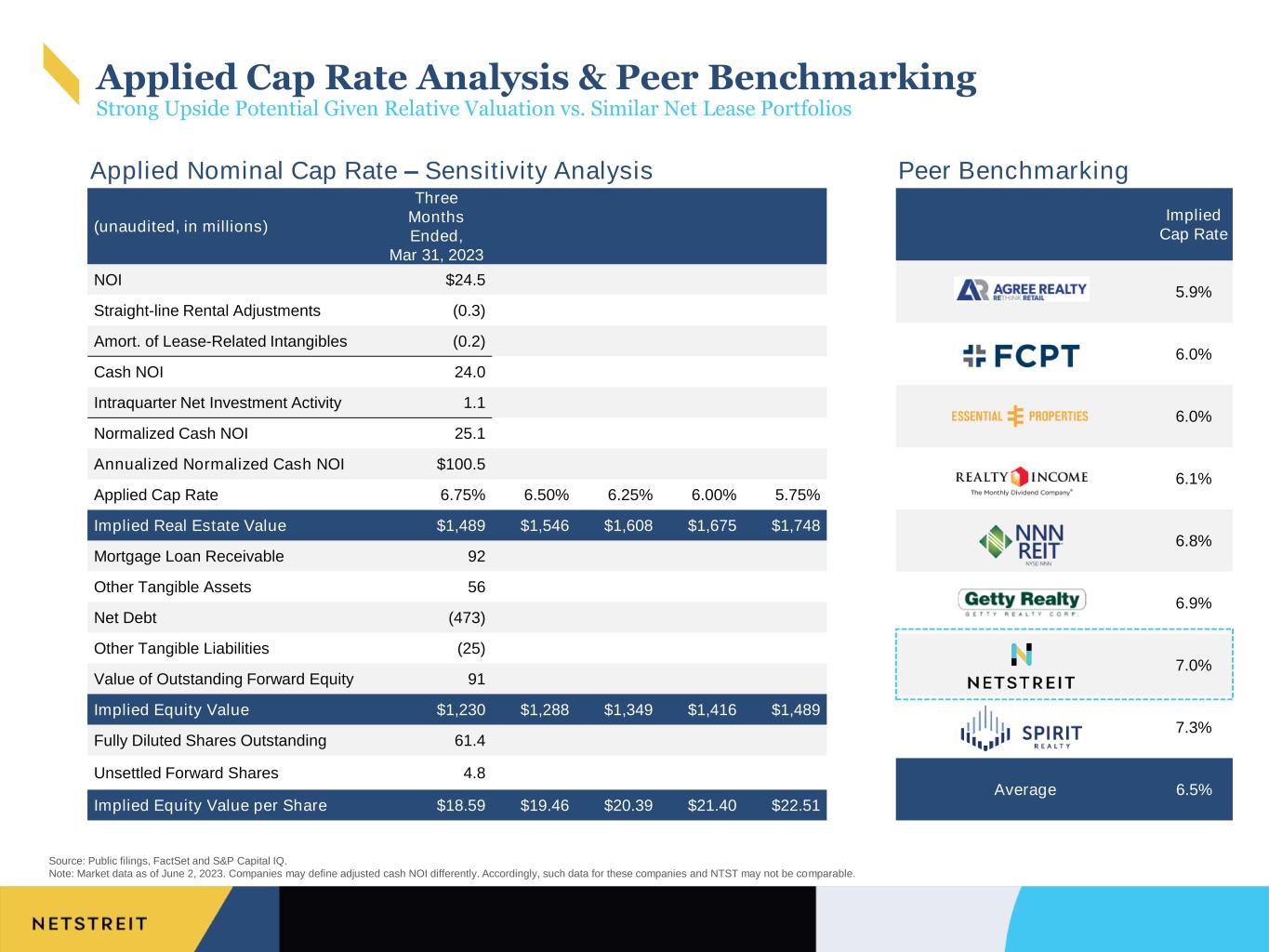

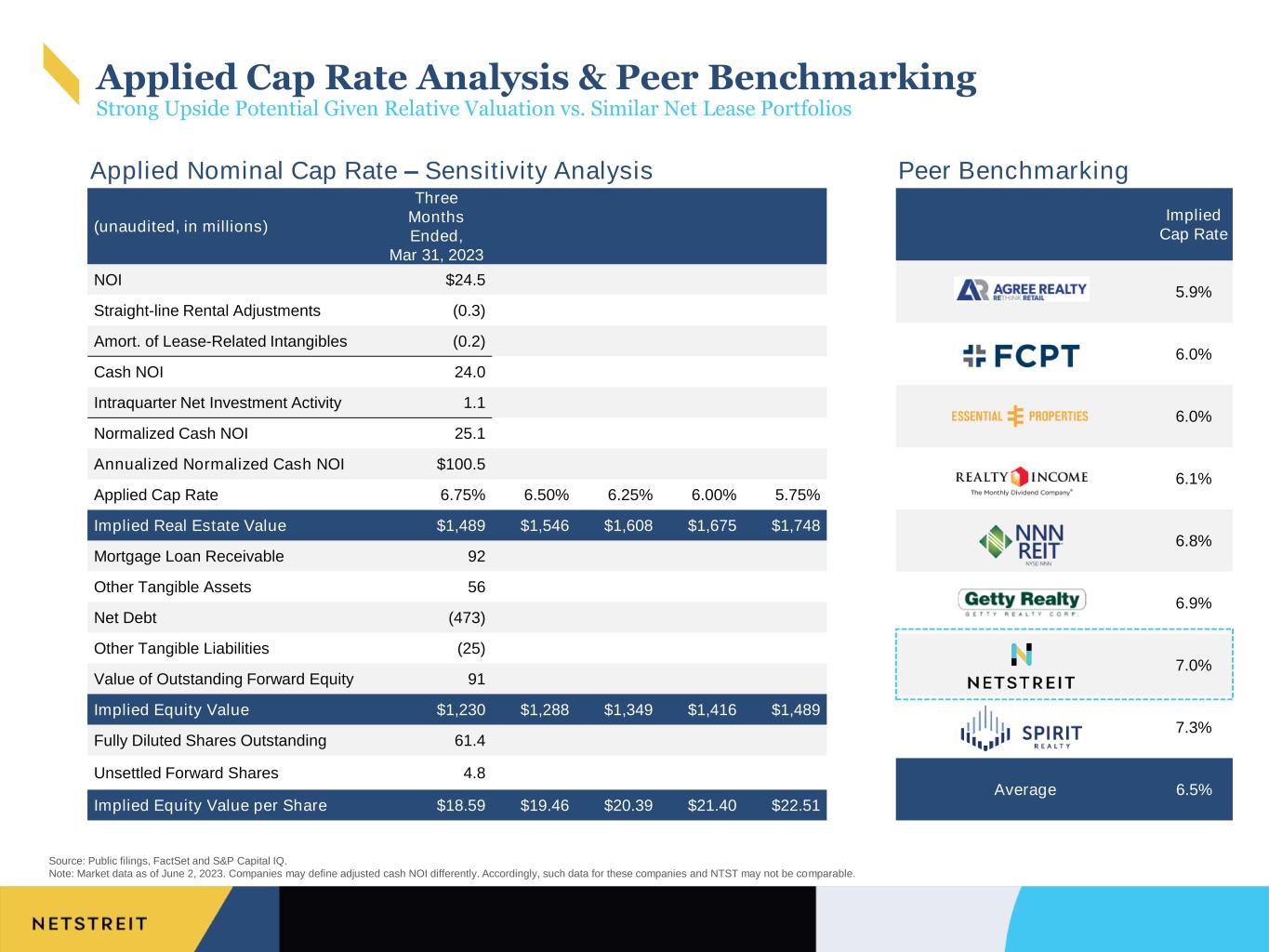

Implied Cap Rate 5.9% 6.0% 6.0% 6.1% 6.8% 6.9% 7.0% 7.3% Average 6.5% Applied Nominal Cap Rate – Sensitivity Analysis Source: Public filings, FactSet and S&P Capital IQ. Note: Market data as of June 2, 2023. Companies may define adjusted cash NOI differently. Accordingly, such data for these companies and NTST may not be comparable. Peer Benchmarking (unaudited, in millions) Three Months Ended, Mar 31, 2023 NOI $24.5 Straight-line Rental Adjustments (0.3) Amort. of Lease-Related Intangibles (0.2) Cash NOI 24.0 Intraquarter Net Investment Activity 1.1 Normalized Cash NOI 25.1 Annualized Normalized Cash NOI $100.5 Applied Cap Rate 6.75% 6.50% 6.25% 6.00% 5.75% Implied Real Estate Value $1,489 $1,546 $1,608 $1,675 $1,748 Mortgage Loan Receivable 92 Other Tangible Assets 56 Net Debt (473) Other Tangible Liabilities (25) Value of Outstanding Forward Equity 91 Implied Equity Value $1,230 $1,288 $1,349 $1,416 $1,489 Fully Diluted Shares Outstanding 61.4 Unsettled Forward Shares 4.8 Implied Equity Value per Share $18.59 $19.46 $20.39 $21.40 $22.51 Applied Cap Rate Analysis & Peer Benchmarking Strong Upside Potential Given Relative Valuation vs. Similar Net Lease Portfolios

18 Case Studies

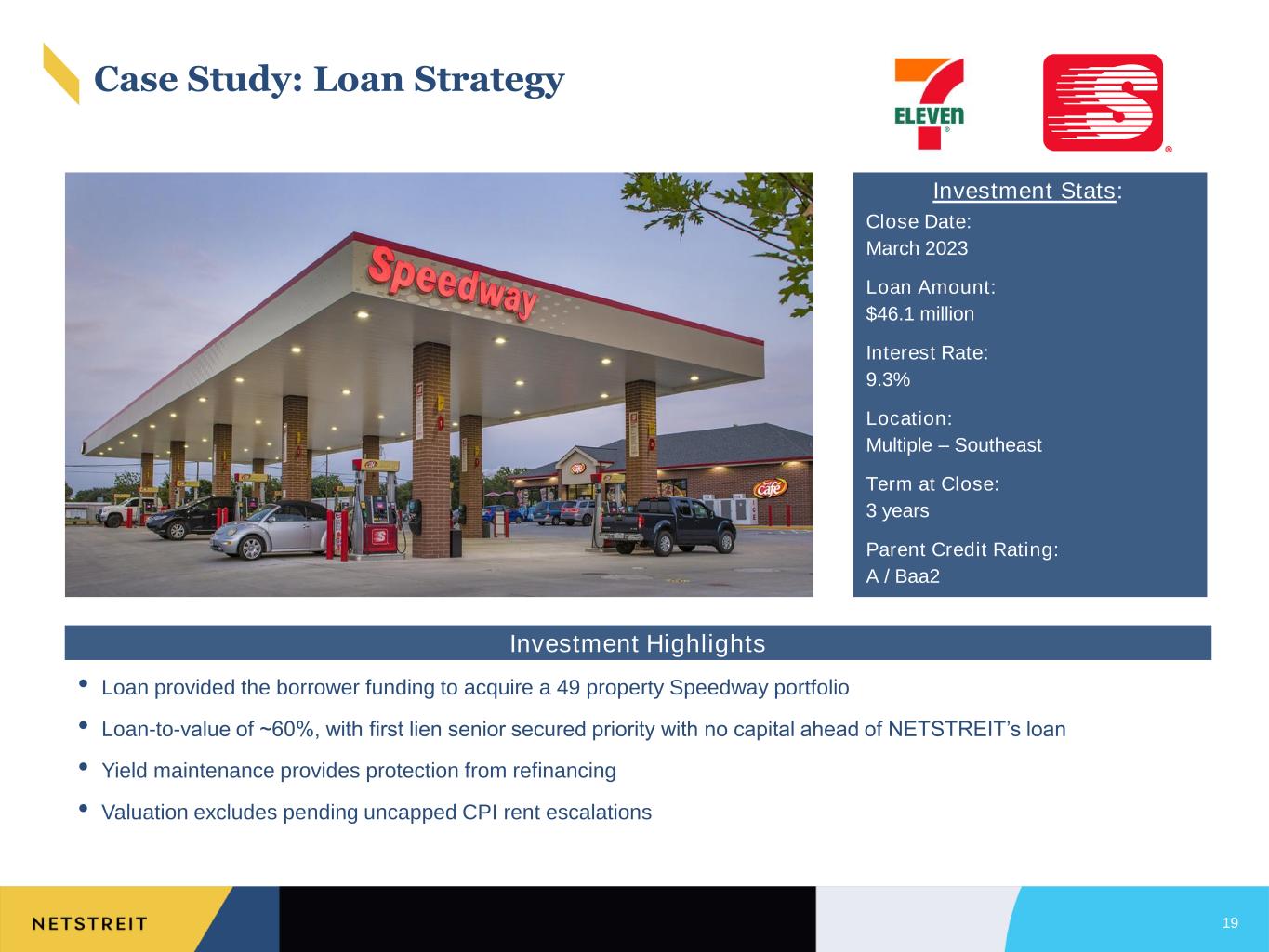

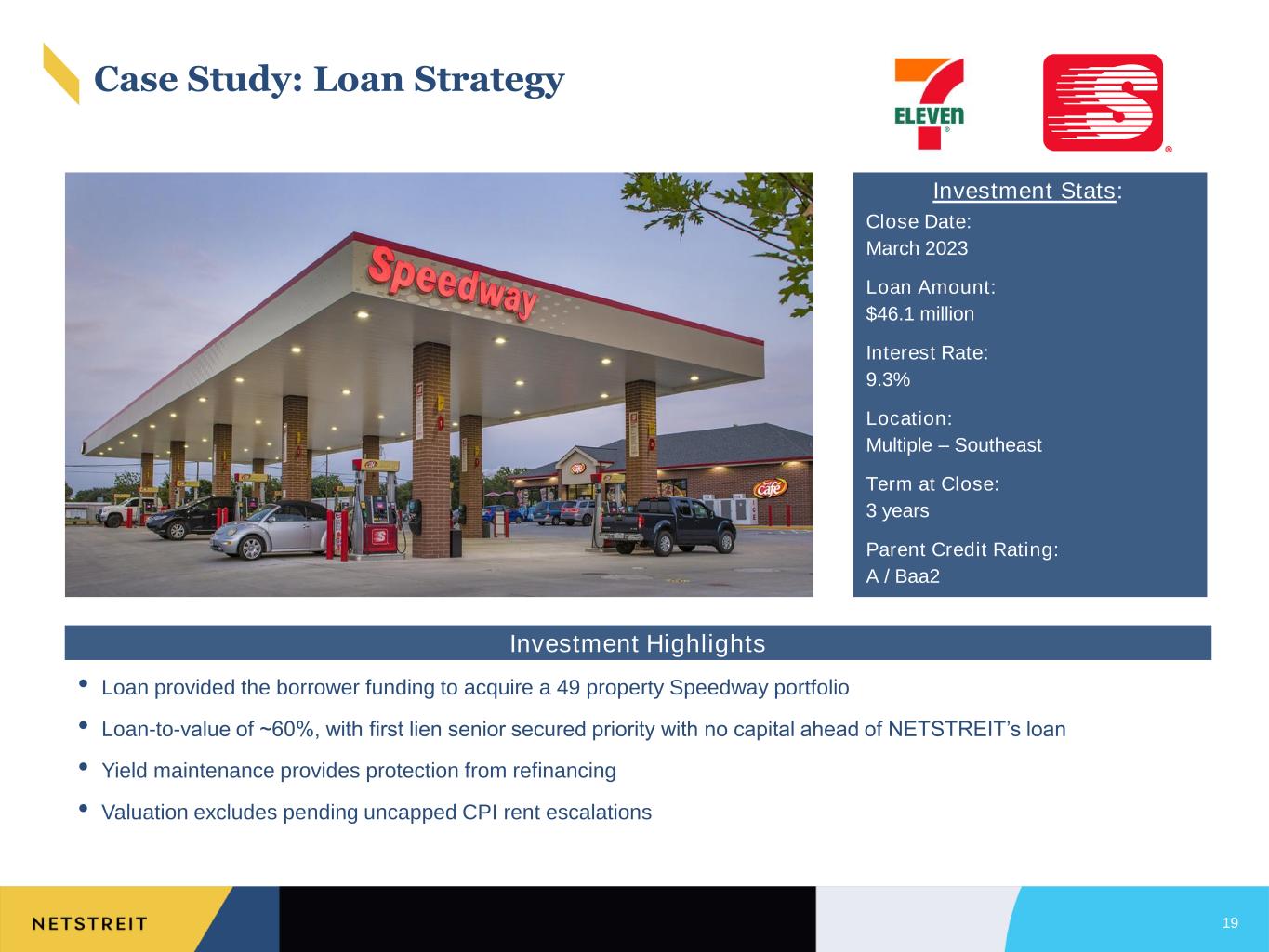

19 • Loan provided the borrower funding to acquire a 49 property Speedway portfolio • Loan-to-value of ~60%, with first lien senior secured priority with no capital ahead of NETSTREIT’s loan • Yield maintenance provides protection from refinancing • Valuation excludes pending uncapped CPI rent escalations Close Date: March 2023 Loan Amount: $46.1 million Interest Rate: 9.3% Location: Multiple – Southeast Term at Close: 3 years Parent Credit Rating: A / Baa2 Investment Stats: Investment Highlights Case Study: Loan Strategy

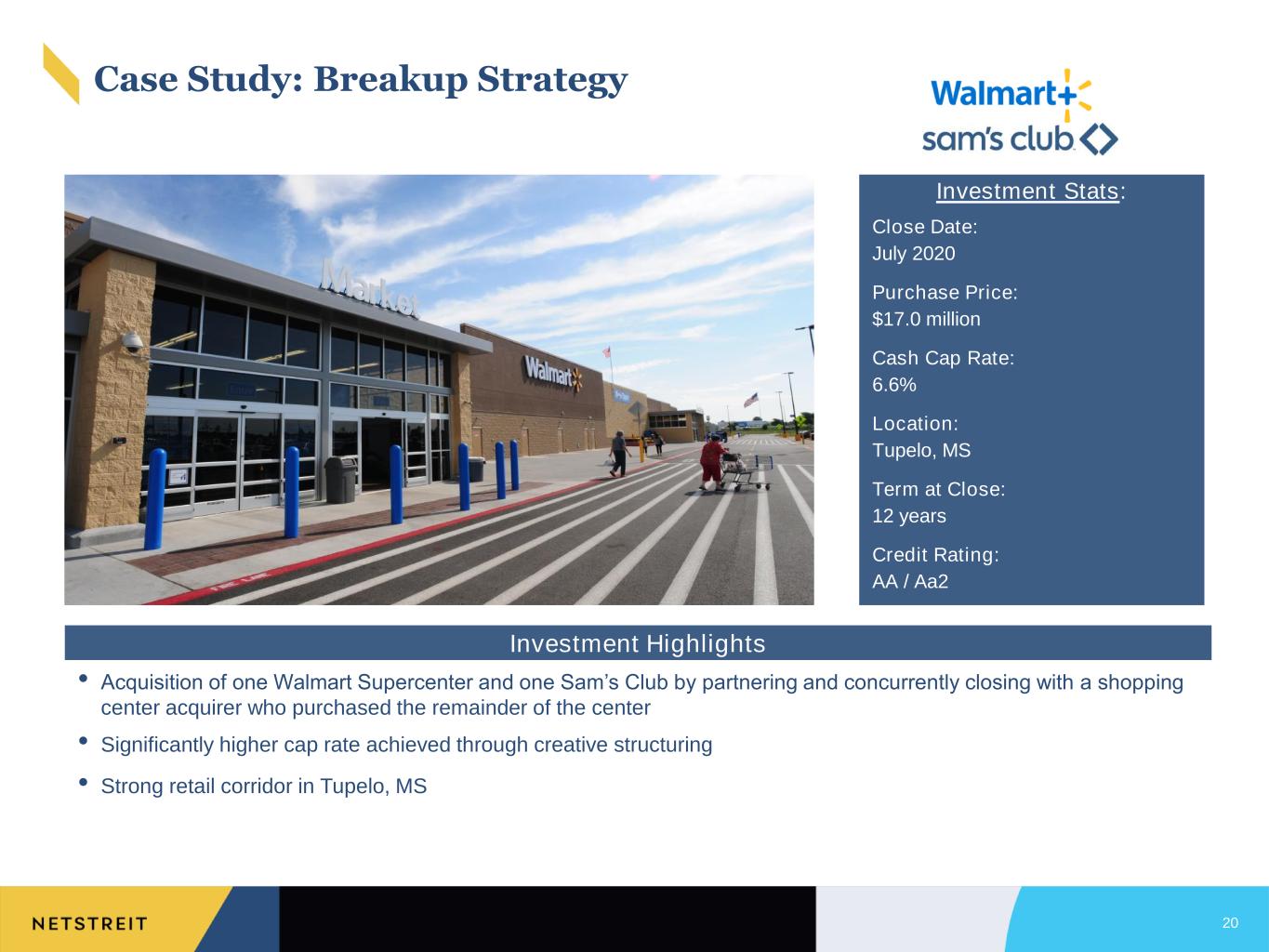

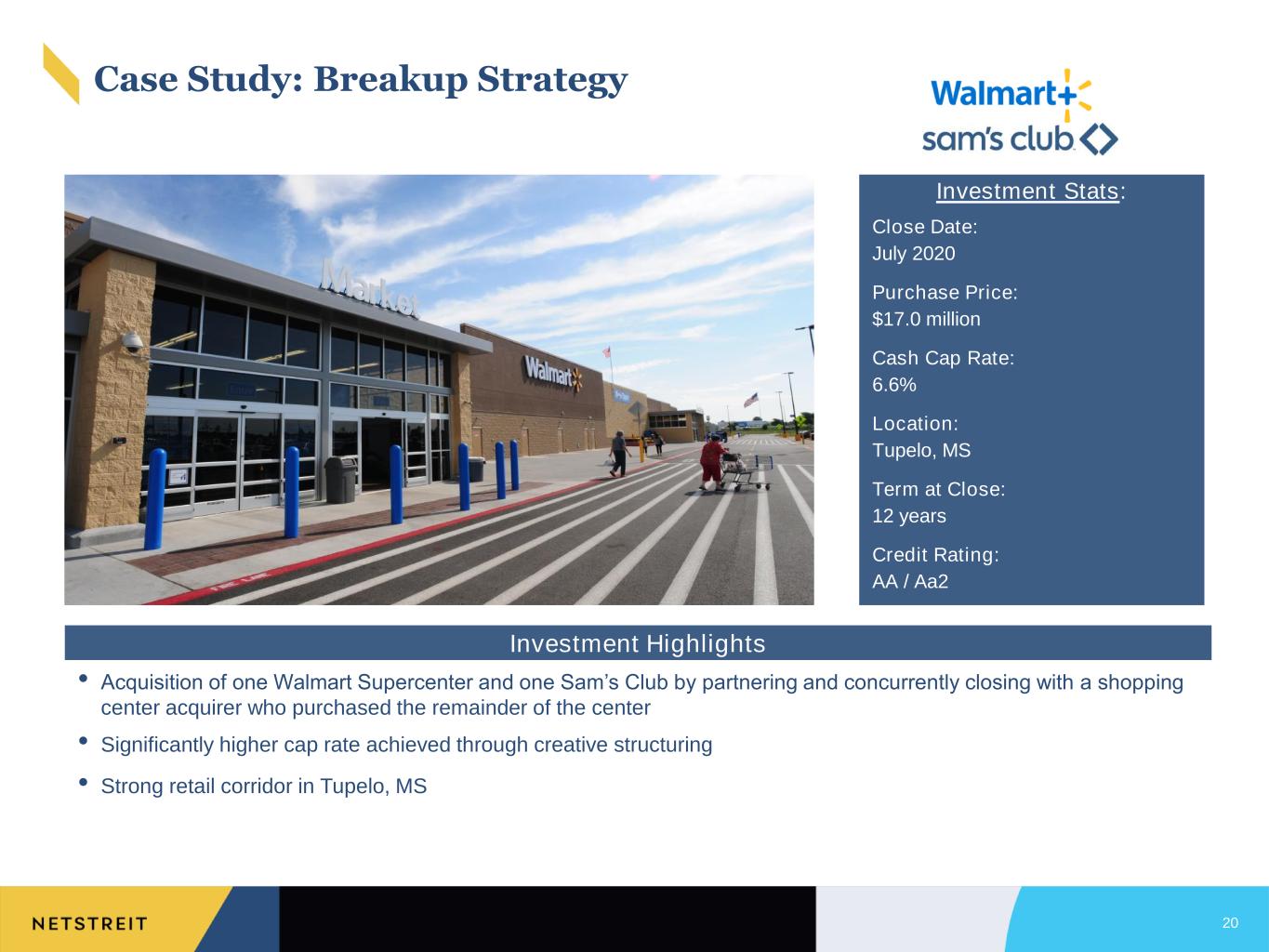

20 • Acquisition of one Walmart Supercenter and one Sam’s Club by partnering and concurrently closing with a shopping center acquirer who purchased the remainder of the center • Significantly higher cap rate achieved through creative structuring • Strong retail corridor in Tupelo, MS INVESTMENT STATS:INVETMENT STATS: Close Date: July 2020 Purchase Price: $17.0 million Cash Cap Rate: 6.6% Location: Tupelo, MS Term at Close: 12 years Credit Rating: AA / Aa2 Investment Stats: Case Study: Breakup Strategy Investment Highlights

21 • NTST negotiated a new 10-year lease with only a 7.4% rent reduction to increase lease term by six years • Cash cap rate of 6.9% compares favorably to other 10-year Tractor Supply transactions in the market • Exceptional real estate that tenant is committed to long term INVESTMENT STATS: Close Date: March 2021 Purchase Price: $6.2 million Post-B&E Cash Cap Rate: 6.9% Location: Olympia, WA Term at Close of B&E: 10.5 Years Credit Rating: BBB / Baa1 Investment Stats: Case Study: Blend & Extend Investment Highlights

22 • Created a master lease to encompass an existing Festival Foods store and a newly acquired Festival Foods location • Master lease has 15 years of initial term for both properties, which included extending the WALT of the existing site • Excellent retail area with population of 330,000 in a 5-mile radius • Strong performing stores with credit enhanced through additional term and master lease structure Close Date: December 2022 Purchase Price: $22.4 million Cash Cap Rate: 7.2% Location: Greenfield, WI Term at Close: 15 years Credit Rating: Investment Grade Profile Investment Stats: Case Study: Sale Leaseback Master Lease Investment Highlights

23 Commitment to ESG

24 ▪ Dedication to reducing the Company’s ecological footprint ▪ Endorsement of renewable resources and encouragement of tenants to practice leading sustainability initiatives ▪ New corporate headquarters is LEED v4 O+M: EB Gold Certified ▪ Implementation of energy conservation practices in the office E Environmental Responsibility ▪ Emphasis on creating a culture driven by diversity & inclusion ▪ Commitment to employee well-being & satisfaction in the workplace ▪ Creation of leading employee training and development programs to promote growth S Social Responsibility ▪ Management team & board of directors comprised of members with diverse background of skills, experience, and perspectives ▪ Enactment of ideal board features to enhance the Company’s fiduciary responsibility to shareholders ▪ Rigorous risk management procedures to protect shareholder interests G Corporate Governance Areas of Focus The Company’s mission is to be the leader in the net lease industry by practicing and implementing innovative, impactful Environmental, Social and Governance policies with the highest ethical standards Corporate Responsibility NETSTREIT is committed to fulfilling its responsibility as an outstanding corporate citizen

25 Promote health and well-being in our offices. Company provides insurance benefits to our employees and family. Company provides employees with fitness memberships. Ensure inclusive and equitable quality education and promote lifelong learnings opportunities for all. Company provides continuing education for employees and offers paid internship to college students. Ensure women’s full and effective participation and equal opportunities at all levels of decision-making. Over 40% of the board members and employee base are female. Promote sustained, inclusive, full and decent productive employment. Company culture promotes inclusivity and growth. Reduced inequality and empower and promote inclusion of all, irrespective of age, sex, race, religion, or economic status. Company culture promotes and empower inclusivity of all. Company has efforts to recruit in underserved communities. Corporate Responsibility NETSTREIT aligns its corporate responsibility efforts to support that of the United Nations Sustainable Development Goals (SDGs)

26 Source: Company data. Portfolio data represents portfolio as of 3/31/2023. Corporate sustainability programs for each tenant is published on their or their parent entity’s website. ENVIRONMENTAL SOCIAL GHG/CO2 Emission Plastic Usage/ Sustainable Packaging Renewable Energy/Energy Conservation Water Conservation/ Clean Water Eco-Friendly Products/ Sustainably/ Ethically Sourced Waste Reduction/ Recycling Agriculture/ Deforestration Community Engagement/ Philanthropy Diversity, Equity and Inclusion Responsible Supply Chain Product Safety & Quality CVS ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Walgreens ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Dollar General ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 7-Eleven ✓ ✓ ✓ ✓ ✓ ✓ Home Depot ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Speedway ✓ Advance Auto Parts ✓ ✓ ✓ ✓ ✓ ✓ Dollar Tree/ Family Dollar ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Sams/Wal-Mart ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Lowe's ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Ahold Delhaize ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Best Buy ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Big Lots ✓ ✓ ✓ ✓ ✓ Festival Foods ✓ ✓ ✓ ✓ Floor & Décor ✓ ✓ ✓ ✓ ✓ Winn Dixie ✓ ✓ ✓ ✓ ✓ ✓ Dick's Sporting Goods ✓ ✓ ✓ ✓ ✓ Tractor Supply ✓ ✓ ✓ ✓ ✓ ✓ Environmental Responsibility Our top tenants have corporate sustainability programs that govern their business operations. 18 of our top 20 tenants in our portfolio have ESG commitments

27 We can achieve up to 2.5 bps pricing adjustment if we meet certain annual key performance indicators set by our sustainability agent. The KPI is based on the percentages of our portfolio ABR that is derived by tenants who have set targets of reducing GHG with SBTi or have made commitments to set a target at a future date with SBTi. Source: Tenants within our portfolio with Science Base Target initiatives targets or commitments as of March 31, 2023. Tenants SBTi Targets SBTi Commitment Advance Auto Parts, Inc Burlington Best Buy Co., Inc. Bridgestone Corporation CVS Health DaVita Kohl's, Inc. Koninklijke Ahold Delhaize N.V. La-Z-Boy Incorporated Lowe's Companies, Inc. Panera Bread Recreational Equipment, Inc Starbucks Coffee Company Target Corporation The Home Depot The Kroger Co. The Wendy's Company Ulta Beauty, Inc. Walmart Inc. Yum! Brands, Inc. Environmental Responsibility To showcase our commitment to the reduction of greenhouse gas emissions, we incorporated to our $600 million credit facility, a sustainability-linked loan feature based on the Science Based Targets initiatives (“SBTi”)

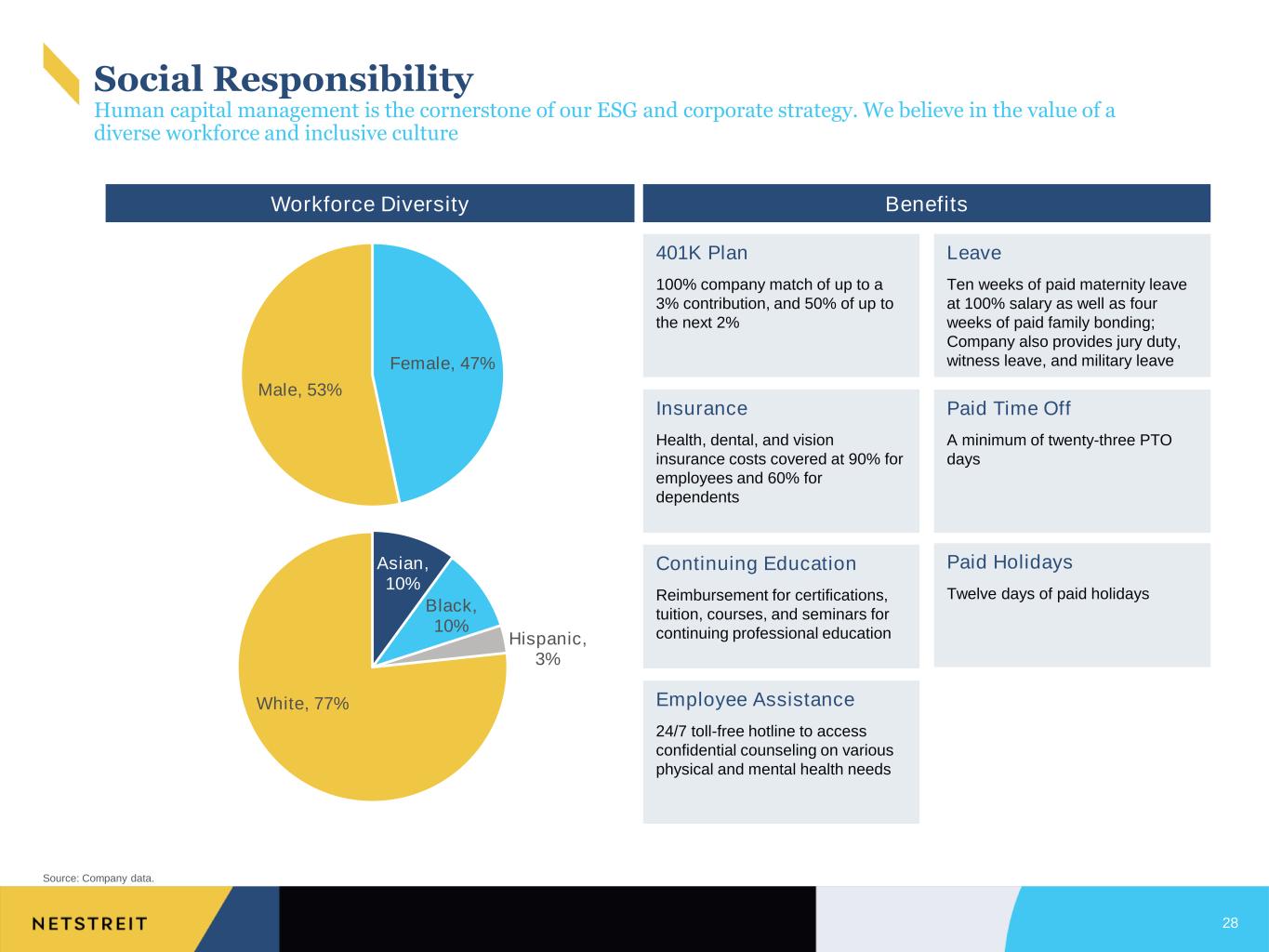

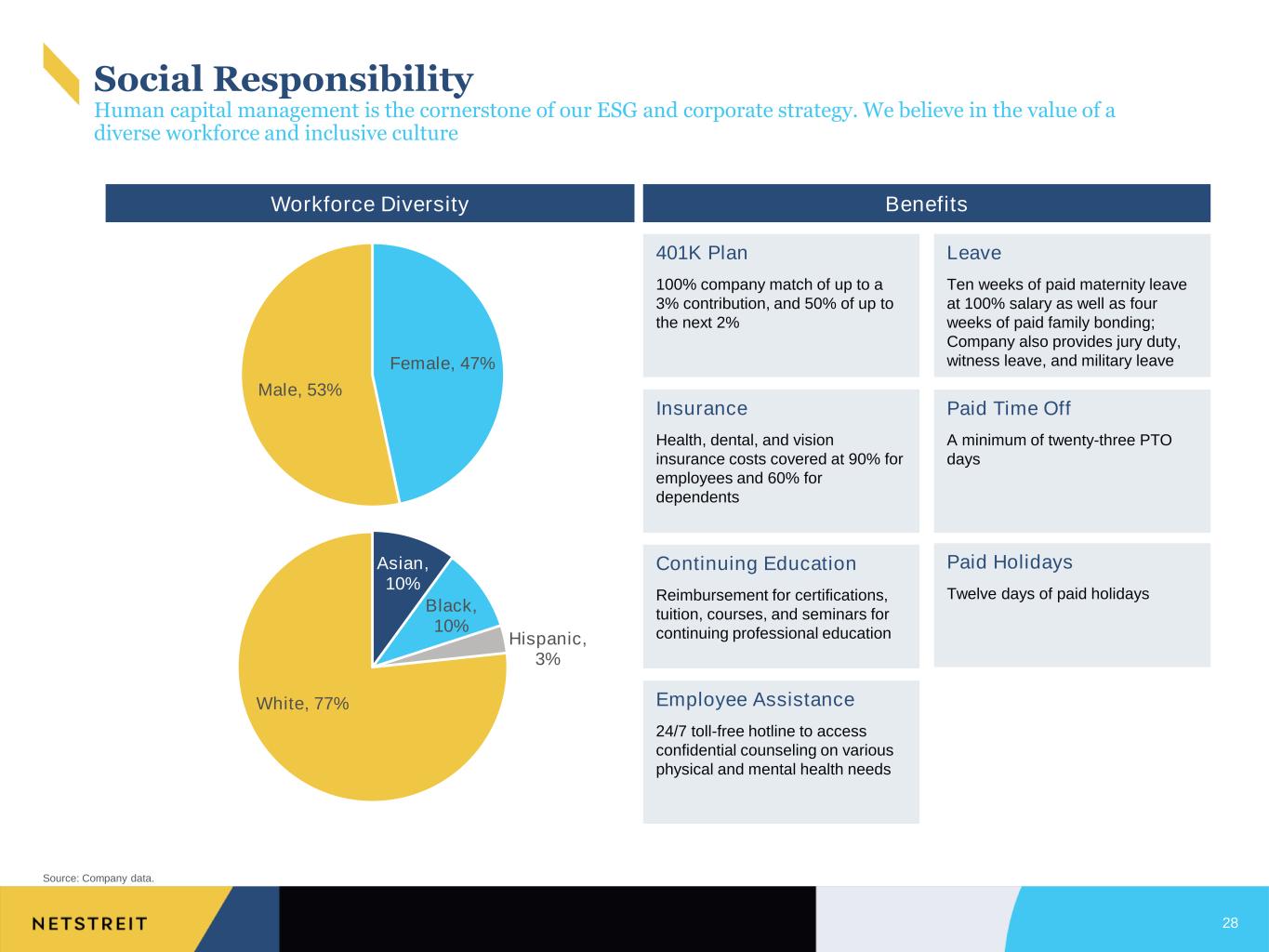

28 401K Plan 100% company match of up to a 3% contribution, and 50% of up to the next 2% Insurance Health, dental, and vision insurance costs covered at 90% for employees and 60% for dependents Leave Ten weeks of paid maternity leave at 100% salary as well as four weeks of paid family bonding; Company also provides jury duty, witness leave, and military leave Paid Time Off A minimum of twenty-three PTO days Paid Holidays Twelve days of paid holidays Employee Assistance 24/7 toll-free hotline to access confidential counseling on various physical and mental health needs Continuing Education Reimbursement for certifications, tuition, courses, and seminars for continuing professional education BenefitsWorkforce Diversity Source: Company data. Female, 47% Male, 53% Asian, 10% Black, 10% Hispanic, 3% White, 77% Social Responsibility Human capital management is the cornerstone of our ESG and corporate strategy. We believe in the value of a diverse workforce and inclusive culture

29 Source: Company data. Annual Director Elections Majority Voting Standard For Election of Directors Director Resignation Policy Annual Director and Committee Assessments No poison pill or differential voting stock structure to chill shareholder participation Shareholders’ right to amend the charter and bylaws by simple majority vote Separate non-executive Chair and CEO roles and Lead Independent Director with strong role and significant governance duties Governance Highlights Board Independence and Diversity 86% Independent Directors 50% Diverse Independent Directors 43% Female Directors 4 Fully Independent Committees Corporate Governance We are committed to acting with honesty and integrity and conducting all corporate opportunities in an ethical manner

30 Financial Information and Non-GAAP Reconciliations

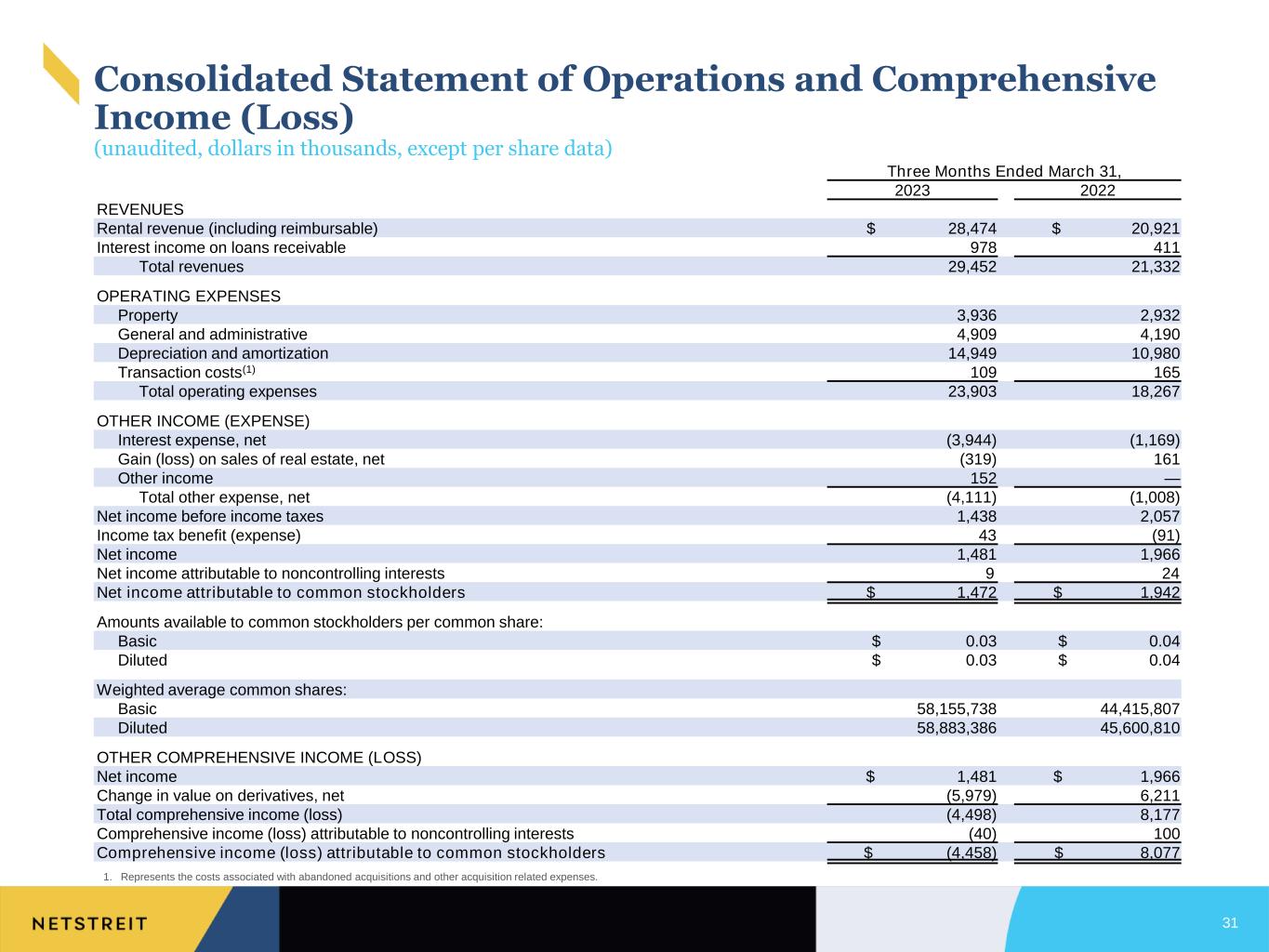

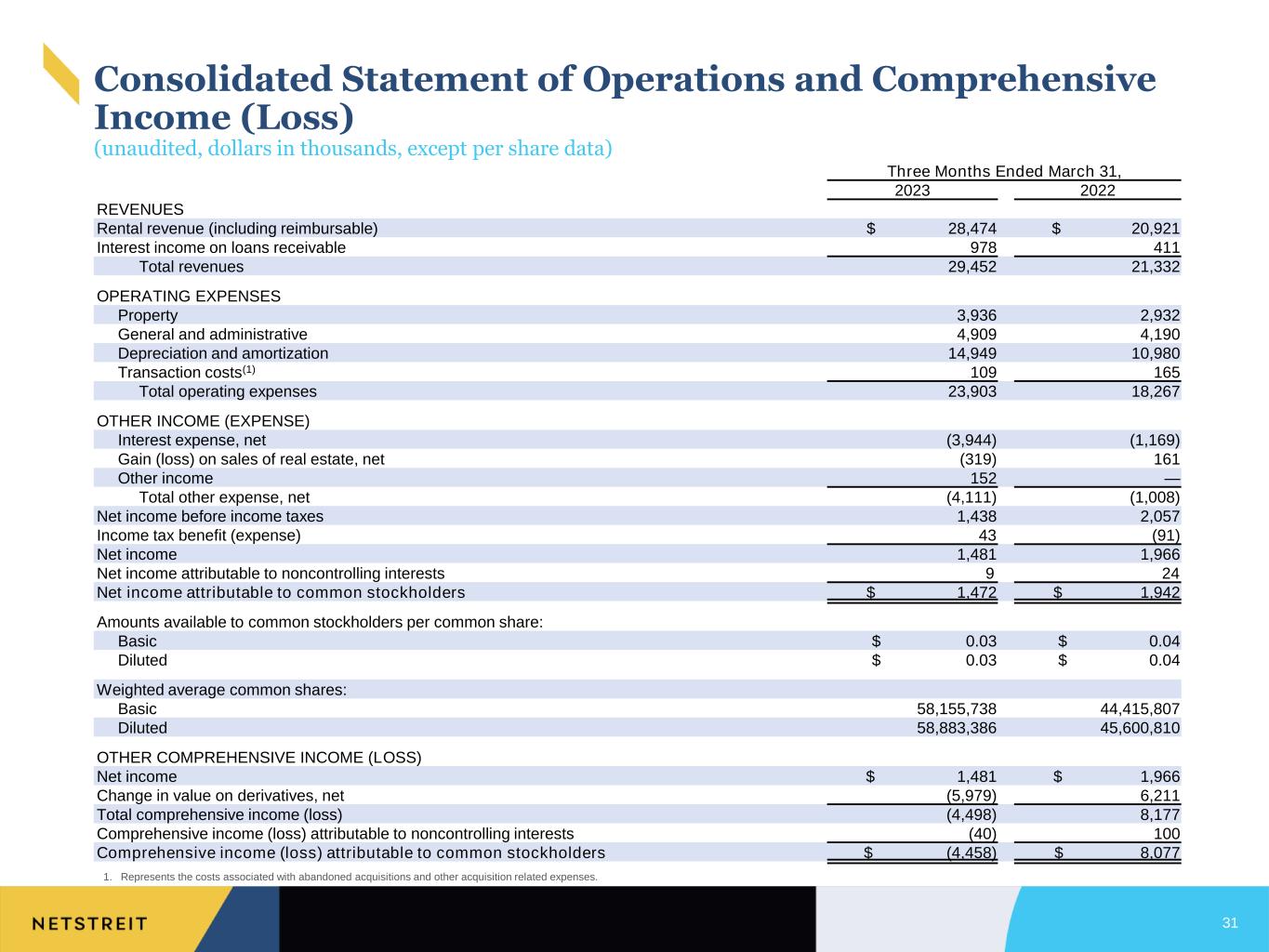

Three Months Ended March 31, 2023 2022 REVENUES Rental revenue (including reimbursable) $ 28,474 $ 20,921 Interest income on loans receivable 978 411 Total revenues 29,452 21,332 OPERATING EXPENSES Property 3,936 2,932 General and administrative 4,909 4,190 Depreciation and amortization 14,949 10,980 Transaction costs(1) 109 165 Total operating expenses 23,903 18,267 OTHER INCOME (EXPENSE) Interest expense, net (3,944) (1,169) Gain (loss) on sales of real estate, net (319) 161 Other income 152 — Total other expense, net (4,111) (1,008) Net income before income taxes 1,438 2,057 Income tax benefit (expense) 43 (91) Net income 1,481 1,966 Net income attributable to noncontrolling interests 9 24 Net income attributable to common stockholders $ 1,472 $ 1,942 Amounts available to common stockholders per common share: Basic $ 0.03 $ 0.04 Diluted $ 0.03 $ 0.04 Weighted average common shares: Basic 58,155,738 44,415,807 Diluted 58,883,386 45,600,810 OTHER COMPREHENSIVE INCOME (LOSS) Net income $ 1,481 $ 1,966 Change in value on derivatives, net (5,979) 6,211 Total comprehensive income (loss) (4,498) 8,177 Comprehensive income (loss) attributable to noncontrolling interests (40) 100 Comprehensive income (loss) attributable to common stockholders $ (4,458) $ 8,077 1. Represents the costs associated with abandoned acquisitions and other acquisition related expenses. Consolidated Statement of Operations and Comprehensive Income (Loss) (unaudited, dollars in thousands, except per share data) 31

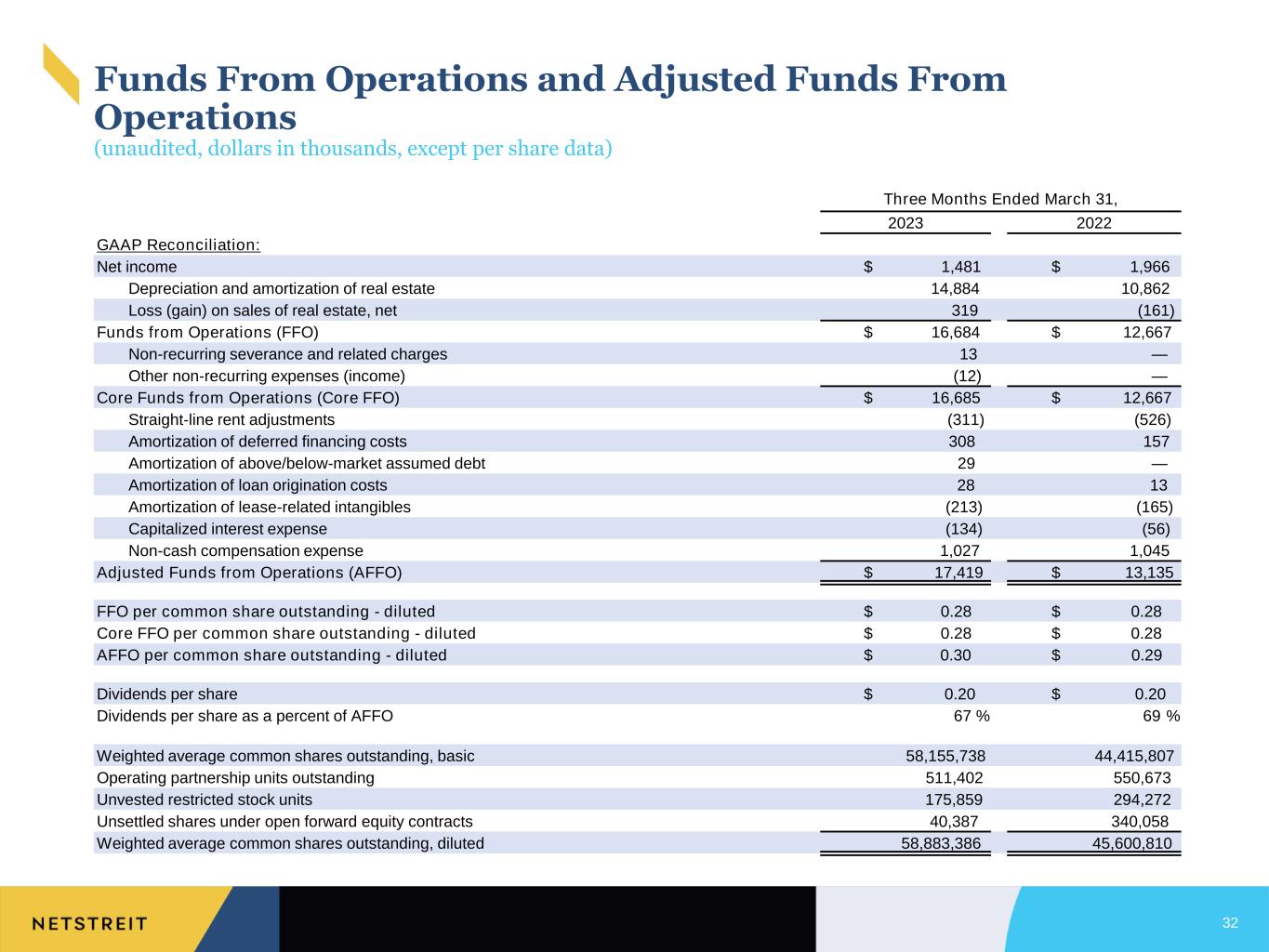

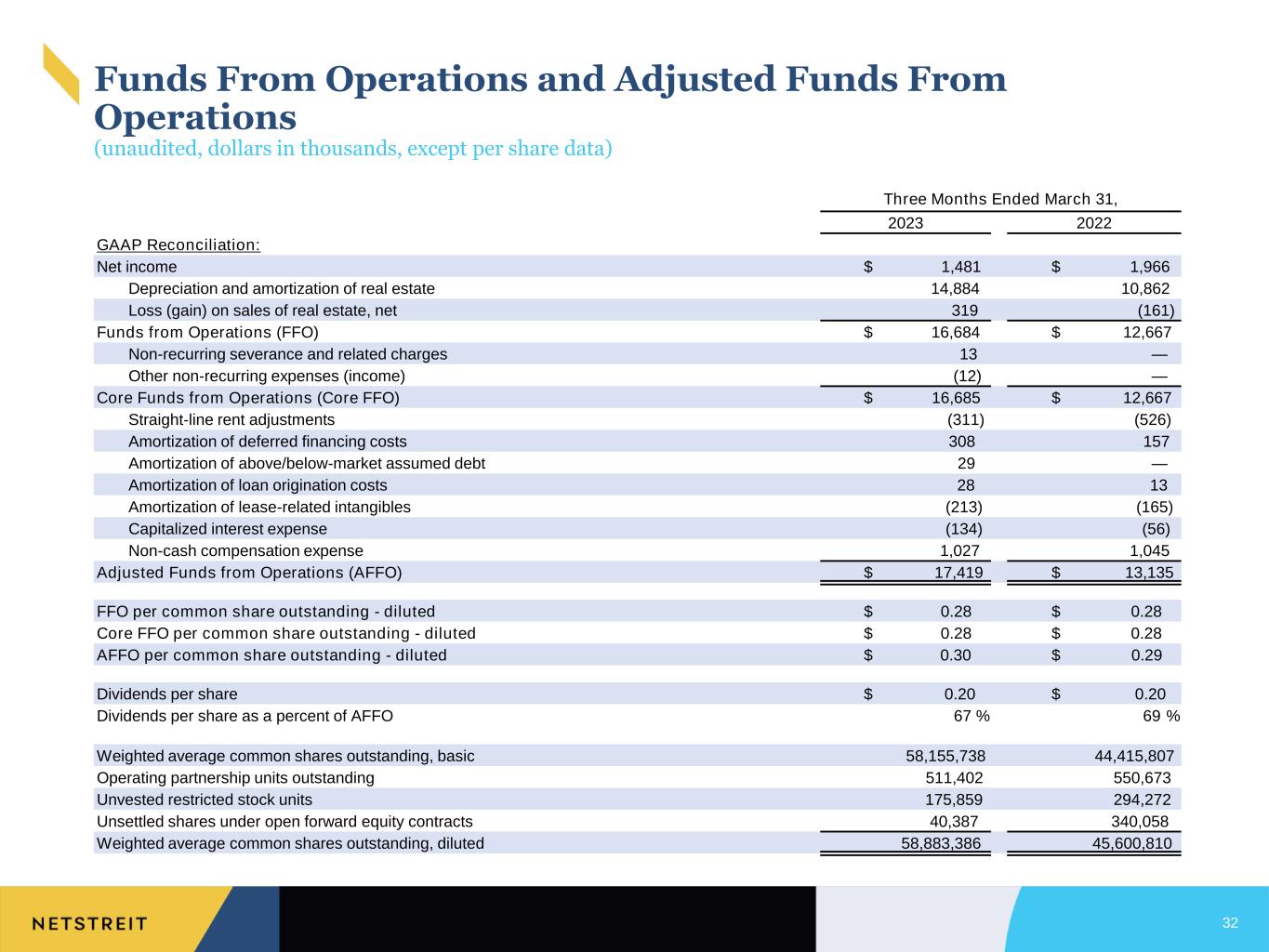

Three Months Ended March 31, 2023 2022 GAAP Reconciliation: Net income $ 1,481 $ 1,966 Depreciation and amortization of real estate 14,884 10,862 Loss (gain) on sales of real estate, net 319 (161) Funds from Operations (FFO) $ 16,684 $ 12,667 Non-recurring severance and related charges 13 — Other non-recurring expenses (income) (12) — Core Funds from Operations (Core FFO) $ 16,685 $ 12,667 Straight-line rent adjustments (311) (526) Amortization of deferred financing costs 308 157 Amortization of above/below-market assumed debt 29 — Amortization of loan origination costs 28 13 Amortization of lease-related intangibles (213) (165) Capitalized interest expense (134) (56) Non-cash compensation expense 1,027 1,045 Adjusted Funds from Operations (AFFO) $ 17,419 $ 13,135 FFO per common share outstanding - diluted $ 0.28 $ 0.28 Core FFO per common share outstanding - diluted $ 0.28 $ 0.28 AFFO per common share outstanding - diluted $ 0.30 $ 0.29 Dividends per share $ 0.20 $ 0.20 Dividends per share as a percent of AFFO 67 % 69 % Weighted average common shares outstanding, basic 58,155,738 44,415,807 Operating partnership units outstanding 511,402 550,673 Unvested restricted stock units 175,859 294,272 Unsettled shares under open forward equity contracts 40,387 340,058 Weighted average common shares outstanding, diluted 58,883,386 45,600,810 Funds From Operations and Adjusted Funds From Operations (unaudited, dollars in thousands, except per share data) 32

1. The adjustment removes base rent and interest income for new investments completed during the period shown and replaces the removed amount with an estimated equivalent amount for the for the full period shown. The adjustment also removes base rent for properties disposed of during the period shown. Three Months Ended March 31, 2023 2022 GAAP Reconciliation: Net income $ 1,481 $ 1,966 Depreciation and amortization of real estate 14,884 10,862 Amortization of lease-related intangibles (213) (165) Non-real estate depreciation and amortization 65 117 Interest expense, net 3,944 1,169 Income tax (benefit) expense (43) 91 Amortization of loan origination costs 28 13 EBITDA 20,146 14,053 Loss (gain) on sales of real estate, net 319 (161) EBITDAre 20,465 13,892 Straight-line rent adjustments (311) (526) Non-recurring severance and related charges 13 — Other non-recurring expenses (income) (12) — Non-cash compensation expense 1,027 1,045 Adjusted EBITDAre $ 21,182 $ 14,411 Adjusted EBITDAre $ 21,182 Adjustments for intraquarter investment activities(1) 1,862 Annualized Adjusted EBITDAre $ 92,176 472,876 Net debt / Annualized Adjusted EBITDAre 5.1x 0.00513 Pro forma Net debt / Annualized Adjusted EBITDAre 4.1x EBITDAre and Adjusted EBITDAre (unaudited, dollars in thousands) 33

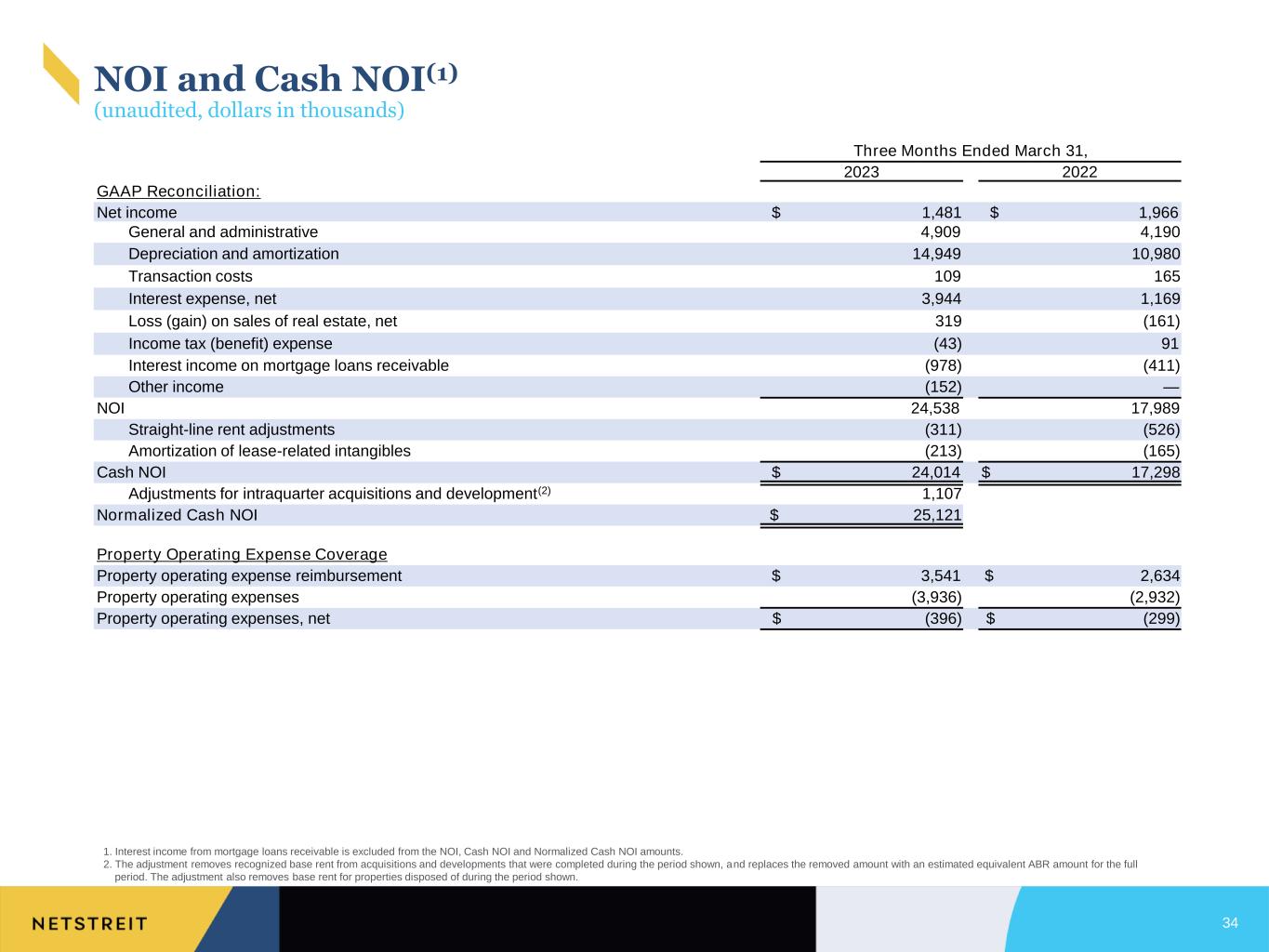

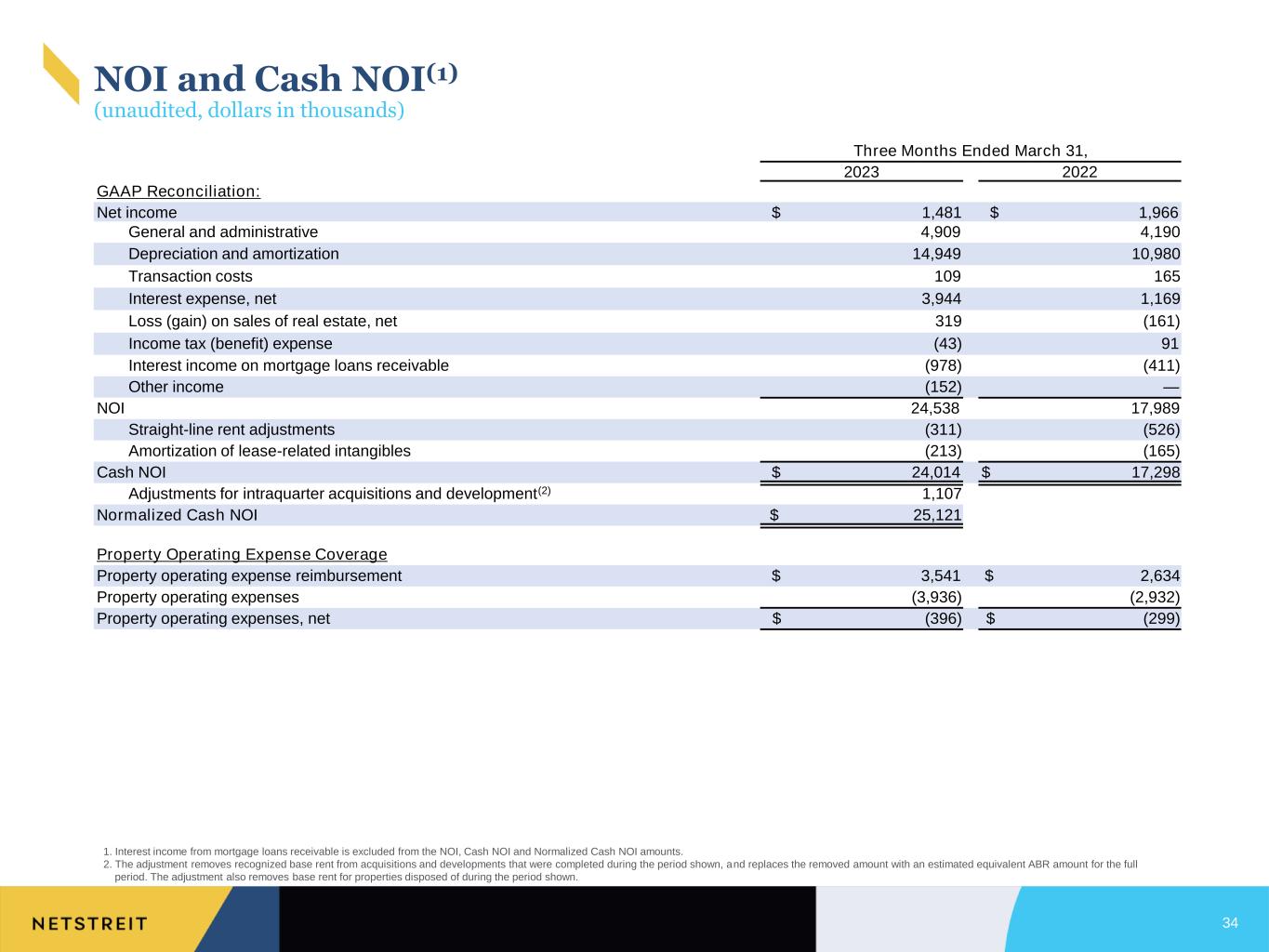

1. Interest income from mortgage loans receivable is excluded from the NOI, Cash NOI and Normalized Cash NOI amounts. 2. The adjustment removes recognized base rent from acquisitions and developments that were completed during the period shown, and replaces the removed amount with an estimated equivalent ABR amount for the full period. The adjustment also removes base rent for properties disposed of during the period shown. Three Months Ended March 31, 2023 2022 GAAP Reconciliation: Net income $ 1,481 $ 1,966 General and administrative 4,909 4,190 Depreciation and amortization 14,949 10,980 Transaction costs 109 165 Interest expense, net 3,944 1,169 Loss (gain) on sales of real estate, net 319 (161) Income tax (benefit) expense (43) 91 Interest income on mortgage loans receivable (978) (411) Other income (152) — NOI 24,538 17,989 Straight-line rent adjustments (311) (526) Amortization of lease-related intangibles (213) (165) Cash NOI $ 24,014 $ 17,298 Adjustments for intraquarter acquisitions and development(2) 1,107 Normalized Cash NOI $ 25,121 Property Operating Expense Coverage Property operating expense reimbursement $ 3,541 $ 2,634 Property operating expenses (3,936) (2,932) Property operating expenses, net $ (396) $ (299) NOI and Cash NOI(1) (unaudited, dollars in thousands) 34

March 31, 2023 December 31, 2022 ASSETS Real estate, at cost: Land $ 417,704 $ 401,146 Buildings and improvements 966,743 907,084 Total real estate, at cost 1,384,447 1,308,230 Less accumulated depreciation (72,682) (62,526) Property under development 6,501 16,796 Real estate held for investment, net 1,318,266 1,262,500 Assets held for sale 5,798 23,208 Mortgage loans receivable, net 92,267 46,378 Cash, cash equivalents and restricted cash 6,596 70,543 Lease intangible assets, net 154,213 151,006 Other assets, net 50,242 52,057 Total assets $ 1,627,382 $ 1,605,692 LIABILITIES AND EQUITY Liabilities: Term loans, net $ 373,415 $ 373,296 Revolving credit facility 96,000 113,000 Mortgage note payable, net 7,901 7,896 Lease intangible liabilities, net 29,348 30,131 Liabilities related to assets held for sale 34 406 Accounts payable, accrued expenses and other liabilities 25,062 22,540 Total liabilities 531,760 547,269 Equity: Stockholders’ equity Common stock, $0.01 par value, 400,000,000 shares authorized; 60,862,466 and 58,031,879 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively 609 580 Additional paid-in capital 1,145,160 1,091,514 Distributions in excess of retained earnings (77,237) (66,937) Accumulated other comprehensive income 17,743 23,673 Total stockholders’ equity 1,086,275 1,048,83 Noncontrolling interests 9,347 9,593 Total equity 1,095,622 1,058,423 Total liabilities and equity $ 1,627,382 $ 1,605,692 Consolidated Balance Sheets (unaudited, dollars in thousands, except per share data) 35

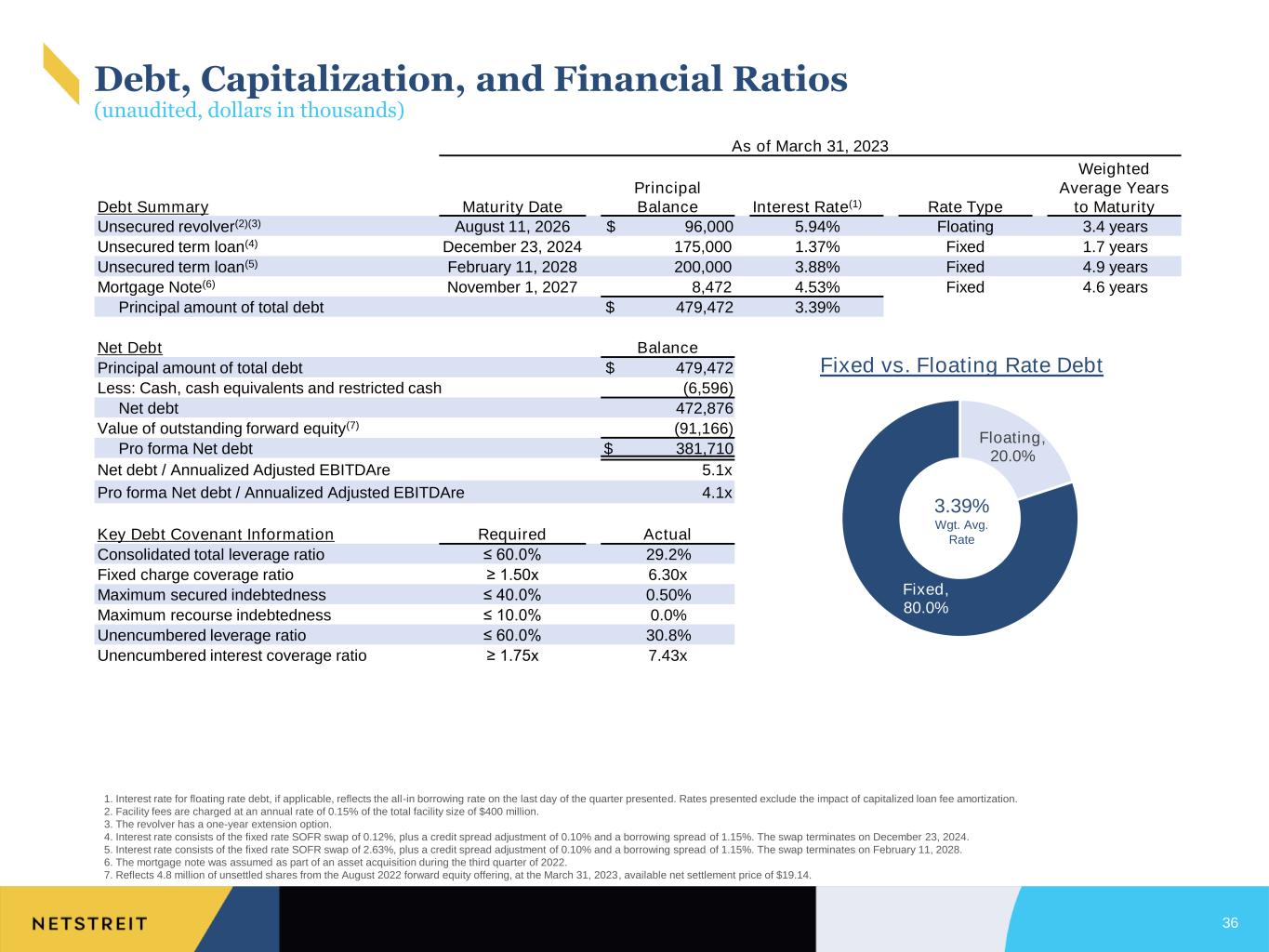

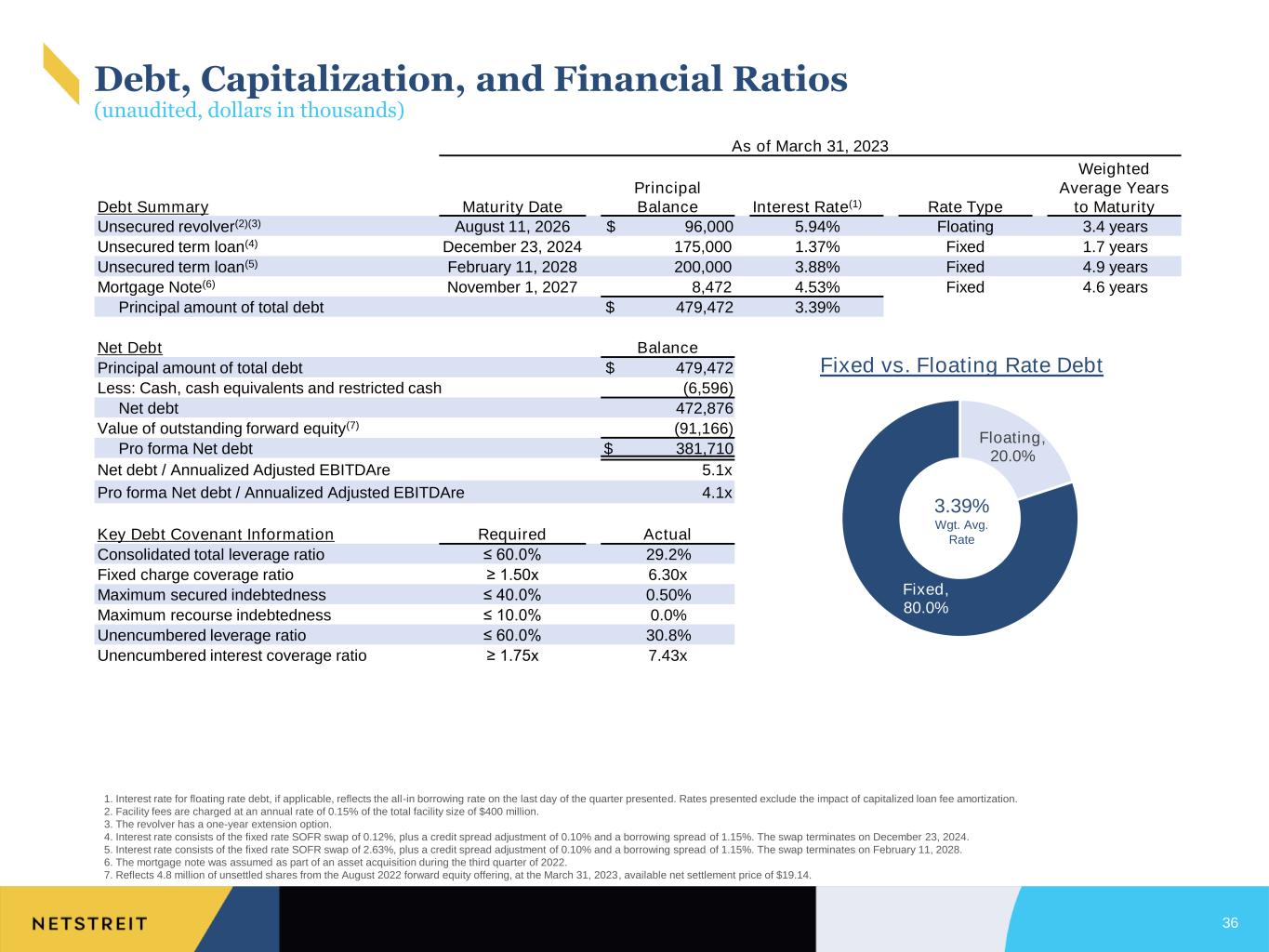

As of March 31, 2023 Debt Summary Maturity Date Principal Balance Interest Rate(1) Rate Type Weighted Average Years to Maturity Unsecured revolver(2)(3) August 11, 2026 $ 96,000 5.94% Floating 3.4 years Unsecured term loan(4) December 23, 2024 175,000 1.37% Fixed 1.7 years Unsecured term loan(5) February 11, 2028 200,000 3.88% Fixed 4.9 years Mortgage Note(6) November 1, 2027 8,472 4.53% Fixed 4.6 years Principal amount of total debt $ 479,472 3.39% Net Debt Balance Principal amount of total debt $ 479,472 Less: Cash, cash equivalents and restricted cash (6,596) Net debt 472,876 Value of outstanding forward equity(7) (91,166) Pro forma Net debt $ 381,710 Net debt / Annualized Adjusted EBITDAre 5.1x Pro forma Net debt / Annualized Adjusted EBITDAre 4.1x Key Debt Covenant Information Required Actual Consolidated total leverage ratio ≤ 60.0% 29.2% Fixed charge coverage ratio ≥ 1.50x 6.30x Maximum secured indebtedness ≤ 40.0% 0.50% Maximum recourse indebtedness ≤ 10.0% 0.0% Unencumbered leverage ratio ≤ 60.0% 30.8% Unencumbered interest coverage ratio ≥ 1.75x 7.43x 1. Interest rate for floating rate debt, if applicable, reflects the all-in borrowing rate on the last day of the quarter presented. Rates presented exclude the impact of capitalized loan fee amortization. 2. Facility fees are charged at an annual rate of 0.15% of the total facility size of $400 million. 3. The revolver has a one-year extension option. 4. Interest rate consists of the fixed rate SOFR swap of 0.12%, plus a credit spread adjustment of 0.10% and a borrowing spread of 1.15%. The swap terminates on December 23, 2024. 5. Interest rate consists of the fixed rate SOFR swap of 2.63%, plus a credit spread adjustment of 0.10% and a borrowing spread of 1.15%. The swap terminates on February 11, 2028. 6. The mortgage note was assumed as part of an asset acquisition during the third quarter of 2022. 7. Reflects 4.8 million of unsettled shares from the August 2022 forward equity offering, at the March 31, 2023, available net settlement price of $19.14. Floating, 20.0% Fixed, 80.0% 3.39% Wgt. Avg. Rate Debt, Capitalization, and Financial Ratios (unaudited, dollars in thousands) Fixed vs. Floating Rate Debt 36

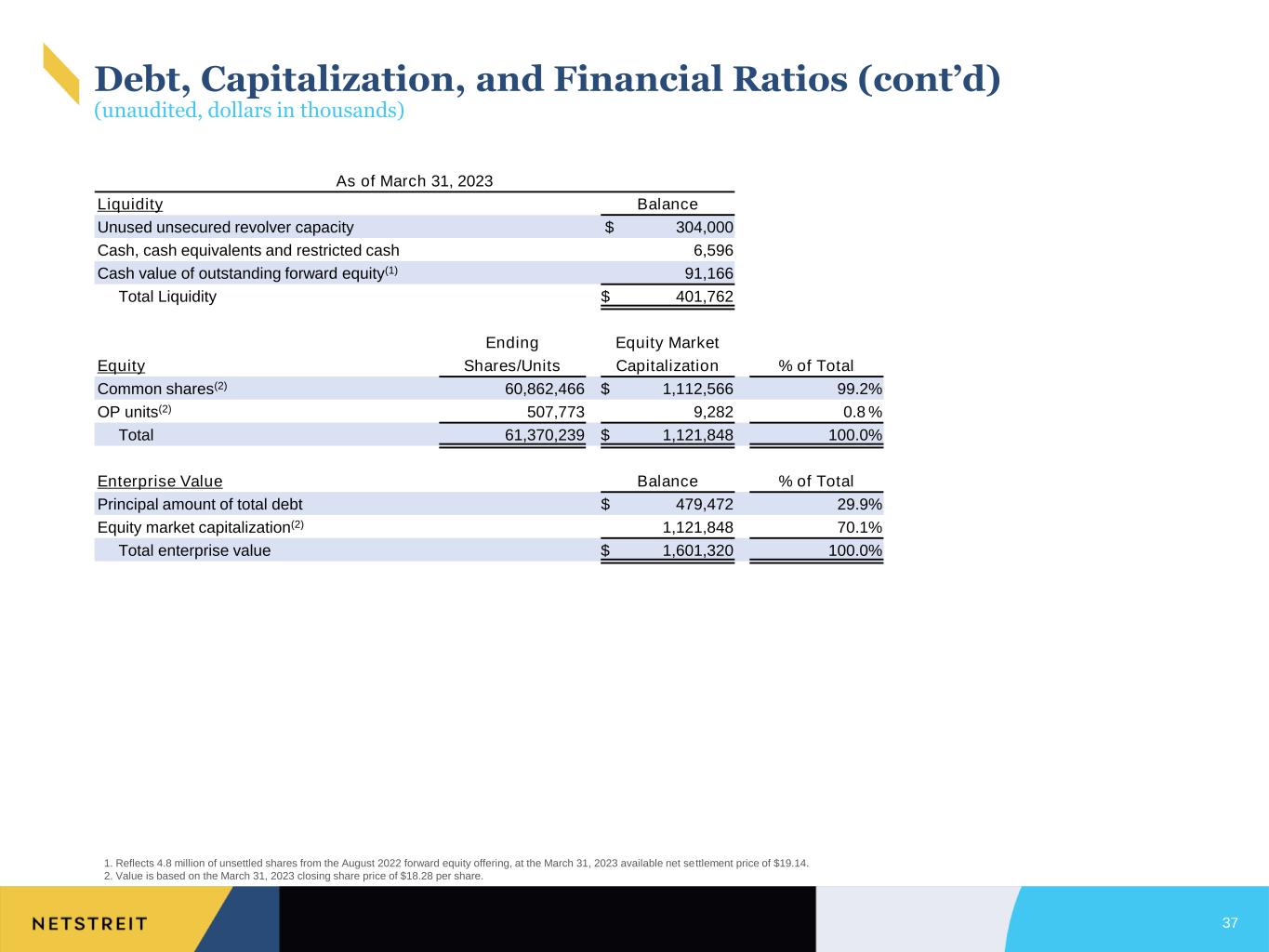

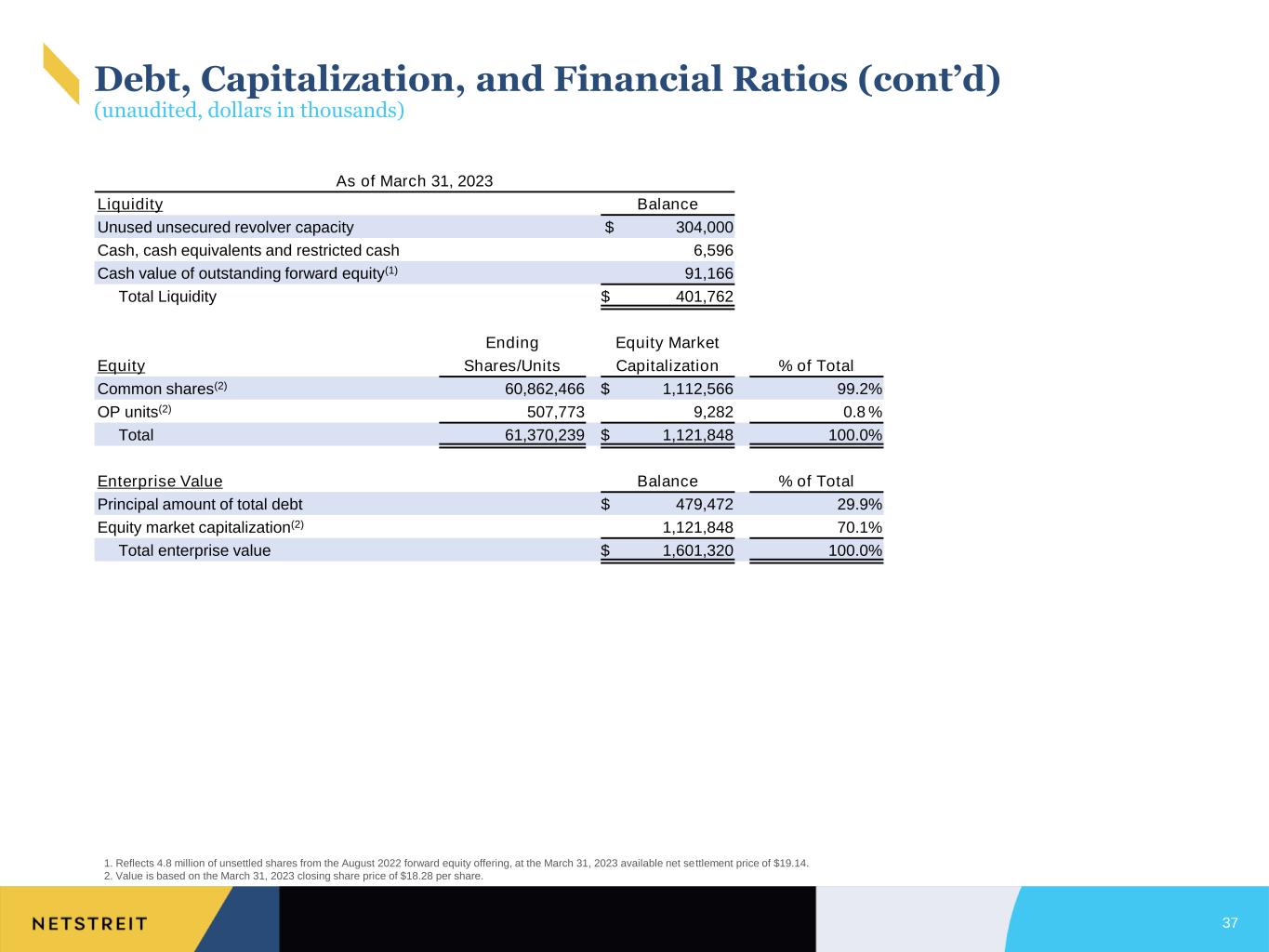

As of March 31, 2023 Liquidity Balance Unused unsecured revolver capacity $ 304,000 Cash, cash equivalents and restricted cash 6,596 Cash value of outstanding forward equity(1) 91,166 Total Liquidity $ 401,762 Ending Equity Market Equity Shares/Units Capitalization % of Total Common shares(2) 60,862,466 $ 1,112,566 99.2% OP units(2) 507,773 9,282 0.8 % Total 61,370,239 $ 1,121,848 100.0% Enterprise Value Balance % of Total Principal amount of total debt $ 479,472 29.9% Equity market capitalization(2) 1,121,848 70.1% Total enterprise value $ 1,601,320 100.0% 1. Reflects 4.8 million of unsettled shares from the August 2022 forward equity offering, at the March 31, 2023 available net settlement price of $19.14. 2. Value is based on the March 31, 2023 closing share price of $18.28 per share. Debt, Capitalization, and Financial Ratios (cont’d) (unaudited, dollars in thousands) 37

Non-GAAP Measures and Definitions FFO, Core FFO, and AFFO FFO means funds from operations. It is a non-GAAP measure defined by NAREIT as net income (computed in accordance with GAAP). Our FFO is net income in accordance with GAAP, excluding gains (or losses) resulting from dispositions of properties, plus depreciation and amortization and impairment charges on depreciable real property. Core FFO means core funds from operations. Core FFO is a non-GAAP financial measure defined as FFO adjusted to remove the effect of unusual and non-recurring items that are not expected to impact our operating performance or operations on an ongoing basis. These have included non-recurring severance and related charges and gains on insurance proceeds. AFFO means adjusted funds from operations. AFFO is a non-GAAP financial measure defined as Core FFO adjusted for GAAP net income related to non-cash revenues and expenses, such as straight-line rent, amortization of lease-related intangibles, capitalized interest expense, non-cash compensation expense, and amortization of deferred financing, amortization of above/below-market assumed debt, and amortization of loan origination costs. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values historically have risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO to be useful in evaluating potential property acquisitions and measuring operating performance. We further consider FFO, Core FFO and AFFO to be useful in determining funds available for payment of distributions. FFO, Core FFO and AFFO do not represent net income or cash flows from operations as defined by GAAP. You should not consider FFO, Core FFO and AFFO to be alternatives to net income as a reliable measure of our operating performance; nor should you consider FFO, Core FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity. FFO, Core FFO and AFFO do not measure whether cash flow is sufficient to fund our cash needs, including principal amortization, capital improvements and distributions to stockholders. FFO, Core FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined by GAAP. Further, FFO, Core FFO and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO, Core FFO and AFFO. EBITDA, EBITDAre, Adjusted EBITDAre and Annualized Adjusted EBITDAre EBITDA is computed by us as earnings before interest expense, income tax expense and depreciation and amortization. EBITDAre is the NAREIT definition of EBITDA (as defined above), but it is further adjusted to follow the definition included in a white paper issued in 2017 by NAREIT, which recommended that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from sales of depreciable property and impairment charges on depreciable real property. Adjusted EBITDAre, as computed by us, is EBITDAre adjusted to exclude straight-line rent, non-cash compensation expense, non-recurring severance and related charges, and gain on insurance proceeds. 38

Annualized Adjusted EBITDAre is Adjusted EBITDAre, plus adjustments for intraquarter investment activity, multiplied by four. We present EBITDA, EBITDAre and Adjusted EBITDAre as they are measures commonly used in our industry. We believe that these measures are useful to investors and analysts because they provide supplemental information concerning our operating performance, exclusive of certain non-cash items and other costs. We use EBITDA and EBITDAre as measures of our operating performance and not as measures of liquidity. EBITDA, EBITDAre and Adjusted EBITDAre do not include all items of revenue and expense included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Additionally, our computation of EBITDA and EBITDAre may differ from the methodology for calculating these metrics used by other equity REITs and, therefore, may not be comparable to similarly titled measures reported by other equity REITs. NOI, Cash NOI, and Normalized Cash NOI NOI means net operating income, and it is computed in accordance with GAAP. We compute NOI as net income (computed in accordance with GAAP), excluding general and administrative expenses, interest expenses (or income), income tax expense, transaction costs, depreciation and amortization, gains (or losses) from the sales of depreciable property, real estate impairment losses, interest income on mortgage loans receivable, and other income (or expense). Cash NOI is computed by us as NOI excluding straight-line rent and amortization of lease-related intangibles. We believe NOI and Cash NOI provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis. NOI and Cash NOI are not measurements of financial performance under GAAP, and our NOI and Cash NOI may not be comparable to similarly titled measures of other companies. You should not consider our NOI and Cash NOI as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Normalized Cash NOI is computed by us as Cash NOI adjusted to remove recognized base rent from acquisitions and development that were completed during the period shown, and then replace the removed amount with an estimated equivalent ABR for the full period. It is further adjusted to remove base rent for properties disposed of during the period shown. Other Definitions ABR means annualized base rent. ABR is annualized contractual base rent in place as of the most recent quarter end for all leases that commenced as of that date, and annualized cash interest on mortgage loans receivable in place as of that date. Cash Yield is the annualized base rent contractually due from acquired properties, completed developments, and interest income from mortgage loans receivable, divided by the gross investment amount, or gross proceeds in the case of dispositions. Non-GAAP Measures and Definitions (cont’d) 39

Defensive Category is considered by us to represent tenants that focus on necessity goods and essential services in the retail sector, including discount stores, grocers, drug stores and pharmacies, home improvement, automotive service and quick-service restaurants, which we refer to as defensive retail industries. The defensive sub-categories as we define them are as follows: (1) Necessity, which are retailers that are considered essential by consumers and include sectors such as drug stores, grocers and home improvement, (2) Discount, which are retailers that offer a low price point and consist of off-price and dollar stores, (3) Service, which consist of retailers that provide services rather than goods, including, tire and auto services and quick service restaurants, and (4) Other, which are retailers that are not considered defensive in terms of being considered necessity, discount or service, as defined by us. Investments are lease agreements in place at owned properties, properties that have leases associated with mortgage loans receivable, or in the case of master lease arrangements each property under the master lease is counted as a separate lease. Investment Grade (Rated) represents tenants, or tenants that are subsidiaries of a parent entity with a credit rating of BBB- (S&P/Fitch), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher. Investment Grade Profile (Unrated) represents tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody’s, Fitch or NAIC. Net Debt is a non-GAAP measure computed by us as the principal amount of total debt outstanding less cash, cash equivalents, and restricted cash. Occupancy is expressed as a percentage, and it is the number of economically occupied properties divided by the total number of properties owned. Mortgage loans receivable and properties under development are excluded from the calculation. OP Units means operating partnership units not held by NETSTREIT. Pro forma Net Debt is a non-GAAP measure adjusted for the value of forward equity contracts as of the prior period end. Sub-Investment Grade (Rated) represents tenants or tenants that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BB+ (S&P/Fitch), Ba1 (Moody’s) or NAIC3 (National Association of Insurance Commissioners) or lower. Non-GAAP Measures and Definitions (cont’d) 40

41 Investor Relations ir@netstreit.com 972-597-4825