Exhibit 10.4

ACAR LEASING LTD.,

as the Titling Trust,

GM FINANCIAL,

as Servicer,

APGO TRUST, as Settlor,

and

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Collateral Agent and Indenture Trustee

2020-1 SERVICING SUPPLEMENT

Dated as of January 2, 2020

TABLE OF CONTENTS

| Page | ||||||

ARTICLE I DEFINITIONS AND INTERPRETIVE PROVISIONS | 1 | |||||

SECTION 1.1. | General Definitions | 1 | ||||

ARTICLE II SERVICING OF2020-1 DESIGNATED POOL | 2 | |||||

SECTION 2.1. | Servicing of2020-1 Designated Pool | 2 | ||||

SECTION 2.2. | Identification of2020-1 Lease Agreements and2020-1 Leased Vehicles; Securitization Value | 2 | ||||

SECTION 2.3. | Accounts | 2 | ||||

SECTION 2.4. | General Provisions Regarding Accounts | 4 | ||||

SECTION 2.5. | Reallocation and Repurchase of2020-1 Lease Agreements and2020-1 Leased Vehicles; Purchase of Matured Vehicles | 5 | ||||

SECTION 2.6. | 2020-1 Designated Pool Collections | 7 | ||||

SECTION 2.7. | Servicing Compensation; Expenses | 8 | ||||

SECTION 2.8. | Third Party Claims | 8 | ||||

SECTION 2.9. | Reporting by the Servicer; Delivery of Certain Documentation; Inspection; Asset-Level Information | 8 | ||||

SECTION 2.10. | Annual Independent Accountant’s Report | 9 | ||||

SECTION 2.11. | Servicer Defaults; Termination of the Servicer | 10 | ||||

SECTION 2.12. | Representations and Warranties | 12 | ||||

SECTION 2.13. | Custody of Lease Documents | 13 | ||||

SECTION 2.14. | Reserve Account | 13 | ||||

SECTION 2.15. | Liability of Successor Servicer | 14 | ||||

SECTION 2.16. | Merger or Consolidation of, or Assumption of Obligations of the Servicer | 14 | ||||

SECTION 2.17. | Resignation of the Servicer | 15 | ||||

SECTION 2.18. | Separate Existence | 15 | ||||

SECTION 2.19. | Like Kind Exchange Program; Pull Ahead Program | 15 | ||||

SECTION 2.20. | Dispute Resolution | 16 | ||||

ARTICLE III MISCELLANEOUS | 19 | |||||

SECTION 3.1. | Termination of2020-1 Servicing Supplement | 19 | ||||

SECTION 3.2. | Amendment | 19 | ||||

SECTION 3.3. | GOVERNING LAW | 20 | ||||

SECTION 3.4. | Relationship of2020-1 Servicing Supplement to Other Trust Documents | 20 | ||||

SECTION 3.5. | [Reserved] | 20 | ||||

SECTION 3.6. | Notices | 20 | ||||

SECTION 3.7. | Severability of Provisions | 20 | ||||

SECTION 3.8. | Binding Effect | 21 | ||||

i

SECTION 3.9. | Table of Contents and Headings | 21 | ||||

SECTION 3.10. | Counterparts | 21 | ||||

SECTION 3.11. | Further Assurances | 21 | ||||

SECTION 3.12. | Third-Party Beneficiaries | 21 | ||||

SECTION 3.13. | No Petition | 21 | ||||

SECTION 3.14. | Limitation of Liability | 21 | ||||

SECTION 3.15. | Preparation of Securities and Exchange Commission Filings | 22 | ||||

SECTION 3.16. | Review Reports | 22 | ||||

SECTION 3.17. | Regulation RR Risk Retention | 22 |

EXHIBITS

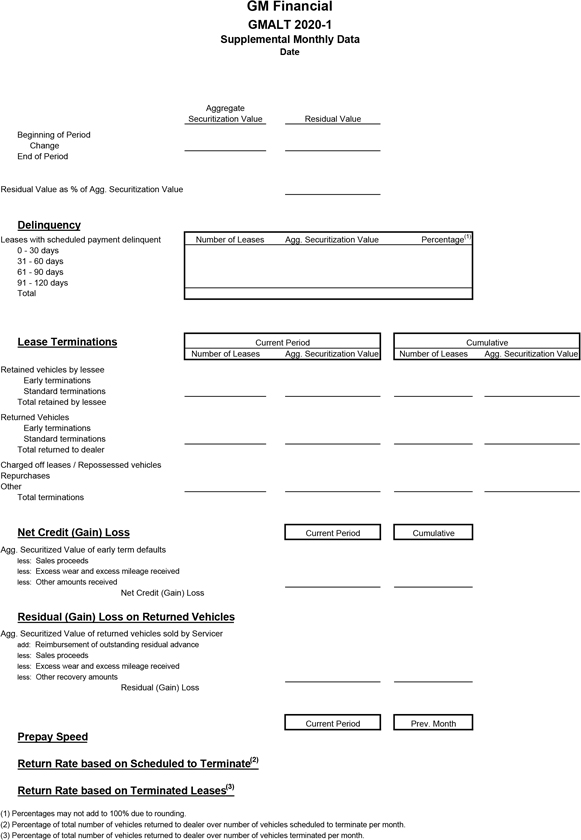

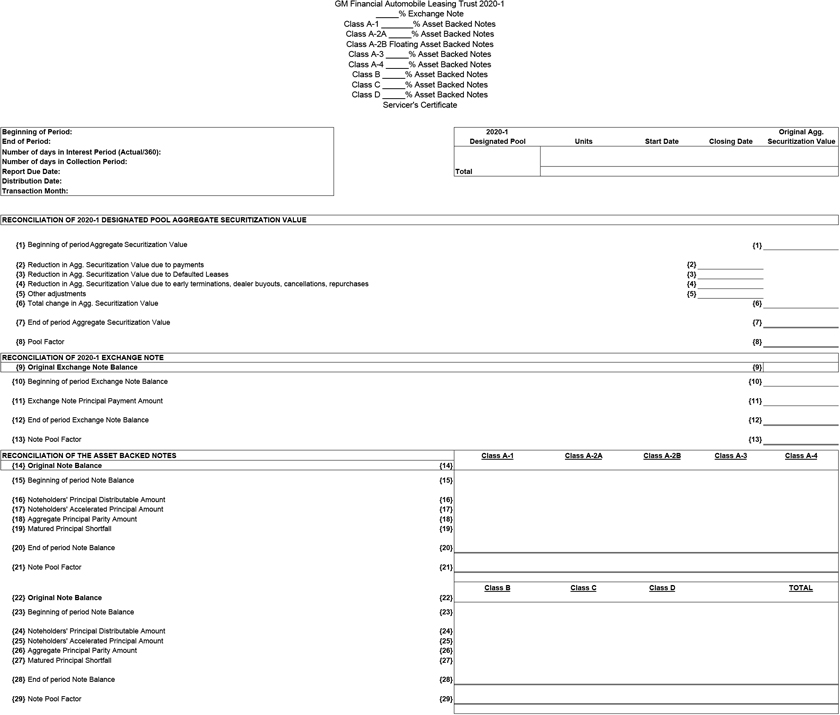

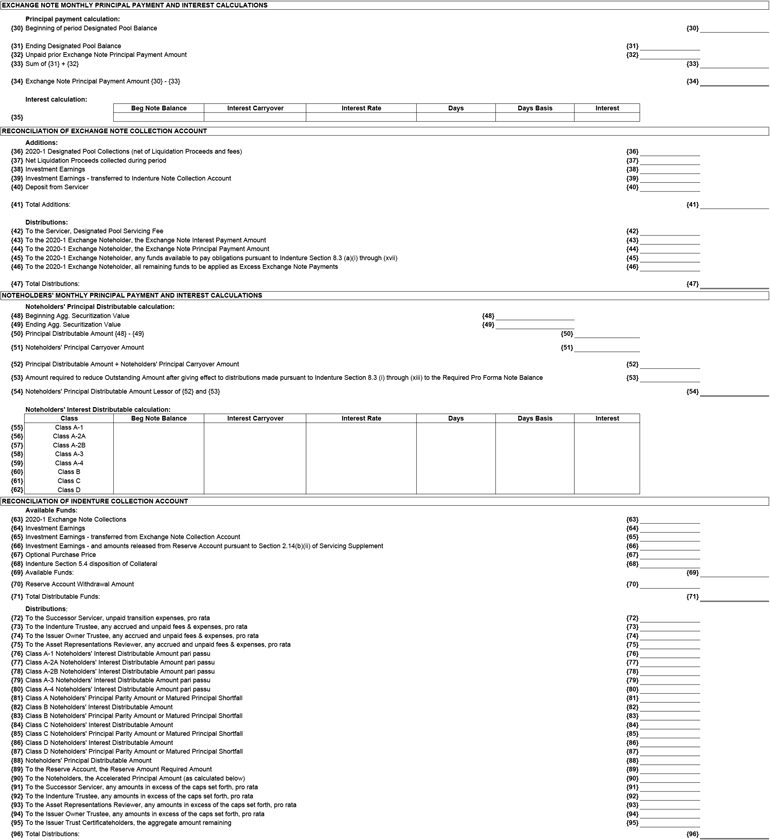

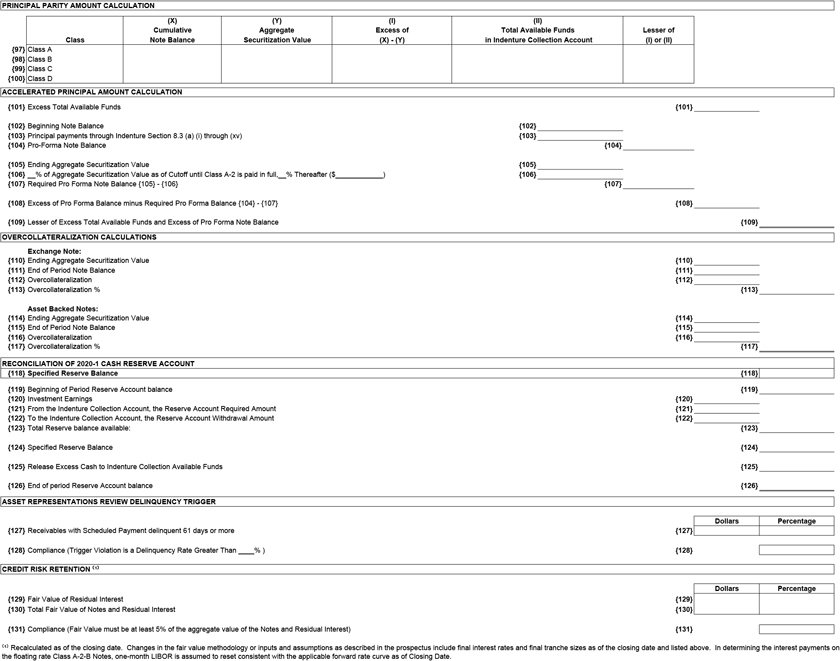

Exhibit A – | Form of Servicer Report | A-1 |

ii

2020-1 SERVICING SUPPLEMENT, dated as of January 2, 2020 (as the same may be amended, restated, supplemented or otherwise modified from time to time, this “2020-1 Servicing Supplement” or this “Agreement”), among ACAR Leasing Ltd., a Delaware statutory trust (the “Titling Trust”), AmeriCredit Financial Services, Inc. d/b/a GM Financial, a Delaware corporation (“GM Financial”), as servicer (in such capacity, the “Servicer”), APGO Trust (“APGO”), a Delaware statutory trust, as settlor of the Titling Trust (in such capacity, the “Settlor”), and Wells Fargo Bank, National Association (“Wells Fargo”), a national banking association, as collateral agent (in such capacity, the “Collateral Agent”) and indenture trustee (the “Indenture Trustee”).

RECITALS

WHEREAS, pursuant to an Amended and Restated Trust Agreement, dated as of January 31, 2011 (the “Titling Trust Agreement”), between the Settlor and Wilmington Trust Company, as Owner Trustee, Administrative Trustee and Delaware Trustee, the Titling Trust was created to, among other things, take assignments and conveyances of and hold in trust various assets (the “Trust Assets”);

WHEREAS, the Titling Trust, the Servicer, the Settlor and the Collateral Agent, have entered into a Third Amended and Restated Servicing Agreement, dated as of January 24, 2018 (as the same may be further amended, restated, supplemented or otherwise modified from time to time, the “Basic Servicing Agreement”), which provides for, among other things, the servicing of the Trust Assets by the Servicer; and

WHEREAS, the parties hereto acknowledge that in connection with the execution of the2020-1 Exchange Note Supplement, dated as of January 2, 2020 (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “2020-1 Exchange Note Supplement”) to the Second Amended and Restated Credit and Security Agreement, dated as of January 24, 2018 (as the same may be further amended, restated, supplemented or otherwise modified from time to time, the “Credit and Security Agreement”), each among the Titling Trust, as borrower, GM Financial, as lender and Servicer, and Wells Fargo, as Administrative Agent and Collateral Agent, pursuant to which an Exchange Note (the “2020-1 Exchange Note”) will be created, it is necessary and desirable to enter into a supplement to the Basic Servicing Agreement to provide for, among other things, the servicing of the Trust Assets allocated to the2020-1 Designated Pool.

NOW, THEREFORE, in consideration of the mutual agreements herein contained, and of other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS AND INTERPRETIVE PROVISIONS

SECTION 1.1. General Definitions. Capitalized terms used in this2020-1 Servicing Supplement that are not otherwise defined herein shall have the meanings assigned to them in Appendix 1 to the2020-1 Exchange Note Supplement or, if not defined therein, in Appendix A

to the Credit and Security Agreement. The “Other Definitional Provisions” set forth in Section 1.2 of the Basic Servicing Agreement are incorporated by reference into this2020-1 Servicing Supplement.

ARTICLE II

SERVICING OF2020-1 DESIGNATED POOL

SECTION 2.1. Servicing of2020-1 Designated Pool. The parties hereto agree that the Servicer shall service, administer and make collections on the2020-1 Designated Pool in accordance with the terms and provisions of the Basic Servicing Agreement, as amended and supplemented by the terms and provisions of this2020-1 Servicing Supplement.

SECTION 2.2. Identification of2020-1 Lease Agreements and2020-1 Leased Vehicles; Securitization Value. On the Closing Date, the Servicer shall identify as2020-1 Exchange Note Assets the Lease Agreements and the Leased Vehicles relating to such Lease Agreements listed on the Schedule of2020-1 Lease Agreements and2020-1 Leased Vehicles attached as Schedule A to the2020-1 Exchange Note Supplement. The Servicer shall calculate the Securitization Value for each2020-1 Lease Agreement as of the Cutoff Date.

SECTION 2.3. Accounts.

(a) The Indenture Trustee shall establish and maintain, at all times during the term of the Indenture, a2020-1 Eligible Deposit Account in the name of and under the control of the Indenture Trustee for the benefit of the Noteholders (said account being called the “2020-1 Exchange Note Collections Account” and being initially identified as “GM Financial2020-1 Exchange Note Collections Account”). Deposits to and withdrawals from the2020-1 Exchange Note Collections Account shall be made as set forth in the2020-1 Servicing Agreement, the2020-1 Exchange Note Supplement and the Indenture.

(b) The Indenture Trustee shall establish and maintain, at all times during the term of the Indenture, a2020-1 Eligible Deposit Account in the name of and under the control of the Indenture Trustee for the benefit of the Noteholders (said account being called the “Indenture Collections Account” and being initially identified as “GM Financial2020-1 Indenture Collections Account”). Deposits to and withdrawals from the2020-1 Indenture Collections Account shall be made as set forth in the2020-1 Exchange Note Supplement and the Indenture.

(c) The Indenture Trustee shall establish and maintain, at all times during the term of the Indenture, a2020-1 Eligible Deposit Account in the name of and under the control of the Indenture Trustee for the benefit of the Noteholders (said account being called the “Note Payment Account” and being initially identified as “GM Financial2020-1 Note Payment Account”). Deposits to and withdrawals from the Note Payment Account shall be made as set forth in the Indenture.

(d) The Indenture Trustee shall establish and maintain, at all times during the term of the Indenture, a2020-1 Eligible Deposit Account in the name of and under control of the Indenture Trustee for the benefit of the Noteholders (said account being called the “Reserve Account” and being initially identified as “GM Financial2020-1 Reserve Account”).

2

(e) All monies deposited from time to time in the Accounts pursuant to this2020-1 Servicing Supplement and the other Program Documents and the Accounts shall be held by the Indenture Trustee as part of the Indenture Collateral and shall be applied to the purposes herein and therein provided. If any Account shall cease to be a2020-1 Eligible Deposit Account, the Indenture Trustee shall, as necessary, assist the Servicer in causing such Account to be moved to an institution at which it shall be a2020-1 Eligible Deposit Account.

(f) If, at any time, any of the Accounts ceases to be a2020-1 Eligible Deposit Account, the Servicer shall within thirty (30) days (or such longer period as to which the Rating Agencies rating any securities backed by the related Exchange Note may consent) establish a new Account as a2020-1 Eligible Deposit Account and shall transfer any cash and/or any investments on deposit or credited to such earlier existing Account into such new Account.

(g) The Indenture Trustee or other Person holding the Accounts shall be the “Securities Intermediary” with respect to the Accounts. If the Securities Intermediary in respect of the Accounts is not the Indenture Trustee, the Servicer shall obtain the express agreement of such Person to the obligations of the Securities Intermediary set forth in this Section 2.3(g). The Securities Intermediary agrees that:

(i) Each of the Accounts is an account to which “financial assets” within the meaning ofSection 8-102(a)(9) (“Financial Assets”) of the UCC in effect in the State of New York will be credited;

(ii) All securities or other property underlying any Financial Assets credited to any Account shall be registered in the name of the Securities Intermediary, endorsed to the Securities Intermediary or in blank or credited to another securities account maintained in the name of the Securities Intermediary and in no case will any Financial Asset credited to an Account be registered in the name of the Issuer, payable to the order of the Issuer or specially endorsed to the Issuer;

(iii) All property delivered to the Securities Intermediary pursuant to the2020-1 Servicing Agreement and the Indenture will be promptly credited to the applicable Account;

(iv) Each item of property (whether investment property, security, instrument or cash) credited to an Account shall be treated as a Financial Asset;

(v) If at any time the Securities Intermediary shall receive any order from the Indenture Trustee directing transfer or redemption of any Financial Asset relating to an Account, the Securities Intermediary shall comply with such entitlement order without further consent by the Issuer or the Servicer;

(vi) Each Account shall be governed by the laws of the State of New York, regardless of any provision of any other agreement. For purposes of the UCC, New York shall be deemed to be the Securities Intermediary’s jurisdiction and the Accounts (as well as the “securities entitlements” (as defined inSection 8-102(a)(17) of the UCC) related thereto) shall be governed by the laws of the State of New York;

3

(vii) The Securities Intermediary has not entered into, and until termination of the Indenture, will not enter into, any agreement with any other Person relating to the Accounts and/or any Financial Assets credited thereto pursuant to which it has agreed to comply with entitlement orders (as defined inSection 8-102(a)(8) of the UCC) of such other Person and the Securities Intermediary has not entered into, and until the termination of the Indenture will not enter into, any agreement with the Issuer purporting to limit or condition the obligation of the Securities Intermediary to comply with entitlement orders as set forth in Section 2.4; and

(viii) Except for the claims and interest of the Indenture Trustee and the Issuer in the Accounts, the Securities Intermediary knows of no claim to, or interest in, the Accounts or in any Financial Asset credited thereto. If any other Person asserts any Lien, encumbrance, or adverse claim (including any writ, garnishment, judgment, warrant of attachment, execution or similar process) against the Accounts or in any Financial Asset carried therein, the Securities Intermediary will promptly notify the Indenture Trustee, the Noteholders and the Issuer thereof.

The Indenture Trustee shall possess all right, title and interest in all funds on deposit from time to time in the Accounts and in all proceeds thereof, and shall be the only Person authorized to originate entitlement orders in respect of the Accounts.

SECTION 2.4. General Provisions Regarding Accounts.

(a) So long as no Event of Default shall have occurred and be continuing, all or a portion of the funds in the2020-1 Exchange Note Collections Account, the Indenture Collections Account, the Note Payment Account and the Reserve Account shall be invested at the direction of the Servicer in2020-1 Permitted Investments that mature no later than the Business Day prior to the next Payment Date in the Collection Period following the Collection Period during which the investment is made. All income or other gain from investments of monies deposited in the2020-1 Exchange Note Collections Account, the Indenture Collections Account and the Reserve Account during a Collection Period shall be deposited into the2020-1 Exchange Note Collections Account, the Indenture Collections Account or the Reserve Account, as applicable, on the related Payment Date, and any loss resulting from such investments shall be charged to2020-1 Exchange Note Collections Account, the Indenture Collections Account or the Reserve Account, as applicable. The Titling Trust will be the tax owner of the2020-1 Exchange Note Collections Account and all investment earnings on the2020-1 Exchange Note Collections Account will be taxable to the Titling Trust. The Issuer or, if there is a single Issuer Trust Certificateholder, such Issuer Trust Certificateholder will be the tax owner of the Indenture Collections Account and all investment earnings on the Indenture Collections Account will be taxable to the Issuer or such Issuer Trust Certificateholder, as the case may be. The Issuer or, if there is a single Issuer Trust Certificateholder, such Issuer Trust Certificateholder, will be the tax owner of the Reserve Account and all investment earnings on the Reserve Account will be taxable to the Issuer or such Issuer Trust Certificateholder, as the case may be.

The Indenture Trustee will not be directed to make any investment of any funds or to sell any2020-1 Permitted Investment held in the2020-1 Exchange Note Collections Account, the Indenture Collections Account and the Reserve Account unless the security interest Granted and

4

perfected in the2020-1 Exchange Note Collections Account, the Indenture Collections Account and the Reserve Account will continue to be perfected in such2020-1 Permitted Investment or the proceeds of such sale, in either case without any further action by any Person. Except as directed by the Note Purchaser after the occurrence and during the continuance of an Event of Default, no such2020-1 Permitted Investment shall be sold prior to maturity. The Servicer acknowledges that upon its written request and at no additional cost, it has the right to receive notification after the completion of each such investment or the Indenture Trustee’s receipt of a broker’s confirmation. The Servicer agrees that such notifications will not be provided by the Indenture Trustee hereunder, and the Indenture Trustee shall make available, upon request and in lieu of notifications, periodic account statements that reflect such investment activity. No statement need be made available if no activity has occurred in the relevant Account during such period.

(b) If (i) the Servicer shall have failed to give investment directions for funds on deposit in the2020-1 Exchange Note Collections Account, the Indenture Collections Account and the Reserve Account to the Indenture Trustee by 12:00 noon, New York City time (or such other time as may be agreed by the Indenture Trustee), on any Business Day, (ii) an Event of Default shall have occurred and be continuing but the Notes shall not have been declared due and payable pursuant to Section 5.2 of the Indenture, or (iii) if the Notes shall have been declared due and payable following an Event of Default but amounts collected or receivable from the Issuer Trust Estate are being applied as if there had not been such a declaration, then the Indenture Trustee shall hold funds on deposit in the2020-1 Exchange Note Collections Account, the Indenture Collections Account and the Reserve Account uninvested.

(c) Subject to Section 6.1(c) of the Indenture, the Indenture Trustee shall not in any way be held liable by reason of any insufficiency in the2020-1 Exchange Note Collections Account, the Indenture Collections Account and the Reserve Account resulting from any loss on any2020-1 Permitted Investment included therein except for losses attributable to the Indenture Trustee as obligor as a result of the Indenture Trustee’s failure to make payments on such2020-1 Permitted Investments issued by the Indenture Trustee, in its commercial capacity as principal obligor and not as trustee, in accordance with their terms.

SECTION 2.5. Reallocation and Repurchase of2020-1 Lease Agreements and2020-1 Leased Vehicles; Purchase of Matured Vehicles.

(a) In the event the Servicer (i) grants an extension with respect to any2020-1 Lease Agreement that is inconsistent with the Customary Servicing Practices or that extends the term of such2020-1 Lease Agreement past the Exchange Note Final Scheduled Payment Date, (ii) modifies any2020-1 Lease Agreement to change the related Contract Residual Value or Monthly Payment, or (iii) is notified the Titling Trust no longer owns any2020-1 Leased Vehicle, except to the extent that any such modification listed in clauses (i) and (ii) of this Section 2.5(a) is required by law or court order, the Servicer shall, on the Deposit Date related to the Collection Period in which such extension was granted, modification was made or notice was received, as applicable, cause the reallocation of the affected2020-1 Lease Agreement and the related2020-1 Leased Vehicle to the Lending Facility Pool by depositing to the2020-1 Exchange Note Collections Account an amount equal to the Repurchase Payment with respect to such2020-1 Lease Agreement and the related2020-1 Leased Vehicle.

5

(b) Upon (i) discovery by the Servicer, the Depositor or any Noteholder, or (ii) the receipt of written notice by or actual knowledge of an Authorized Officer of the Owner Trustee or Indenture Trustee, that any representation or warranty contained in Section 2.12 was incorrect in respect of any2020-1 Lease Agreement or the related2020-1 Leased Vehicle as of the Cutoff Date or the2020-1 Closing Date, as applicable, in a manner that materially adversely affects the interest of the Issuer or the Noteholders in such2020-1 Lease Agreement or such2020-1 Leased Vehicle, the entity discovering such incorrectness, (i) in the case such entity is a Noteholder, may, and (ii) in the case such entity is the Depositor, Owner Trustee or Indenture Trustee, shall, give prompt written notice to the Servicer requesting that the Servicer reallocate the affected2020-1 Lease Agreement and the related2020-1 Leased Vehicle to the Lending Facility Pool;provided,that if the Noteholder providing such notice is not a Noteholder of record, such Noteholder must provide the Servicer with a written certification stating that it is a beneficial owner of a Note, together with supporting documentation supporting that statement (which may include, but is not limited to, a trade confirmation, an account statement or a letter from a broker or dealer verifying ownership) together with such notice. If Noteholders representing five percent or more of the Outstanding Amount of the most senior Class of Notes inform the Indenture Trustee, by notice in writing, of any breach of the Servicer’s representations and warranties made pursuant toSection 2.12(c), the Indenture Trustee shall inform the Servicer in the manner specified in the preceding sentence on behalf of such Noteholders. By no later than the end of the Collection Period including the date that is two (2) months after the date on which the Servicer discovers or is notified of such incorrectness, the Servicer shall cure in all material respects the circumstance or condition with respect to which the representation or warranty was incorrect as of the Cutoff Date or the2020-1 Closing Date, as applicable. If the Servicer does not cure such circumstance or condition by such date, then the Servicer shall cause the reallocation of the affected2020-1 Lease Agreement and the related2020-1 Leased Vehicle to the Lending Facility Pool by depositing to the2020-1 Exchange Note Collections Account on the Deposit Date relating to the next succeeding Payment Date an amount equal to the Repurchase Payment with respect to such2020-1 Lease Agreement and the related2020-1 Leased Vehicle. The Indenture Trustee will (i) notify the Servicer, GM Financial and the Depositor, as soon as practicable and in any event within five (5) Business Days and in the manner set forth for providing notices hereunder, of all demands or requests communicated (in writing or orally) to the Trustee for the reallocation of any2020-1 Lease Agreement and the related2020-1 Leased Vehicle pursuant to this clause (b), (ii) promptly upon request by the Servicer, GM Financial or the Depositor, provide to them any other information reasonably requested to facilitate compliance by them with Rule15Ga-1 under the Exchange Act and Items 1104(e) and 1121(c) of Regulation AB, and (iii) if requested by the Servicer, GM Financial or the Depositor, provide a written certification no later than fifteen (15) days following any calendar quarter or calendar year that the Trustee has not received any reallocation demands for such period, or if reallocation demands have been received during such period, that the Trustee has provided all the information reasonably requested under clause (ii) above with respect to such demands. In no event will the Trustee or the Issuer have any responsibility or liability in connection with any filing required to be made by a securitizer under the Exchange Act or Regulation AB.

(c) Notwithstanding the provisions of Section 2.6(b) of the Basic Servicing Agreement, if the Servicer discovers a breach, or is provided with any notice of a breach pursuant to such section, regarding a Lease Agreement or Leased Vehicle that is a2020-1 Lease Agreement or2020-1 Leased Vehicle on the date that such breach is discovered or such notice is

6

provided, the Servicer shall be obligated to take the actions described in such Section 2.6(b) by no later than the Payment Date following the Collection Period in which the related breach is discovered or the related notice is provided (rather than by the Payment Date following the Collection Period that ends at least thirty (30) days after the Servicer discovers or is notified of such breach).

(d) The Servicer shall provide written notice to the Indenture Trustee and the Noteholders of each reallocation to the Lending Facility Pool of a2020-1 Lease Agreement and the related2020-1 Leased Vehicle pursuant to Section 2.5(a) or (b) that was made during a Collection Period in the Servicer Report that is delivered for such Collection Period.

(e) The Servicer may purchase any2020-1 Leased Vehicle that becomes a Matured Vehicle pursuant to Section 2.6(f) of the Basic Servicing Agreement for a purchase price equal to the Contract Residual Value of the related2020-1 Lease Agreement.

(f) The obligation of the Servicer under this Section 2.5 shall survive any termination of the Servicer hereunder.

(g) For so long as the Notes are Outstanding, the Servicer will not be permitted to reallocate any2020-1 Lease Agreements and related2020-1 Leased Vehicles from the2020-1 Designated Pool to the Lending Facility Pool except in accordance with the terms of this Section 2.5 and Section 3.1 of the2020-1 Exchange Note Supplement.

(h) If a Lessee changes its domicile and such change would reasonably be expected to result in the Titling Trust doing business in a jurisdiction in which it is not licensed and authorized to conduct business in the manner contemplated by the Program Documents, then on the Payment Date related to the Collection Period that ends at least thirty (30) days after the Servicer discovers or is notified of such change, the Servicer shall purchase such2020-1 Lease Agreement and the related2020-1 Leased Vehicle by either (i) depositing to the Indenture Collections Account an amount equal to the Repurchase Payment, or (ii) appropriately segregating and designating an amount equal to the Repurchase Payment on its records, pending application thereof pursuant to2020-1 Servicing Agreement.

SECTION 2.6. 2020-1 Designated Pool Collections.

(a) The Servicer shall, with respect to all2020-1 Designated Pool Collections, from time to time determine the amount of such2020-1 Designated Pool Collections and during each Collection Period shall deposit all such2020-1 Designated Pool Collections in the2020-1 Exchange Note Collections Account when required pursuant to clause (b).

(b) Notwithstanding Section 2.7(b) of the Basic Servicing Agreement, the Servicer shall remit, or shall cause its agent to remit, all2020-1 Designated Pool Collections to the2020-1 Exchange Note Collections Account by the close of business on the second (2nd) Business Day after receipt thereof or, in the case of any2020-1 Designated Pool Collections received by the Servicer or such agent for which the Servicer or such agent, as applicable, does not have all Payment Information by the close of business on such second (2nd) Business Day, by the close of business on the day on which all such Payment Information is received. Pending deposit into the2020-1 Exchange Note Collections Account,2020-1 Designated Pool Collections may be

7

employed by the Servicer at its own risk and for its own benefit and need not be segregated from its own funds.

SECTION 2.7. Servicing Compensation; Expenses. As compensation for the performance of its obligations under the2020-1 Servicing Agreement, on each Payment Date the Servicer shall be entitled to receive a fee for its performance during the immediately preceding Collection Period or, with respect to the first Payment Date, the period from and excluding the Cutoff Date to and including February 29, 2020 (the “Designated Pool Servicing Fee”) in accordance with Article V of the2020-1 Exchange Note Supplement in an amount equal the sum of (x) to the product of(i) one-twelfth (1/12th) (or, with respect to the first Payment Date, a fraction equal to the number of days from and excluding the Cutoff Date through and including February 29, 2020, over 360),times (ii) the Servicing Fee Rate,times (iii) the Aggregate Securitization Value as of the opening of business on the first day of such Collection Period,plus (y) any Administrative Charges collected on the2020-1 Lease Agreements and2020-1 Leased Vehicles and any other expenses reimbursable to the Servicer.

SECTION 2.8. Third Party Claims. In addition to the requirements set forth in Section 2.14 of the Basic Servicing Agreement, upon learning of a Claim or Lien of whatever kind of a third party that would be likely to have a material adverse effect on the interests of the Depositor or the Issuer with respect to the2020-1 Exchange Note Assets, the Servicer shall immediately notify the Depositor, the Indenture Trustee and the Noteholders of any such Claim or Lien.

SECTION 2.9. Reporting by the Servicer; Delivery of Certain Documentation; Inspection; Asset-Level Information.

(a) On each Determination Date, prior to 12:00 p.m. (Central time), the Issuer shall cause the Servicer to deliver to the Indenture Trustee, the Titling Trust and the Collateral Agent, a Servicer Report with respect to the next Payment Date and the related Collection Period. The Issuer shall also cause the Servicer to deliver a Servicer Report to each Rating Agency on the same date the Servicer Report is publicly available (provided that if the Servicer Report is not made publicly available, the Servicer will deliver it to each Rating Agency, no later than the twenty-second (22nd) of each month (or if not a Business Day, the next succeeding Business Day)). Solely in the case of the Servicer Report delivered on the first Determination Date, such Servicer Report will contain the disclosure required by Rule 4(c)(1)(ii) of Regulation RR, 17 C.F.R. §246.1, et seq. (the “Credit Risk Retention Rules”). In addition, upon the determination by the Servicer of a Benchmark Replacement and/or the making of any Benchmark Replacement Conforming Changes, the Servicer will include in the Servicer’s Certificate any information regarding the Unadjusted Benchmark Replacement, the Benchmark Replacement Adjustment, any such Benchmark Replacement Conforming Changes and the Interest Accrual Period in which such Benchmark Replacement will be implemented. Notwithstanding Section 3.2(a) of the Basic Servicing Agreement, the Servicer shall deliver such Servicer Reports in accordance with this Section 2.9 until the date on which the Notes are no longer Outstanding.

(b) In addition to the report with respect to the2020-1 Exchange Note which the Servicer is obligated to deliver pursuant to Section 3.1(c) of the Basic Servicing Agreement, the Servicer shall deliver to the Depositor, the Indenture Trustee and the Titling Trust, on or before

8

March 31 (or ninety (90) days after the end of the Servicer’s fiscal year, if other than December 31) of each year, beginning March 31, 2021, an Officer’s Certificate, dated as of March 31 (or other applicable date) of such year, stating that (i) a review of the activities of the Servicer during the preceding twelve (12) month period (or, in the case of the first such Officer’s Certificate, the period from the Closing Date to the date of the first such Officer’s Certificate) and of its performance under the2020-1 Servicing Agreement has been made under such officer’s supervision, and (ii) to such officer’s knowledge, based on such review, the Servicer has fulfilled all its obligations under the2020-1 Servicing Agreement throughout such period, or, if there has been a default in the fulfillment of any such obligation, specifying each such default known to such officer and the nature and status thereof.

(c) The Servicer will deliver to the Issuer, on or before March 31 of each year, beginning on March 31, 2021, a report regarding the Servicer’s assessment of compliance with certain minimum servicing criteria during the immediately preceding calendar year, as required under Rules13a-18 and15d-18 of the Exchange Act and Item 1122 of Regulation AB.

(d) To the extent required by Regulation AB, the Servicer will cause any affiliated servicer or any other party deemed to be participating in the servicing function pursuant to Item 1122 of Regulation AB to provide to the Issuer, on or before March 31 of each year, beginning on March 31, 2021, a report regarding such party’s assessment of compliance with certain minimum servicing criteria during the immediately preceding calendar year, as required under Rules13a-18 and15d-18 of the Exchange Act and Item 1122 of Regulation AB.

(e) Each of Wells Fargo Bank, National Association, in its capacity as Collateral Agent under this2020-1 Servicing Supplement and in its capacity as Indenture Trustee under the Program Documents, acknowledges that to the extent it is deemed to be participating in the servicing function pursuant to Item 1122 of Regulation AB, it will take any action reasonably requested by the Servicer to ensure compliance with the requirements of Section 2.9(d) and Section 2.10(b) hereof and with Item 1122 of Regulation AB. Such required documentation will be delivered to the Servicer by March 15 of each calendar year.

(f) The Servicer shall deliver copies of all reports, notices and certificates delivered by it pursuant to the2020-1 Servicing Agreement to the Depositor, the Indenture Trustee and the Titling Trust on the date or dates due, including any notice of material failure given pursuant to Section 2.2(a) of the Basic Servicing Agreement and the Officer’s Certificate relating to the2020-1 Exchange Note delivered by it pursuant to Section 2.9(b) of this2020-1 Servicing Supplement.

(g) On or before the fifteenth (15th) day following each Payment Date, the Servicer will prepare a FormABS-EE, including an asset data file and asset-related document containing the asset-level information for each2020-1 Exchange Note Asset for the prior Collection Period as required by Item 1A of Form10-D.

SECTION 2.10. Annual Independent Accountant’s Report.

(a) The Servicer shall cause the cause a firm of nationally recognized independent certified public accountants (the “Independent Accountants”), who may also render other

9

services to the Servicer or its Affiliates, to deliver to the Indenture Trustee, the Owner Trustee and the Collateral Agent, on or before March 31 (or 90 days after the end of the Issuer’s fiscal year, if other than December 31) of each year, beginning on March 31, 2021, a report with respect to the preceding calendar year, addressed to the board of directors of the Servicer, providing its attestation report on the servicing assessment delivered pursuant to Section 2.9(c), including disclosure of any material instance ofnon-compliance, as required by Rule13a-18 and15d-18 of the Exchange Act and Item 1122(b) of Regulation AB. Such attestation will be in accordance with Rules1-02(a)(3) and2-02(g) of RegulationS-X under the Securities Act and the Exchange Act.

(b) Each party required to deliver an assessment of compliance described in Section 2.9(d) shall cause Independent Accountants, who may also render other services to such party or its Affiliates, to deliver to the Indenture Trustee, the Owner Trustee, the Collateral Agent and the Servicer, on or before March 31 (or 90 days after the end of the Issuer’s fiscal year, if other than December 31) of each year, beginning on March 31, 2021, a report with respect to the preceding calendar year, addressed to the board of directors of such party, providing its attestation report on the servicing assessment delivered pursuant to Section 2.9(d), including disclosure of any material instance ofnon-compliance, as required by Rule13a-18 and15d-18 of the Exchange Act and Item 1122(b) of Regulation AB. Such attestation will be in accordance with Rules1-02(a)(3) and2-02(g) of RegulationS-X under the Securities Act and the Exchange Act.

(c) The Servicer shall cause the Independent Accountants to deliver to the Depositor, the Indenture Trustee, the Issuer and the Titling Trust, on or before April 30 (orone-hundred and twenty (120) days after the end of the Servicer’s fiscal year, if other than December 31) of each year, beginning on April 30, 2021 with respect to the twelve (12) months ended the immediately preceding December 31 (or other applicable date) (or such other period as shall have elapsed from the2020-1 Closing Date to the date of such certificate (which period shall not be less than six (6) months)), a statement (the “Accountants’ Report”) addressed to the Board of Directors of the Servicer, to the effect that such firm has audited the books and records of GM Financial, in which the Servicer is included as a consolidated subsidiary, and issued its report thereon in connection with the audit report on the consolidated financial statements of GM Financial and that (i) such audit was made in accordance with generally accepted auditing standards, and accordingly included such tests of the accounting records and such other auditing procedures as such firm considered necessary in the circumstances, and (ii) the firm is independent of the Servicer within the meaning of the Code of Professional Ethics of the American Institute of Certified Public Accountants.

SECTION 2.11. Servicer Defaults; Termination of the Servicer.

(a) Each of the following acts or occurrences constitutes a “Servicer Default” under the2020-1 Servicing Agreement with respect to the2020-1 Exchange Note:

(i) any failure by the Servicer to deposit in the2020-1 Exchange Note Collections Account any required payment, any failure by the Servicer to make or cause the Titling Trust to make any required payments from the2020-1 Exchange Note Collections Account on account of the2020-1 Exchange Note or any failure of the Servicer to make any required payment under any other Program Document, which

10

failure continues unremedied for a period of five (5) Business Days after the earlier of the date on which (1) notice of such failure is given to the Servicer by the Indenture Trustee, or (2) an Authorized Officer of the Servicer has actual knowledge of such failure;

(ii) any failure by the Servicer duly to observe or to perform any covenants or agreements of the Servicer set forth in the2020-1 Servicing Agreement or any other Program Document (other than a covenant or agreement a default in the observance or performance of which is elsewhere in this Section specifically dealt with), which failure shall materially and adversely affects the interests of the2020-1 Secured Parties and shall continue unremedied for a period of sixty (60) days after written notice of such failure is received by the Servicer from the Indenture Trustee or after discovery of such failure by the Servicer;

(iii) any representation or warranty made or deemed made by the Servicer in the2020-1 Servicing Agreement or in any other Program Document or which is contained in any certificate, document or financial or other statement furnished at any time under or in connection herewith or therewith shall prove to have been incorrect, and such incorrectness has a material adverse effect on the interests of the2020-1 Secured Parties or the Issuer which failure, if capable of being cured, has not been cured for a period of sixty (60) days after written notice of such breach is received by the Servicer from the Indenture Trustee or after discovery of such breach by the Servicer; or

(iv) an Insolvency Event occurs with respect to the Servicer.

(b) Promptly after having obtained knowledge of any Servicer Default, but in no event later than two (2) Business Days thereafter, the Servicer shall deliver to the Indenture Trustee and the Noteholders, written notice thereof in an Officer’s Certificate, accompanied in each case by a description of the nature of the default and the efforts of the Servicer to remedy the same.

(c) In addition to the provisions of Section 4.1(d) of the Basic Servicing Agreement, if a Servicer Default shall have occurred and be continuing with respect to the2020-1 Exchange Note, the Titling Trust shall, acting at the written direction of the Majority Noteholders, or, if there are no Notes Outstanding, the Titling Trust, acting at the direction of Issuer Trust Certificateholder, by notice given to the Servicer, terminate the rights and obligations of the Servicer under the2020-1 Servicing Agreement in accordance with such Section and the Indenture Trustee, acting at the written direction of the Majority Noteholders, shall appoint a Successor Servicer to fulfill the obligations of the Servicer hereunder in respect of the2020-1 Lease Agreements and2020-1 Leased Vehicles. Any such Person shall accept its appointment by a written assumption in a form acceptable to the Indenture Trustee. In the event the Servicer is removed as servicer of the2020-1 Exchange Note Assets, (i) the Servicer shall deliver or cause to be delivered to or at the direction of the Successor Servicer all Lease Documents with respect to the2020-1 Lease Agreements and the2020-1 Leased Vehicles that are then in the possession of the Servicer, (ii) the Servicer shall deliver or cause to be delivered to or at the direction of the Successor Servicer all Security Deposits held by the Servicer with respect to the2020-1 Exchange Note Assets, and (iii) the Servicer shall deliver to the Successor Servicer all servicing records directly maintained by the Servicer, containing as of the close of business on

11

the date of demand all of the data maintained by the Servicer, in computer format in connection with servicing the2020-1 Exchange Note Assets. If no Person has accepted its appointment as Successor Servicer when the predecessor Servicer ceases to act as Servicer in accordance with this Section 2.11, the Indenture Trustee, will, without further action, be automatically appointed the Successor Servicer. Notwithstanding the above, if the Indenture Trustee is unwilling or legally unable to act as Successor Servicer, it may appoint, or petition a court of competent jurisdiction to appoint, an institution whose business includes the servicing of lease agreements and the related lease assets, as Successor Servicer. The Indenture Trustee will be released from its duties and obligations as Successor Servicer on the date that a new servicer agrees to appointment as Successor Servicer hereunder. All reasonable costs and expenses incurred in connection with transferring the servicing of the2020-1 Exchange Note Assets to the successor Servicer and amending this agreement to reflect such succession as Servicer pursuant to this Section shall be paid by the predecessor Servicer upon presentation of reasonable documentation of such costs and expenses. Any Successor Servicer shall be entitled to such compensation as the Servicer would have been entitled to under this2020-1 Servicing Supplement if the Servicer had not resigned or been terminated hereunder or such additional compensation as the Majority Noteholders and such Successor Servicer may agree on.

(d) Notwithstanding the provisions of Section 4.1(f) of the Basic Servicing Agreement, with respect to any Servicer Default related to the2020-1 Exchange Note Assets, only the Indenture Trustee, acting at the written direction of the Majority Noteholders, or, if there are no Notes Outstanding, the Titling Trust, acting at the direction of the Issuer Trust Certificateholder, may waive any default of the Servicer in the performance of its obligations under the2020-1 Servicing Agreement and its consequences with respect to the2020-1 Exchange Note and, upon any such waiver, such default shall cease to exist and any Servicer Default arising therefrom shall be deemed to have been remedied for every purpose of the2020-1 Exchange Note Servicing Agreement. No such waiver shall extend to any subsequent or other default or impair any right consequent thereto.

SECTION 2.12. Representations and Warranties. The Servicer makes the following representations and warranties to the Depositor, the Indenture Trustee and the Noteholders as of the2020-1 Closing Date:

(a) The representations and warranties contained in Section 2.6(a) of the Basic Servicing Agreement as to each2020-1 Lease Agreement and the related2020-1 Leased Vehicle were true and correct as of the Cutoff Date;

(b) The representations and warranties set forth in Section 5.1 of the Basic Servicing Agreement are true and correct as of the date hereof;

(c) Each2020-1 Lease Agreement and2020-1 Leased Vehicle is an Eligible Collateral Asset as of the date hereof;

(d) All information heretofore furnished by the Servicer or any of its Affiliates to the Indenture Trustee or the Owner Trustee for purposes of or in connection with the2020-1 Servicing Agreement or any of the other Program Documents or any transaction contemplated hereby or thereby is, and all information hereafter furnished by the Servicer or any of its

12

Affiliates to the Indenture Trustee, the Owner Trustee or any of the Noteholders will be, (i) true and accurate in every material respect on the date such information is stated or certified, and (ii) does not and will not contain any material misstatement of fact or omit to state a material fact or any fact necessary to make the statements contained therein misleading, in the case of each of (i) and (ii) when taken together with all other information provided on or prior to the date hereof; and

(e) No Servicer Default or event which with the giving of notice or lapse of time, or both, would become a Servicer Default has occurred and is continuing as of the2020-1 Closing Date.

(f) With respect to any2020-1 Lease Agreement that constitutes “electronic chattel paper” under the UCC, the Servicer, as custodian of the Lease Documents relating to the2020-1 Designated Pool, maintains control of a single electronically authenticated authoritative copy of the related2020-1 Lease Agreement.

SECTION 2.13. Custody of Lease Documents.

(a) Pursuant to Section 2.3 of the Basic Servicing Agreement, the Servicer, either directly or through an agent, will act as custodian of the Lease Documents relating to the2020-1 Designated Pool, as agent and bailee for the benefit of the Issuer and the Indenture Trustee. All Lease Documents relating to the2020-1 Designated Pool shall be identified and maintained in such a manner so as to permit retrieval and access. If a Successor Servicer has been appointed hereunder, the Servicer shall promptly deliver all such Lease Documents to the Successor Servicer. If the Servicer is terminated under the2020-1 Servicing Agreement upon the occurrence of a Servicer Default, the costs associated with transferring all such Lease Documents shall be paid by the Servicer.

(b) With respect to any2020-1 Lease Agreement that constitutes “electronic chattel paper” under the UCC, the Servicer, as custodian of the Lease Documents relating to the2020-1 Designated Pool, shall at all times maintain control of a single electronically authenticated authoritative copy of the related2020-1 Lease Agreement.

(c) In accordance with Section 2.10(h)(ii) of the Indenture and with respect to any Indenture Collateral that constitutes an instrument or tangible chattel paper, the Servicer, as custodian of the Lease Documents relating to the2020-1 Designated Pool, acknowledges that it is holding such instruments and tangible chattel paper solely on behalf and for the benefit of the Indenture Trustee.

SECTION 2.14. Reserve Account.

(a) On the2020-1 Closing Date, GMF Leasing LLC shall deposit the Specified Reserve Balance into the Reserve Account. Amounts held from time to time in the Reserve Account shall be held by the Indenture Trustee for the benefit of the Noteholders.

(b) On each Payment Date (i) if the amount on deposit in the Reserve Account (without taking into account any amount on deposit in the Reserve Account representing net investment earnings) is less than the Specified Reserve Balance, then the Indenture Trustee shall,

13

after payment of any amounts required to be distributed pursuant to clauses (i) through (xiv) of Section 8.3(a) of the Indenture, deposit in the Reserve Account the Reserve Account Required Amount pursuant to Section 8.3(a)(xv) of the Indenture, and (ii) if the amount on deposit in the Reserve Account, after giving effect to all other deposits thereto and withdrawals therefrom to be made on such Payment Date is greater than the Specified Reserve Balance, in which case the Indenture Trustee shall distribute the amount of such excess as part of Available Funds on such Payment Date.

(c) On each Payment Date, the Servicer shall instruct the Indenture Trustee to withdraw the Reserve Account Withdrawal Amount from the Reserve Account and deposit such amounts in the Indenture Collections Account to be included as Total Available Funds for that Payment Date.

SECTION 2.15. Liability of Successor Servicer. No Successor Servicer will have any responsibility and will not be in default hereunder or incur any liability for any failure, error, malfunction or any delay in carrying out any of their duties under this Supplement if such failure or delay results from such Successor Servicer acting in accordance with information prepared or supplied by any Person other than the Successor Servicer or the failure of any such other Person to prepare or provide such information. No Successor Servicer will have any responsibility for and will not be in default and will incur no liability for, (a) any act or failure to act of any third party, including the Servicer, (b) any inaccuracy or omission in a notice or communication received by such Successor Servicer from any third party, (c) the invalidity or unenforceability of any2020-1 Lease Agreement under applicable law, (d) the breach or inaccuracy of any representation or warranty made with respect to any2020-1 Lease Agreement or2020-1 Leased Vehicle, or (e) the acts or omissions of any successor to it as Successor Servicer.

SECTION 2.16. Merger or Consolidation of, or Assumption of Obligations of the Servicer. Notwithstanding the provisions of Section 5.3 of the Basic Servicing Agreement, GM Financial shall not merge or consolidate with any other Person, convey, transfer or lease substantially all its assets as an entirety to another Person, or permit any other Person to become the successor to GM Financial’s business unless, after the merger, consolidation, conveyance, transfer, lease or succession, the successor or surviving entity shall be capable of fulfilling the duties of GM Financial contained in this Agreement. Any corporation (a) into which GM Financial may be merged or consolidated, (b) resulting from any merger or consolidation to which GM Financial shall be a party, (c) which acquires by conveyance, transfer, or lease substantially all of the assets of GM Financial, or (d) succeeding to the business of GM Financial, in any of the foregoing cases shall execute an agreement of assumption to perform every obligation of GM Financial under this Agreement and, whether or not such assumption agreement is executed, shall be the successor to GM Financial under this Agreement without the execution or filing of any paper or any further act on the part of any of the parties to this Agreement, anything in this Agreement to the contrary notwithstanding;provided,however, that nothing contained herein shall be deemed to release GM Financial from any obligation. GM Financial shall provide notice of any merger, consolidation or succession pursuant to this Section to the Owner Trustee, the Indenture Trustee and the Noteholders. Notwithstanding the foregoing, GM Financial shall not merge or consolidate with any other Person or permit any other Person to become a successor to GM Financial’s business, unless (x) immediately after giving effect to such transaction, no representation or warranty made pursuant to Section 2.12

14

shall have been breached (for purposes hereof, such representations and warranties shall speak as of the date of the consummation of such transaction), (y) GM Financial shall have delivered to the Owner Trustee, the Indenture Trustee and the Noteholders an Officer’s Certificate and an Opinion of Counsel each stating that such consolidation, merger or succession and such agreement of assumption comply with this Section and that all conditions precedent, if any, provided for in this Agreement relating to such transaction have been complied with, and (z) GM Financial shall have delivered to the Owner Trustee, the Collateral Agent and the Indenture Trustee an Opinion of Counsel stating, in the opinion of such counsel, either that (i) all financing statements and continuation statements and amendments thereto have been executed and filed that are necessary to preserve and protect the interest of the Trust in the2020-1 Exchange Note and the Other Conveyed Property (and reciting the details of the filings), or (ii) no such action shall be necessary to preserve and protect such interest.

SECTION 2.17. Resignation of the Servicer. Notwithstanding Section 5.4 of the Basic Servicing Agreement, the Servicer shall not resign as Servicer under the2020-1 Servicing Agreement except if it is prohibited by law from performing its obligations in respect of the2020-1 Exchange Note Assets under the Basic Servicing Agreement or hereunder and delivers to the Trustee, the Indenture Trustee and the Noteholders an Opinion of Counsel to such effect concurrently with the delivery of any notice of resignation pursuant to Section 5.4 of the Basic Servicing Agreement.

SECTION 2.18. Separate Existence. The Servicer shall take all reasonable steps to maintain the Titling Trust’s, the Settlor’s, the Depositor’s and the Issuer’s identities as separate legal entities, and shall make it manifest to third parties that each of the Titling Trust, the Settlor, the Depositor and the Issuer is an entity with assets and liabilities distinct from those of the Servicer and not a division of the Servicer. All transactions and dealings between the Servicer, on the one hand, and the Settlor, the Titling Trust, the Depositor and the Issuer, on the other hand, will be conducted on anarm’s-length basis. The Servicer shall take all other actions necessary on its part to ensure that the Depositor complies with Section 2.5(d) of the Exchange Note Transfer Agreement and, to the extent within its control, take all action necessary to ensure that the Issuer complies with Section 3.16 of the Indenture. The Servicer shall take all action necessary to ensure that the Titling Trust shall not take any of the following actions:

(a) engage in any business other than that contemplated by the Titling Trust Agreement or enter into any transaction or indenture, mortgage, instrument, agreement, contract, lease or other undertaking which is not directly or indirectly related to the transactions contemplated by the Titling Trust Documents; and

(b) issue, incur, assume, guarantee or otherwise become liable, directly or indirectly, for any obligations, liabilities or responsibilities other than as set forth in the Titling Trust Documents.

SECTION 2.19. Like Kind Exchange Program; Pull Ahead Program.

(a) Notwithstanding the provisions of the Basic Servicing Agreement, a2020-1 Leased Vehicle may be reallocated from the2020-1 Designated Pool to the Lending Facility Pool in connection with a Like Kind Exchange if the full Base Residual Value of the related

15

2020-1 Leased Vehicle is deposited to the2020-1 Exchange Note Collections Account by no later than the second (2nd) Business Day following the date of such reallocation;provided, that if the Net Liquidation Proceeds with respect to such2020-1 Leased Vehicle are determined prior to the deposit of such Base Residual Value to the2020-1 Exchange Note Collections Account, then such Net Liquidation Proceeds may instead be deposited to the2020-1 Exchange Note Collections Account in full satisfaction of this Section 2.19(a). If the Servicer has deposited the full Base Residual Value of a2020-1 Leased Vehicle to the2020-1 Exchange Note Collections Account in connection with a Like Kind Exchange and (i) the related Net Liquidation Proceeds are determined thereafter to be less than such Base Residual Value, then the Servicer shall be permitted to withdraw the excess of the related Base Residual Value so deposited over the related Net Liquidation Proceeds from the2020-1 Exchange Note Collections Account for its own account, and (ii) the related Net Liquidation Proceeds are determined thereafter to be greater than such Base Residual Value, then the Servicer shall be obligated to deposit the excess of the related Net Liquidation Proceeds over the Base Residual Value to the2020-1 Exchange Note Collections Account from its own funds by no later than the second (2nd) Business Day following the date on which such Net Liquidation Proceeds are determined.

(b) Notwithstanding the provisions of the Basic Servicing Agreement, a2020-1 Lease Agreement may be a Pull Ahead Lease Agreement pursuant to a Pull Ahead Program if all amounts due and payable under the related2020-1 Lease Agreement (other than (i) Excess Mileage/Wear and Tear Fees, which shall be charged to such Lessee to the extent applicable in accordance with the terms of such2020-1 Lease Agreement and the Servicer’s Customary Servicing Practices, and (ii) Monthly Payments that are waived in connection with such Lessee’s participation in the Pull Ahead Program and in connection with which a Pull Ahead Payment is received by the Titling Trust or by the Servicer on its behalf and allocated to the2020-1 Exchange Note Collections Account) are deposited to the2020-1 Exchange Note Collections Account by no later than the second (2nd) Business Day following the date that such2020-1 Lease Agreement would terminate pursuant to the Pull Ahead Program. The Servicer will not be entitled to reimbursement from any2020-1 Designated Pool Collections for any amounts that it deposits to the2020-1 Collections Account from its own funds in connection with any Pull Ahead Lease Agreement.

SECTION 2.20. Dispute Resolution.

(a) If the Owner Trustee, the Indenture Trustee, any Noteholder, the Depositor or the Indenture Trustee on behalf of certain Noteholders in accordance with Section 2.5(b) hereof has requested that the Servicer reallocate any2020-1 Lease Agreement and the related2020-1 Leased Vehicle to the Lending Facility Pool pursuant to Section 2.5(b) hereof due to an alleged breach of a representation and warranty with respect to such2020-1 Lease Agreement and the related2020-1 Leased Vehicle (each, a “Reallocation Request”), and the Reallocation Request has not been resolved within 180 days of the receipt of notice of the Reallocation Request by the Servicer (which resolution may take the form of a reallocation of the related2020-1 Lease Agreement and the related2020-1 Leased Vehicle to the Lending Facility Pool against payment of the related Repurchase Amount by GM Financial, a withdrawal of the related Reallocation Request by the party that originally requested the reallocation or a cure of the condition that led to the related breach in the manner set forth herein), then the Servicer or Depositor shall describe the unresolved Reallocation Request on the Form10-D that is filed that relates to the Collection

16

Period during with the related180-day period ended, and any of the party that originally requested the reallocation, any Noteholder or the Indenture Trustee on behalf of certain Noteholders in accordance with the following sentence (any such Person, a “Requesting Party”) may refer the matter, in its discretion, to either mediation (includingnon-binding arbitration) or binding third-party arbitration;provided, that if the Noteholder seeking to refer the matter to mediation or arbitration is not a Noteholder of record, such Noteholder must provide the Servicer and the Indenture Trustee with a written certification stating that it is a beneficial owner of a Note, together with supporting documentation supporting that statement (which may include, but is not limited to, a trade confirmation, an account statement or a letter from a broker or dealer verifying ownership) before the Servicer will be obligated to participate in the related mediation or arbitration. Noteholders representing five percent or more of the Outstanding Amount of the most senior Class of Notes may direct the Indenture Trustee, by notice in writing, in relation to any matter described in the preceding sentence, to initiate either mediation (includingnon-binding arbitration) or binding third party arbitration, as directed by such Noteholders, on behalf of such Noteholders and to conduct such mediation or arbitration pursuant to instructions provided by such Noteholders in accordance with the Indenture. The Requesting Party shall provide notice to the Sponsor and the Depositor and refer the matter to mediation or arbitration according to the ADR Rules of the ADR Organization within 90 days following the date on which the Form10-D is filed that relates to the Collection Period during which the related180-day period ended. The Servicer agrees to participate in the dispute resolution method selected by the Requesting Party.

(b) If the Requesting Party selects mediation for dispute resolution:

(i) The mediation will be administered by the ADR Organization using its ADR Rules. However, if any ADR Rules are inconsistent with the procedures for mediation stated in this Section 2.20, the procedures in this Section 2.20 will control.

(ii) A single mediator will be selected by the ADR Organization from a list of neutrals maintained by it according to the ADR Rules. The mediator must be impartial, an attorney admitted to practice in the State of New York and have at least 15 years of experience in commercial litigation and, if possible, consumer finance or asset-backed securitization matters.

(iii) Commercially reasonable efforts shall be used to begin the mediation within 15 Business Days after the selection of the mediator and conclude within 30 days after the start of the mediation.

(iv) Expenses of the mediation will be allocated to the parties as mutually agreed by them as part of the mediation.

(v) If the parties fail to agree at the completion of the mediation, the Requesting Party may refer the Reallocation Request to arbitration under this Section 3.13 or may initiate litigation regarding such Reallocation Request.

17

(c) If the Requesting Party selects arbitration for dispute resolution:

(i) The arbitration will be administered by the ADR Organization using its ADR Rules. However, if any ADR Rules are inconsistent with the procedures for arbitration stated in this Section 2.20, the procedures in this Section 2.20 will control.

(ii) A single arbitrator will be selected by the ADR Organization from a list of neutrals maintained by it according to the ADR Rules. The arbitrator must be an attorney admitted to practice in the State of New York and have at least 15 years of experience in commercial litigation and, if possible, consumer finance or asset-backed securitization matters. The arbitrator will be independent and impartial and will comply with the Code of Ethics for Arbitrators in Commercial Disputes in effect at the time of the arbitration. Before accepting an appointment, the arbitrator must promptly disclose any circumstances likely to create a reasonable inference of bias or conflict of interest or likely to preclude completion of the proceedings within the stated time schedule. The arbitrator may be removed by the ADR Organization for cause consisting of actual bias, conflict of interest or other serious potential for conflict.

(iii) The arbitrator will have the authority to schedule, hear and determine any motions, according to New York law, and will do so at the motion of any party. Discovery will be completed with 30 days of selection of the arbitrator and will be limited for each party to two witness depositions, each not to exceed five hours, two interrogatories, one document request and one request for admissions. However, the arbitrator may grant additional discovery on a showing of good cause that the additional discovery is reasonable and necessary. Briefs will be limited to no more than ten pages each, and will be limited to initial statements of the case, motions and apre-hearing brief. The evidentiary hearing on the merits will start no later than 60 days after selection of the arbitrator and will proceed for no more than six consecutive Business Days with equal time allocated to each party for the presentation of evidence and cross examination. The arbitrator may allow additional time for discovery and hearings on a showing of good cause or due to unavoidable delays.

(iv) The arbitrator will make its final determination no later than 90 days after its selection. The arbitrator will resolve the dispute according to the terms of this Agreement and the other Basic Documents, and may not modify or change this Agreement or the other Basic Documents in any way. The arbitrator will not have the power to award punitive damages or consequential damages in any arbitration conducted by them. In its final determination, the arbitrator will determine and award the expenses of the arbitration (including filing fees, the fees of the arbitrator, expense of any record or transcript of the arbitration and administrative fees) to the parties in its reasonable discretion. The determination of the arbitrator will be in writing and counterpart copies will be promptly delivered to the parties. The determination will be final andnon-appealable, except for actions to confirm or vacate the determination permitted under federal or State law, and may be entered and enforced in any court of competent jurisdiction. The arbitrator may not award remedies that are not consistent with this Agreement and the other Basic Documents.

18

(v) By selecting arbitration, the Requesting Party is giving up the right to sue in court, including the right to a trial by jury.

(vi) The Requesting Party may not bring a putative or certificated class action to arbitration. If this waiver of class action rights is found to be unenforceable for any reason, the Requesting Party agrees that it will bring its claims in a court of competent jurisdiction.

(d) For each mediation or arbitration:

(i) Any mediation or arbitration will be held in New York, New York at the offices of the mediator or arbitrator or at another location selected by the Servicer. Any party or witness may participate by teleconference or video conference.

(ii) The Servicer and the Requesting Party will have the right to seek provisional relief from a competent court of law, including a temporary restraining order, preliminary injunction or attachment order, if such relief is available by law.

(e) The Servicer will not be required to produce personally identifiable customer information for purposes of any mediation or arbitration. The existence and details of any unresolved Reallocation Request, any informal meetings, mediations or arbitration proceedings, the nature and amount of any relief sought or granted, any offers or statements made and any discovery taken in the proceeding will be confidential, privileged and inadmissible for any purpose in any other mediation, arbitration, litigation or other proceeding. The parties will keep this information confidential and will not disclose or discuss it with any third party (other than a party’s attorneys, experts, accountants and other advisors, as reasonably required in connection with the mediation or arbitration proceeding under this Section 2.6), except as required by law, regulatory requirement or court order. If a party to a mediation or arbitration proceeding receives a subpoena or other request for information from a third party (other than a governmental regulatory body) for confidential information of the other party to the mediation or arbitration proceeding, the recipient will promptly notify the other party and will provide the other party with the opportunity to object to the production of its confidential information.

ARTICLE III

MISCELLANEOUS

SECTION 3.1. Termination of2020-1 Servicing Supplement. This2020-1 Servicing Supplement (and, accordingly, the Basic Servicing Agreement insofar as it relates to the2020-1 Exchange Note) will be terminated in the event that the Basic Servicing Agreement is terminated in accordance therewith and may also be terminated at the option of the Servicer or the Titling Trust at any time following the payment in full of the2020-1 Exchange Note.

SECTION 3.2. Amendment.

(a) This2020-1 Servicing Supplement (and, accordingly, the Basic Servicing Agreement, insofar as it relates to the2020-1 Exchange Note) may be amended by the parties hereto with the consent of the Majority Noteholders;provided, that to the extent that any such

19

amendment materially affects any Other Exchange Note, such amendment shall require the consent of the Exchange Noteholder thereof affected thereby.

(b) The parties hereto acknowledge and agree that (i) the right of the Indenture Trustee to consent to any amendment of this2020-1 Servicing Supplement is subject to the following terms: the parties hereto will not (1) without the prior written consent of the Required Noteholders, waive timely performance or observance by the Servicer under the2020-1 Servicing Agreement and (2) without the prior written consent of all Noteholders, reduce the required percentage of the Notes that is required to consent to any amendment pursuant to this Section 3.2 and (ii) any consent provided by the Indenture Trustee in violation of such terms shall be of no force or effect hereunder.

SECTION 3.3. GOVERNING LAW.THIS SUPPLEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS OF THE STATE OF NEW YORK, WITHOUT GIVING EFFECT TO OTHERWISE APPLICABLE PRINCIPLES OF CONFLICTS OF LAW (OTHER THAN SECTION5-1401 OF THE NEW YORK GENERAL OBLIGATIONS LAW).

SECTION 3.4. Relationship of2020-1 Servicing Supplement to Other Trust Documents. Unless the context otherwise requires, this2020-1 Servicing Supplement and the other Trust Documents shall be interpreted so as to give full effect to all provisions hereof and thereof. In the event of any actual conflict between the provisions of this2020-1 Servicing Supplement and the Basic Servicing Agreement, with respect to the servicing of any2020-1 Exchange Note Assets, the provisions of this2020-1 Servicing Supplement shall prevail. This2020-1 Servicing Supplement shall supplement the Basic Servicing Agreement as it relates to the2020-1 Exchange Note and the2020-1 Designated Pool and not to any other Exchange Note or Designated Pool or the Lending Facility Pool.

SECTION 3.5. [Reserved].

SECTION 3.6. Notices. For purposes of the2020-1 Servicing Agreement, all demands, notices, directions, requests and communications hereunder shall be in writing and shall be delivered or mailed by registered or certified first-class United States mail, postage prepaid, hand delivery, prepaid courier service, or facsimile transmission, and addressed in each case as follows: (a) if to the Servicer, GM Financial, 801 Cherry Street, Suite 3500, Fort Worth, Texas, 76102, Attention: Chief Financial Officer, and (b) if to the Indenture Trustee, Wells Fargo Bank, National Association, 600 South 4th Street, MACN9300-061, Minneapolis, Minnesota 55479. Notices to the other parties to this2020-1 Servicing Supplement shall be delivered as provided in Section 6.5 of the Basic Servicing Agreement.

SECTION 3.7. Severability of Provisions. If any one or more of the covenants, agreements, provisions or terms of this2020-1 Servicing Supplement or the2020-1 Servicing Agreement shall be for any reason whatsoever held invalid, then such covenants, agreements, provisions or terms shall be deemed severable from the remaining covenants, agreements, provisions and terms of this2020-1 Servicing Supplement or the2020-1 Servicing Agreement, as applicable, and shall in no way affect the validity or enforceability of the other covenants,

20

agreements, provisions and terms of this2020-1 Servicing Supplement or the2020-1 Servicing Agreement.

SECTION 3.8. Binding Effect. The provisions of this2020-1 Servicing Supplement and the2020-1 Servicing Agreement shall be binding upon and inure to the benefit of the parties hereto and their permitted successors and assigns.

SECTION 3.9. Table of Contents and Headings. The Table of Contents and Article and Section headings herein are for convenience of reference only and shall not define or limit any of the terms or provisions hereof.

SECTION 3.10. Counterparts. This2020-1 Servicing Supplement may be executed in any number of counterparts, each of which so executed and delivered shall be deemed to be an original, but all of which counterparts shall together constitute but one and the same instrument.

SECTION 3.11. Further Assurances. Each party shall take such acts, and execute and deliver to any other party such additional documents or instruments as may be reasonably requested in order to effect the purposes of this2020-1 Servicing Supplement and the2020-1 Servicing Agreement and to better assure and confirm unto the requesting party its rights, powers and remedies hereunder.

SECTION 3.12. Third-Party Beneficiaries. The Issuer, the Depositor and each Noteholder shall be third-party beneficiaries of the2020-1 Servicing Agreement. Except as otherwise provided in the2020-1 Servicing Agreement, no other Person shall have any rights hereunder.

SECTION 3.13. No Petition. Each of the parties hereto, in addition to the provisions of Section 6.13 of the Basic Servicing Agreement, covenants and agrees that prior to the date that is one (1) year and one (1) day after the date on which all Notes have been paid in full, it will not institute against, or join any other person in instituting against the Titling Trust or the Settlor, any bankruptcy, reorganization, arrangement, insolvency or liquidation Proceeding or other Proceeding under any Insolvency Law.

SECTION 3.14. Limitation of Liability. It is expressly understood and agreed by the parties hereto that (a) this2020-1 Servicing Supplement is executed and delivered by Wilmington Trust Company, not individually or personally but solely as owner trustee of the Titling Trust and the Settlor, in the exercise of the powers and authority conferred and vested in it under the Titling Trust Agreement and Settlor Trust Agreement, as applicable, (b) each of the representations, undertakings and agreements herein made on the part of the Titling Trust and the Settlor is made and intended not as personal representations, undertakings and agreements by Wilmington Trust Company but is made and intended for the purpose for binding only the Titling Trust and the Settlor, (c) nothing herein contained shall be construed as creating any liability on Wilmington Trust Company, individually or personally, to perform any covenant either express or implied contained herein, all such liability, if any, being expressly waived by the parties hereto and any Person claiming by, through or under the parties hereto, (d) Wilmington Trust Company has made no investigation as to the accuracy or completeness of any representations and warranties made by the Issuer in this Agreement, and (e) under no

21

circumstances shall Wilmington Trust Company be personally liable for the payment of any indebtedness or expenses of the Titling Trust and the Settlor or be liable for the breach or failure of any obligation, representation, warranty or covenant made or undertaken by the Titling Trust and the Settlor under this2020-1 Servicing Supplement or the other related documents.

SECTION 3.15. Preparation of Securities and Exchange Commission Filings. The Servicer will file or will cause to be filed, on behalf of the Issuer and the Depositor, any documents, forms or other items required to be filed by the Issuer or the Depositor pursuant to the rules and regulations set by the Commission and relating to the Notes or the Program Documents.

SECTION 3.16. Review Reports.

Upon the request of any Noteholder to the Servicer for a copy of any Review Report (as defined in the2020-1 Asset Representations Review Agreement), the Servicer shall promptly provide a copy of such Review Report to such Noteholder;provided, that if the requesting Noteholder is not a Noteholder of record, such Noteholder must provide the Servicer with a written certification stating that it is a beneficial owner of a Note, together with supporting documentation supporting that statement (which may include, but is not limited to, a trade confirmation, an account statement or a letter from a broker or dealer verifying ownership) before the Servicer delivers such Review Report to such Noteholder;provided,further, that if such Review Report contains personally identifiable information regarding Lessees, then the Servicer may condition its delivery of that portion of the Review Report to the requesting Noteholder on such Noteholder’s delivery to the Servicer of an agreement acknowledging that such Noteholder may use such information only for the limited purpose of assessing the nature of the related breaches of representations and warranties and may not use that information for any other purpose.

SECTION 3.17. Regulation RR Risk Retention. GM Financial, as Sponsor, agrees that (a) GM Financial will cause the Depositor to, and the Depositor will, retain the “eligible horizontal residual interest” (the “Retained Interest”) (as defined in the Credit Risk Retention Rules) on the2020-1 Closing Date, and (b) GM Financial will not, and will cause the Depositor and each affiliate of GM Financial not to, sell, transfer, finance, pledge or hedge the Retained Interest except as permitted by the Credit Risk Retention Rules. The representations and warranties set forth in this Section 3.17 shall survive the termination of this Agreement and resignation by, or termination of, GM Financial in its capacity as Servicer hereunder.

[Remainder of Page Intentionally Left Blank]

22

IN WITNESS WHEREOF, the parties hereto have caused this2020-1 Servicing Supplement to be duly executed by their respective officers duly authorized as of the day and year first above written.

| ACAR LEASING LTD., | ||

| By: | Wilmington Trust Company, not in its individual capacity but solely as Owner Trustee | |

| By: | ||

| Name: | ||

| Title: | ||

| AMERICREDIT FINANCIAL SERVICES, INC. | ||

| d/b/a GM Financial, in its individual capacity and as Servicer | ||

| By: | ||

| Name: | ||

| Title: |

| APGO TRUST, as Settlor | ||