Exhibit 99.1

May 8, 2020

Virgil Roberts, Board Chair

Wayne-Kent A. Bradshaw, Chief Executive Officer

Broadway Financial Corporation

5055 Wilshire Boulevard, Suite 500

Los Angeles, CA 90036

Subject: Offer to Acquire Broadway Financial Corporation

Gentlemen:

We are disappointed that your Board of Directors has rejected out of hand and will not discuss our offer to acquire 100% of the common stock of Broadway Financial Corporation for $1.75 per share, a 12% premium to tangible book value1 and almost 30% premium to the30-day average closing price when made.

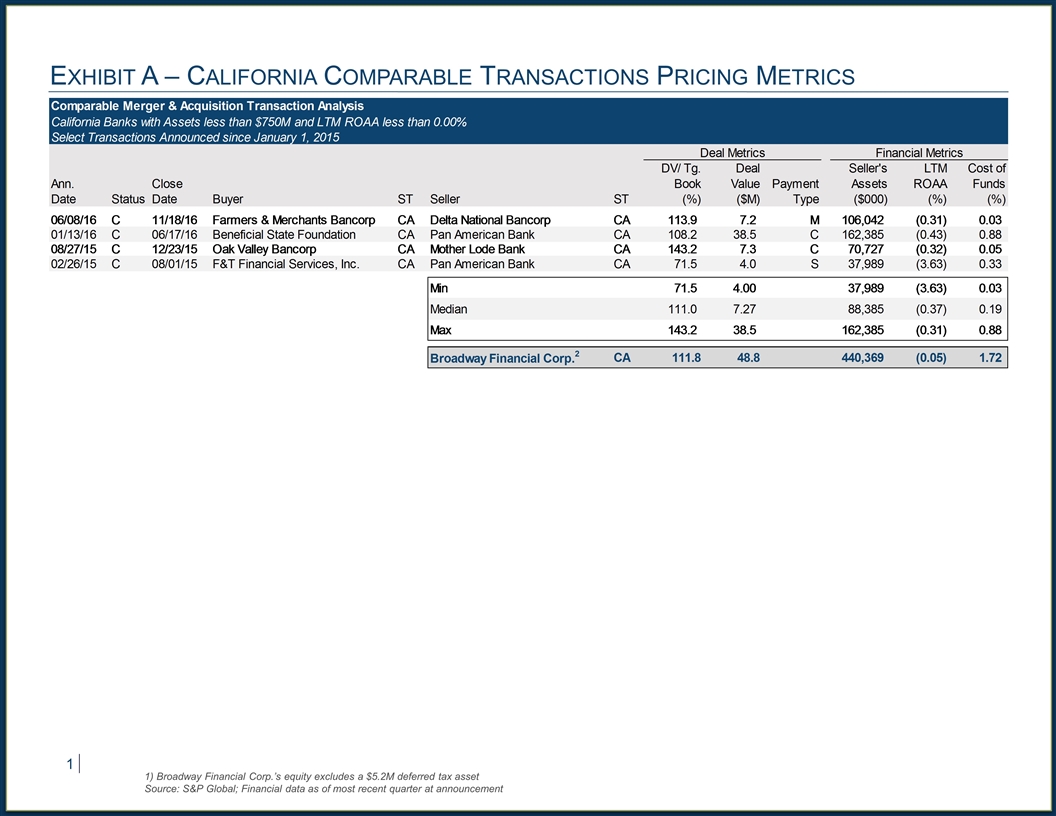

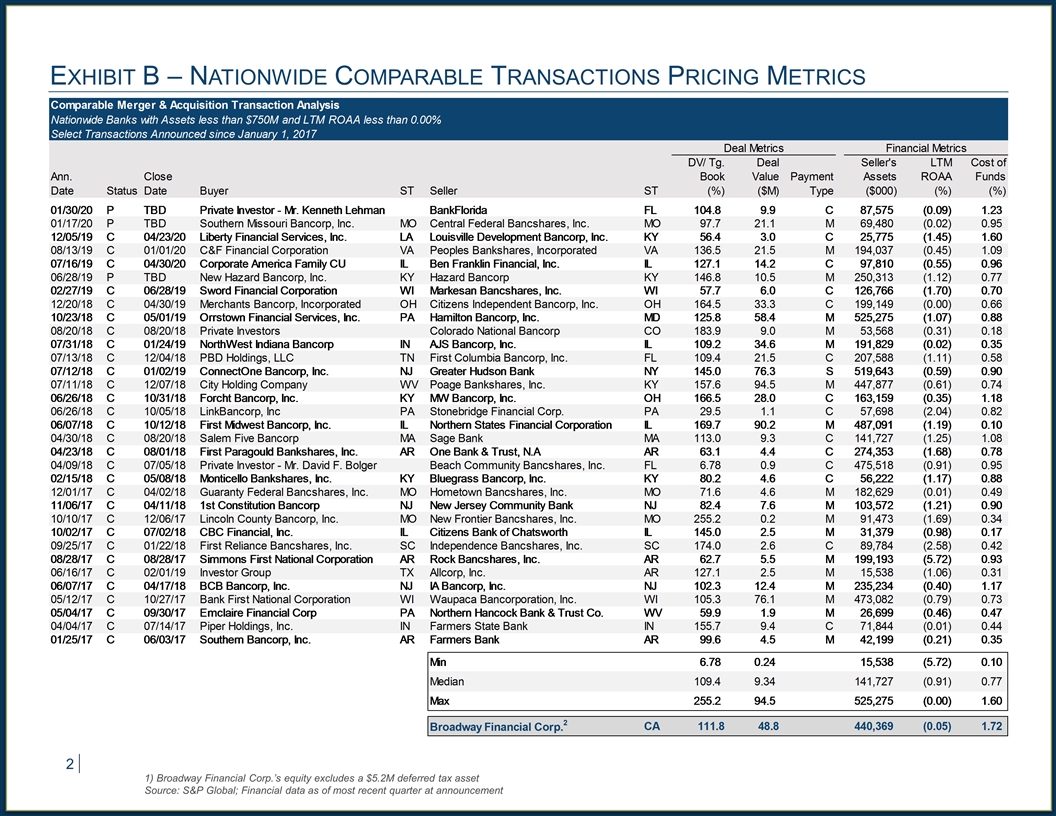

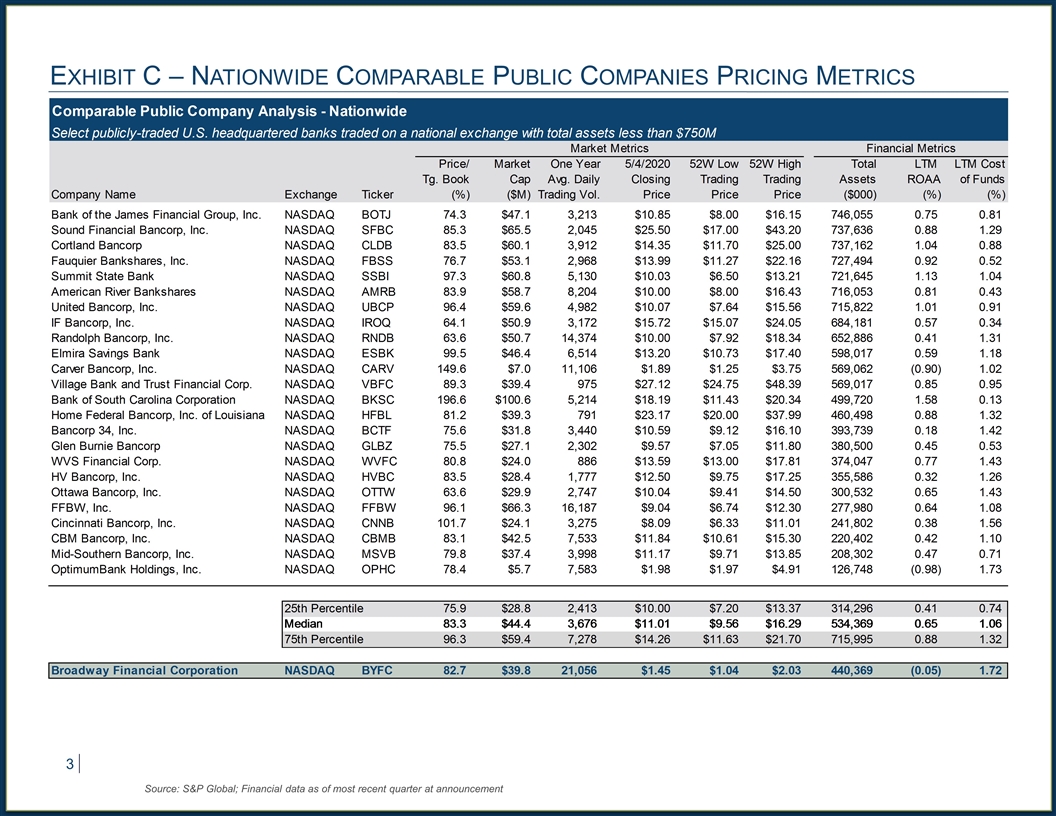

Our offer price is above the median transaction price for M&A transactions for comparable banks2 in both California (EXHIBIT A: California Comparable Transactions) and the United States (EXHIBIT B: Nationwide Comparable Transactions) and represents a substantial premium to current trading values for public banks generally (EXHIBIT C: Nationwide Comparable Public Companies).

Broadway’s earnings have fallen in each of the past five years and it continues to lag its peers. Its cost of funds (1.72%) is higher than any comparable bank’s and a multiple of the peer group averages (See exhibits). Moreover, Broadway has among the highest concentrations in commercial real estate of any bank or thrift regulated by the Office of the Comptroller of the Currency, making it particularly exposed to credit losses from the current pandemic.Broadway’s Board of Directors is not representing the interests of shareholders by ignoring our offer of $1.75 per share, or 112% of tangible book value, particularly in light of the dramatic reductions in bank valuationspost-COVID-19. For example, Bank of Southern California in San Diego, CA and CalWest Bancorp in Rancho Santa Margarita, CA recently reported that they agreed to reduce merger consideration by approximately 20%.

To be clear, we will extend to the Board a second chance to consider our offer to negotiate a definitive agreement to acquire all outstanding common shares on the following terms:

| | • | | All cash purchase of $1.75 per share |

| | • | | Standard terms and conditions to be proposed by the company and its advisors.3 |

| 1 | Book value of equity less intangible deferred tax asset at 12/31/19 |

| 2 | Depository M&A deals with bank target assets less than $750 million and negative LTM ROAA |

| 3 | We are prepared to consider any reasonable and customary form of a Letter of Intent to be provided by the Company. We have yet to be asked a single question about our original offer so we are concerned the Company may be attempting to create “strawman” excuses by objecting to immaterial language that we provided. Therefore, we are making clear we are open to any such form of the LOI that the Company may propose. |

https://www.thecapitalcorps.com