Filed pursuant to Rule 253(g)(2)

File No. 024-11393

OFFERING CIRCULAR DATED MARCH 11, 2021

EdenLedger, Inc. (dba FanVestor)

2055 Lombard Street, #470217

San Francisco, CA 94147

+1 (415) 944-9430

fanvestor.com

UP TO 3,333,333 SHARES OF NON-VOTING COMMON STOCK

We are seeking to raise up to $8,333,333 from the sale of Non-Voting Common Stock (the “Shares”) to the public. There is no minimum offering dollar amount.

SEE “SECURITIES BEING OFFERED” AT PAGE 33

| | | Price | | | Underwriting discount and commissions (1) | | | Proceeds to Issuer (2) | |

| Per Share | | $ | 2.50 | | | $ | 0.025 | | | $ | 2.475 | |

| Total Maximum | | $ | 8,333,333 | | | $ | 83,333 | | | $ | 8,250,000 | |

| (1) | We have not engaged any placement agent or firm commitment underwriter in connection with this offering. To the extent that we do so, we will file a supplement to the Offering Statement of which this Offering Circular is a part. The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to perform administrative and technology related functions in connection with this offering, but not for firm commitment underwriting or placement agent services. The amount above includes the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. See “Plan of Distribution and Selling Security Holders” for details. |

| (2) | Does not include other expenses of the offering. See “Plan of Distribution and Selling Security Holders” for a description of these expenses. |

The minimum investment amount for shares of our Non-Voting Common Stock is $250.00, or 100 shares.

We expect that, not including state filing fees, the amount of expenses of the offering that we will pay will be approximately $8,333,333 if we raise the maximum amount.

The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date which is three years from this offering being qualified by the United States Securities and Exchange Commission (the “SEC”), or (3) the date at which the offering is earlier terminated by the Company in its sole discretion. At least every 12 months after this offering has been qualified by the SEC, the Company will file a post-qualification amendment to include the Company’s recent financial statements. The offering is being conducted on a best-efforts basis.

The Company intends to engage Prime Trust, LLC as an escrow agent to hold funds tendered by investors. We may hold a series of closings at which we receive the funds from the Escrow Agent and issue the shares to investors. After each closing, funds tendered by investors will be available to the Company and since there is no minimum offering amount, we will have access to these funds even if they do not cover the expenses of this offering. After the initial closing of this offering, we expect to hold closings on a bi-monthly basis.

Holders of Non-Voting Common Stock will not be entitled to vote on any matters submitted to a vote of the shareholders except as required by Delaware law, the Company’s bylaws or Certificate of Incorporation. See “Securities Being Offered.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 4.

Sales of these securities will commence on approximately March 10, 2021.

The Company is following the “Offering Circular” format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Implications of Being an Emerging Growth Company.

TABLE OF CONTENTS

In this Offering Circular, the term “FanVestor,” “we,” “us”, “our” or “the Company” refers to EdenLedger, Inc. (dba FanVestor).

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Implications of Being an Emerging Growth Company

We are not subject to the ongoing reporting requirements of the Exchange Act of 1934, as amended (the “Exchange Act”) because we are not registering our securities under the Exchange Act. Rather, we will be subject to the more limited reporting requirements under Regulation A, including the obligation to electronically file:

| | ● | annual reports (including disclosure relating to our business operations for the preceding three fiscal years, or, if in existence for less than three years, since inception, related party transactions, beneficial ownership of the issuer’s securities, executive officers and directors and certain executive compensation information, management’s discussion and analysis (“MD&A”) of the issuer’s liquidity, capital resources, and results of operations, and two years of audited financial statements), |

| | ● | semi-annual reports (including disclosure primarily relating to the issuer’s interim financial statements and MD&A) and |

| | ● | current reports for certain material events. |

In addition, at any time after completing reporting for the fiscal year in which our offering statement was qualified, if the securities of each class to which this offering statement relates are held of record by fewer than 300 persons and offers or sales are not ongoing, we may immediately suspend our ongoing reporting obligations under Regulation A.

If and when we become subject to the ongoing reporting requirements of the Exchange Act, as an issuer with less than $1.07 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| | ● | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| | ● | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| | ● | will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| | ● | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| | ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and |

| | ● | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”), or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

SUMMARY

The Company

EdenLedger, Inc., was incorporated under the laws of the State of Delaware on December 13, 2018. EdenCoin, Inc. (“EdenCoin”) was a corporation formed on July 7, 2017, under the laws of Delaware, and considered a predecessor entity. The Voting Common Stock of both companies was 100% owned by Michael Golomb, the founder and CEO of both companies. On October 3, 2019, an Agreement of Merger was approved between the two companies and the surviving corporation was EdenLedger, Inc. dba FanVestor (“FanVestor,” the “Company,” “we,” or “us”).

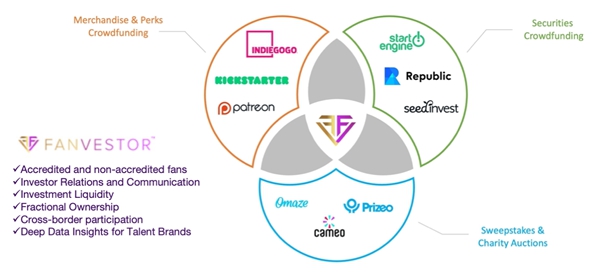

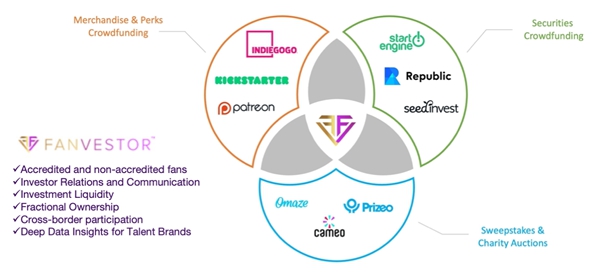

The Company is a data-driven investment platform creating a new ecosystem that enables fans, both accredited and non-accredited, to invest in and engage with their favorite talent, musicians, athletes as well as entertainment and sport/e-sport organizations. We have two wholly-owned subsidiaries: FanVestor CF LLC and FanPerks LLC, discussed below.

In some of the offerings we intend to facilitate, we anticipate operating as a technology platform, connecting celebrities and investors for which we will not act as a securities intermediary and will not be regulated as such. We will operate and be regulated as a funding portal for offerings taking place under Regulation Crowdfunding; we expect the funding portal to go live in the fourth quarter of 2020. We will partner with Dalmore Group, LLC, a registered broker-dealer, in connection with those offerings. See “The Company’s Business — Partnerships and Collaborations,” below.

Through FanVestor CF LLC, we intend to facilitate the following types of offerings that are exempt from registration under the Securities Act:

| | ● | Regulation A+ offerings: In partnership with Dalmore Group, we plan to host offerings under Regulation A under the Securities Act (“Regulation A+”) offerings on our platform. These offerings would involve issuers seeking to raise anywhere from $100,000 to $75,000,000 and we anticipate providing an array of technology and support services, including assisting with custodial accounts and coordinating vendors. |

| | ● | Regulation Crowdfunding offerings: FanVestor CF LLC, which will operate our funding portal, is in the registration process with the SEC and FINRA. We have completed our interview with FINRA and expect to have our registration finalized in December 2020. Once registered, we plan to host offerings under Regulation Crowdfunding under the Securities Act. These offerings would involve issuers seeking to raise anywhere from $10,000 to $5,000,000. We also expect to provide an array of ancillary services permitted by Regulation Crowdfunding, including campaign page design services, marketing consulting services, assisting with due diligence, custodial accounts, and coordinating vendors. |

| ● | Rule 506(c) offerings: In partnership with Dalmore Group, we plan to host offerings under Rule 506(c) of Regulation D. Accredited investors are allowed to invest in these offerings and we would host these offerings either on a stand-alone basis or concurrently with a Regulation Crowdfunding offering. Under Rule 506(c), issuers can use general solicitation to attract investors and, therefore, issuers engaged in a concurrent Regulation Crowdfunding offering can also raise additional funds from accredited investors providing they comply with the requirements of each exemption. We anticipate providing technology and support services for these offerings. |

In addition to fan-sourced fundraising, the FanVestor platform aims to offer advanced investor relations tools.

Through FanPerks LLC, we plan to facilitate non-security promotional activities, such as licensed sweepstakes and auctions for exclusive perk offerings (virtual and physical goods or services, rewards) and charitable fundraising campaigns.

We are a pre-revenue company without an operating history upon which to base an evaluation of our business and prospects. Our lack of operating history may hinder our ability to successfully meet our objectives and make it difficult for potential investors to evaluate our business or prospective operations. We have not generated any revenues since inception, and we are not currently profitable and may never become profitable.

Our financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Our ability to continue as a going concern is contingent upon our ability to raise additional capital as required. Our net losses for the year ended December 31, 2019, were $1,203,497 compared to $398,016 for year-end December 31, 2018. As of June 30, 2020, the Company had an accumulated deficit of $2,842,516. The Company does not currently generate any cash on its own. To date, we have funded operations with loans from our founder and CEO, Michael Golomb, a loan made through the Small Business Administration’s Paycheck Protection Program, and capital raised from the issuance of our securities.

These factors raise substantial doubt about our ability to continue as a going concern. We are dependent on additional capital resources for our planned principal operations and are subject to significant risks and uncertainties, including failing to secure funding to operationalize our planned operations or failing to profitably operate the business.

The Offering

| Securities offered by us: | | Maximum of 3,333,333 shares of Non-Voting Common Stock. |

| | | |

| Non-Voting Common Stock outstanding before the offering (1): | | 13,474,078 shares |

| | | |

| Non-Voting Common Stock outstanding after the offering (1): | | 16,807,411 shares, assuming we raise the maximum offering amount |

| | | |

| Use of proceeds (2): | | Product commercialization, marketing and brand development, purchase of intellectual property, and payment of deferred salaries. |

| (1) | We have granted Restricted Stock Awards under our Amended and Restated 2019 Equity Incentive Plan (“Equity Incentive Plan”). Our Equity Incentive Plan reserves for issuance 1,875,000 shares of Non-Voting Common Stock, of which 1,734,216 have been issued subject to vesting. The number of shares of Non-Voting Common Stock outstanding before and after the offering shown above does not include shares of unvested Non-Voting Common Stock issued under our Equity Incentive Plan or any shares of Non-Voting Common Stock that will remain reserved for issuance pursuant to our Equity Incentive Plan. |

| (2) | As part of this Offering, we will allow certain holders of the Company’s outstanding convertible notes to exchange their notes for shares of our Non-Voting Common Stock in this Offering as a form of consideration in lieu of new cash being raised by FanVestor. We will accept up to $944,423 in exchanged convertible notes at the option of the note holders. We will adjust our use of proceeds to account for any reduced cash receipts. |

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| | ● | We are an early stage company and have not yet generated any profits; |

| | ● | Our financials were prepared on a “going concern” basis; |

| ● | We have an amount of debt that may be considered significant for a company of our size, and we may incur additional debt in the future, which may materially and adversely affect our business, financial position, results of operations and cash flows; |

| ● | Voting control of the Company is in the hands of a single stockholder. |

| ● | We may not be able to generate sufficient cash to service all of our debt or refinance our obligations and may be forced to take other actions to satisfy our obligations under such indebtedness, which may not be successful; |

| ● | Any valuation of the Company at this stage is difficult to assess; |

| | ● | Voting control is in the hands of a single stockholder; |

| ● | We operate in a regulatory environment that is evolving and uncertain; |

| | ● | We operate in a highly regulated industry; |

| | ● | In the event we are required or decide to register as a broker-dealer, our current business model could be affected; |

| ● | We may be liable for misstatements made by issuers on our funding portal; |

| | ● | Our compliance is focused on U.S. laws and we have not analyzed foreign laws regarding the participation of non-U.S. residents; |

| | ● | FanVestor will be required to ensure that any sweepstakes occurring on its platform comply with state gaming and/or sweepstakes regulation; |

| | ● | FanVestor’s service offerings are relatively new in an industry that is still quickly evolving; |

| | ● | We are reliant on one main type of service; |

| | ● | We depend on key personnel and face challenges recruiting needed personnel; |

| | ● | FanVestor and its providers are vulnerable to hackers and cyber attacks; |

| | ● | FanVestor currently relies on one escrow agent and technology service provider; |

| | ● | We depend on our advisors and consultants who are subject to non-disclosure and confidentiality agreements; We are dependent on general economic conditions; |

| | ● | We face significant market competition; |

| | ● | Our revenues and profits are subject to fluctuations; and |

| | ● | If the Company cannot raise sufficient funds it will not succeed. |

| ● | Any valuation at this stage is difficult to assess; |

| ● | The Company may accept cancellation of debt as consideration for the issuance of its Non-Voting Common Stock in this Offering. |

| ● | There is no guarantee of return on investment; |

| ● | There is no minimum amount set as a condition to this offering; |

| ● | This offering involves “rolling closings,” which may mean that earlier investors do not have the benefit of information that later investors have; |

| ● | This investment is illiquid; |

| ● | Our management has discretion as to the use of proceeds; |

| ● | If you purchase securities in this offering, you will suffer immediate dilution of your investment; |

| ● | The value of your investment may be further diluted if the company issues additional options, convertible securities or shares of Non-Voting Common Stock; |

| ● | Investors in this Offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under the agreement. |

RISK FACTORS

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, relatively early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to the Company and our Business

We are an early stage company and have not yet generated any profits.

FanVestor was formed in 2018 and has only recently commenced revenue-generating operations. Accordingly, the company has a limited history upon which an evaluation of its performance and future prospects can be made. Our current and proposed operations are subject to all the business risks associated with new enterprises. These include likely fluctuations in operating results as the company reacts to developments in its market, managing its growth and the entry of competitors into the market. We will only be able to pay dividends on any shares once our directors determine that we are financially able to do so. FanVestor has incurred a net loss and has had limited revenues generated since inception. There is no assurance that we will be profitable in the next three years or generate sufficient revenues to pay dividends to the holders of the shares.

Our financials were prepared on a “going concern” basis.

Our financial statements were prepared on a “going concern” basis. Certain matters, as described below and in Note 1 to the accompanying financial statements indicate there may be substantial doubt about the company’s ability to continue as a going concern. We have not generated profits since inception, and we have had a history of losses. We have sustained losses of $1,203,497 and $398,016 for the years ended December 31, 2019 and 2018, respectively, and have an accumulated deficit of $1,789,750 as of December 31, 2019. More recently, we have sustained losses of $1,052,766 and $345,636 for the periods ending June 30, 2020 and 2019, respectively, and an accumulated deficit of $2,842,516 as of June 30, 2020. Our ability to continue operations is dependent upon our ability to generate sufficient cash flows from operations to meet our obligations, which the company has not been able to accomplish to date, and/or to obtain additional capital financing.

We have an amount of debt that may be considered significant for a company of our size, and we may incur additional debt in the future, which may materially and adversely affect our business, financial position, results of operations and cash flows.

Our current strategic initiatives require substantial capital. We may seek to raise any necessary additional funds through equity or debt financings or other sources that may be dilutive to existing stockholders. We cannot assure you that we will be able to obtain additional funds on commercially reasonable terms, if at all.

As at June 30, 2020 we had $1,949,108 of accrued liabilities. In addition to the loans made to the Company by its Founder and CEO, Michael Golomb through the Golomb Family Trust, the Company received $300,000 consideration for two Convertible Promissory Notes, one of which was purchased by the Golomb Family Trust, during 2020. Additionally, in May 2020, the Company applied for and was granted a loan under the Small Business Association’s Payroll Protection Program (“PPP”) in the amount of $55,645. The terms of the PPP were established by statute and interpreted by the SBA. Our lender confirmed on October 20, 2020 that a complete file was received to be able to begin processing forgiveness of the PPP loan. On January 8, 2021 we received notice that all but $5,000 on this loan was forgiven as of December 10, 2020. However, our debt level in general could limit our ability to obtain additional financing and could have other important negative consequences, including:

| | ● | make it more difficult for us to satisfy our obligations to the holders of our outstanding debt, resulting in possible defaults on and accelerations of such indebtedness; |

| | ● | require us to dedicate a substantial portion of our cash flows from operations to make payments on our debt, which would reduce the availability of our cash flows from operations to fund working capital, capital expenditures or other general corporate purposes; |

| | ● | increase our vulnerability to general adverse economic and industry conditions, including interest rate fluctuations; |

| | ● | limit our ability to refinance our existing indebtedness or borrow additional funds in the future; |

| | ● | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; |

| | ● | place us at a possible competitive disadvantage relative to less leveraged competitors and competitors that have better access to capital resources; and |

| | ● | limit our ability to react to competitive pressures or make it difficult for us to carry our capital spending that is necessary or important to our growth strategy. |

Any of the foregoing impacts of our substantial indebtedness could have a material adverse effect on our business, financial condition and results of operations. Additionally, if we are unable to secure financing on commercially reasonable terms, if at all, our business, financial position, results of operations and cash flows may be materially and adversely affected.

We may not be able to generate sufficient cash to service all of our debt or refinance our obligations and may be forced to take other actions to satisfy our obligations under such indebtedness, which may not be successful.

Our ability to make scheduled payments on our indebtedness or to refinance our obligations under our debt agreements, will depend on our financial and operating performance, which, in turn, will be subject to prevailing economic and competitive conditions and to the financial and business risk factors we face as described in this section, many of which may be beyond our control. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures or planned growth objectives, seek to obtain additional equity capital or restructure our indebtedness. In the future, our cash flows and capital resources may not be sufficient for payments of interest on and principal of our debt, and such alternative measures may not be successful and may not permit us to meet scheduled debt service obligations. In addition, the recent worldwide economic slowdown make it more difficult for us to refinance our indebtedness on favorable terms, or at all. In the absence of such operating results and resources, we may be required to dispose of material assets to meet our debt service obligations. We may not be able to consummate those sales, or, if we do, we will not control the timing of the sales or whether the proceeds that we realize will be adequate to meet debt service obligations when due.

Voting control is in the hands of a single stockholder.

Voting control is concentrated in the hands of the company’s Founder, CEO and Director, Michael Golomb. Furthermore, he has the status of “Super Director” under our Bylaws, giving him four votes and tie-breaking authority while other directors have one vote each. Subject to any fiduciary duties owed to owners or investors under Delaware law, our CEO may be able to exercise significant influence on matters requiring owner approval, including the election of directors, approval of significant company transactions, and will have unfettered control over the company’s management and policies. You may have interests and views that are different from our management. For example, management may support proposals and actions with which you may disagree with. The concentration of ownership could delay or prevent a change in control of the company or otherwise discourage a potential acquirer from attempting to obtain control of the company, which in tum could reduce the price potential investors are willing to pay for the company. In addition, our CEO could use his voting influence to maintain the company’s existing management, delay or prevent changes in control of the company, or support or reject other management and board proposals that are subject to owner approval.

We operate in a regulatory environment that is evolving and uncertain.

The regulatory framework for online capital formation or crowdfunding is very new. The regulations that govern our operations have been in existence for a very few years. Further, there are constant discussions among legislators and regulators with respect to changing the regulatory environment. New laws and regulations could be adopted in the United States and abroad. Further, existing laws and regulations may be interpreted in ways that would impact our operations, including how we communicate and work with investors and the companies that use our platforms’ services. For instance, over the past year, there have been several attempts to modify the current regulatory regime. Some of those suggested reforms could make it easier for anyone to sell securities (without using our services), or could increase our regulatory burden, including requiring us to register as a broker-dealer before we choose to do so. Any such changes would have a negative impact on our business.

We operate in a highly regulated industry.

We are subject to extensive regulation and failure to comply with such regulation could have an adverse effect on our business. Further our subsidiary, FanVestor CF, is registered as a funding portal with the SEC and FINRA and regulated entities such as us are often subject to FINRA fines. See “Regulations.” In addition, some of the restrictions and rules applicable to our subsidiary could adversely affect and limit some of our business plans.

In the event we are required or decide to register as a broker-dealer, our current business model could be affected.

Under our current structure, we believe we are not required to register as a broker-dealer under federal and state laws. We intend to partner with Dalmore Group LLP, which is registered in 50 states, with respect to in our security offerings under Regulation A and Regulation D. Further, other than our CEO, Michael Golomb, none of our officers have previous experience in securities markets or regulations. None of our officers are registered securities professionals or passed qualifying exams administered by FINRA. We comply with the rules surrounding funding portals and restrict our activities and services so as to not be deemed a broker-dealer under state and federal regulations, see “Business – Regulation.” However, if we were deemed by a relevant authority to be acting as a broker-dealer, we could be subject to a variety of penalties, including fines and rescission offers. Further, we may decide for business reasons or we may be required to register as a broker-dealer, which would increase our costs, especially our compliance costs. If we are required but decide not to register as a broker-dealer or act in association with a broker-dealer in our transactions, we may not be able to continue to operate under our current business model.

We may be liable for misstatements made by issuers on our funding portal.

Under the Securities Act and the Exchange Act, celebrity issuers making offerings through our funding portal may be liable for including untrue statements of material facts or for omitting information that could make the statements made misleading. This liability may also extend in Regulation Crowdfunding offerings to funding portals, such as our subsidiary. There may also be circumstances in which we are liable for making misleading statements in connection with Regulation Crowdfunding, A and Regulation D offerings. See “Business -- Regulation – Regulation Crowdfunding – Liability” and “Business -- Regulation – Regulation A and Regulation D – Liability” Even though due diligence defenses may be available; there can be no assurance that if we were sued, we would prevail. Further, even if we do succeed, lawsuits are time consuming and expensive, and being a party to such actions may cause us reputational harm that would negatively impact our business.

FanVestor will be required to ensure that any sweepstakes occurring on its platform comply with state gaming and/or sweepstakes regulation.

Rules and regulations governing sweepstakes, promotions, and giveaways vary by state and country, and these rules and regulations could restrict FanVestor’s ability to host sweepstakes offered by campaign sponsors if those sweepstakes are not done in compliance with those rules and regulations. Further, changes in laws or regulations in various states or countries over sweepstakes, promotions and giveaways or a negative finding of law regarding the characterization of certain campaigns on FanVestor could result in FanVestor’s inability host such sweepstakes, impacting a source of revenue.

FanVestor’s product offerings are relatively new in an industry that is still quickly evolving.

The principal securities regulations that we work with, Regulation Crowdfunding, Regulation A, and Regulation D have only been in effect in their current form since 2015 and 2016, respectively. FanVestor’s ability to continue to penetrate the market remains uncertain as potential issuers may choose to use different platforms or providers (including, in the case of Regulation A, using their own online platform), or determine alternative methods of financing. Investors may decide to invest their money elsewhere. Further, our potential market may not be as large, or our industry may not grow as rapidly, as anticipated. With a smaller market than expected, we may have fewer customers. Success will likely be a factor of investing in the development and implementation of marketing campaigns, subsequent adoption by issuers as well as investors, and favorable changes in the regulatory environment.

We are reliant on one main type of service.

All of our current services are variants on one type of service, providing a platform for online capital formation. Our revenues are therefore dependent upon the market for online capital formation.

We depend on key personnel and face challenges recruiting needed personnel.

Our future success depends on the efforts of a small number of key personnel, including our founder and Chief Executive Officer, Michael Golomb with respect to strategy, compliance, capital markets, and back-office operations, and our Chief Operating Officer, Larry Namer, with respect to day-to-day operations, market strategy execution, business development, marketing, and other customer facing workstreams. Our software engineer team, and in particular Naji Bekhazi, is critical to continually innovate and improve our products while operating in a highly regulated industry. In addition, due to our limited financial resources and the specialized expertise required, we may not be able to recruit the individuals needed for our business needs. There can be no assurance that we will be successful in attracting and retaining the personnel we require to operate and be innovative.

FanVestor and its providers are vulnerable to hackers and cyber attacks.

As an internet-based business, we may be vulnerable to hackers who may access the data of our investors and the celebrity issuers that utilize our platform. Further, any significant disruption in service on the FanVestor platform or in its computer systems could reduce the attractiveness of the FanVestor platform and result in a loss of investors and companies interested in using our platform. Further, we rely on a third-party technology provider to provide some of our back-up technology as well as act as our escrow agent. Any disruptions of services or cyber attacks either on our technology provider or on FanVestor could harm our reputation and materially negatively impact our financial condition and business.

We depend on our advisors and consultants who are subject to non-disclosure and confidentiality agreements.

In certain cases, the company may rely on trade secrets to protect intellectual property, proprietary technology and processes, which the company has acquired, developed or may develop in the future. There can be no assurances that secrecy obligations will be honored or that others will not independently develop similar or superior products or technology. The protection of intellectual property and/or proprietary technology through claims of trade secret status has been the subject of increasing claims and litigation by various companies both in order to protect proprietary rights as well as for competitive reasons even where proprietary claims are unsubstantiated. The prosecution of proprietary claims or the defense of such claims is costly and uncertain given the uncertainty and rapid development of the principles of law pertaining to this area. The company, in common with other firms, may also be subject to claims by other parties with regard to the use of intellectual property, technology information and data, which may be deemed proprietary to others

We are dependent on general economic conditions.

Our business model is dependent on investors investing in the companies presented on our platforms. Investment dollars are disposable income. Our business model is thus dependent on national and international economic conditions. Adverse national and international economic conditions may reduce the future availability of investment dollars, which would negatively impact our revenues and possibly our ability to continue operations. It is not possible to accurately predict the potential adverse impacts on the company, if any, of current economic conditions on its financial condition, operating results and cash flow.

We face significant market competition.

We facilitate online capital formation. Though this is a new market, we compete against a variety of entrants in the market as well likely new entrants into the market. Some of these follow a regulatory model that is different from ours and might provide them competitive advantages. New entrants could include those that may already have a foothold in the securities industry, including some established broker-dealers. Further, online capital formation is not the only way to address helping start-ups raise capital, and the company has to compete with a number of other approaches, including traditional venture capital investments, loans and other traditional methods of raising funds and companies conducting crowdfunding raises on their own websites. Additionally, some competitors and future competitors may be better capitalized than us, which would give them a significant advantage in marketing and operations.

Our revenues and profits are subject to fluctuations.

It is difficult to accurately forecast our revenues and operating results, and these could fluctuate in the future due to a number of factors. These factors may include adverse changes in: number of investors and amount of investors’ dollars, the success of world securities markets, general economic conditions, our ability to market our platform to companies and investors, headcount and other operating costs, and general industry and regulatory conditions and requirements. The company’s operating results may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations may be significant and could impact our ability to operate our business.

If the Company cannot raise sufficient funds it will not succeed.

FanVestor is offering Non-Voting Common Stock in the amount of up to $8,333,333 in this offering and may close on any investments that are made. Even if the maximum amount is raised, the company is likely to need additional funds in the future in order to grow, and if it cannot raise those funds for whatever reason, including reasons relating to the company itself or to the broader economy, it may not survive. If the company manages to raise only the minimum amount of funds sought, it will have to find other sources of funding for some of the plans outlined in “Use of Proceeds.”

Risks Related to the Securities and the Offering

Any valuation at this stage is difficult to assess.

The valuation for the offering was established by the company. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially startups, is difficult to assess and you may risk overpaying for your investment.

The Company may accept cancellation of debt as consideration for the issuance of its Non-Voting Common Stock in this Offering.

The Company is making available to its current holders of convertible notes the opportunity to exchange their notes for out shares of Non-Voting Common Stock being issued in this Offering. The notes would convert under their own terms without the exchange occurring. The value of the principal and interest of the outstanding convertible notes that may be exchanged in this Offering is $944,424. Any debt cancellation accepted by the Company would reduce the total new cash proceeds the Company may receive. As such, the Company may not receive the full amount of new cash consideration to invest in its operations by accepting the debt cancellation.

There is no guarantee of return on investment.

There is no assurance that a purchaser will realize a return on its investment or that it will not lose its entire investment. For this reason, each purchaser should read the Form 1A and all Exhibits carefully and should consult with its own attorney and business advisor prior to making any investment decision.

There is no minimum amount set as a condition to closing this offering.

Because this is a “best efforts” offering with no minimum, we will have access to any funds tendered. This might mean that any investment made could be the only investment in this offering, leaving the company without adequate capital to pursue its business plan or even to cover the expenses of this offering.

This offering involves “rolling closings,” which may mean that earlier investors may not have the benefit of information that later investors have.

We may conduct closings on funds tendered in the offering at any time. At that point, investors whose subscription agreements have been accepted will become our shareholders. We may file supplements to our Offering Circular reflecting material changes and investors whose subscriptions have not yet been accepted will have the benefit of that additional information. These investors may withdraw their subscriptions and get their money back. Investors whose subscriptions have already been accepted, however, will already be our shareholders and will have no such right.

This investment is illiquid.

There is no currently established market for reselling these securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer.

Our management has discretion as to the use of proceeds.

The net proceeds from this offering will be used for the purposes described under “Use of Proceeds.” The company reserves the right to use the funds obtained from this offering for other similar purposes not presently contemplated which it deems to be in the best interests of the company and its investors in order to address changed circumstances or opportunities. As a result of the foregoing, the success of the company will be substantially dependent upon the discretion and judgment of management with respect to application and allocation of the net proceeds of this offering. Investors in our shares will be entrusting their funds to the company’s management, upon whose judgment and discretion the investors must depend.

If you purchase securities in this offering, you will suffer immediate dilution of your investment.

The public offering price of our Non-Voting Common Stock in this offering is substantially higher than the net tangible book value per share of our Non-Voting Common Stock. Therefore, if you purchase securities in the offering, you will pay an effective price per share of Non-Voting Common Stock that substantially exceeds our net tangible book value per share after giving effect to the offering. Based on a public offering price of $2.50 per share of Non-Voting Common Stock, if you purchase shares in this offering and we sell the maximum amount offered, you will experience immediate dilution of $2.18 per share, representing the difference between the public offering price of the securities and our net tangible book value per share after giving effect to the proceeds we received from this offering. Furthermore, if any of our outstanding Convertible Promissory Notes are exercised at prices below the public offering price, or we grant stock options under our equity incentive plans or issue additional convertible securities, you may experience further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution would incur if you participate in this offering.

The value of your investment may be further diluted if the company issues additional options, convertible securities or shares of Non-Voting Common Stock.

Our Amended Certificate of Incorporation provides that we can issue up to 17,500,000 shares of our Non-Voting Common Stock, whether in a subsequent offering, in connection with an acquisition or otherwise. We have granted 1,734,216 shares of Non-Voting Common Stock under our Equity Incentive Plan. Our Equity Incentive Plan reserves for issuance a total of 1,875,000 shares of Non-Voting Common Stock. We may in the future increase the number or percentage of shares reserved for issuance under this plan or adopt another plan. We have also agreed to issue shares of Non-Voting Common Stock to the holders of our Convertible Promissory Notes, which includes our Founder, CEO and Chairman of the Board, Michael Golomb, as discussed under “Interests of Management and Others in Certain Transactions.” The issuance of additional shares of Non-Voting Common Stock, Convertible Promissory Notes, additional grants of Non-Voting Common Stock under our Equity Incentive Plan, or other stock-based incentive program, may dilute the value of your holdings. The company views stock-based incentive compensation as an important competitive tool, particularly in attracting both managerial and technological talent.

The subscription agreement has a forum selection provision that requires disputes be resolved in state or federal courts in the State of Delaware, regardless of convenience or cost to you, the investor.

In order to invest in this offering, investors agree to resolve disputes arising under the subscription agreement in state or federal courts located in the State of Delaware, for the purpose of any suit, action or other proceeding arising out of or based upon the agreement, including those related federal securities laws. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder. This forum selection provision may limit your ability to obtain a favorable judicial forum for disputes with us. Alternatively, if a court were to find the provision inapplicable to, or unenforceable in an action, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business, financial condition or results of operations.

Investors in this Offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under the agreement.

Investors in this Offering will be bound by the subscription agreement, which includes a provision under which investors waive the right to a jury trial of any claim they may have against the company arising out of or relating to the agreement, including any claims made under the federal securities laws. By signing the agreement, the investor warrants that the investor has reviewed this waiver with his or her legal counsel, and knowingly and voluntarily waives the investor’s jury trial rights following consultation with the investor’s legal counsel.

If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of Delaware, which governs the agreement, by a federal or state court in the State of Delaware. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the subscription agreement. You should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement.

If you bring a claim against the company in connection with matters arising under the agreement, including claims under the federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against the company. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder. If a lawsuit is brought against the company under the agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if the jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms the agreement with a jury trial. No condition, stipulation or provision of the subscription agreement serves as a waiver by any holder of the company’s securities or by the company of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the Shares are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor with regard to ownership of the Shares, that were in effect immediately prior to the transfer of the Shares, including but not limited to the subscription agreement.

DILUTION

Dilution means a reduction in value, control or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares.

The following table demonstrates the price that new investors are paying for their shares with the effective cash price paid by the existing shareholder. The table gives effect to the sale of shares by us at $2,500,000, $5,000,000, and $8,333,333 (the maximum amount offered).

| | | $2,500,000

Raise | | | $5,000,00

Raise | | | $8,333,333

Raise | |

| Price per Share for new investors | | $ | 2.50 | | | $ | 2.50 | | | $ | 2.50 | |

| Shares issued to new investors | | | 1,000,000 | | | | 2,000,000 | | | | 3,333,333 | |

| Gross proceeds | | $ | 2,500,000 | | | $ | 5,000,000 | | | $ | 8,333,333 | |

| Less: offering costs | | $ | (350,000 | ) | | $ | (650,000 | ) | | $ | (833,333 | ) |

| Net offering proceeds | | $ | 2,150,000 | | | $ | 4,350,000 | | | $ | 7,500,000 | |

| Adjusted net tangible book value pre-financing (as of June 30, 2020) | | $ | (1,805,666 | ) | | $ | (1,805,666 | ) | | $ | (1,805,666 | ) |

| Adjusted net tangible book value post-financing | | $ | 344,334 | | | $ | 2,544,334 | | | $ | 5,694,334 | |

| Shares issued and outstanding pre-financing(1) | | | 14,631,562 | | | | 14,631,562 | | | | 14,631,562 | |

| Shares issued and outstanding post-financing(2) | | | 15,631,562 | | | | 16,631,562 | | | | 17,964,895 | |

| Net tangible book value per share prior to offering | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) |

| Increase/(decrease) per share attributable to new investors | | $ | 0.02 | | | $ | 0.15 | | | $ | 0.32 | |

| Net tangible book value per share after offering | | $ | 0.02 | | | $ | 0.15 | | | $ | 0.32 | |

| Dilution per share to new investors | | $ | 2.48 | | | $ | 2.35 | | | $ | 2.18 | |

| Dilution per share to new investors | | | 99 | % | | | 94 | % | | | 87 | % |

| (1) | The issued and outstanding shares reflects a 1:1.25 split that was effective upon the filing of our Certificate of Amendment to our Amended and Restated Certificate of Incorporation, effective on October 28, 2020. |

| (2) | This does not include the number of shares that may be issued by reason of conversion of outstanding Convertible Promissory Notes sold during 2020 under the terms of the Notes. Note holders will have the option to exchange their notes for shares of the Company’s Non-Voting Common Stock in this Offering. The aggregate value of the principal and interest of the outstanding Convertible Promissory Notes is $944,424, with the Company’s founder and CEO, Michael Golomb, holding Convertible Promissory Notes with principal and interest outstanding of $246,105. Should the Notes convert pursuant to the terms of the Notes rather than being exchange for shares in this Offering, the Company would be required to issue 396,018 shares of its Non-Voting Common Stock based on discounted per share prices of either $2.00 per share or $1.88 per share. |

To date, the company has 2,121,650 shares of Non-Voting Common Stock outstanding under its Amended and Restated 2019 Equity Incentive Plan (“Equity Incentive Plan”) to its directors, executive officers, employees, consultants and advisors.

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another Regulation A round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most often occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| | ● | In June 2020 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. |

| | ● | In December 2020 the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. |

| | ● | In June 2021 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the number of shares of Common Stock underlying convertible notes that the company may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

USE OF PROCEEDS

We estimate that the net proceeds from this offering will be approximately $7,499,999 assuming we raise the maximum offering amount and after deducting the estimated offering expenses of approximately $8,333,333 (excluding state filing fees).

The following table below sets forth the uses of proceeds assuming an offering amount of $2,500,000, $5,000,000, and $8,333,333 (the maximum offering amount). For further discussion, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Plan of Operations.”

| | | $2,500,000

Raise | | | $5,000,000

Raise | | | $8,333,333

Raise | |

| Offering Proceeds | | | | | | | | | |

| Shares sold by the Company | | | 833,333 | | | | 1,666,667 | | | | 3,333,333 | |

| Gross proceeds | | $ | 2,500,000 | | | $ | 5,000,000 | | | $ | 8,333,333 | |

| Offering expenses | | $ | (350,000 | ) | | $ | (650,000 | ) | | $ | (8333,333 | ) |

| Total Offering Proceeds Available for Use | | $ | 2,150,000 | | | $ | 4,350,000 | | | $ | 7,500,00 | |

| | | | | | | | | | | | | |

| Estimated Expenditures | | | | | | | | | | | | |

| Compliance, operations, general and administrative | | $ | 675,000 | | | $ | 1,180,000 | | | $ | 2,340,000 | |

| Engineering and product | | $ | 620,000 | | | $ | 960,000 | | | $ | 1,930,000 | |

| Business development, sales and marketing | | $ | 525,000 | | | $ | 1,180,000 | | | $ | 2,900,000 | |

| Payment of deferred compensation | | $ | 330,000 | | | $ | 330,000 | | | $ | 330,000 | |

| Total Expenditures | | $ | 2,150,000 | | | $ | 4,350,000 | | | $ | 7,500,000 | |

| Working capital reserves | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| (1) | Excludes state filing fees of approximately $12,000. |

As part of this Offering, we will allow certain holders of the Company’s outstanding Convertible Promissory Notes to exchange their Notes for shares of our Non-Voting Common Stock in this Offering as a form of consideration in lieu of new cash being raised by FanVestor. We will accept up to $944,423 in exchanged Convertible Promissory Notes at the option of the note holders. The proceeds from the Convertible Promissory Notes were used for general operations across product development, marketing, and general and administrative expenses. We will adjust our use of proceeds to account for any reduced cash receipts with a continued emphasis on compliance and operations, and product engineering.

The above figures represent only estimated costs. This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds from this offering.

We reserve the right to change the above use of proceeds if management believes it is in the best interests of the Company.

THE COMPANY’S BUSINESS

Overview

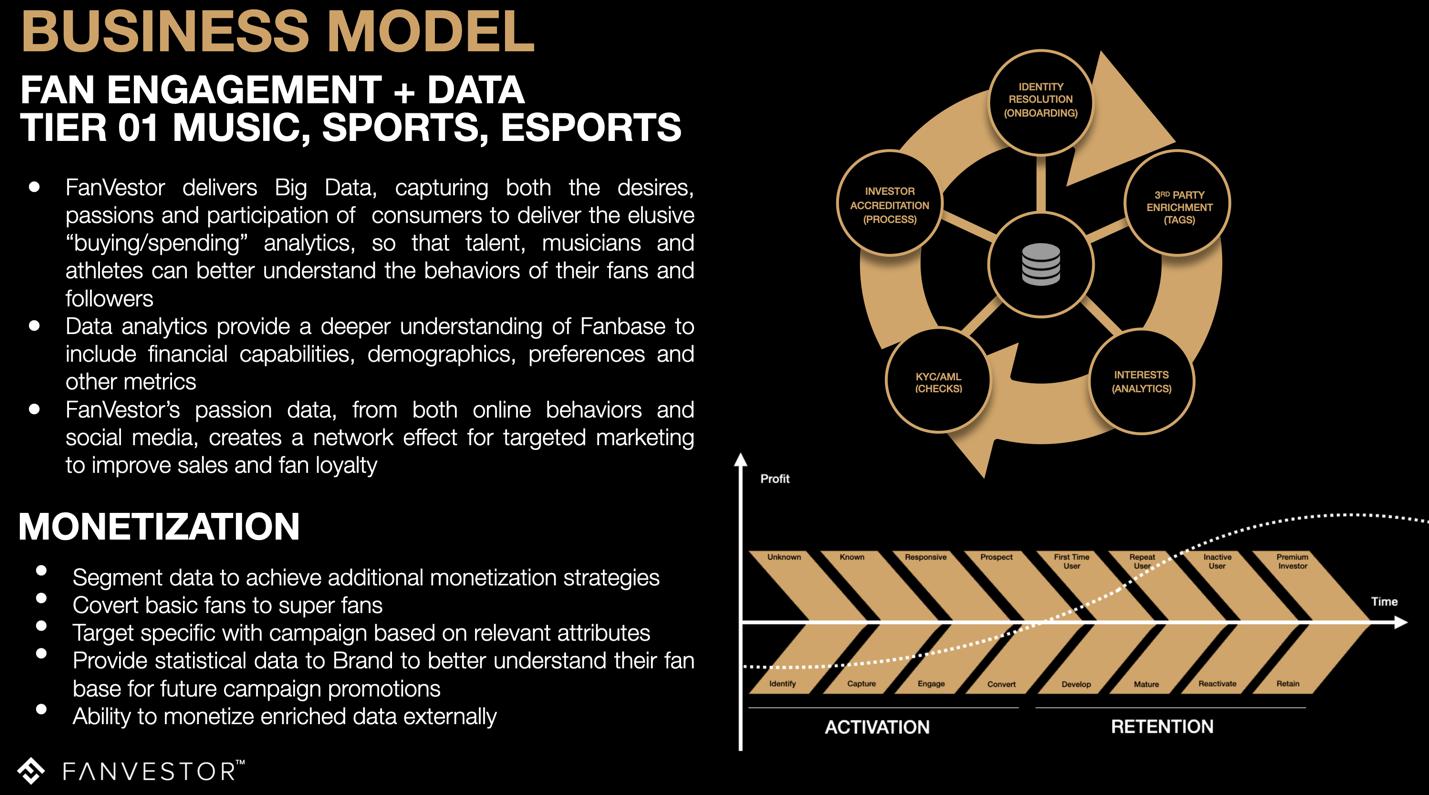

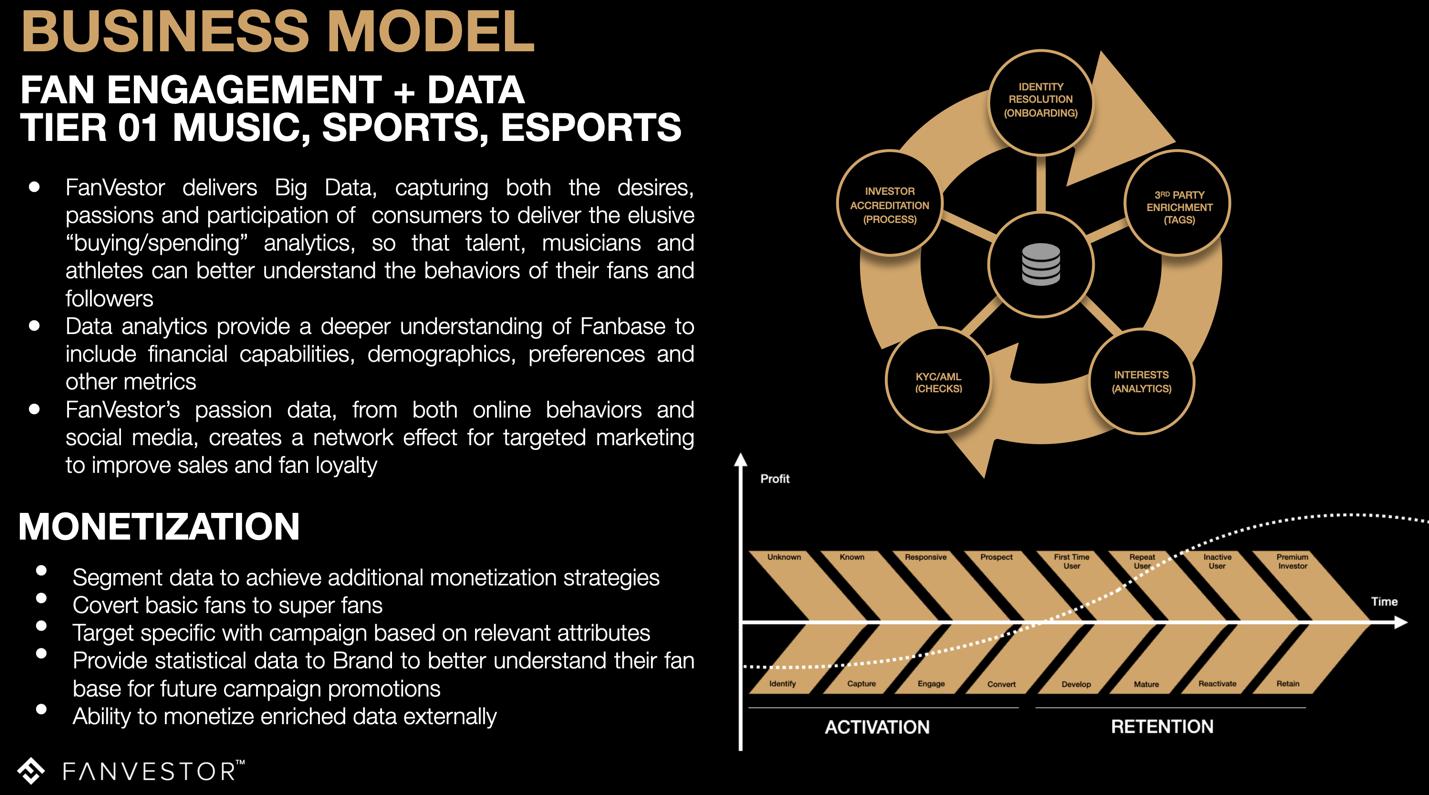

Our original concept was created by Michael Golomb, founder and CEO back in 2017, resulting in EdenLedger, Inc.’s incorporation on December 13, 2018 under the laws of Delaware. EdenLedger’s predecessor company, EdenCoin, Inc. was a corporation formed on July 7, 2017, under the laws of Delaware. Michael Golomb, the founder and CEO of both companies, owned 100% of the Voting Common Stock of both companies. The Company is a data-driven investment platform creating a new ecosystem that enables fans, both accredited and non-accredited, to invest in and engage with their favorite talent; musicians, athletes and entertainment and sport/e-sport organizations.

FanVestor is an innovative crowdfunding platform that has built a crowdfunding platform specifically focused on media celebrities, athletes, artists, esports leaders, fashion icons – the most influential talent brands and their fans. Celebrities harness the power of their fan bases, and raise funds for their next project, business endeavor and/or charity. We have taken a dual approach to the talent/fan relationship.

First, because we are focused exclusively on celebrity talent brands across industries, we have created a “safe zone” that allows talent to be in a group of their peers – other top-tier talent in sports, tv/film, music, fashion and art. Because of the public nature of celebrity, their brand image is often priority number one, and being amongst their peers creates an acceptable situation. This is especially important when looking to raise money, as no celebrity wants to appear to need money. In addition, because our platform focuses on the talent-fan relationship, celebrities are able to position any fundraising as a “thank you” to fans and giving them a chance to share in their success. This starts with identifying a project, establishing the project type and business goals (new branded product launch, new business expansion, social good campaign/charity, etc.). FanVestor then identifies the product offerings that align most to the project type, business goals and talent brand image – this can be a sweepstakes, merchandise/perks and experience offering, or an offering of securities with equity positions taken by fans. Talent then communicates to their fans across all social media, email/text, and press channels alerting fans of the opportunity to join them in their next project. Fans will visit FanVestor on the web app or their mobile device to learn about the offering and commit to participation via a sweepstakes, commerce or securities investment. FanVestor helps manage the communications with fans from lead to commitments to post-purchase.

Secondly, we are attracting fans to our platform. We will be working with talent across multiple categories and creating the largest database of celebrity fans and superfans. Because talent will invite their fans to FanVestor, once registered they become a customer of FanVestor, allowing us to communicate about talent offerings, exclusive content, and new opportunities with relevant celebrities. As they invest, we will be able to leverage their data and profile to create repetitive success for every talent project and will quickly become the only place celebrities will go to raise funds for projects, business endeavors and charities across a diverse group of fans, including their own.

We believe that FanVestor is the only platform of its kind in the global crowdfunding nation. We aim to facilitate financial ignition of innovative celebrities who have the energy and talent to start and grow successful campaigns for both their charitable causes and personal projects.

Our micro-securitization platform will allow both accredited and non-accredited fans to invest in their favorite celebrity brands. Prior to the introduction of FanVestor, fans and followers connected with their favorite celebrities by purchasing branded products, attending events and consuming content on social media. FanVestor enables these emotional “fan” connections to move to the next level and become “investors.”

FanVestor was the back-to-back winner of the 2020 and 2021 FinTech Breakthrough Award for Crowdfunding Innovation and aims to become a first-of-its-kind FINRA-regulated equity crowdfunding and engagement platform that provides a one-stop shop for music, sport, and entertainment celebrity driven businesses to capitalize on their social media fan basis. Think of us as StartEngine meets E! Entertainment.

Fans can interact with their favorites and participate in equity crowdfunding projects, specialized e-commerce, auctions, sweepstakes, exclusive rewards and charity events on the FanVestor platforms (iOS, Android, Web-app).

FanVestor believes it has a stellar leadership team, composed of seasoned entrepreneurs, technologists and advisors with proven success and key industry relationships. FanVestor’s Founder and CEO Michael Golomb is a long-time business leader, having helped raise more than $2 billion through multiple IPOs and other fundraising activities, Larry Namer, COO, was Co-Founder of E! Entertainment TV, and Naji Bekhazi (EVP Engineering & Products), who brings 35 years of running engineering organizations at several global companies with two successful exits.

Board Directors and Advisors to FanVestor include seasoned entrepreneurs, technologists with proven success and key industry relationships:

| ● | Marty Pompadur - the former head of ABC TV Network and Chairman of NewsCorp Europe |

| ● | Phil M. Quartararo – Former CEO of Warner Brothers Music, EMI Records and Virgin Records |

| ● | Bryan Goldberg - Co-Founder of Bleacher Report; Founder/CEO Bustle, Gawker, Elite Daily, Mic, The Outline, The Zoe Report |

| ● | Anya Goldin - Former 17-year Latham & Watkins equity partner and Board Member at public & private companies |

| ● | Yung Kim - Former President and an executive board member of Korea Telecom (KT) |

| ● | Rita Sallis - Infrastructure Investment Board Member, advised by J.P. Morgan and a former CIO of New York City |

| ● | Yobie Benjamin - Former Global CTO of Citigroup and Chief Strategy Officer of Ernst & Young |

| ● | Marvin Liao - Former Yahoo! Partner at Venture Capital Fund 500 Startups, running the San Francisco-based accelerator program, 400+ pre-seed and seed-stage startups investments |

| ● | Alan Qiu - Director of Investment for Panorama Capital and former Vice President, Business Development and International Business for PINTEC (NASDAQ:PT) |

In July 2020, the Company kicked off its multi-year partnership with iHeartMedia, featuring opportunities from DJ Khaled, The Jonas Brothers, Jackson Wang, Ryan Seacrest, The Ben& Ashley Show, LA Dodger’s Justin Turner & Max Muncy, as well as several individual campaigns with Paul Oakenfold and Hamilton the Musical. These current opportunities are for fan experiences and are not active offerings of securities. Our current agreement with iHeartMedia continues through December 31, 2021.

FanVestor has two wholly owned subsidiaries:

| ● | FanVestor CF, which will be conducting Regulation CF securities offerings through our official Regulation CF funding portal commencing upon FINRA’s formal authorization; and |

| ● | FanPerks, through which we conduct our non-security type offerings, such as licensed sweepstakes, auctions for perks (virtual and physical goods or services), and charitable fundraising campaigns. |

Our Innovation

FanVestor’s all-in-platform for fan investing and fan commerce offers experiences, product offerings – both virtual and physical, and tiered levels of rewards for both commercial and charitable projects offered by celebrities to their fans.

FanVestor’s business model is also unique to the marketplace, capitalizing on the recent changes in regulations and tech innovation such as:

| ● | JOBS Act/compliance - creating financial investment opportunities for non-accredited investors |

| ● | Regulated by the SEC and FINRA |

| ● | Next-generation data science - enabling our data-driven data management platform to collect valuable data that delivers the entertainment industry key data such as the buying habits of celebrities’ fan base and other key features which can then be used to grow and expand one’s digital, online/offline businesses. up to optimize data management, analytics, and communication tools for persons of social influence by providing deep insights into fan data, purchasing history and enriched user attributes for celebrities |

| ● | Social media engagement platforms - Our platform is brand agnostic, meaning any established talent, musician, athlete, entertainment or sport organization can raise capital from their direct and indirect social media followers using the FanVestor technology platform through our investment offerings, micro-securitization, and innovative rewards. With this data, FanVestor’s platform enables celebrities to communicate with their fan base using targeted messaging and retargeting products to further monetize projects. Our application leverages the social integrations and followers of celebrities across multiple social media platforms (e.g., Facebook, Twitter, YouTube, Instagram, and Tik Tok), and then layers the data enrichment concept to grow our platform user base. |

In both March 2020 and 2021, FanVestor was recognized as the winner of “Crowdfunding Innovation Award” by FinTech Breakthrough, part of Tech Breakthrough, a market intelligence company.

Principal Products and Services

FanVestor filed its full U.S. patent in December 2020 (US#62/950,038).

Current Services

Depending on the type of offering being made, we anticipate operating as a technology platform connecting celebrities and investors for which we do not act as a securities intermediary and are not regulated as such. Our subsidiary, FanVestor CF LLC is now registered as a funding portal for offerings taking place under Regulation Crowdfunding. We will partner with Dalmore Group, LLC, a registered broker-dealer, in connection with those offering. See “Partnerships and Collaborations,” below.

We intend to facilitate the following types of offerings that are exempt from registration under the Securities Act:

| ● | Regulation A+ offerings: In partnership with Dalmore Group, through FanVestor we plan to host Regulation A+ offerings on our platform. These offering would involve issuers seeking to raise anywhere from $100,000 to $75,000,000. We also anticipate providing an array of technology and support services, including custodial accounts and coordinating vendors. |

| ● | Regulation Crowdfunding offerings: Through FanVestor CF LLC, our funding portal is registered with the SEC and FINRA. Through FanVestor CF, LLC, we plan to host Regulation Crowdfunding offerings. These offerings would involve issuers seeking to raise anywhere from $10,000 to $5,000,000. We also expect to provide an array of services permitted by Regulation Crowdfunding, including campaign page design services, marketing consulting services, assisting with due diligence, custodial accounts, and coordinating vendors. |

| ● | Rule 506(c) offerings: In partnership with Dalmore Group, through FanVestor, we plan to host offerings under Rule 506(c) of Regulation D. Accredited investors are allowed to invest in these offerings and we would host these offerings either on a stand-alone basis or concurrently with a Regulation Crowdfunding offering. Under Rule 506(c), issuers can use general solicitation to attract investors and, therefore, issuers engaged in a concurrent Regulation Crowdfunding offering can also raise additional funds from accredited investors providing they comply with the requirements of each exemption. |

Through FanPerks LLC, we plan to facilitate non-security type offerings, such as licensed sweepstakes and auctions for exclusive perks offerings (virtual and physical goods or services, rewards) and charitable fundraising campaigns.

Services Under Development

We have taken a phased approach to our product roadmap, focusing and prioritizing our development and financial resources initially on features and functionality that will drive user and fan acquisition, talent partnerships, and product offerings that allow us to deliver immediately for all prospective talent projects. Our business model focus on top-tier talent. These talent brands have influence with millions of fans and can activate those fans to take action within minutes of an Instagram post, tweet, YouTube video, TikTok video or press announcement, so our product offering prioritizes user experience, stability and scalability, In terms of user experience, we made it easy for fans to register on FanVestor and set up their profile. We then scaled, tested and re-tested the system for stability with 2,200 transactions per second with only 30 instances of horizontal scaling, which basically confirmed that we could have 40-50 million registered users on the platform, which would support the biggest celebrity fanbases in the world. With our pilot iHeartMedia partnership, our technical tests were validated with no issues related to website visits, registrations, and engagement across iOS, Android, and the web app.

While deep into discussions with talent and their management teams, it became clear that we needed product options depending on the stage of project and appetite of the talent. Therefore, we created multiple product offerings that would cover 99% of the asks of talent, without any customization. This was critical as many talent brands want to be “unique” and customize for their individual fanbases. With four offerings, we can address 99% of the talent demands in terms of service offerings. The four offerings we developed are:

| ● | Sweepstakes - with free and paid entries for experiential rewards; |

| ● | Perks and commerce – which allows fans to purchase products that can be packaged with unique experiences and value adds by the talent (e.g. autographed basketball included, etc.); |

| ● | Securities - through Regulation CF or Regulation A to raise funds up to $50 million for a business project providing potential future value to investors; and |