- RCOR Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Renovacor (RCOR) S-1IPO registration

Filed: 15 Oct 21, 5:10pm

Delaware | 2836 | 80-0948910 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Title Of Each Class Of Securities To Be Registered | Amount To Be Registered (1) | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price (7) | Amount Of Registration Fee | ||||

Common Stock, par value $0.0001 per share issuable upon exercise of the Public Warrants and Private Placement Warrants | 7,811,322 (2) | $ 11.50 | $89,830,203 | $8,327.26 | ||||

Common Stock, par value $0.0001 per share issuable upon exercise of the Pre-Funded Warrants | 715,224 (3) | $ 7.99 (5) | $5,714,639.76 | $529.75 | ||||

Common stock, par value $0.0001 per share | 12,668,314 (4) | $ 7.99 (5) | $101,219,828.86 | $9,383.08 | ||||

Private Placement Warrants to purchase Common Stock | 3,500,000 | $— (6) | — (6) | — (6) | ||||

Total | 24,694,860 | $196,764,671.62 | $18,240.09 | |||||

(1) | Pursuant to Rule 416(a) under the Securities Act, this Registration Statement shall also cover any additional shares of the Registrant’s common stock that become issuable as a result of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration that results in an increase to the number of outstanding shares of the Registrant’s common stock, as applicable. |

(2) | Consists of (i) 4,311,322 shares of common stock issuable upon the exercise of 8,622,644 Public Warrants (as defined herein); and (ii) 3,500,000 shares of common stock issuable upon the exercise of 3,500,000 Private Placement Warrants (as defined herein). |

(3) | Consists of up to 715,224 shares of common stock issuable upon the exercise of the Pre-Funded Warrant (as defined herein). |

(4) | Consists of (i) 2,284,776 outstanding PIPE Shares (as defined herein); (ii) 6,305,061 outstanding Old Renovacor Stockholder Shares (as defined herein); (iii) 1,655,661 outstanding Sponsor Shares (as defined herein); (iv) 1,922,816 Earnout Shares (as defined herein) that may be issued pursuant to the earnout provisions of the Merger Agreement (as defined herein) and (v) 500,000 Sponsor Earnout Shares (as defined herein) that are held in escrow and subject to forfeiture pursuant to certain conditions more fully described in the Sponsor Support Agreement (as defined herein). These shares are being registered for resale on this Registration Statement. |

(5) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) (and 457(g) in the case of the shares of common stock issuable upon exercise of the Pre-Funded Warrant) under the Securities Act based on the average of the high and low prices of Renovacor, Inc.’s common stock, par value $0.0001 per share, on the New York Stock Exchange on October 8, 2021 (such date being within five business days of the date that this registration statement was filed with the U.S. Securities and Exchange Commission). |

(6) | In accordance with Rule 457(i), the entire registration fee for the private placement warrants is allocated to the shares of common stock underlying such warrants, and no separate fee is payable for the private placement warrants. |

(7) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

| • | up to 4,311,322 shares of Common Stock that are issuable upon the exercise of 8,622,644 warrants originally issued in the initial public offering of Chardan Healthcare Acquisition 2 Corp. (“Chardan”) to the holders thereof (the “Public Warrants”); |

| • | up to 3,500,000 shares of Common Stock that are issuable upon the exercise of 3,500,000 warrants originally issued in a private placement concurrently with the initial public offering of Chardan (the “Private Placement Warrants”); and |

| • | up to 715,224 shares of Common Stock that are issuable upon the exercise of a pre-funded warrant originally issued in the PIPE Investment (as defined below) (the“Pre-Funded Warrant”, and together with the Public Warrants and the Private Placement Warrants, the “Warrants”). |

| • | up to 2,284,776 shares of Common Stock (the “PIPE Shares”) issued in a private placement pursuant to subscription agreements entered into between us and the subscribers on March 22, 2021 (the “PIPE Investment”); |

| • | up to 6,305,061 shares of Common Stock (the “Old Renovacor Stockholder Shares”) issued to certain former stockholders of Old Renovacor (defined below) (the “Old Renovacor Stockholders”) in connection with the Merger (as defined below); |

| • | up to 1,655,661 shares of Common Stock (the “Sponsor Shares”) originally issued in a private placement to Chardan Investments 2, LLC (the “Sponsor”) and certain of its directors and employees; |

| • | up to 1,922,816 shares of Common Stock (the “Earnout Shares”) that may be issued pursuant to the earnout provisions of the Merger Agreement (as defined herein); |

| • | up to 500,000 shares of restricted Common Stock held in escrow and subject to forfeiture pursuant to certain conditions more fully described in the Sponsor Support Agreement (as defined herein) (the “Sponsor Earnout Shares”); and |

| • | up to 3,500,000 Private Placement Warrants. |

Page | ||||

1 | ||||

8 | ||||

10 | ||||

66 | ||||

68 | ||||

69 | ||||

70 | ||||

71 | ||||

84 | ||||

94 | ||||

125 | ||||

134 | ||||

148 | ||||

155 | ||||

158 | ||||

162 | ||||

168 | ||||

175 | ||||

177 | ||||

180 | ||||

180 | ||||

180 | ||||

F-1 | ||||

| * | The diagram above is representative of the current stage of our development and does not reflect our expectations of the clinical trials needed or an agreed upon pathway with the FDA for commercialization of our product candidates. We acknowledge that the required clinical studies and pathway to commercialization must be agreed upon with the FDA. |

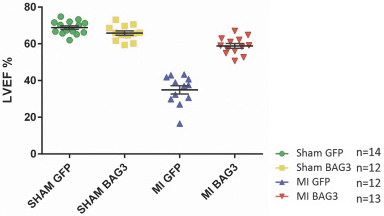

| • | Advancing our lead product candidate, REN-001, throughIND-enabling activities, clinical trials and regulatory approvalREN-001, and, if approved by the FDA, commercializeREN-001 for the rare disease indication BAG3-associated DCM. We anticipate submission of an IND forREN-001 inmid-2022 and the subsequent commencement of clinical trials. We plan to apply for regulatory designations such as Orphan Drug Designation and Fast Track Designation to facilitate the development ofREN-001 to help bringREN-001 to patients in an expedited manner. |

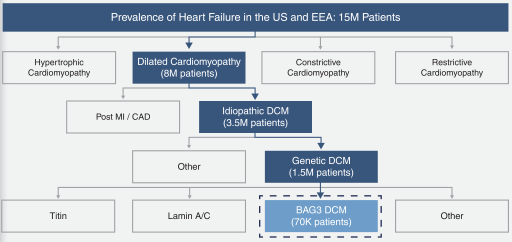

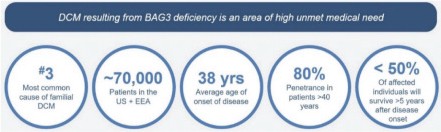

| • | Leveraging our deep understanding of BAG3 biology. Our vision is to develop gene therapies for BAG3-associated diseases with high unmet medical need REN-001, is a recombinant AAV9-based gene therapy designed to deliver a fully functional BAG3 gene to augment BAG3 protein levels in cardiomyocytes and slow or halt progression of BAG3 DCM. We also intend to leverage our expertise in BAG3 biology to investigate the utility of BAG3 gene therapy for additional pipeline product opportunities across other potential cardiovascular and CNS indications. Our founder, |

Dr. Arthur M. Feldman, M.D., Ph.D., the Laura H. Carnell Professor of Medicine at the Lewis Katz School of Medicine at Temple University, is a highly regarded cardiovascular scientist and pre-eminent expert on the role of BAG3 in human disease. We intend to leverage Dr. Feldman’s expertise to advance our lead product candidate,REN-001, as well as to develop a research pipeline of additional product candidates. We believe that through our licensed intellectual property, specifically patents for BAG3 gene therapy through multiple routes of administration and in multiple indications, we have developed substantial barriers to entry. |

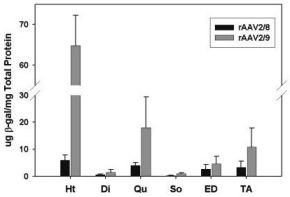

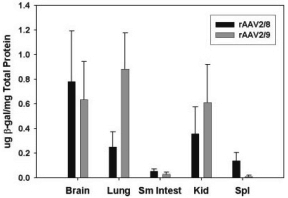

| • | Overcoming challenges of existing gene therapy approaches REN-001, utilizes a local intracoronary vector delivery approach with the intended goal of improved cardiac uptake and methods to maximize dwell time in the cardiac circulation. |

| • | Utilizing what we believe is a superior local delivery approach with the potential to reduce total vector burden and manufacturing costs REN-001 for BAG3-associated DCM. This method of local delivery has been shown to be effective at transducing cardiac tissue in preclinical pig models. Specifically, ICr showed improved transduction in the heart relative to other intracoronary delivery methods. ICr delivery is expected to allow for a lower total dose per patient relative to intravenous, or IV, delivery. Advantages of a lower total dose per patient include the potential for decreased risk of adverse events related to total vector exposure and the potential for reduced manufacturing cost. |

| • | Leverage and grow our leadership team REN-001 through development. As development ofREN-001 and other product candidates progress, we intend to expand our senior management team and clinical, manufacturing, and research and development expertise to support our growth. |

| • | We have incurred significant operating losses since our inception and expect to incur significant losses for the foreseeable future. |

| • | We will require additional funding in order to finance operations and, if we are unable to raise capital when need on acceptable terms, we could be forced to delay, reduce, or eliminate our product development programs or commercialization efforts. |

| • | Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates. |

| • | We are very early in our research and development efforts. Our business is dependent on our ability to advance our current and future product candidates through preclinical studies and clinical trials, obtain marketing approval and ultimately commercialize them. |

| • | Our business is highly dependent on the success of our lead product candidate, REN-001, and our other product candidates. |

| • | Preclinical and clinical development involve a lengthy and expensive process with an uncertain outcome. We may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our current product candidates or any future product candidates. |

| • | There is no guarantee that the toxicology and biodistribution studies in healthy pigs and the efficacy studies in haploinsufficient mice will be successful, or that the FDA will not require further testing in these or other animal models. |

| • | As an organization, we have limited experience designing and no experience implementing clinical trials and we have never conducted pivotal clinical trials. Failure to adequately design a trial, or incorrect assumptions about the design of the trial, could adversely affect the ability to initiate the trial, enroll patients, complete the trial, or obtain regulatory approval on the basis of the trial results, as well as lead to increased or unexpected costs. |

| • | We may not be able to file our IND to commence clinical trials for our lead product candidate, REN-001 or our other product candidates on the timelines we expect, and even if we are able to, the FDA may not permit us to proceed. |

| • | REN-001 and our other product candidates may cause adverse events or undesirable side effects that could delay or prevent our regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if any. |

| • | Changes in regulatory requirements, guidance from the FDA and other regulatory authorities or unanticipated events during our preclinical studies and clinical trials of REN-001 or our other product candidates may result in changes to preclinical studies or clinical trials or additional preclinical or clinical trial requirements, which could result in increased costs to us and could delay our development timeline. |

| • | If we are unable to successfully commercialize REN-001 or any of our other product candidates for which we receive regulatory approval, or experience significant delays in doing so, our business will be materially harmed. |

| • | We face significant competition, and if our competitors develop product candidates more rapidly than we do or their product candidates are more effective, our ability to develop and successfully commercialize products may be adversely affected. |

| • | We rely on licenses of intellectual property from Temple and may license intellectual property from other third parties in the future, and such licenses may not provide adequate rights or may not be available in the future on commercially reasonable terms, if at all, and our licensors may be unable to obtain and maintain patent protection for the technology or products that they license to us. |

| • | If the scope of any patent protection we obtain is not sufficiently broad, or if we lose any of our patent protection, our ability to prevent our competitors from developing and commercializing similar or identical product candidates would be adversely affected. |

| • | Chardan identified a material weakness in its internal control over financial reporting. This material weakness could continue to adversely affect our ability to report our results of operations and financial condition accurately and in a timely manner. |

| • | Insiders have substantial influence over us, which could limit your ability to affect the outcome of key transactions, including a change of control. |

| • | presenting only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus; |

| • | not being required to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting; |

| • | presenting reduced disclosure about our executive compensation arrangements; |

| • | not being required to hold non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | extended transition periods for complying with new or revised accounting standards. |

Shares of Common Stock offered by us | 8,526,546 shares of Common Stock, which consists of (i) up to 4,311,322 shares of Common Stock that are issuable upon the exercise of 8,622,644 Public Warrants; (ii) up to 3,500,000 shares of Common Stock that are issuable upon the exercise of 3,500,000 Private Placement Warrants; and (iii) up to 715,224 shares of Common Stock that are issuable upon the exercise of the Pre-Funded Warrant. |

Shares of Common Stock outstanding prior to the exercise of all Warrants | 17,256,042 shares (as of September 30, 2021). |

Shares of Common Stock outstanding assuming exercise of all Warrants | 25,782,588 shares (as of September 30, 2021). |

Exercise price of Warrants | Each Public Warrant is exercisable for one-half of one share of Common Stock at a price of $11.50 per share, subject to adjustment as described herein. |

| Each Private Placement Warrant is exercisable for one share of Common Stock at a price of $11.50 per share, subject to adjustment as described herein. |

| The Pre-Funded Warrant is exercisable for shares of Common Stock at an exercise price of $0.01 per share, subject to adjustment as described herein. |

Use of proceeds | We will receive up to an aggregate of approximately $89.8 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. See “ Use of Proceeds. |

Shares of Common Stock offered by the Selling Securityholders | 12,668,314 shares of Common Stock, consisting of (i) up to 2,284,776 PIPE Shares; (ii) up to 6,305,061 of Old Renovacor Stockholder Shares; (iii) up to 1,655,661 Sponsor Shares; (iv) up to 1,922,816 Earnout Shares; and (v) up to 500,000 Sponsor Earnout Shares. |

Private Placement Warrants offered by the Selling Securityholders | Up to 3,500,000 Private Placement Warrants. |

Use of proceeds | We will not receive any proceeds from the sale of shares of Common Stock or the Private Placement Warrants by the Selling Securityholders. |

Transfer restrictions | Certain of our stockholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Restrictions on Resales of Our Securities-Lock-up Agreements |

NYSE stock symbols | Our Common Stock and Public Warrants are listed on the NYSE under the symbols “RCOR” and “RCOR.WS,” respectively. |

| • | 4,311,322 shares of our Common Stock issuable upon the exercise of 8,622,644 Public Warrants outstanding as of September 30, 2021, each with an exercise price of $11.50 per share; |

| • | 3,500,000 shares of our Common Stock issuable upon the exercise of 3,500,000 Private Placement Warrants outstanding as of September 30, 2021, each with an exercise price of $11.50 per share; |

| • | 715,224 shares of our Common Stock issuable upon the exercise of the Pre-Funded Warrant outstanding as of September 30, 2021, with an exercise price of $0.01 per share; |

| • | 1,995,362 Earnout Shares reserved for issuance upon triggering events for such Earnout Shares as set forth in the Merger Agreement, including 1,922,816 Earnout Shares being registered pursuant to this Registration Statement and 72,546 Earnout Shares underlying restricted stock unit awards which may be issued in respect of Exchanged Options (as defined below); |

| • | 1,111,250 shares of our Common Stock issuable upon the exercise of stock options outstanding as of September 30, 2021 with a weighted average exercise price of $7.39 per share; and |

| • | 1,240,537 shares of our Common Stock reserved for future issuance under our 2021 Omnibus Incentive Plan, or the 2021 Incentive Plan, as well as any automatic increases in the number of shares of Common Stock reserved for future issuance under our the 2021 Incentive Plan. |

| • | continue to advance our BAG3-based gene therapy products; |

| • | continue preclinical development of, and initiate clinical development of REN-001 and our other product candidates; |

| • | continue to advance the preclinical and clinical development of our earlier discovery stage programs; |

| • | seek to discover and develop additional product candidates; |

| • | establish manufacturing processes and arrangements with third parties for the manufacture of initial quantities of our product candidates and component materials and validate clinical- and commercial-scale current good manufacturing practices, or cGMP, facilities; |

| • | seek regulatory approvals for any of our product candidates that successfully complete clinical trials; |

| • | maintain, expand and protect our intellectual property portfolio; |

| • | acquire or in-license other product candidates and technologies; |

| • | incur additional legal, accounting or other expenses in operating our business, including the additional costs associated with operating as a public company; and |

| • | increase our employee headcount and related expenses to support these activities. |

| • | delays or disruptions in preclinical experiments and IND-enabling studies due to restrictions ofon-site staff, limited or no access to animal facilities, and unforeseen circumstances at contract research organizations, or CROs, and vendors; |

| • | limitations on employee or other resources that would otherwise be focused on the conduct of our preclinical work and any clinical trials we subsequently commence, including because of sickness of |

employees or their families, the desire of employees to avoid travel or contact with large groups of people, an increased reliance on working from home, school closures, or mass transit disruptions; |

| • | delays in necessary interactions with regulators, ethics committees, and other important agencies and contractors due to limitations in employee resources or forced furlough of government or contractor personnel; and |

| • | limitations on maintaining our corporate culture that facilitates the transfer of institutional knowledge within our organization and fosters innovation, teamwork, and a focus on execution. |

| • | interruption of key clinical trial activities, such as clinical trial site data monitoring and efficacy, safety and translational data collection, processing and analyses, due to limitations on travel imposed or recommended by federal, state, or local governments, employers and others or interruption of clinical trial subject visits, which may impact the collection and integrity of subject data and clinical study endpoints; |

| • | delays or difficulties in initiating or expanding clinical trials, including delays or difficulties with clinical site initiation and recruiting clinical site investigators and clinical site staff; |

| • | delays or difficulties in enrolling and retaining patients in our clinical trials; |

| • | increased rates of patients withdrawing from our clinical trials following enrollment as a result of contracting COVID-19 or other health conditions or being forced to quarantine; |

| • | interruption of, or delays in receiving, supplies of our product candidates from our contract manufacturing organizations, or CMOs, due to staffing shortages, production slowdowns, or stoppages and disruptions in materials and reagents; |

| • | diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

| • | interruption or delays in the operations of the FDA and comparable foreign regulatory agencies; |

| • | changes in regulations as part of a response to the coronavirus pandemic which may require us to change the ways in which our clinical trials are conducted, which may result in unexpected costs, or to discontinue any such clinical trials altogether; |

| • | delays in receiving approval from local regulatory authorities to initiate any planned clinical trials; |

| • | limitations on employee resources that would otherwise be focused on the conduct of our preclinical studies and clinical trials, including because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people; |

| • | refusal of the FDA or comparable regulatory authorities to accept data from clinical trials in affected geographies; and |

| • | additional delays, difficulties or interruptions as a result of current or future shutdowns due to the coronavirus pandemic, or other pandemics, in countries where we or our third-party service providers operate. |

| • | timely and successful completion of preclinical studies, including toxicology studies, biodistribution studies and minimally efficacious dose studies in animals, where applicable; |

| • | effective INDs or comparable foreign applications that allow commencement of our planned clinical trials or future clinical trials for our product candidates; |

| • | successful enrollment and completion of clinical trials, including under the FDA’s current Good Clinical Practices, or cGCPs, and current Good Laboratory Practices, or cGLPs; |

| • | positive results from our future clinical programs that support a finding of safety and effectiveness and an acceptable risk-benefit profile of our product candidates in the intended populations; |

| • | receipt of marketing approvals from applicable regulatory authorities; |

| • | establishment of arrangements with CMOs for clinical supply and, where applicable, commercial manufacturing capabilities; |

| • | establishment and maintenance of patent and trade secret protection and/or regulatory exclusivity for our product candidates; |

| • | commercial launch of our product candidates, if approved, whether alone or in collaboration with others; |

| • | acceptance of the benefits and use of our product candidates, including method of administration, if and when approved, by patients, the medical community and third-party payors; |

| • | effective competition with other therapies; |

| • | establishment and maintenance of healthcare coverage and adequate reimbursement and patients’ willingness to pay out-of-pocket |

| • | enforcement and defense of intellectual property rights and claims; and |

| • | maintenance of a continued acceptable safety, tolerability and efficacy profile of our product candidates following approval. |

| • | developing a manufacturing process to produce our product candidates on a large scale and in a cost-effective manner; |

| • | educating medical personnel regarding the potential side-effect profile of our product candidates and, as the clinical program progresses, on any observed side effects with the therapy; |

| • | training a sufficient number of medical personnel on how to properly administer our product candidates; |

| • | developing a reliable and safe and an effective means of genetically modifying our AAV/BAG3-based gene therapies; |

| • | sourcing starting material suitable for clinical and commercial manufacturing; and |

| • | establishing sales and marketing capabilities, as well as developing a distribution network to support the commercialization of any approved products. |

| • | regulators or institutional review boards, or IRBs, the FDA or ethics committees may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| • | we may experience delays in reaching, or fail to reach, agreement on acceptable terms with prospective trial sites and prospective CROs, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | clinical trial sites deviating from trial protocol or dropping out of a trial; |

| • | clinical trials of any product candidates may fail to show safety or efficacy, produce negative or inconclusive results and we may decide, or regulators may require us, to conduct additional preclinical studies or clinical trials or we may decide to abandon product development programs; |

| • | novel therapies, such as gene therapies with less well-characterized safety profiles, may require slower or more staggered early clinical trial enrollment to adequately assess safety data; |

| • | the number of subjects required for clinical trials of any product candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate or subjects may drop out of these clinical trials or fail to return for post-treatment follow-up at a higher rate than we anticipate; |

| • | third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all, or may deviate from the clinical trial protocol or drop out of the trial, which may require that we add new clinical trial sites or investigators; |

| • | we may elect to, or regulators, IRBs, or ethics committees may require that we or our investigators, suspend or terminate clinical research or trials for various reasons, including noncompliance with regulatory requirements or a finding that the participants in our trials are being exposed to unacceptable health risks; |

| • | the cost of clinical trials of any of our product candidates may be greater than we anticipate; |

| • | the quality of our product candidates or other materials necessary to conduct clinical trials of our product candidates may be inadequate to initiate or complete a given clinical trial; |

| • | our inability or the inability of third parties to manufacture sufficient quantities of our product candidates for use in clinical trials; |

| • | reports from clinical testing of other therapies may raise safety or efficacy concerns about our product candidates; |

| • | our failure to establish an appropriate safety profile for a product candidate based on clinical or preclinical data for such product candidate as well as data emerging from other studies or trials in the same class as our product candidate; and |

| • | the FDA or applicable foreign regulatory agencies may require us to submit additional data such as long-term toxicology studies, or impose other requirements before permitting us to initiate a clinical trial. |

| • | regulatory authorities may request that we recall or withdraw the product from the market or may limit the approval of the product through labeling or other means; |

| • | regulatory authorities may require the addition of labeling statements, such as a “black box” warning or a contraindication or a precaution; |

| • | we may be required to change the way the product is distributed or administered, conduct additional clinical trials, or change the labeling of the product; |

| • | we may decide to recall or remove the product from the marketplace; |

| • | we could be sued and/or held liable for injury caused to individuals exposed to or taking our product candidates; |

| • | damage to the public perception of the safety of REN-001 or our other product candidates; and |

| • | our reputation may suffer. |

| • | the federal Anti-Kickback Statute, which prohibits, among other things, persons or entities from knowingly and willfully soliciting, offering, receiving or providing any remuneration (including any kickback, bribe or certain rebates), directly or indirectly, overtly or covertly, in cash or in kind, in return for, either the referral of an individual or the purchase, lease, or order, or arranging for or recommending the purchase, lease, or order of any good, facility, item or service, for which payment may be made, in whole or in part, under a federal healthcare program such as Medicare and Medicaid. A person or entity does not need to have actual knowledge of the federal Anti-Kickback Statute or specific intent to violate it in order to have committed a violation. In addition, the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the civil False Claims Act; |

| • | the federal false claims and civil monetary penalties laws, including the civil False Claims Act, which prohibits, among other things, individuals or entities from knowingly presenting, or causing to be presented, to the federal government, claims for payment or approval that are false or fraudulent, knowingly making, using or causing to be made or used, a false record or statement material to a false or fraudulent claim, or from knowingly making or causing to be made a false statement to avoid, decrease or conceal an obligation to pay money to the federal government; |

| • | the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, which imposes criminal and civil liability for, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, or knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false statement, in connection with the delivery of, or payment for, healthcare benefits, items or services. Similar to the federal Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation; |

| • | HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH, and their implementing regulations, also impose obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information without appropriate authorization by covered entities subject to the rule, such as health plans, healthcare clearinghouses and certain healthcare providers as well as their business associates that perform certain services for or on their behalf involving the use or disclosure of individually identifiable health information; |

| • | the federal Physician Payments Sunshine Act, which requires certain manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report annually to the CMS information related to payments and other “transfers of value” made to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, as well as ownership and investment interests held by the physicians described above and their immediate family members; |

| • | the Foreign Corrupt Practices Act, or the FCPA, which prohibits companies and their intermediaries from making, or offering or promising to make improper payments to non-U.S. officials for the purpose of obtaining or retaining business or otherwise seeking favorable treatment; and |

| • | analogous state and foreign laws and regulations, such as state anti-kickback and false claims laws, which may apply to our business practices, including but not limited to, research, distribution, sales and marketing arrangements and claims involving healthcare items or services reimbursed by non- governmental third-party payors, including private insurers, or by the patients themselves; state laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government, or otherwise restrict payments that may be made to healthcare providers and other potential referral sources; state laws and regulations that require drug and biologic manufacturers to file reports relating to pricing and marketing information or which require tracking gifts and other remuneration and items of value provided to physicians, other healthcare providers and entities; state and local laws that require the registration of pharmaceutical sales representatives; state and foreign laws governing the privacy and security of health information in some circumstances, many of which differ from each other in significant ways and often are not preempted by HIPAA; state and foreign governments that have enacted or proposed requirements regarding the collection, distribution, use, security, and storage of personally identifiable information and other data relating to individuals (including the EU General Data Protection Regulation 2016/679, or the GDPR, and the California Consumer Protection Act, or the CCPA), and federal and state consumer protection laws are being applied to enforce regulations related to the online collection, use, and dissemination of data, thus complicating compliance efforts. |

| • | an inability to initiate or continue clinical trials of REN-001 or our other product candidates under development; |

| • | delay in submitting regulatory applications, or receiving marketing approvals, for our product candidates; |

| • | subjecting third-party manufacturing facilities to additional inspections by regulatory authorities; |

| • | requirements to cease development or to recall batches of our product candidates; and |

| • | in the event of approval to market and commercialize REN-001 or our other product candidates, an inability to meet commercial demands forREN-001 or our other product candidates. |

| • | launching commercial sales of our product candidates, whether alone or in collaboration with others; |

| • | receiving an approved label with claims that are necessary or desirable for successful marketing, and that does not contain safety or other limitations that would impede our ability to market our product candidates; |

| • | creating market demand for our product candidates through marketing, sales and promotion activities; |

| • | hiring, training, and deploying a sales force or contracting with third parties to commercialize our product candidates; |

| • | manufacturing, either on our own or through third parties, product candidates in sufficient quantities and at acceptable quality and cost to meet commercial demand at launch and thereafter; |

| • | establishing and maintaining agreements with wholesalers, distributors, and group purchasing organizations on commercially reasonable terms; |

| • | creating partnerships with, or offering licenses to, third parties to promote and sell product candidates in foreign markets where we receive marketing approval; |

| • | maintaining patent and trade secret protection and regulatory exclusivity for our product candidates; |

| • | achieving market acceptance of our product candidates by patients, the medical community, and third-party payors; |

| • | achieving appropriate reimbursement for our product candidates; |

| • | effectively competing with other therapies; and |

| • | maintaining an acceptable tolerability profile of our product candidates following launch. |

| • | issue a warning letter asserting that we are in violation of the law; |

| • | request voluntary product recalls; |

| • | seek an injunction or impose administrative, civil or criminal penalties or monetary fines; |

| • | suspend or withdraw regulatory approval; |

| • | suspend any ongoing clinical trials; |

| • | refuse to approve a pending BLA or comparable foreign marketing application (or any supplements thereto); |

| • | restrict the marketing or manufacturing of the product; |

| • | seize or detain the product or otherwise require the withdrawal of the product from the market; |

| • | refuse to permit the import or export of product candidates; or |

| • | refuse to allow us to enter into supply contracts, including government contracts. |

| • | the prevalence and severity of any adverse side effects associated with our product candidates; |

| • | limitations or warnings contained in the labeling approved for our product candidates by the FDA or comparable foreign regulatory authority, such as a “black box” warning; |

| • | availability of alternative treatments, including any competitive therapies in development that could be approved or commercially launched prior to approval of our product candidates; |

| • | the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies; |

| • | the strength of marketing and distribution support and timing of market introduction of competitive products; |

| • | pricing; |

| • | payor acceptance; |

| • | the impact of any future changes to the healthcare system in the United States; |

| • | the effectiveness of our sales and marketing strategies; and |

| • | the likelihood that the FDA may require development of a REMS, as a condition of approval or post-approval or may not agree with our proposed REMS or may impose additional requirements that limit the promotion, advertising, distribution or sales of our product candidates. |

| • | the USPTO and various foreign governmental patent agencies require compliance with a number of procedural, documentary, fee payment and other provisions during the patent process, the noncompliance with which can result in abandonment or lapse of a patent or patent application, and partial or complete loss of patent rights in the relevant jurisdiction; |

| • | patent applications may not result in any patents being issued; |

| • | patents may be challenged, invalidated, modified, revoked, circumvented, found to be unenforceable or otherwise may not provide any competitive advantage; |

| • | our competitors, many of whom have substantially greater resources than we do and many of whom have made significant investments in competing technologies, may seek or may have already obtained patents that will limit, interfere with or block our ability to make, use and sell REN-001 and any of our other product candidates; |

| • | there may be significant pressure on the U.S. government and international governmental bodies to limit the scope of patent protection both inside and outside the United States for disease treatments that prove successful, as a matter of public policy regarding worldwide health concerns; and |

| • | countries other than the United States may have patent laws less favorable to patentees than those upheld by U.S. courts, allowing foreign competitors a better opportunity to create, develop and market competing products. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | whether and the extent to which our technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| • | our right to sublicense patents and other rights to third parties; |

| • | our diligence obligations with respect to the use of the licensed technology in relation to our development and commercialization of REN-001 and any of our other product candidates, and what activities satisfy those diligence obligations; |

| • | our right to transfer or assign the license; |

| • | the inventorship or ownership of inventions and know-how resulting from the joint creation or use of intellectual property by us and our licensors; and |

| • | the priority of invention of patented technology. |

| • | others may be able to develop products that are similar to REN-001 and any of our other product candidates that are not covered by the claims of any issued patents that we own or license; |

| • | we or our licensors or predecessors might not have been the first to make the inventions covered by any issued patent or patent application that we own or license; |

| • | we or our licensors or predecessors might not have been the first to file patent applications covering certain of our inventions; |

| • | others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing our owned or licensed intellectual property rights; |

| • | it is possible that our pending patent applications will not lead to issued patents; |

| • | issued patents that we own or license may be held invalid or unenforceable, including as a result of legal challenges by our competitors; |

| • | our competitors might conduct research and development activities in countries where we do not have patent rights and then use the information learned from such activities to develop competitive products for sale in our major commercial markets; |

| • | we may not develop additional proprietary technologies that are patentable; |

| • | the patents of others may have an adverse effect on our business; and |

| • | we may choose not to file a patent for certain trade secrets or know-how, and a third party may subsequently file a patent covering such intellectual property. |

| • | result in costly litigation that may cause negative publicity; |

| • | divert the time and attention of our technical personnel and management; |

| • | cause development delays; |

| • | prevent us from commercializing REN-001 and any other product candidates until the asserted patent expires or is held finally invalid or not infringed in a court of law; |

| • | require us to develop non-infringing technology, which may not be possible on a cost-effective basis; |

| • | subject us to significant liability to third parties; or |

| • | require us to enter into royalty or licensing agreements, which may not be available on commercially reasonable terms, or at all, or which might be non-exclusive, which could result in our competitors gaining access to the same technology. |

| • | identifying, recruiting, integrating, maintaining, and motivating additional employees; |

| • | managing our internal development efforts effectively, including the clinical and FDA or other comparable authority review process for REN-001 and our other product candidates, while complying with our contractual obligations to contractors and other third parties; and |

| • | improving our operational, financial and management controls, reporting systems and procedures. |

| • | decreased demand for our products; |

| • | injury to our reputation and significant negative media attention; |

| • | withdrawal of clinical trial participants and inability to continue clinical trials; |

| • | initiation of investigations by regulators; |

| • | costs to defend the related litigation; |

| • | a diversion of management’s time and our resources; |

| • | substantial monetary awards to trial participants or patients; |

| • | product recalls, withdrawals or labeling, marketing or promotional restrictions; |

| • | significant negative financial impact; |

| • | exhaustion of any available insurance and our capital resources; |

| • | the inability to commercialize REN-001 or our other product candidates; and |

| • | a decline in our stock price. |

| • | actual or anticipated fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to ours; |

| • | changes in the market’s expectations about our operating results; |

| • | the public’s reaction to our press releases, other public announcements and filings with the SEC; |

| • | speculation in the press or investment community; |

| • | actual or anticipated developments in our business, competitors’ businesses or the competitive landscape generally; |

| • | the commencement, enrollment, or results of our current and future preclinical studies and clinical trials, and the results of trials of our competitors or those of other companies in our market sector; |

| • | regulatory approval of our product candidates, or limitations to specific label indications or patient populations for our use, or changes or delays in the regulatory review process; |

| • | the success or failure of our efforts to acquire, license, or develop additional product candidates; |

| • | innovations or new products developed by us or our competitors; |

| • | manufacturing, supply or distribution delays or shortages; |

| • | any changes to our relationship with any manufacturers, suppliers, licensors, future collaborators, or other strategic partners; |

| • | the operating results failing to meet the expectation of securities analysts or investors in a particular period; |

| • | changes in financial estimates and recommendations by securities analysts concerning us or the market in general; |

| • | operating and stock price performance of other companies that investors deem comparable to ours; |

| • | changes in laws and regulations affecting our business; |

| • | commencement of, or involvement in, litigation involving us; |

| • | changes in our capital structure, such as future issuances of securities or the incurrence of additional debt; |

| • | the volume of our Common Stock available for public sale; |

| • | any major change in our board of directors or management; |

| • | sales of substantial amounts of our Common Stock by our directors, officers or significant stockholders or the perception that such sales could occur; |

| • | general economic and political conditions such as recessions, interest rates, “trade wars,” pandemics (such as COVID-19) and acts of war or terrorism; and |

| • | other risk factors and other matters described or referenced under the sections “ Risk Factors Cautionary Note Regarding Forward-Looking Statements. |

| • | the timing and cost of, and level of investment in, research, development, regulatory approval and commercialization activities relating to REN-001 and our other product candidates, which may change from time to time; |

| • | coverage and reimbursement policies with respect to REN-001 and our other product candidates, if approved, and potential future drugs or biologics that compete with our products; |

| • | the cost of manufacturing REN-001 and our other product candidates, which may vary depending on the quantity of production and the terms of our agreements with CMOs; |

| • | the timing and amount of the milestone or other payments we must make to the licensors and other third parties from whom we have in-licensed or acquired our product candidates; |

| • | the level of demand for any approved products, which may vary significantly; |

| • | future accounting pronouncements or changes in our accounting policies; |

| • | macroeconomic conditions, both nationally and locally; and |

| • | any other change in the competitive landscape of our industry, including consolidation among our competitors or partners. |

| • | our board of directors will be divided into three classes, with each class serving staggered three-year terms, which may delay the ability of stockholders to change the membership of a majority of our board of directors; |

| • | our board of directors has the exclusive right to expand the size of our board of directors and to elect directors to fill a vacancy created by the expansion of our board of directors or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our board of directors; |

| • | our stockholders may not act by written consent, which forces stockholder action to be taken at an annual or special meeting of stockholders; |

| • | a special meeting of stockholders may be called only by the chairperson of our board of directors, our chief executive officer, or a majority of our board of directors, which may delay the ability of our stockholders to force consideration of a proposal or to take action, including the removal of directors; |

| • | our second amended and restated certificate of incorporation prohibits cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director candidates; |

| • | our board of directors may alter certain provisions of our amended and restated bylaws without obtaining stockholder approval; |

| • | the approval of the holders of at least two-thirds of our Common Stock entitled to vote at an election of our board of directors is required to adopt, amend, or repeal our amended and restated bylaws or repeal the provisions of our second amended and restated certificate of incorporation regarding the election and removal of directors; |

| • | stockholders must provide advance notice and additional disclosures to nominate individuals for election to the board of directors or to propose matters that can be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain voting control of our Common Stock; and |

| • | our board of directors is authorized to issue shares of preferred stock and to determine the terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer. |

| • | our ability to maintain the listing of our Common Stock and Warrants on the NYSE, following the Business Combination and operate as a public company; |

| • | our ability to recognize the anticipated benefits of the Business Combination; |

| • | our ability to raise additional capital to fund our operations and continue the development of our current and future product candidates; |

| • | the accuracy of our projections and estimates regarding our expenses, capital requirements, cash utilization, and need for additional financing; |

| • | the initiation, progress, success, cost, and timing of our development activities, preclinical studies and future clinical trials; |

| • | the timing, scope and likelihood of regulatory filings and approvals, including final regulatory approval of our product candidates; |

| • | the preclinical nature of our business and our ability to successfully advance current and future product candidates through development activities, preclinical studies, and clinical trials; |

| • | the timing of our future Investigational New Drug, or IND, applications and the likelihood of, and our ability to obtain and maintain, regulatory clearance of such IND applications for our product candidates; |

| • | the novelty of our approach to the treatment of BAG3-associated dilated cardiomyopathy, or DCM, utilizing adeno-associated virus, or AAV, BAG3-based gene therapies to target BAG3 mutations, and the challenges we will face due to the novel nature of such technology; |

| • | our dependence on the success of our product candidates, in particular REN-001; |

| • | the potential scope and value of our intellectual property and proprietary rights; |

| • | our ability, and the ability of our licensors, to obtain, maintain, defend, and enforce intellectual property and proprietary rights protecting our product candidates, and our ability to develop and commercialize our product candidates without infringing, misappropriating, or otherwise violating the intellectual property or proprietary rights of third parties; |

| • | the success of competing therapies that are or become available; |

| • | regulatory developments and approval pathways in the United States and foreign countries for our product candidates; |

| • | the performance of third parties in connection with the development of our product candidates, including third parties conducting our future clinical trials as well as third-party suppliers and manufacturers; |

| • | our ability to attract and retain strategic collaborators with development, regulatory, and commercialization expertise; |

| • | the extent to which COVID-19 and variants thereof, such as the delta variant, and measures taken to contain its spread ultimately impact our business, including development activities, preclinical studies, and future clinical trials; |

| • | the public opinion and scrutiny of AAV/BAG3-based gene therapies for the treatment of heart failure and our potential impact on public perception of our products and product candidates; |

| • | our ability to successfully commercialize our product candidates and develop sales and marketing capabilities, if our product candidates are approved; |

| • | our ability to generate revenue from future product sales and our ability to achieve and maintain profitability; |

| • | the size and growth of the potential markets for our product candidates and our ability to serve those markets; |

| • | changes in applicable laws or regulations; |

| • | our ability to recruit and retain key members of management and other clinical and scientific personnel; |

| • | the possibility that we may be adversely impacted by other economic, business, and/or competitive factors; and |

| • | other risks and uncertainties indicated in this prospectus, including those under the heading “ Risk Factors |

| • | Old Renovacor appointed a voting majority of directors to our board of directors. Subsequent to the Business Combination, our board of directors consisted of seven directors: (i) five directors were designated by Old Renovacor, four of which are independent directors in accordance with the rules of the NYSE and one of which is our Chief Executive Officer and (ii) two directors were designated by the Sponsor; |

| • | The executive officers of Old Renovacor became our executive officers; |

| • | Old Renovacor represented a significant majority of the assets (excluding cash held in the trust account of Chardan that holds the proceeds from the Chardan IPO, or the Trust Account) and operations of the combined company; and |

| • | The intended strategy of the combined company will continue to focus on Old Renovacor’s core product/service offerings related to gene therapy-based treatments for cardiovascular disease. |

Shares and Exchanged Options transferred upon the closing of the Business Combination (1)(2) | 6,500,000 | |||

Value per share (3) | $ | 10.00 | ||

Total share consideration (1)(2) | $ | 65,000,000 | ||

(1) | Amount includes (i) 194,926 shares underlying the Exchanged Options and (ii) an aggregate of 13 fractional shares which was cash settled at the Effective Time. |

(2) | Amount excludes the issuance of 2,000,000 earn-out shares, or the Earnout Shares, to certain stockholders and option holders of Old Renovacor as a result of the combined company satisfying the performance conditions subsequent to Closing. |

(3) | Share consideration is calculated using a $10.00 reference price. Actual total share consideration will be dependent on the value of the Company’s Common Stock at the Effective Time. |

| • | Chardan will issue 600,000 shares of the Earnout Consideration, in the aggregate, if at any time during the period beginning on the Closing Date and ending on December 31, 2023, or the First Earnout Period, the VWAP (as defined in the Merger Agreement) of the Company’s Common Stock over any 20 Trading Days (as defined in the Merger Agreement) (which may or may not be consecutive) within any 30 consecutive Trading Day period is greater than or equal to $17.50 per share of our Common Stock, or the First Milestone. |

| • | Chardan will issue an additional 600,000 shares of the Earnout Consideration, in the aggregate, if at any time during the period beginning on the Closing Date and ending on December 31, 2025, or the Second Earnout Period, the VWAP of the Company’s Common Stock over any 20 Trading Days (which may or may not be consecutive) within any 30 consecutive Trading Day period is greater than or equal to $25.00 per share of our Common Stock, or the Second Milestone. |

| • | Chardan shall issue an additional 800,000 shares of the Earnout Consideration, in the aggregate, if at any time during the period beginning on the Closing Date and ending on December 31, 2027, or the Third Earnout Period and together with the First Earnout Period and the Second Earnout Period, each, an Earnout Period and collectively, the Earnout Periods, the VWAP of the Company’s Common Stock over any 20 Trading Days (which may or may not be consecutive) within any 30 consecutive Trading Day period is greater than or equal to $35.00 per share of our Common Stock, or the Third Milestone, and together with the First Milestone and the Second Milestone, the Earnout Milestones. |

| • | Upon the consummation of any Change in Control during any Earnout Period, any Earnout Milestone with respect to such Earnout Period that has not yet been achieved shall automatically be deemed to have been achieved regardless of the valuation of our Common Stock in such Change in Control transaction and Chardan will take all actions necessary to provide for the issuance of the shares of our Common Stock comprising the applicable Earnout Consideration issuable in respect of such Earnout Milestone(s) prior to the consummation of such Change in Control. |

Expiration | Target Price | Earnout Shares Issued | ||||||

December 31, 2023 | $ | 17.50 | 600,000 | |||||

December 31, 2025 | $ | 25.00 | 600,000 | |||||

December 31, 2027 | $ | 35.00 | 800,000 | |||||

2,000,000 | ||||||||

Expiration | Target Price | Earnout Shares Issued | ||||||

December 31, 2023 | $ | 17.50 | 150,000 | |||||

December 31, 2025 | $ | 25.00 | 150,000 | |||||

December 31, 2027 | $ | 35.00 | 200,000 | |||||

500,000 | ||||||||

| • | The consummation of the Business Combination and reclassification of cash held in Trust Account to cash and cash equivalents, net of redemptions (see below); |

| • | The consummation of the PIPE Investment; |

| • | The accounting for deferred offering costs and transaction costs incurred by both Chardan and Old Renovacor; and |

| • | The accounting for the Earnout Consideration and Sponsor Earnout Consideration. |

Number of Shares | Percentage of Outstanding Shares | |||||||

Old Renovacor Stockholders | 6,305,061 | 36.1 | % | |||||

Old Renovacor PIPE Investment (1) | 1,750,000 | 10.0 | % | |||||

| 8,055,061 | 46.1 | % | ||||||

Chardan IPO shares | 6,510,544 | 37.3 | % | |||||

Chardan founder shares (2) | 1,655,661 | 9.5 | % | |||||

Chardan Sponsor PIPE Investment | 250,000 | 1.4 | % | |||||

Chardan Sponsor stockholder PIPE Investment | 1,000,000 | 5.7 | % | |||||

| 9,416,205 | 53.9 | % | ||||||

Pro forma ownership at June 30, 2021 | 17,471,266 | 100.0 | % | |||||

(1) | Includes 715,224 shares underlying the Pre-Funded Warrant, which is immediately exercisable following Closing subject to a cap on the beneficial ownership of the holder thereof of 9.99%. |

(2) | Excludes the Sponsor Earnout Consideration, which are certain Sponsor Shares totaling 500,000 placed into escrow and subject to forfeiture. |

Chardan (Historical) | Old Renovacor (Historical) | Transaction Accounting Adjustments | Pro Forma Combined | |||||||||||||||

ASSETS | ||||||||||||||||||

Current assets: | ||||||||||||||||||

Cash and cash equivalents | $ | 304,575 | $ | 448,800 | $ | 86,254,797 | A | $ | 90,807,359 | |||||||||

| 30,000,000 | B | |||||||||||||||||

| (4,579,813 | ) | C | ||||||||||||||||

| (500,000 | ) | D | ||||||||||||||||

| (21,121,000 | ) | J | ||||||||||||||||

Prepaid expenses and other current assets | — | 545,282 | — | 545,282 | ||||||||||||||

Total current assets | 304,575 | 994,082 | 90,053,984 | 91,352,641 | ||||||||||||||

Marketable securities held in Trust Account | 86,254,797 | — | (86,254,797 | ) | A | — | ||||||||||||

Property | — | 129 | — | 129 | ||||||||||||||

Deferred merger costs | — | 2,324,118 | (2,324,118 | ) | C | — | ||||||||||||

Total assets | $ | 86,559,372 | $ | 3,318,329 | $ | 1,475,069 | $ | 91,352,770 | ||||||||||

LIABILITIES, TEMPORARY EQUITY AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||||||||||||

Current liabilities: | ||||||||||||||||||

Accounts payable and accrued expenses | $ | 1,917,910 | $ | 3,228,040 | $ | (2,941,435 | ) | C | 2,204,515 | |||||||||

Promissory note — related party | 500,000 | — | (500,000 | ) | D | — | ||||||||||||

Warrant liabilities | 3,745,000 | — | — | 3,745,000 | ||||||||||||||

Share earn-out liability | — | — | 20,801,887 | I | 20,801,887 | |||||||||||||

Total liabilities | 6,162,910 | 3,228,040 | 17,360,452 | 26,751,402 | ||||||||||||||

Temporary equity: | ||||||||||||||||||

Common Stock subject to possible redemption | 86,254,797 | — | (86,254,797 | ) | E | — | ||||||||||||

Convertible preferred stock | — | 10,073,820 | (10,073,820 | ) | F | — | ||||||||||||

Total temporary equity | 86,254,797 | 10,073,820 | (96,328,617 | ) | — | |||||||||||||

Stockholders’ equity: | ||||||||||||||||||

Common Stock | 215 | 198 | 228 | B | 1,676 | |||||||||||||

| 863 | E | |||||||||||||||||

| (198 | ) | F | ||||||||||||||||

| 631 | F | |||||||||||||||||

| (50 | ) | G | ||||||||||||||||

| (211 | ) | J | ||||||||||||||||

Additional paid-in capital | 24,785 | 312,877 | 29,999,772 | B | 77,044,453 | |||||||||||||

| (1,814,342 | ) | C | ||||||||||||||||

| 86,253,934 | E | |||||||||||||||||

| 10,074,018 | F | |||||||||||||||||

| (631 | ) | F | ||||||||||||||||

| 50 | G | |||||||||||||||||

| (5,883,335 | ) | H | ||||||||||||||||

| (20,801,887 | ) | I | ||||||||||||||||

| (21,120,789 | ) | J | ||||||||||||||||

Accumulated deficit | (5,883,335 | ) | (10,296,606 | ) | (2,148,154 | ) | C | (12,444,760 | ) | |||||||||

| 5,883,335 | H | |||||||||||||||||

Total stockholders’ equity (deficit) | (5,858,335 | ) | (9,983,531 | ) | 80,443,234 | 64,601,368 | ||||||||||||

Total liabilities, temporary equity and stockholders’ equity (deficit) | $ | 86,559,372 | $ | 3,318,329 | $ | 1,475,069 | $ | 91,352,770 | ||||||||||

Chardan (Historical) | Old Renovacor (Historical) | Transaction Accounting Adjustments | Pro Forma Combined | |||||||||||||||

Operating expenses: | ||||||||||||||||||

Operating | $ | 1,932,184 | $ | — | $ | — | $ | 1,932,184 | ||||||||||

Research and development | — | 4,487,936 | (181,533 | ) | AA | 4,410,700 | ||||||||||||

| 14,058 | AA | |||||||||||||||||

| 90,239 | DD | |||||||||||||||||

General and administrative | 39,243 | 911,925 | — | 951,168 | ||||||||||||||

Loss from operations | (1,971,427 | ) | (5,399,861 | ) | 77,236 | (7,294,052 | ) | |||||||||||

Other income (expense): | ||||||||||||||||||

Interest earned on marketable securities held in Trust Account | 7,166 | — | (7,166 | ) | CC | — | ||||||||||||

Change in fair value of warrant liability | 280,000 | — | — | 280,000 | ||||||||||||||

Net loss | $ | (1,684,261 | ) | $ | (5,399,861 | ) | $ | 70,070 | $ | (7,014,052 | ) | |||||||

Net Loss per Share (Note 4): | ||||||||||||||||||

Weighted average shares outstanding, basic and diluted | 10,778,305 | 1,955,906 | 17,471,266 | |||||||||||||||

Basic and diluted net loss per common share | $ | (0.16 | ) | $ | (2.94 | ) | $ | (0.40 | ) | |||||||||

Chardan (Historical as Revised) | Old Renovacor (Historical) | Transaction Accounting Adjustments | Pro Forma Combined | |||||||||||||||

Operating expenses: | ||||||||||||||||||

Operating and formation costs | $ | 801,961 | $ | — | $ | — | $ | 801,961 | ||||||||||

Research and development | — | 2,424,567 | (2,813 | ) | AA | 2,658,465 | ||||||||||||

| 56,232 | AA | |||||||||||||||||

| 180,479 | DD | |||||||||||||||||

General and administrative | — | 805,276 | 2,148,154 | BB | 2,953,430 | |||||||||||||

Loss from operations | (801,961 | ) | (3,229,843 | ) | (2,382,052 | ) | (6,413,856 | ) | ||||||||||

Other income (expense): | ||||||||||||||||||

Interest earned on marketable securities held in Trust Account | 21,191 | — | (21,191 | ) | CC | — | ||||||||||||

Transaction costs | (9,357 | ) | — | — | (9,357 | ) | ||||||||||||

Compensation expense on Private Placement Warrants | (1,680,000 | ) | — | — | (1,680,000 | ) | ||||||||||||

Change in fair value of warrant liability | (945,000 | ) | — | — | (945,000 | ) | ||||||||||||

Net loss | $ | (3,415,127 | ) | $ | (3,229,843 | ) | $ | (2,403,243 | ) | $ | (9,048,213 | ) | ||||||

Net Loss per Share (Note 4): | ||||||||||||||||||

Weighted average shares outstanding of Common Stock | 3,498,861 | 1,838,075 | 17,471,266 | |||||||||||||||

Basic and diluted net loss per share | $ | (0.98 | ) | $ | (1.94 | ) | $ | (0.52 | ) | |||||||||

| A. | Reflects the reclassification of marketable securities held in the trust account to cash and cash equivalents. |

| B. | Represents cash proceeds of approximately $30,000,000 from the private placement of 2,284,776 shares of our Common Stock at $10.00 per share and the Pre-Funded Warrant entitling the holder thereof to purchase 715,224 shares of the Company’s Common Stock, at an initial purchase price of $9.99 per share underlying thePre-Funded Warrant pursuant to the concurrent PIPE Investment. ThePre-Funded Warrant is immediately exercisable at an exercise price of $0.01 and will be exercisable indefinitely, provided that the holder of thePre-Funded Warrant is prohibited from exercising suchPre-Funded Warrant in an amount that would cause such holder’s beneficial ownership of the Company’s Common Stock to exceed 9.9%. |

| C. | Represents settlement of preliminary estimated transaction costs of $5,464,893 inclusive of advisory, banking, printing, legal and accounting fees that are expensed as a part of the Business Combination and equity issuance costs that are capitalized into additional paid-in capital. As of June 30, 2021, $2,941,435 was accrued and $2,324,118 was capitalized on the balance sheet of Old Renovacor. Equity issuance costs of $3,316,739 are offset to additionalpaid-in capital and the remaining balance is expensed through accumulated deficit. The costs expensed through accumulated deficit are included in the unaudited pro forma condensed combined statement of operations for the year ended December 31, 2020 as discussed below (please refer adjustment BB). |

| D. | Represents repayment of outstanding notes payable. |

| E. | Reflects the reclassification of approximately $86,254,797 of common stock subject to possible redemption to permanent equity. |

| F. | Represents the recapitalization of Old Renovacor’s outstanding equity comprised of 2,578,518 shares of convertible preferred stock and 1,987,636 shares of common stock, par value $0.0001 (aggregate value of $10,074,018 reflected as an increase in additional paid-in capital) and the issuance of 6,305,061 shares of our Common Stock (total par value of $631) to Old Renovacor shareholders as consideration for the reverse recapitalization. |

| G. | Reflects adjustment for the Sponsor Earnout Shares totaling 500,000 shares which shall be placed into escrow and subject to forfeiture. Chardan has preliminarily determined that the Sponsor Earnout Shares |

| are not indexed to Chardan’s own stock and are therefore accounted for as a liability which will be remeasured to fair value at subsequent reporting dates. The change in estimated fair value is noted in adjustment (I). |

| H. | Reflects the reclassification of Chardan’s historical accumulated deficit. |

| I. | Represents the estimated fair value of the Earnout Consideration for Old Renovacor capital stockholders and Sponsor Earnout Shares. Chardan has preliminarily determined that the Earnout Consideration for Old Renovacor capital stockholders and Sponsor Earnout Shares are not indexed to Chardan’s own stock and is therefore each accounted for as a liability which will be remeasured to fair value at subsequent reporting dates with the change in fair value recognized as a gain or loss in the statement of operations. The pro forma value of the Earnout Consideration for Old Renovacor capital stockholders and Sponsor Earnout Shares was estimated utilizing a Monte Carlo simulation model. The significant assumptions utilized in estimating the fair value of the Earnout Consideration for Old Renovacor capital stockholders and Sponsor Earnout Shares include the following: (1) our Common Stock price of $10.00; (2) the volatility of Chardan’s common stock of 95.0%; and (3) the expected probability of 7.5% and term to a Change in Control of 5-7 years. A 20% increase or decrease in the stock price would change the estimated fair value to $27,050,000 and $18,025,000, respectively. A 20% increase or decrease in the volatility would change the estimated fair value to $21,500,000 and $23,400,000, respectively. Estimates are subject to change as additional information becomes available and additional analyses are performed and such changes could be material once the final valuation is determined at the Effective Time. |

| J. | Reflects the redemptions of 2,112,100 shares of Chardan’s common stock, par value $0.0001 per share, that were offered and sold by Chardan in the Chardan IPO and registered pursuant to the IPO registration statement, or the Chardan IPO Shares, for aggregate redemption payments of $21,121,000 allocated to common stock and additional paid-in capital using par value $0.0001 per share and a redemption price of $10.00 per share. |

| AA. | Reflects elimination of historical stock-based compensation expense related to canceled Old Renovacor option awards and the recognition of incremental compensation expense related to replacement (modification) of option awards issued. The value of the replacement options was estimated utilizing a Black-Scholes model. The significant assumptions utilized in estimating the fair value of the replacement options include the following: (1) our Common Stock price of $10.00; (2) the strike price ranging from $0.12 to $10.83; (3) volatility of Chardan’s common stock of 95.0%; and (4) the expected term of the award (approximating 5 years). Estimates are subject to change as additional information becomes available and additional analyses are performed and such changes could be material once the final valuation is determined at the Effective Time. |

| BB. | Reflects estimated transactions costs of $2,148,154 as if incurred on January 1, 2020, the date the Business Combination occurred for the purposes of the unaudited pro forma condensed combined statement of operations. The amount presented is comprised of transaction costs outlined in adjustment (C) that were not yet recognized and expensed in the historical Chardan and Old Renovacor statement of operations as part of the Business Combination. |

| CC. | Reflects elimination of investment income on the Trust Account. |

| DD. | Represents the estimated compensation expense related to the Earnout RSU Awards. Chardan has determined that the Earnout RSU Awards contain a market-based vesting condition under ASC 718. Compensation expense in the unaudited pro forma condensed combined statement of operations |

| assume the Business Combination occurred on January 1, 2020. The value of the Earnout RSU Awards was estimated utilizing a Monte Carlo simulation model, and the total value of the Earnout RSU Awards was estimated to be $1,173,113, which will be recognized over the implied service period for the award of 6.5 years, and results in incremental compensation expense $90,239 and $180,479 for the six months ended June 30, 2021, and the year ended December, 31, 2020, respectively. The significant assumptions utilized in estimating the fair value of the Earnout RSU awards include the following: (1) our Common Stock price of $10.00; (2) the volatility of Chardan’s common stock of 95.0%; and (3) the expected probability of 7.5% and term to a Change in Control of 5-7 years. A 20% increase or decrease in the stock price would change compensation expense by $(34,700) and $(53,230), respectively, for the six months ended June 30, 2021, and $41,681 and $(32,441), respectively, for the year ended December 31, 2020. A 20% increase or decrease in the volatility would change compensation expense by $(46,095) and $(42,194), respectively, for the six months ended June 30, 2021, and $(3,901) and $11,704, respectively, for the year ended December 31, 2020. The actual fair values of these awards and the related compensation expense are subject to change as additional information becomes available and as additional analyses are performed, such changes could be material once the final valuation is determined at the Effective Time. |

For the Six Months Ended June 30, 2021 | For the Year Ended December 31, 2021 | |||||||

Pro forma net loss | $ | (7,014,052 | ) | $ | (9,048,213 | ) | ||

Weighted average shares outstanding of Common Stock (1) | 17,471,266 | 17,471,266 | ||||||

Net loss per share (basic and diluted) (2) | $ | (0.40 | ) | $ | (0.52 | ) | ||

Excluded securities: (2) | ||||||||

Earnout Consideration | 1,922,843 | 1,922,843 | ||||||

Sponsor Earnout Consideration | 500,000 | 500,000 | ||||||

Earnout RSU Awards | 77,157 | 77,157 | ||||||

Public Warrants (3) | 4,311,322 | 4,311,322 | ||||||

Private Placement Warrants | 3,500,000 | 3,500,000 | ||||||

Replacement stock options | 194,926 | 194,926 | ||||||

(1) | Includes 715,224 shares underlying the Pre-Funded Warrant, which is immediately exercisable followingthe consummation of the Business Combination, which closed on September 2, 2021, subject to a 9.99% beneficial ownership limitation, which may be increased up to 19.99% at the option of the holder from time to time. The Pre-Funded Warrant is exercisable for nominal consideration and has an indefinite life, and therefore, is included in pro forma weighted average shares outstanding for the periods presented. |

(2) | The potentially dilutive outstanding securities were excluded from the computation of pro forma net loss per share, basic and diluted, because their effect would have been anti-dilutive or issuance of such shares is contingent upon the satisfaction of certain conditions which were not satisfied by the end of the period. |

(3) | Each Public Warrant entitles the registered holder to purchase one-half (1/2) of a share of Common Stock, there are currently 8,622,644 Public Warrants issued. |

| • | initiate IND-enabling studies for ourREN-001 AAV-based gene therapy program; |

| • | continue our current research programs and preclinical development of product candidates from our current research programs; |

| • | advance additional product candidates into preclinical and clinical development; |

| • | advance our clinical-stage product candidate into later stage clinical trials; |

| • | seek to discover, validate, and develop additional product candidates, including carrying out activities related to our discovery stage programs; |

| • | seek regulatory approvals for any product candidates that successfully complete clinical trials; |

| • | scale up our manufacturing processes and capabilities, or arrange for a third party to do so on our behalf, to support our clinical trials of our product candidates and potential commercialization of any of our product candidates for which we may obtain marketing approval; |

| • | establish a sales, marketing, and distribution infrastructure or channel to commercialize any product candidate for which we may obtain regulatory approval; |