As filed with the Securities and Exchange Commission on April 29, 2021

Registration No. 333-236458

Registration No. 333-236458-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

iCap Vault 1, LLC

Vault Holding 1, LLC

(Exact name of registrant as specified in governing instruments)

3535 Factoria Blvd. SE, Suite 500

Bellevue, WA 98006

(425) 278-9030

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chris Christensen

Chief Executive Officer

iCap Vault Management, LLC

3535 Factoria Blvd. SE, Suite 500

Bellevue, WA 98006

(425) 278-9030

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Laura Anthony, Esq.

Craig D. Linder, Esq.

Anthony L.G., PLLC

625 N. Flagler Drive, Suite 600

West Palm Beach, FL 33401

(561) 514-0936

Approximate date of commencement of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box: [ ]

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large Accelerated Filer | Accelerated Filer | Non-Accelerated Filer | Smaller Reporting Company | Emerging Growth Company | ||||||

| iCap Vault 1, LLC | [ ] | [ ] | [X] | [X] | [X] | |||||

| Vault Holding 1, LLC | [ ] | [ ] | [X] | [X] | [X] |

If an emerging growth company, indicate by check mark if each registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

| iCap Vault 1, LLC | [ ] | |

| Vault Holding 1, LLC | [ ] |

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a) may determine.

EXPLANATORY NOTE

The registrants are filing this post-effective amendment to update the financial statements and other information contained in the registrants’ registration statement on Form S-11 (Registration Nos. 333-236458 and 333-236458-01) (the “Registration Statement”), which was declared effective by the Securities and Exchange Commission on November 24, 2020. The Registration Statement relates to the offering of up to $500,000,000 aggregate principal amount of Variable Denomination Floating Rate Demand Notes of iCap Vault 1, LLC, which are fully and unconditionally guaranteed by Vault Holding 1, LLC (“Notes”). As of April 29, 2021, no securities have been sold pursuant to the Registration Statement. No additional securities are being registered pursuant to this post-effective amendment to the Registration Statement. All applicable registration fees were previously paid on February 14, 2020.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED APRIL 29, 2021 |

iCap Vault 1, LLC

$500,000,000

Demand Notes

The Demand Notes

will be Fully and Unconditionally Guaranteed by

Vault Holding 1, LLC

iCap Vault 1, LLC (the “Company” or the “Vault”) is offering to sell Variable Denomination Floating Rate Demand Notes, marketed and sold as “Demand Notes” (the “Notes”) on a continuous basis, in a direct public offering, without any involvement of underwriters. Unless otherwise provided herein, all references to the “Notes” in this prospectus also include Notes purchased with reinvested interest. The Notes will have the following principal terms and features:

| ● | The Notes are subject to repayment at an investor’s demand at any time, unless an investor agrees to waive the right to demand repayment in order to receive an Interest Rate Premium, or redemption by the Company at any time. See “Description of the Notes – Interest Rate Premium Rewards Program” on page 62 of this prospectus. | |

| ● | The Notes will be secured by the membership interests in Vault Holding 1, LLC, which will hold interests in real estate, through wholly owned subsidiaries, and real estate-based financial instruments. However, the Notes’ security interest in such membership interests will be subordinated to the security interest in favor of lenders of credit facilities. | |

| ● | The Notes (including the Notes purchased with reinvested interest) will accrue a floating rate of interest (the “Floating Rate”) at a rate per annum equal to the Average Savings Account Rate as posted by the FDIC plus 2.00%, reset quarterly on January 1, April 1, July 1, and October 1 of each year based on the Average Savings Account Rate posted by the FDIC on December 15, March 15, June 15, and September 15, respectively, of the prior month. See “Description of the Notes – Interest” on page 62 of this prospectus. As of April 29, 2021, the Floating Rate equals 2.04%. In addition to the Floating Rate, we will pay investors Interest Rate Premiums pursuant to our Interest Rate Premium Rewards Program as described in “Description of the Notes – Interest Rate Premium Rewards Program” on page 62 of this prospectus. | |

| ● | The Floating Rate and Interest Rate Premiums payable on the Notes will accrue based on a 365-day year. If an investor elects to opt-into automatic interest reinvestment into Notes, the Floating Rate and Interest Rate Premiums will be credited to the investor’s Notes on a daily basis and will be reinvested (daily compounding). Otherwise, the Floating Rate and Interest Rate Premiums will be non-compounding and credited to a separate non-interest bearing investor account with the Company on the last business day of each calendar month with no interest reinvestment into Notes. | |

| ● | The Floating Rate of the Notes (including the Notes purchased with reinvested interest) will be disclosed on the Company’s website at www.icapequity.com/vault and in pricing supplements filed with the Securities and Exchange Commission prior to the effective date of the quarterly reset of the Floating Rates. | |

| ● | The payment of principal and interest on the Notes is fully and unconditionally guaranteed by Vault Holding 1, LLC. While it is intended that Vault Holding 1, LLC will eventually hold interests in real estate, as of the date of this prospectus, Vault Holding 1, LLC has no prior operating history and no assets, and as such, there is no underlying collateral held by Vault Holding 1, LLC as security for the guarantee. Further, Vault Holding 1, LLC has the right to subordinate the obligations and guaranty of Vault Holding 1, LLC and the security interests pledged by Vault Holding 1, LLC to those of a third- party lender, if doing so is required by the lender to secure a loan for the benefit of Vault Holding 1, LLC. | |

| ● | The Notes have no stated maturity. | |

| ● | The Notes are issuable in any amount, subject to a minimum initial investment for any one Note of $25; however, the Company can waive the minimum initial investment requirement on a case to case basis in its sole discretion. | |

| ● | The Notes are in book-entry form only. | |

| ● | The Notes will be senior obligations of the Company issued under an indenture between us, as issuer, Vault Holding 1, LLC, as guarantor, and American Stock Transfer & Trust Company, LLC, as the indenture trustee. However, the Notes will be structurally subordinated to indebtedness or other liabilities of special purpose entity subsidiaries (as our special purpose entity subsidiaries are not guaranteeing the notes). | |

| ● | We are a “blind pool” and, therefore, investors may not have the opportunity to evaluate the Company’s investments before they are made. |

We intend to commence the offering promptly. The Notes are offered on a continuous basis, and the offering is expected to continue for a period in excess of 30 days, until the earlier of such time as all of the Notes being offered hereunder have been sold, or three (3) years after the effective date of registration statement relating to this prospectus, if not closed earlier. The maximum aggregate principal amount of the Notes to be issued is equal to $500,000,000. The outstanding principal amount of the Notes will increase and decrease from time to time.

The Company has the sole right to accept offers to purchase Notes and may reject, at its sole discretion, any proposed purchase of Notes in whole or in part. Except as otherwise provided herein, the Notes will be offered directly to the public by us, without an underwriter, on a self-underwritten, best efforts basis, which means our officers and manager will attempt to sell the securities we are offering in this prospectus. This prospectus will permit our officers and manager to sell the Notes directly to the public, with no commission or other remuneration payable to them for any securities they may sell. In offering the securities on our behalf, the officers and manager will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934.

The Company has engaged Cobalt Capital, Inc., a Florida corporation and FINRA/SIPC registered broker-dealer (“Cobalt”), to provide broker-dealer services, but not underwriting or placement agent services, in thirteen specified states, including Texas, Florida, Arizona, Arkansas, Virginia, Utah, Maryland, Oklahoma, Nebraska, North Carolina, Delaware, West Virginia, and Montana and up to eight (8) additional states in connection with this Offering. As compensation for these broker-dealer services, the Company has agreed to pay Cobalt an aggregate monthly fee of $8,500 per month for the thirteen (13) states plus an additional $300 per month for each additional state during the term of the Offering.

We may elect to engage one or more FINRA member firms (the “Placement Agents”), as placement agents for this Offering, in which event the Placement Agents will also conduct the Offering on a “best efforts” basis, and we would expect in such case to pay estimated total commissions up to 1.0% of the aggregate principal amount of the Notes sold to investors, payable over four calendar quarters (“Quarterly Commission Payments”) in arrears on the last day of each calendar quarter (March 31, June 30, September 30 and December 31) (each a “Quarterly Commission Payment Date”) at a rate of 0.25% per quarter, commencing on the Quarterly Commission Payment Date following the issuance of such Notes, to the extent that such Notes have not been redeemed or repurchased, with such payments calculated on the average daily outstanding principal balances of such Notes during the applicable calendar quarter; provided, however, to the extent that such Notes have been redeemed or repurchased prior to the completion of the applicable four Quarterly Commission Payment Dates, no Quarterly Commission Payment shall be made on such redeemed or repurchased Notes during any Quarterly Commission Payment Date after such redemption or repurchase of such Notes.

Following the four Quarterly Commission Payments, to the extent that such Notes have not been redeemed or repurchased, we expect to pay an annual administration fee to Placement Agents of up to 1.0% of the outstanding aggregate principal amount of such Notes, payable quarterly (“Quarterly Administration Payments”) in arrears on the last day of each calendar quarter (March 31, June 30, September 30 and December 31) (each a “Quarterly Administration Payment Date”) at a rate of 0.25% per quarter, commencing on the Quarterly Administration Payment Date following the fourth Quarterly Commission Payment of such Notes, with such payments calculated on the average daily outstanding principal balances of such Notes during the applicable calendar quarter; provided, however, to the extent that such Notes have been redeemed or repurchased, no Quarterly Administration Payment shall be made on such Notes during any Quarterly Administration Payment Date after such redemption or repurchase of such Notes. For more information, see the section titled “Plan of Distribution” and “Use of Proceeds” herein.

Notwithstanding the foregoing, (i) Placement Agents will not be entitled to any compensation on Notes which are purchased through the reinvestment of interest, including but not limited to Quarterly Commission Payments and Quarterly Administration Payments and (ii) pursuant to FINRA Rule 2310, under no circumstances will the Quarterly Administration Payments, in addition to the Quarterly Commission Payments and all other forms of underwriting compensation, including fees paid to Cobalt for broker-dealer services, exceed 10% of the gross offering proceeds.

The services to be provided by Placement Agents in exchange for the Quarterly Administration Payments include, but are not limited to:

(i) responding to customer inquiries of a general nature regarding us;

(ii) responding to customer inquiries and requests regarding investor reports, notices, proxies and proxy statements, and other fund documents;

(iii) forwarding prospectuses, tax notices and annual and semi-annual reports to beneficial owners of the Notes;

(iv) assisting customers in changing account options, account designations and account addresses; and

(v) providing such other similar services as we may reasonably request to the extent an authorized service provider is permitted to do so under applicable statutes, rules, or regulations.

We may also elect to engage one or more foreign distributors (non-FINRA member firms) as placement agents for this Offering (the “Foreign Placement Agents”) and we would expect in such case to pay estimated total commissions up to 1.0% of the aggregate principal amount of the Notes sold to foreign investors, payable in the same manner as the Quarterly Commission Payments set forth above. Following the four Quarterly Commission Payments, to the extent that such Notes have not been redeemed or repurchased, we expect to pay an annual administration fee to Foreign Placement Agents of up to 1.0% of the outstanding aggregate principal amount of such Notes, payable in the same manner as the Quarterly Administration Payments set forth above.

The Company reserves the right to withdraw, cancel or modify the offer to sell Notes, or agree to changes for commissions and administrative payments, at any time without notice. We cannot assure you that all or any portion of the Notes we are offering will be sold. We do not have to sell any minimum amount of Notes to accept and use the proceeds of this offering. Proceeds from the sale of the Notes will be placed in our general corporate bank account when received. We have not made any arrangement to place any of the proceeds from this offering in an escrow, trust or similar account. Therefore, you cannot be guaranteed of the return of your investment. We have the right to reject any subscription for Notes, in whole or in part, for any reason.

The Notes do not constitute a savings, deposit or other bank account and are not insured by or subject to the protection of the Federal Deposit Insurance Corporation, the Securities Investor Protection Corporation or any other federal or state agency. The Notes are not a money market fund, which are typically diversified funds consisting of short-term debt securities of many issuers, and therefore do not meet the diversification and investment quality standards set forth for money market funds by the Investment Company Act of 1940.

The Notes will not be listed on any securities exchange or quoted on Nasdaq or any over-the-counter market. We do not intend to make a market in the Notes and we do not anticipate that a market in the Notes will develop. See “Risk Factors – Risks Related to this Offering and the Notes – There is no public trading market for our Notes” of this prospectus. Currently, we have not requested a rating for the Notes; however, third parties we engage in the future to rate the Notes may rate them. After this registration statement becomes effective, we will file periodic reports, primarily annual and quarterly reports, with the Securities and Exchange Commission.

See “Plan of Distribution” for a description of anticipated expenses to be incurred in connection with our offering and selling the Notes.

The Company and Vault Holding 1, LLC are each an “emerging growth company,” as such term is defined in Section 2(a)(19) of the Securities Act of 1933, as amended, and will be subject to reduced public reporting requirements. See “Emerging Growth Company Status.”

| Per Note | Total (3) | |||||||

| Public offering price | 100 | % | $ | 500,000,000 | ||||

| Underwriting discounts and commissions (1) | None | None | ||||||

| Offering proceeds to iCap Vault 1, LLC before expenses (2) | 100 | % | $ | 500,000,000 | ||||

| (1) | The Notes are not being offered or sold pursuant to any underwriting or similar agreement, and no commissions or other remuneration will be paid in connection with their sale. Notwithstanding, we reserve the right to engage FINRA member broker-dealers (the “Placement Agents”), which may include Cobalt if it elects to sign a placement agent agreement with us, and pay the Placement Agents a commission of up to 1.0% ($5,000,000) of the aggregate principal amount of the Notes sold to investors through such Placement Agents, payable over four quarters in arrears on the last day of each calendar quarter to the extent that such Notes have not been redeemed or repurchased. See “Use of Proceeds” and “Plan of Distribution” of this prospectus. This commission could reduce offering proceeds to iCap Vault 1, LLC before expense down to $495,000,000. | |

| (2) | Does not include estimated offering expenses including, without limitation, legal, accounting, auditing, transfer agent, other professional, printing, travel, blue-sky compliance and other expenses of this Offering. We estimate the total expenses of this Offering, excluding any underwriting commissions and expenses, will be approximately $1,200,000. | |

| (3) | Assumes that the maximum aggregate offering amount of $500,000,000 is received by us. |

We are not, and Cobalt, our broker dealer and selling agent, is not, making an offer to sell the Notes in any jurisdiction where the offer or sale is not permitted. Persons effecting transactions in the Notes should confirm the registration of these securities under the securities laws of the states in which transactions occur or the existence of applicable exemptions from such registration.

The Notes are speculative securities. You should purchase the Notes only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 23 of this prospectus to read about the risks you should consider before buying our Notes. You should carefully consider the risk factors set forth in this prospectus. An investment in our Notes is not suitable for all investors. The Notes are only suitable for persons with substantial financial resources and with no need for liquidity in this investment. Our consolidated financial statements contain an explanatory paragraph regarding our ability to continue as a going concern.

POTENTIAL INVESTORS SHOULD RECOGNIZE THAT BY PURCHASING NOTES OF THE COMPANY, THEY WILL NOT THEREBY ACQUIRE ANY INTEREST, DIRECTLY OR INDIRECTLY, IN THE COMPANY OR ANY OF THE PRIOR PROGRAMS OR ANY FUTURE PROGRAM SPONSORED BY ICAP VAULT MANAGEMENT, LLC (THE “MANAGER”) OR ITS AFFILIATES. INVESTORS SHOULD RECOGNIZE THAT ANY PRIOR PERFORMANCE OR TRACK RECORD INFORMATION RECEIVED REGARDING THE MANAGER AND ITS AFFILIATES AS SET FORTH HEREIN IS GIVEN SOLELY TO ALLOW INVESTORS TO ASSESS THE EXPERIENCE OF THE MANAGER AND ITS AFFILIATES. THE MANAGER AND ITS AFFILIATES MAY CONTINUE TO ENGAGE IN MANAGEMENT AND INVESTMENT ACTIVITIES RELATED TO PRE-EXISTING INVESTMENTS AND ACTIVITIES OR OPERATIONS OF THE PRIOR FUNDS AS WELL AS FUTURE FUNDS.

Please read this prospectus before investing and keep it for future reference. Upon completion of this offering, we will file periodic reports and other information about us with the SEC. This information will be available free of charge by contacting us at 3535 Factoria Blvd. SE, Suite 500, Bellevue, Washington 98006 or by phone at (425) 278-9030 or on our website at www.icapequity.com/vault. The Securities and Exchange Commission also maintains a website at www.sec.gov that contains such information.

We anticipate that we will be exempt from the registration requirements of the Investment Company Act of 1940, as amended (the “Investment Company Act”), by reason of the exemption specified in Section 3(c)(5)(C) of the Investment Company Act (excludes from regulation as an “investment company” any entity that is primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate).

You should read this prospectus and any applicable prospectus supplement, including the information incorporated by reference, carefully before you decide whether to invest in Notes. You should assume that the information in this prospectus is accurate only as of the date of this prospectus. Our business, financial condition and prospects may have changed since that date. To the extent required by applicable law, we will update this prospectus during the offering period to reflect material changes to the disclosure contained herein.

Any statement that we make in this prospectus may be modified or superseded by us in a subsequent prospectus supplement. The registration statement we filed with the Securities and Exchange Commission includes exhibits that provide more detailed descriptions of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the Securities and Exchange Commission and any prospectus supplement.

You may invest in the Notes by completing the onboarding process available on the Company’s website and by sending your investment by one of the methods described in this prospectus under the heading “Description of the Notes—How to Make an Initial Investment.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE WILL NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS BEEN CLEARED OF COMMENTS AND IS DECLARED EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OF SALE IS NOT PERMITTED.

Delivery of the Notes will be made in book-entry form through American Stock Transfer & Trust Company, LLC, as Security Registrar, for the account of the investors.

The date of this prospectus is ____________, 2021.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with any different information. You should not assume that the information contained or incorporated by reference in this prospectus or any prospectus supplement is accurate as of any date other than as of the date of this prospectus, the applicable prospectus supplement or the date the documents incorporated by reference were filed with the SEC. We are offering to sell, and seeking offers to buy, the securities registered by this prospectus only in jurisdictions where these offers and sales are permitted.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

NOTICES TO INVESTORS OF CERTAIN STATES AND SUITABILITY STANDARDS

Notice to Alaska Investors

The Notes will be sold in Alaska to accredited investors only (as defined in Rule 501 of Regulation D under the Securities Act of 1933, as amended). The investor should purchase the Notes for investment purposes only and not with a view to distribution. The investors suitability requirements stated above represent minimum suitability requirements we establish from prospective Noteholders in the state of Alaska. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to Arizona Investors

We have established suitability standards for Arizona investors, which require such investors to have either (i) a minimum of $150,000 (or $200,000 when combined with spouse) in gross income during the prior year and a reasonable expectation that the investor will have such income in the current year or (ii) minimum net worth of $350,000 (or $400,000 when combined with spouse) exclusive of home, home furnishings and automobiles, with the investment in the Notes offered hereby not exceeding 10% of the net worth of the investor (together with a spouse, if applicable). The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of Arizona. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to California Investors

We have established suitability standards for California investors, which require such investors to have either (i) an estimated gross income of at least $65,000 during the current tax year and a net worth of at least $250,000 (exclusive of home, furnishings and automobiles), or (ii) a net worth of at least $500,000 (exclusive of home, furnishings and automobiles). In addition, California investors should limit their investment in the Notes to 10% of the investor’s net worth (exclusive of home, furnishings and automobiles). The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of California. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to Idaho Investors

We have established suitability standards for Idaho investors, which require such investors to have either (i) a liquid net worth of $85,000 and annual gross income of $85,000 or (ii) a liquid net worth of $300,000. Additionally, an Idaho investor’s total investment in us shall not exceed 10% of his or her liquid net worth. Liquid net worth is defined as that portion of net worth consisting of cash, cash equivalents and readily marketable securities. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of Idaho. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to Kentucky Investors

We have established suitability standards for Kentucky investors, which require such investors to have either (i) annual gross income of at least $70,000 and a liquid net worth of at least $70,000 or (ii) a liquid net worth of $250,000. Liquid net worth is defined as that portion of net worth consisting of cash, cash equivalents and readily marketable securities. Additionally, a Kentucky investor’s total investment in us shall not exceed 10% of his or her liquid net worth. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of Kentucky. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

| 1 |

Notice to Nebraska Investors

We have established suitability standards for Nebraska investors, which require such investors to have either (i) gross income of at least $150,000 (or $200,000 when combined with spouse) in the prior year and a reasonable expectation that the investor will have such income in the current year; or (ii) a net worth (exclusive of home, furnishings and automobiles) of $350,000 (or $400,000 when combined with spouse). Additionally, Nebraska investors must limit their aggregate investment in this offering and in the securities of other non-publicly traded programs to 10% of such investor’s net worth (exclusive of home, furnishings and automobiles). Investors who are accredited investors as defined in Regulation D under the Securities Act of 1933, as amended, are not subject to the foregoing investment concentration limit. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of Nebraska. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to New Jersey Investors

The Notes will be sold in New Jersey to accredited investors only (as defined in Rule 501 of Regulation D under the Securities Act of 1933, as amended). The investor should purchase the Notes for investment purposes only and not with a view to distribution. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of New Jersey. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to New Mexico Investors

We have established suitability standards for New Mexico investors, which require such investors to have either (i) a minimum net worth of at least $250,000 (exclusive of home, furnishings and automobiles) or (ii) an annual gross income of at least $70,000 and a net worth of at least $70,000 (exclusive of home, furnishings and automobiles). In addition, a New Mexico investor’s maximum investment in us and our affiliates cannot exceed ten percent (10%) of his or her liquid net worth. Liquid net worth is defined as that portion of net worth which consists of cash, cash equivalents, and readily marketable securities. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of New Mexico. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to North Carolina Investors

We have established suitability standards for North Carolina investors, which require such investors to have either (i) a minimum annual gross income of $70,000 and a minimum net worth of $70,000 (exclusive of home, home furnishings and automobiles) or (ii) a minimum net worth of $250,000 (exclusive of home, home furnishings and automobiles). The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of North Carolina. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to North Dakota Investors

We have established suitability standards for North Dakota investors, which require such investors to have either (i) a minimum annual gross income of $70,000 and a minimum net worth of $70,000 (exclusive of home, home furnishings and automobiles) or (ii) a minimum net worth of $250,000 (exclusive of home, home furnishings and automobiles). In addition, investors in North Dakota must represent that they have a net worth of at least ten times their investment in us. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of North Dakota. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to Oregon Investors

The Notes will be sold in Oregon to accredited investors only (as defined in Rule 501 of Regulation D under the Securities Act of 1933, as amended, or Oregon Administrative Rule 441-035-0010). The investor should purchase the Notes for investment purposes only and not with a view to distribution. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective Noteholders in the state of Oregon. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notice to Pennsylvania Investors

The Notes will be sold in Pennsylvania to accredited investors only (as defined in Rule 501 of Regulation D under the Securities Act of 1933, as amended). The investor should purchase the Notes for investment purposes only and not with a view to distribution. The investors suitability requirements stated above represent minimum suitability requirements we establish from prospective Noteholders in the state of Pennsylvania. However, satisfaction of these requirements will not necessarily mean that the Notes are a suitable investment for prospective investor, or that we will accept the prospective investor’s subscription agreement.

Notwithstanding the foregoing suitability standards, we are not, and Cobalt, our broker dealer and selling agent, is not, making an offer to sell the Notes in any jurisdiction where the offer or sale is not permitted.

Assessing Suitability

In addition to the minimum suitability standards described above, our officers and manager selling the Notes on our behalf and participating broker-dealers recommending the purchase of the Notes in this offering are required to make every reasonable effort to determine that the purchase of the Notes in this offering is a suitable and appropriate investment for each investor based on information provided by the investor regarding the investor’s financial situation and investment objectives and must maintain records for at least six years of the information used to determine that an investment in the Notes is suitable and appropriate for each investor. Relevant information for this purpose will include at least the age, investment objectives, investment experience, income, net worth, financial situation and other investments of the prospective investor, as well as other pertinent factors. In making this determination, our officers and manager selling the Notes on our behalf or Placement Agents recommending the purchase of the Notes in this offering will, based on a review of the information provided by you, consider whether you:

| ● | meet the minimum income and net worth standards established in your state; |

| ● | can reasonably benefit from an investment in our Notes based on your overall investment objectives and portfolio structure; |

| ● | are able to bear the economic risk of the investment based on your overall financial situation, including the risk that you may lose your entire investment; and |

| ● | have an apparent understanding of the following: |

| ● | the fundamental risks of your investment; |

| ● | the lack of liquidity of your Notes; |

| ● | the restrictions on transferability of your Notes; and |

| ● | the background and qualifications of the Manager; and |

| ● | the tax consequences of your investment. |

Regulation Best Interest

In June 2019, the Securities and Exchange Commission (“SEC”) adopted Regulation Best Interest (“Reg BI”) and Form CRS to establish a new standard of conduct requiring broker-dealers to satisfy a higher standard of care and disclosure when recommending securities and investment strategies, including rollovers and withdrawals from 401(k) and other plans, complex or risky products, COVID-19 related investments, and SPACs and other structured investment vehicles, to retail customers and retirement plan participants. A retail customer is any natural person, or the legal representative of such person, who receives a recommendation of any securities transaction or investment strategy involving securities from a broker-dealer and uses the recommendation primarily for personal, family, or household purposes. When making such a recommendation to a retail customer, broker-dealers and natural persons who are associated persons of a broker-dealer must act in the best interest of the retail customer at the time the recommendation is made, without placing their financial or other interest ahead of the retail customer’s interests and should consider reasonable alternatives in determining whether the broker-dealer and its associated persons have a reasonable basis for making the recommendation.

Reg BI and Form CRS, together with the interpretations adopted contemporaneously by the SEC, bring the legal requirements and mandated disclosures for broker-dealers serving retail investors in line with reasonable investor expectations, while preserving access (in terms of both choice and cost) to a variety of investment services and products. As Reg BI and Form CRS became effective on June 30, 2020, no administrative or case law exists under Reg BI and the full scope of its applicability is uncertain.

Cobalt, broker-dealer and selling agent of the Company, and the Placement Agents are required to comply with Reg BI, as it is intended to enhance existing standards of conduct.

Under SEC rules, Reg BI’s general obligation is satisfied only if the broker-dealer or associated persons comply with four specified component obligations:

| ● | Disclosure Obligation: the broker-dealer must provide certain required disclosure before or at the time of the recommendation, about the recommendation and the relationship between the broker-dealer or associated person and the retail customer of the broker-dealer or associated person. The disclosure includes a customer relationship summary on Form CRS. However, the broker-dealer’s disclosures are separate from the disclosures we provide to investors in this prospectus; | |

| ● | Care Obligation: the broker-dealer must exercise reasonable diligence, care, and skill in making the recommendation; | |

| ● | Conflict of Interest Obligation: the broker-dealer must establish, maintain, and enforce written policies and procedures reasonably designed to address conflicts of interest; and | |

| ● | Compliance Obligation: the broker-dealer must establish, maintain, and enforce written policies and procedures reasonably designed to achieve compliance with Reg BI. |

Any or all of the quantitative standards listed in the suitability standards above may be more restrictive pursuant to Reg BI.

The high cost, high risk and complex products may be subject to greater scrutiny by broker-dealers and their salespersons and that broker-dealers are under a duty of care to evaluate other alternatives in the investor’s best interest and that other alternatives are likely to exist. There is no guarantee that a broker-dealer will deem an investment in our Notes to be in your best interest. See “Risk Factors—Compliance with the SEC’s Reg BI by Placement Agents may negatively impact our ability to raise capital in the Offering, which could harm our ability to achieve our investment objectives” of this prospectus.

| 2 |

The distribution of this prospectus and the offering of the Notes may be restricted in certain jurisdictions. You should inform yourself about and observe any such restrictions. This prospectus does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

An individual investor must either be at least 18 years of age or must be the adult custodian for a minor under the Uniform Gifts/Transfers to Minors Act (UGMA/UTMA).

An investment in the Notes involves risks. Prospective investors should carefully review the risk factors, as well as the other information, contained or incorporated by reference in this prospectus. You should consult your own financial and legal advisers as to the risks involved in an investment in the Notes and whether an investment is suitable for you.

All of the money you invest will be designated as the principal balance of your Note. If you elect to opt-into automatic interest reinvestment into your Notes, all interest earned on your Notes will be reinvested monthly. The Notes are secured debt obligations solely of the Company and are not obligations of, or directly or indirectly guaranteed by, any affiliate of the Company other than Vault Holding 1, LLC, a direct wholly owned subsidiary of the Company

The Notes are not a money market fund, which is typically a diversified fund consisting of short-term debt securities of many issuers. The Notes are not subject to the requirements of the Investment Company Act of 1940 (including those regarding diversification and quality of investments for money market funds) or the Employee Retirement Income Security Act of 1974, as amended. The Notes are not equivalent to a savings, deposit or other bank account and are not subject to the protection of Federal Deposit Insurance Corporation regulation or any other insurance. The Notes are not transferable, assignable or negotiable (other than by operation of law), they are not listed on any securities exchange, and there is no secondary market for the Notes. As a result, there is no public market valuation for the Notes.

In this prospectus, unless the context otherwise requires, “we,” “us,” “our,” or the “Company” refers collectively to iCap Vault 1, LLC, a Delaware limited liability company, formed July 30, 2018, the issuer of the Notes in this Offering, and its subsidiaries.

We use a twelve-month year ending on December 31st of each calendar year. In a twelve-month calendar year, each quarter includes three-months of operations; the first, second, third and fourth quarters end on March 31, June 30, September 30 and December 31, respectively.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements. Certain other amounts that appear in this prospectus may not sum due to rounding.

Unless otherwise indicated, all references to “dollars” and “$” in this prospectus are to, and amounts are presented in, U.S. dollars.

Unless otherwise indicated or the context otherwise requires, financial and operating data in this prospectus reflect the consolidated business and operations of the Company and its subsidiaries.

| 3 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include statements we make concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Some forward-looking statements appear under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” When used in this prospectus, the words “estimates,” “expects,” “anticipates,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “foresees,” “seeks,” “likely,” “may,” “might,” “will,” “should,” “goal,” “target” or “intends” and variations of these words or similar expressions (or the negative versions of any such words) are intended to identify forward-looking statements. All forward-looking statements are based upon information available to us on the date of this prospectus.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among other things, the matters discussed in this prospectus in the sections captioned “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.”

All forward-looking statements attributable to us in this prospectus apply only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law.

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information and industry publications. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

| 4 |

This summary highlights material information concerning our business and this offering. This summary does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the information incorporated by reference into this prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

In this prospectus, unless the context indicates otherwise, “iCap Vault 1,” the “Company,” “we,” “our,” “ours” or “us” refer to iCap Vault 1, LLC, a Delaware limited liability company, and its subsidiaries, including its wholly-owned direct subsidiary Vault Holding, LLC, a Delaware limited liability company and its subsidiaries and the Company’s wholly-owned direct subsidiary Vault Holding 1, LLC, a Delaware limited liability company and its subsidiaries. Unless the context indicates otherwise, “iCap Enterprises” or “iCap,” in this prospectus refers to iCap Enterprises, Inc., a Washington corporation, which is our sponsor. Unless otherwise clear from the context, references throughout this prospectus to “operating agreements” refer to the amended and restated limited liability company operating agreements of iCap Vault 1, LLC and Vault Holding 1, LLC to be effective on or prior to the effectiveness by the Securities and Exchange Commission of the registration statement of which this prospectus forms a part and the forms of which are filed as Exhibits 3.3 and 3.6 to the registration statement of which this prospectus is a part.

Business Overview

iCap Vault 1, LLC was formed as a Delaware limited liability company on July 30, 2018. Vault Holding, LLC was formed as a Delaware limited liability company on September 27, 2018. Vault Holding 1, LLC was formed as a Delaware limited liability company on April 28, 2020. The Company has commenced only limited operations, primarily focused on organizational matters in connection with this registered public offering (“Offering”). Each of Vault Holding, LLC and Vault Holding 1, LLC was formed with the intention of owning one or more standalone subsidiaries which itself will hold real property investments. Additionally, each of Vault Holding, LLC and Vault Holding 1, LLC provides guaranties to secured demand noteholders of the Company. Vault Holding, LLC provides such a guaranty to holders of private placement secured demand notes. Vault Holding 1, LLC shall provide a guaranty to holders of the notes the Company intends to offer through this registered offering. To date, Vault Holding, LLC made two loans and purchased three townhomes.

One loan in the amount of $3,209,105, provided by the Company as an investment in Vault Holding, LLC, to Colpitts Sunset LLC, an affiliated entity, in exchange for a promissory note bearing 10% interest and secured by a deed of trust on property owned by Colpitts Sunset, LLC, and another loan in the amount of $2,000,000 to individuals who are minority co-owners of an affiliated entity, provided by the Company as an investment in Vault Holding, LLC, in exchange for a promissory note bearing 8% interest and secured by a deed of trust on property owned by the borrower. On April 23, 2021, $1,000,000 of the note was disbursed and the remaining portion is payable at the Company’s discretion, upon written request of the borrower delivered to the Company on or before October 22, 2021.

Effective April 23, 2021, the Company invested $1,714,757 into Vault Holding, LLC, which subsequently invested $1,714,757 into VH Willows Townhomes, LLC, a wholly-owned subsidiary of Vault Holding, LLC. VH Willows Townhomes, LLC purchased three townhomes totaling $1,710,000 from iCap Investments, LLC, an affiliated entity.

Vault Holding 1, LLC has not commenced operations and has no assets and liabilities.

iCap Vault Management, LLC, the manager (“Manager”) of the Company, was formed as a Delaware limited liability company on July 31, 2018, and has since been only engaged in limited operations.

We are not a blank check company and do not consider ourselves to be a blank check company as we:

| ● | Have a specific business plan, which is to acquire income-producing real estate properties and financial instruments related to real properties in selected metropolitan statistical areas in the U.S. (each, a “Portfolio Investment”) with the objective of generating a rate of return from the acquired U.S. real estate that is greater than the costs necessary to purchase, finance and service the U.S. real estate. We are not a real estate investment trust and do not intend to be treated as such. We have provided a detailed plan for the next twelve (12) months throughout our prospectus. | |

| ● | Have no intention of entering into a reverse merger with any entity in an unrelated industry in the future. |

As of April 28, 2021, since our inception, we have generated approximately $61,000 in interest income, all of which is from a related party promissory note. As of December 31, 2020, we have member’s deficit of $142,592. The capital raised in this offering has been budgeted to cover the costs associated with beginning to operate our company, marketing expense, and acquisition related costs. We intend on using the majority of the proceeds from this Offering for the acquisition of properties and financial instruments. However, closing and other acquisition related costs such as title insurance, professional fees and taxes will likely require cash. We do not have the ability to quantify any of the expenses as they will all depend on size of deal, price, and place versus procuring new financing, due diligence performed (such as appraisal, environmental, property condition reports), legal and accounting, etc. There is no way to predict or otherwise detail the expenses. We intend on generating revenues in the following ways from our properties: from net rental income on our properties and from price appreciation of the properties upon their disposition. For the financial instruments secured by real estate that we invest in, we intend on generating revenues from the interest income received on such financial instruments.

We intend to engage in the following activities:

| ● | Purchase single-family, multi-family, and commercial properties that have potential to be or are cash flow positive, meaning properties that have a positive monthly income after all expenses (e.g. mortgages, operating expenses, taxes) and maintenance reserves are paid. In order to determine if a property is “cash flow positive”, the Manager will review the total gross rent, income, or receipts from the property and subtract any and all expenses including utilities, taxes, maintenance, and other reserve expenses. If this number is a positive number, the Company will deem the property “cash flow positive.” Depending on how positive the cash flow is or has potential to be, coupled with the estimated market value of the property relative to the purchase price and the potential for price appreciation will determine whether management will purchase the property or not on behalf of the Company. | |

| ● | Purchase additional properties or make other real estate investments that relate to varying property types including office, retail and industrial properties. Such property types may include operating properties and properties under development or construction and may be purchased from affiliates of the Company. | |

| ● | Invest in any opportunity our Manager sees fit within the confines of the market, marketplace and economy so long as those investments are real estate related and within the investment objectives of the Company, including, but not limited to, real estate-based financial instruments, such as loans or investment funds that invest in real estate. To this end, the Company may invest in financial instruments that bear a relation to real estate, such as preferred equity, common equity, or loan instruments that are secured or unsecured by the properties, investments into real estate operating companies, real estate holding companies, pooled investment funds, some of which may be affiliates of the Company or its Manager or entities with whom management of the Company has had prior relationships. |

Please see our “DESCRIPTION OF BUSINESS” on page 80. We believe we will need at least $500,000 to provide working capital and $500,000 for professional fees for the next 12 months.

For the years ended December 31, 2020 and 2019, we generated no revenues, reported a net loss of $1,121,160 and $266,555, respectively, and cash flow used in operating activities of $1,323,486 and $71,897, respectively. As of December 31, 2020, we had member’s deficit of $142,592. Our auditors have raised substantial doubt regarding our ability to continue as a going concern in the independent auditors’ report to the consolidated financial statements for the years ended December 31, 2020 and 2019 included in this prospectus as a result of our accumulated deficit and no source of revenue sufficient to cover our cost of operation. See “Risk Factors—We have a history of operating losses and our auditors have indicated that there is a substantial doubt about our ability to continue as a going concern.”

| 5 |

Investment Strategy

The Company’s Portfolio Investments will consist of income-producing properties, including single-family homes, multi-family apartments, townhomes, commercial properties and mixed-use properties. The revenue generated from the Portfolio Investments will be used to pay interest and principal on the Notes and fund its operations. Additionally, the Company’s Portfolio Investments will consist of properties that the Company may acquire at a discount from market values, with the intention of selling the property at market prices for a gain. These properties may be held for short-term or long-term periods of time as the Company may determine in its discretion, and may or may not generate revenue during the period of ownership by the Company. The Company’s Portfolio Investments may also consist of financial instruments that bear a relation to real estate, such as preferred equity, common equity, or loan instruments that are secured or unsecured by the properties, investments into real estate operating companies, real estate holding companies, REIT holdings and joint ventures, pooled investment funds, any of which may be affiliates of, or transactions with, the Company or its Manager or entities with whom management of the Company has had prior relationships. See the section titled “Certain Relationships and Related Transactions” herein.

Portfolio Investments may be held directly by the Company or held in a standalone wholly owned limited liability company (a “Portfolio SPE”) and one or more Portfolio SPEs may be held by a holding company that is wholly owned by the Company, rather than by the Company directly. The rental and interest income allows us to provide a rate of return to investors who acquire the Notes. The Notes will be secured by the membership interests in Vault Holding 1, LLC. The Company’s business plan targets primarily income-producing properties and seeks to acquire the properties debt-free at the subsidiary level, and the Company expects to generate income from the financial instruments that it may hold. Notwithstanding, we may leverage our properties with up to 85% of their value. In all cases, the debt on any given property must be such that it fits with the investment policies of the Company as discussed in this prospectus. The Portfolio Investments will serve as collateral for one or more credit facilities entered into by the Company or an affiliate of us. The Company has the right to subordinate the obligations and the security interests of the Notes to those of a third party lender, if doing so is required by the lender to secure a loan for the benefit of the Company. Vault Holding 1, LLC has the right to subordinate the obligations and guaranty of Vault Holding 1, LLC and the security interests pledged by Vault Holding 1, LLC to those of a third party lender, if doing so is required by the lender to secure a loan for the benefit of Vault Holding 1, LLC.

The locations of the properties are determined by selecting metropolitan statistical areas upon consultation with market professionals, such as real estate analytics companies, title and escrow companies, real estate brokerages, land-use specialists, licensed surveyors and civil engineers, and in-depth internal review of economic data. The Company may adjust its investment criteria to accommodate changing market conditions, but will generally seek attractive locations with strong rental income and a likelihood of long-term appreciation of value.

The Company’s management has developed processes and controls to evaluate possible investment opportunities. The process begins by identifying metropolitan statistical areas within the U.S. (“Markets”) with strong economic fundamentals that are likely to result in long-term property appreciation and increased rents. The Markets are selected after an in-depth internal review of economic data by the Company’s internal staff. After reviewing this data, a committee consisting of key members of the management team, including Chris Christensen and Jim Christensen (the “Investment Committee”) may approve a Market. After a Market has been approved, the Company’s acquisition team will search for purchase opportunities for the Company that meet the criteria of the applicable investment policies of the Company. Chris Christensen is the Company’s Chief Executive Officer, a manager of iCap Vault 1, LLC, Vault Holding, LLC, and Vault Holding 1, LLC, and a Board member of the Manager. Jim Christensen is the Company’s Chief Operating Officer, a manager of iCap Vault 1, LLC, Vault Holding, LLC, and Vault Holding 1, LLC, and a Board member of the Manager.

Every investment opportunity will undergo due diligence performed by the Company’s real estate underwriters, who will then present investment opportunities to the Investment Committee for its review and approval. The Investment Committee may delegate investment decision-making authority to sub-teams, provided such investments meet the criteria established by the Investment Committee. The Company will complete due diligence on prospective investments and maintain closing procedures that provide for the safety of the invested funds, generally through a third-party escrow company. The investment process has three major areas of focus: analysis and approval, documentation and closing, and post-closing management. Post-closing management of the real estate portfolio will be done by real estate management companies, who will manage the leasing, cash flows, and maintenance of the properties.

| 6 |

Meeting Noteholder Demand Payment Obligations

The Company will establish two sources of liquidity to address demand payments: First, the Company will set aside up to 10% of the outstanding principal balances in available cash reserves; provided, however, the Company reserves the right to increase the amount set aside for available cash reserve; second, the Company plans to establish accounts with commercial banks and non-bank lending sources, such as insurance companies, private equity funds and private lending organizations (each a “Liquidity Source”) for the provision of credit facilities, including, but not limited to, lines of credit, pursuant to which funds will be advanced to the Company.

One or all of these Liquidity Sources may place a lien on one or more of the Portfolio Investments. If the amount of monies extended by the Liquidity Sources exceeds 85% of the Company’s aggregate Portfolio Investment value (the “Lending Ratio”), then the Company will be required to sell certain of its Portfolio Investments at such amount needed to satisfy its demand payment obligations and achieve a Lending Ratio of 85% or less. Except for the security that may be required by the Liquidity Sources, the Company intends to maintain the Portfolio Investments free and clear of liens and encumbrances. The Notes will be subordinate at times to the rights of the Liquidity Sources as well as to other higher-ranking obligations of the Company, including property taxes and management fees.

The Company may, in its discretion, dispose of some or all of its Portfolio Investments to reposition the portfolio or to meet the Company’s payment obligations. The Company will maintain cash reserves, which may be used to purchase properties, honor demand payment requests of noteholders, make tax or other distributions to its member, or cover the costs of the Company’s day-to-day operations.

Members and Management

The sole member of Vault Holding, LLC and Vault Holding 1, LLC is iCap Vault 1, LLC. The sole member of iCap Vault 1, LLC is iCap Vault, LLC, which is owned by iCap Enterprises, Inc., a Washington corporation wholly owned by Chris Christensen. The primary officers of iCap Enterprises are Chris Christensen and Jim Christensen. Chris Christensen is the Company’s Chief Executive Officer, a manager of iCap Vault 1, LLC, Vault Holding, LLC and Vault Holding 1, LLC, and a Board member of the Manager. Jim Christensen is the Company’s Chief Operating Officer, a manager of iCap Vault 1, LLC, Vault Holding, LLC and Vault Holding 1, LLC, and a Board member of the Manager.

The Manager is the manager of iCap Vault 1, LLC, Vault Holding, LLC and Vault Holding 1, LLC. The officers of the Manager are the same as the officers of iCap Enterprises, Inc. The management and supervision of iCap Vault 1, LLC, Vault Holding, LLC and Vault Holding 1, LLC is vested exclusively in the Manager (including its duly appointed agents), which has full control over the business and affairs of iCap Vault 1, LLC, Vault Holding, LLC and Vault Holding 1, LLC pursuant to the Amended and Restated Limited Liability Company Operating Agreements of iCap Vault 1, LLC, Vault Holding, LLC and Vault Holding 1, LLC (the “Operating Agreements”), respectively. The Board of Managers of the Manager intend to devote a majority of their working hours to the Company, but may be less. Even if we sell all the securities offered, the majority of the proceeds of the offering will be spent for ongoing operational and investment acquisition costs. Following this Offering, we may be required to raise additional capital to cover the costs associated with our plans of operation.

| 7 |

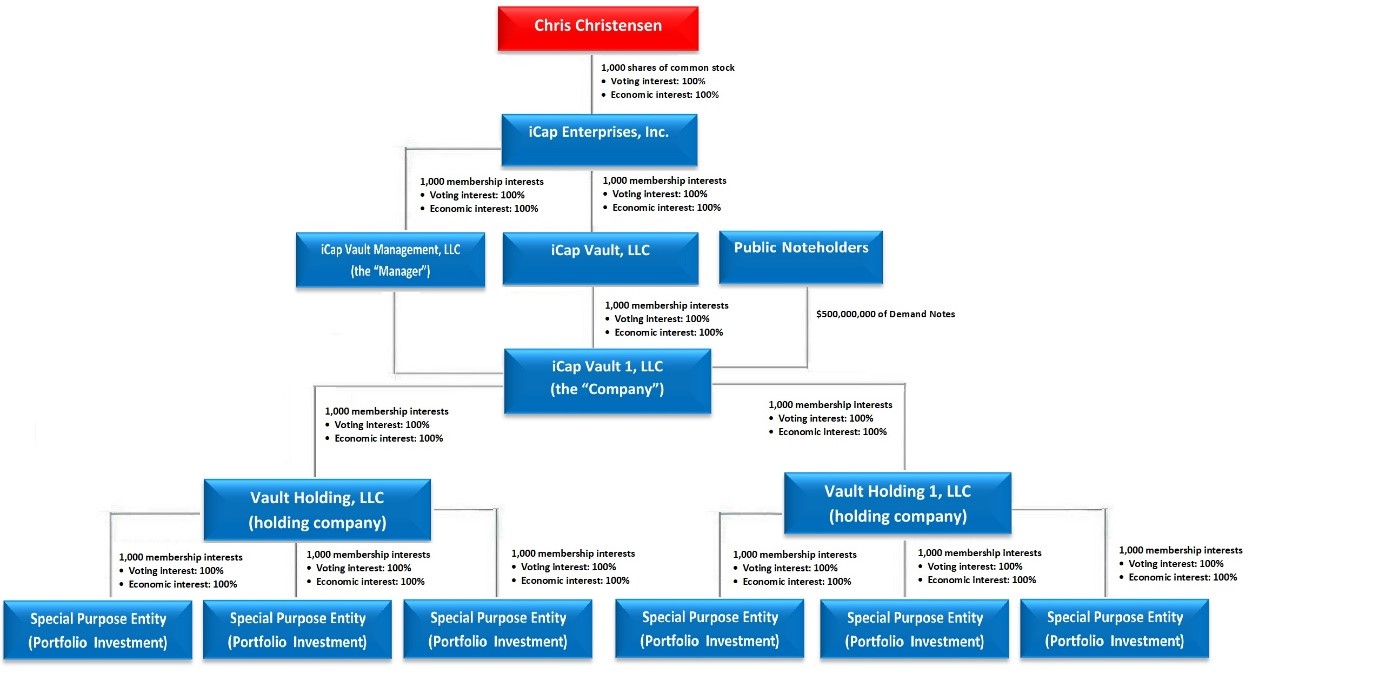

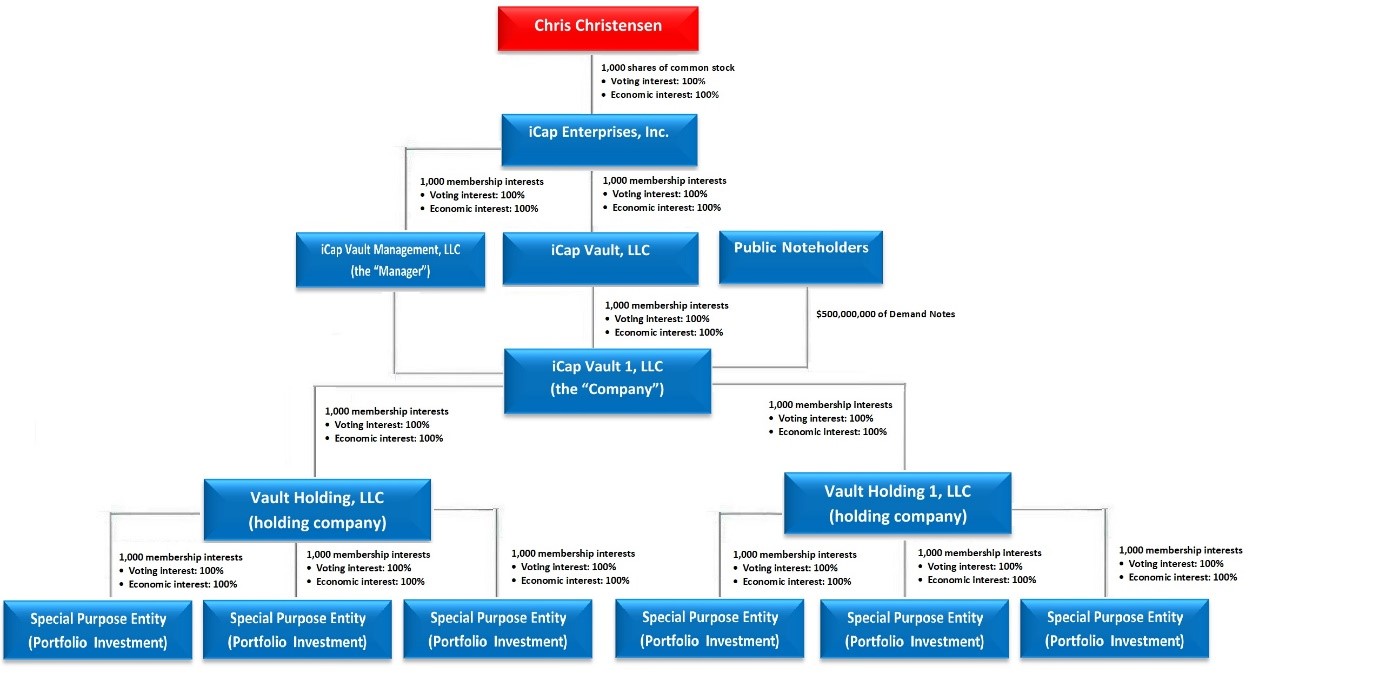

The following diagram reflects our planned organizational structure following the completion of the Offering:

The Manager may delegate day-to-day management responsibility of the Company to any person, provided that the Manager will retain ultimate responsibility for the management and conduct of the activities of the Company and all decisions relating to the selection and disposition of the Company’s investments.

The Company anticipates that the Company will be exempt from the registration requirements of the Investment Company Act of 1940, as amended (the “Investment Company Act”), by reason of the exemption specified in Section 3(c)(5)(C) of the Investment Company Act (excludes from regulation as an “investment company” any entity that is primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate).

Organizational Strength and Experience

The members of the senior management team have overseen many pooled investment funds based in real estate and have collectively closed in excess of $8 billion in transactions in the small and mid-cap spaces throughout their careers. iCap Enterprises also maintains a network of strategic relationships. The team leverages relationships with sourcing, development, construction, and fund administration constituents to maintain a pipeline of real estate purchase opportunities. Property owners, builders, developers, lenders and brokers are the primary entities for deal sourcing.

| 8 |

iCap Enterprises has capacity to expand its team to manage large amounts of capital from the sale of the Notes and to deploy such proceeds towards real estate that meets its investment criteria. iCap Enterprises has invested significant resources to build the technology and infrastructure needed to manage large amounts of noteholders, capital, and real estate. The number of employees who manage this infrastructure will grow as the capital under management increases.

The Manager and its affiliates have never been denied a license to practice a trade or business or ever experienced an event of bankruptcy, receivership, assignment for the benefit of creditors or similar proceeding.

The “Prior Performance Summary” section of this prospectus contains a discussion of the programs previously offered by our sponsor, iCap Enterprises, including certain executive officers and directors, from January 1, 2011 through December 31, 2020. Certain financial results and other information relating to such programs with investment objectives similar to ours are also provided in the “Prior Performance Tables” included as Appendix A to this prospectus. The prior performance of the programs previously sponsored by iCap Enterprises is not necessarily indicative of the results that we will achieve. For example, our prior programs were privately offered and did not bear the additional costs associated with being a publicly held entity.

Investment Experience

As a newly formed investment vehicle, iCap Vault 1, LLC has no operating or prior performance history. Vault Holding 1, LLC has not commenced operations and has no assets and liabilities. The information presented in this section represents the limited historical experience of the principals of the Manager and its affiliates. Prospective investors in the Company should not rely on the information below as being indicative of the types of investments the Company may make or of the types of returns the Company’s investments may generate. Prospective investors should not assume that the Company will experience returns, if any, comparable to those described herein.

iCap Enterprises has significant prior experience in investing in single-family, multi-family, light commercial and land development properties. Although this prospectus refers to “iCap Enterprises” as though it were an entity capable of taking action, prospective investors should bear in mind that such references are intended to refer to the business activities undertaken by one or more of the companies constituting a part of this affiliated group of companies. The Company will not acquire an interest in any of iCap Enterprises’ affiliated entities, but may benefit from their collective experience, inasmuch as those entities, as well as their respective employees, will be available to assist the Manager, and therefore the Company, as it conducts its business.

Management Fees; Transactions with Related Parties

In return for the provision of the services by the Manager to iCap Vault 1, LLC and Vault Holding 1, LLC and for the other actions of the Manager under the Operating Agreements, iCap Vault 1, LLC will pay iCap Vault Management, LLC an annual management fee (“Management Fee”) equal to (i) 1.30% of the outstanding aggregate principal balances of these registered Notes and (ii) 1.00% of the outstanding aggregate principal balance of the privately placed secured demand notes offered pursuant to that certain Private Placement Memorandum of the Company dated October 1, 2018 (“Private Placement Notes”). The Management Fee will be paid in arrears on the last day of each calendar quarter and will be calculated on the average daily outstanding principal balances of the Notes and Private Placement Notes during the applicable quarter.

Prior to January 1, 2020, certain shared operating expenses of the Company’s affiliated entities were allocated to the Company. The affiliated entities include iCap Equity, LLC and iCap PNW Management LLC. These allocations were based on several factors including size of notes payable, number of individual investors, and term of operations with an allocation period. Effective January 1, 2020, management decided to increase the Management Fee from 1.00% to 1.30% of outstanding aggregate principal balances of the Notes in lieu of allocating expenses from affiliated entities to the Company. Therefore, when the Company issues these registered Notes, the management fee paid by the Company shall be 1.30% of outstanding aggregate principal balances of the Notes. The management fee of 1.00% of the outstanding aggregate principal balance of the Private Placement Notes will remain the same. The Manager or an affiliate of the Manager may elect to pay any Company expenses, in which event the Company will reimburse such party for those out-of-pocket costs. The amount of reimbursable cost incurred to date is approximately $393,000. Additionally, in the event any personnel of the Manager or its affiliates perform any professional service for the Company, the Company shall pay the Manager or such affiliate(s) for such services at rates that are no higher than is standard in the market.

The Manager may charge the Company or any of its subsidiaries an underwriting fee to cover the costs of due diligence and underwriting involved in closing a real estate purchase or disposition. The underwriting fee will be paid at the time of purchase or disposition, will be non-refundable, and is expected to generally be less than $10,000 per transaction. Additionally, in the event the Company or the Manager acquires or becomes an affiliate of a real estate brokerage company, the Company may pay customary brokerage fees to such entity for the acquisition or disposition of the Company’s assets.

| 9 |

If the Manager, or an affiliate of the Manager or the Company, guarantees, whether personally or otherwise, a loan, bond or other obligation of the Company, a holding company, or a Portfolio SPE, that guarantor will be entitled to receive from the benefiting entity an annual fee equal to 1% of the total amount of the credit facility, bond amount, or other obligation that is the subject of the guarantee.