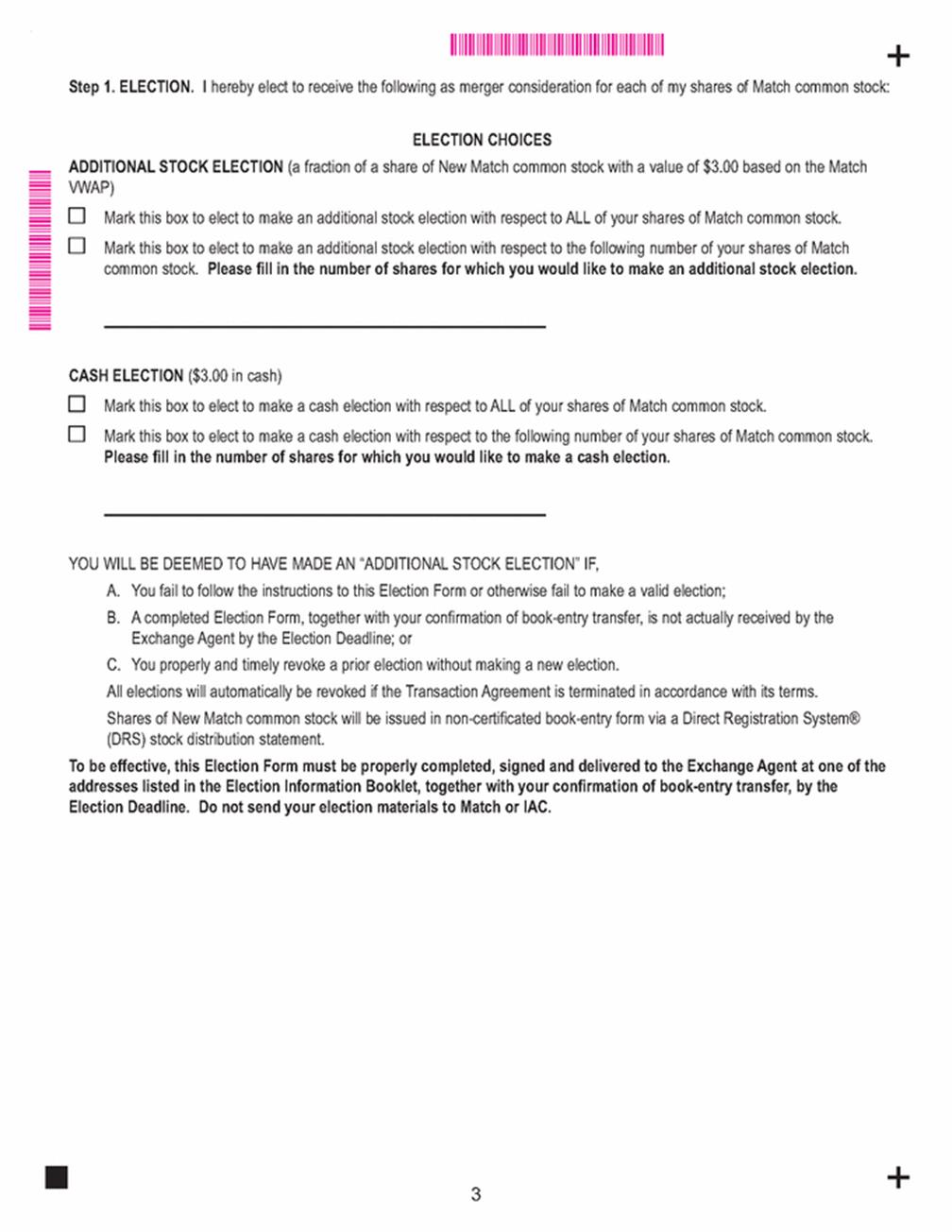

. Dear Match Group, Inc. Stockholder: Thank you for your support as we work toward completing the Separation (as defined below) of Match Group, Inc. (“Match”) and IAC/InterActiveCorp (“IAC”). On December 19, 2019, IAC, IAC Holdings, Inc., a direct wholly owned subsidiary of IAC (“New IAC”), Valentine Merger Sub LLC, an indirect wholly owned subsidiary of IAC (“New Match Merger Sub”), and Match entered into a Transaction Agreement (as amended, the “Transaction Agreement”) that provides, subject to the terms and conditions set forth in the Transaction Agreement, for the separation of the businesses of Match from the remaining businesses of IAC through a series of transactions (collectively, the “Separation”). Following the Separation, IAC will be renamed “Match Group, Inc.” (“New Match”) and will own the businesses of Match and certain IAC financing subsidiaries, and New IAC will be renamed “IAC/InterActiveCorp” and will own IAC’s other businesses. Pursuant to a merger of Match with New Match Merger Sub with New Match Merger Sub surviving the merger (the “Match Merger”), the pre-Separation stockholders of Match (other than IAC, Match or any wholly owned subsidiary of IAC) will own shares in New Match along with the pre-Separation stockholders of IAC. The adoption of the Transaction Agreement will be considered at a special meeting of Match stockholders, currently scheduled to be held on June 25, 2020. The consummation of the Separation is subject to the satisfaction of a number of conditions, including, among others, stockholders of IAC and Match approving the Separation and related matters. We expect that the Separation will be completed during the second quarter of 2020. Under the terms of the Transaction Agreement, each Match common stockholder (other than IAC, Match and their wholly owned subsidiaries) as of the Match Merger effective time will have the right to receive as consideration in the Match Merger, for each share of Match common stock that such stockholder owns as of the Match Merger effective time, one share of New Match common stock plus, at such stockholder’s election, either (1) a fraction of a share of New Match common stock with a value of $3.00, calculated based on the Match VWAP (an “additional stock election”), or (2) $3.00 in cash (a “cash election”). The “Match VWAP” will be equal to (i) the average of the daily dollar-volume-weighted average trading price of a share of Match common stock for the ten consecutive NASDAQ Global Select Market (“NASDAQ”) trading days ending on the fifth NASDAQ trading day immediately before the date on which the Separation is completed, (ii) minus $3.00. Enclosed is an Election Form and related documents for you to choose an additional stock election or cash election in connection with the Match Merger. In order to make an election, please complete, sign and return the Election Form, with confirmation of book-entry transfer of your shares of Match common stock to the exchange agent for the Separation, Computershare Trust Company, N.A. (the “Exchange Agent” or “Computershare”). In addition, enclosed is an Election Information Booklet for your reference. Please use the enclosed envelope to return your Election Form and confirmation of a book-entry transfer to the Exchange Agent. Do not send any documents to Match or IAC. The Election Form, together with your confirmation of book-entry transfer, must be RECEIVED by the Exchange Agent no later than 5:00 p.m., New York City time, on the date that is five business days preceding the special meeting of Match stockholders (the “Election Deadline”). Match and IAC will publicly announce the Election Deadline at least five business days prior to the date of the Election Deadline, but you are encouraged to return your Election Form and confirmation of book-entry transfer as promptly as practicable. In addition, if the special meeting of Match’s stockholders to approve the Separation is postponed, we expect that the Election Deadline will be postponed by the same period such that the Election Deadline is still 5:00 p.m., New York City time, on the date that is five business days preceding the special meeting of Match stockholders. You may also obtain up-to-date information regarding the Election Deadline by contacting MacKenzie Partners, Inc., at 800-322-2885 (Toll-Free), 212-929-5500 or proxy@mackenziepartners.com. There is a limited period of time for you to deliver your Election Form and confirmation of book-entry transfer. Therefore, we encourage you to submit your Election Form and confirmation of book-entry transfer promptly. 038J7B