Exhibit 99.2

1 Creating a Digital Publishing Leader October 2021

Cautionary Statement Regarding Forward - Looking Information 2 This presentation may contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements in this presentation that are forward - looking include, but are not limited to, statements regarding the completion of the sale of Meredith to Dotdash; the anticipa ted benefits of the transaction; the expectation that Dotdash will be one of the largest publishers in America with enough scale on a pro forma basis to crack into comScore’s top 10, reac hin g 175 million online consumers monthly, including 95 percent of US women; the future financial performance of the combined company; anticipated funding of the transaction; and th e c ompletion of the sale of Meredith Corporation’s local media group to Gray. The use of words such as “may”, “will”, “could”, “would”, “should”, “anticipates,” “estimates, “expects, “p lans” and “believes,” among others, generally identify forward - looking statements. Actual results could differ materially from those contained in these forward - looking statements for a variety of reasons, including, among others: (i) our respective abilities to market our products and services in a successful and cost - effective manner, (ii) the display of links to websites offering our respective products and services in a prominent manner in search results, (iii) our continued ability to market, distribute and monetize our respective products an d s ervices through search engines, digital app stores and social media platforms, as and if applicable, (iv) the failure or delay of the markets and industries in which our respective bu sinesses operate to migrate online and the continued growth and acceptance of online products and services as effective alternatives to traditional products and services, (v) our contin ued ability to develop and monetize versions of our respective products and services for mobile and other digital devices, (vi) our ability to engage directly with users, subscribers and c ons umers directly on a timely basis, (vii) our ability to access, collect and use personal data about our respective users and subscribers, as and if applicable, (viii) the ability of IAC’s C hai rman and Senior Executive, certain members of his family and IAC’s Chief Executive Officer to exercise significant influence over IAC’s operations, (ix) our respective abilities to comp ete , (x) adverse economic events or trends (particularly those that adversely impact advertising spending levels and consumer confidence and spending behavior), either generally and/or in any o f t he markets in which our respective businesses operate, (xi) our ability to build, maintain and/or enhance our various respective brands, (xii) the impact of the COVID - 19 outbreak on o ur respective businesses, (xiii) our ability to protect our respective systems, technology and infrastructure from cyberattacks and to protect personal and confidential user information , a s well as cyberattacks experienced by third parties, (xiv) the occurrence of data security breaches and/or fraud, (xv) increased liabilities and costs related to the processing, storag e, use and disclosure of personal and confidential user information, (xvi) the integrity, quality, efficiency and scalability of our respective systems, technology and infrastructur e ( and those of third parties with whom we do business), (xvii) changes in key personnel and (xviii) the risks inherent in the consummation and success of the proposed acquisition of Meredi th by Dotdash and the ability to achieve the expected benefits thereof, including (among others) the risk that the parties fail to obtain the required regulatory approvals or fulf ill the other conditions to closing on the expected timeframe or at all, the occurrence of any other event, change or circumstance that could delay the transaction or result in the terminati on of the acquisition agreement or the risks that IAC’s synergy estimates are inaccurate or that combined company faces higher than anticipated integration or other costs in connection with th e proposed acquisition. Certain of these and other risks and uncertainties are (or in the future may be) discussed in IAC’s and Meredith’s respective filings with the Securities and Exc hange Commission. Other unknown or unpredictable factors that could also adversely affect IAC’s or Meredith’s business, financial condition and results of operations may arise from t ime to time. In light of these risks and uncertainties, these forward - looking statements may not prove to be accurate. Accordingly, you should not place undue reliance on these forward - looki ng statements, which are being made as of the date of this presentation. IAC and Meredith do not undertake to update these forward - looking statements. See pages 19 - 20 for definition s of non - GAAP measures and related reconciliations.

Neil Vogel Chief Executive Officer Dotdash Joey Levin Chief Executive Officer IAC Tim Quinn Chief Financial Officer Dotdash Today’s Presenters 3

IAC’s Dotdash to acquire Meredith Holdings Corporation, comprised of Meredith Corporation’s National Media Group and its corporate operations (“NMG”), following its spin - off from Meredith Corporation (“MDP”), in an all - cash transaction Transaction Overview 4 Key Terms ● $42.18 per share in cash for NMG, following its spin - off from MDP, representing a total enterprise value of approximately $2.7 billion — Per share price is subject to downward adjustment for certain items set forth in the agreement, including if cash payment to MDP prior to spin - off and certain other amounts exceed $625 million ● Transaction expected to be funded with IAC cash and up to $1.6 billion of debt at Dotdash Meredith — IAC has received a commitment for an $850 million bridge facility; long - term financing at Dotdash expected to be obtained prior to closing ● Dotdash will manage the combination; reported as an IAC segment Timing and Approvals ● Close by year - end 2021 (targeted for Dec 1, 2021) ● Closing conditioned upon receipt of antitrust approvals and completion of NMG spin - off from MDP ● No shareholder approval of IAC/NMG transaction required

The Modern Digital Publisher – Intent - Driven Premium Content 5 95% of U.S. women reached every month 175 Million U.S. online consumers reached each month 70%+ of pro forma 2021 Adj EBITDA expected from Digital $450+ Million Pro Forma Adj Digital EBITDA in 2023 TOP 10 U.S. Internet property 560 Million Magazine copies per year

World Class Brand Portfolio 6 HOME FOOD HEALTH BEAUTY & STYLE LIFESTYLE FINANCE ENTERTAINMENT 96 Million 144 Million Monthly Audience Monthly Audience Source: Comscore July ‘21

Dotdash Meredith is a Premium Content Powerhouse 7 Premium Site Speed, Clean Usable Design, Limited Respectful Ads 100+ editorial and design awards over the past year Comprehensive product reviews supported by 50,000+ sq. ft. of testing facilities One million+ articles: text, video, and visual assets continually updated Scaled and Comprehensive Independent Research and Testing Editorial Excellence

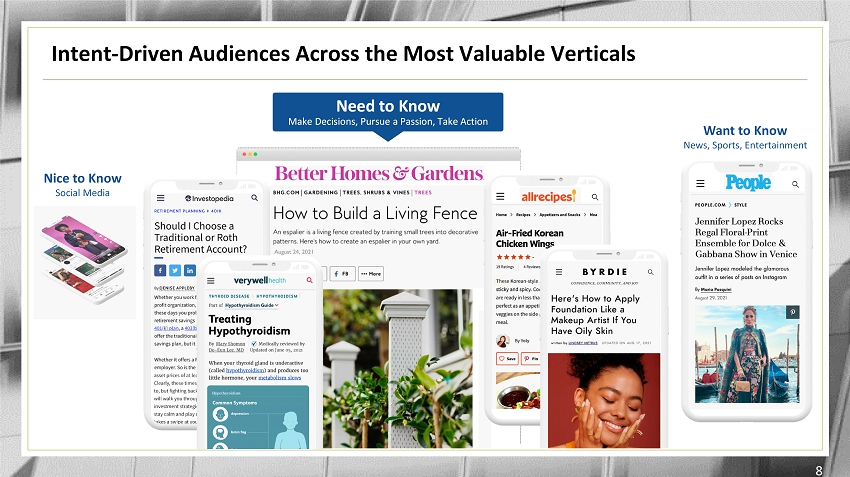

Intent - Driven Audiences Across the Most Valuable Verticals 8 Nice to Know Social Media 8 Want to Know News, Sports, Entertainment Need to Know Make Decisions, Pursue a Passion, Take Action

Brand - Driven Intent Audiences are the Most Valuable 9 Growing Diverse Revenue World Class Brands Intent - Driven Audiences › Contextual Relevance › Do Not Need Personal Information › Superior Performance › Advertising › Commerce › Performance Marketing › Consumer Revenue › Best Content › Fastest Sites › Fewer, Better Ads

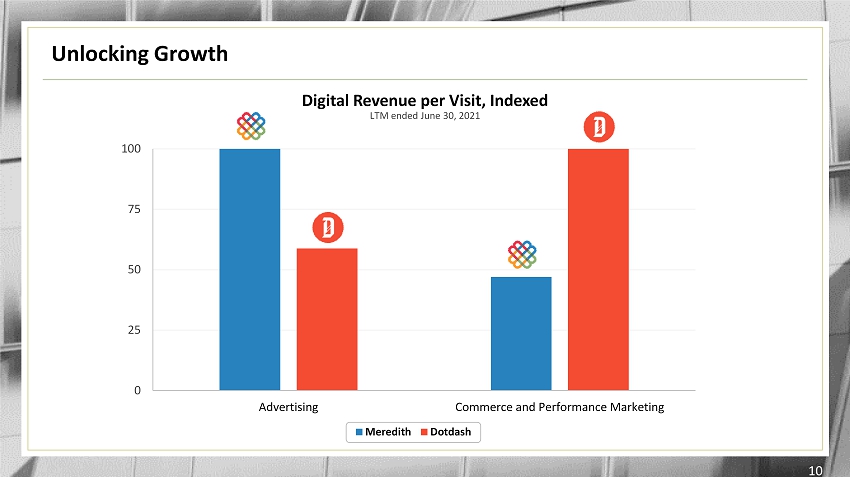

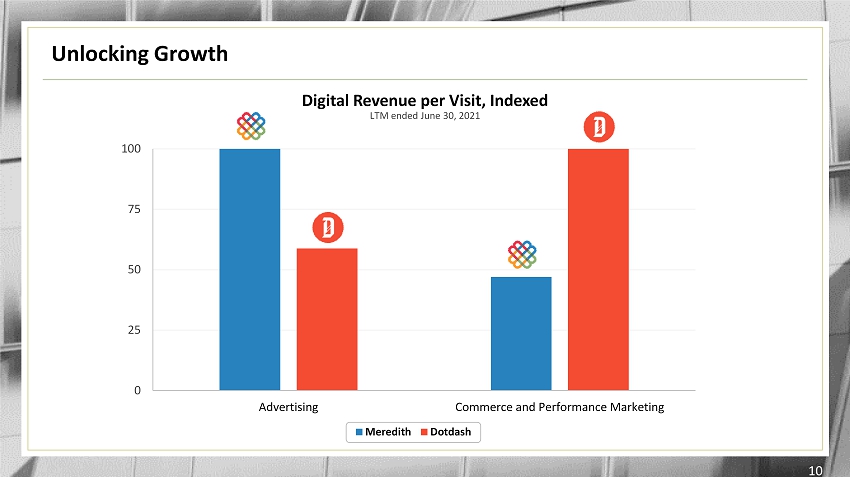

0 25 50 75 100 Advertising Commerce and Performance Marketing Meredith Dotdash Unlocking Growth 10 Digital Revenue per Visit, Indexed LTM ended June 30, 2021

Print Strategy – Assets in Support of Digital 11 • Meredith is the largest magazine publisher in the U.S. • Branding benefit and current cash flow from the portfolio • Magazine ad revenues are experiencing secular declines and accelerated through COVID; digital ad sales surpassed print in ‘21 • Continue to offer consumers and advertisers a unique value proposition that combines the best of print and digital • Invest behind top performing titles • Focus on profitability v. scale, and marketing and branding benefit Today Looking Ahead

Dotdash and Meredith Historical Financials $525 $593 $656 $738 $1,839 $1,787 $1,435 $1,372 $2,356 $2,365 $2,071 $2,109 2018 2019 2020 LTM 1 12 Digital Print Digital CAGR: 15% CAGR: 8% 6,526 6,742 7,792 8,002 2018 2019 2020 LTM 1 $363 $422 $375 $358 2018 2019 2020 LTM 1 Revenue ($ millions) Adj. EBITDA ($ millions) 2,957 3,707 4,186 4,500 2018 2019 2020 LTM Total Sessions (millions) (2) CAGR: 18% CAGR: 32% 1 $21 $40 $66 $88 2018 2019 2020 LTM 1 (1) For the calendar year ended Dec 31; LTM for period ended June 30, 2021 (2) Sessions measured by Google Analytics, other internal reporting sources $131 $168 $214 $264 2018 2019 2020 LTM 1

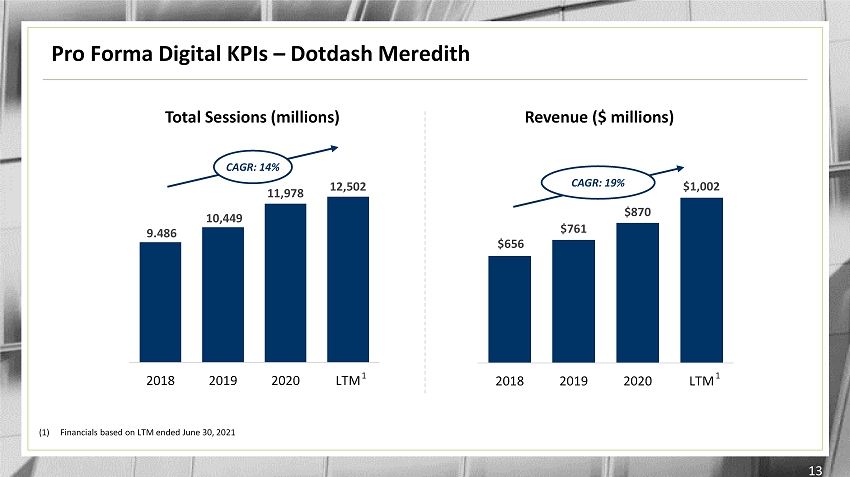

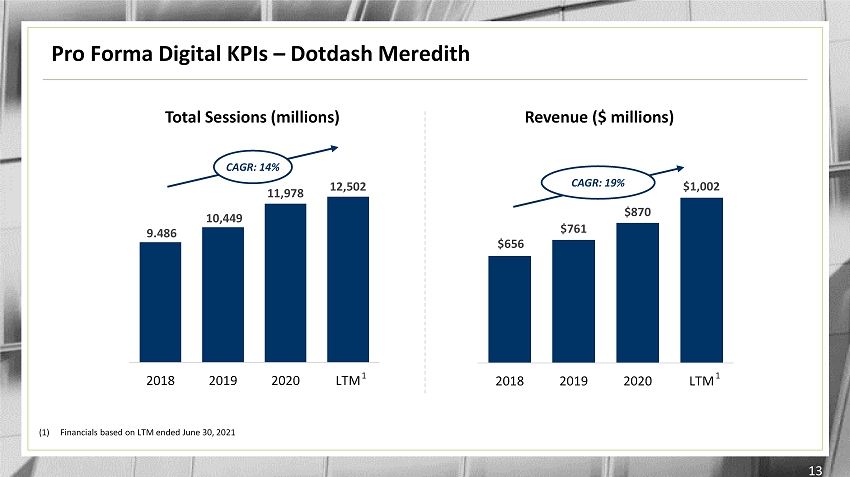

Pro Forma Digital KPIs – Dotdash Meredith 13 $656 $761 $870 $1,002 2018 2019 2020 LTM Revenue ($ millions) 9.486 10,449 11,978 12,502 2018 2019 2020 LTM Total Sessions (millions) 1 1 CAGR: 19% CAGR: 14% (1) Financials based on LTM ended June 30, 2021

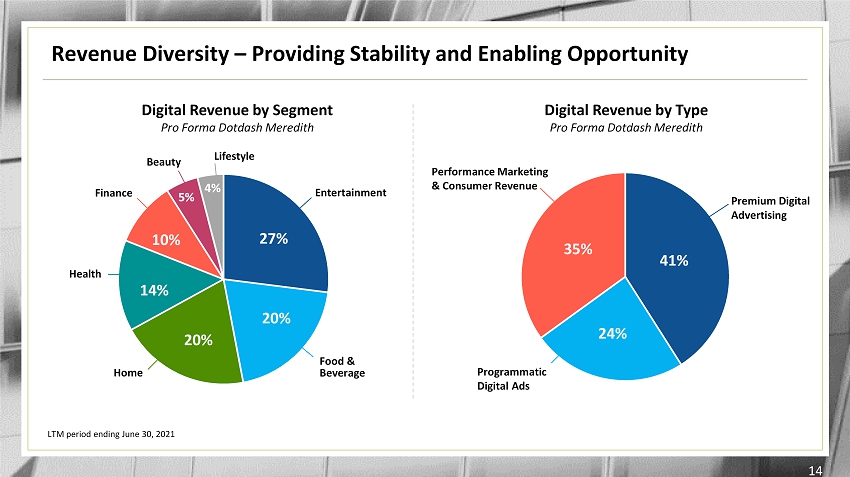

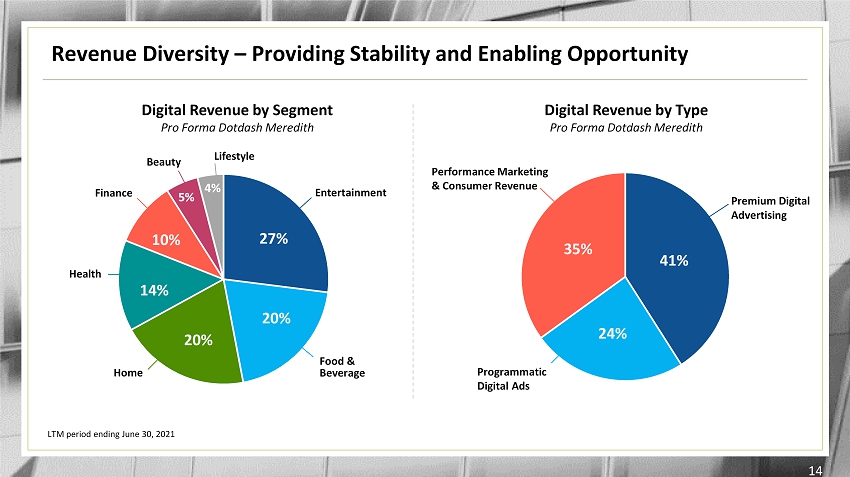

Revenue Diversity – Providing Stability and Enabling Opportunity 14 27% 20% 20% 14% 10% 5% 4% Food & Beverage Entertainment Home Health Finance Lifestyle Beauty Digital Revenue by Segment Pro Forma Dotdash Meredith Digital Revenue by Type Pro Forma Dotdash Meredith 41% 24% 35% Performance Marketing & Consumer Revenue Premium Digital Advertising Programmatic Digital Ads LTM period ending June 30, 2021

Growing U.S. Digital Ad Market 15 Source: eMarketer $ in billions Total U.S. Ad Spend $ 242 $ 396 0 50 100 150 200 250 300 350 400 2020 2025 CAGR: 9% Total U.S Digital Ad Spend $ 152 $ 304 0 50 100 150 200 250 300 350 2020 2025 CAGR: 15%

Creating Value 16 Run the Dotdash playbook — superior content, respectful advertising, best UI/UX — across the Meredith brands 15 - 20% Annual Digital Growth Manage Print to Support Digital Up to $50M in Savings Year 1 Capture operating synergies Targeting $450M of combined Adjusted Digital EBITDA in 2023 $450M Adjusted Digital EBITDA Focus on top titles and quality subscribers

IAC Going Forward 17 • Diverse portfolio of premium internet assets • Industry leading businesses in three large categories (Home Services, Digital Publishing, and Care) • Significant growth potential in rest of portfolio • Optimizing capital allocation and enhancing strategic flexibility Angi Publishing Search Emerging Minority Investments

10 Public Companies and $95 Billion in Value Created for Shareholders IAC’s Track Record of Creating Value 18 S&P IAC $13.09 $40.84 10.4% CAGR 15.3% CAGR $1.00 Invested when Barry Diller took control is today worth $- $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 SpinCos and Subsidiaries S&P

Adjusted EBITDA Reconciliation – Dotdash 19 (a) Adjusted EBITDA is defined as operating income excluding: (1) stock - based compensation expense; (2) depreciation; (3) acquisitio n - related items consisting of (i) amortization of intangible assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses re cognized on changes in the fair value of contingent consideration arrangements; (4) expenses related to Meredith Corporation’s National Media Group’s acquisition, dis pos ition and restructuring related activities; (5) impairments of Meredith Corporation’s National Media Group’s long lived assets; and (6) expenses associated with the acqu isi tion of Meredith Corporation’s National Media Group by Dotdash. IAC does not have the ability to prepare a reconciliation of digital Adjusted EBITDA to Dotdash and Meredith combined net inc ome (loss) for 2021 or 2023 because the forecast for certain expenses following the acquisition (e.g., stock - based compensation and certain expenses associated with the acquisition) is not yet complete. DOTDASH LTM RECONCILIATION OF OPERATING INCOME TO ADJUSTED EBITDA 12/31/2018 12/31/2019 12/31/2020 6/30/2021 (unaudited) (millions) Operating income 19 29 50 77 Add back: Stock-based compensation Depreciation 1 1 2 2 Amortization of intangibles 2 10 14 8 Adjusted EBITDA (a) 21$ 40$ 66$ 88$ YTD Ended

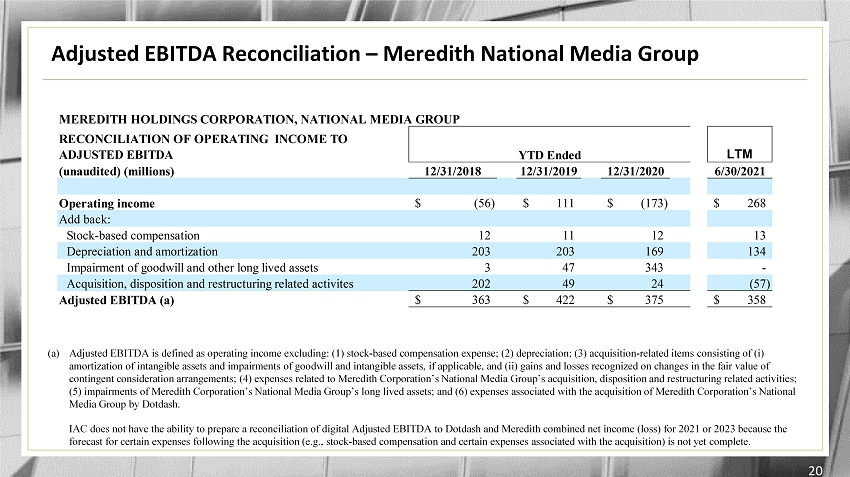

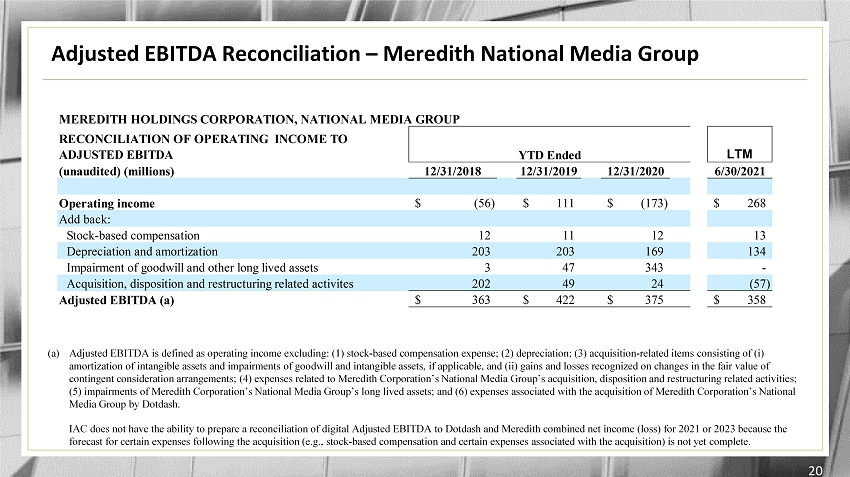

Adjusted EBITDA Reconciliation – Meredith National Media Group 20 (a) Adjusted EBITDA is defined as operating income excluding: (1) stock - based compensation expense; (2) depreciation; (3) acquisitio n - related items consisting of (i) amortization of intangible assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses re cognized on changes in the fair value of contingent consideration arrangements; (4) expenses related to Meredith Corporation’s National Media Group’s acquisition, dis pos ition and restructuring related activities; (5) impairments of Meredith Corporation’s National Media Group’s long lived assets; and (6) expenses associated with the acqu isi tion of Meredith Corporation’s National Media Group by Dotdash. IAC does not have the ability to prepare a reconciliation of digital Adjusted EBITDA to Dotdash and Meredith combined net inc ome (loss) for 2021 or 2023 because the forecast for certain expenses following the acquisition (e.g., stock - based compensation and certain expenses associated with the acquisition) is not yet complete. MEREDITH HOLDINGS CORPORATION, NATIONAL MEDIA GROUP RECONCILIATION OF OPERATING INCOME TO ADJUSTED EBITDA LTM (unaudited) (millions) 12/31/2018 12/31/2019 12/31/2020 6/30/2021 Operating income (56)$ 111$ (173)$ 268$ Add back: Stock-based compensation 12 11 12 13 Depreciation and amortization 203 203 169 134 Impairment of goodwill and other long lived assets 3 47 343 - Acquisition, disposition and restructuring related activites 202 49 24 (57) Adjusted EBITDA (a) 363$ 422$ 375$ 358$ YTD Ended