Updated Consolidated �Cap Table September 1, 2021 Networked, Harmonized, Optimized, Live. Exhibit 99.1

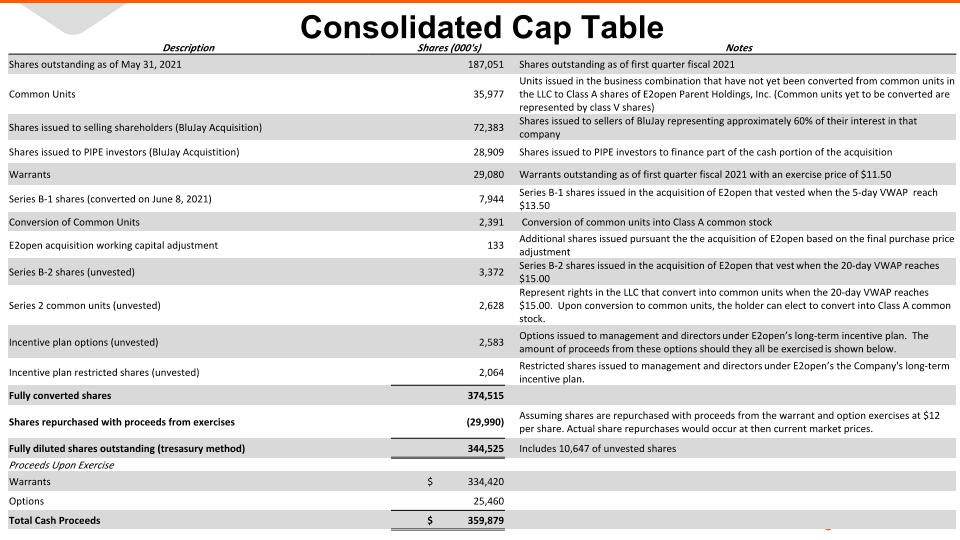

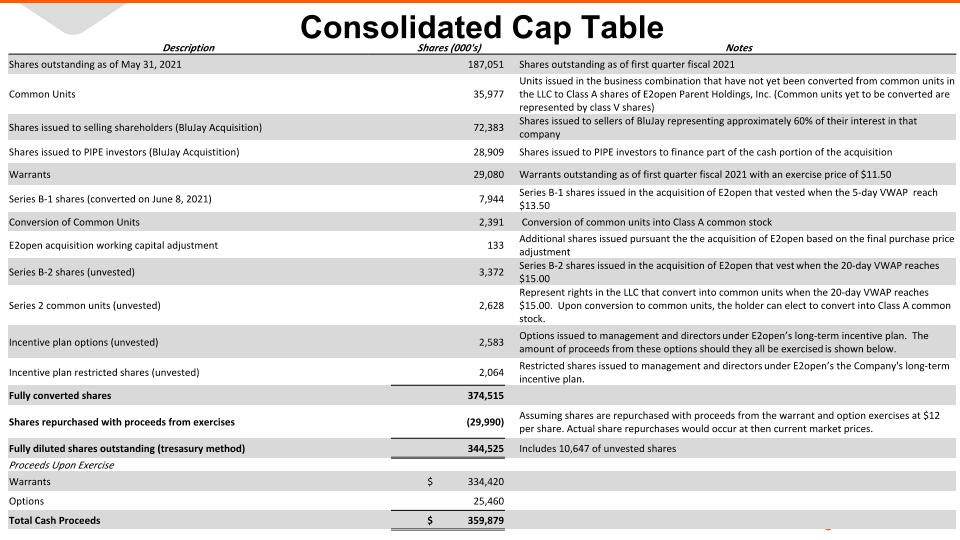

Consolidated Cap Table Description Shares (000's) Notes Shares outstanding as of May 31, 2021 187,051 Shares outstanding as of first quarter fiscal 2021 Common Units 35,977 Units issued in the business combination that have not yet been converted from common units in the LLC to Class A shares of E2open Parent Holdings, Inc. (Common units yet to be converted are represented by class V shares) Shares issued to selling shareholders (BluJay Acquisition) 72,383 Shares issued to sellers of BluJay representing approximately 60% of their interest in that company Shares issued to PIPE investors (BluJay Acquistition) 28,909 Shares issued to PIPE investors to finance part of the cash portion of the acquisition Warrants 29,080 Warrants outstanding as of first quarter fiscal 2021 with an exercise price of $11.50 Series B-1 shares (converted on June 8, 2021) 7,944 Series B-1 shares issued in the acquisition of E2open that vested when the 5-day VWAP reach $13.50 Conversion of Common Units 2,391 Conversion of common units into Class A common stock E2open acquisition working capital adjustment 133 Additional shares issued pursuant the the acquisition of E2open based on the final purchase price adjustment Series B-2 shares (unvested) 3,372 Series B-2 shares issued in the acquisition of E2open that vest when the 20-day VWAP reaches $15.00 Series 2 common units (unvested) 2,628 Represent rights in the LLC that convert into common units when the 20-day VWAP reaches $15.00. Upon conversion to common units, the holder can elect to convert into Class A common stock. Incentive plan options (unvested) 2,583 Options issued to management and directors under E2open’s long-term incentive plan. The amount of proceeds from these options should they all be exercised is shown below. Incentive plan restricted shares (unvested) 2,064 Restricted shares issued to management and directors under E2open’s the Company's long-term incentive plan. Fully converted shares 374,515 Shares repurchased with proceeds from exercises (29,990) Assuming shares are repurchased with proceeds from the warrant and option exercises at $12 per share. Actual share repurchases would occur at then current market prices. Fully diluted shares outstanding (tresasury method) 344,525 Includes 10,647 of unvested shares Proceeds Upon Exercise Warrants $ 334,420 Options 25,460 Total Cash Proceeds $ 359,879