UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 28, 2021

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission File Number 001-39272

E2open Parent Holdings, Inc.

(Exact name of registrant as specified in its charter)

Delaware | | | | 86-1874570 | |

(State or other jurisdiction of incorporation) | | | | (IRS Employer Identification No.) |

| | | | |

9600 Great Hills Trail, Suite 300E Austin, TX | | | | 78759 |

(address of principal executive offices) | | | | (zip code) |

| | 866-432-6736 | | |

| | (Registrant’s telephone number, including area code) | | |

Securities registered pursuant to Section 12(b) of Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, par value $0.0001 per share | | ETWO | | New York Stock Exchange |

| | | | |

Warrants to purchase one share of Class A Common Stock

at an exercise price of $11.50 | | ETWO WT | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer | | ☐ | Accelerated filer | | ☐ |

| | | | | |

Non-accelerated filer | | ☒ | Smaller reporting company | | ☒ |

| | | | | |

| | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued it audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of August 31, 2020, the aggregate market value of the registrant’s Class A ordinary shares held by non-affiliates of the registrant was $425,592,000 based on the closing sale price of $10.28 as reported on The New York Stock Exchange. The Class A ordinary shares automatically converted into Class A common stock in connection with the Domestication, as defined herein.

There were 187,051,142 shares of common stock issued and outstanding as of May 14, 2021.

DOCUMENTS INCORPORATED BY REFERENCE: None

E2open Parent Holdings, Inc.

TABLE OF CONTENTS

2

GLOSSARY OF TERMS

| | |

Abbreviation | | Term |

| | |

Class A Common Stock | | Class A common stock, par value $0.0001 per share |

| | |

Class V Common Stock | | Class V common stock, par value $0.0001 per share |

| | |

Common Units | | common units representing limited liability company interests of E2open Holdings, LLC, which are non-voting, economic interests in E2open Holdings, LLC |

| | |

Domestication | | CC Neuberger Principal Holdings I changed its jurisdiction of incorporation from the Cayman Islands to the State of Delaware on February 4, 2021 |

| | |

Forward Purchase Agreement | | agreement dated as of April 28, 2020 by and between CCNB1 and Neuberger Berman Opportunistic Capital Solutions Master Fund LP |

| | |

Forward Purchase Shares | | 20,000,000 Class A ordinary shares purchased pursuant to the Forward Purchase Agreement |

| | |

Forward Purchase Warrants | | 5,000,000 redeemable warrants purchased pursuant to the Forward Purchase Agreement |

| | |

Insight Partners | | entities affiliated with Insight Venture Management, LLC, including funds under management; controlling shareholder of E2open Holdings, LLC holding less than 50% voting interests |

| | |

LIBOR | | London Interbank Offered Rate |

| | |

Lock-up Period | | period commencing on February 4, 2021 and ending on August 4, 2021 |

| | |

PIPE Investment | | an aggregate of 69,500,000 shares of Class A Common Stock purchased in connection with the Business Combination at $10.00 per for a total of $695.0 million |

| | |

RCU | | restricted common units representing Series 1 and Series 2 of E2open Holdings, LLC |

| | |

SaaS | | software-as-a-service or a software distribution model in which a company hosts applications for customers and makes these applications available to customers via the internet/cloud technology |

| | |

SCM | | supply chain management |

| | |

SEC | | U.S. Securities and Exchange Commission |

| | |

U.S. GAAP | | generally accepted accounting principles in the United States |

| | |

SKU | | stock-keeping record, a functional application that may be used as a standalone or with other functional applications/SKUs, each of which belongs to only one product family, and each product family has between four and ten SKUs |

| | |

TAM | | total addressable market, which is the estimated potential market size for SCM software in North America and Europe |

| | |

NYSE | | New York Stock Exchange |

| | |

VWAP | | daily per share volume-weighted average price of the Class A Common Stock on the NYSE as displayed on the Bloomberg page under the heading Bloomberg VWAP |

| | |

3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (2021 Form 10-K) contains “forward-looking statements” within the meaning of the federal securities law. These forward-looking statements give E2open Parent Holdings, Inc.’s (we, our, us, Company or E2open) current expectations and include projections of results of operations or financial condition or forecasts of future events. Words such as “may,” “can,” “should,” “will,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” and similar expressions are used to identify forward-looking statements. Without limiting the generality of the forgoing, forward-looking statements contained in this document include our expectations regarding our future growth, operational and financial performance and business prospects and opportunities.

These forward-looking statements are based on information available as of the date of this 2021 Form 10-K and management’s current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside our control and our directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. We do not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| • | the ability to recognize the anticipated benefits of the Business Combination (as defined below), which may be affected by, among other things, competition, and our ability to grow and manage growth profitably and retain our key employees; |

| • | changes in applicable laws or regulations; |

| • | the inability to develop and maintain effective internal controls; |

| • | the inability to attract new customers or upsell/cross sell existing customers; |

| • | failure to renew existing customer subscriptions on terms favorable to us; |

| • | risks associated with our extensive and expanding international operations; |

| • | the inability to develop and market new and enhanced solutions; |

| • | the failure of the market for cloud-based SCM solutions to develop as quickly as we expect; |

| • | inaccuracies in information sourced for our knowledge databases; |

| • | failure to compete successfully in a fragmented and competitive SCM market; |

| • | the inability to adequately protect key intellectual property rights or proprietary technology; |

| • | the diversion of management’s attention and consumption of resources as a result of potential acquisitions of other companies; |

| • | risks associates with our past and prospective acquisitions, including the failure to successfully integrate operations, personnel, systems, technologies and products of the acquired companies, adverse tax consequences of acquisitions, greater than expected liabilities of the acquired companies and charges to earnings from acquisitions; |

| • | failure to maintain adequate operational and financial resources or raise additional capital or generate sufficient cash flows; |

| • | cyber-attacks and security vulnerabilities; |

| • | our inability to maintain the listing of our Class A Common Stock on the NYSE; and |

| • | certain other factors discussed elsewhere in this 2021 Form 10-K. |

For a further discussion of these and other factors that could impact our future results and performance, see Part I, Item 1A., Risk Factors.

4

EXPLANATORY NOTE

The Business Combination

On February 4, 2021 (Closing Date), CC Neuberger Principal Holdings I (CCNB1) consummated the Business Combination (as defined below), pursuant to which it acquired E2open Holdings, LLC and its operating subsidiaries (collectively, E2open) (the acquisition is referred to herein as the Business Combination). In connection with the closing of the Business Combination, pursuant to the Business Combination Agreement, dated as of October 14, 2020, various entities merged with and into E2open, with E2open surviving the merger as a direct, wholly-owned subsidiary of CCBN1. CCBN1 changed its name to E2open Parent Holdings, Inc.

The Annual Report on Form 10-K for the year ended December 31, 2020 for CCNB1 was filed with the SEC on May 5, 2021 and contains a description of the blank check company prior to the consummation of the Business Combination. As a February 28 year end company, this 2021 Form 10-K describes the operations of E2open and contains the financial results of E2open for the period both before and after the Business Combination through February 28, 2021.

Further information regarding the Business Combination is set forth in (1) our Definitive Proxy statement filed with the SEC on January 12, 2021 (Proxy Statement) and (2) our Current Report on Form 8-K filed with the SEC on February 10, 2021.

PART I

Item 1. Business

Company Overview

We are a leading provider of 100% cloud-based, end-to-end SCM software. We generate revenue from the sale of software subscriptions and professional services. Our software combines networks, data and applications to provide a deeply embedded, mission-critical platform that allows customers to optimize their supply chain by accelerating growth, reducing costs, increasing visibility and driving improved resiliency. Given the mission-critical nature of our solutions, we maintain long-term relationships with our customers, which is reflected by our high gross retention and average customer tenure. In aggregate, we serve more than 1,200 customers in over 180 countries across a wide range of end-markets, including technology, consumer, industrial and transportation, among others.

We operate in what we believe is an attractive industry with strong secular tailwinds and a TAM of more than $45 billion. This TAM is comprised of significant whitespace, which we estimate is more than $1 billion. This opportunity within our existing customer base is largely driven by their current technology solution which is often a combination of legacy point solutions and home-grown applications, many of which are tied together with manual processes and spreadsheets. As manufacturing has evolved from brands owning the full production lifecycle to orchestrating disparate manufacturing, distribution and selling processes, supply chains have grown more complex, increasing demand for software solutions like ours and the need to modernize the existing technology landscape with cloud-based modern solutions. We believe our fully cloud-based, end-to-end software platform offers a differentiated solution for customers that gives them better value as compared to solutions offered by some of our competitors.

5

Our Platform

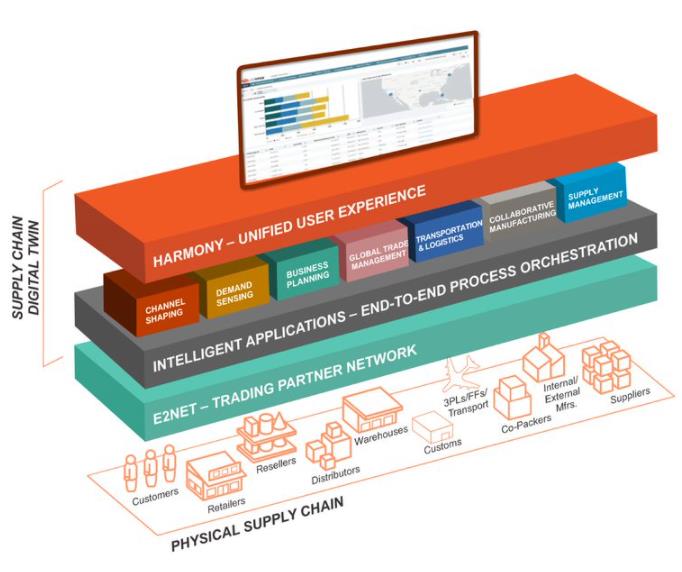

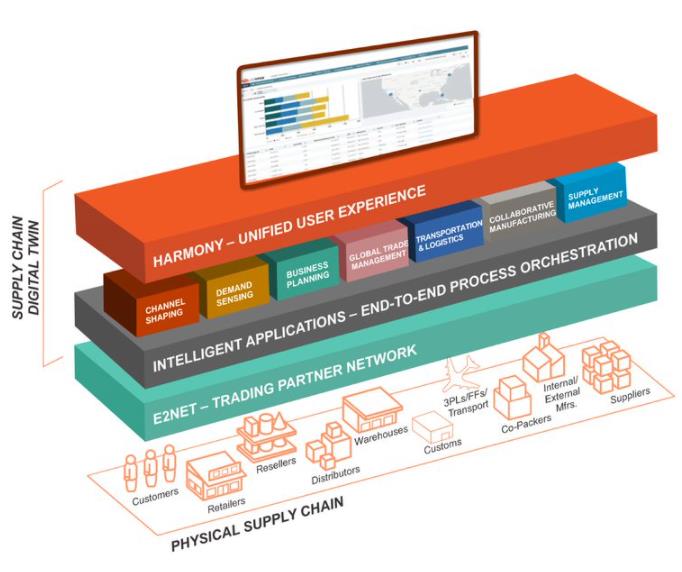

Our harmonized SaaS platform brings together networks, data and applications to facilitate end-to-end supply chain visibility across planning, execution and procurement and delivers a strong value proposition.

Network

Our network combines four distinct, but connected, ecosystems: Demand, Supply, Logistics and Global Trade, which we estimate supports more than 220,000 trading partners and captures more than eight billion transaction data points each year.

Our Demand ecosystem represents the global footprint established by retailers, distributors, re-sellers and those who sell goods primarily through online channels. We estimate that we process over $2 billion in claims every quarter, more than 40 million channel sales transactions every month and over 94 million channel inventory transactions every month.

Our Supply ecosystem is comprised of companies and other participants for which we source components and materials and/or provide manufacturing capacity for the production of goods. We estimate that, at any moment in time, we oversee an average of more than 58 million shipments as well as process an average of over 61 million orders and 17 million invoices for our customers and supply and manufacturing network participants based on samples taken over a 12-month period.

Our Logistics ecosystem includes global logistics services that transport components, raw materials and finished goods across all modes. We estimate that we facilitate over 26% of global ocean container bookings within this ecosystem in addition to tracking the movement of over 46 million containers every month.

Our Global Trade ecosystem allows participants to automate the global movement of goods and facilitate cross-border transactions for businesses, which we believe is increasingly important given the velocity with which import and export laws change on a global scale. This ecosystem provides our network with data on trade regulations across more than 180 countries that we estimate supports annual processing of over 12 million export pre-customs entry lines, 15 million free trade agreement bill of materials qualifications and 92 million restricted party-list screenings, annually.

Our network connects participants across all of these ecosystems, enabling customers to analyze data, identify problems proactively and optimize asset efficiency. We are a leading provider with a unique network of ecosystems, and do not rely on third party providers for network information.

6

Data

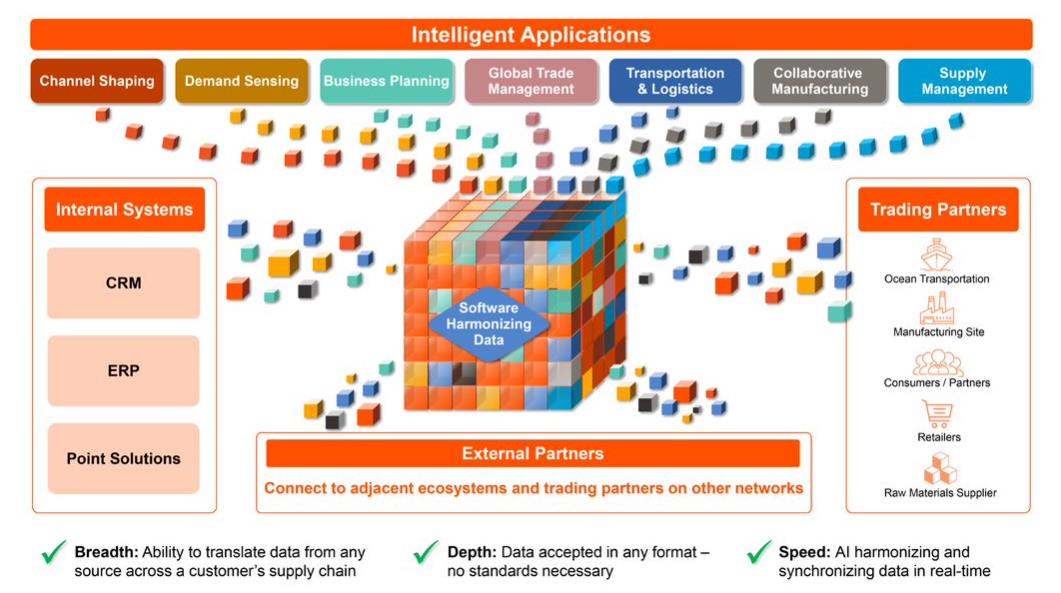

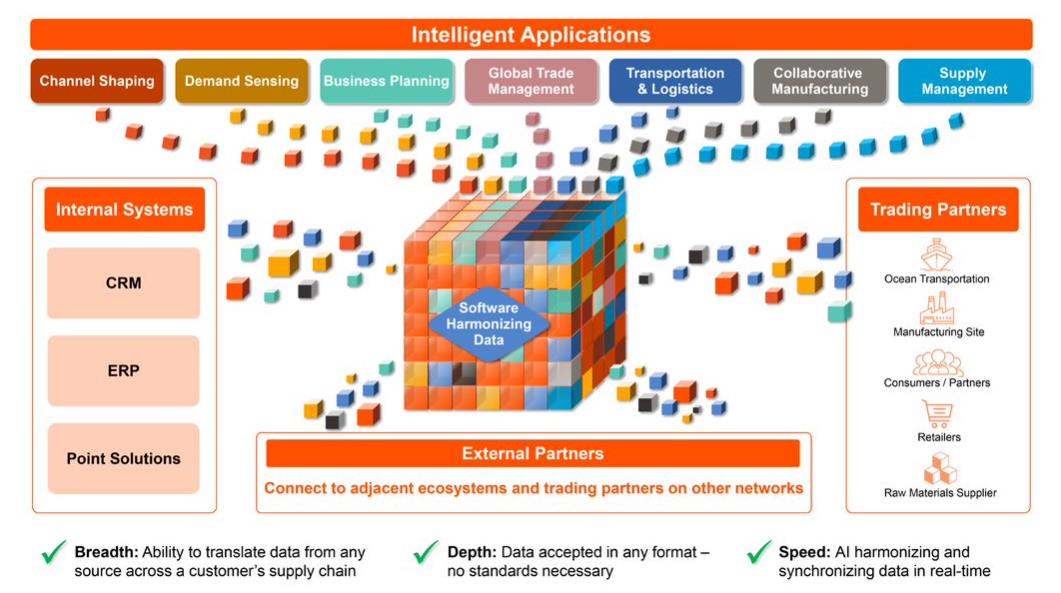

Our proprietary algorithms capture the data within our network ecosystems that feed our solutions to deliver compelling value to our customers. Additionally, our customers can combine internal and external vendor data with our network to drive informed decision-making based on real-time information. We believe our ability to capture and harmonize data from our customers and their trading partners in any native format demonstrates the strong capabilities of our software architecture and integrated data model. We believe that our combination of network ecosystems, data and applications providing end-to-end supply chain visibility and connecting more than 220,000 trading partners is unique.

Applications

Our end-to-end applications provide artificial intelligence and machine learning-based advanced analytics to help customers gain insights for enhanced decision-making across supply chain planning, execution and procurement functions. Our applications are organized into seven product families: Channel Shaping, Demand Sensing, Business Planning, Global Trade Management, Transportation and Logistics, Collaborative Manufacturing and Supply Management.

Channel Shaping allows customers to optimize activity across retail, distributor and online channels, which includes capabilities for partner selection, aligning market incentives, managing on-shelf availability, tracking sell-through and inventory as well as managing performance incentives.

Demand Sensing utilizes artificial intelligence and machine learning to forecast demand based on historical trends, current sell-through dynamics, weather and other relevant factors.

Business Planning helps ensure optimized global performance through scenario-based planning and execution algorithms balancing supply, demand, inventory and financial targets.

Global Trade Management automates import and export processes to enable efficient and compliant cross-border trade while optimizing customs duties and reducing broker fees.

Transportation and Logistics orchestrates the movement of goods by allowing customers to connect with key stakeholders to optimize carriers, simplify tendering, track shipments and streamline payments.

Collaborative Manufacturing provides comprehensive visibility into internal and external manufacturing activities by monitoring yields, quality, cycle-times/utilization and other key indicators to track performance, identify deficiencies and facilitate corrective actions.

Supply Management ensures the continuity of supply by orchestrating procurement, capacity, inventory management and drop-ship fulfilment across multiple-tiers of the manufacturing process.

Competitive Strengths

We believe the following competitive strengths will contribute to our ongoing success.

Attractive Industry Tailwinds and Large TAM

We participate in the growing SCM software industry. We estimate that the TAM is more than $45 billion across North America and Europe, and we anticipate this market will continue to grow. Several secular trends are increasing the demand for SCM software, including:

| • | Complexity of Global Supply Chains |

| o | Brand owners have transitioned from being manufacturers to orchestrators that produce little, but manage a vast network of outsourced trading partners that support their minute-by-minute operations across channel, manufacturing, supply, global trade and logistics. |

| o | As supply chains become increasingly global and complex, SCM software is essential to run supply chains efficiently at scale. |

| • | Need for Integrating Siloed Data to Drive Decision Making |

| o | Manufacturers are increasingly focused on utilizing disparate data to drive more efficient decision making. |

7

| o | Historically, data to help manufacturers bring their products to market has existed in silos within various departments of the manufacturers, as well as across their extended partner ecosystems. |

| o | Access to timely and comprehensive data is valuable not just to each department within a manufacturer, but also critical for partners of the manufacturer to run efficient operations on its behalf. |

| o | Brand owners are increasingly focused on applying data from different parts of the supply chain to make more informed manufacturing decisions, such as using retail demand sensing to forecast required manufacturing output. |

| o | Brand owners are increasingly focused on a flexible, multi-modal value proposition spanning carriers, shippers and third-party logistics providers. |

| • | Regulatory Environment Complexity |

| o | Manufacturers increasingly need to navigate complex frameworks of regional and local taxes, tariffs and regulatory compliance protocols. |

| o | SCM software solutions help automate these tasks and reduce the regulatory burden for companies, which will continue to be a strategic priority. |

| • | Geographic Consolidation |

| o | Shippers and third-party logistics providers operate in a global environment and want to execute within a single technology platform. |

| o | Many SCM technology solutions have historically had stronger capabilities within the region in which they were initially developed. North America is the most developed, with Europe served by a smaller number of SCM software solutions while Latin America and Asia-Pacific (APAC) are comparatively underpenetrated. |

| o | As a result of disruptions related to COVID-19 and recent events like the Suez Canal blockage, it has become increasingly important to diversify supply chains to mitigate disruption risk resulting from concentration within a supply chain. The complexity that arises from diversifying a supply chain and increasing the number of trading partners across more geographies and production facilities drives further demand for SCM software. |

We believe that the TAM has approximately 85% whitespace for modern SCM solutions. Many companies currently rely on legacy on premise applications or homegrown and/or spreadsheet-based solutions created over time, each of which require significant manual effort to achieve end-to-end supply chain visibility. Moreover, these SCM solutions often rely on latent and one-off point-to-point connections with partners for collecting data. These alternatives provide less value and are significantly more error prone, creating an attractive competitive dynamic within the industry for modern SCM software providers where there is significant opportunity to grow without the need to replace an incumbent competitor. We believe there is more than $1 billion of whitespace for the solutions we already offer, which we believe provides very actionable growth opportunities through expanding our existing customer relationships.

Category-Defining End-to-End Provider of Mission-Critical Software

As businesses have transitioned from being owners of the production lifecycle to orchestrators of discrete manufacturing, distribution and selling processes, they have increasingly looked to software solutions to manage this growing complexity. However, most SCM software has not been designed to address these challenges comprehensively, and manufacturers often employ multiple point solutions with siloed data and processes that inhibit visibility, resulting in sub-optimal decision-making based on inaccurate or outdated information. Our approach, which is built around a cloud-based SaaS platform with end-to-end visibility and real-time, network-powered data, provides best-of-breed functionality across the supply chain and facilitates optimal supply chain performance.

As described above, we operate a software platform that integrates network ecosystems, data and applications across a harmonized and simplified user interface, driving a compelling value proposition and return on investment for our customers. This has created a mission-critical software solution and long-term relationships with customers as evidenced by our high gross retention rate. Additionally, we have been widely recognized as a differentiated leader by Gartner, International Data Corporation, Nucleus and others in the realm of multi-enterprise solutions, which we believe will be the future of SCM software. In May 2021, E2open was placed by Gartner in the Leaders quadrant with the highest ability to execute and completeness of vision in its 2021 Magic Quadrant for Multienterprise Supply Chain Business Networks for the second year in a row.

8

Strong Network Effects Enhanced by a Flexible and Integrated Data Model

Our core offerings are underpinned by an integrated data model that facilitates the flow and processing of data for participants across several ecosystems and applications. This model facilitates low latency, “many-to-one-to-many” data exchange across trading partner ecosystems. The combination of our integrated and flexible data model along with the four network ecosystems powers our customers’ solutions allowing them to efficiently orchestrate their end-to-end supply chains. This architecture is designed to ensure that each participant and data source within these ecosystems enhances our applications, which in turn improves the network and the value we deliver to our customers and participants alike.

Our software architecture and ability to harmonize disparate forms of data create a scalable software platform that can efficiently integrate acquisitions and new product applications seamlessly into a consolidated and holistic SaaS solution. Our software architecture and this ability has been a driving force behind our robust track-record of successful acquisition integrations, and we believe our scalable platform will allow us to generate substantial value through tuck-in and transformative acquisitions in the future.

Importantly, we believe there is incremental value we can create by utilizing the data flowing through our network to develop insights that can further help our customers as well as other target markets. We plan to work to develop a comprehensive strategy to capture this market opportunity and deepen our relationships with customers, which has the potential to meaningfully accelerate revenue growth.

Long-Term Relationships with Diversified and Blue-Chip Customer Base with Proven Wallet Share Expansion

We deliver solutions for some of the largest brand owners and manufacturers globally, and we estimate more than 125 of our customers have annual revenues of over $10 billion. We believe we are mission-critical to our customers’ operations, as evidenced by our gross retention. We possess a diverse customer base consisting of more than 1,200 clients that spans a broad spectrum of industries including the technology, industrial, consumer and transportation sectors, among others.

Our customers utilize our solutions to orchestrate their supply chains, which we believe enables them to realize significant value and return on investment. For example, a leading consumer packaged goods company was able to cut forecast errors by 40% and reduce inventory by 35% using our product suite. They are now able to leverage our platform to forecast every product using artificial intelligence and machine learning technology. Moreover, a leading high-tech company has utilized our software to realize $300 million in savings over three years. An additional example includes a high-growth, large-scale consumer technology platform, which utilized our software to reduce its execution time from eight weeks to seven days, creating substantial opportunity to accelerate their revenue growth in addition to reducing costs.

9

In March 2021, the Suez Canal was blocked for six days after the grounding of Ever Given, a container ship. During this crisis, our customers utilized our tools to monitor and respond to the situation, making real-time adjustments to their supply chains.

Growth Strategies

We intend to profitably grow our business and create shareholder value through the following strategic initiatives:

Expand Within Existing Customers

As described above, we believe there is significant opportunity to drive growth through expansion of our existing customer relationships. We have an opportunity to more than triple our revenue over time without any new logos, new products or acquisitions given that we believe there is more than a $1 billion of whitespace. Our acquisition strategy is focused on acquiring complimentary best-of-breed point solutions to incorporate into our integrated end-to-end platform. As a result, we currently sell just one SKU to many of our customers, as most acquired companies had only one product to offer their customers. We believe this represents a significant opportunity to cross-sell additional products to these customers, accelerating growth and strengthening relationships with our installed base, especially as it grows over time with new customer wins. Importantly, we have a strong track record of achieving growth within our existing customer base. From fiscal 2018 to fiscal 2020, we increased the recurring revenue with a leading consumer packaged goods company, a leading industrial manufacturer, a blue-chip technology firm and a global hardware and software technology provider by 2.7x, 2.0x, 1.9x and 1.6x, respectively.

Win New Customers

As part of our growth strategy, the second growth lever is winning new customers, which we anticipate accelerating by optimizing our sales force through several measures. First, we plan to invest in our salesforce by hiring account acquisition experts, funded by identified savings projects across various areas. Additionally, we plan to pursue strategic partnerships and leverage the networks of our new board of directors to elevate conversations with C-level executives at key targets in our pipeline. We also intend to utilize

10

these relationships and networks as well as our own channel reseller and partner network to accelerate growth through the onboarding of new customers.

Continue Strategic Acquisitions

A third lever of our growth strategy is to continue strategic acquisitions. We plan to utilize a disciplined approach to acquisitions, focusing on opportunities that will create value by strategically broadening our product offering as well as financially through the realization of integration-related synergies. Our key strategic acquisition criteria include mission-critical solutions in core markets; complementary cloud applications with minimal product overlap; new customer relationships in vertical or geographic markets; and TAM, proprietary data and/or network expansion. We have a large pipeline of actionable targets, including one large and transformative opportunity as well as a larger list of tuck-in opportunities identified in accordance with the criteria described above.

We have a demonstrated track record of success in expanding our product offering and accelerating growth through acquisitions. Through our acquisitions of INTTRA Inc. (INTTRA) and Amber Road, Inc. (Amber Road), we were able to enhance our value proposition to customers through the addition of ocean shipping logistics solutions as well as global trade management offerings, both of which contributed to our ability to provide end-to-end supply chain visibility. The acquisition of INTTRA increased the power of our network ecosystems through the integration of 26% of the global ocean freight data, which further strengthened the network effects of our software platform and business model. Our acquisition of Amber Road enhanced our platform by providing customers with global trade management solutions to automate their import and export processes and help improve sourcing decisions across more than 180 countries. Importantly, we also have a track record of efficiently integrating acquired solutions operationally and financially. Across each of our acquisitions since 2015, we have met or exceeded our integration-related cost savings targets in each case and with 20% cumulative outperformance as a whole.

Additional Organic Growth Building Blocks

We also believe there are several additional building blocks of organic growth acceleration that provide a margin of safety for achieving our annual steady-state subscription revenue growth target, including price/value maximization, data and analytics, sales force optimization and partnerships/new sales channels.

Intellectual Property

We consider the protection of our intellectual property and proprietary information to be an important facet of our business. We own a number of trademarks, patents, copyrights and domain names registered in the United States and abroad that, together, are meaningful to our business, including the E2OPEN, Amber Road and INTTRA marks (among others). From time to time, we have pursued enforcement of our intellectual property rights against third parties and expect to do so in the future when cost effective. In addition, we enter into customary confidentiality and invention assignment agreements with employees and contractors involved in the development of our intellectual property.

Government Regulation and Compliance

We are subject to various laws and regulations of the United States and other jurisdictions, including the European Union, by supranational, national and local government authorities, including with respect to sanctions compliance, privacy laws, labor and employment laws and other laws. In the United States, our global sanctions compliance is monitored by the Office of Foreign Assets Control of the U.S. Treasury Department (OFAC), and certain of our subsidiaries have received a license from OFAC permitting certain business, transactions or other activities involving sanctioned countries. We monitor these regulatory requirements, including the requirements for retaining our OFAC license and our compliance on a regular basis.

Organizational Structure

Following the completion of the Business Combination, our organizational structure is what is commonly referred to as an umbrella partnership C corporation (or Up-C) structure. This organizational structure will allow certain owners of E2open Holdings to retain their equity ownership in E2open Holdings, an entity that is classified as a partnership for U.S. federal income tax purposes, in the form of Common Units, Series 1 RCU and Series 2 RCU. Each continuing owner of E2open Holdings also holds a number of shares of Class V common stock equal to the number of Common Units held by such owner, which has no economic value, but which entitles the holder thereof to one vote per share at any meeting of our shareholders. Those investors who, prior to the Business Combination, held Class A ordinary shares or Class B ordinary shares of CCNB1 and certain other investors and vested option holders will, by contrast, hold their equity ownership in the Company, a Delaware corporation that is a domestic corporation for U.S. federal income tax purposes.

11

Significant Agreements

For information related to our significant agreements, see the Notes to the Consolidated Financial Statements contained herein.

Seasonality

Our quarterly operating results have fluctuated in the past and are expected to fluctuate in the future due to a variety of factors, many of which are outside of our control, including seasonality in our business as a result of customer budget cycles and customary European vacation schedules, with higher sales in the third and fourth fiscal quarters. As a result, our past results may not be indicative of our future performance and comparing our operating results on a period-to-period basis may not be meaningful.

Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (Securities Act), as modified by the Jumpstart Our Business Startups Act of 2012, as amended (JOBS Act), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the closing of CCNB1’s initial public offering (IPO), (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.0 billion in nonconvertible debt securities during the prior three-year period. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Human Capital

We believe our success in delivering 100% cloud-based, end-to-end SCM software relies on our culture, values, and the creativity and commitment of our people. As of February 28, 2021, we had 2,436 full-time employees with 650 in North America, 207 in Europe and 1,579 in Asia-Pacific, respectively. Our core operating principles are the foundation for our success:

| • | build relationships on trust and respect; |

| • | be direct and transparent; |

| • | learn and operate with intensity; |

| • | make and meet commitments reliably; |

12

We invest in our people and strive to maintain a healthy, safe and secure work environment where our employees are treated with respect and dignity. In March 2020, as a result of the COVID-19 pandemic, we transitioned to a fully virtual workplace, accommodating school, family and the health needs of our employees. We also implemented travel restrictions for all non-essential business in a manner consistent with local standards and risks. We endeavor to create an inclusive and diverse community that inspires collaboration, integrity, engagement and innovation while offering the opportunity for personal and professional growth.

We use a framework called E2-Connect to encourage a continual open and interactive communication between employees and their manager allowing individual needs to be recognized and met and company goals to be supported. This allows the employee and their manager to establish a professional development plan that facilitates personal employee growth while advancing our strategy.

We also work to keep our employees updated on our developments, achievements and new product offerings through various All-Hands meetings with our senior leadership team, as well as all employees. We consistently work to improve the employee experience by addressing feedback collected through the various surveys throughout the year, including manager interaction, employee benefits and our response to the COVID-19 pandemic.

To ensure our employees’ personal and professional growth, we developed E2open University where employees can participate in various online training classes. These training classes are continually developed or new classes are added, so that our employees have a full range of classes available. Each year, our employees receive role-specific training which includes topics, such as our products overview, anti-harassment, insider trading, cyber security awareness, compliance with our Code of Business Conduct and other compliance and industry-specific subjects.

Financial Information About Industry Segments

We have one reportable segment consisting of cloud-based, end-to-end SCM software. We internally evaluate our software as one industry segment, and, accordingly, we do not report segment information.

Available Information

Our website address is www.e2open.com. Electronic copies of our SEC filings are available through the Investor Relations tab as soon as practicable after the reports are filed with the SEC. Additionally, our Code of Ethics, Corporate Governance Guidelines, Whistleblower Policy and the charters of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are located under the Governance tab of the Investor Relations section of our website.

Item 1A. Risk Factors

Risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this 2021 Form 10-K and other public statements we make are described below. Based on the information currently known to us, we believe that the matters discussed below identify the material risk factors affecting our business. However, the risks and uncertainties we face are not limited to those described below. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial, but that could later become material, may also adversely affect our business.

Summary of Risk Factors

The following summarizes risks and uncertainties that could materially adversely affect our business, financial condition, results of operations and stock price. You should read this summary together with the detailed description of each risk factor contained below.

Risks Related to the Global Pandemic

| • | The ongoing COVID-19 pandemic, including the resulting global economic uncertainty, measures taken in response to the pandemic and changes to the way our customers are operating their businesses, could materially impact our business and future results of operations and financial condition. |

Risks Related to our Business Model

| • | Our business depends on customers renewing their subscription agreements. Any decline in renewal or net retention rates could harm our future operating results. |

13

| • | Our large customers have substantial negotiating leverage, which may require that we agree to terms and conditions that result in increased cost of sales, decreased revenue and lower average selling prices and gross margins, all of which could harm our results of operations. |

| • | Given many of our key customers are enterprise customers, our sales cycle is longer and more expensive, and we may encounter pricing pressure and implementation and configuration challenges. |

| • | If we are unable to sell products to new customers or to sell additional products or upgrades to our existing customers, it could adversely affect our revenue growth and operating results. |

| • | Because we generally recognize revenue from subscriptions for our services over the term of the subscription, downturns or upturns in new business may not be immediately reflected in our operating results. |

| • | Because our long-term success depends on our ability to operate our business internationally and increase sales of our products to customers located outside of the United States, our business is susceptible to risks associated with international operations. |

| • | We have experienced rapid growth in recent periods, and our recent growth rates may not be indicative of our future growth. |

| • | If we fail to maintain adequate operational and financial resources, particularly if we continue to grow rapidly, we may be unable to execute our business plan or maintain high levels of service and customer satisfaction. |

| • | Cyber-attacks and security vulnerabilities could result in serious harm to our reputation, business and financial condition. |

| • | If we fail to integrate our products with a variety of operating systems, software applications, platforms and hardware that are developed by others or ourselves, our products may become less competitive or obsolete and our results of operations would be harmed. |

| • | We have a significant amount of goodwill and intangible assets on our balance sheet, and our results of operations may be adversely affected if we fail to realize the full value of our goodwill and intangible assets. |

Risks Related to Macroeconomic and Market Conditions

| • | Adverse or weakened general economic and market conditions may reduce spending on supply chain technology and information, which could harm our revenue, results of operations and cash flows. |

| • | Our success depends in part on our ability to develop and market new and enhanced solutions modules, and we may not be able to do so, or do so quickly enough to respond to changes in demand. Even if we anticipate changes in demand, it may be difficult for us to transition existing customers to new versions of our solutions. |

| • | The market for cloud-based SCM solutions is still evolving. If this market develops more slowly than we expect, our revenue may fail to grow or decline, and we may incur additional operating losses. |

| • | We face intense competition, and our failure to compete successfully would make it difficult for us to add and retain customers and would impede the growth of our business. |

Risks Related to Key Third-Party Relationships

| • | Interruptions or performance problems associated with our products, including disruptions at any third-party data center upon which we rely, may impair our ability to support our customers. |

| • | The information we source from third parties for inclusion in our knowledge databases may not be accurate and complete, our trade experts may make errors in interpreting legal and other requirements when processing this information and our trade content may not be updated on a timely basis, which can expose our customers to fines and other substantial claims and penalties. |

| • | Interruptions or performance problems associated with our internal infrastructure, and its reliance on technologies from third parties, may adversely affect our ability to manage our business and meet reporting obligations. |

| • | We leverage third-party software for use with our solution. Performance issues, errors and defects or failure to successfully integrate or license necessary third-party software could cause delays, errors or failures of our solution, increases in our expenses and reductions in our sales, which could materially and adversely affect our business and results of operations. |

Risks Related to the Business Combination

| • | Our management team has limited experience managing a public company. |

| • | We will incur increased costs and obligations as a result of being a public company. |

| • | Failure to achieve and maintain effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act could impair our ability to produce timely and accurate financial statements or comply with applicable regulations which could have a material adverse effect on our business. |

14

| • | We qualify as an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, it could make our securities less attractive to investors and may make it more difficult to compare our performance to the performance of other public companies. |

| • | The reverse merger with CCNB1 increases the potential for shareholder litigation. |

| • | Our Sponsor and its affiliates, together with affiliates of Insight Partners, will beneficially own a significant equity interest in us and their interests may conflict with us or your interests. |

| • | We are a holding company and our only material asset is our interest in E2open Holdings, and we are accordingly dependent upon distributions made by our subsidiaries to pay taxes, make payments under the Tax Receivable Agreement and pay dividends. |

| • | Pursuant to the Tax Receivable Agreement, we are required to pay certain sellers 85% of the tax savings that we realize as a result of increases in tax basis in E2open Holdings. These payments may be substantial, as well as exceed actual tax benefits. The timing of these payments may also be accelerated. |

Risks Related to Acquisitions

| • | Acquisitions present many risks that could have a material adverse effect on our business and results of operations. |

Risks Related to our Indebtedness

| • | Our substantial level of indebtedness and significant leverage may materially adversely affect our ability to raise additional capital to fund our operations and limit our ability to react to changes in the economy or our industry. |

| • | Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly. |

| • | Our debt agreements contains restrictions that limit our flexibility in operating our business. |

| • | We may not be able to generate sufficient cash to service all of our indebtedness, and we may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful. |

| • | A lowering or withdrawal of the ratings assigned to our debt securities by rating agencies may increase our future borrowing costs and reduce our access to capital. |

Risks Related to Legal and Regulatory

| • | We may not be able to adequately protect our proprietary and intellectual property rights in our data or technology. |

| • | Our use of open source software could negatively affect our ability to sell our products and subject us to possible litigation. |

| • | We may in the future be sued by third parties for various claims including alleged infringement of proprietary intellectual property rights. |

| • | We are subject to sanctions, anti-corruption, anti-bribery and similar laws, and non-compliance with such laws can subject us to criminal penalties or significant fines and harm our business and reputation. |

| • | Changes in tax laws or regulations in the various tax jurisdictions we are subject to that are applied adversely to us or our paying customers could increase the costs of our products and services and harm our business. |

| • | Our ability to use our net operating loss carryforwards may be subject to limitation. |

Risks Related to Ownership of Our Securities

| • | A significant portion of our Class A Common Stock is restricted from immediate resale, but it may be sold into the market in the future. This could cause the market price of our Class A Common Stock to drop significantly, even if our business is doing well. |

| • | We may issue additional shares of our Class A Common Stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of your shares. |

| • | If analysts do not publish or cease publishing research or reports about us, our business or our market, or if they adversely change their recommendations regarding our Class A Common Stock, then the price and trading volume of our securities could decline. |

| • | We may amend the terms of the warrants in a manner that may be adverse to holders of the public warrants with the approval by the holders of at least 50% of the then outstanding public warrants. As a result, the exercise price of your warrants could be increased, the exercise period could be shortened and the number of shares of Class A Common Stock purchasable upon exercise of a warrant could be decreased, all without your approval. |

| • | Our warrants may have an adverse effect on the market price of our Class A Common Stock. |

15

General Risks

| • | Changes in existing financial accounting standards or practices may harm our results of operations. |

| • | We may be subject to liability if we breach our contracts, and our insurance may be inadequate to cover our losses. |

| • | We may be subject to litigation for any of a variety of claims, which could adversely affect our business, results of operations and financial condition. |

| • | Changes in laws and regulations related to the internet or changes in the internet infrastructure itself may diminish the demand for our platform and could harm our business. |

Risks Related to the Global Pandemic

The ongoing COVID-19 pandemic, including the resulting global economic uncertainty, measures taken in response to the pandemic and changes to the way our customers are operating their businesses, could materially impact our business and future results of operations and financial condition.

The COVID-19 pandemic has disrupted the global economy and strained governments, health care systems and businesses. It is difficult to predict the continuing impact on global economic markets, which ultimate impact will depend upon the efficacy and availability of vaccines and the actions taken by governments and businesses in response to the pandemic. Adverse market conditions resulting from the spread of COVID-19 could materially adversely affect our business through a decrease in the rate of spending on software products, our customers’ inability or unwillingness to purchase our offerings; reductions in the amount or duration of customers’ subscription contracts or increased customer attrition rates. The COVID-19 pandemic could also cause our third-party data center hosting facilities and cloud computing platform providers, which are critical to our infrastructure, to shut down their business, experience security incidents or experience interference with the supply chain of hardware required by their systems and services, any of which could materially adversely affect our business.

In response to the COVID-19 pandemic, we have temporarily closed our offices, enabled our employees to work remotely and implemented travel restrictions for all non-essential business in a manner consistent with local standards and risks. If the COVID-19 pandemic worsens, especially in regions where we have offices, our business activities could be adversely affected. We may take further actions that alter our business operations as may be required by local, state or federal authorities or that we determine are in the best interests of our employees. Such measures could negatively affect our sales and marketing efforts, sales cycles, employee productivity or customer retention, any of which could harm our financial condition and business operations.

Almost 50% of our employees reside in India, that is in the midst of a devastating second wave of COVID-19, recording well over 300,000 new infections each day so far in May. On May 7, 2021, the country recorded a global record 414,188 new cases. In order to protect our valued Indian employees, we may take further actions that alter our business operations as may be required by local, state or federal authorities or that we determine are in the best interests of our employees. These measures could negatively affect our sales and marketing efforts, sales cycles, employee productivity or customer retention, any of which could harm our financial condition and business operations. Due to the complexity of our products and trained nature of our employees in India, a continued worsening of COVID-19 in India could negatively affect our strategic sales goals or professional services revenue due to our inability to find temporary workers or back-fill employees to service our sales team or customers.

To the extent the COVID-19 pandemic adversely affects our business and financial results, it may also have the effect of heightening many of the other risks described in this Risk Factors section, including, in particular, risks related to our ability to secure customer renewals, the addition of new customers and increased revenue from existing customers, risks relating to cyber-attacks and security vulnerabilities and global supply chain disruptions.

Risks Related to our Business Model

Our business depends on customers renewing their subscription agreements. Any decline in renewal or net retention rates could harm our future operating results.

Approximately 85% of our revenue is recurring and consists of subscription revenue. Our subscription products generally have recurring annual subscription periods. While many of our subscriptions provide for automatic renewal, our customers may opt-out of automatic renewal and customers have no obligation to renew a subscription after the expiration of the term. Our customers may or may not renew their subscriptions as a result of a number of factors, including the general economic downturns due to COVID-19, their satisfaction or dissatisfaction with our products and services, our pricing or pricing structure, the pricing or capabilities of the products and services offered by our competitors, the effects of economic conditions or reductions in our paying customers’ spending levels. In addition, our customers may renew for fewer subscriptions, renew for shorter contract lengths if they were previously on multi-year contracts or switch to lower cost offerings of our products and services.

16

It is difficult to accurately predict long-term customer retention. Our customers’ subscription retention rates may decline or fluctuate as a result of a number of factors, including their level of satisfaction with our products, the prices of our products, the prices of products and services offered by our competitors or reductions in our customers’ spending levels. If our customers do not renew their subscription arrangements, maintenance or other services agreements or if they renew them on less favorable terms, our revenue may decline. A substantial portion of our quarterly subscription revenue is attributable to agreements entered into during previous quarters. As a result, if there is a decline in renewed subscription agreements in any one quarter, only a small portion of the decline will be reflected in our revenue recognized in that quarter and the rest will be reflected in our revenue recognized in the following four quarters or more.

Our large customers have substantial negotiating leverage, which may require that we agree to terms and conditions that result in increased cost of sales, decreased revenue and lower average selling prices and gross margins, all of which could harm our results of operations.

Some of our customers have significant bargaining power when negotiating new licenses or subscriptions or renewals of existing agreements, and they have the ability to buy similar products from other vendors or develop such systems internally. These customers have and may continue to seek advantageous pricing and other commercial and performance terms that may require us to develop additional features in the products we sell to them or add complexity to our customer agreements. Currently, as customers become larger, our pricing model recognizes various factors such as number of products purchased and the penetration of those products within a customer’s operations. As such, when a customer buys more products, their average cost per product can decline even though the total revenue from them increases, and, to date, we have generally seen sales to customers increase in proportion to or in excess of any reductions in the cost per product. However, there can be no guarantee that these results will continue in the future. If we are unable to negotiate renewals with our large customers on favorable terms, our results of operations could be harmed.

Given many of our key customers are enterprise customers, our sales cycle is longer and more expensive, and we may encounter pricing pressure and implementation and configuration challenges.

Many of our largest customers are enterprise customers, which means we face longer sales cycles, greater competition, more complex customer due diligence, less favorable contractual terms and less predictability in completing some of our sales.

Consequently, a target customer’s decision to use our services may be an enterprise-wide decision and, if so, these types of sales require us to provide greater levels of education regarding the use and benefits of our products and services as well as education regarding privacy and data protection laws and regulations to prospective customers. In addition, larger enterprise customers may demand more configuration, integration services and features. As a result of these factors, these sales opportunities may require us to devote greater sales support and professional services resources to individual customers, driving up costs and time required to complete sales, while potentially requiring us to delay revenue recognition on some of these transactions until the technical or implementation requirements have been met.

If we are unable to sell products to new customers or to sell additional products or upgrades to our existing customers, it could adversely affect our revenue growth and operating results.

To increase our revenue, we must add new customers (whether through sales or acquisitions) or sell additional products or upgrades to existing customers. Even if we capture a significant volume of leads from our digital marketing activities, we must be able to convert those leads into sales of our products to new or existing customers in order to achieve revenue growth.

We primarily rely on our direct sales force to sell our products to new and existing customers and convert qualified leads into sales. Accordingly, our ability to achieve significant growth in revenue in the future will depend on our ability to recruit, train and retain sufficient numbers of sales personnel, and on the productivity of those personnel. Our recent and planned personnel additions may not become as productive as we would like or in a timely manner, and we may be unable to hire or retain sufficient numbers of qualified individuals in the future in the markets where we do or plan to do business. If we are unable to sell products to new customers and additional products or upgrades to our existing customers through our direct sales force or through our channel partners, which supplement our direct sales force by distributing our products and generating sales opportunities, we may be unable to grow our revenue and our operating results could be adversely affected.

17

Because we generally recognize revenue from subscriptions for our services over the term of the subscription, downturns or upturns in new business may not be immediately reflected in our operating results.

We generally recognize revenue from customers ratably over the terms of their subscription and support agreements, which are typically 36 months. As a result, most of the revenue we report in each quarter is the result of subscription and support agreements entered into during previous quarters. Consequently, a decline in new or renewed subscriptions in any one quarter may not be reflected in our revenue results for that quarter. However, any such decline will negatively impact our revenue in future quarters. Accordingly, the effect of significant downturns in sales and market acceptance of our services and potential changes in our attrition rate, may not be fully reflected in our results of operations until future periods. Our subscription model also makes it difficult for us to rapidly increase our revenue through additional sales in any period, as revenue from new customers must be recognized over the applicable subscription and support term.

Because our long-term success depends on our ability to operate our business internationally and increase sales of our products to customers located outside of the United States, our business is susceptible to risks associated with international operations.

We have significant international operations in India, the United Kingdom, Poland, Germany, Belgium, China, Hong Kong and Malaysia as well as international operations in other countries. We market and sell our products worldwide. We expect to continue to expand our international operations for the foreseeable future. The continued international expansion of our operations requires significant management attention and financial resources and results in increased administrative and compliance costs. Our limited experience in operating our business in certain regions outside the United States increases the risk that our expansion efforts into those regions may not be successful. In particular, our business model may not be successful in particular countries or regions outside the United States for reasons that we currently are unable to anticipate. We are subject to risks associated with international sales and operations including, but not limited to:

| • | fluctuations in currency exchange rates; |

| • | the complexity of, or changes in, foreign regulatory requirements and the burdens of complying with a wide variety of foreign laws and different legal standards; |

| • | difficulties in managing the staffing of international operations, including compliance with local labor and employment laws and regulations; |

| • | potentially adverse tax consequences, including the complexities of foreign value added tax systems, overlapping tax regimes, restrictions on the repatriation of earnings and changes in tax rates; |

| • | dependence on resellers and distributors to increase customer acquisition or drive localization efforts, including in new or evolving markets, which resellers and distributors may fail to maintain standards consistent with our brand and reputation; |

| • | increased financial accounting and reporting burdens and complexities, including treatment of revenue from international sources; |

| • | longer sales and payment cycles and difficulties in collecting accounts receivable; |

| • | political, social and economic instability, including war, terrorist attacks, civil unrest and security concerns in general; |

| • | reduced or varied protection for intellectual property rights in some countries and the risk of potential theft or compromise of our technology, data or intellectual property in connection with our international operations, whether by state-sponsored malfeasance or other foreign entities or individuals; |

| • | laws and policies of the U.S. and other jurisdictions affecting international trade (including import and export control laws, tariffs and trade barriers); |

| • | the risk of U.S. regulation of foreign operations; and |

| • | other factors beyond our control such as natural disasters and public health crises, including pandemics. |

The occurrence of any one of these risks could negatively affect our international business and, consequently, our operating results. We cannot be certain that the investment and additional resources required to establish, acquire or integrate operations in other countries will produce desired levels of revenue or profitability. If we are unable to effectively manage our expansion into additional geographic markets, our financial condition and results of operations could be harmed.

18

We have experienced rapid growth in recent periods, and our recent growth rates may not be indicative of our future growth.

We have experienced organic and acquisition-driven growth in recent periods, and revenue growth in future periods may not be consistent with recent history. We believe our revenue growth depends on a number of factors, including, but not limited to, our ability to:

| • | renew and grow current customer subscriptions; |

| • | introduce and grow adoption of our products and services in new markets; |

| • | adequately expand our sales force and otherwise scale our operations as a business; |

| • | expand the features and capabilities of our platform, including through the creation and use of additional integrations; |

| • | maintain the security and reliability of our platform; |

| • | price and package our products and services effectively; |

| • | successfully compete against established companies and new market entrants; |

| • | increase awareness of our brand on a global basis; and |

| • | execute on our acquisition strategy. |

We may not be able to successfully implement our strategic initiatives in accordance with our expectations or in the timeframe we desire, which may result in an adverse impact on our business and financial results. We also expect our operating expenses to increase in future periods, and if our revenue growth does not increase to offset these anticipated increases in our operating expenses, our business, results of operations and financial condition will be harmed, and we may not be able to achieve or maintain profitability.

If we fail to maintain adequate operational and financial resources, particularly if we continue to grow rapidly, we may be unable to execute our business plan or maintain high levels of service and customer satisfaction.

We have experienced, and expect to continue to experience, rapid growth, particularly through acquisitions, which has placed, and may continue to place, significant demands on our management and our operational and financial resources. Our organizational structure is becoming more complex as we scale our operational, financial and management controls, as well as our reporting systems and procedures, and expand internationally. As we continue to grow, we face challenges of integrating, developing, training and motivating a rapidly growing employee base in our various offices around the world and navigating a complex multi-national regulatory landscape. If we fail to manage our anticipated growth and change in a manner that preserves the functionality of our platforms and solutions, the quality of our products and services may suffer, which could negatively affect our brand and reputation and harm our ability to attract customers.

To manage growth in our operations and personnel, we need to continue to grow and improve our operational, financial and management controls and our reporting systems and procedures. We will require significant expenditures and the allocation of valuable management resources to grow and change in these areas. Our expansion has placed, and our expected future growth will continue to place, a significant strain on our management, customer experience, research and development, sales and marketing, administrative, financial and other resources.

We anticipate that significant additional investments will be required to scale our operations and increase productivity, address the needs of our customers, further develop and enhance our products and services, expand into new geographic areas and scale with our overall growth. If additional investments are required due to significant growth, this will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term.

Cyber-attacks and security vulnerabilities could result in serious harm to our reputation, business and financial condition.

Threats to network and data security are constantly evolving and becoming increasingly diverse and sophisticated. Our products and services, servers and computer systems and those of third parties that we rely on in our operations could be vulnerable to cybersecurity risks. As such, we may be subject to risks inherent to companies that process client data for client mission critical systems like SCM solutions.

19

We are the target of attempts to identify and exploit system vulnerabilities and/or penetrate or bypass our security measures in order to gain unauthorized access to our systems. To mitigate these risks, we employ multiple methods at different layers of our systems to defend against intrusion and attack. Despite our efforts to keep our systems secure and remedy identified vulnerabilities, future attacks could be successful and result in contractual liability to clients or loss of client trust and ultimately client business.

We may experience breaches of our security measures due to human error, system errors or vulnerabilities. In particular, our platform and the other systems or networks used in our business may experience an increase in attempted cyber-attacks, targeted intrusion, ransomware and phishing campaigns. We maintain errors, omission and cyber liability insurance policies covering security and privacy damages. However, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all.

At present, we believe the regulatory and private action risks related to personal data we process as part of our business-to-business supply chain solutions are low. We process a limited amount of personal data, typically business contact information, supplied by our clients. Regulations surrounding personal data are rapidly changing and that makes global compliance challenging and unpredictable. Failure to comply with regulations may subject us to regulatory investigations, reputational harm, contractual liability to clients and potential liability to data subjects.

If we fail to integrate our products with a variety of operating systems, software applications, platforms and hardware that are developed by others or ourselves, our products may become less competitive or obsolete and our results of operations would be harmed.

Our products must integrate with a variety of network, hardware and software platforms, and we need to continuously modify and enhance our products to adapt to changes in hardware, software, networking, browser and database technologies. We believe a significant component of our value proposition to customers is the ability to optimize and configure our products to integrate with our systems and those of third parties. If we are not able to integrate our products in a meaningful and efficient manner, demand for our products could decrease and our business and results of operations would be harmed.

In addition, we have a large number of solutions, and maintaining and integrating them effectively requires extensive resources. Our continuing efforts to make our products more interoperative may not be successful. Failure of our products to operate effectively with future infrastructure platforms and technologies could reduce the demand for our products, resulting in customer dissatisfaction and harm to our business. If we are unable to respond to changes in a cost-effective manner, our products may become less marketable, less competitive or obsolete, and our business and results of operations may be harmed.

We have a significant amount of goodwill and intangible assets on our balance sheet, and our results of operations may be adversely affected if we fail to realize the full value of our goodwill and intangible assets.

We have goodwill of $2,628.6 million and $752.8 million and net intangible assets of $824.9 million and $467.6 million as of February 28, 2021 and February 29, 2020, respectively. In accordance with U.S. GAAP, goodwill and intangible assets with an indefinite life are not amortized but are subject to a periodic impairment evaluation. Goodwill and acquired intangible assets with an indefinite life are tested for impairment at least annually or when events and circumstances indicate that fair value of a reporting unit may be below their carrying value. Acquired intangible assets with definite lives are amortized on a straight-line basis over the estimated period over which we expect to realize economic value related to the intangible asset. In addition, we review long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset might not be recoverable. If indicators of impairment are present, we evaluate the carrying value in relation to estimates of future undiscounted cash flows. Our ability to realize the value of the goodwill and intangible assets will depend on the future cash flows of the businesses we have acquired, which in turn depend in part on how well we have integrated these businesses into our own business. Judgments made by management relate to the expected useful lives of long-lived assets and our ability to realize undiscounted cash flows of the carrying amounts of such assets. The accuracy of these judgments may be adversely affected by several factors, including significant:

| • | underperformance relative to historical or projected future operating results; |

| • | changes in the manner of our use of acquired assets or the strategy for our overall business; |

| • | negative industry or economic trends; or |

| • | decline in our market capitalization relative to net book value for a sustained period. |