- FROG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

JFrog (FROG) PRE 14APreliminary proxy

Filed: 22 Mar 22, 4:12pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

JFROG LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all the boxes that apply):

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

270 E. Caribbean Drive

Sunnyvale, California 94089

(408) 329-1540

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To our Shareholders:

Notice is hereby given that the annual general meeting of shareholders of JFrog Ltd. (the “Company”) is to be held on Monday, May 16, 2022 at 9:00 a.m., Pacific time, or at any adjournments thereof (the “Annual General Meeting”), at our U.S. headquarters located at 270 E. Caribbean Drive, Sunnyvale, California 94089.

The agenda for the Annual General Meeting is as follows:

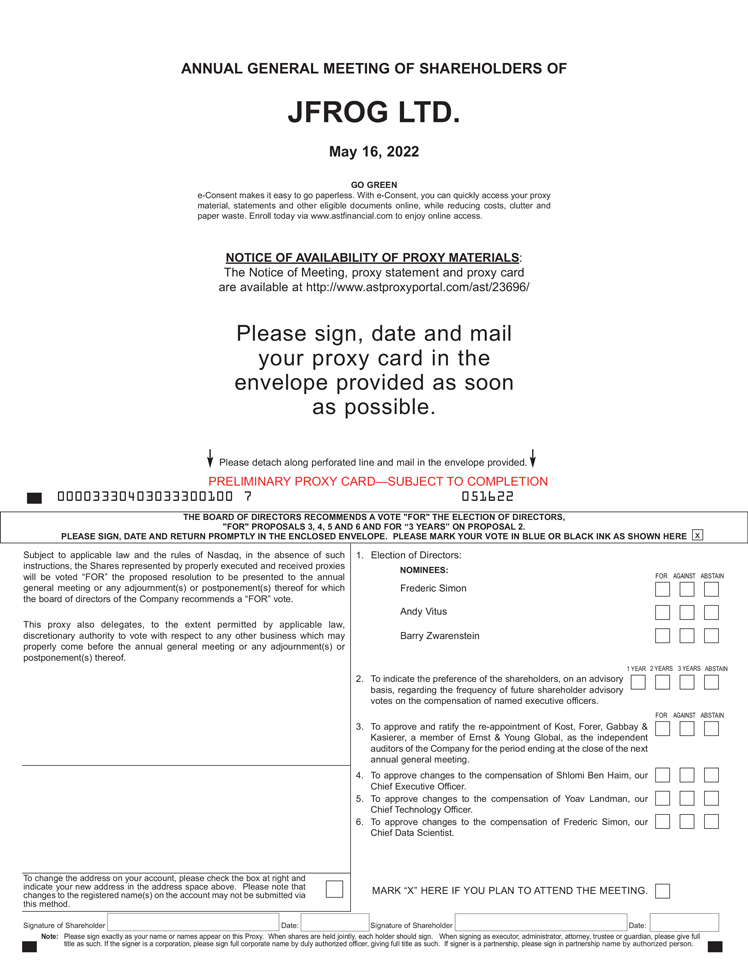

(1) To elect as Class II directors the three nominees named in the accompanying proxy statement to serve until our 2025 annual general meeting of shareholders or until their respective successors are duly elected and qualified or until such director’s earlier death, resignation or removal.

(2) To indicate the preference of the shareholders, on an advisory basis, regarding the frequency of future shareholder advisory votes on the compensation of named executive officers.

(3) To approve and ratify the re-appointment of Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as the independent auditors of the Company for the period ending at the close of the next annual general meeting.

(4) To approve changes to the compensation of Shlomi Ben Haim, our Chief Executive Officer.

(5) To approve changes to the compensation of Yoav Landman, our Chief Technology Officer.

(6) To approve changes to the compensation of Frederic Simon, our Chief Data Scientist.

In addition, shareholders will be requested to review at the Annual General Meeting the Company’s audited consolidated financial statements for the year ended December 31, 2021, and to transact such other business as may properly come before the Annual General Meeting.

These proposals are described more fully in the attached proxy statement, which we urge you to read in its entirety.

The record date for the Annual General Meeting is April 6, 2022 (the “Record Date”). Only shareholders of record at the close of business on that date may vote at the Annual General Meeting or any adjournments, postponements, or continuations thereof. This notice and the accompanying proxy statement and proxy card are being first mailed to shareholders on or about April [●], 2022.

The Annual General Meeting is currently scheduled to be held in person. Due to the ongoing COVID-19 pandemic, we urge shareholders to vote by proxy. Please note that certain health and safety measures may be required for those attending the meeting in person, in accordance with applicable laws, and the Company may subsequently decide to hold a virtual general meeting. We encourage shareholders who plan to attend the Annual General Meeting to check our website at https://investors.jfrog.com prior to the meeting where we will post relevant updates.

If you intend to attend the Annual General Meeting in person, you must notify the Company by submitting your name and the number of registered shares you hold to our Investor Relations’ e-mail address investors@jfrog.com by 9:00 a.m. PDT on Friday, May 13, 2022. Please read this proxy statement carefully to ensure that you have proper evidence of share ownership as of April 6, 2022, as we will not be able to accommodate guests without such evidence at the Annual General Meeting.

Details regarding how to attend the Annual General Meeting and the business to be conducted at the Annual General Meeting are more fully described in the accompanying notice of annual general meeting of shareholders and proxy statement.

The approval of each of the proposals requires the affirmative vote of the Company’s shareholders holding at least a majority of the Company’s ordinary shares, NIS 0.01 par value per share, present, in person or by proxy, and voting on the matter.

Your vote is important. Regardless of whether you plan to attend the Annual General Meeting, it is important that your shares be represented and voted at the Annual General Meeting, and we hope you will vote as soon as possible. Prior to the meeting, you may vote by proxy over the Internet, by telephone, or by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet or by telephone, written proxy or voting instruction card will ensure your representation at the Annual General Meeting regardless of whether you attend the Annual General Meeting.

As of March 1, 2022, the Company is not aware of any controlling shareholder.

The Company currently is unaware of any other matters that may be raised at the Annual General Meeting. Should any other matters be properly raised at the Annual General Meeting, the persons designated as proxies shall vote according to their own judgment on those matters.

Thank you for your ongoing support of, and continued interest in, JFrog Ltd.

Sincerely,

Shlomi Ben Haim

Chairman of the Board

Sunnyvale, California

April [●], 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 16, 2022

The proxy statement, proxy card and annual report to shareholders are available at

https://investors.jfrog.com/investor-relations

JFROG LTD.

270 E. Caribbean Dr.

Sunnyvale, California 94089

PROXY STATEMENT FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

We are furnishing this proxy statement to the holders of ordinary shares, NIS 0.01 par value per share, of JFrog Ltd., a company organized under the laws of the State of Israel (referred to as “we,” “us,” “our” or the “Company”), in connection with the solicitation by our board of directors of proxies for use at an annual general meeting of shareholders and any postponements, adjournment or continuations thereof, or the Annual General Meeting. The Annual General Meeting will be held on Monday, May 16, 2022, at 9:00 a.m., Pacific time, or at any adjournments thereof, at our U.S. headquarters located at 270 E. Caribbean Drive, Sunnyvale, California 94089.

At the Annual General Meeting, you will be requested to approve the following matters:

(1) To elect as Class II directors the three nominees named in the accompanying proxy statement to serve until our 2025 annual general meeting of shareholders or until their respective successors are duly elected and qualified or until such director’s earlier death, resignation or removal.

(2) To indicate the preference of the shareholders, on an advisory basis, regarding the frequency of future shareholder advisory votes on the compensation of named executive officers.

(3) To approve and ratify the re-appointment of Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as the independent auditors of the Company for the period ending at the close of the next annual general meeting.

(4) To approve changes to the compensation of Shlomi Ben Haim, our Chief Executive Officer.

(5) To approve changes to the compensation of Yoav Landman, our Chief Technology Officer.

(6) To approve changes to the compensation of Frederic Simon, our Chief Data Scientist.

In addition, shareholders will be requested to review at the Annual General Meeting the Company’s audited consolidated financial statements for the year ended December 31, 2021, and to transact such other business as may properly come before the Annual General Meeting.

The record date for the Annual General Meeting is April 6, 2022, or the Record Date. Only shareholders of record at the close of business on that date are entitled to vote at the Annual General Meeting. This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the Annual General Meeting, and any postponements, adjournments or continuations thereof.

By signing and returning the proxy card, you authorize each of Shlomi Ben Haim, our Chief Executive Officer, or Jacob Shulman, our Chief Financial Officer, to represent you and vote your shares at the Annual General Meeting in accordance with your instructions. Each of the foregoing may also vote your shares to adjourn the Annual General Meeting and will be authorized to vote your shares at any adjournments, postponements, or continuations of the Annual General Meeting.

YOUR VOTE IS VERY IMPORTANT.

| Page | ||||

QUESTIONS AND ANSWERS | 1 | |||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

Shareholder Recommendations for Nominations to Our Board of Directors | 16 | |||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

PROPOSAL NUMBER 3 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 24 | |||

Fees Paid to the Independent Registered Public Accounting Firm | 24 | |||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| Page | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

Limitation of Liability and Indemnification of Officers and Directors | 63 | |||

| 63 | ||||

| 65 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

SHAREHOLDER PROPOSAL DEADLINES FOR 2023 ANNUAL GENERAL MEETING | 67 | |||

| 67 | ||||

| A-1 | ||||

| B-1 | ||||

JFROG LTD.

PROXY STATEMENT

FOR THE 2022 ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held at 9:00 a.m., Pacific time, on Monday, May 16, 2022

The information provided in the “Questions and Answers” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read the entire proxy statement carefully.

ABOUT THE PROXY MATERIALS AND ANNUAL GENERAL MEETING

Why am I receiving these materials?

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2022 Annual General Meeting of shareholders of the Company and any adjournments, postponements or continuations thereof. The Annual General Meeting will be held on Monday, May 16, 2022 at 9:00 a.m., Pacific time at 270 E. Caribbean Drive, Sunnyvale, California 94089.

Shareholders as of the Record Date are invited to attend the Annual General Meeting and are requested to vote on the items of business described in this proxy statement. The proxy materials and our 2021 annual report can be accessed online at our Investor Relations website at https://investors.jfrog.com/investor-relations.

What proposals am I voting on?

You are being asked to vote on six proposals:

(1) To elect as Class II directors the three nominees named in the accompanying proxy statement to serve until our 2025 annual general meeting of shareholders or until their respective successors are duly elected and qualified or until such director’s earlier death, resignation or removal.

(2) To indicate the preference of the shareholders, on an advisory basis, regarding the frequency of future shareholder advisory votes on the compensation of named executive officers.

(3) To approve and ratify the re-appointment of Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as the independent auditors of the Company for the period ending at the close of the next annual general meeting.

(4) To approve changes to the compensation of Shlomi Ben Haim, our Chief Executive Officer.

(5) To approve changes to the compensation of Yoav Landman, our Chief Technology Officer.

(6) To approve changes to the compensation of Frederic Simon, our Chief Data Scientist.

You will also be voting on any other business as may properly come before the Annual General Meeting or any adjournments, postponements, or continuations thereof.

What other matters may be brought before the Annual General Meeting?

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the Annual General Meeting. If any other matters are properly brought before the Annual General Meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

1

In accordance with the Israeli Companies Law 5759-1999 and regulations promulgated thereunder (the “Companies Law”), any shareholder of the Company holding at least one percent of the outstanding voting rights of the Company for the meeting may submit to the Company a proposed additional agenda item for the meeting, to our offices: JFrog Ltd., 270 E. Caribbean Drive, Sunnyvale, California 94089, Attn: General Counsel, no later than April 11, 2022. To the extent that there are any additional agenda items that our board of directors determines to add as a result of any such submission, we will publish an updated agenda and proxy card with respect to the meeting, no later than April 18, 2022, which will be furnished to the Securities and Exchange Commission (the “SEC”), on Form DEFA 14A, and will be made available to the public on the Commission’s website at www.sec.gov.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote “FOR” Proposals 1, 3, 4, 5, and 6, and “THREE YEARS” for Proposal No. 2.

Who is entitled to vote at the Annual General Meeting?

Holders of our ordinary shares as of the close of business on April 6, 2022, the Record Date for the Annual General Meeting are entitled to vote at the Annual General Meeting. Shareholders are not permitted to cumulate votes with respect to the election of directors. Each ordinary share is entitled to one vote on each matter properly brought before the Annual General Meeting. The total number of outstanding ordinary shares, NIS 0.01 par value per share, as of [●], was [●].

Shareholder of Record: Shares Registered in Your Name. If, at the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Company, LLC, or AST, then you are a shareholder of record. As a shareholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card, to vote at the Annual General Meeting, or by Internet, by telephone, or by mail by following the instructions on the proxy card.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If, at the close of business on the Record Date, your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other nominee, then you are the beneficial owner of shares held in “street name”. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual General Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your account by following the voting instructions your broker, bank or other nominee provides. You are also invited to attend the Annual General Meeting. However, since you are not the shareholder of record, you may not vote your shares at the Annual General Meeting unless you obtain a legal proxy from your broker, bank or other nominee, giving you the right to vote the shares as well as a statement from such record holder that it did not vote such shares.

How can I vote my shares?

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record, you may vote in one of the following ways:

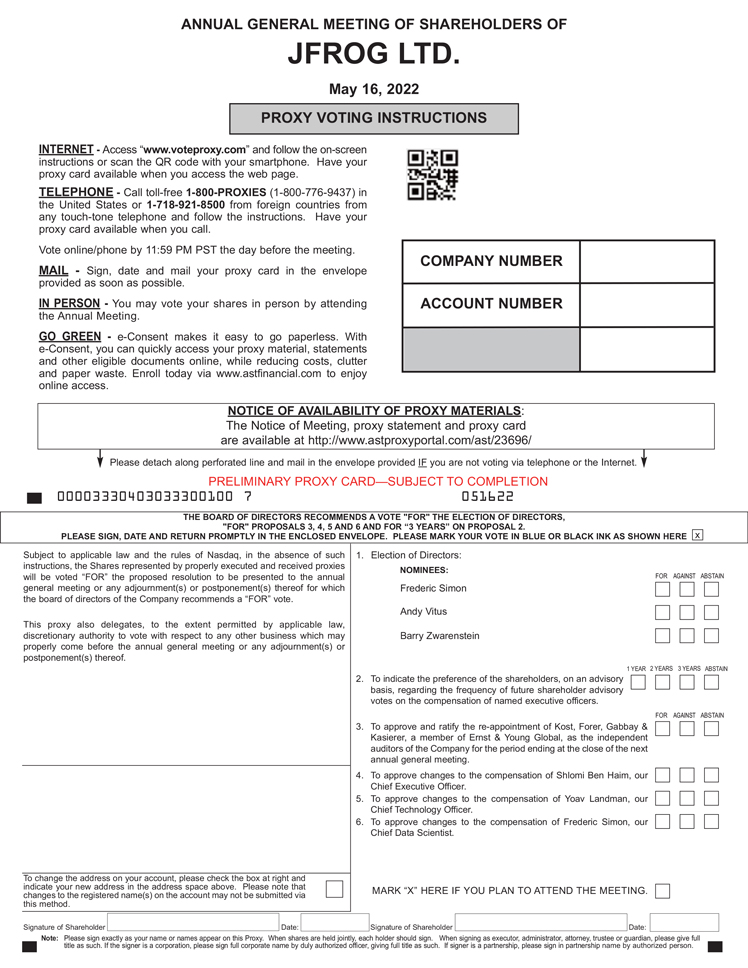

| • | You may vote by mail. To vote by mail, complete, sign and date the proxy card that accompanies this proxy statement and return it promptly in the postage-prepaid envelope provided. Your completed, signed and dated proxy card must be received by 11:59 p.m., Pacific time, on May 15, 2022. |

| • | You may vote by telephone. To vote over the telephone, call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call. You will be asked to provide the control number from your proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Pacific time, on May 15, 2022. |

2

| • | You may vote via the Internet. To vote via the Internet, go to www.voteproxy.com to complete an electronic proxy card (have your proxy card in hand when you visit the website) or scan the QR code on the proxy card with your smartphone. You will be asked to provide the control number from your proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Pacific time, on May 15, 2022. |

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee

If you are a beneficial owner of shares held of record by a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Beneficial owners of shares should generally be able to vote by returning the voting instruction card to their broker, bank or other nominee, or by telephone or via the Internet. However, the availability of telephone or Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a beneficial owner, you may not vote your shares at the Annual General Meeting unless you obtain a legal proxy from your broker, bank or other nominee, giving you the right to vote these shares.

Can I change my vote or revoke my proxy?

Shareholder of Record: Shares Registered in Your Name. If you are a shareholder of record, you can change your vote or revoke your proxy by:

| • | entering a new vote by telephone or via the Internet (until the applicable deadline for each method as set forth above); |

| • | returning a later-dated proxy card (which automatically revokes the earlier proxy); |

| • | providing a written notice of revocation prior to the Annual General Meeting to our general counsel at our principal executive offices as follows: JFrog Ltd., 270 E. Caribbean Drive, Sunnyvale, California 94089, Attn: General Counsel; or |

| • | attending the Annual General Meeting and voting in-person. Attendance at the Annual General Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or cast your vote in-person at the Annual General Meeting. |

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of your shares, you must contact the broker, bank or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. The persons named in the proxy, Shlomi Ben Haim, our Chief Executive Officer, and Jacob Shulman, our Chief Financial Officer, and have been designated as proxies for the Annual General Meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted electronically at the Annual General Meeting in accordance with the instruction of the shareholder on such proxy. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above and, if any other matters are properly brought before the annual general meeting, the shares will be voted in accordance with the proxies’ judgment.

How many votes do I have?

Holders of our ordinary shares are entitled to one vote for each share held as of the Record Date.

3

What is the quorum requirement for the Annual General Meeting?

A quorum is the minimum number of shares required to be present or represented at the Annual General Meeting for the meeting to be properly held under our amended and restated articles of association and Companies Law. The quorum required for our Annual General Meeting consists of at least two shareholders present in person, by proxy or written ballot who hold or represent between them at least 331⁄3% of the total outstanding voting rights, within half an hour of the time fixed for the commencement of the meeting. A meeting adjourned for lack of a quorum shall be adjourned either to the same day in the next week, at the same time and place, to such day and at such time and place as indicated in the notice to such meeting, or to such day and at such time and place as the chairperson of the meeting shall determine. At the reconvened meeting, any number of shareholders present in person or by proxy shall constitute a quorum.

What are broker non-votes?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee, as applicable, as to how to vote on matters deemed “non-routine” and there is at least one “routine” matter to be voted upon at the annual general meeting. Generally, if shares are held in “street name,” the beneficial owner of the shares is entitled to give voting instructions to the broker, bank or other nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank or other nominee votes shares on the “routine” matters but does not vote shares on the “non-routine” matters, those shares will be treated as broker non-votes with respect to the “non-routine” proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

What matters are considered “routine” and “non-routine”?

Only the ratification of the appointment of EY as our independent registered public accounting firm for our fiscal year ending December 31, 2022 (Proposal No. 3) is considered “routine” under applicable federal securities rules and the Companies Law. The other proposals currently on the agenda for the meeting are considered “non-routine” under applicable federal securities rules.

What are the effects of abstentions and broker non-votes?

If you submit a proxy but do not indicate any voting instructions, the proxy holders will vote in accordance with the recommendations of our board of directors. If you are a beneficial owner of shares held in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions, the broker, bank or other nominee may generally vote in its discretion on “discretionary” matters. However, if the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a “non-discretionary” matter, it will be unable to vote your shares on that matter. When this occurs, it is generally referred to as a “broker non-vote.”

Broker non-votes will be counted for purposes of calculating whether a quorum is present at the annual general meeting but will not be counted for purposes of determining the number of votes cast on a proposal. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any of the proposals.

What is the voting requirement to approve each of the proposals?

According to our amended and restated articles of association and the Companies Law, approval of each proposal requires the majority of the voting power present and voting at the Annual General Meeting or at any adjournments, postponements, or continuations thereof.

4

This means that the numbers of shares voted “For” the proposal must exceed the numbers of shares voted “Against” the proposal. Abstentions and broker non-votes are not considered votes cast for this purpose, and will have no effect on the vote.

Who will count the votes?

Votes will be counted by the inspector of election appointed for the Annual General Meeting, who will separately count “For” and “Against” votes, abstentions, and broker non-votes.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Shareholder of Record: Shares Registered in Your Name. If you are a shareholder of record and you submit a proxy but you do not provide voting instructions, your shares will be voted:

| • | “FOR” each of the three nominees for Class II director named in this proxy statement; |

| • | To indicate a preference that future shareholder advisory votes on the compensation of our named executive officers occur every “THREE YEARS”; |

| • | “FOR” the ratification of the appointment of EY as our independent registered public accounting firm for our fiscal year ending December 31, 2022; |

| • | “FOR” the vote to approve changes to the compensation of Shlomi Ben Haim, our Chief Executive Officer; |

| • | “FOR” the vote to approve changes to the compensation of Yoav Landman, our Chief Technology Officer; and |

| • | “FOR” the vote to approve changes to the compensation of Frederic Simon, our Chief Data Scientist. |

In addition, if any other matters are properly brought before the Annual General Meeting or any adjournments, postponements, or continuations thereof, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. Brokers, banks and other nominees holding shares of ordinary shares in “street name” for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole “routine” matter-Proposal No. 3 (ratification of the appointment of EY). Absent direction from you, however, your broker, bank or other nominee will not have the discretion to vote on Proposal No. 1 relating to the election of directors, and Proposal Nos. 2, 4, 5 and 6.

How can I contact JFrog’s transfer agent?

You may contact our transfer agent, AST, by telephone at (800) 937-5449 (toll-free for United States residents), or by email at info@amstock.com. Materials may be mailed to AST at:

American Stock Transfer & Trust Company, LLC

6201 15th Avenue

Brooklyn, NY 11219

How can I attend the Annual General Meeting?

The Annual General Meeting will be held at 270 E. Caribbean Drive, Sunnyvale, California 94089. You will be able to attend the Annual General Meeting. Space for the Annual General Meeting is limited. Therefore, admission will be on a first-come, first-served basis. Registration will open at 8:30 a.m. Pacific time and the Annual General Meeting will begin at 9:00 a.m. Pacific time.

5

Each shareholder who attends the Annual General Meeting in person should be prepared to present:

| • | valid government photo identification, such as a driver’s license or passport; and |

| • | if you are a street name shareholder, proof of beneficial ownership as of the Record Date, such as your most recent account statement reflecting your share ownership as of that date, along with a copy of the voting instruction card provided by your broker, bank, trustee or other nominee or similar evidence of ownership. |

| • | The Annual General Meeting is currently scheduled to be held in person. Due to the ongoing COVID-19 pandemic, we urge shareholders to vote by proxy. Please note that certain health and safety measures may be required for those attending the meeting in person, in accordance with applicable laws, and the Company may subsequently decide to hold a virtual general meeting. We encourage shareholders who plan to attend the Annual General Meeting to check our website at https://investors.jfrog.com prior to the meeting where we will post relevant updates and instructions. |

Beneficial Owner of Shares Held in “Street Name”: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you were a beneficial owner of shares that are held in “street name” at the close of business on the Record Date, you may not vote your shares at the Annual General Meeting unless you obtain a “legal proxy” from your broker, bank or other nominee who is the shareholder of record with respect to your shares. You may still attend the Annual General Meeting even if you do not have a legal proxy.

Use of cameras, recording devices, computers and other electronic devices, such as smart phones and tablets, will not be permitted at the Annual General Meeting. Photography and video are prohibited at the Annual General Meeting.

How are proxies solicited for the Annual General Meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the Annual General Meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

Where can I find the voting results of the Annual General Meeting?

We will announce preliminary voting results at the Annual General Meeting. We will also disclose voting results on a Current Report on Form 8-K filed with the SEC within four business days after the Annual General Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual General Meeting, we will file a Current Report on Form 8-K to publish preliminary results and, within four business days after final results are known, file an additional Current Report on Form 8-K to publish the final results.

What does it mean if I receive more than one set of printed materials?

If you receive more than one set of printed materials, your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each set of printed materials, as applicable, to ensure that all of your shares are voted.

6

I share an address with another shareholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the proxy materials and annual report, to multiple shareholders who share the same address unless we receive contrary instructions from one or more of the shareholders. This procedure reduces our printing and mailing costs. Shareholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the proxy materials and annual report, to any shareholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s proxy materials and annual report, you may contact us as follows:

JFrog Ltd.

Attention: Investor Relations

270 E, Caribbean Drive

Sunnyvale, CA 94089

Tel: (408) 329-1540

Shareholders who hold shares in street name may contact their broker, bank or other nominee to request information about householding.

Is there a list of shareholders entitled to vote at the Annual General Meeting?

The names of shareholders of record entitled to vote at the Annual General Meeting will be available from our Investor Relations department ten days prior to the meeting for any purpose germane to Annual General Meeting, between the hours of 9:00 a.m. and 4:30 p.m., Pacific time, at our corporate headquarters located at 270 E. Caribbean Drive, Sunnyvale, California 94089. Please contact Investor Relations at investors@jfrog.com a reasonable time in advance to make appropriate arrangements, but in no event less than 48 hours in advance of your desired visiting time.

When are shareholder proposals due for next year’s annual general meeting?

Please see the section entitled Shareholder Proposal Deadlines for 2023 Annual General Meeting in this proxy statement for more information regarding the deadlines for the submission of shareholder proposals for our 2023 annual general meeting.

7

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of the Board of Directors

Our board of directors is currently comprised of ten members. Our board of directors consists of three classes of directors, each serving staggered three-year terms. Upon expiration of the term of a class of directors, directors in that class will be elected for a three-year term at the annual general meeting of shareholders in the year in which that term expires. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

The following table sets forth the names, ages, and certain other information for each of the directors with terms expiring at the annual general meeting (the director nominees) and for each of the continuing members of our board of directors. All information is as of March 1, 2022.

Name | Class | Age | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated | ||||||||||||||||

Nominees for Director | ||||||||||||||||||||||

Frederic Simon | II | 50 | | Co-Founder, Chief Data Scientist and Director | | 2008 | 2022 | 2025 | ||||||||||||||

Andy Vitus(1) | II | 48 | Director | 2016 | 2022 | 2025 | ||||||||||||||||

Barry Zwarenstein(1) | II | 73 | Director | 2020 | 2022 | 2025 | ||||||||||||||||

Continuing Directors | ||||||||||||||||||||||

Shlomi Ben Haim | I | 52 | | Co-Founder, Chief Executive Officer and Director | | 2008 | 2024 | — | ||||||||||||||

Jessica Neal(2) | I | 45 | Director | 2020 | 2024 | — | ||||||||||||||||

Jeff Horing | I | 57 | Director | 2018 | 2024 | — | ||||||||||||||||

Elisa Steele(1)(3) | III | 55 | Director | 2020 | 2023 | — | ||||||||||||||||

Yoav Landman | III | 50 | | Co-Founder, Chief Technology Officer and Director | | 2008 | 2023 | — | ||||||||||||||

Yossi Sela(2)(3) | III | 69 | Lead Independent Director | 2012 | 2023 | — | ||||||||||||||||

Meerah Rajavel(2) | III | 50 | Director | 2021 | 2024 | — | ||||||||||||||||

| (1) | Member of audit committee |

| (2) | Member of compensation committee |

| (3) | Member of nominating and corporate governance committee |

Frederic Simon. Mr. Simon is one of our co-founders and has served as a member of our board of directors since April 2008 and numerous other roles including as our Chief Architect from April 2008 to August 2013, Chief Presale Engineer from August 2013 to July 2018, and most recently as Chief Data Scientist since January 2019. Prior to joining us, Mr. Simon co-founded AlphaCSP where he was global Chief Technology Officer from September 1998 to September 2000 and main consultant for the Israel branch from October 2000 to July 2008.

He holds a first degree from Prytanée National Militaire de La Flèche in France and a Masters in Computer Science from École Centrale de Lille, France.

8

We believe that Mr. Simon is qualified to serve on our board of directors because of the perspective and experience he brings as a co-founder and his knowledge of the industry in which we operate.

Andy Vitus. Mr. Vitus has served as a member of our board of directors since January 2016. He joined Scale Venture Partners, a venture capital fund, in January 2003, and has served as a Partner of the firm since April 2010. Mr. Vitus currently serves as a director of several privately held companies. He holds a B.S. in Electrical Engineering from the University of Cape Town and an M.S. in Electrical Engineering from Stanford University.

We believe that Mr. Vitus is qualified to serve on our board of directors because of his business expertise gained from his experience in the venture capital industry.

Barry Zwarenstein. Barry Zwarenstein has served as a member of our board of directors since January 2020. He has served as Chief Financial Officer of Five9, Inc., a provider of cloud software for contact centers, since January 2012 and as Interim Chief Executive Officer from December 2017 to May 2018. Mr. Zwarenstein served as Senior Vice President and Chief Financial Officer of SMART Modular Technologies, Inc., a designer, manufacturer and supplier of electronic subsystems to original equipment manufacturers acquired by Silver Lake Partners in August 2011, and previously served as director of Dealertrack Technologies, Inc. Since July 2020, Mr. Zwarenstein has served on the board of directors of Aria Systems, Inc., a provider of a cloud-based billing and monetization platform. Since August 2020, Mr. Zwarenstein has served on the board of directors of On24, Inc., a provider of a cloud-based digital experience platform used to market products and services. Mr. Zwarenstein holds a Bachelor of Commerce from the University of KwaZulu-Natal, South Africa and an M.B.A. from the Wharton School at the University of Pennsylvania. Mr. Zwarenstein is qualified as a Chartered Accountant, South Africa.

We believe that Mr. Zwarenstein is qualified to serve on our board of directors because of his corporate finance and business expertise.

Shlomi Ben Haim. Mr. Ben Haim is one of our co-founders and has served as a member of our board of directors and as our Chief Executive Officer since April 2008 and as Chairman of our board of directors since January 2020. From October 2000 to June 2009, he was with AlphaCSP Ltd. (“AlphaCSP”), a company implementing software applications that was acquired by Malam Group, most recently as Chief Executive Officer from June 2006 to June 2009 and as an executive director from October 2000 to June 2006. Prior to joining AlphaCSP, Mr. Ben Haim served in the Israeli Air Force from October 1988 to October 2000 where he led several military units and reached the rank of Major. Mr. Ben Haim holds a B.A. in Business Administration and Management from Ben-Gurion University of the Negev, Israel and an M.Sc. from Clark University.

We believe that Mr. Ben Haim is qualified to serve on our board of directors because of the perspective and experience he brings as our co-founder and Chief Executive Officer.

Jessica Neal. Ms. Neal has served as a member of our board of directors since March 2020. She has served in various executive positions at Netflix, Inc., a media-services provider and production company, including as Chief Talent Officer since October 2017, Vice President of Talent from June 2017 to October 2017 and Vice President of Talent and Talent Acquisition from May 2006 to September 2013. From September 2015 to June 2017, Ms. Neal served as Chief People Officer at Scopely, Inc., an interactive entertainment company and mobile games developer and publisher. From October 2013 to July 2015, she served as Vice President - Talent at Coursera Inc., an online learning platform. Ms. Neal holds a B.F.A. in Fine Arts from The Visual School of Visual Arts New York City.

We believe that Ms. Neal is qualified to serve on our board of directors because of her knowledge and experience in the software industry and professional experience as an executive of various technology companies.

9

Jeff Horing. Jeff Horing has served as a member of our board of directors since September 2018. He has been a Managing Director of Insight Venture Partners (“Insight Ventures”), a private equity investment firm he co-founded, since 1995. Since September 2014, Mr. Horing has served on the board of directors of Alteryx, Inc., a software company, and since February 2015, Mr. Horing has served on the board of directors of nCino, Inc., a financial technology company. In addition, Mr. Horing currently serves on the board of directors of several privately held companies. He holds a B.S. and B.A. from the University of Pennsylvania’s Moore School of Engineering and the Wharton School, respectively, and an M.B.A. from the M.I.T. Sloan School of Management.

We believe that Mr. Horing is qualified to serve on our board of directors because of his corporate finance and business expertise gained from his experience in the venture capital industry, including his time spent serving on boards of directors of various technology companies and familiarity with Israeli companies.

Yossi Sela. Yossi Sela has served as a member of our board of directors since May 2012 and as our lead independent director since January 2020. He has been with Gemini Israel Ventures, a venture capital fund, since January 1993 and Managing Partner since 1999 and the Chairman of Bridges Israel, an impact investment fund, since March 2018. Mr. Sela currently serves on the board of directors of several privately held companies. He holds a B.Sc. in Electrical Engineering from the Technion - Israel Institute of Technology, Israel and an M.B.A. from Tel Aviv University, Israel.

We believe that Mr. Sela is qualified to serve on our board of directors because of his business expertise gained from his experience in the venture capital industry, including his time spent serving on boards of directors of various companies and familiarity with Israeli companies.

Elisa Steele. Ms. Steele has served as a member of our board of directors since March 2020. Ms. Steele previously served as Chief Executive Officer of Namely, Inc., (“Namely”) a financial and human capital management software company, from August 2018 to July 2019. Prior to joining Namely, Ms. Steele served as Chief Executive Officer and President of Jive Software, Inc. (“Jive Software”) a communication and collaboration software company acquired by Aurea Software, Inc., from February 2015 to July 2017. From January 2014 to February 2015, Ms. Steele served in various executive positions at Jive Software, including President; Executive Vice President, Strategy and Chief Marketing Officer; and Executive Vice President, Marketing and Products. Prior to joining Jive Software, from August 2013 to December 2013, she served as Corporate Vice President and Chief Marketing Officer of Consumer Applications and Services at Microsoft Corporation, a provider of software, services and solutions. Ms. Steele joined Microsoft through its acquisition of Skype, an Internet communications company, where she served as Chief Marketing Officer from July 2012 to August 2013. Since 2017, Ms. Steele has served on the board of directors of Splunk Inc., a provider of real-time operational intelligence software. Ms. Steele also currently serves on the boards of Amplitude, Bumble and Procore Technologies. Ms. Steele holds a B.S. in Business Administration from the University of New Hampshire and holds an M.B.A. from San Francisco State University.

We believe that Ms. Steele is qualified to serve on our board of directors because of her knowledge and experience in the software industry and professional experience as an executive of various technology companies.

Yoav Landman. Mr. Landman is one of our co-founders and has served as a member of our board of directors and as our Chief Technology Officer since April 2008. From January 2002 to December 2008, he was with AlphaCSP, where he served as a Senior Consultant and as a member of management. Mr. Landman is also the creator of JFrog Artifactory. Mr. Landman holds a Masters of Computing from The Royal Melbourne Institute of Technology, Australia and an LL.B. from the University of Haifa, Israel.

We believe that Mr. Landman is qualified to serve on our board of directors because of the perspective and experience he brings as our co-founder and Chief Technology Officer.

10

Meerah Rajavel. Ms. Rajavel has served as a member of our board of directors since December 2021. She is the Chief Information Officer at Citrix, a position she has held since December 2019. Prior to Citrix, Ms. Rajavel served as the Chief Information Officer and Head of Cloud Product Operations at Forcepoint, a computer security software and data protection company, from December 2016 to December 2019. Prior to Forcepoint, Ms. Rajavel served as the Chief Information Officer at Qlik Inc, a software vendor specializing in data visualization, and served as the Senior Director of IT Cloud Services at McAfee (Intel Security) from 2011 to 2015. Prior to 2011, Ms. Rajavel served in a variety of IT leadership roles at Cybersource, InfoSys and Solix Technologies. Ms. Rajavel holds a Master of Business Administration in General Management from the Leavey School of Business at Santa Clara University; a Bachelor of Engineering in Computer Science from Thiagaraja College of Engineering in India; and a Project Management Professional Certification from University of California, Santa Cruz.

We believe that Ms. Rajavel is qualified to serve on our board of directors because of her knowledge and experience in the software industry and professional experience as an executive of various technology companies.

Our board of directors has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, and considering the relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, our board of directors has determined that each of our directors, other than Messrs. Ben Haim, Landman, and if re-elected, Mr. Simon, is an “independent director” as defined under the rules of the Nasdaq Global Select Market, or Nasdaq. In addition, our board of directors determined that Messrs. Zwarenstein and Vitus and Ms. Steele, who are members of our audit committee, satisfy the enhanced independence standards for audit committee members established by applicable SEC and Nasdaq rules. Our board of directors has determined that Mr. Sela, and Mses. Neal and Rajavel, who are members of our compensation committee, satisfy the enhanced independence standards for compensation committee members established by applicable SEC and Nasdaq rules. Our board of directors has determined that Mr. Sela and Ms. Steele, who are members of our nominating and corporate governance committee, satisfy the independence standards for nominating and corporate governance committee members established by applicable SEC and Nasdaq rules.

Frederic Simon, our Co-Founder, Chief Data Scientist and member of our board of directors, is married to the sister of Shlomi Ben Haim, our Co-Founder, Chief Executive Officer, and member of our board of directors. There are no other family relationships among any of our directors or executive officers.

Our board of directors has adopted corporate governance guidelines that provide that if the board of directors does not have an independent chairperson, the board of directors will appoint a lead independent director. The lead independent director will be responsible for calling separate meetings of the independent directors, determining the agenda and serving as chair of meetings of independent directors, reporting to the chairperson of the board of directors regarding feedback from executive sessions, serving as spokesperson for the company as requested, and performing such other responsibilities as may be designated by a majority of the independent directors from time to time. Our lead independent director is Yossi Sela.

11

The table below provides certain information regarding the composition of our board of directors. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| Board Diversity Matrix (As of March 1, 2022) | ||||||||||||||

Total Number of Directors | 10 |

| ||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

Part I: Gender Identity |

| |||||||||||||

Directors | 3 | 6 | — | 1 | ||||||||||

Part II: Demographic Background |

| |||||||||||||

African American or Black | ||||||||||||||

Alaskan Native or Native American | ||||||||||||||

Asian | 1 | |||||||||||||

Hispanic or Latinx | ||||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||

White | 2 | 5 | ||||||||||||

Two or More Races or Ethnicities | ||||||||||||||

LGBTQ+ | ||||||||||||||

Did Not Disclose Demographic Background | 2 |

| ||||||||||||

Role of Board in Risk Oversight Process

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. Our board of directors reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular board meeting, receives reports on all significant committee activities at each regular board meeting, and evaluates the risks inherent in significant transactions. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and also, among other things, discusses and reviews with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our nominating and corporate governance committee assists our board of directors in fulfilling its oversight responsibilities with respect to risks relating to our corporate governance practices, the qualifications and independence of the board of directors and potential conflicts of interest. Our compensation committee assesses risks relating to our executive compensation plans and arrangements, whether our compensation policies and programs have the potential to encourage excessive risk taking, and whether different compensation policies and practices could mitigate any such risk taking.

Our board of directors believes its current structure serves as a flexible framework within which our board of directors and its committees operate, subject to the requirements of applicable law and regulations. Under these guidelines, it is our policy that the positions of chairman of the board of directors and Chief Executive Officer may be held by the same person (subject to approval by our shareholders pursuant to the Companies Law). Under such circumstance, the guidelines also provide that the board of directors shall designate an independent director to serve as lead independent director who shall, among other things, discuss the agenda for board meetings with the chairman and approve such agenda, and chair executive sessions of the independent directors.

12

During our fiscal year ended December 31, 2021, our board of directors held eight meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served. We do not have a formal policy regarding attendance by members of our board of directors at annual general meetings of shareholders, but we strongly encourage our directors to attend. Two of our then active nine directors attended our 2021 annual meeting of shareholders.

Our board of directors has established a standing audit committee, a standing compensation committee, and a standing nominating and corporate governance committee. Each of the committees has the composition and the responsibilities described below.

Audit Committee

Our audit committee currently consists of Messrs. Zwarenstein and Vitus and Ms. Steele, with Mr. Zwarenstein serving as chairperson. Each of Messrs. Zwarenstein and Vitus and Ms. Steele meet the requirements for independence under the listing standards of Nasdaq and the applicable rules and regulations of the SEC. In addition, our board of directors has determined that Mr. Zwarenstein is an audit committee financial expert within the meaning of Item 407(d)(5) of Regulation S-K under the Securities Act.

Our audit committee oversees our corporate accounting and financial reporting process and assists our board of directors in monitoring our financial systems and our legal and regulatory compliance. Our audit committee also:

| • | Retains, oversees, compensates, evaluates and terminates our independent auditors, subject to the approval of the board of directors, and in the case of retention, to that of the shareholders; |

| • | approves or, as required, pre-approves, all audit, audit-related and all permitted non-audit services and related fees and terms, other than de minimis non-audit services, to be performed by the independent registered public accounting firm; |

| • | oversees the accounting and financial reporting processes of our company and audits of our financial statements, the effectiveness of our internal control over financial reporting and prepares such reports as may be required of an audit committee under the rules and regulations promulgated under the Exchange Act; |

| • | reviews with management, and our independent auditor, as applicable, our annual, semi-annual and quarterly audited and unaudited financial statements prior to publication and/or filing (or submission, as the case may be) to the SEC; |

| • | recommends to the board of directors the retention, promotion, demotion and termination of the internal auditor, and the internal auditor’s engagement fees and terms, in accordance with the Companies Law; |

| • | approves the yearly or periodic work plan proposed by the internal auditor; |

| • | reviews with our general counsel and/or external counsel, as deemed necessary, legal or regulatory matters that could have a material impact on the financial statements or our compliance policies and procedures; |

| • | reviews policies and procedures with respect to transactions (other than transactions related to the compensation or terms of services) between the company and officers and directors, or affiliates of officers or directors, or transactions that are not in the ordinary course of the company’s business; |

| • | reviews and approves any engagements or transactions that require the audit committee’s approval under the Companies Law. |

13

| • | Receives and retains reports of suspected business irregularities and legal compliance issues, and suggests to the board of directors remedial courses of action; and |

| • | establishes procedures for the handling of employee’s complaints as to the management of our business and the protection to be provided to such employees. |

Our audit committee operates under a written charter approved by our board of directors that satisfies the listing standards of Nasdaq and the applicable rules and regulations of the SEC. The charter is available on our website at https://investors.jfrog.com/. Our audit committee held five meetings during 2021.

Compensation Committee

Our compensation committee currently consists of Mr. Sela and Mses. Neal and Rajavel, with Ms. Neal serving as the chairperson, each of whom meets the requirements for independence under the listing standards of Nasdaq and the applicable rules and regulations of the SEC. Each member of our compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, or Rule 16b-3.

In accordance with the Companies Law, the roles of the compensation committee are, among others, as follows:

| • | recommend to the board of directors with respect to the approval of the compensation policy (the “Compensation Policy”) for office holders (as defined below) and, once every three years, regarding any extensions to a compensation policy that was adopted for a period of more than three years; |

| • | review the implementation of the Compensation Policy and periodically recommend to the board of directors with respect to any amendments or updates to the Compensation Policy; |

| • | resolve whether or not to approve arrangements with respect to the terms of office and employment of office holders; and |

| • | exempt, under certain circumstances, transactions with our Chief Executive Officer from the approval of the annual general meeting of our shareholders. |

An office holder is defined in the Companies Law as a general manager, chief business manager, deputy general manager, vice general manager, any other person assuming the responsibilities of any of these positions regardless of such person’s title, a director and any other manager directly subordinate to the general manager.

Our compensation committee oversees our corporate compensation programs. Our compensation committee also:

| • | oversees the development and implementation of compensation policies in accordance with the requirements of the Companies Law as well as other compensation policies, incentive-based compensation plans, and the implementation of such policies, and recommends to our board of directors any amendments or modifications the committee deems appropriate, including as required under the Companies Law; |

| • | reviews and approves the grants of options and other incentive awards to the Chief Executive Officer and other executive officers, including reviewing and approving corporate goals and objectives and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, including evaluating their performance in light of such goals and objectives; |

| • | approves and exempts certain transactions regarding office holders’ compensation pursuant to the Companies Law; |

| • | assists the board of directors with administering our equity-based compensation plans; and |

| • | selects, engages, compensates and terminates compensation consultants, legal counsel, financial advisors and such other advisors as it deems necessary and advisable to assist the committee in carrying out its responsibilities and functions. |

14

Our compensation committee operates under a written charter approved by our board of directors and that satisfies the applicable rules and regulations of the SEC and the Nasdaq listing rules. The charter is available on our website at https://investors.jfrog.com/. Our compensation committee held six meetings during 2021.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee currently consists of Mr. Sela and Ms. Steele, with Ms. Steele serving as the chairperson, each of whom meets the requirements for independence under the listing standards of Nasdaq and the applicable rules and regulations of the SEC.

Our nominating and corporate governance committee oversees and assists our board of directors in reviewing and recommending nominees for election as directors. Our nominating and corporate governance committee also:

| • | identifies and evaluates the qualifications of, or makes recommendations to our board of directors regarding, proposed nominees for election to our board of directors and its committees; |

| • | identifies, evaluates and recommends director candidates consistent with the criteria approved by our board of directors and qualification requirements under the Companies Law; |

| • | identifies, evaluates and recommends director candidates to ensure compliance with the listing standards of the Nasdaq and applicable diversity requirements of the Nasdaq and the California Corporations Code; |

| • | facilitates the annual performance review of our board of directors and of its committees; |

| • | considers and makes recommendations to our board of directors regarding the composition, organization and governance of our board of directors and its committees; and |

| • | develops, evaluates and makes recommendations to our board of directors regarding corporate governance practices. |

Our nominating and corporate governance committee operates under a written charter approved by our board of directors and that satisfies the applicable rules and regulations of the SEC and the Nasdaq listing rules. The charter is available on our website at https://investors.jfrog.com/. Our nominating and corporate governance committee held five meetings in 2021.

Executive Sessions of Non-Employee Directors

To encourage and enhance communication among non-employee directors, and as required under applicable Nasdaq rules, our corporate governance guidelines provide that the non-employee directors will meet in executive sessions without management directors or management present on a periodic basis, but no less than two times per year. In addition, if any of our non-employee directors are not independent directors, then our independent directors will also meet in executive session on a periodic basis, but no less than two times a year.

Compensation Committee Interlocks and Insider Participation

During 2021, our compensation committee was comprised of Messrs. Sela and Horing and Ms. Neal. Ms. Rajavel replaced Mr. Horing as a member of our compensation committee in February 2022. Ms. Neal is the chairperson of our compensation committee. None of the members of our compensation committee during 2021 is an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

15

Considerations in Evaluating Director Nominees

In its evaluation of director candidates, including the members of the board of directors eligible for re-election, our nominating and corporate governance committee considers the current composition, organization and governance of the board, the needs of the board and its respective committees, and the desired board qualifications, expertise and characteristics, such as character, professional ethics and integrity, judgment, business acumen, proven achievement and competence in one’s field, the ability to exercise sound business judgment, tenure on the board and skills that are complementary to the board, an understanding of the Company’s business, an understanding of the responsibilities that are required of a member of the board, other time commitments, diversity with respect to professional background, education, race, ethnicity, gender, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the board.

Consistent with criteria approved by the board of directors and the qualification requirements set forth under the Israeli Companies Law, our nominating and corporate governance committee evaluates each individual in the context of the membership of the board of directors as a group, with the objective of having a group that can best perpetuate the success of the business and represent shareholder interests through the exercise of sound judgment using its diversity of viewpoints and experience in the various areas. Each director should be an individual of high character and integrity. The board of directors annually evaluates the performance of the board of directors and its committees. Our nominating and corporate governance committee reviews the self-assessment questionnaires to evaluate the performance of individual members. In determining whether to recommend a director for re-election, our nominating and corporate governance committee also considers the director’s participation in and contributions to the activities of the board of directors and the company, the director’s other time commitments, and other qualifications and characteristics determined by the board of directors.

After completing their review and evaluation of director candidates, in accordance with the rules of the Nasdaq Global Select Market and the Israeli Companies Law, our nominating and corporate governance committee will recommend a director nominee for selection by our board of directors. Our board of directors has the final authority in determining the selection of director candidates for nomination to our board of directors.

Shareholder Recommendations for Nominations to Our Board of Directors

From time to time shareholders may present proposals, including to nominate a candidate to serve on our board of directors that may be proper subjects to add to the agenda for consideration at a general meeting of shareholders. Under Section 66(b) of the Companies Law and the regulations thereto, shareholders who meet the conditions set out in that section, specifically – holding, in the aggregate, at least 1% of the voting power in the Company – may submit a request to include an item to the agenda within 7 days following our notice of convening a shareholders’ general meeting at which directors are to be elected and certain other proposals are to be considered, provided the requested item is appropriate for presentation at a general meeting and for consideration by the shareholders.

In addition, shareholder proposals may be submitted for inclusion in a proxy statement under Rule 14a-8 under the Exchange Act. In accordance with the Companies Law, the deadline for submission of shareholder proposals for inclusion in our proxy materials for the 2023 annual general meeting of shareholders is [•], 2022; however, if the date of the 2023 annual general meeting is changed by more than 30 days from the date of the last annual general meeting, the proposal must be received no later than a reasonable time before we begin to print and send our annual proxy materials. In addition, Rule 14a-8 proposals must otherwise comply with the requirements of the rule.

Any nomination should be sent in writing to JFrog Ltd., 270 E. Caribbean Drive, Sunnyvale, CA 94089, Attn: General Counsel. Please see the section entitled “Shareholder Proposal Deadlines for 2023 Annual General Meeting” in this proxy statement for more information.

16

Communications with the Board of Directors

In cases where shareholders wish to communicate directly with our non-management directors, messages can be sent to our Chairman of the Board at JFrog Ltd., 270 E. Caribbean Drive, Sunnyvale, CA 94089, with copies sent to our General Counsel and Chief Financial Officer at JFrog Ltd., 270 E. Caribbean Drive, Sunnyvale, CA 94089. Our General Counsel will, in consultation with appropriate directors as necessary, review incoming shareholder communications and decide whether a response to any shareholder or interested party communication is necessary.

This procedure does not apply to (i) communications to non-management directors from our officers or directors who are shareholders or (ii) shareholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are discussed further in the section entitled “Shareholder Proposal Deadlines for 2023 Annual General Meeting” in this proxy statement.

Policy Prohibiting Hedging or Pledging of Securities

Under our insider trading policy, our employees, including our executive officers, and the members of our board of directors are prohibited from, directly or indirectly, among other things, (1) engaging in short sales, (2) trading in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options, restricted stock units and other compensatory awards issued to such individuals by us), (3) purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted to them by us as part of their compensation or held, directly or indirectly, by them, (4) pledging any of our securities as collateral for any loans and (5) holding our securities in a margin account.

Code of Business Conduct and Ethics

Our board of directors has adopted a written code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer, and other executive and senior financial officers. The full text of our code of business conduct and ethics is available on the corporate governance section of our website, which is located at https://investors.jfrog.com/corporate-governance/overview. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Exchange Act. The Board, through its Audit Committee, receives reports on compliance with the Code. The Company makes whistleblower reporting available to all of its employees and external parties via a web and telephone hotline system supplied and operated by a third party. The system allows individuals to make reports, including anonymously, to the Company or directly to the Chair of the Audit Committee, and enables follow up directly with the reporter while maintaining anonymity, as needed. Management reports on the status of the whistleblower program to the Audit Committee at its quarterly meetings.

Environmental, Social and Governance (ESG)

The Company is aware of and focused on the environmental, social and governance matters that are important to its investors, customers, employees and other stakeholders. Both our management team and board of directors are committed to prioritizing consideration of environmental stewardship, social responsibility and corporate governance. Moving forward our objective is to fully integrate ESG considerations into the Company culture with a view toward enhancing sustainability and promoting employee and community well-being. The Company is working with its advisors to create a comprehensive roadmap for its ESG efforts and initiatives going forward.

17

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Non-Employee Director Compensation Policy

Pursuant to our non-employee director compensation policy, each non-employee director is eligible to receive compensation for his or her service consisting of cash retainers and equity awards. Our board of directors or our compensation committee has the discretion to amend, suspend or terminate the non-employee director compensation policy as it deems necessary or appropriate, subject to the terms of our Compensation Policy and the Companies Law.

Cash Compensation

All non-employee directors are entitled to receive the following annual cash compensation for their services:

Board member: | $ | 30,000 | ||

Lead non-employee director: | $ | 10,000 | ||

Audit committee chair: | $ | 20,000 | ||

Member of audit committee: | $ | 10,000 | ||

Compensation committee chair: | $ | 15,000 | ||

Member of compensation committee: | $ | 6,000 | ||

Nominating and governance committee chair: | $ | 7,500 | ||

Member of nominating and governance committee: | $ | 4,000 |

For clarity, each non-employee director who serves as the chair of a committee receives only the additional annual fee for services as the chair of the committee and not the additional annual fee for services as a member of the committee while serving as such chair, provided that the non-employee director who serves as the lead non-employee director receives the annual fee for services as the lead non-employee director and the annual fee for services as a board member.

Each annual cash retainer and additional annual fee is paid quarterly in arrears on a prorated basis to each non-employee director who served in the relevant capacity at any point during the immediately preceding fiscal quarter, and such payment is made no later than 30 days following the end of such immediately preceding fiscal quarter.

Equity Compensation

Non-employee directors are entitled to receive all types of awards other than incentive stock options under our 2020 Equity Incentive Plan (the “2020 Plan”), including discretionary awards not covered under the non-employee director compensation policy. Nondiscretionary, automatic grants of equity awards are made to our non-employee directors as follows:

| • | Initial Award. Each person who first becomes a non-employee director after the effective date of the policy (either by election or appointment) will be granted an equity award on the first trading day on or after such individual first becomes a non-employee director as follows: (i) with respect to each individual who first becomes a non-employee director on or prior to the one year anniversary of the effective date of the policy, the initial award will consist of options to purchase our ordinary shares with a value of $350,000, with any resulting fractional shares rounded down to the nearest whole share; and (ii) with respect to each individual who first becomes a non-employee director after the one year anniversary of the effective date of the policy, the initial award will consist of restricted share units (each an “RSU”) with a value of $350,000, with any resulting fractional shares rounded down to the nearest whole share. Each such initial award will vest as to 1/12th of the shares subject to such initial award on each three month anniversary of the applicable non-employee director’s initial start date on the same day of the month as such start date, in each case subject to the non-employee director continuing to be a member of our board of directors through the applicable vesting date. |

18

| • | Annual Award. Each non-employee director who has completed at least six months of continuous service as a non-employee director as of the date of each annual general meeting of our shareholders will be granted an award of RSUs on the first trading day immediately following such annual general meeting with a value of $175,000, with any resulting fractional shares rounded down to the nearest whole share. Each such annual award will be scheduled to vest as to 1/4th of the shares subject to the annual award on each three month anniversary of the date of grant on the same day of the month as such date of grant, in each case subject to the non-employee director continuing to be a member of our board of directors through the applicable vesting date. |