OPENDOOR TECHNOLOGIES INC. NON-GAAP MEASURES & KEY METRICS (Unaudited) Period Ended ($ in millions, except markets, homes purchased, homes sold, homes in inventory, and margins) Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Key Metrics Total Markets (at period end) 53 51 51 45 44 Total Revenue $ 2,857 $ 3,361 $ 4,198 $ 5,151 $ 3,822 Homes Purchased 3,427 8,380 14,135 9,020 9,639 Homes Sold 7,512 8,520 10,482 12,669 9,794 Homes in Inventory (at period end) 12,788 16,873 17,013 13,360 17,009 Inventory (at period end) $ 4,460 $ 6,093 $ 6,628 $ 4,664 $ 6,096 Non-GAAP Financial Measures Adjusted Gross (Loss) Profit $ (92) $ 110 $ 556 $ 512 $ 279 Selling Costs (78) (100) (100) (136) (99) Holding Costs (37) (32) (34) (44) (28) Contribution (Loss) Profit $ (207) $ (22) $ 422 $ 332 $ 152 Adjusted EBITDA $ (351) $ (211) $ 218 $ 176 $ 0.4 Adjusted Net (Loss) Income $ (467) $ (328) $ 122 $ 99 $ (80) Margins Total Revenue 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % Adjusted Gross (Loss) Profit (3.2) % 3.3 % 13.2 % 9.9 % 7.3 % Contribution Margin (7.2) % (0.7) % 10.1 % 6.4 % 4.0 % Adjusted EBITDA (12.3) % (6.3) % 5.2 % 3.4 % — % Adjusted Net (Loss) Income (16.3) % (9.8) % 2.9 % 1.9 % (2.1) % Exhibit 99.3

OPENDOOR TECHNOLOGIES INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amounts which are presented in thousands, and per share amounts) (Unaudited) Three Months Ended December 31, Year Ended December 31, 2022 2021 2022 2021 REVENUE $ 2,857 $ 3,822 $ 15,567 $ 8,021 COST OF REVENUE 2,786 3,550 14,900 7,291 GROSS PROFIT 71 272 667 730 OPERATING EXPENSES: Sales, marketing and operations 194 225 1,006 544 General and administrative 23 117 346 620 Technology and development 48 32 169 134 Goodwill Impairment 60 — 60 — Restructuring 17 — 17 — Total operating expenses 342 374 1,598 1,298 LOSS FROM OPERATIONS (271) (102) (931) (568) WARRANT FAIR VALUE ADJUSTMENT — — — 12 LOSS ON EXTINGUISHMENT OF DEBT (25) — (25) — INTEREST EXPENSE (113) (73) (385) (143) OTHER (LOSS) INCOME – Net 10 (16) (10) 38 LOSS BEFORE INCOME TAXES (399) (191) (1,351) (661) INCOME TAX EXPENSE — — (2) (1) NET LOSS $ (399) $ (191) $ (1,353) $ (662) Net loss per share attributable to common shareholders: Basic $ (0.63) $ (0.31) $ (2.16) $ (1.12) Diluted $ (0.63) $ (0.31) $ (2.16) $ (1.12) Weighted-average shares outstanding: Basic 634,595 612,516 627,105 592,574 Diluted 634,595 612,516 627,105 592,574

OPENDOOR TECHNOLOGIES INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In millions, except share data) (Unaudited) December 31, 2022 December 31, 2021 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 1,137 $ 1,731 Restricted cash 654 847 Marketable securities 144 484 Escrow receivable 30 84 Mortgage loans held for sale pledged under agreements to repurchase — 7 Real estate inventory, net 4,460 6,096 Other current assets ($1 and $4 carried at fair value) 41 91 Total current assets 6,466 9,340 PROPERTY AND EQUIPMENT – Net 58 45 RIGHT OF USE ASSETS 41 42 GOODWILL 4 60 INTANGIBLES – Net 12 12 OTHER ASSETS 27 7 TOTAL ASSETS $ 6,608 $ 9,506 LIABILITIES AND SHAREHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable and other accrued liabilities $ 110 $ 137 Non-recourse asset-backed debt - current portion 1,376 4,240 Other secured borrowings — 7 Interest payable 12 12 Lease liabilities - current portion 7 4 Total current liabilities 1,505 4,400 NON-RECOURSE ASSET-BACKED DEBT – Net of current portion 3,020 1,862 CONVERTIBLE SENIOR NOTES 959 954 LEASE LIABILITIES – Net of current portion 38 42 Total liabilities 5,522 7,258 SHAREHOLDERS’ EQUITY: Common stock, $0.0001 par value; 3,000,000,000 shares authorized; 637,387,025 and 616,026,565 shares issued, respectively; 637,387,025 and 616,026,565 shares outstanding, respectively — — Additional paid-in capital 4,148 3,955 Accumulated deficit (3,058) (1,705) Accumulated other comprehensive loss (4) (2) Total shareholders’ equity 1,086 2,248 TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 6,608 $ 9,506

OPENDOOR TECHNOLOGIES INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) Year Ended December 31, 2022 2021 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (1,353) $ (662) Adjustments to reconcile net loss to cash, cash equivalents, and restricted cash provided by (used in) operating activities: Depreciation and amortization 83 47 Amortization of right of use asset 7 8 Stock-based compensation 171 536 Warrant fair value adjustment — (12) Gain on settlement of lease liabilities — (5) Inventory valuation adjustment 737 56 Goodwill impairment 60 — Change in fair value of equity securities 35 (35) Net fair value adjustments and loss on sale of mortgage loans held for sale (1) (4) Origination of mortgage loans held for sale (118) (196) Proceeds from sale and principal collections of mortgage loans held for sale 128 197 Loss on early extinguishment of debt 25 — Changes in operating assets and liabilities: Escrow receivable 54 (83) Real estate inventory 896 (5,656) Other assets 37 (52) Accounts payable and other accrued liabilities (25) 76 Interest payable 2 4 Lease liabilities (8) (13) Net cash provided by (used in) operating activities 730 (5,794) CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of property and equipment (37) (33) Purchase of intangible assets — (1) Purchase of marketable securities (28) (486) Proceeds from sales, maturities, redemptions and paydowns of marketable securities 328 92 Purchase of non-marketable equity securities (25) (15) Proceeds from sale of non-marketable equity securities 3 — Capital returns of non-marketable equity securities 3 — Acquisitions, net of cash acquired (10) (33) Net cash provided by (used in) investing activities 234 (476) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of convertible senior notes, net of issuance costs — 953 Purchase of capped calls related to convertible senior notes — (119) Proceeds from exercise of stock options 4 15

Proceeds from issuance of common stock for ESPP 2 — Proceeds from warrant exercise — 22 Proceeds from the February 2021 Offering — 886 Issuance cost of common stock — (29) Proceeds from non-recourse asset-backed debt 10,108 11,499 Principal payments on non-recourse asset-backed debt (11,822) (5,838) Proceeds from other secured borrowings 114 192 Principal payments on other secured borrowings (121) (192) Payment of loan origination fees and debt issuance costs (26) (47) Payment for early extinguishment of debt (10) — Net cash (used in) provided by financing activities (1,751) 7,342 NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH (787) 1,072 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of period 2,578 1,506 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period $ 1,791 $ 2,578 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during the period for interest $ 355 $ 122 DISCLOSURES OF NONCASH ACTIVITIES: Stock-based compensation expense capitalized for internally developed software $ 16 $ 12 Issuance of common stock in extinguishment of warrant liabilities $ — $ (35) RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: Cash and cash equivalents $ 1,137 $ 1,731 Restricted cash 654 847 Cash, cash equivalents, and restricted cash $ 1,791 $ 2,578

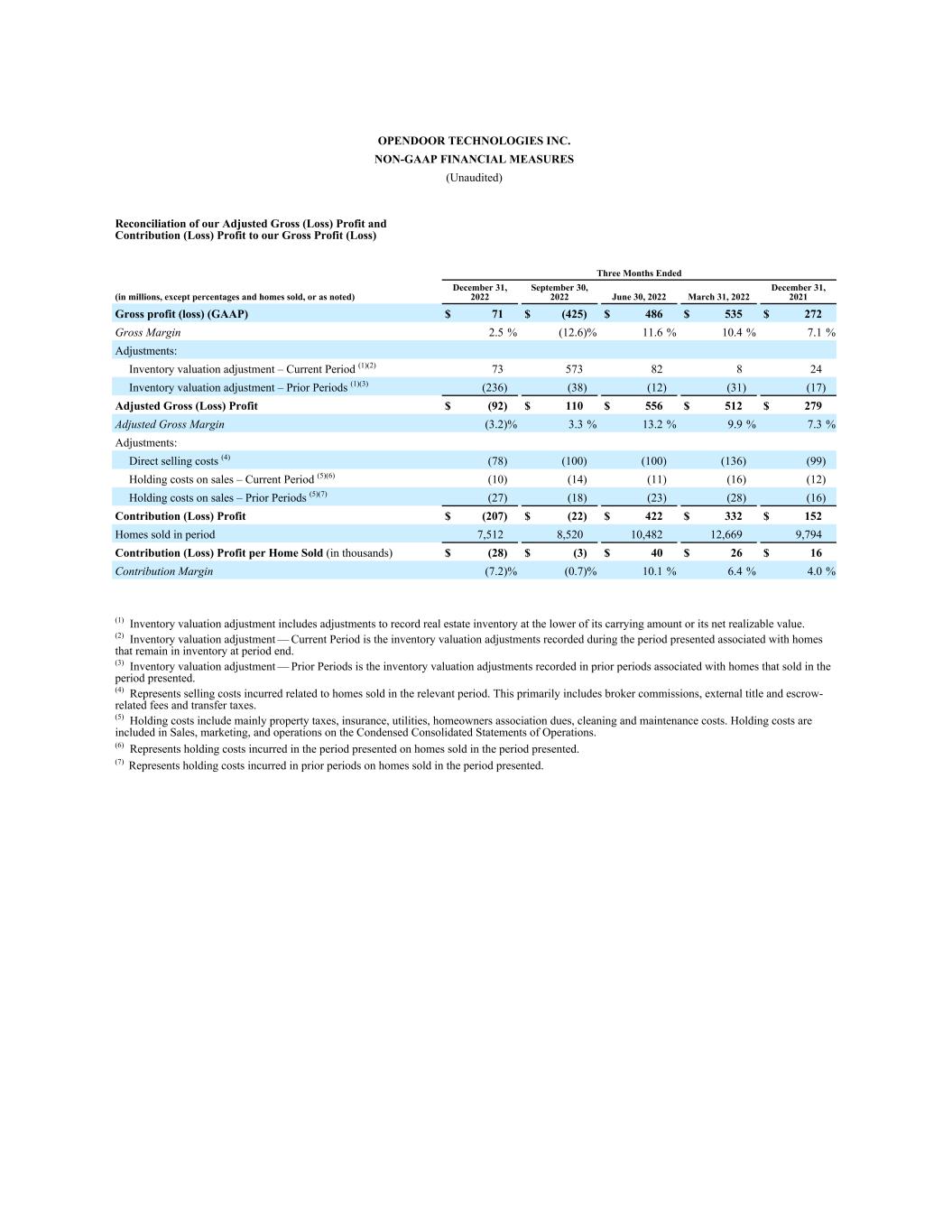

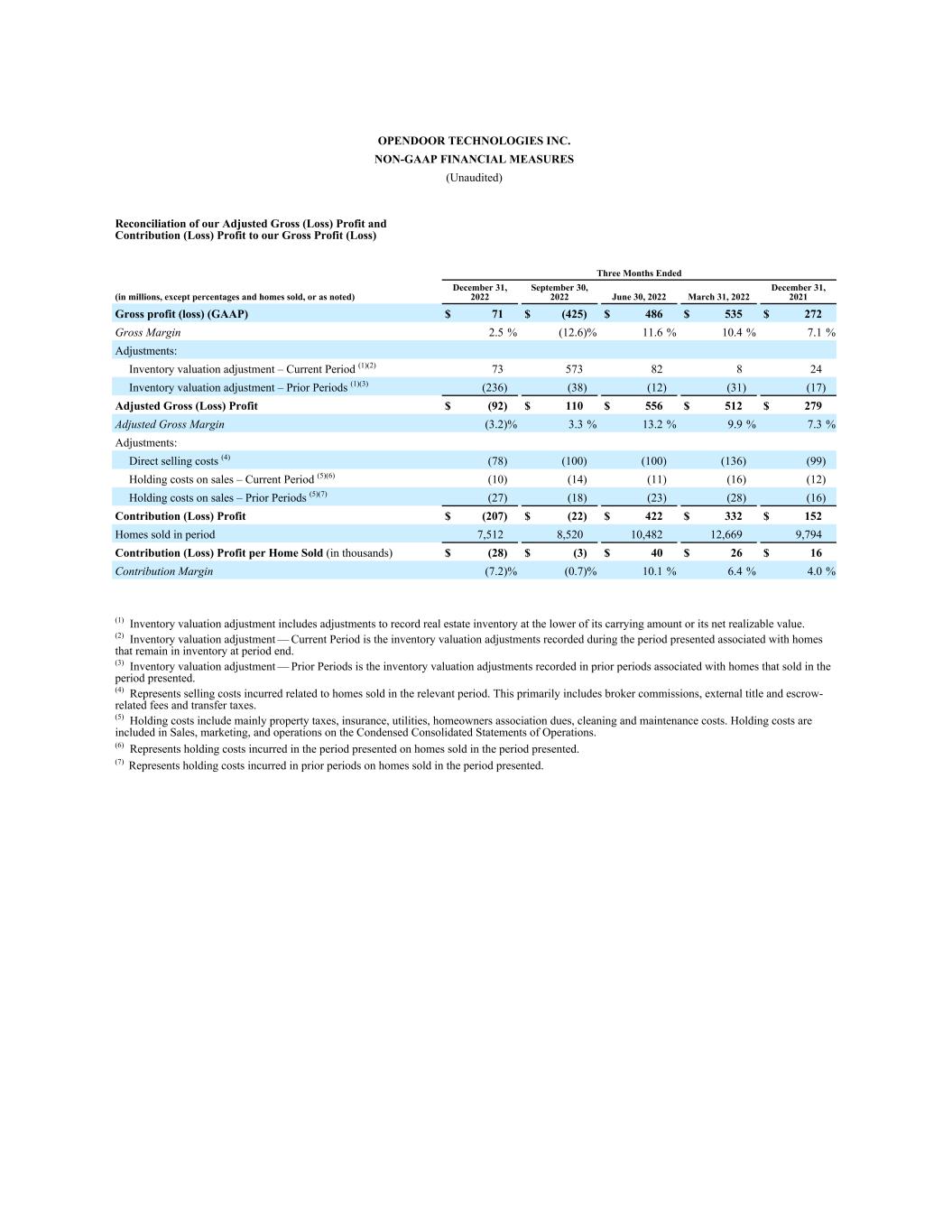

OPENDOOR TECHNOLOGIES INC. NON-GAAP FINANCIAL MEASURES (Unaudited) Reconciliation of our Adjusted Gross (Loss) Profit and Contribution (Loss) Profit to our Gross Profit (Loss) Three Months Ended (in millions, except percentages and homes sold, or as noted) December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Gross profit (loss) (GAAP) $ 71 $ (425) $ 486 $ 535 $ 272 Gross Margin 2.5 % (12.6) % 11.6 % 10.4 % 7.1 % Adjustments: Inventory valuation adjustment – Current Period͏ (1)(2) 73 573 82 8 24 Inventory valuation adjustment – Prior Periods͏ (1)(3) (236) (38) (12) (31) (17) Adjusted Gross (Loss) Profit $ (92) $ 110 $ 556 $ 512 $ 279 Adjusted Gross Margin (3.2) % 3.3 % 13.2 % 9.9 % 7.3 % Adjustments: Direct selling costs (4) (78) (100) (100) (136) (99) Holding costs on sales – Current Period͏ (5)(6) (10) (14) (11) (16) (12) Holding costs on sales – Prior Periods͏ (5)(7) (27) (18) (23) (28) (16) Contribution (Loss) Profit $ (207) $ (22) $ 422 $ 332 $ 152 Homes sold in period 7,512 8,520 10,482 12,669 9,794 Contribution (Loss) Profit per Home Sold (in thousands) $ (28) $ (3) $ 40 $ 26 $ 16 Contribution Margin (7.2) % (0.7) % 10.1 % 6.4 % 4.0 % (1) Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value. (2) Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end. (3) Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented. (4) Represents selling costs incurred related to homes sold in the relevant period. This primarily includes broker commissions, external title and escrow- related fees and transfer taxes. (5) Holding costs include mainly property taxes, insurance, utilities, homeowners association dues, cleaning and maintenance costs. Holding costs are included in Sales, marketing, and operations on the Condensed Consolidated Statements of Operations. (6) Represents holding costs incurred in the period presented on homes sold in the period presented. (7) Represents holding costs incurred in prior periods on homes sold in the period presented.

Reconciliation of our Adjusted Net (Loss) Income and Adjusted EBITDA to our Net (Loss) Income Three Months Ended (in millions, except percentages) December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Net (loss) income (GAAP) $ (399) $ (928) $ (54) $ 28 $ (191) Adjustments: Stock-based compensation (7) 52 59 67 71 Equity securities fair value adjustment(1) (1) 11 3 22 16 Intangibles amortization expense(2) 2 2 3 2 2 Inventory valuation adjustment – Current Period͏(3)(4) 73 573 82 8 24 Inventory valuation adjustment — Prior Periods͏(3)(5) (236) (38) (12) (31) (17) Restructuring(6) 17 — — — — Loss on extinguishment of debt 25 — — — — Goodwill impairment 60 — — — — Legal contingency accrual and related expenses 1 — 42 3 14 Other(7) (2) — (1) — 1 Adjusted Net (Loss) Income $ (467) $ (328) $ 122 $ 99 $ (80) Adjustments: Depreciation and amortization, excluding amortization of intangibles and right of use assets 12 8 12 9 9 Property financing(8) 93 102 76 58 62 Other interest expense(9) 20 13 13 10 10 Interest income(10) (9) (7) (6) — (1) Income tax expense — 1 1 — — Adjusted EBITDA $ (351) $ (211) $ 218 $ 176 $ 0.4 Adjusted EBITDA Margin (12.3) % (6.3) % 5.2 % 3.4 % — % (1) Represents the gains and losses on certain financial instruments, which are marked to fair value at the end of each period. (2) Represents amortization of acquisition-related intangible assets. The acquired intangible assets have useful lives ranging from 1 to 5 years and amortization is expected until the intangible assets are fully amortized. (3) Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value. (4) Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end. (5) Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented. (6) Restructuring costs consist mainly of employee termination benefits, relocation packages and bonuses as well as costs related to the exiting of certain non-cancelable leases. (7) Includes primarily gain or loss on interest rate lock commitments, gain or loss on the sale of available for sale securities, sublease income, and income from equity method investments. (8) Includes interest expense on our non-recourse asset-backed debt facilities. (9) Includes amortization of debt issuance costs and loan origination fees, commitment fees, unused fees, other interest related costs on our asset-backed debt facilities, interest expense related to the 2026 convertible senior notes outstanding, and interest expense on other secured borrowings. (10) Consists mainly of interest earned on cash, cash equivalents and marketable securities.