OPENDOOR TECHNOLOGIES INC. NON-GAAP MEASURES & KEY METRICS (Unaudited) Period Ended ($ in millions, except markets, homes purchased, homes sold, homes in inventory, and margins) Q3 2024 Q2 2024 Q1 2024 Q4 2023 Q3 2023 Key Metrics Total Markets (at period end) 50 50 50 50 53 Total Revenue $ 1,377 $ 1,511 $ 1,181 $ 870 $ 980 Gross profit $ 105 $ 129 $ 114 $ 72 $ 96 Net loss $ (78) $ (92) $ (109) $ (91) $ (106) Inventory (at period end) $ 2,145 $ 2,234 $ 1,881 $ 1,775 $ 1,311 Non-GAAP Financial Measures Adjusted Gross Profit $ 99 $ 154 $ 104 $ 66 $ 84 Selling Costs (32) (43) (34) (26) (28) Holding Costs (15) (16) (13) (10) (13) Contribution Profit $ 52 $ 95 $ 57 $ 30 $ 43 Adjusted EBITDA $ (38) $ (5) $ (50) $ (69) $ (49) Adjusted Net Loss $ (70) $ (31) $ (80) $ (97) $ (75) Margins Total Revenue 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % Gross profit 7.6 % 8.5 % 9.7 % 8.3 % 9.8 % Adjusted Gross Profit 7.2 % 10.2 % 8.8 % 7.6 % 8.6 % Contribution Profit 3.8 % 6.3 % 4.8 % 3.4 % 4.4 % Net loss (5.7) % (6.1) % (9.2) % (10.5) % (10.8) % Adjusted EBITDA (2.8) % (0.3) % (4.2) % (7.9) % (5.0) % Adjusted Net Loss (5.1) % (2.1) % (6.8) % (11.1) % (7.7) % Inventory Rollforward Homes in Inventory (at beginning of period) 6,399 5,706 5,326 4,007 3,558 Homes Purchased 3,504 4,771 3,458 3,683 3,136 Homes Sold (3,615) (4,078) (3,078) (2,364) (2,687) Homes in Inventory (at period end) 6,288 6,399 5,706 5,326 4,007 Exhibit 99.3

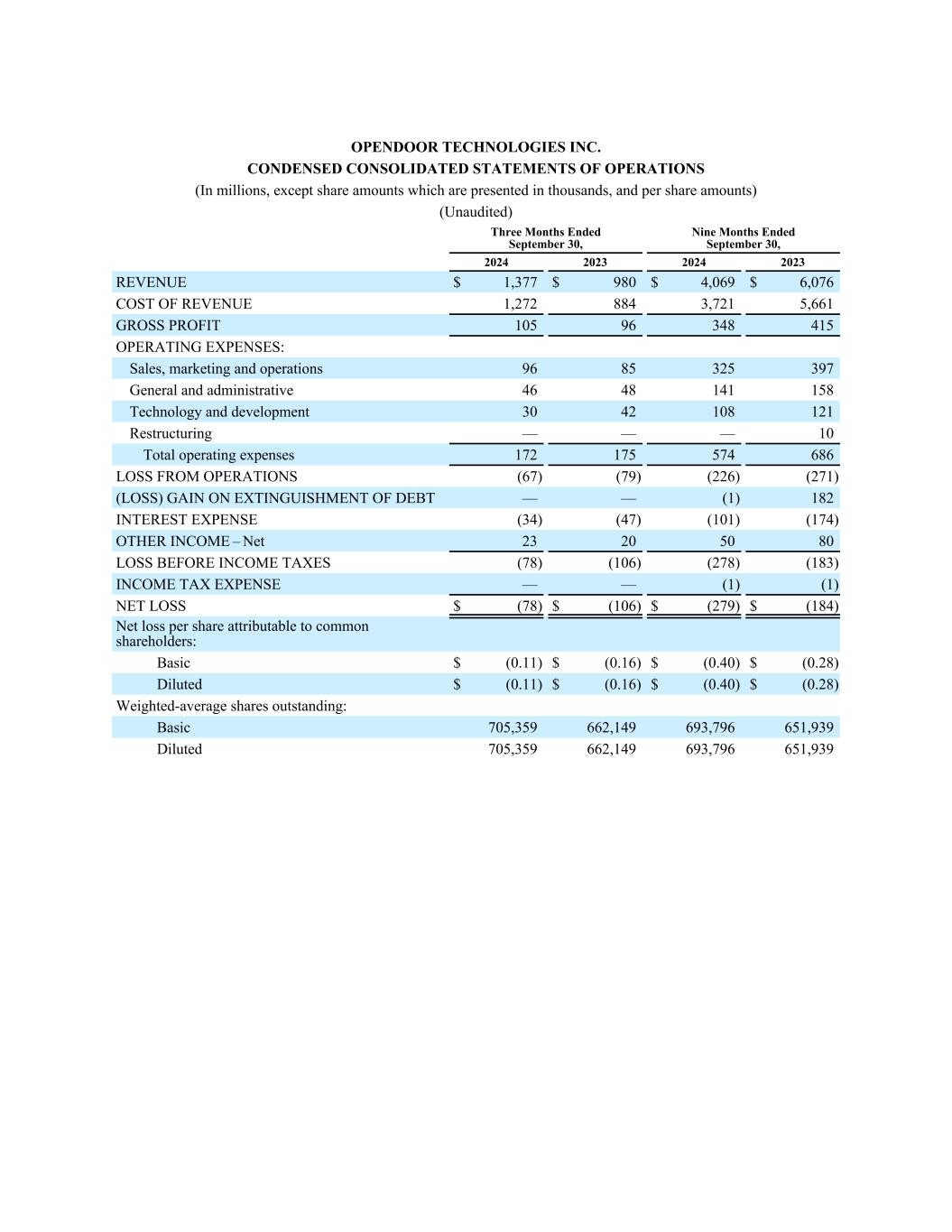

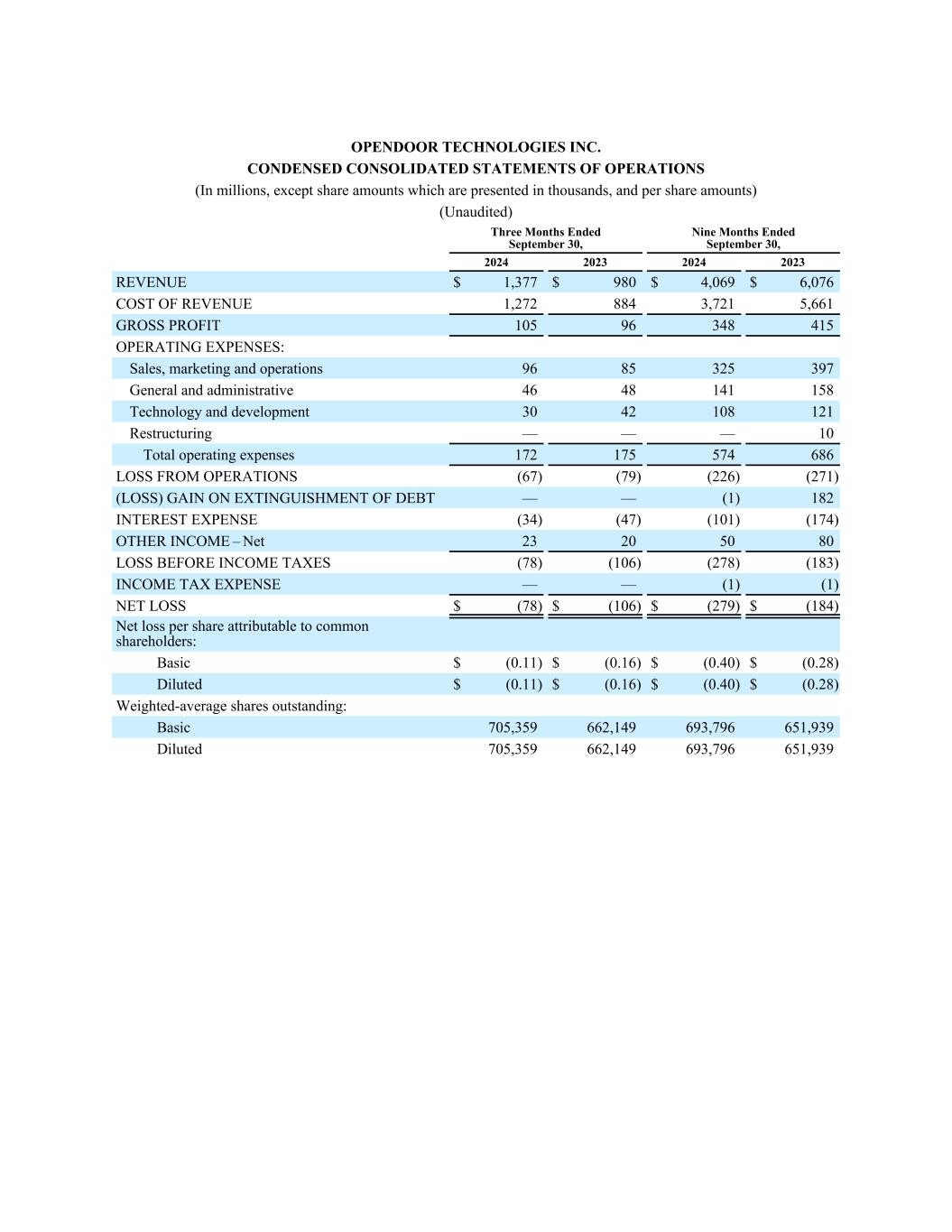

OPENDOOR TECHNOLOGIES INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amounts which are presented in thousands, and per share amounts) (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 REVENUE $ 1,377 $ 980 $ 4,069 $ 6,076 COST OF REVENUE 1,272 884 3,721 5,661 GROSS PROFIT 105 96 348 415 OPERATING EXPENSES: Sales, marketing and operations 96 85 325 397 General and administrative 46 48 141 158 Technology and development 30 42 108 121 Restructuring — — — 10 Total operating expenses 172 175 574 686 LOSS FROM OPERATIONS (67) (79) (226) (271) (LOSS) GAIN ON EXTINGUISHMENT OF DEBT — — (1) 182 INTEREST EXPENSE (34) (47) (101) (174) OTHER INCOME – Net 23 20 50 80 LOSS BEFORE INCOME TAXES (78) (106) (278) (183) INCOME TAX EXPENSE — — (1) (1) NET LOSS $ (78) $ (106) $ (279) $ (184) Net loss per share attributable to common shareholders: Basic $ (0.11) $ (0.16) $ (0.40) $ (0.28) Diluted $ (0.11) $ (0.16) $ (0.40) $ (0.28) Weighted-average shares outstanding: Basic 705,359 662,149 693,796 651,939 Diluted 705,359 662,149 693,796 651,939

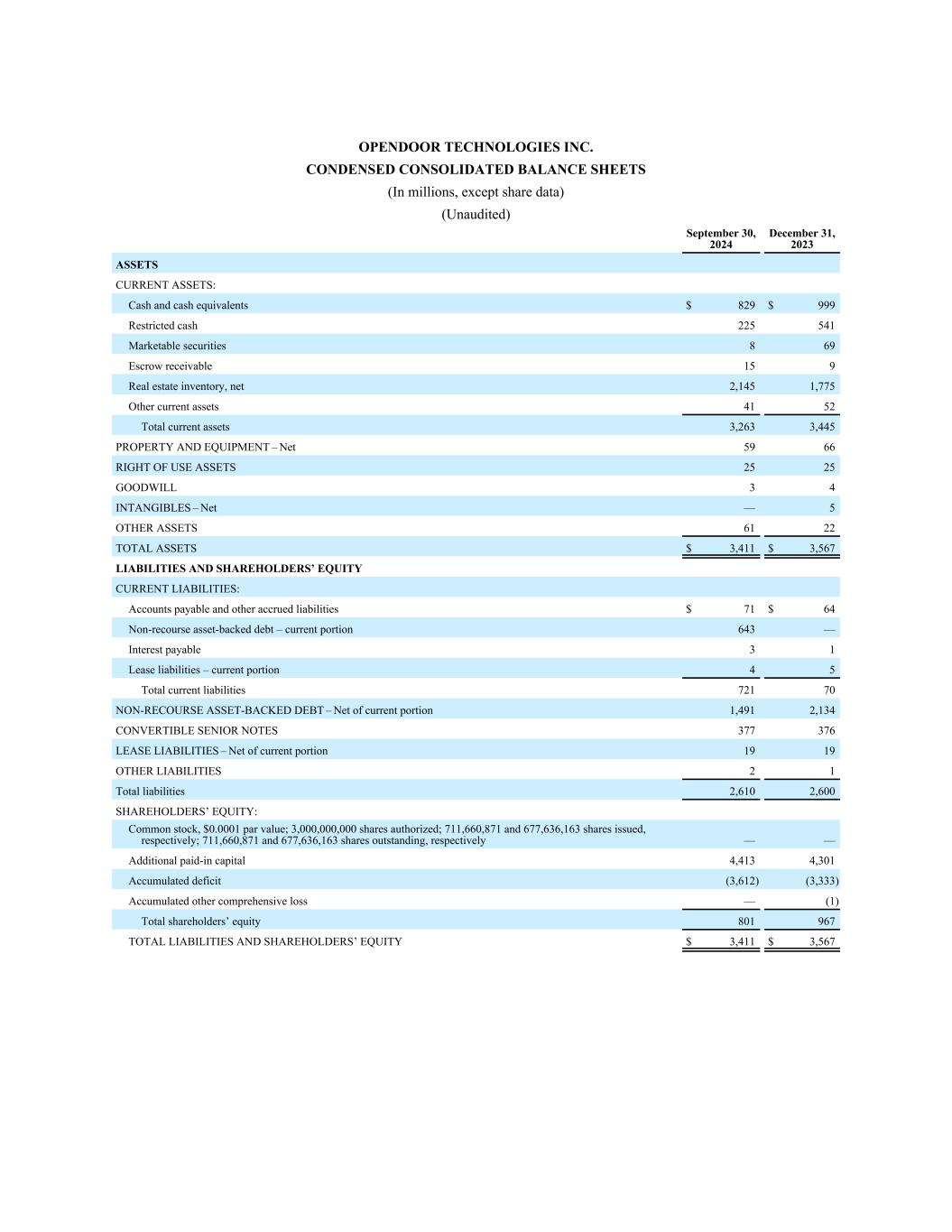

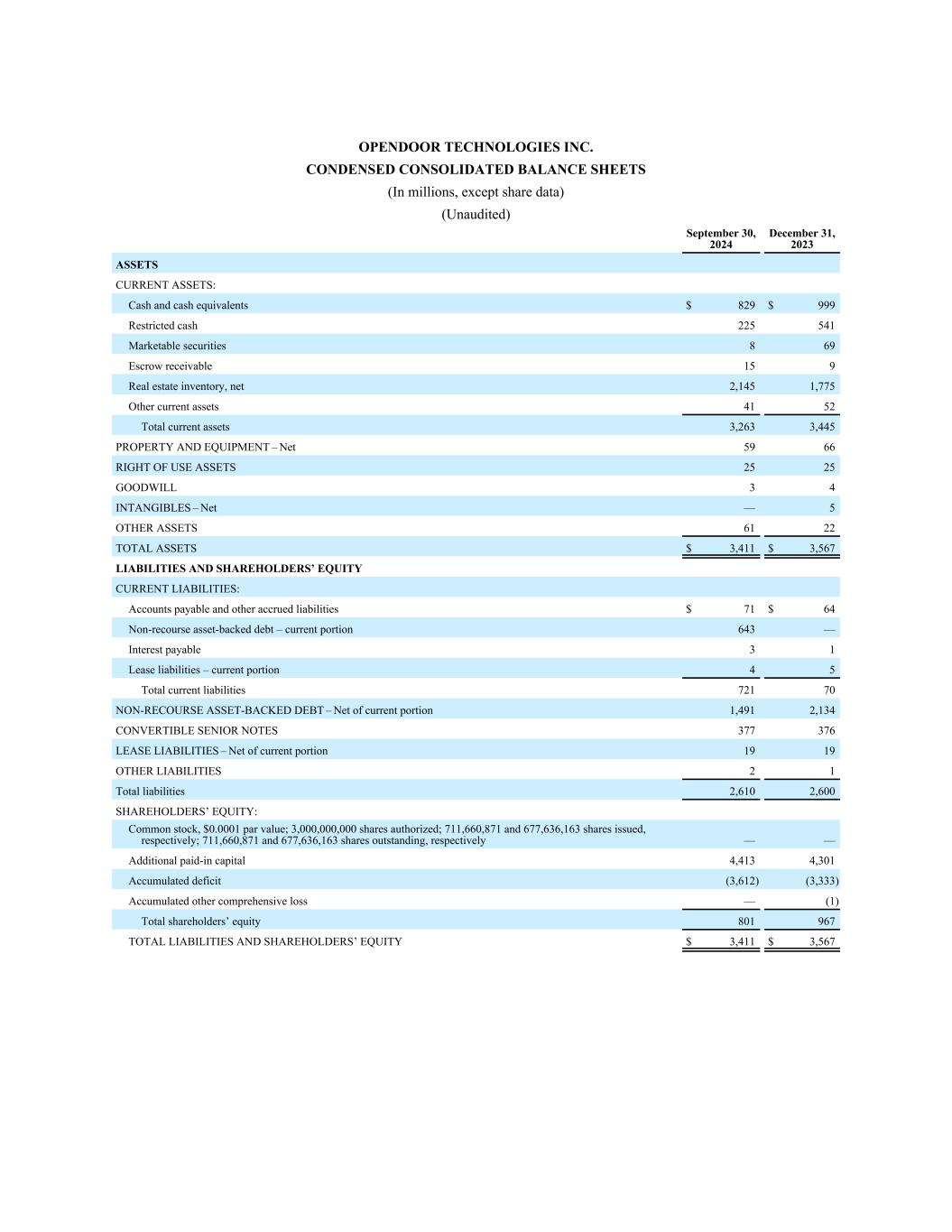

OPENDOOR TECHNOLOGIES INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In millions, except share data) (Unaudited) September 30, 2024 December 31, 2023 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 829 $ 999 Restricted cash 225 541 Marketable securities 8 69 Escrow receivable 15 9 Real estate inventory, net 2,145 1,775 Other current assets 41 52 Total current assets 3,263 3,445 PROPERTY AND EQUIPMENT – Net 59 66 RIGHT OF USE ASSETS 25 25 GOODWILL 3 4 INTANGIBLES – Net — 5 OTHER ASSETS 61 22 TOTAL ASSETS $ 3,411 $ 3,567 LIABILITIES AND SHAREHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable and other accrued liabilities $ 71 $ 64 Non-recourse asset-backed debt – current portion 643 — Interest payable 3 1 Lease liabilities – current portion 4 5 Total current liabilities 721 70 NON-RECOURSE ASSET-BACKED DEBT – Net of current portion 1,491 2,134 CONVERTIBLE SENIOR NOTES 377 376 LEASE LIABILITIES – Net of current portion 19 19 OTHER LIABILITIES 2 1 Total liabilities 2,610 2,600 SHAREHOLDERS’ EQUITY: Common stock, $0.0001 par value; 3,000,000,000 shares authorized; 711,660,871 and 677,636,163 shares issued, respectively; 711,660,871 and 677,636,163 shares outstanding, respectively — — Additional paid-in capital 4,413 4,301 Accumulated deficit (3,612) (3,333) Accumulated other comprehensive loss — (1) Total shareholders’ equity 801 967 TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 3,411 $ 3,567

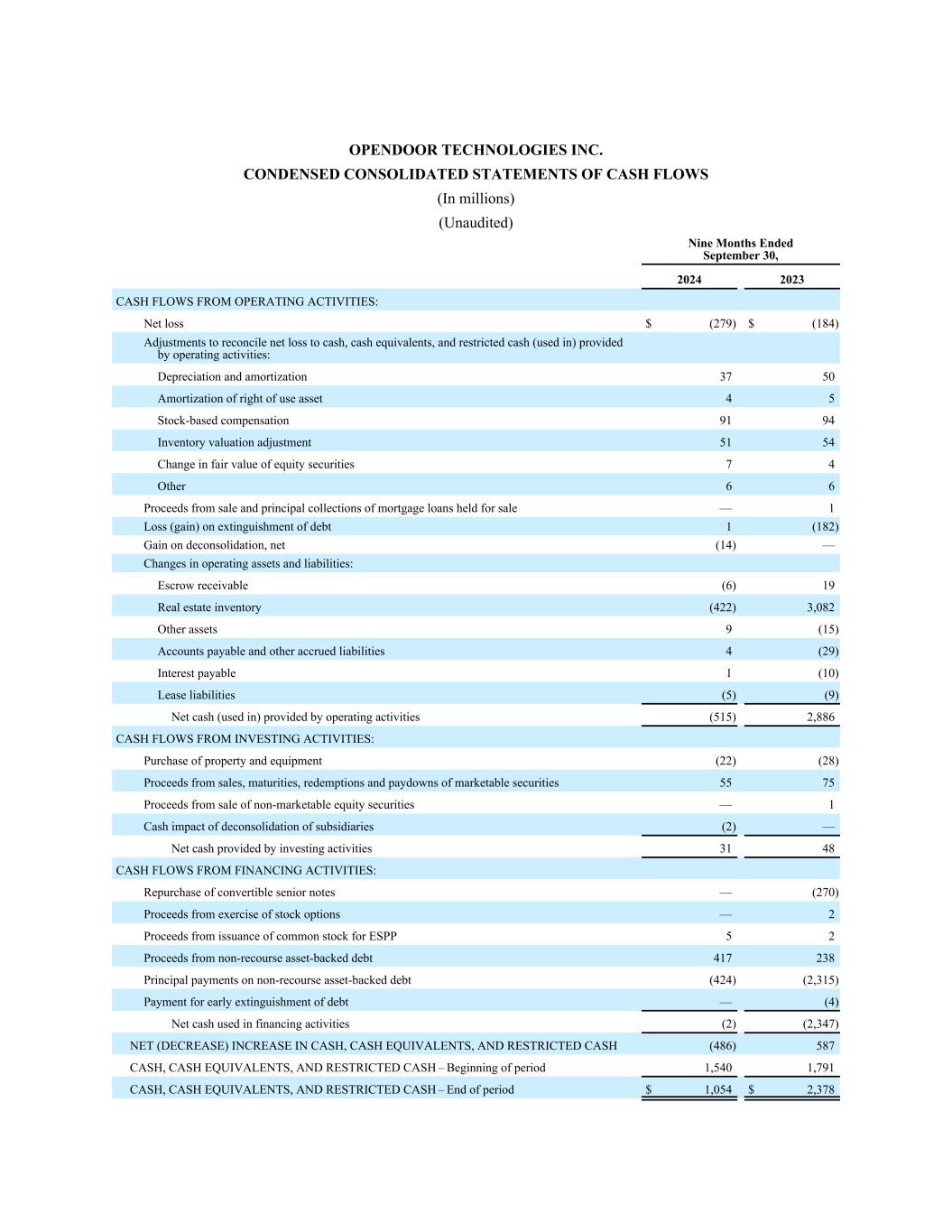

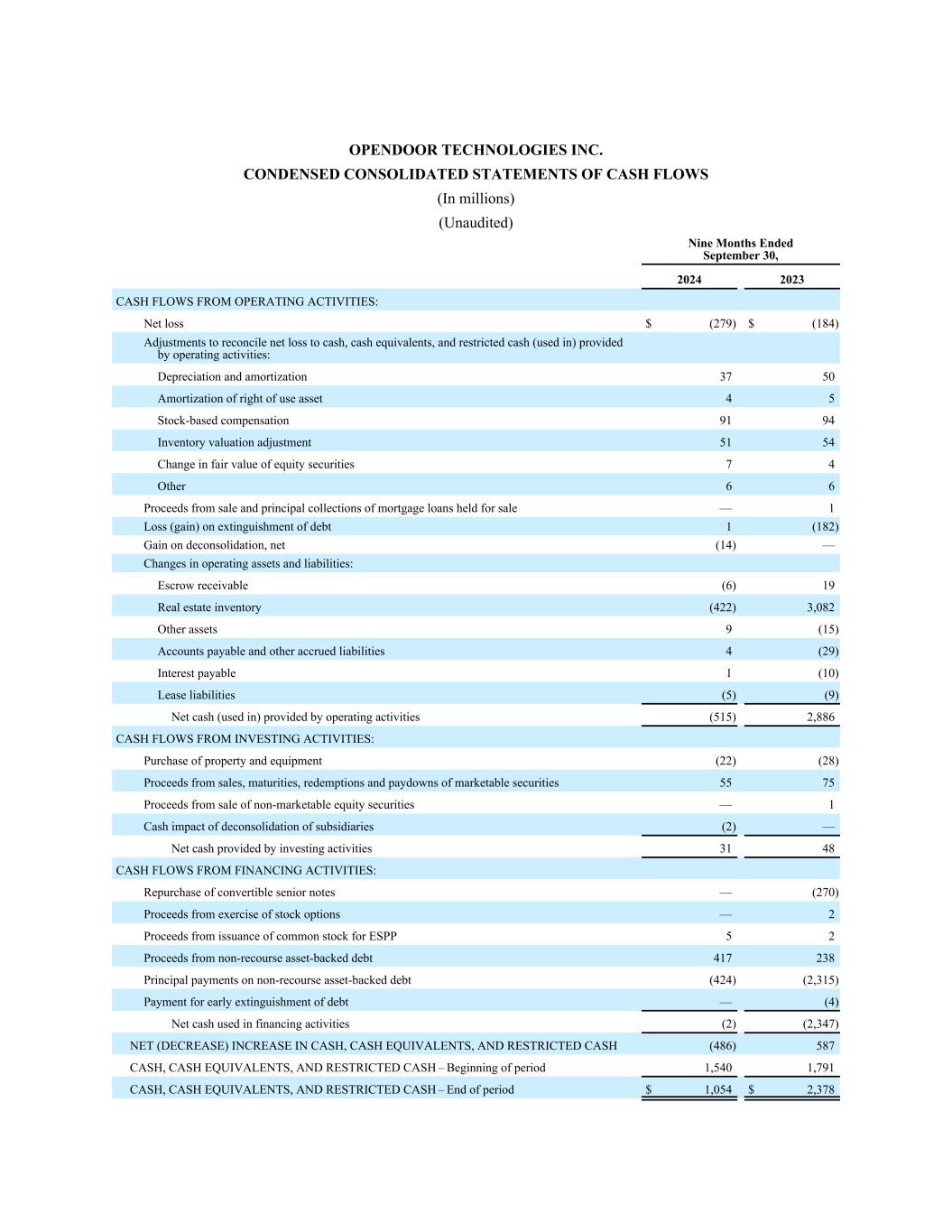

OPENDOOR TECHNOLOGIES INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) Nine Months Ended September 30, 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (279) $ (184) Adjustments to reconcile net loss to cash, cash equivalents, and restricted cash (used in) provided by operating activities: Depreciation and amortization 37 50 Amortization of right of use asset 4 5 Stock-based compensation 91 94 Inventory valuation adjustment 51 54 Change in fair value of equity securities 7 4 Other 6 6 Proceeds from sale and principal collections of mortgage loans held for sale — 1 Loss (gain) on extinguishment of debt 1 (182) Gain on deconsolidation, net (14) — Changes in operating assets and liabilities: Escrow receivable (6) 19 Real estate inventory (422) 3,082 Other assets 9 (15) Accounts payable and other accrued liabilities 4 (29) Interest payable 1 (10) Lease liabilities (5) (9) Net cash (used in) provided by operating activities (515) 2,886 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of property and equipment (22) (28) Proceeds from sales, maturities, redemptions and paydowns of marketable securities 55 75 Proceeds from sale of non-marketable equity securities — 1 Cash impact of deconsolidation of subsidiaries (2) — Net cash provided by investing activities 31 48 CASH FLOWS FROM FINANCING ACTIVITIES: Repurchase of convertible senior notes — (270) Proceeds from exercise of stock options — 2 Proceeds from issuance of common stock for ESPP 5 2 Proceeds from non-recourse asset-backed debt 417 238 Principal payments on non-recourse asset-backed debt (424) (2,315) Payment for early extinguishment of debt — (4) Net cash used in financing activities (2) (2,347) NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH (486) 587 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of period 1,540 1,791 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period $ 1,054 $ 2,378

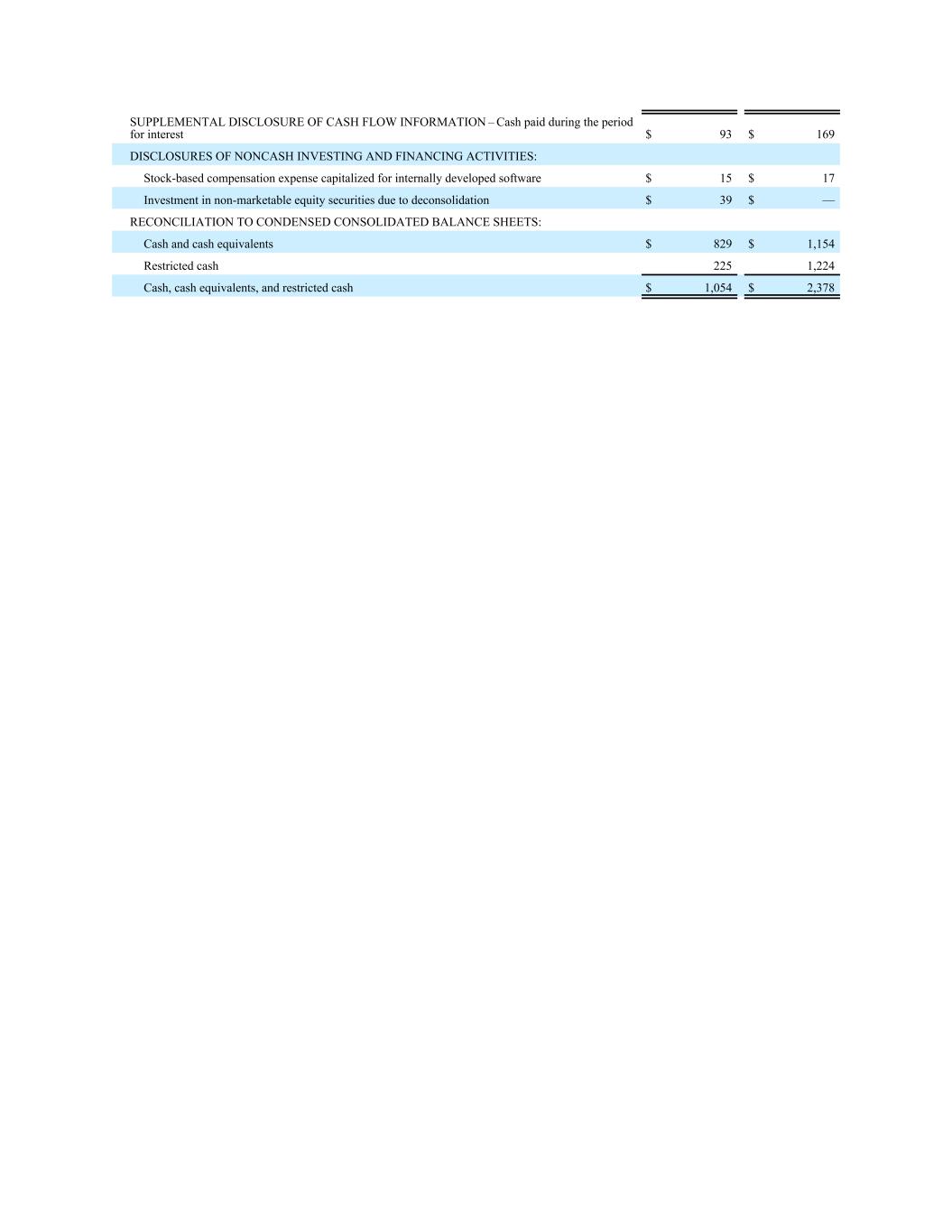

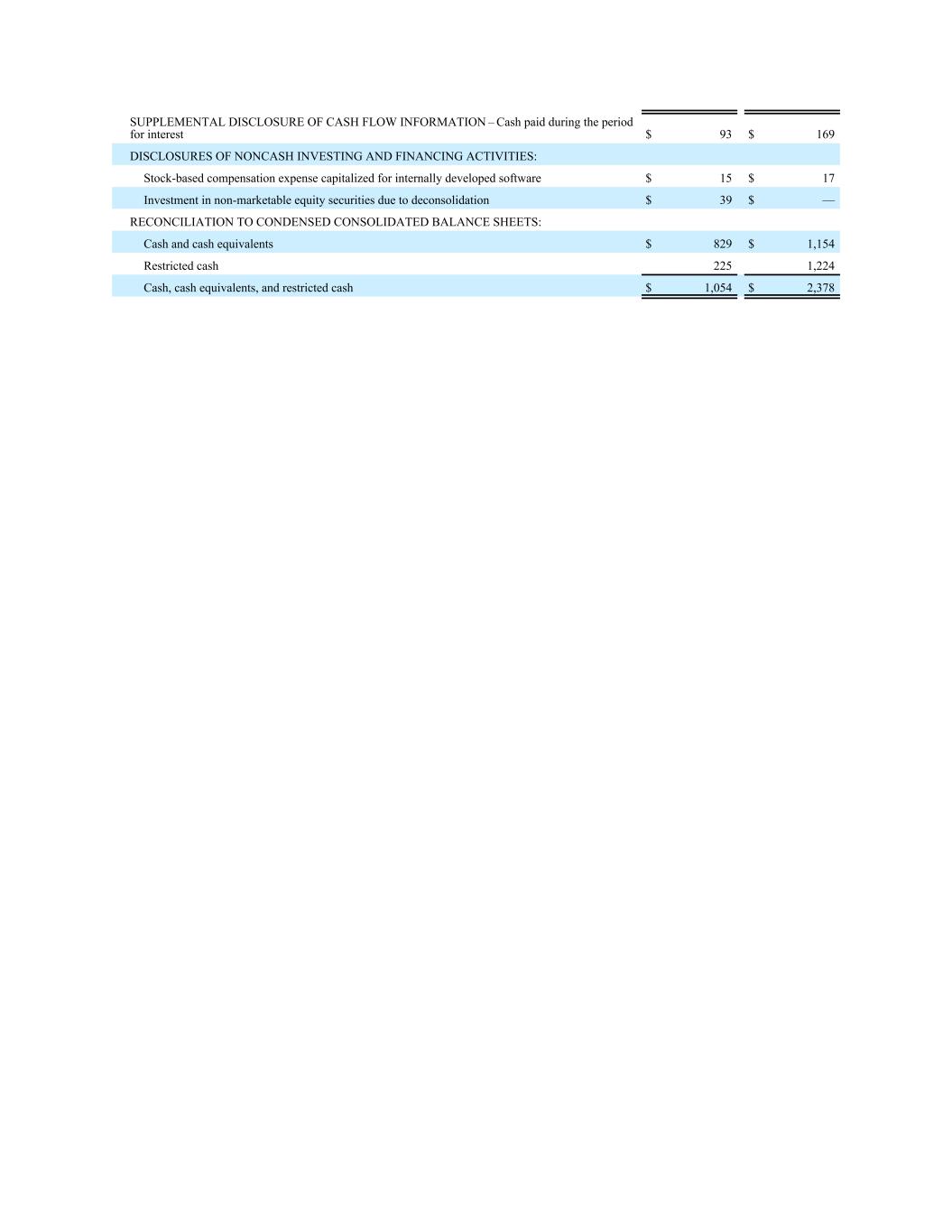

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during the period for interest $ 93 $ 169 DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES: Stock-based compensation expense capitalized for internally developed software $ 15 $ 17 Investment in non-marketable equity securities due to deconsolidation $ 39 $ — RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: Cash and cash equivalents $ 829 $ 1,154 Restricted cash 225 1,224 Cash, cash equivalents, and restricted cash $ 1,054 $ 2,378

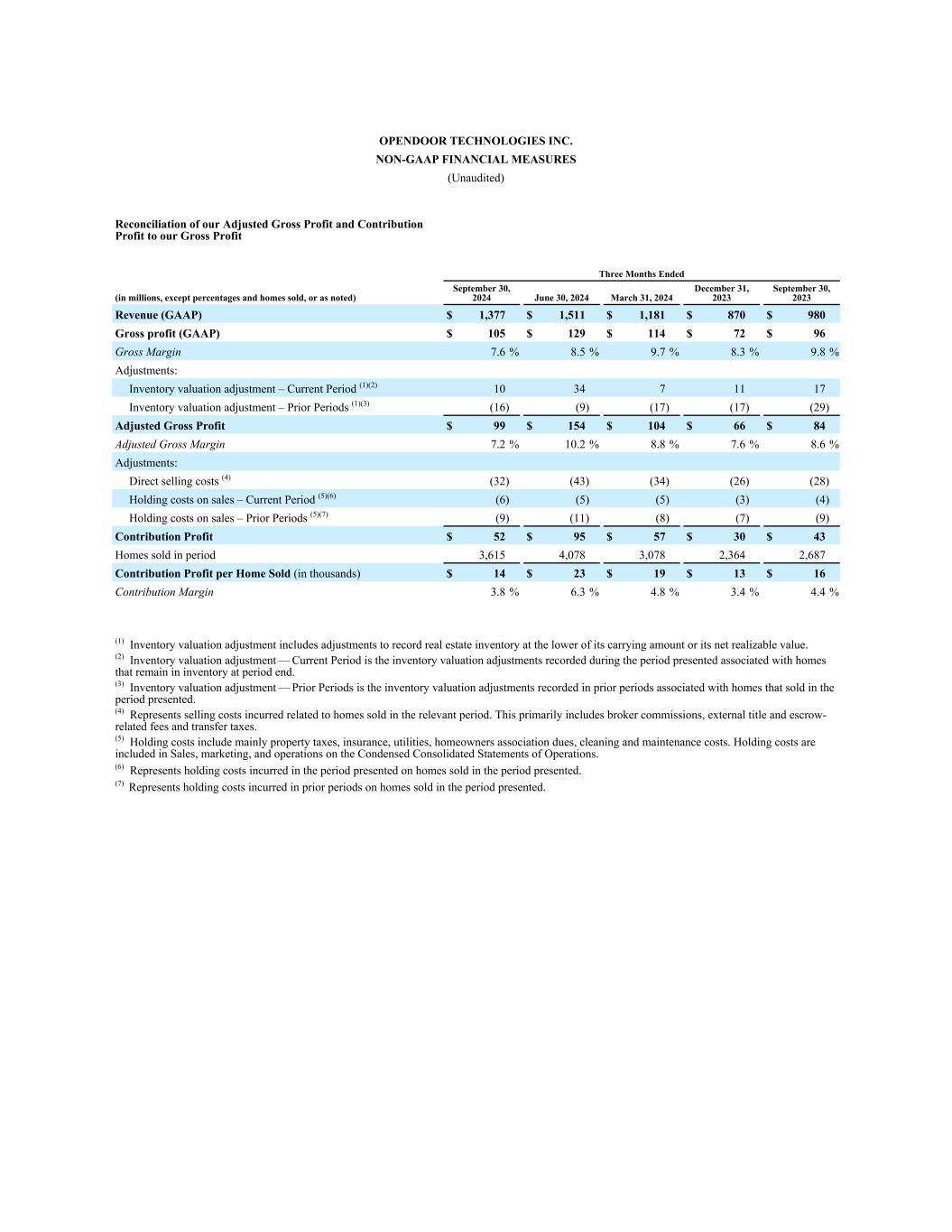

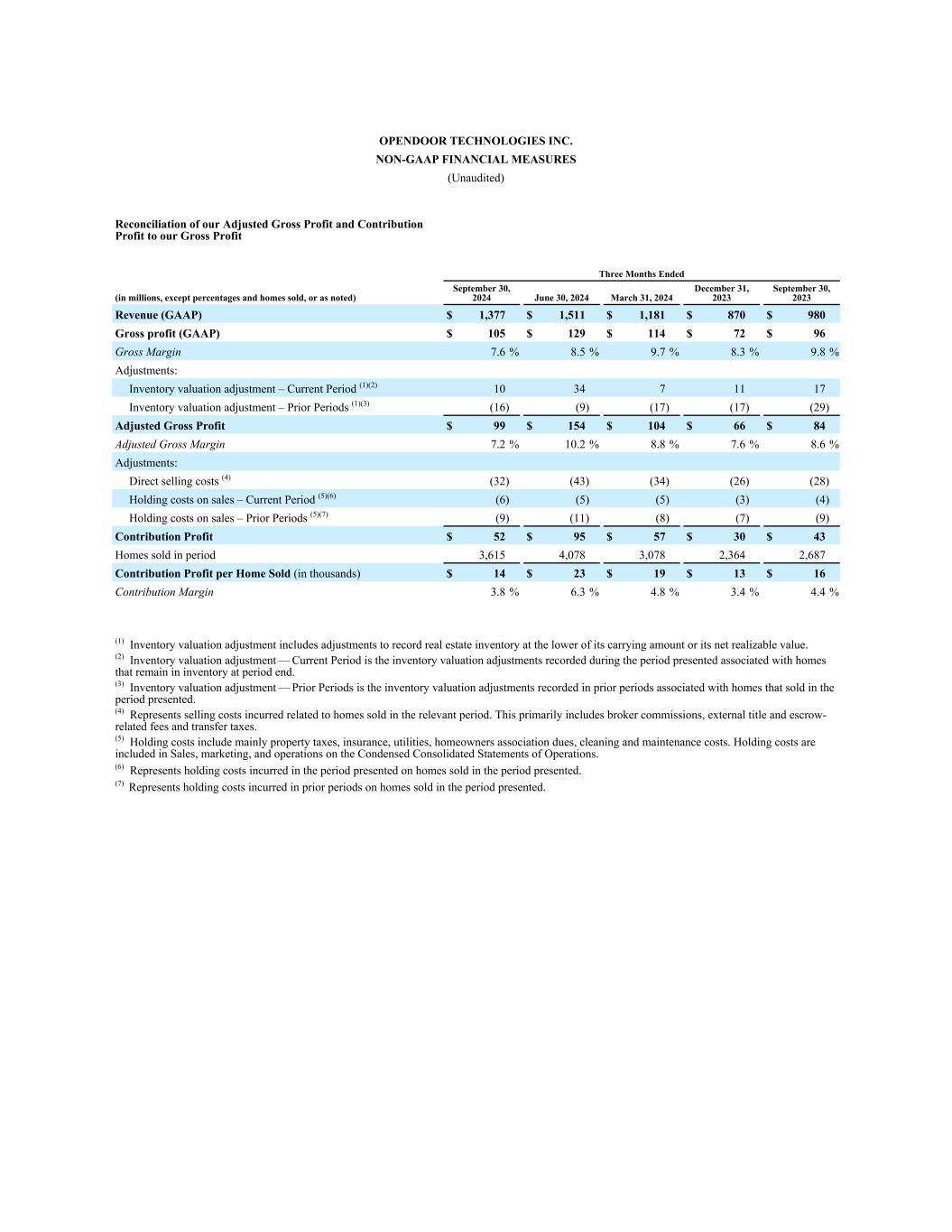

OPENDOOR TECHNOLOGIES INC. NON-GAAP FINANCIAL MEASURES (Unaudited) Reconciliation of our Adjusted Gross Profit and Contribution Profit to our Gross Profit Three Months Ended (in millions, except percentages and homes sold, or as noted) September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 Revenue (GAAP) $ 1,377 $ 1,511 $ 1,181 $ 870 $ 980 Gross profit (GAAP) $ 105 $ 129 $ 114 $ 72 $ 96 Gross Margin 7.6 % 8.5 % 9.7 % 8.3 % 9.8 % Adjustments: Inventory valuation adjustment – Current Period͏ (1)(2) 10 34 7 11 17 Inventory valuation adjustment – Prior Periods͏ (1)(3) (16) (9) (17) (17) (29) Adjusted Gross Profit $ 99 $ 154 $ 104 $ 66 $ 84 Adjusted Gross Margin 7.2 % 10.2 % 8.8 % 7.6 % 8.6 % Adjustments: Direct selling costs (4) (32) (43) (34) (26) (28) Holding costs on sales – Current Period͏ (5)(6) (6) (5) (5) (3) (4) Holding costs on sales – Prior Periods͏ (5)(7) (9) (11) (8) (7) (9) Contribution Profit $ 52 $ 95 $ 57 $ 30 $ 43 Homes sold in period 3,615 4,078 3,078 2,364 2,687 Contribution Profit per Home Sold (in thousands) $ 14 $ 23 $ 19 $ 13 $ 16 Contribution Margin 3.8 % 6.3 % 4.8 % 3.4 % 4.4 % (1) Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value. (2) Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end. (3) Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented. (4) Represents selling costs incurred related to homes sold in the relevant period. This primarily includes broker commissions, external title and escrow- related fees and transfer taxes. (5) Holding costs include mainly property taxes, insurance, utilities, homeowners association dues, cleaning and maintenance costs. Holding costs are included in Sales, marketing, and operations on the Condensed Consolidated Statements of Operations. (6) Represents holding costs incurred in the period presented on homes sold in the period presented. (7) Represents holding costs incurred in prior periods on homes sold in the period presented.

OPENDOOR TECHNOLOGIES INC. NON-GAAP FINANCIAL MEASURES (Unaudited) Reconciliation of our Adjusted Net Loss and Adjusted EBITDA to our Net Loss Three Months Ended (in millions, except percentages) September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 Revenue (GAAP) $ 1,377 $ 1,511 $ 1,181 $ 870 $ 980 Net loss (GAAP) $ (78) $ (92) $ (109) $ (91) $ (106) Adjustments: Stock-based compensation 25 33 33 32 31 Equity securities fair value adjustment(1) 3 2 2 (3) 11 Intangibles amortization expense(2) 1 1 2 2 2 Inventory valuation adjustment – Current Period͏(3)(4) 10 34 7 11 17 Inventory valuation adjustment — Prior Periods͏(3)(5) (16) (9) (17) (17) (29) Restructuring(6) — — — 4 — Loss (gain) on extinguishment of debt — 1 — (34) — Other(7) (15) (1) 2 (1) (1) Adjusted Net Loss $ (70) $ (31) $ (80) $ (97) $ (75) Adjustments: Depreciation and amortization, excluding amortization of intangibles 10 7 11 15 9 Property financing(8) 30 26 32 32 38 Other interest expense(9) 4 4 5 5 9 Interest income(10) (12) (12) (18) (24) (30) Income tax expense — 1 — — — Adjusted EBITDA $ (38) $ (5) $ (50) $ (69) $ (49) Adjusted EBITDA Margin (2.8) % (0.3) % (4.2) % (7.9) % (5.0) % (1) Represents the gains and losses on certain financial instruments, which are marked to fair value at the end of each period. (2) Represents amortization of acquisition-related intangible assets. The acquired intangible assets have useful lives ranging from 1 to 5 years and amortization is expected until the intangible assets are fully amortized. (3) Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value. (4) Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end. (5) Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented. (6) Restructuing costs consist primarily of severance and employee termination benefits and bonuses incurred in connection with employees' roles being eliminated. (7) Includes primarily gain on deconsolidation, net, sublease income, and income from equity method investments. (8) Includes interest expense on our non-recourse asset-backed debt facilities. (9) Includes amortization of debt issuance costs and loan origination fees, commitment fees, unused fees, other interest related costs on our asset-backed debt facilities, and interest expense related to the 2026 Notes outstanding. (10) Consists mainly of interest earned on cash, cash equivalents, restricted cash, and marketable securities.