- MP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MP Materials (MP) DEF 14ADefinitive proxy

Filed: 26 Apr 23, 6:10am

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 13, 2023

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of MP Materials Corp., a Delaware corporation (the “Company”), will be held on Tuesday, June 13, 2023, at 8:00 a.m. Pacific Time. To increase access for all of our stockholders, the Annual Meeting will be online and a completely virtual meeting of stockholders. You may attend, vote and submit questions during the Annual Meeting via the live audio webcast on the Internet at www.virtualshareholdermeeting.com/MP2023. You will not be able to attend the Annual Meeting in person nor will there be any physical location.

Only stockholders of record at the close of business on April 18, 2023, are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. We are committed to ensuring our stockholders have the same rights and opportunities to participate in the Annual Meeting as if it had been held in a physical location. As further described in the proxy materials for the Annual Meeting, you are entitled to attend the Annual Meeting via the live audio webcast on the Internet at www.virtualshareholdermeeting.com/MP2023. While we encourage you to vote in advance of the Annual Meeting, you may also vote and submit questions relating to meeting matters during the Annual Meeting (subject to time restrictions). You may vote by telephone, Internet or mail prior to the Annual Meeting.

To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/MP2023, you must enter the 16-digit control number found next to the box with the arrow included on your Notice of Internet Availability of Proxy Materials (the “Internet Notice”) or proxy card (if you receive a printed copy of the proxy materials).

The Annual Meeting will be held for the following purposes:

| 1. | To elect the two Class III directors named in this Proxy Statement to serve until the 2026 annual meeting of stockholders and until their respective successors are duly elected and qualified or until such director’s earlier death, resignation or removal; |

| 2. | To hold an advisory vote to approve the compensation paid to the Company’s named executive officers; |

| 3. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| 4. | To consider and transact such other business as may properly come before the Annual Meeting. |

On or about April 26, 2023, we began mailing to certain stockholders the Internet Notice containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) and how to vote online.

| By order of the Board of Directors, | ||||

| Las Vegas, Nevada |  | |||

| April 26, 2023 | Elliot D. Hoops General Counsel and Secretary | |||

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of the Company: The Internet Notice, Proxy Statement and Annual Report are available at www.proxyvote.com.

Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to access and review the proxy materials and submit your proxy or voting instructions as soon as possible. You may vote your proxy by telephone or Internet (instructions are on your proxy card, voter instruction form and the Internet Notice, as applicable) or, if you received your proxy materials by mail, by completing, signing and mailing the enclosed proxy card in the enclosed envelope.

TABLE OF CONTENTS

1

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains certain statements that are not historical facts and are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “will,” “target,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements are all subject to risks, uncertainties and changes in circumstances that could significantly affect the Company’s future financial results and business.

Accordingly, the Company cautions that the forward-looking statements contained herein are qualified by important factors that could cause actual results to differ materially from those reflected by such statements. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; changes in the price of rare earth oxide and continued demand for rare earth oxide; uncertainty of the projected financial information with respect to the Company; continued demand for NdFeB alloy and magnets which may decrease materially in the future; the effects of competition on the Company’s future business; risks related to the rollout of the Company’s business strategy, including Stage II and III, and the timing of achieving expected business milestones; risks related to the Company’s definitive long-term agreement with General Motors; the Company’s ability to produce and supply NdFeB alloy and magnets to third parties, including General Motors, which is subject to a number of uncertainties and contingencies; the impact of the global COVID-19 pandemic and other variants, on any of the foregoing risks; and those factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 under the heading “Risk Factors,” and other documents to be filed by the Company with the Securities and Exchange Commission. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. The Company does not intend to update publicly any forward-looking statements except as required by law.

1

2023 PROXY STATEMENT SUMMARY

This summary contains highlights about our Company and the upcoming 2023 Annual Meeting of Stockholders. This summary does not contain all of the information that you may wish to consider in advance of the meeting, and we encourage you to read the entire Proxy Statement before voting.

2023 Annual Meeting of Stockholders

| Date and Time: | Tuesday, June 13, 2023, at 8:00 a.m., Pacific Time | |

| Location: | Live audio webcast on the Internet at www.virtualshareholdermeeting.com/MP2023* | |

| Record Date: | April 18, 2023 |

| * | This year’s Annual Meeting will be conducted via live audio webcast. You may attend, ask questions relating to meeting matters (subject to time restrictions) and vote during the Annual Meeting via the live audio webcast on the Internet at the link above. You will not be able to attend the Annual Meeting in person. There will be no physical location for stockholders to attend. |

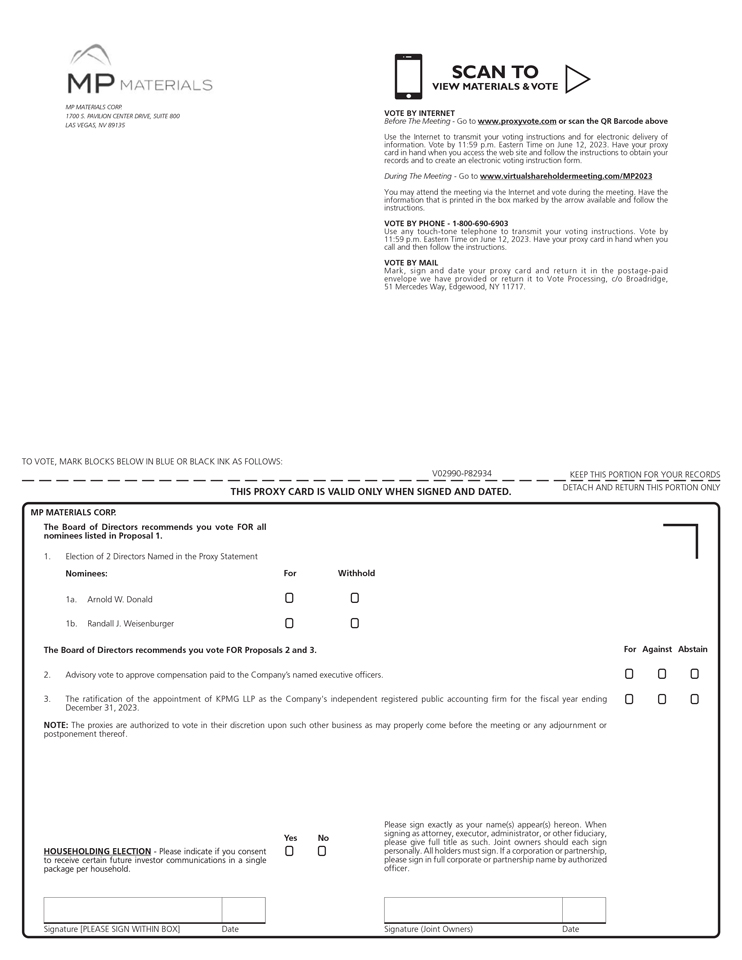

Voting Matters and Board Recommendations

| Proposal | Matter | Board Recommendation | ||

| 1 | Election of the Two Class III Directors named in this Proxy Statement (Arnold W. Donald and Randall J. Weisenburger) | FOR each Nominee | ||

| 2 | Advisory Vote to Approve Compensation Paid to the Company’s Named Executive Officers | FOR | ||

| 3 | Ratification of the Appointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2023 | FOR | ||

2

OVERVIEW OF MP MATERIALS CORP.

| • | Largest Producer of Rare Earth Materials in Western Hemisphere—The Company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility in California, North America’s only active and scaled rare earth production site. Separated rare earth elements are critical inputs to the world’s most powerful and efficient magnets found in electric vehicles, unmanned aerial vehicles, defense systems, wind turbines and various advanced technologies. |

| • | Restoring the full rare earth supply chain to the United States—The Company is developing U.S. metal, alloy and magnet manufacturing capacity to build these critical components for electrification domestically. The Company completed construction of the building shell for its first magnetics facility in Ft. Worth, Texas in 2022 and expects to begin delivery of rare earth alloy flake in 2023 and magnets in 2025. |

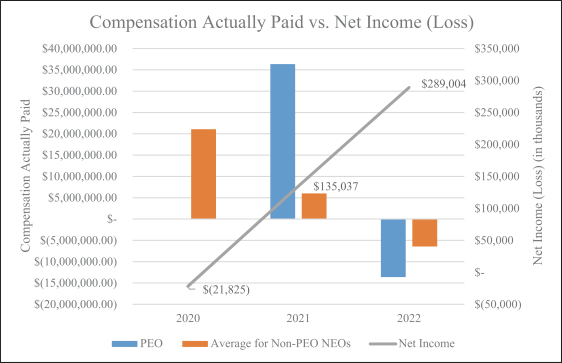

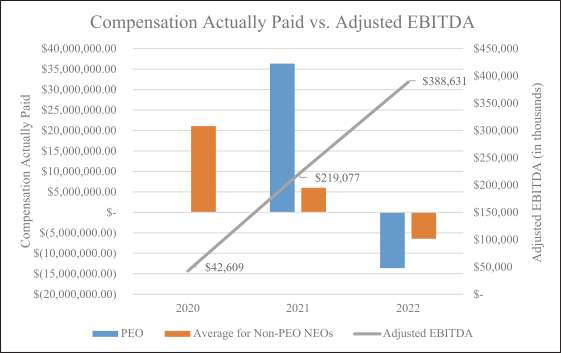

| • | Record Financial Results—The Company achieved record overall financial results in 2022. The Company generated record revenue of $527.5 million, up 59% year over year, net income of $289.0 million, up 114% year over year, and Adjusted EBITDA of $388.6 million, up 77% year over year. For a further discussion regarding Adjusted EBITDA and a reconciliation of net income to Adjusted EBITDA, please see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, beginning on page 34. |

| • | Record Production and Sales at Mountain Pass—In 2022, the Company achieved record financial performance by producing a record 42,499 metric tons of rare earth oxides (“REO”) in concentrate (the highest rare earth production in the United States and Mountain Pass history) and selling a record 43,198 metric tons of REO. |

| • | Began Commissioning of Stage II Separations Facilities—In 2022, the Company substantially completed construction and/or commissioning of several circuits of the Stage II separation facilities, including concentrate drying and roasting. |

| • | Signed Definitive Supply Agreement with General Motors—In 2022, the Company signed a definitive long-term agreement with General Motors to supply alloy and magnets powering 12+ Ultium Platform electric vehicle models. |

| • | Financial Discipline—As of December 31, 2022, the Company had $1.2 billion of cash, cash equivalents, and short-term investments and $492 million of net cash. |

3

1700 S. Pavilion Center Drive, Suite 800

Las Vegas, Nevada 89135

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

June 13, 2023

This Proxy Statement is being furnished to the stockholders of MP Materials Corp. (the “Company,” “MP Materials” or “MP”) in connection with the solicitation of proxies for the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 13, 2023 at 8:00 a.m., Pacific Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Internet Availability of Proxy Materials (the “Internet Notice”). The Annual Meeting will be held via live audio webcast on the Internet at www.virtualshareholdermeeting.com/MP2023. This solicitation is being made by the Board of Directors of the Company (the “Board of Directors” or the “Board”). You will be able to vote and submit questions online through the virtual meeting platform during the Annual Meeting.

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement, the Internet Notice, the accompanying proxy card, and the Annual Report on Form 10-K for the fiscal year ended December 31, 2022, available to our stockholders electronically via the Internet at www.proxyvote.com. On or about April 26, 2023, we will mail to our stockholders the Internet Notice containing instructions on how to access this Proxy Statement and vote online or by telephone. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them pursuant to the instructions provided in the Internet Notice. The Internet Notice instructs you on how to access and review all of the important information contained in this Proxy Statement.

4

THE INFORMATION PROVIDED IN THE “QUESTIONS AND ANSWERS” FORMAT BELOW IS FOR YOUR CONVENIENCE AND INCLUDES ONLY A SUMMARY OF CERTAIN INFORMATION CONTAINED IN THIS PROXY STATEMENT. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.

QUESTIONS AND ANSWERS

Why am I receiving these materials?

We are distributing our proxy materials because our Board is soliciting your proxy to vote at the Annual Meeting. This Proxy Statement summarizes the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares.

Pursuant to SEC rules, we are providing access to our proxy materials via the Internet at www.proxyvote.com. Accordingly, we are sending an Internet Notice to all of our stockholders as of the close of business on April 18, 2023 (the “Record Date”). All stockholders may access our proxy materials on the website referred to in the Internet Notice. You may also request to receive a printed set of the proxy materials. You can find instructions regarding how to access our proxy materials via the Internet and how to request a printed copy in the Internet Notice. Additionally, by following the instructions in the Internet Notice, you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe that these rules allow us to provide our stockholders with the information they need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

How can I attend the Annual Meeting?

Stockholders as of the Record Date (or their duly appointed proxy holder) may attend, vote and submit questions virtually during the Annual Meeting by logging in at http://www.virtualshareholdermeeting.com/MP2023. To log in, stockholders (or their authorized representatives) will need the control number provided on their proxy card, voting instruction form or Internet Notice. If you are not a stockholder or do not have a control number, you may still access the Annual Meeting as a guest, but you will not be able to submit questions or vote at the Annual Meeting. The Annual Meeting will begin promptly at 8:00 a.m., Pacific Time, on Tuesday, June 13, 2023. We encourage you to access the Annual Meeting prior to the start time. Online access will open at 7:45 a.m., Pacific Time, and you should allow ample time to log in to the Annual Meeting webcast and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. A recording of the Annual Meeting will be available at http://www.virtualshareholdermeeting.com/MP2023 for 90 days after the Annual Meeting.

Can I ask questions at the virtual Annual Meeting?

Stockholders as of the Record Date who attend and participate in our virtual Annual Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the meeting. We also encourage you to submit questions in advance of the meeting until 11:59 p.m. Eastern Time the day before the Annual Meeting by going to www.proxyvote.com and logging in with your control number. During the Annual Meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of procedure. The rules of procedure, including the types of questions that will be accepted, will be posted on the Annual Meeting website. To ensure the orderly conduct of the Annual Meeting, we encourage you to submit questions in advance. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Stockholders must have available their control number provided on their proxy card, voting instruction form or Internet Notice to ask questions during the meeting.

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual Annual Meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual shareholder meeting login page: http://www.virtualshareholdermeeting.com/MP2023.

5

What proposals will be voted on at the Annual Meeting?

Stockholders will vote on three proposals at the Annual Meeting:

| • | the election of the two Class III directors named in this Proxy Statement to serve until the 2026 annual meeting of stockholders and until their respective successors are duly elected and qualified or until such director’s earlier death, resignation or removal; |

| • | to hold an advisory vote to approve the compensation paid to the Company’s named executive officers; and |

| • | the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. |

We will also consider other business, if any, that properly comes before the Annual Meeting.

What happens if other business not discussed in this Proxy Statement comes before the Annual Meeting?

The Company does not know of any business to be presented at the Annual Meeting other than the proposals discussed in this Proxy Statement. If other business properly comes before the Annual Meeting under our Amended and Restated Certificate of Incorporation (the “Charter”), Amended and Restated Bylaws (the “Bylaws”), and rules established by the SEC, the proxies will use their discretion in casting all of the votes that they are entitled to cast.

How does the Board recommend that stockholders vote on the proposals?

Our Board recommends that stockholders vote “FOR” the election of the two director nominees named in this Proxy Statement, “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers, and “FOR” the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023.

Who is entitled to vote?

As of the Record Date, 177,620,546 shares of common stock, par value $0.0001 per share, were outstanding. Only holders of record of our common stock as of the Record Date will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Each stockholder is entitled to one vote for each share of our common stock held by such stockholder on the Record Date.

How do I vote in advance of the Annual Meeting?

If you are a holder of record of shares of common stock of the Company, you may direct your vote without attending the Annual Meeting by following the instructions on the Internet Notice or proxy card to vote by Internet or by telephone, or by signing, dating and mailing a proxy card.

If you hold your shares in street name via a broker, bank or other nominee, you may direct your vote without attending the Annual Meeting by signing, dating and mailing your voting instruction card. Internet or telephonic voting may also be available. Please see your voting instruction card provided by your broker, bank or other nominee for further details.

How do I vote during the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted if you are attending the Annual Meeting by entering the 16-digit control number found on your proxy card or Internet Notice when you log into the Annual Meeting at http://www.virtualshareholdermeeting.com/MP2023.

6

Shares held in street name through a brokerage account or by a broker, bank or other nominee may be voted at the Annual Meeting by entering the 16-digit control number found on your Internet Notice or voter instruction card when you log into the meeting at http://www.virtualshareholdermeeting.com/MP2023.

Even if you plan to attend the Annual Meeting, we recommend that you vote in advance, as described above under “How do I vote in advance of the Annual Meeting?” so that your vote will be counted if you are unable to attend the Annual Meeting.

Can I change my vote or revoke my proxy?

You may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

| • | delivering to the attention of the Secretary at the address on the first page of this Proxy Statement a written notice of revocation of your proxy; |

| • | delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or |

| • | attending the Annual Meeting and voting electronically, as indicated above under “How do I vote during the Annual Meeting?” Attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If your shares are held in the name of a bank, broker or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other nominee. Please note that if your shares are held of record by a bank, broker or other nominee, and you decide to attend and vote at the Annual Meeting, your vote at the Annual Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

What is a broker non-vote?

Brokers, banks or other nominees holding shares on behalf of a beneficial owner may vote those shares in their discretion on certain “routine” matters even if they do not receive timely voting instructions from the beneficial owner. With respect to “non-routine” matters, the broker, bank or other nominee is not permitted to vote shares for a beneficial owner without timely received voting instructions. The only routine matter to be presented at the Annual Meeting is the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal Three). Proposal One and Proposal Two are non-routine matters.

A broker non-vote occurs when a broker, bank or other nominee does not vote on a non-routine matter because the beneficial owner of such shares has not provided voting instructions with regard to such matter. A broker, bank or other nominee may exercise its discretionary voting authority on Proposal Three because Proposal Three is a routine matter, and as such there will be no broker non-votes on Proposal Three. Broker non-votes may occur as to Proposal One and Proposal Two, or any other non-routine matters that are properly presented at the Annual Meeting. Broker non-votes will have no impact on the voting results for Proposal One and Proposal Two, or any other non-routine matter that comes before the Annual Meeting.

What constitutes a quorum?

The presence at the Annual Meeting, either in person or by proxy, of holders of a majority of the aggregate number of shares of our issued and outstanding common stock entitled to vote thereat as of the Record Date shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining whether there is a quorum at the Annual Meeting. Your shares are counted as being present if you participate virtually at the Annual Meeting and cast your vote online during the Annual Meeting prior to the closing of the polls by visiting http://www.virtualshareholdermeeting.com/MP2023, or if you vote by proxy via the Internet, by telephone or by returning a properly executed and dated proxy card or voting instruction form by mail.

7

What vote is required to approve each matter to be considered at the Annual Meeting?

Proposal One: Election of the Two Class III Directors Named in this Proxy Statement.

Our Bylaws provide that the election of directors shall be determined by a plurality of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. This means that once a quorum has been established, the director nominees receiving the highest number of votes are elected up to the maximum number of directors to be elected at the Annual Meeting. Thus, the nominees receiving the highest number of votes at the Annual Meeting will be elected, even if these votes do not constitute a majority of the votes cast. A broker non-vote on Proposal One will not have any effect.

Proposal Two: Advisory Vote to Approve Compensation Paid to the Company’s Named Executive Officers.

The proposal to approve an advisory resolution regarding the compensation of the Company’s named executive officers requires approval by the affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote thereon with respect to such proposal. An abstention or a broker non-vote on Proposal Two will not have any effect.

Proposal Three: Ratification of the Appointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2023.

The proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year requires approval by the affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote thereon with respect to such proposal. An abstention on Proposal Three will have no effect. Brokers will have discretionary authority to vote on this proposal. Accordingly, there will not be any broker non-votes on Proposal Three.

What is the deadline for submitting a proxy?

To ensure that proxies are received in time to be counted prior to the Annual Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern Time on June 12, 2023, and proxies submitted by mail should be received by the close of business on June 12, 2023 (the day prior to the date of the Annual Meeting).

What does it mean if I receive more than one Internet Notice or proxy card?

If you hold your shares in more than one account, you will receive an Internet Notice or proxy card for each account. To ensure that all of your shares are voted, please complete, sign, date and return a proxy card for each account or use the Internet Notice or proxy card for each account to vote by Internet or by telephone.

How will my shares be voted if I return a blank proxy card or a blank voting instruction card?

If you are a holder of record of our common stock and you sign and return a proxy card or otherwise submit a proxy without giving specific voting instructions, your shares will be voted:

| • | “FOR” the election of the two Class III directors named in this Proxy Statement; |

| • | “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers; and |

| • | “FOR” the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. |

8

If you hold your shares in street name via a broker, bank or other nominee and do not provide the broker, bank or other nominee with voting instructions (including by signing and returning a blank voting instruction card), your shares:

| • | will be counted as present for purposes of establishing a quorum; |

| • | will be voted in accordance with the broker’s, bank’s or other nominee’s discretion on “routine” matters, which includes the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal Three); and |

| • | will not be counted in connection with the election of the two Class III director nominees named in this Proxy Statement (Proposal One) and the approval, on an advisory, of the compensation of the Company’s named executive officers (Proposal Two) or any other non-routine matters that are properly presented at the Annual Meeting. For each of these proposals, your shares will be treated as “broker non-votes.” A broker non-vote will have no impact on voting results for non-routine matters. |

Our Board knows of no matter to be presented at the Annual Meeting other than Proposals One, Two, and Three. If any other matters properly come before the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

Who is making this solicitation and who will pay the expenses?

This proxy solicitation is being made on behalf of our Board. The Company will pay the cost of soliciting proxies for the Annual Meeting. In addition to solicitation by mail, our employees may solicit proxies personally or by telephone or facsimile, but they will not receive additional compensation for these services. Arrangements may be made with brokerage houses, custodians, nominees and fiduciaries to send proxy materials to their principals and we may reimburse them for their expenses. We have retained D.F. King & Co., Inc. to assist in the solicitation of proxies at a cost that is not expected to exceed $17,500 plus reasonable out-of-pocket expenses.

Will a stockholder list be available for inspection?

A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by stockholders for any purpose germane to the meeting for 10 business days prior to the Annual Meeting, at MP Materials Corp., 1700 S. Pavilion Center Drive, Suite 800, Las Vegas, Nevada 89135, between the hours of 9:00 a.m. and 5:00 p.m. Pacific Time. The stockholder list will also be available to stockholders of record for examination during the Annual Meeting at http://www.virtualshareholdermeeting.com/MP2023. You will need the control number included on your Internet Notice, proxy card, or voting instruction form, or otherwise provided by your bank, broker or other nominee.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we send only one Proxy Statement, Internet Notice and one Annual Report to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge, by calling (866) 540-7095 or writing to Broadridge Householding Department, 51 Mercedes Way, Edgewood, NY 11717, and an additional copy of proxy materials will be promptly delivered to you. Similarly, if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future, you may also contact

9

Broadridge at the above telephone number or address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

When are stockholder proposals due for next year’s annual meeting of the stockholders?

Our stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of our Charter, our Bylaws, and the rules established by the SEC.

Under Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), if you want us to include a proposal in the proxy materials for our 2024 annual meeting of stockholders, we must receive the proposal at our executive offices at 1700 S. Pavilion Center Drive, Suite 800, Las Vegas, Nevada 89135, no later than December 28, 2023, provided, however, that if the date of our 2024 annual meeting of stockholders is more than 30 days before or after June 13, 2024, then the deadline to timely receive such material shall be a reasonable time before we begin to print and send our proxy materials.

Pursuant to our Bylaws, a stockholder proposal of business submitted outside of the process established in Rule 14a-8 and nominations of directors must be received no earlier than the close of business on February 14, 2024, and not later than the close of business on March 15, 2024, provided, however, that if the date of our 2024 annual meeting of stockholders is more than 30 days before June 13, 2024, or more than 60 days after June 13, 2024, then such notice must be delivered not earlier than the close of business on the 120th day before the meeting and not later than the later of (x) the close of business on the 90th day before the meeting or (y) the close of business on the 10th day following the day on which we first publicly announce the date of the 2024 annual meeting of stockholders. All proposals submitted outside of the process established in Rule 14a-8 and nominations of directors must comply with the requirements set forth in our Bylaws. In addition, stockholders who intend to solicit proxies in support of director nominees other than the Company’s director nominees must comply with the additional requirements of Rule 14a-19(b). Any proposal or nomination should be addressed to the attention of our Secretary, and we suggest that it be sent by certified mail, return receipt requested.

Whom can I contact for further information?

You may request additional copies, without charge, of this Proxy Statement and other proxy materials or ask questions about the Annual Meeting, the proposals, or the procedures for voting your shares by writing to our Secretary at 1700 S. Pavilion Center Drive, Suite 800, Las Vegas, Nevada 89135, or by emailing our Investor Relations Group at ir@mpmaterials.com.

10

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL ONE

ELECTION OF THE TWO CLASS III DIRECTORS NAMED IN THIS PROXY STATEMENT

General

In accordance with our Charter, we have a classified Board, with directors in three separate classes, Class I, Class II and Class III, with only one class of directors being elected in each year. At the Annual Meeting, our stockholders will vote on two Class III directors for a three-year term and until the election and qualification of their respective successors in office, or until such director’s earlier death, resignation or removal. Each of our other current directors will continue to serve as a director until the expiration of their respective terms and until the election and qualification of his or her successor, or until his or her earlier death, resignation or removal.

Our Board nominated Arnold W. Donald and Randall J. Weisenburger for re-election to our Board as Class III directors at the Annual Meeting. Messrs. Donald and Weisenburger currently serve on our Board and have consented to be named in this Proxy Statement and have agreed to serve, if elected, until the 2026 annual meeting of stockholders and until their successors have been duly elected and qualified or until their earlier death, resignation or removal. There are no family relationships between or among any of our executive officers, nominees, or continuing directors. Daniel Gold was not nominated for re-election as a Class III director and his term as a director will expire at the Annual Meeting. The size of the Board will be reduced from eight to seven members effective immediately upon the occurrence of the Annual Meeting.

Directors

The following table sets forth information with respect to our director nominees for election at the Annual Meeting and continuing directors:

| Name | Independent | Age | Director Since | |||||||

Class III Directors—Nominees for Election at the Annual Meeting | ||||||||||

Arnold W. Donald | Yes | 68 | 2023 | |||||||

Randall J. Weisenburger | Yes | 64 | 2020 | |||||||

Class I Directors—Term Expiring at the 2024 Annual Meeting | ||||||||||

James H. Litinsky | No | 45 | 2020 | |||||||

Andrew A. McKnight | Yes | 45 | 2020 | |||||||

Class II Directors—Term Expiring at the 2025 Annual Meeting | ||||||||||

Connie K. Duckworth | Yes | 68 | 2020 | |||||||

Maryanne R. Lavan | Yes | 63 | 2020 | |||||||

General (Retired) Richard B. Myers | Yes | 81 | 2020 | |||||||

11

Summary of Director Experience and Qualifications

The matrix below summarizes what our Board believes are desirable types of experience, qualifications, attributes and skills possessed by one or more of the Company’s directors because of their particular relevance to the Company’s business and strategy. While all of these were considered by the Board in connection with this year’s director nomination process, the following matrix does not encompass all experience, qualifications, attributes or skills of our directors.

| Donald | Duckworth | Lavan | Litinsky | McKnight | Myers | Weisenburger | ||||||||

Qualification and Attributes | ||||||||||||||

Accounting/Auditing | ● | ● | ● | ● | ● | ● | ● | |||||||

Business Operations | ● | ● | ● | ● | ● | ● | ● | |||||||

Capital Management | ● | ● | ● | ● | ● | ● | ● | |||||||

Corporate Governance Leadership | ● | ● | ● | ● | ● | ● | ● | |||||||

Financial Expertise/Literacy | ● | ● | ● | ● | ● | ● | ● | |||||||

Independence | ● | ● | ● | ● | ● | ● | ||||||||

Industry Experience | ● | ● | ● | ● | ||||||||||

International | ● | ● | ● | ● | ● | ● | ● | |||||||

Investment Markets | ● | ● | ● | ● | ● | ● | ● | |||||||

Other Recent Public Board Experience | ● | ● | ● | ● | ● | ● | ||||||||

Public Company Executive Experience | ● | ● | ● | ● | ● | |||||||||

Regulatory/Risk Management | ● | ● | ● | ● | ● | ● | ● | |||||||

Government, Law or Military | ● | ● | ● | ● | ● | |||||||||

Demographic Background | ||||||||||||||

MP Board Tenure (in Years) | Less than 1 | 2 | 2 | 2 | 2 | 2 | 2 | |||||||

Age (Years) | 68 | 68 | 63 | 45 | 45 | 81 | 64 | |||||||

Gender (Male/Female) | M | F | F | M | M | M | M | |||||||

Race/Ethnicity | ||||||||||||||

African American | ● | |||||||||||||

White/Caucasian | ● | ● | ● | ● | ● | ● | ||||||||

Biographies of our Board Members

Set forth below are the names and certain information about our Board of Directors and our Board Nominees, Arnold W. Donald and Randall J. Weisenburger.

Board Nominees—Class III Directors

Arnold W. Donald currently serves as a director of Bank of America Corporation (NYSE: BAC) since 2013 and Salesforce, Inc. (NYSE: CRM) since January 2023. He was President and Chief Executive Officer of Carnival Corporation (NYSE: CCL) and Carnival plc, a cruise and vacation company, from July 2013 to August 2022, and served as a director from 2001 to 2022. From November 2010 to June 2012, Mr. Donald served as President and Chief Executive Officer of The Executive Leadership Council, a nonprofit organization that seeks to support, develop, and increase the number of African American corporate executives globally. In addition, he served as President and Chief Executive Officer of the Juvenile Diabetes Research Foundation International from January 2006 to February 2008. He also served as the Chairman and Chief Executive Officer of Merisant from 2000 to 2003, a privately held global manufacturer of tabletop sweeteners, and remained as Chairman until 2005. In addition, Mr. Donald was a member of the board of directors of Crown Holdings, Inc. (NASDAQ: CCK) from 1999 to 2019. Further, Mr. Donald held several senior leadership positions with global responsibilities at Monsanto over a more than 20-year tenure, including President of its Agricultural Group and President of its Nutrition and Consumer Sector. Mr. Donald earned a B.A. in economics from Carleton College, a B.S. in mechanical engineering from Washington University in St. Louis, and an M.B.A. from The University of Chicago Booth School of Business. Mr. Donald brings to our Board extensive experience in regulated, consumer, retail, and distribution businesses both as an executive and as a director of public companies.

12

Randall J. Weisenburger was the Executive Vice President and Chief Financial Officer of Omnicom Group Inc. (NYSE: OMC), a global media, marketing and corporate communications holding company, from 1998 to 2014. In 2015, Mr. Weisenburger formed Mile 26 Capital. Mr. Weisenburger was a founding member of Wasserstein Perella, and, from 1993 to 1998, was President and Chief Executive Officer of the firm’s merchant banking subsidiary, Wasserstein & Co. He also held various roles within the firm’s portfolio of investment companies including Co-Chairman of Collins & Aikman Corp., CEO of Wickes Manufacturing, Vice Chairman of Maybelline Inc., and Chairman of American Law Media. Before Wasserstein Perella, Mr. Weisenburger was a member of the First Boston Corporation. Mr. Weisenburger currently serves as the Presiding Director and Senior Independent Director of Carnival Corporation (NYSE: CCL), a cruise and vacation company. He is also a director of Valero Energy Corporation (NYSE: VLO), an oil and gas company, and a director of Corsair Gaming Inc. (NASDAQ: CRSR), a computer gaming company. Mr. Weisenburger holds an M.B.A. from the Wharton School of the University of Pennsylvania, where he was named the Henry Ford Scholar, and a B.A. in Finance and Accounting from Virginia Polytechnic Institute and State University (Virginia Tech). Mr. Weisenburger brings to our Board extensive experience in business leadership, capital markets, finance and compliance, organizational leadership and public company governance.

Continuing Directors—Class I Directors

James H. Litinsky is the Founder, Chairman, and Chief Executive Officer of MP Materials Corp. (NYSE: MP). Mr. Litinsky is also the Founder, Chief Executive Officer, and Chief Investment Officer of JHL Capital Group LLC, an alternative investment management firm. Prior to founding JHL in 2006, he was a member of the Drawbridge Special Opportunities Fund at Fortress Investment Group LLC, a global investment management firm. Prior to Fortress, he was a director of Finance at Omnicom Group, Inc., and worked as a merchant banker at Allen & Company. Mr. Litinsky received a B.A. in Economics from Yale University, cum laude, and a J.D. and M.B.A. from the Northwestern University School of Law and the Kellogg School of Management. He was admitted to the Illinois Bar. Mr. Litinsky currently serves on the board of the Shirley Ryan AbilityLab and the Museum of Contemporary Art Chicago. As Founder, Chairman, and CEO of the Company, Mr. Litinsky brings to our Board an extensive understanding of the Company’s business and industry. In addition, Mr. Litinsky brings to our Board valuable business, leadership, and management insights into the strategic direction and growth trajectory of the Company.

Andrew A. McKnight is a Managing Partner of the Credit Funds Business of Fortress Investment Group LLC. Mr. McKnight heads the liquid strategies and serves on the investment committee for the Credit Funds and is a member of the Management Committee of Fortress. Mr. McKnight is also the Co-CIO of the Drawbridge Special Opportunities Fund, the Fortress Lending Funds and Fortress Credit Opportunities Funds. Mr. McKnight previously served on the board of directors of Mosaic Acquisition Corp. from 2017 to 2020; HRG Group, Inc. from 2016 to 2018; and Fidelity & Guaranty Life Assurance Company in 2017. Prior to joining Fortress in February 2005, Mr. McKnight worked at Fir Tree Partners where he was responsible for analyzing and trading high yield and convertible bonds, bank debt, derivatives and equities for the value-based hedge fund. Prior to Fir Tree, Mr. McKnight worked at Goldman, Sachs & Co. in Leveraged Finance and the Distressed Bank Debt trading group. Mr. McKnight serves on the Board for the Center for Politics at the University of Virginia, the Board of Advisors for SMU’s Cox School of Business Alternative Asset Management Center and the Board of Center for New American Security. In addition, Mr. McKnight is a member of the Council on Foreign Relations. Mr. McKnight received a B.A. in Economics from the University of Virginia. Mr. McKnight brings to our Board extensive experience in management, finance and investments and executive leadership skills.

Continuing Directors—Class II Directors

Connie K. Duckworth was a Partner and Managing Director of Goldman Sachs, a multinational investment bank and financial services company, until 2000, when she retired following a 20-year career. Ms. Duckworth was named Partner in 1990, the first female sales and trading partner in Goldman Sachs’ history. After Goldman Sachs, Ms. Duckworth founded a social enterprise ARZU, Inc., in 2004 to empower destitute

13

women weavers in rural Afghanistan and served pro bono as its Chairman and CEO until its merger with UK based Turquoise Mountain in 2019. Since 2010, Ms. Duckworth has served as a director of Steelcase Inc. (NYSE: SCS), a manufacturer of commercial furniture and related products. Previously, she served as a trustee of Equity Residential (NYSE: EQR), a Maryland real estate investment trust, until June 2022, and served on the boards of directors of Northwestern Mutual, Russell Investment Group, Nuveen Investments, Smurfit Stone Container Corporation, and DNP Select Income Fund. In her philanthropic work, Ms. Duckworth is a trustee of the University of Pennsylvania and chairs the International Board of Advisors of the University of Texas at Austin. She serves on the board of Northshore-Edward-Elmurst Health, in Evanston, Illinois, where she was the first and only female Chairman of the Board. She is a founding member of the U.S.-Afghan Women’s Council in Washington, D.C., and a member of the Bush Institute’s Women’s Initiative Policy Advisory Council in Dallas. The recipient of numerous awards for leadership, social impact and innovation, Ms. Duckworth holds an M.B.A. from the Wharton School and a B.A. from the University of Texas at Austin. Ms. Duckworth brings to our Board executive leadership experience in the financial services industry and as a non-profit entrepreneur. In addition, Ms. Duckworth brings to our Board insight into the Board’s roles and responsibilities, particularly in the areas of environmental, social, and governance matters, gained from her extensive experience as a public company board member.

Maryanne R. Lavan is the Senior Vice President, General Counsel, and Corporate Secretary of Lockheed Martin Corporation (NYSE: LMT), a global security and aerospace company. In this role, she is responsible for the legal affairs and law department of Lockheed Martin, including serving as counsel to its senior leadership and board of directors. She joined Lockheed Martin in 1990 and previously served as Vice President of Corporate Internal Audit, providing independent assessments of governance, internal controls, and risk management. Ms. Lavan graduated magna cum laude from the State University of New York at Albany with a Bachelor of Science degree. She received her J.D. from the Washington College of Law, American University. Ms. Lavan is a member of the Public Contract Law Section of the American Bar Association. She serves on the governing bodies for the Leadership Council on Legal Diversity, Equal Justice Works, Council for Court Excellence, University at Albany Foundation, Collegiate Directions Inc., and The Potomac School. Ms. Lavan brings to our Board extensive expertise in legal issues, public company governance, and matters relating to internal controls and risk management.

Retired U.S. Air Force General Richard B. Myers loyally served the United States for 40 years before retiring as a four-star general. He served as the 15th Chairman of the Joint Chiefs of Staff from 2001 until his retirement in 2005. In this capacity, he was the highest-ranking officer in the United States military and served as the principal military advisor to the President, Secretary of Defense, and National Security Council. From 2016 to February 2022, General Myers was the President of Kansas State University. He currently serves on the Board of Regents of the Uniformed Services University of the Health Sciences. General Myers previously served on the board of directors of Deere & Co. (NYSE: DE) from 2006 to 2015; Northrop Grumman Corporation (NYSE: NOC) from 2006 to 2017; United Technologies Corporation from 2006 to 2017; and Aon PLC (NYSE: AON) from 2006 until 2022. He was also the Colin L. Powell Chair of National Security, Leadership, Character, and Ethics at the National Defense University and was chairman of the board of directors of the United Service Organization’s World Board of Governors. In addition, he serves on the board of trustees of non-profit organization Fisher House Foundation and served on the board of directors of MRIGlobal. General Myers brings to our Board diverse leadership experience and consensus building skills as well as invaluable insights regarding supply chains, national security, and geopolitics. In addition, General Myers brings to our Board extensive public company governance expertise and board experience.

Recommendation of Our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE TWO CLASS III NOMINEES NAMED ABOVE.

14

CORPORATE GOVERNANCE

Classified Board of Directors

Our Board is divided into three classes of directors that serve staggered three-year terms. At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the same class whose term is then expiring. As a result, only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. The size of the Board will be reduced from eight to seven members effective immediately upon the occurrence of the Annual Meeting.

Each director’s term continues until its expiration and until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Our Charter and Bylaws authorize only our Board to fill vacancies on our Board. The Board intends that any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. This classification of our Board may have the effect of delaying or preventing changes in control of our Company.

Director Independence

Our common stock is listed on the New York Stock Exchange (the “NYSE”). Under the rules of the NYSE, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the rules of the NYSE, a director will only qualify as an “independent director” if the director has no material relationship with the listed company, broadly taking into consideration all relevant facts and circumstances.

Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

At least annually, our Board evaluates all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our Board will make an annual determination of whether each director is independent within the meaning of the independence standards of the NYSE and the SEC.

Our Board has determined that each of Messrs. Donald, McKnight, Weisenburger and Gold, General Myers and Mses. Lavan and Duckworth qualifies as an “independent director” as defined under the rules of the NYSE. Mr. Litinsky, who serves as our Chairman and CEO, is not independent. Our Board also has determined that Mr. Weisenburger, and Mses. Duckworth and Lavan, who comprise our Audit Committee, Messrs. McKnight, Donald, Weisenburger and Gold, who comprise our Compensation Committee, and Mses. Duckworth and Lavan, and General Myers, who comprise our Nominating and Corporate Governance Committee, satisfy the independence standards for such committees established by the SEC and the rules of the NYSE, as applicable. In making such determinations, our Board considered the relationships that each such non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director and any institutional stockholder with which he or she is affiliated.

15

Board Leadership Structure

Our Corporate Governance Guidelines provide the Board will determine the Board leadership structure in a manner that it determines to be in the best interests of the Company and its stockholders. The Chairman of the Board and CEO positions may, but need not be, filled by the same individual.

At this time, the offices of the Chairman of the Board and the CEO are combined, with Mr. Litinsky serving as the Company’s Chairman and CEO. The Board believes that combining the Chairman and CEO positions is the

appropriate corporate governance structure for the Company at this time because it most effectively utilizes Mr. Litinsky’s extensive experience and knowledge of the Company and the industry, and provides for the most efficient leadership of our Board and Company. Board governance is balanced with a strong Presiding Director position, which is designed to maintain the Board’s firm independent oversight.

As Presiding Director, Mr. Weisenburger has the following duties:

| • | serve as a liaison between the Chairman of the Board and the independent directors; |

| • | lead any executive sessions of the Board; |

| • | preside at, and chair, Board meetings and meetings of stockholders at which the Chairman of the Board is absent; |

| • | serve as temporary Chairperson of the Board in the event of the inability of the Chairperson of the Board to fulfill his/her role due to crisis or other event or circumstance which would make leadership by existing management inappropriate or ineffective, in which case the Presiding Director shall have the authority to convene meetings of the Board; |

| • | collaborate with the Chairman of the Board on the frequency of Board meetings and any need for special Board meetings, if required; |

| • | have authority to call meetings of the independent directors; |

| • | lead the Board in discussions concerning the CEO’s performance and CEO succession; |

| • | together with the Chairman of the Board, approve meeting agendas and meeting schedules for the Board; |

| • | together with the Chairman of the Board, approve information sent to the Board, as necessary; |

| • | serve as a liaison for stockholders who request direct communications with the Board; |

| • | recommend to the Board, in concert with the chairpersons of the respective Board committees, the retention of consultants and advisors who directly report to the Board, including such independent legal, financial or other advisors as he or she deems appropriate, without consulting or obtaining the advance authorization of any officer of the Company; and |

| • | perform such other duties and responsibilities as requested by the Board. |

Role of the Board in Risk Oversight

The Board is responsible for the oversight of risk, while management is responsible for the day-to-day management of risk. The Board, directly and through its committees, carries out its oversight role by regularly reviewing and discussing with management the risks inherent in the operation of our business and applicable risk mitigation efforts. Management meets regularly to discuss the Company’s business strategies, challenges, risks and opportunities and reviews those items with the Board at regularly scheduled meetings. The Compensation Committee is responsible for overseeing the management of risks relating to our compensation plans and arrangements, including whether the Company’s incentive compensation plans encourage excessive or inappropriate risk taking. The Audit Committee is responsible for overseeing our risk assessment and management processes related to, among other things, cybersecurity, environmental, social and governance (“ESG”) matters, our financial reports and record-keeping, major

16

litigation and financial risk exposures and the steps management has taken to monitor and control such exposures. The Nominating and Corporate Governance Committee is responsible for risk oversight associated with corporate governance practices and the composition of our Board and its committees.

Evaluations of the Board of Directors

Under our Corporate Governance Guidelines, the Board evaluates its performance and the performance of its committees and individual directors on an annual basis through an evaluation process administered by our Nominating and Corporate Governance Committee. The Board discusses each evaluation to determine what, if any, actions should be taken to improve the effectiveness of the Board or any committee thereof or of the directors.

Board and Committee Meetings and Attendance

Directors are expected to make every effort to attend all meetings of the Board and all meetings of the committees on which they serve. In 2022, our Board had four Board meetings. During 2022, each member of our Board attended at least 75% of all Board and relevant Committee meetings held during the period in which such director served. Our independent directors hold regularly scheduled executive sessions without our management present. These executive sessions of independent directors are chaired by our Presiding Director.

Board Attendance at Annual Stockholders’ Meeting

Each director is encouraged and generally expected to attend the Company’s annual meeting of stockholders. Each of our directors (who was then serving as a director) attended the Company’s 2022 Annual Meeting of Stockholders.

Board Committees

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and responsibilities of each of the committees of our Board are described below. Copies of the charters of the committees, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are available on the investor relations page of our website at https://investors.mpmaterials.com/governance/governance-documents/default.aspx. The information in or accessible through our website is not incorporated into, and is not considered part of, this Proxy Statement. Members serve on these committees until their resignation or until otherwise determined by our Board. Our Board may establish other committees as it deems necessary or appropriate from time to time.

The following table provides membership and meeting information for 2022 for each of these committees of our Board with directors marked with an asterisk (*) identified as committee chair:

Name** | Audit | Compensation | Nominating and Corporate Governance | |||

Connie K. Duckworth | X | — | X* | |||

Daniel Gold | — | X | — | |||

James H. Litinsky | — | — | — | |||

Maryanne R. Lavan | X | — | X | |||

Andrew A. McKnight | — | X* | — | |||

General (Retired) Richard B. Myers | — | — | X | |||

Randall J. Weisenburger | X* | X | — | |||

Total meetings held in 2022 | 5 | 4 | 3 |

| ** | Arnold W. Donald joined the Company’s Board of Directors and the Compensation Committee on March 8, 2023. |

17

Audit Committee

Randall J. Weisenburger, Connie K. Duckworth, and Maryanne R. Lavan are the members of the Audit Committee. Mr. Weisenburger is the Chairman of the Audit Committee. Each proposed member of the Audit Committee qualifies as an independent director under the NYSE corporate governance standards and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board has determined that Mr. Weisenburger qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K, and that each of the members is financially literate, as defined under the rules of the NYSE. Under its charter, the functions of the Audit Committee include, among other things:

| • | appointment, compensation, retention, replacement, and oversight of the work of, and termination of, the independent auditor and any other independent registered public accounting firm engaged by the Company, and resolution of disagreements between management and the independent auditor and any such other firm regarding accounting and financial reporting; |

| • | pre-approval of all audit and permitted non-audit and tax services to be provided by the independent auditors or any other registered public accounting firm engaged by the Company; |

| • | setting clear hiring policies for employees or former employees of the independent registered public accounting firm; |

| • | obtaining and reviewing a report, at least annually, from the independent auditors describing (i) the independent auditor’s internal quality control procedures; (ii) any material issues raised by the most recent internal quality control review, or peer review, of the audit firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm and any steps taken to deal with such issues, (iii) all relationships between the independent auditor and the Company; and (iv) any other information pertaining to the independence of the independent auditor; |

| • | reviewing and approving any related person transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC; |

| • | discussing with management and the independent auditor, as appropriate, any audit problems or difficulties and management’s response, and the Company’s risk assessment and risk management policies, including the Company’s major financial risk exposure and steps taken by management to monitor and mitigate such exposure; |

| • | reviewing the Company’s financial reporting and accounting standards and principles, significant changes in such standards or principles or in their application and the key accounting decisions affecting the Company’s financial statements, including alternatives to, and the rationale for, the decisions made; and |

| • | reviewing the Company’s information technology (“IT”) security controls with a member of the senior management team program. Evaluate the adequacy of the Company’s IT security program, compliance and controls with a member of the senior management team. |

In addition, the Audit Committee oversees the preparation of the Company’s ESG report, including reviewing any ESG-related disclosures.

Compensation Committee

Andrew A. McKnight, Arnold W. Donald, Randall J. Weisenburger, and Daniel Gold are the members of the Compensation Committee. Mr. McKnight is the Chairman of the Compensation Committee. All of the members of the Compensation Committee are independent directors and are considered to be a “non-employee director” under Rule 16b-3 of the Exchange Act. Mr. Donald was appointed as a member of the Compensation Committee on March 8, 2023.

Under its charter, the functions of the Compensation Committee include reviewing and approving annually the evaluation process and compensation structure for the Company’s or its subsidiaries’ officers; and evaluating, reviewing and recommending to the Board any changes to, or additional, stock-based and other incentive compensation plans.

18

The Compensation Committee charter also provides that the Compensation Committee shall have the sole authority to retain or obtain the advice of a compensation consultant, legal counsel or other adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by NYSE and the SEC.

Nominating and Corporate Governance Committee

Connie K. Duckworth, General Richard B. Myers, and Maryanne R. Lavan are members of the Nominating and Governance Committee. Ms. Duckworth is the Chairperson of the Nominating and Corporate Governance Committee. All of the members of the Nominating and Governance Committee are independent directors.

Under its charter, the functions of the Nominating and Corporate Governance Committee include, among other things:

| • | identifying individuals qualified to become a member of the Board in the event of a vacancy on the Board and recommending to the Board the director nominees for the next annual meeting of stockholders; |

| • | reviewing periodically the committee structure of the Board and recommending to the Board any changes to committee structure, the appointment of directors to Board committees and the assignment of committee chairs; |

| • | recommending to the Board the Corporate Governance Guidelines applicable to the Company and monitor compliance with such guidelines; |

| • | developing and recommending to the Board a code of business conduct and ethics applicable to the Company and monitoring compliance with such code, including review of conflicts of interest or waivers; |

| • | reviewing periodically CEO succession and reporting its findings and recommendations to the Board, and working with the Board in evaluating potential successors to executive officer positions; |

| • | leading the Board in its annual review of the performance of (a) the Board; (b) the Board committees; and (c) management; |

| • | recommending to the Board nominees for each Board committee; and |

| • | overseeing the Company’s ESG efforts and progress, including the review of any such disclosures. |

The Nominating and Corporate Governance Committee has the sole authority to retain and terminate any search firm to be used to identify director candidates and shall have sole authority to approve the search firm’s fees and other retention terms. In addition, on a periodic basis, the Nominating and Corporate Governance Committee will conduct an in-depth, broad scope and detailed review of succession planning efforts of the Company’s management team.

The Nominating and Corporate Governance Committee has not set specific minimum qualifications for director positions. Instead, the Nominating and Corporate Governance Committee will review nominations for election or re-election to the Board on the basis of a particular candidate’s merits and the Company’s needs after taking into account the current composition of the Board. When evaluating candidates annually for nomination for election, the Nominating and Corporate Governance Committee will consider an individual’s skills, diversity, independence, experience in areas that address the needs of the Board and ability to devote adequate time to Board duties. The Board believes that its membership should continue to reflect diversity and the Board and the Nominating and Corporate Governance Committee are committed to actively seeking women and diverse candidates for the pool from which director candidates are chosen in support of the Board’s commitment to diversity. The Nominating and Corporate Governance Committee and any search firm the Nominating and Corporate Governance Committee engages shall include (but need not be limited to) qualified female and racially/ethnically diverse candidates in the initial pool from which new director candidates are selected. In addition, the Nominating and Corporate Governance Committee shall also consider in director searches suitable

19

director candidates from corporate backgrounds beyond the executive suite and non-corporate backgrounds. Whenever a new seat or a vacated seat on the Board is being filled, candidates that appear to best fit the needs of the Board and the Company will be identified, interviewed and evaluated by the Nominating and Corporate Governance Committee. Potential director candidates recommended by the Company’s management and stockholders are evaluated in the same manner as nominees identified by the Nominating and Corporate Governance Committee. Candidates selected by the Nominating and Corporate Governance Committee will then be recommended to the full Board.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines, which provide the framework for our corporate governance along with our Charter, Bylaws, committee charters and other key governance practices and policies. Our Corporate Governance Guidelines cover a wide range of subjects, including the conduct of Board meetings, independence and selection of directors, Board membership criteria, and Board committee composition. Our corporate governance guidelines includes a commitment to include (but need not be limited to) qualified female and racially/ethnically diverse candidates in the initial pool from which new director candidates are selected.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics applicable to its directors, executive officers and employees and a Code of Ethics for Senior Executive and Financial Officers that comply with the rules and regulations of the NYSE. The Code of Business Conduct and Ethics codifies the business and ethical principles that govern all aspects of the Company’s business. Copies of the Code of Business Conduct and Ethics and the Code of Ethics for Senior Executive and Financial Officers are available at https://investors.mpmaterials.com/governance/governance-documents/default.aspx. If we ever were to amend or waive any provision of our Code of Ethics for Senior Executive and Financial Officers that applies to our directors or executive officers, we intend to satisfy our disclosure obligations with respect to any such waiver or amendment by posting such information on our internet website set forth above rather than by filing a Form 8-K. The information in or accessible through our website is not incorporated into, and is not considered part of, this Proxy Statement.

Stock Ownership by Directors

The Board believes that an ownership stake in the Company strengthens the alignment of interests between directors and stockholders. The Board has adopted stock ownership guidelines requiring each non-employee and non-affiliated director that participates in our non-employee and non-affiliated director compensation program to own common stock (or equivalents) having a value of at least five times the annual cash retainer fee, within five years of becoming a director, which shall be maintained through such director’s term of service. In the event that the annual cash retainer fee is increased, non-employee and non-affiliated directors will have five years to meet the new ownership guidelines. Until the required ownership guideline is reached, non-employee directors are required to retain at least 50% of the net profit shares acquired from the vesting or exercise of their awards. The Compensation Committee will periodically review the ownership and holding requirements for non-employee and non-affiliated directors and make recommendations to the Board with regard to any changes.

Prohibition on Hedging and Pledging of Company Securities

The Company has a policy that prohibits officers, directors and employees from engaging in hedging transactions, such as the purchase or sale of puts or calls, or the use of any other derivative instruments. Officers, directors and employees of the Company are also prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan without the approval of the Board.

Stockholder Communications

Any stockholder or other interested party who wishes to communicate with our Board or any individual director may send written communications to our Board or such director c/o MP Materials Corp., 1700 S. Pavilion Center

20

Drive, Suite 800, Las Vegas, Nevada 89135, Attention: Secretary. Our Secretary shall initially review and compile all such communications and may summarize such communications prior to forwarding to the appropriate party. Our Secretary will not forward communications that are not relevant to the duties and responsibilities of the Board. The Board will generally respond, or cause the Company to respond, in writing to bona fide communications from stockholders addressed to one or more members of the Board.

Director Nominations by Stockholders

Nominations of persons for election to the Board may be made by any stockholder of the Company who is a stockholder of record and complies with the notice procedures set forth in the Bylaws, and such nominations must be accompanied by a written consent from the proposed nominee to being named as a nominee and to serve as a director if elected. All candidates, regardless of the source of their recommendation, are evaluated in the same manner as nominees identified by the Nominating and Corporate Governance Committee.

21

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

The Company’s Audit Committee charter requires that the Audit Committee review on an ongoing basis and approve or disapprove all related person transactions that are required to be disclosed by Item 404 of Regulation S-K in accordance with the Company’s Related Person Transaction Policy. The Company reviews all relationships and transactions reported to it in which the Company and our directors and executive officers or their immediate family members or any person who is known by the Company to be the beneficial owner of more than five percent (5%) of our voting stock are participants to determine whether such persons have a direct or indirect material interest. The Company’s General Counsel is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions and for then determining, based on the facts and circumstances, whether the Company or a related person has a direct or indirect material interest in the transaction.

Registration Rights Agreement

On November 17, 2020, we consummated the transactions contemplated by the Agreement and Plan of Merger, dated as of July 15, 2020, as amended on August 26, 2020 (the “Merger Agreement”), by and among Fortress Value Acquisition Corporation (“FVAC”), certain direct wholly-owned subsidiaries of FVAC, MP Mine Operations LLC (“MPMO”), which owns the Mountain Pass mine and processing facilities, and Secure Natural Resources LLC, a Delaware limited liability company (“SNR”), which holds the mineral rights to the Mountain Pass mine and surrounding areas as well as intellectual property rights related to the processing and development of rare earth minerals. Pursuant to the Merger Agreement, among other things, MPMO and SNR each became wholly-owned subsidiaries of FVAC (the “Business Combination”), which was in turn renamed “MP Materials Corp.”