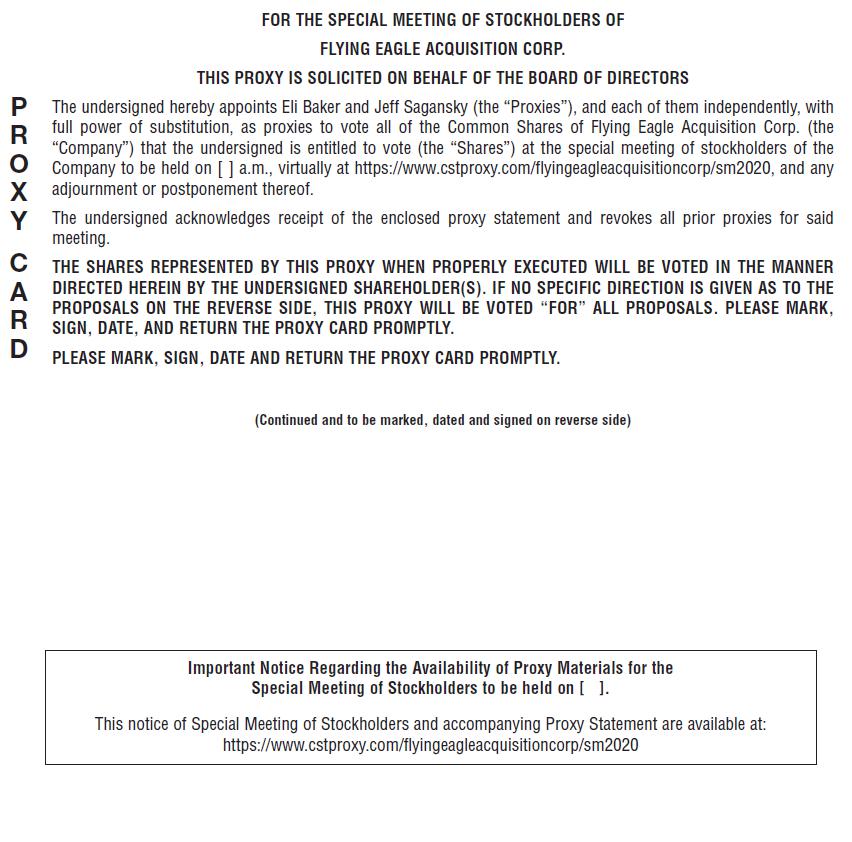

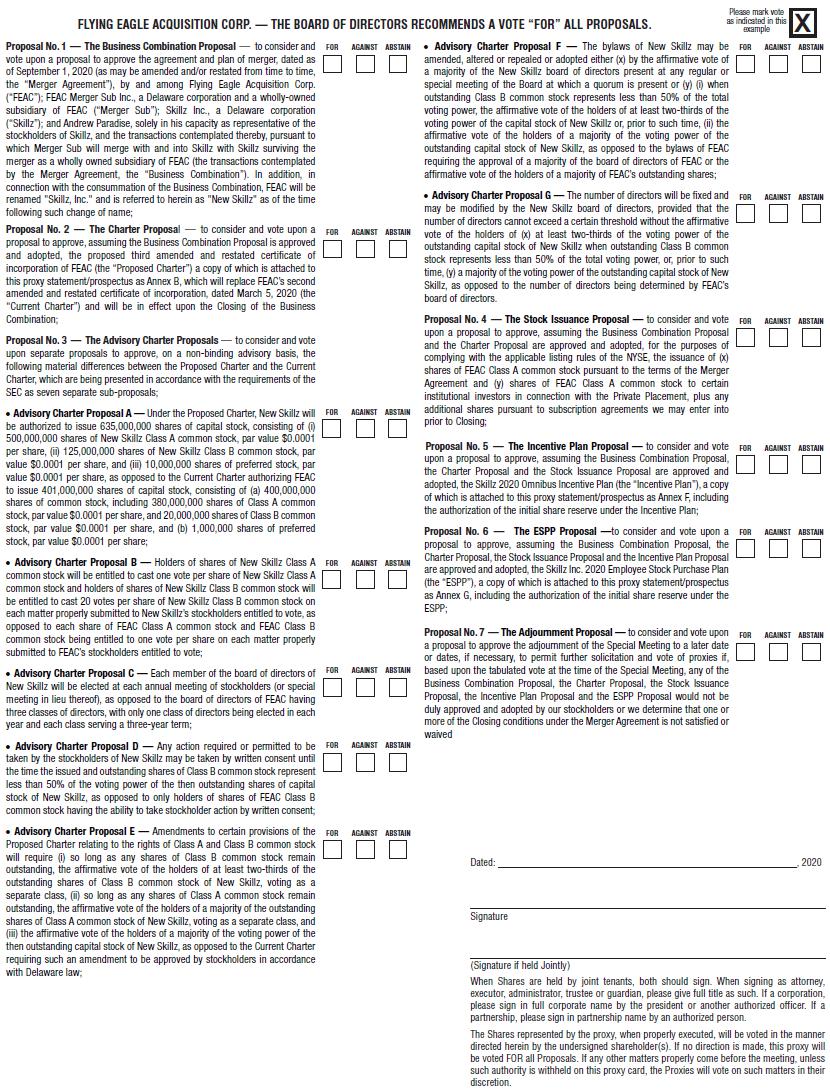

| FLYING EAGLE ACQUISITION CORP. — THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL PROPOSALS. asthis X Proposal No. 1 — The Business Combination Proposal — to consider and vote upon a proposal to approve the agreement and plan of merger, dated as of September 1, 2020 (as may be amended and/or restated from time to time, the “Merger Agreement”), by and among Flying Eagle Acquisition Corp. (“FEAC”); FEAC Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of FEAC (“Merger Sub”); Skillz Inc., a Delaware corporation (“Skillz”); and Andrew Paradise, solely in his capacity as representative of the stockholders of Skillz, and the transactions contemplated thereby, pursuant to which Merger Sub will merge with and into Skillz with Skillz surviving the merger as a wholly owned subsidiary of FEAC (the transactions contemplated by the Merger Agreement, the “Business Combination”). In addition, in connection with the consummation of the Business Combination, FEAC will be renamed "Skillz, Inc." and is referred to herein as "New Skillz" as of the time following such change of name; Proposal No. 2 — The Charter Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal is approved and adopted, the proposed third amended and restated certificate of incorporation of FEAC (the “Proposed Charter”) a copy of which is attached to this proxy statement/prospectus as Annex B, which will replace FEAC’s second amended and restated certificate of incorporation, dated March 5, 2020 (the “Current Charter”) and will be in effect upon the Closing of the Business Combination; Proposal No. 3 — The Advisory Charter Proposals — to consider and vote upon separate proposals to approve, on a non-binding advisory basis, the following material differences between the Proposed Charter and the Current Charter, which are being presented in accordance with the requirements of the SEC as seven separate sub-proposals; · Advisory Charter Proposal A — Under the Proposed Charter, New Skillz will be authorized to issue 635,000,000 shares of capital stock, consisting of (i) 500,000,000 shares of New Skillz Class A common stock, par value $0.0001 per share, (ii) 125,000,000 shares of New Skillz Class B common stock, par value $0.0001 per share, and (iii) 10,000,000 shares of preferred stock, par value $0.0001 per share, as opposed to the Current Charter authorizing FEAC to issue 401,000,000 shares of capital stock, consisting of (a) 400,000,000 shares of common stock, including 380,000,000 shares of Class A common stock, par value $0.0001 per share, and 20,000,000 shares of Class B common stock, par value $0.0001 per share, and (b) 1,000,000 shares of preferred stock, par value $0.0001 per share; · Advisory Charter Proposal B — Holders of shares of New Skillz Class A common stock will be entitled to cast one vote per share of New Skillz Class A common stock and holders of shares of New Skillz Class B common stock will be entitled to cast 20 votes per share of New Skillz Class B common stock on each matter properly submitted to New Skillz’s stockholders entitled to vote, as opposed to each share of FEAC Class A common stock and FEAC Class B common stock being entitled to one vote per share on each matter properly submitted to FEAC’s stockholders entitled to vote; · Advisory Charter Proposal C — Each member of the board of directors of New Skillz will be elected at each annual meeting of stockholders (or special meeting in lieu thereof), as opposed to the board of directors of FEAC having three classes of directors, with only one class of directors being elected in each year and each class serving a three-year term; · Advisory Charter Proposal D — Any action required or permitted to be taken by the stockholders of New Skillz may be taken by written consent until the time the issued and outstanding shares of Class B common stock represent less than 50% of the voting power of the then outstanding shares of capital stock of New Skillz, as opposed to only holders of shares of FEAC Class B common stock having the ability to take stockholder action by written consent; · Advisory Charter Proposal E — Amendments to certain provisions of the Proposed Charter relating to the rights of Class A and Class B common stock FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN · Advisory Charter Proposal F — The bylaws of New Skillz may be amended, altered or repealed or adopted either (x) by the affirmative vote of a majority of the New Skillz board of directors present at any regular or special meeting of the Board at which a quorum is present or (y) (i) when outstanding Class B common stock represents less than 50% of the total voting power, the affirmative vote of the holders of at least two-thirds of the voting power of the capital stock of New Skillz or, prior to such time, (ii) the affirmative vote of the holders of a majority of the voting power of the outstanding capital stock of New Skillz, as opposed to the bylaws of FEAC requiring the approval of a majority of the board of directors of FEAC or the affirmative vote of the holders of a majority of FEAC’s outstanding shares; · Advisory Charter Proposal G — The number of directors will be fixed and may be modified by the New Skillz board of directors, provided that the number of directors cannot exceed a certain threshold without the affirmative vote of the holders of (x) at least two-thirds of the voting power of the outstanding capital stock of New Skillz when outstanding Class B common stock represents less than 50% of the total voting power, or, prior to such time, (y) a majority of the voting power of the outstanding capital stock of New Skillz, as opposed to the number of directors being determined by FEAC’s board of directors. Proposal No. 4 — The Stock Issuance Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal and the Charter Proposal are approved and adopted, for the purposes of complying with the applicable listing rules of the NYSE, the issuance of (x) shares of FEAC Class A common stock pursuant to the terms of the Merger Agreement and (y) shares of FEAC Class A common stock to certain institutional investors in connection with the Private Placement, plus any additional shares pursuant to subscription agreements we may enter into prior to Closing; Proposal No. 5 — The Incentive Plan Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal, the Charter Proposal and the Stock Issuance Proposal are approved and adopted, the Skillz 2020 Omnibus Incentive Plan (the “Incentive Plan”), a copy of which is attached to this proxy statement/prospectus as Annex F, including the authorization of the initial share reserve under the Incentive Plan; Proposal No. 6 — The ESPP Proposal —to consider and vote upon a proposal to approve, assuming the Business Combination Proposal, the Charter Proposal, the Stock Issuance Proposal and the Incentive Plan Proposal are approved and adopted, the Skillz Inc. 2020 Employee Stock Purchase Plan (the “ESPP”), a copy of which is attached to this proxy statement/prospectus as Annex G, including the authorization of the initial share reserve under the ESPP; Proposal No. 7 — The Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, any of the Business Combination Proposal, the Charter Proposal, the Stock Issuance Proposal, the Incentive Plan Proposal and the ESPP Proposal would not be duly approved and adopted by our stockholders or we determine that one or more of the Closing conditions under the Merger Agreement is not satisfied or waived FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN will require (i) so long as any shares of Class B common stock remain outstanding, the affirmative vote of the holders of at least two-thirds of the outstanding shares of Class B common stock of New Skillz, voting as a separate class, (ii) so long as any shares of Class A common stock remain outstanding, the affirmative vote of the holders of a majority of the outstanding shares of Class A common stock of New Skillz, voting as a separate class, and (iii) the affirmative vote of the holders of a majority of the voting power of the then outstanding capital stock of New Skillz, as opposed to the Current Charter requiring such an amendment to be approved by stockholders in accordance with Delaware law; Dated: , 2020 Signature (Signature if held Jointly) When Shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by an authorized person. The Shares represented by the proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder(s). If no direction is made, this proxy will be voted FOR all Proposals. If any other matters properly come before the meeting, unless such authority is withheld on this proxy card, the Proxies will vote on such matters in their discretion. |