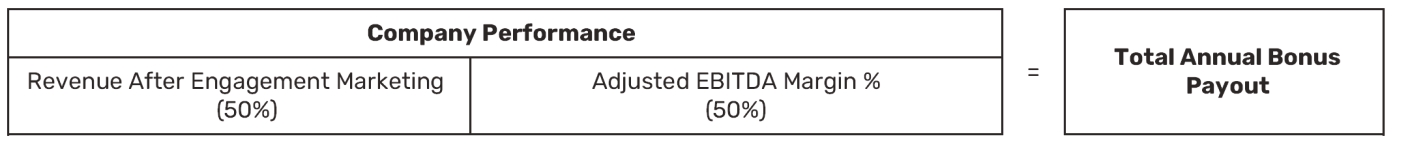

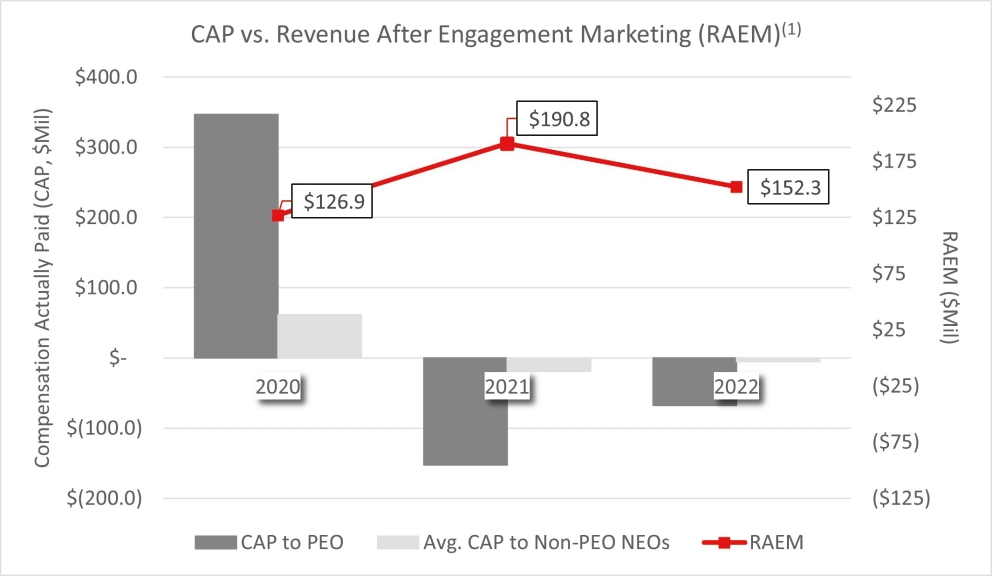

Bonuses under the annual cash bonus program can be earned at threshold, target and maximum amounts representing 50%, 100% and 200%, respectively, of the annual total incentive opportunity for each named executive officer. If Revenue After Engagement Marketing performance was achieved at $230 million, $257.7 million, or $300 million, the bonus would payout at 50%, 100%, or 200%, respectively, of target. Revenue After Engagement Marketing is a not a generally accepted accounting principle (“GAAP”) financial performance metric. Revenue After Engagement Marketing is determined by taking consolidated revenue and adjusting for engagement marketing expenses included in sales and marketing expenses. Accordingly, stockholders should not rely on this metric as an indicator of financial performance. If Adjusted EBITDA Margin was achieved at negative 39%, negative 33.7% or negative 24.5%, the bonus would payout at 50%, 100%, or 200%, respectively, of target. To the extent performance falls between threshold and target or target and maximum, interpolation is used to determine the amount of bonus payable. If less than threshold performance is achieved, no bonus is paid out.

For 2022, the Compensation Committee determined not to pay any bonuses under the annual cash bonus program to the Company’s NEOs.

One-time Bonuses for Certain NEOs

For Mr. Roswig, who joined the Company in 2022, Skillz provided him with a cash signing bonus of $200,000, which is repayable to the Company should he voluntarily resign prior to the two-year anniversary of his start date. See discussion in “Executive Compensation—Compensation Discussion and Analysis—Employment Arrangements” for additional details. In addition, pursuant to certain transaction bonus award letters dated February 4, 2021, Mr. Chafkin and Ms. Edelman were eligible to receive a transaction retention bonus of $225,000 on June 16, 2022, relating to the closing of the Company’s successful business combination with Flying Eagle Acquisition Corp. on December 16, 2020 (the “Business Combination”).

Long Term Equity Incentive Grants

Our equity award program is the primary vehicle for offering long-term incentives to our named executive officers. The equity awards we have historically granted and currently grant include options to purchase shares of our Class A Common Stock and RSU awards that are settled in shares of our Class A Common Stock upon vesting, and we have granted to our named executive officers both awards that vest over a long-term period and awards that vest only upon the achievement of specified performance milestones, in each case subject to continued service. As a result, a significant portion of our named executive officers’ total compensation is at risk, depending on long-term stock price performance.

While we strive to offer a total level of compensation that is competitive within specific roles and geographical markets, we do not have an inflexible set of criteria for granting equity awards; instead, the Compensation Committee exercises its judgment and discretion, in consultation with our Chief Executive Officer and a compensation consultant. The Compensation Committee considers, among other things, the role and responsibility of the named executive officer, competitive market factors, the amount of stock-based equity compensation already held by the named executive officer, the impact of any dramatic changes in our stock price over a short period of time and the cash-based compensation received by the named executive officer, to determine the level and types of equity awards that it approves. We generally grant substantial one-time new hire equity awards to our employees, including executives, upon their commencement of employment with us, or upon their promotion to new positions. Additionally, as part of our ongoing executive compensation review and alignment process, we periodically grant additional equity awards to our executives. See “Executive Compensation—2022 Grants of Plan-Based Awards” below.

The Compensation Committee meets periodically, including to approve equity award grants to our executives from time to time. We do not have, nor do we plan to establish, any program, plan or practice to time equity award grants in coordination with releasing material non-public information.

2022 CEO Performance Equity Award

As previously disclosed, on March 14, 2022, the Board and Mr. Paradise agreed to cancel Mr. Paradise’s 2021 CEO Performance Award. The 2021 CEO Performance Award was divided into four tranches, each vesting upon the achievement of a corresponding market capitalization milestone ranging from two to five times the Company’s market capitalization baseline calculated at the time of grant. In canceling the 2021 CEO Performance Award, the Board and Mr. Paradise took into consideration a number of factors, including (i) changes in the Company’s market capitalization since the award was granted, (ii) the desire by the Board and Company to conduct an equity refresh grant for the broad-based employee population, which is facilitated by the cancellation of the 2021 CEO Performance Award and (iii) the cancellation resulting in less dilution to stockholders.

In November 2022, the Special Committee approved a new multi-year award of 9,661,525 PSUs for Mr. Paradise, which vest over four, one-year periods, in each case subject to continuous service with the Company through each applicable vesting date and the attainment of certain corporate performance goals. Once the Special Committee approves the performance milestones, the PSU award will be deemed granted by the Company under the Omnibus Plan. Mr. Paradise also was awarded 28,984,577 RSUs,