BIC Holdings LLC - Trean Holdings LLC

Notes to the Combined Financial Statements

December 31, 2018

Note 23. Transactions with Related Parties

The Company owed Stop-Loss approximately $18 as of December 31, 2018. These amounts are included within accounts payable and accrued expenses on the combined balance sheet as of December 31, 2018.

The Company was owed amounts from Trean Intermediaries totaling approximately $44 as of December 31, 2018, which are included in related party receivables on the combined balance sheets.

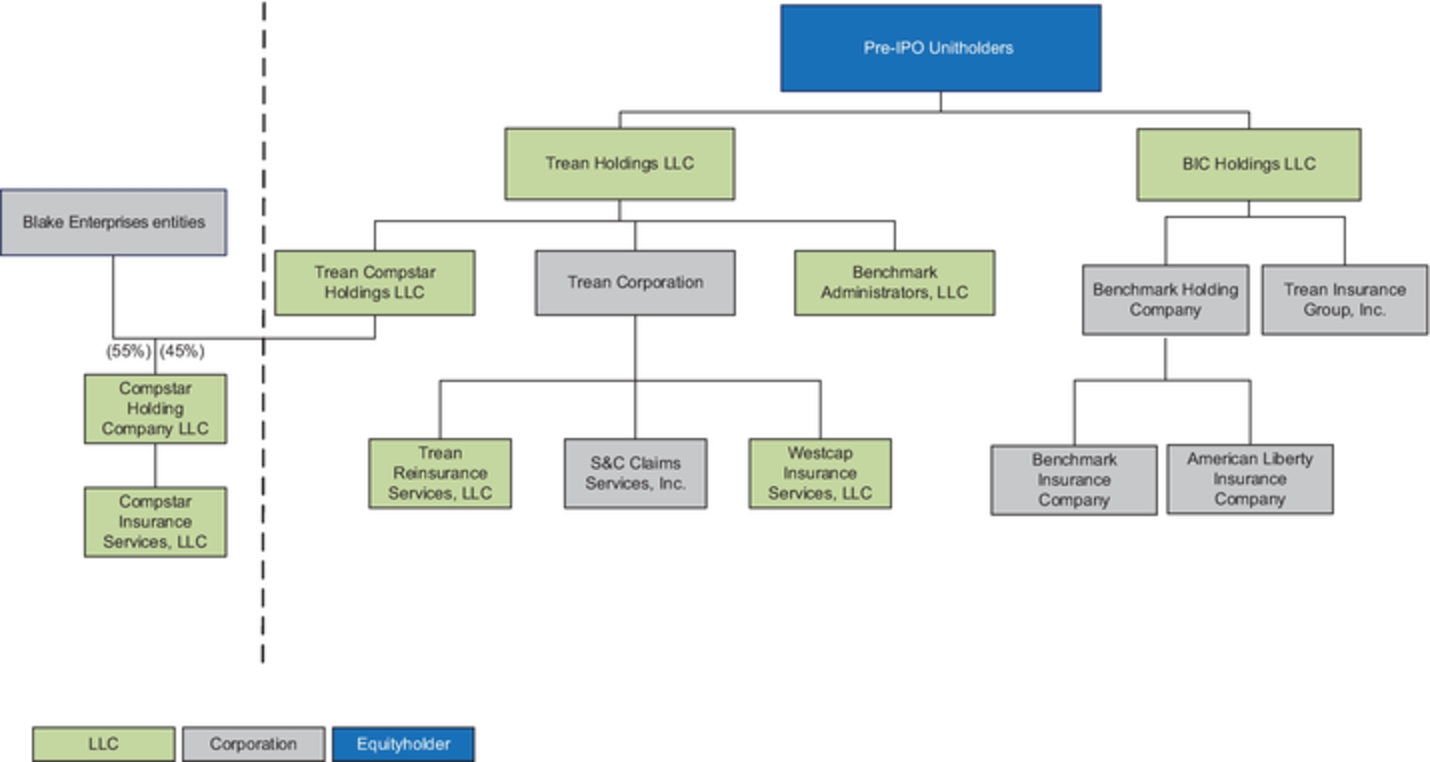

As disclosed in Note 6, effective April 2, 2018, the Company owns a 45% interest in Compstar Holdings LLC (Compstar), a program manager which handles the underwriting, premium collection and servicing of insurance policies for the Company. The Company recorded $116,584 of gross earned premiums for the period April 2, 2018 to December 31, 2018 resulting in gross commissions of $24,711 due to Compstar. All receivables are stated net of the commissions due under the Program Manager Agreement and totaled $15,890 as of December 31, 2018, which is recorded in related party receivables in the combined balance sheet. The Company’s ownership interest, and right to receive any distributions, is listed as collateral on debt taken out by Compstar.

Note 24. Subsequent Events

Events or transactions that occur after the balance sheet date, but before the combined financial statements are complete, are reviewed by the Company to determine if they are to be recognized and/or disclosed as appropriate.

On February 19, 2019, Benchmark Insurance Company purchased First Choice Casualty Insurance Company, a Nevada domiciled insurance carrier, for approximately $5,314. The Company acquired First Choice Casualty Insurance Company in order to obtain the ability to direct the operations of First Choice Casualty Insurance Company and to gain synergies to increase the total premiums written by Benchmark Insurance Company.

On March 31, 2019, Benchmark Holdings Company purchased the remaining 25% of outstanding voting shares of American Liberty Insurance Company for approximately $1,155. The purchase price was determined based on the statutory surplus of American Liberty Insurance Company and shown as shares subject to mandatory redemption on the combined balance sheet as of December 31, 2018. This amount is shown at fair value and was determined using level 3 inputs. The Company recorded $769 in expenses in 2018 related to the remeasurement of the equity interest in American Liberty Insurance Company. This is included in general and administrative expenses on the combined statement of operations for the year ended December 31, 2018.

On December 17, 2019, Trean redeemed all of its Series A preferred shares for $1,000. After the redemption, no Series A preferred shares remain outstanding.

On December 31, 2019, Benchmark Holdings Company redeemed nine shares of its Series B redeemable preferred stock for $900.

On December 31, 2019, Trean Underwriting Managers, LLC was dissolved. All contracts associated with Trean Underwriting Managers, LLC will be operating under Trean Corporation.

On December 31, 2019, Trean Corporation surrendered its ownership in Stop Loss Re, LLC for no compensation.

On January 13, 2020, Trean Corporation sold 15% ownership in Trean I for $3,000. Trean Corporation maintains a 10% ownership in Trean I.

All of the effects of subsequent events that provide additional evidence about conditions that existed at the combined balance sheet date, including the estimates inherent in the process of preparing the combined financial statements, are recognized in the combined financial statements. Subsequent events have been evaluated through February 4, 2020, which is the date the combined financial statements were available to be issued.