July 2, 2020

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549-3561

| Attn: | Mr. John Stickel |

| Attorney Advisor |

| | |

| | Trean Insurance Group, Inc. |

| | Registration Statement on Form S-1 |

| |

| Submitted June 19, 2020 |

| | CIK No. 0001801754 |

Dear Mr. Stickel:

Reference is made to the above captioned registration statement (the “Registration Statement”). On behalf of our client, Trean Insurance Group, Inc. (the “Company”), we are providing the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with a supplemental submission regarding the proposed disclosure of the Company’s estimated preliminary financial results for the two months ended May 31, 2020 (the “Estimated Preliminary Financial Results”). The Company intends to include the Estimated Preliminary Financial Results in an amendment to the Registration Statement which the Company intends to file with the Commission on the date it commences the roadshow for its initial public offering.

We have attached as Exhibit A to this letter a draft of the “Summary—Recent developments” section that presents results for the two months ended May 31, 2020, compared to the Company’s results for May 31, 2019 or for the three months ended June 30, 2019, as applicable.

Please contact me at (212) 735-2573 or Dwight.Yoo@skadden.com if the Staff has any questions or requires additional information.

| Very truly yours, |

| | |

| | |

| | /s/ Dwight S. Yoo |

| cc: | Andrew M. O’Brien, President and Chief Executive Officer, Trean Insurance Group, Inc. Julie A. Baron, Chief Financial Officer, Trean Insurance Group, Inc. Richard D. Truesdell, Jr., Davis Polk & Wardwell LLP Shane Tintle, Davis Polk & Wardwell LLP |

EXHIBIT A

Recent developments

Estimated preliminary financial results for the two months ended May 31, 2020 (unaudited)

While unaudited interim condensed combined financial statements are not available for any period subsequent to March 31, 2020, based on the information currently available to us, we preliminarily estimate:

Gross written premiums increased $1.9 million, or 2.9%, to $69.6 million for the two months ended May 31, 2020, compared to $67.7 million for the two months ended May 31, 2019.

Net earned premiums increased $0.4 million, or 3.0%, to $13.8 million for the two months ended May 31, 2020, compared to $13.4 million for the two months ended May 31, 2019.

Consistent with the first quarter of 2020, the COVID-19 pandemic has not had a significant impact on our premium revenue for the two months ended May 31, 2020. The substantial majority of workers’ compensation risks that we insure, both through our Owned MGAs and our Program Partners, are not in classes of business that to date have heightened exposure to COVID-19. Growth in premiums and payroll for the month of May 2020 was generally consistent with prior months’ growth during 2020. The merger of LCTA Risk Services, Inc. into Trean Corporation, effective April 1, 2020, began to generate additional premiums in the month of May 2020. The incremental addition of insured employees from this acquisition in May 2020 offset the portion of our workers’ compensation portfolio that was impacted by business shutdowns driven by COVID-19.

Our combined ratio was 93.5% (comprised of a loss ratio of 58.5% and an expense ratio of 35.0%) for the two months ended May 31, 2020, compared to 82.2% (comprised of a loss ratio of 55.7% and an expense ratio of 26.5%) for the three months ended June 30, 2019.

The increase in the loss ratio for the two months ended May 31, 2020 compared to the three months ended June 30, 2019 was principally due to management’s decision to factor in what it believes to be an appropriate level of conservatism with respect to reserves for incurred but not yet reported losses in light of recent economic conditions and other effects related to the COVID-19 pandemic, including potential delays in reporting and settling claims as a result of shelter-in-place and similar orders. The increase in the expense ratio was principally due to higher general and administrative expenses, including increases in salaries and benefits resulting from a larger workforce, professional services expenses and other costs related to the initial public offering and reorganization transactions, and additional fees incurred in connection with the 2020 First Horizon Credit Agreement (as defined below) entered into in May 2020. Additionally, our acquisition of LCTA Risk Services, Inc., effective April 1, 2020, increased expenses starting in April with additional premiums first being generated in May. We are currently engaged in discussions regarding the potential acquisition of a workers' compensation carrier with which we have a longstanding relationship and have entered into an exclusivity agreement with the target company. The proposed purchase price is approximately $12.0 million.

The preliminary financial results for the two months ended May 31, 2020 are preliminary and estimated. Actual financial results for the two months ended May 31, 2020 may differ materially from the preliminary financial results. We are currently in the process of performing procedures to prepare our unaudited interim condensed combined financial statements for the quarter ended June 30, 2020, but those financial statements will not be available until after the closing of this offering. To date, we have not identified any unusual or particular events or trends that occurred during the two months ended May 31, 2020 that we believe will materially affect the preliminary financial results presented above.

The preliminary financial results should not be viewed as a substitute for our unaudited interim condensed combined financial statements or our annual audited financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Accordingly, you should not place undue reliance on the preliminary financial results. The preliminary financial results should be read in conjunction with “Management’s discussion and analysis of financial condition and results of operations,” “Forward-looking statements,” “Risk factors,” “Selected historical combined financial and other data” and our combined financial statements and related notes thereto included elsewhere in this prospectus.

The preliminary financial results presented above have been prepared by, and are the responsibility of, management. Our independent registered public accounting firm, Deloitte & Touche LLP, has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial results for the two months ended May 31, 2020. Accordingly, Deloitte & Touche LLP does not express an opinion or any other form of assurance with respect thereto.

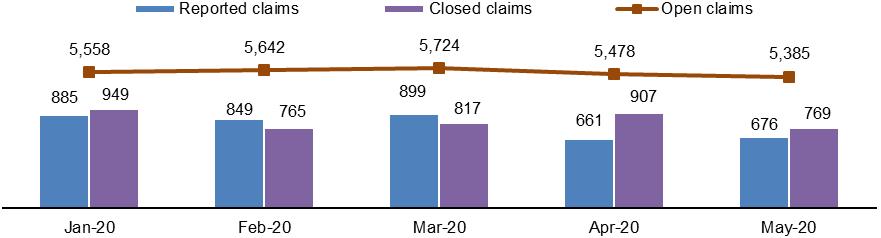

Workers’ compensation monthly claims data

For the two months ended May 31, 2020, we are seeing fewer claims reported despite insuring more employees. We have not seen a significant impact on the number of reported claims or on the average value of incurred losses due to the COVID-19 pandemic. The number of workers’ compensation insured employees increased by approximately 1.5% year-over-year from April 30, 2019 to April 30, 2020. The number of workers’ compensation insured employees increased by approximately 4.0% year-over-year from May 31, 2019 to May 31, 2020. In contrast, the number of claims reported on a monthly basis during the two months ended May 31, 2020 declined compared to the number of claims reported monthly during the first quarter of 2020 and compared to the number of claims reported during the two months ended May 31, 2019. In addition, closed claims outpaced reported claims in April 2020 and May 2020.

May 2020 YTD monthly workers’ compensation claims

May 2020 YTD closed: 4,207 May 2020 YTD reported: 3,970

May 2019 YTD monthly workers’ compensation claims

May 2019 YTD closed: 3,586 May 2019 YTD reported: 4,153