COVID-19

As a result of the public health risk and government-imposed quarantines and other restrictions on commercial activity to contain the spread of COVID-19, the Company’s Retail and Concessions sales were significantly impacted during fiscal year 2020. From March 2020 to May 2020, we temporarily closed all of our stores in North America and Europe; during this period, many of our concessions locations were also closed and in some geographies, non-essential products (including our own) could not be sold at concessions locations that otherwise remained open.

Though we cannot estimate the precise impact of the COVID-19 pandemic on our results of operations, we note that net sales, gross profit and operating income (loss) were (in thousands) $629,091, $362,569 and $80,840, respectively, for the first six months of fiscal year 2021, compared to $325,777, $118,001 and $(66,349), respectively, for the first six months of fiscal year 2020, compared to $608,355, $323,190 and $68,640, respectively, for the first six months of fiscal year 2019. In addition, segment revenues for North America and Europe were $485,407 and $143,684, respectively for the first six months of fiscal year 2021, compared to $216,376 and $109,401, respectively for the first six months of fiscal year 2020, compared to $ 393,899 and $214,456, respectively for the first six months of fiscal year 2019. Segment operating income (loss) for North America and Europe were $89,951 and $(9,111), respectively, for the first six months of fiscal year 2021, compared to $(34,812) and $(31,537), respectively, for the first six months of fiscal year 2020, compared to $54,808 and $13,832, respectively, for the first six months of fiscal year 2019. We believe that such reductions in net sales, gross profit, operating income (loss) and segment operating income (loss) were largely attributable to the impact of COVID-19, in particular due to the temporary closure of all of our stores during March 2020 to May 2020, which resulted in no revenues generated at our stores during such period.

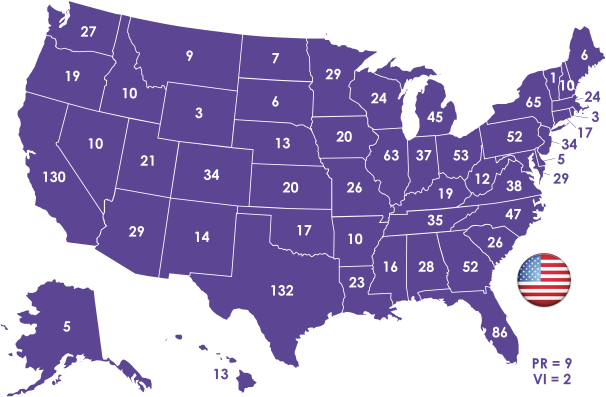

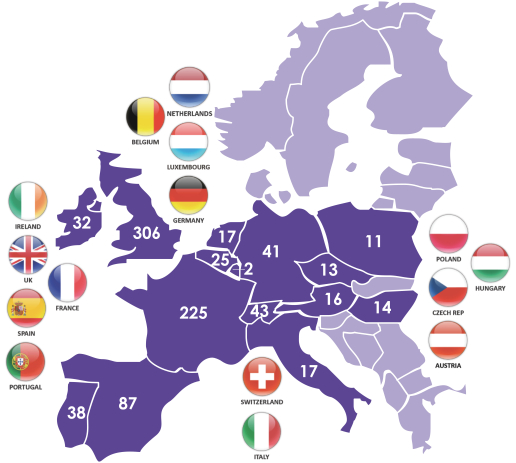

Beginning in May 2020, we began to reopen our stores, but closed some of our stores again in North America (particularly in California, New York, Texas and certain Canadian provinces) and Europe from October to December 2020. As of January 30, 2021, we had 53 and 568 stores temporarily closed in North America and Europe, respectively. Throughout the pandemic, some of our stores that remained in operation were subject to restrictions on the number of customers allowed in the stores. As of July 31, 2021, none of our stores were closed as a direct result of the COVID-19 pandemic, and we had resumed sales at all of our concessions locations. During store closures, we focused on managing costs to preserve financial strength and liquidity, through for example employee furloughs, executive pay reductions, rent payment negotiations and inventory management. See Note 7, “Commitments and Contingencies,” of our consolidated financial statements and Note 5, “Commitments and Contingencies,” of our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus for more information regarding the impact of the COVID-19 pandemic on our lease accounting.

As a result of store closures, restricted business operations after reopening in many areas and other aspects of responding to the COVID-19 pandemic, we incurred a number of costs that do not align with our normal business operations. These include store occupancy costs (primarily store lease costs) and store labor costs for periods when our stores were closed and additional cleaning and protective equipment. We estimate that these costs (net of recoveries) for fiscal year 2020 were approximately $60 million, and these costs are included in net income and Adjusted EBITDA for the periods shown. In fiscal year 2020, we deferred occupancy payments for a significant number of our stores due to COVID-19. These deferrals are accrued, and we continued to recognize expense during the deferral periods based on the contractual terms of our lease agreements. As of July 31, 2021 and January 30, 2021, approximately $20.7 million $43.7 million, respectively, of payment deferrals remained outstanding and potentially payable to our lessors, and is included in the “Accrued expenses and other current liabilities” on our balance sheet. In addition, in fiscal year 2021, we have continued to

69