The information in this preliminary proxy statement/prospectus is not complete and may be changed. We may not sell the securities described herein until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS

DATED APRIL 29, 2022 SUBJECT TO COMPLETION

LIONHEART ACQUISITION CORPORATION II

4218 NE 2nd Avenue

Miami, Florida 33137

Dear Stockholder:

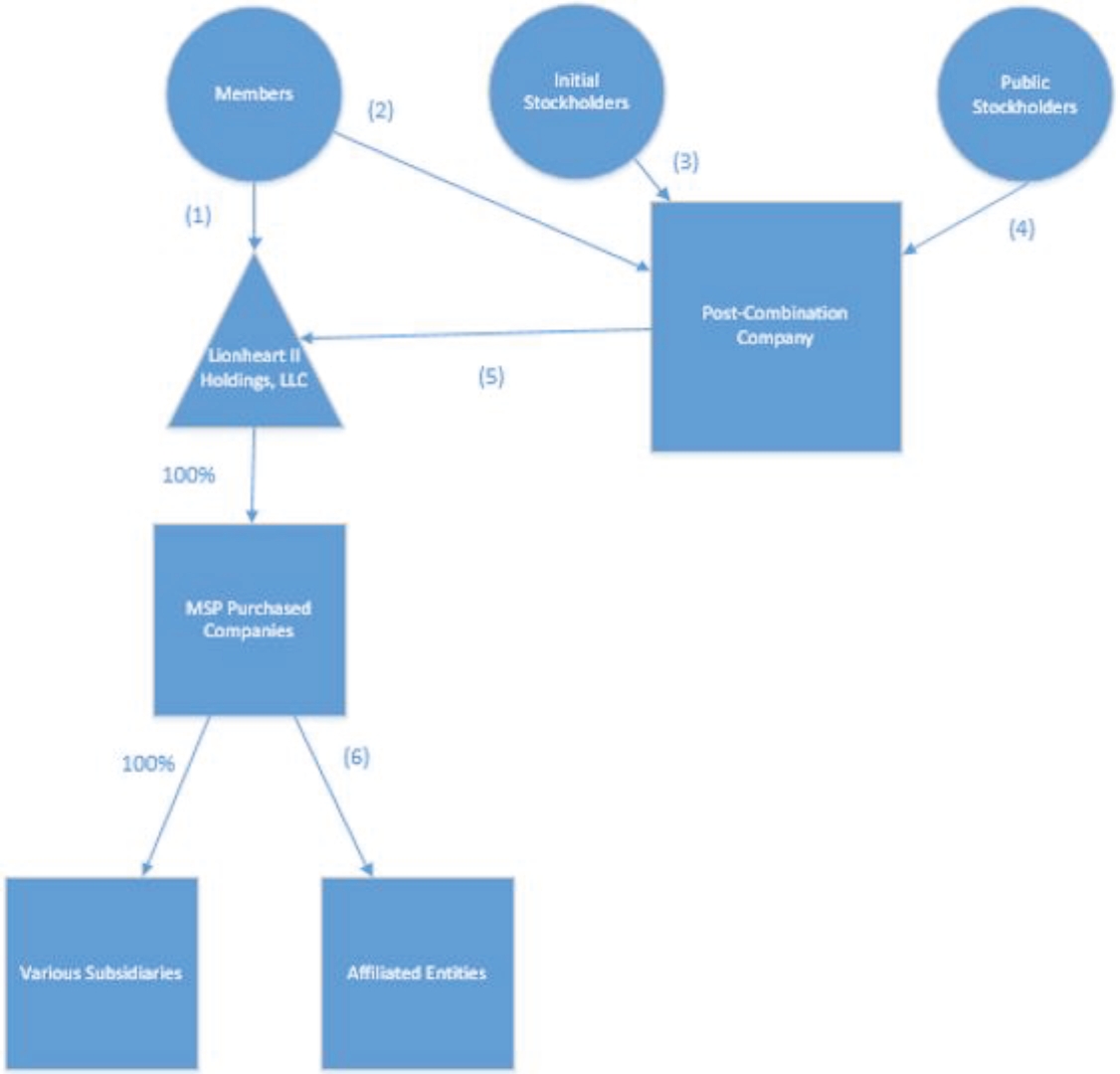

On July 11, 2021, Lionheart Acquisition Corporation II, a Delaware corporation (“we,” “us,” “our,” or the “Company”), entered into a Membership Interest Purchase Agreement (as it may be amended, supplemented or otherwise modified from time to time in accordance with its terms, the “MIPA”) by and among the Company, Lionheart II Holdings, LLC, a newly formed wholly owned subsidiary of the Company (“Opco”), the MSP Purchased Companies (as defined in the MIPA) (collectively, “MSP”), the members of MSP (the “Members”), and John H. Ruiz, in his capacity as the representative of the Members (the “Members’ Representative”).

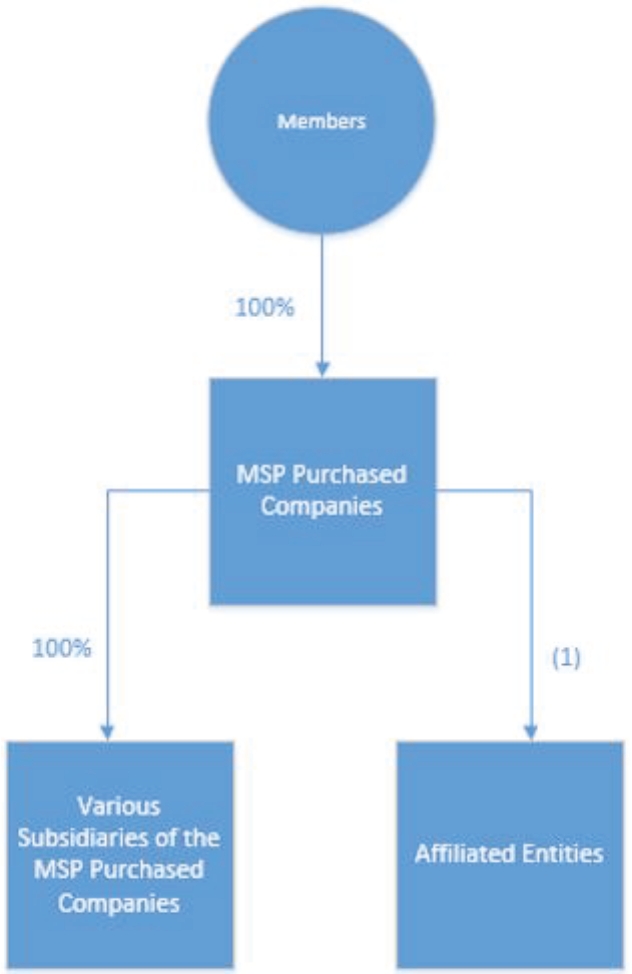

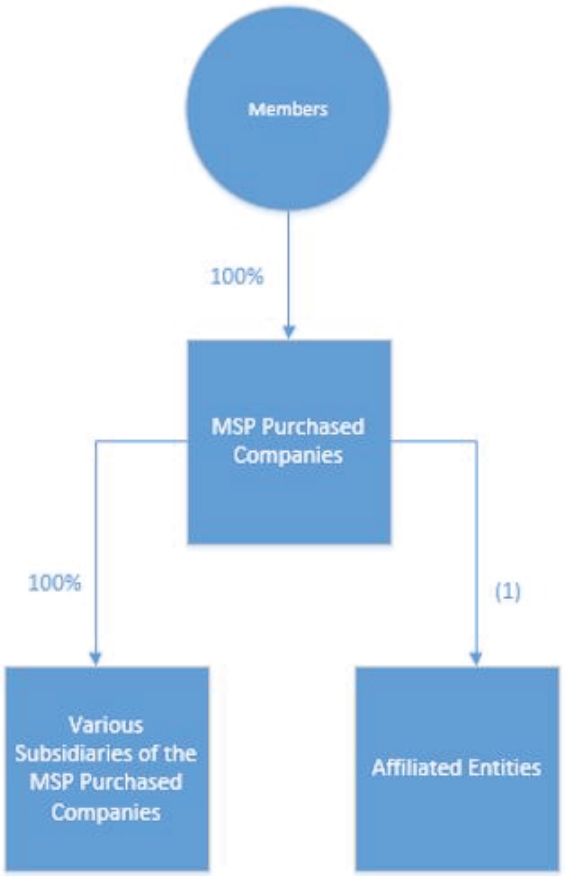

Pursuant to the MIPA, the Members will sell and assign all of their membership interests in MSP to Opco in exchange for non-economic voting shares of Class V common stock, par value $0.0001, of the Company (“Class V Common Stock”) and non-voting economic Class B Units of Opco (“Class B Units,” and each pair consisting of one share of Class V Common Stock and one Class B Unit, an “Up-C Unit”) or, pursuant to notice delivered to the Company, with respect to all or a portion of the Up-C Units to be received by each such Member, one share of Class A Common Stock in lieu of each Up-C Unit (such transaction, the “Business Combination”).

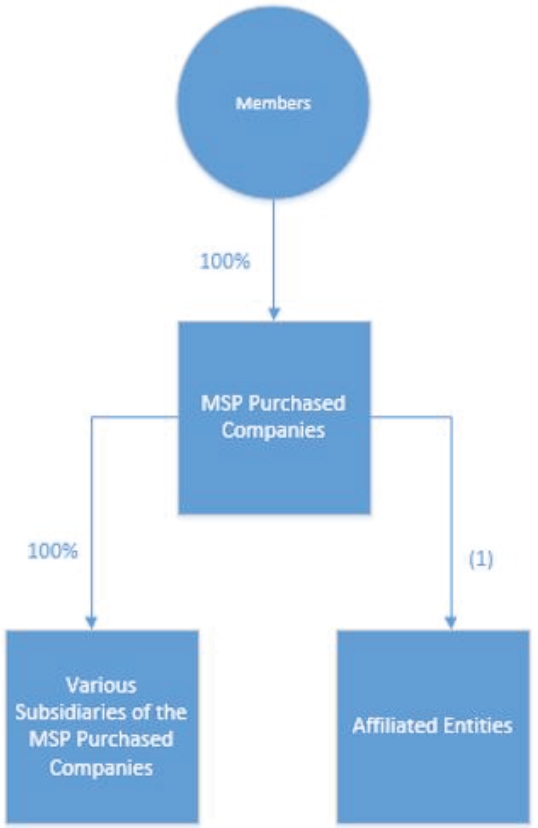

Following the closing of the Business Combination (the “Closing”), the Company will be organized in an “Up-C” structure in which the business of MSP and its subsidiaries will be held directly or indirectly by Opco, and the Company will own all of the voting economic Class A Units of Opco and the Members and their designees will own all of the non-voting economic Class B Units in accordance with the terms of the first amended and restated limited liability company agreement of Opco (the “LLC Agreement”) to be entered into at the Closing. Each Up-C Unit may be exchanged for either, at the Company’s option, (a) cash or (b) one share of Class A common stock, par value $0.0001, of the Company (“Class A Common Stock”), subject to the provisions set forth in the LLC Agreement.

Subject to the terms and conditions set forth in the MIPA, the aggregate consideration to be paid to the Members (or their designees) will consist of (i) 3,250,000,000 Up-C Units and (ii) rights to receive payments under the tax receivable agreement to be entered into at the Closing. Of the Up-C Units to be issued to certain Members at the Closing, 6,000,000 (the “Escrow Units”) will be deposited into an escrow account with Continental Stock Transfer and Trust Company to satisfy any indemnification claims that may be brought pursuant to the MIPA.

In connection with the Business Combination, and to provide additional consideration to holders of Class A Common Stock that do not redeem their shares of Class A Common Stock, the Company intends, subject to compliance with applicable law, to declare a dividend comprising an aggregate of approximately 1,029,000,000 newly issued warrants, each to purchase one share of Class A Common Stock for an exercise price of $11.50 per share (the “New Warrants”), conditioned upon the consummation of any redemptions by the holders of Class A Common Stock and the Closing, to the holders of record of the Class A Common Stock as of the close of business on the date of Closing (the “Closing Date”), which is expected to include the 5,750,000 shares of Class A Common Stock into which Founder Shares will convert in connection with the Business Combination, after giving effect to the waiver of the right, title and interest in, to or under, participation in any such dividend by the Members, on behalf of themselves and any of their designees. The number of New Warrants to be distributed in respect of each share of unredeemed Class A Common Stock is contingent upon, and will vary with, the aggregate number of shares of Class A Common Stock that are redeemed in connection with the Business Combination. Assuming no additional redemptions (after giving effect to the redemption of 10,946,369 shares of Class A Common Stock in connection with the Company stockholder vote to approve the amendment to the Company’s charter to extend the date by which the Company must complete an initial business combination from February 18, 2022 to August 18, 2022) (the “no redemption scenario”) and that the distribution is made, holders of Class A Common Stock who do not redeem their shares would receive at least 55 New Warrants per share of Class A Common Stock they hold, which would proportionally increase if other holders elect to redeem their shares of Class A Common Stock. Pursuant to the terms of the LLC Agreement, at least twice a month, to the extent any New Warrants have been exercised in accordance with their terms, the Company following the Business Combination is required to purchase from the MSP Principals (as defined in the LLC Agreement), proportionately, the number of Up-C Units or shares of Class A Common Stock owned by such MSP Principal equal to the aggregate amount of the exercise price received in connection with exercise of the New Warrants during an applicable period (the “Aggregate Exercise Price”) divided by the Warrant Exercise Price (as defined in the LLC Agreement) in exchange for the Aggregate Exercise Price. For more information, see the LLC Agreement attached hereto as Annex D. Pursuant to the terms of the Existing Warrant Agreement (as defined in the accompanying proxy statement/prospectus), the exercise price of the Public Warrants and Private Warrants could decrease to $0.0001 after giving effect to the issuance of the New Warrants.

Following the Closing, the Company will have two classes of authorized common stock. The shares of Class A Common Stock and the shares of Class V Common Stock each will be entitled to one vote per share on matters submitted to a vote of stockholders. Holders of the Class V Common Stock will not have any of the economic rights in the Company (including rights to dividends and distributions upon liquidation) provided to holders of the Class A Common Stock. Holders of Class V Common Stock will also hold Class B Units, and will have economic rights in Opco. Following the Closing, assuming the no redemption scenario and excluding the impact of any outstanding warrants or New Warrants, John H. Ruiz, the Chief Executive Officer (“CEO”) and founder of MSP will control approximately 65.22% of the combined voting power of the capital stock of the Company, and Frank C. Quesada, the Chief Legal Officer (“CLO”) of MSP, will control approximately 27.36% of the combined voting power of the capital stock of the Company (in each case, assuming no attributed ownership based on Messrs. Ruiz and Quesada’s investment in VRM) (See “

Certain Relationships and Related Party Transactions” beginning on page

247). Such ownership percentages will be affected by the level of redemptions by Public Stockholders and the exercise of outstanding warrants or New Warrants. See “Summary—Ownership of the Post-Combination Company.”

In connection with the Closing, the Class B common stock, par value $0.0001 per share, of the Company (the “Class B Common Stock”), issued prior to the initial public offering of the Company, held by our sponsor, Lionheart Equities, LLC (the “Sponsor”), and certain other Company stockholders will automatically convert into shares of Class A Common Stock on a one-for-one basis. The Sponsor, Nomura, MSP, the Members and/or their respective affiliates may purchase shares of Class A Common Stock on the open market. Such purchases (“Open Market Purchases”) will be made prior to the Special Meeting and will be separate from the redemption process conducted in connection with the Business Combination. The purposes of any Open Market Purchases would be to reduce the number of shares of Class A Common Stock that may be redeemed in connection with the Business Combination, and may include a business decision to increase such purchaser’s ownership at an attractive price. The Sponsor, Nomura, MSP, the Members and/or their respective affiliates shall only make Open Market Purchases to the extent the price per Class A Common Stock so acquired is no higher than the redemption price that would be available in connection with the redemption procedures described in the accompanying proxy statement/prospectus. In addition, the Sponsor, Nomura, MSP, the Members and/or their respective affiliates will waive any redemption rights with respect to any shares of Class A Common Stock purchased in Open Market Purchases and will not vote any shares of Class A Common Stock purchased in Open Market Purchases in favor of the Proposals. In addition, the Sponsor and certain members of our board of directors and/or management team have agreed to (a) vote all of their shares of Class B Common Stock and all of their shares of Class A Common Stock in favor of the Business Combination and each other proposal described in the accompanying proxy statement/prospectus (collectively, the “Proposals”), (b) certain restrictions on their shares of Class A Common Stock and (c) in the case of the Sponsor, bear any transaction costs in excess of $60,000,000 that are allocable to the Company in accordance with the MIPA. However, we intend to waive such obligations of the Sponsor, our directors and/or our officers to vote their shares of common stock in favor of the Proposals in respect of any shares purchased by such purchasers in Open Market Purchases.