equipment receivables generated by consumer purchases, the sales companies have a purchase money security interest in the financed equipment. The purchase money security interests in such turf equipment are automatically perfected and have a first priority against other lenders and creditors of the obligor. Except in limited circumstances, no financing statements are filed and no notations of liens are recorded on titles by the sales companies for turf equipment receivables generated by consumer purchases. In the absence of financing statements being filed with respect to turf equipment receivables generated by consumer purchases, a purchaser of such turf equipment from the obligor may take the equipment free of the trust’s security interest if the purchaser, without knowledge of the trust’s security interest, buys the equipment for value and primarily for the buyer’s personal, family or household purposes.

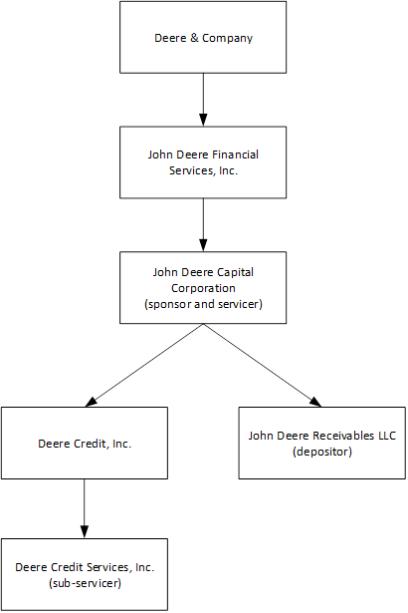

Obligors are not notified of the sale from the sales companies to JDCC. Furthermore, because either the servicer or thesub-servicer continues to service the contracts, the obligors are not notified of the sale from JDCC to the depositor and, in the ordinary course, no action is taken to record the transfer of the security interest from JDCC to the depositor by amendment of the financing statements or, if applicable, the certificates of title for the financed equipment or otherwise. No amendment is required to be filed under the UCC to maintain perfection of JDCC’s interest in the financed equipment. To perfect its interests in the contracts, JDCC takes possession of the contracts.

With respect to the trust, under the purchase agreement, JDCC will sell and assign its interests in the equipment securing the receivables to the depositor, and under the sale and servicing agreement, the depositor will assign its interests in the equipment securing the receivables to the trust. However, because of the administrative burden and expense, none of the depositor, the servicer, thesub-servicer or the owner trustee will amend any financing statement or, if applicable, any certificate of title to identify the trust as the new secured party on the financing statement or, if applicable, the certificate of title relating to the equipment. Also, the servicer will continue to hold any certificates of title relating to the equipment in its possession as custodian for the trust under the sale and servicing agreement. See “Description of the Transfer and Servicing Agreements—Sale and Assignment of Receivables.”

There are certain limited circumstances under the UCC and applicable federal law in which prior or subsequent transferees of receivables held by the trust could have an interest in those receivables with priority over the trust’s interest. A purchaser of these receivables who gives new value and takes possession of the instruments that evidence the receivables (i.e., the chattel paper) in the ordinary course of his or her business may, under certain circumstances, have priority over the interest of the trust in the receivables. In addition, while JDCC is the servicer, cash collections on the receivables will, under certain circumstances, be commingled with the funds of JDCC and, in the event of the bankruptcy of JDCC, the trust may not have a perfected interest in these collections.

In most states, an assignment such as that under the purchase agreement and the sale and servicing agreement is an effective conveyance of a security interest without amendment of any lien perfected by a UCC financing statement relating to the equipment or, if applicable, noted on an equipment’s certificate of title, and the assignee succeeds thereby to the assignor’s rights as secured party. By not identifying the trust as the secured party on the financing statement or certificate of title, the security interest of the trust in the equipment could be defeated through fraud or negligence. In the absence of error, fraud or forgery by the equipment owner or the servicer or thesub-servicer, or administrative error by state or local agencies, the proper initial filing of the financing statement relating to the agricultural, turf (which includes consumer and commercial equipment), construction and forestry equipment or, if applicable, the notation of the relevant sales company’s lien on the certificates of title will be sufficient to protect the trust against the rights of subsequent purchasers of the equipment or subsequent lenders who take a security interest in the equipment securing a receivable. Except in limited circumstances, no financing statements are filed and no notations of liens are recorded on titles for turf equipment receivables generated by consumer purchases.

If there is any equipment as to which the original secured party failed to obtain and assign to JDCC a perfected security interest, any security interest of JDCC would be subordinated to, among others, subsequent purchasers of the equipment and holders of perfected security interests. This failure, however, would constitute a breach of the warranties of JDCC under the purchase agreement and would create an obligation of the servicer to repurchase the related receivables unless the breach is cured. The depositor will assign its rights under the purchase agreement to the trust. See “Description of the Transfer and Servicing Agreements—Sale and Assignment of Receivables.”

Under the laws of most states, the perfected security interest in personal property would continue for four months after the location of the debtor changes to a state other than the state in which a financing statement was filed initially to perfect the security interest in the property or, if applicable, in which the property is initially registered (or

85