| Copyright © 2024 Harmony Biosciences. All rights reserved. Q3 2024 Financial Results and Business Updates October 29, 2024 |

| Forward-Looking Statements This presentation includes forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in these materials or elsewhere, including statements regarding Harmony Biosciences Holdings, Inc.’s (the “Company”) future financial position, business strategy and plans and objectives of management for future operations, should be considered forward-looking statements. Forward-looking statements use words like “believes,” “plans,” “expects,” “intends,” “will,” “would,” “anticipates,” “estimates,” “may,” “could,” “might,” “continue,” “potential,” and similar words or expressions in discussions of the Company’s future operations, financial performance or the Company’s strategies, but the absence of these words does not mean that a statement is not forward-looking. These statements are based on current expectations or objectives that are inherently uncertain. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expressed or implied forwarding-looking statements, including, but not limited to the risk factors discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 22, 2024 and its other filings with the SEC. While the Company may elect to update such forward-looking statements at some point in the future, it disclaims any obligation to do so, even if subsequent events cause its views to change. This presentation includes information related to market opportunity as well as cost and other estimates obtained from internal analyses and external sources. The internal analyses are based upon management’s understanding of market and industry conditions and have not been verified by independent sources. Similarly, the externally sourced information has been obtained from sources the Company believes to be reliable, but the accuracy and completeness of such information cannot be assured. Neither the Company, nor any of its respective officers, directors, managers, employees, agents, or representatives, (i) make any representations or warranties, express or implied, with respect to any of the information contained herein, including the accuracy or completeness of this presentation or any other written or oral information made available to any interested party or its advisor (and any liability therefore is expressly disclaimed), (ii) have any liability from the use of the information, including with respect to any forward-looking statements, or (iii) undertake to update any of the information contained herein or provide additional information as a result of new information or future events or developments. 2 |

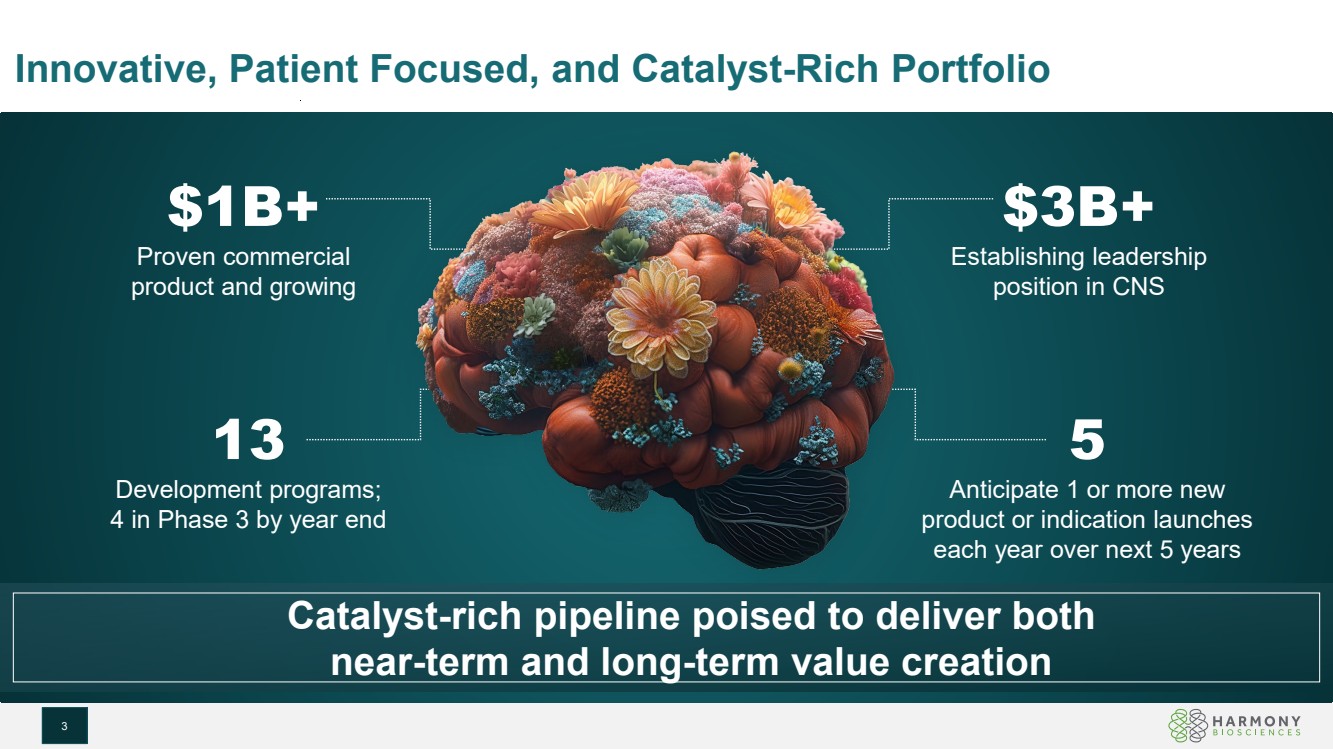

| Innovative, Patient Focused, and Catalyst-Rich Portfolio 3 5 Anticipate 1 or more new product or indication launches each year over next 5 years $1B+ Proven commercial product and growing $3B+ Establishing leadership position in CNS 13 Development programs; 4 in Phase 3 by year end Catalyst-rich pipeline poised to deliver both near-term and long-term value creation |

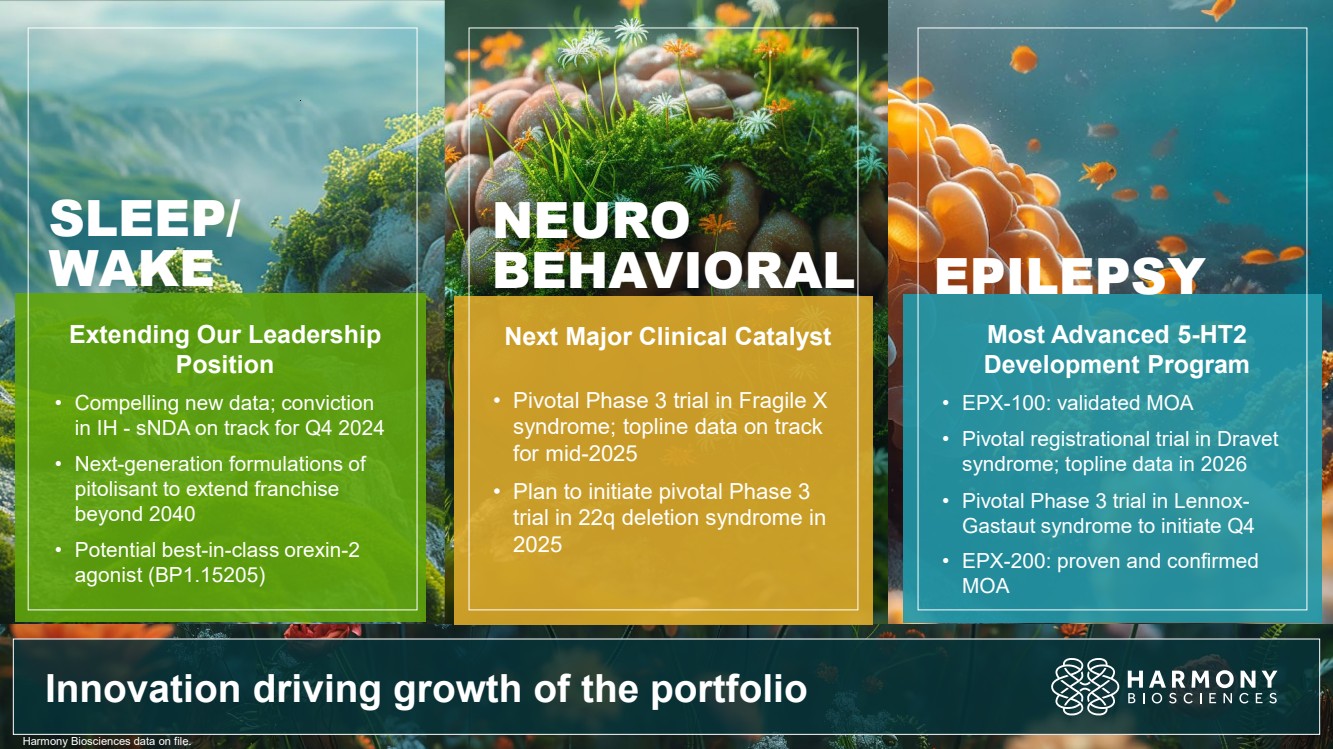

| Innovation driving growth of the portfolio Extending Our Leadership Position • Compelling new data; conviction in IH - sNDA on track for Q4 2024 • Next-generation formulations of pitolisant to extend franchise beyond 2040 • Potential best-in-class orexin-2 agonist (BP1.15205) Next Major Clinical Catalyst • Pivotal Phase 3 trial in Fragile X syndrome; topline data on track for mid-2025 • Plan to initiate pivotal Phase 3 trial in 22q deletion syndrome in 2025 Most Advanced 5-HT2 Development Program • EPX-100: validated MOA • Pivotal registrational trial in Dravet syndrome; topline data in 2026 • Pivotal Phase 3 trial in Lennox-Gastaut syndrome to initiate Q4 • EPX-200: proven and confirmed MOA SLEEP/ WAKE NEURO BEHAVIORAL EPILEPSY Harmony Biosciences data on file. |

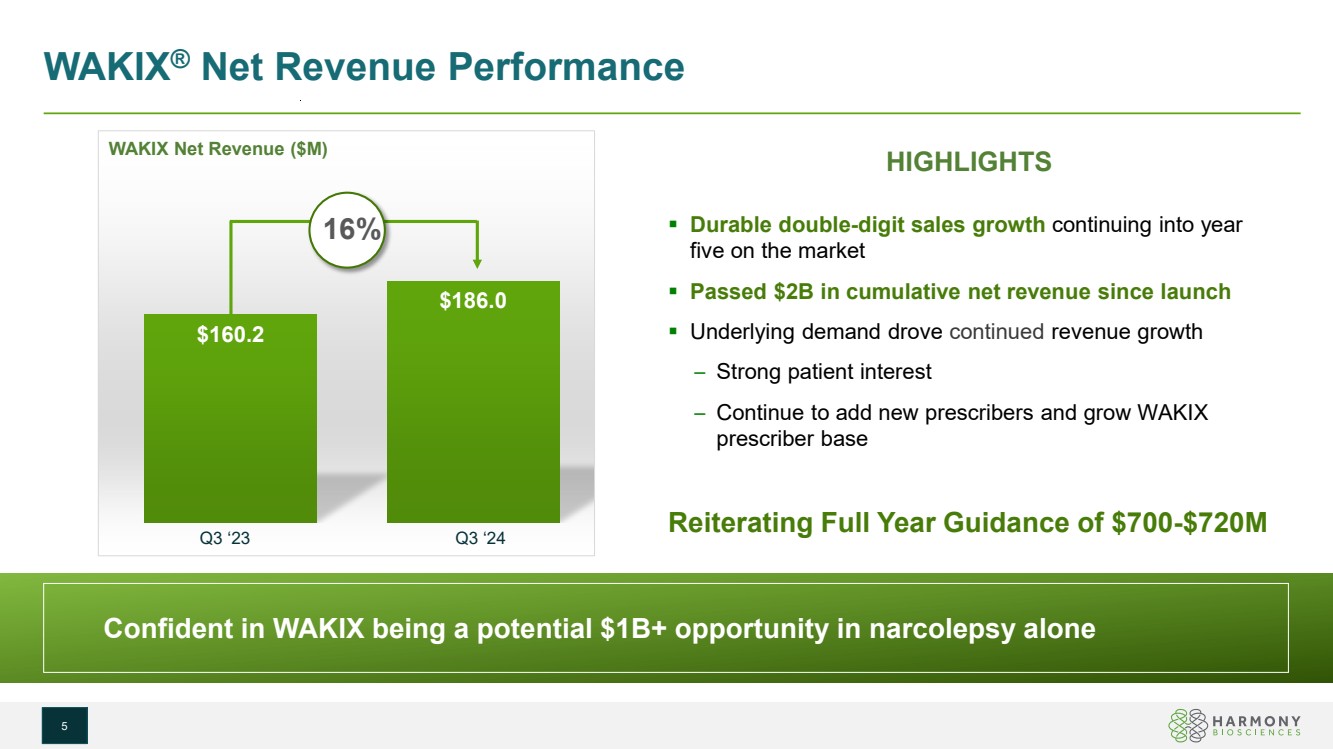

| $160.2 $186.0 HIGHLIGHTS Durable double-digit sales growth continuing into year five on the market Passed $2B in cumulative net revenue since launch Underlying demand drove continued revenue growth – Strong patient interest – Continue to add new prescribers and grow WAKIX prescriber base Q3 ‘23 Q3 ‘24 Reiterating Full Year Guidance of $700-$720M WAKIX Net Revenue ($M) WAKIX® Net Revenue Performance 5 16% Confident in WAKIX being a potential $1B+ opportunity in narcolepsy alone Confident in WAKIX being a potential $1B+ opportunity in narcolepsy alone |

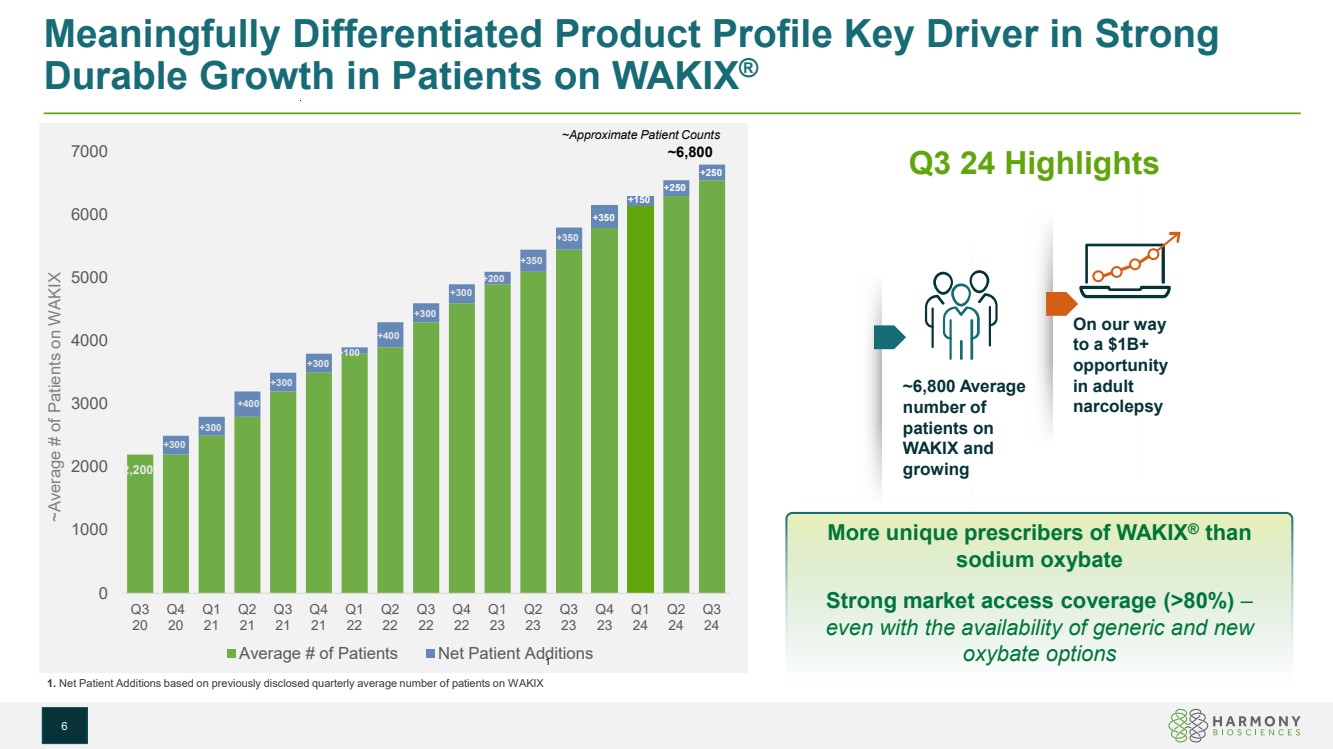

| 0 1000 2000 3000 4000 5000 6000 7000 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Average # of Patients Net Patient Additions Meaningfully Differentiated Product Profile Key Driver in Strong Durable Growth in Patients on WAKIX® 6 Q3 24 Highlights More unique prescribers of WAKIX® than sodium oxybate Strong market access coverage (>80%) – even with the availability of generic and new 1 oxybate options ~Average # of Patients on WAKIX ~Approximate Patient Counts 2,200 +300 +300 +400 +400 +300 +300 +300 +300 +350 +350 +350 +200 +100 ~6,800 1. Net Patient Additions based on previously disclosed quarterly average number of patients on WAKIX ~6,800 Average number of patients on WAKIX and growing On our way to a $1B+ opportunity in adult narcolepsy +150 +250 +250 |

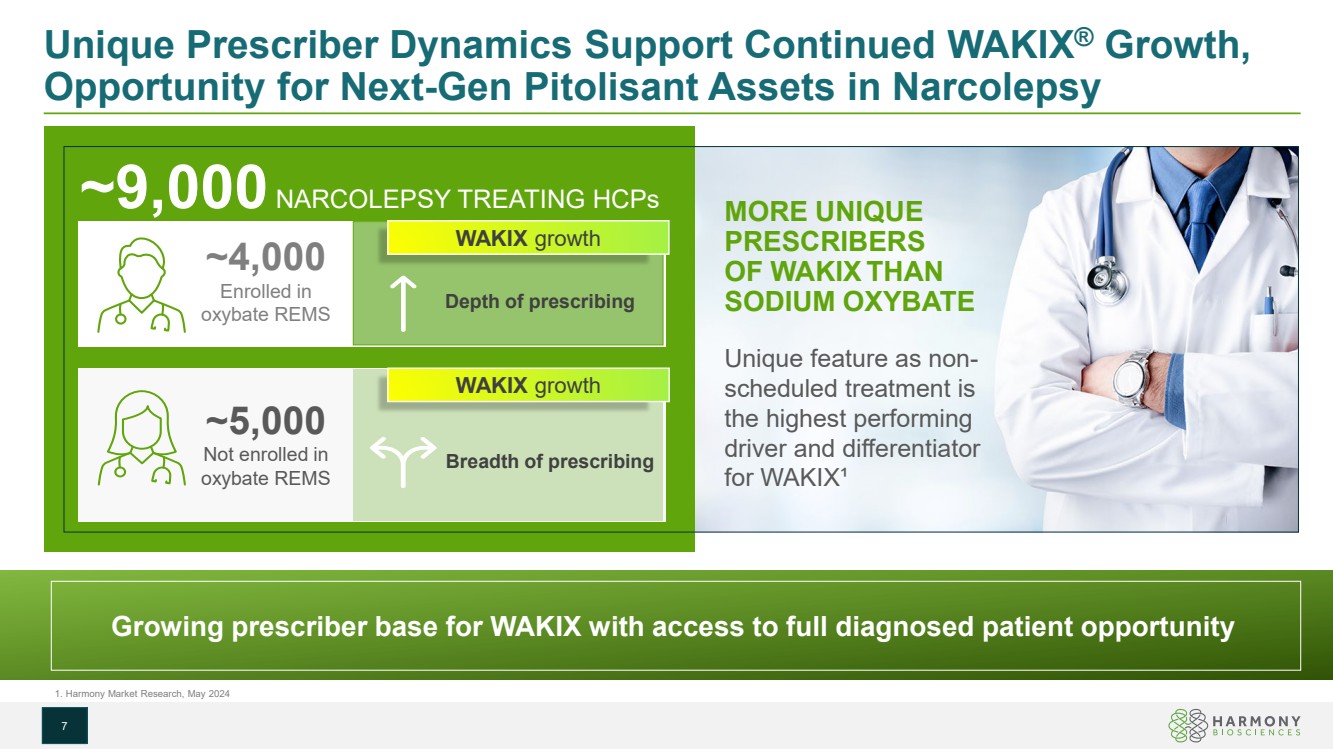

| Unique Prescriber Dynamics Support Continued WAKIX® Growth, Opportunity for Next-Gen Pitolisant Assets in Narcolepsy 7 ~4,000 Enrolled in oxybate REMS ~5,000 Not enrolled in oxybate REMS Depth of prescribing Breadth of prescribing WAKIX growth ~9,000 NARCOLEPSY TREATING HCPs WAKIX growth Growing prescriber base for WAKIX with access to full diagnosed patient opportunity 1. Harmony Market Research, May 2024 MORE UNIQUE PRESCRIBERS OF WAKIX THAN SODIUM OXYBATE Unique feature as non-scheduled treatment is the highest performing driver and differentiator for WAKIX¹ |

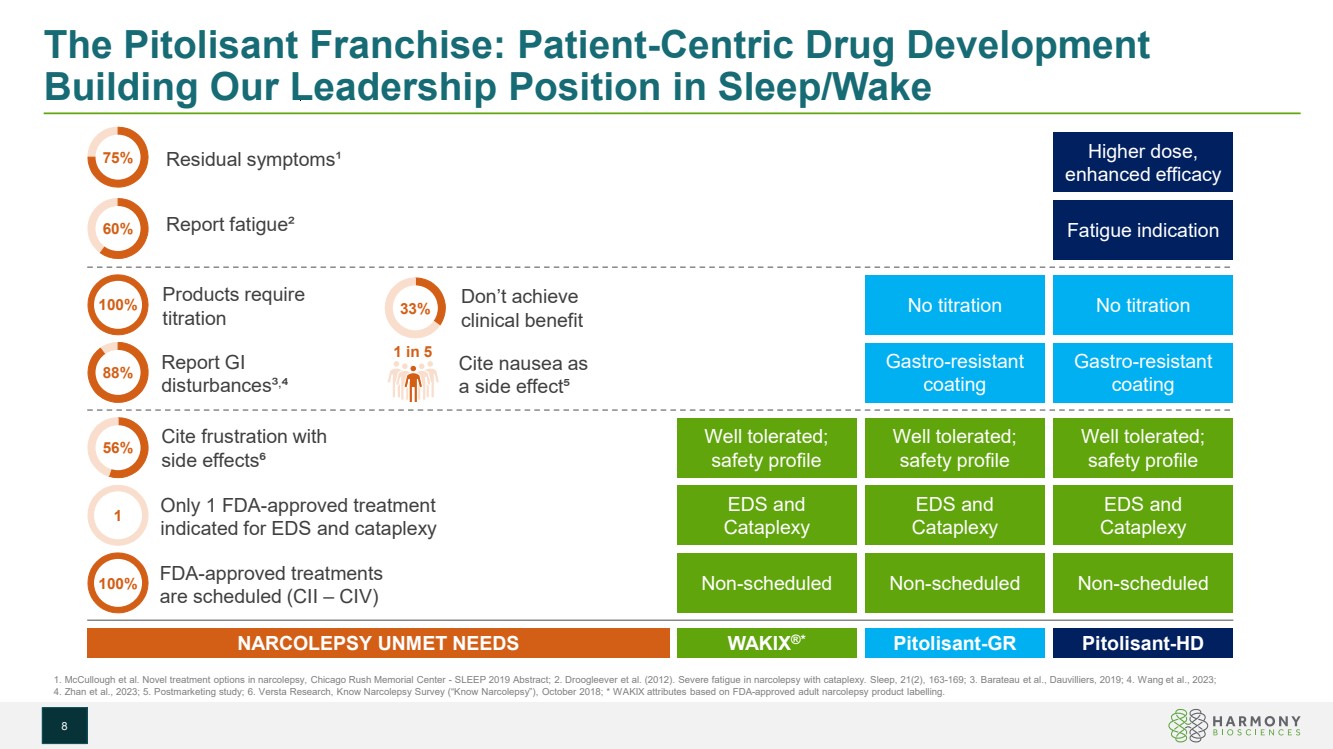

| The Pitolisant Franchise: Patient-Centric Drug Development Building Our Leadership Position in Sleep/Wake 8 Non-scheduled Gastro-resistant coating EDS and Cataplexy No titration Fatigue indication Higher dose, enhanced efficacy Non-scheduled EDS and Cataplexy Non-scheduled EDS and Cataplexy Gastro-resistant coating No titration Well tolerated; safety profile Well tolerated; safety profile Well tolerated; safety profile WAKIX®* Pitolisant-GR Pitolisant-HD Products require titration NARCOLEPSY UNMET NEEDS FDA-approved treatments are scheduled (CII – CIV) Only 1 FDA-approved treatment indicated for EDS and cataplexy 1. McCullough et al. Novel treatment options in narcolepsy, Chicago Rush Memorial Center - SLEEP 2019 Abstract; 2. Droogleever et al. (2012). Severe fatigue in narcolepsy with cataplexy. Sleep, 21(2), 163-169; 3. Barateau et al., Dauvilliers, 2019; 4. Wang et al., 2023; 4. Zhan et al., 2023; 5. Postmarketing study; 6. Versta Research, Know Narcolepsy Survey (“Know Narcolepsy”), October 2018; * WAKIX attributes based on FDA-approved adult narcolepsy product labelling. Residual symptoms¹ Report fatigue² Report GI disturbances³, ⁴ Cite nausea as a side effect⁵ Cite frustration with side effects⁶ Don’t achieve clinical benefit 60% 75% 100% 88% 56% 100% 1 33% 1 in 5 |

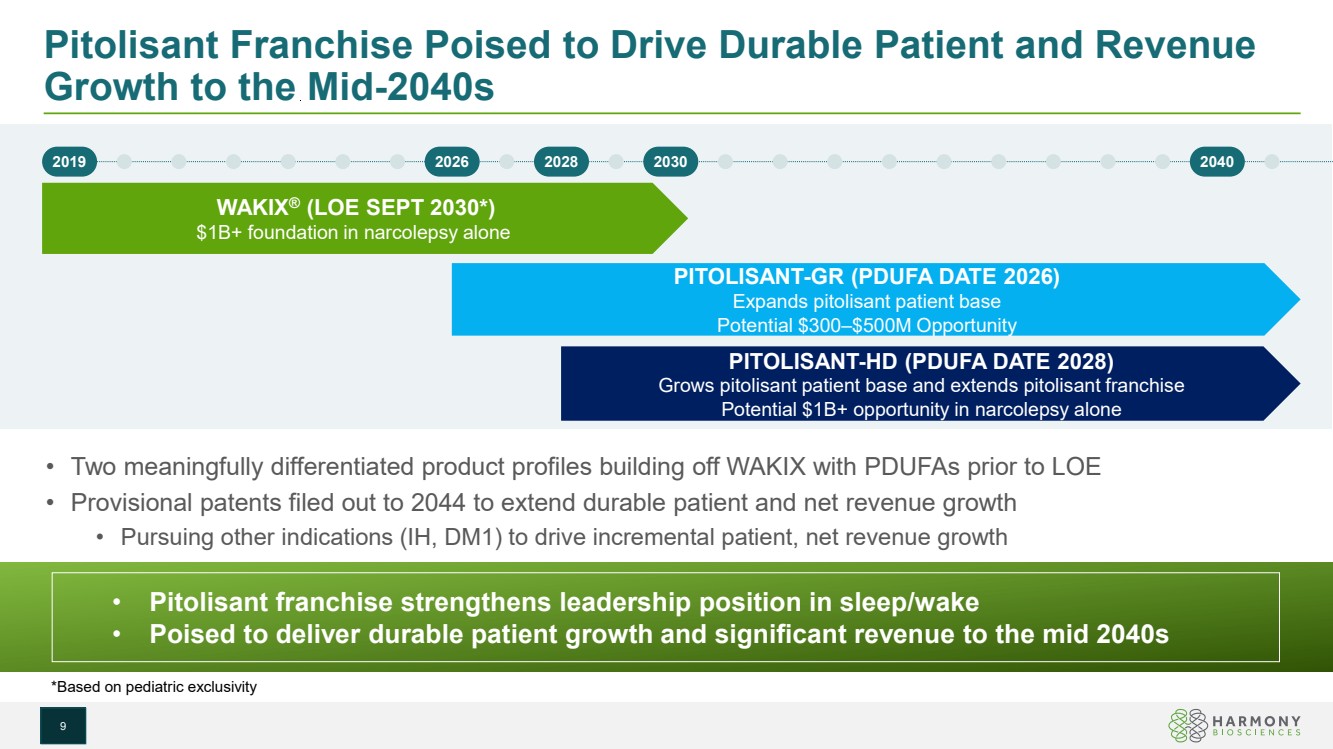

| Pitolisant Franchise Poised to Drive Durable Patient and Revenue Growth to the Mid-2040s • Two meaningfully differentiated product profiles building off WAKIX with PDUFAs prior to LOE • Provisional patents filed out to 2044 to extend durable patient and net revenue growth • Pursuing other indications (IH, DM1) to drive incremental patient, net revenue growth *Based on pediatric exclusivity WAKIX® (LOE SEPT 2030*) $1B+ foundation in narcolepsy alone PITOLISANT-GR (PDUFA DATE 2026) Expands pitolisant patient base Potential $300–$500M Opportunity PITOLISANT-HD (PDUFA DATE 2028) Grows pitolisant patient base and extends pitolisant franchise Potential $1B+ opportunity in narcolepsy alone 2019 2026 2028 2030 2040 • Pitolisant franchise strengthens leadership position in sleep/wake • Poised to deliver durable patient growth and significant revenue to the mid 2040s 9 |

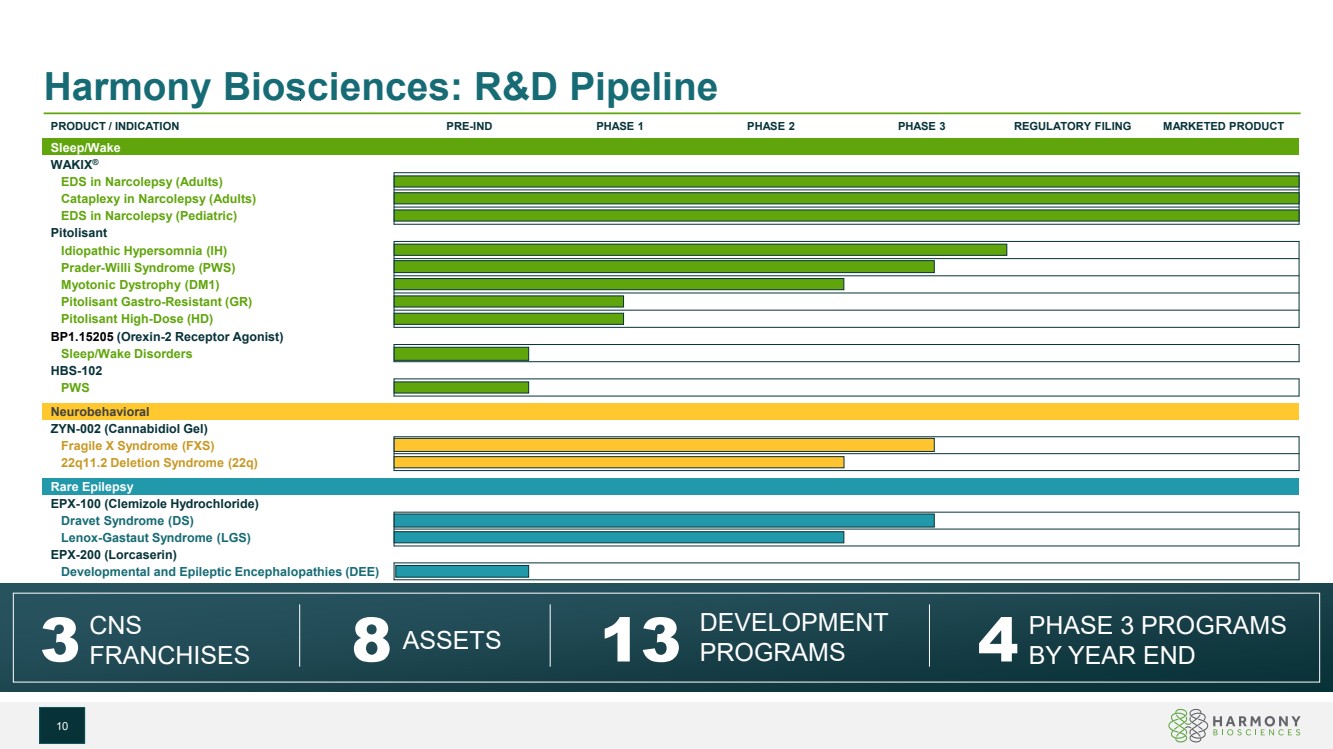

| Harmony Biosciences: R&D Pipeline PRODUCT / INDICATION PRE-IND PHASE 1 PHASE 2 PHASE 3 REGULATORY FILING MARKETED PRODUCT Sleep/Wake WAKIX® EDS in Narcolepsy (Adults) Cataplexy in Narcolepsy (Adults) EDS in Narcolepsy (Pediatric) Pitolisant Idiopathic Hypersomnia (IH) Prader-Willi Syndrome (PWS) Myotonic Dystrophy (DM1) Pitolisant Gastro-Resistant (GR) Pitolisant High-Dose (HD) BP1.15205 (Orexin-2 Receptor Agonist) Sleep/Wake Disorders HBS-102 PWS Neurobehavioral ZYN-002 (Cannabidiol Gel) Fragile X Syndrome (FXS) 22q11.2 Deletion Syndrome (22q) Rare Epilepsy EPX-100 (Clemizole Hydrochloride) Dravet Syndrome (DS) Lenox-Gastaut Syndrome (LGS) EPX-200 (Lorcaserin) Developmental and Epileptic Encephalopathies (DEE) 3 CNS FRANCHISES 13 DEVELOPMENT 8 PROGRAMS ASSETS 4PHASE 3 PROGRAMS BY YEAR END 10 |

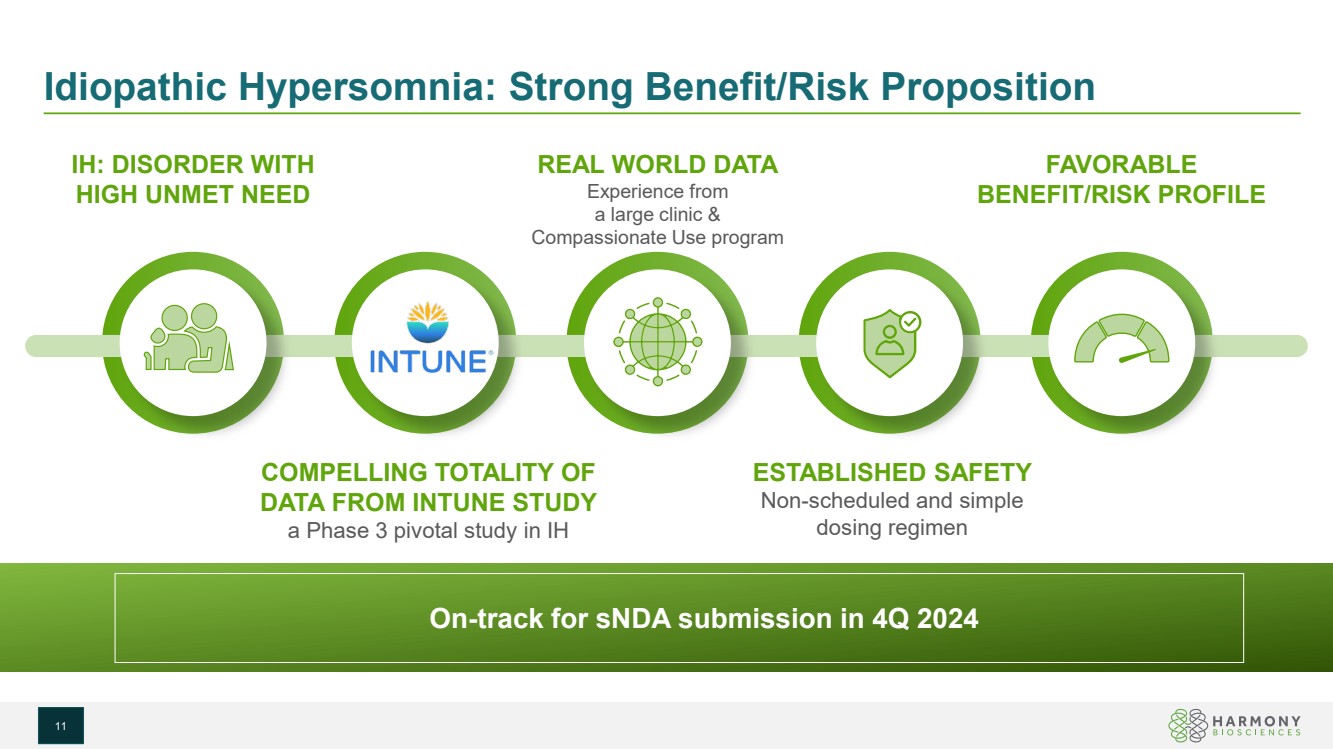

| Idiopathic Hypersomnia: Strong Benefit/Risk Proposition IH: DISORDER WITH HIGH UNMET NEED ESTABLISHED SAFETY Non-scheduled and simple dosing regimen FAVORABLE BENEFIT/RISK PROFILE COMPELLING TOTALITY OF DATA FROM INTUNE STUDY a Phase 3 pivotal study in IH REAL WORLD DATA Experience from a large clinic & Compassionate Use program On-track for sNDA submission in 4Q 2024 11 |

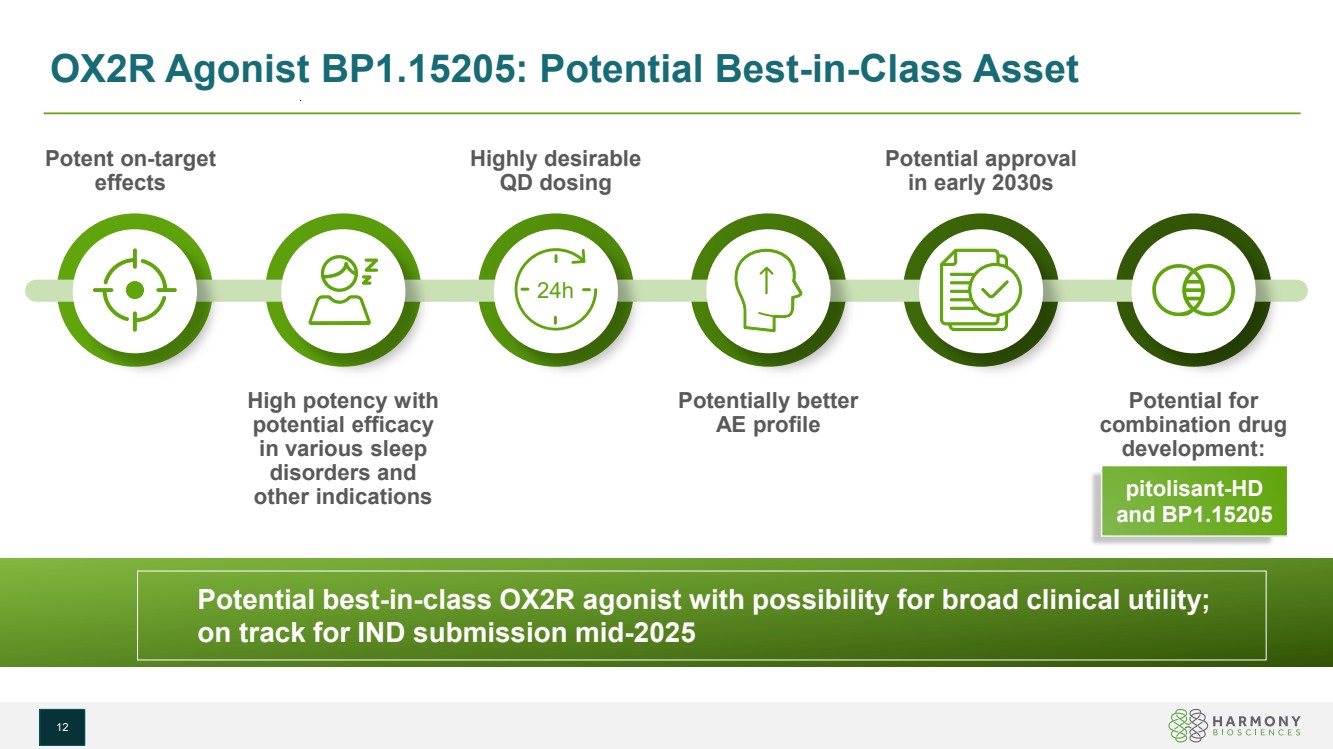

| OX2R Agonist BP1.15205: Potential Best-in-Class Asset High potency with potential efficacy in various sleep disorders and other indications Potent on-target effects Potentially better AE profile Highly desirable QD dosing 24h Potential approval in early 2030s Potential for combination drug development: pitolisant-HD and BP1.15205 Potential best-in-class OX2R agonist with possibility for broad clinical utility; on track for IND submission mid-2025 12 |

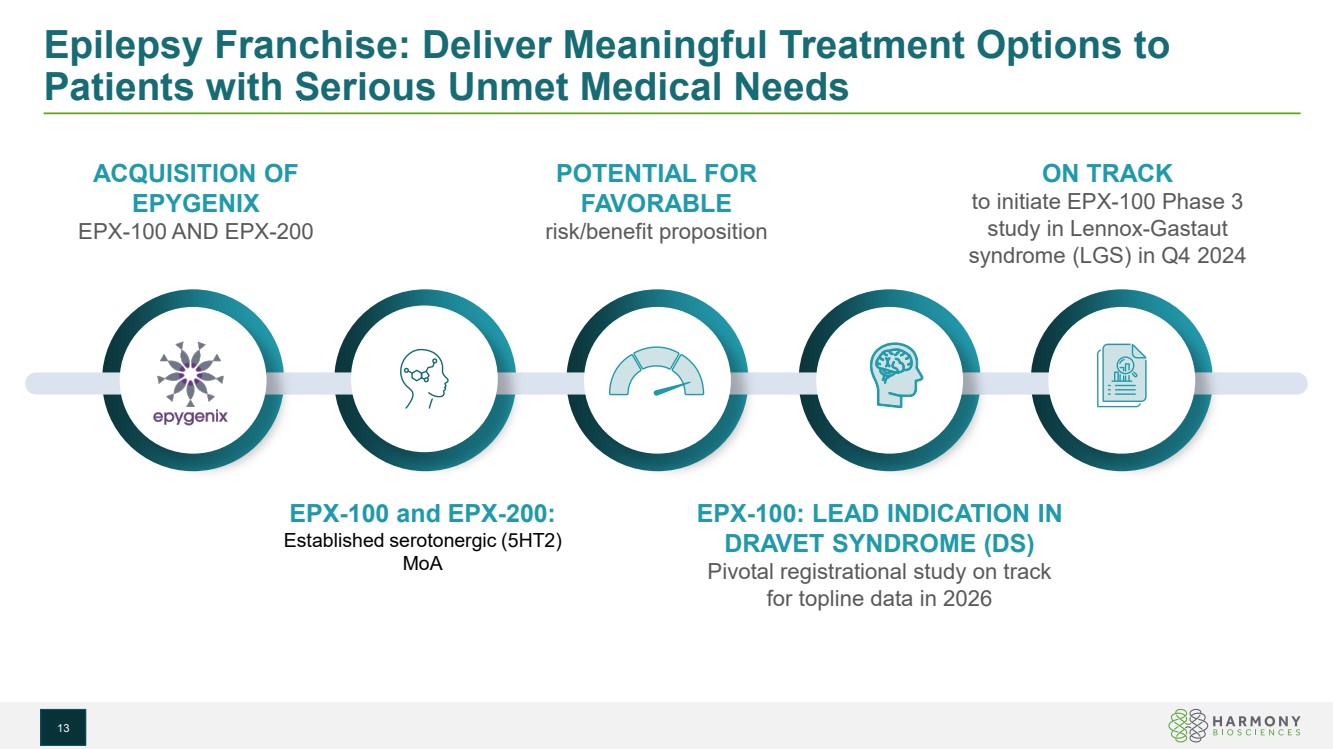

| Epilepsy Franchise: Deliver Meaningful Treatment Options to Patients with Serious Unmet Medical Needs ACQUISITION OF EPYGENIX EPX-100 AND EPX-200 EPX-100 and EPX-200: Established serotonergic (5HT2) MoA POTENTIAL FOR FAVORABLE risk/benefit proposition EPX-100: LEAD INDICATION IN DRAVET SYNDROME (DS) Pivotal registrational study on track for topline data in 2026 ON TRACK to initiate EPX-100 Phase 3 study in Lennox-Gastaut syndrome (LGS) in Q4 2024 13 |

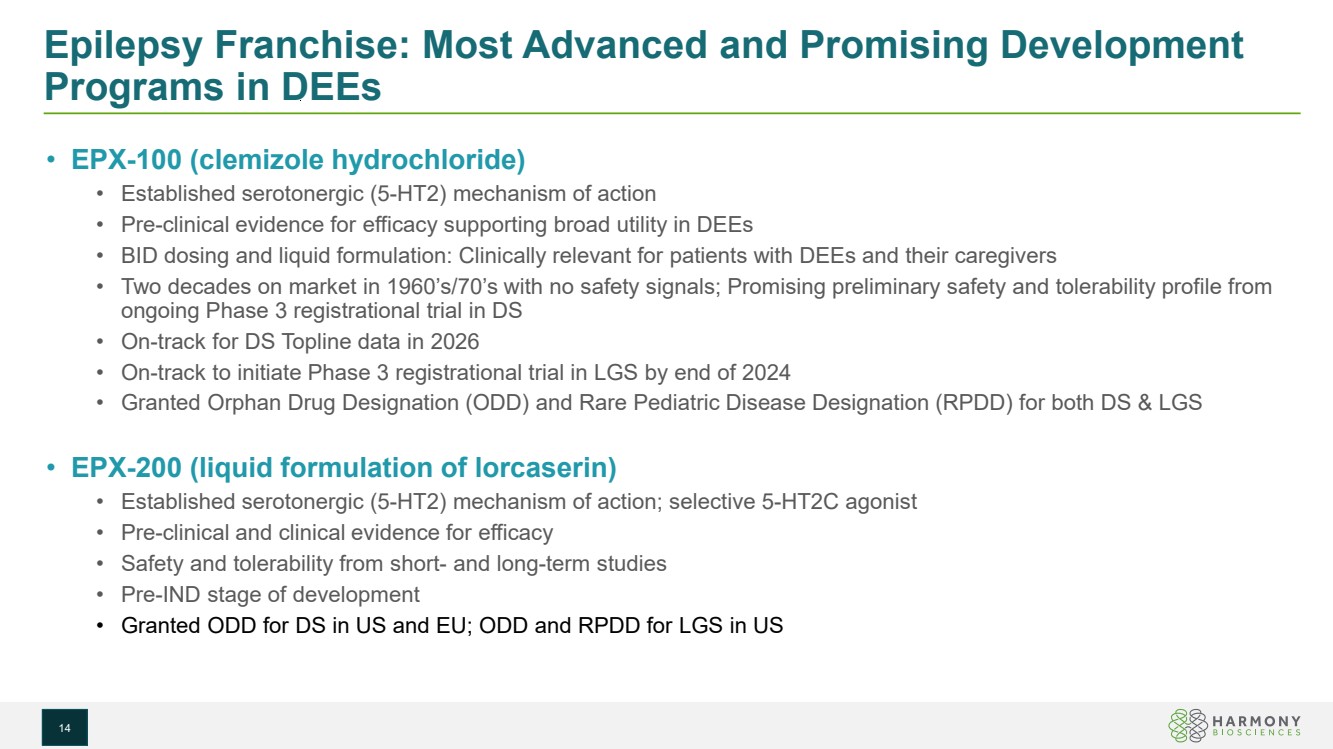

| Epilepsy Franchise: Most Advanced and Promising Development Programs in DEEs • EPX-100 (clemizole hydrochloride) • Established serotonergic (5-HT2) mechanism of action • Pre-clinical evidence for efficacy supporting broad utility in DEEs • BID dosing and liquid formulation: Clinically relevant for patients with DEEs and their caregivers • Two decades on market in 1960’s/70’s with no safety signals; Promising preliminary safety and tolerability profile from ongoing Phase 3 registrational trial in DS • On-track for DS Topline data in 2026 • On-track to initiate Phase 3 registrational trial in LGS by end of 2024 • Granted Orphan Drug Designation (ODD) and Rare Pediatric Disease Designation (RPDD) for both DS & LGS • EPX-200 (liquid formulation of lorcaserin) • Established serotonergic (5-HT2) mechanism of action; selective 5-HT2C agonist • Pre-clinical and clinical evidence for efficacy • Safety and tolerability from short- and long-term studies • Pre-IND stage of development • Granted ODD for DS in US and EU; ODD and RPDD for LGS in US 14 |

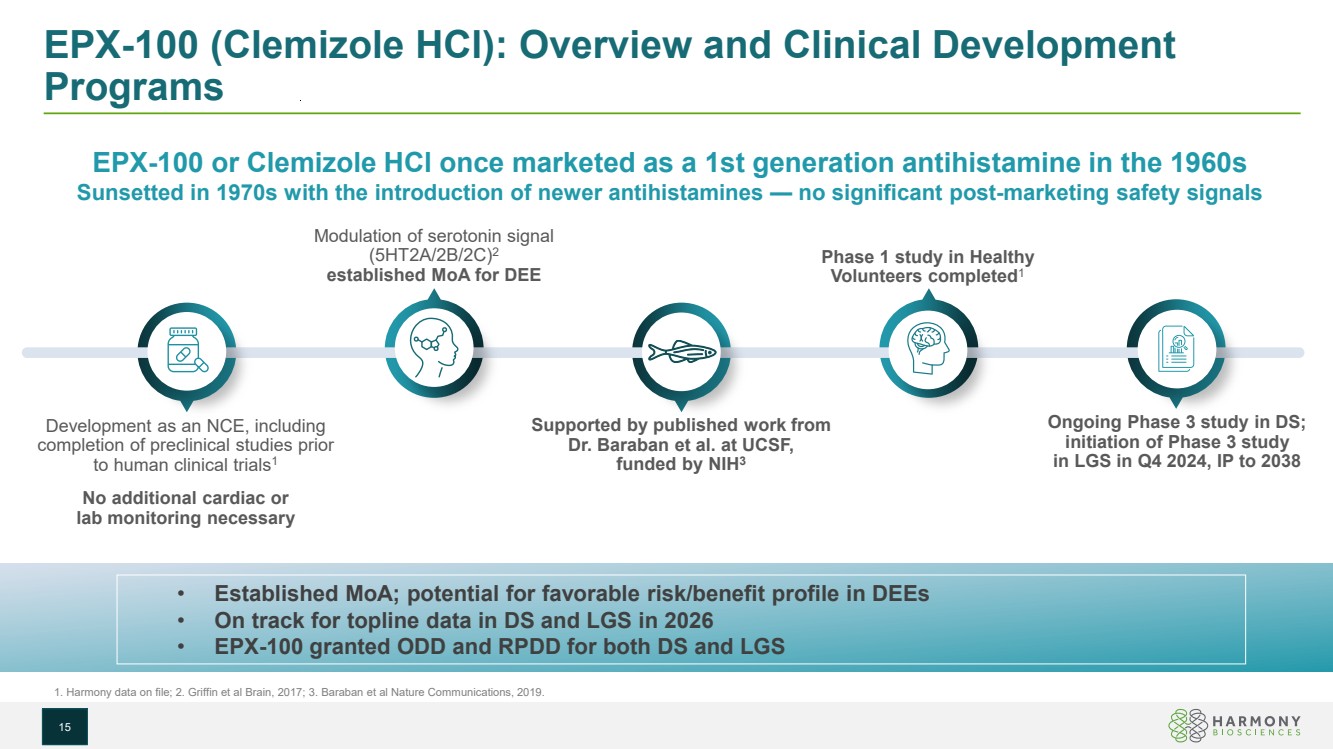

| EPX-100 (Clemizole HCl): Overview and Clinical Development Programs • Established MoA; potential for favorable risk/benefit profile in DEEs • On track for topline data in DS and LGS in 2026 • EPX-100 granted ODD and RPDD for both DS and LGS EPX-100 or Clemizole HCl once marketed as a 1st generation antihistamine in the 1960s Sunsetted in 1970s with the introduction of newer antihistamines — no significant post-marketing safety signals 1. Harmony data on file; 2. Griffin et al Brain, 2017; 3. Baraban et al Nature Communications, 2019. Development as an NCE, including completion of preclinical studies prior to human clinical trials1 No additional cardiac or lab monitoring necessary Phase 1 study in Healthy Volunteers completed1 Modulation of serotonin signal (5HT2A/2B/2C)2 established MoA for DEE Ongoing Phase 3 study in DS; initiation of Phase 3 study in LGS in Q4 2024, IP to 2038 Supported by published work from Dr. Baraban et al. at UCSF, funded by NIH3 15 |

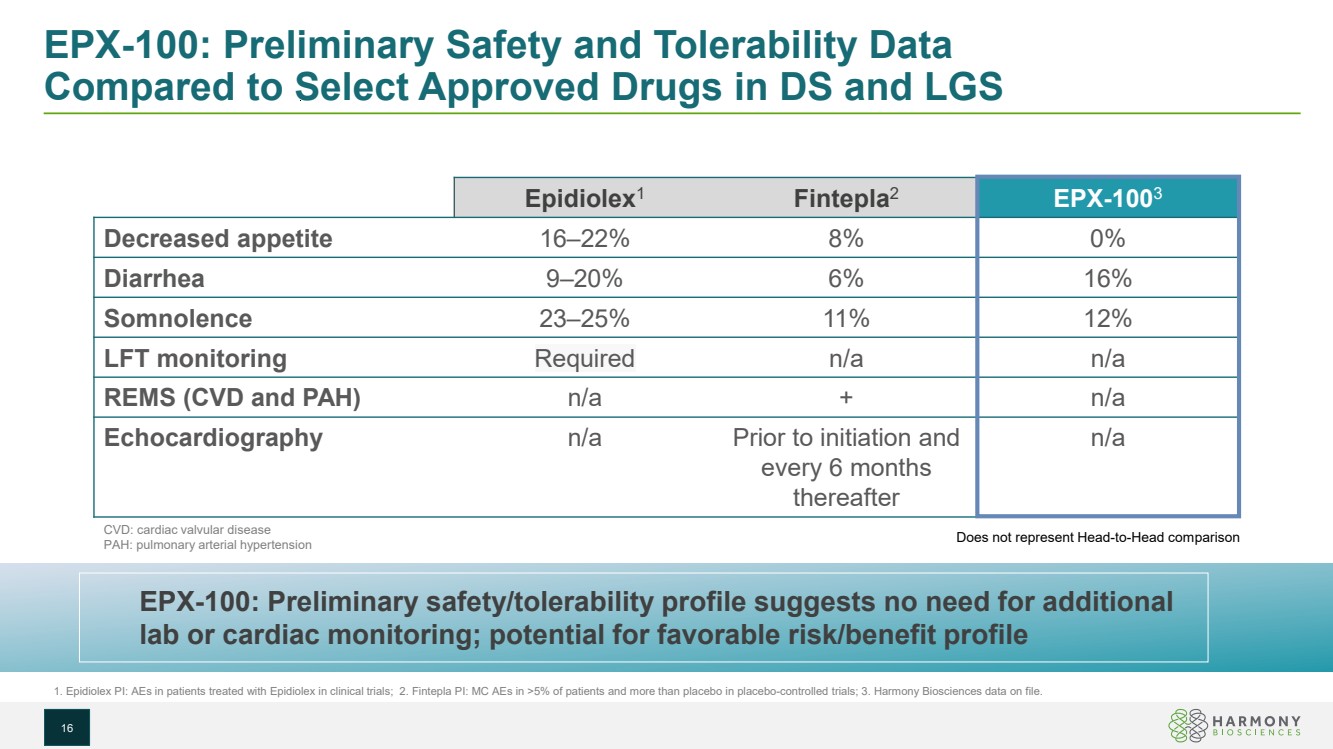

| EPX-100: Preliminary Safety and Tolerability Data Compared to Select Approved Drugs in DS and LGS 16 Epidiolex1 Fintepla2 EPX-1003 Decreased appetite 16–22% 8% 0% Diarrhea 9–20% 6% 16% Somnolence 23–25% 11% 12% LFT monitoring Required n/a n/a REMS (CVD and PAH) n/a + n/a Echocardiography n/a Prior to initiation and every 6 months thereafter n/a 1. Epidiolex PI: AEs in patients treated with Epidiolex in clinical trials; 2. Fintepla PI: MC AEs in >5% of patients and more than placebo in placebo-controlled trials; 3. Harmony Biosciences data on file. EPX-100: Preliminary safety/tolerability profile suggests no need for additional lab or cardiac monitoring; potential for favorable risk/benefit profile CVD: cardiac valvular disease PAH: pulmonary arterial hypertension Does not represent Head-to-Head comparison |

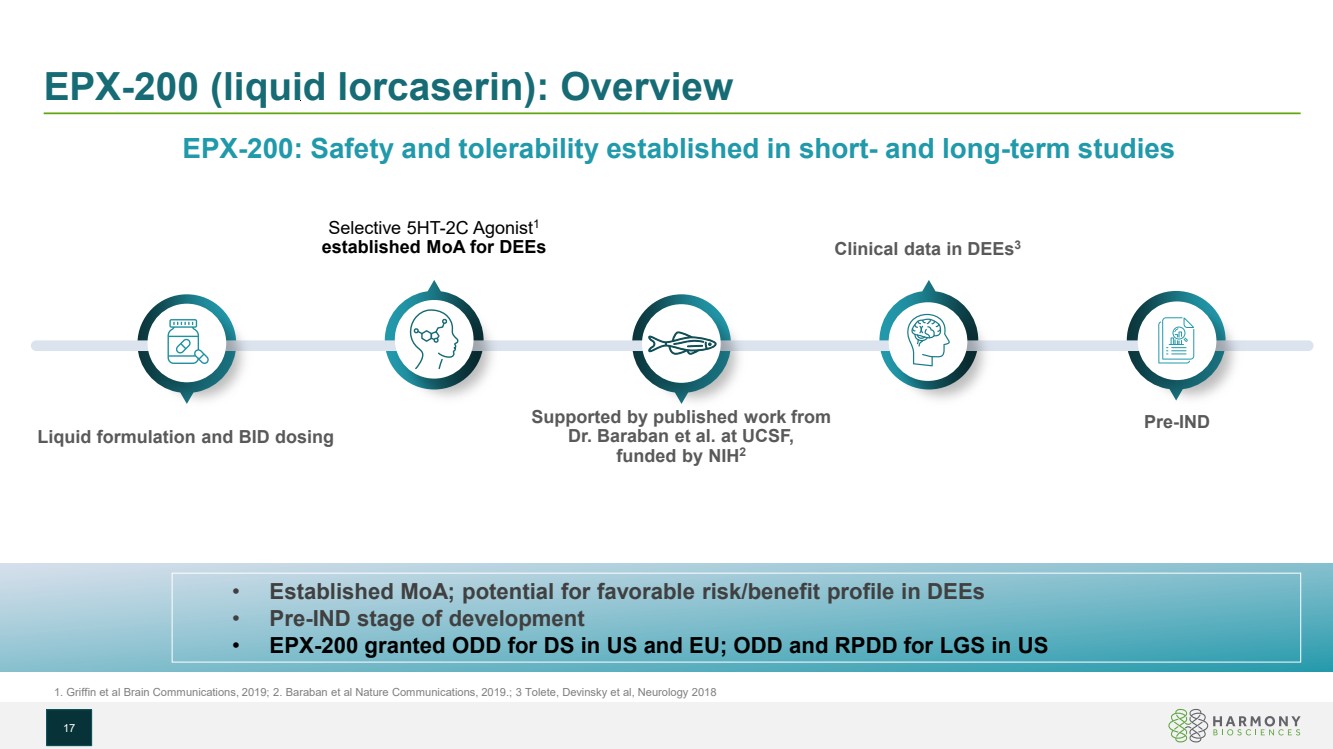

| EPX-200 (liquid lorcaserin): Overview • Established MoA; potential for favorable risk/benefit profile in DEEs • Pre-IND stage of development • EPX-200 granted ODD for DS in US and EU; ODD and RPDD for LGS in US EPX-200: Safety and tolerability established in short- and long-term studies 1. Griffin et al Brain Communications, 2019; 2. Baraban et al Nature Communications, 2019.; 3 Tolete, Devinsky et al, Neurology 2018 Liquid formulation and BID dosing Clinical data in DEEs3 Selective 5HT-2C Agonist1 established MoA for DEEs Supported by published work from Pre-IND Dr. Baraban et al. at UCSF, funded by NIH2 17 |

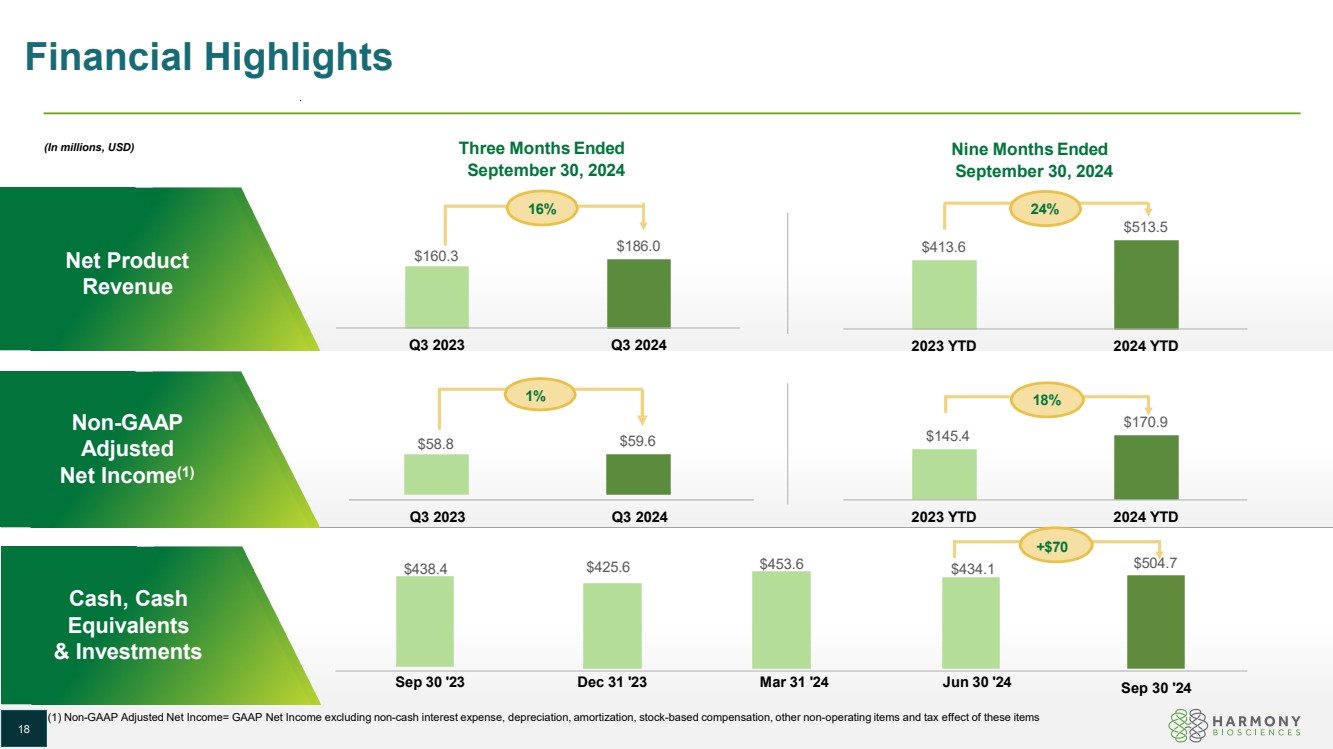

| Financial Highlights Net Product Revenue Non-GAAP Adjusted Net Income(1) Cash, Cash Equivalents & Investments $160.3 $186.0 Q3 2023 Q3 2024 $58.8 $59.6 $413.6 $513.5 2023 YTD 2024 YTD $145.4 $170.9 2023 YTD 2024 YTD $438.4 $425.6 $453.6 $434.1 $504.7 Sep 30 '24 Sep 30 '23 Dec 31 '23 Mar 31 '24 Jun 30 '24 (1) Non-GAAP Adjusted Net Income= GAAP Net Income excluding non-cash interest expense, depreciation, amortization, stock-based compensation, other non-operating items and tax effect of these items 16% 24% 18% (In millions, USD) Three Months Ended September 30, 2024 Q3 2023 Q3 2024 1% Nine Months Ended September 30, 2024 18 18 +$70 |

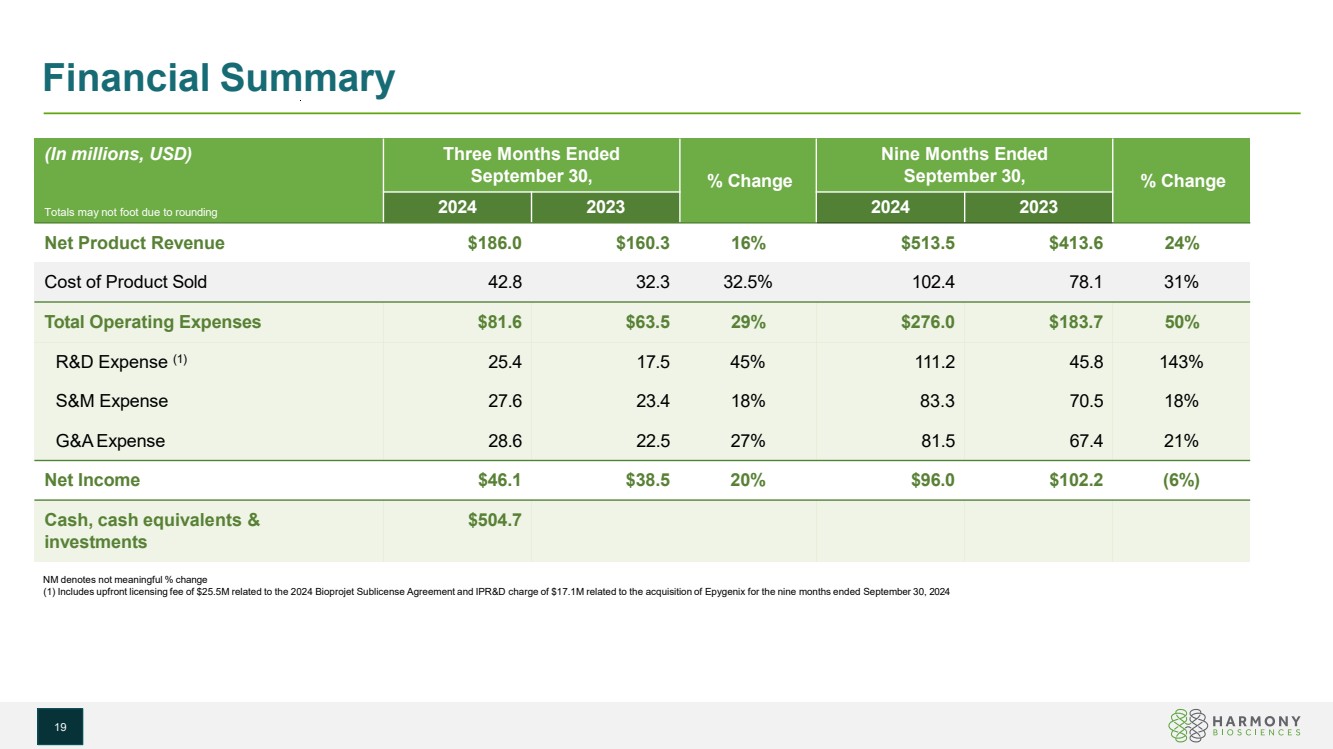

| Financial Summary NM denotes not meaningful % change (1) Includes upfront licensing fee of $25.5M related to the 2024 Bioprojet Sublicense Agreement and IPR&D charge of $17.1M related to the acquisition of Epygenix for the nine months ended September 30, 2024 (In millions, USD) Totals may not foot due to rounding Three Months Ended September 30, % Change Nine Months Ended September 30, % Change 2024 2023 2024 2023 Net Product Revenue $186.0 $160.3 16% $513.5 $413.6 24% Cost of Product Sold 42.8 32.3 32.5% 102.4 78.1 31% Total Operating Expenses $81.6 $63.5 29% $276.0 $183.7 50% R&D Expense (1) 25.4 17.5 45% 111.2 45.8 143% S&M Expense 27.6 23.4 18% 83.3 70.5 18% G&AExpense 28.6 22.5 27% 81.5 67.4 21% Net Income $46.1 $38.5 20% $96.0 $102.2 (6%) Cash, cash equivalents & investments $504.7 19 |

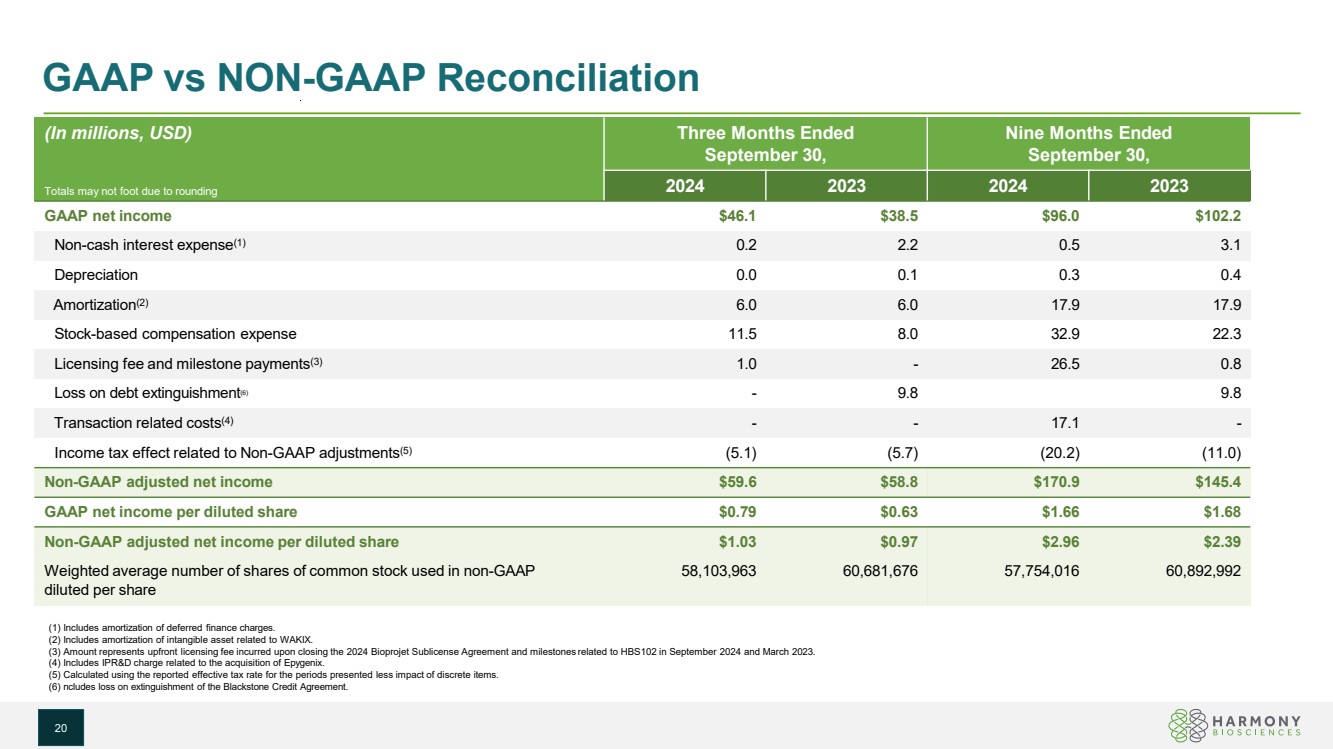

| GAAP vs NON-GAAP Reconciliation (In millions, USD) Totals may not foot due to rounding Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 GAAP net income $46.1 $38.5 $96.0 $102.2 Non-cash interest expense(1) 0.2 2.2 0.5 3.1 Depreciation 0.0 0.1 0.3 0.4 Amortization(2) 6.0 6.0 17.9 17.9 Stock-based compensation expense 11.5 8.0 32.9 22.3 Licensing fee and milestone payments(3) 1.0 - 26.5 0.8 Loss on debt extinguishment(6) - 9.8 9.8 Transaction related costs(4) - - 17.1 - Income tax effect related to Non-GAAP adjustments(5) (5.1) (5.7) (20.2) (11.0) Non-GAAP adjusted net income $59.6 $58.8 $170.9 $145.4 GAAP net income per diluted share $0.79 $0.63 $1.66 $1.68 Non-GAAP adjusted net income per diluted share $1.03 $0.97 $2.96 $2.39 Weighted average number of shares of common stock used in non-GAAP diluted per share 58,103,963 60,681,676 57,754,016 60,892,992 (1) Includes amortization of deferred finance charges. (2) Includes amortization of intangible asset related to WAKIX. (3) Amount represents upfront licensing fee incurred upon closing the 2024 Bioprojet Sublicense Agreement and milestones related to HBS102 in September 2024 and March 2023. (4) Includes IPR&D charge related to the acquisition of Epygenix. (5) Calculated using the reported effective tax rate for the periods presented less impact of discrete items. (6) ncludes loss on extinguishment of the Blackstone Credit Agreement. 20 |

| 21 Commitment to patients Addressing unmet medical needs Delivering meaningful treatment options Helping patients thrive DELIVER ON PROMISE TO PATIENTS Innovative Catalyst-rich pipeline Profitable biotech company Meaningful investment opportunity DELIVER STONG VALUE TO SHAREHOLDERS |

| company/harmonybiosciences/ @harmonybio harmony_biosciences www.harmonybiosciences.com |