Exhibit 99.2

1 Fourth Quarter 2021 Earnings Call March 28, 2022

2 Safe Harbor This presentation (this “Presentation”) contains “forward - looking statements” within the meaning of U . S . federal securities laws . Such forward - looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions, plans, prospects, financial results (including guidance) or strategies regarding Lightning eMotors, Inc . (“Lightning eMotors”, “the “Company”, “us”, “our” or “we”) and its management team . Any statements other than statements of historical fact contained in this Presentation, including statements as to future results of operations and financial position, planned products and services, business strategy and plans, objectives of management for future operations of Lightning eMotors, market size and growth opportunities, competitive position and technological and market trends, are forward - looking statements . In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements . The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking . These forward - looking statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Lightning eMotors’ management and are not predictions of actual performance . There can be no assurance that future developments affecting Lightning eMotors will be those anticipated . These forward - looking statements contained in this Presentation are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause actual results or outcomes to be materially different from any future results or outcomes expressed or implied by the forward - looking statements . These risks, uncertainties, assumptions and other factors are listed in our filings with the SEC . Forward - looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all . Should one or more of these risks or uncertainties materialize, or should any of the assumptions being made prove incorrect, actual results may vary in material respects from those projected in these forward - looking statements . We undertake no obligation to update or revise any forward looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws . This Presentation contains projected financial information with respect to Lightning eMotors . Such projected financial information constitutes forward - looking information, and is for illustrative information purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . Our ability to meet our guidance is dependent on our receipt of a sufficient supply of critical components for the manufacture of our vehicles and powertrains . See the cautionary statements above . Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved . For example, sales pipeline may not be indicative of future sales and can vary significantly from period to period . Additionally, because backlog is comprised of non - binding agreements and purchase orders from customers and does not constitute a legal obligation, amounts included in backlog may not result in actual revenue and are an uncertain indicator of our future earnings . Certain market data information in this Presentation is based on the estimates of Lightning eMotors management . Lightning eMotors obtained the industry, market and competitive position data used throughout this Presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties . Lightning eMotors believes its estimates to be accurate as of the date of this Presentation . However, this information may prove to be inaccurate because of the method by which Lightning eMotors obtained some of the data for its estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process . No representations or warranties, express or implied are given in, or in respect of, this Presentation . To the fullest extent permitted by law in no circumstances will Lightning eMotors or any of its subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Lightning eMotors has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness . This data is subject to change . In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Lightning eMotors . Viewers of this Presentation should each make their own evaluation of Lightning eMotors and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . The financial information and data contained in this Presentation are unaudited . Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, documents to filed by Lightning eMotors with the SEC . Some of the financial information and data contained in this Presentation, such as EBITDA and Adjusted EBITDA have not been prepared in accordance with United States generally accepted accounting principles ("GAAP") . The Company defines EBITDA as net loss before depreciation and amortization and interest expense . Adjusted EBITDA is defined as net loss before depreciation and amortization, interest expense, stock - based compensation, gains or losses related to the change in fair value of warrants, derivative and earnout share liabilities, gains or losses on extinguishment of debt and other non - recurring costs determined by management, such as business combination related expenses and inducement expense . Lightning eMotors believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Lightning eMotors’ financial condition and results of operations . Lightning eMotors’ management uses these non - GAAP measures for trend analyses and for budgeting and planning purposes . Lightning eMotors believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Lightning eMotors’ financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP . The principal limitation of these non - GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Lightning eMotors’ financial statements . In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures . In order to compensate for these limitations, management presents non - GAAP financial measures in connection with GAAP results . You should review Lightning eMotors’ audited financial statements, which will be included its SEC filings . All trademarks, service marks, and trade names of Lightning eMotors used herein are trademarks, service marks, or registered trade names of Lightning eMotors, as noted herein . Any other product, company names, or logos mentioned herein are the trademarks and/or intellectual property of their respective owners, and their use is not intended to, and does not imply, a relationship with Lightning eMotors, or an endorsement or sponsorship by or of Lightning eMotors . Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Lightning eMotors will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks and trade names .

3 Tim Reeser Founder and Chief Executive Officer Today’s Presenters Teresa Covington Chief Financial Officer Kash Sethi Chief Revenue Officer

4 Agenda Supply Chain and Manufacturing Update 3 5 Q&A 6 Lightning Overview 1 Building a Stronger Company 2 4 Sales and Business Development Update Financial Summary

5 Lightning Overview and CEO update Collins Cut - Away School Bus Chassis on the Lightning Production Line

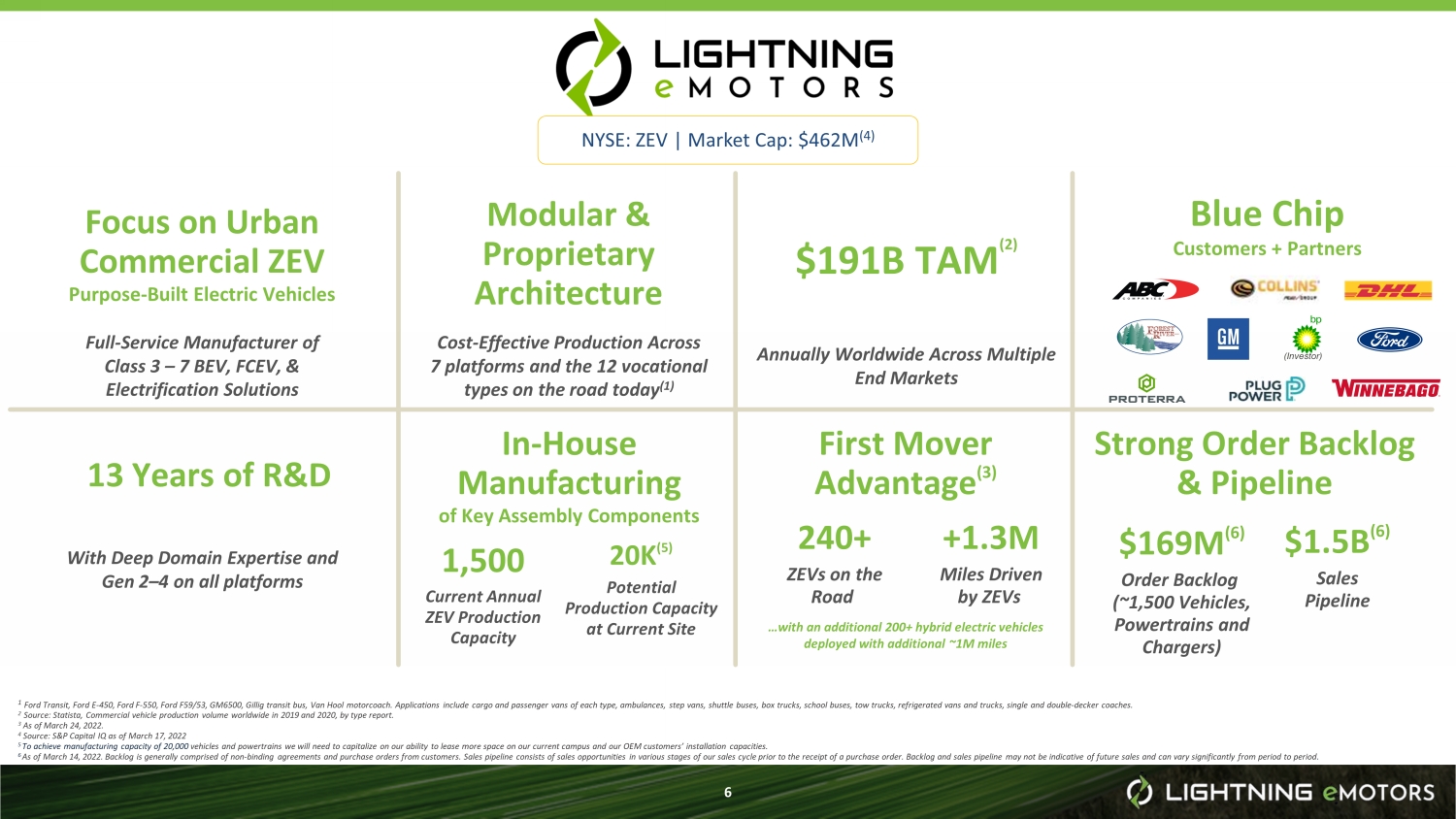

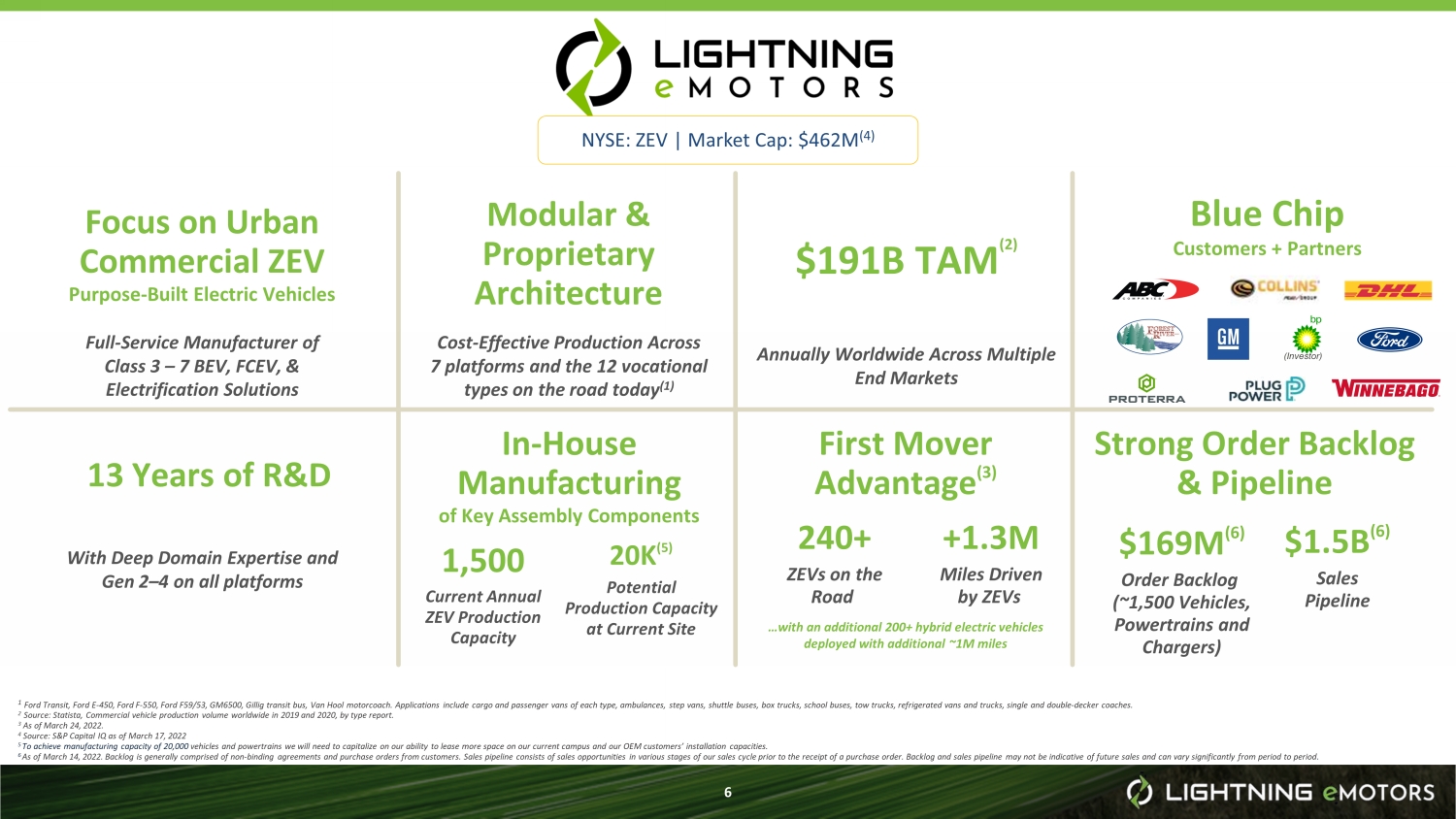

6 1 Ford Transit, Ford E - 450, Ford F - 550, Ford F59/53, GM6500, Gillig transit bus, Van Hool motorcoach. Applications include cargo and passenger vans of each type, ambulances, step vans, shuttle buses, box trucks, sch oo l buses, tow trucks, refrigerated vans and trucks, single and double - decker coaches. 2 Source: Statista, Commercial vehicle production volume worldwide in 2019 and 2020, by type report. 3 As of March 24, 2022. 4 Source: S&P Capital IQ as of March 17, 2022 5 To achieve manufacturing capacity of 20,000 vehicles and powertrains we will need to capitalize on our ability to lease more space on our current campus and our OEM cust ome rs’ installation capacities. 6 As of March 14, 2022. Backlog is generally comprised of non - binding agreements and purchase orders from customers. Sales pipelin e consists of sales opportunities in various stages of our sales cycle prior to the receipt of a purchase order. Backlog and sal es pipeline may not be indicative of future sales and can vary significantly from period to period . $191B TAM (2) Blue Chip Customers + Partners Modular & Proprietary Architecture Focus on Urban Commercial ZEV Purpose - Built Electric Vehicles Cost - Effective Production Across 7 platforms and the 12 vocational types on the road today (1) Annually Worldwide Across Multiple End Markets Full - Service Manufacturer of Class 3 – 7 BEV, FCEV, & Electrification Solutions In - House Manufacturing of Key Assembly Components 13 Years of R&D 240+ ZEVs on the Road +1.3M Miles Driven by ZEVs Strong Order Backlog & Pipeline $169M (6) Order Backlog (~1,500 Vehicles, Powertrains and Chargers) $1.5B (6) Sales Pipeline 1,500 Current Annual ZEV Production Capacity 20K (5) Potential Production Capacity at Current Site First Mover Advantage (3) With Deep Domain Expertise and Gen 2 – 4 on all platforms …with an additional 200+ hybrid electric vehicles deployed with additional ~1M miles (Investor) NYSE: ZEV | Market Cap: $462M (4)

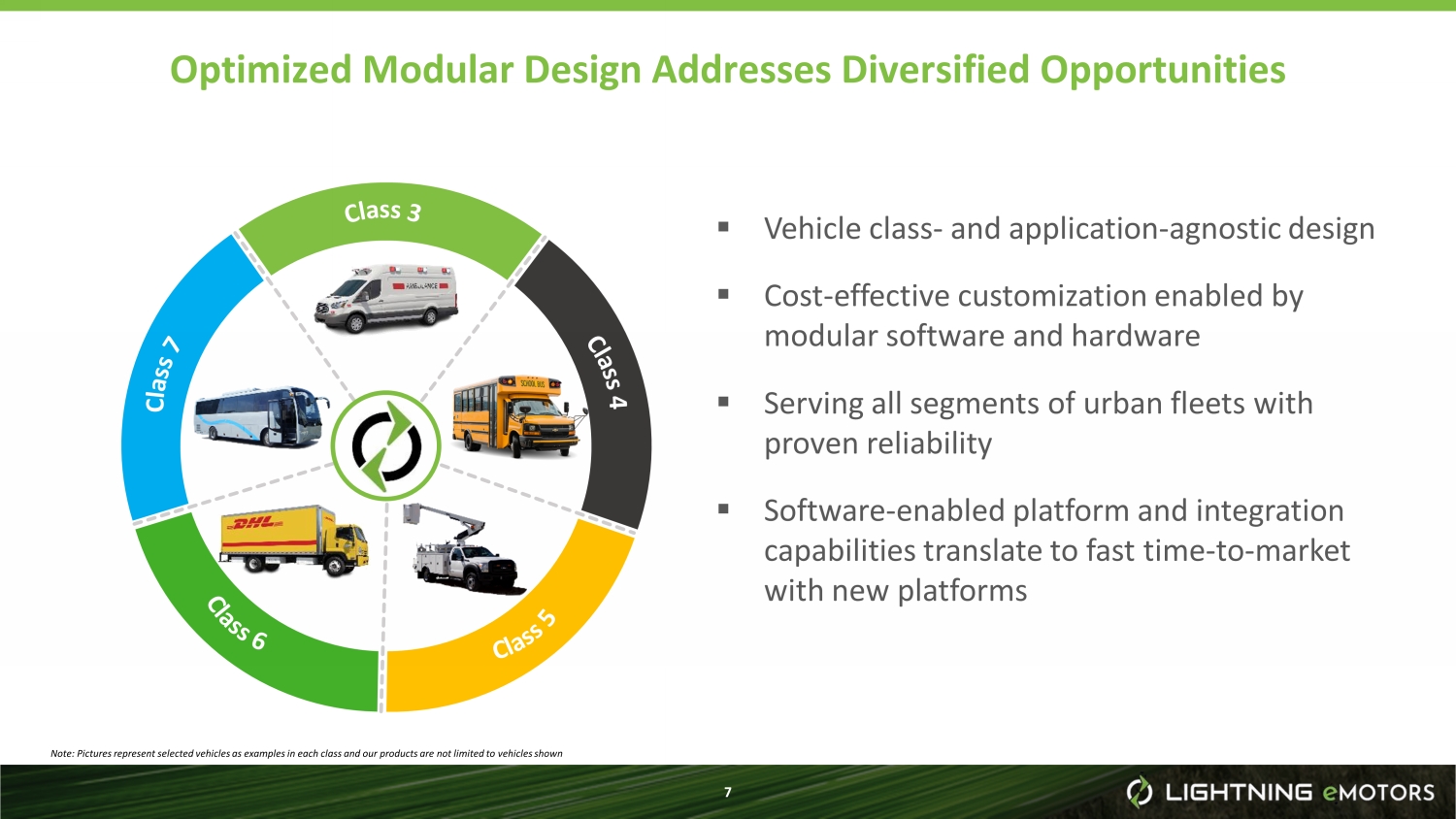

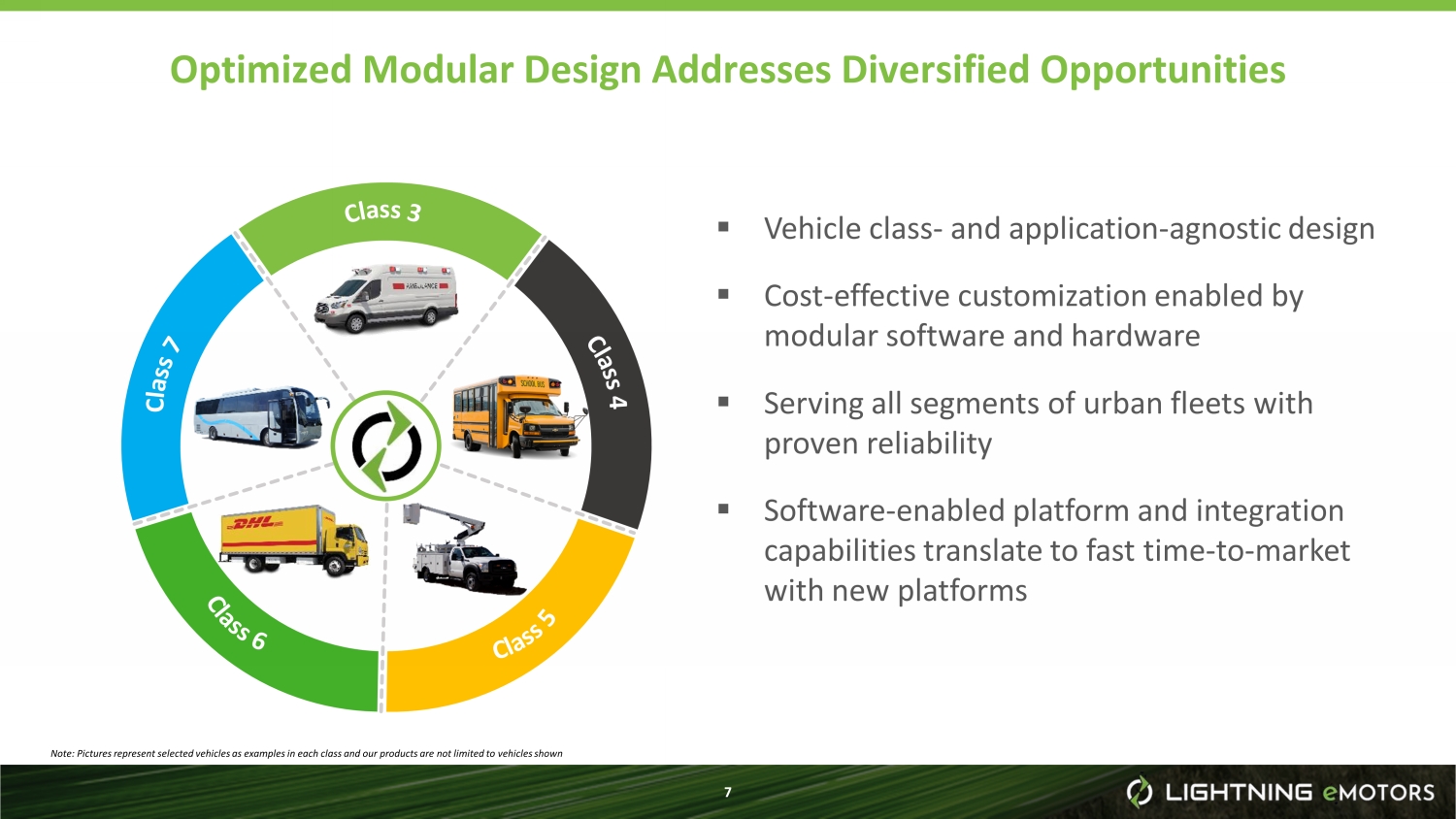

7 Optimized Modular Design Addresses Diversified Opportunities Note: Pictures represent selected vehicles as examples in each class and our products are not limited to vehicles shown ▪ Vehicle class - and application - agnostic design ▪ Cost - effective customization enabled by modular software and hardware ▪ Serving all segments of urban fleets with proven reliability ▪ Software - enabled platform and integration capabilities translate to fast time - to - market with new platforms

8 Partnering with GM to Electrify Medium Duty Trucks • Class 3 through 6 commercial vehicles • Applications include school buses, shuttle buses, delivery trucks, work trucks, and more • Broadens and diversifies Lightning’s chassis supply • Can be used to diversify our offerings to Forest River and Collins • First production chassis scheduled to ship from GM in volume later this year

9 • Batteries: • Our previously announced battery partnership agreements have put us in an excellent position regarding battery supply, with inventory on - hand today. • Chassis: • Major chassis OEMs have publicly spoken to limited chassis availability. This is now expected to continue through 2022. • Signed chassis supply agreement with GM • Announced our own Lightning eChassis • Announced Partnership with Forest River for factory - certified Lightning repower powertrains to support over 50,000 eligible Forest River shuttles buses on the road today • Accessory components : • Accessories continued to be constrained in 2021, with both logistics and supply delays. Lightning continues to work on supply chain diversification, as well as additional vertical integration of key components to ensure supply and lower long - term volume pricing Supply Disruptions Remain, but Progress in Key Areas

10 • Completed the expansion of manufacturing facility space to over 140 ,000 square feet • Production capacity at 3,000 vehicles and powertrain systems per year in two shifts (currently running one shift) • Renovating additional 3,700 square feet for vehicle research & development annex and dyno and battery test center • Added advanced equipment such as laser cutters, collaborative robots and augmented reality software to increase productivity Already In Production with Expanded Facility

11 Sales and Business Development Update

12 Products & Markets Update Market / Vehicle Applications Body / Channel Partner Status Cargo Vans and Delivery Trucks (Class 3 - 6) • Vehicles on the road with multiple customers • Ongoing production • Repeat orders received • Selling direct and via regional dealer partners Passenger Vans & Shuttle Buses (Class 3 - 5) • Vehicles on the road with multiple customers • Ongoing production • Repeat orders received • Selling via Forest River dealer network School Buses (Class 4) • Vehicles on the road/in production • Collins dealer network conducting customer demos – positive feedback so far • Selling via Collins dealer network Mature products, vehicle partners and dealer networks Hundreds of ZEVs on the road, repeat orders and strong demand As of March 14 th 2022 sales pipeline (1) potential $1.5B and backlog (1) $169.3M 1 As of March 14, 2022. Backlog generally comprises non - binding agreements and purchase orders from customers. Sales pipeline con sists of sales opportunities in various stages of our sales cycle prior to the receipt of a purchase order. Backlog and sales pi peline may not be indicative of future sales and can vary significantly from period to period.

13 Products & Markets Update Market / Vehicle Applications Body/Channel Partner Status Ambulances (Class 3) • Vehicles in production • Initial deployments with US fleets in 1H 2022 Motorcoach & Transit Bus Repowers (Single and Double Deck) • Pilot units successfully tested in the field • Conducting various customer demos in CA, CO and FL • Expecting increase in campus transportation business post - COVID RVs (Class 3) • Concept vehicle “ eRV ” revealed in January 2022 Additional OEM partnerships and vehicle applications in development – stay tuned for additional updates this year!

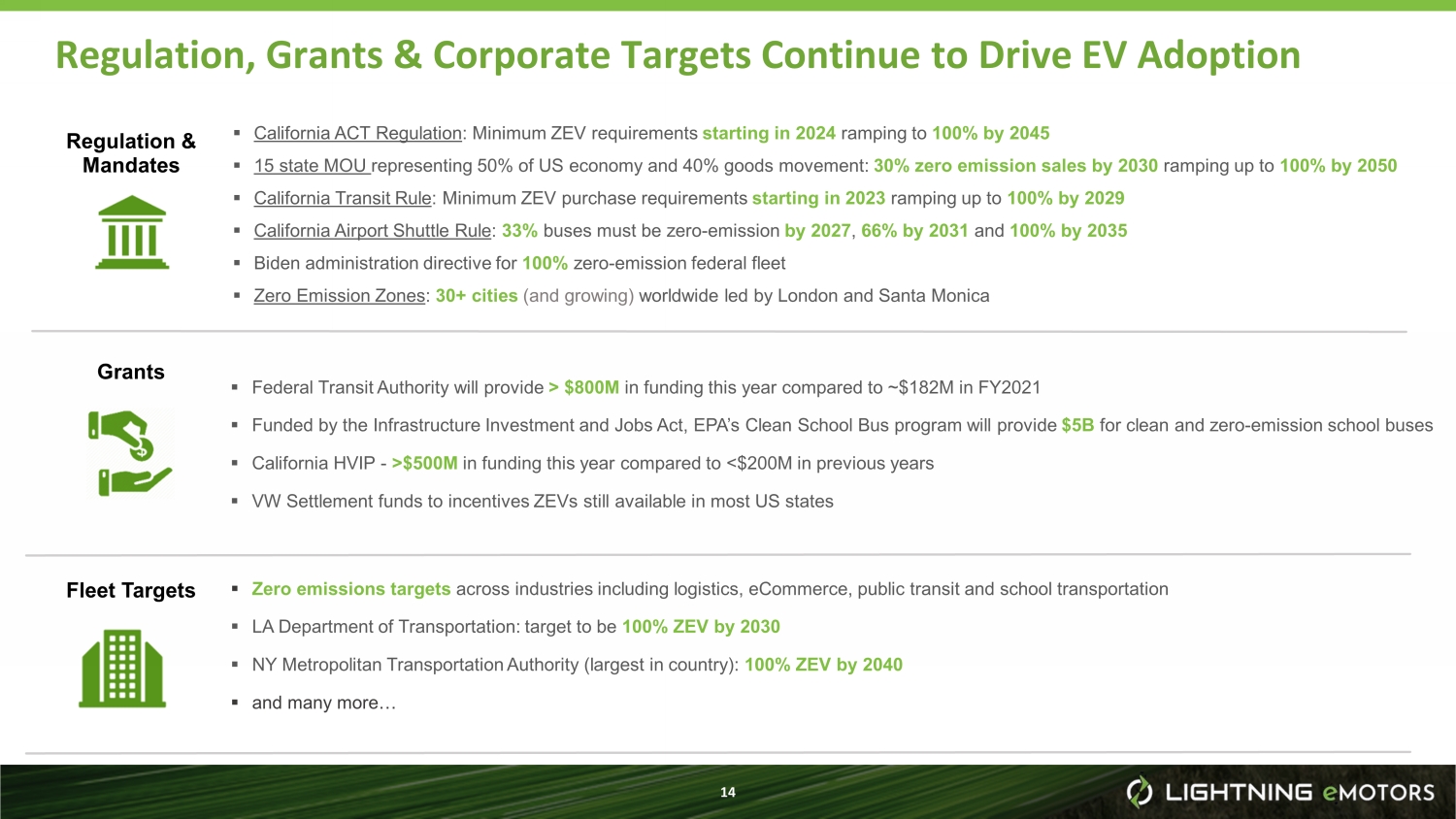

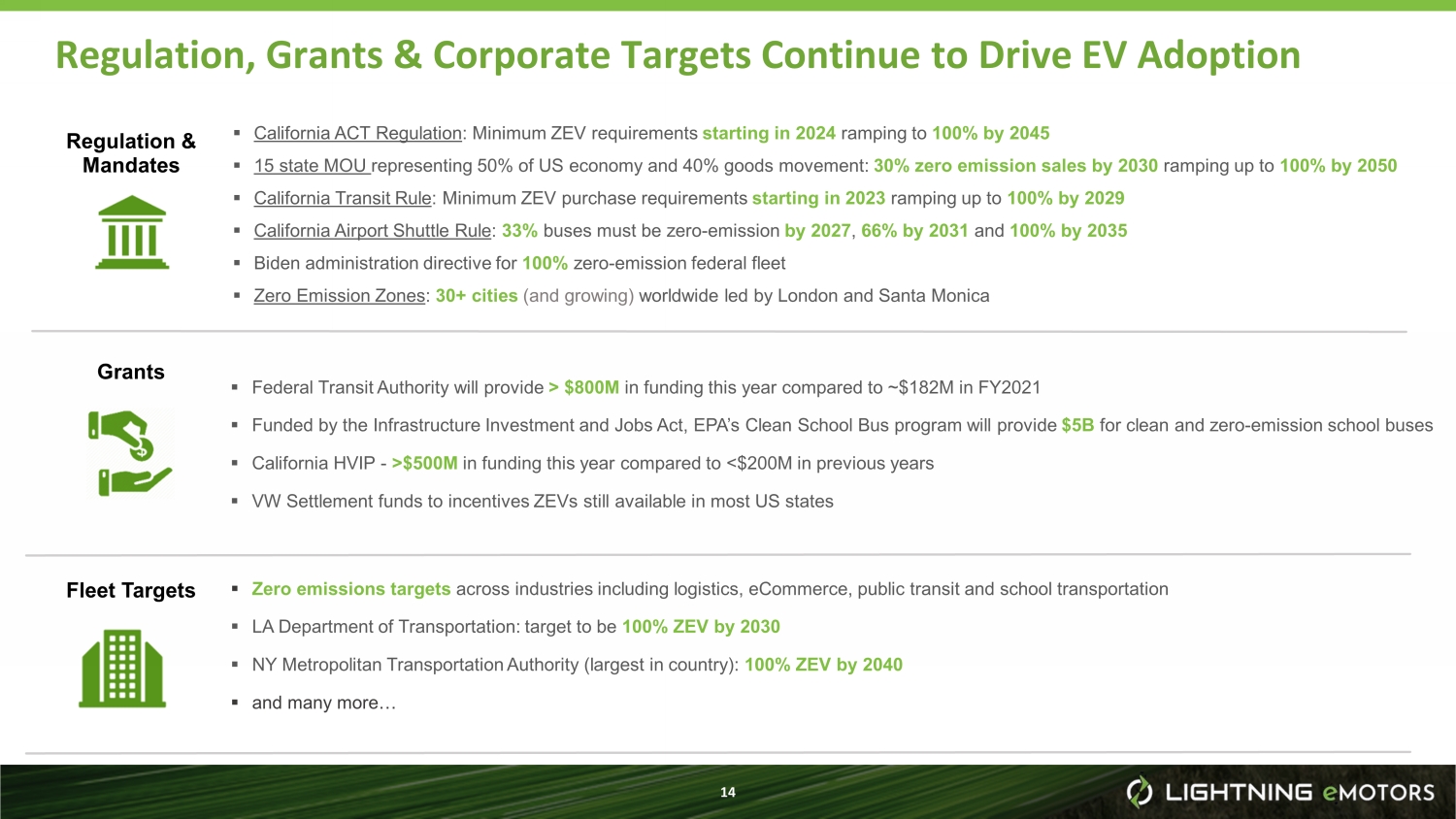

14 ▪ California ACT Regulation : Minimum ZEV requirements starting in 2024 ramping to 100% by 2045 ▪ 15 state MOU representing 50% of US economy and 40% goods movement: 30% zero emission sales by 2030 ramping up to 100% by 2050 ▪ California Transit Rule : Minimum ZEV purchase requirements starting in 2023 ramping up to 100% by 2029 ▪ California Airport Shuttle Rule : 33% buses must be zero - emission by 2027 , 66% by 2031 and 100% by 2035 ▪ Biden administration directive for 100% zero - emission federal fleet ▪ Zero Emission Zones : 30+ cities (and growing) worldwide led by London and Santa Monica Regulation, Grants & Corporate Targets Continue to Drive EV Adoption Regulation & Mandates ▪ Federal Transit Authority will provide > $800M in funding this year compared to ~$182M in FY2021 ▪ Funded by the Infrastructure Investment and Jobs Act, EPA’s Clean School Bus program will provide $5B for clean and zero - emission school buses ▪ California HVIP - >$500M in funding this year compared to <$200M in previous years ▪ VW Settlement funds to incentives ZEVs still available in most US states Grants ▪ Zero emissions targets across industries including logistics, eCommerce, public transit and school transportation ▪ LA Department of Transportation: target to be 100% ZEV by 2030 ▪ NY Metropolitan Transportation Authority (largest in country): 100% ZEV by 2040 ▪ and many more… Fleet Targets

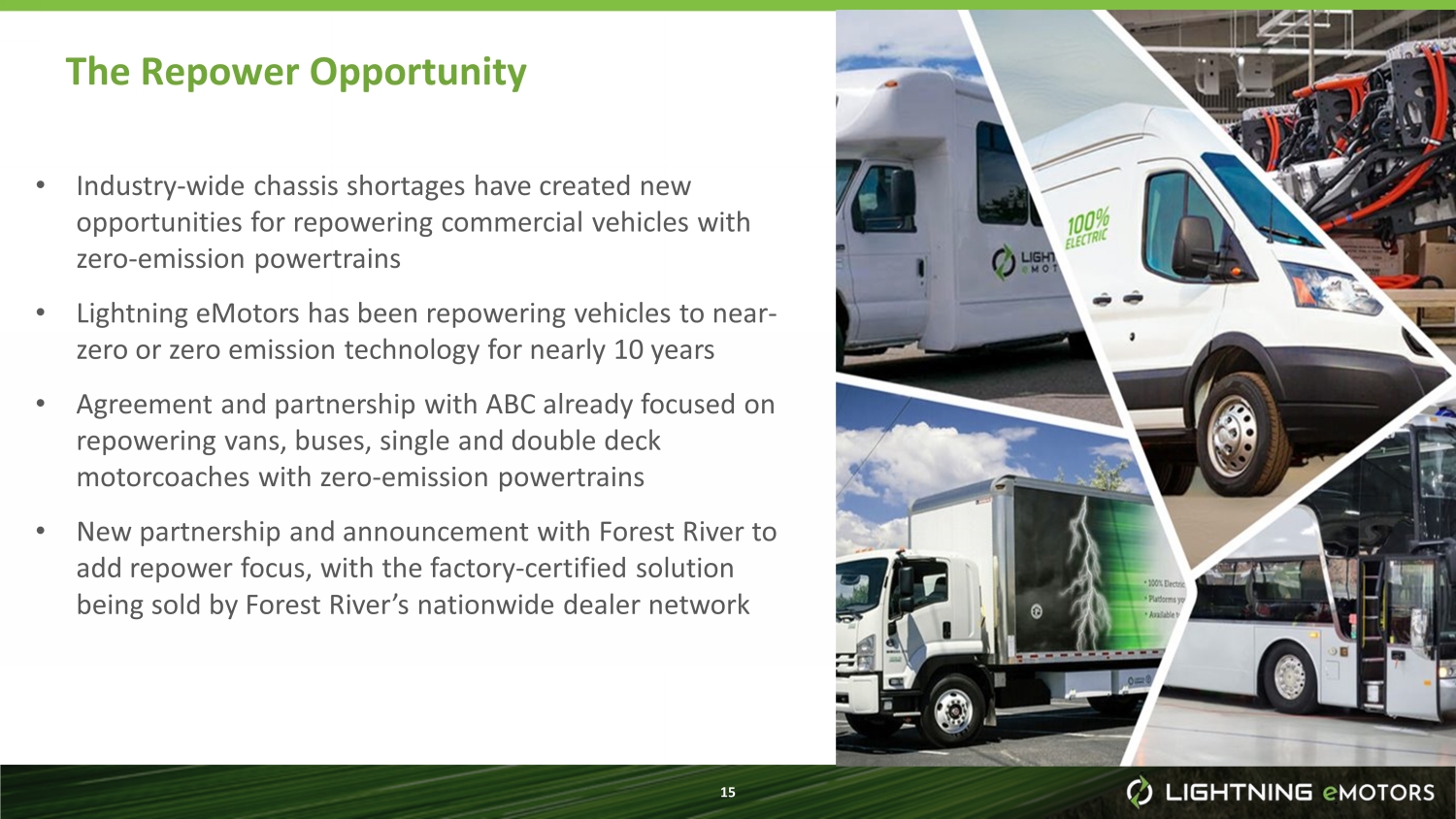

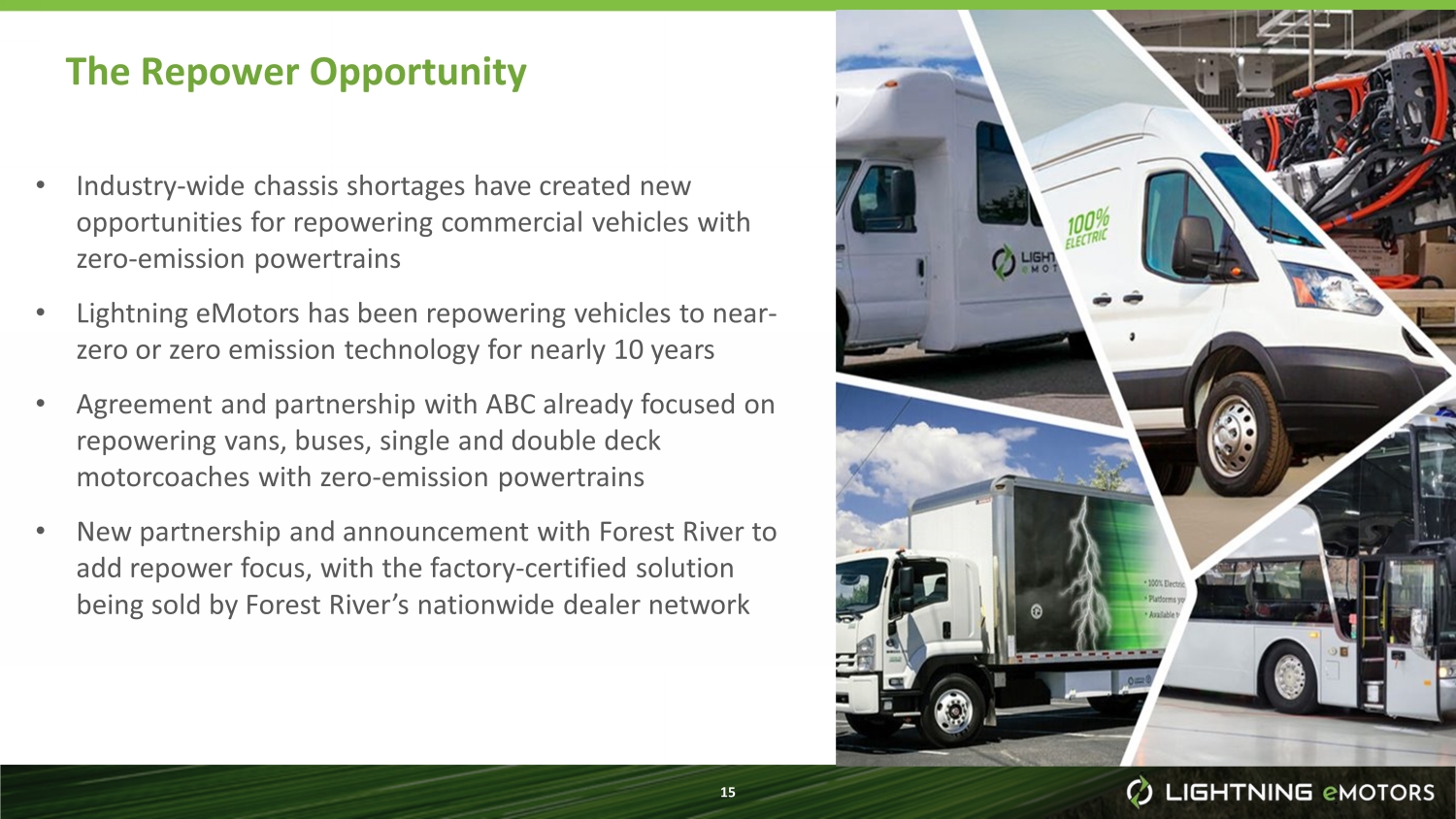

15 The Repower Opportunity • Industry - wide chassis shortages have created new opportunities for repowering commercial vehicles with zero - emission powertrains • Lightning eMotors has been repowering vehicles to near - zero or zero emission technology for nearly 10 years • Agreement and partnership with ABC already focused on repowering vans, buses, single and double deck motorcoaches with zero - emission powertrains • New partnership and announcement with Forest River to add repower focus, with the factory - certified solution being sold by Forest River’s nationwide dealer network

16 Financial Update

17 ($’s in millions) 1 Represents calculations based upon Non - GAAP metrics. See slide 19 for reconciliation of GAAP to Non - GAAP measures. $4.2 (63.5%) ($17.2) $22.2 $26.3 ($15.9) 2021 Q4 Actuals Lightning eMotors Business Update 2021 Q4 and 2020 Q4 2020 Q4 Actuals $3.7 (31.0%) ($5.2) ($13.4) ($11.5) ($5.1) Revenue Gross Margin % Operating Profit (Loss) Net Income(Loss) EBITDA Adjusted EBITDA (1)

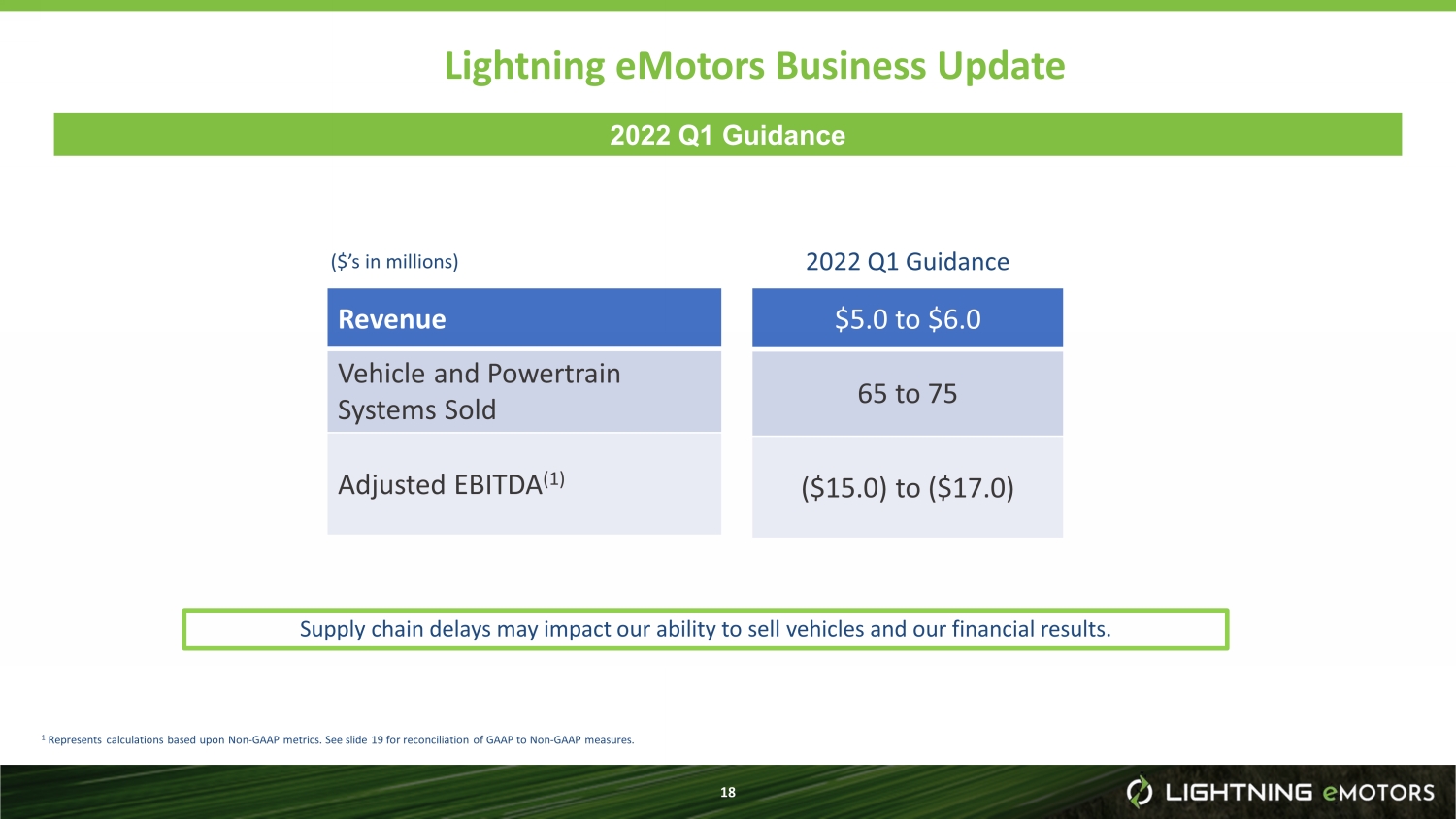

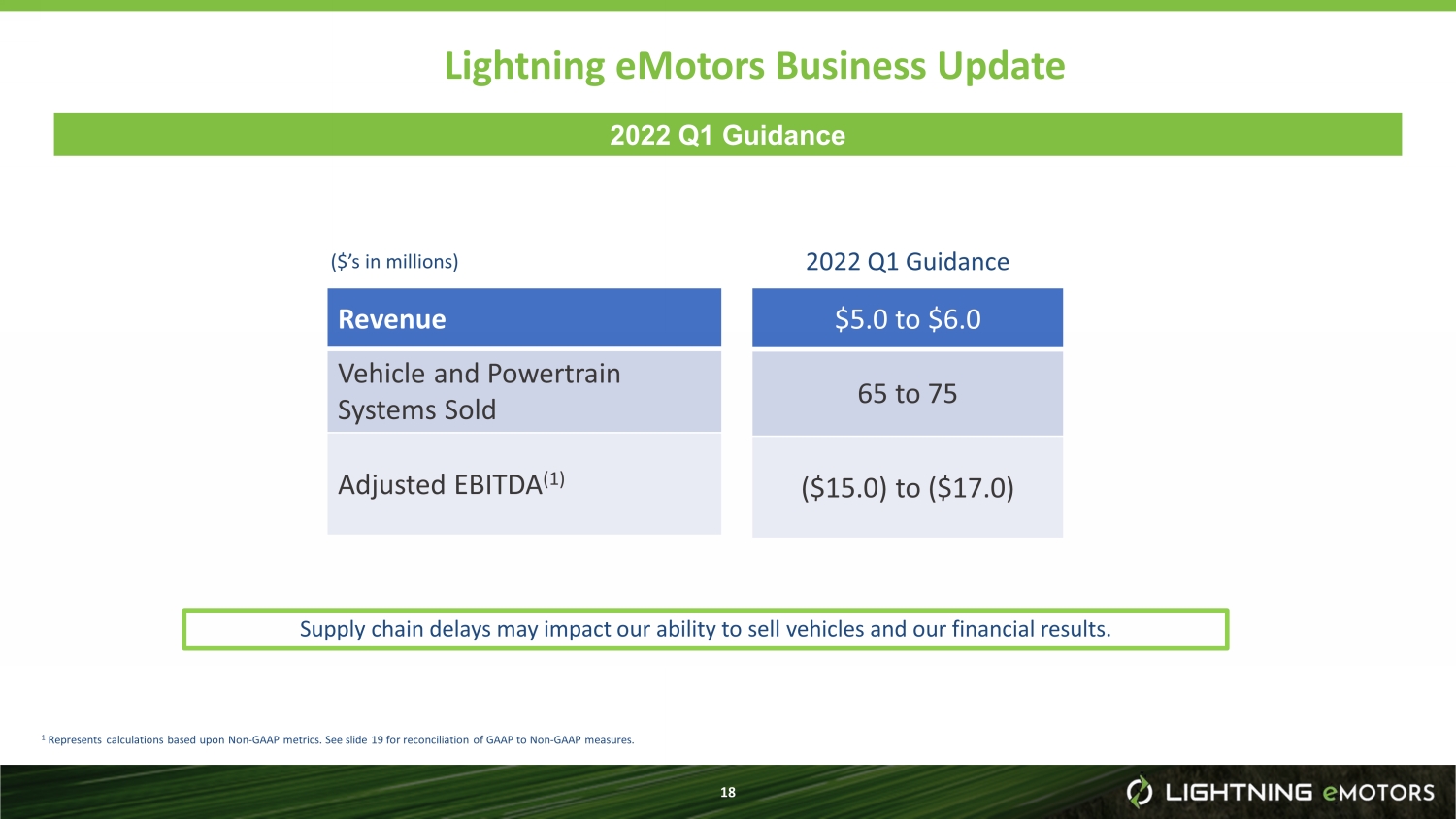

18 Revenue Vehicle and Powertrain Systems Sold Adjusted EBITDA (1) $5.0 to $6.0 65 to 75 ($15.0) to ($17.0) 2022 Q1 Guidance Supply chain delays may impact our ability to sell vehicles and our financial results. Lightning eMotors Business Update 2022 Q1 Guidance ($’s in millions) 1 Represents calculations based upon Non - GAAP metrics. See slide 19 for reconciliation of GAAP to Non - GAAP measures.

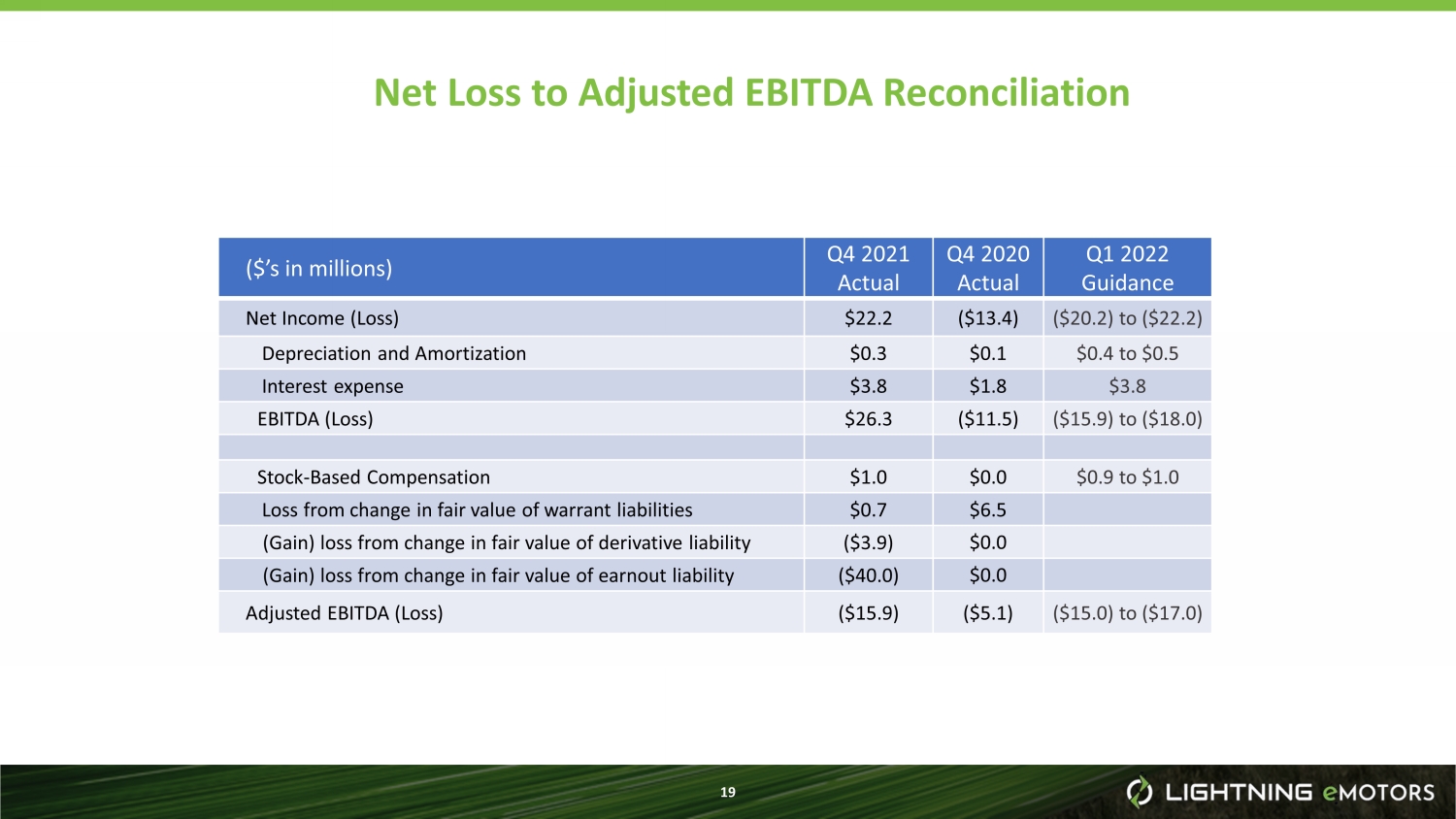

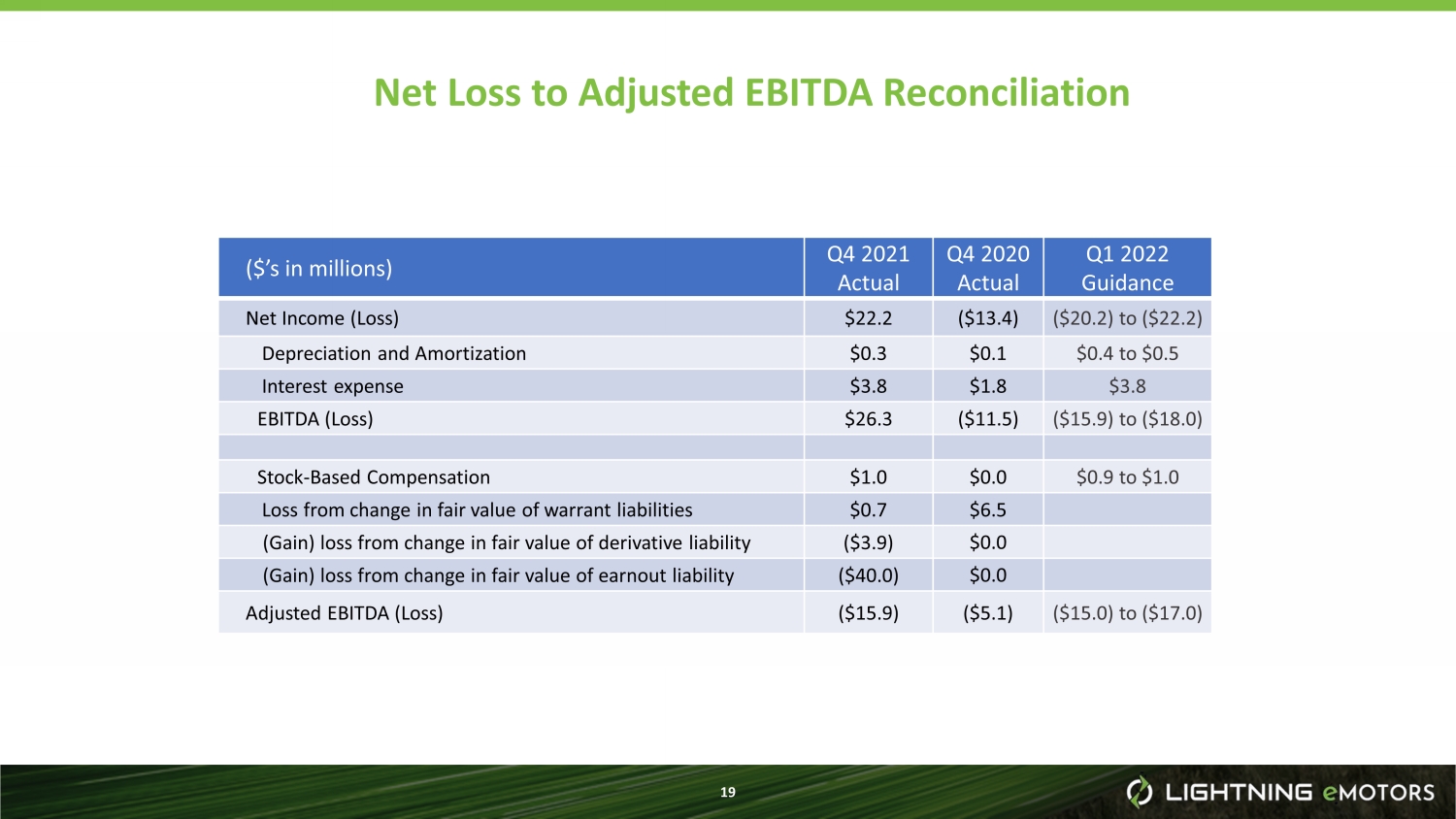

19 Net Loss to Adjusted EBITDA Reconciliation ($’s in millions) Q4 2021 Actual Q4 2020 Actual Q1 2022 Guidance Net Income (Loss) $22.2 ($13.4) ($20.2) to ($22.2) Depreciation and Amortization $0.3 $0.1 $0.4 to $0.5 Interest expense $3.8 $1.8 $3.8 EBITDA (Loss) $26.3 ($11.5) ($15.9) to ($18.0) Stock - Based Compensation $1.0 $0.0 $0.9 to $1.0 Loss from change in fair value of warrant liabilities $0.7 $6.5 (Gain) loss from change in fair value of derivative liability ($3.9) $0.0 (Gain) loss from change in fair value of earnout liability ($40.0) $0.0 Adjusted EBITDA (Loss) ($15.9) ($5.1) ($15.0) to ($17.0)

20 Thank You