Exhibit 99.2

Acquiring the External Manager – A Transformative Step in RP’s Evolution January 10, 2025 2

Cautionary Note Regarding Forward - Looking Statements This presentation relates to a proposed acquisition by Royalty Pharma plc (the “Company”) of its external manager, RP Management, LLC (the “Transaction”). The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this document unless stated otherwise, and neither the delivery of this document at any time, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This document contains statements that constitute “forward - looking statements” as that term is defined in the United States Private Securities Litigation Reform Act of 1995, including statements that express the company’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, in contrast with statements that reflect historical facts. Examples include discussion of Royalty Pharma’s strategies, financing plans, growth opportunities, market growth, and plans for capital deployment, plus the benefits of the Transaction, including cash savings, enhanced alignment with shareholders, increased investment returns, expectations regarding management continuity, transparency and governance, and the benefits of simplification to its structure. In some cases, you can identify such forward - looking statements by terminology such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “target,” “forecast,” “guidance,” “goal,” “predicts,” “project,” “potential” or “continue,” the negative of these terms or similar expressions. Forward - looking statements are based on management’s current beliefs and assumptions and on information currently available to the company. However, these forward - looking statements are not a guarantee of Royalty Pharma’s performance, and you should not place undue reliance on such statements, including because the Transaction is subject to shareholder approval. Forward - looking statements are subject to many risks, uncertainties and other variable circumstances, and other factors. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned not to place undue reliance on such statements. Many of these risks are outside of Royalty Pharma’s control and could cause its actual results to differ materially from those it thought would occur. The forward - looking statements included in this document are made only as of the date hereof. Royalty Pharma does not undertake, and specifically declines, any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required by law. For further information, please reference Royalty Pharma’s reports and documents filed with the U.S. Securities and Exchange Commission (“SEC”) by visiting EDGAR on the SEC’s website at www.sec.gov. Additional Information and Where to Find It In connection with the Transaction, Royalty Pharma will file with the SEC a proxy statement on Schedule 14A. The definitive proxy statement will be sent to the stockholders of Royalty Pharma seeking their approval of the Transaction and other related matters. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT ON SCHEDULE 14A WHEN IT BECOMES AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING ROYALTY PHARMA, THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents, including the proxy statement, and other documents filed with the SEC by the Company through the website maintained by the SEC at https://www.sec.gov/edgar/browse/?CIK=1802768&owner=exclude . Copies of documents filed with the SEC by Royalty Pharma will be made available free of charge by accessing its website at https:// www.royaltypharma.com/investors/ or by contacting Royalty Pharma via email by sending a message to ir@royaltypharma.com. 3

Participants in the Solicitation Royalty Pharma and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Royalty Pharma in connection with the Transaction under the rules of the SEC. Information about the interests of the directors and executive officers of Royalty Pharma and other persons who may be deemed to be participants in the solicitation of stockholders of Royalty Pharma in connection with the Transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement related to the Transaction, which will be filed with the SEC. Information about the directors and executive officers of Royalty Pharma and their ownership of Royalty Pharma common stock is also set forth in Royalty Pharma’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on April 25, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1802768/000114036124022029/ny20020881x1_def14a.htm) and in Royalty Pharma’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1802768/000180276824000012/rprx - 20231231.htm). Information about the directors and executive officers of Royalty Pharma, their ownership of the Royalty Pharma common stock, and Royalty Pharma’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain Relationships and Related Stockholder Matters” included in Royalty Pharma’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 15, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1802768/000180276824000012/rprx - 20231231.htm), and in the sections entitled “Certain Relationships and Related Party Transactions,” and “Security Ownership of Certain Beneficial Owners,” included in the Company’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on April 25, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1802768/000114036124022029/ny20020881x1_def14a.htm). Additional information regarding the interests of such participants in the solicitation of proxies in respect of the Transaction will be included in the proxy statement and other relevant materials to be filed with the SEC when they become available. These documents can be obtained free of charge from the SEC’s website at www.sec.gov. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Non - GAAP Measures Also, this presentation will include certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Additional information regarding non - GAAP liquidity measures can be found on slide 18 and in the Company’s earnings release furnished with its Current Report on Form 8 - K dated November 6, 2024, which are available on the Company’s website. Any non - GAAP liquidity measures presented are not, and should not be viewed as, substitutes for measures required by GAAP, have no standardized meaning prescribed by GAAP and may not be comparable to the calculation of similar measures of other companies. 4

Key Highlights 5 Pablo Legorreta Founder & Chief Executive Officer

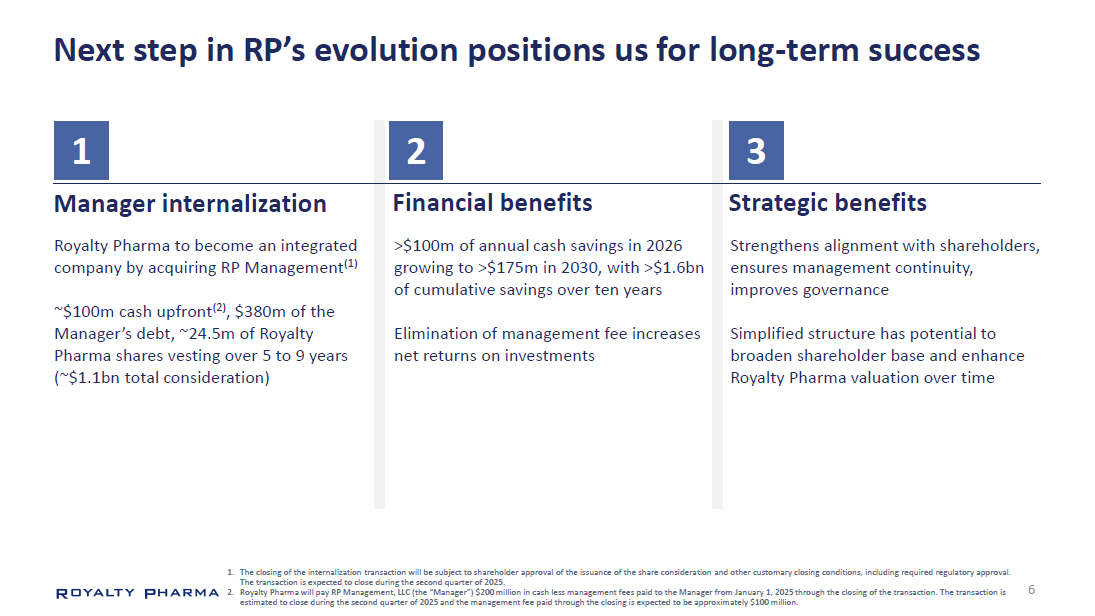

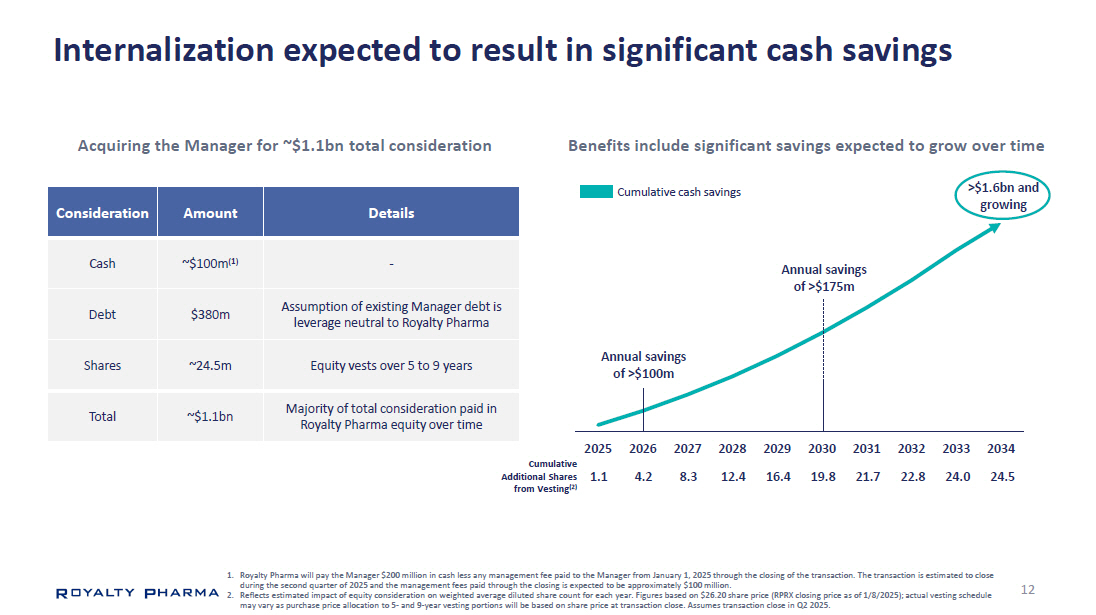

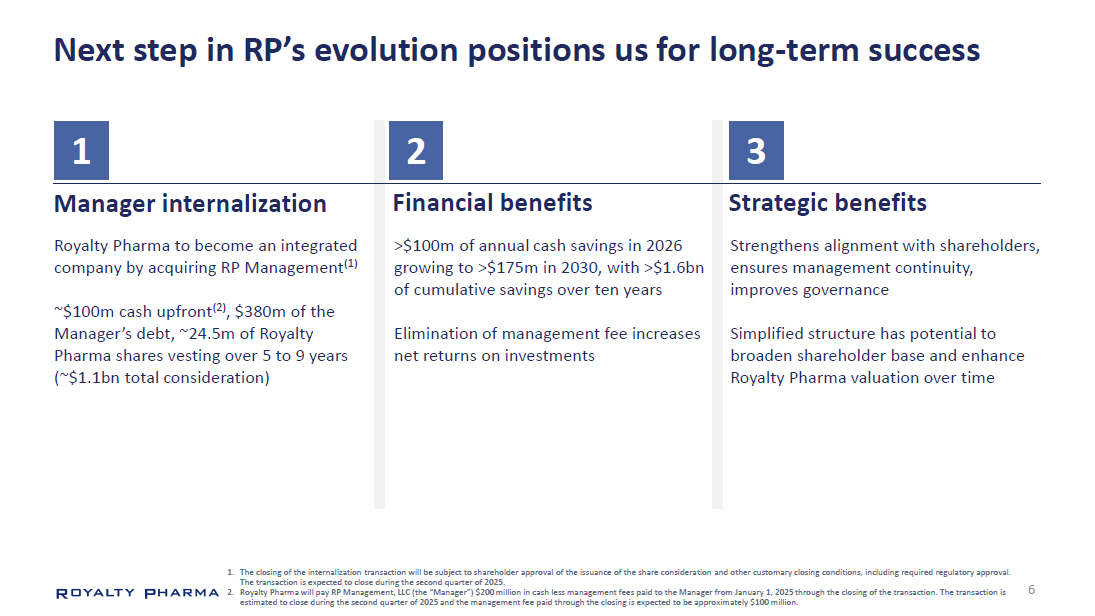

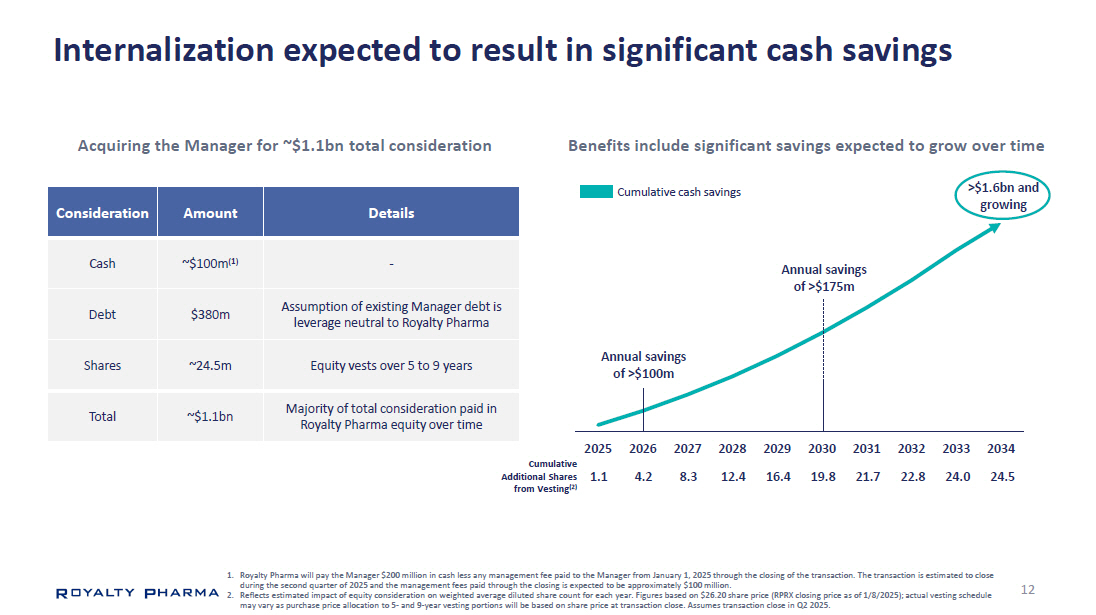

Next step in RP’s evolution positions us for long - term success 6 1. The closing of the internalization transaction will be subject to shareholder approval of the issuance of the share consideration and other customary closing conditions, including required regulatory approval. The transaction is expected to close during the second quarter of 2025. 2. Royalty Pharma will pay RP Management, LLC (the “Manager”) $200 million in cash less management fees paid to the Manager from January 1, 2025 through the closing of the transaction. The transaction is estimated to close during the second quarter of 2025 and the management fee paid through the closing is expected to be approximately $100 million. ~$100m cash upfront (2) , $380m of the Manager’s debt, ~24.5m of Royalty Pharma shares vesting over 5 to 9 years (~$1.1bn total consideration) Manager internalization Royalty Pharma to become an integrated company by acquiring RP Management (1) 1 Elimination of management fee increases net returns on investments Financial benefits >$100m of annual cash savings in 2026 growing to >$175m in 2030, with >$1.6bn of cumulative savings over ten years 1 2 3 Strengthens alignment with shareholders, ensures management continuity, improves governance Simplified structure has potential to broaden shareholder base and enhance Royalty Pharma valuation over time Strategic benefits

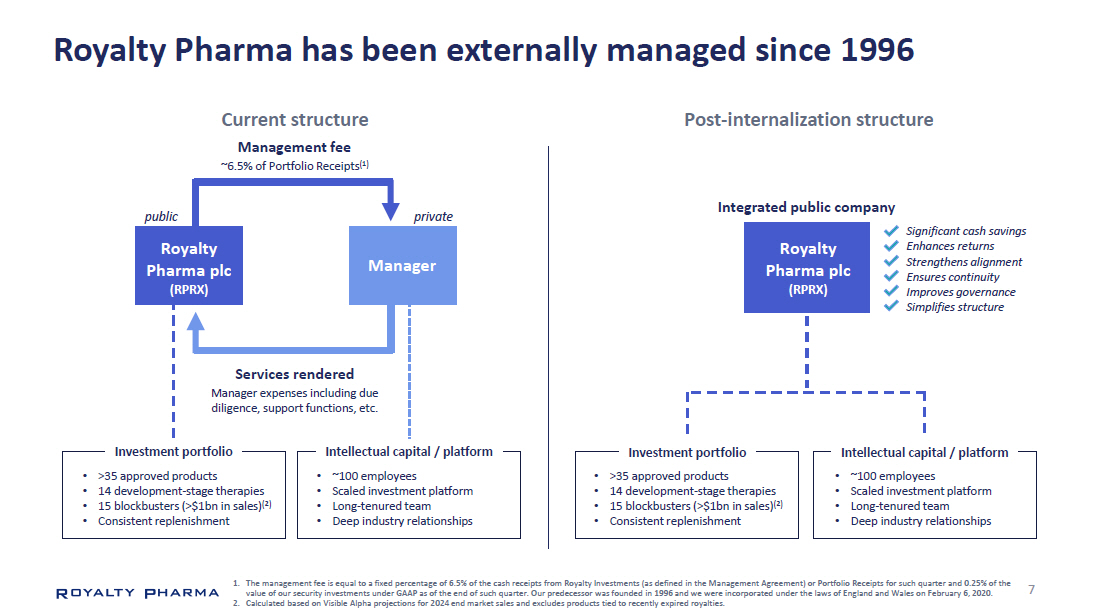

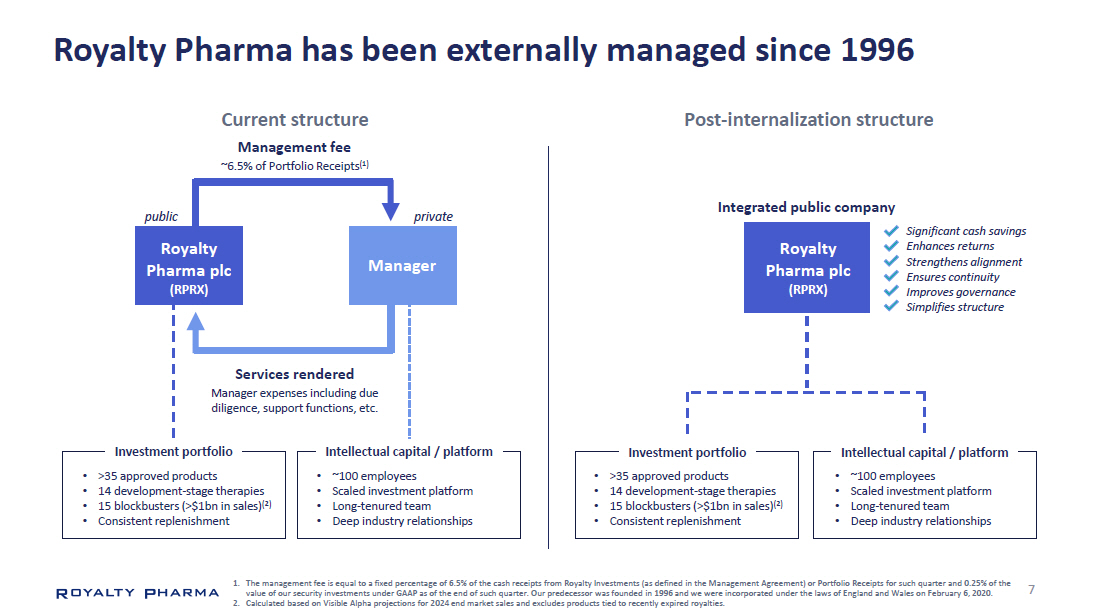

7 Royalty Pharma has been externally managed since 1996 1. The management fee is equal to a fixed percentage of 6.5% of the cash receipts from Royalty Investments (as defined in the Management Agreement) or Portfolio Receipts for such quarter and 0.25% of the value of our security investments under GAAP as of the end of such quarter. Our predecessor was founded in 1996 and we were incorporated under the laws of England and Wales on February 6, 2020. 2. Calculated based on Visible Alpha projections for 2024 end market sales and excludes products tied to recently expired royalties. Post - internalization structure Current structure Management fee ~6.5% of Portfolio Receipts (1) ager Investment portfolio Intellectual capital / platform • ~100 employees • Scaled investment platform • Long - tenured team • Deep industry relationships Royalty Pharma plc (RPRX) Investment portfolio • ~100 employees • Scaled investment platform • Long - tenured team • Deep industry relationships Integrated public company public Man Royalty Pharma plc (RPRX) Services rendered Manager expenses including due diligence, support functions, etc. Intellectual capital / platform p r i v a t e • >35 approved products • 14 development - stage therapies • 15 blockbusters (>$1bn in sales) (2) • Consistent replenishment • >35 approved products • 14 development - stage therapies • 15 blockbusters (>$1bn in sales) (2) • Consistent replenishment Significant cash savings Enhances returns Strengthens alignment Ensures continuity Improves governance Simplifies structure

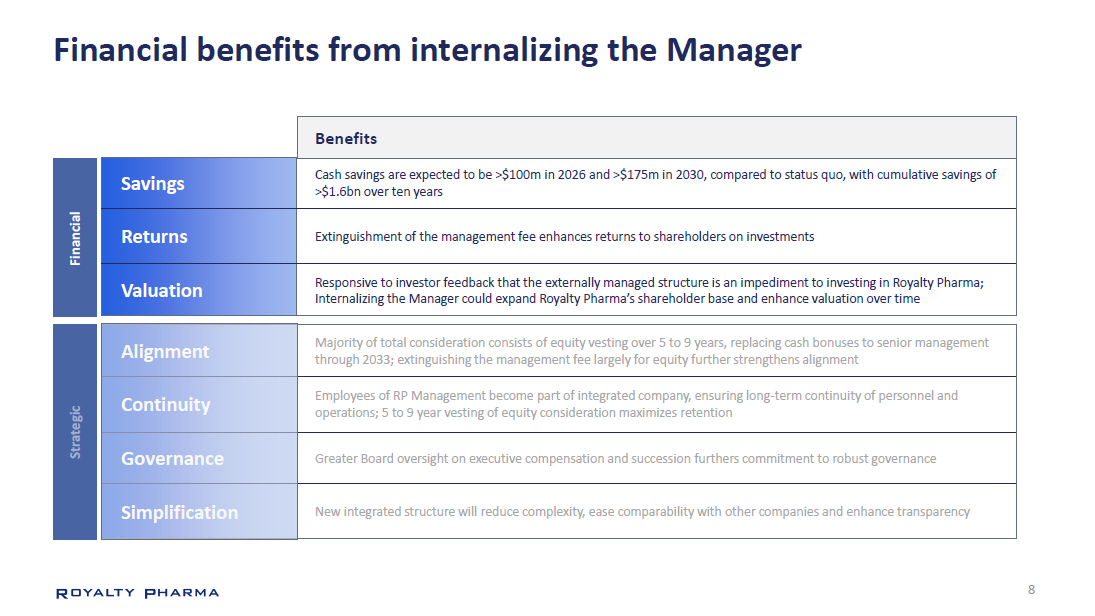

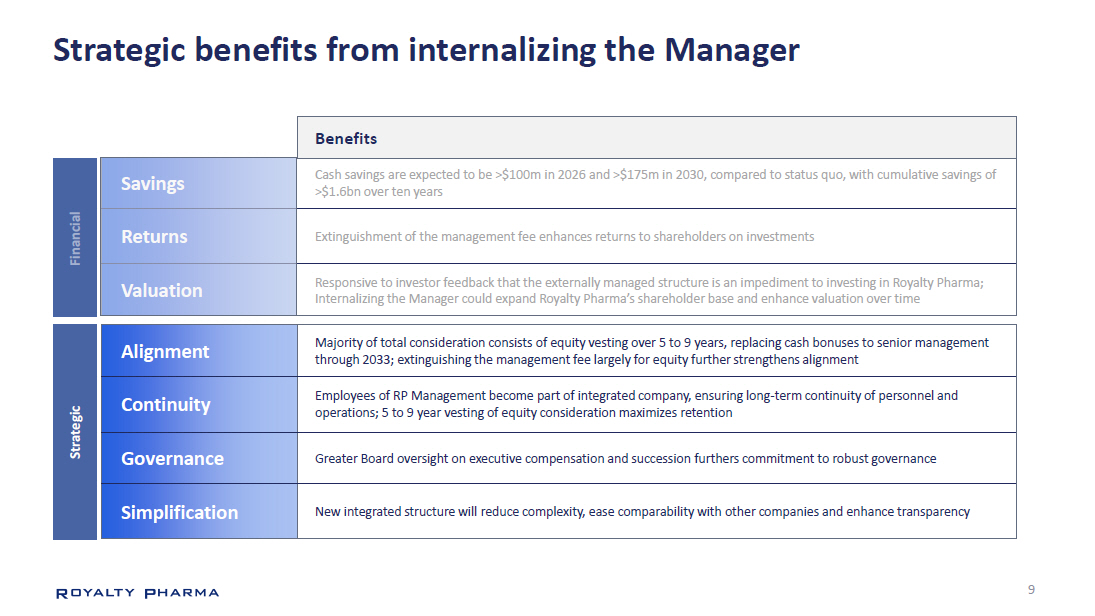

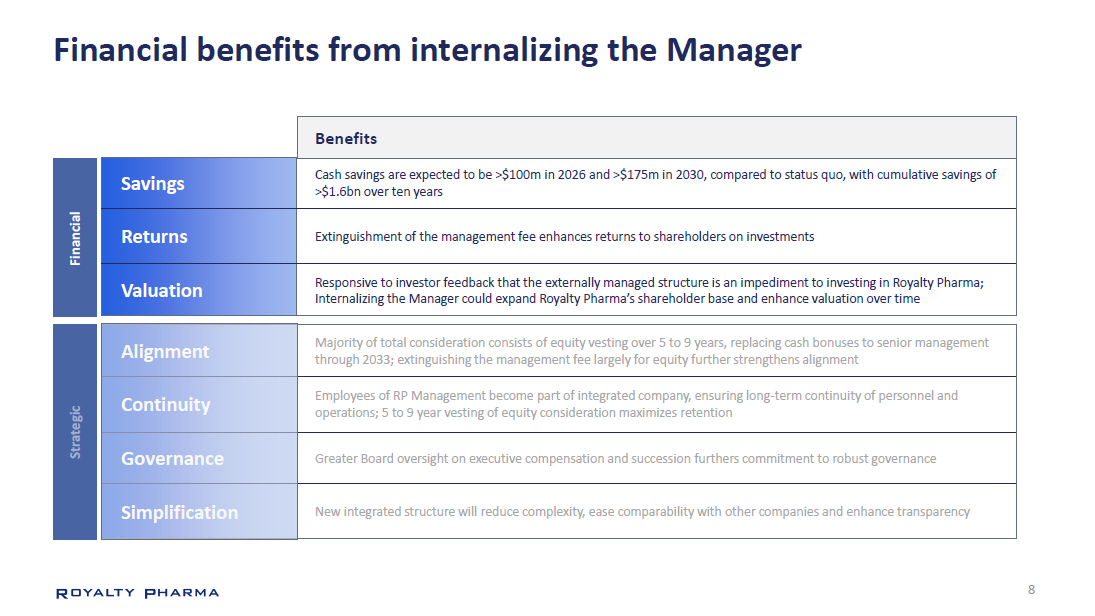

8 Financial benefits from internalizing the Manager Alignment Continuity Governance Sim p lifi c a t i on Benefits Cash savings are expected to be >$100m in 2026 and >$175m in 2030, compared to status quo, with cumulative savings of >$1.6bn over ten years Savings Extinguishment of the management fee enhances returns to shareholders on investments Returns Responsive to investor feedback that the externally managed structure is an impediment to investing in Royalty Pharma; Internalizing the Manager could expand Royalty Pharma’s shareholder base and enhance valuation over time Valuation Financial gi c e t a r St Majority of total consideration consists of equity vesting over 5 to 9 years, replacing cash bonuses to senior management through 2033; extinguishing the management fee largely for equity further strengthens alignment Employees of RP Management become part of integrated company, ensuring long - term continuity of personnel and operations; 5 to 9 year vesting of equity consideration maximizes retention Greater Board oversight on executive compensation and succession furthers commitment to robust governance New integrated structure will reduce complexity, ease comparability with other companies and enhance transparency

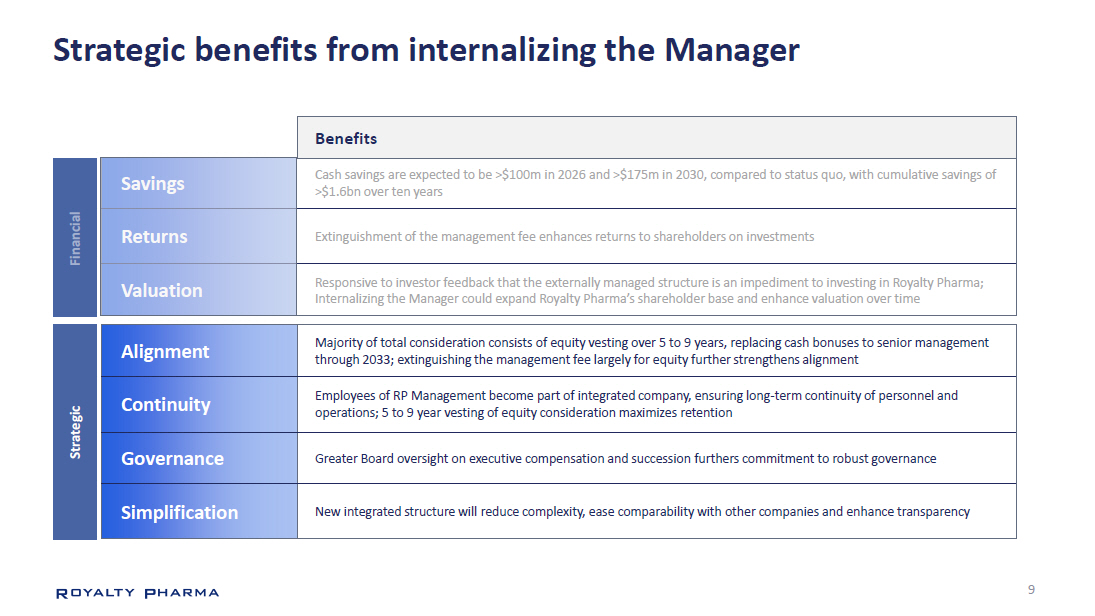

9 Strategic benefits from internalizing the Manager Majority of total consideration consists of equity vesting over 5 to 9 years, replacing cash bonuses to senior management through 2033; extinguishing the management fee largely for equity further strengthens alignment Alignment Employees of RP Management become part of integrated company, ensuring long - term continuity of personnel and operations; 5 to 9 year vesting of equity consideration maximizes retention Continuity Greater Board oversight on executive compensation and succession furthers commitment to robust governance Governance New integrated structure will reduce complexity, ease comparability with other companies and enhance transparency Simplification Savings Returns V alu a ti o n nc ial n a i F Strategic Benefits Cash savings are expected to be >$100m in 2026 and >$175m in 2030, compared to status quo, with cumulative savings of >$1.6bn over ten years Extinguishment of the management fee enhances returns to shareholders on investments Responsive to investor feedback that the externally managed structure is an impediment to investing in Royalty Pharma; Internalizing the Manager could expand Royalty Pharma’s shareholder base and enhance valuation over time

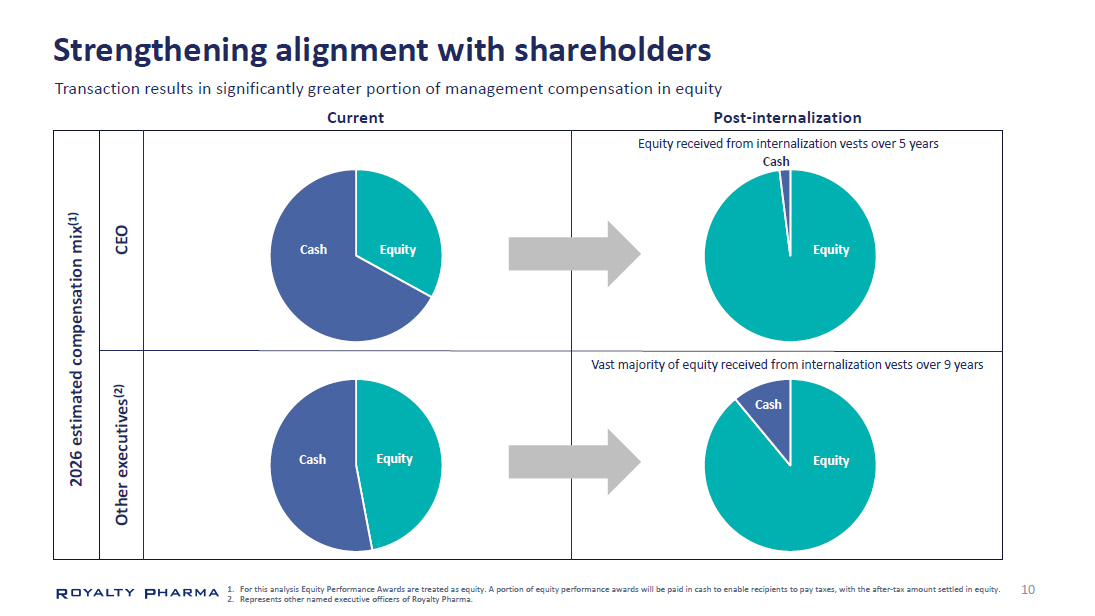

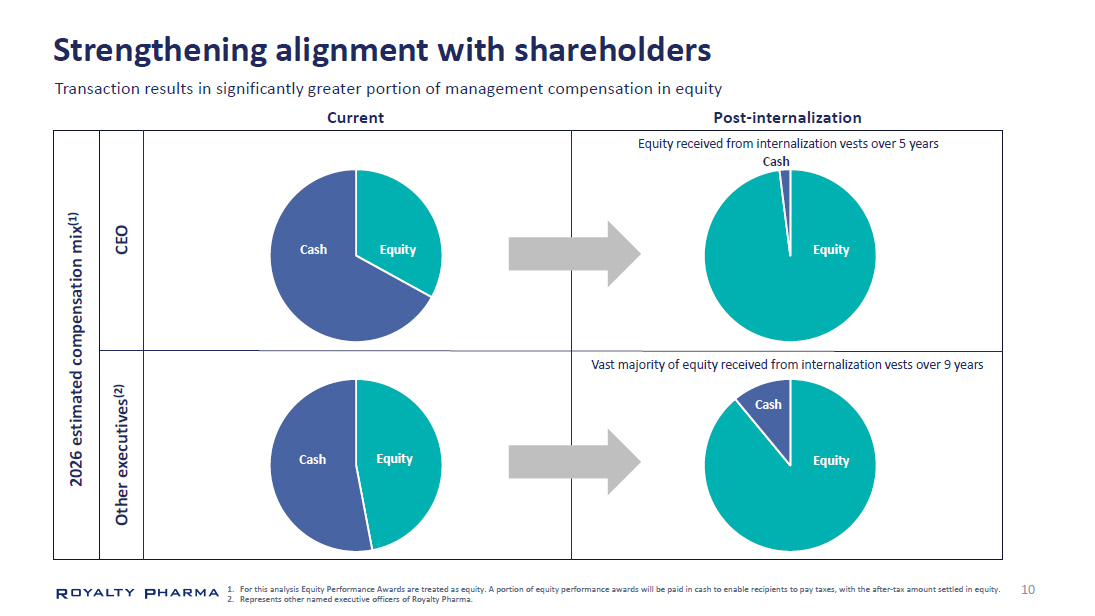

10 Strengthening alignment with shareholders 1. For this analysis Equity Performance Awards are treated as equity. A portion of equity performance awards will be paid in cash to enable recipients to pay taxes, with the after - tax amount settled in equity. 2. Represents other named executive officers of Royalty Pharma. 2026 estimated compensation mix (1) C E O Other executives (2) C a sh E quity C a sh E qu ity E quity C a sh E quity Transaction results in significantly greater portion of management compensation in equity Current Post - internalization Equity received from internalization vests over 5 years Cash Vast majority of equity received from internalization vests over 9 years

Financi a ls Terrance Coyne Executive Vice President Chief Financial Officer 11

12 Internalization expected to result in significant cash savings Benefits include significant savings expected to grow over time Cumulative cash savings >$1.6bn and growing Annual savings of >$100m Equity vesting ends 2 0 2 5 2 0 26 2 0 27 2 0 28 2 0 29 2 0 30 2 0 31 2 0 32 2 0 33 2 0 34 Deferred equity payments begins 1. Royalty Pharma will pay the Manager $200 million in cash less any management fee paid to the Manager from January 1, 2025 through the closing of the transaction. The transaction is estimated to close during the second quarter of 2025 and the management fee paid through the closing is expected to be approximately $100 million. Details Amount Consideration - ~$100m (1) Cash Assumption of existing Manager debt is leverage neutral to Royalty Pharma $380m Debt Equity vests over 5 to 9 years ~24.5m Shares Majority of total consideration paid in Royalty Pharma equity over time ~$1.1bn Total Acquiring the Manager for ~$1.1bn total consideration Annual savings of >$175m

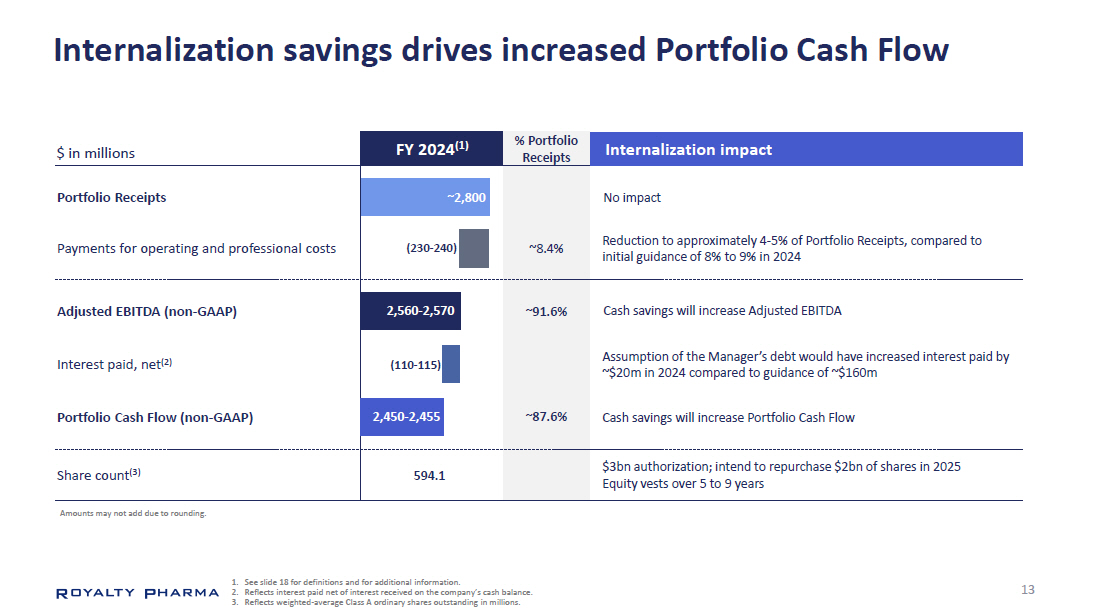

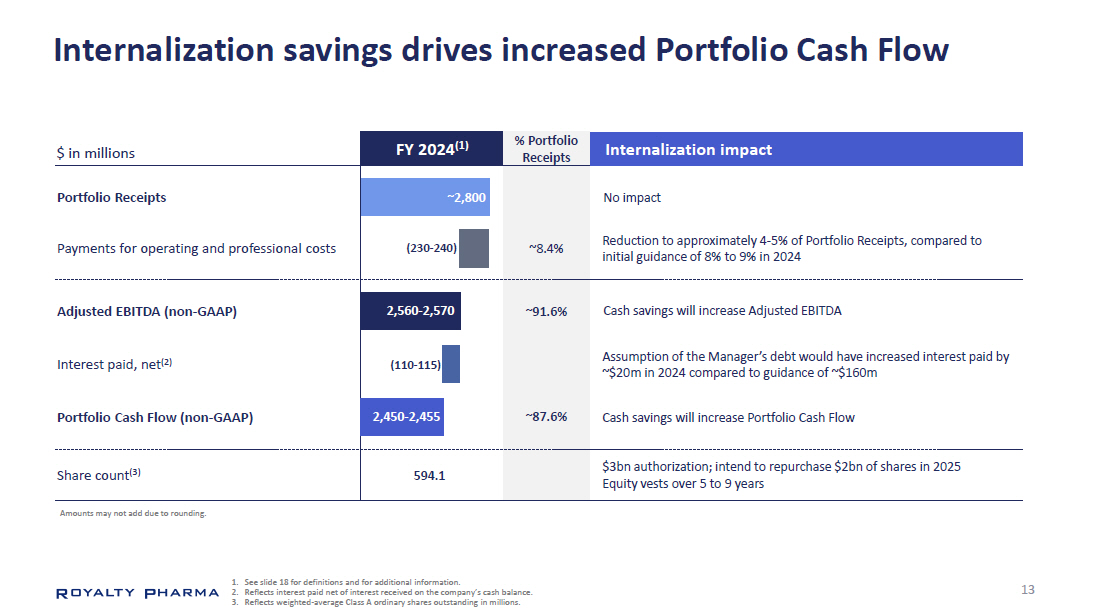

13 Internalization savings drives increased Portfolio Cash Flow 1. See slide 18 for definitions and for additional information. 2. Reflects interest paid net of interest received on the company’s cash balance. 3. Reflects weighted - average Class A ordinary shares outstanding in millions. FY 2024 (1) $ in millions Portfolio Receipts Payments for operating and professional costs Interest paid, net (2) Portfolio Cash Flow (non - GAAP) ~ 87 . 6% ~8.4% % Portfolio Receipts ~ 2, 8 00 2,450 - 2,455 (230 - 240) Adjusted EBITDA (non - GAAP) 2,560 - 2,570 ~ 91 . 6% Share count (3) 594.1 Reduction to approximately 4 - 5% of Portfolio Receipts, compared to initial guidance of 8% to 9% in 2024 Amounts may not add due to rounding. (110 - 115) $3bn authorization; intend to repurchase $2bn of shares in 2025 Equity vests over 5 to 9 years Cash savings will increase Portfolio Cash Flow Cash savings will increase Adjusted EBITDA Internalization impact No impact Assumption of the Manager’s debt would have increased interest paid by ~$20m in 2024 compared to guidance of ~$160m

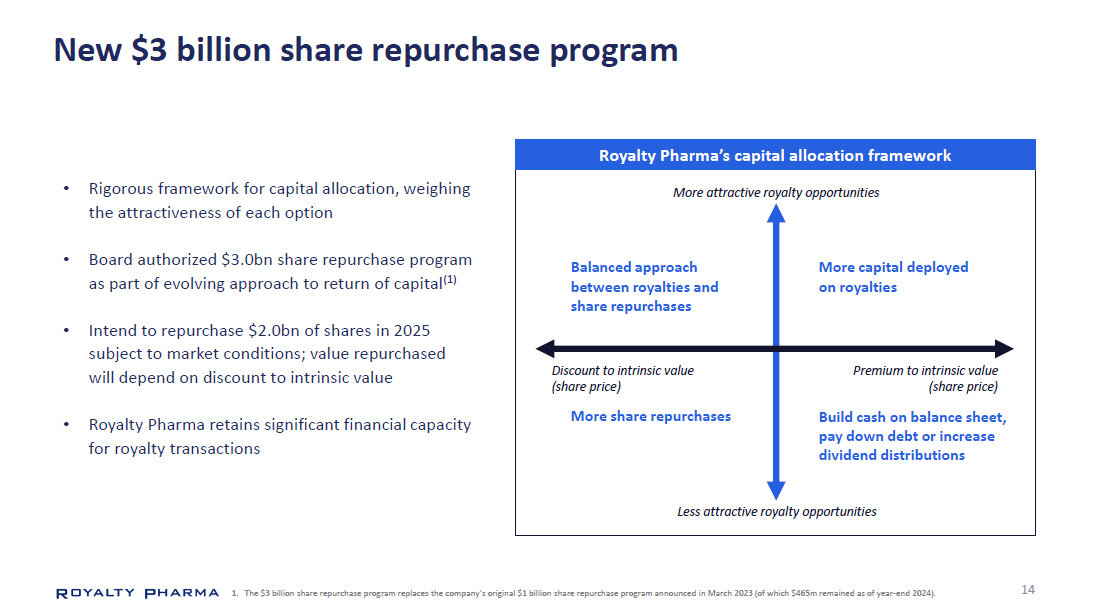

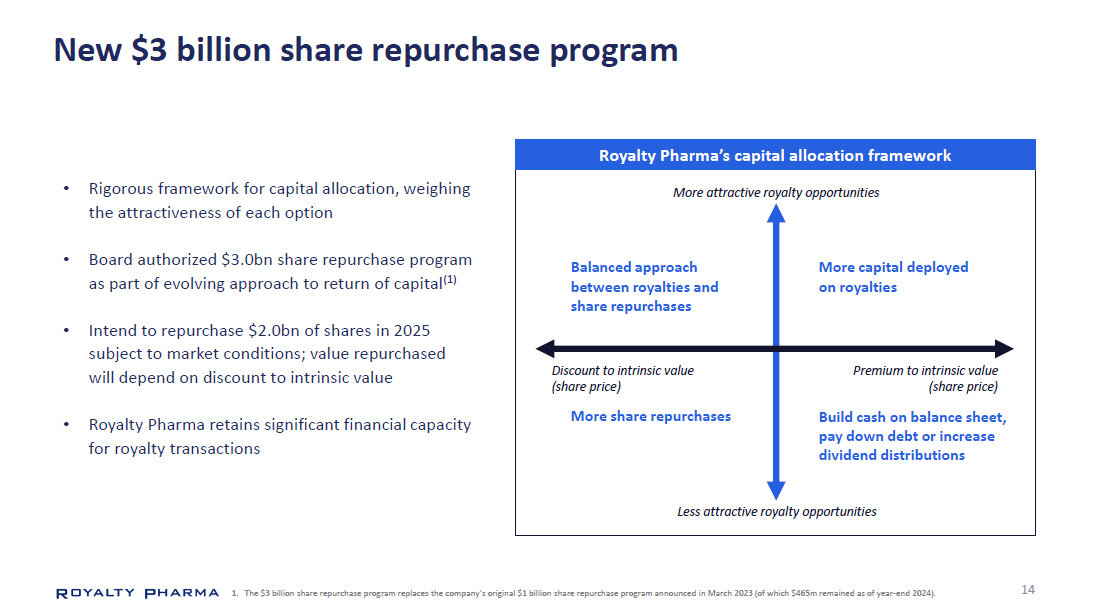

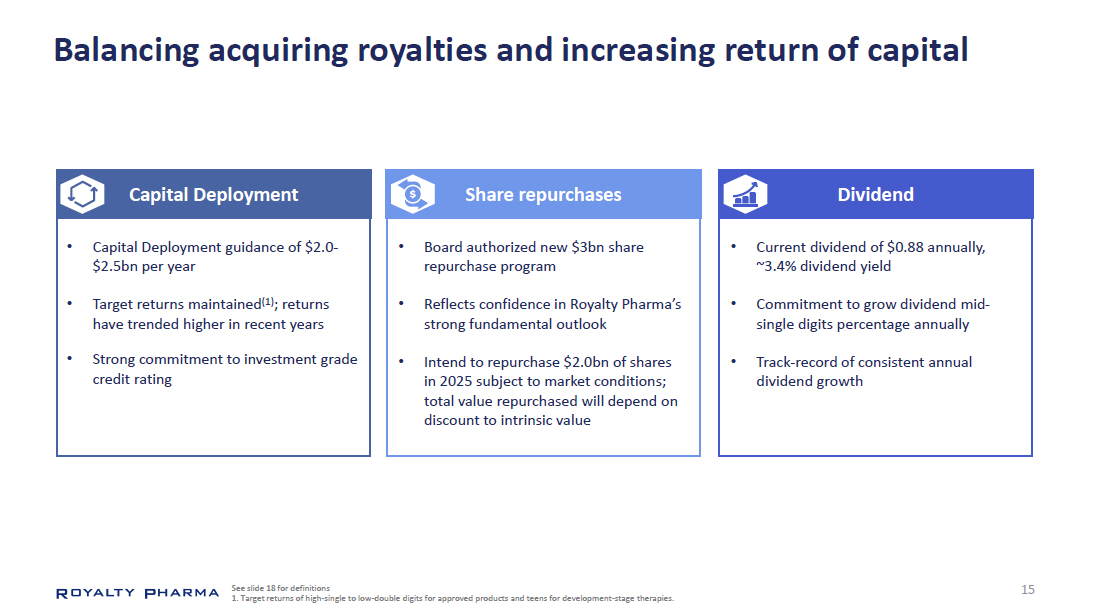

New $3 billion share repurchase program 14 • Rigorous framework for capital allocation, weighing the attractiveness of each option • Board authorized $3.0bn share repurchase program as part of evolving approach to return of capital (1) • Intend to repurchase $2.0bn of shares in 2025 subject to market conditions; value repurchased will depend on discount to intrinsic value • Royalty Pharma retains significant financial capacity for royalty transactions Royalty Pharma’s capital allocation framework 1. The $3 billion share repurchase program replaces the company’s original $1 billion share repurchase program announced in March 2023 (of which $465m remained as of year - end 2024). Royalty Pharma’s capital allocation framework Discount to intrinsic value (share price) Premium to intrinsic value (share price) Less attractive royalty opportunities More attractive royalty opportunities More share repurchases Build cash on balance sheet, pay down debt or increase dividend distributions More capital deployed on royalties Balanced approach between royalties and share repurchases

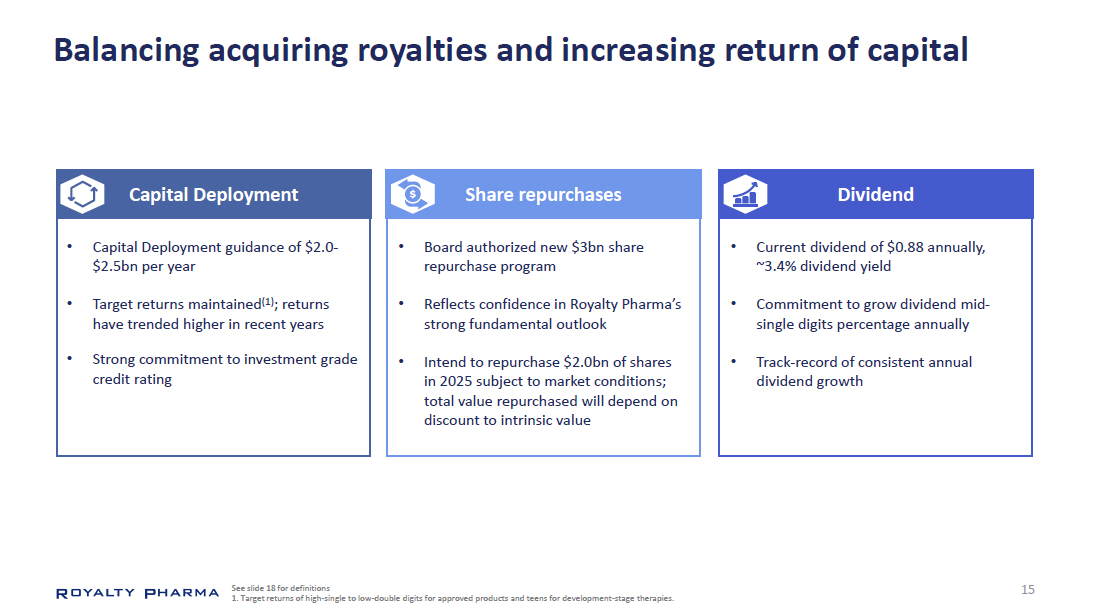

15 Balancing acquiring royalties and increasing return of capital Capital Deployment Share repurchases Dividend • Board authorized new $3bn share repurchase program • Reflects confidence in Royalty Pharma’s strong fundamental outlook • Intend to repurchase $2.0bn of shares in 2025 subject to market conditions; total value repurchased will depend on discount to intrinsic value • Capital Deployment guidance of $2.0 - $2.5bn per year • Target returns maintained (1) ; returns have trended higher in recent years • Strong commitment to investment grade credit rating • Current dividend of $0.88 annually, ~3.4% dividend yield • Commitment to grow dividend mid - single digits percentage annually • Track - record of consistent annual dividend growth See slide 18 for definitions 1. Target returns of high - single to low - double digits for approved products and teens for development - stage therapies.

Conclusion 16 Pablo Legorreta Founder & Chief Executive Officer

17 Internalizing the Manager is the next step in our evolution Ongoing business Integrated public company Fund s t r uc t u r e 1996 to 2003 2025 and beyond E x t ernally managed public company Expanded i n v e s tm e n t scope Royalty Pharma evolution (1996 to present) Internalizing management company 2004 to 2011 2012 to 2020 2020 to 2025 Our predecessor was founded in 1996 and we were incorporated under the laws of England and Wales on February 6, 2020.

F ootno t es Portfolio Receipts is a key performance metric that represents our ability to generate cash from our portfolio investments, the primary source of capital that we can deploy to make new portfolio investments. Portfolio Receipts is defined as the sum of Royalty Receipts and Milestones and other contractual receipts. Royalty Receipts includes variable payments based on sales of products, net of contractual payments to the legacy non - controlling interests, that are attributed to Royalty Pharma (“Royalty Receipts”). Milestones and other contractual receipts include sales - based or regulatory milestone payments and other fixed contractual receipts, net of contractual payments to the legacy non - controlling interests, that are attributed to Royalty Pharma. Portfolio Receipts does not include proceeds from equity securities or marketable securities, both of which are not central to our fundamental business strategy. Capital Deployment represents the total outflows that will drive future Portfolio Receipts and reflects cash paid at the acquisition date and any subsequent associated contractual payments reflected in the period in which cash was paid. Capital Deployment is calculated as the summation of the following line items from our GAAP consolidated statements of cash flows: Investments in equity method investees, Purchases of available for sale debt securities, Acquisitions of financial royalty assets, Acquisitions of other financial assets, Milestone payments, Development - stage funding payments - ongoing, Development - stage funding payments - upfront and milestone less Contributions from legacy non - controlling interests - R&D . 1) Portfolio Receipts is calculated as the sum of the following line items from our GAAP consolidated statements of cash flows: Cash collections from financial royalty assets, Cash collections from intangible royalty assets, Other royalty cash collections, Proceeds from available for sale debt securities and Distributions from equity method investees less Distributions to legacy non - controlling interests - Portfolio Receipts , which represent contractual distributions of Royalty Receipts and milestones and other contractual receipts to the Legacy Investors Partnerships and RPSFT. Distributions to RPSFT substantially ended in December 2023 when we acquired the remaining interest in RPCT held by RPSFT. 2) Adjusted EBITDA is defined under the revolving credit agreement as Portfolio Receipts minus payments for operating and professional costs. Operating and professional costs reflect Payments for operating and professional costs from the statements of cash flows. See GAAP to Non - GAAP reconciliation in the Company’s Current Report on Form 8 - K dated January 10, 2025. See the Company’s Annual Report on Form 10 - K filed with SEC on February 15, 2024 for additional discussion on defined term. 3) Portfolio Cash Flow is defined under the revolving credit agreement as Adjusted EBITDA minus interest paid or received, net. See GAAP to Non - GAAP reconciliation in the Company’s Current Report on Form 8 - K dated January 10, 2025. See the Company’s Annual Report on Form 10 - K filed with SEC on February 15, 2024 for additional discussion on defined term. 4) 18