January 2024 Investor Presentation © 2024 Mission Produce, Inc. The MISSION & TOWER DESIGN® and MISSION PRODUCE™ are trademarks of Mission Produce, Inc. All rights reserved.

Notice to and Undertaking by Recipients This presentation does not purport to be all-inclusive or to contain all of the information that the Recipient may require. The Company expressly disclaims any and all liability relating to or resulting from the use of this presentation. This presentation may not be reproduced, forwarded to any person or published, in whole or in part. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any security. The information contained herein is for informational purposes and may not be relied upon in connection with the purchase or sale of any security. Forward-Looking Statements Statements in this presentation that are not historical in nature are forward-looking statements that, within the meaning of the federal securities laws, including the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, involve known and unknown risks and uncertainties. Words such as "may", "will", "expect", "intend", "plan", "believe", "seek", "could", "estimate", "judgment", "targeting", "should", "anticipate", "goal" and variations of these words and similar expressions, are also intended to identify forward-looking statements. The forward-looking statements in this presentation address a variety of subjects, including statements about our short-term and long-term assumptions, goals and targets. Many of these assumptions relate to matters that are beyond our control and changing rapidly. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurances that our expectations will be attained. Readers are cautioned that actual results could differ materially from those implied by such forward- looking statements due to a variety of factors, including: limitations regarding the supply of fruit, either through purchasing or growing; fluctuations in the market price of fruit; increasing competition; risks associated with doing business internationally, including Mexican and Peruvian economic, political and/or societal conditions; inflationary pressures; establishment of sales channels and geographic markets; loss of one or more of our largest customers; general economic conditions or downturns; supply chain failures or disruptions; disruption to the supply of reliable and cost-effective transportation; failure to recruit or retain employees, poor employee relations, and/or ineffective organizational structure; inherent farming risks, including climate change; seasonality in operating results; failures associated with information technology infrastructure, system security and cyber risks; new and changing privacy laws and our compliance with such laws; food safety events and recalls; failure to comply with laws and regulations; changes to trade policy and/or export/import laws and regulations; risks from business acquisitions, if any; lack of or failure of infrastructure; material litigation or governmental inquiries/actions; failure to maintain or protect our brand; changes in tax rates or international tax legislation; risks associated with global conflicts; inability to accurately forecast future performance; the viability of an active, liquid, and orderly market for our common stock; volatility in the trading price of our common stock; concentration of control in our executive officers, and directors over matters submitted to stockholders for approval; limited sources of capital appreciation; significant costs associated with being a public company and the allocation of significant management resources thereto; reliance on analyst reports; failure to maintain proper and effective internal control over financial reporting; restrictions on takeover attempts in our charter documents and under Delaware law; the selection of Delaware as the exclusive forum for substantially all disputes between us and our stockholders; risks related to restrictive covenants under our credit facility, which could affect our flexibility to fund ongoing operations, uses of capital and strategic initiatives, and, if we are unable to maintain compliance with such covenants, lead to significant challenges in meeting our liquidity requirements and acceleration of our debt; and other risks and factors discussed from time to time in our Annual and Quarterly Reports on Forms 10-K and 10-Q and in our other filings with the Securities and Exchange Commission. You can obtain copies of our SEC filings on the SEC’s website at www.sec.gov. The forward-looking statements contained in this presentation are made as of the date hereof and the Corporation does not intend to, nor does it assume any obligation to, update or supplement any forward-looking statements after the date hereof to reflect actual results or future events or circumstances. Industry Information Market data and industry information used throughout this presentation are based on management's knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management's review of independent industry surveys and publications and other publicly available information prepared by a number of third-party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management's estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. Non-GAAP Financial Measure This presentation contains the non-GAAP financial measure “Adjusted EBITDA.” Management believes these measures provide useful information for analyzing the underlying business results. These measures are not in accordance with, nor are they a substitute for or superior to, the comparable financial measures by generally accepted accounting principles (“GAAP”). Reconciliations of these non-GAAP financial measures to the most comparable GAAP measures are included in the Appendix to this presentation where possible. The Company is unable to reconcile certain forecasted non-GAAP financial measures used herein, including adjusted EBITDA, without unreasonable efforts because a forecast of certain items, including taxes, interest, stock-based compensation, depreciation and amortization, income (loss) from equity method investees, other income, and other special, non-recurring or one-time items is not practical. Adjusted EBITDA refers to net income (loss), before interest expense, income taxes, depreciation and amortization expense, stock-based compensation expense, other income (expense), and income (loss) from equity method investees, further adjusted by asset impairment and disposals, net of insurance recoveries, farming costs for nonproductive orchards (which represents land lease costs), certain noncash and nonrecurring ERP costs, transaction costs, material legal settlements, amortization of inventory adjustments recognized from business combinations, and any special, non-recurring, or one-time items such as remeasurements or impairments, and any portion of these items attributable to the noncontrolling interest. Safe Harbor Statement 2

Mission Produce A global leader in the worldwide avocado business with four decades of investments in people, technology, and infrastructure ➤ Global Marketing & Distribution ➤Year-Round Supply ➤ Vertical Integration ➤ Strategically Located ➤ Long-Standing Grower Relationships ➤ Large, Addressable Market ➤ Economies of Scale 3

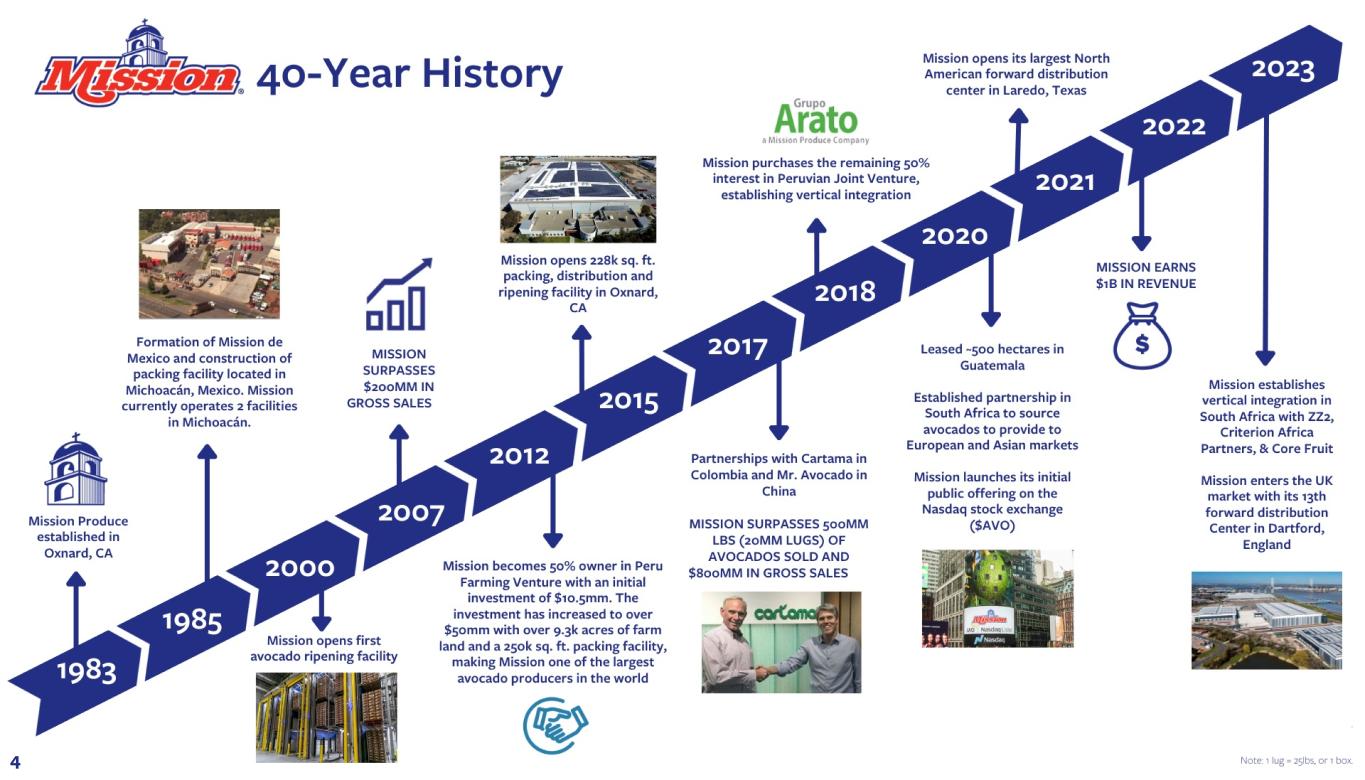

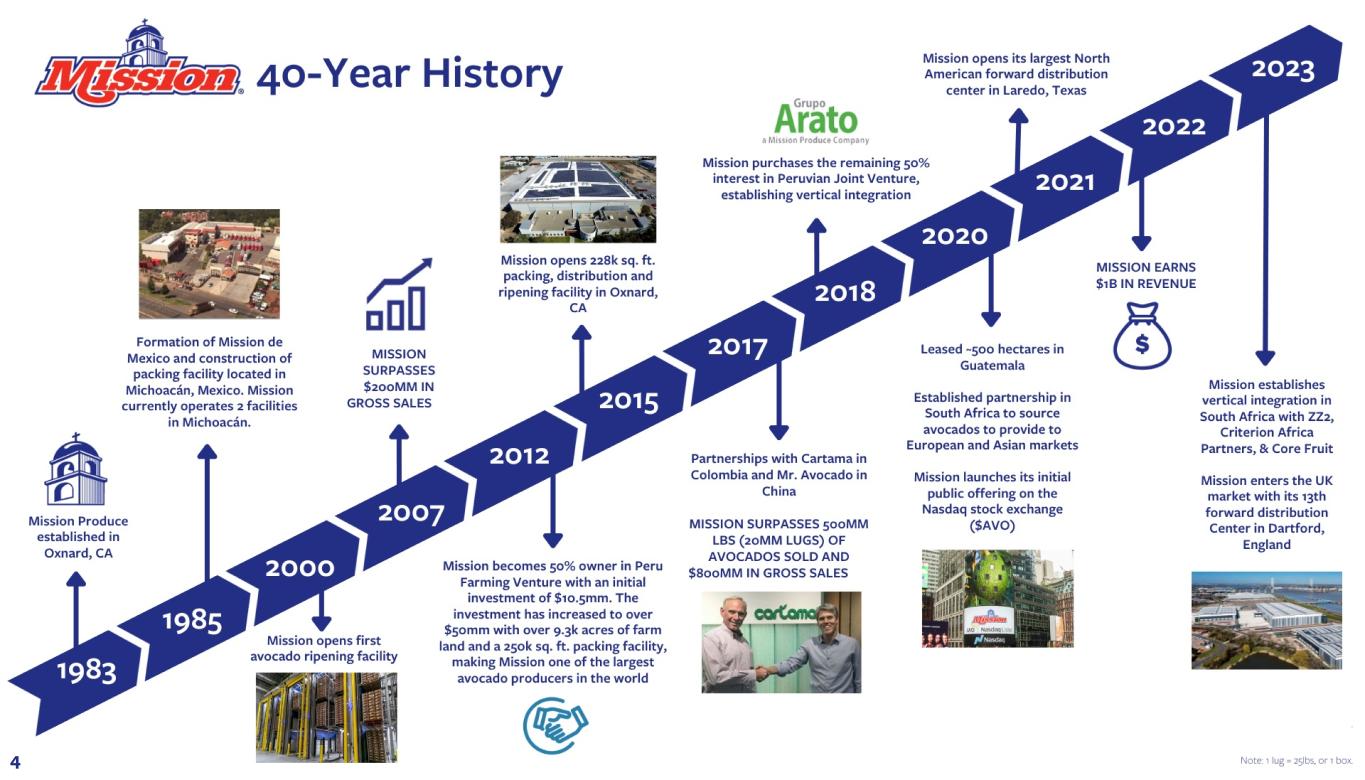

4

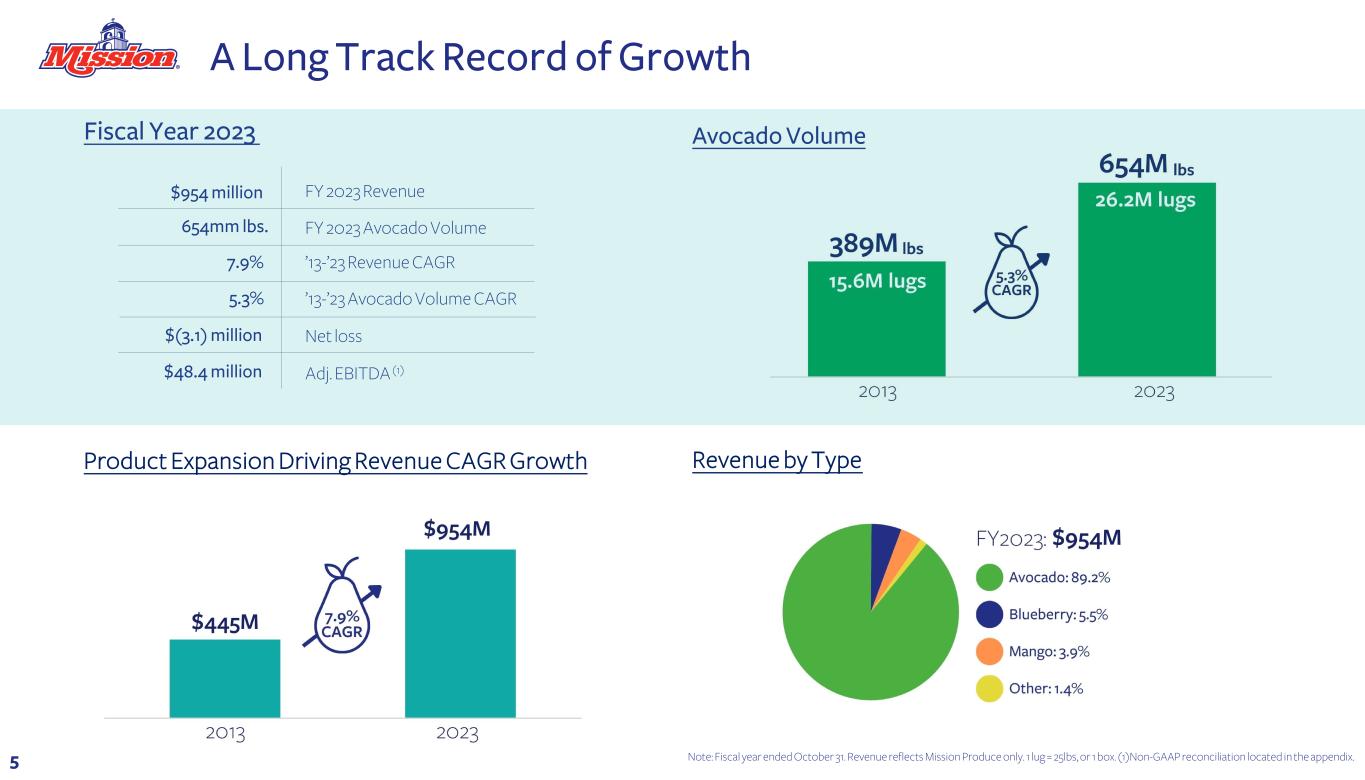

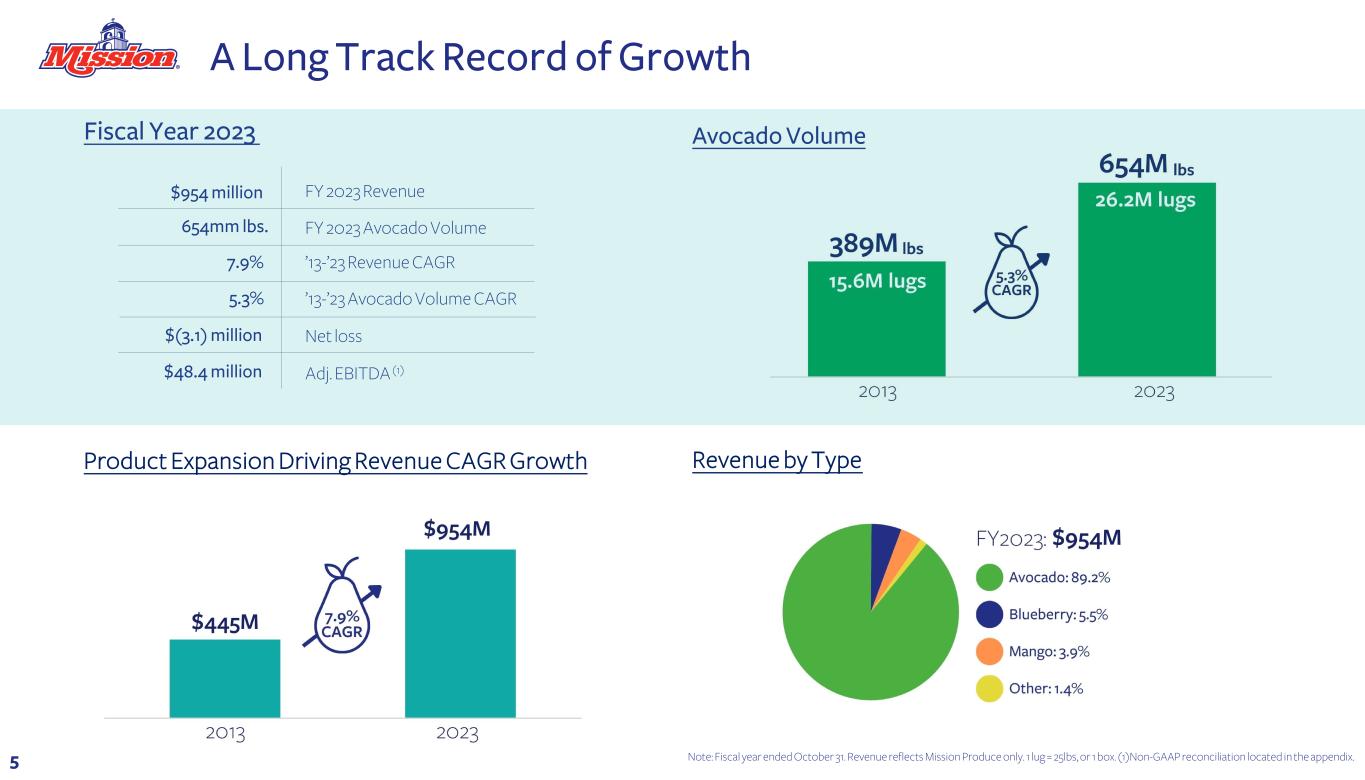

A Long Track Record of Growth $954 million FY 2023 Revenue 5.3% ’13-’23 Avocado Volume CAGR 7.9% ’13-’23 Revenue CAGR FY 2023 Avocado Volume654mm lbs. Note: Fiscal year ended October 31. Revenue reflects Mission Produce only. 1 lug = 25lbs, or 1 box. (1)Non-GAAP reconciliation located in the appendix. Revenue by Type Avocado VolumeFiscal Year 2023 5 $(3.1) million Adj. EBITDA (1) Product Expansion Driving Revenue CAGR Growth $48.4 million Net loss

Focused Growth Strategy Capitalize on strong growth trends in our core U.S. market by expanding our nationwide distribution network Leverage our global supply chain and distribution capabilities to continue developing international markets Diversify sourcing to enhance our global market-leading position and year-round supply position Continue to vertically integrate our supply chain 3

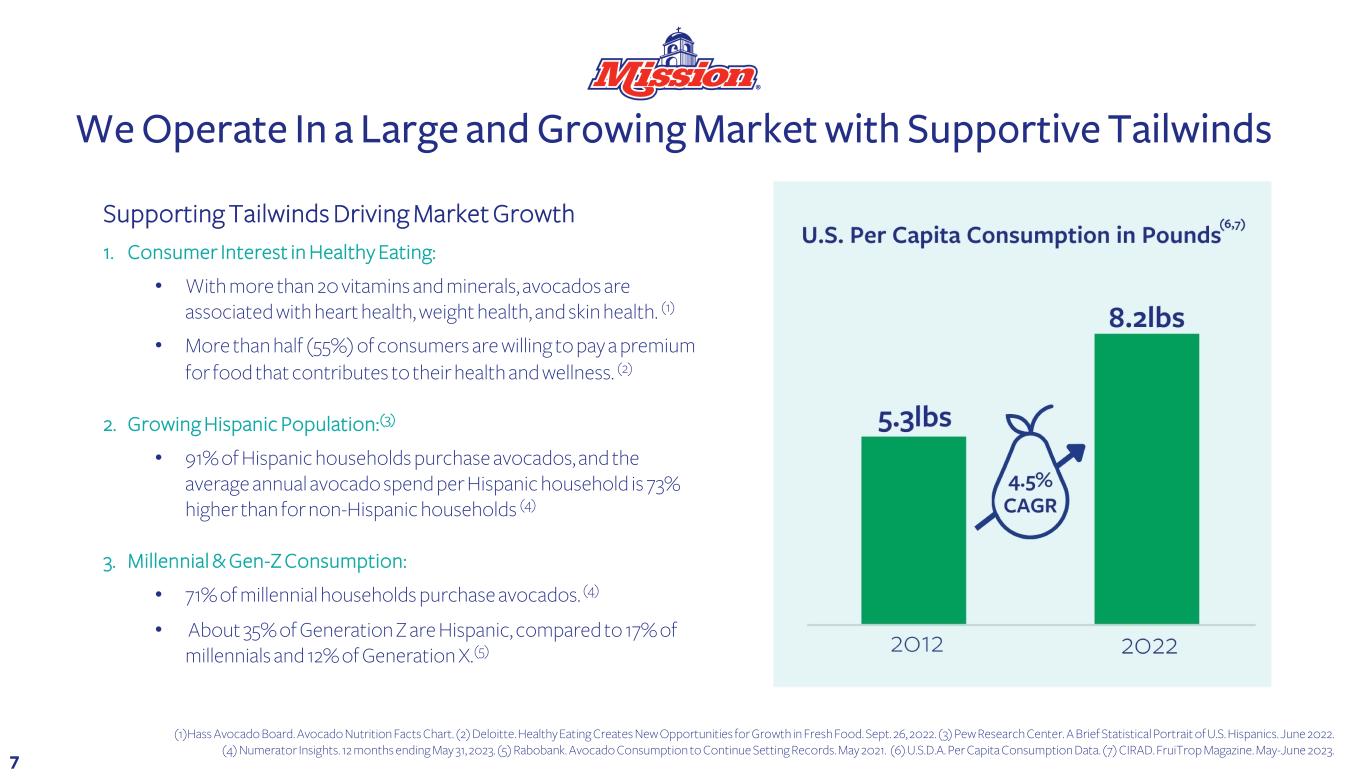

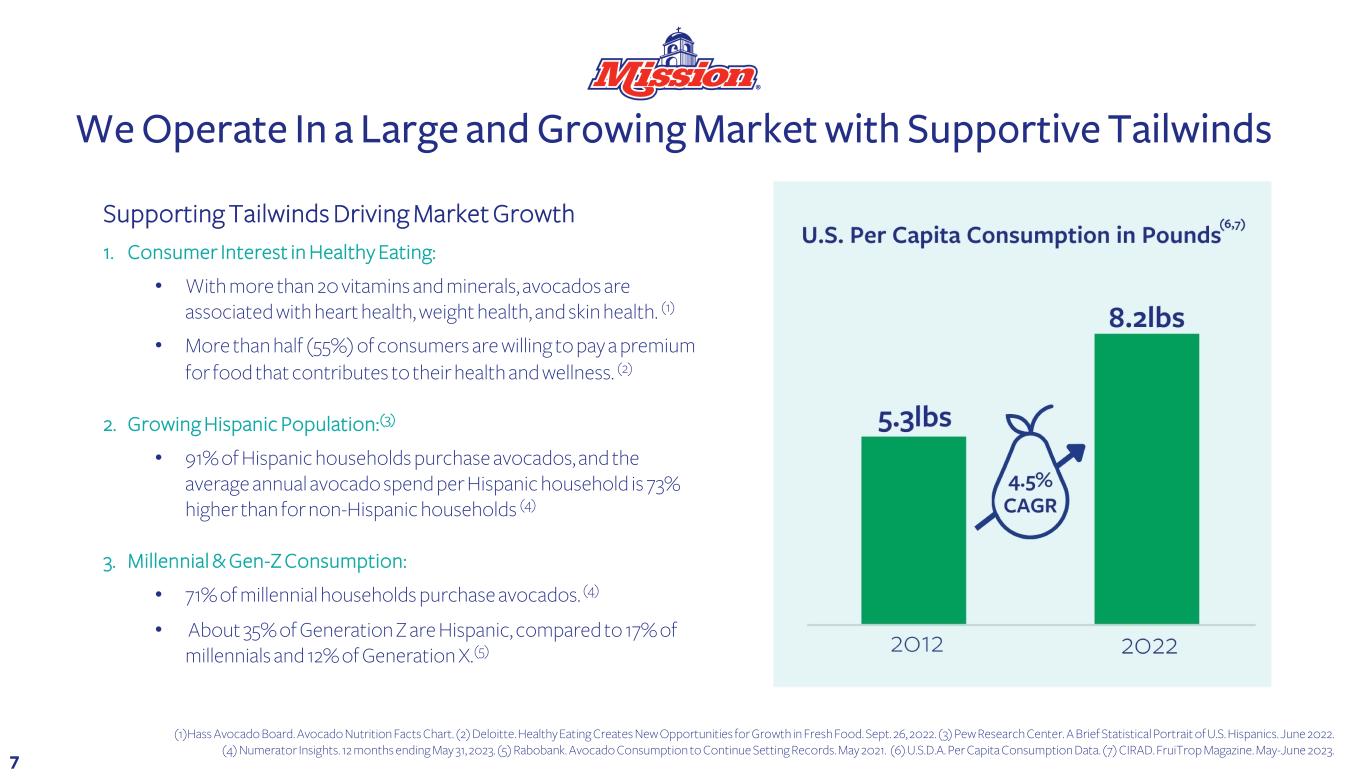

Supporting Tailwinds Driving Market Growth 1. Consumer Interest in Healthy Eating: • With more than 20 vitamins and minerals, avocados are associated with heart health, weight health, and skin health. (1) • More than half (55%) of consumers are willing to pay a premium for food that contributes to their health and wellness. (2) 2. Growing Hispanic Population:(3) • 91% of Hispanic households purchase avocados, and the average annual avocado spend per Hispanic household is 73% higher than for non-Hispanic households (4) 3. Millennial & Gen-Z Consumption: • 71% of millennial households purchase avocados. (4) • About 35% of Generation Z are Hispanic, compared to 17% of millennials and 12% of Generation X.(5) We Operate In a Large and Growing Market with Supportive Tailwinds (1)Hass Avocado Board. Avocado Nutrition Facts Chart. (2) Deloitte. Healthy Eating Creates New Opportunities for Growth in Fresh Food. Sept. 26, 2022. (3) Pew Research Center. A Brief Statistical Portrait of U.S. Hispanics. June 2022. (4) Numerator Insights. 12 months ending May 31, 2023. (5) Rabobank. Avocado Consumption to Continue Setting Records. May 2021. (6) U.S.D.A. Per Capita Consumption Data. (7) CIRAD. FruiTrop Magazine. May-June 2023. 7

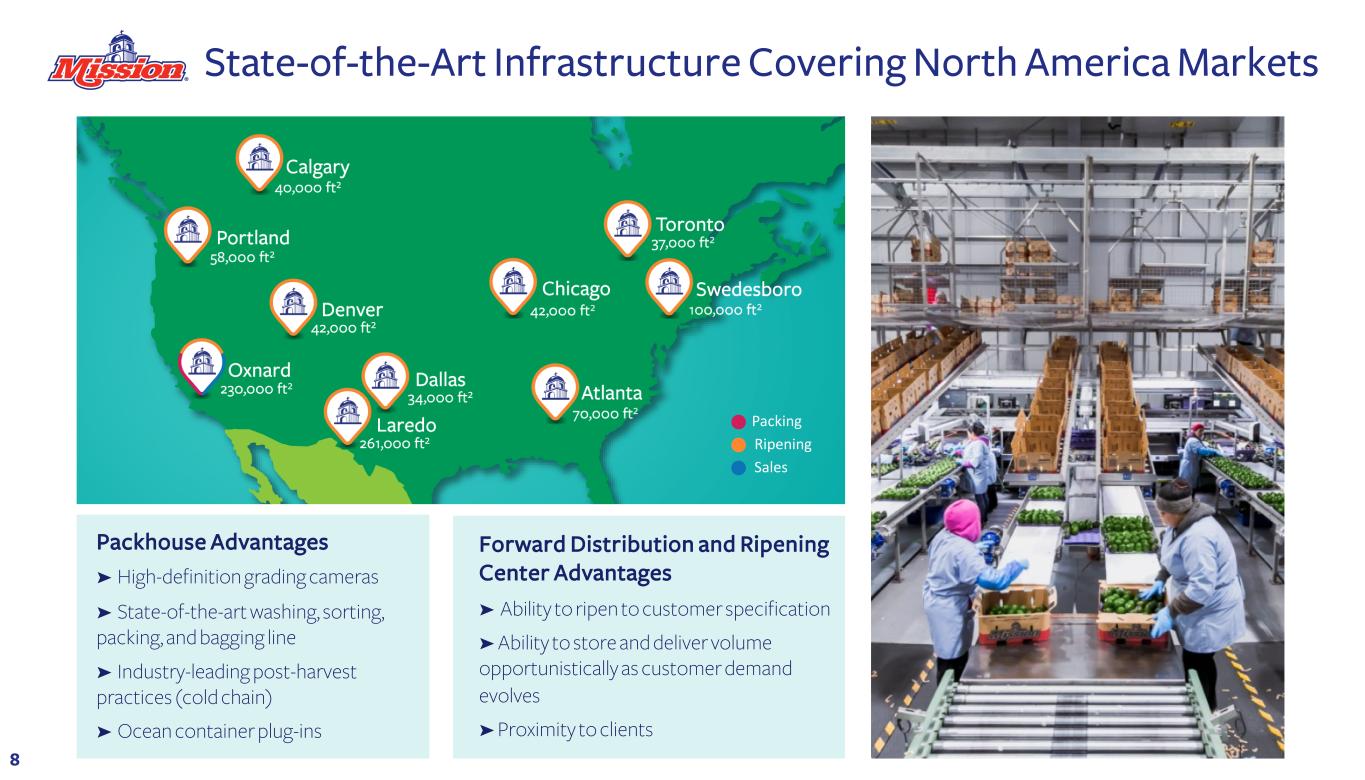

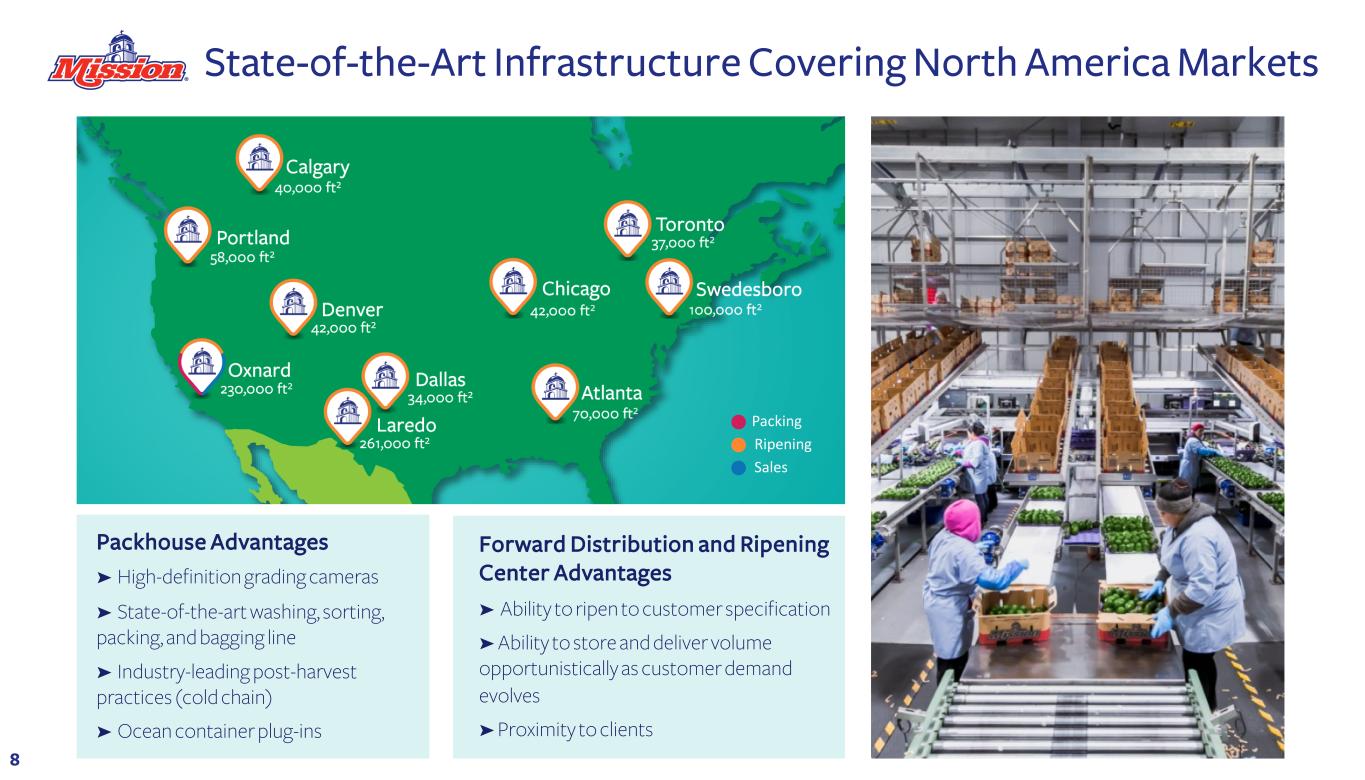

State-of-the-Art Infrastructure Covering North America Markets Packhouse Advantages ➤ High-definition grading cameras ➤ State-of-the-art washing, sorting, packing, and bagging line ➤ Industry-leading post-harvest practices (cold chain) ➤ Ocean container plug-ins Forward Distribution and Ripening Center Advantages ➤ Ability to ripen to customer specification ➤ Ability to store and deliver volume opportunistically as customer demand evolves ➤ Proximity to clients Packing Ripening Sales 8

Channel Segmentation Strategy Based on Growth and Profitability We are the preferred partner across Retail, Food Service, Wholesale, and International Channels ➤ Leading our customer & partner relationships with excellence ➤ Competitive positioning in sales, sourcing, and operations to serve customers year-round, growing demand across the globe ➤ Alignment with margin-accretive customers that hold strong market positions in their respective channel ➤ Strategic locations in key markets ➤ Scalability ➤ Surety of supply ➤ Consistent quality 9 ➤ Innovative solutions ➤ World-class service ➤ Market intelligence ➤ Superior Products ➤ Dedication to our core values: FIRST (Fun, Innovative, Reliable, Successful, Trustworthy)

Mission is Positioned as a Preferred Supplier by Offering Custom Programs & Value-Added Services We provide customers with leading operations and industry insights geared toward driving sales • Ripening to customer specifications • Logistics management (especially trucking) • Hands-on training to facilitate proper fruit handling & educational resources • Merchandising and promotional support • Around-the-clock customer support and availability • Consumer-friendly bagging and custom packaging • Category management • Avocado Intel Insights on market trends and consumer behavior • Quarterly category analysis & reviews 10

(1) Rabobank. Global Growth Far from Over. May 2023. (2) CIRAD. FruiTrop Magazine May-June 2023. Global Avocado Consumption is Poised to Grow 2022 Global Per Capita Consumption (1,2) Mission is driving year-round availability in international markets to meet growing demand International Growth Opportunity: ➤ Increasing global availability ➤ Increasing household penetration ➤ Innovation & expansion of logistics & production Competitive International Positioning: ➤ Meeting gaps in supply with increasing exports ➤ Increasing international distribution in key markets ➤ Expanding international customer base in EU & Asia (1) 11

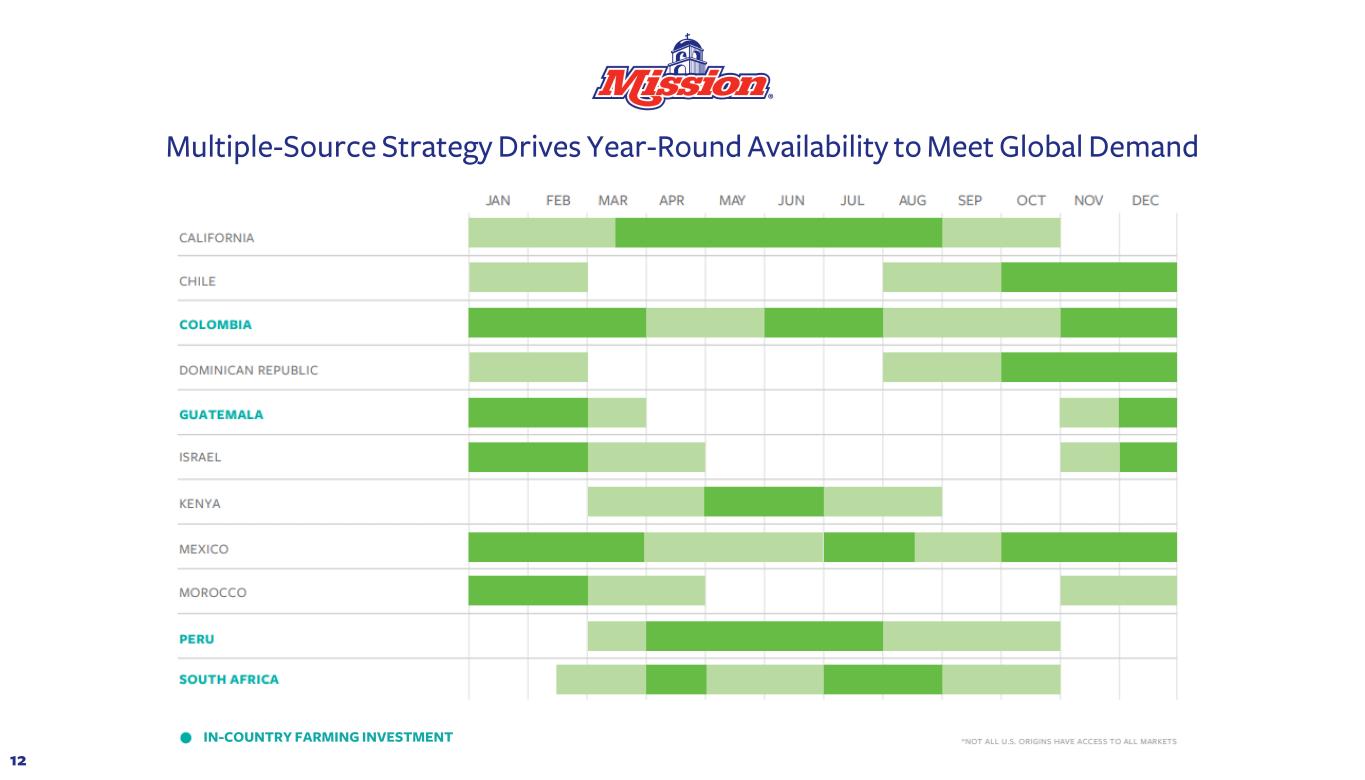

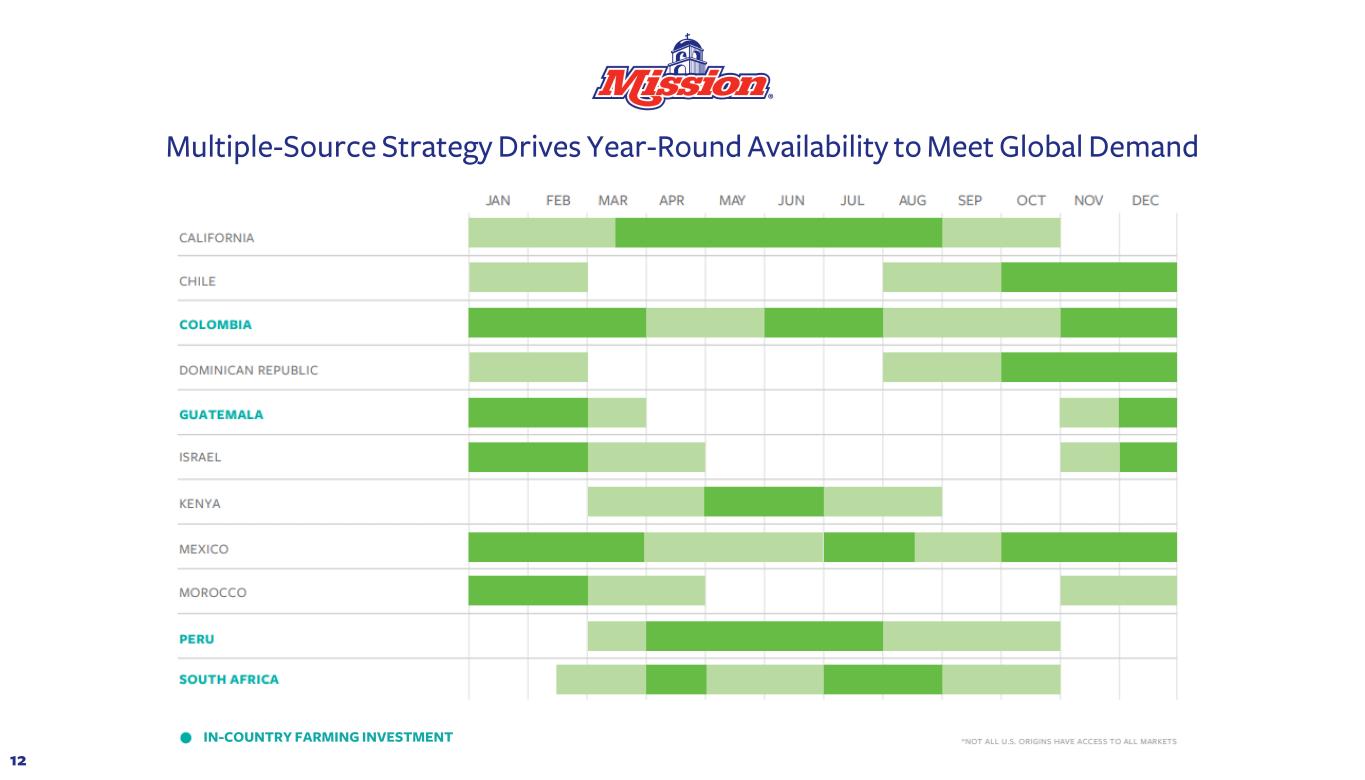

Multiple-Source Strategy Drives Year-Round Availability to Meet Global Demand 12 IN-COUNTRY FARMING INVESTMENT

We own 100% of our avocado and mango farming operations and packhouse, as well as a controlling interest in our blueberry farming operation. • It enables us to leverage our resources to grow, pack, and ship complementary commodities, such as mangos and blueberries • With commodities year-round, we can employ our workforce year- round, promoting talent retention • We benefit from enhanced quality control • We can offer strong supply reliability to our customers • By owning our fruit, we can decrease our reliance on other origins to fulfill demand International Farming and Vertical Integration: Peru Case Study Vertical integration strengthens our competitive position:

1,730 1,800 2,630 2,630 2,630 2,640 3,000 3,360 3,720 3,930 3,870 200 200 300 300 300 300 300 300 10 80 110 140 230 340 350 390 460 560 1,730 1,810 2,710 2,940 2,970 3,170 3,640 4,010 4,410 4,690 4,730 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Note: Hectare count is approximate and has been rounded to the nearest tenth. Owned Operations: Cultivated Farms Annual Growth in Peru Avocados Mangos Blueberries Total Cultivated Hectares By Commodity 14 Hectares

15 Developing Origins: Guatemala & Colombia Cumulative Hectare Growth 200 300 740 0 1 0 2 0 3 0 4 0 5 0 6 0 7 0 8 0 9 0 1 0 0 2021 2022 2023 Guatemala: 15 570 600 700 0 2 0 4 0 6 0 8 0 1 0 0 1 20 0 1 40 0 2021 2022 2023 Colombia : 50/50 JV Note: Hectare count is approximate and has been rounded to the nearest tenth.

(1) The Blueberries segment was consolidated prospectively on May 1, 2022. (2) Includes 2018 buyout of remaining 50% interest in Peru farming JV. $38.0 $43.5 $9.1 $10.8 $29.3 $29.9 $45.2 $26.1 $6.9 $12.9 $67.3 $73.4 $61.2 $49.8 FY2020 FY2021 FY2022 Q2Y TD2023 Capital Expenditures ($mm) ➤ Invested >$500mm across capital expenditures and equity investments during the past 10 years: (2) ➤ Mega facility in Laredo, TX supporting MX distribution throughout North America ➤ UK distribution facility supporting expansion to retail/food service customer base in UK market ➤ Avocado orchard development in Peru and Guatemala ➤ Modest leverage ratio despite capital-intensive model ➤ Slowing investments in distribution & farming ➤ Distribution – focus on capacity utilization ➤ Farming – finish existing projects outside of Peru to fill in supply calendar Recent Capital Investments We have invested heavily in our business historically, which we believe will put us in a position to generate strong, free-cash flows in the coming years Blueberries(1) International Farming Marketing & Distribution 16 FY2023

Long-term Financial Outlook ➤ Bullish outlook on avocado consumption driving global revenue growth, with volume and market share growth translating to improved leverage of distribution and farming investments ➤ Year-over-year variability to be expected in our industry – growth unlikely to come in steady, stable increments Estimated Total Revenue Growth: Mid-Single Digits Estimated Adjusted EBITDA Growth: High-Single Digits 17

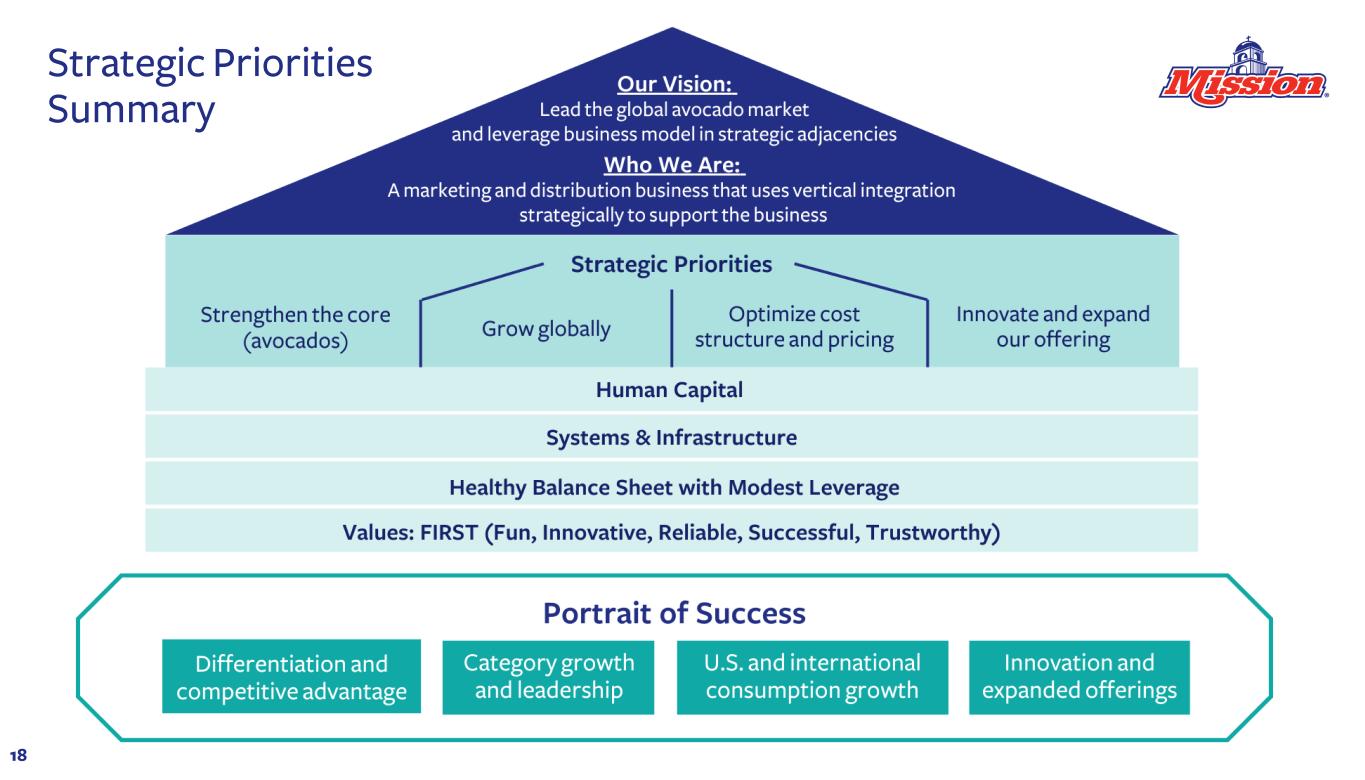

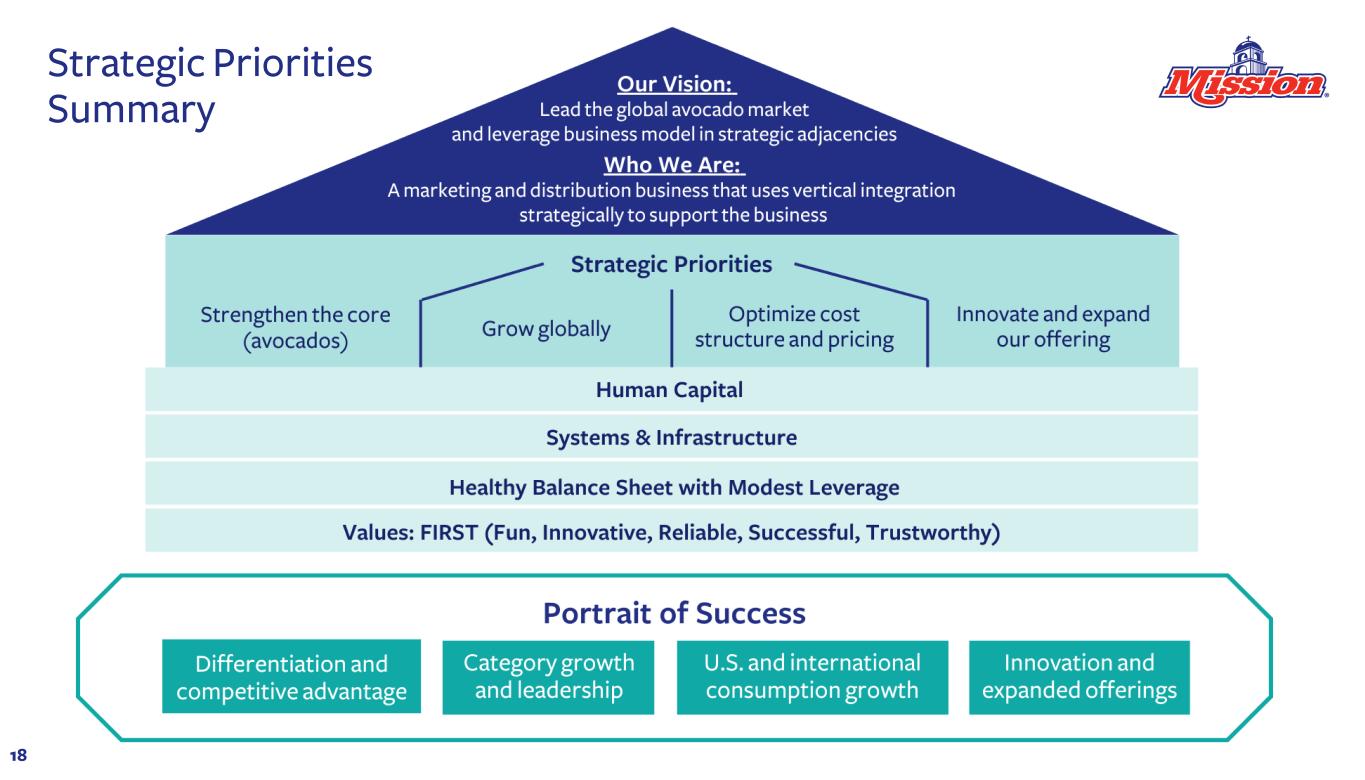

Strategic Priorities Summary 18

This presentation contains the non-GAAP financial measure “Adjusted EBITDA.” Management believes these measures provide useful information for analyzing the underlying business results. These measures are not in accordance with, nor are they a substitute for or superior to, the comparable financial measures by generally accepted accounting principles (“GAAP”). Reconciliations of these non- GAAP financial measures to the most comparable GAAP measures are included in the Appendix to this presentation where possible. The Company is unable to reconcile certain forecasted non-GAAP financial measures used herein, including adjusted EBITDA, without unreasonable efforts because a forecast of certain items, including taxes, interest, stock-based compensation, depreciation and amortization, income (loss) from equity method investees, other income, and other special, non-recurring or one-time items is not practical. Adjusted EBITDA refers to net income (loss), before interest expense, income taxes, depreciation and amortization expense, stock-based compensation expense, other income (expense), and income (loss) from equity method investees, further adjusted by asset impairment and disposals, net of insurance recoveries, farming costs for nonproductive orchards (which represents land lease costs), certain noncash and nonrecurring ERP costs, transaction costs, amortization of inventory adjustments recognized from business combinations, and any special, non-recurring, or one- time items such as remeasurements or impairments, and any portion of these items attributable to the noncontrolling interest. 19 Appendix: Non-GAAP Reconciliation