SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.__)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| [X] | Definitive Proxy Statement. |

| [ ] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to § 240.14a-12. |

Hamilton Lane Private Assets Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials: |

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: ___

(2) Form, Schedule or Registration Statement No.:___

(3) Filing Party:

(4) Date Filed:

Hamilton Lane Private Assets Fund

c/o Hamilton Lane Advisors, L.L.C.

110 Washington St., Ste. 1300

Conshohocken, PA 19428

December 3, 2021

Dear Shareholders:

The enclosed Proxy Statement discusses a proposal to be voted upon by the shareholders (“Shareholders”) of the Hamilton Lane Private Assets Fund (the “Fund”) at a special meeting of Shareholders to be held at the offices of Hamilton Lane Advisors, L.L.C., 110 Washington St., Ste. 1300, Conshohocken, PA 19428, on January 14, 2022 at 11:00 a.m. Eastern Time (the “Meeting”). Shareholders of record as of the close of business on November 29, 2021 are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

The Meeting is being called for Shareholders to vote on a proposal (the “Proposal”) to elect two (2) individuals to the Board of Trustees of the Fund (the “Board”) and to transact such other business as may properly come before the Meeting. The Fund’s current Trustees, a majority of whom are not “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the Fund, have unanimously recommended that the Proposal be submitted to Shareholders for approval at the Meeting. The enclosed Proxy Statement contains additional information about the Proposal.

All Shareholders are cordially invited to attend the Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, regardless of whether or not you plan to attend the Meeting. You may vote by mail, telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. If you have any questions regarding the Proposal or the voting process, please call our proxy agent, Broadridge toll-free at 1-800-690-6903. If you attend the Meeting, you may revoke your proxy and vote your shares in person.

In light of the COVID-19 pandemic, the Fund is urging all shareholders to take advantage of voting by mail, by telephone or through the Internet. Additionally, while the Meeting is anticipated to occur as-planned, there is a possibility that, due to the COVID-19 pandemic, the Meeting may be postponed or the location or approach may need to be changed, including the possibility of holding the Meeting via remote communications for the health and safety of all Meeting participants. Should this occur, the Fund will publicly announce the decision to do so in advance and will provide details on how shareholders may participate in the alternative meeting. Any announcement will also be posted to the Fund’s website, www.hamiltonlane.com, following release. If you plan to attend the Meeting in person, please note that the Meeting will be held in accordance with any recommended and required social distancing and safety guidelines, as applicable.

Thank you for your investment in the Fund. I encourage you to exercise your rights in governing the Fund by voting on the Proposal. The Board unanimously recommends that you cast your vote FOR the proposal to elect each proposed individual as a Trustee of the Fund, as described in the Proxy Statement.

| | Very truly yours, |

| | |

| | /s/ Andrew Schardt |

| | Andrew Schardt

Trustee and President of Hamilton Lane Private

Assets Fund |

IMPORTANT INFORMATION

| Q. | Why am I receiving this proxy statement? |

| A. | You are being asked to vote on a proposal (“Proposal”) to elect the proposed individuals to the Board of Trustees (the “Board”) of Hamilton Lane Private Assets Fund (the “Fund”). The current Trustees of the Fund, a majority of whom are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)), have unanimously recommended that each proposed nominee be submitted to the Fund’s shareholders for election at the Special Meeting of Shareholders (the “Meeting”). The 1940 Act requires a certain percentage of the Trustees of the Fund to have been elected by shareholders and that such elections occur before the Board can appoint any new Trustee to fill vacancies or expand the Board. The Board recommends that you vote for the Proposal in order to elect the Fund’s proposed nominees and facilitate future compliance with the requirement of the 1940 Act. |

| Q. | Who is eligible to vote? |

| A. | Any person who owned shares of a Fund on the “record date,” which was November 29, 2021 (even if that person has since sold those shares), is eligible to vote on the Proposal. |

| Q. | Who are the nominees proposed for election as Trustees? |

| A. | Gail Susan Ball and Timothy S. Galbraith (each, a “Nominee,” and together, the “Nominees”). More information about the Nominees is available in the Proxy Statement. Thomas J. Allingham and Holly Flanagan are resigning from the Board and will cease to serve as Trustees effective when the new Trustees take office. |

| Q. | How many of the proposed individuals will be Independent Trustees if elected or re-elected? |

| A. | If elected by shareholders, the Nominees, Gail Susan Ball and Timothy S. Galbraith, will be Independent Trustees of the Fund. Independent Trustees have no affiliation with the Funds, apart from any personal investments they choose to make in the Funds as private individuals. Independent Trustees play a critical role in overseeing Fund operations and representing the interests of shareholders. |

| Q. | When will the proposed individuals take office? |

| A. | If the Nominees are elected by shareholders at the Meeting, the Board will work with the Fund management on an orderly transition. Thomas J. Allingham and Holly Flanagan are resigning from the Board and will cease to serve as Trustees effective when the new Trustees take office. |

| Q. | How long will each Trustee serve? |

| A. | Each incumbent Trustee may serve on the Board until he is removed, resigns or is subject to various disabling events such as death or incapacity. A Trustee may resign by an instrument in writing signed by him and delivered to the other Trustees, and such resignation shall be effective upon such delivery or at any later date according to the terms of the instrument. A Trustee may be removed by a written instrument signed by at least two thirds of the number of Trustees or at a meeting of shareholders of the trust by a vote of shareholders owning at least two-thirds of the outstanding shares of the trust. |

Q. How does the Board recommend that I vote?

| A. | The Board, including all of the Board’s current Independent Trustees, recommends that you vote in favor of the Proposal. |

| Q. | What vote is required to approve the Proposal? |

| A. | If a quorum is present, a plurality of the votes cast shall be sufficient to approve the Proposal. A “plurality of votes cast” means that those Nominees receiving the two highest numbers of affirmative votes cast, whether or not such votes constitute a majority, will be elected at the Meeting. For purposes of electing Trustees, not voting or withholding your vote by voting “abstain” (or a direction to your broker, bank or other nominee to withhold your vote, called a “broker non-vote”) is not counted as a vote cast, and therefore will have no effect on the outcome of the election of directors. |

| Q. | I have only a few shares — does my vote matter? |

| A. | Your vote is important. If many shareholders choose not to vote, the Fund might not receive enough votes to reach a quorum to hold the Meeting. If it appears that there will not be a quorum, the Fund would have to send additional mailings or otherwise solicit shareholders to try to obtain more votes. |

| Q. | What’s the deadline for submitting my vote? |

| A. | We encourage you to vote as soon as possible to make sure that the Fund receives enough votes to act on the Proposal. Unless you attend the Meeting to vote in person, your vote must be received by 11:59 p.m. Eastern Time on January 13, 2022. |

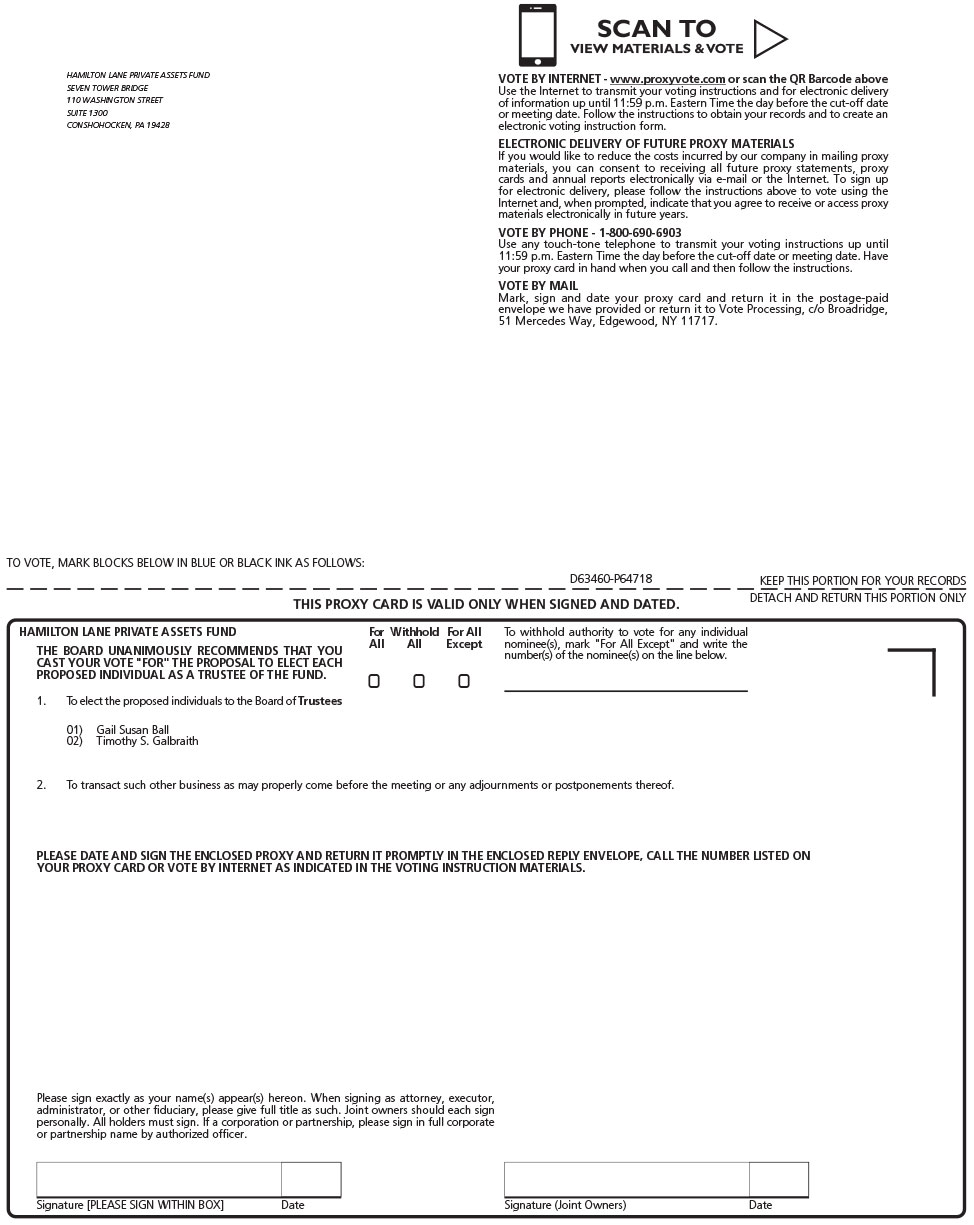

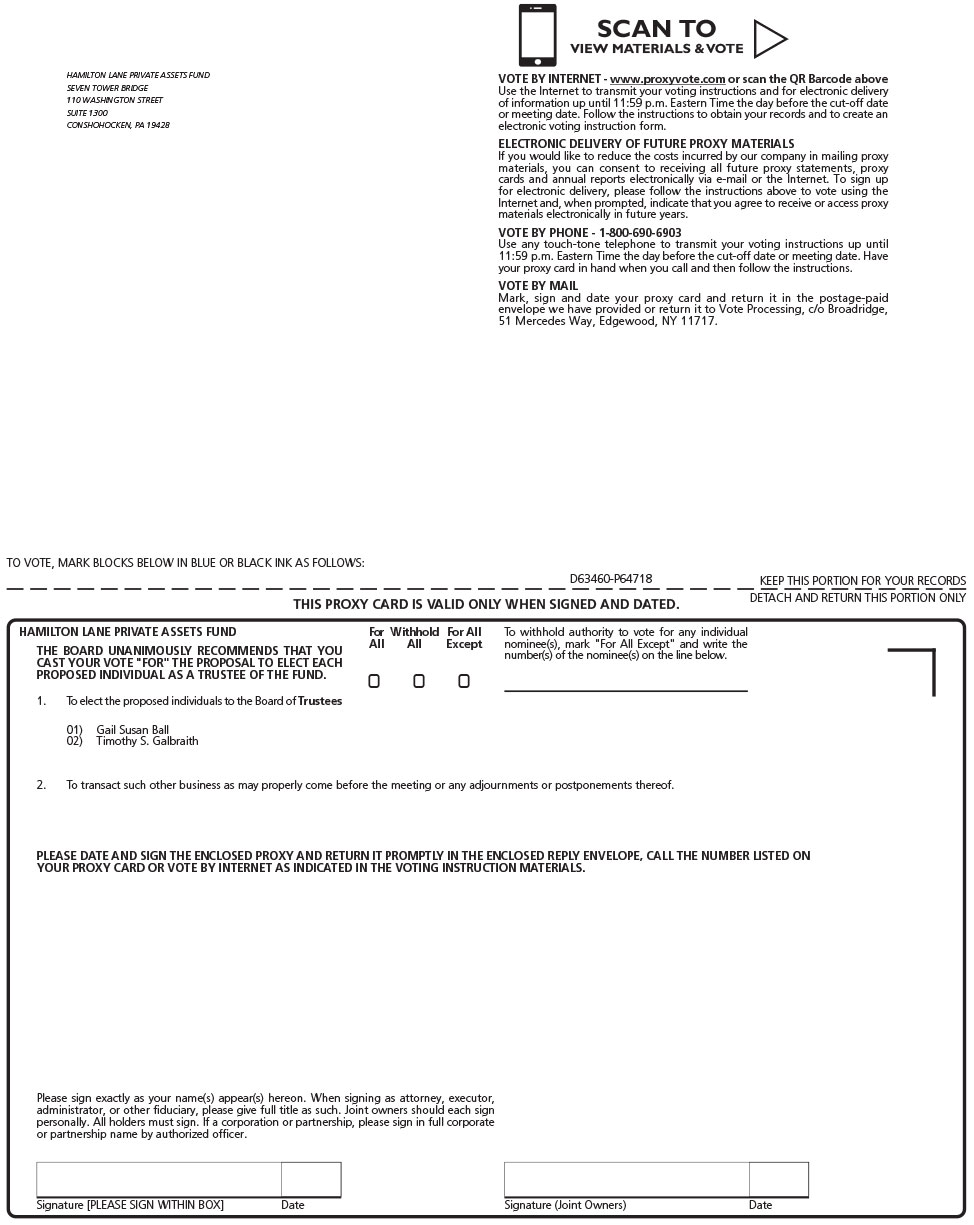

A. You may vote in any of four ways:

| o | Through the Internet. Please follow the instructions on your proxy card. |

| o | By telephone, with a toll-free call to the phone number indicated on the proxy card. |

| o | By mailing in your proxy card. |

| o | In person at the Meeting at the offices of the Adviser, 110 Washington St., Ste. 1300, Conshohocken, PA 19428, on January 14, 2022 at 11:00 a.m. Eastern Time. |

We encourage you to vote via the Internet or telephone using the control number on your proxy card and following the simple instructions because these methods result in the most efficient means of transmitting your vote and reduce the need for the Fund to conduct telephone solicitations and/or follow up mailings. If you would like to change your previous vote, you may vote again using any of the methods described above.

| Q. | How should I sign the proxy card? |

| A. | You should sign your name exactly as it appears on the proxy card. Unless you have instructed us otherwise, either owner of a joint account may sign the card, but again, the owner must sign the name exactly as it appears on the card. The proxy card for accounts of which the signer is not the owner should be signed in a way that indicates the signer’s authority—for example, “Mary Smith, Custodian.” |

| Q. | What happens if I sign and return my proxy card but do not mark my vote? |

| A. | The named proxies will vote your shares to approve the Proposal and at their discretion on any other matter that may come before the Meeting that the Fund did not have notice of a reasonable time prior to the mailing of the Proxy Statement. |

| A. | You may revoke your proxy at any time before it is exercised by giving written notice of your revocation to the Fund’s Secretary, or by the execution and delivery of a later-dated proxy. You may also revoke your proxy by attending the Meeting, requesting the return of your proxy, and voting in person. |

Q. Whom should I call if I have questions?

| A. | If you have any questions regarding the proposals or the voting process, please call our proxy agent, Broadridge toll-free at 1-800-690-6903. |

Hamilton Lane Private Assets Fund

c/o Hamilton Lane Advisors, L.L.C.

110 Washington St., Ste. 1300

Conshohocken, PA 19428

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held January 14, 2022, 2021

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting (“Meeting”) of shareholders (“Shareholders”) of the Hamilton Lane Private Assets Fund (the “Fund”), will be held at the offices of Hamilton Lane Advisors, L.L.C., 110 Washington St., Ste. 1300, Conshohocken, PA 19428, on January 14, 2022 at 11:00 a.m. Eastern Time.

At the Meeting, Shareholders will be asked to act upon the following:

| | 1. | To elect the proposed individuals to the Board of Trustees. |

| | 2. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

The Board unanimously recommends that you cast your vote “FOR” the PROPOSAL

TO Elect each proposed individual as A Trustee of the Fund.

Any Shareholder who owned shares of a Fund as of the close of business on November 29, 2021 (the “Record Date”) will receive notice of the Meeting and will be entitled to vote at the Meeting or any postponements or adjournments thereof. Proxies or voting instructions may be revoked at any time before they are exercised by executing and submitting a revised proxy, by giving written notice of revocation to the Fund’s Secretary, or by voting in person at the Meeting. The Notice of Special Meeting of Shareholders, Proxy Statement and proxy card are being mailed on or about December 3, 2021 to Shareholders as of the Record Date.

| | By Order of the Board of Trustees of Hamilton

Lane Private Assets Fund, on behalf of each

Fund | |

| | | |

| | /s/ Andrew Schardt | |

| | Andrew Schardt

Trustee and President of Hamilton Lane Private

Assets Fund December 3, 2021 | |

YOUR VOTE IS IMPORTANT

You can vote easily and quickly over the Internet, by toll-free telephone call, or by mail. Just follow the simple instructions that appear on your proxy card. Please help the Fund reduce the need to conduct telephone solicitation and/or follow-up mailings by voting today.

Hamilton Lane Private Assets Fund

c/o Hamilton Lane Advisors, L.L.C.

110 Washington St., Ste. 1300

Conshohocken, PA 19428

PROXY STATEMENT

For

SPECIAL MEETING OF SHAREHOLDERS

To Be Held January 14, 2022

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”), for use at a Special Meeting of Shareholders (the “Meeting”) of Hamilton Lane Private Assets Fund (the “Fund”), to be held at the offices of Hamilton Lane Advisors, L.L.C. (the “Adviser”), 110 Washington St., Ste. 1300, Conshohocken, PA 19428, on January 14, 2022 at 11:00 a.m. Eastern Time, and at any and all adjournments thereof.

The Meeting has been called by the Board for the following purposes:

| | 1. | To elect the proposed individuals to the Board of Trustees, and |

| | 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

You will find this Proxy Statement divided into four (4) parts:

Part 1 Provides details on the proposal to elect the proposed individuals to the Board (the “Proposal”) (see page 2).

Part 2 Provides information about ownership of shares of the Fund (see page 9).

Part 3 Provides information on proxy voting and the operation of the Meeting (see page 11).

Part 4 Provides information on other matters (see page 14).

Please read this Proxy Statement before voting on the Proposal. You may call toll-free at 1-800-690-6903 if you have any questions about the Proxy Statement, or if you would like additional information on how to attend the Meeting and vote in person. Only shareholders of record as of the close of business on November 29, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

We anticipate that the Notice of Special Meeting of Shareholders, Proxy Statement and the proxy card will be mailed to Fund shareholders (“Shareholders”) beginning on or about December 3, 2021.

Annual Report. The Fund’s most recent Annual Report is available upon request without charge. You may view the Annual Report at the Fund’s website at www.hamiltonlane.com. You may also request the Annual Report by calling toll-free at (888) 882-8212.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF MATERIALS

FOR THE MEETING TO BE HELD ON January 14, 2022

The Proxy Statement for the Meeting is available at www.proxyvote.com

_____________________________________________________________________________

PART 1

DESCRIPTION OF PROPOSAL

ELECTION OF PROPOSED INDIVIDUALS TO THE BOARD OF TRUSTEES OF THE FUND

_____________________________________________________________________________

Background

Shareholders are being asked to vote on a proposal to elect the following Trustee nominees (each a “Nominee”) to the Board of Trustees of the Fund: Gail Susan Ball and Timothy S. Galbraith. Each of the Nominee Trustees has agreed to stand for election and to serve on the Board of Trustees if elected. Thomas J. Allingham and Holly Flanagan are resigning from the Board and will cease to serve as Trustees effective when the new Trustees take office. The Fund is not required, and does not intend, to hold annual shareholder meetings for the election of Trustees. As a result, if elected, the Nominee Trustees will hold office as a Trustee for the lifetime of the Fund or until he or she sooner dies, resigns, retires or is removed.

Gail Susan Ball and Timothy S. Galbraith were selected by the Fund’s Nominating Committee appointed by the Board on November 29, 2021, as Trustees subject to shareholder approval. The Investment Company Act of 1940, as amended, (the “1940 Act”) requires a certain percentage of the Trustees to have been elected by shareholders and that those elections occur before the Board can appoint any new Trustees to fill vacancies or expand the Board. To properly seat the Nominees and to facilitate future compliance with the requirements of the 1940 Act, the Board of Trustees now proposes to have shareholders elect Gail Susan Ball and Timothy S. Galbraith to serve as Trustees to the Fund.

Gail Susan Ball and Timothy S. Galbraith will each serve as a non-interested person Trustee of the Fund as that term is defined in Section 2(a)(19) of the 1940 Act (referred to hereafter as an “Independent Trustee”).

Management

Management of the Fund

The Board has overall responsibility for the management and supervision of the business operations of the Fund on behalf of the Shareholders. A majority of Trustees of the Board are and will be persons who are not “interested persons,” as defined in Section 2(a)(19) of the Investment Company Act (the “Independent Trustees”). To the extent permitted by the Investment Company Act and other applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, service providers or the Adviser. There are currently five Trustees, three of whom are Independent Trustees. The Trustees set broad policies for the Fund, choose the Fund’s officers and hire the Fund’s investment adviser. The officers of the Fund manage the day-to-day operations and are responsible to the Board.

The following tables lists the Current and Nominee Trustees and officers of the Fund and a statement of their present positions, principal occupations during the past five years, the number of portfolios each Incumbent Trustee or Nominee Trustee oversees and the other directorships held by the Incumbent Trustees or Nominee Trustees during the past five years, if applicable. There are no familial relationships among the officers, Incumbent Trustees and Nominee Trustee. Except as otherwise noted, the address for all individuals listed in the tables below is c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212.

Nominees for Independent Trustee

| Name, Address and Year of Birth | Position(S) With The Fund | Principal Occupation(S) During Past 5 Years | Portfolios in Fund Complex Overseen by Trustee | Other Directorships** Held by Trustee |

Gail Susan Ball Birth Year: 1957 | Nominee | Executive in Residence and Special Program Director of WE Hatch (since 2020); Managing Partner at Alumni Ventures Group, Chestnut Street Ventures, Social Venture Fund and AVG Women’s Fund (2017-2019) | 1 | CGHK, LLC (since 2019); Silver Lining Finance (since 2019) |

Timothy S. Galbraith Birth Year: 1964 | Nominee | Chief Investment Officer and Founder of Innovation Beta (since 2017); Portfolio Manager of Transamerica Multi-Manager Alternative Strategies Portfolio Fund (2016-2017) | 1 | N/A |

Current Independent Trustees

| Name, Address and Year of Birth | Position(S) With The Fund | Length Of Time Serviced* | Principal Occupation(S) During Past 5 Years | Portfolios in Fund Complex Overseen by Trustee | Other Directorships** Held by Trustee |

Jeffrey P. Ladouceur Birth Year: 1970 | Trustee | Since Inception | Director of SEI Investments (since 2010) | 1 | N/A |

| * | Each Trustee serves an indefinite term, until his or her successor is elected. |

| ** | Includes any company with a class of securities registered pursuant to Section 12 of the Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered under the Investment Company Act. |

Interested Trustees and Officers

| Name, Address And Year of Birth | Position(S) With The Fund | Length Of Time Serviced* | Principal Occupation(S) During Past 5 Years | Portfolios in Fund Complex Overseen by Trustee | Other Directorships** Held by Trustee |

Andrew Schardt Birth Year: 1978 | Trustee and President | Since Inception | Managing Director and Global Head of Direct Credit at Hamilton Lane Advisors, L.L.C. (since 2008) | 1 | N/A |

Frederick W. Shaw Birth Year: 1975 | Trustee and Assistant Secretary | Since Inception | Chief Risk Officer (since April 2020); Managing Director, Head of Risk, Compliance and Strategic Integrations (2019 – 2020); Managing Director, Global Chief Compliance and Anti-Money Laundering Officer (2017 – 2019); and Principal, Director of Compliance (2011 – 2017) at Hamilton Lane Advisors, L.L.C. | 1 | N/A |

| Name, Address And Year of Birth | Position(S) With The Fund | Length Of Time Serviced* | Principal Occupation(S) During Past 5 Years | Portfolios in Fund Complex Overseen by Trustee | Other Directorships** Held by Trustee |

Elina Magid Birth Year: 1980 | Treasurer | Since Inception | Head of Fund Accounting at Hamilton Lane Advisors, L.L.C. (since 2017); Senior Manager at Deloitte & Touche LLP (2002 – 2017) | N/A | N/A |

Adam B. Shane Birth Year: 1983 | Secretary | Since Inception | Attorney at Hamilton Lane Advisors, L.L.C. (since 2014) | N/A | N/A |

Allison Callahan Birth Year: 1981 | Assistant Secretary | Since March 2020 | Funds Product Associate at Hamilton Lane Advisors, L.L.C. (since 2020); Sales Associate at Coventry (life insurance firm) (January 2020 – November 2020); Manager at Hartford Funds (registered investment company) (2014 – 2019) | N/A | N/A |

Gerard Scarpati Birth Year: 1955 | Chief Compliance Officer | Since Inception | Compliance Director at Vigilant Compliance, LLC (since 2010) | N/A | N/A |

| * | Each Trustee serves an indefinite term, until his or her successor is elected. |

| ** | Includes any company with a class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act or any company registered under the Investment Company Act. |

Leadership Structure and Oversight Responsibilities

Overall responsibility for oversight of the Fund rests with the Board. The Fund has engaged the Adviser to manage the Fund on a day-to-day basis. The Board is responsible for overseeing the Adviser and other service providers in the operations of the Fund in accordance with the provisions of the Investment Company Act, applicable provisions of state and other laws and the Declaration of Trust. The Board is currently composed of five members, three of whom are Independent Trustees. The Independent Trustees have also engaged independent legal counsel to assist them in performing their oversight responsibility. The Independent Trustees will meet with their independent legal counsel in-person prior to and during each quarterly in-person board meeting. The Board has established an audit committee (the “Audit Committee”), a nominating committee (the “Nominating Committee”), and a valuation committee (“Valuation Committee”), and may establish ad hoc committees or working groups from time to time to assist the Board in fulfilling its oversight responsibilities.

The Board has appointed Jeffrey P. Ladouceur, an Independent Trustee, to serve in the role of Chairman. The Chairman’s role is to preside at all meetings of the Board and to act as liaison with the Adviser, other service providers, counsel and other Trustees generally between meetings. The Chairman serves as a key point person for dealings between management and the Trustees. The Chairman may also perform such other functions as may be delegated by the Board from time to time. The Board has determined that the Board’s leadership structure is appropriate because it allows the Board to exercise informed and independent judgment over matters under its purview and it allocates areas of responsibility among committees of Trustees and the full Board in a manner that enhances effective oversight.

The Fund is subject to a number of risks, including investment, compliance, operational and valuation risks, among others. Risk oversight forms part of the Board’s general oversight of the Fund and will be addressed as part of various Board and committee activities. Day-to-day risk management functions are subsumed within the responsibilities of the Adviser and other service providers (depending on the nature of the risk), which carry out the Fund’s investment management and business affairs. The Adviser and other service providers employ a variety of processes, procedures and controls to identify various events or circumstances that give rise to risks, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each of the Adviser and other service providers has their own independent interests in risk management, and their policies and methods of risk management will depend on their functions and business models. The Board recognizes that it is not possible to identify all of the risks that may affect the Fund or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board will require senior officers of the Fund, including the President, Chief Financial Officer and Chief Compliance Officer, and the Adviser, to report to the full Board on a variety of matters at regular and special meetings of the Board, including matters relating to risk management. The Board and the Audit Committee will also receive regular reports from the Fund’s independent registered public accounting firm on internal control and financial reporting matters. The Board will also receive reports from certain of the Fund’s other primary service providers on a periodic or regular basis, including the Fund’s custodian and distributor. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Audit Committee. The Fund’s Audit Committee currently consists of the Fund’s current Independent Trustees, Messrs. Allingham and Ladoucer and Ms Flanagan. The Audit Committee is responsible for overseeing the Fund’s accounting and financial reporting policies and practices, its internal controls, and, as appropriate, the internal controls of certain service providers; overseeing the quality and objectivity of the Fund’s financial statements and the independent audit of those financial statements; and acting as a liaison between the Fund’s independent auditors and the full Board. In performing its responsibilities, the Audit Committee will select and recommend annually to the entire Board a firm of independent certified public accountants to audit the books and records of the Fund for the ensuing year, and will review with the firm the scope and results of each audit. The Audit Committee operates under a written charter approved by the Board. During the fiscal year ended March 31, 2021, the Audit Committee met one time.

Nominating Committee. The Board has formed a Nominating Committee that is responsible for selecting and nominating persons to serve as Trustees of the Fund. The Nominating Committee is responsible for both nominating candidates to be appointed by the Board to fill vacancies and for nominating candidates to be presented to Shareholders for election. In performing its responsibilities, the Nominating Committee will consider candidates recommended by management of the Fund and by Shareholders and evaluate them both in a similar manner, as long as the recommendation submitted by a Shareholder includes at a minimum: the name, address and telephone number of the recommending Shareholder and information concerning the Shareholder’s interests in the Fund in sufficient detail to establish that the Shareholder held Shares on the relevant record date; and the name, address and telephone number of the recommended nominee and information concerning the recommended nominee’s education, professional experience, and other information that might assist the Nominating Committee in evaluating the recommended nominee’s qualifications to serve as a trustee. The Nominating Committee may solicit candidates to serve as trustees from any source it deems appropriate. With the Board’s prior approval, the Nominating Committee may employ and compensate counsel, consultants or advisers to assist it in discharging its responsibilities. The Nominating Committee currently consists of each of the Fund’s Independent Trustees. During the fiscal period ended March 31, 2021, the Nominating Committee did not meet.

Valuation Committee. The Board has formed a Valuation Committee that is responsible for reviewing fair valuations of securities held by the Fund in instances as required by the valuation procedures adopted by the Board and is responsible for carrying out the provisions of its charter. The Valuation Committee currently consists of each of the Fund’s Trustees. During the fiscal period ended March 31, 2021, the Valuation Committee met two times.

Incumbent Trustees and Nominee Qualifications

Below is information about the current Interested Trustee and the Independent Trustees and the attributes that qualify them to serve as a Trustee. The information provided below is not all-inclusive. Many Trustee attributes involve intangible elements, such as intelligence, work ethic, and the willingness to work together, as well as the ability to communicate effectively, exercise judgment, ask incisive questions, manage people and problems, and develop solutions. The Board does not believe any one factor is determinative in assessing a Trustee’s qualifications, but that the experience and background of each make them highly qualified. Generally, the Fund believes that each Trustee is competent to serve because of their individual overall merits including: (i) experience, (ii) qualifications, (iii) attributes and (iv) skills.

Current Interested Trustees

Andrew Schardt

Mr. Schardt has been a Trustee of the Fund since the Fund’s inception. Mr. Schardt has over 15 years of industry experience.

Frederick W. Shaw

Mr. Shaw has been a Trustee of the Fund since the Fund’s inception. Mr. Shaw has more than 20 years of compliance and industry experience.

Current Independent Trustees

Jeffrey P. Ladouceur

Mr. Ladouceur has been a Trustee of the Fund since the Fund’s inception. Mr. Ladouceur has more than 20 years of investment industry experience.

Nominee Independent Trustees

Gail Susan Ball

Ms. Ball currently serves as the executive in residence and special program director of WE Hatch. She previously served as the EVP and CEO of Bancorp Bank and was the managing partner Alumni Ventures Group, Chestnut Street Ventures, Social Venture Fund and AVG Women’s Fund. Ms. Ball also possesses board-level experience through her service on the boards of two private companies and Fulton Bank. The Board believes Ms. Ball’s experience and expertise adds depth and understanding to its consideration of the Trustee's obligations to the Fund and shareholders.

Timothy S. Galbraith

Mr. Galbraith is currently the founder and Chief Investment Officer of Innovation Beta, a fintech startup. Previously he was Chief Investment Officer for alternatives for Transamerica Asset Management and the portfolio manager for the firm’s alternative investments mutual fund. He served as head of alternative investment strategies at Morningstar Associates and was managing director at Bear Stearns Asset Management responsible for the growth and operation of the independent hedge fund platform business. Mr. Galbraith has a BA from Claremont McKenna College and an MBA from Columbia University. The Board believes Mr. Galbraith’s financial service experience and prior mutual fund service adds depth and understanding to its consideration of the Trustee’s obligations to the Fund and shareholders.

Compensation

Trustees of the Fund who are deemed to be “interested persons” of the Fund receive no compensation from the Fund or Fund. Each Trustee who is not an “interested person” of the Fund receives a retainer of $20,000 per year.

The following table sets forth certain information regarding the compensation of the Fund’s Trustees.

| Name of Trustee | | Aggregate Compensation from the Fund(1) | | | Total Compensation from Funds and Fund Complex Paid to Trustees(2) | |

| Thomas J. Allingham II | | $ | 20,000 | | | $ | 20,000 | |

| | | | | | | | | |

| Holly Flanagan | | $ | 20,000 | | | $ | 20,000 | |

| | | | | | | | | |

| Jeffrey P. Ladouceur | | $ | 20,000 | | | $ | 20,000 | |

(1) The compensation estimated to be paid by the Fund for the first full fiscal year for services to the Fund.

(2) The total estimated compensation to be paid from the Fund and Fund Complex for a full calendar year.

Ownership of the Fund

As of September 30, 2021, the following Trustee and/or Officer owned shares of the Fund:

| Name | Position(S) | Shares Owned |

| Andrew Schardt | Trustee and President | 9,633.911 |

As of September 30, 2021, no other officer or Trustee of the Fund beneficially owned any shares of the Fund. The officers and Trustees of the Fund collectively own less than 1% of each class of the Fund’s outstanding shares.

Independent Auditor’s Fees

Cohen & Company, Ltd. (“Cohen”) has been selected to serve as the independent registered public accounting firm for the Fund for its current fiscal year and acted as the independent registered public accounting firm for the Fund during its most recently completed fiscal year. Cohen has advised the Trust that, to the best of its knowledge and belief, its professionals did not have any direct or material indirect ownership interest in the independent registered public accounting firm inconsistent with independent professional standards pertaining to independent registered public accounting firms. It is not expected that representatives Cohen will be present at the Meeting; however, representatives of Cohen are expected to be available by telephone to answer any questions that may arise and will have the opportunity to make a statement at the Meeting if they desire to do so.

Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees

In fiscal 2021, the independent registered public accounting firm billed the Trust for the following fees:

| | Fiscal Year 2021 |

| Audit Fees(1) | $92,000 |

| Audit-Related Fees(2) | $0 |

| Tax Fees(3) | $6,000 |

| All Other Fees(4) | $0 |

| (1) | “Audit Fees” are fees for professional services for the audit of each Funds’ annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

| (2) | “Audit-Related Fees” are for assurance and related services that are reasonably related to the performance of the audit of the Funds’ financial statements and are not reported under “Audit Fees.” This includes reviews of semi-annual financial statements. |

| (3) | “Tax Fees” are for professional services for preparing tax returns. |

| (4) | “All Other Fees” are for products and services other than those services reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.” |

In fiscal 2021, the percentage of services designated for Audit Fees, Audit-Related Fees, Tax Fees, and All Other Fees that were approved by the audit committee were 100%, 0%, 0%, and 0%, respectively.

Audit Committee Pre-Approval Procedures. The Registrant’s Audit Committee must pre-approve the audit and non-audit services provided by the independent auditors to the Company and acts to assure that the independent auditors are not engaged to perform specific non-audit services proscribed by law or regulation. There were no non-audit fees billed by Cohen for services rendered to the Fund, its Adviser or any entity controlling, controlled by or under common control with the Adviser that provided ongoing services to the Fund during fiscal 2021.

The Board unanimously recommends that you cast your vote “FOR” the PROPOSAL TO Elect each proposed individual as A Trustee of the Fund.

_____________________________________________________________________________

PART 2

INFORMATION ABOUT OWNERSHIP OF SHARES OF THE FUND

_____________________________________________________________________________

Outstanding Shares

As of October 31, 2021, there were 75,480.665 Class R Shares and 20,627,057.846 Class I Shares and 201,419.390 Class D Shares of the Fund outstanding.

To the knowledge of the Fund, as of October 31, 2021, no single Shareholder or “group” (as that term is used in Section 13(d) of the Securities Exchange Act of 1934, as amended) beneficially owned more than 5% of any class of a Fund’s outstanding Shares, except as described in the table below. A control person is one who owns, either directly or indirectly, more than 25% of the voting securities of a Fund or class or acknowledges the existence of control. A party that controls a Fund or class may be able to significantly affect the outcome of any item presented to Shareholders for approval. As a group, the Trustees and officers of the Fund owned less than 1% of the outstanding shares of the Fund of the Record Date. As a result, the Trustees and officers as a group are not deemed to control the Fund.

The following table identifies those Shareholders known to the Fund to own beneficially or of record 5% or more of the voting securities of a class of a Fund’s shares as of the Record Date. The Fund does not have any knowledge of the identity of the ultimate beneficiaries of the Shares listed below.

| Fund and Class | Name and Address of Beneficial Owner | Number of Shares of Class Beneficially Owned | % Outstanding Shares of I Class Beneficially Owned | % Outstanding Shares of R Class Beneficially Owned | % Outstanding Shares of D Class Beneficially Owned |

Class I | MASSACHUSETTS MUTUAL LIFE INSURANCE CO 1295 STATE ST SPRINGFIELD, MA 01111 | 10,545,742.592 | 51.13% | | |

HAMILTON LANE ADVISORS, LLC 110 WASHINGTON ST, STE. 1300 CONSHOHOCKEN, PA 18428 | 3,177,019.889 | 15.40% | | |

MARIO LUCIO GIANNINI c/o 110 WASHINGTON ST, STE. 1300 CONSHOHOCKEN, PA 18428 | 1,435,605.464 | 6.96% | | |

| Class R | SIERRA NEVADA EPL INC PO BOX 847 ROSEVILLE, CA 95661 | 27,124.774 | | 35.94% | |

FEDERICO BECKMANN VIDAL TRUST PO BOX 1704 LA JOLLA, CA 92038 | 23,843.931 | | 31.59% | |

Fund and Class | Name and Address of Beneficial Owner | Number of Shares of Class Beneficially Owned | % Outstanding Shares of I Class Beneficially Owned | % Outstanding Shares of R Class Beneficially Owned | % Outstanding Shares of D Class Beneficially Owned |

| | HAMILTON LANE ADVISORS, LLC 110 WASHINGTON ST, STE. 1300 CONSHOHOCKEN, PA 18428 | 10,000.000 | | 13.25% | |

NFS LLC FBO LOUIS DIAMOND 150 N 5TH ST 2C BROOKLYN, NY 11211 | 9,633.911 | | 12.76% | |

JAB RE VENTURE LLC 680 NE 32ND ST BOCA RATON, FL 33431 | 4,878.049 | | 6.46% | |

| Class D | FROST BANK MANAGEMENT AGENT FOR JOSEPH B HOOD TESTAMENTARY TRUST 640 TAYLOR ST FORT WORTH, TX 76102 | 43,821.209 | | | 21.76% |

NFS LLC FBO ROBERT BRYAN 718 DIPLOMAT PKWY HALLANDALE, FL 33009 | 28,483.786 | | | 14.14% |

FROST BANK MANAGEMENT AGENT FOR WEISS INVESTMENT PROPERTIES LTD 4517 TEAL DR CORP CHRISTI, TX 78410 | 27,388.256 | | | 13.60% |

NFS LLC FBO TOLUNAY-WONG ENGINEERS INC 10710 S SAM HOUSTON PKWY W STE 100 HOUSTON, TX 77031 | 21,910.605 | | | 10.88% |

FROST BANK MANAGEMENT AGENT FOR DONNA HOOD FAMILY TRUST AGENCY 2209 MIRAMAR ST WICHITA FALLS, TX 76308 | 21,910.605 | | | 10.88% |

FRANCIS C JAEGER AND JODI T JAEGER W195S7816 ANCIENT OAKS DR MUSKEGO, WI 53150 | 13,268.747 | | | 6.59% |

NFS/FMTC FBO THOMAS PRITCHARD RO 11519 SUMMERHILL LN HOUSTON, TX 77024 | 10,517.090 | | | 5.22% |

_____________________________________________________________________________

PART 3

INFORMATION ON PROXY VOTING AND THE OPERATION OF THE SPECIAL MEETING

_____________________________________________________________________________

The Proxy

The Board is soliciting proxies so that each Shareholder has the opportunity to vote on the Proposal to be considered at the Meeting. A proxy for voting your shares at the Meeting is enclosed. All properly executed and unrevoked proxies received in time for the Meeting will be voted in accordance with the instructions contained in the proxies. If no specification is made, the shares represented by a duly executed proxy will be voted for approval of the Proposal and at the discretion of the holders of the proxy on any other matter that may come before the Meeting that the Fund did not have notice of a reasonable time prior to the mailing of this Proxy Statement.

Who is Eligible To Vote

Shareholders of record of the Fund as of the close of business on November 29, 2021 are entitled to vote at the Meeting and any adjournments thereof. Each whole share is entitled to one vote on each matter on which it is entitled to vote, and each fractional share is entitled to a proportionate fractional vote.

Shareholder Proposals

The Fund did not receive any Shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the SEC, Shareholder proposals may, under certain conditions, be included in the Fund’s proxy statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Fund’s proxy materials must be received by the Fund within a reasonable time before the solicitation is made. The fact that the Fund receives a Shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of Shareholders are not required as long as there is no particular requirement under the 1940 Act that must be met by convening such a Shareholder meeting. Any Shareholder proposal should be sent to the Fund’s Secretary, Mr. Adam B. Shane, at the following address: Hamilton Lane Private Assets Fund, c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212. Under the Fund’s Agreement and Declaration of Fund, and to the extent permitted by the 1940 Act, Shareholders holding at least 25% of the shares of a Fund or class thereof may call a meeting of Shareholders for purposes of any action warranting approval by the applicable Fund or class, provided that such Shareholders furnish a written application for such meeting to the Board and the Board does not call or give notice of such meeting for a period of 30 days after receiving the Shareholders’ written application.

Proxies, Quorum and Voting at the Special Meetings

Shareholders may use the proxy card provided if they are unable to attend the Meeting in person or wish to have their shares voted by a proxy even if they do attend the Meeting. Any Shareholder that has given a proxy to someone has the power to revoke that proxy at any time prior to its exercise by executing a later-dated, superseding proxy or by submitting a notice of revocation to the Secretary of the Fund. The Secretary of the Fund, Mr. Adam B. Shane, may be reached at the following address: Hamilton Lane Private Assets Fund, c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212. In addition, although mere attendance at the Meeting will not revoke a proxy, a Shareholder present at the Meeting may withdraw a previously submitted proxy and vote in person.

Telephonic Voting. Shareholders may call the toll-free phone number indicated on their proxy cards to vote their shares. Shareholders will need to enter the control number set forth on their proxy cards and then will be prompted to answer a series of simple questions. The telephonic procedures are designed to authenticate a Shareholder’s identity, to allow Shareholders to vote their shares and to confirm that their instructions have been properly recorded.

Internet Voting. Shareholders may submit an “electronic” proxy over the Internet in lieu of returning each executed proxy card. In order to use this voting feature, Shareholders should go to the website indicated on the Shareholder’s proxy cards and enter the control number set forth on the proxy cards. Shareholders will be prompted to follow a simple set of instructions, which will appear on the website.

Quorum. The presence in person or by proxy of the holders of one-third of the shares of the Fund present in person or represented by proxy and entitled to vote shall constitute a quorum for the transaction of business at the Meeting. Broker non-votes (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) and abstentions will be considered present for purposes of determining the existence of a quorum and the number of shares of the Fund represented at the Meeting, but will not be treated as affirmative votes for the Proposal.

If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the Proposal are not received, Shareholders may vote to adjourn the Meetings in order to solicit additional proxies. Any adjournment may be held without the necessity of further notice. A Shareholder vote may be taken on one or more proposals prior to such adjournment if sufficient votes for its approval have been received and it is otherwise appropriate. Such vote will be considered final regardless of whether the Meeting is adjourned to permit additional solicitation with respect to any other proposal.

Required Vote

The affirmative vote of a plurality of shares of the Fund will be required to elect each of the proposed individuals as Trustees. This means that, provided a quorum is present, the two proposed individuals who receive the highest number of votes cast at the Meeting will be elected as Trustees. The proposed individuals will be elected even if they receive approval from less than a majority of the votes cast at the Meeting. Because they are running unopposed, the two proposed individuals are expected to be elected as Trustees, as all individuals who receive votes in favor will be elected, while votes not cast, or votes to withhold, will have no effect on the election outcome.

Method of Solicitation and Expenses

The Board of Trustees of the Fund is making this solicitation of proxies. The Fund expects that the solicitation will be primarily by mail, but may also include telephone, electronic or other means of communication. If the Fund does not receive your proxy by a certain time, you may receive a telephone call from the proxy soliciting agent asking you to vote. Certain officers, employees and agents of the Fund and Adviser may solicit proxies in person or by telephone, internet, facsimile transmission, or mail, for which they will not receive any special compensation. Authorization to execute proxies may be obtained from Shareholders through instructions transmitted by telephone, facsimile, electronic mail or other electronic means. The cost of this solicitation will be borne by the Fund.

Shareholder Communications

The Fund’s Board believes that it is important for Shareholders to have a process to send communications to the Board. Accordingly, a Shareholder wishing to communicate with the Board may do so in writing, signed by the Shareholder and setting forth: (a) the name and address of the Shareholder; (b) the number of shares of the Fund owned by the Shareholder; and (c) if the shares are owned indirectly through a broker or other record owner, the name of the broker or other record owner. These communications should be addressed as follows: Hamilton Lane Private Assets Fund c/o Hamilton Lane Advisors, L.L.C., 110 Washington St., Suite 1300, Conshohocken, PA.

The Secretary of the Fund is responsible for collecting, reviewing, and organizing all properly-submitted Shareholder communications. With respect to each properly-submitted Shareholder communication, the Secretary, in most instances, either will: (i) provide a copy of the communication to the appropriate committee of the Board or to the full Board at the committee’s or Board’s next regularly-scheduled meeting; or (ii) if the Secretary determines that the communication requires more immediate attention, forward the communication to the appropriate committee of the Board or to the full Board promptly after receipt.

The Secretary, in good faith, may determine that a Shareholder communication should not be provided to the appropriate committee of the Board or to the full Board because the communication: (i) does not reasonably relate to the Fund or the Fund’s operations, management, activities, policies, service providers, Board of Trustees, or a committee of the Board, officers, or Shareholders, or other matters relating to an investment in the Fund; or (ii) is ministerial in nature (such as a request for Fund literature, share data, or financial information).

Other Matters to Come Before the Meetings

No business other than the matter described above is expected to come before the Meeting, but should any other matter requiring a vote of Shareholders arise, including any question as to an adjournment or postponement of the Meeting, the persons named on the enclosed proxy card will vote thereon according to their best judgment in the interests of the Fund.

_____________________________________________________________________________

PART 4

OTHER MATTERS

______________________________________________________________________________

Organization and Operation of the Fund

Hamilton Lane Private Assets Fund (the “Fund”) a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company. The Fund was organized as a Delaware trust on February 7, 2020 and commenced operations on January 4, 2021.

The Fund’s principal executive offices are located at Hamilton Lane Private Assets Fund, c/o Hamilton Lane Advisors, L.L.C., 110 Washington St., Ste. 1300, Conshohocken, PA 19428. The Board of Trustees of the Fund supervises the business activities of the Fund. Like other mutual funds, the Fund retains various organizations to perform specialized services. The Fund retains Hamilton Lane Advisors, L.L.C., located at 110 Washington St., Ste. 1300, Conshohocken, PA 19428, as the investment adviser to of the Fund. UMB Distribution Services, LLC, located at 235 West Galena Street, Milwaukee, WI 53212, serves as principal underwriter and distributor of the Fund. UMB Fund Services, Inc., located at 235 West Galena Street, Milwaukee, WI 53212, serves as the administrator, transfer agent, and fund accountant.

Proxy Statement Delivery

If you and another Shareholder share the same address, the Fund may only send one Proxy Statement unless you or the other Shareholder(s) request otherwise. Call or write to the Fund if you wish to receive a separate copy of the Proxy Statement, and the Fund will promptly mail a copy to you. You may also call or write to the Fund if you wish to receive a separate proxy in the future or if you are receiving multiple copies now and wish to receive a single copy in the future. For such requests, call the Fund at 1-877-779-1999 or write the Fund’s transfer agent at Hamilton Lane Private Assets Fund, c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212.

Fiscal Year

The Fund’s fiscal year ends on March 31.

PLEASE DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED REPLY ENVELOPE, CALL THE NUMBER LISTED ON YOUR PROXY CARD OR VOTE BY INTERNET AS INDICATED IN THE VOTING INSTRUCTION MATERIALS.