Creating a Diversified Global CX Leader March 29, 2023 Exhibit 99.1

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 2 Additional Information and Where to Find It In connection with the proposed transaction between Concentrix Corporation (“Concentrix”) and Webhelp, Concentrix plans to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, Concentrix will mail the definitive proxy statement to each stockholder entitled to vote at the special meeting relating to the transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT CONCENTRIX WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The definitive proxy statement, the preliminary proxy statement, and other relevant materials in connection with the transaction (when they become available) and any other documents filed by Concentrix with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) and Concentrix’ website at www.concentrix.com. Participants in the Solicitation Concentrix and its directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from Concentrix’ stockholders in connection with the transaction. Information regarding the interests of such individuals in the proposed transaction will be included in the proxy statement relating to such transaction when it is filed with the SEC. You may obtain information about Concentrix’ executive officers and directors in Concentrix’ definitive proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on February 9, 2023. To the extent holdings of such participants in Concentrix’ securities are not reported, or have changed since the amounts described in the proxy statement for the 2023 annual meeting of stockholders, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. These documents may be obtained free of charge from the SEC’s website at www.sec.gov and Concentrix’ website at www.concentrix.com. Information for U.S. Persons holding Webhelp Shares This proposed business combination is made for the securities of a non-U.S. company. The offer is subject to disclosure and procedural requirements in France and other non- U.S. jurisdictions that are different from those of the United States. The transaction will be structured to comply with the securities laws and regulations in France, the United States and other applicable jurisdictions that are applicable to transactions of this type. It may be difficult for U.S. holders of Webhelp shares to enforce their rights and any claims they may have arising under the federal securities laws of the United States, since Webhelp is incorporated in a non-U.S. jurisdiction, and some or all of its officers and directors may be residents of a non-U.S. jurisdiction. U.S. holders may not be able to sue a non-U.S. company or its officers or directors in a non-U.S. court for violations of the U.S. securities laws. Further, it may be difficult to compel a non-U.S. company and its affiliates to subject themselves to a U.S. court's judgment.

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 3 This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include, but are not limited to, statements regarding the combination with Webhelp and the timing thereof, including works council consultations, regulatory approvals and the satisfaction of other closing conditions and the timing thereof, the expected accretion to revenue growth, profitability and non- GAAP EPS and the pace thereof, the estimated size of the transaction and the combined company, including estimated pro forma revenues in 2023, the expected revenue and adjusted EBITDA contributions of the Webhelp business to the Company, the expected growth of the Webhelp business, the expected debt profile and cash flows of the combined company, the pro forma adjusted EBITDA and net debt of the combined company, the expected cost synergies to be achieved from the transaction, and the pro forma ownership structure of the combined company, statements regarding the Company’s expected future financial condition and results of operations, including revenue, operating income, profit margins, effective tax rate and leverage, and statements that include words such as believe, expect, may, will, provide, could and should and other similar expressions. These forward-looking statements are inherently uncertain and involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Risks and uncertainties include, among other things: risks related to the proposed transaction, including that the proposed transaction will not be consummated; the ability to receive shareholder approval and regulatory approvals for the proposed transaction in a timely manner, on acceptable terms or at all, or to satisfy the other closing conditions to the proposed transaction; conditions in the credit markets and the ability to obtain financing for the proposed transaction on a favorable basis if at all; the ability to retain key employees and successfully integrate the Webhelp business; our ability to realized estimated cost savings, synergies or other anticipated benefits of the proposed transaction, or that such benefits may take longer to realize than expected; diversion of management’s attention; the potential impact of the announcement or consummation of the proposed acquisition on relationships with clients and other third parties; risks related to general economic conditions, including consumer demand, interest rates, inflation, supply chains and the effects of the conflict in Ukraine; cyberattacks on our, Webhelp’s or our respective clients’ networks and information technology systems; the failure of our or Webhelp’s staff and contractors to adhere to our and our respective clients’ controls and processes; the inability to protect personal and proprietary information; the inability to execute on our digital CX strategy; the loss of key personnel or the inability to attract and retain staff with the skills and expertise needed for our business; increases in the cost of labor; the effects of the COVID-19 pandemic and other communicable diseases, natural disasters, adverse weather conditions or public health crises; geopolitical, economic and climate- or weather-related risks in regions with a significant concentration of the our or Webhelp’s operations; the inability to successfully identify, complete and integrate strategic acquisitions or investments; competitive conditions in our industry and consolidation of our competitors; higher than expected tax liabilities; the demand for CX solutions and technology; variability in demand by our or Webhelp’s clients or the early termination of our or Webhelp’s client contracts; the level of business activity of our or Webhelp’s clients and the market acceptance and performance of their products and services; currency exchange rate fluctuations; the operability of our or Webhelp’s communication services and information technology systems and networks; changes in law, regulations or regulatory guidance; damage to our or Webhelp’s reputation through the actions or inactions of third parties; investigative or legal actions; and other factors contained in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2022. The Company does not undertake a duty to update forward-looking statements, which speak only as of the date on which they are made.

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 4 Note: 1 EUR = 1.08 USD, based on Webhelp results for FYE December 31, 2022, as adjusted for U.S. GAAP; 1 Adjusted EBITDA is a non-GAAP financial measure and excludes transaction and integration costs, share-based compensation and amortization of intangibles; 2 Non-GAAP diluted EPS is a non-GAAP financial measure and excludes transaction and integration costs, share-based compensation and amortization of intangibles; includes cost synergies as realized and before one-time costs Combines two best-in-class CX providers to create a global leader well positioned for future growth, margin expansion and value creation $4.8B transaction value, consisting of cash, stock and note payable to sellers Value Accretive Transaction: Mid- to high-single digit non-GAAP EPS accretion in 1 year, with double digit accretion expected in year 22 Enhanced Financial Profile: Adds ~$3.0B of revenue and ~$500M of Adjusted EBITDA1 in FY2023E Transaction expected to close by end of 2023 creates a global CX market leader and a world class platform for growth and value creation

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 5 Note: 1 EUR = 1.08 USD, based on Webhelp results for FYE December 31, 2022, as adjusted for U.S. GAAP; 1 Based on Webhelp FY2022 revenue; 2 Adjusted EBITDA is a non-GAAP financial measure and excludes transaction and integration costs, share-based compensation and amortization of intangibles ▪ Webhelp is a technology-enabled BPO, specializing in CX, sales, marketing and payment services ▪ Webhelp’s focus is on engineering performance improvements and delivering a lasting transformation in its clients’ operating models to further enhance customer experience and drive efficiency gains ▪ Strong client and delivery footprint in Europe, Latin America, and Africa ▪ Unique coverage with onshore / nearshore / offshore / home-shore and multilingual hubs solutions A CX leader across diversified industries Technology & consumer electronics 21% Communications & media 20% Retail, travel and ecommerce 32% BFSI 13% Healthcare 2% Other 13% Revenue by geography1 EMEA 76% Americas 19% APAC 5% Revenue by industry1 50+ Industry awards in 2022 $3B FY23E Revenue $500M FY23E Adj. EBITDA2 15%+ 5 year FY18-FY23E Revenue CAGR 58+ Countries served 1,000+ Total clients 10 years Average tenure of the top 10 clients

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 6 Adds clients in attractive growing markets, further diversifying our marquee client list Significantly expands footprint in Europe, Latin America and Africa Expands breadth and global reach of high-value services and digital capabilities 3 4 2 Enhances Concentrix’s position as a leader in a $550B+ growing CX market1 Strengthens support for clients and staff combining complementary cultures 5 Accretive to revenue growth, profitability, and non-GAAP EPS in first year6

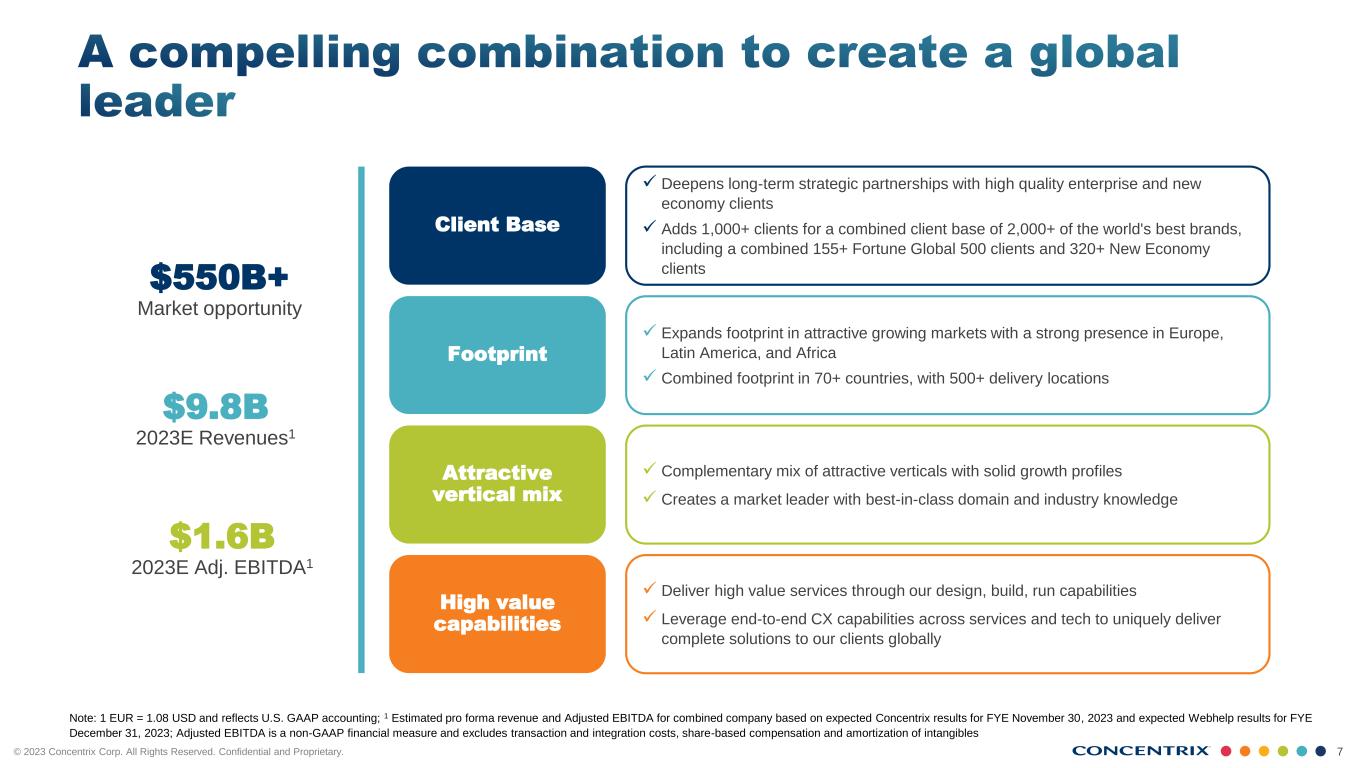

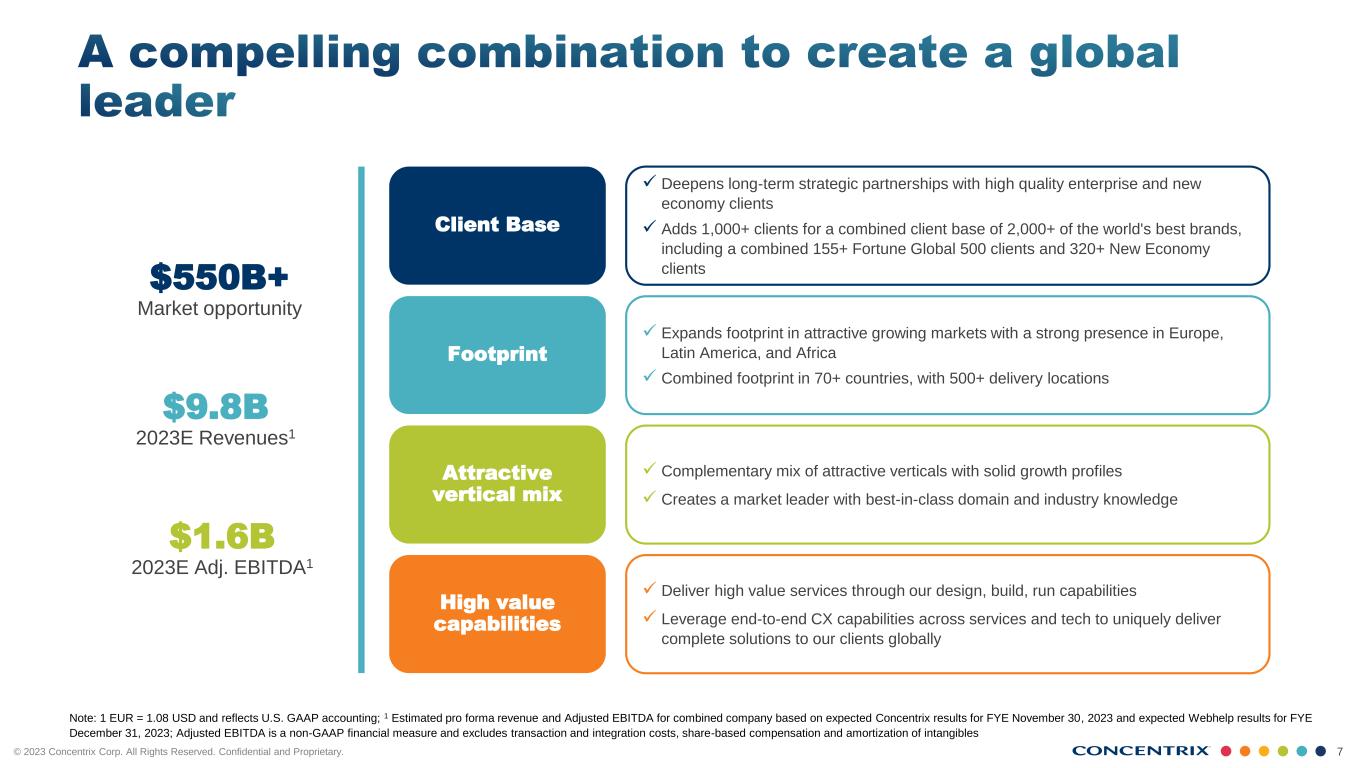

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 7 Note: 1 EUR = 1.08 USD and reflects U.S. GAAP accounting; 1 Estimated pro forma revenue and Adjusted EBITDA for combined company based on expected Concentrix results for FYE November 30, 2023 and expected Webhelp results for FYE December 31, 2023; Adjusted EBITDA is a non-GAAP financial measure and excludes transaction and integration costs, share-based compensation and amortization of intangibles Client Base ✓ Deepens long-term strategic partnerships with high quality enterprise and new economy clients ✓ Adds 1,000+ clients for a combined client base of 2,000+ of the world's best brands, including a combined 155+ Fortune Global 500 clients and 320+ New Economy clients Footprint ✓ Expands footprint in attractive growing markets with a strong presence in Europe, Latin America, and Africa ✓ Combined footprint in 70+ countries, with 500+ delivery locations High value capabilities ✓ Deliver high value services through our design, build, run capabilities ✓ Leverage end-to-end CX capabilities across services and tech to uniquely deliver complete solutions to our clients globally $9.8B 2023E Revenues1 $550B+ Market opportunity Attractive vertical mix ✓ Complementary mix of attractive verticals with solid growth profiles ✓ Creates a market leader with best-in-class domain and industry knowledge $1.6B 2023E Adj. EBITDA1

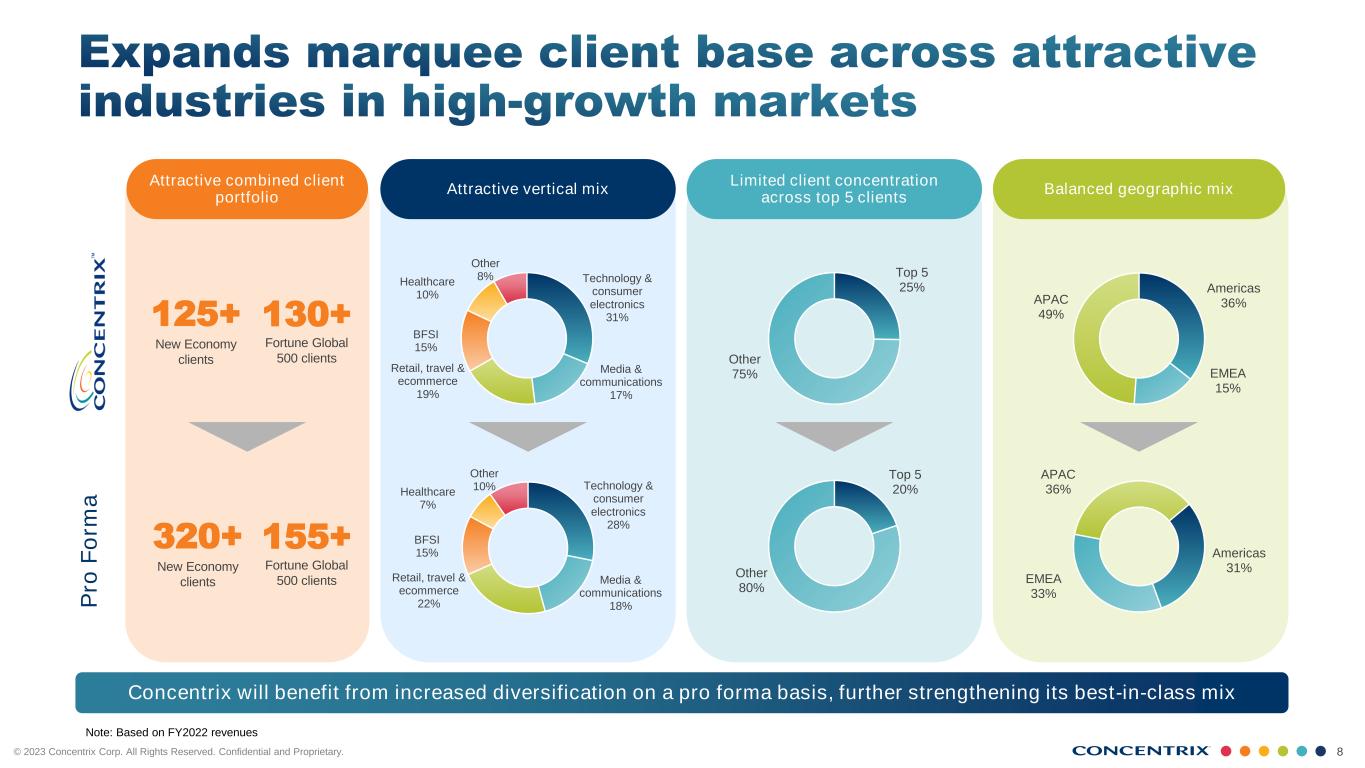

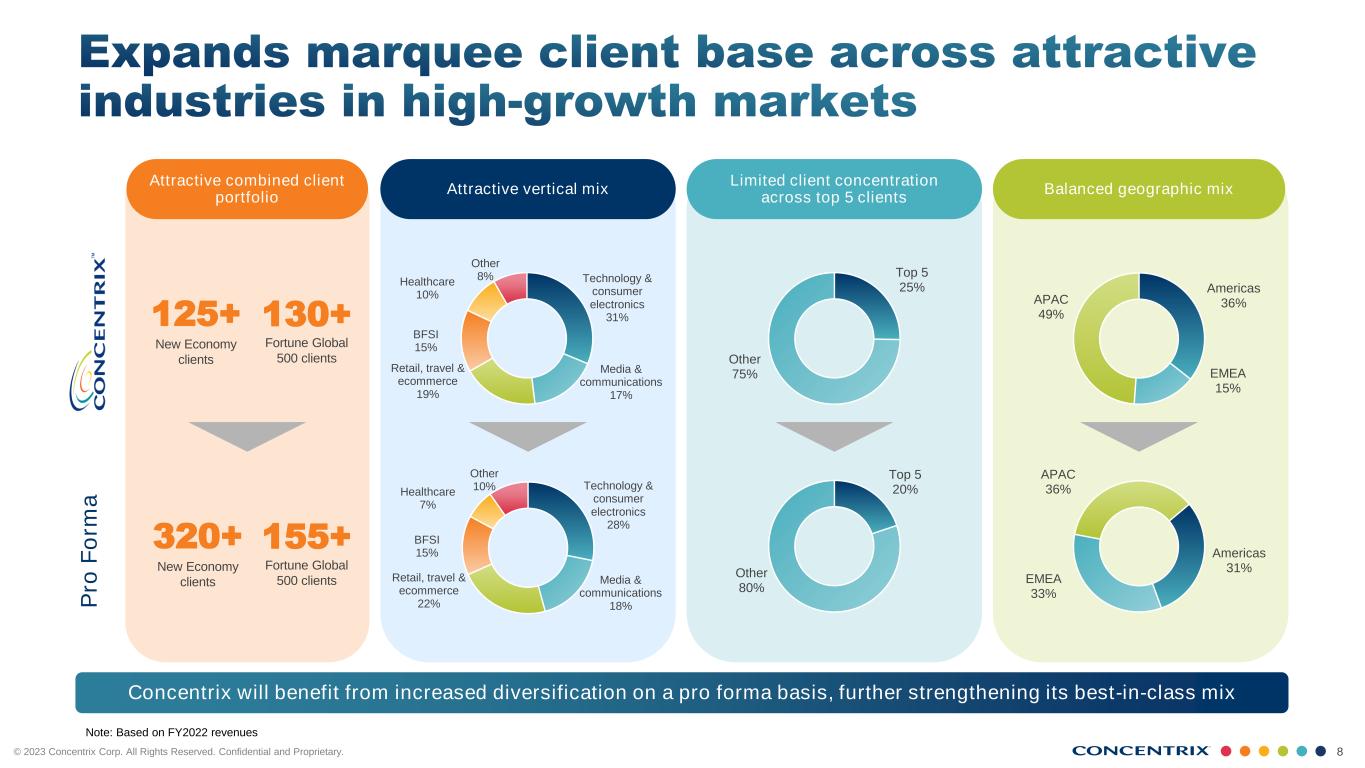

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 8 Concentrix will benefit from increased diversification on a pro forma basis, further strengthening its best-in-class mix Note: Based on FY2022 revenues Attractive vertical mix Limited client concentration across top 5 clients Balanced geographic mix Technology & consumer electronics 28% Media & communications 18% Retail, travel & ecommerce 22% BFSI 15% Healthcare 7% Other 10% Top 5 25% Other 75% Top 5 20% Other 80% Technology & consumer electronics 31% Media & communications 17% Retail, travel & ecommerce 19% BFSI 15% Healthcare 10% Other 8% P ro F o rm a Americas 36% EMEA 15% APAC 49% Americas 31% EMEA 33% APAC 36% Attractive combined client portfolio 155+ Fortune Global 500 clients 125+ New Economy clients 320+ New Economy clients 130+ Fortune Global 500 clients

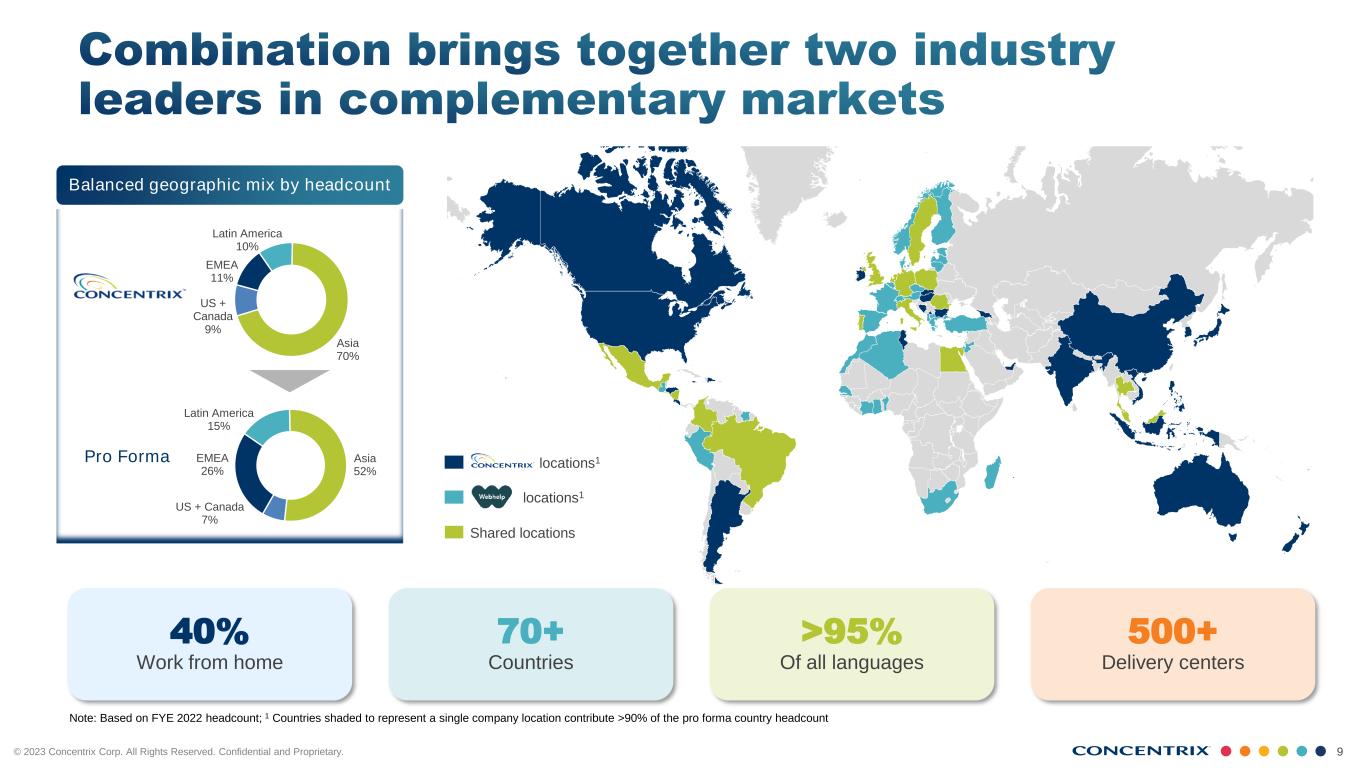

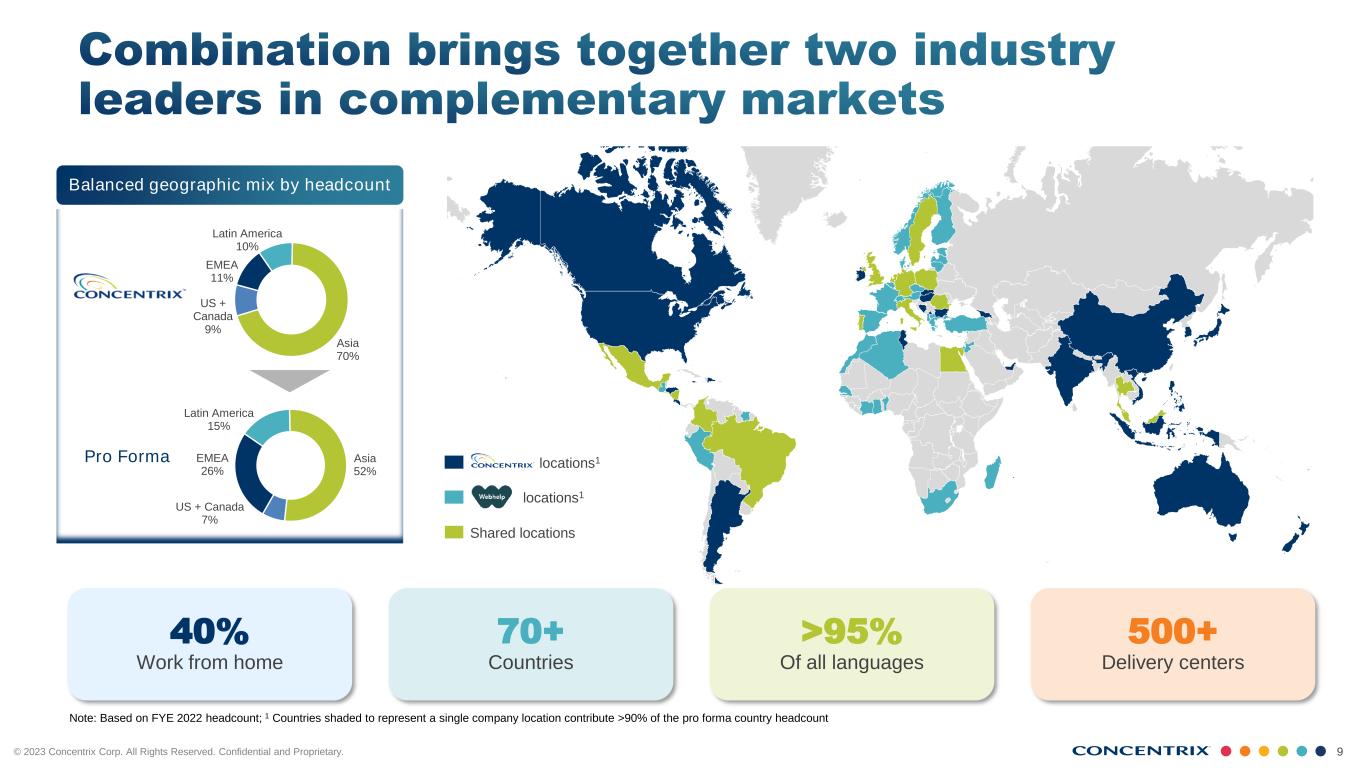

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 9 Note: Based on FYE 2022 headcount; 1 Countries shaded to represent a single company location contribute >90% of the pro forma country headcount 40% Work from home >95% Of all languages 500+ Delivery centers Balanced geographic mix by headcount EMEA 11% Latin America 10% Asia 70% US + Canada 9% EMEA 26% Latin America 15% Asia 52% US + Canada 7% Pro Forma 70+ Countries locations1 Shared locations locations1

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 10 locations Shared locations locations Mexico El Salvador Poland Slovakia China Japan S. Korea Australia United Arab Emirates United Kingdom Brazil Argentina Hungary Germany France United States India Singapore Canada Colombia Romania Digital Enablement CX Strategy Experience Design Experience Platforms Digital & Cloud Engineering Data & Analytics AI & Automation Center of Excellence

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 11 • Everest Group CX Management PEAK Matrix Leader in EMEA • Everest Group CX Management PEAK Matrix Major Contender in the America • Everest Group CX Management PEAK Matrix Major Contender & Star Performer in APAC • Everest Group Trust and Safety Star Performer • Forrester Omnichannel Wave Leader • Forrester Customer Analytics Wave Contender • Forrester RPA Wave Strong Performer • Forrester Loyalty Service Provider Wave Leader • Forrester RPA Wave Strong Performer • Everest Group CX Analytics PEAK Matrix Leader • Everest Group CX Management PEAK Matrix Leader • NelsonHall Ltd. Digital Experience Consulting NEAT • NelsonHall Cognitive CX Services NEAT Leader • Catalyst awarded a Google Cloud Premier Partnership • Leader in the 2022 Magic Quadrant™ for Customer Service Business Process Outsourcing We expect our shared commitment to staff, diversity, culture and thought leadership to continue to be recognized as a differentiator in a dynamic market P a s s io n f o r c li e n t in n o v a ti o n P a s s io n f o r o u r p e o p le • NelsonHall Customer Care and Sales Capability NEAT Leader • NelsonHall Banking, Financial Services, and Insurance (BFSI) Leader

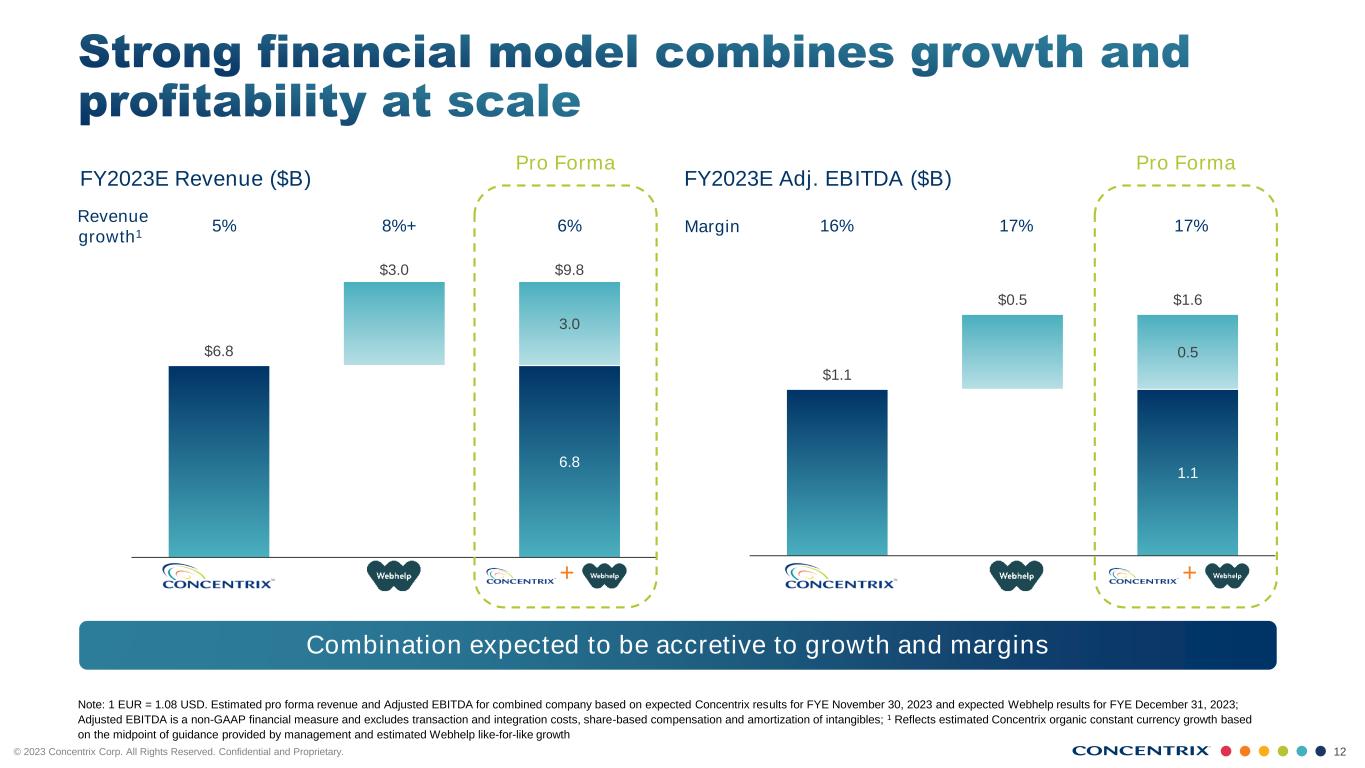

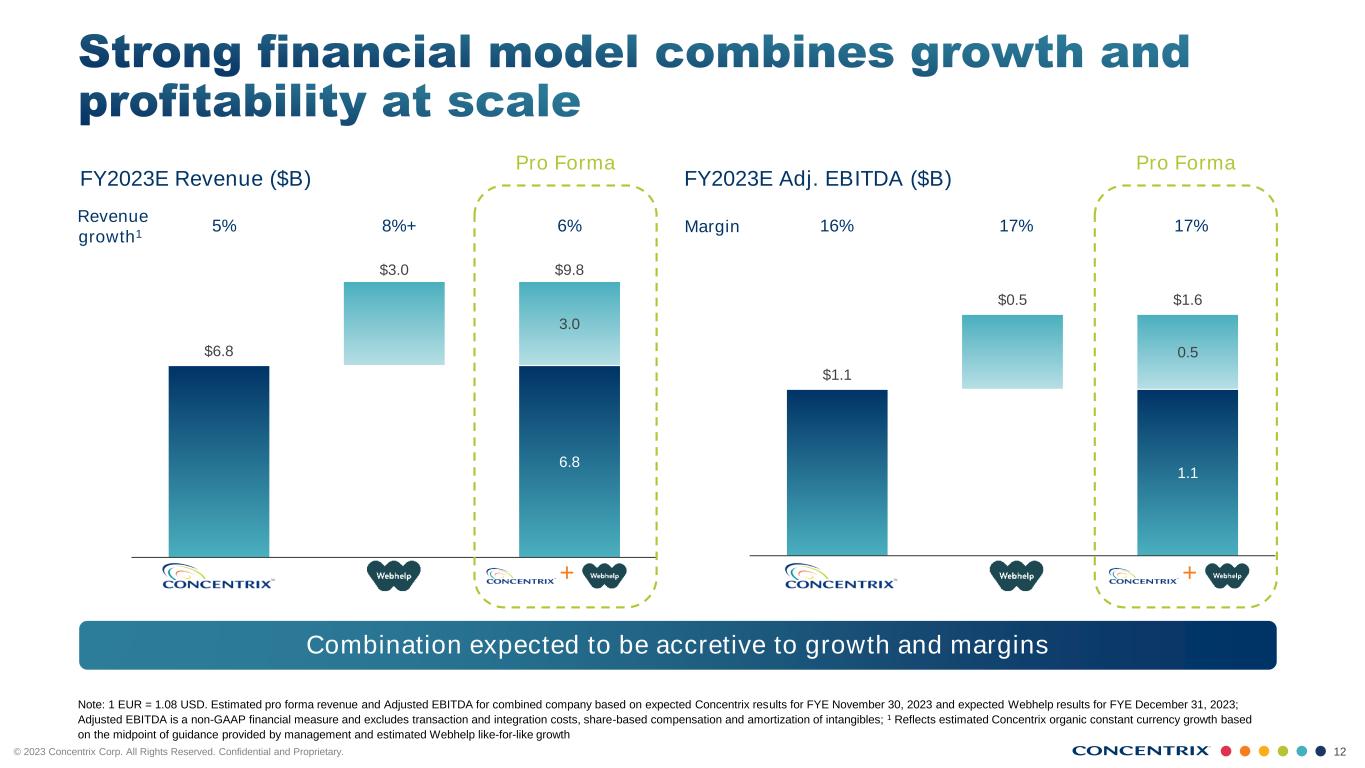

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 12 1.1 0.5 $1.1 $0.5 $1.6 Concentrix Webhelp Total Note: 1 EUR = 1.08 USD. Estimated pro forma revenue and Adjusted EBITDA for combined company based on expected Concentrix results for FYE November 30, 2023 and expected Webhelp results for FYE December 31, 2023; Adjusted EBITDA is a non-GAAP financial measure and excludes transaction and integration costs, share-based compensation and amortization of intangibles; 1 Reflects estimated Concentrix organic constant currency growth based on the midpoint of guidance provided by management and estimated Webhelp like-for-like growth FY2023E Revenue ($B) FY2023E Adj. EBITDA ($B) 6.8 3.0 $6.8 $3.0 $9.8 Concentrix Webhelp Total Revenue growth1 5% 8%+ 6% + + Margin 16% 17% 17% Combination expected to be accretive to growth and margins Pro Forma Pro Forma

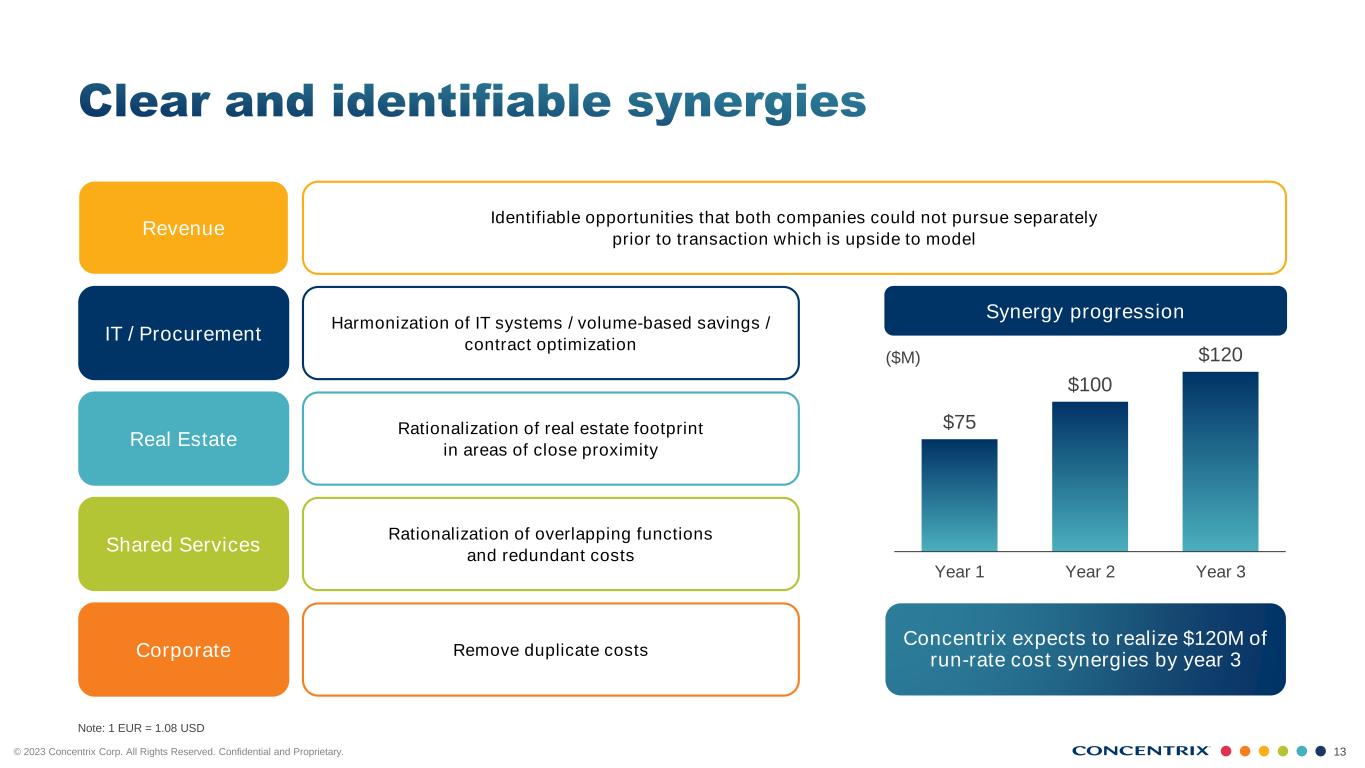

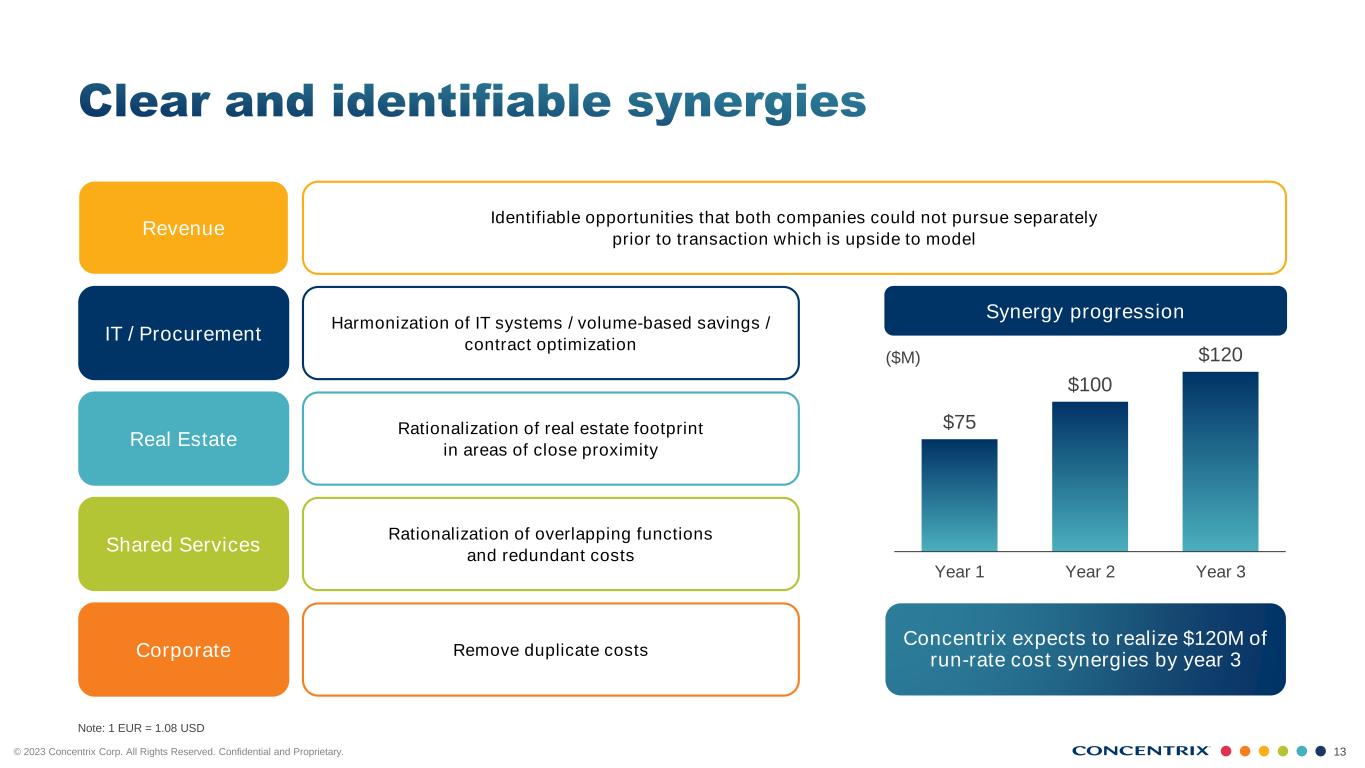

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 13 IT / Procurement Harmonization of IT systems / volume-based savings / contract optimization Corporate Remove duplicate costs Real Estate Rationalization of real estate footprint in areas of close proximity Shared Services Rationalization of overlapping functions and redundant costs Concentrix expects to realize $120M of run-rate cost synergies by year 3 Note: 1 EUR = 1.08 USD Synergy progression $75 $100 $120 Year 1 Year 2 Year 3 ($M) Revenue Identifiable opportunities that both companies could not pursue separately prior to transaction which is upside to model

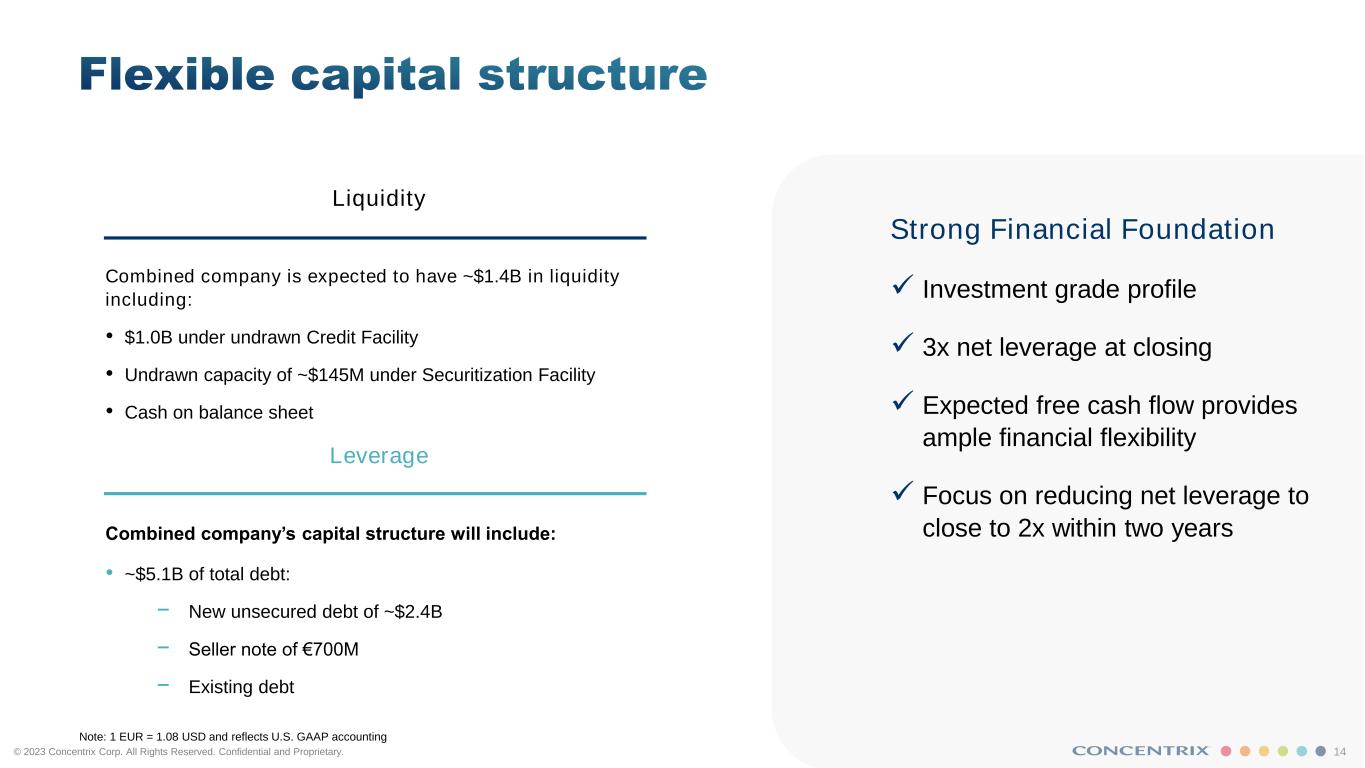

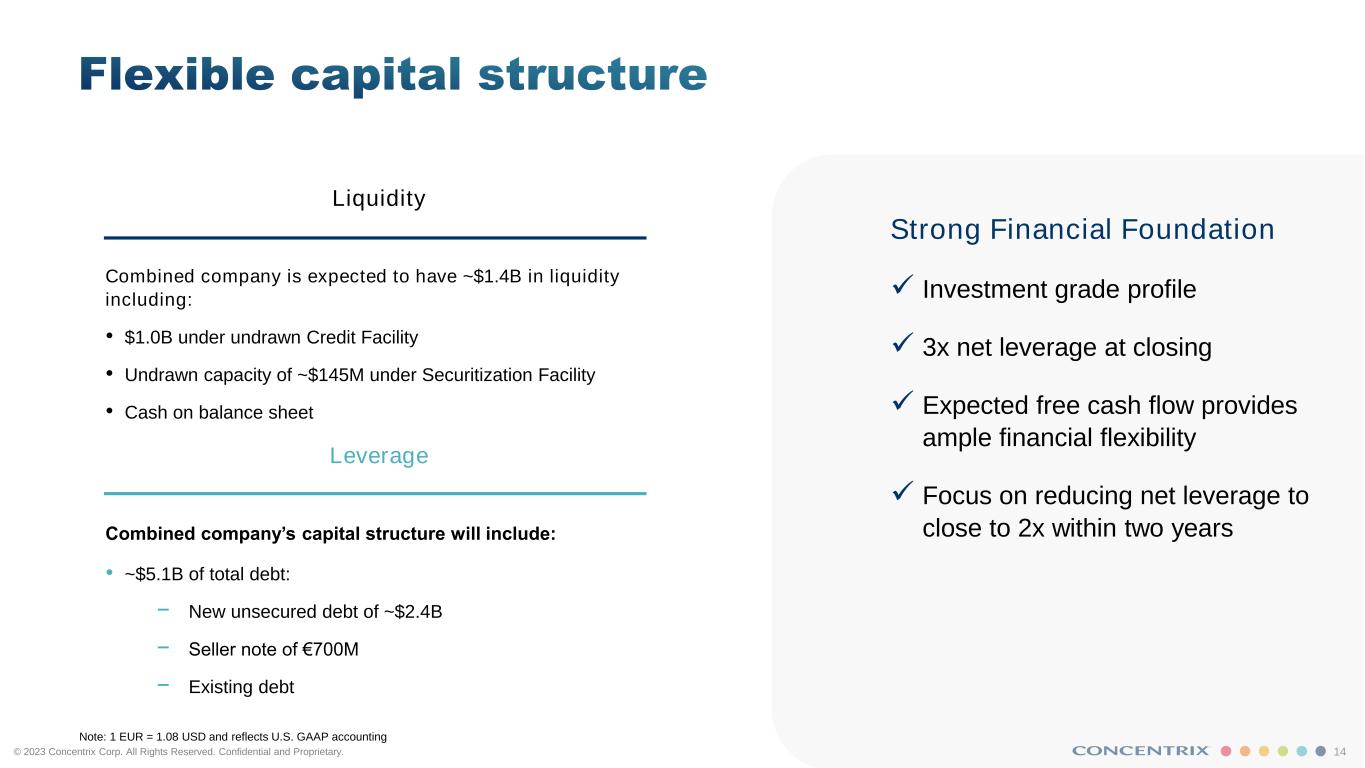

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 14 Liquidity Combined company is expected to have ~$1.4B in liquidity including: • $1.0B under undrawn Credit Facility • Undrawn capacity of ~$145M under Securitization Facility • Cash on balance sheet Leverage Combined company’s capital structure will include: • ~$5.1B of total debt: − New unsecured debt of ~$2.4B − Seller note of €700M − Existing debt Note: 1 EUR = 1.08 USD and reflects U.S. GAAP accounting Strong Financial Foundation ✓ Investment grade profile ✓ 3x net leverage at closing ✓ Expected free cash flow provides ample financial flexibility ✓ Focus on reducing net leverage to close to 2x within two years

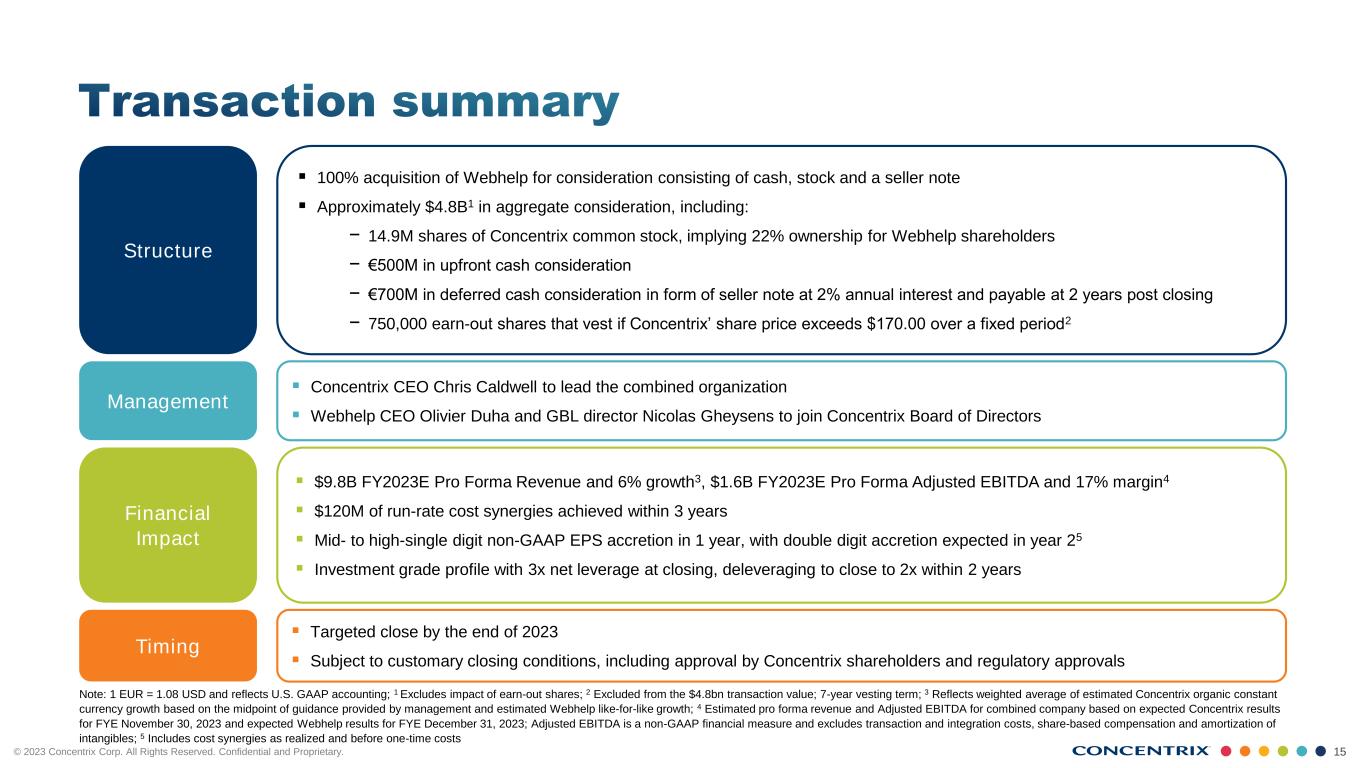

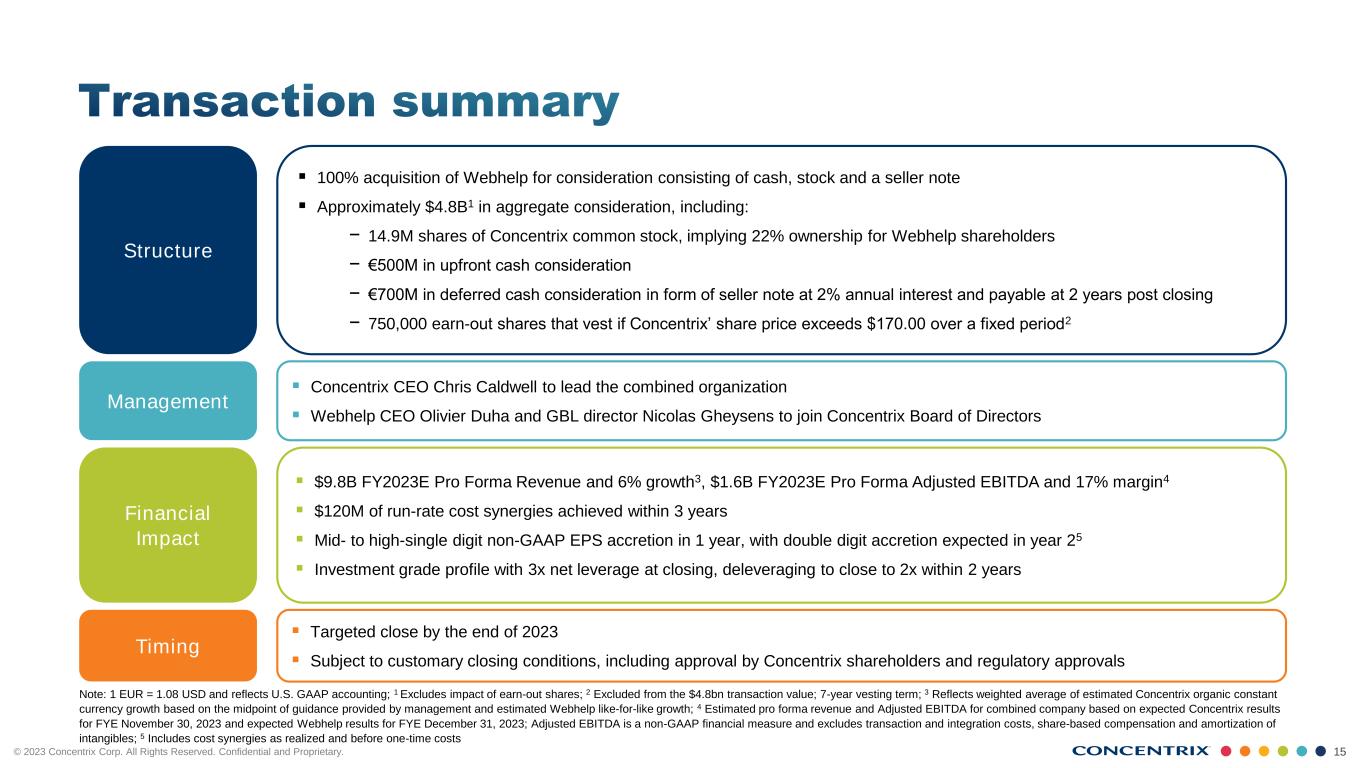

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 15 Structure ▪ 100% acquisition of Webhelp for consideration consisting of cash, stock and a seller note ▪ Approximately $4.8B1 in aggregate consideration, including: − 14.9M shares of Concentrix common stock, implying 22% ownership for Webhelp shareholders − €500M in upfront cash consideration − €700M in deferred cash consideration in form of seller note at 2% annual interest and payable at 2 years post closing − 750,000 earn-out shares that vest if Concentrix’ share price exceeds $170.00 over a fixed period2 Financial Impact ▪ $9.8B FY2023E Pro Forma Revenue and 6% growth3, $1.6B FY2023E Pro Forma Adjusted EBITDA and 17% margin4 ▪ $120M of run-rate cost synergies achieved within 3 years ▪ Mid- to high-single digit non-GAAP EPS accretion in 1 year, with double digit accretion expected in year 25 ▪ Investment grade profile with 3x net leverage at closing, deleveraging to close to 2x within 2 years Timing ▪ Targeted close by the end of 2023 ▪ Subject to customary closing conditions, including approval by Concentrix shareholders and regulatory approvals Note: 1 EUR = 1.08 USD and reflects U.S. GAAP accounting; 1 Excludes impact of earn-out shares; 2 Excluded from the $4.8bn transaction value; 7-year vesting term; 3 Reflects weighted average of estimated Concentrix organic constant currency growth based on the midpoint of guidance provided by management and estimated Webhelp like-for-like growth; 4 Estimated pro forma revenue and Adjusted EBITDA for combined company based on expected Concentrix results for FYE November 30, 2023 and expected Webhelp results for FYE December 31, 2023; Adjusted EBITDA is a non-GAAP financial measure and excludes transaction and integration costs, share-based compensation and amortization of intangibles; 5 Includes cost synergies as realized and before one-time costs Management ▪ Concentrix CEO Chris Caldwell to lead the combined organization ▪ Webhelp CEO Olivier Duha and GBL director Nicolas Gheysens to join Concentrix Board of Directors

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 16 Welcome to our next chapter…

© 2 0 2 3 C o n c e n tr ix C o rp . A ll R ig h ts R e s e rv e d . C o n fi d e n ti a l a n d P ro p ri e ta ry . 17 Appendix

© 2023 Concentrix Corp. All Rights Reserved. Confidential and Proprietary. 18 We refer to certain non-GAAP financial measures in this presentation, including: • Non-GAAP diluted earnings per common share (“EPS”), which is diluted EPS excluding the per share, tax effected impact of acquisition-related and integration expenses, including related restructuring costs, amortization of intangible assets and share-based compensation. • Adjusted earnings before interest, taxes, depreciation, and amortization, or adjusted EBITDA, which is operating income, adjusted to exclude acquisition-related and integration expenses, including related restructuring costs, amortization of intangible assets, and share-based compensation, plus depreciation. We believe that providing this additional information is useful to better assess and understand base operating performance, especially when comparing results with previous periods and for planning and forecasting in future periods, primarily because management typically monitors the business adjusted for these items in addition to GAAP results. As these non-GAAP financial measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures employed by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures and should be used as a complement to, and in conjunction with, data presented in accordance with GAAP. A reconciliation of the forward-looking adjusted EBITDA and non-GAAP diluted EPS to the most directly comparable GAAP financial measures is not provided because we are unable to provide such reconciliation without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of such items and the periods in which such items may be recognized. For the same reasons, we are unable to address the probable significance of the unavailable information, which could be material to future results.