Fourth Quarter Earnings Call Supplemental Information March 7, 2024

Enhabit Home Health & Hospice 2 Disclaimers Forward looking statements Statements contained in this presentation which are not historical facts, such as those relating to future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All such estimates, projections, and forward-looking information speak only as of the date hereof, and Enhabit undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by the Company include, but are not limited to, our ability to execute on our strategic plans; regulatory and other developments impacting the markets for our services; changes in reimbursement rates; general economic conditions; changes in the episodic versus non-episodic mix of our payors, the case mix of our patients and payment methodologies; our ability to attract and retain key management personnel and healthcare professionals; potential disruptions or breaches of our or our vendors’, payors’, and other contract counterparties’ information systems; the outcome of litigation; our ability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures; our ability to successfully integrate technology in our operations; our ability to control costs, particularly labor and employee benefit costs; and factors that affect the timing and options in our strategic review and, following our strategic review, consummating a strategic transaction on attractive terms or at all. Additional information regarding risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this presentation are described in reports filed with the SEC, including our annual report on Form 10-K and subsequent quarterly reports on Form 10- Q, copies of which are available on the Company’s website at http://investors.ehab.com. Note regarding presentation of non-GAAP financial measures This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted earnings per share, and Adjusted free cash flow. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP are presented at the end of this presentation. Our Form 8-K, filed with the SEC as of the date of this presentation, provides further explanation and disclosure regarding Enhabit’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Note regarding presentation of same-store comparisons The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on home health and hospice locations open throughout both the full current period and the immediately prior period presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

Contents 2023 Year in Review 4 2024 Priorities 5 Quarterly Results at a Glance 6 Consolidated Results 7-8 Clinical Expertise and High-Quality Outcomes 9 Payor Innovation 10 De Novos and Acquisitions 11 Home Health Segment 12-13 Hospice Segment 14-15 Consolidated Adjusted EBITDA 16 Debt and Liquidity Metrics 17 Adjusted Free Cash Flow 18 2024 Guidance and Guidance Considerations 19-20 Adjusted Free Cash Flow Assumptions and Uses of Adjusted Free Cash Flow 21-22 Appendix, Including Company Overview, Operational Metrics & Reconciliations to GAAP 23-39

Enhabit Home Health & Hospice 4 2023 Year in Review First full year as a standalone company Payor innovation Successful recruitment and retention efforts De novo strategy High-quality outcomes • 41 new agreements (59 since inception of team) – Two new national agreements • Success shifting non-episodic visits into payor innovation contracts – Q1 = 5%; Q4 = 25% • 597 net new full-time nurses • Eliminated all agency nursing contract labor • Implemented hospice case management model • No staffing-constrained hospice locations • Eight locations opened • Two additional locations pending regulatory approval • 30-day hospital readmission rate 20.5% better than national average • Hospice visits in last days of life 53.2% better than national average • Award-winning quality/patient experience

Enhabit Home Health & Hospice 5 2024 Priorities Home Health Hospice De Novos People Strategy • Stabilize Medicare as a % of total home health revenue • Leverage payor innovation strategy – Improve Medicare Advantage rates – Shift away from lower rate contracts • Grow through increased clinical staffing, ability to accept new payors and alignment of clinical resource utilization with patient acuity and complexities • Grow census through improved staffing capacity with case management model • Gain operating leverage in hospice fixed cost structure by growing census • Increase use of analytics to drive high-quality care via case management model • Focus on efficiencies in referral to admission process • Open 10 de novo locations • Ramp up staffing, referral and admission growth in de novo locations opened in 2023 • Continue to increase net full-time nursing and therapy headcount to support home health growth • Focus on employee engagement to retain workforce

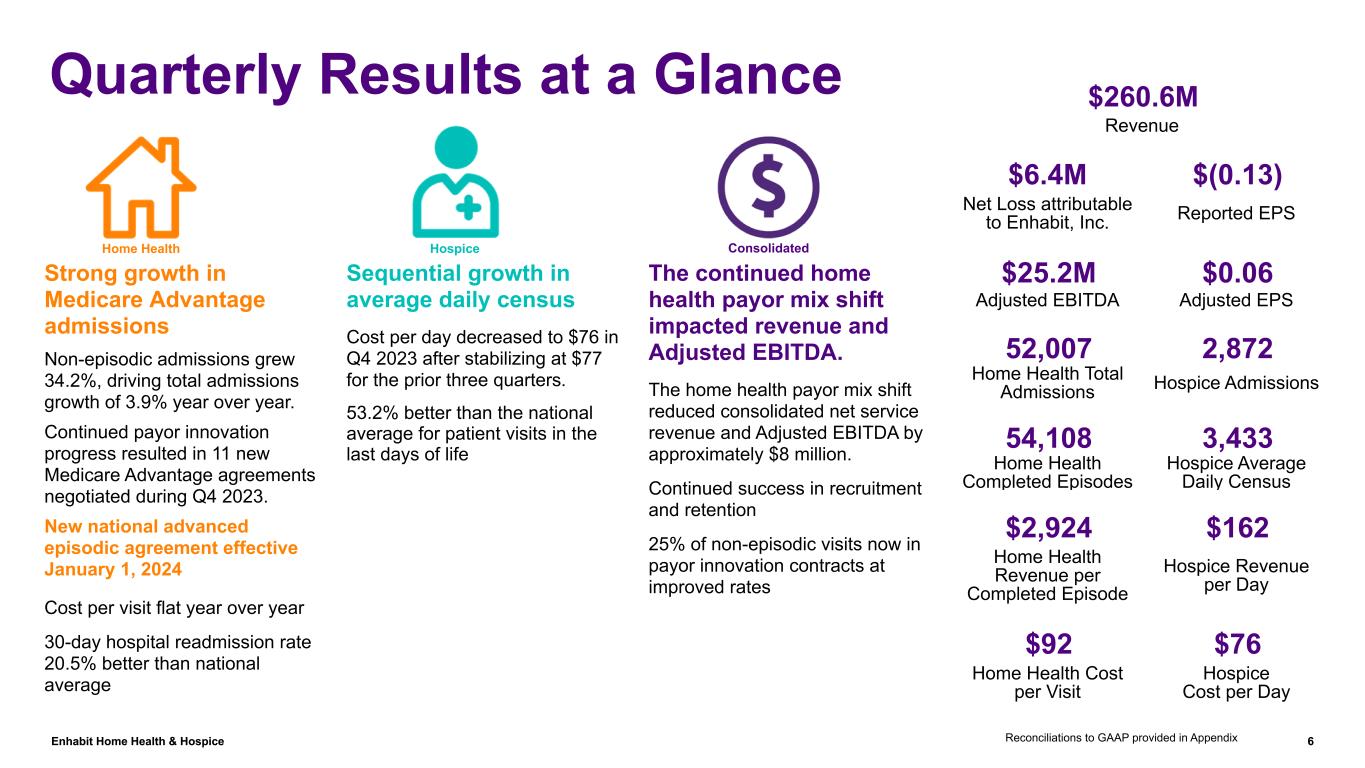

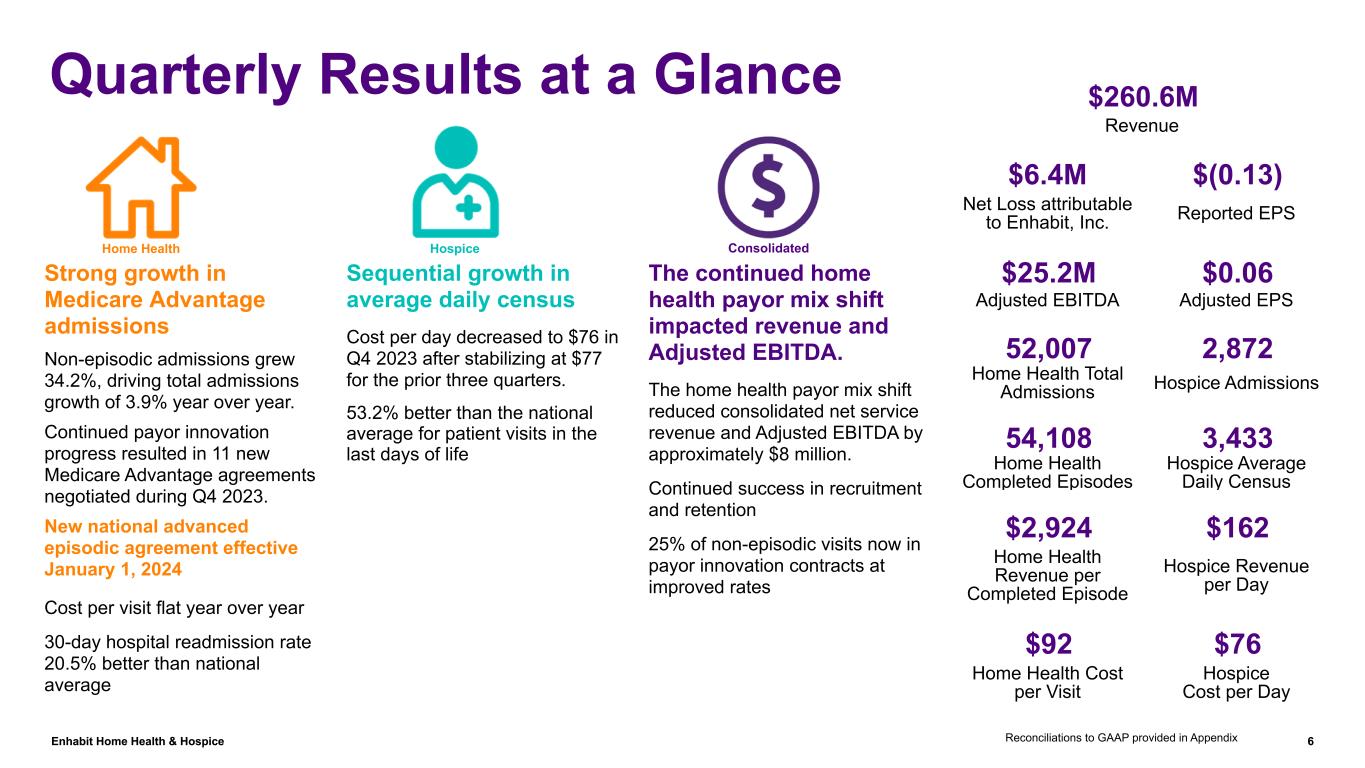

Enhabit Home Health & Hospice 6 Strong growth in Medicare Advantage admissions Non-episodic admissions grew 34.2%, driving total admissions growth of 3.9% year over year. Continued payor innovation progress resulted in 11 new Medicare Advantage agreements negotiated during Q4 2023. New national advanced episodic agreement effective January 1, 2024 Cost per visit flat year over year 30-day hospital readmission rate 20.5% better than national average Sequential growth in average daily census Cost per day decreased to $76 in Q4 2023 after stabilizing at $77 for the prior three quarters. 53.2% better than the national average for patient visits in the last days of life Reconciliations to GAAP provided in Appendix The continued home health payor mix shift impacted revenue and Adjusted EBITDA. The home health payor mix shift reduced consolidated net service revenue and Adjusted EBITDA by approximately $8 million. Continued success in recruitment and retention 25% of non-episodic visits now in payor innovation contracts at improved rates $260.6M Revenue $6.4M $(0.13) Net Loss attributable to Enhabit, Inc. Reported EPS $25.2M $0.06 Adjusted EBITDA Adjusted EPS 52,007 2,872 Home Health Total Admissions Hospice Admissions 54,108 3,433 Home Health Completed Episodes Hospice Average Daily Census $2,924 $162 Home Health Revenue per Completed Episode Hospice Revenue per Day $92 $76 Home Health Cost per Visit Hospice Cost per Day Quarterly Results at a Glance Home Health ConsolidatedHospice

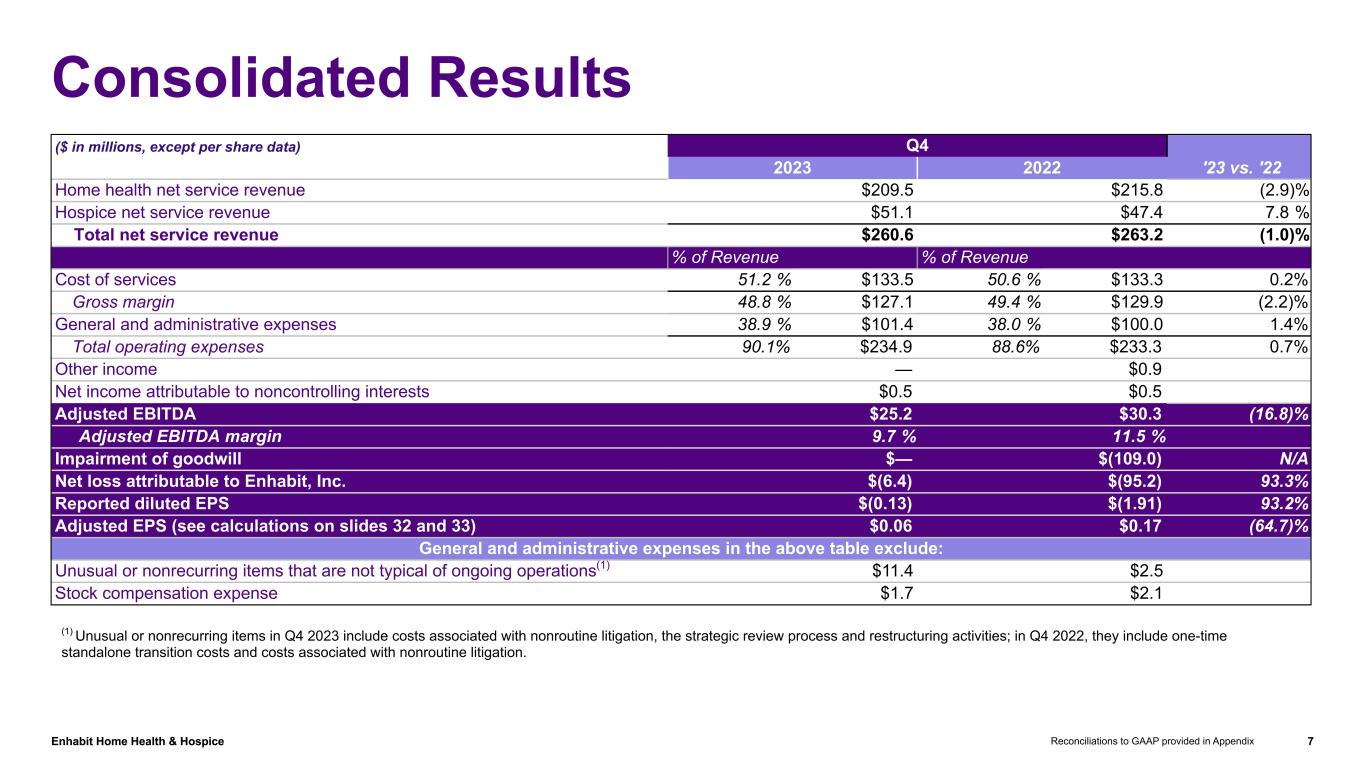

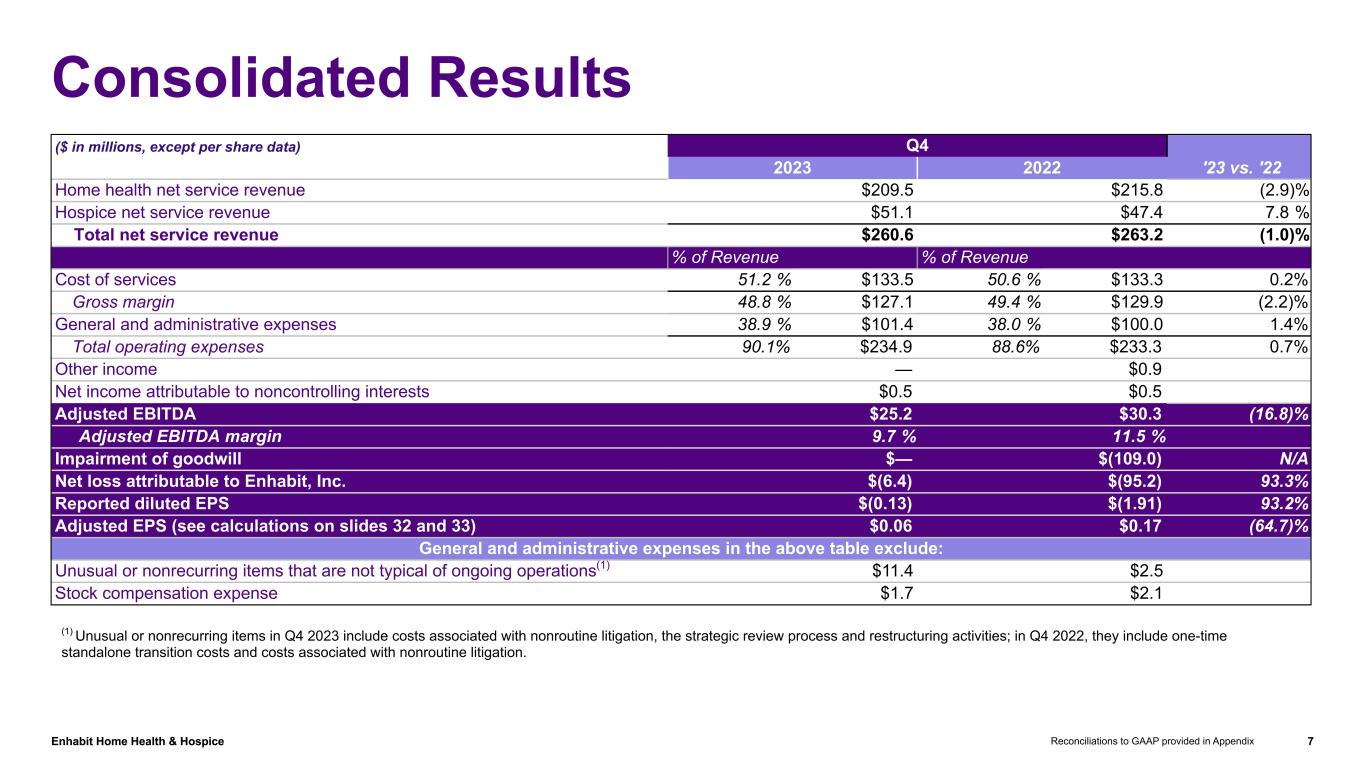

Enhabit Home Health & Hospice 7 Consolidated Results ($ in millions, except per share data) Q4 '23 vs. '222023 2022 Home health net service revenue $209.5 $215.8 (2.9) % Hospice net service revenue $51.1 $47.4 7.8 % Total net service revenue $260.6 $263.2 (1.0) % % of Revenue % of Revenue Cost of services 51.2 % $133.5 50.6 % $133.3 0.2 % Gross margin 48.8 % $127.1 49.4 % $129.9 (2.2) % General and administrative expenses 38.9 % $101.4 38.0 % $100.0 1.4 % Total operating expenses 90.1 % $234.9 88.6 % $233.3 0.7 % Other income — $0.9 Net income attributable to noncontrolling interests $0.5 $0.5 Adjusted EBITDA $25.2 $30.3 (16.8) % Adjusted EBITDA margin 9.7 % 11.5 % Impairment of goodwill $— $(109.0) N/A Net loss attributable to Enhabit, Inc. $(6.4) $(95.2) 93.3 % Reported diluted EPS $(0.13) $(1.91) 93.2 % Adjusted EPS (see calculations on slides 32 and 33) $0.06 $0.17 (64.7) % General and administrative expenses in the above table exclude: Unusual or nonrecurring items that are not typical of ongoing operations(1) $11.4 $2.5 Stock compensation expense $1.7 $2.1 Reconciliations to GAAP provided in Appendix (1) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities; in Q4 2022, they include one-time standalone transition costs and costs associated with nonroutine litigation.

Enhabit Home Health & Hospice 8 Consolidated Results (continued) • The continued shift to more non-episodic admissions in home health impacted consolidated revenue and Adjusted EBITDA by approximately $8 million, net of the impact from improved pricing of payor innovation contracts. Consolidated Adjusted EBITDA decreased $5.1 million, or 16.8%, year over year Consolidated revenue decreased $2.6 million, or 1.0%, year over year Reconciliations to GAAP provided in Appendix Continued success in recruitment and retention • 21.5% increase in full-time nursing candidate pool year over year resulted in 119 net new full-time home health nursing hires in Q4 2023 • Agency nursing contract labor eliminated as of December 31, 2023

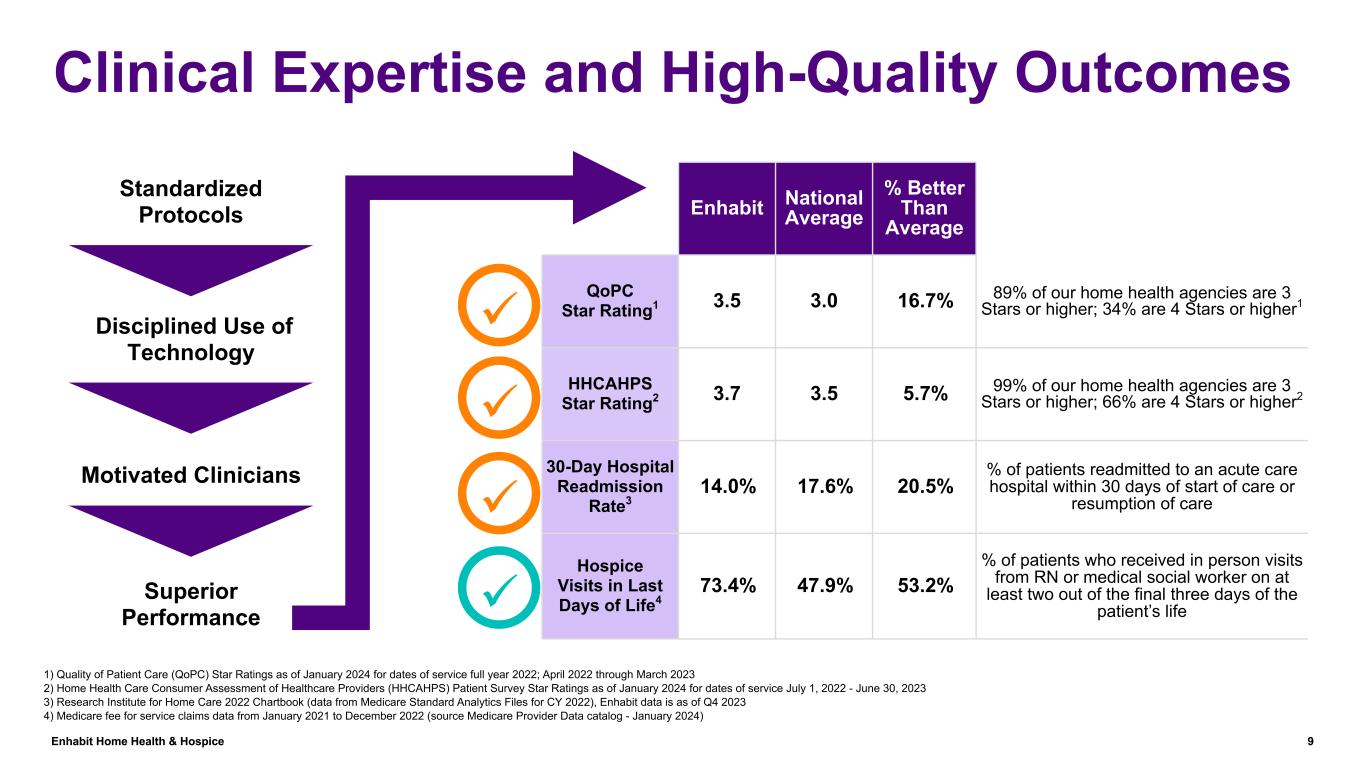

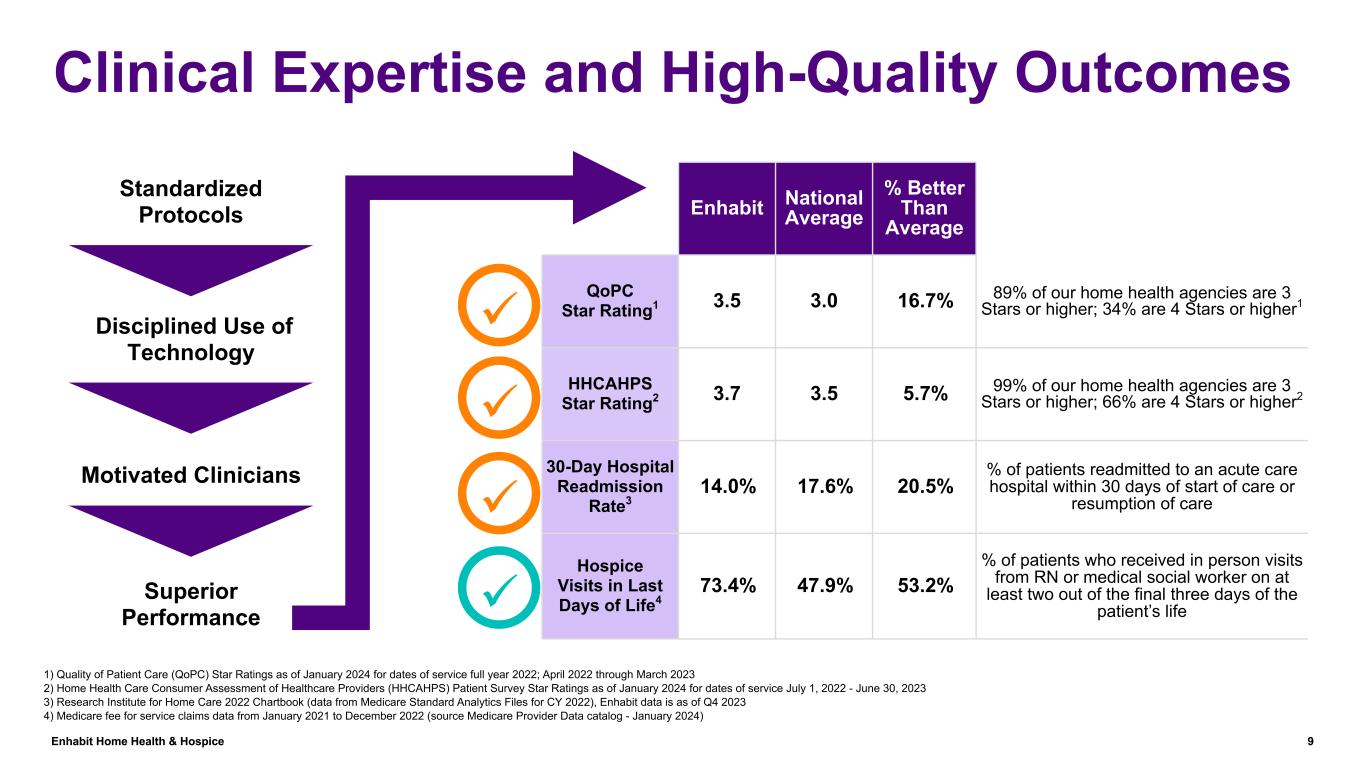

Enhabit Home Health & Hospice 9 Clinical Expertise and High-Quality Outcomes Enhabit National Average % Better Than Average QoPC Star Rating1 3.5 3.0 16.7% 89% of our home health agencies are 3 Stars or higher; 34% are 4 Stars or higher1 HHCAHPS Star Rating2 3.7 3.5 5.7% 99% of our home health agencies are 3 Stars or higher; 66% are 4 Stars or higher2 30-Day Hospital Readmission Rate3 14.0% 17.6% 20.5% % of patients readmitted to an acute care hospital within 30 days of start of care or resumption of care Hospice Visits in Last Days of Life4 73.4% 47.9% 53.2% % of patients who received in person visits from RN or medical social worker on at least two out of the final three days of the patient’s life Standardized Protocols Motivated Clinicians Disciplined Use of Technology Superior Performance ü ü ü ü 1) Quality of Patient Care (QoPC) Star Ratings as of January 2024 for dates of service full year 2022; April 2022 through March 2023 2) Home Health Care Consumer Assessment of Healthcare Providers (HHCAHPS) Patient Survey Star Ratings as of January 2024 for dates of service July 1, 2022 - June 30, 2023 3) Research Institute for Home Care 2022 Chartbook (data from Medicare Standard Analytics Files for CY 2022), Enhabit data is as of Q4 2023 4) Medicare fee for service claims data from January 2021 to December 2022 (source Medicare Provider Data catalog - January 2024)

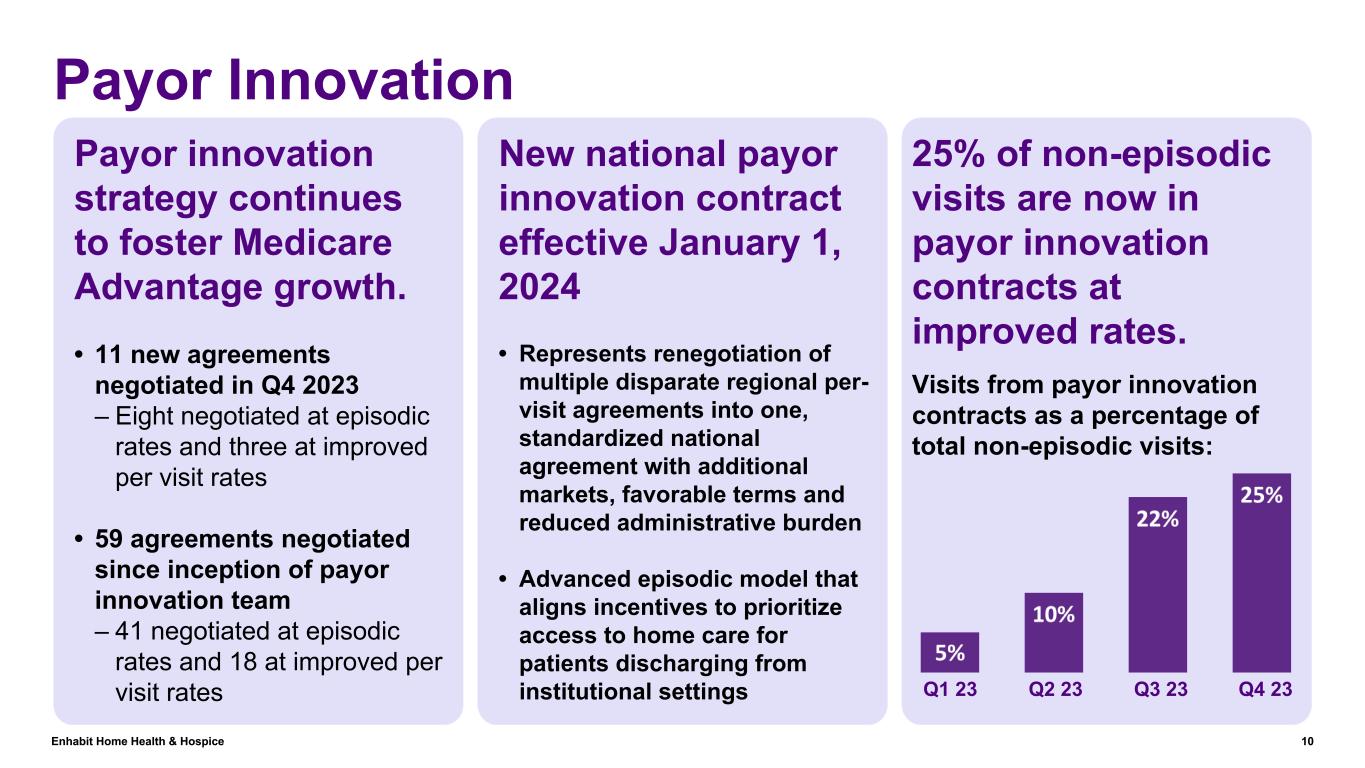

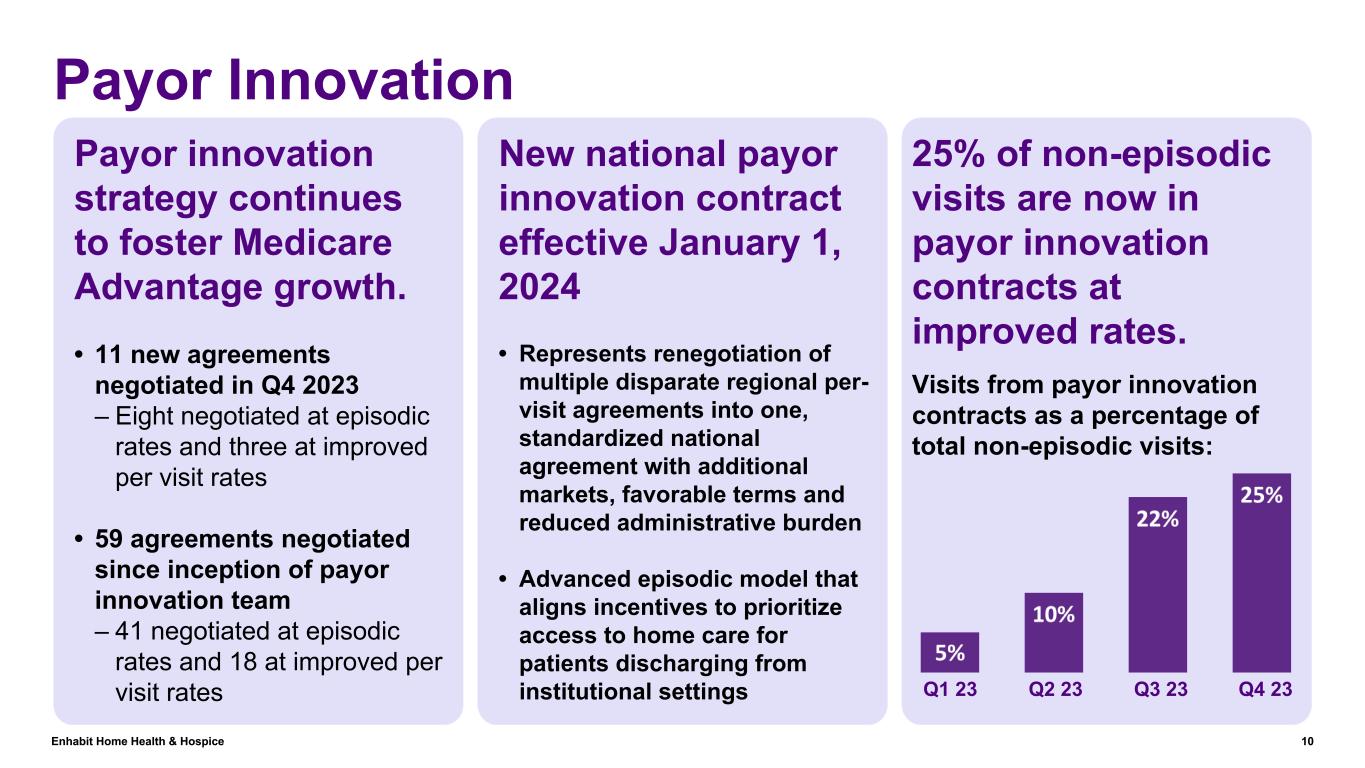

Enhabit Home Health & Hospice 10 Payor Innovation Payor innovation strategy continues to foster Medicare Advantage growth. New national payor innovation contract effective January 1, 2024 25% of non-episodic visits are now in payor innovation contracts at improved rates. • 11 new agreements negotiated in Q4 2023 – Eight negotiated at episodic rates and three at improved per visit rates • 59 agreements negotiated since inception of payor innovation team – 41 negotiated at episodic rates and 18 at improved per visit rates • Represents renegotiation of multiple disparate regional per- visit agreements into one, standardized national agreement with additional markets, favorable terms and reduced administrative burden • Advanced episodic model that aligns incentives to prioritize access to home care for patients discharging from institutional settings Visits from payor innovation contracts as a percentage of total non-episodic visits: Q1 23 Q4 23Q3 23Q2 23

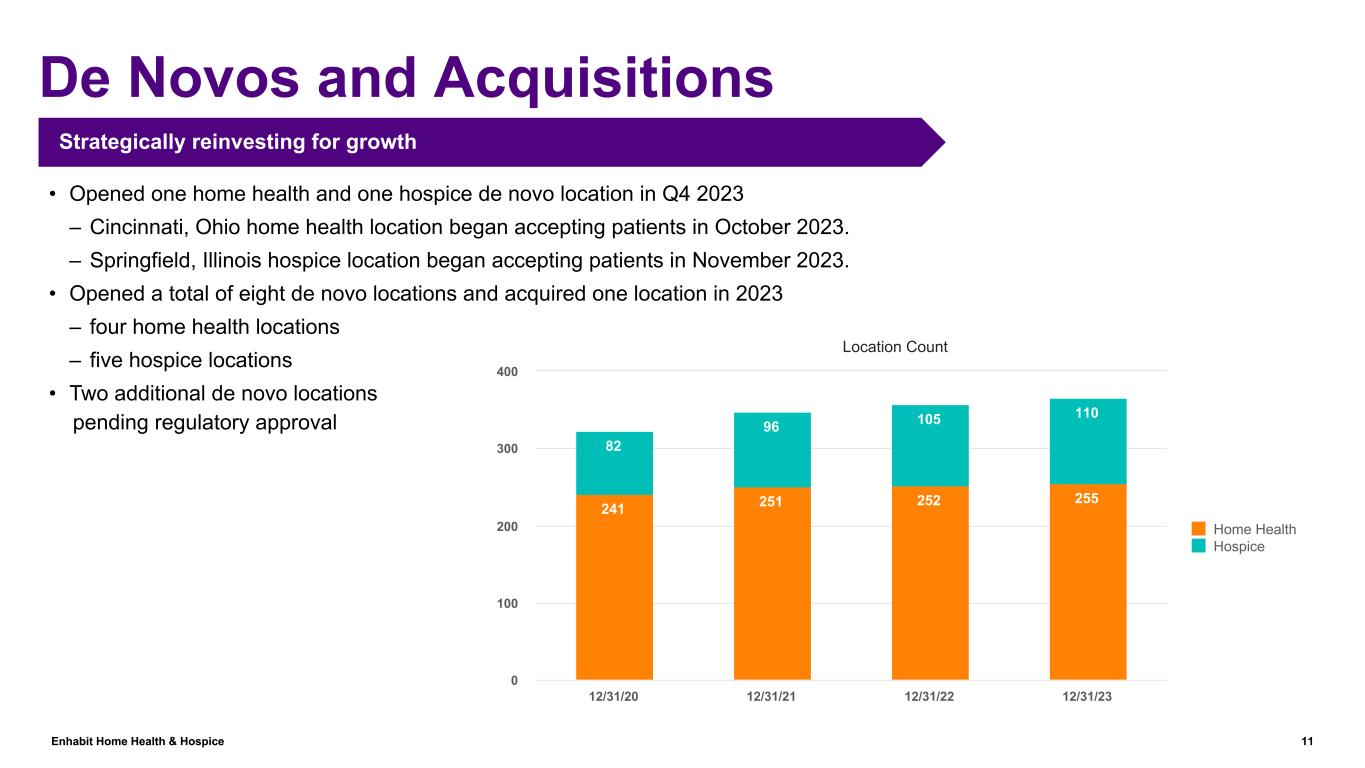

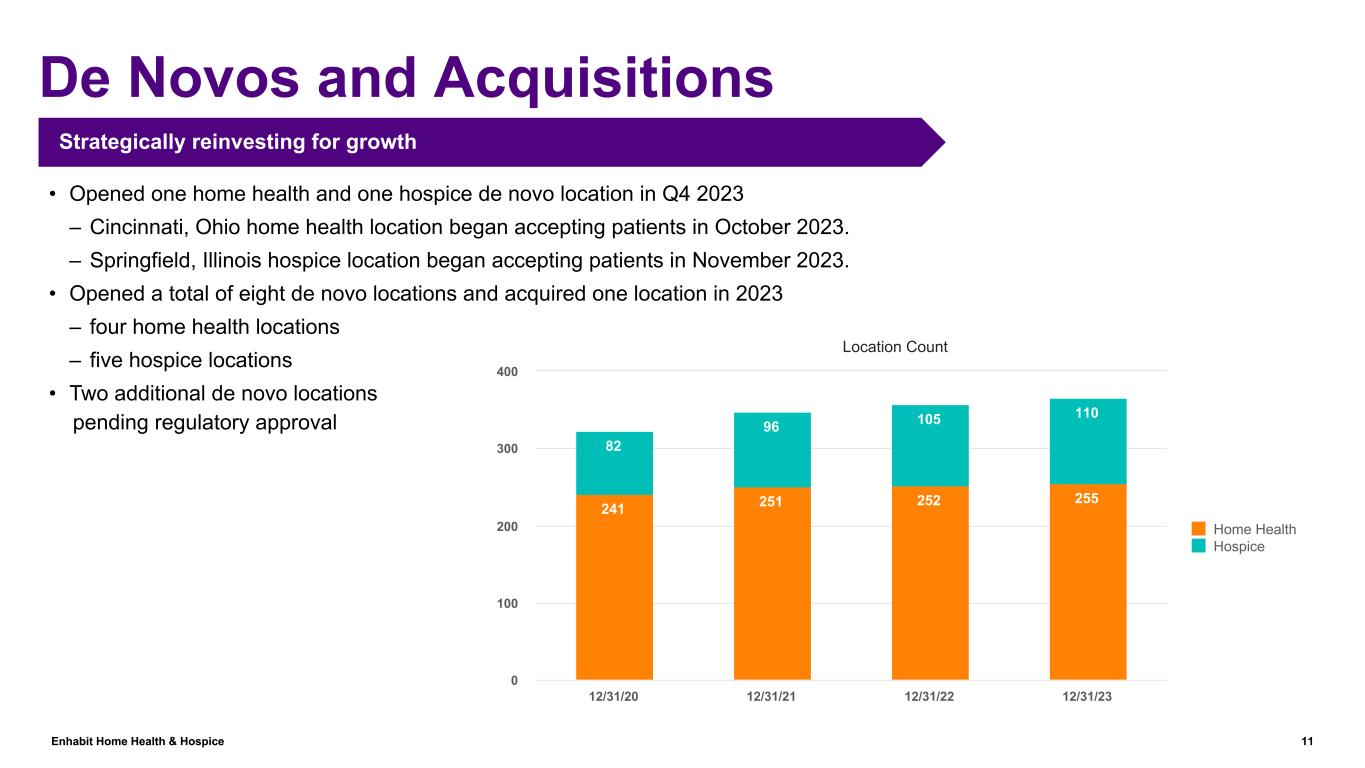

Enhabit Home Health & Hospice 11 De Novos and Acquisitions Strategically reinvesting for growth • Opened one home health and one hospice de novo location in Q4 2023 – Cincinnati, Ohio home health location began accepting patients in October 2023. – Springfield, Illinois hospice location began accepting patients in November 2023. • Opened a total of eight de novo locations and acquired one location in 2023 – four home health locations – five hospice locations • Two additional de novo locations pending regulatory approval Home Health Hospice Total December 31, 2020 241 82 323 De Novo Locations Opened 0 3 3 Acquired Locations 11 11 22 Merged/Closed Locations (1) 0 (1) December 31, 2021 251 96 347 De Novo Locations Opened 1 3 4 Acquired Locations 2 6 8 Merged/Closed Locations (2) 0 (2) Closed Locations (1) 0 (1) December 31, 2022 252 105 357 De Novo Locations Opened 3 5 8 Acquired Locations 1 0 1 Closed Locations (1) 0 (1) December 31, 2023 255 110 365 241 251 252 255 82 96 105 110 Home Health Hospice 12/31/20 12/31/21 12/31/22 12/31/23 0 100 200 300 400 Location Count

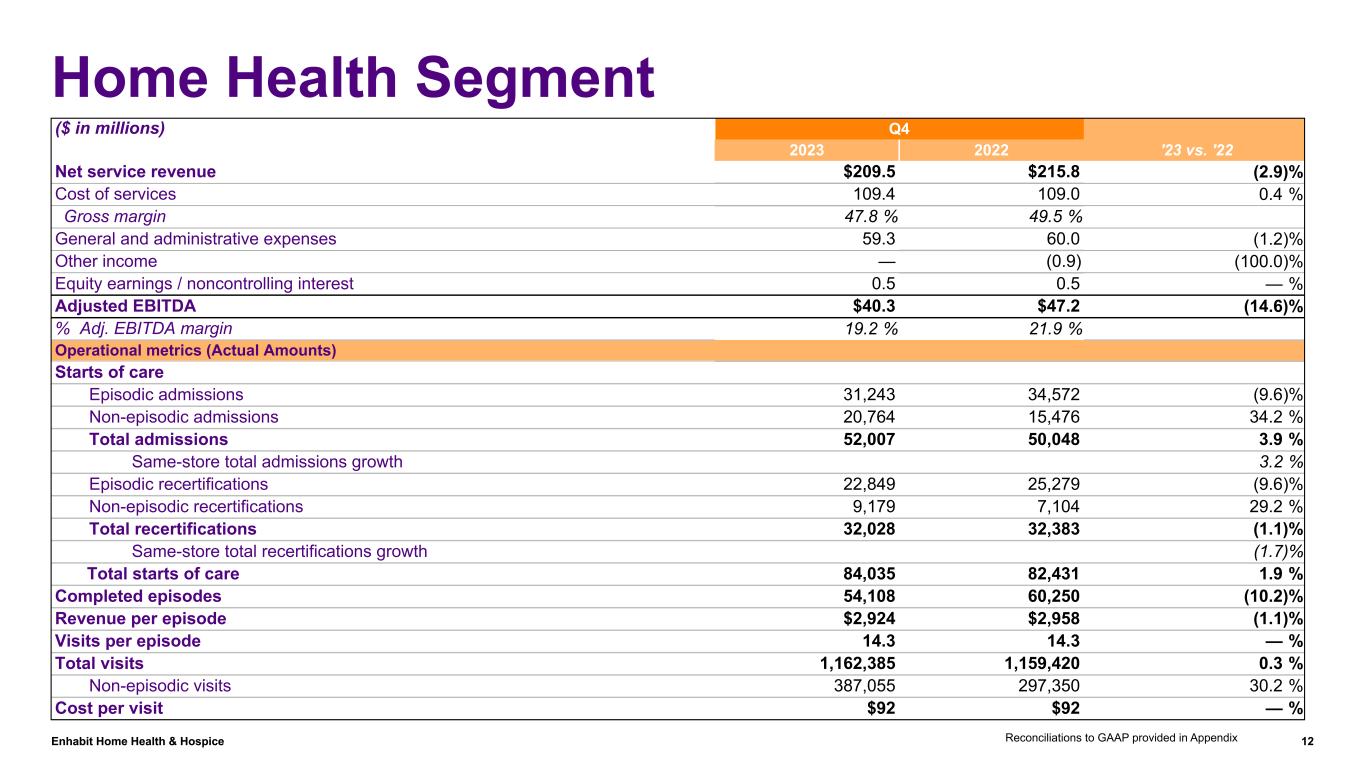

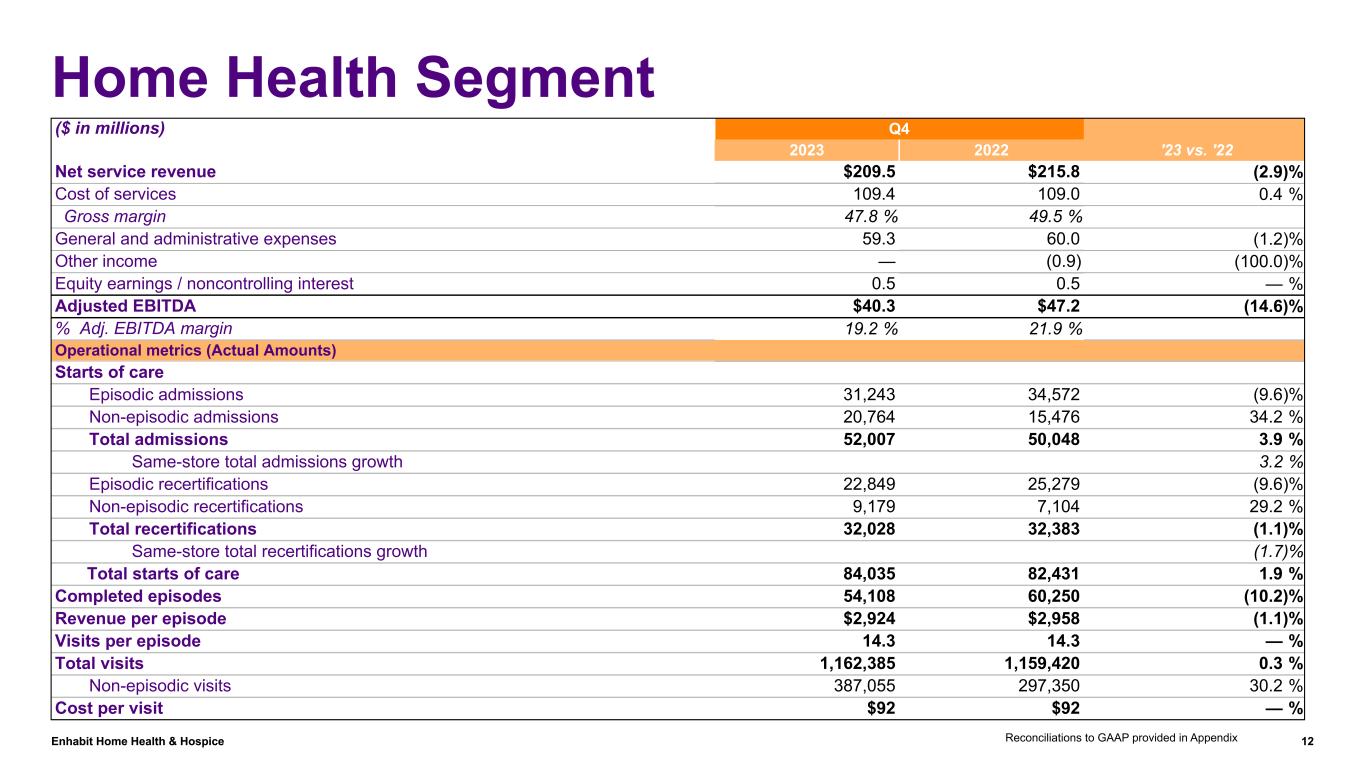

Enhabit Home Health & Hospice 12 Home Health Segment ($ in millions) Q4 '23 vs. '222023 2022 Net service revenue $209.5 $215.8 (2.9) % Cost of services 109.4 109.0 0.4 % Gross margin 47.8 % 49.5 % General and administrative expenses 59.3 60.0 (1.2) % Other income — (0.9) (100.0) % Equity earnings / noncontrolling interest 0.5 0.5 — % Adjusted EBITDA $40.3 $47.2 (14.6) % % Adj. EBITDA margin 19.2 % 21.9 % Operational metrics (Actual Amounts) Starts of care Episodic admissions 31,243 34,572 (9.6) % Non-episodic admissions 20,764 15,476 34.2 % Total admissions 52,007 50,048 3.9 % Same-store total admissions growth 3.2 % Episodic recertifications 22,849 25,279 (9.6) % Non-episodic recertifications 9,179 7,104 29.2 % Total recertifications 32,028 32,383 (1.1) % Same-store total recertifications growth (1.7) % Total starts of care 84,035 82,431 1.9 % Completed episodes 54,108 60,250 (10.2) % Revenue per episode $2,924 $2,958 (1.1) % Visits per episode 14.3 14.3 — % Total visits 1,162,385 1,159,420 0.3 % Non-episodic visits 387,055 297,350 30.2 % Cost per visit $92 $92 — % Reconciliations to GAAP provided in Appendix

Enhabit Home Health & Hospice 13 Home Health Segment (continued) Revenue decreased $6.3 million, or 2.9%, year over year primarily due to the continued payor mix shift to more non- episodic admissions. • Total admissions growth was driven by 34.2% year-over-year growth in non-episodic admissions. • The continued shift to more non-episodic admissions reduced revenue approximately $8 million, net of the impact from improved pricing of payor innovation contracts. • Approximately 33% of visits in Q4 2023 were non-episodic, up from approximately 26% in Q4 2022. • Revenue per episode decreased 1.1% year over year primarily due to patient mix. Adjusted EBITDA decreased $6.9 million, or 14.6%, year over year primarily due to the continued payor mix shift to more non-episodic admissions ($8 million). Cost per visit remained flat year over year as the reduction in nursing contract labor offset the impact of merit and market increases. Home health total admissions increased 3.9% year over year Reconciliations to GAAP provided in Appendix

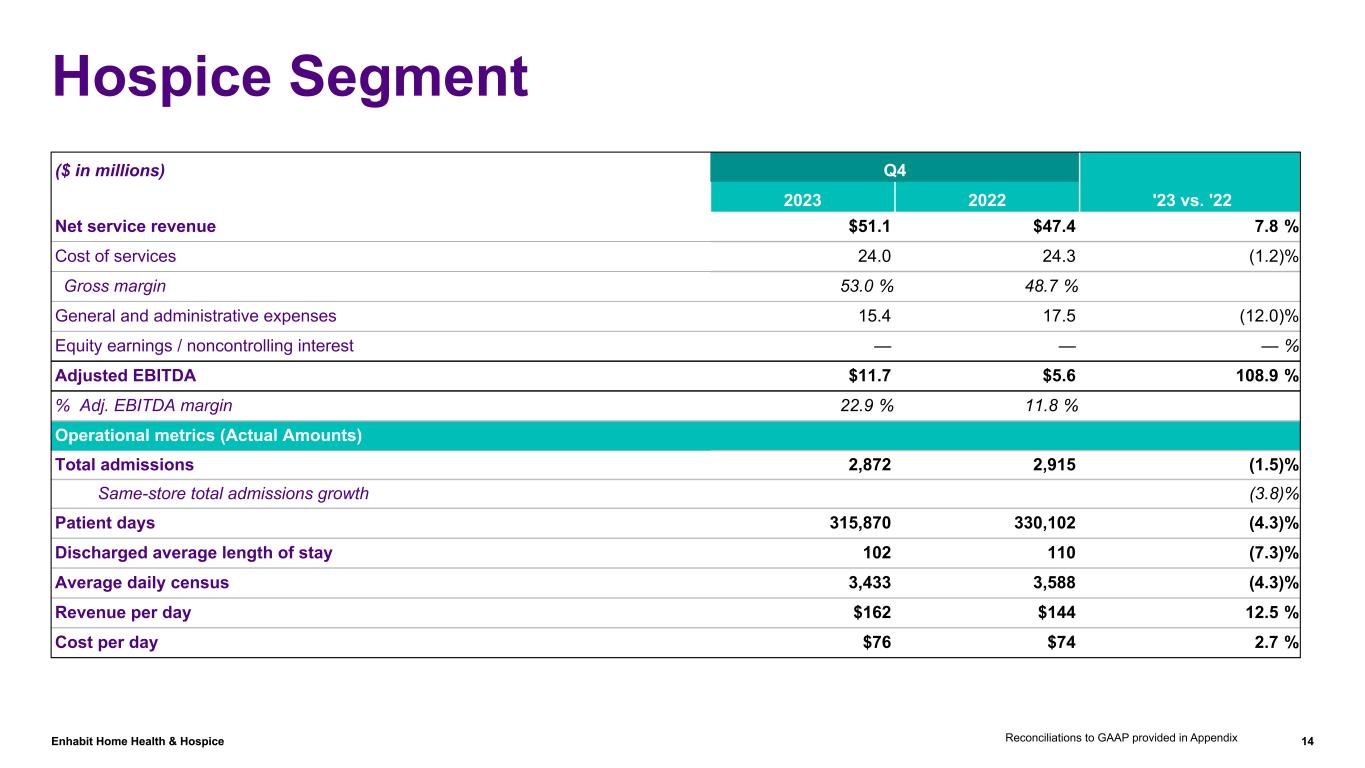

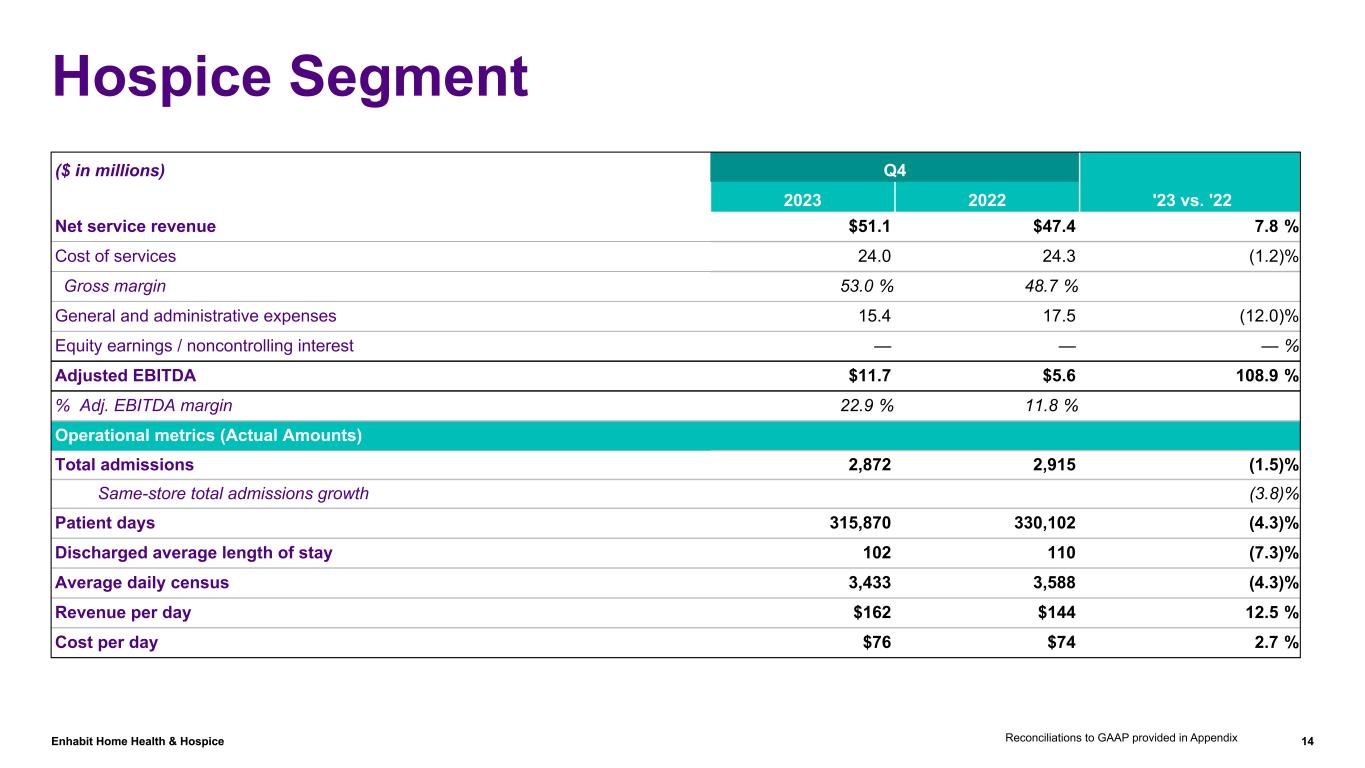

Enhabit Home Health & Hospice 14 Hospice Segment ($ in millions) Q4 '23 vs. '222023 2022 Net service revenue $51.1 $47.4 7.8 % Cost of services 24.0 24.3 (1.2) % Gross margin 53.0 % 48.7 % General and administrative expenses 15.4 17.5 (12.0) % Equity earnings / noncontrolling interest — — — % Adjusted EBITDA $11.7 $5.6 108.9 % % Adj. EBITDA margin 22.9 % 11.8 % Operational metrics (Actual Amounts) Total admissions 2,872 2,915 (1.5) % Same-store total admissions growth (3.8) % Patient days 315,870 330,102 (4.3) % Discharged average length of stay 102 110 (7.3) % Average daily census 3,433 3,588 (4.3) % Revenue per day $162 $144 12.5 % Cost per day $76 $74 2.7 % Reconciliations to GAAP provided in Appendix

Enhabit Home Health & Hospice 15 Hospice Segment (continued) Hospice average daily census decreased 4.3% year over year. Revenue increased $3.7 million, or 7.8%, year over year primarily due to an increase in revenue per day. • Admissions decreased 1.5% year over year. • Revenue per day increased 12.5% year over year primarily due to changes in our estimated recoverability of net service revenue and increased Medicare reimbursement rates. • Average daily census increased 1.3% sequentially. Adjusted EBITDA increased $6.1 million year over year primarily due to an increase in revenue per day and a reduction in general and administrative expenses. • Cost per day increased 2.7% year over year primarily due to increased labor costs resulting from the implementation of the new case management staffing model, including costs associated with dedicated on-call and triage nurses. – Cost per day decreased to $76 in Q4 2023 after stabilizing at $77 for the prior three quarters as the elimination of nursing contract labor and increased census helped gain leverage against the fixed costs associated with the case management staffing model. • General and administrative expenses decreased year over year primarily due to reduced headcount at hospice branch locations resulting from implementation of the case management staffing model. Reconciliations to GAAP provided in Appendix

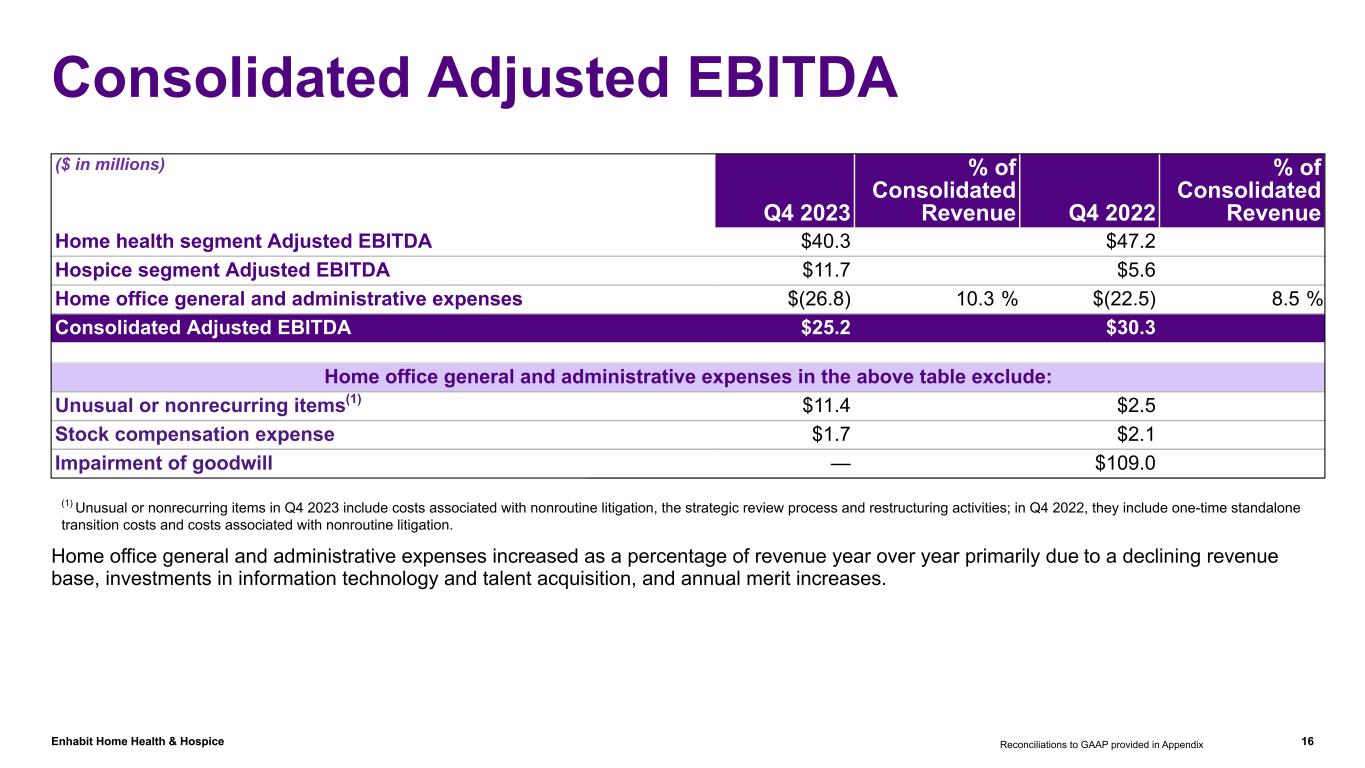

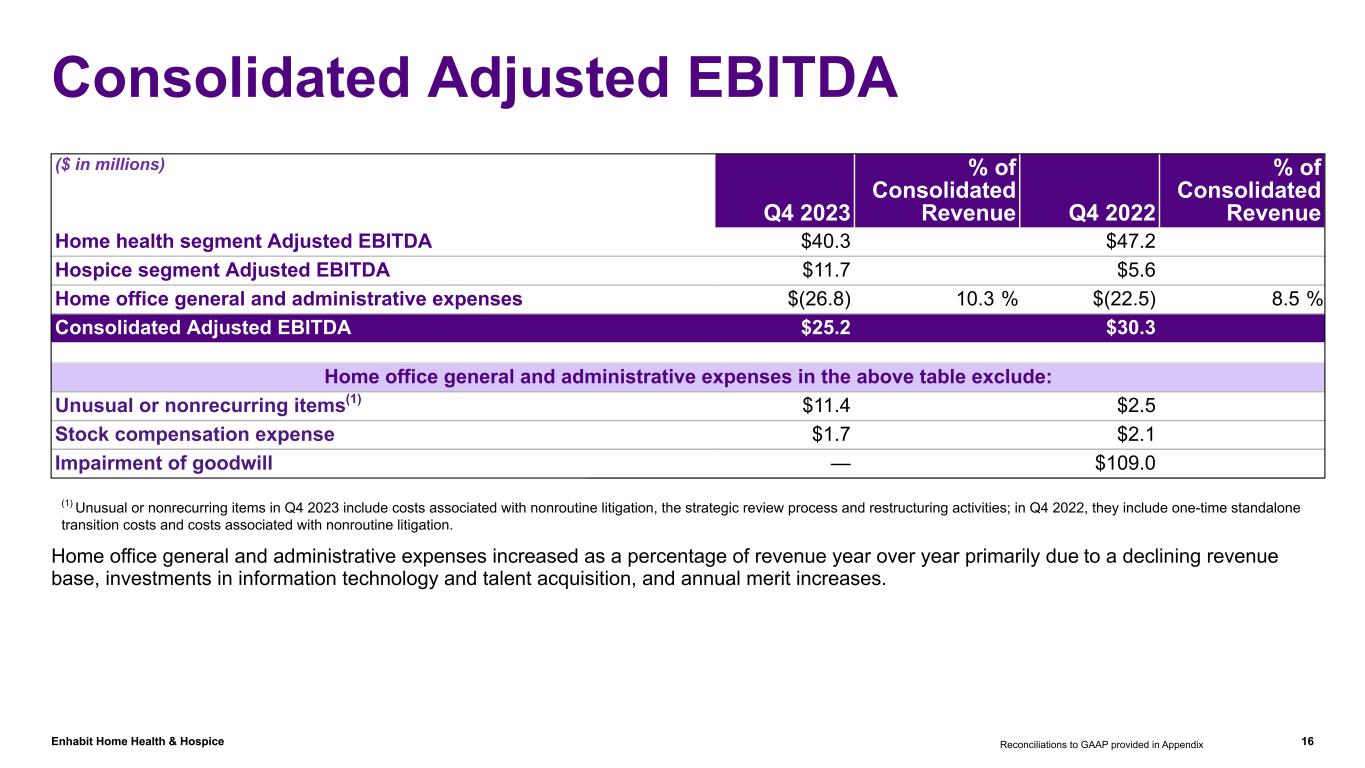

Enhabit Home Health & Hospice 16 Consolidated Adjusted EBITDA ($ in millions) Q4 2023 % of Consolidated Revenue Q4 2022 % of Consolidated Revenue Home health segment Adjusted EBITDA $40.3 $47.2 Hospice segment Adjusted EBITDA $11.7 $5.6 Home office general and administrative expenses $(26.8) 10.3 % $(22.5) 8.5 % Consolidated Adjusted EBITDA $25.2 $30.3 Home office general and administrative expenses in the above table exclude: Unusual or nonrecurring items(1) $11.4 $2.5 Stock compensation expense $1.7 $2.1 Impairment of goodwill — $109.0 (1) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities; in Q4 2022, they include one-time standalone transition costs and costs associated with nonroutine litigation. Home office general and administrative expenses increased as a percentage of revenue year over year primarily due to a declining revenue base, investments in information technology and talent acquisition, and annual merit increases. Reconciliations to GAAP provided in Appendix

Enhabit Home Health & Hospice 17 Debt & Liquidity Metrics ($ in millions) December 31, 2023 December 31, 2022 Advances under revolving credit facility, due 2027(1)(3) $180.0 $190.0 $400 million term loan facility, due 2027 (1)(2) $367.1 $387.9 Finance lease obligations $5.5 $5.2 Total debt $552.6 $583.1 Less: Cash and cash equivalents $27.4 $22.9 Net debt $525.2 $560.2 Net debt to Adjusted EBITDA 5.4 x 3.8 x Trailing twelve-month Adjusted EBITDA $97.6 $149.3 Available liquidity(3) $60.8 $179.5 Reconciliations to GAAP provided in Appendix (1) The Q4 2023 weighted average interest rate was 7.5% (SOFR + credit spread adjustment + 250 bps). (2) In October 2022, Enhabit entered into an interest rate swap to fix the rate on $200 million of its term loan. The swap fixes the SOFR component of the interest rate at 4.3%. (3) In November 2023, Enhabit entered into a Credit Agreement Amendment. A component of the amendment was a permanent reduction of the revolver capacity from $350 million to $220 million.

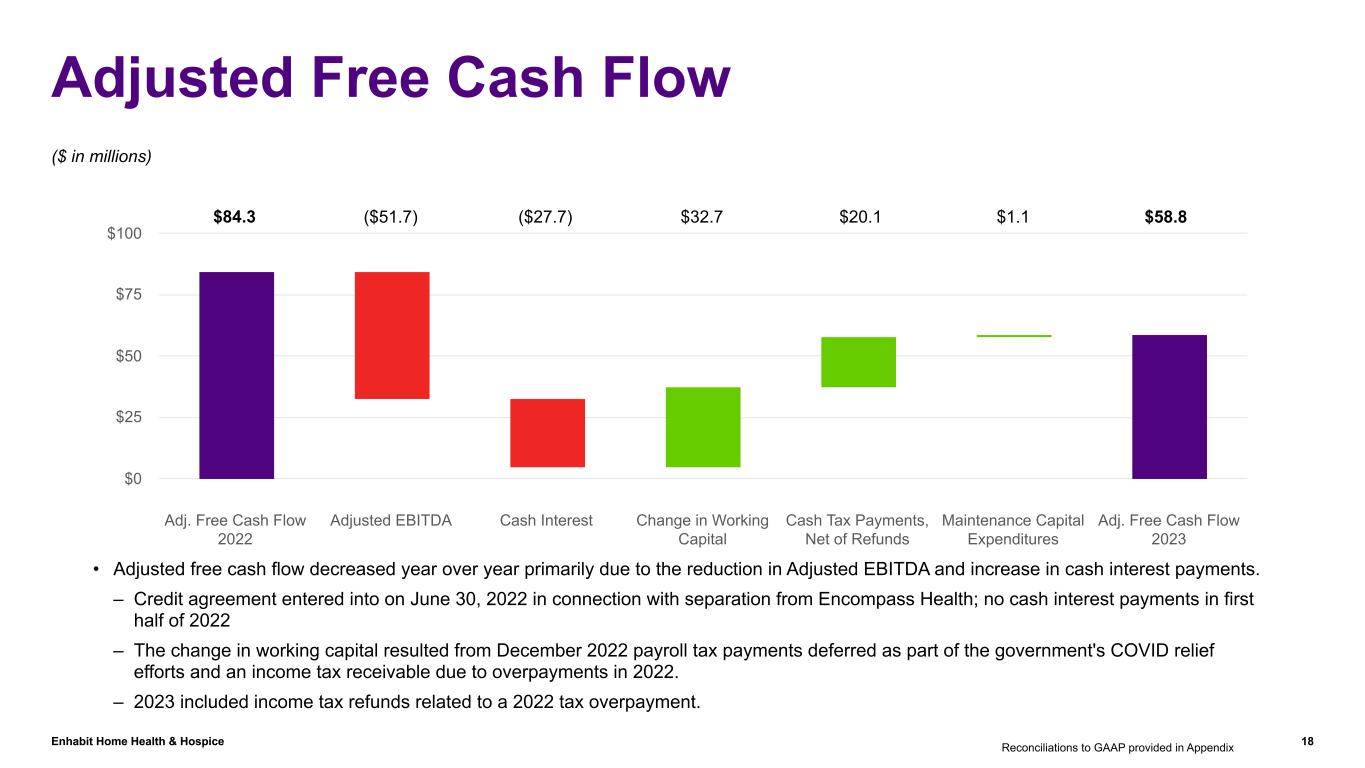

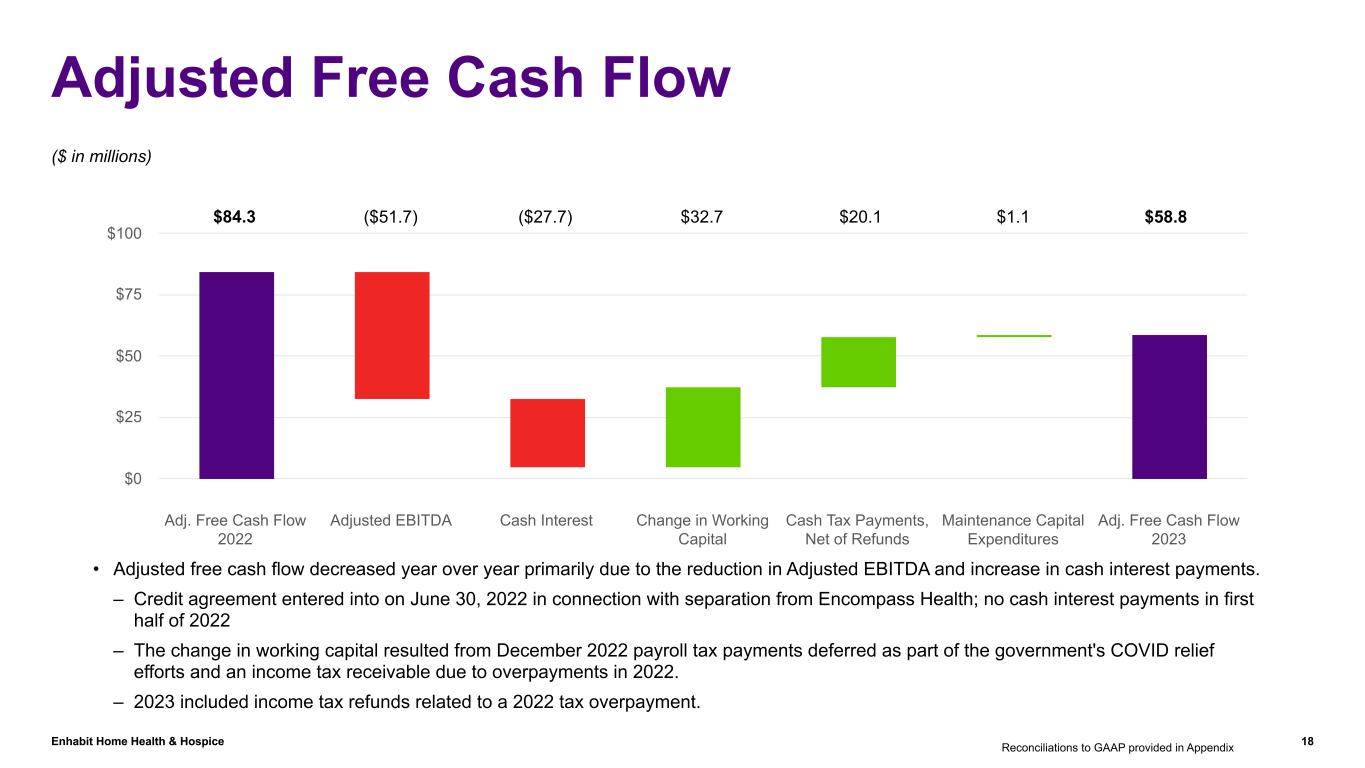

Enhabit Home Health & Hospice 18 Adjusted Free Cash Flow 2022 YTD 2021 YTD Adjusted EBITDA ($ in thousands) $87,317 $105,012 Change in net working capital (6,561) (8,297) Cash interest payments (123) (145) Cash tax payments - - Maintenance capital expenditures 2616 3,129 Adjusted free cash flow $78,017 $93,441 ($ in millions) $84.3 $(51.7) $20.1$(27.7) $32.7 $1.1 $58.8 Adj. Free Cash Flow 2022 Adjusted EBITDA Cash Interest Change in Working Capital Cash Tax Payments, Net of Refunds Maintenance Capital Expenditures Adj. Free Cash Flow 2023 $0 $25 $50 $75 $100 Reconciliations to GAAP provided in Appendix • Adjusted free cash flow decreased year over year primarily due to the reduction in Adjusted EBITDA and increase in cash interest payments. – Credit agreement entered into on June 30, 2022 in connection with separation from Encompass Health; no cash interest payments in first half of 2022 – The change in working capital resulted from December 2022 payroll tax payments deferred as part of the government's COVID relief efforts and an income tax receivable due to overpayments in 2022. – 2023 included income tax refunds related to a 2022 tax overpayment. $84.3 ($51.7) ($27.7) $32.7 $20.1 $1.1 $58.8

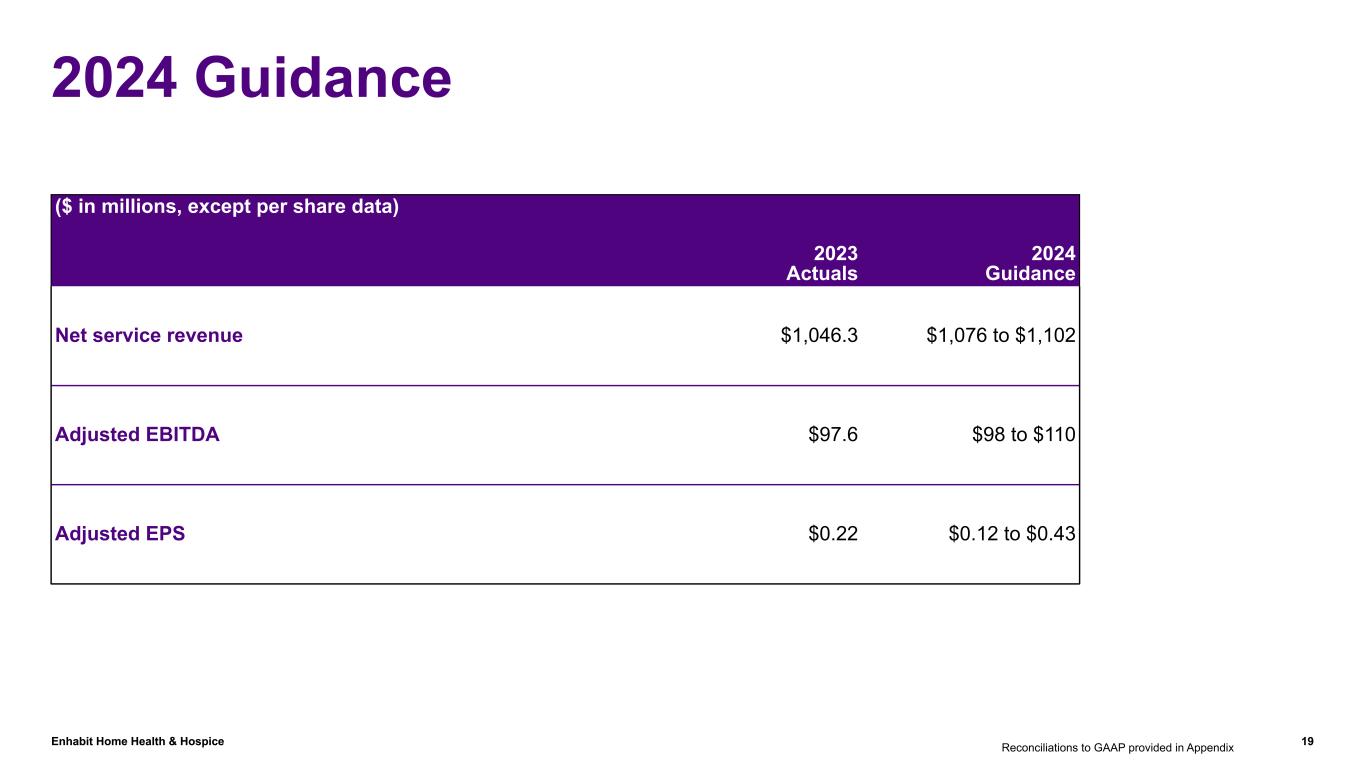

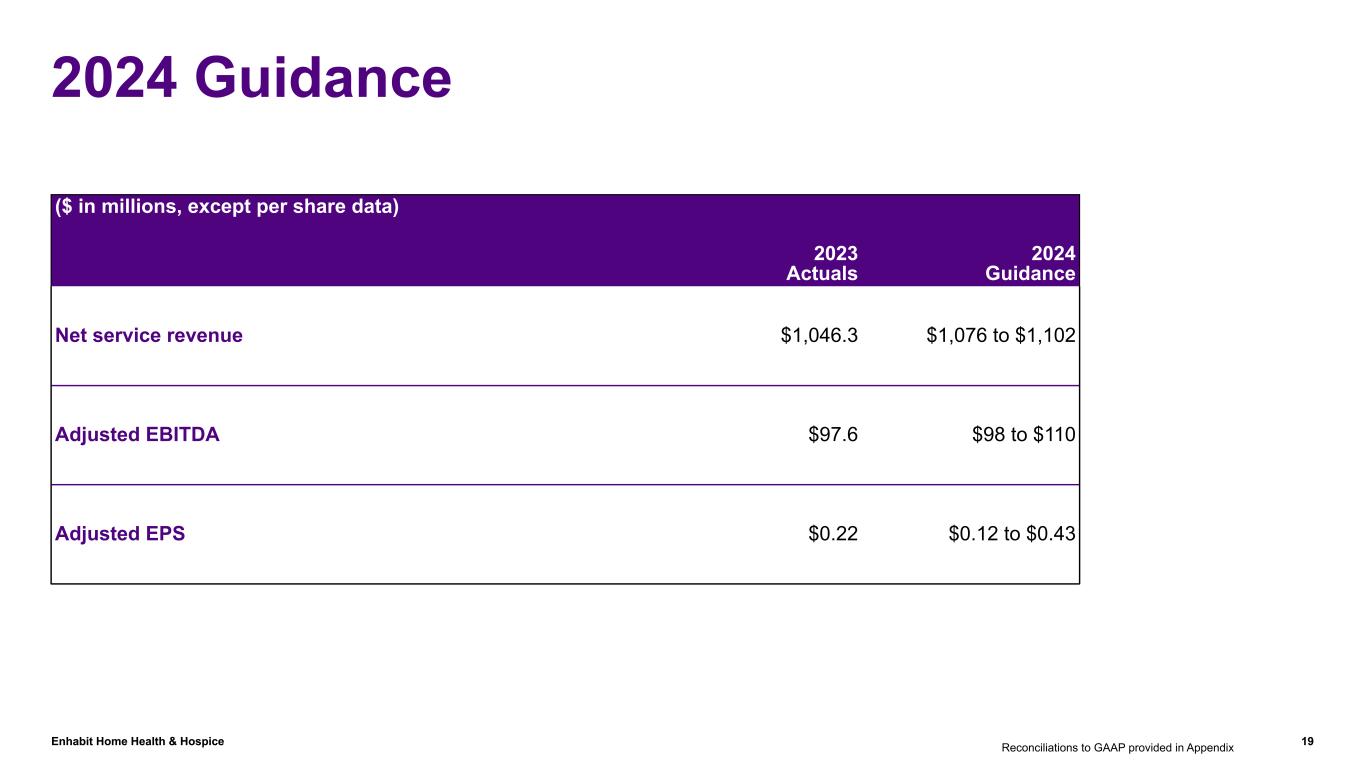

Enhabit Home Health & Hospice 19 2024 Guidance ($ in millions, except per share data) 2023 Actuals 2024 Guidance Net service revenue $1,046.3 $1,076 to $1,102 Adjusted EBITDA $97.6 $98 to $110 Adjusted EPS $0.22 $0.12 to $0.43 Reconciliations to GAAP provided in Appendix

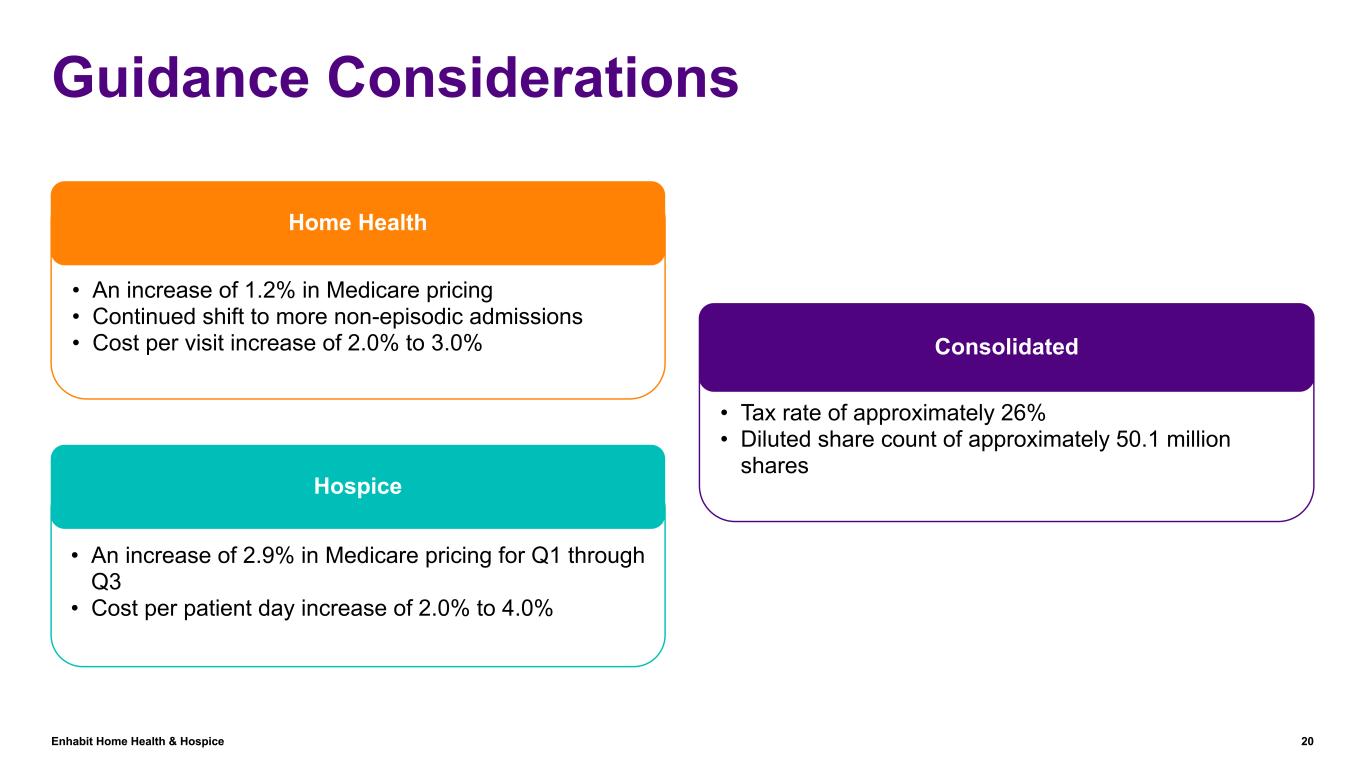

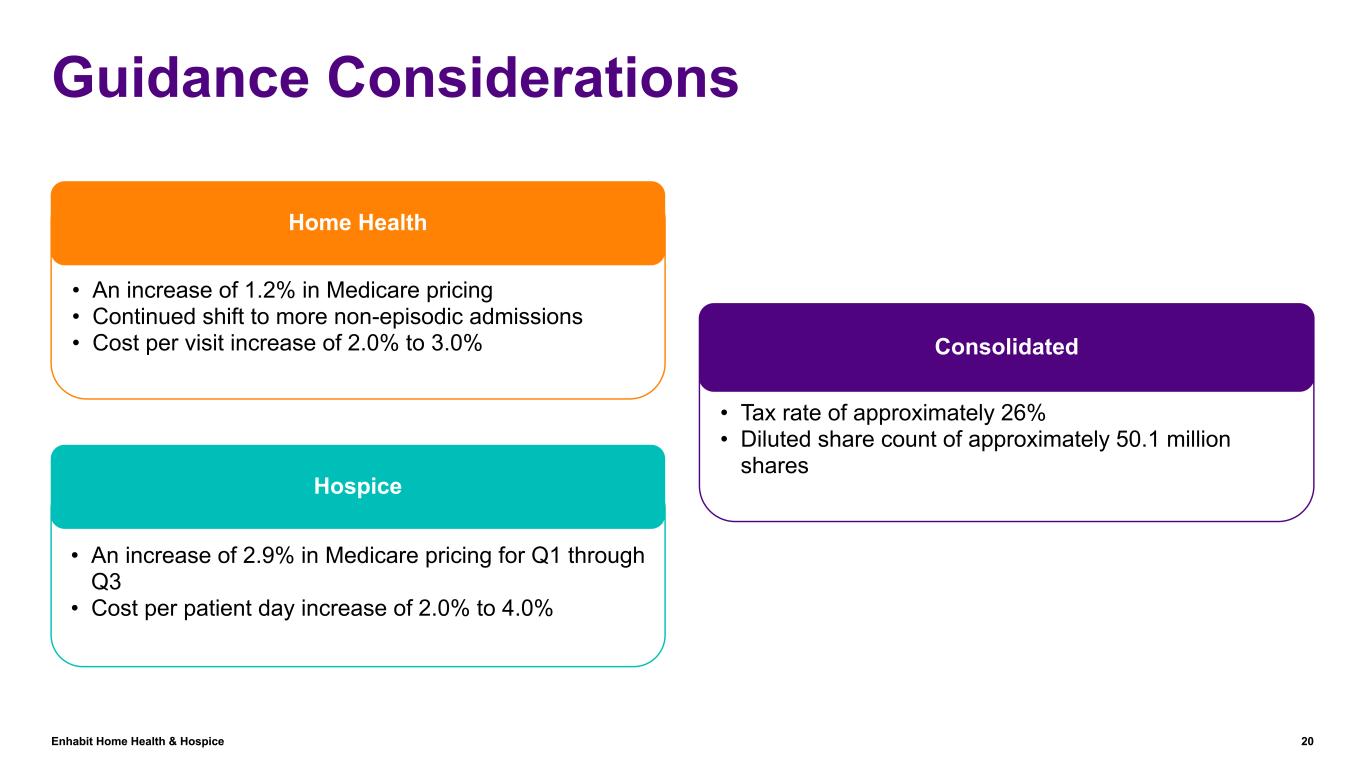

Enhabit Home Health & Hospice 20 Guidance Considerations • An increase of 1.2% in Medicare pricing • Continued shift to more non-episodic admissions • Cost per visit increase of 2.0% to 3.0% Home Health • An increase of 2.9% in Medicare pricing for Q1 through Q3 • Cost per patient day increase of 2.0% to 4.0% Hospice • Tax rate of approximately 26% • Diluted share count of approximately 50.1 million shares Consolidated

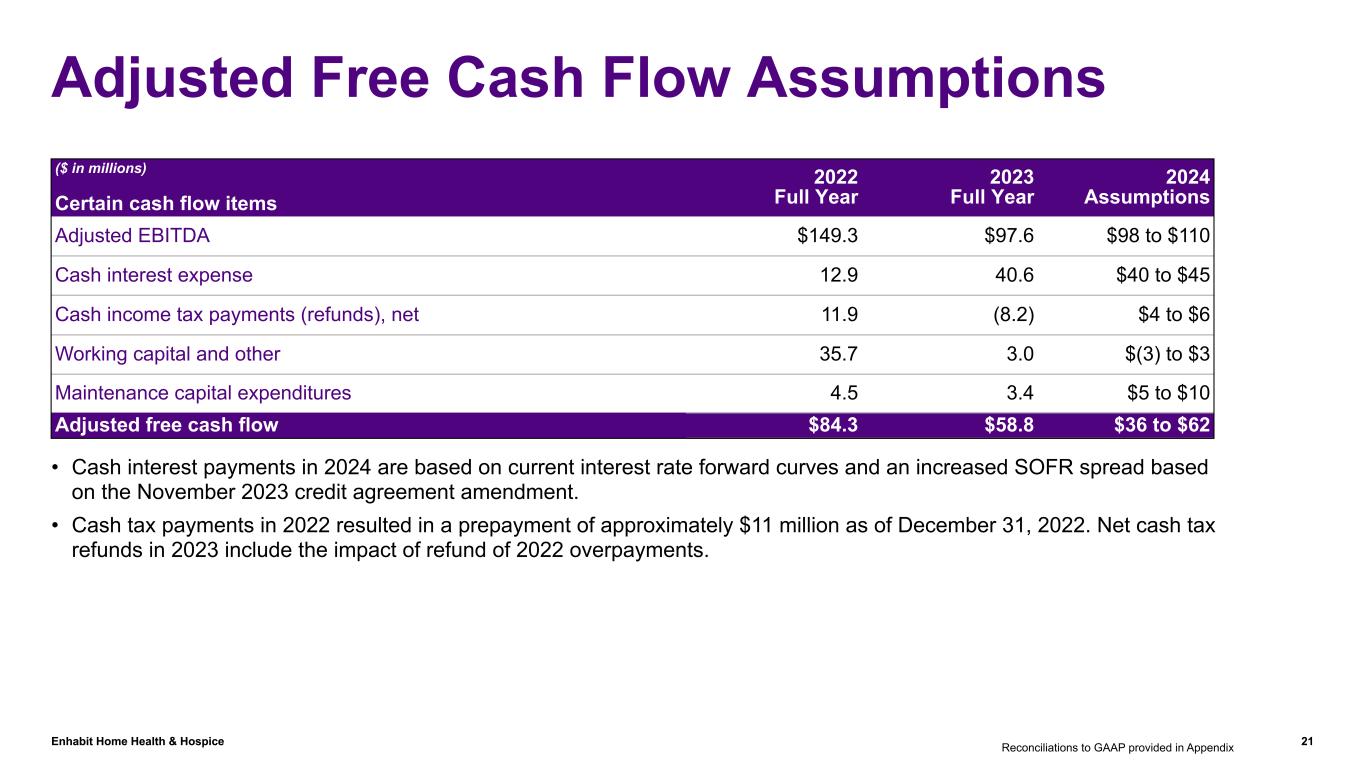

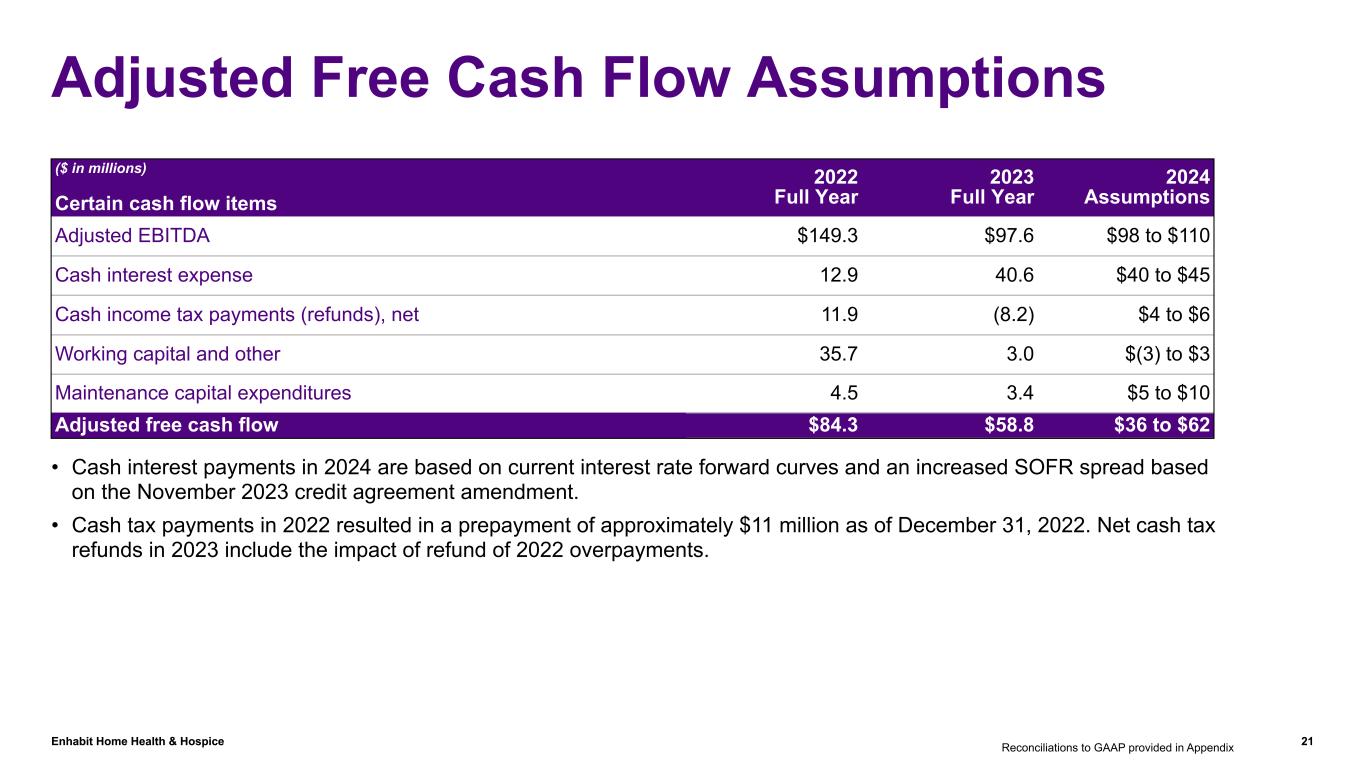

Enhabit Home Health & Hospice 21 Adjusted Free Cash Flow Assumptions ($ in millions) Certain cash flow items 2022 Full Year 2023 Full Year 2024 Assumptions Adjusted EBITDA $149.3 $97.6 $98 to $110 Cash interest expense 12.9 40.6 $40 to $45 Cash income tax payments (refunds), net 11.9 (8.2) $4 to $6 Working capital and other 35.7 3.0 $(3) to $3 Maintenance capital expenditures 4.5 3.4 $5 to $10 Adjusted free cash flow $84.3 $58.8 $36 to $62 Reconciliations to GAAP provided in Appendix • Cash interest payments in 2024 are based on current interest rate forward curves and an increased SOFR spread based on the November 2023 credit agreement amendment. • Cash tax payments in 2022 resulted in a prepayment of approximately $11 million as of December 31, 2022. Net cash tax refunds in 2023 include the impact of refund of 2022 overpayments.

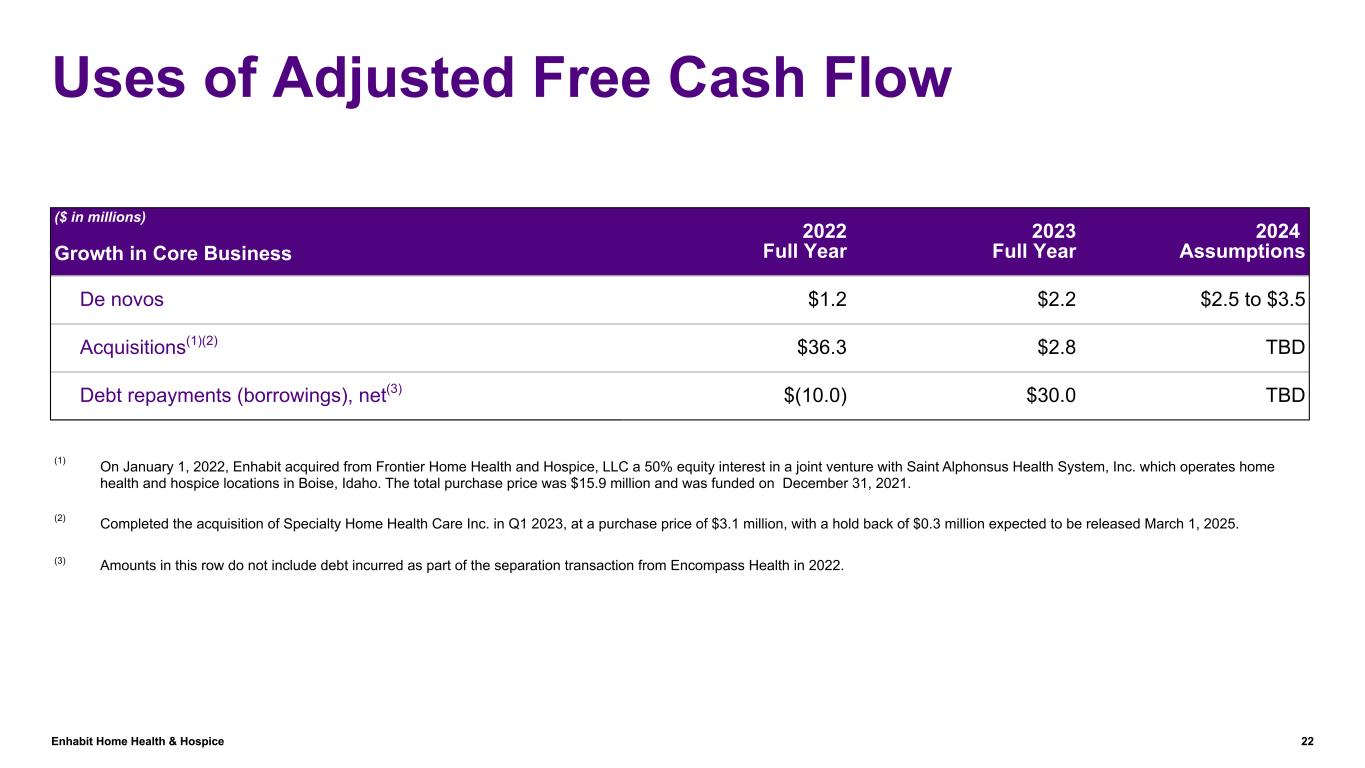

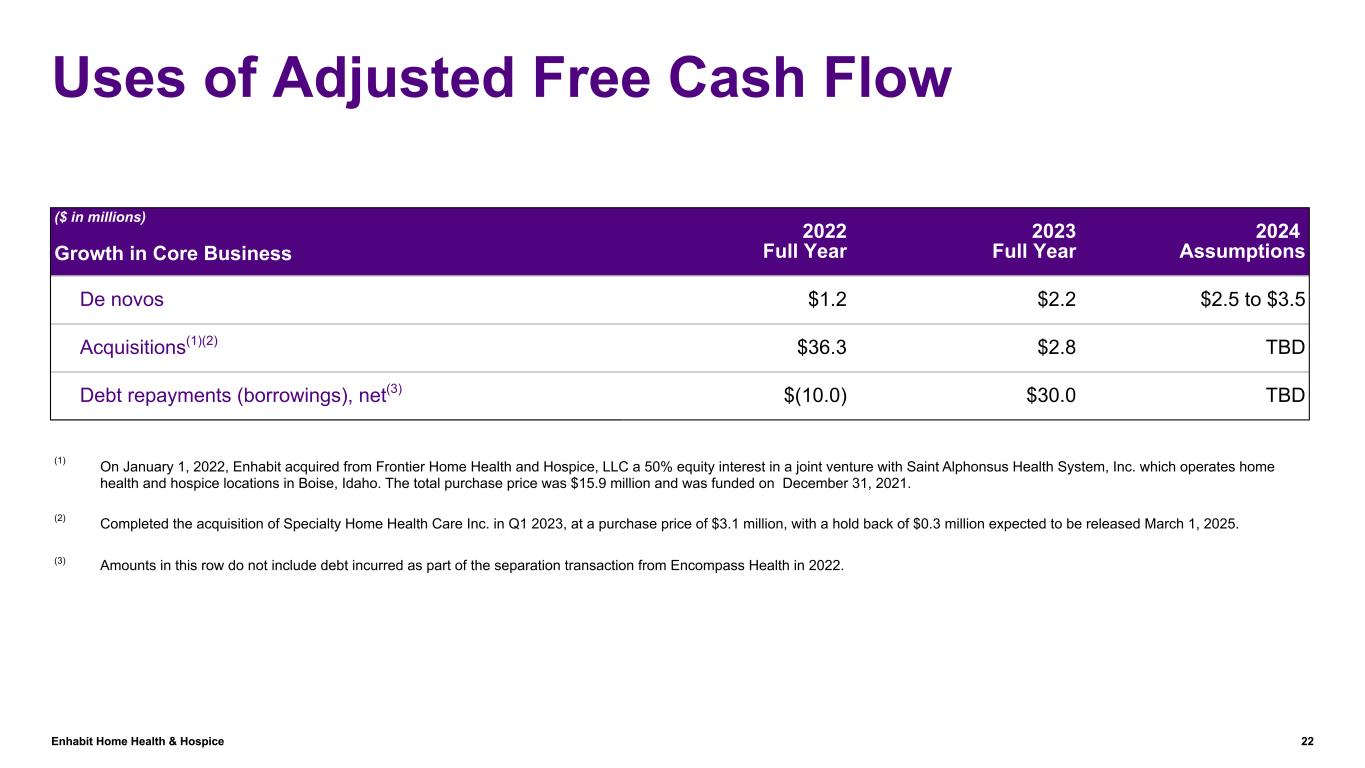

Enhabit Home Health & Hospice 22 Uses of Adjusted Free Cash Flow ($ in millions) Growth in Core Business 2022 Full Year 2023 Full Year 2024 Assumptions De novos $1.2 $2.2 $2.5 to $3.5 Acquisitions(1)(2) $36.3 $2.8 TBD Debt repayments (borrowings), net(3) $(10.0) $30.0 TBD (1) On January 1, 2022, Enhabit acquired from Frontier Home Health and Hospice, LLC a 50% equity interest in a joint venture with Saint Alphonsus Health System, Inc. which operates home health and hospice locations in Boise, Idaho. The total purchase price was $15.9 million and was funded on December 31, 2021. (2) Completed the acquisition of Specialty Home Health Care Inc. in Q1 2023, at a purchase price of $3.1 million, with a hold back of $0.3 million expected to be released March 1, 2025. (3) Amounts in this row do not include debt incurred as part of the separation transaction from Encompass Health in 2022.

Enhabit Home Health & Hospice 23 Appendix

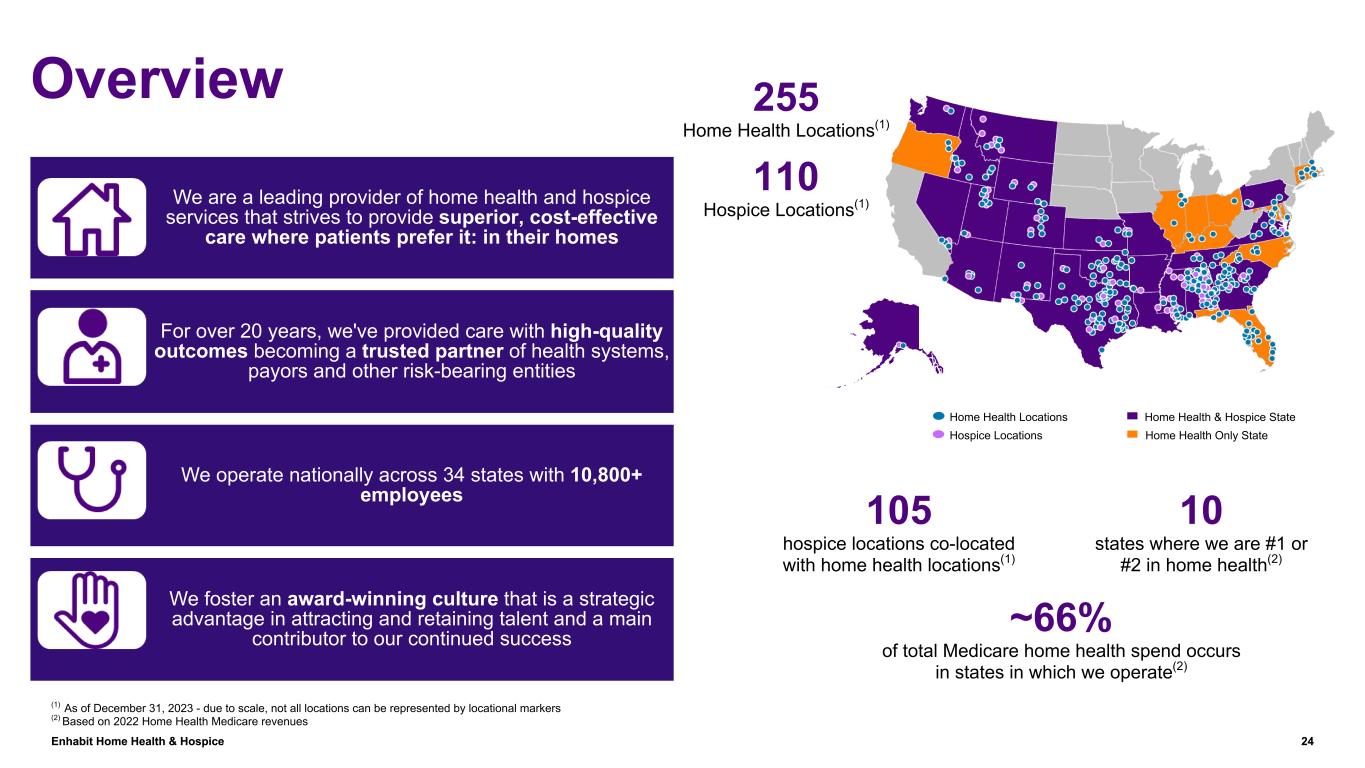

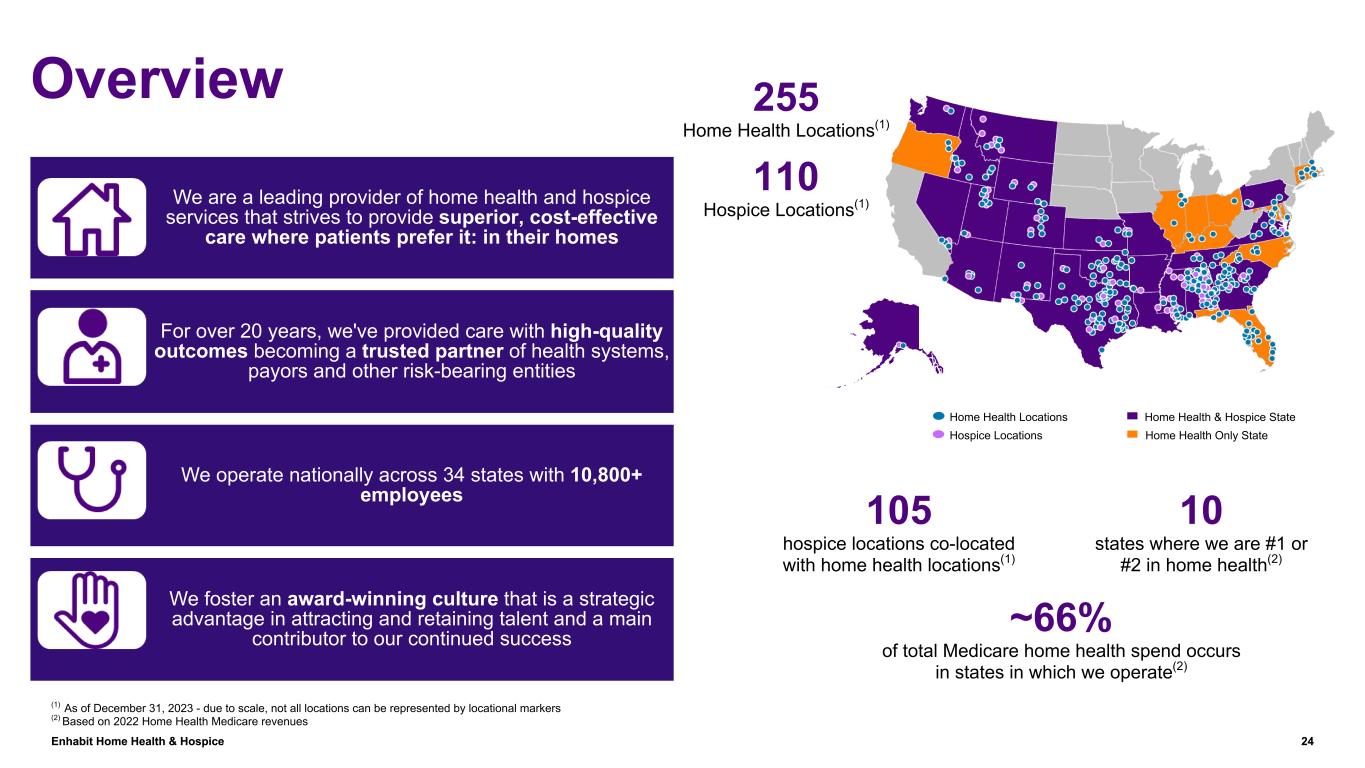

Enhabit Home Health & Hospice 24 Overview 105 hospice locations co-located with home health locations(1) 10 states where we are #1 or #2 in home health(2) ~66% of total Medicare home health spend occurs in states in which we operate(2) Home Health Locations Hospice Locations Home Health & Hospice State Home Health Only State (1) As of December 31, 2023 - due to scale, not all locations can be represented by locational markers (2) Based on 2022 Home Health Medicare revenues 110 Hospice Locations(1) 255 Home Health Locations(1) We are a leading provider of home health and hospice services that strives to provide superior, cost-effective care where patients prefer it: in their homes For over 20 years, we've provided care with high-quality outcomes becoming a trusted partner of health systems, payors and other risk-bearing entities We operate nationally across 34 states with 10,800+ employees We foster an award-winning culture that is a strategic advantage in attracting and retaining talent and a main contributor to our continued success

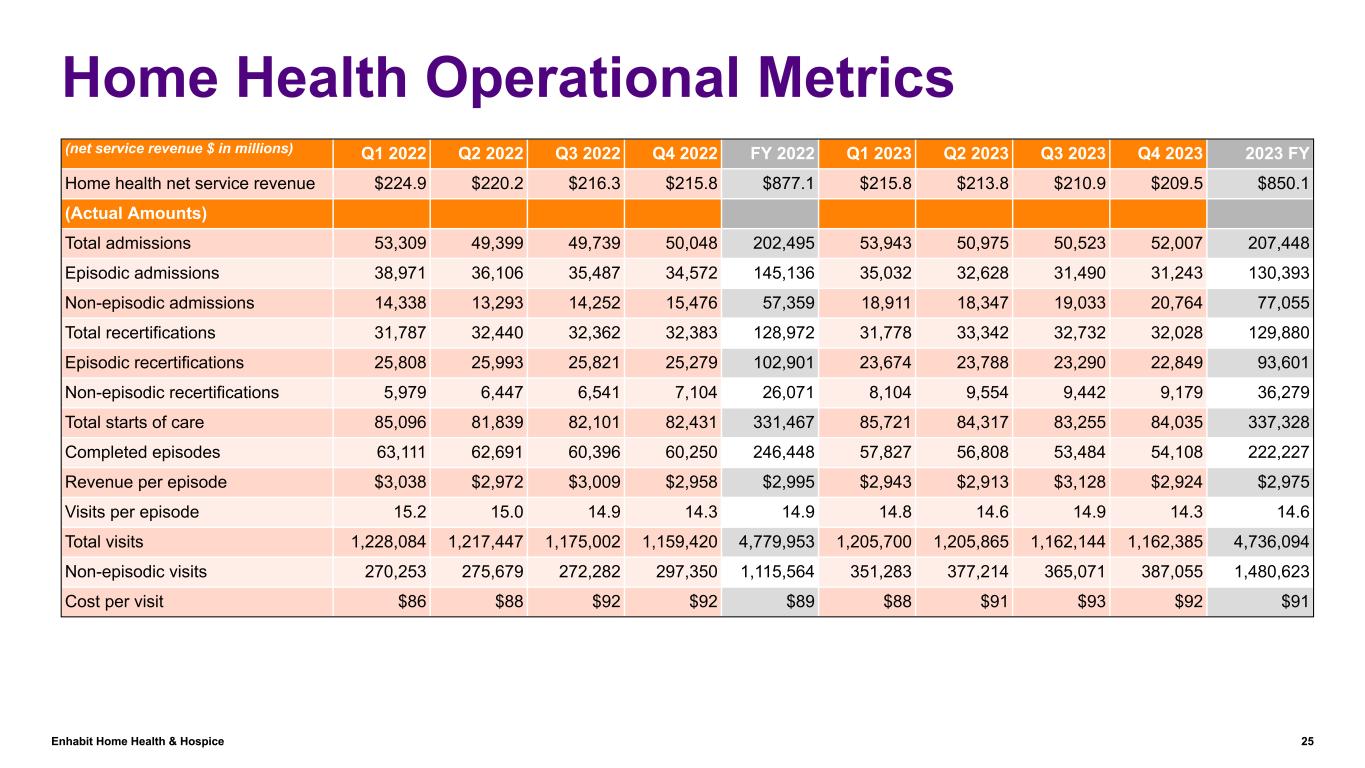

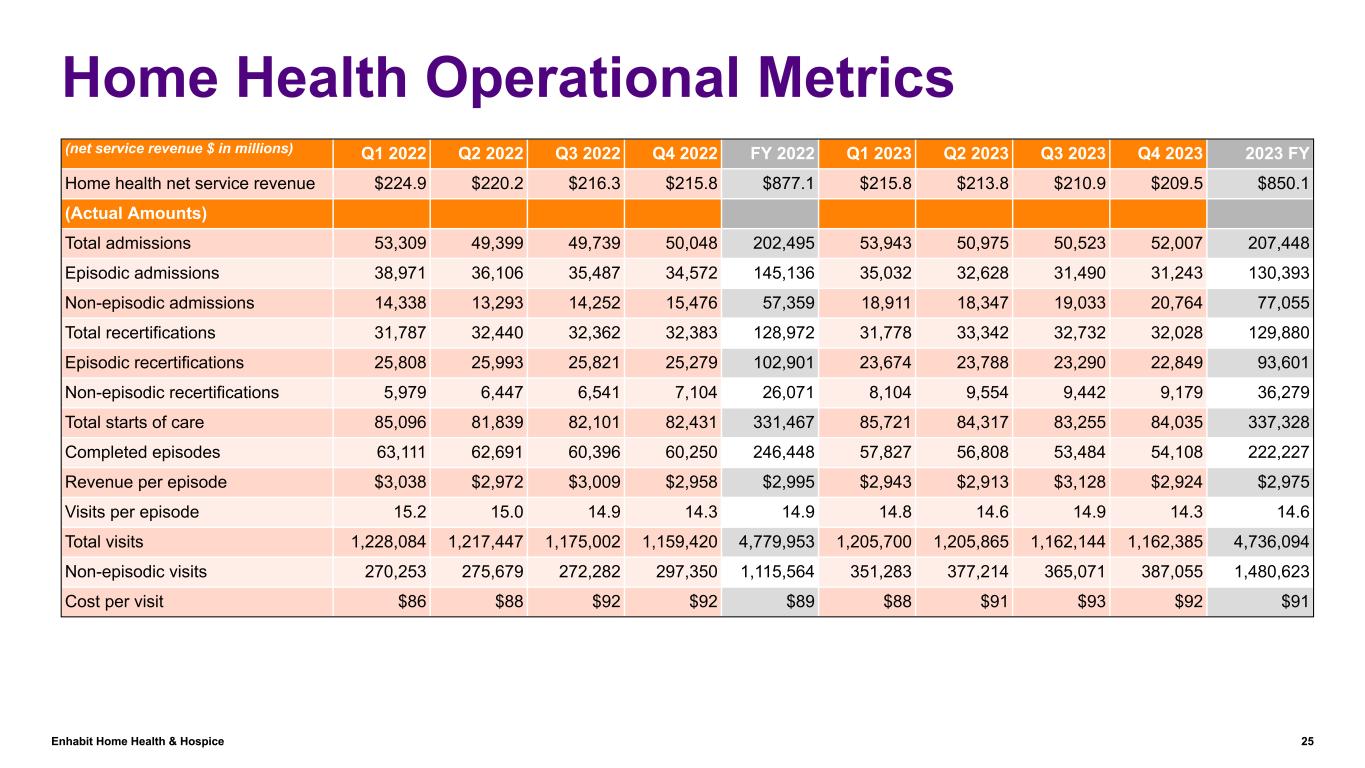

Enhabit Home Health & Hospice 25 Home Health Operational Metrics (net service revenue $ in millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 FY 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 2023 FY Home health net service revenue $224.9 $220.2 $216.3 $215.8 $877.1 $215.8 $213.8 $210.9 $209.5 $850.1 (Actual Amounts) Total admissions 53,309 49,399 49,739 50,048 202,495 53,943 50,975 50,523 52,007 207,448 Episodic admissions 38,971 36,106 35,487 34,572 145,136 35,032 32,628 31,490 31,243 130,393 Non-episodic admissions 14,338 13,293 14,252 15,476 57,359 18,911 18,347 19,033 20,764 77,055 Total recertifications 31,787 32,440 32,362 32,383 128,972 31,778 33,342 32,732 32,028 129,880 Episodic recertifications 25,808 25,993 25,821 25,279 102,901 23,674 23,788 23,290 22,849 93,601 Non-episodic recertifications 5,979 6,447 6,541 7,104 26,071 8,104 9,554 9,442 9,179 36,279 Total starts of care 85,096 81,839 82,101 82,431 331,467 85,721 84,317 83,255 84,035 337,328 Completed episodes 63,111 62,691 60,396 60,250 246,448 57,827 56,808 53,484 54,108 222,227 Revenue per episode $3,038 $2,972 $3,009 $2,958 $2,995 $2,943 $2,913 $3,128 $2,924 $2,975 Visits per episode 15.2 15.0 14.9 14.3 14.9 14.8 14.6 14.9 14.3 14.6 Total visits 1,228,084 1,217,447 1,175,002 1,159,420 4,779,953 1,205,700 1,205,865 1,162,144 1,162,385 4,736,094 Non-episodic visits 270,253 275,679 272,282 297,350 1,115,564 351,283 377,214 365,071 387,055 1,480,623 Cost per visit $86 $88 $92 $92 $89 $88 $91 $93 $92 $91

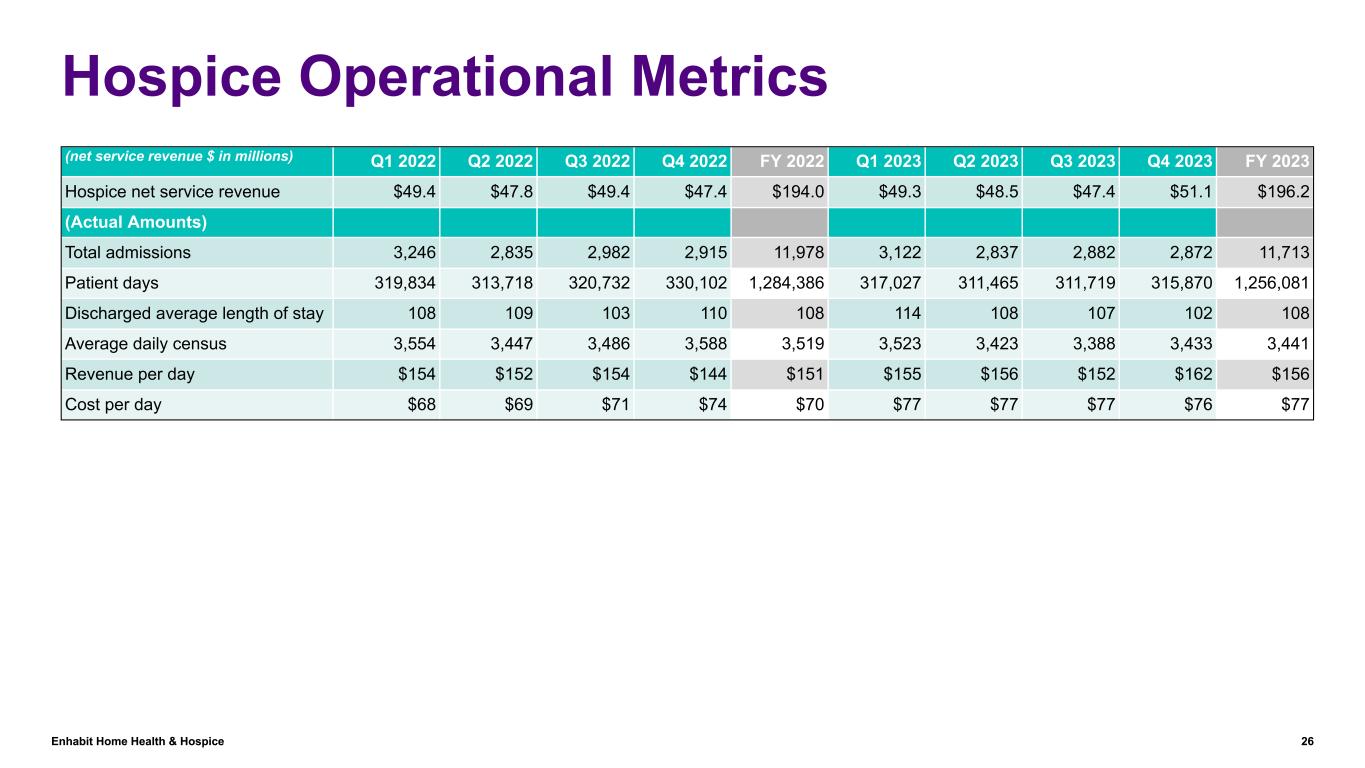

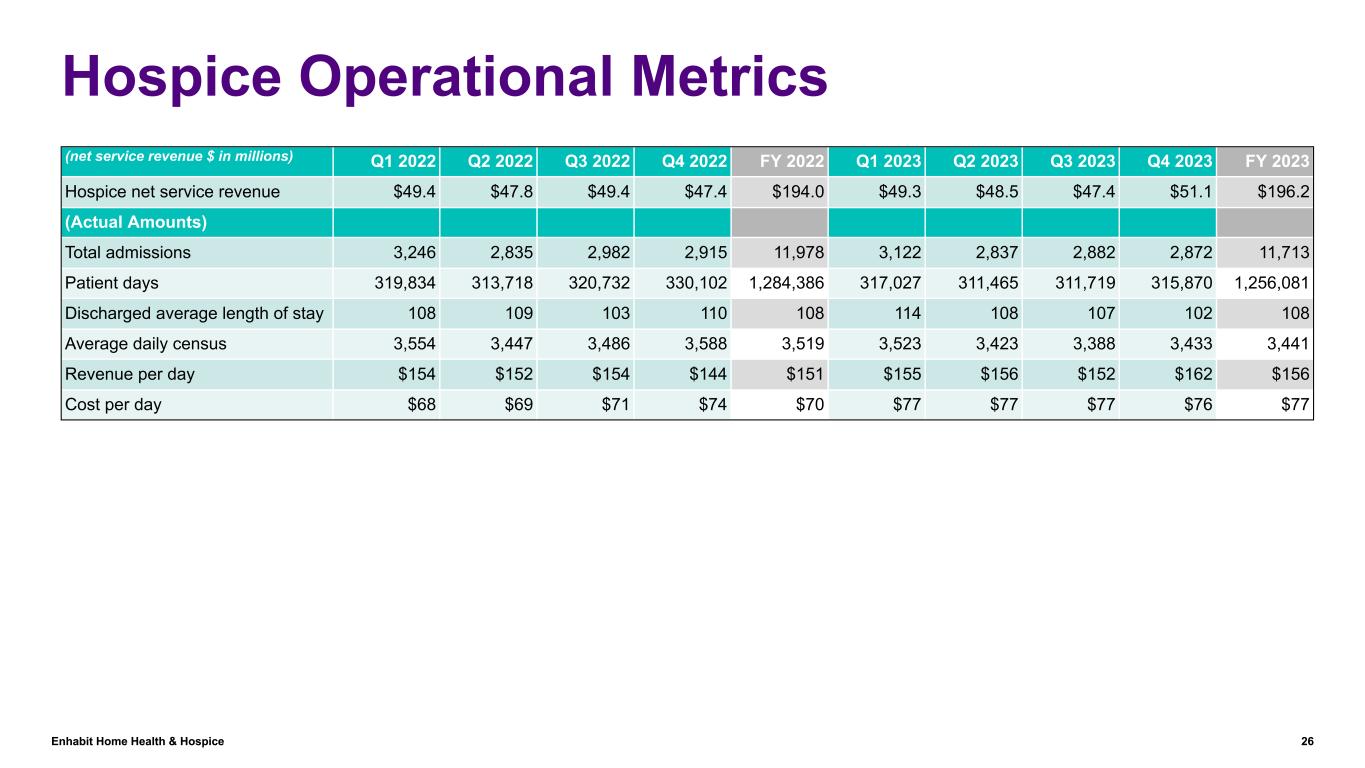

Enhabit Home Health & Hospice 26 Hospice Operational Metrics (net service revenue $ in millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 FY 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 Hospice net service revenue $49.4 $47.8 $49.4 $47.4 $194.0 $49.3 $48.5 $47.4 $51.1 $196.2 (Actual Amounts) Total admissions 3,246 2,835 2,982 2,915 11,978 3,122 2,837 2,882 2,872 11,713 Patient days 319,834 313,718 320,732 330,102 1,284,386 317,027 311,465 311,719 315,870 1,256,081 Discharged average length of stay 108 109 103 110 108 114 108 107 102 108 Average daily census 3,554 3,447 3,486 3,588 3,519 3,523 3,423 3,388 3,433 3,441 Revenue per day $154 $152 $154 $144 $151 $155 $156 $152 $162 $156 Cost per day $68 $69 $71 $74 $70 $77 $77 $77 $76 $77

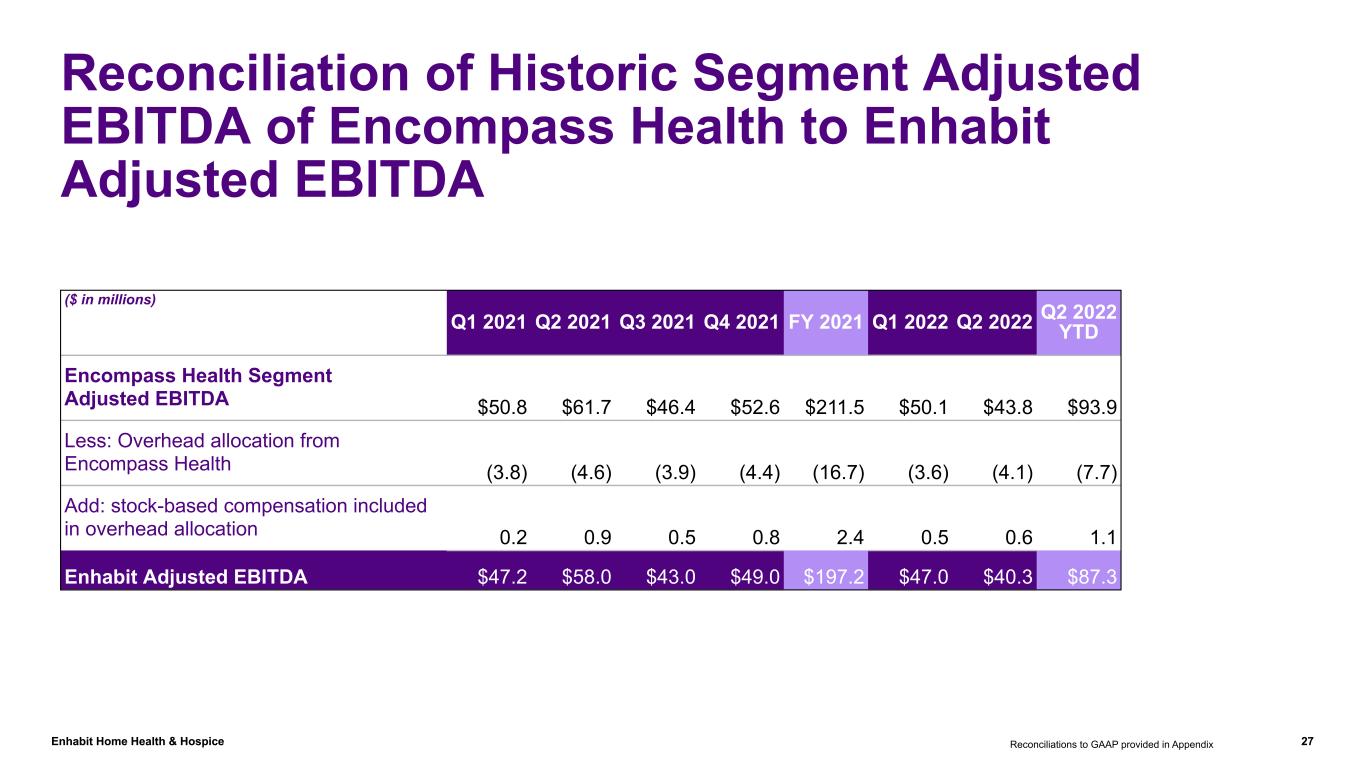

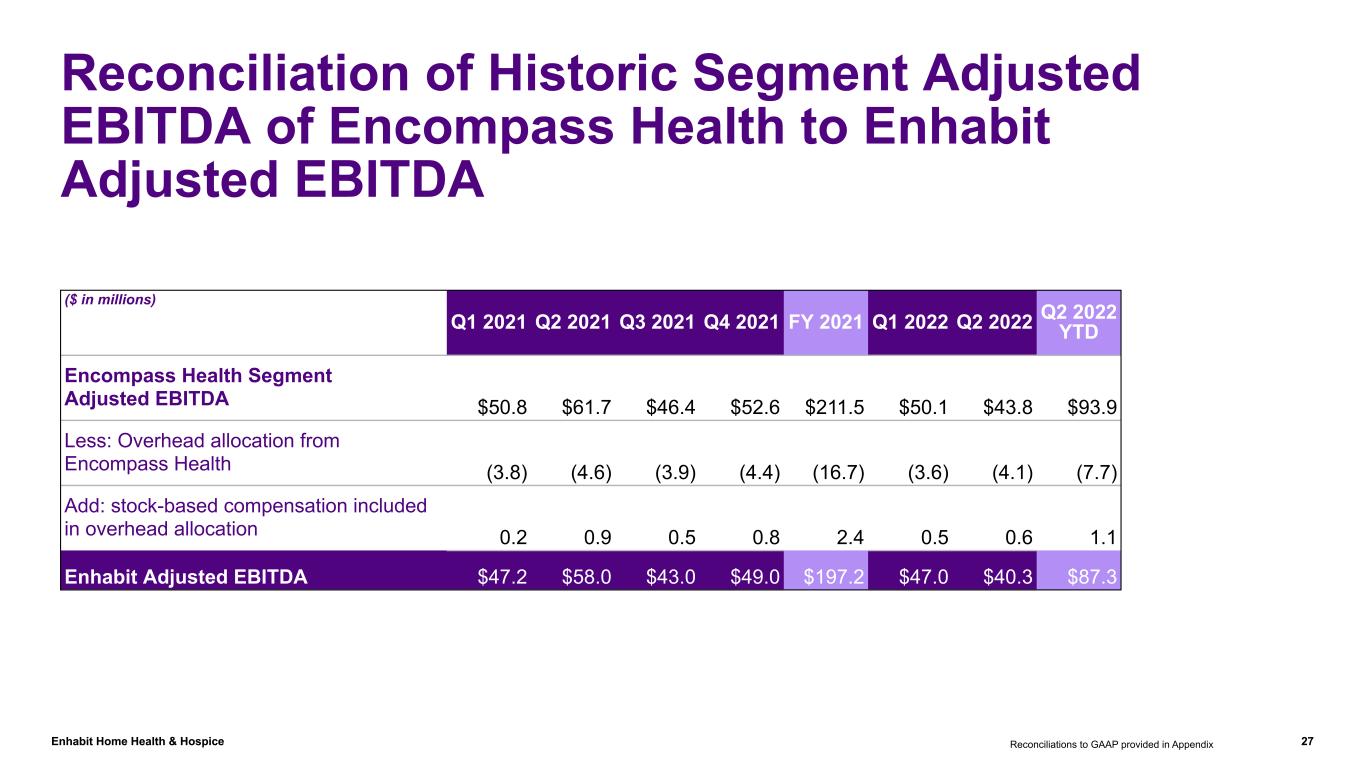

Enhabit Home Health & Hospice 27 Reconciliation of Historic Segment Adjusted EBITDA of Encompass Health to Enhabit Adjusted EBITDA PLACE HOLDER – WILL NEED: • EBITDA to Net income • Adjusted EPS to reported EPS and Net income ($ in millions) Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY 2021 Q1 2022 Q2 2022 Q2 2022 YTD Encompass Health Segment Adjusted EBITDA $50.8 $61.7 $46.4 $52.6 $211.5 $50.1 $43.8 $93.9 Less: Overhead allocation from Encompass Health (3.8) (4.6) (3.9) (4.4) (16.7) (3.6) (4.1) (7.7) Add: stock-based compensation included in overhead allocation 0.2 0.9 0.5 0.8 2.4 0.5 0.6 1.1 Enhabit Adjusted EBITDA $47.2 $58.0 $43.0 $49.0 $197.2 $47.0 $40.3 $87.3 Reconciliations to GAAP provided in Appendix

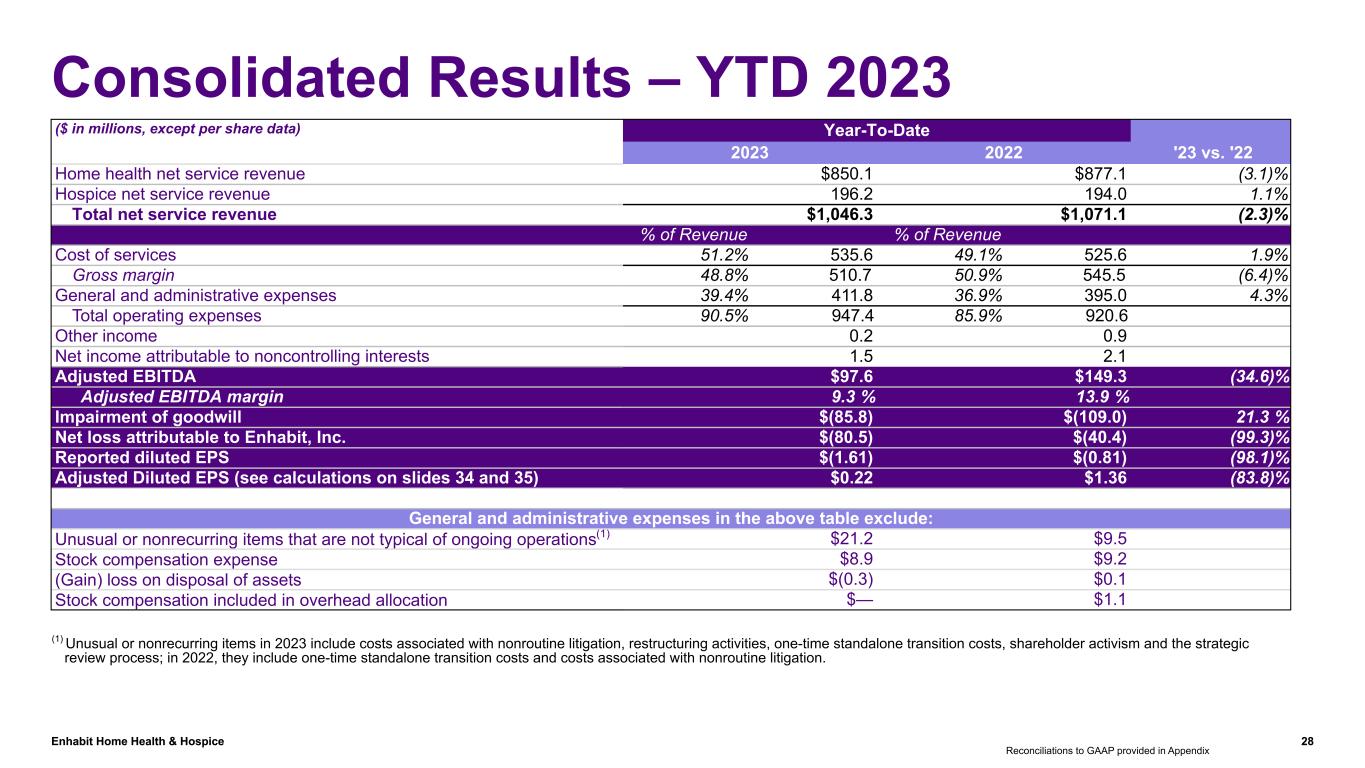

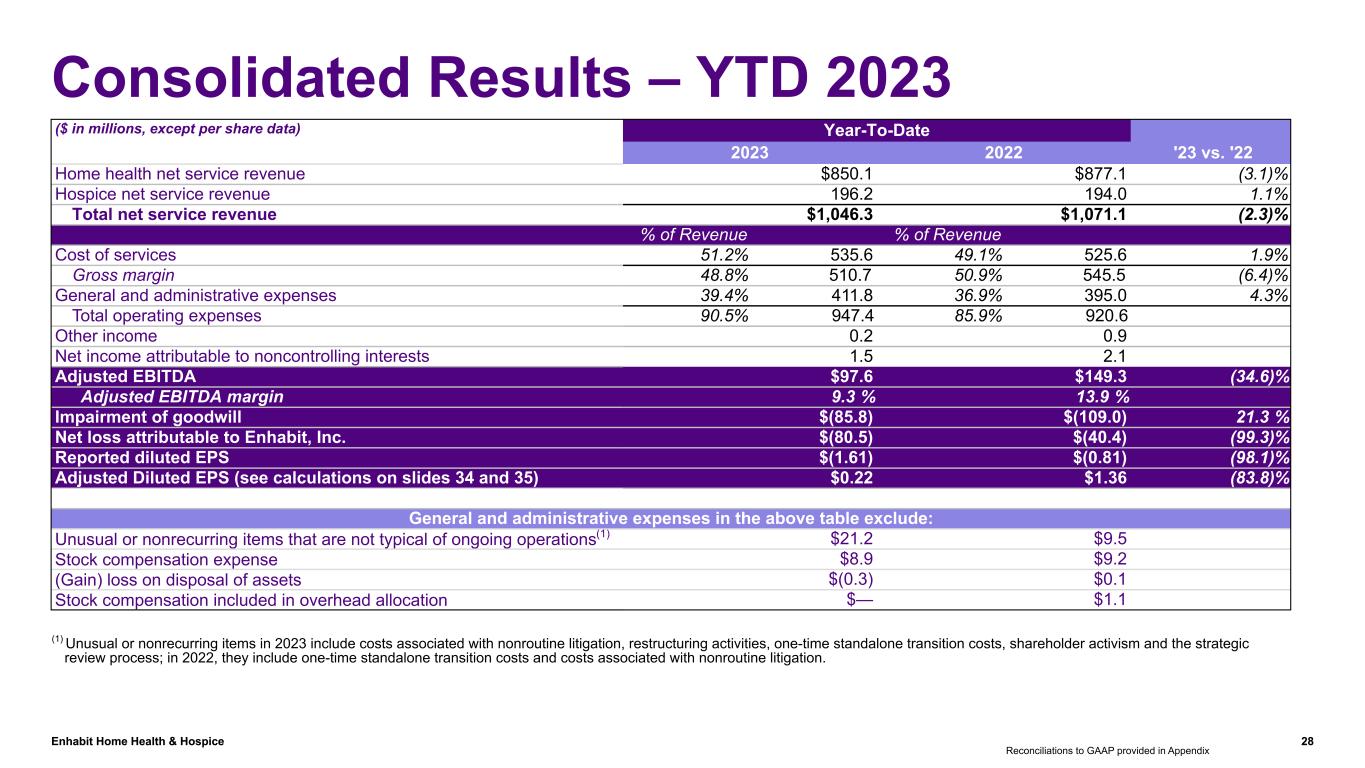

Enhabit Home Health & Hospice 28 Consolidated Results – YTD 2023 ($ in millions, except per share data) Year-To-Date '23 vs. '222023 2022 Home health net service revenue $850.1 $877.1 (3.1) % Hospice net service revenue 196.2 194.0 1.1 % Total net service revenue $1,046.3 $1,071.1 (2.3) % % of Revenue % of Revenue Cost of services 51.2 % 535.6 49.1 % 525.6 1.9 % Gross margin 48.8 % 510.7 50.9 % 545.5 (6.4) % General and administrative expenses 39.4 % 411.8 36.9 % 395.0 4.3 % Total operating expenses 90.5 % 947.4 85.9 % 920.6 Other income 0.2 0.9 Net income attributable to noncontrolling interests 1.5 2.1 Adjusted EBITDA $97.6 $149.3 (34.6) % Adjusted EBITDA margin 9.3 % 13.9 % Impairment of goodwill $(85.8) $(109.0) 21.3 % Net loss attributable to Enhabit, Inc. $(80.5) $(40.4) (99.3) % Reported diluted EPS $(1.61) $(0.81) (98.1) % Adjusted Diluted EPS (see calculations on slides 34 and 35) $0.22 $1.36 (83.8) % General and administrative expenses in the above table exclude: Unusual or nonrecurring items that are not typical of ongoing operations(1) $21.2 $9.5 Stock compensation expense $8.9 $9.2 (Gain) loss on disposal of assets $(0.3) $0.1 Stock compensation included in overhead allocation $— $1.1 Reconciliations to GAAP provided in Appendix (1) Unusual or nonrecurring items in 2023 include costs associated with nonroutine litigation, restructuring activities, one-time standalone transition costs, shareholder activism and the strategic review process; in 2022, they include one-time standalone transition costs and costs associated with nonroutine litigation.

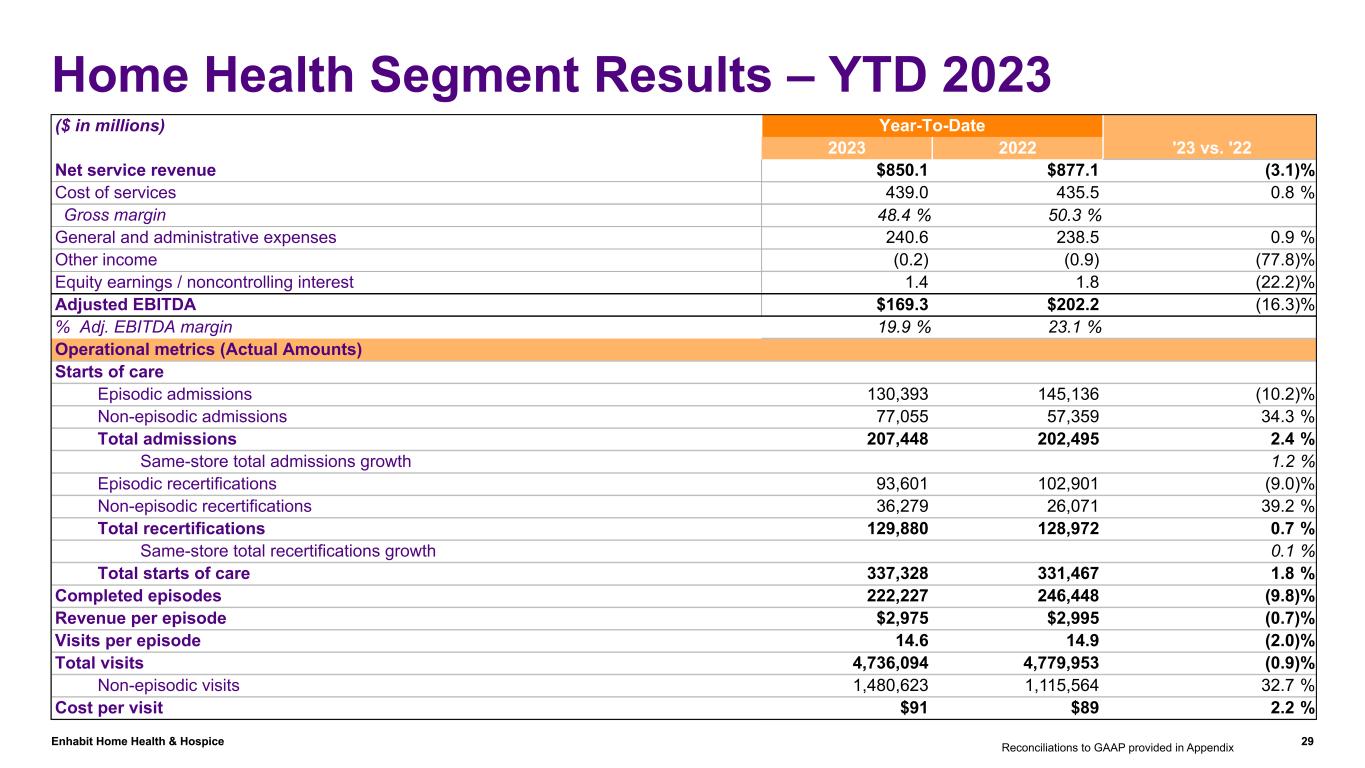

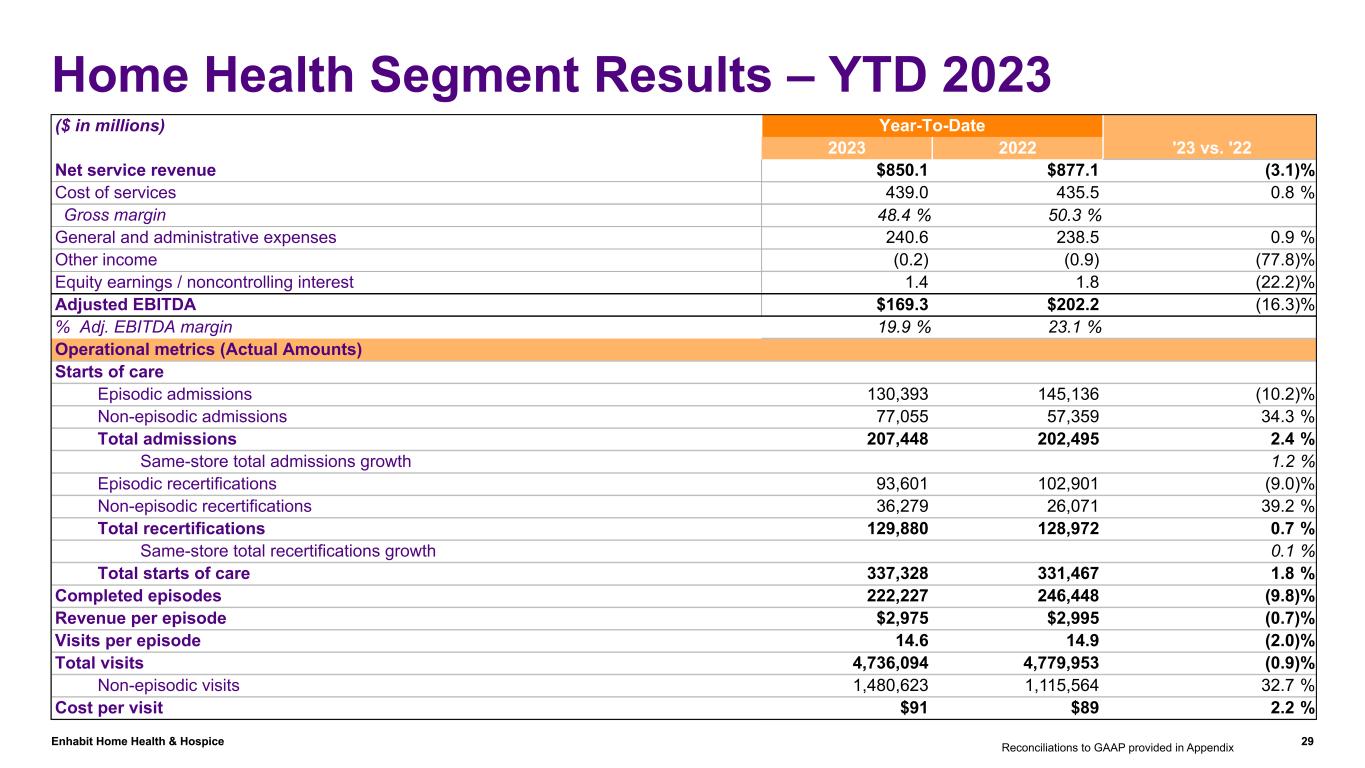

Enhabit Home Health & Hospice 29 Home Health Segment Results – YTD 2023 ($ in millions) Year-To-Date '23 vs. '222023 2022 Net service revenue $850.1 $877.1 (3.1) % Cost of services 439.0 435.5 0.8 % Gross margin 48.4 % 50.3 % General and administrative expenses 240.6 238.5 0.9 % Other income (0.2) (0.9) (77.8) % Equity earnings / noncontrolling interest 1.4 1.8 (22.2) % Adjusted EBITDA $169.3 $202.2 (16.3) % % Adj. EBITDA margin 19.9 % 23.1 % Operational metrics (Actual Amounts) Starts of care Episodic admissions 130,393 145,136 (10.2) % Non-episodic admissions 77,055 57,359 34.3 % Total admissions 207,448 202,495 2.4 % Same-store total admissions growth 1.2 % Episodic recertifications 93,601 102,901 (9.0) % Non-episodic recertifications 36,279 26,071 39.2 % Total recertifications 129,880 128,972 0.7 % Same-store total recertifications growth 0.1 % Total starts of care 337,328 331,467 1.8 % Completed episodes 222,227 246,448 (9.8) % Revenue per episode $2,975 $2,995 (0.7) % Visits per episode 14.6 14.9 (2.0) % Total visits 4,736,094 4,779,953 (0.9) % Non-episodic visits 1,480,623 1,115,564 32.7 % Cost per visit $91 $89 2.2 % Reconciliations to GAAP provided in Appendix

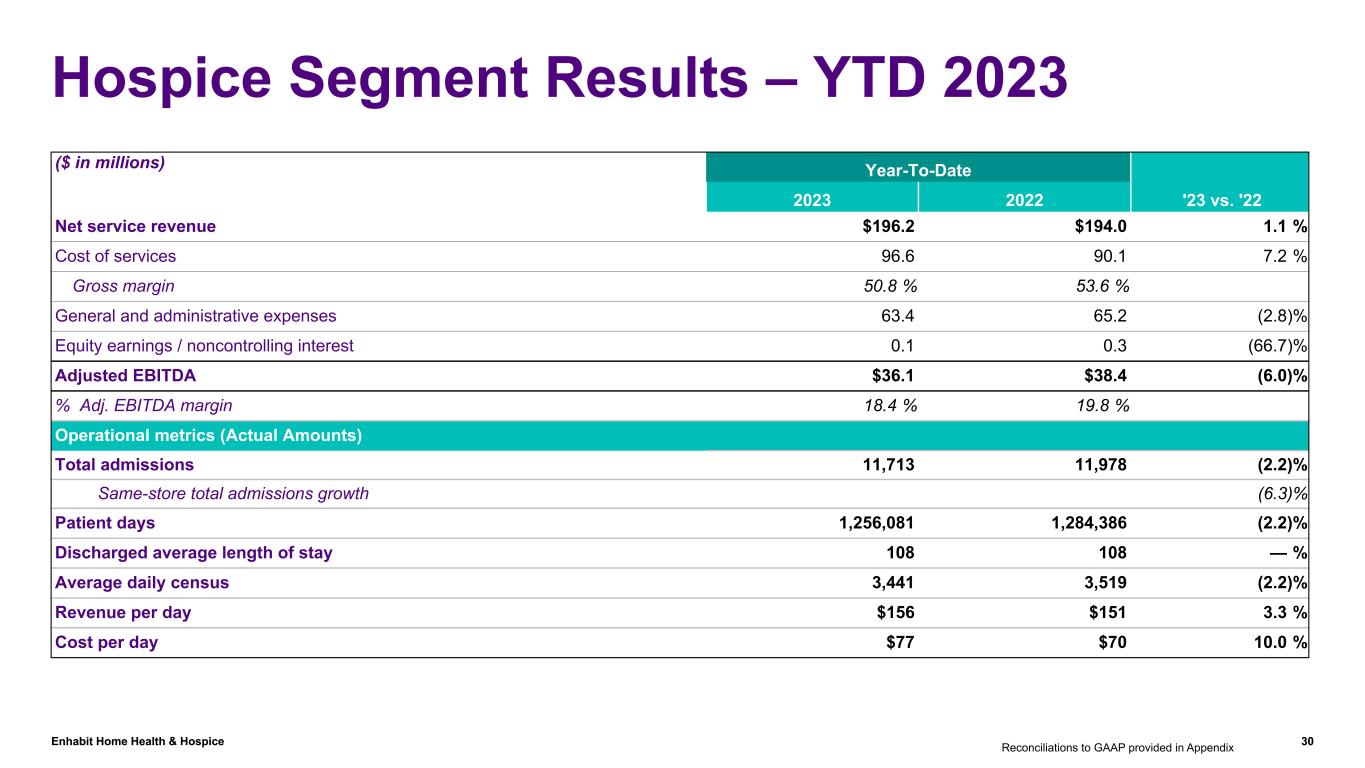

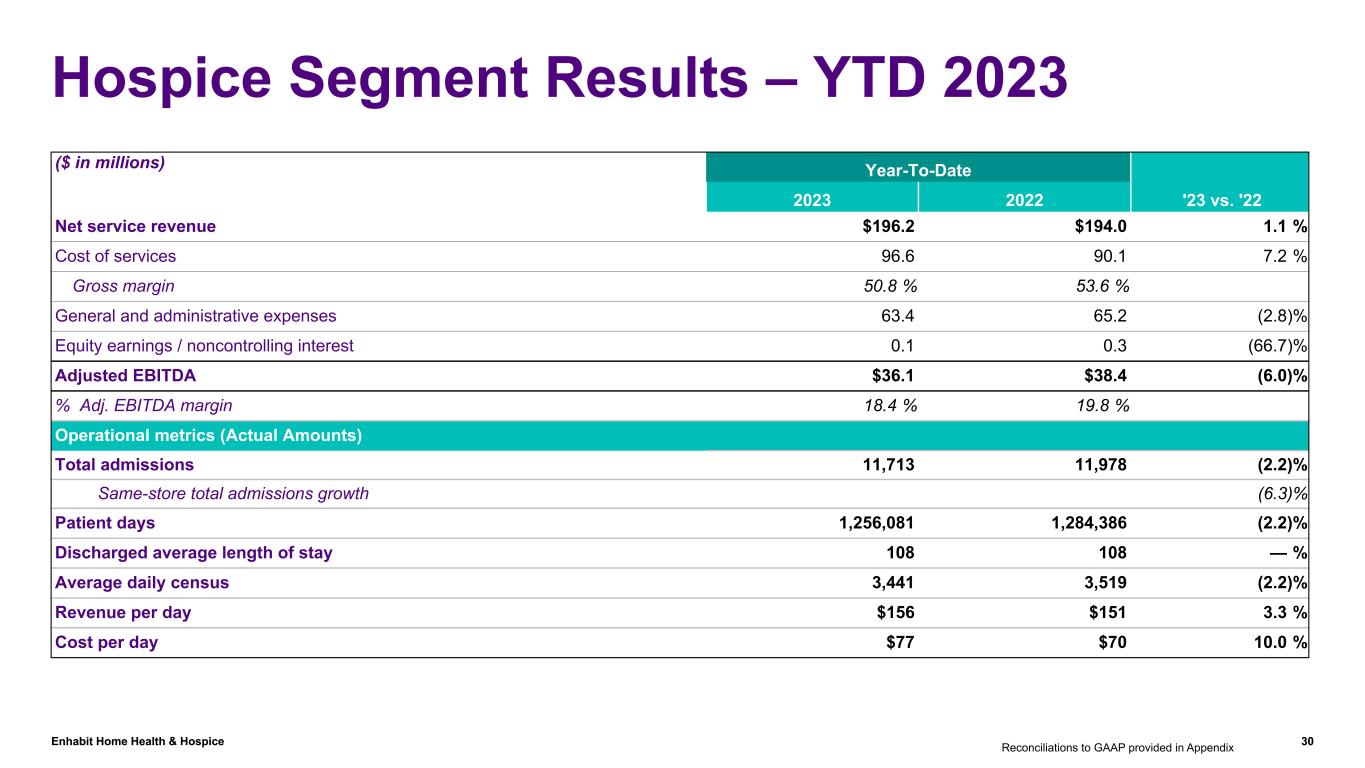

Enhabit Home Health & Hospice 30 Hospice Segment Results – YTD 2023 ($ in millions) Year-To-Date '23 vs. '222023 2022 Net service revenue $196.2 $194.0 1.1 % Cost of services 96.6 90.1 7.2 % Gross margin 50.8 % 53.6 % General and administrative expenses 63.4 65.2 (2.8) % Equity earnings / noncontrolling interest 0.1 0.3 (66.7) % Adjusted EBITDA $36.1 $38.4 (6.0) % % Adj. EBITDA margin 18.4 % 19.8 % Operational metrics (Actual Amounts) Total admissions 11,713 11,978 (2.2) % Same-store total admissions growth (6.3) % Patient days 1,256,081 1,284,386 (2.2) % Discharged average length of stay 108 108 — % Average daily census 3,441 3,519 (2.2) % Revenue per day $156 $151 3.3 % Cost per day $77 $70 10.0 % Reconciliations to GAAP provided in Appendix

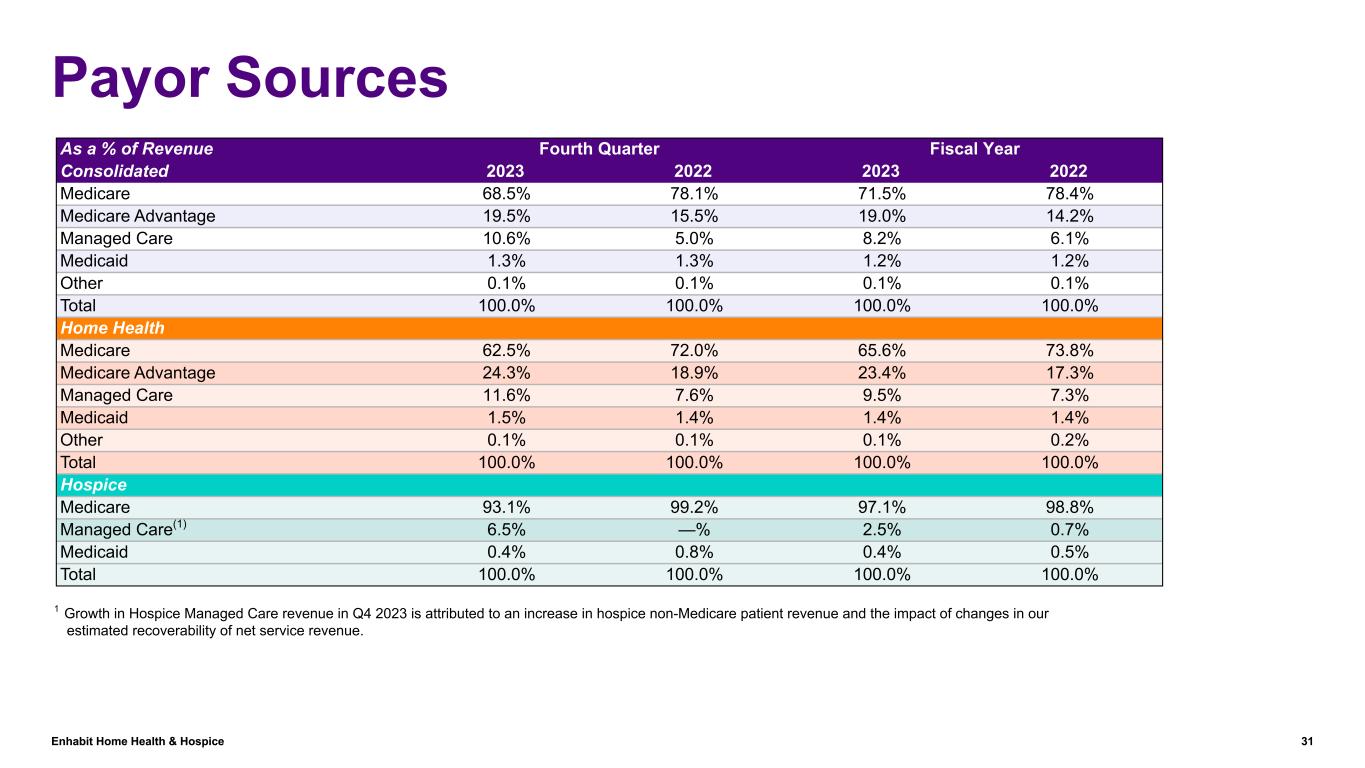

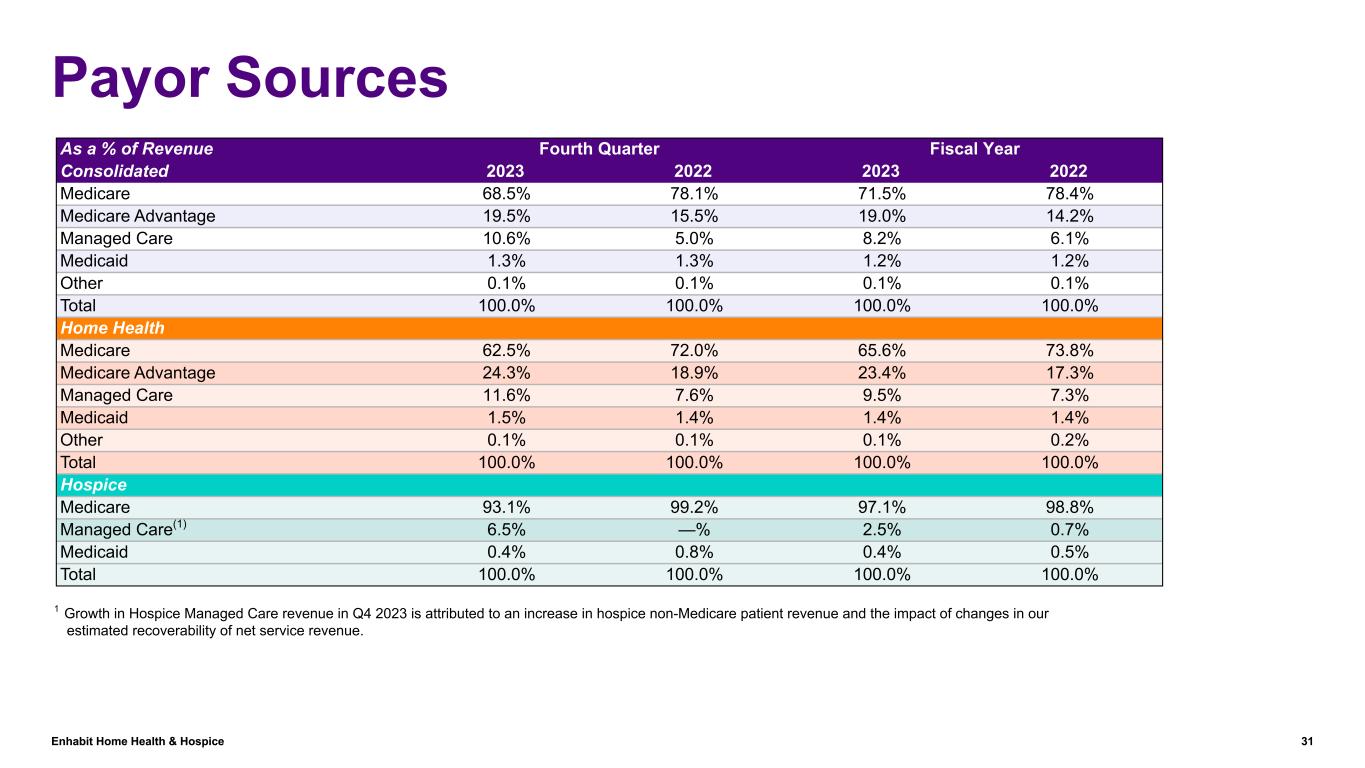

Enhabit Home Health & Hospice 31 Payor Sources As a % of Revenue Fourth Quarter Fiscal Year Consolidated 2023 2022 2023 2022 Medicare 68.5% 78.1% 71.5% 78.4% Medicare Advantage 19.5% 15.5% 19.0% 14.2% Managed Care 10.6% 5.0% 8.2% 6.1% Medicaid 1.3% 1.3% 1.2% 1.2% Other 0.1% 0.1% 0.1% 0.1% Total 100.0% 100.0% 100.0% 100.0% Home Health Medicare 62.5% 72.0% 65.6% 73.8% Medicare Advantage 24.3% 18.9% 23.4% 17.3% Managed Care 11.6% 7.6% 9.5% 7.3% Medicaid 1.5% 1.4% 1.4% 1.4% Other 0.1% 0.1% 0.1% 0.2% Total 100.0% 100.0% 100.0% 100.0% Hospice Medicare 93.1% 99.2% 97.1% 98.8% Managed Care(1) 6.5% —% 2.5% 0.7% Medicaid 0.4% 0.8% 0.4% 0.5% Total 100.0% 100.0% 100.0% 100.0% 1 Growth in Hospice Managed Care revenue in Q4 2023 is attributed to an increase in hospice non-Medicare patient revenue and the impact of changes in our estimated recoverability of net service revenue.

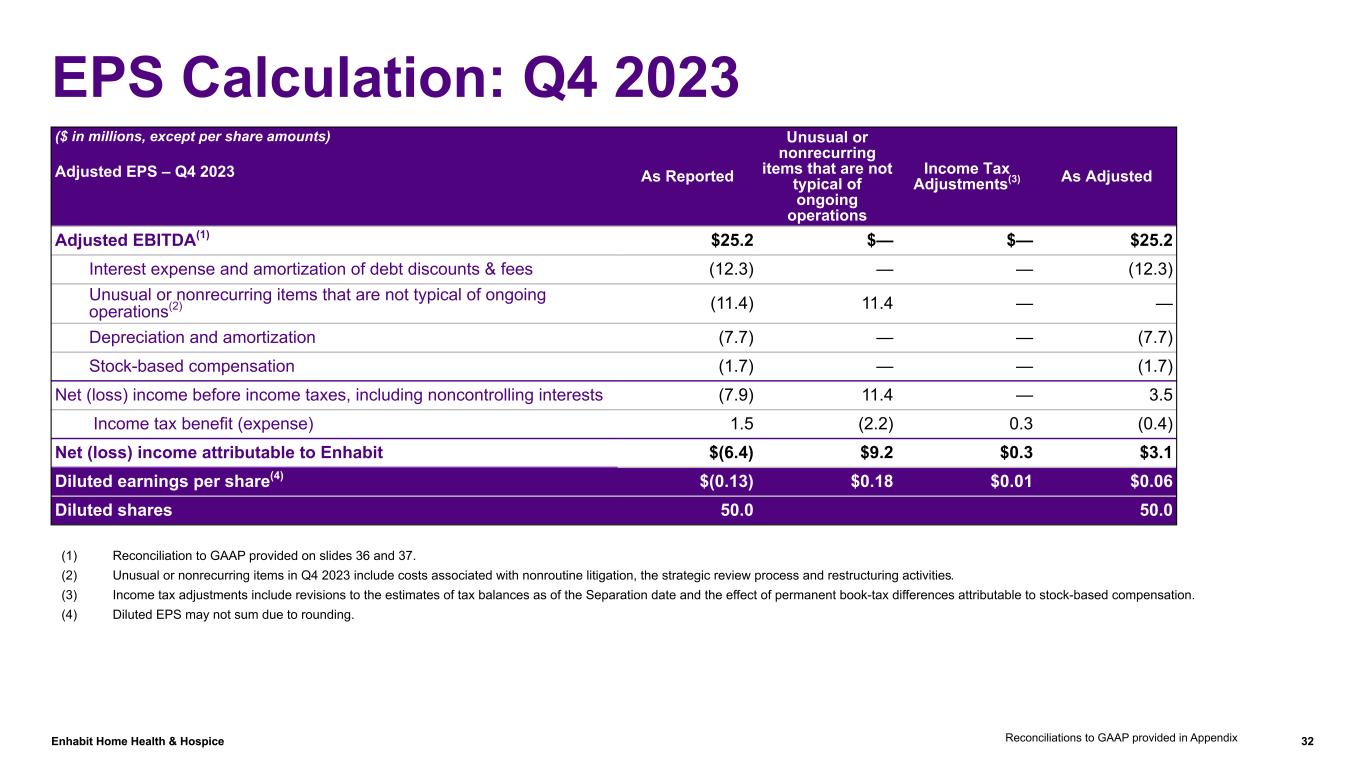

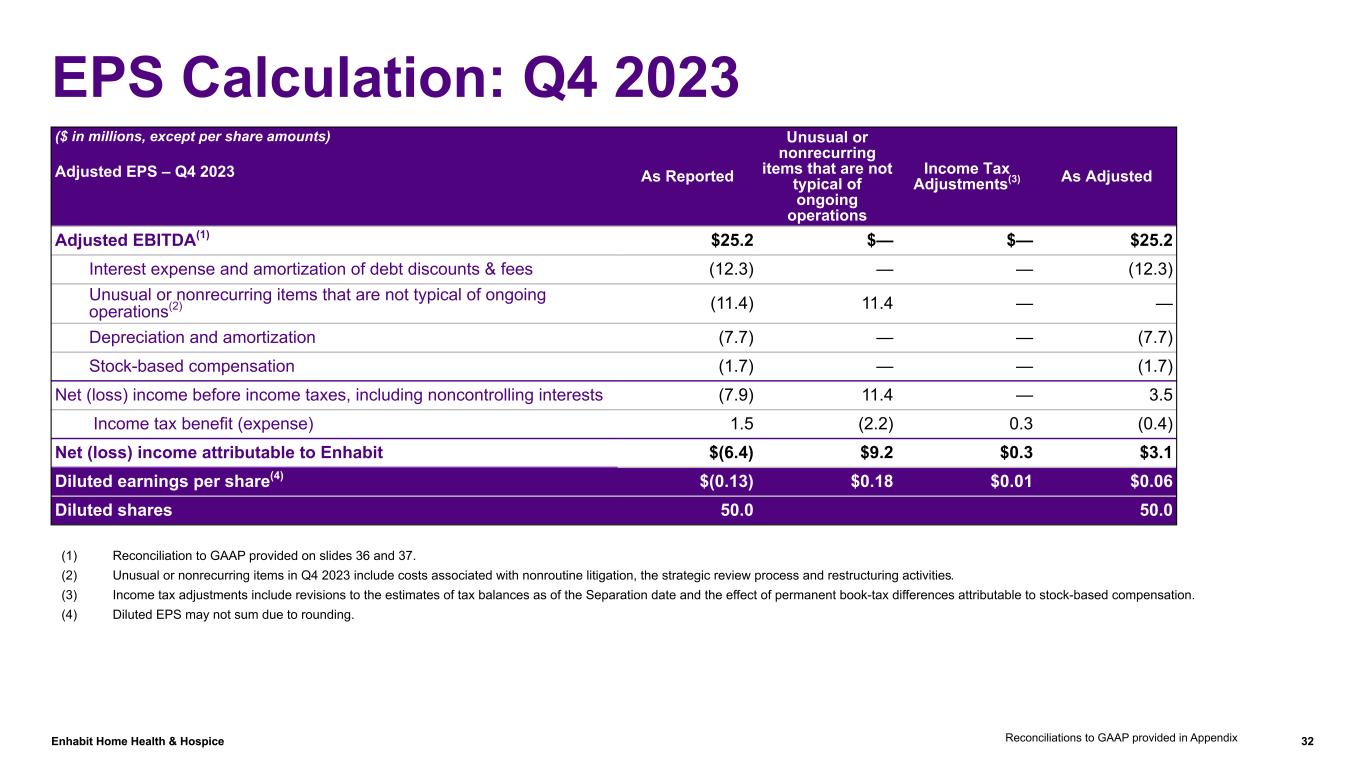

Enhabit Home Health & Hospice 32 EPS Calculation: Q4 2023 ($ in millions, except per share amounts) Adjusted EPS – Q4 2023 As Reported Unusual or nonrecurring items that are not typical of ongoing operations Income Tax Adjustments(3) As Adjusted Adjusted EBITDA(1) $25.2 $— $— $25.2 Interest expense and amortization of debt discounts & fees (12.3) — — (12.3) Unusual or nonrecurring items that are not typical of ongoing operations(2) (11.4) 11.4 — — Depreciation and amortization (7.7) — — (7.7) Stock-based compensation (1.7) — — (1.7) Net (loss) income before income taxes, including noncontrolling interests (7.9) 11.4 — 3.5 Income tax benefit (expense) 1.5 (2.2) 0.3 (0.4) Net (loss) income attributable to Enhabit $(6.4) $9.2 $0.3 $3.1 Diluted earnings per share(4) $(0.13) $0.18 $0.01 $0.06 Diluted shares 50.0 50.0 (1) Reconciliation to GAAP provided on slides 36 and 37. (2) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities. (3) Income tax adjustments include revisions to the estimates of tax balances as of the Separation date and the effect of permanent book-tax differences attributable to stock-based compensation. (4) Diluted EPS may not sum due to rounding. Reconciliations to GAAP provided in Appendix

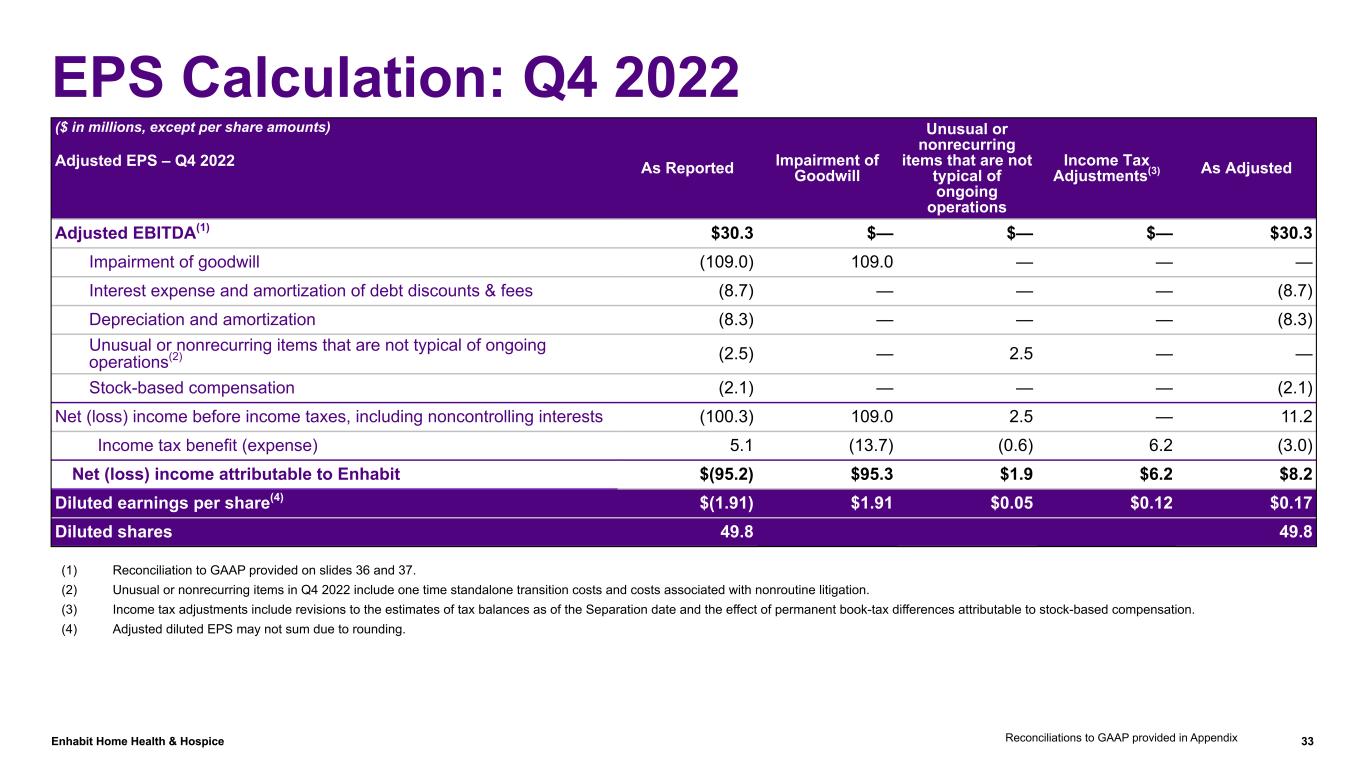

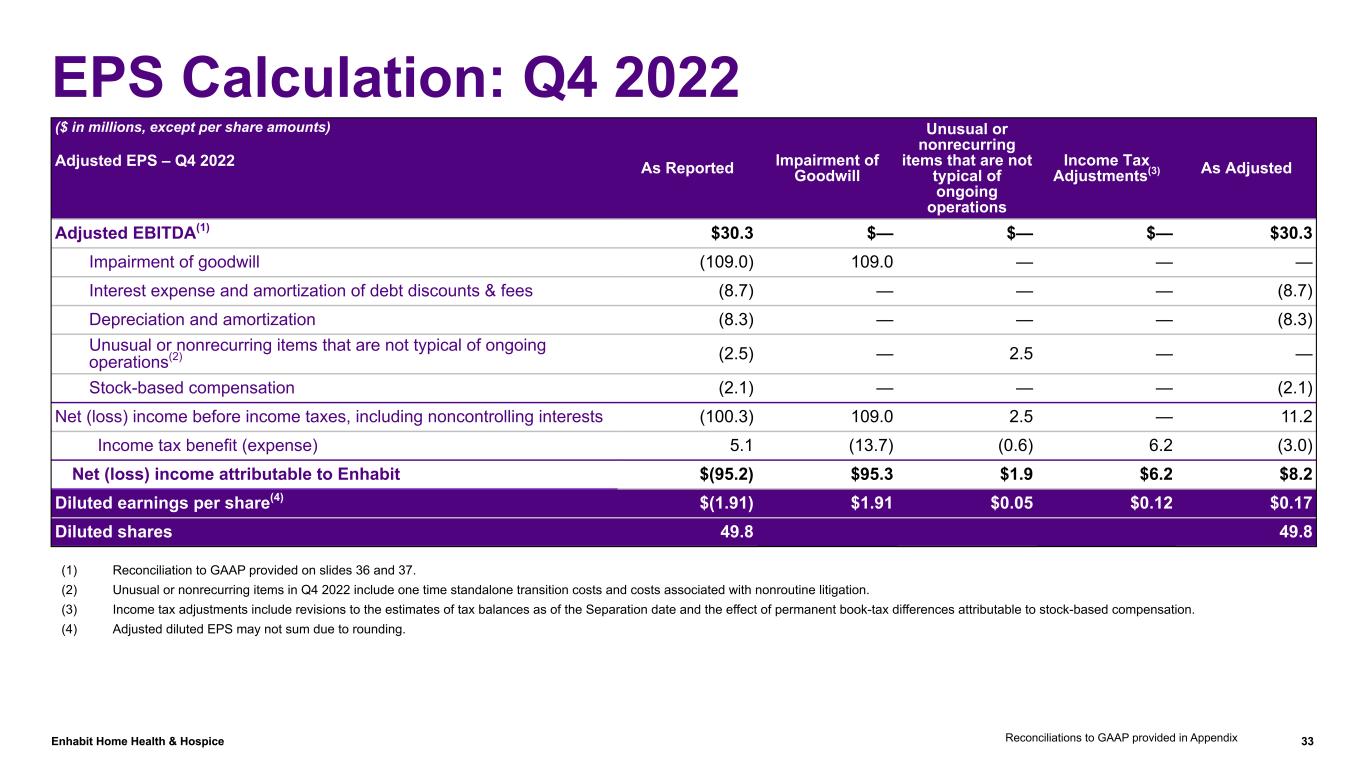

Enhabit Home Health & Hospice 33 EPS Calculation: Q4 2022 ($ in millions, except per share amounts) Adjusted EPS – Q4 2022 As Reported Impairment of Goodwill Unusual or nonrecurring items that are not typical of ongoing operations Income Tax Adjustments(3) As Adjusted Adjusted EBITDA(1) $30.3 $— $— $— $30.3 Impairment of goodwill (109.0) 109.0 — — — Interest expense and amortization of debt discounts & fees (8.7) — — — (8.7) Depreciation and amortization (8.3) — — — (8.3) Unusual or nonrecurring items that are not typical of ongoing operations(2) (2.5) — 2.5 — — Stock-based compensation (2.1) — — — (2.1) Net (loss) income before income taxes, including noncontrolling interests (100.3) 109.0 2.5 — 11.2 Income tax benefit (expense) 5.1 (13.7) (0.6) 6.2 (3.0) Net (loss) income attributable to Enhabit $(95.2) $95.3 $1.9 $6.2 $8.2 Diluted earnings per share(4) $(1.91) $1.91 $0.05 $0.12 $0.17 Diluted shares 49.8 49.8 (1) Reconciliation to GAAP provided on slides 36 and 37. (2) Unusual or nonrecurring items in Q4 2022 include one time standalone transition costs and costs associated with nonroutine litigation. (3) Income tax adjustments include revisions to the estimates of tax balances as of the Separation date and the effect of permanent book-tax differences attributable to stock-based compensation. (4) Adjusted diluted EPS may not sum due to rounding. Reconciliations to GAAP provided in Appendix

Enhabit Home Health & Hospice 34 EPS Calculation: YTD 2023 ($ in millions, except per share amounts) Adjusted EPS – YTD 2023 As Reported Impairment of Goodwill Unusual or nonrecurring items that are not typical of ongoing operations Income Tax Adjustments(3) As Adjusted Adjusted EBITDA(1) $97.6 $— $— $— $97.6 Impairment of goodwill (85.8) 85.8 — — — Interest expense and amortization of debt discounts & fees (43.0) — — — (43.0) Depreciation and amortization (30.9) — — — (30.9) Unusual or nonrecurring items that are not typical of ongoing operations (2) (21.2) — 21.2 — — Stock-based compensation (8.9) — — — (8.9) Gain on disposal or impairment of assets 0.3 — — — 0.3 Net (loss) income before income taxes, including noncontrolling interests (91.9) 85.8 21.2 — 15.1 Income tax benefit (expense) 11.4 (11.1) (5.1) 0.9 (3.9) Net (loss) income attributable to Enhabit $(80.5) $74.7 $16.1 $0.9 $11.2 Diluted earnings per share(4) (1.61) 1.50 0.32 0.02 0.22 Diluted shares 49.9 49.9 (1) Reconciliation to GAAP provided on slide 36 and 37. (2) Unusual or nonrecurring items in 2023 include costs associated with nonroutine litigation, restructuring activities, one-time standalone transition costs, shareholder activism and the strategic review process. (3) Income tax adjustments include revisions to the estimates of tax balances as of the Separation date and the effect of permanent book-tax differences attributable to stock-based compensation. (4) Diluted EPS may not sum due to rounding. Reconciliations to GAAP provided in Appendix

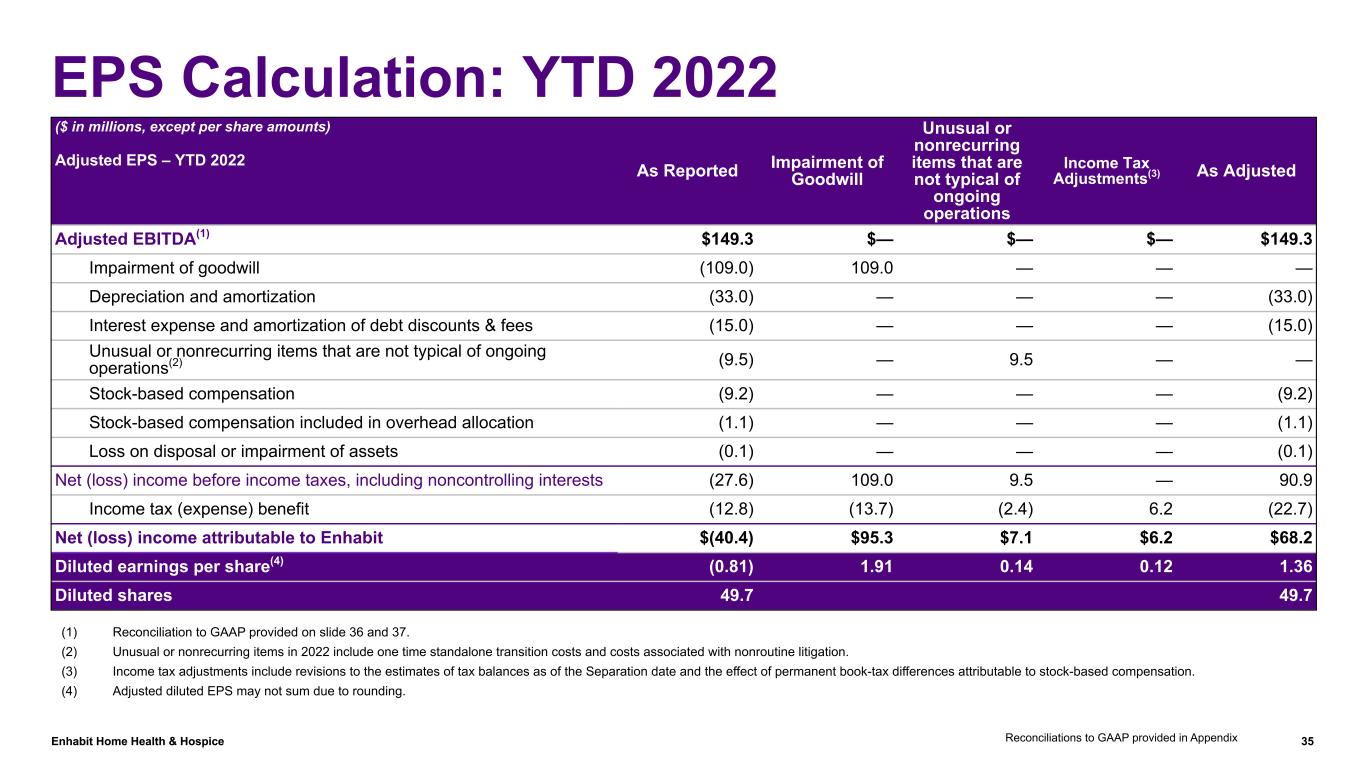

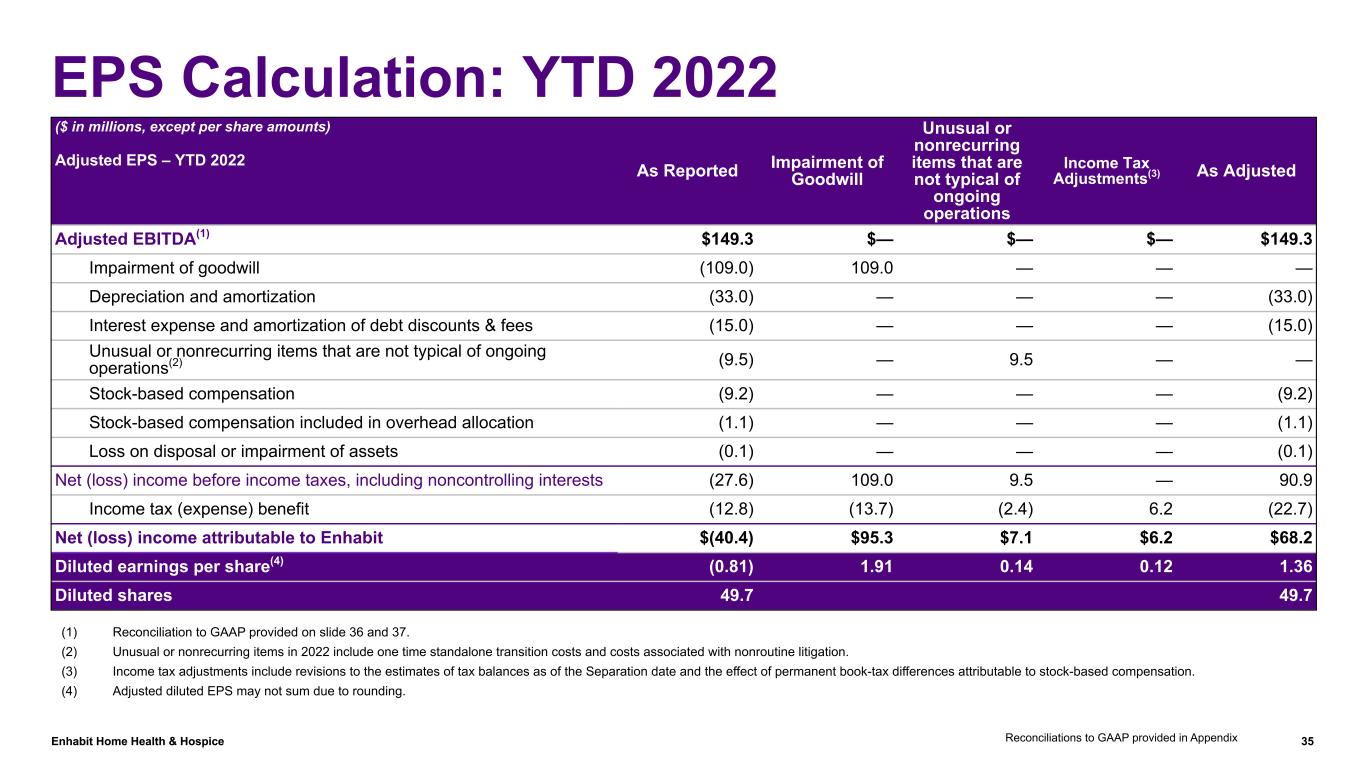

Enhabit Home Health & Hospice 35 EPS Calculation: YTD 2022 ($ in millions, except per share amounts) Adjusted EPS – YTD 2022 As Reported Impairment of Goodwill Unusual or nonrecurring items that are not typical of ongoing operations Income Tax Adjustments(3) As Adjusted Adjusted EBITDA(1) $149.3 $— $— $— $149.3 Impairment of goodwill (109.0) 109.0 — — — Depreciation and amortization (33.0) — — — (33.0) Interest expense and amortization of debt discounts & fees (15.0) — — — (15.0) Unusual or nonrecurring items that are not typical of ongoing operations(2) (9.5) — 9.5 — — Stock-based compensation (9.2) — — — (9.2) Stock-based compensation included in overhead allocation (1.1) — — — (1.1) Loss on disposal or impairment of assets (0.1) — — — (0.1) Net (loss) income before income taxes, including noncontrolling interests (27.6) 109.0 9.5 — 90.9 Income tax (expense) benefit (12.8) (13.7) (2.4) 6.2 (22.7) Net (loss) income attributable to Enhabit $(40.4) $95.3 $7.1 $6.2 $68.2 Diluted earnings per share(4) (0.81) 1.91 0.14 0.12 1.36 Diluted shares 49.7 49.7 (1) Reconciliation to GAAP provided on slide 36 and 37. (2) Unusual or nonrecurring items in 2022 include one time standalone transition costs and costs associated with nonroutine litigation. (3) Income tax adjustments include revisions to the estimates of tax balances as of the Separation date and the effect of permanent book-tax differences attributable to stock-based compensation. (4) Adjusted diluted EPS may not sum due to rounding. Reconciliations to GAAP provided in Appendix

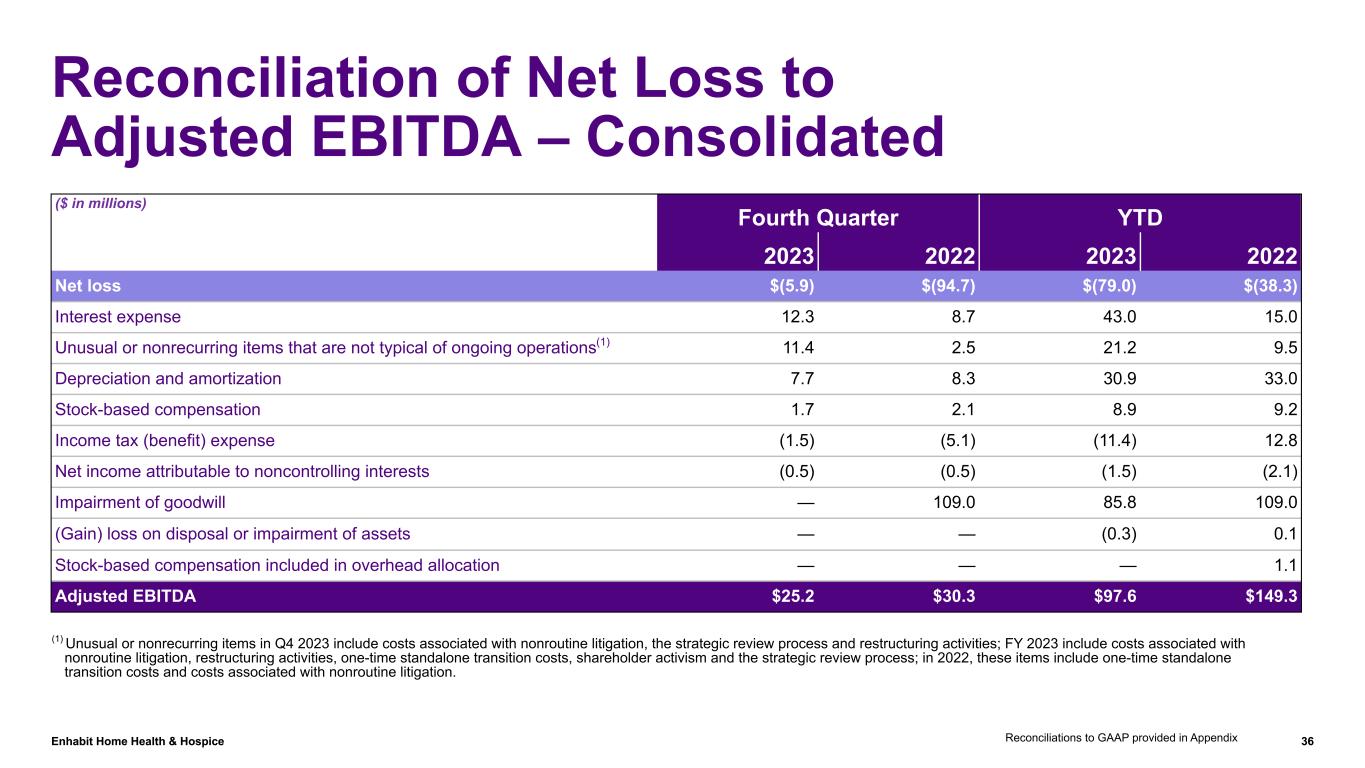

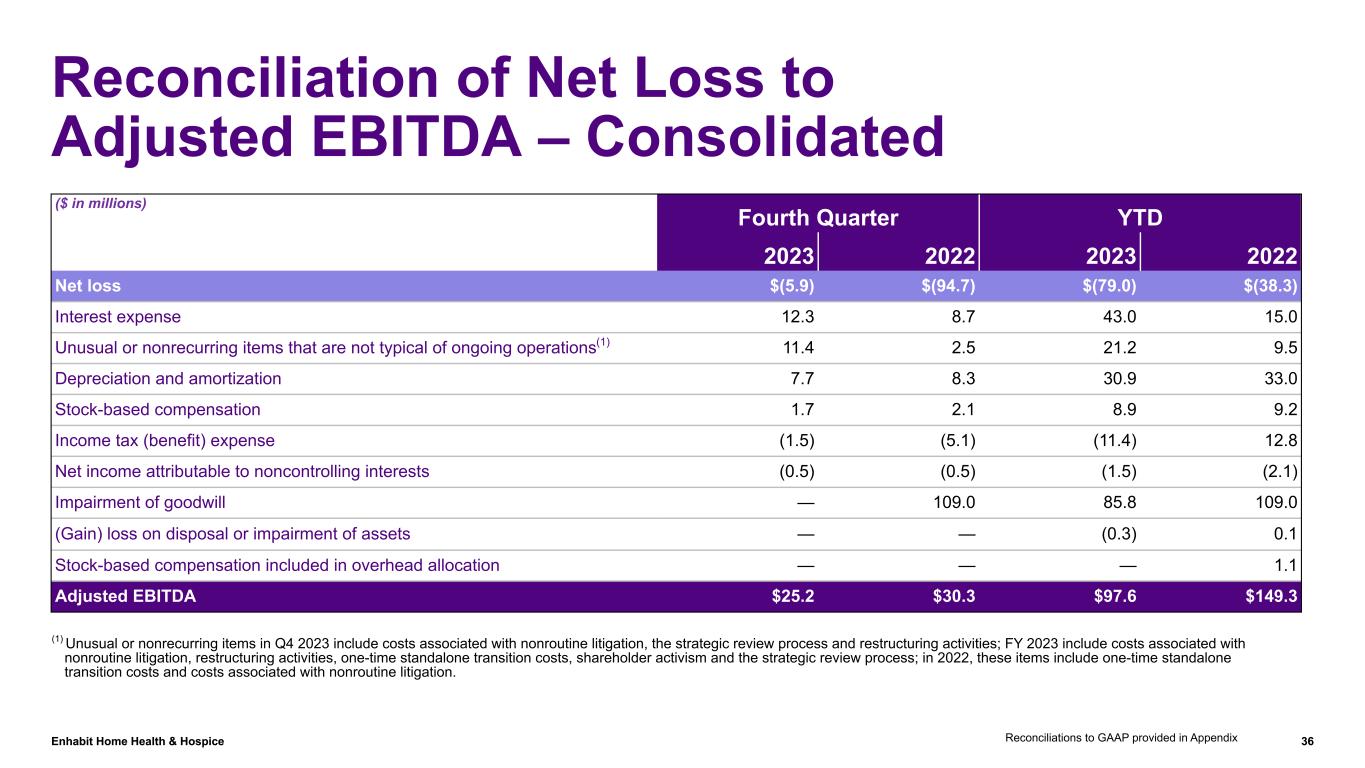

Enhabit Home Health & Hospice 36 Reconciliation of Net Loss to Adjusted EBITDA – Consolidated ($ in millions) Fourth Quarter YTD 2023 2022 2023 2022 Net loss $(5.9) $(94.7) $(79.0) $(38.3) Interest expense 12.3 8.7 43.0 15.0 Unusual or nonrecurring items that are not typical of ongoing operations(1) 11.4 2.5 21.2 9.5 Depreciation and amortization 7.7 8.3 30.9 33.0 Stock-based compensation 1.7 2.1 8.9 9.2 Income tax (benefit) expense (1.5) (5.1) (11.4) 12.8 Net income attributable to noncontrolling interests (0.5) (0.5) (1.5) (2.1) Impairment of goodwill — 109.0 85.8 109.0 (Gain) loss on disposal or impairment of assets — — (0.3) 0.1 Stock-based compensation included in overhead allocation — — — 1.1 Adjusted EBITDA $25.2 $30.3 $97.6 $149.3 (1) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities; FY 2023 include costs associated with nonroutine litigation, restructuring activities, one-time standalone transition costs, shareholder activism and the strategic review process; in 2022, these items include one-time standalone transition costs and costs associated with nonroutine litigation. Reconciliations to GAAP provided in Appendix

Enhabit Home Health & Hospice 37 Reconciliation of Net Cash Provided by Operating Activities to Adjusted EBITDA (1) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities; FY 2023 include costs associated with nonroutine litigation, restructuring activities, one-time standalone transition costs, shareholder activism and the strategic review process; in 2022, these items include one-time standalone transition costs and costs associated with nonroutine litigation. ($ in millions) Fourth Quarter YTD 2023 2022 2023 2022 Net cash provided by operating activities $2.8 $4.1 $48.4 $80.1 Unusual or nonrecurring items not typical of ongoing operations(1) 11.4 2.5 21.2 9.5 Interest expense excluding amortization of debt discounts and fees 11.2 8.7 40.9 15.0 Change in assets and liabilities, excluding derivative instruments 3.1 19.2 (11.9) 29.2 Current portion of income tax (benefit) expense (3.0) (3.3) 0.2 17.1 Net income attributable to noncontrolling interests in continuing operations (0.5) (0.5) (1.5) (2.1) Other 0.2 (0.4) 0.3 (0.6) Stock-based compensation included in overhead allocation — — — 1.1 Adjusted EBITDA $25.2 $30.3 $97.6 $149.3 Reconciliations to GAAP provided in Appendix

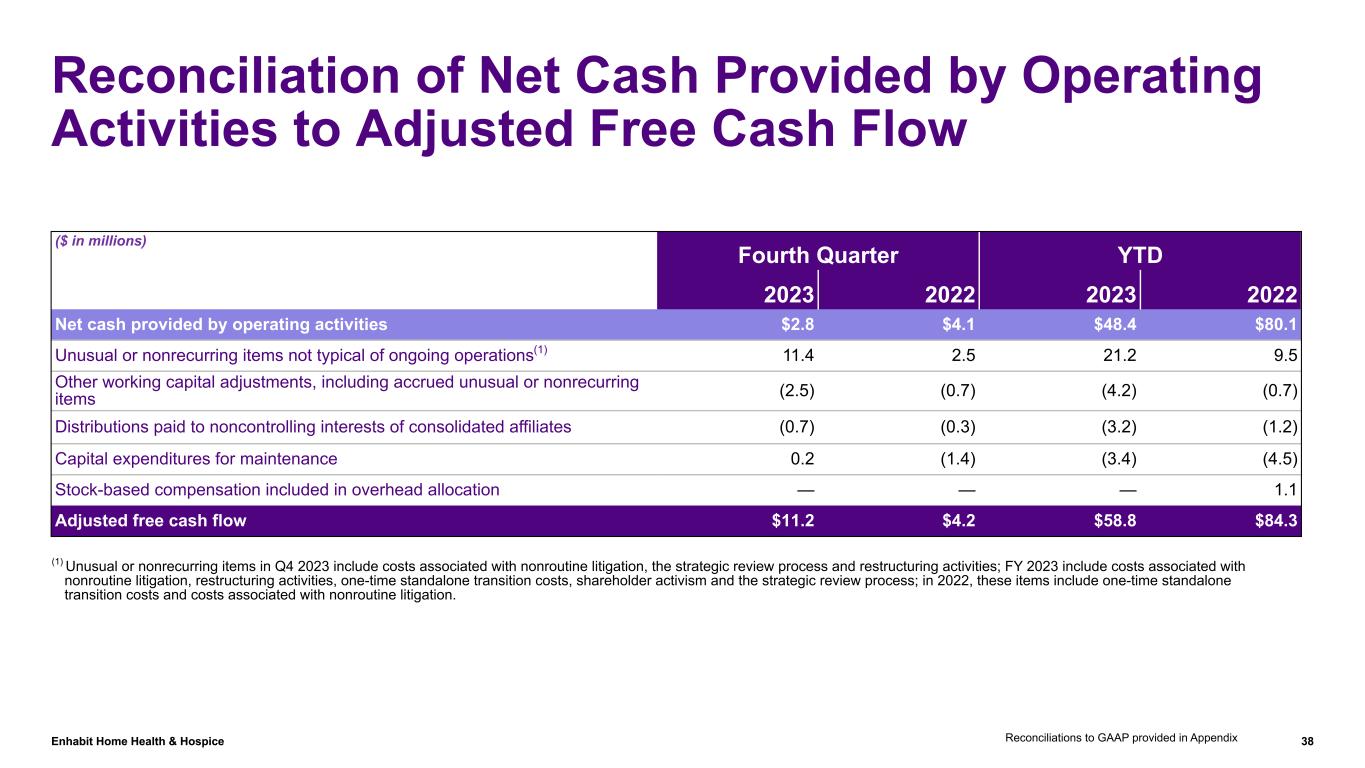

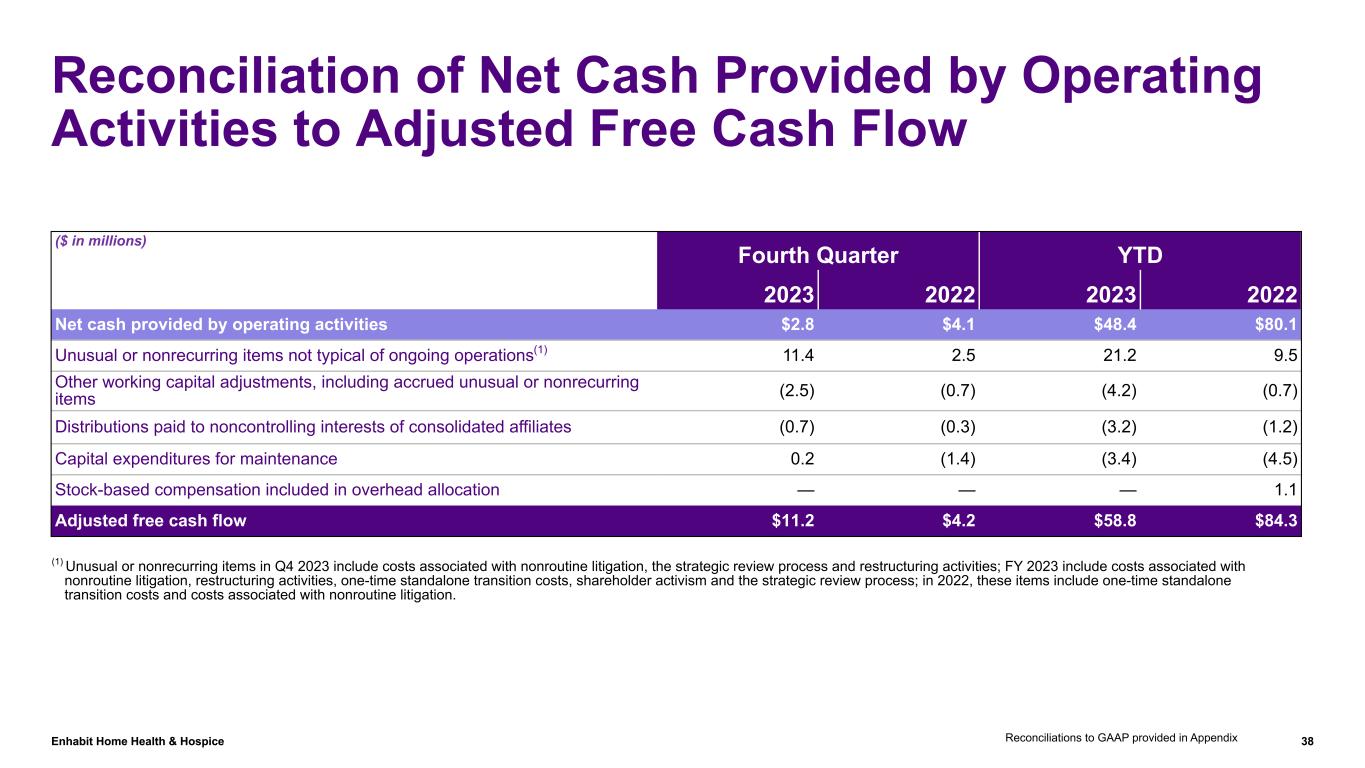

Enhabit Home Health & Hospice 38 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow PLACE HOLDER – WILL NEED: • EBITDA to Net income • Adjusted EPS to reported EPS and Net income ($ in millions) Fourth Quarter YTD 2023 2022 2023 2022 Net cash provided by operating activities $2.8 $4.1 $48.4 $80.1 Unusual or nonrecurring items not typical of ongoing operations(1) 11.4 2.5 21.2 9.5 Other working capital adjustments, including accrued unusual or nonrecurring items (2.5) (0.7) (4.2) (0.7) Distributions paid to noncontrolling interests of consolidated affiliates (0.7) (0.3) (3.2) (1.2) Capital expenditures for maintenance 0.2 (1.4) (3.4) (4.5) Stock-based compensation included in overhead allocation — — — 1.1 Adjusted free cash flow $11.2 $4.2 $58.8 $84.3 (1) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities; FY 2023 include costs associated with nonroutine litigation, restructuring activities, one-time standalone transition costs, shareholder activism and the strategic review process; in 2022, these items include one-time standalone transition costs and costs associated with nonroutine litigation. Reconciliations to GAAP provided in Appendix

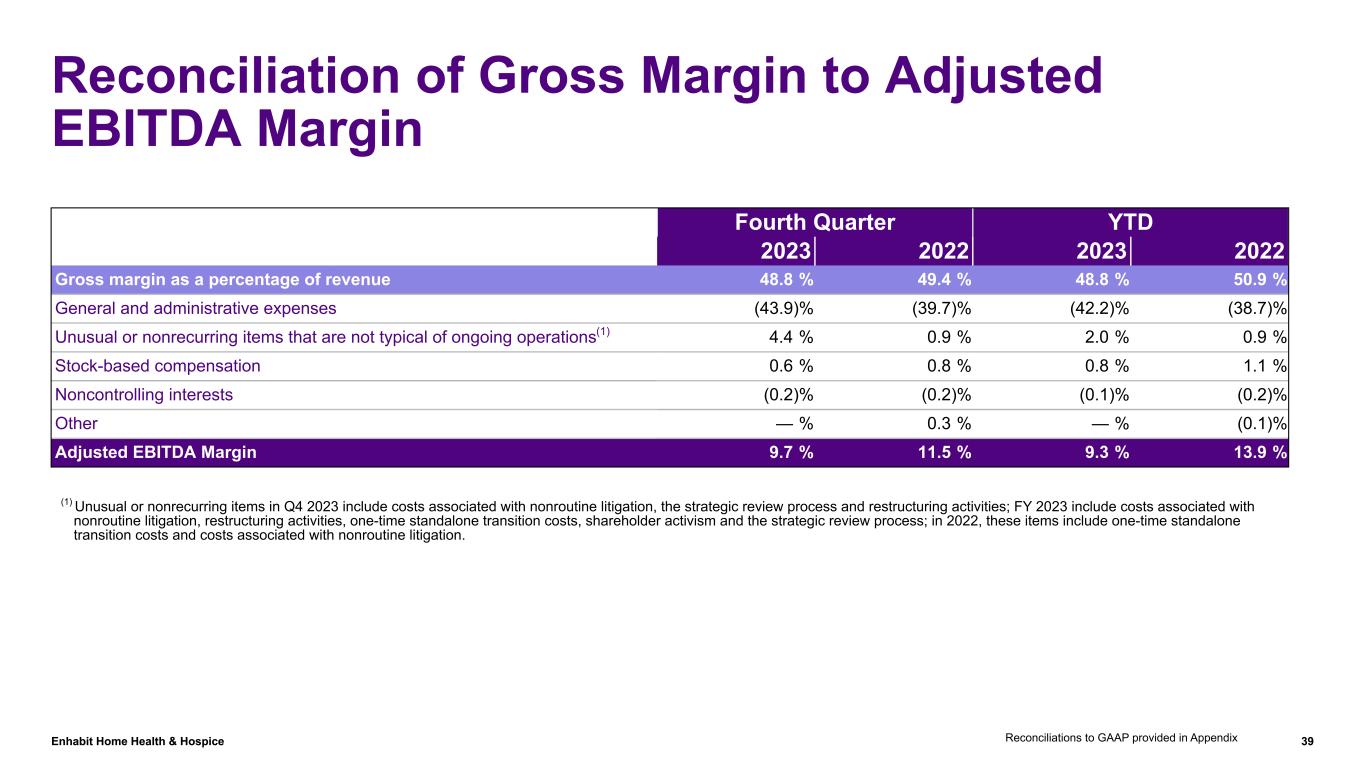

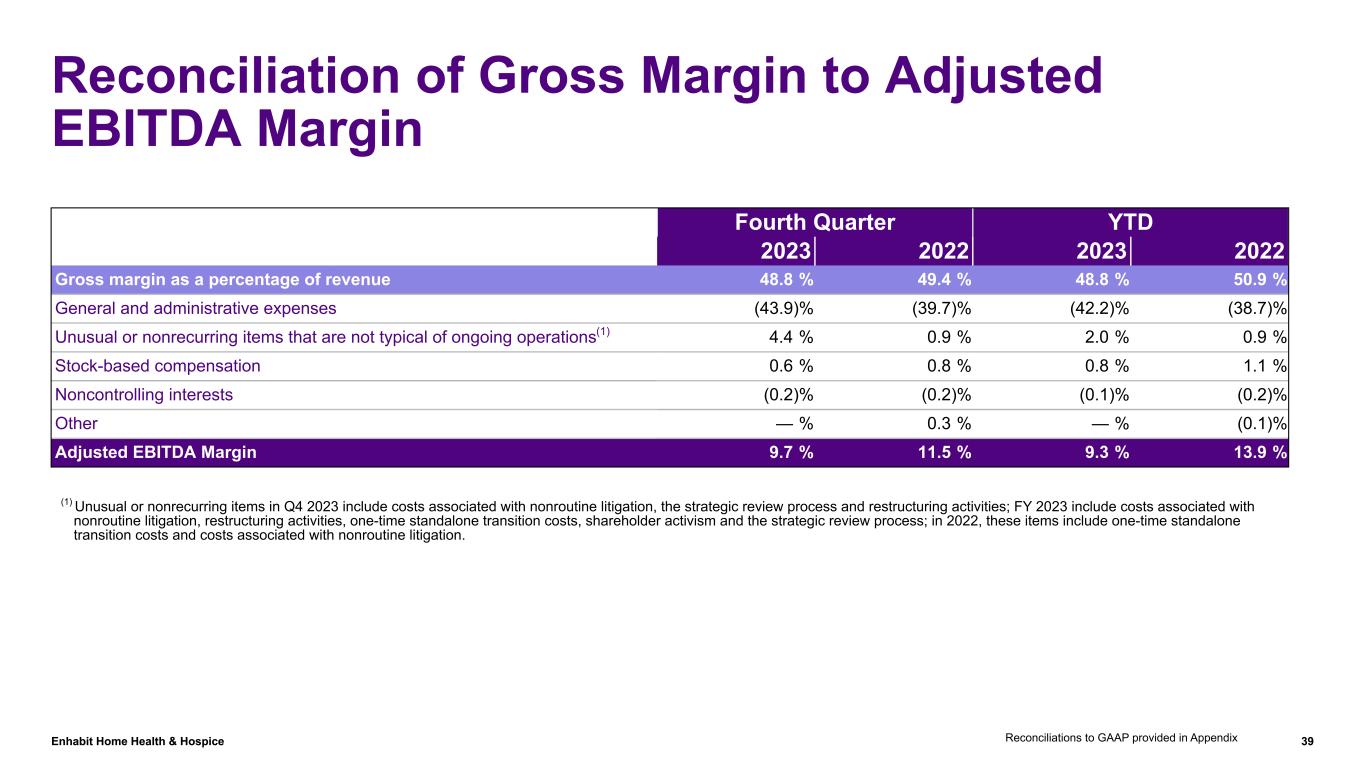

Enhabit Home Health & Hospice 39 Reconciliation of Gross Margin to Adjusted EBITDA Margin Fourth Quarter YTD 2023 2022 2023 2022 Gross margin as a percentage of revenue 48.8 % 49.4 % 48.8 % 50.9 % General and administrative expenses (43.9) % (39.7) % (42.2) % (38.7) % Unusual or nonrecurring items that are not typical of ongoing operations(1) 4.4 % 0.9 % 2.0 % 0.9 % Stock-based compensation 0.6 % 0.8 % 0.8 % 1.1 % Noncontrolling interests (0.2) % (0.2) % (0.1) % (0.2) % Other — % 0.3 % — % (0.1) % Adjusted EBITDA Margin 9.7 % 11.5 % 9.3 % 13.9 % (1) Unusual or nonrecurring items in Q4 2023 include costs associated with nonroutine litigation, the strategic review process and restructuring activities; FY 2023 include costs associated with nonroutine litigation, restructuring activities, one-time standalone transition costs, shareholder activism and the strategic review process; in 2022, these items include one-time standalone transition costs and costs associated with nonroutine litigation. Reconciliations to GAAP provided in Appendix