- TALK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Talkspace (TALK) 425Business combination disclosure

Filed: 13 Jan 21, 6:15am

Exhibit 99.3 Color palette 15.193.167 39.50.90 250.100.117 122.111.233 Virtual Behavioral 156.163.193 Health for All 114.183.0 Talkspace - the leading behavioral health platform. 0.98.179 186.204.255 183.228.224 239.244.246 JANUARY 13TH 2021 1Exhibit 99.3 Color palette 15.193.167 39.50.90 250.100.117 122.111.233 Virtual Behavioral 156.163.193 Health for All 114.183.0 Talkspace - the leading behavioral health platform. 0.98.179 186.204.255 183.228.224 239.244.246 JANUARY 13TH 2021 1

Disclaimer About this Presentation Color palette This investor presentation (this “Presentation”) has been prepared for use by Hudson Executive Investment Corp. (“Hudson”) and Groop Internet Platform, Inc. (d/b/a Talkspace) (the “Company”) in connection with their proposed business combination (the “Business Combination”). This presentation is for informational purposes only and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Hudson and Talkspace. The information contained herein does not purport to be all-inclusive and none of 15.193.167 Hudson, the Company or their respective affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Hudson, the Company, or any of their respective affiliates, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein to the extent you deem necessary. 39.50.90 Forward Looking Statements Certain statements in this Presentation may be considered “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward-looking statements generally relate to future events or Hudson’s or the Company’s future financial or operating performance. For example, projections of future revenue and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, 250.100.117 “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Hudson and its management, and the Company and its management, as the case may be, are inherently uncertain. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither Hudson nor the Company undertakes any duty to update these forward-looking statements. 122.111.233 Use of Projections This Presentation contains financial forecasts with respect to the Company’s projected financial results, including revenue. The Company's independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections should not be relied upon as being necessarily indicative of future results. The 156.163.193 assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data 114.183.0 In this Presentation, Hudson and the Company rely on and refer to certain information and statistics obtained from third-party sources which they believe to be reliable. Neither Hudson nor the Company has independently verified the accuracy or completeness of any such third-party information. Additional Information 0.98.179 Hudson intends to file with the SEC a proxy statement / prospectus on Form S-4 relating to the proposed Business Combination, which will be mailed to its stockholders once definitive. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Hudson’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement / prospectus and the amendments thereto and the proxy statement / prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about the Company, Hudson and the Business Combination. When available, the proxy statement / prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of Hudson as of a record date to be established for voting on the proposed Business Combination. Stockholders will 186.204.255 also be able to obtain copies of the preliminary proxy statement / prospectus, the definitive proxy statement / prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Talkspace, Broadway #607, New York, NY 10025. Participants in the Solicitation 183.228.224 Hudson and its directors and executive officers may be deemed participants in the solicitation of proxies from Hudson’s stockholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in Hudson is contained in Hudson’s Registration Statement on Form S-1, as effective on June 8, 2020, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Talkspace, Broadway #607, New York, NY 10025. Additional information regarding the interests of such participants will be contained in the proxy statement / prospectus for the proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the 239.244.246 solicitation of proxies from the stockholders of Hudson in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement / prospectus for the proposed Business Combination when available. 2Disclaimer About this Presentation Color palette This investor presentation (this “Presentation”) has been prepared for use by Hudson Executive Investment Corp. (“Hudson”) and Groop Internet Platform, Inc. (d/b/a Talkspace) (the “Company”) in connection with their proposed business combination (the “Business Combination”). This presentation is for informational purposes only and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Hudson and Talkspace. The information contained herein does not purport to be all-inclusive and none of 15.193.167 Hudson, the Company or their respective affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Hudson, the Company, or any of their respective affiliates, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein to the extent you deem necessary. 39.50.90 Forward Looking Statements Certain statements in this Presentation may be considered “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward-looking statements generally relate to future events or Hudson’s or the Company’s future financial or operating performance. For example, projections of future revenue and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, 250.100.117 “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Hudson and its management, and the Company and its management, as the case may be, are inherently uncertain. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither Hudson nor the Company undertakes any duty to update these forward-looking statements. 122.111.233 Use of Projections This Presentation contains financial forecasts with respect to the Company’s projected financial results, including revenue. The Company's independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections should not be relied upon as being necessarily indicative of future results. The 156.163.193 assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data 114.183.0 In this Presentation, Hudson and the Company rely on and refer to certain information and statistics obtained from third-party sources which they believe to be reliable. Neither Hudson nor the Company has independently verified the accuracy or completeness of any such third-party information. Additional Information 0.98.179 Hudson intends to file with the SEC a proxy statement / prospectus on Form S-4 relating to the proposed Business Combination, which will be mailed to its stockholders once definitive. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Hudson’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement / prospectus and the amendments thereto and the proxy statement / prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about the Company, Hudson and the Business Combination. When available, the proxy statement / prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of Hudson as of a record date to be established for voting on the proposed Business Combination. Stockholders will 186.204.255 also be able to obtain copies of the preliminary proxy statement / prospectus, the definitive proxy statement / prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Talkspace, Broadway #607, New York, NY 10025. Participants in the Solicitation 183.228.224 Hudson and its directors and executive officers may be deemed participants in the solicitation of proxies from Hudson’s stockholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in Hudson is contained in Hudson’s Registration Statement on Form S-1, as effective on June 8, 2020, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Talkspace, Broadway #607, New York, NY 10025. Additional information regarding the interests of such participants will be contained in the proxy statement / prospectus for the proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the 239.244.246 solicitation of proxies from the stockholders of Hudson in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement / prospectus for the proposed Business Combination when available. 2

We are excited to announce the $1.4bn SPAC merger of Talkspace and Hudson Executive Talkspace is the largest and only pure-play virtual behavioral health platform in the public markets Leverages Hudson’s extensive CEO network, enterprise contacts, and deep industry experience to accelerate scale and capabilities Provides Talkspace with additional capital to fuel organic and inorganic growth 3 We are excited to announce the $1.4bn SPAC merger of Talkspace and Hudson Executive Talkspace is the largest and only pure-play virtual behavioral health platform in the public markets Leverages Hudson’s extensive CEO network, enterprise contacts, and deep industry experience to accelerate scale and capabilities Provides Talkspace with additional capital to fuel organic and inorganic growth 3

Today’s presenters Color palette 15.193.167 39.50.90 250.100.117 122.111.233 156.163.193 Oren Frank Doug Braunstein 114.183.0 Co-founder and Chief Chairman and President 0.98.179 Executive Officer Former CFO and Vice Chairman of J.P. Morgan 186.204.255 183.228.224 239.244.246 4Today’s presenters Color palette 15.193.167 39.50.90 250.100.117 122.111.233 156.163.193 Oren Frank Doug Braunstein 114.183.0 Co-founder and Chief Chairman and President 0.98.179 Executive Officer Former CFO and Vice Chairman of J.P. Morgan 186.204.255 183.228.224 239.244.246 4

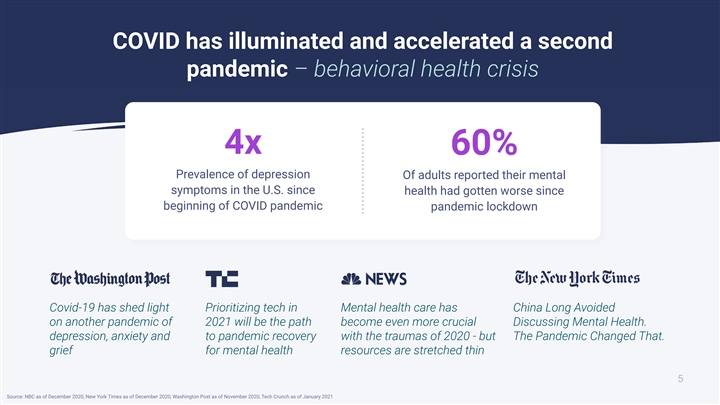

COVID has illuminated and accelerated a second Color palette pandemic 15.193.167 39.50.90 250.100.117 4x 60% 122.111.233 Prevalence of depression Of adults reported their mental symptoms in the U.S. since health had gotten worse since 156.163.193 beginning of COVID pandemic pandemic lockdown 114.183.0 0.98.179 186.204.255 183.228.224 239.244.246 5 Source: NBC as of December 2020, New York Times as of December 2020, Washington Post as of November 2020, Tech Crunch as of January 2021COVID has illuminated and accelerated a second Color palette pandemic 15.193.167 39.50.90 250.100.117 4x 60% 122.111.233 Prevalence of depression Of adults reported their mental symptoms in the U.S. since health had gotten worse since 156.163.193 beginning of COVID pandemic pandemic lockdown 114.183.0 0.98.179 186.204.255 183.228.224 239.244.246 5 Source: NBC as of December 2020, New York Times as of December 2020, Washington Post as of November 2020, Tech Crunch as of January 2021

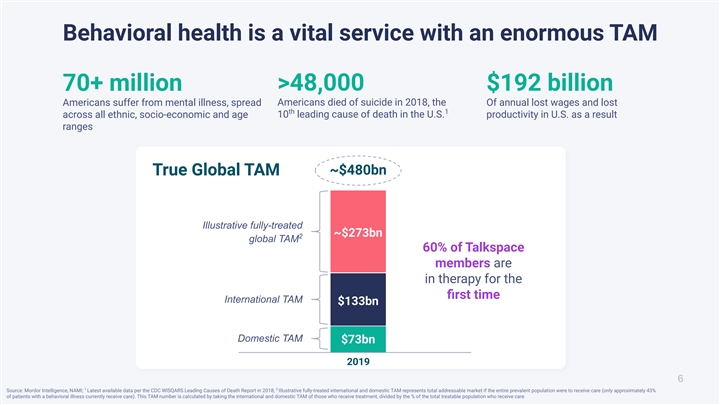

Behavioral health is a vital service with an enormous TAM Color palette 15.193.167 70+ million >48,000 $192 billion Americans suffer from mental illness, spread Americans died of suicide in 2018, the Of annual lost wages and lost th 1 39.50.90 across all ethnic, socio-economic and age 10 leading cause of death in the U.S. productivity in U.S. as a result ranges 250.100.117 ~$480bn True Global TAM 122.111.233 156.163.193 Illustrative fully-treated ~$273bn 114.183.0 2 global TAM 60% of Talkspace members are 0.98.179 in therapy for the 186.204.255 first time International TAM $133bn 183.228.224 Domestic TAM $73bn 239.244.246 2019 6 1 2 Source: Mordor Intelligence, NAMI; Latest available data per the CDC WISQARS Leading Causes of Death Report in 2018; Illustrative fully-treated international and domestic TAM represents total addressable market if the entire prevalent population were to receive care (only approximately 43% of patients with a behavioral illness currently receive care). This TAM number is calculated by taking the international and domestic TAM of those who receive treatment, divided by the % of the total treatable population who receive care Behavioral health is a vital service with an enormous TAM Color palette 15.193.167 70+ million >48,000 $192 billion Americans suffer from mental illness, spread Americans died of suicide in 2018, the Of annual lost wages and lost th 1 39.50.90 across all ethnic, socio-economic and age 10 leading cause of death in the U.S. productivity in U.S. as a result ranges 250.100.117 ~$480bn True Global TAM 122.111.233 156.163.193 Illustrative fully-treated ~$273bn 114.183.0 2 global TAM 60% of Talkspace members are 0.98.179 in therapy for the 186.204.255 first time International TAM $133bn 183.228.224 Domestic TAM $73bn 239.244.246 2019 6 1 2 Source: Mordor Intelligence, NAMI; Latest available data per the CDC WISQARS Leading Causes of Death Report in 2018; Illustrative fully-treated international and domestic TAM represents total addressable market if the entire prevalent population were to receive care (only approximately 43% of patients with a behavioral illness currently receive care). This TAM number is calculated by taking the international and domestic TAM of those who receive treatment, divided by the % of the total treatable population who receive care

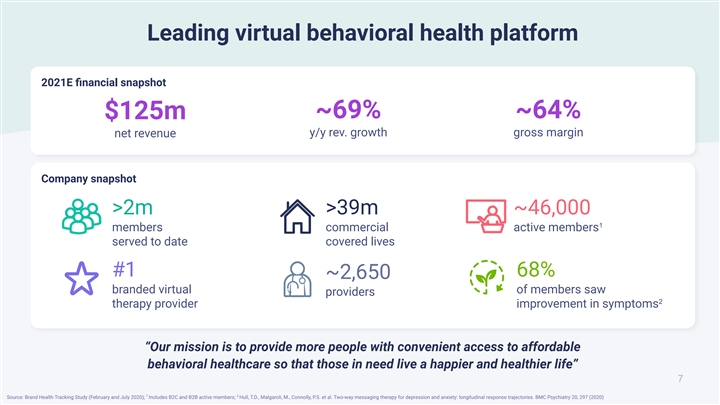

Leading virtual behavioral health platform Color palette 15.193.167 2021E financial snapshot 39.50.90 ~69% ~64% $125m y/y rev. growth gross margin net revenue 250.100.117 122.111.233 Company snapshot 156.163.193 >2m >39m ~46,000 1 members commercial active members 114.183.0 served to date covered lives 0.98.179 #1 68% ~2,650 branded virtual of members saw providers 186.204.255 2 therapy provider improvement in symptoms 183.228.224 “Our mission is to provide more people with convenient access to affordable 239.244.246 behavioral healthcare so that those in need live a happier and healthier life” 7 1 2 Source: Brand Health Tracking Study (February and July 2020); Includes B2C and B2B active members; Hull, T.D., Malgaroli, M., Connolly, P.S. et al. Two-way messaging therapy for depression and anxiety: longitudinal response trajectories. BMC Psychiatry 20, 297 (2020) Leading virtual behavioral health platform Color palette 15.193.167 2021E financial snapshot 39.50.90 ~69% ~64% $125m y/y rev. growth gross margin net revenue 250.100.117 122.111.233 Company snapshot 156.163.193 >2m >39m ~46,000 1 members commercial active members 114.183.0 served to date covered lives 0.98.179 #1 68% ~2,650 branded virtual of members saw providers 186.204.255 2 therapy provider improvement in symptoms 183.228.224 “Our mission is to provide more people with convenient access to affordable 239.244.246 behavioral healthcare so that those in need live a happier and healthier life” 7 1 2 Source: Brand Health Tracking Study (February and July 2020); Includes B2C and B2B active members; Hull, T.D., Malgaroli, M., Connolly, P.S. et al. Two-way messaging therapy for depression and anxiety: longitudinal response trajectories. BMC Psychiatry 20, 297 (2020)

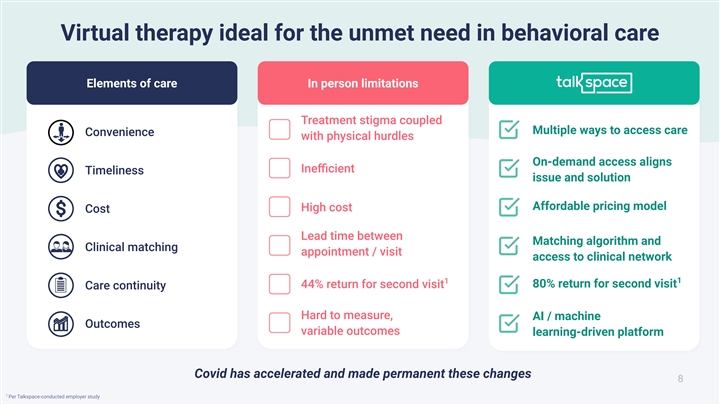

Virtual therapy ideal for the unmet need in behavioral care Color palette 15.193.167 Elements of care In person limitations 39.50.90 Multiple ways to access care 250.100.117 On-demand access aligns 122.111.233 issue and solution 156.163.193 Affordable pricing model 114.183.0 Matching algorithm and access to clinical network 0.98.179 1 80% return for second visit 186.204.255 AI / machine 183.228.224 learning-driven platform 239.244.246 Covid has accelerated and made permanent these changes 8 1 Per Talkspace-conducted employer study Virtual therapy ideal for the unmet need in behavioral care Color palette 15.193.167 Elements of care In person limitations 39.50.90 Multiple ways to access care 250.100.117 On-demand access aligns 122.111.233 issue and solution 156.163.193 Affordable pricing model 114.183.0 Matching algorithm and access to clinical network 0.98.179 1 80% return for second visit 186.204.255 AI / machine 183.228.224 learning-driven platform 239.244.246 Covid has accelerated and made permanent these changes 8 1 Per Talkspace-conducted employer study

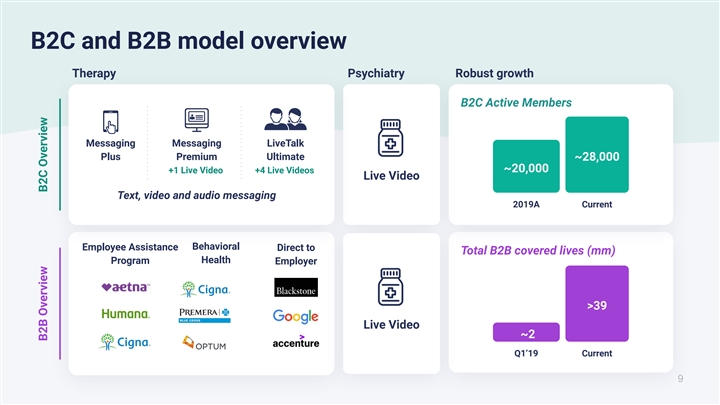

B2C and B2B model overview Color palette Therapy Psychiatry Robust growth 15.193.167 B2C Active Members 39.50.90 250.100.117 Messaging Messaging LiveTalk Plus Premium Ultimate ~28,000 ~20,000 +1 Live Video +4 Live Videos 122.111.233 Live Video Text, video and audio messaging 156.163.193 2019A Current 114.183.0 Behavioral Employee Assistance Direct to Total B2B covered lives (mm) Health Program Employer 0.98.179 186.204.255 >39 183.228.224 Live Video ~2 Q1’19 Current 239.244.246 9 B2B Overview B2C OverviewB2C and B2B model overview Color palette Therapy Psychiatry Robust growth 15.193.167 B2C Active Members 39.50.90 250.100.117 Messaging Messaging LiveTalk Plus Premium Ultimate ~28,000 ~20,000 +1 Live Video +4 Live Videos 122.111.233 Live Video Text, video and audio messaging 156.163.193 2019A Current 114.183.0 Behavioral Employee Assistance Direct to Total B2B covered lives (mm) Health Program Employer 0.98.179 186.204.255 >39 183.228.224 Live Video ~2 Q1’19 Current 239.244.246 9 B2B Overview B2C Overview

The strongest brand in digital behavioral health Instantly recognizable, 1 Highest brand awareness highly influential spokespeople relative to competitors Multi-faceted marketing approach is core to success in consumer market Top US behavioral telehealth brands 10 1 Source: July 2020 Brand survey - 1,200 U.S. consumers, 18-49 y.o; Measurement of aided awareness.The strongest brand in digital behavioral health Instantly recognizable, 1 Highest brand awareness highly influential spokespeople relative to competitors Multi-faceted marketing approach is core to success in consumer market Top US behavioral telehealth brands 10 1 Source: July 2020 Brand survey - 1,200 U.S. consumers, 18-49 y.o; Measurement of aided awareness.

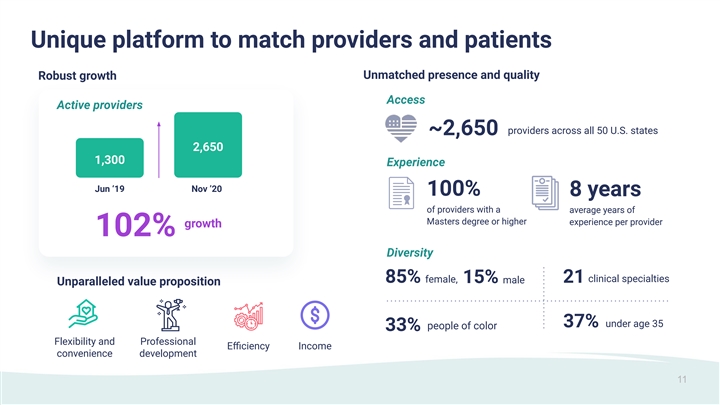

Unique platform to match providers and patients Unmatched presence and quality Robust growth Access Active providers providers across all 50 U.S. states ~2,650 2,650 1,300 Experience Jun ‘19 Nov ’20 100% 8 years of providers with a average years of Masters degree or higher experience per provider growth 102% Diversity clinical specialties 85% f emale, 15% male 21 Unparalleled value proposition 37% under age 35 people of color 33% Flexibility and Professional Efficiency Income convenience development 11Unique platform to match providers and patients Unmatched presence and quality Robust growth Access Active providers providers across all 50 U.S. states ~2,650 2,650 1,300 Experience Jun ‘19 Nov ’20 100% 8 years of providers with a average years of Masters degree or higher experience per provider growth 102% Diversity clinical specialties 85% f emale, 15% male 21 Unparalleled value proposition 37% under age 35 people of color 33% Flexibility and Professional Efficiency Income convenience development 11

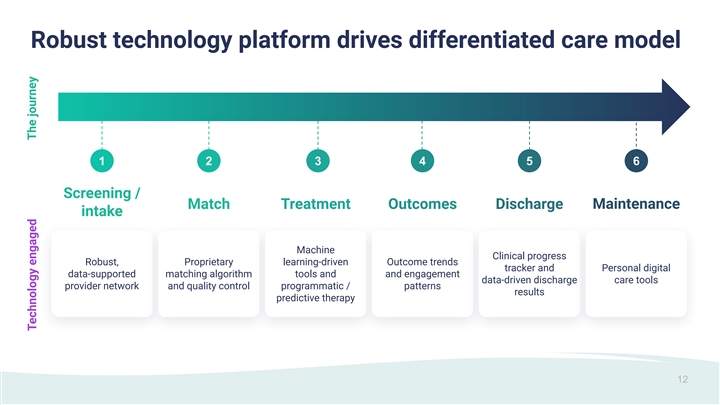

Robust technology platform drives differentiated care model 1 2 3 4 5 6 Screening / Match Treatment Outcomes Discharge Maintenance intake Machine Clinical progress Robust, Proprietary learning-driven Outcome trends tracker and Personal digital data-supported matching algorithm tools and and engagement data-driven discharge care tools provider network and quality control programmatic / patterns results predictive therapy 12 Technology engaged The journeyRobust technology platform drives differentiated care model 1 2 3 4 5 6 Screening / Match Treatment Outcomes Discharge Maintenance intake Machine Clinical progress Robust, Proprietary learning-driven Outcome trends tracker and Personal digital data-supported matching algorithm tools and and engagement data-driven discharge care tools provider network and quality control programmatic / patterns results predictive therapy 12 Technology engaged The journey

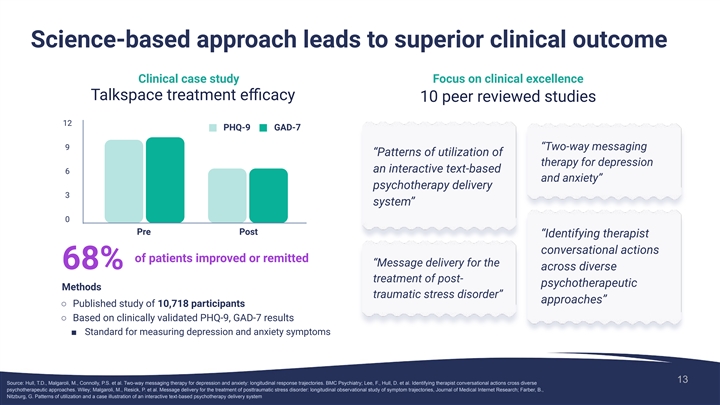

Science-based approach leads to superior clinical outcome Clinical case study Focus on clinical excellence Talkspace treatment efficacy 10 peer reviewed studies 12 PHQ-9 GAD-7 9 “Two-way messaging “Patterns of utilization of therapy for depression an interactive text-based 6 and anxiety” psychotherapy delivery 3 system” 0 Pre Post “Identifying therapist conversational actions of patients improved or remitted “Message delivery for the 68% across diverse treatment of post- psychotherapeutic Methods traumatic stress disorder” approaches” ○ Published study of 10,718 participants ○ Based on clinically validated PHQ-9, GAD-7 results ■ Standard for measuring depression and anxiety symptoms 13 Source: Hull, T.D., Malgaroli, M., Connolly, P.S. et al. Two-way messaging therapy for depression and anxiety: longitudinal response trajectories. BMC Psychiatry; Lee, F., Hull, D. et al. Identifying therapist conversational actions cross diverse psychotherapeutic approaches. Wiley; Malgaroli, M., Resick, P. et al. Message delivery for the treatment of posttraumatic stress disorder: longitudinal observational study of symptom trajectories, Journal of Medical Internet Research; Farber, B., Nitzburg, G. Patterns of utilization and a case illustration of an interactive text-based psychotherapy delivery system Science-based approach leads to superior clinical outcome Clinical case study Focus on clinical excellence Talkspace treatment efficacy 10 peer reviewed studies 12 PHQ-9 GAD-7 9 “Two-way messaging “Patterns of utilization of therapy for depression an interactive text-based 6 and anxiety” psychotherapy delivery 3 system” 0 Pre Post “Identifying therapist conversational actions of patients improved or remitted “Message delivery for the 68% across diverse treatment of post- psychotherapeutic Methods traumatic stress disorder” approaches” ○ Published study of 10,718 participants ○ Based on clinically validated PHQ-9, GAD-7 results ■ Standard for measuring depression and anxiety symptoms 13 Source: Hull, T.D., Malgaroli, M., Connolly, P.S. et al. Two-way messaging therapy for depression and anxiety: longitudinal response trajectories. BMC Psychiatry; Lee, F., Hull, D. et al. Identifying therapist conversational actions cross diverse psychotherapeutic approaches. Wiley; Malgaroli, M., Resick, P. et al. Message delivery for the treatment of posttraumatic stress disorder: longitudinal observational study of symptom trajectories, Journal of Medical Internet Research; Farber, B., Nitzburg, G. Patterns of utilization and a case illustration of an interactive text-based psychotherapy delivery system

Multiple levers for continued rapid growth M&A International expansion Expand partnerships Expand user base ■ Multiple adjacency and drive engagement areas to enter ■ Highly exportable ■ Expand base and platform capabilities ■ Further expand care penetration of ■ Expand base through ■ 30mm+ near-term capabilities existing B2B clients driven brand awareness international ■ Add new B2B client addressable patients ■ Drive member relationships engagement beyond episodic care 14Multiple levers for continued rapid growth M&A International expansion Expand partnerships Expand user base ■ Multiple adjacency and drive engagement areas to enter ■ Highly exportable ■ Expand base and platform capabilities ■ Further expand care penetration of ■ Expand base through ■ 30mm+ near-term capabilities existing B2B clients driven brand awareness international ■ Add new B2B client addressable patients ■ Drive member relationships engagement beyond episodic care 14

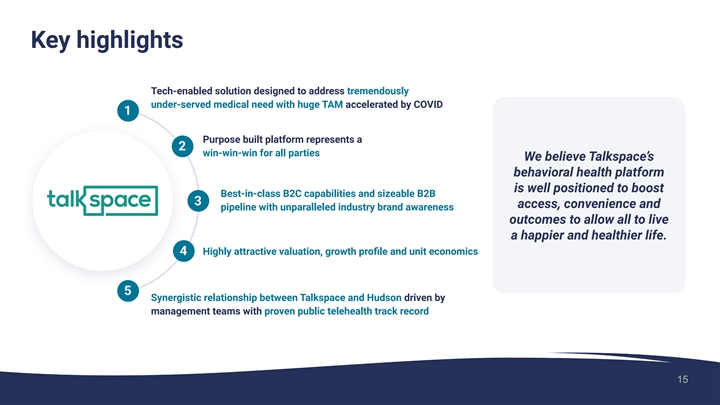

Key highlights Tech-enabled solution designed to address tremendously under-served medical need with huge TAM accelerated by COVID 1 Purpose built platform represents a 2 win-win-win for all parties We believe Talkspace’s behavioral health platform is well positioned to boost Best-in-class B2C capabilities and sizeable B2B 3 access, convenience and pipeline with unparalleled industry brand awareness outcomes to allow all to live a happier and healthier life. 4 Highly attractive valuation, growth profile and unit economics 5 Synergistic relationship between Talkspace and Hudson driven by management teams with proven public telehealth track record 15Key highlights Tech-enabled solution designed to address tremendously under-served medical need with huge TAM accelerated by COVID 1 Purpose built platform represents a 2 win-win-win for all parties We believe Talkspace’s behavioral health platform is well positioned to boost Best-in-class B2C capabilities and sizeable B2B 3 access, convenience and pipeline with unparalleled industry brand awareness outcomes to allow all to live a happier and healthier life. 4 Highly attractive valuation, growth profile and unit economics 5 Synergistic relationship between Talkspace and Hudson driven by management teams with proven public telehealth track record 15

Thank you Therapy for All Demi Lovato, Singer, Songwriter, Activist, Mental Health Advocate 16Thank you Therapy for All Demi Lovato, Singer, Songwriter, Activist, Mental Health Advocate 16

Appendix 17Appendix 17

Transaction overview Talkspace is preparing to go public through a SPAC Merger with Hudson Executive Investment Corp., which has raised a $300 million PIPE to further support long-term growth 1 HEIC’s IPO raised $414 million in June 2020, with its common stock trading on the NASDAQ under symbol “HEC” The transaction is expected to be funded through a combination of: HEIC’s $414 million of cash in trust $300 million of committed PIPE financing $25 million from Hudson Executive Capital funded at closing with an additional $25mm available to backstop SPAC redemptions $250 million of growth capital funded to balance sheet Talkspace will trade on the NASDAQ under the ticker “TALK” at closing, expected late Q1 / early Q2 18 1 Hudson Executive Investment Corp. trades on the NASDAQ under the following symbols “HEC” (common stock), “HECCU” (units) and “HECCW” (warrants) Transaction overview Talkspace is preparing to go public through a SPAC Merger with Hudson Executive Investment Corp., which has raised a $300 million PIPE to further support long-term growth 1 HEIC’s IPO raised $414 million in June 2020, with its common stock trading on the NASDAQ under symbol “HEC” The transaction is expected to be funded through a combination of: HEIC’s $414 million of cash in trust $300 million of committed PIPE financing $25 million from Hudson Executive Capital funded at closing with an additional $25mm available to backstop SPAC redemptions $250 million of growth capital funded to balance sheet Talkspace will trade on the NASDAQ under the ticker “TALK” at closing, expected late Q1 / early Q2 18 1 Hudson Executive Investment Corp. trades on the NASDAQ under the following symbols “HEC” (common stock), “HECCU” (units) and “HECCW” (warrants)

Hudson Executive Investment Corp. overview Doug Braunstein Doug Bergeron Founder / Managing Partner of Hudson Managing Partner of Hudson Executive Capital Executive Capital 35-year successful FinTech track record Former CFO / Vice Chairman of J.P. Morgan including 12 years as CEO of VeriFone, during and Head of Americas Investment Banking which time enterprise value grew from $50 million to over $5 billion 35-years of M&A leadership, including some of largest Healthcare transactions Tech investor and mentor to management teams CEO network: Select Healthcare Executives HEC is an investment firm that helps drive portfolio Marc Casper: President, CEO and Director company strategy through active engagement with management Stephen Hemsley: Former CEO and current Chairman Dedicated investment team with deep knowledge of Alan Miller: Founder, Chairman and CEO public market positioning Fred Eshelman: Former Chairman and CEO Leverage CEO network for guidance on investments Paul Ormond: Former Chairman and CEO HEC, along with Doug Braunstein and Doug Bergeron, is a co-sponsor of the SPAC 19Hudson Executive Investment Corp. overview Doug Braunstein Doug Bergeron Founder / Managing Partner of Hudson Managing Partner of Hudson Executive Capital Executive Capital 35-year successful FinTech track record Former CFO / Vice Chairman of J.P. Morgan including 12 years as CEO of VeriFone, during and Head of Americas Investment Banking which time enterprise value grew from $50 million to over $5 billion 35-years of M&A leadership, including some of largest Healthcare transactions Tech investor and mentor to management teams CEO network: Select Healthcare Executives HEC is an investment firm that helps drive portfolio Marc Casper: President, CEO and Director company strategy through active engagement with management Stephen Hemsley: Former CEO and current Chairman Dedicated investment team with deep knowledge of Alan Miller: Founder, Chairman and CEO public market positioning Fred Eshelman: Former Chairman and CEO Leverage CEO network for guidance on investments Paul Ormond: Former Chairman and CEO HEC, along with Doug Braunstein and Doug Bergeron, is a co-sponsor of the SPAC 19