The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described in this preliminary proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY—SUBJECT TO COMPLETION, DATED APRIL 5, 2021

PROXY STATEMENT FOR

SPECIAL MEETING OF STOCKHOLDERS OF

HUDSON EXECUTIVE INVESTMENT CORP.

(A DELAWARE CORPORATION)

PROSPECTUS FOR 129,430,805 SHARES OF COMMON STOCK OF HUDSON EXECUTIVE INVESTMENT CORP. WHICH WILL BE RENAMED “TALKSPACE, INC.” IN CONNECTION WITH THE BUSINESS COMBINATION DESCRIBED HEREIN

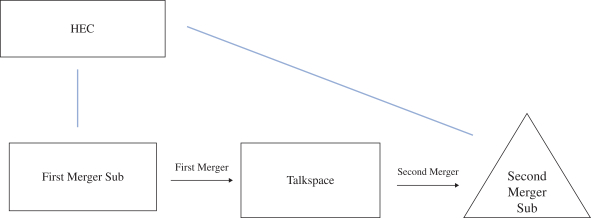

The board of directors of Hudson Executive Investment Corp., a Delaware corporation (“HEC”, “we” or “our”), has unanimously approved (1) each of the mergers of (x) Tailwind Merger Sub I, Inc., a Delaware corporation and a direct wholly owned subsidiary of HEC (“First Merger Sub”), with and into Groop Internet Platform, Inc. (d/b/a “Talkspace”), a Delaware corporation (“Talkspace”) (the “First Merger”), with Talkspace surviving the First Merger, and (y) immediately following the First Merger and as part of the same overall transaction as the First Merger, Talkspace to be merged with and into Tailwind Merger Sub II, LLC, a Delaware limited liability company (“Second Merger Sub”), with Second Merger Sub surviving the merger as a wholly owned subsidiary of HEC, in each case, pursuant to the terms of the Agreement and Plan of Merger, dated as of January 12, 2021 (the “Merger Agreement”), by and among HEC, Talkspace, First Merger Sub, and Second Merger Sub (the “Second Merger”, and together with the First Merger, the “business combination”), attached to this proxy statement/prospectus as Annex A, as more fully described elsewhere in this proxy statement/prospectus; and (2) the other transactions contemplated by the Merger Agreement (together with the business combination, the “Transactions”). In connection with the business combination, HEC will change its name to “Talkspace, Inc.”

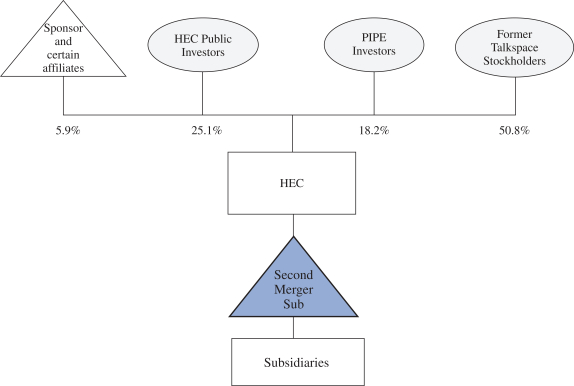

As a result of and upon the Closing (as defined below), among other things, and as more fully described elsewhere in this proxy statement/prospectus, all shares of Talkspace common stock and Talkspace preferred stock (as defined herein) (collectively, “Talkspace stock”) and all vested options exercisable for common stock of Talkspace outstanding as of immediately prior to Closing (“Vested Talkspace Options”) will be cancelled or assumed, as applicable, and converted into the right to receive, at the election of the holders thereof, a number of shares of common stock of Talkspace, Inc. (“Talkspace, Inc. common stock”) or a combination of shares of Talkspace, Inc. common stock and cash, in each case, as adjusted pursuant to the terms of the Merger Agreement, which in the aggregate with the unvested options to acquire common stock of Talkspace to be assumed by Talkspace, Inc. in exchange for options to acquire Talkspace, Inc. common stock (“Unvested Talkspace Options”, and together with Vested Talkspace Options, “Talkspace Options”), will equal $1,400,000,000, reduced by certain deductions for the parties’ transaction expenses and the value (the “Sponsor Share Amount”) of the shares of HEC’s Class B common stock held by HEC Sponsor LLC (the “Sponsor”) immediately prior to the consummation of the Transactions (the “Closing Merger Consideration”). The maximum amount of cash (the “Closing Cash Consideration”) that may be paid to the pre-closing holders of shares of Talkspace stock and Vested Talkspace Options pursuant to the foregoing is equal to (i) the amount of cash held by HEC in its trust account (after reduction for the aggregate amount of cash payable in respect of any HEC stockholder redemptions), plus (ii) the amounts received by HEC upon the consummation of the PIPE Investment and the transactions contemplated under the HEC Forward Purchase Agreement, minus (iii) $250,000,000, minus (iv) the transaction expenses of the parties to the Merger Agreement. The maximum number of shares (the “Closing Share Consideration”) of Talkspace, Inc. common stock that may be issued to the pre-closing holders of Talkspace stock and Talkspace Options (including shares of Talkspace’s common stock underlying any Talkspace Options on a net exercise basis), pursuant to the foregoing is equal to a number determined dividing (a)(i) the Closing Merger Consideration, minus (ii) the Closing Cash Consideration, minus (iii) the Sponsor Share Amount, minus (iv) the transaction expenses of the parties to the Merger Agreement, by (b) $10.00. At the election of the Company, in certain circumstances the Closing Cash Consideration may be reduced (with a corresponding increase to the Closing Share Consideration) to the extent required to ensure that the business combination qualifies for the Intended Income Tax Treatment (as defined herein). However, in no event shall the consideration payable in connection with the Transactions in respect of all outstanding shares of Talkspace stock and Talkspace Options (including shares of Talkspace’s common stock underlying any Talkspace Options on a net exercise basis) exceed (i) an amount in cash equal to the Closing Cash Consideration and (ii) a number of shares of Talkspace, Inc. common stock equal to the Closing Share Consideration (the “Maximum Consideration”). It is anticipated that, upon the Closing (as defined below): (i) existing stockholders of Talkspace will own approximately 50.8% of Talkspace, Inc. on a fully diluted net exercise basis; (ii) HEC’s public stockholders (other than the PIPE Investors) will retain an ownership interest of approximately 25.1% in Talkspace, Inc. on a fully diluted net exercise basis; (iii) the PIPE Investors (as defined below) will own approximately 18.2% of Talkspace, Inc. on a fully diluted net exercise basis; and (iv) the Sponsor (and its affiliates) will own approximately 5.9% of Talkspace, Inc. on a fully diluted net exercise basis. These indicative levels of ownership interest: (i) exclude the impact of the shares of HEC’s Class A common stock underlying warrants, (ii) assume that no public stockholder exercises redemption rights with respect to its shares for a pro rata portion of the funds in the trust account and (iii) assume the transaction expenses of the parties to the Merger Agreement equal $49 million.

This proxy statement/prospectus also relates to the issuance by HEC of up to 21,068,268 shares of Talkspace, Inc. common stock upon the exercise of options to purchase shares of Talkspace, Inc. common stock following the Closing and the resale of such shares of Talkspace, Inc. common stock (the “Resale Shares”). The holders of the Resale Shares may from time to time sell, transfer or otherwise dispose of any or all of their Resale Shares in a number of different ways and at varying prices, and we will not receive any proceeds from such transactions. See “Proposal No. 1—The Business Combination Proposal—Certain Agreements Related to the Business Combination—Merger Agreement—Closing Merger Consideration.”

HEC’s units, HEC’s Class A common stock and HEC’s warrants are currently listed on the Nasdaq Stock Market (the “Nasdaq”) under the symbols “HECCU,” “HEC” and “HECCW”, respectively. Upon the Closing, HEC’s units will separate into the component securities and will no longer trade as a separate security. HEC intends to apply for listing, effective at the time of the Closing, of Talkspace, Inc. common stock and Talkspace, Inc. warrants on the Nasdaq under the symbols “TALK” and “TALKW”, respectively. This proxy statement/prospectus provides stockholders of HEC with detailed information about the proposed business combination and other matters to be considered at the special meeting of HEC. We encourage you to read this entire document, including the Annexes and other documents referred to herein, carefully and in their entirety. You should also carefully consider the risk factors described in the section entitled “Risk Factors” beginning on page 50 of this proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated , 2021, and is first being mailed to HEC’s stockholders on or about , 2021.